Mortgage Fraud Investigator Core Responsibilities

A Mortgage Fraud Investigator plays a crucial role in safeguarding a financial institution's integrity by detecting and preventing fraudulent mortgage activities. Key responsibilities include analyzing loan applications, conducting interviews, and collaborating with legal and compliance departments. Essential skills encompass technical proficiency in data analysis, operational acumen for process evaluation, and strong problem-solving abilities to navigate complex fraud schemes. These competencies are vital for achieving organizational objectives, and a well-structured resume can effectively highlight these qualifications, showcasing a candidate's potential impact.

Common Responsibilities Listed on Mortgage Fraud Investigator Resume

- Conduct thorough investigations of mortgage applications for potential fraud.

- Analyze financial documents and transaction histories to identify discrepancies.

- Collaborate with underwriting, legal, and compliance departments.

- Interview applicants and relevant parties to gather information.

- Prepare detailed reports outlining findings and recommendations.

- Stay updated on industry regulations and fraud trends.

- Coordinate with law enforcement agencies when necessary.

- Review and enhance internal fraud detection processes.

- Present findings to management and assist in implementing corrective measures.

- Utilize advanced data analysis tools to assess risk levels.

- Train staff on identifying and reporting suspicious activities.

High-Level Resume Tips for Mortgage Fraud Investigator Professionals

In the competitive field of mortgage fraud investigation, a well-crafted resume is essential for making a strong first impression on potential employers. Your resume serves as your personal marketing tool, showcasing your skills, experience, and achievements to stand out in a crowded job market. As a Mortgage Fraud Investigator, your resume must not only highlight your investigative abilities but also reflect your knowledge of industry regulations and your track record of successful fraud detection. This guide will provide practical and actionable resume tips specifically tailored for professionals in the mortgage fraud investigation sector, helping you to create a compelling narrative that captures the attention of hiring managers.

Top Resume Tips for Mortgage Fraud Investigator Professionals

- Tailor your resume for each job application by closely aligning your skills and experiences with the specific job description.

- Highlight relevant investigations you have conducted, emphasizing your role and the outcomes achieved.

- Quantify your achievements with specific metrics, such as the amount of fraudulent activity detected or the percentage of cases resolved successfully.

- Include industry-specific certifications and training, such as Certified Fraud Examiner (CFE) or specialized mortgage fraud courses.

- Showcase your familiarity with regulatory compliance, including knowledge of laws and regulations that govern mortgage lending and fraud detection.

- Utilize action verbs to describe your experiences, such as "investigated," "analyzed," "collaborated," and "reported," to convey your proactive approach.

- Incorporate keywords from the job listing to pass through Applicant Tracking Systems (ATS) and catch the employer’s eye.

- Highlight your analytical and problem-solving skills, as these are critical in identifying and addressing fraudulent activities.

- Include a professional summary at the top of your resume that encapsulates your expertise and career goals in mortgage fraud investigation.

- Keep your resume concise and focused, ideally one page, to ensure that hiring managers can quickly grasp your qualifications.

By implementing these tips, you can significantly enhance your resume's effectiveness, increasing your chances of landing a job in the Mortgage Fraud Investigator field. A targeted and polished resume will not only showcase your qualifications but also demonstrate your commitment to excellence in this critical area of financial security.

Why Resume Headlines & Titles are Important for Mortgage Fraud Investigator

In the competitive field of mortgage fraud investigation, crafting a compelling resume is essential for standing out among a sea of candidates. The resume headline or title serves as the first impression a hiring manager will have, encapsulating a candidate's key qualifications and expertise in a succinct manner. A strong headline should be impactful, highlighting relevant skills and experiences that align directly with the job requirements. This strategic approach allows candidates to immediately grab the attention of hiring managers and set the stage for a deeper evaluation of their qualifications, making the headline a pivotal element in the resume.

Best Practices for Crafting Resume Headlines for Mortgage Fraud Investigator

- Keep it concise: Aim for a headline that is brief yet informative, ideally under 10 words.

- Be role-specific: Tailor the headline to reflect the specific position of Mortgage Fraud Investigator.

- Highlight key qualifications: Include core skills or certifications that are relevant to fraud investigation.

- Use action-oriented language: Employ strong verbs that convey proactive and results-driven qualities.

- Incorporate industry keywords: Use relevant terminology that aligns with the job description for better visibility.

- Avoid jargon: Ensure the language is clear and understandable to a broad audience.

- Showcase your experience level: Indicate years of experience or notable achievements in the field.

- Make it unique: Differentiate your headline from generic titles by including specific details about your expertise.

Example Resume Headlines for Mortgage Fraud Investigator

Strong Resume Headlines

Certified Mortgage Fraud Investigator with 7+ Years of Experience

Detail-Oriented Analyst Specializing in Fraud Detection and Prevention

Proven Track Record of Identifying and Mitigating Mortgage Fraud Risks

Experienced Investigator with Expertise in Compliance and Regulatory Standards

Weak Resume Headlines

Mortgage Investigator

Looking for a Job in Fraud Investigation

Experienced Professional

The strong headlines are effective because they immediately communicate the candidate's specific qualifications and achievements related to mortgage fraud investigation. They utilize impactful language and relevant keywords, making them attractive to hiring managers seeking qualified candidates. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail, offering no insights into the applicant's skills or experiences, ultimately blending in with countless other resumes that may not stand out in a crowded job market.

Writing an Exceptional Mortgage Fraud Investigator Resume Summary

A well-crafted resume summary is crucial for a Mortgage Fraud Investigator, as it serves as a powerful introduction that quickly captures the attention of hiring managers. This brief yet impactful section of the resume showcases the candidate's key skills, relevant experience, and notable accomplishments in the field of mortgage fraud detection and prevention. A strong summary not only highlights what makes the candidate stand out but also aligns their qualifications with the specific requirements of the job they are applying for. By being concise and tailored, the resume summary can set the tone for the rest of the application, making it an essential component in the competitive job market.

Best Practices for Writing a Mortgage Fraud Investigator Resume Summary

- Quantify achievements to demonstrate impact, such as money saved or fraud cases resolved.

- Focus on relevant skills that align with the job description, such as analytical skills or knowledge of fraud detection software.

- Tailor the summary specifically for each job application to reflect the employer's needs.

- Use active language to convey a sense of urgency and capability.

- Keep it concise, ideally within 3-5 sentences, to maintain the reader's attention.

- Highlight certifications or specialized training relevant to mortgage fraud investigation.

- Incorporate industry-specific terminology to show familiarity with the field.

- Showcase a keen understanding of regulatory compliance and risk management practices.

