Mortgage Customer Service Representative Core Responsibilities

A Mortgage Customer Service Representative plays a crucial role in facilitating communication between clients, loan officers, and underwriting departments. Key responsibilities include addressing customer inquiries, providing detailed information about mortgage products, and processing loan applications. Strong technical skills in mortgage software, operational knowledge of loan processes, and exceptional problem-solving abilities are essential for success. These competencies not only enhance customer satisfaction but also contribute to the organization’s goals by ensuring efficient service delivery. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's ability to bridge various functions within the company.

Common Responsibilities Listed on Mortgage Customer Service Representative Resume

- Responding to customer inquiries regarding mortgage products and services.

- Assisting clients in completing loan applications and gathering necessary documentation.

- Coordinating with loan officers and underwriters to facilitate loan processing.

- Providing updates to customers on the status of their applications.

- Resolving customer concerns and complaints in a timely manner.

- Maintaining accurate records of customer interactions and transactions.

- Educating clients about mortgage options and terms to promote informed decisions.

- Staying updated on industry regulations and compliance requirements.

- Collaborating with sales and marketing teams to promote mortgage products.

- Utilizing mortgage software to process applications and manage client files.

- Performing follow-ups with clients to ensure satisfaction and retention.

- Participating in training programs to enhance service skills and product knowledge.

High-Level Resume Tips for Mortgage Customer Service Representative Professionals

In the competitive world of mortgage services, a well-crafted resume is crucial for Mortgage Customer Service Representative professionals. Your resume is often the first impression you make on a potential employer, serving as a powerful tool to showcase your skills, experience, and achievements. A thoughtfully designed resume can set you apart from other candidates, demonstrating not only your qualifications but also your commitment to the role. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Customer Service Representative professionals, ensuring that your application stands out in a crowded field.

Top Resume Tips for Mortgage Customer Service Representative Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases.

- Highlight your customer service experience, emphasizing your ability to handle inquiries and resolve issues effectively.

- Quantify your achievements where possible, such as the number of customers assisted or satisfaction ratings received.

- Showcase industry-specific skills, such as knowledge of mortgage products, loan processing, and regulatory compliance.

- Include certifications related to mortgage services, like NMLS licensing, to enhance your credibility.

- Use a clear and professional format that is easy to read, ensuring that key information is easily accessible.

- Focus on soft skills such as communication, problem-solving, and empathy, as these are vital in customer service roles.

- Provide examples of teamwork and collaboration in previous roles, as these are important in a customer-focused environment.

- Keep your resume concise, ideally one page, while ensuring it contains all necessary information that highlights your qualifications.

- Regularly update your resume to reflect new skills, experiences, or accomplishments to stay relevant in the job market.

By implementing these tips, you can significantly increase your chances of landing a job in the Mortgage Customer Service Representative field. A well-structured and tailored resume will not only showcase your qualifications but also demonstrate your enthusiasm and professionalism, making a compelling case to potential employers.

Why Resume Headlines & Titles are Important for Mortgage Customer Service Representative

In the competitive field of mortgage services, the role of a Mortgage Customer Service Representative is critical in ensuring client satisfaction and smooth transaction processes. A well-crafted resume headline or title serves as the first impression a candidate makes on hiring managers, encapsulating their core qualifications in a succinct manner. An impactful headline can capture attention immediately, setting the tone for the rest of the resume. By being concise and directly related to the job at hand, a strong headline not only highlights a candidate's strengths but also differentiates them from the competition, making it essential for success in the hiring process.

Best Practices for Crafting Resume Headlines for Mortgage Customer Service Representative

- Be concise: Aim for a headline that is no longer than 10-12 words.

- Use role-specific keywords: Incorporate terminology relevant to the mortgage industry.

- Focus on strengths: Highlight your most impressive skills or achievements.

- Be relevant: Tailor your headline to match the job description.

- Showcase experience: Mention years of experience or specific expertise in mortgage services.

- Avoid jargon: Use clear language that can be easily understood by hiring managers.

- Be authentic: Ensure that the headline accurately reflects your true capabilities.

- Consider adding metrics: If applicable, include quantifiable achievements to bolster your credibility.

