Mortgage Loss Mitigation Specialist Core Responsibilities

A Mortgage Loss Mitigation Specialist plays a crucial role in managing and minimizing financial losses for lenders by negotiating with borrowers at risk of default. Key responsibilities include assessing borrower situations, analyzing financial documents, developing tailored repayment plans, and collaborating with legal and customer service teams. Essential skills encompass technical knowledge of mortgage products, operational efficiency, and strong problem-solving capabilities. These competencies not only drive the organization’s risk management goals but also enhance customer satisfaction. A well-structured resume can effectively highlight these qualifications, showcasing a candidate's ability to bridge critical functions within the organization.

Common Responsibilities Listed on Mortgage Loss Mitigation Specialist Resume

- Evaluate borrower financial situations and hardship circumstances.

- Review and analyze financial documents and credit reports.

- Develop and propose loss mitigation strategies and options.

- Negotiate repayment plans, loan modifications, and settlements.

- Coordinate with internal departments such as legal and underwriting.

- Maintain accurate records of borrower communications and transactions.

- Prepare and submit loss mitigation recommendations to decision-makers.

- Monitor and follow up on the effectiveness of implemented solutions.

- Ensure compliance with federal and state regulations.

- Provide exceptional customer service and support to borrowers.

- Educate borrowers on available options and processes.

- Analyze industry trends to improve mitigation strategies.

High-Level Resume Tips for Mortgage Loss Mitigation Specialist Professionals

In the competitive field of mortgage loss mitigation, a well-crafted resume serves as a vital tool for professionals seeking to make their mark. Often the first impression a candidate leaves on potential employers, a resume must not only highlight relevant skills but also effectively showcase achievements that set one candidate apart from another. For Mortgage Loss Mitigation Specialists, this means presenting a clear narrative of their expertise in navigating complex situations, negotiating with stakeholders, and driving positive outcomes for both clients and organizations. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Loss Mitigation Specialist professionals, ensuring that your resume stands out in a crowded job market.

Top Resume Tips for Mortgage Loss Mitigation Specialist Professionals

- Tailor your resume to the job description by incorporating keywords and phrases that align with the specific requirements of the position.

- Highlight relevant experience in mortgage servicing, loss mitigation, and customer service to demonstrate your suitability for the role.

- Quantify your achievements, such as the percentage of successful loan modifications or the number of cases resolved, to provide tangible evidence of your impact.

- Include industry-specific skills, such as knowledge of regulatory compliance, risk assessment, and negotiation techniques, to enhance your qualifications.

- Utilize a clear and professional format that enhances readability, ensuring that your most important information stands out.

- Incorporate a summary statement at the top of your resume that captures your career highlights and sets the tone for the rest of the document.

- Showcase your ability to work collaboratively with borrowers, lenders, and other stakeholders to find mutually beneficial solutions.

- Consider including relevant certifications or training, such as Certified Mortgage Loss Mitigation Specialist (CMLMS), to add credibility to your profile.

- Keep your resume concise, ideally within one page, while ensuring that all important information is included without overwhelming the reader.

- Proofread for errors and ensure consistency in formatting, as attention to detail reflects your professionalism and commitment to quality.

By implementing these tips, Mortgage Loss Mitigation Specialist professionals can significantly increase their chances of landing a job in this field. A targeted and well-structured resume not only showcases your qualifications but also demonstrates your understanding of the industry's unique demands, ultimately making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Mortgage Loss Mitigation Specialist

The role of a Mortgage Loss Mitigation Specialist is critical in navigating the complexities of the mortgage industry, particularly in helping borrowers avoid foreclosure and find sustainable financial solutions. In a competitive job market, resume headlines and titles play a pivotal role in capturing the attention of hiring managers. A strong headline or title serves as a succinct summary of a candidate's key qualifications, allowing them to stand out among numerous applications. By presenting a clear and impactful phrase, candidates can effectively communicate their value proposition, making it essential that these headlines are concise, relevant, and directly aligned with the position being applied for.

Best Practices for Crafting Resume Headlines for Mortgage Loss Mitigation Specialist

- Keep it concise—aim for one impactful sentence.

- Use industry-specific terminology to highlight expertise.

- Focus on key qualifications relevant to loss mitigation.

- Incorporate metrics or accomplishments when possible.

- Avoid generic phrases; be specific about your skills.

- Use action words that convey your contributions.

- Tailor the headline for each job application.

- Highlight certifications or specialized training related to mortgage loss mitigation.

Example Resume Headlines for Mortgage Loss Mitigation Specialist

Strong Resume Headlines

"Dedicated Mortgage Loss Mitigation Specialist with 5+ Years of Experience in Reducing Foreclosure Rates"

“Results-Driven Financial Consultant Specializing in Strategic Loss Mitigation Solutions”

“Certified Mortgage Professional Skilled in Negotiating Payment Plans and Loan Modifications”

Weak Resume Headlines

“Looking for a Job in Mortgage”

“Mortgage Specialist”

Strong headlines are effective because they immediately convey the candidate’s unique qualifications and relevant experience in the mortgage loss mitigation field, making a compelling case for their candidacy. They provide clear insights into the candidate's skills and accomplishments, which can prompt hiring managers to delve deeper into the resume. Conversely, weak headlines fail to impress due to their vagueness and lack of specificity, leaving hiring managers without a clear understanding of the candidate’s strengths or how they align with the job requirements. Generic phrases do not capture attention and risk blending in with numerous other applications.