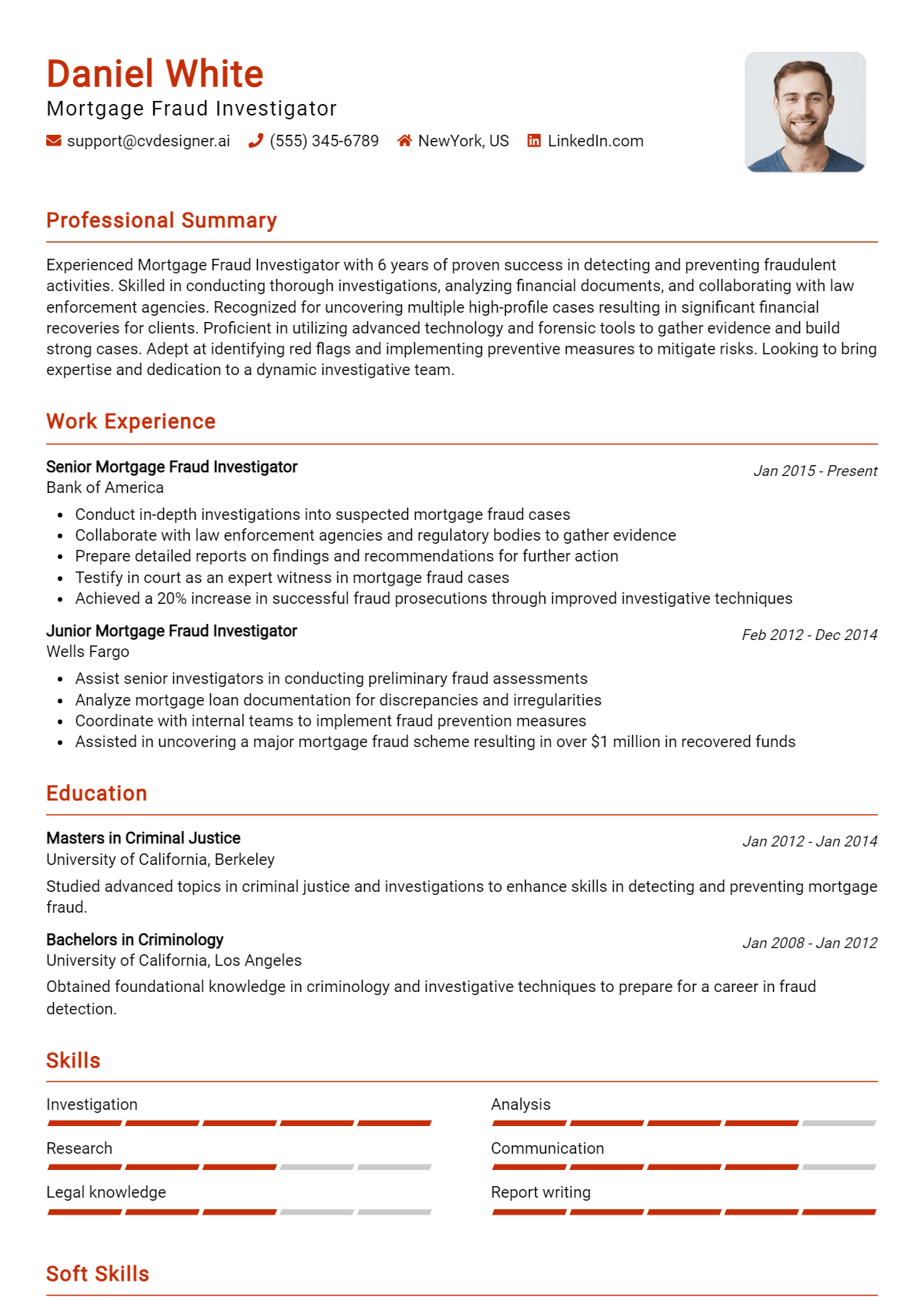

Example Mortgage Fraud Investigator Resume Summaries

Strong Resume Summaries

Results-driven Mortgage Fraud Investigator with over 7 years of experience in identifying and preventing fraudulent activities, saving organizations an estimated $2 million annually. Proven expertise in analyzing complex financial documents and employing advanced investigative techniques to uncover deceptive practices.

Detail-oriented professional with a track record of successfully resolving over 150 mortgage fraud cases, utilizing strong analytical skills and forensic accounting methods. Certified Fraud Examiner (CFE) with a comprehensive understanding of federal regulations and compliance standards.

Accomplished Mortgage Fraud Investigator with 10+ years in the financial services sector, recognized for implementing innovative fraud detection systems that reduced false positives by 30%. Adept at collaborating with law enforcement agencies to facilitate legal actions against offenders.

Weak Resume Summaries

Experienced investigator looking for a job in mortgage fraud. I have skills that could be useful.

Seeking a position as a Mortgage Fraud Investigator where I can apply my knowledge and skills to help the company.

The strong resume summaries are effective because they provide specific details about the candidates' achievements and relevant experience, utilizing quantifiable metrics that demonstrate their impact in previous roles. In contrast, the weak summaries lack specificity and measurable outcomes, making them too general and unremarkable. They fail to capture the essence of what makes the candidate a strong fit for the position, ultimately diminishing their chances of standing out in a competitive job market.

Work Experience Section for Mortgage Fraud Investigator Resume

The work experience section of a Mortgage Fraud Investigator resume is critical as it serves as a comprehensive showcase of a candidate's professional journey, emphasizing their technical skills, leadership abilities, and capacity to produce high-quality outcomes. This section not only highlights relevant experiences but also allows candidates to illustrate their expertise in detecting and preventing mortgage fraud through quantifiable achievements. Aligning past experiences with industry standards is essential, as it demonstrates an understanding of the field and the ability to apply knowledge effectively in real-world scenarios.

Best Practices for Mortgage Fraud Investigator Work Experience

- Clearly outline technical skills related to mortgage fraud detection and investigation.

- Quantify achievements with metrics, such as percentage of fraud cases resolved or financial impacts mitigated.

- Highlight collaboration with law enforcement and other stakeholders in fraud investigations.

- Include specific tools and technologies used in investigations to demonstrate technical proficiency.

- Detail leadership roles in team projects or initiatives that improved fraud detection methodologies.

- Tailor experience descriptions to reflect industry standards and key competencies valued by employers.

- Use action verbs to convey initiative and impact in previous roles.

- Keep descriptions concise while providing enough detail to convey depth of experience.

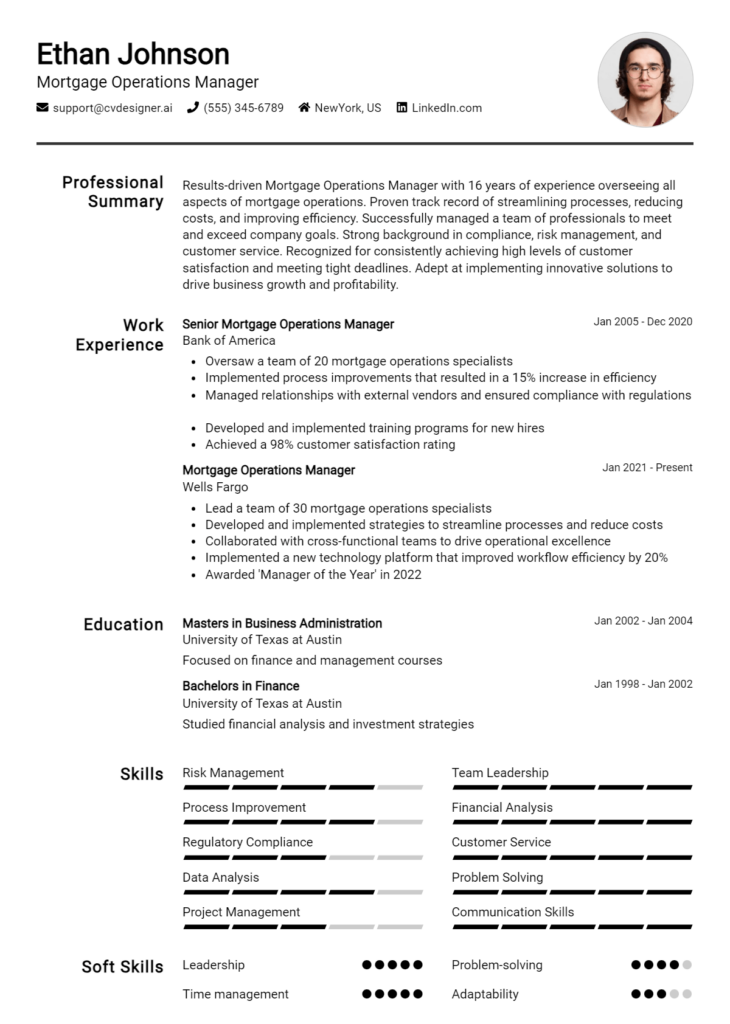

Example Work Experiences for Mortgage Fraud Investigator

Strong Experiences

- Led a team of 10 investigators to successfully uncover a $5 million mortgage fraud scheme, resulting in the prosecution of three individuals and a 30% increase in detection rates.

- Implemented a new data analytics tool that reduced investigation time by 25%, enhancing the team’s efficiency in identifying suspicious activity.

- Collaborated with federal law enforcement agencies to resolve over 100 cases of mortgage fraud, contributing to a 40% reduction in fraud-related losses for the organization.

Weak Experiences

- Worked on mortgage fraud cases.

