Mortgage Collections Specialist Core Responsibilities

A Mortgage Collections Specialist plays a pivotal role in managing overdue accounts and facilitating effective communication between borrowers and the financial institution. Key responsibilities include analyzing payment histories, negotiating repayment plans, and ensuring compliance with regulations. This role requires strong technical skills in financial software, operational abilities to streamline collection processes, and problem-solving skills to address borrower concerns. These competencies are essential for achieving organizational goals, and a well-structured resume can effectively highlight these qualifications, making candidates stand out in the competitive job market.

Common Responsibilities Listed on Mortgage Collections Specialist Resume

- Monitor and manage overdue mortgage accounts to minimize delinquencies.

- Communicate with borrowers via phone, email, and letters regarding outstanding payments.

- Negotiate payment arrangements and settlements with customers.

- Document all interactions and maintain accurate records in the database.

- Collaborate with legal and compliance teams to ensure adherence to regulations.

- Conduct thorough account reviews to identify potential risks and escalate issues.

- Provide exceptional customer service while addressing borrower concerns.

- Generate reports on collection activities and account status for management review.

- Assist in developing and implementing collection strategies.

- Stay updated on industry trends and regulatory changes affecting mortgage collections.

High-Level Resume Tips for Mortgage Collections Specialist Professionals

In the competitive landscape of the mortgage industry, a well-crafted resume is essential for Mortgage Collections Specialist professionals looking to make a lasting impression. Your resume is often the first opportunity to showcase your skills and achievements to potential employers, and it serves as a reflection of your professional capabilities. A strong resume not only highlights your relevant experience but also communicates your understanding of the mortgage collections process and your ability to navigate challenging situations effectively. In this guide, we will provide practical and actionable resume tips specifically tailored for Mortgage Collections Specialist professionals, ensuring you present yourself as the ideal candidate for the job.

Top Resume Tips for Mortgage Collections Specialist Professionals

- Customize your resume for each application by aligning your skills and experience with the specific job description.

- Emphasize relevant experience in mortgage collections, including duties such as follow-up calls, payment negotiations, and account management.

- Quantify your achievements by including specific numbers, such as the percentage of accounts resolved or the total amount collected.

- Highlight your knowledge of relevant laws and regulations in the mortgage and collections industry to demonstrate compliance awareness.

- Showcase your communication skills, as effective communication is critical when dealing with clients regarding sensitive financial matters.

- Include any relevant certifications or training that can enhance your credibility, such as Certified Collections Specialist (CCS) or similar qualifications.

- Utilize action verbs to convey your accomplishments and responsibilities effectively, such as "managed," "negotiated," or "resolved."

- Incorporate industry-specific keywords to ensure your resume passes through Applicant Tracking Systems (ATS) and reaches hiring managers.

- Keep the layout professional and easy to read, using clear headings and bullet points to make important information stand out.

- Proofread your resume multiple times to eliminate any typos or grammatical errors, as attention to detail is crucial in the mortgage collections field.

By implementing these tips, you can significantly enhance your chances of landing a job in the Mortgage Collections Specialist field. A targeted and professional resume will not only showcase your qualifications effectively but also demonstrate your commitment to excellence in the industry. Taking the time to refine your resume can set you apart from other candidates and open doors to exciting career opportunities.

Why Resume Headlines & Titles are Important for Mortgage Collections Specialist

In the competitive field of mortgage collections, a well-crafted resume headline or title serves as the first impression a candidate makes on hiring managers. The headline is crucial as it encapsulates a candidate's key qualifications in a succinct and impactful phrase, allowing them to stand out in a sea of applicants. A strong headline can immediately grab attention, showcasing relevant skills and experience tailored directly to the role of a Mortgage Collections Specialist. It should be concise, targeted, and reflective of the specific job being applied for, setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Mortgage Collections Specialist

- Keep it concise—aim for one impactful phrase.

- Make it role-specific by including the job title.

- Highlight key skills or achievements relevant to mortgage collections.

- Use action-oriented language to convey a sense of proactivity.

- Incorporate industry-specific keywords to enhance visibility.

- Avoid clichés and generic phrases that lack specificity.

- Tailor the headline for each application to reflect the job description.