Writing an Exceptional Mortgage Loss Mitigation Specialist Resume Summary

A resume summary is a crucial component for a Mortgage Loss Mitigation Specialist as it serves as the first impression a potential employer will have of a candidate. A well-crafted summary quickly captures the attention of hiring managers by succinctly highlighting the applicant's key skills, relevant experience, and notable accomplishments specific to the role. It should be concise yet impactful, tailored to align with the job description, and designed to showcase how the candidate can contribute to the organization’s goals regarding loss mitigation and customer support.

Best Practices for Writing a Mortgage Loss Mitigation Specialist Resume Summary

- Quantify Achievements: Use numbers and percentages to demonstrate your impact in previous roles.

- Focus on Relevant Skills: Highlight skills that are directly applicable to loss mitigation, such as negotiation, customer service, and problem-solving.

- Tailor to the Job Description: Customize your summary for each application to reflect the specific requirements and keywords of the job.

- Be Concise: Aim for 3-5 sentences that clearly convey your value without overwhelming the reader.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey confidence and initiative.

- Highlight Industry Knowledge: Mention any specific knowledge of mortgage products or regulations that can set you apart.

- Showcase Customer-Centric Approach: Emphasize your commitment to helping clients navigate financial challenges.

- Include Relevant Certifications: If applicable, mention any certifications or training that enhance your qualifications in loss mitigation.

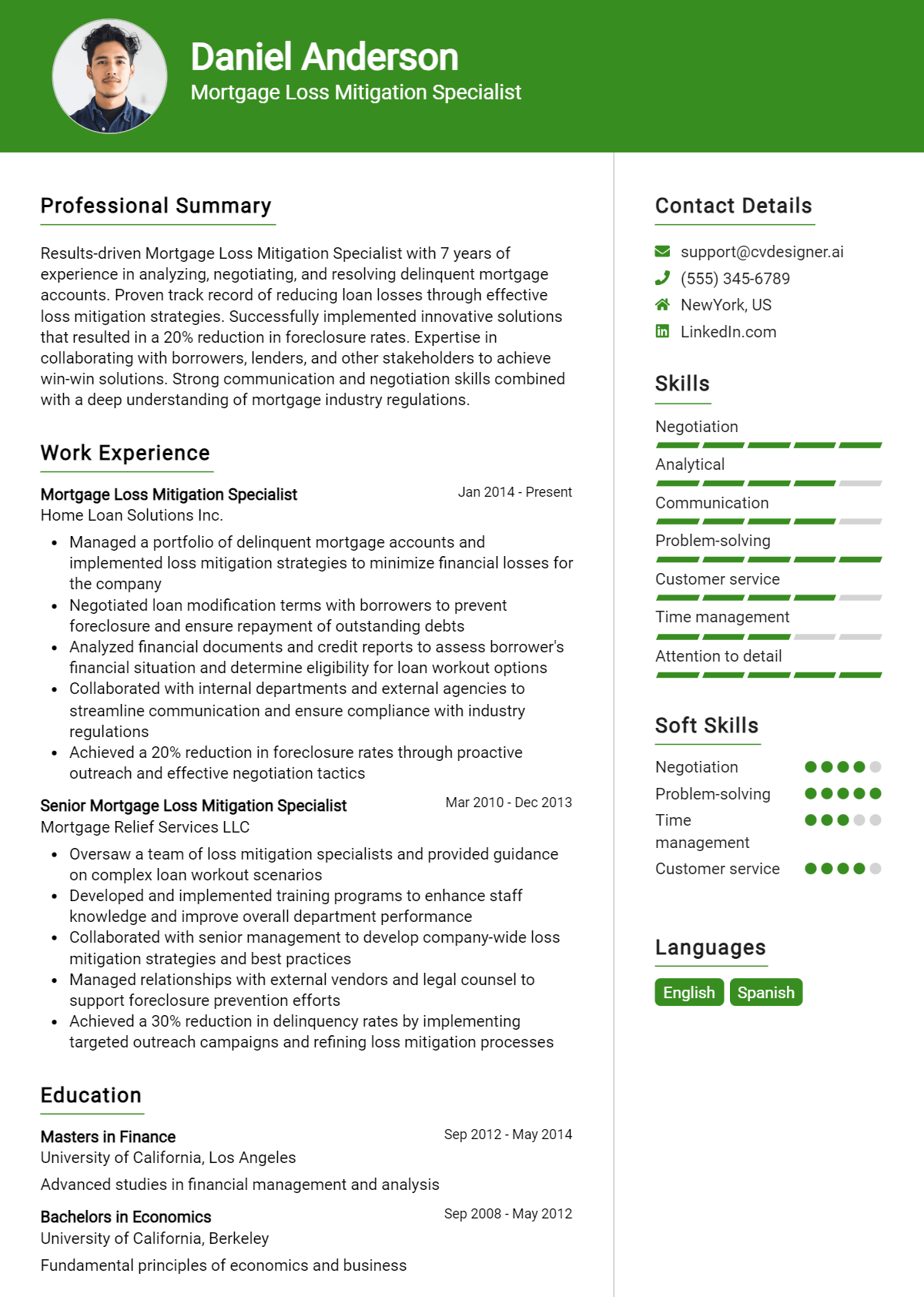

Example Mortgage Loss Mitigation Specialist Resume Summaries

Strong Resume Summaries

Proven Mortgage Loss Mitigation Specialist with over 5 years of experience in negotiating loan modifications and short sales, achieving a 90% success rate in helping clients avoid foreclosure. Skilled in analyzing financial situations and developing tailored solutions that prioritize customer satisfaction.