- Assisted in some investigations and helped with paperwork.

- Participated in team discussions about fraud detection.

The examples presented above illustrate the distinction between strong and weak experiences in a Mortgage Fraud Investigator's resume. Strong experiences are characterized by specific accomplishments and quantifiable results that demonstrate a candidate's impact and technical leadership. In contrast, weak experiences lack detail and fail to convey meaningful contributions or outcomes, which can diminish a candidate's appeal to potential employers.

Education and Certifications Section for Mortgage Fraud Investigator Resume

The education and certifications section of a Mortgage Fraud Investigator resume plays a crucial role in establishing the candidate's qualifications and expertise in the field. This section not only showcases the academic background necessary for understanding complex financial systems but also highlights industry-relevant certifications that demonstrate a commitment to professional standards and continuous learning. By providing information on relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and alignment with the job role, making them more appealing to potential employers.

Best Practices for Mortgage Fraud Investigator Education and Certifications

- Focus on relevant degrees, such as Criminal Justice, Finance, or Forensic Accounting.

- Include industry-recognized certifications, such as Certified Fraud Examiner (CFE) or Certified Mortgage Specialist (CMS).

- Highlight any specialized training in mortgage fraud detection or investigation techniques.

- Provide details on relevant coursework related to fraud analysis, risk management, or financial regulations.

- Keep the section concise and focused, avoiding unrelated educational experiences.

- List the most recent certifications first to showcase ongoing professional development.

- Consider including honors or awards received during educational pursuits that demonstrate excellence.

- Use clear formatting to ensure the information is easy to read and understand.

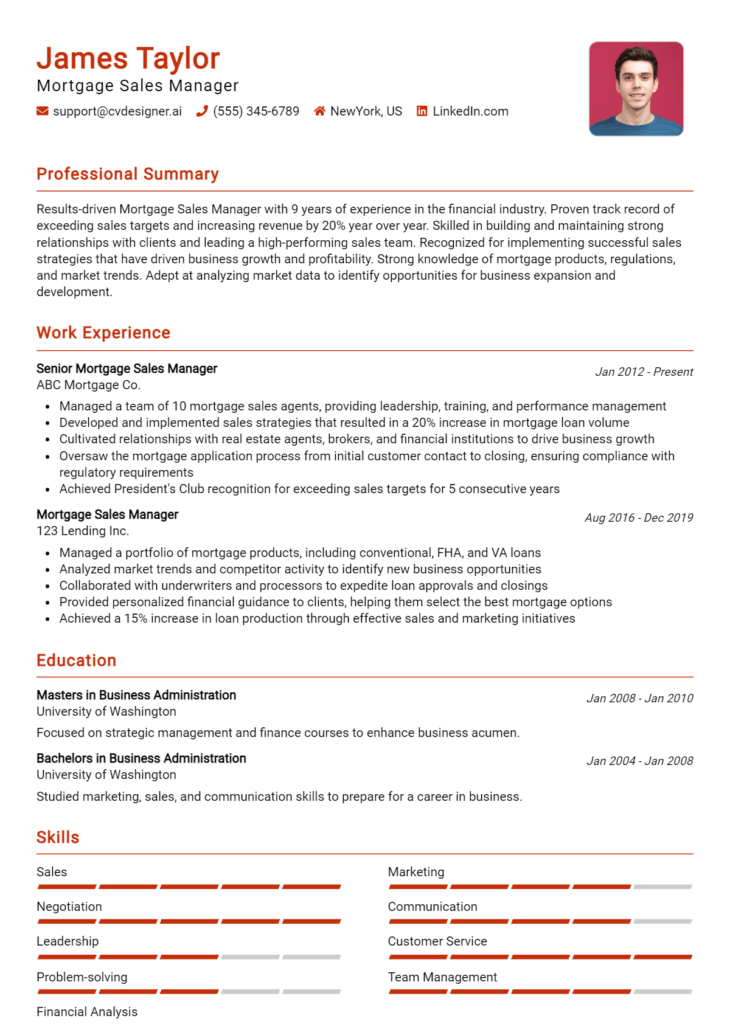

Example Education and Certifications for Mortgage Fraud Investigator

Strong Examples

- Bachelor of Science in Criminal Justice, University of Anytown, Graduated May 2021.

- Certified Fraud Examiner (CFE), Association of Certified Fraud Examiners, 2022.

- Specialized Training in Mortgage Fraud Detection, National Mortgage Fraud Association, 2023.

- Relevant Coursework: Advanced Financial Analysis, Risk Assessment in Lending, and Forensic Accounting Techniques.

Weak Examples

- Bachelor of Arts in English Literature, University of Anytown, Graduated May 2018.

- Certification in Basic Computer Skills, Online Course, 2020.

- High School Diploma, Anytown High School, Graduated June 2016.

- Certificate in Customer Service, Local Community College, 2019.

The strong examples provided are considered effective because they directly relate to the core competencies and knowledge required for a Mortgage Fraud Investigator role, showcasing relevant degrees, certifications, and specialized training. In contrast, the weak examples are ineffective due to their lack of relevance to the mortgage fraud field, highlighting educational qualifications that do not enhance the candidate's suitability for the position.

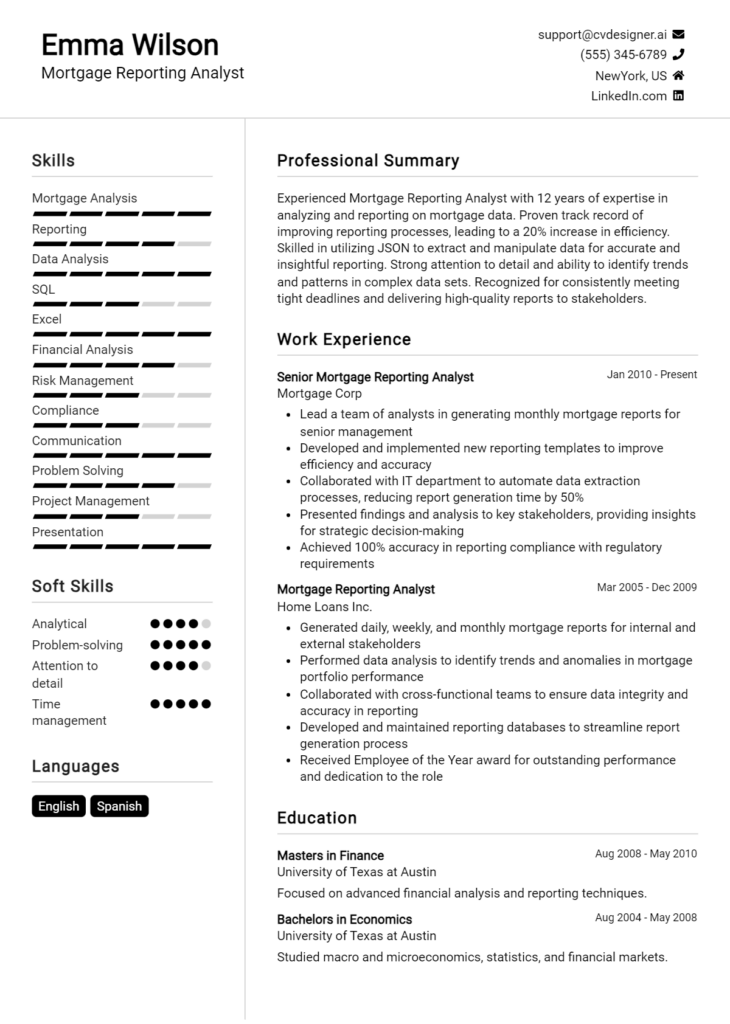

Top Skills & Keywords for Mortgage Fraud Investigator Resume

As a Mortgage Fraud Investigator, showcasing the right skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only have the technical abilities necessary to detect and analyze fraudulent activities but also possess the soft skills that enable effective communication and problem-solving. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing an interview. By demonstrating your expertise in these areas, you can prove your capability to safeguard financial institutions and protect consumers from fraudulent practices.