- Consider including quantifiable achievements for added impact.

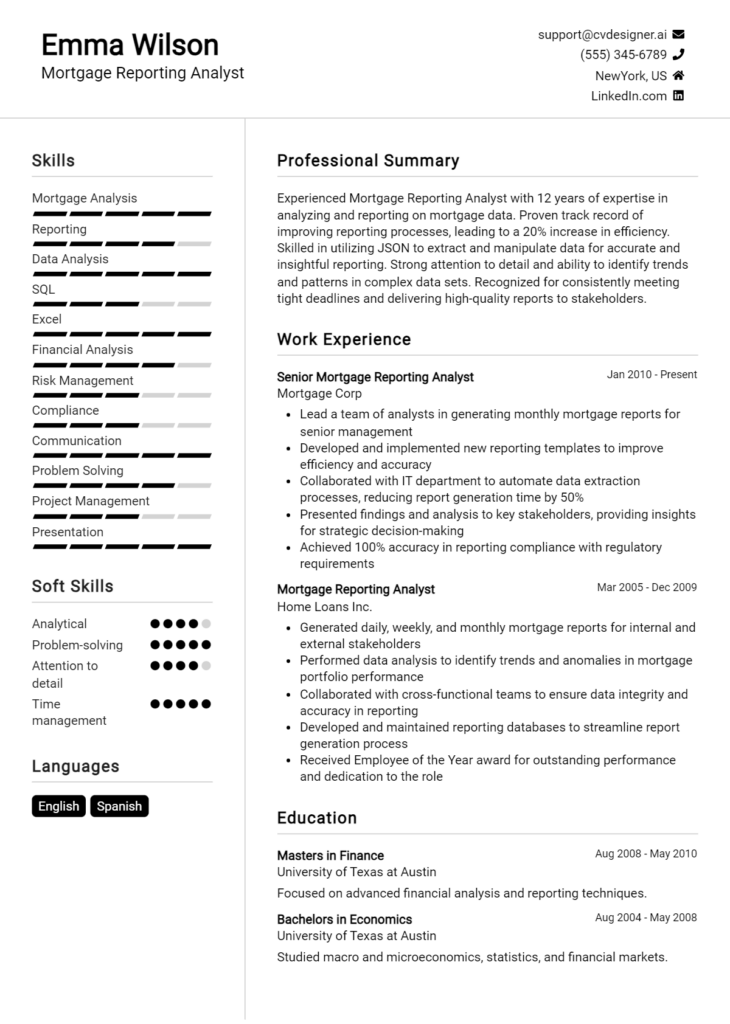

Example Resume Headlines for Mortgage Collections Specialist

Strong Resume Headlines

"Results-Driven Mortgage Collections Specialist with 5+ Years of Experience in Asset Recovery"

“Detail-Oriented Collections Professional Specializing in High-Volume Accounts Management”

“Skilled Negotiator with Proven Track Record in Reducing Delinquency Rates by 30%”

Weak Resume Headlines

“Collections Specialist”

“Looking for a Job in Finance”

The strong headlines are effective because they clearly communicate the candidate's relevant experience and achievements, positioning them as a desirable candidate for the role. They use specific language that resonates with hiring managers looking for expertise in mortgage collections. In contrast, the weak headlines lack detail and focus, failing to convey any unique value or qualifications, which can lead to a quick dismissal by recruiters. A compelling headline can make all the difference in capturing attention and standing out in a competitive job market.

