Mortgage Broker Core Responsibilities

Mortgage Brokers play a crucial role in facilitating property financing by connecting borrowers with lenders. They assess clients' financial needs, gather necessary documentation, and analyze various loan options to recommend the best solutions. Strong technical, operational, and problem-solving skills are vital, as brokers navigate complex financial regulations and market conditions. These abilities not only enhance client satisfaction but also contribute to the organization's overarching goals. A well-structured resume can effectively highlight these qualifications, showcasing the broker's expertise and value.

Common Responsibilities Listed on Mortgage Broker Resume

- Conducting thorough financial assessments of clients.

- Researching and comparing loan products from multiple lenders.

- Preparing and submitting loan applications on behalf of clients.

- Advising clients on mortgage options and terms.

- Negotiating loan terms with lenders to secure favorable rates.

- Ensuring compliance with legal and regulatory requirements.

- Maintaining up-to-date knowledge of market trends and mortgage products.

- Building and maintaining relationships with clients and lenders.

- Providing exceptional customer service throughout the loan process.

- Gathering and verifying documentation for loan approval.

- Tracking loan progress and communicating updates to clients.

- Identifying potential problems and offering solutions to clients.

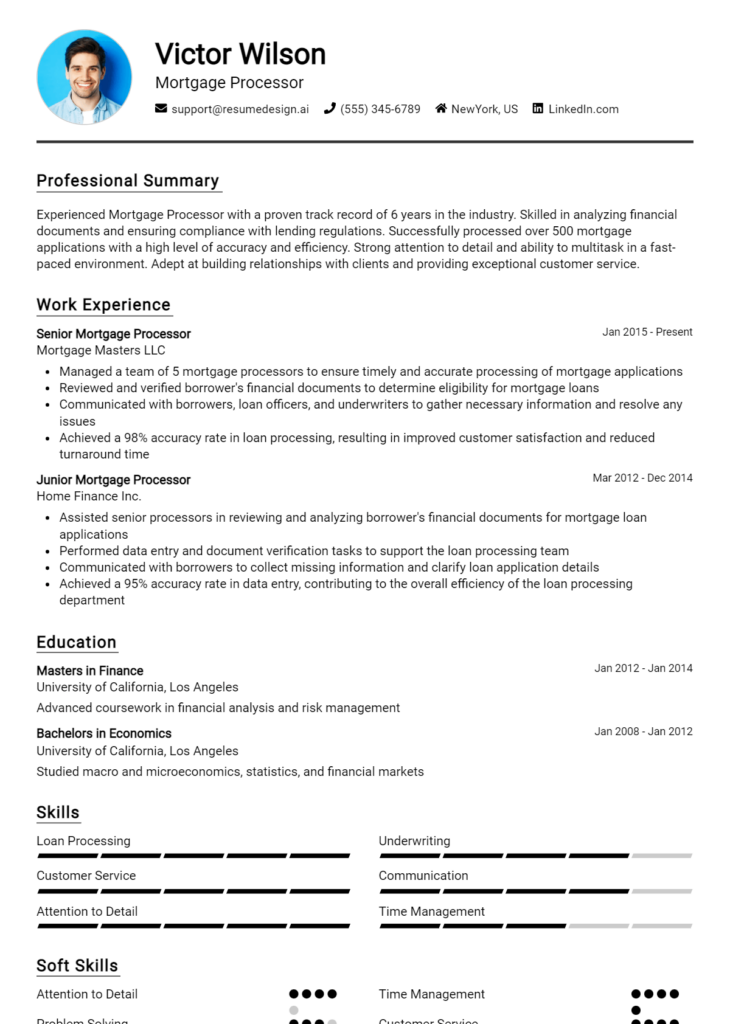

High-Level Resume Tips for Mortgage Broker Professionals

In the competitive field of mortgage brokering, a well-crafted resume is essential for making a strong first impression on potential employers. Your resume serves as a marketing tool that not only showcases your skills and experience but also highlights your achievements in the industry. Given that hiring managers often skim through numerous applications, your resume must stand out by clearly reflecting your qualifications and the unique value you bring to the table. This guide will provide practical and actionable resume tips specifically tailored for Mortgage Broker professionals, helping you create a compelling document that opens doors to new opportunities.

Top Resume Tips for Mortgage Broker Professionals

- Tailor your resume for each job application by aligning your skills and experiences with the specific job description.

- Showcase relevant experience in mortgage brokering, including any positions held, duration, and key responsibilities.

- Quantify your achievements with specific numbers, such as the volume of loans closed or customer satisfaction ratings.

- Highlight industry-specific skills, such as knowledge of mortgage products, underwriting processes, and regulatory compliance.

- Include certifications and licenses pertinent to mortgage brokering, such as NMLS registration or specialized training programs.