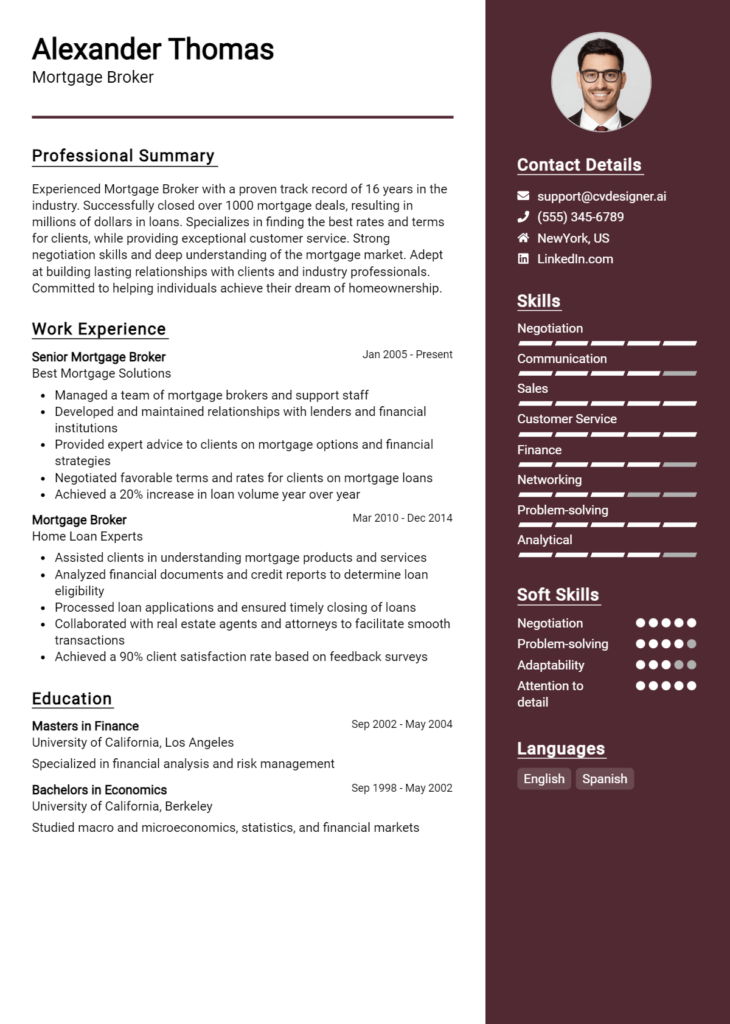

Example Resume Headlines for Mortgage Customer Service Representative

Strong Resume Headlines

"Experienced Mortgage Customer Service Representative with 5+ Years in the Industry"

“Detail-Oriented Customer Advocate Specializing in Mortgage Solutions and Client Satisfaction”

“Results-Driven Professional with a Proven Track Record in Mortgage Processing and Client Relations”

“Skilled Mortgage Consultant Focused on Delivering Exceptional Customer Experiences”

Weak Resume Headlines

“Customer Service Representative”

“Looking for a Job in Mortgage”

“Experienced Professional Seeking Opportunities”

Strong headlines are effective because they immediately convey relevant experience and specific qualifications, making it easy for hiring managers to recognize what the candidate brings to the table. They highlight key strengths and demonstrate a clear understanding of the role. Conversely, weak headlines fail to impress because they are vague and non-specific; they do not provide any insight into the candidate's capabilities or relevance to the position. This lack of detail can lead hiring managers to overlook the candidate entirely in favor of those who present themselves more clearly and compellingly.

Writing an Exceptional Mortgage Customer Service Representative Resume Summary

A resume summary is a crucial component for a Mortgage Customer Service Representative, serving as a first impression that grabs the attention of hiring managers. A well-crafted summary quickly highlights key skills, relevant experience, and significant accomplishments that align with the specific demands of the role. In a competitive job market, having a concise and impactful summary tailored to the job description can set a candidate apart, making it essential for showcasing the unique value they bring to the position.

Best Practices for Writing a Mortgage Customer Service Representative Resume Summary

- Quantify achievements to demonstrate impact, such as "processed 200+ mortgage applications monthly."

- Highlight relevant skills, including knowledge of loan products, customer service expertise, and problem-solving abilities.

- Tailor the summary to the job description by using keywords and phrases that reflect the specific requirements of the role.

- Keep it concise, ideally between 3 to 5 sentences, ensuring every word adds value.

- Use action verbs to convey a sense of proactivity and accomplishment, such as "managed," "resolved," or "achieved."

- Showcase customer satisfaction metrics or feedback to highlight success in enhancing client experiences.

- Include relevant certifications or licenses to demonstrate professional credibility.

- Avoid jargon or overly complex language; clarity is key to making a strong impact.