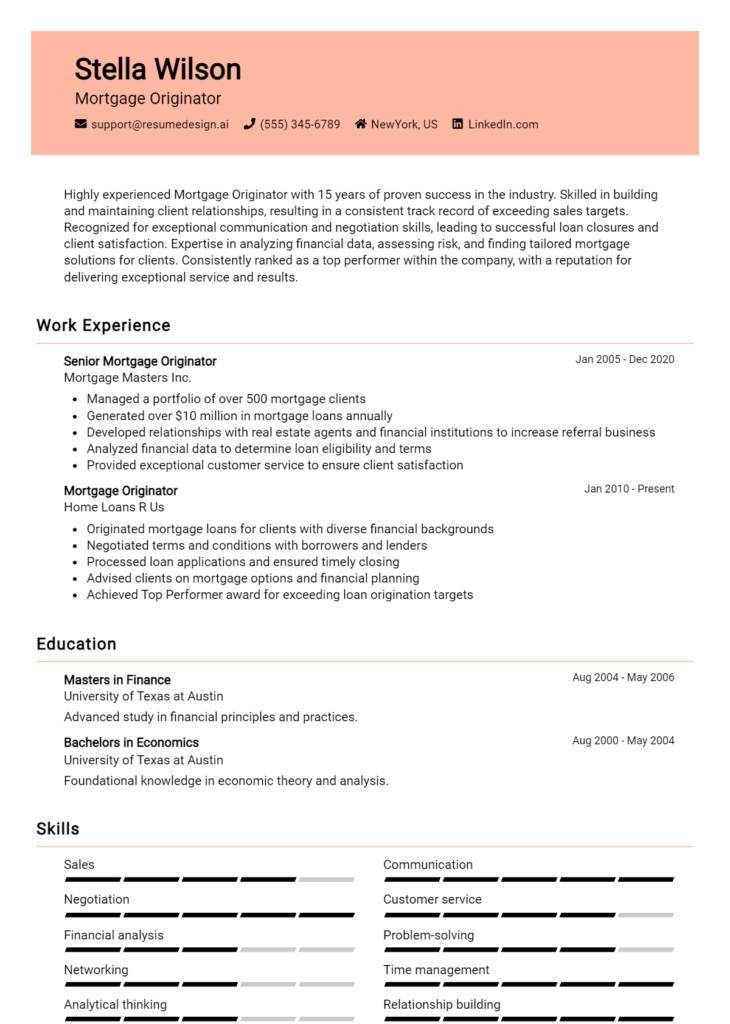

Writing an Exceptional Mortgage Collections Specialist Resume Summary

A well-crafted resume summary is crucial for a Mortgage Collections Specialist, as it serves as the first impression for hiring managers. By succinctly highlighting key skills, relevant experience, and notable accomplishments, a strong summary captures attention and sets the tone for the rest of the resume. It should be concise, impactful, and tailored specifically to the job description, ensuring that it resonates with the employer's needs and expectations. A compelling summary not only reflects the candidate's qualifications but also their understanding of the role, making it an essential component in the competitive job market of mortgage collections.

Best Practices for Writing a Mortgage Collections Specialist Resume Summary

- Quantify Achievements: Use numbers and metrics to demonstrate your impact in previous roles.

- Focus on Relevant Skills: Highlight skills that are directly applicable to the mortgage collections field, such as negotiation and customer service.

- Tailor to the Job Description: Customize your summary to align with the specific requirements and language of the job posting.

- Keep it Concise: Aim for 3-5 sentences that communicate your value without overwhelming the reader.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of proactivity and effectiveness.

- Showcase Industry Knowledge: Mention familiarity with mortgage regulations, collections software, or financial analysis to stand out.

- Include Keywords: Incorporate keywords from the job description to pass through applicant tracking systems.

- Highlight Soft Skills: Emphasize interpersonal skills such as empathy and communication, which are essential in collections roles.