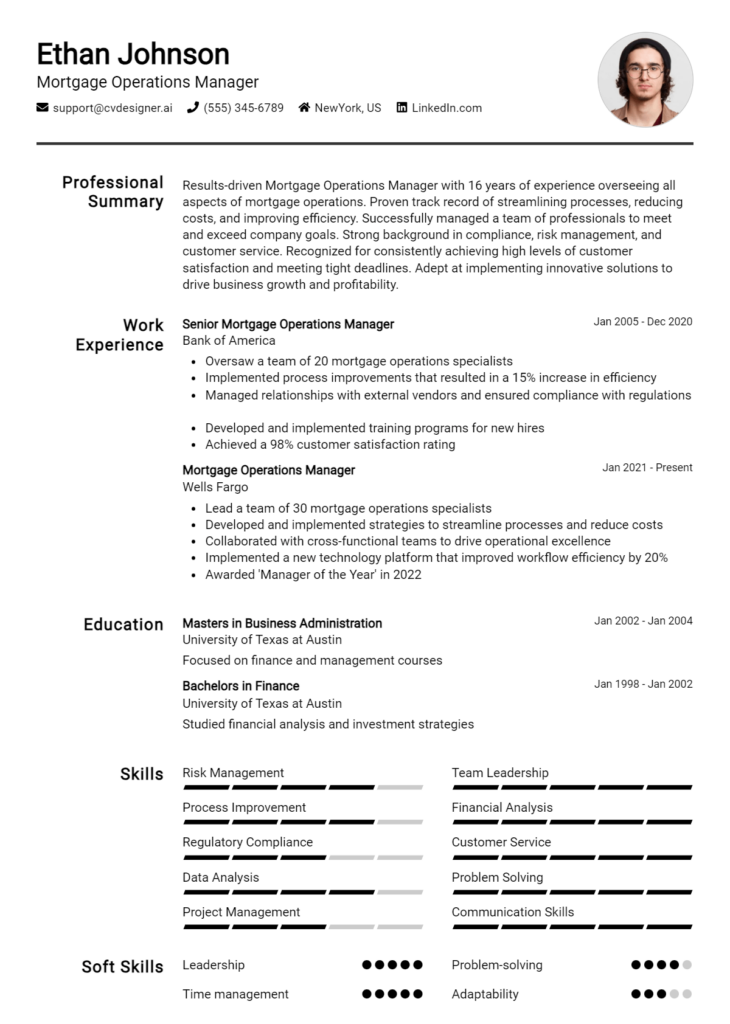

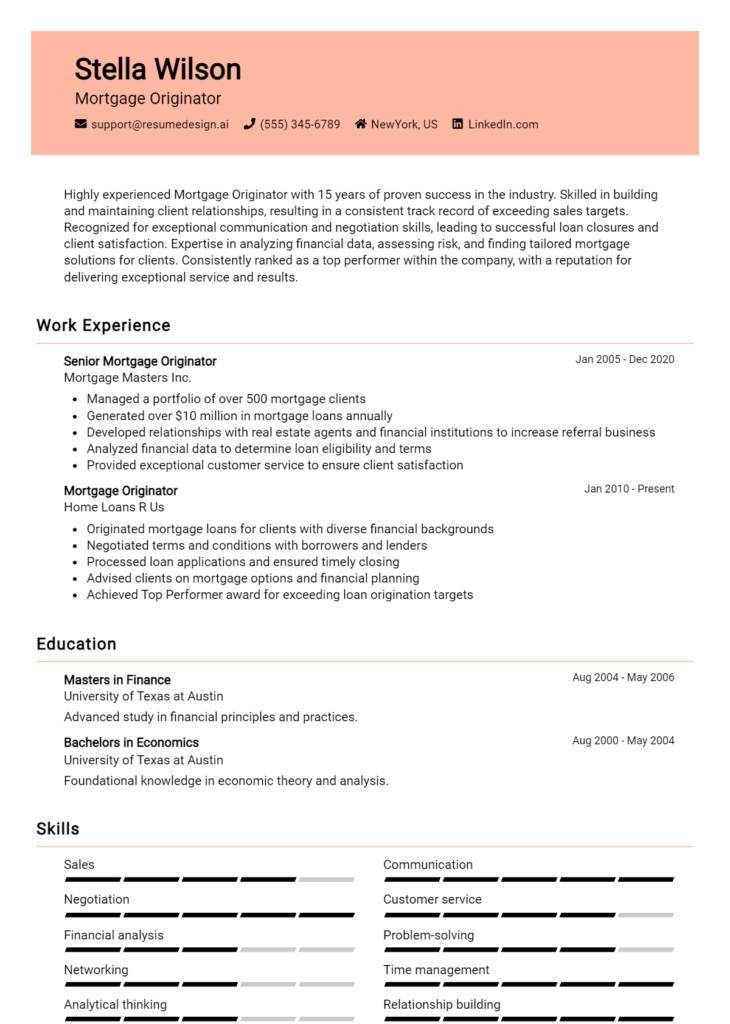

- Utilize a clean and professional format, ensuring your resume is easy to read and visually appealing.

- Incorporate action verbs that convey your contributions and impact, such as "negotiated," "secured," or "advised."

- Keep your resume concise, ideally one page, focusing on the most relevant information and achievements.