Top Hard & Soft Skills for Mortgage Fraud Investigator

Soft Skills

- Analytical Thinking

- Attention to Detail

- Communication Skills

- Problem-Solving

- Critical Thinking

- Ethical Judgment

- Time Management

- Interpersonal Skills

- Team Collaboration

- Adaptability

Hard Skills

- Knowledge of Mortgage Regulations

- Fraud Detection Techniques

- Data Analysis

- Financial Reporting

- Risk Assessment

- Investigative Research

- Familiarity with Forensic Accounting

- Proficiency in AML (Anti-Money Laundering) Practices

- Use of Fraud Detection Software

- Understanding of Credit Reporting Systems

By emphasizing these skills on your resume, you can effectively communicate your qualifications as a Mortgage Fraud Investigator. Additionally, don't forget to showcase your relevant work experience that aligns with these skills to further bolster your application.

Stand Out with a Winning Mortgage Fraud Investigator Cover Letter

I am writing to express my interest in the Mortgage Fraud Investigator position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in financial investigations and a keen eye for detail, I am confident in my ability to identify fraudulent activities and protect the integrity of mortgage lending practices. My experience in analyzing financial documents, coupled with my proficiency in utilizing investigative tools and techniques, has equipped me with the skills necessary to excel in this role.

In my previous position at [Previous Company Name], I successfully led several investigations into mortgage fraud cases, collaborating closely with law enforcement and legal teams to gather evidence and present findings. My analytical skills enabled me to detect inconsistencies in loan applications and financial statements, leading to significant financial recoveries for the institution. I take pride in my ability to communicate effectively with diverse stakeholders, ensuring that all parties are informed throughout the investigation process. This skill has not only aided in building strong professional relationships but also in fostering a culture of transparency and accountability.

I am particularly drawn to the opportunity at [Company Name] because of your commitment to promoting ethical practices in the mortgage industry. I admire your proactive approach to fraud prevention and your dedication to safeguarding both your clients and the financial institution. I am eager to bring my expertise in data analysis and risk assessment to your team, contributing to the innovative strategies you employ in combating mortgage fraud. I am excited about the possibility of working in an environment that values integrity and vigilance.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the goals of [Company Name]. I am enthusiastic about the potential to contribute to your team and help maintain the high ethical standards that define your organization. Please feel free to contact me at [Your Phone Number] or [Your Email] to schedule a conversation.

Common Mistakes to Avoid in a Mortgage Fraud Investigator Resume

When crafting a resume for a Mortgage Fraud Investigator position, it's essential to present your qualifications and experiences effectively. Unfortunately, many candidates make common mistakes that can undermine their chances of landing an interview. By being aware of these pitfalls, you can ensure that your resume stands out for the right reasons. Here are some common mistakes to avoid:

Lack of Specificity: Failing to include specific examples of your experience in mortgage fraud investigations can make your resume vague. Use quantifiable achievements to highlight your expertise.

Ignoring Keywords: Not incorporating industry-specific keywords can lead to your resume being overlooked by applicant tracking systems (ATS). Tailor your resume to include relevant terms related to mortgage fraud and investigation techniques.

Overly Generic Objective Statements: Using a one-size-fits-all objective statement can diminish the impact of your resume. Customize your objective to align with the specific requirements of the Mortgage Fraud Investigator role.

Neglecting Relevant Certifications: Omitting certifications such as Certified Fraud Examiner (CFE) or other relevant credentials can weaken your qualifications. Ensure you highlight any certifications that are pertinent to the role.

Poor Formatting: A cluttered or unprofessional layout can make your resume difficult to read. Use clear headings, bullet points, and consistent formatting to enhance readability and organization.

Including Irrelevant Experience: Listing experience unrelated to mortgage fraud investigation can dilute the focus of your resume. Concentrate on roles and responsibilities that directly relate to the position you are applying for.

Failing to Highlight Soft Skills: Overlooking important soft skills like analytical thinking, attention to detail, and communication can be a missed opportunity. These skills are crucial in the investigative field and should be emphasized.

Typos and Grammatical Errors: Submitting a resume filled with typos or grammatical mistakes can create a negative impression. Always proofread your resume or have someone else review it to ensure it is polished and professional.

Conclusion

As a Mortgage Fraud Investigator, your role is crucial in safeguarding the integrity of the mortgage industry. Key responsibilities include analyzing mortgage applications for discrepancies, conducting thorough investigations into suspicious activity, and collaborating with law enforcement and financial institutions to prevent fraud. It is essential to stay updated on the latest fraud trends and regulatory changes to effectively identify and mitigate risks.

In summary, the importance of a well-crafted resume cannot be overstated. It serves as your first impression and can set you apart in a competitive job market. Make sure your resume highlights your relevant experience, skills, and accomplishments in mortgage fraud investigation.

Now is the perfect time to evaluate your Mortgage Fraud Investigator resume. Are you showcasing your unique qualifications effectively? To assist you in this process, explore the following resources:

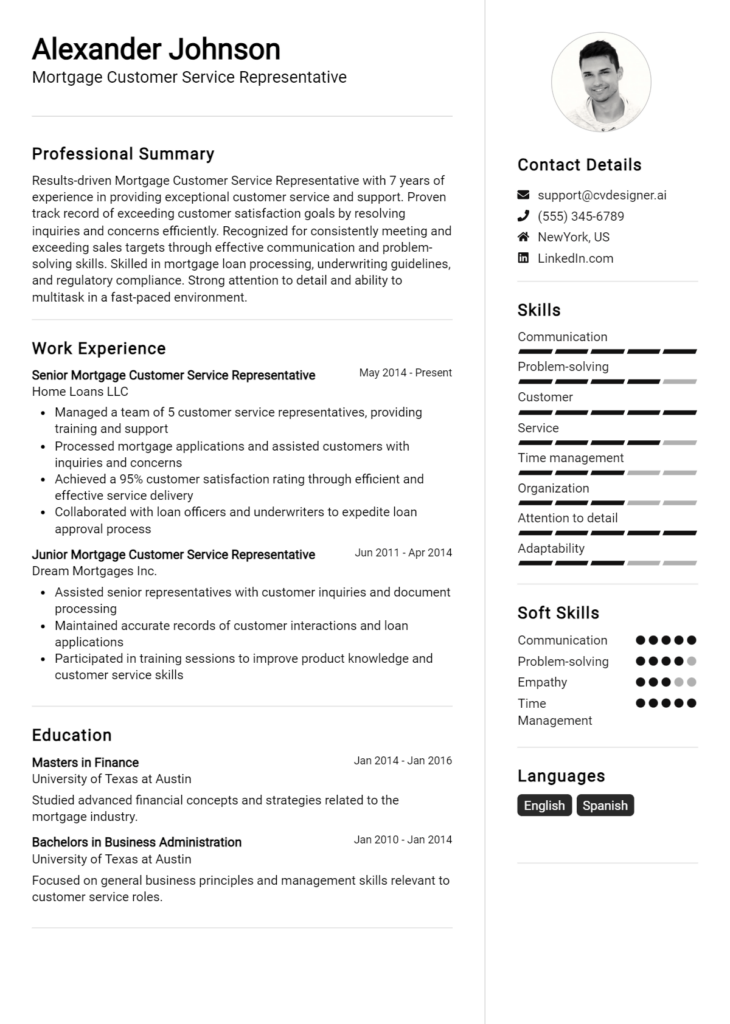

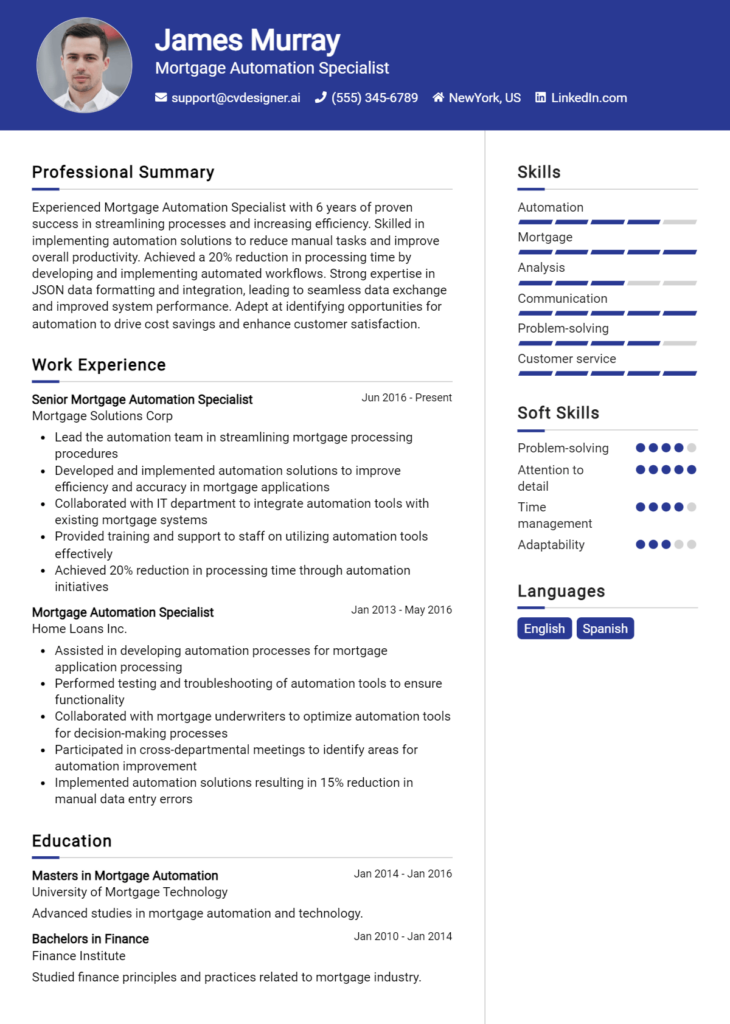

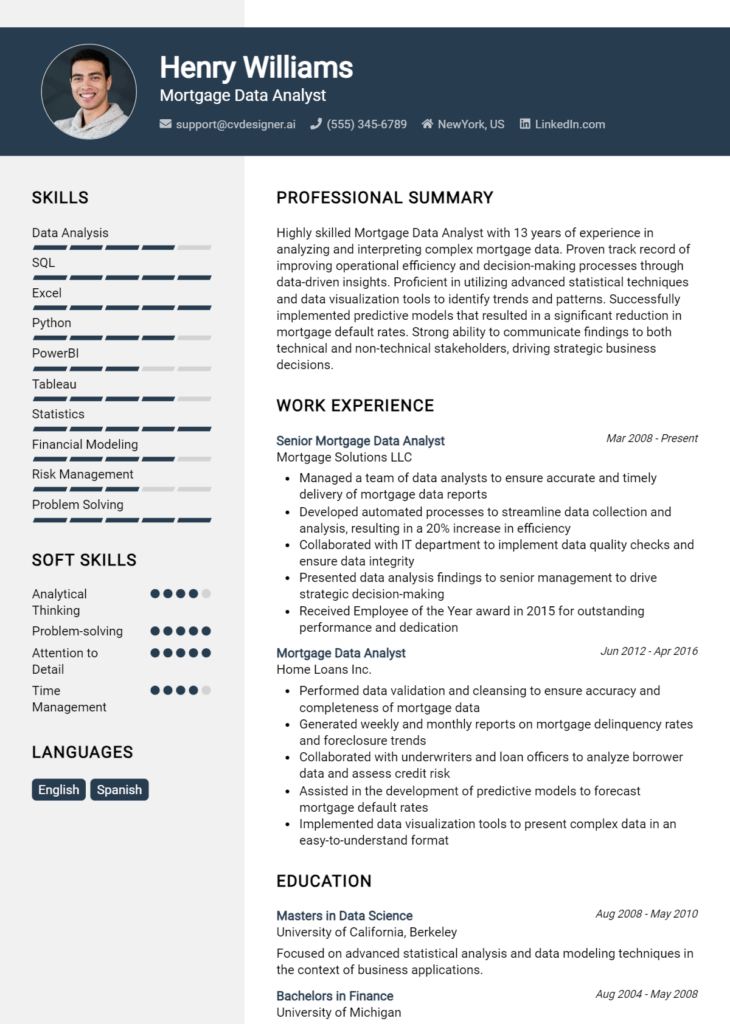

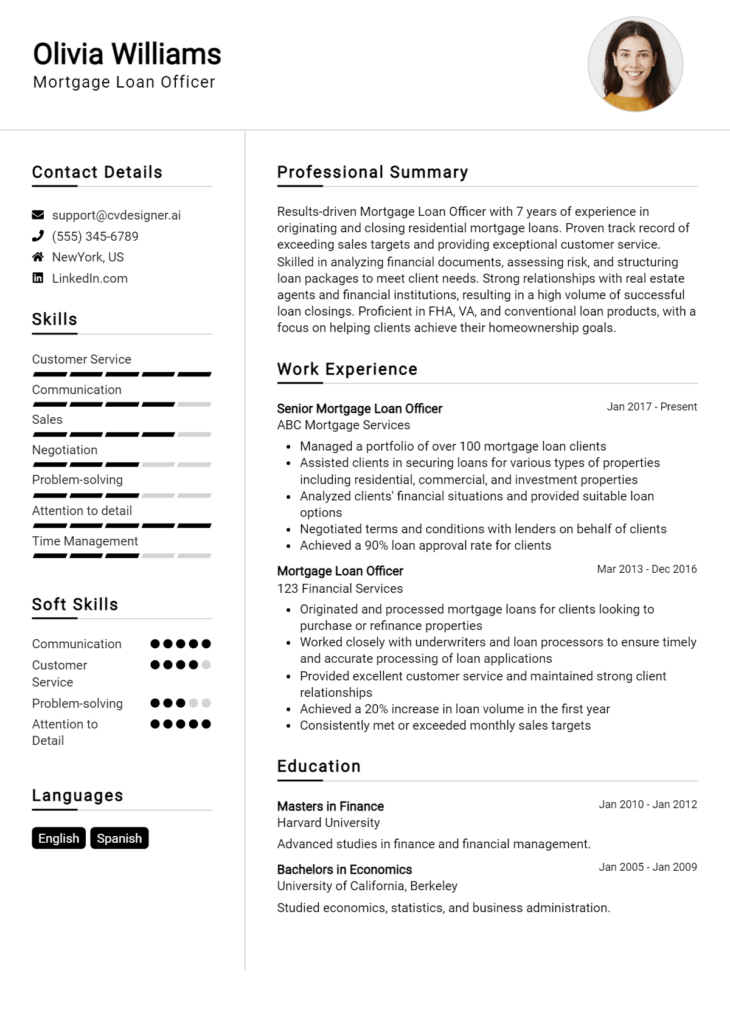

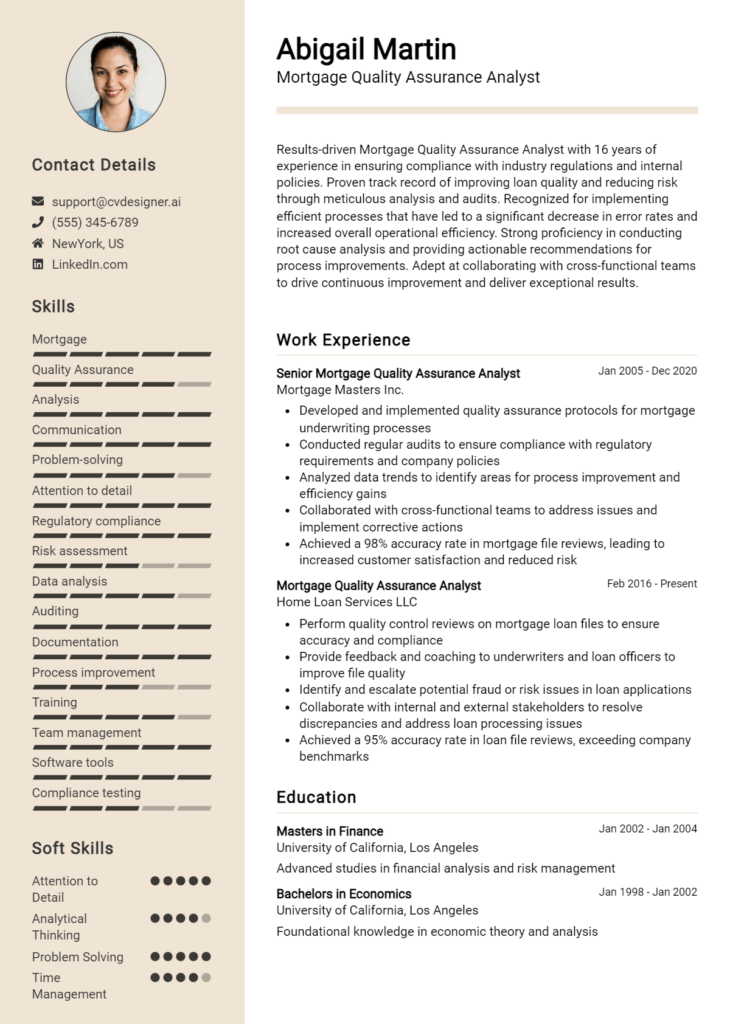

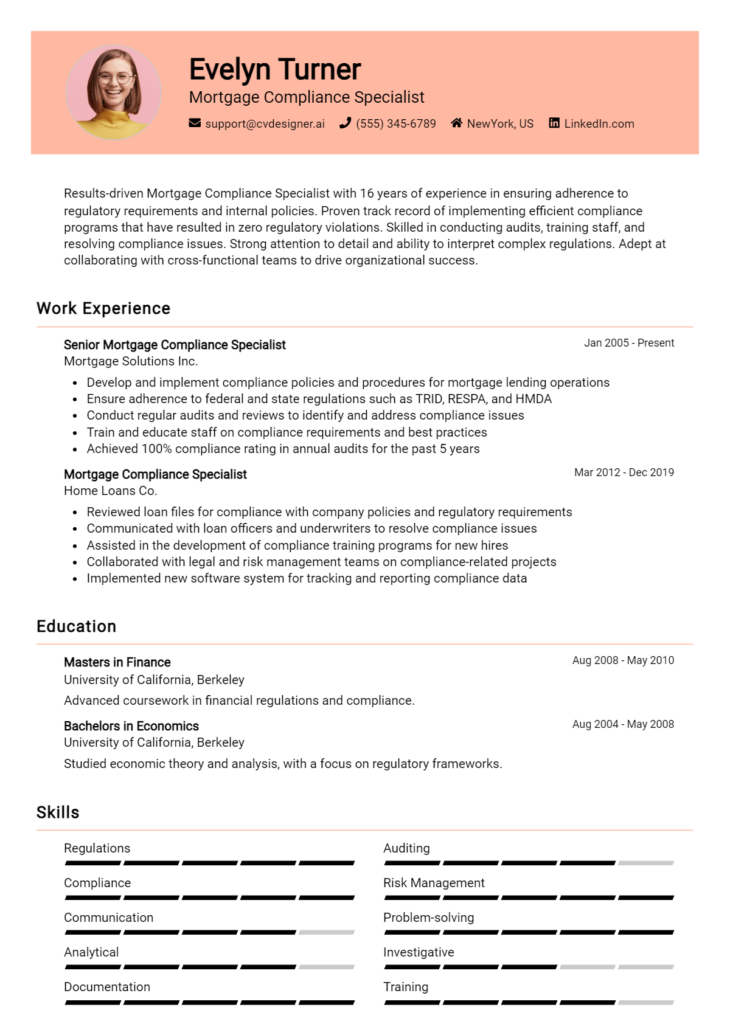

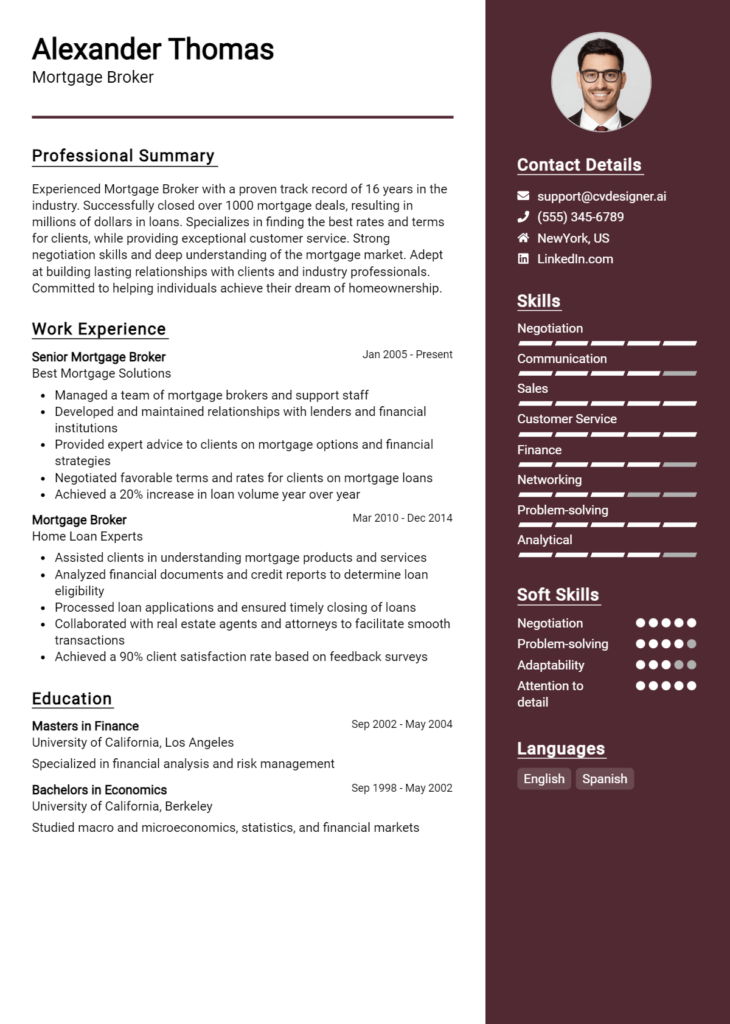