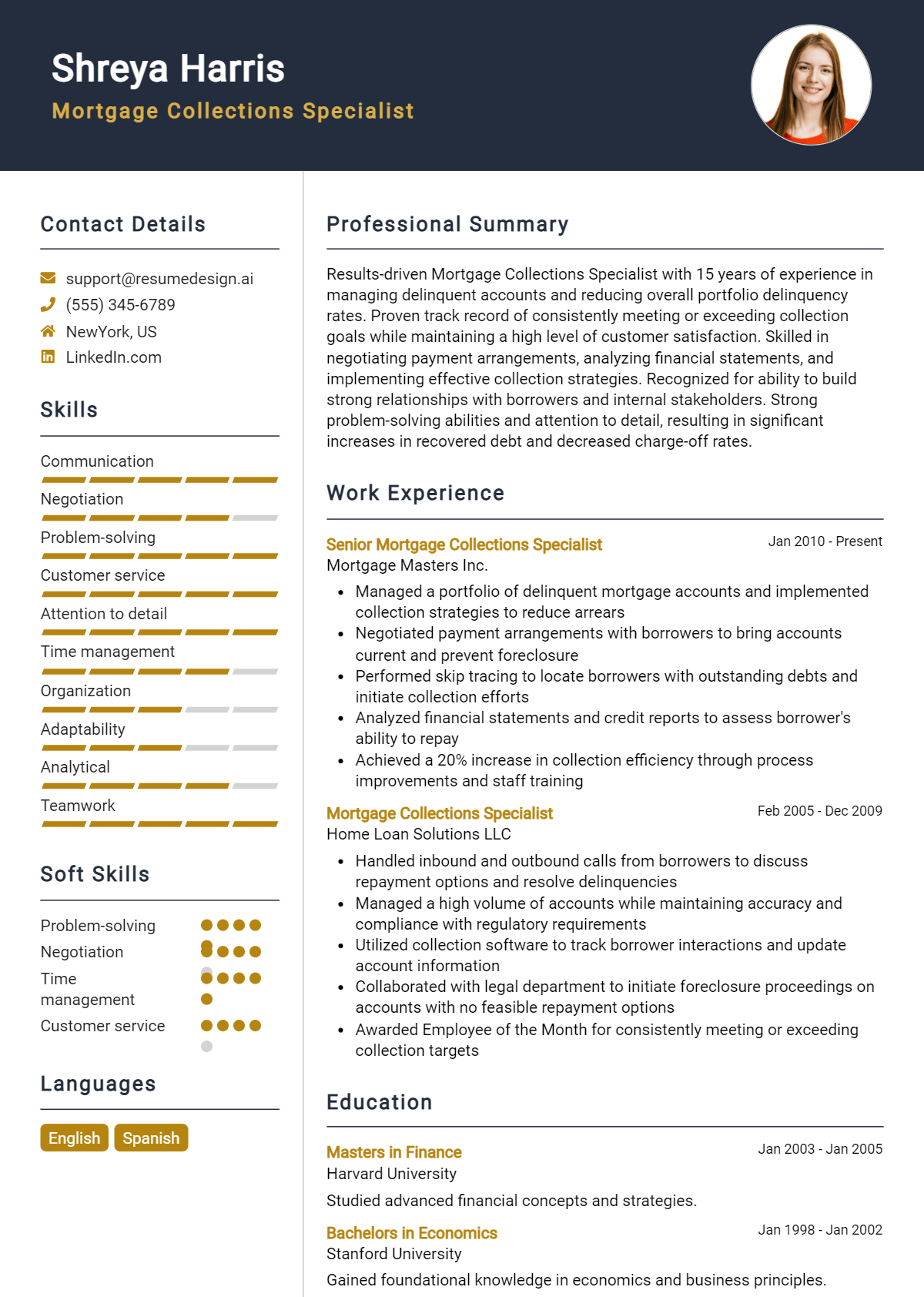

Example Mortgage Collections Specialist Resume Summaries

Strong Resume Summaries

Dedicated Mortgage Collections Specialist with over 5 years of experience managing a portfolio of 300+ accounts, resulting in a 30% reduction in delinquencies through effective negotiation and follow-up strategies.

Proven track record of increasing collection rates by 25% year-over-year by implementing personalized communication techniques and leveraging financial analysis tools to assess client situations.

Results-oriented collections professional with expertise in mortgage regulations and compliance, successfully recovering $2 million in overdue payments while maintaining a customer satisfaction rating above 90%.

Weak Resume Summaries

Experienced in collections and customer service, looking for a new opportunity in mortgage collections.

Responsible for managing accounts and improving payment situations in previous jobs.

The strong resume summaries are considered effective because they provide quantifiable results, specific skills relevant to the mortgage collections role, and demonstrate a clear understanding of the industry. In contrast, the weak summaries lack detail and measurable outcomes, making them too generic and failing to capture the candidate's individual contributions and expertise in the field.