- Consider adding a summary statement at the top that encapsulates your experience and goals in the mortgage industry.

- Proofread your resume thoroughly to eliminate any spelling or grammatical errors, as attention to detail is critical in this field.

By implementing these tips, you can significantly enhance your chances of landing a job in the Mortgage Broker field. A well-structured resume that effectively showcases your expertise and accomplishments will not only capture the attention of hiring managers but also set you apart in a competitive job market. Investing the time to refine your resume can ultimately lead to new career opportunities and professional growth in the mortgage industry.

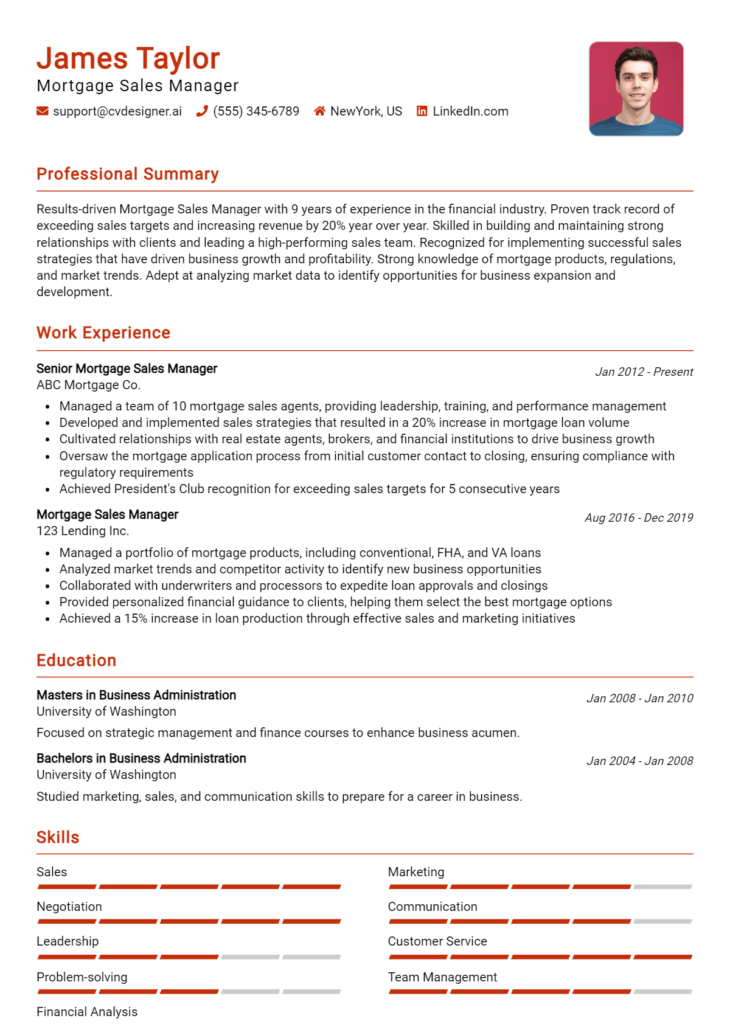

Why Resume Headlines & Titles are Important for Mortgage Broker

In the competitive field of mortgage brokerage, a well-crafted resume headline or title is crucial for making a memorable first impression. As hiring managers sift through countless applications, a strong headline can immediately grab their attention and succinctly summarize a candidate's key qualifications in one impactful phrase. This brief yet powerful statement should be concise, relevant, and directly related to the mortgage broker position being applied for, helping candidates stand out in a crowded job market.

Best Practices for Crafting Resume Headlines for Mortgage Broker

- Keep it concise: Limit your headline to one or two impactful phrases.

- Be specific: Tailor your headline to reflect the exact role you are applying for.

- Highlight key strengths: Focus on your most relevant skills or experiences.

- Use action words: Start with strong verbs to convey confidence and capability.

- Incorporate industry keywords: Use terms familiar to the mortgage industry to enhance credibility.

- Avoid clichés: Steer clear of overused phrases that add little value.

- Showcase achievements: If applicable, include quantifiable achievements to demonstrate success.

- Maintain professionalism: Ensure your tone aligns with the expectations of the mortgage industry.