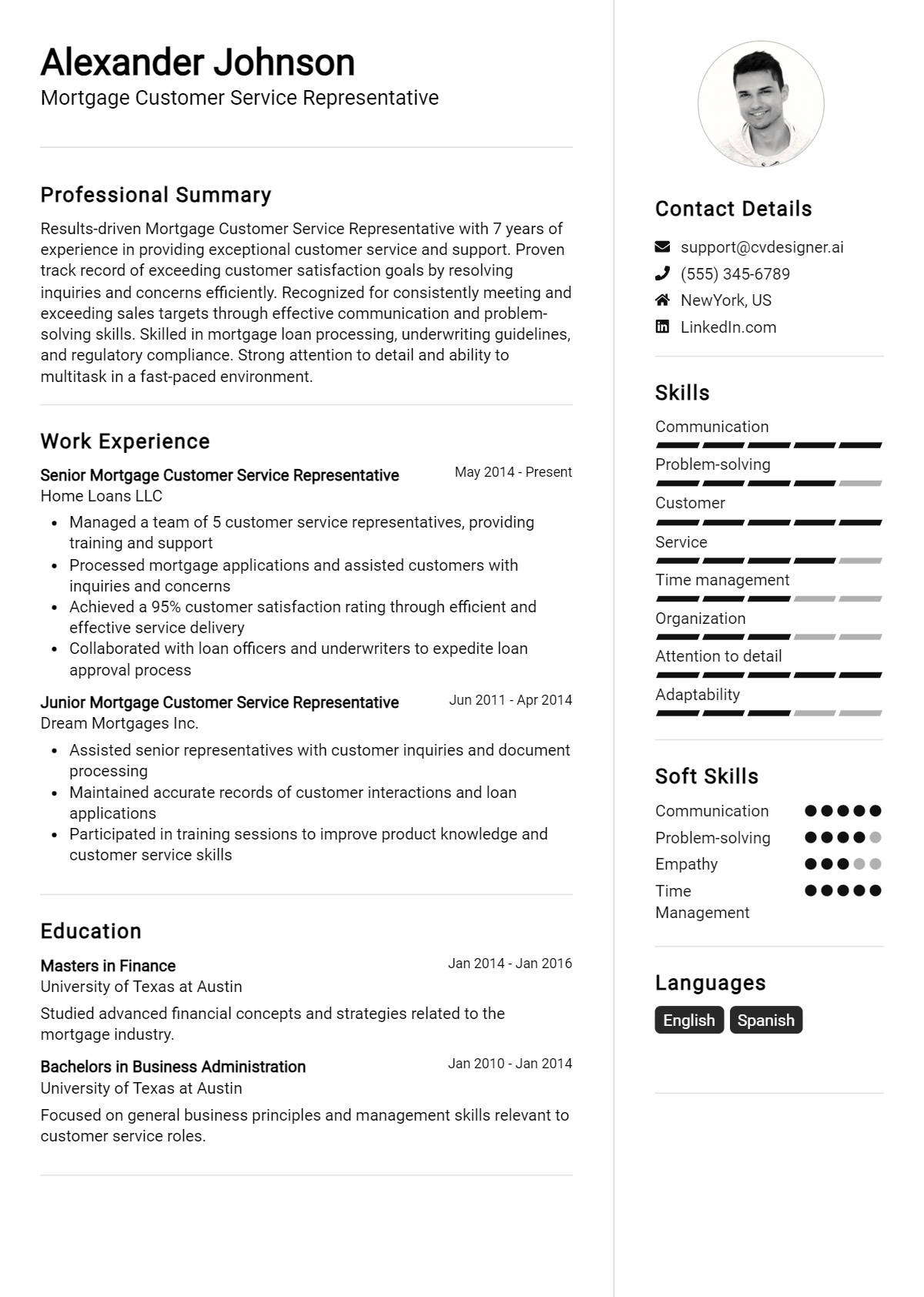

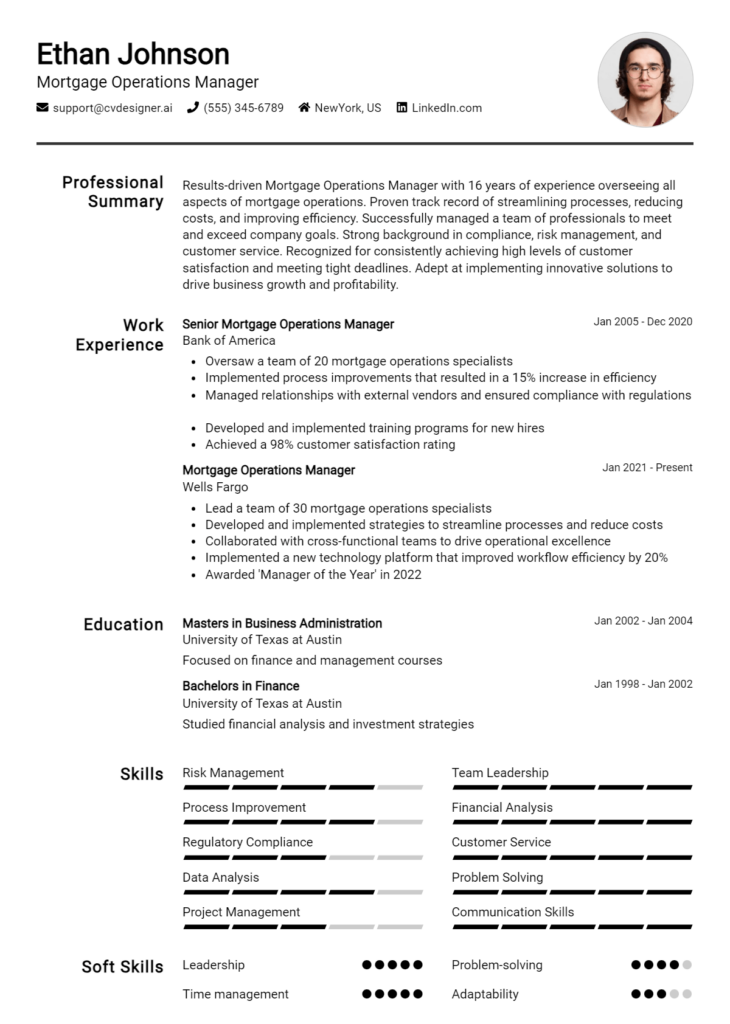

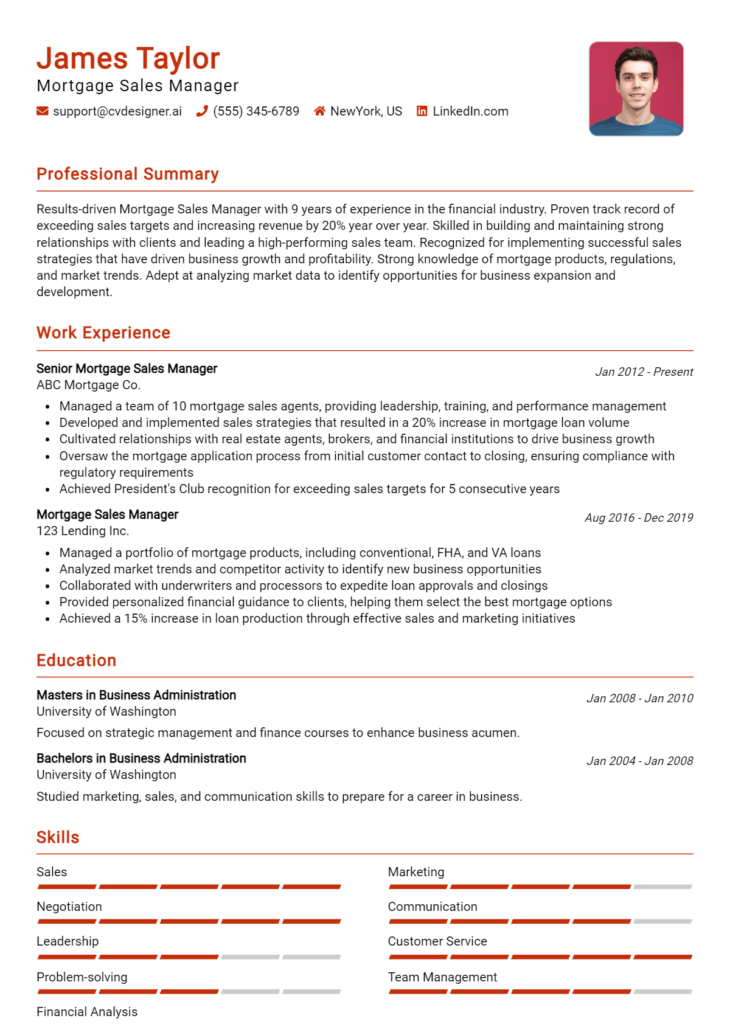

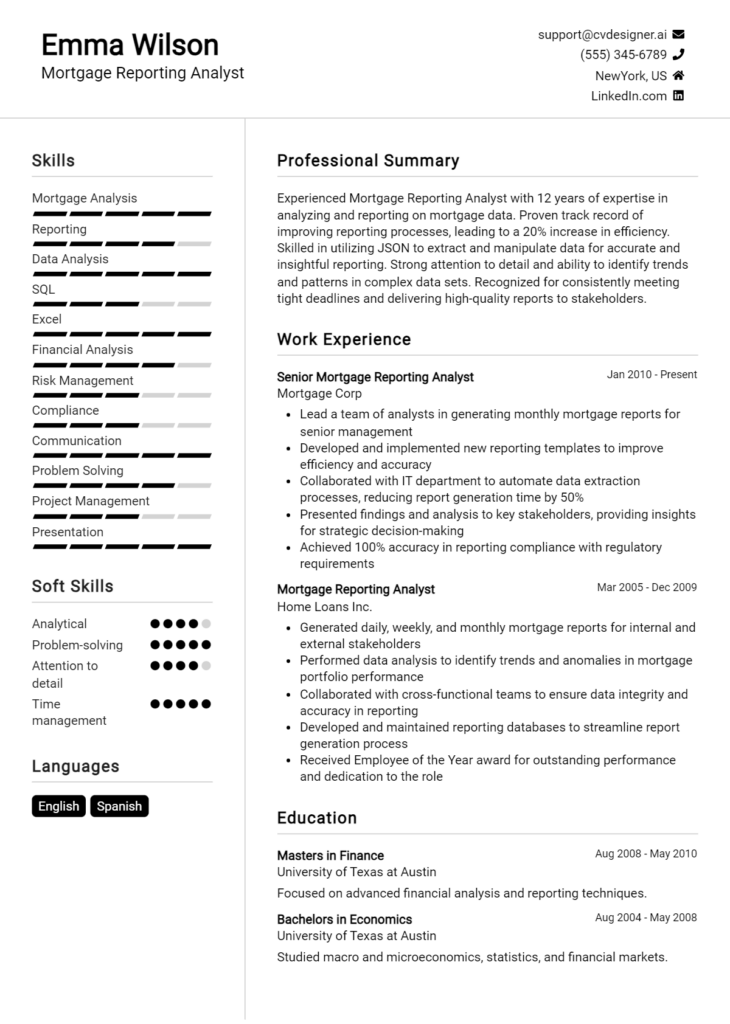

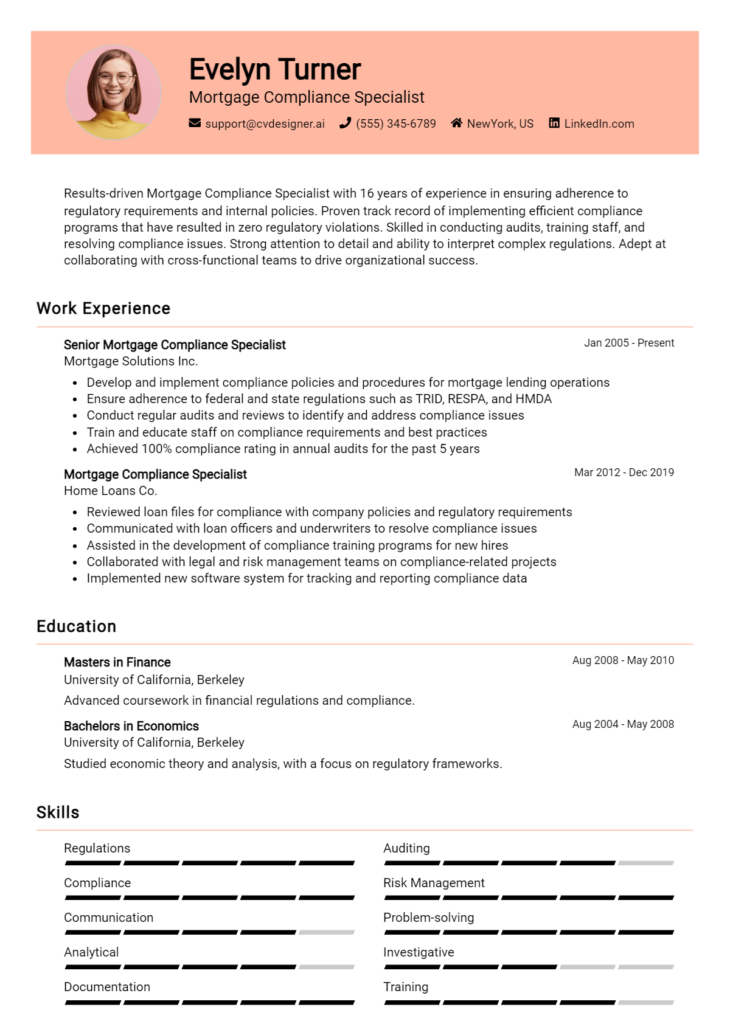

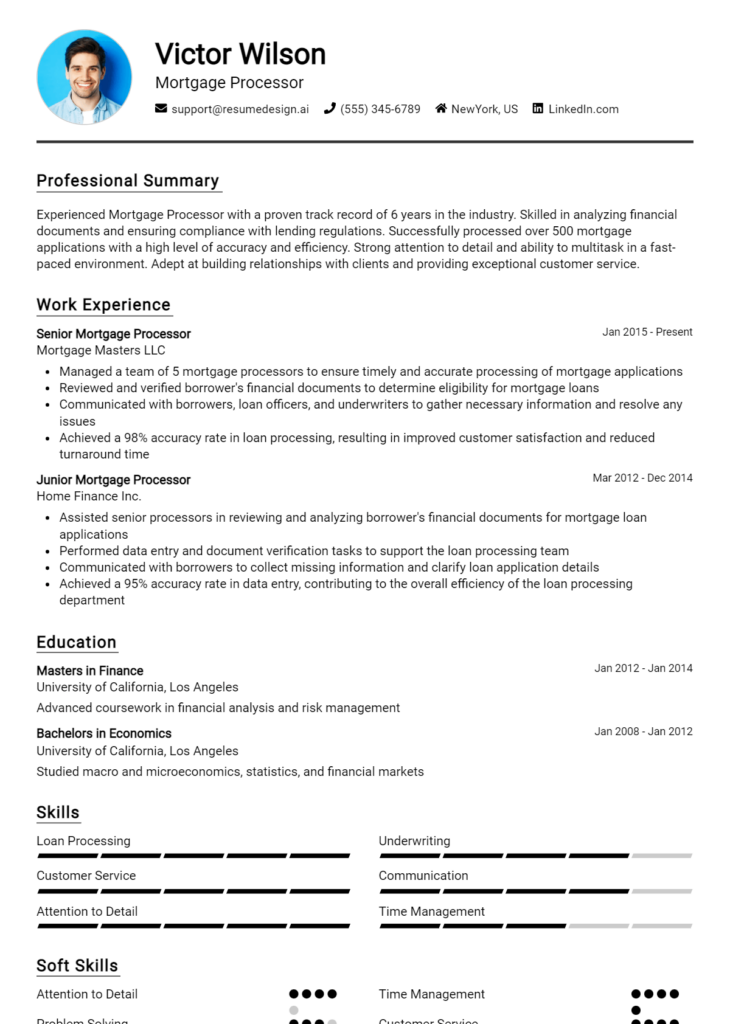

Example Mortgage Customer Service Representative Resume Summaries

Strong Resume Summaries

Dedicated Mortgage Customer Service Representative with over 5 years of experience in the mortgage industry, adept at handling over 150 customer inquiries daily. Successfully improved customer satisfaction ratings by 20% through effective communication and problem resolution.

Results-oriented professional with a proven track record of processing mortgage applications with a 98% accuracy rate. Recognized for exceptional ability to explain complex loan products to clients, leading to a 30% increase in customer understanding and engagement.

Dynamic customer service expert with comprehensive knowledge of mortgage products and regulations. Achieved a 40% reduction in application processing time by implementing streamlined workflows and improving team collaboration.