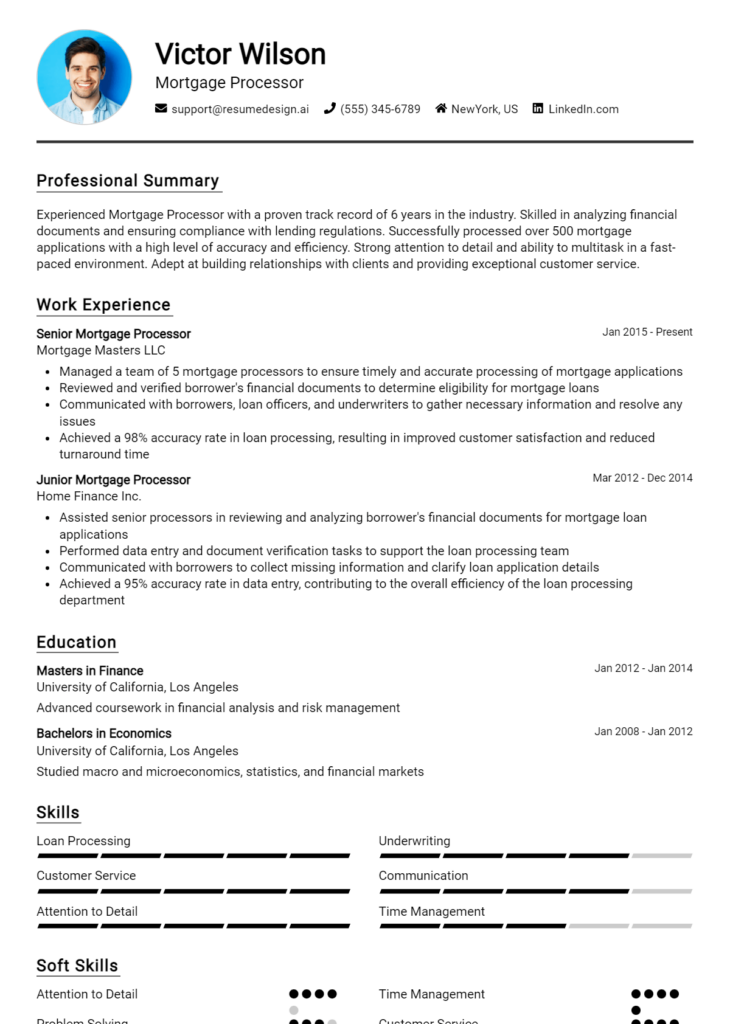

Work Experience Section for Mortgage Collections Specialist Resume

The work experience section of a Mortgage Collections Specialist resume is critical in demonstrating a candidate's relevant skills, accomplishments, and contributions to previous roles. This section provides potential employers with insight into the candidate's technical expertise in mortgage collections, their ability to manage teams effectively, and their commitment to delivering high-quality results. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase how their background makes them a strong fit for the role, ultimately increasing their chances of securing an interview.

Best Practices for Mortgage Collections Specialist Work Experience

- Highlight specific technical skills related to mortgage collections software and data analysis tools.

- Quantify achievements using metrics such as percentage of collections achieved or reduction in delinquency rates.

- Demonstrate collaboration by describing experiences where teamwork led to successful outcomes.

- Use action verbs to convey strong contributions and initiatives taken in previous roles.

- Align past experiences with the requirements of the job description to showcase relevance.

- Include any leadership roles or responsibilities to emphasize management capabilities.

- Highlight continuous improvement efforts and results from implementing new processes.

- Detail customer relationship management to demonstrate communication and negotiation skills.