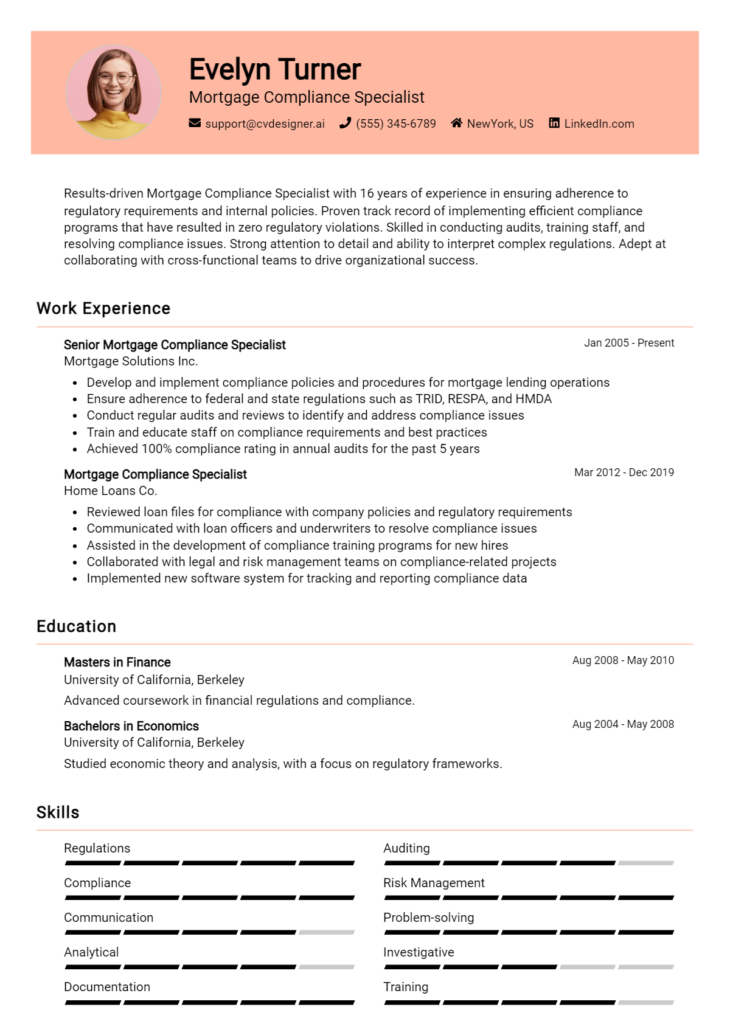

Example Resume Headlines for Mortgage Broker

Strong Resume Headlines

"Experienced Mortgage Broker with a Proven Track Record of Closing High-Value Loans"

“Certified Mortgage Professional Specializing in First-Time Homebuyer Solutions”

“Dynamic Mortgage Broker with 10+ Years of Experience in Commercial and Residential Financing”

Weak Resume Headlines

“Mortgage Broker Seeking Opportunities”

“Hardworking Individual Ready to Work”

The strong headlines are effective because they clearly communicate the candidate's expertise and unique value proposition, making it easy for hiring managers to understand their qualifications at a glance. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, which do not convey the candidate's strengths or suitability for the role. A compelling headline sets the tone for the rest of the resume and can significantly influence a hiring manager's decision to read further.