Weak Resume Summaries

I have experience in customer service and know a bit about mortgages. I am looking for a job in this field.

Motivated individual seeking a mortgage customer service role. I am good at talking to people and solving problems.

The examples of strong resume summaries stand out due to their specificity, quantifiable achievements, and relevant skills that directly relate to the Mortgage Customer Service Representative role. In contrast, the weak summaries are vague, lack measurable outcomes, and do not provide any concrete evidence of the candidate's qualifications or suitability for the position. Therefore, strong summaries effectively communicate the candidate's value, whereas weak summaries fail to make a memorable impact.

Work Experience Section for Mortgage Customer Service Representative Resume

The work experience section of a Mortgage Customer Service Representative resume is a vital component that allows candidates to demonstrate their technical skills, leadership abilities, and capacity to deliver high-quality service. This section serves as a narrative of the candidate's professional journey, showcasing their proficiency in mortgage processes, customer interactions, and problem-solving. By quantifying achievements and aligning their experience with industry standards, candidates can effectively illustrate their value to potential employers, making a compelling case for their suitability for the role.

Best Practices for Mortgage Customer Service Representative Work Experience

- Highlight relevant technical skills related to mortgage processing and customer service.

- Quantify achievements with specific metrics, such as customer satisfaction scores or loan processing times.

- Demonstrate examples of team collaboration and leadership in managing customer service initiatives.

- Use industry-specific language to align experience with the expectations of mortgage professionals.

- Showcase problem-solving abilities through examples of resolving customer issues effectively.