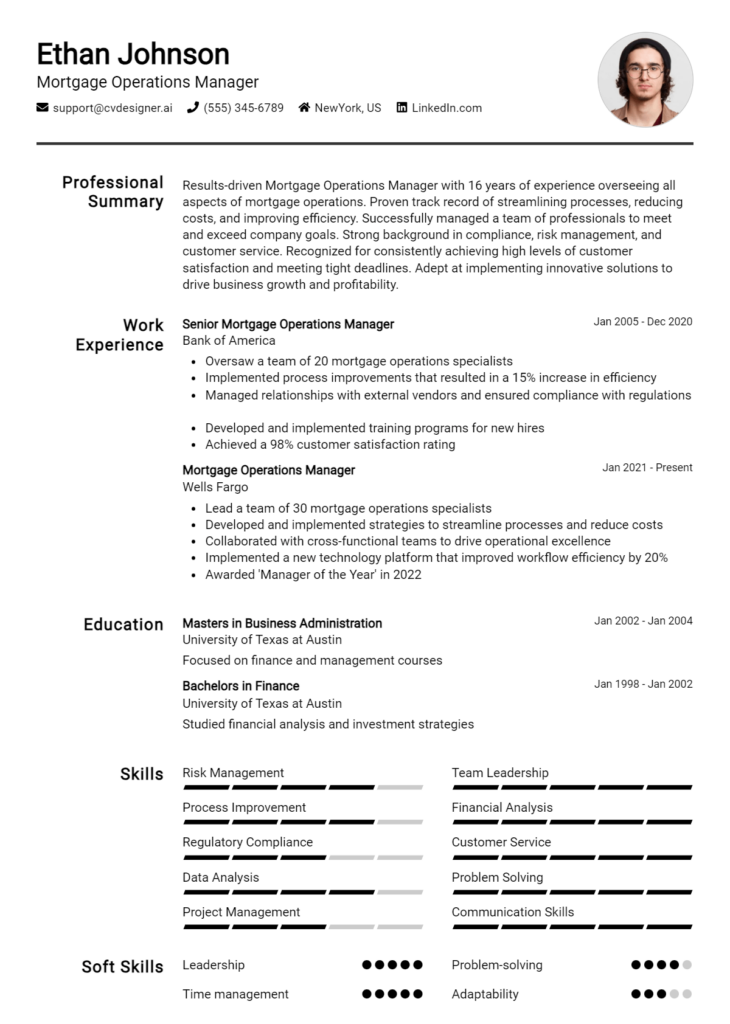

Example Work Experiences for Mortgage Collections Specialist

Strong Experiences

- Increased collections by 25% over 12 months by implementing a new follow-up strategy for overdue accounts.

- Led a team of 10 collections agents, providing training that improved team efficiency by 30% and reduced average call times.

- Successfully managed a project to streamline the collections process, resulting in a 15% reduction in delinquency rates.

- Collaborated with cross-functional teams to develop a customer outreach program that enhanced recovery rates by 20%.

Weak Experiences

- Worked on collections tasks and helped with customer calls.

- Responsible for managing accounts and ensuring payments were made.

- Participated in team meetings and contributed ideas.

- Assisted in various projects related to collections.

The examples provided highlight the difference between strong and weak experiences based on their specificity and impact. Strong experiences present quantifiable results, demonstrate leadership, and illustrate collaborative efforts, making them compelling to potential employers. In contrast, weak experiences lack detail and fail to provide measurable outcomes or clearly defined contributions, which may not resonate as effectively in the competitive job market for Mortgage Collections Specialists.

Education and Certifications Section for Mortgage Collections Specialist Resume

The education and certifications section is a critical component of a Mortgage Collections Specialist resume, as it showcases the candidate's academic background and commitment to the profession. By highlighting industry-relevant certifications and any specialized training, candidates can demonstrate their knowledge of mortgage regulations, collections processes, and customer service skills. This section not only reinforces the candidate's qualifications but also indicates a dedication to continuous learning and professional development, which is essential in a dynamic and ever-evolving industry. Providing detailed information about relevant coursework and credentials can significantly enhance a candidate's credibility and alignment with the specific requirements of the job role.

Best Practices for Mortgage Collections Specialist Education and Certifications

- Include only relevant degrees and certifications that directly relate to mortgage collections.

- Highlight advanced or industry-recognized credentials, such as Certified Mortgage Collections Specialist (CMCS) or similar certifications.

- Provide specific coursework that is pertinent to the role, such as finance, customer service, or collections management.

- List the most recent education and certifications first to showcase current knowledge and skills.

- Use clear and concise language to describe each qualification, avoiding jargon that may not be widely understood.

- Include the institution name and date of completion to add credibility to your qualifications.

- Consider adding any ongoing training or workshops related to mortgage collections to demonstrate commitment to professional development.

- Ensure that all information is accurately represented and up-to-date to maintain integrity and trustworthiness.