Detail-oriented professional with a track record of reducing loss mitigation timelines by 30% through effective communication and collaboration with borrowers and lenders. Expertise in mortgage compliance and risk assessment, ensuring adherence to industry regulations while providing exceptional client support.

Results-driven Loss Mitigation Specialist with a strong background in financial analysis and customer service. Successfully managed a portfolio of over 200 accounts, leading to a 40% increase in loan modifications and a 25% decrease in delinquency rates within one year.

Weak Resume Summaries

I have experience in loss mitigation and am looking for a job in the mortgage industry.

Dedicated professional with skills in customer service and mortgage processes, seeking an opportunity to help clients.

The examples of strong resume summaries effectively demonstrate the candidate's achievements and skills with quantifiable results, making them relevant and appealing to hiring managers. In contrast, the weak summaries lack specificity, measurable outcomes, and appear generic, which fails to capture the attention of potential employers or convey the candidate's true capabilities in the field of mortgage loss mitigation.

Work Experience Section for Mortgage Loss Mitigation Specialist Resume

The work experience section of a Mortgage Loss Mitigation Specialist resume is pivotal in demonstrating the candidate's technical proficiency, team management capabilities, and commitment to delivering high-quality outcomes. This section acts as a narrative of professional growth and expertise, showcasing how the candidate has effectively navigated complex situations in the mortgage industry. It is essential to quantify achievements and align experiences with industry standards, as this not only emphasizes the candidate's value but also highlights their potential to contribute positively to future employers.

Best Practices for Mortgage Loss Mitigation Specialist Work Experience

- Use specific metrics to quantify achievements, such as percentages of loan modifications achieved or reduction in foreclosure rates.

- Highlight technical skills relevant to loss mitigation, such as proficiency in mortgage software and understanding of regulatory compliance.

- Emphasize collaboration with teams, demonstrating your ability to work cross-functionally to achieve common goals.

- Detail leadership roles taken in projects or initiatives, showcasing your ability to manage and mentor others.

- Focus on results-driven statements that reflect your contributions to process improvements and efficiency gains.

- Align your experiences with industry standards and best practices to exhibit relevant knowledge and expertise.

- Utilize action verbs to convey your role in achieving outcomes more dynamically.

- Maintain clarity and conciseness to ensure potential employers can quickly gauge your qualifications.

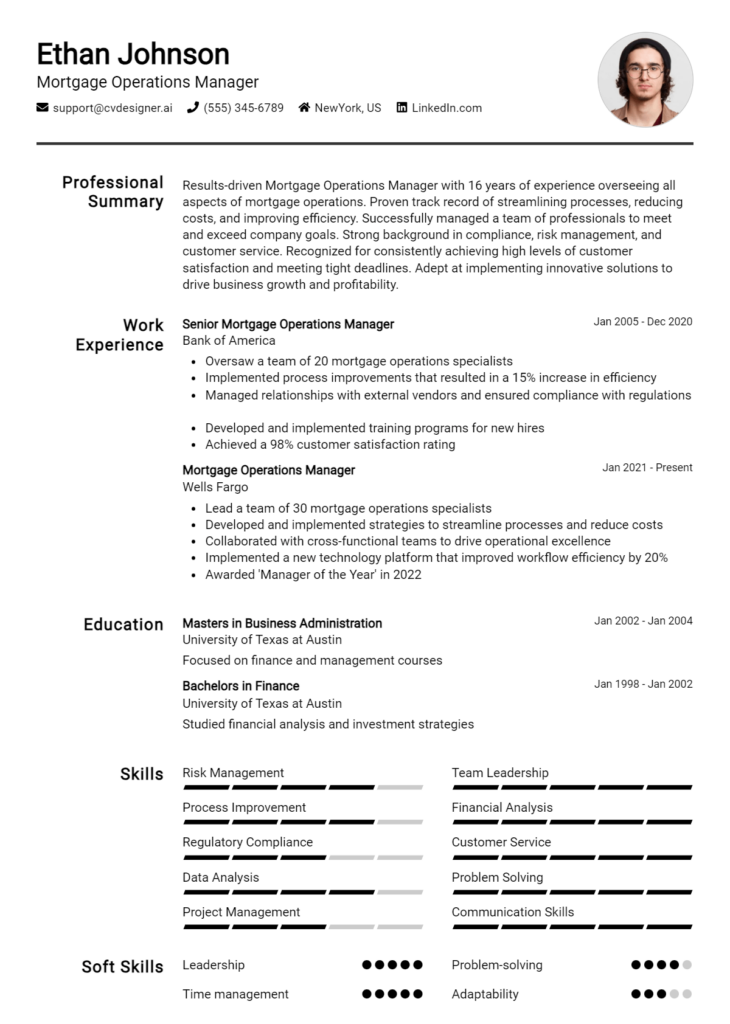

Example Work Experiences for Mortgage Loss Mitigation Specialist

Strong Experiences

- Successfully negotiated loan modifications for over 200 clients, resulting in a 35% reduction in foreclosure rates within a year.

- Led a team of 5 loss mitigation specialists in implementing a new software platform, improving processing time by 40%.

- Developed and executed a training program for new hires, which increased team productivity by 20% within the first quarter.

- Collaborated with legal and compliance departments to ensure 100% adherence to regulatory standards, resulting in zero compliance violations over two years.