Work Experience Section for Mortgage Broker Resume

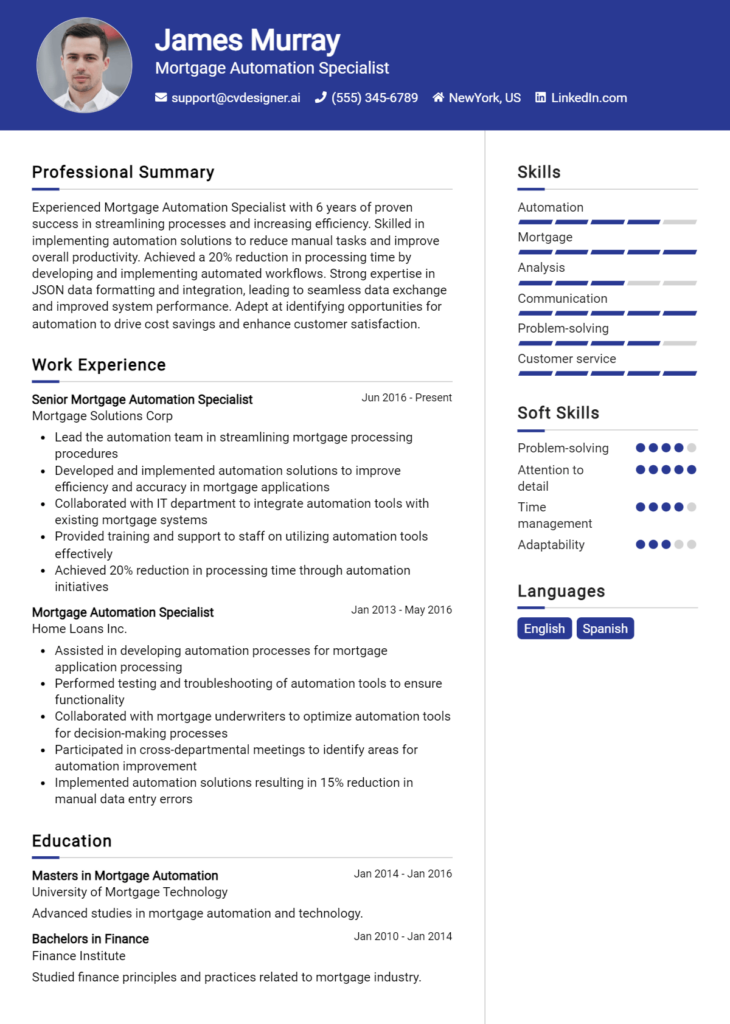

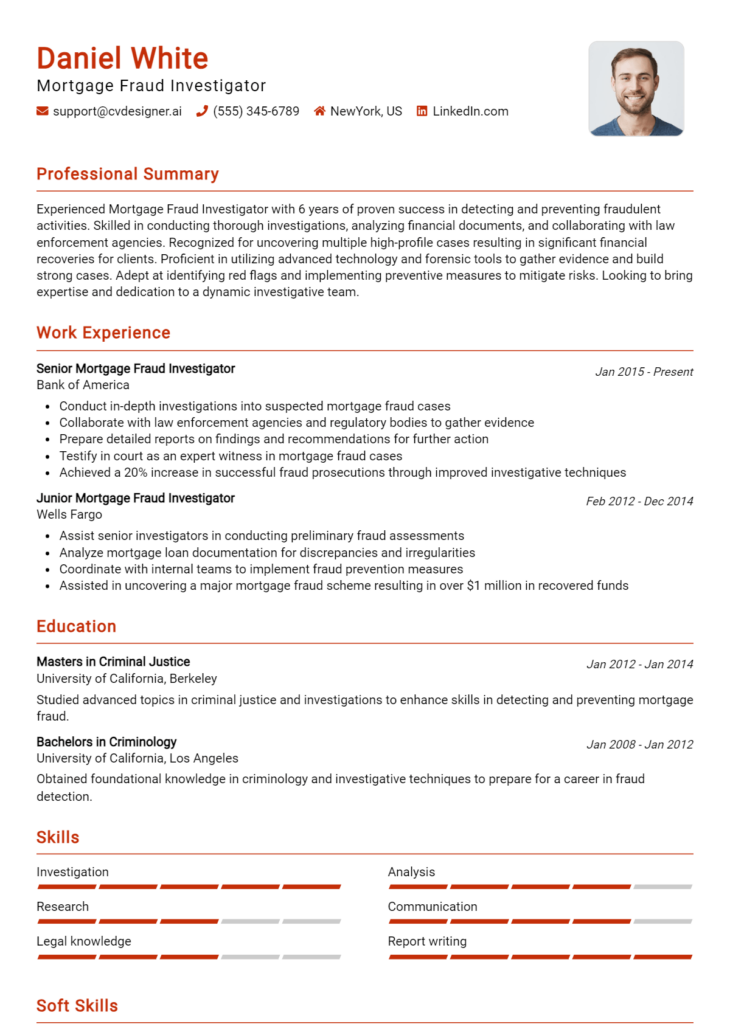

The work experience section of a Mortgage Broker resume is pivotal in demonstrating the candidate's technical skills and their ability to manage teams effectively while delivering high-quality financial products. This section serves as a platform for candidates to showcase their achievements, illustrating how their experiences align with industry standards. By quantifying results and detailing specific contributions, candidates can provide compelling evidence of their capabilities and value to potential employers.

Best Practices for Mortgage Broker Work Experience

- Highlight specific technical skills relevant to mortgage brokerage, such as knowledge of loan origination systems and underwriting processes.

- Quantify achievements where possible, using metrics to demonstrate the impact of your work, like the number of loans processed or the percentage increase in client satisfaction.

- Detail your role in team management, showcasing your ability to lead and collaborate with diverse teams to achieve common goals.

- Include relevant certifications and training that enhance your expertise in the mortgage industry.

- Tailor your experiences to align with the job description, emphasizing responsibilities and results that meet the employer's needs.

- Use action verbs to convey a sense of initiative and accomplishment in your descriptions.

- Provide context for your achievements by explaining the challenges faced and how you overcame them.

- Maintain clarity and conciseness by avoiding jargon and overly complex language, making your experience easily understandable.