- Include continuous education or certifications relevant to the mortgage industry.

- Tailor each experience to reflect the skills and competencies required for the Mortgage Customer Service Representative role.

Example Work Experiences for Mortgage Customer Service Representative

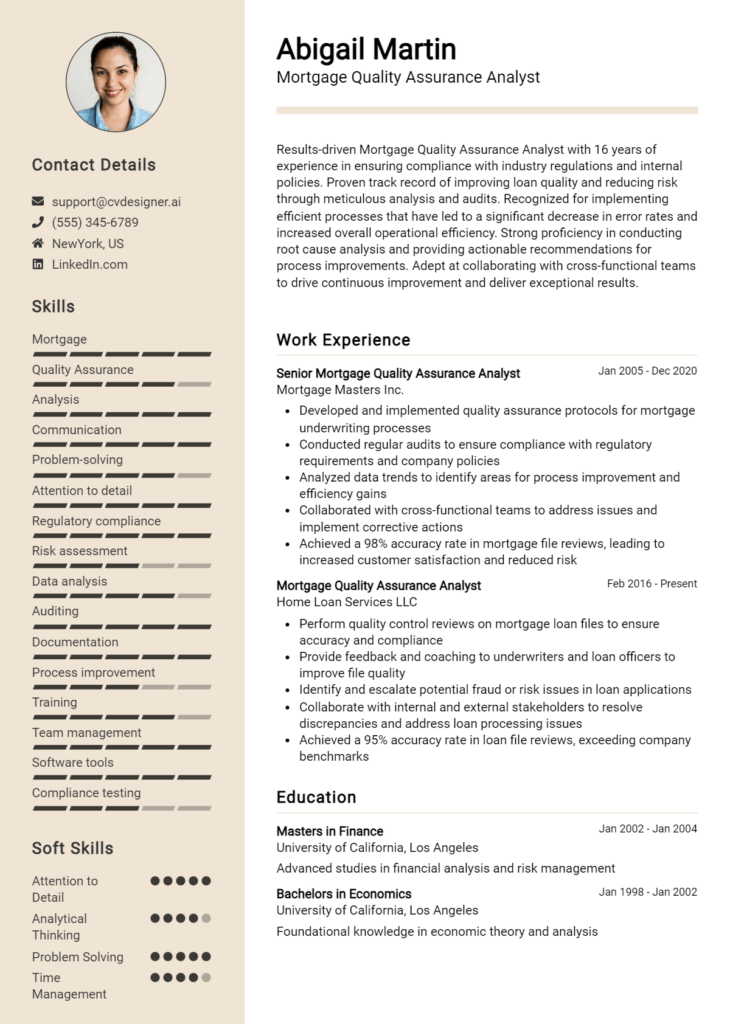

Strong Experiences

- Improved customer satisfaction ratings by 20% within one year by implementing a new feedback system and addressing client concerns promptly.

- Led a team of 5 customer service representatives, conducting training sessions that reduced average response time by 30%.

- Successfully processed over 200 mortgage applications monthly, ensuring compliance with regulatory standards and achieving a 98% approval rate.

- Collaborated with the underwriting department to streamline the loan review process, resulting in a 15% increase in efficiency.

Weak Experiences

- Handled customer inquiries and resolved issues as needed.

- Worked in a team environment to assist customers with mortgage questions.

- Managed various administrative tasks related to customer service.

- Assisted in the processing of loans and other financial documents.

The examples classified as strong experiences clearly demonstrate quantifiable outcomes and specific achievements, reflecting a proactive approach and impactful contributions to the organization. They illustrate the candidate's technical leadership and collaborative efforts, making them compelling evidence of their ability to excel in the Mortgage Customer Service Representative role. In contrast, the weak experiences lack detail and measurable results, failing to convey the candidate's specific skills or contributions effectively.