Weak Experiences

- Worked on loan modifications.

- Assisted in team projects.

- Helped clients with mortgage issues.

- Participated in training sessions.

The examples provided illustrate the distinction between strong and weak experiences in a resume. Strong experiences are characterized by specific, quantifiable accomplishments that demonstrate a clear impact on business outcomes, showcasing leadership and collaboration. In contrast, weak experiences lack detail and fail to convey significant contributions, making them less compelling to potential employers. Clear, results-oriented statements are essential in setting a candidate apart in the competitive field of mortgage loss mitigation.

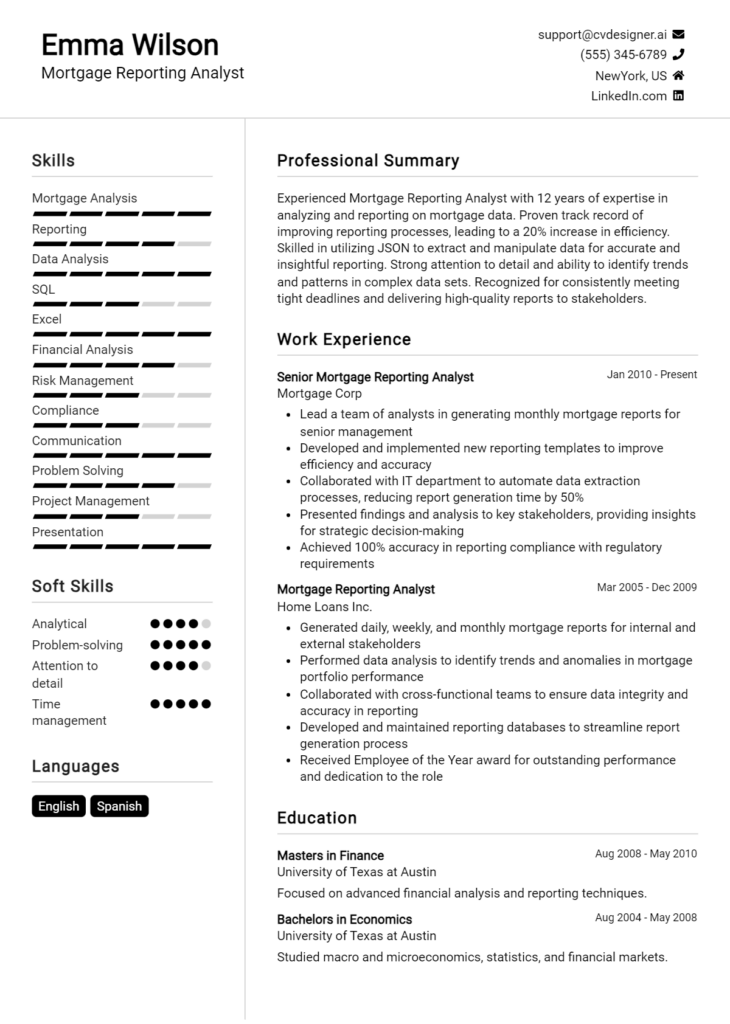

Education and Certifications Section for Mortgage Loss Mitigation Specialist Resume

The education and certifications section of a Mortgage Loss Mitigation Specialist resume is crucial for demonstrating a candidate's academic background and professional qualifications. This section not only showcases relevant degrees but also highlights industry-recognized certifications and continuous learning efforts that are vital in a field that evolves with financial regulations and market conditions. By providing detailed information about relevant coursework and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the job role, making them more attractive to potential employers.

Best Practices for Mortgage Loss Mitigation Specialist Education and Certifications

- Include only relevant degrees and certifications directly related to mortgage lending, finance, or loss mitigation.

- Detail specific coursework that pertains to loss mitigation strategies, loan modification processes, and financial analysis.

- Highlight advanced or industry-recognized credentials, such as Certified Mortgage Specialist (CMS) or Certified Financial Planner (CFP).

- List any additional training or workshops that demonstrate ongoing education in the field.

- Use clear and concise language to describe your educational accomplishments and certifications.

- Order the information chronologically, with the most recent achievements listed first.

- Include the name of institutions, dates of attendance, and any honors received to add credibility.

- Tailor the section to match the job description, emphasizing qualifications that align with the employer's needs.

Example Education and Certifications for Mortgage Loss Mitigation Specialist

Strong Examples

- Bachelor of Science in Finance, XYZ University, 2018

- Certified Mortgage Specialist (CMS), National Association of Mortgage Professionals, 2020

- Coursework in Risk Management and Loss Mitigation Strategies, ABC College, 2019

- Completed training in Foreclosure Prevention and Loan Modification Techniques, 2021

Weak Examples

- Associate Degree in General Studies, DEF Community College, 2015

- Certification in Office Administration, GHI Institute, 2016

- High School Diploma, JKL High School, 2012

- Outdated Real Estate License, 2010

The strong examples listed showcase relevant degrees and certifications that directly support the role of a Mortgage Loss Mitigation Specialist, demonstrating the candidate's expertise and commitment to the field. In contrast, the weak examples reflect qualifications that lack relevance to the position or are outdated, which may not resonate with potential employers looking for candidates with current and applicable knowledge in mortgage loss mitigation. Highlighting pertinent educational achievements is essential for establishing credibility and aligning with job expectations in a competitive job market.