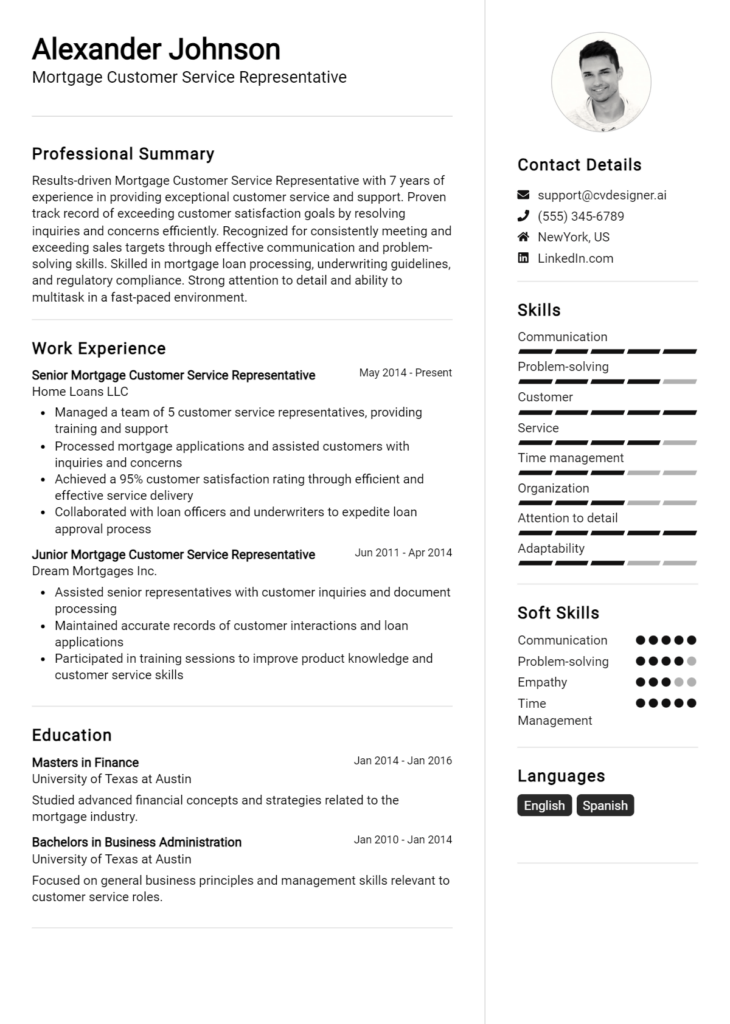

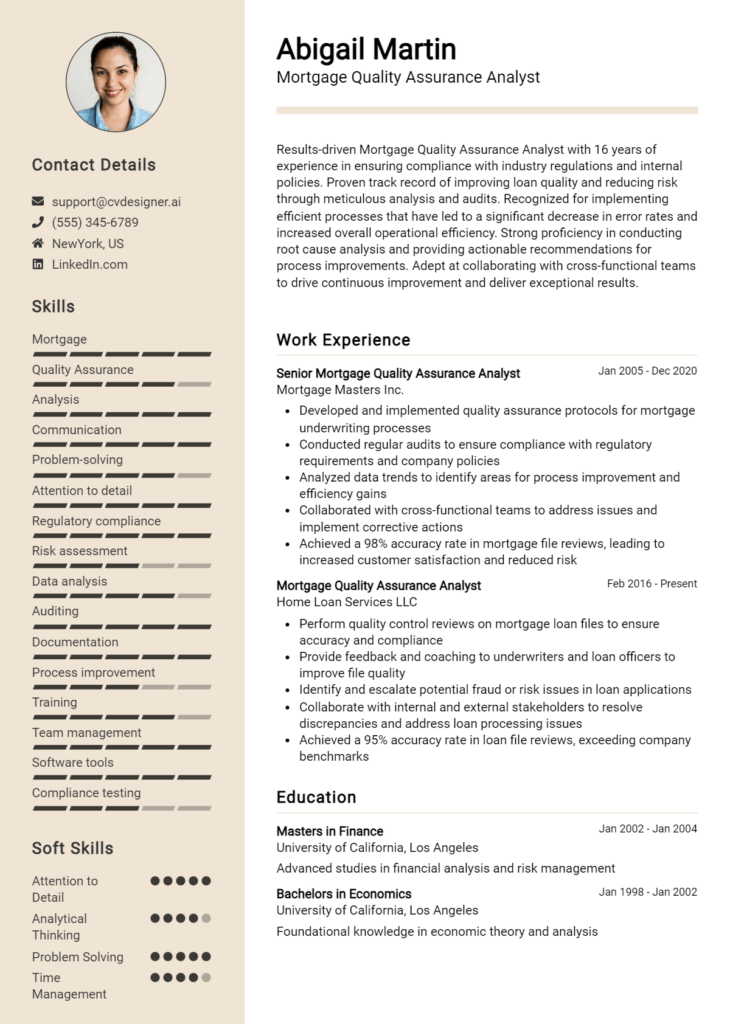

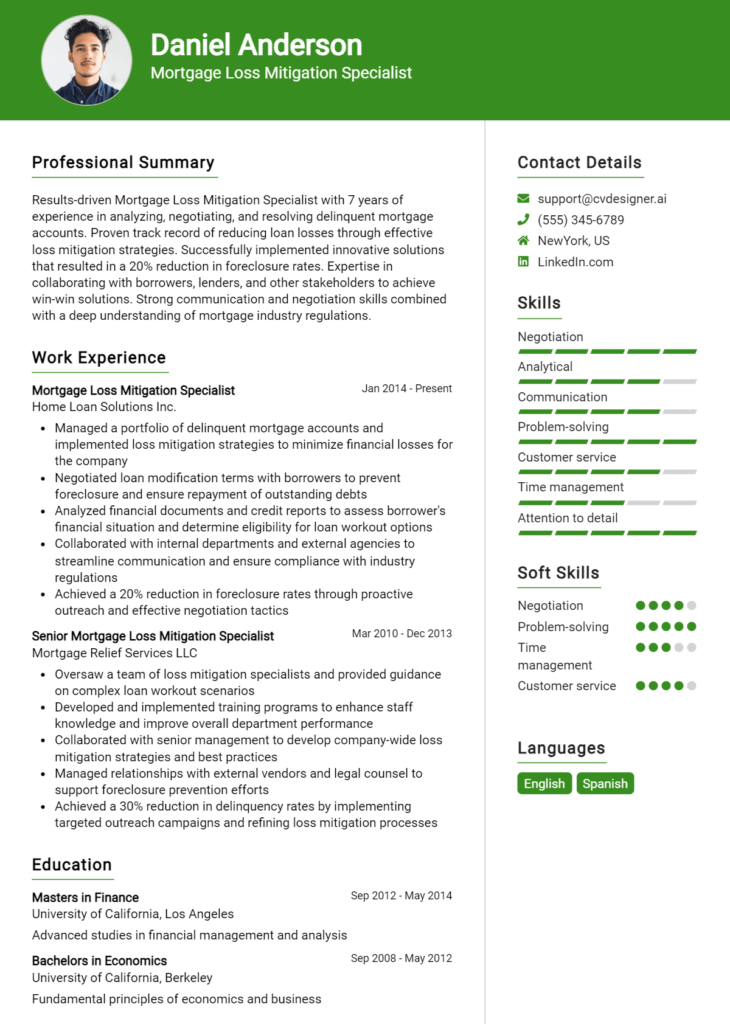

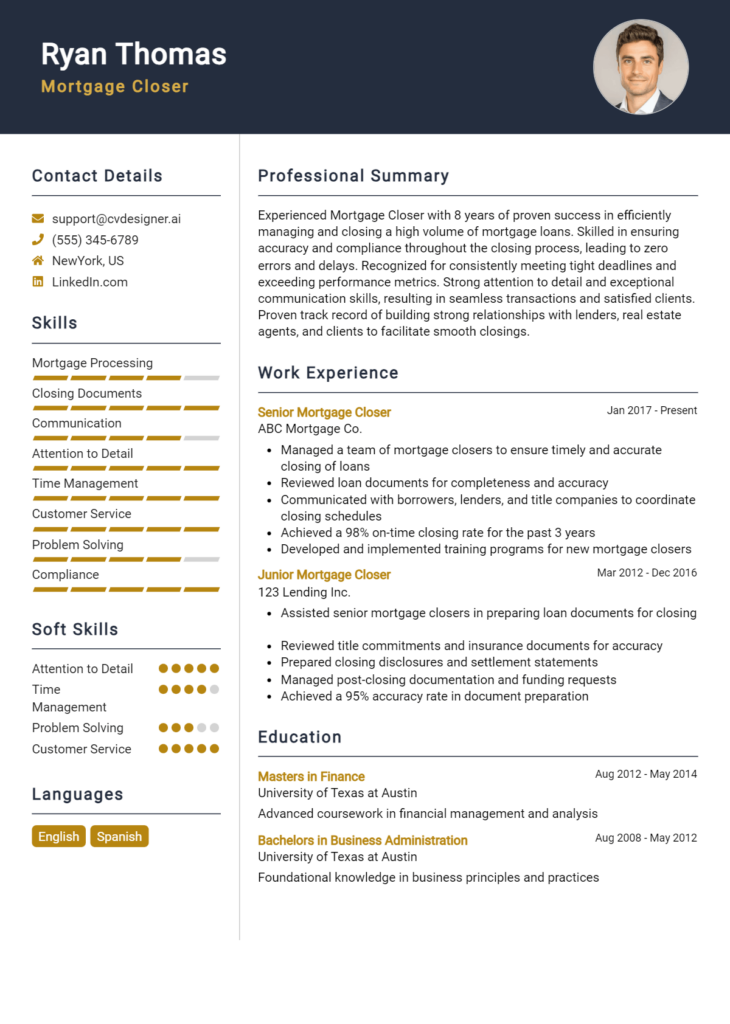

Example Work Experiences for Mortgage Broker

Strong Experiences

- Successfully closed over 150 mortgage transactions in a single fiscal year, achieving a 95% approval rate by implementing rigorous screening processes.

- Led a team of five loan officers to improve client engagement, resulting in a 30% increase in referrals and a 25% boost in overall client satisfaction scores.

- Developed and executed training programs for new hires, enhancing their onboarding experience and reducing the time to productivity by 40%.

- Collaborated with real estate agents and financial planners to streamline the loan application process, decreasing average processing time from 30 days to 20 days.

Weak Experiences

- Worked on various mortgage applications without specifying the number or nature of the loans.

- Assisted colleagues with paperwork and general tasks, lacking detail on any specific contributions made.

- Involved in some team projects but did not outline any measurable outcomes or personal impact.

- Participated in meetings and discussions without explaining the context or results of those interactions.

The examples provided illustrate the differences between strong and weak experiences in a Mortgage Broker resume. Strong experiences are characterized by quantifiable outcomes, specific responsibilities, and demonstrable leadership skills, reflecting a candidate's impact and expertise. In contrast, weak experiences lack detail and measurable results, making it difficult for potential employers to gauge the candidate's true capabilities and contributions to previous roles.