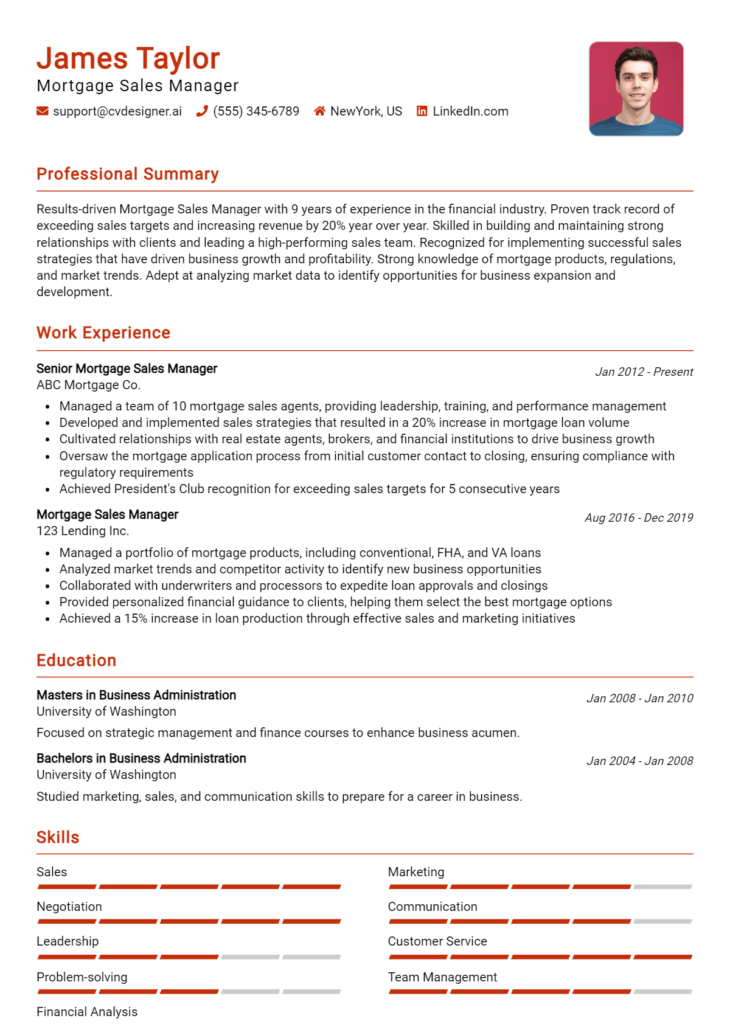

Example Education and Certifications for Mortgage Collections Specialist

Strong Examples

- Bachelor of Science in Finance, XYZ University, 2020

- Certified Mortgage Collections Specialist (CMCS), National Association of Mortgage Collections, 2021

- Coursework in Credit Risk Management and Debt Recovery Strategies, XYZ University

- Continuing Education: Advanced Negotiation Techniques for Collections, ABC Institute, 2022

Weak Examples

- Associate Degree in General Studies, Anytown Community College, 2018

- Certification in Basic Computer Skills, Online Training Center, 2019

- High School Diploma, Anytown High School, 2016

- Outdated Certification in Basic Accounting Principles, 2015

The strong examples are considered effective as they directly relate to the responsibilities and skills required for a Mortgage Collections Specialist, showcasing relevant education, certifications, and continuous learning efforts. In contrast, the weak examples are less effective because they either lack relevance to the mortgage industry or are outdated, failing to demonstrate the candidate's commitment to staying current in their profession.

Top Skills & Keywords for Mortgage Collections Specialist Resume

As a Mortgage Collections Specialist, showcasing the right set of skills on your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess technical knowledge of mortgage collection processes but also demonstrate strong interpersonal abilities. A well-rounded skill set can significantly enhance your effectiveness in handling sensitive client interactions, negotiating payment plans, and resolving issues efficiently. By highlighting both hard and soft skills, you can illustrate your capability to manage collections while maintaining positive relationships with clients, which is essential in this field.