Top Skills & Keywords for Mortgage Loss Mitigation Specialist Resume

As a Mortgage Loss Mitigation Specialist, having the right skills is crucial to effectively assist clients in navigating the complexities of mortgage modifications, repayment plans, and foreclosure alternatives. A well-crafted resume that highlights both hard and soft skills can significantly impact your job prospects in this competitive field. Employers are not only looking for technical expertise but also for individuals who can empathize with clients, communicate clearly, and negotiate effectively. By showcasing a blend of these skills, you can demonstrate your capability to provide valuable support to distressed homeowners and contribute positively to their financial well-being.

Top Hard & Soft Skills for Mortgage Loss Mitigation Specialist

Soft Skills

- Empathy

- Active Listening

- Strong Communication

- Negotiation Skills

- Problem-Solving

- Time Management

- Attention to Detail

- Customer Service Orientation

- Conflict Resolution

- Adaptability

- Team Collaboration

- Stress Management

- Patience

- Decision-Making

- Cultural Sensitivity

Hard Skills

- Knowledge of Mortgage Regulations

- Loss Mitigation Strategies

- Financial Analysis

- Risk Assessment

- Proficiency in Loan Servicing Software

- Data Entry and Management

- Familiarity with Foreclosure Processes

- Customer Relationship Management (CRM) Systems

- Microsoft Office Suite (Excel, Word, PowerPoint)

- Document Review and Compliance

- Understanding of Credit Reporting

- Case Management Techniques

- Financial Counseling

- Report Generation

- Use of Financial Modeling Tools

- Ability to Interpret Financial Statements

- Legal Knowledge Related to Mortgages

- Debt Restructuring Techniques

For more information on how to effectively incorporate skills and work experience into your resume, consider exploring resources that can help you highlight your qualifications and stand out to potential employers.

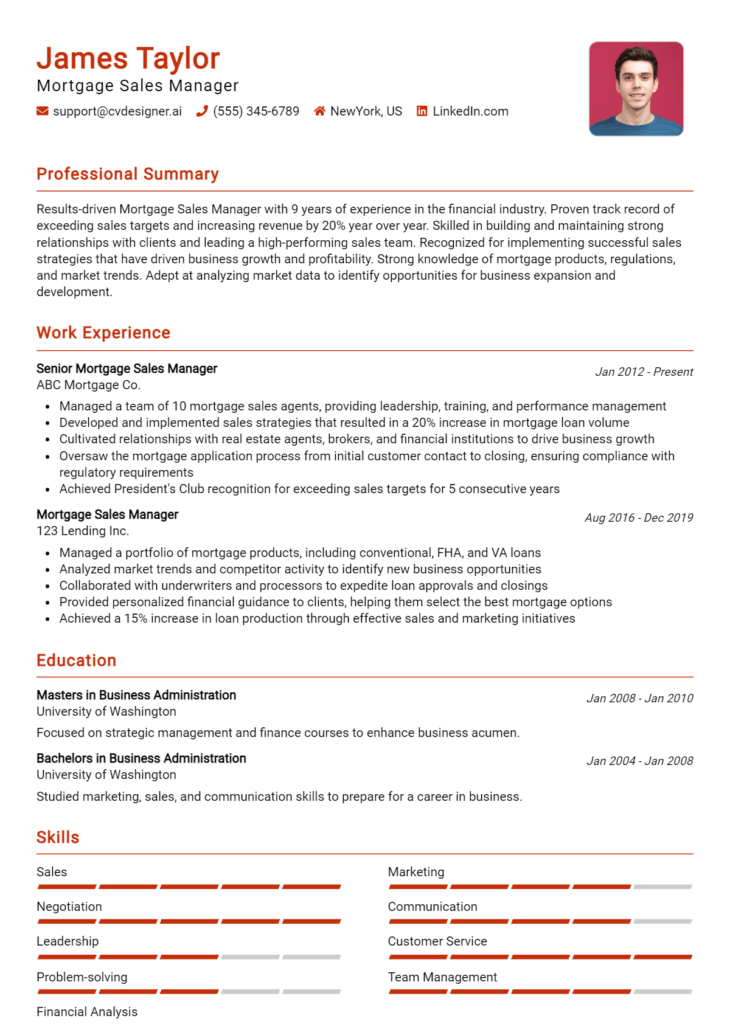

Stand Out with a Winning Mortgage Loss Mitigation Specialist Cover Letter

As a dedicated and detail-oriented professional with over five years of experience in mortgage loss mitigation, I am excited to apply for the Mortgage Loss Mitigation Specialist position at [Company Name]. My background in financial services and my passion for helping clients navigate difficult situations have equipped me with the knowledge and skills necessary to effectively assist homeowners facing potential foreclosure. I am eager to bring my expertise in loss mitigation strategies and my commitment to customer service to your esteemed organization.

Throughout my career, I have successfully managed a diverse portfolio of accounts, working closely with clients to assess their financial situations and develop tailored solutions that align with their needs. I have a proven track record of negotiating with lenders to secure loan modifications, repayment plans, and short sales, helping clients retain their homes or transition to new housing arrangements with dignity. My strong analytical skills enable me to evaluate complex financial documents efficiently, ensuring that I make informed recommendations that benefit both the client and the lender.

In addition to my technical competencies, I pride myself on my ability to communicate effectively and empathetically with clients. Understanding that each situation is unique, I take the time to listen to clients' concerns and provide them with clear and concise information about their options. This personalized approach has not only fostered trust and rapport but has also resulted in high client satisfaction rates and successful outcomes. I am excited about the opportunity to contribute to [Company Name]’s mission to support homeowners and promote financial stability in the community.