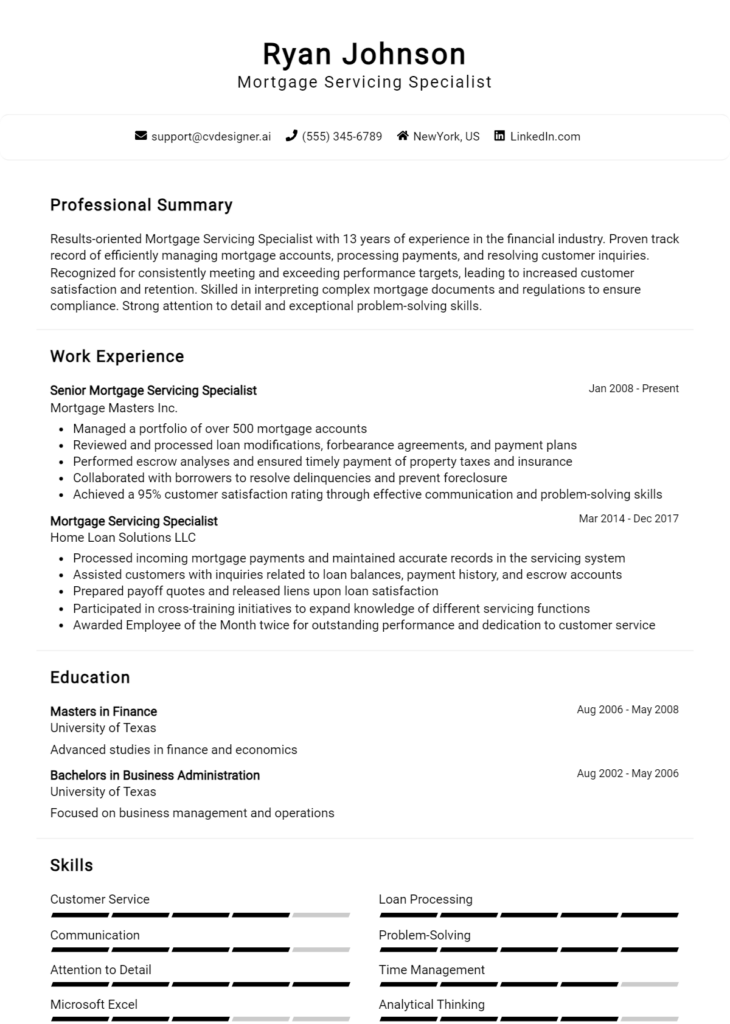

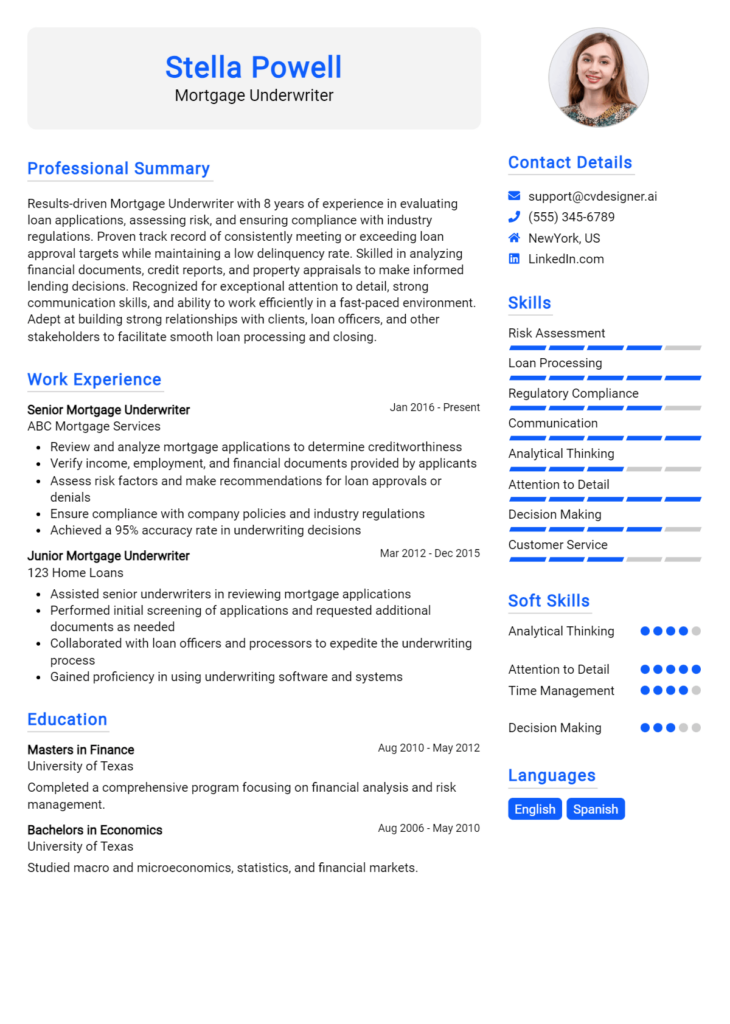

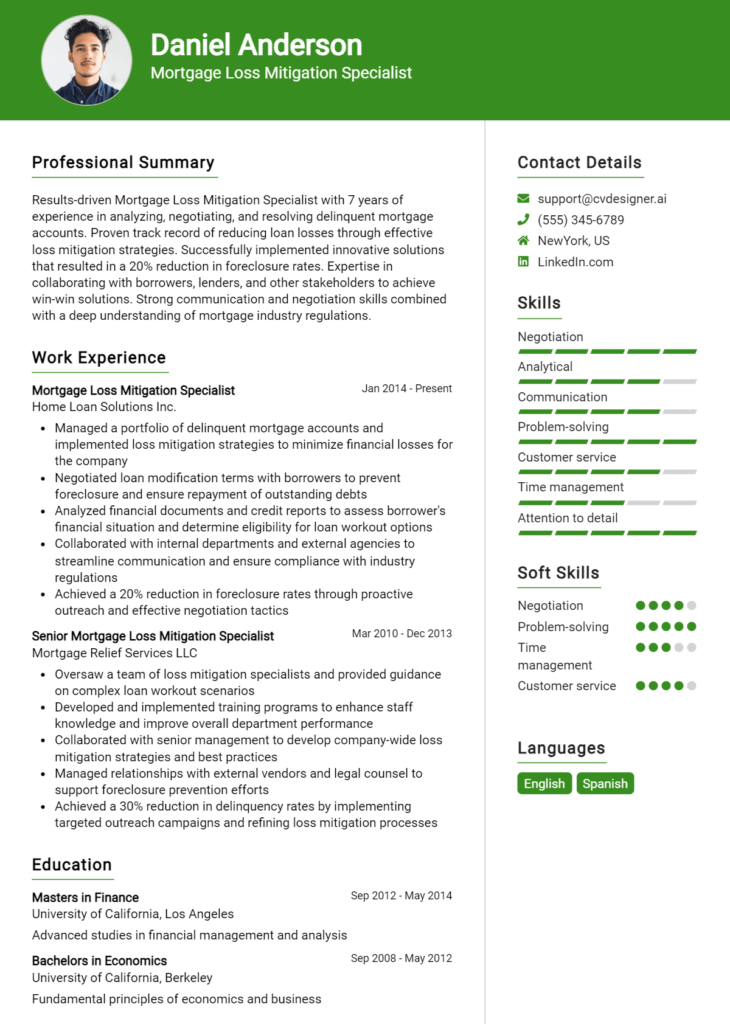

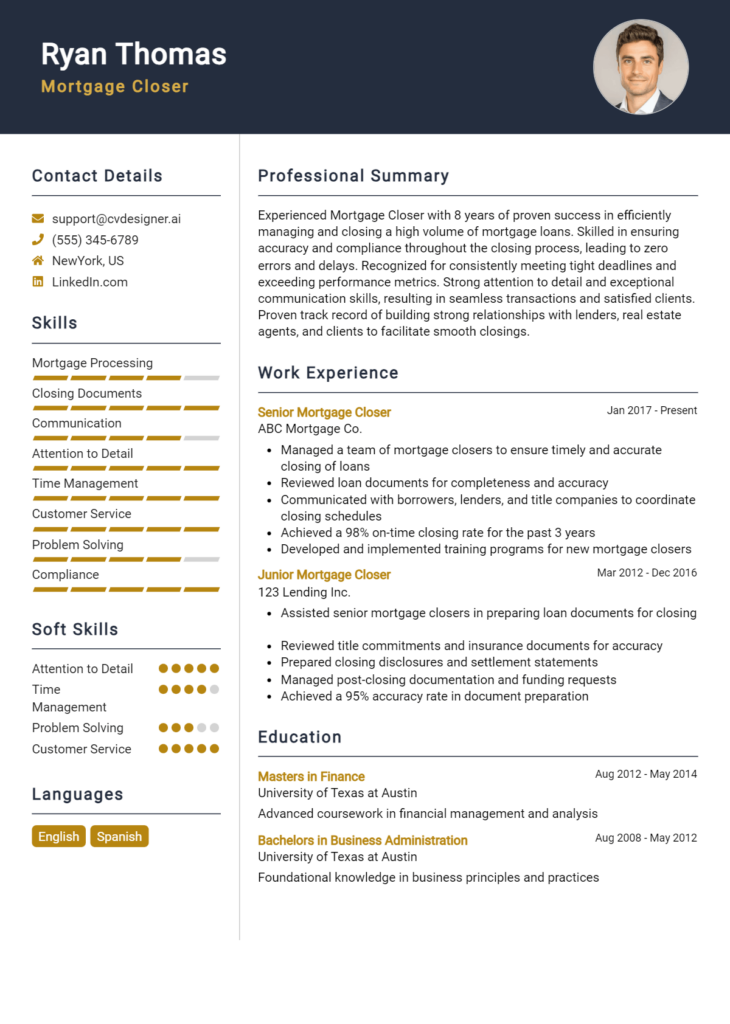

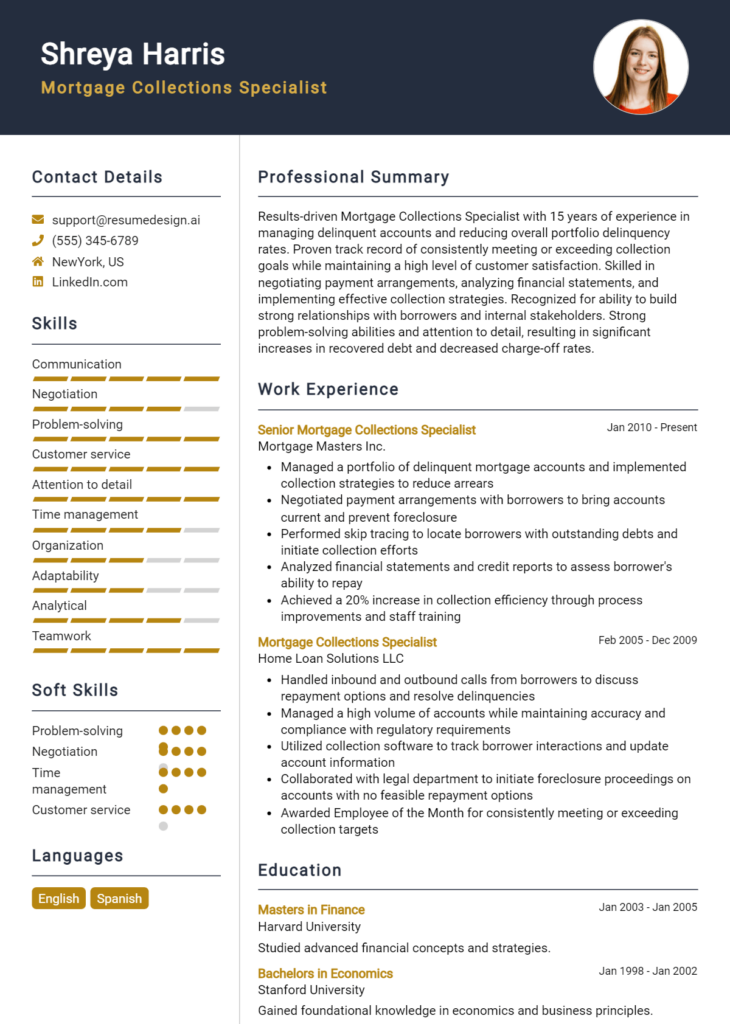

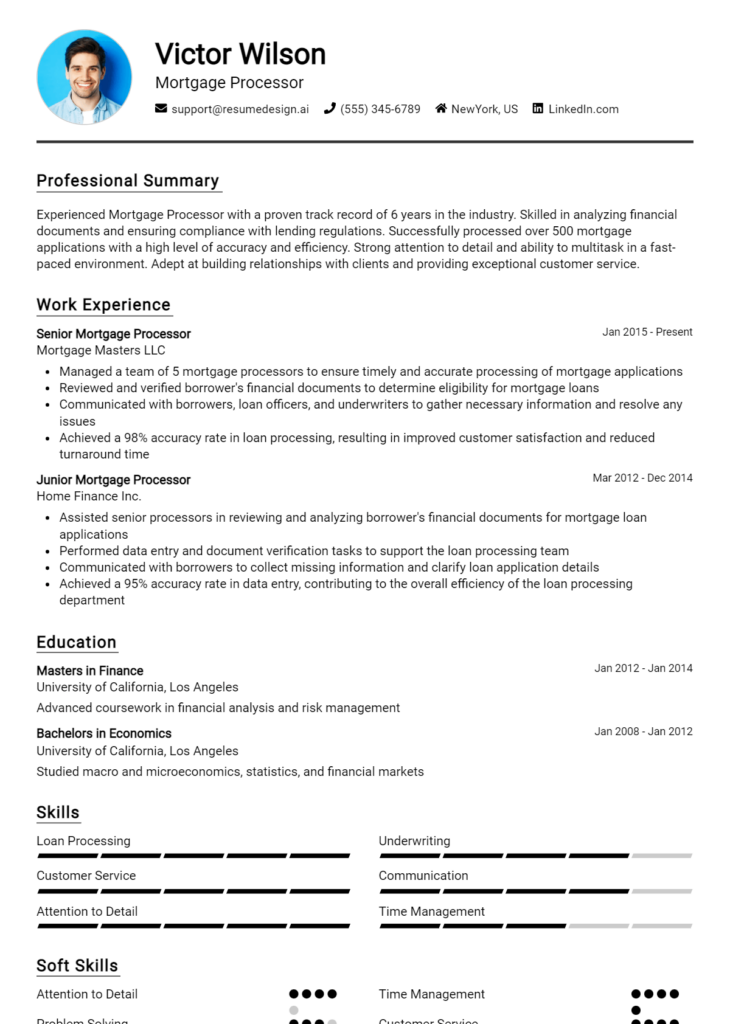