Top Hard & Soft Skills for Mortgage Collections Specialist

Soft Skills

- Strong Communication Skills

- Active Listening

- Empathy

- Negotiation Skills

- Problem-Solving Abilities

- Time Management

- Adaptability

- Conflict Resolution

- Detail-Oriented

- Customer Service Orientation

- Team Collaboration

- Stress Management

- Patience

- Decision-Making

- Cultural Sensitivity

- Relationship Building

- Accountability

Hard Skills

- Knowledge of Mortgage Laws and Regulations

- Proficiency in Collection Software (e.g., FICO, Oracle)

- Data Entry and Management

- Credit Reporting Knowledge

- Financial Analysis

- Understanding of Loan Documentation

- Compliance and Risk Management

- Customer Relationship Management (CRM) Tools

- Payment Processing Systems

- Microsoft Office Suite (Excel, Word, Outlook)

- Familiarity with Debt Recovery Procedures

- Reporting and Analytical Skills

- Knowledge of Fair Debt Collection Practices Act (FDCPA)

- Ability to Work with Financial Statements

- Risk Assessment Techniques

- Data Analysis Techniques

- Record Keeping and Documentation Skills

By emphasizing these skills on your resume, you can effectively demonstrate your qualifications for the Mortgage Collections Specialist position, enhancing your potential for success. Additionally, showcasing relevant work experience that aligns with these skills will further substantiate your candidacy.

Stand Out with a Winning Mortgage Collections Specialist Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Collections Specialist position at [Company Name] as advertised on [Job Board/Company Website]. With a solid background in collections and a deep understanding of mortgage processes, I am confident in my ability to contribute effectively to your team and help enhance your collections strategies. My experience in managing accounts, negotiating payment plans, and maintaining positive customer relationships aligns well with the responsibilities outlined in the job description.

In my previous role at [Previous Company Name], I successfully managed a portfolio of over 300 mortgage accounts, where I employed a combination of empathy and assertiveness to communicate with clients facing financial difficulties. By using my strong analytical skills, I was able to identify patterns and develop tailored solutions that not only facilitated timely payments but also fostered long-term loyalty. I implemented a follow-up system that led to a 20% increase in collections over a six-month period, demonstrating my commitment to achieving results while maintaining compliance with regulatory standards.

I pride myself on my ability to work collaboratively with cross-functional teams, including underwriting and customer service, to ensure a seamless experience for clients. My proficiency in using collections software and CRM systems has enabled me to streamline processes, enhance data accuracy, and improve reporting capabilities. I am excited about the opportunity to bring my skills in negotiation, conflict resolution, and customer service to [Company Name], where I can contribute to your mission of providing exceptional service while achieving collection goals.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasm can benefit [Company Name] as a Mortgage Collections Specialist. I am eager to bring my experience in the mortgage industry and my commitment to customer satisfaction to your esteemed organization.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Mortgage Collections Specialist Resume

When crafting a resume for a Mortgage Collections Specialist position, it’s essential to present your skills and experiences effectively to stand out in a competitive job market. However, many applicants make common mistakes that can hinder their chances of securing an interview. Avoiding these pitfalls will help ensure your resume reflects your qualifications appropriately and professionally.

Generic Objective Statement: Using a vague objective statement fails to convey your specific interest in mortgage collections. Tailor your objective to highlight your relevant skills and commitment to the role.

Lack of Relevant Experience: Omitting specific experiences related to mortgage collections can weaken your application. Be sure to include any relevant positions, even if they were not solely focused on collections.

Ignoring Quantifiable Achievements: Failing to include concrete metrics or achievements can make your accomplishments less impactful. Use numbers to demonstrate your effectiveness, such as “reduced delinquency rates by 20%.”

Inconsistent Formatting: An unprofessional or inconsistent format can distract from your content. Ensure uniformity in font, bullet points, and spacing throughout your resume.

Overuse of Jargon: While industry terminology can be beneficial, overloading your resume with jargon may alienate readers. Use clear language to ensure your qualifications are easily understood.

Neglecting Soft Skills: Focusing solely on technical skills can overlook important soft skills crucial for collections roles. Highlight abilities like communication, negotiation, and empathy to showcase your well-roundedness.

Typos and Grammatical Errors: Spelling or grammatical mistakes can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times or have someone else review it.

Failure to Tailor for Each Application: Sending the same resume for multiple applications may lead to missed opportunities. Customize your resume to align with each job description, emphasizing the most relevant experiences and skills.