I am confident that my proactive approach to mortgage loss mitigation, combined with my commitment to excellence, makes me a valuable addition to your team. I look forward to the opportunity to discuss how my experience and vision align with the goals of [Company Name]. Thank you for considering my application; I am eager to bring my skills to your organization and help make a positive impact on the lives of your clients.

Conclusion

In summary, a Mortgage Loss Mitigation Specialist plays a crucial role in helping homeowners navigate financial difficulties and avoid foreclosure. Key responsibilities include assessing borrower situations, developing repayment plans, negotiating with lenders, and providing education on mortgage options. This position requires strong communication skills, empathy, and a thorough understanding of mortgage products and regulations.

As you reflect on your career as a Mortgage Loss Mitigation Specialist, it's essential to ensure that your resume effectively showcases your skills and experiences. Take the time to review and update your resume to highlight your qualifications in this vital field.

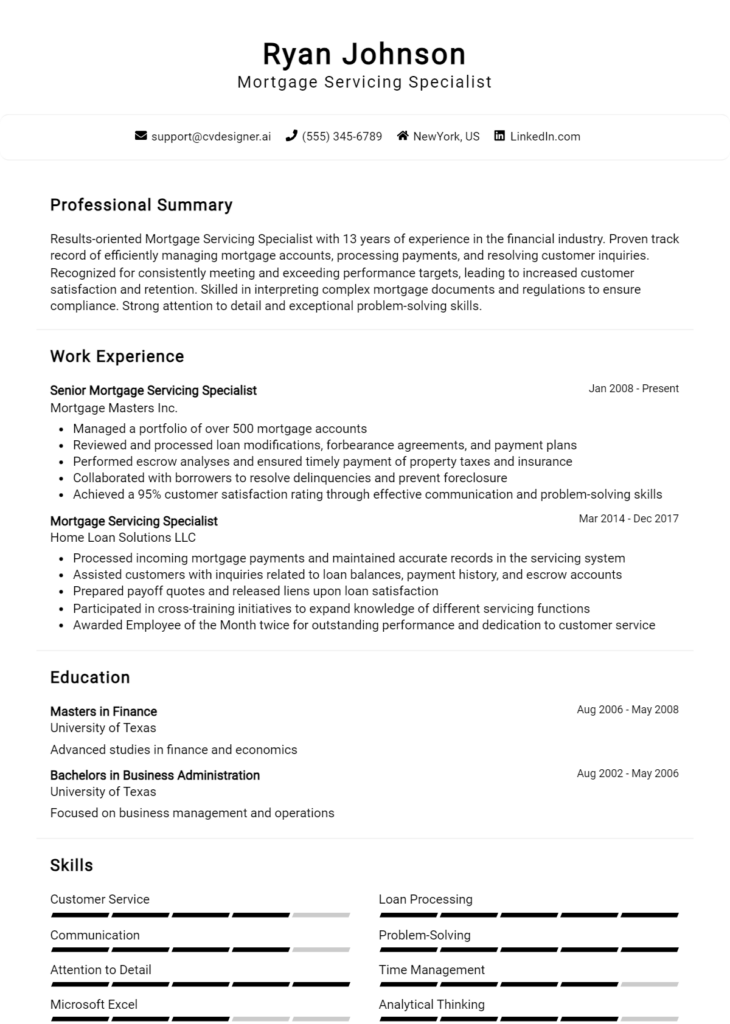

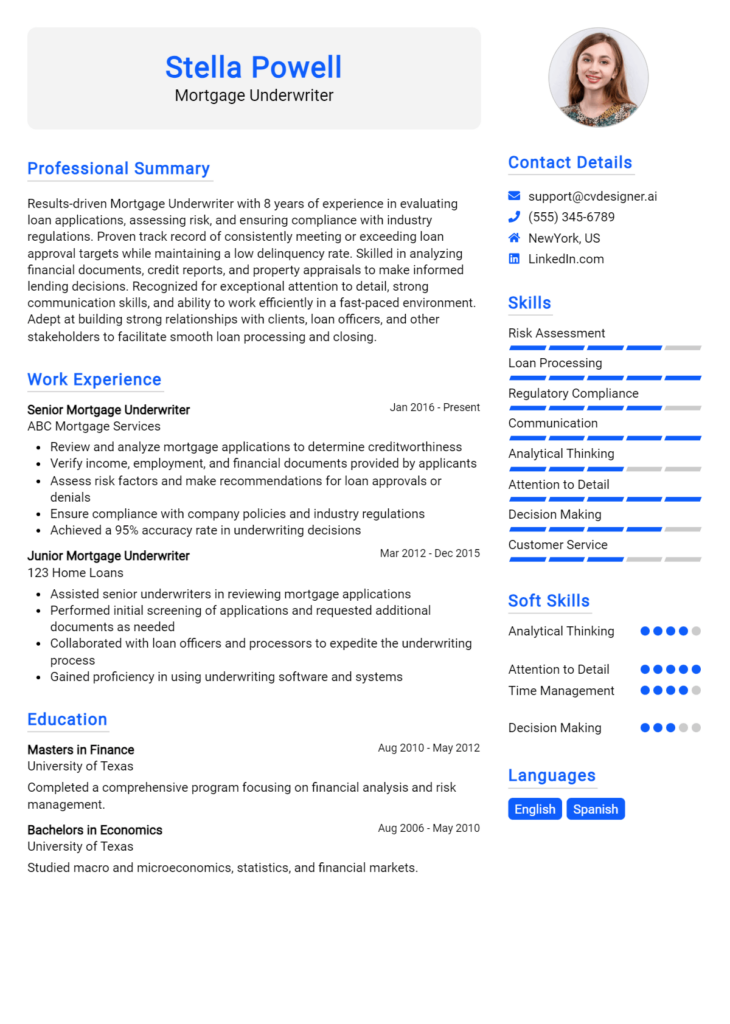

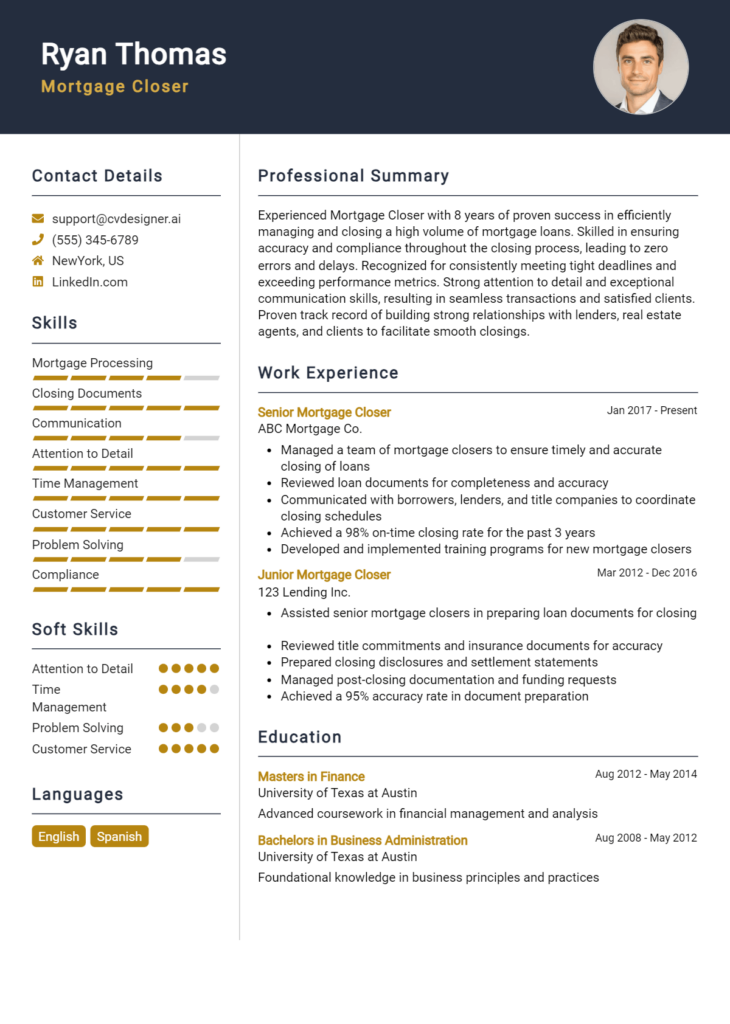

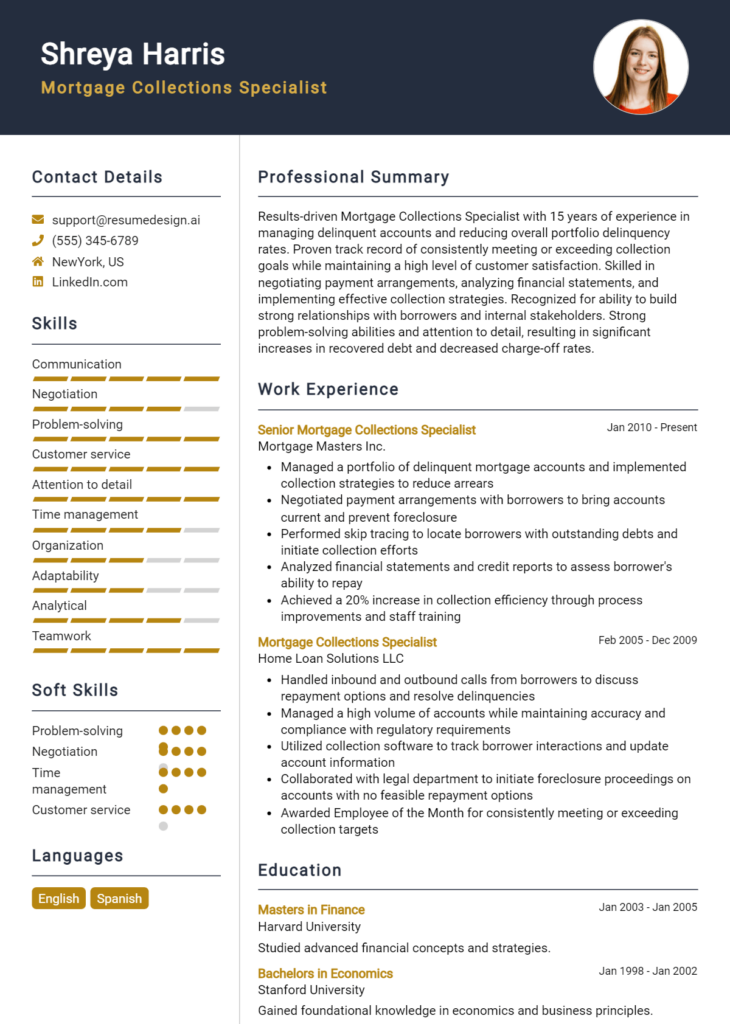