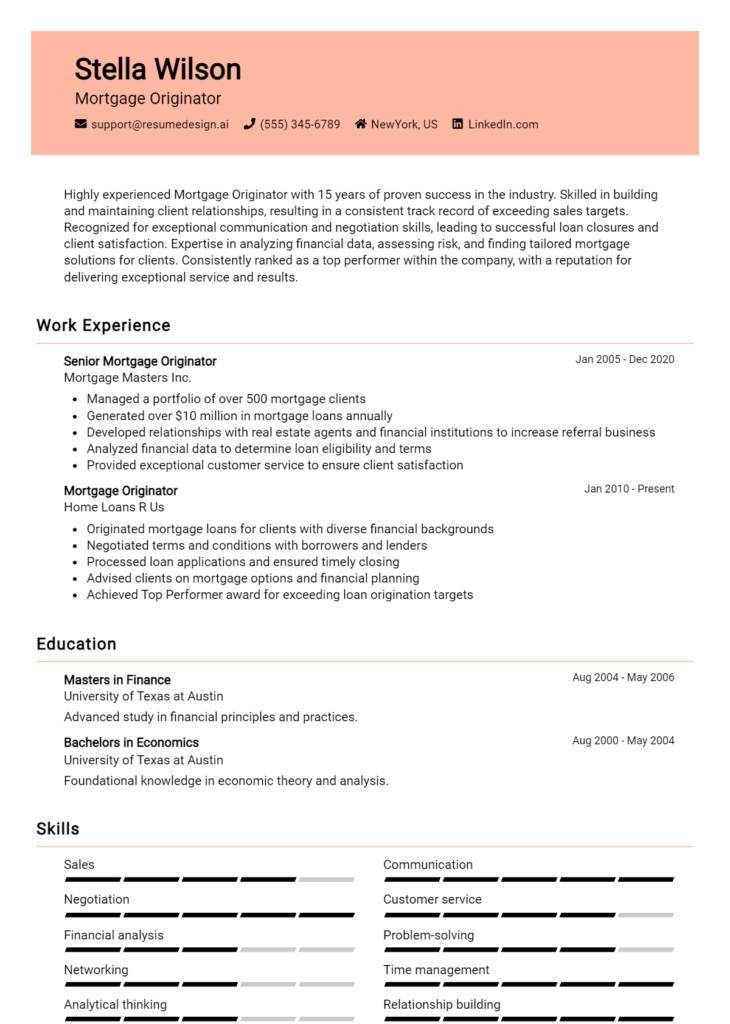

- Check out resume templates to find a design that fits your style.

- Utilize the resume builder for a step-by-step guide to create a professional resume.

- Browse through resume examples to gain inspiration from successful professionals in your field.

- Don’t forget to craft a compelling cover letter using cover letter templates that can help you articulate your passion and qualifications.

Take action today to enhance your resume and increase your chances of landing your next role as a Mortgage Fraud Investigator!