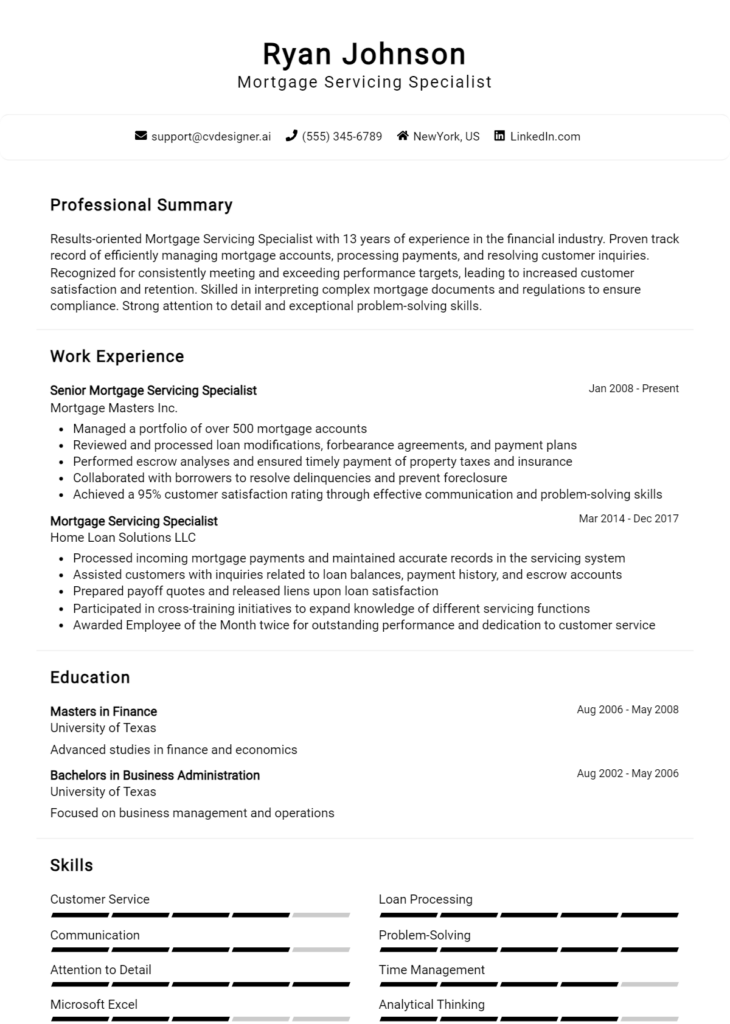

Education and Certifications Section for Mortgage Customer Service Representative Resume

The education and certifications section of a Mortgage Customer Service Representative resume serves as a critical component that underscores the candidate's academic qualifications, industry-specific knowledge, and commitment to professional growth. This section not only provides insight into the candidate's educational foundation but also showcases relevant certifications and specialized training that enhance their expertise in the mortgage industry. By including pertinent coursework and recognized credentials, candidates can significantly bolster their credibility and demonstrate alignment with the specific demands of the job role, making them more appealing to potential employers.

Best Practices for Mortgage Customer Service Representative Education and Certifications

- Focus on relevant degrees, such as Finance, Business Administration, or Economics.

- Include industry-recognized certifications, like the Mortgage Loan Originator (MLO) license.

- Highlight any specialized training in customer service or mortgage processing.

- Provide details on relevant coursework that pertains to mortgage lending and finance.

- List any ongoing education or workshops that reflect a commitment to continuous learning.

- Ensure that all listed certifications and degrees are current and valid.

- Use clear formatting to enhance readability and emphasize important credentials.

- Tailor the education and certifications section to match the specific job description of the role applied for.

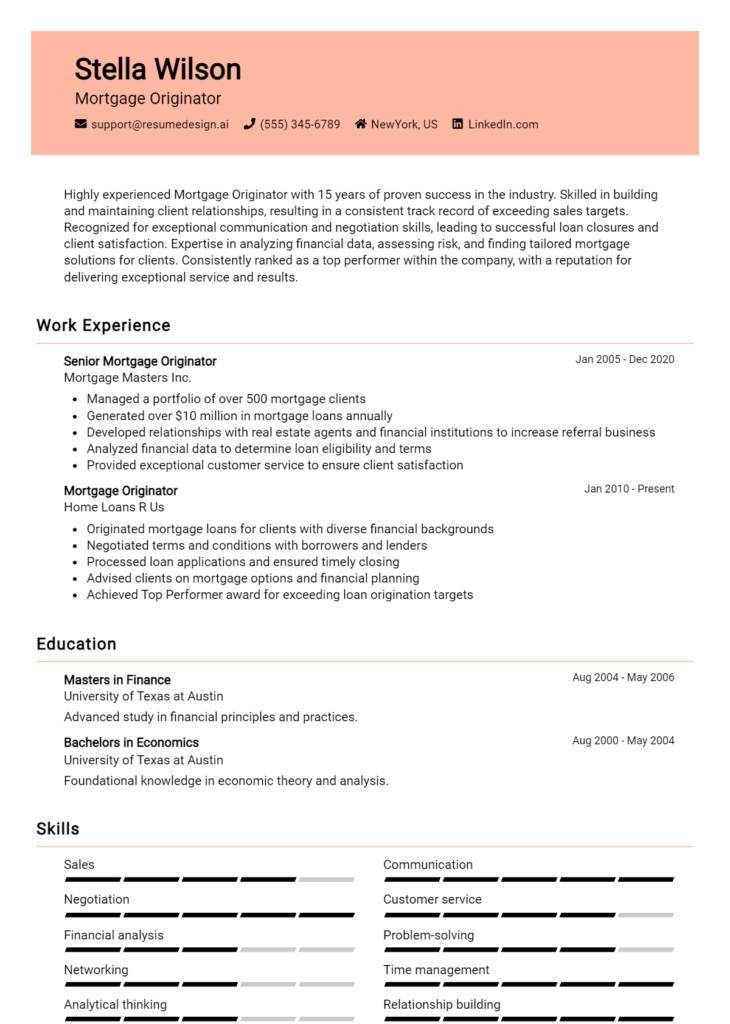

Example Education and Certifications for Mortgage Customer Service Representative

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2022

- Certified Mortgage Loan Originator (MLO), National Mortgage Licensing System, 2023

- Coursework in Mortgage Banking and Risk Management, University of XYZ

- Certification in Customer Service Excellence, International Customer Service Association, 2021

Weak Examples

- Associate Degree in Culinary Arts, Community College, 2019

- Certification in Basic Computer Skills, Online Course, 2020

- High School Diploma, 2018 (without any relevant coursework or distinctions)

- Outdated Certification in Real Estate Principles, 2015

The examples listed as strong are considered effective because they directly relate to the skills and knowledge required for a Mortgage Customer Service Representative role, demonstrating both academic and practical understanding of the industry. In contrast, the weak examples lack relevance to the mortgage sector and do not highlight any pertinent qualifications or certifications that would enhance the candidate's suitability for the position. By choosing strong examples that align with the job requirements, candidates can present themselves as well-prepared and knowledgeable professionals in the mortgage field.