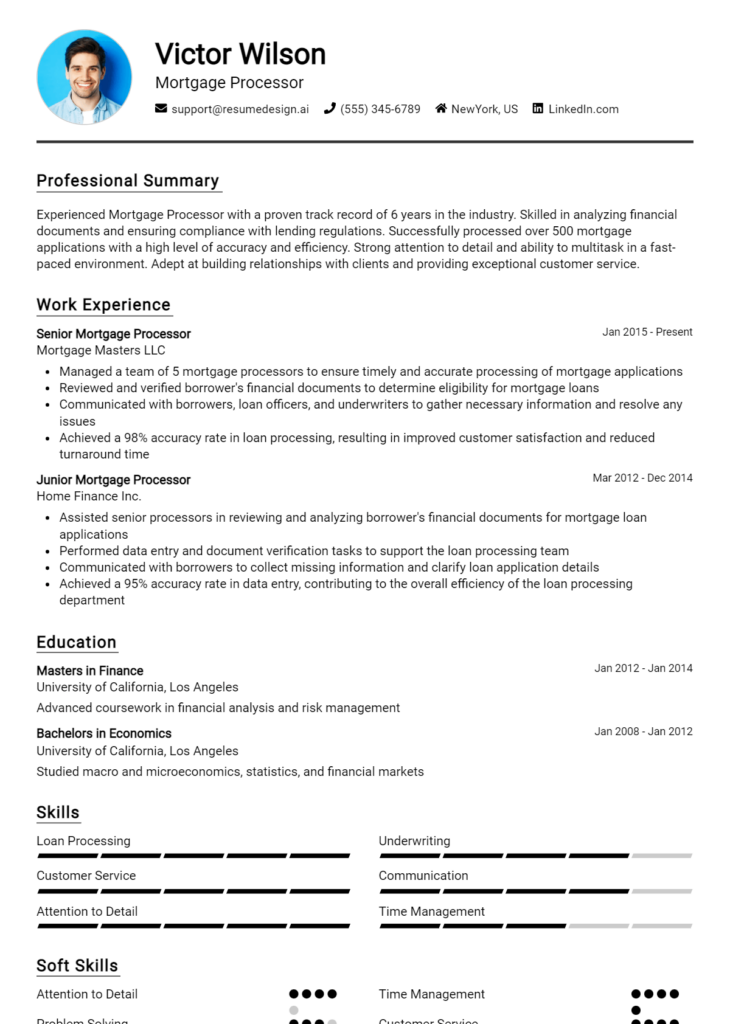

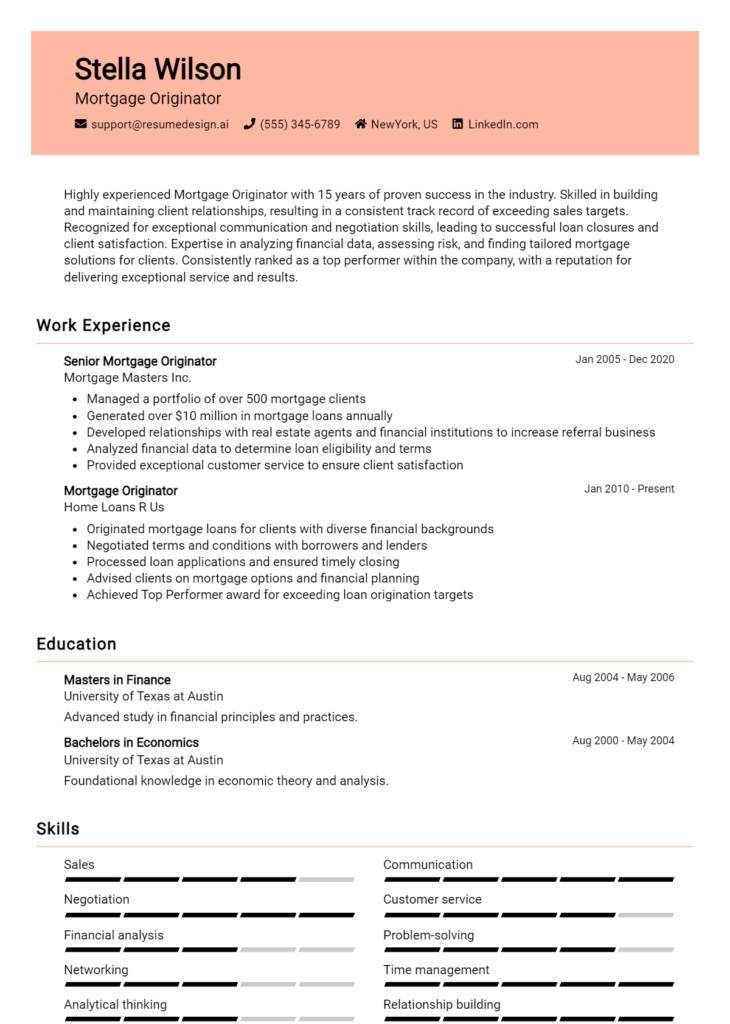

To assist you in this process, consider utilizing available resources such as resume templates, which can provide a professional layout for your information. You might also find the resume builder helpful for creating a tailored resume that stands out. Additionally, exploring resume examples can provide inspiration for how to present your achievements effectively. Don't forget the importance of a compelling introduction—check out the cover letter templates to make a strong first impression.

Take action today to enhance your resume and position yourself for success in the mortgage industry!