Top Skills & Keywords for Mortgage Customer Service Representative Resume

In the competitive field of mortgage customer service, showcasing the right skills in your resume is crucial for standing out to potential employers. A well-crafted resume that highlights both hard and soft skills can demonstrate your proficiency in the industry and your capability to deliver exceptional customer service. Employers often look for candidates who not only possess technical knowledge but also exhibit interpersonal abilities that foster strong relationships with clients. By emphasizing these skills, you can illustrate your readiness to handle inquiries, resolve issues, and support borrowers throughout the mortgage process.

Top Hard & Soft Skills for Mortgage Customer Service Representative

Soft Skills

- Excellent communication skills

- Active listening

- Empathy and emotional intelligence

- Problem-solving abilities

- Adaptability and flexibility

- Conflict resolution

- Patience and understanding

- Time management

- Attention to detail

- Teamwork and collaboration

Hard Skills

- Knowledge of mortgage products and services

- Proficiency in loan processing software

- Understanding of regulatory compliance

- Data entry and management

- Familiarity with credit reports and scoring

- Financial analysis skills

- Proficient in Microsoft Office Suite

- Basic knowledge of real estate principles

- Customer relationship management (CRM) systems

- Strong organizational skills

By integrating these skills into your resume, alongside relevant work experience, you can create a compelling application that highlights your qualifications for the role of a Mortgage Customer Service Representative.

Stand Out with a Winning Mortgage Customer Service Representative Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Mortgage Customer Service Representative position at [Company Name] as advertised. With my background in customer service and a solid understanding of mortgage products, I am excited about the opportunity to contribute to your team and help clients navigate their home financing needs. My experience in the financial services sector has equipped me with the skills necessary to provide exceptional support and guidance to customers, ensuring they feel valued and informed throughout the mortgage process.

In my previous role at [Previous Company Name], I successfully managed a high volume of customer inquiries, assisting clients with everything from mortgage application processes to inquiries about loan options. My ability to explain complex financial terms in simple language helped foster trust and clarity, which in turn led to a 30% increase in customer satisfaction ratings. I am adept at utilizing CRM software to track and manage customer interactions, ensuring that all follow-ups are timely and effective. Additionally, I have a keen eye for detail, which has proven invaluable in reviewing documentation and ensuring compliance with industry regulations.

I am particularly drawn to [Company Name] because of your commitment to providing personalized service and your innovative approach to mortgage solutions. I am eager to bring my proactive problem-solving skills and my passion for helping customers achieve their homeownership dreams to your team. I am confident that my strong communication abilities and customer-centric focus align perfectly with your company’s values and objectives.

Thank you for considering my application. I look forward to the opportunity to discuss how my experience and enthusiasm can contribute to the success of [Company Name]. I am excited about the possibility of being part of a dedicated team that values exceptional customer service in the mortgage industry.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Customer Service Representative Resume

When crafting a resume for the position of a Mortgage Customer Service Representative, it's essential to present oneself in the best light possible. However, many applicants inadvertently make mistakes that can overshadow their qualifications and experience. Understanding these common pitfalls can help you create a more effective resume that stands out to hiring managers. Below are some frequent mistakes to watch out for:

Focusing on Duties Instead of Achievements: Simply listing job responsibilities can make your resume bland. Instead, emphasize specific achievements and how you contributed to your previous roles, such as improving customer satisfaction rates or streamlining processes.

Using Generic Language: Avoid vague phrases like "hardworking" or "team player." Instead, use specific examples and metrics to demonstrate your skills and effectiveness in previous roles.

Neglecting Relevant Skills: Many candidates overlook the importance of tailoring their skills section. Be sure to highlight skills that are particularly relevant to mortgage customer service, such as conflict resolution, knowledge of mortgage products, and proficiency in customer relationship management (CRM) software.

Lack of Industry-Specific Terminology: Failing to use industry jargon can make your resume seem out of touch. Familiarize yourself with mortgage-related terminology and incorporate it naturally into your resume to demonstrate your expertise.

Spelling and Grammar Errors: Typos and grammatical mistakes can undermine your professionalism. Always proofread your resume multiple times and consider using tools or services to catch errors that you might overlook.

Overloading with Information: Including too much information can make your resume overwhelming. Keep it concise and relevant, focusing on the most impactful experiences and qualifications that directly relate to the job.

Ignoring Formatting: A cluttered or unprofessional layout can distract from your content. Use clear headings, bullet points, and consistent formatting to create a clean, easy-to-read document.

Not Customizing for Each Application: Sending out the same resume for every job application can be detrimental. Tailor your resume for each position by incorporating keywords from the job description and aligning your experiences with the specific requirements of the role.

Conclusion

In conclusion, the role of a Mortgage Customer Service Representative is crucial in guiding clients through the complexities of mortgage applications and ensuring a seamless experience. Key responsibilities include assisting customers with inquiries, managing documentation, and providing insights into mortgage products. Strong communication skills, attention to detail, and a customer-oriented mindset are essential traits for success in this position.

As you reflect on your qualifications and experiences, consider reviewing your Mortgage Customer Service Representative resume to ensure it effectively highlights your strengths. Utilize available resources such as resume templates, which offer structured designs to showcase your skills professionally. Additionally, the resume builder can assist in crafting a customized resume that stands out to potential employers. Explore resume examples for inspiration and ideas on how to present your background effectively. Don’t forget the importance of a well-crafted introduction; check out the cover letter templates to complement your application materials. Take action today to enhance your resume and position yourself as a strong candidate in the competitive mortgage industry!