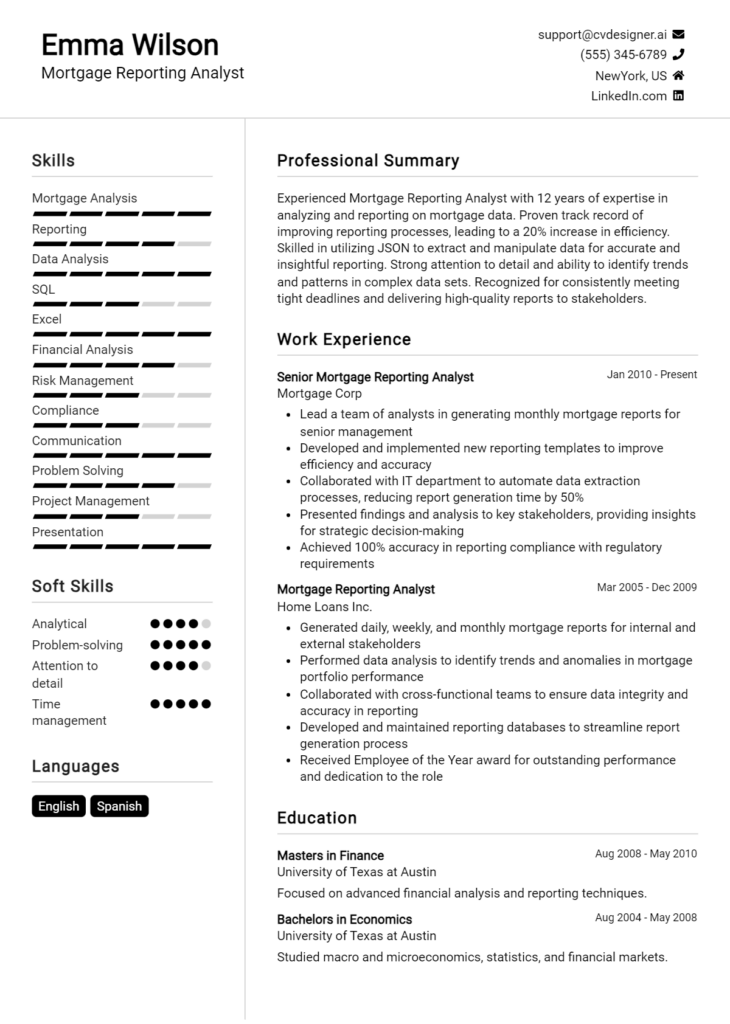

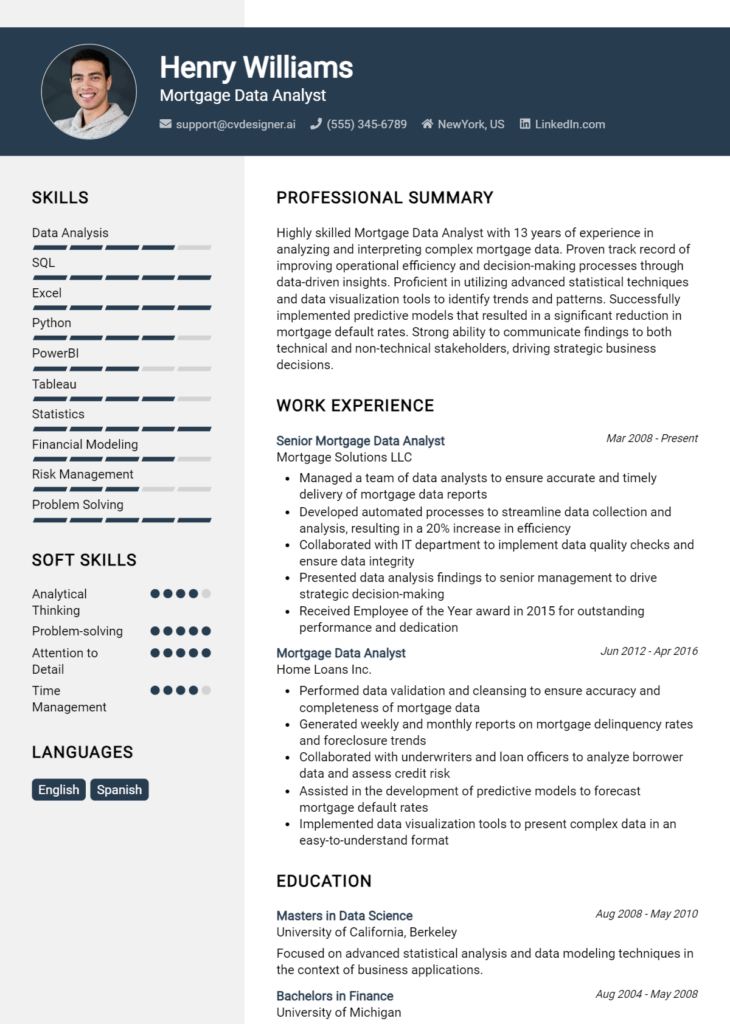

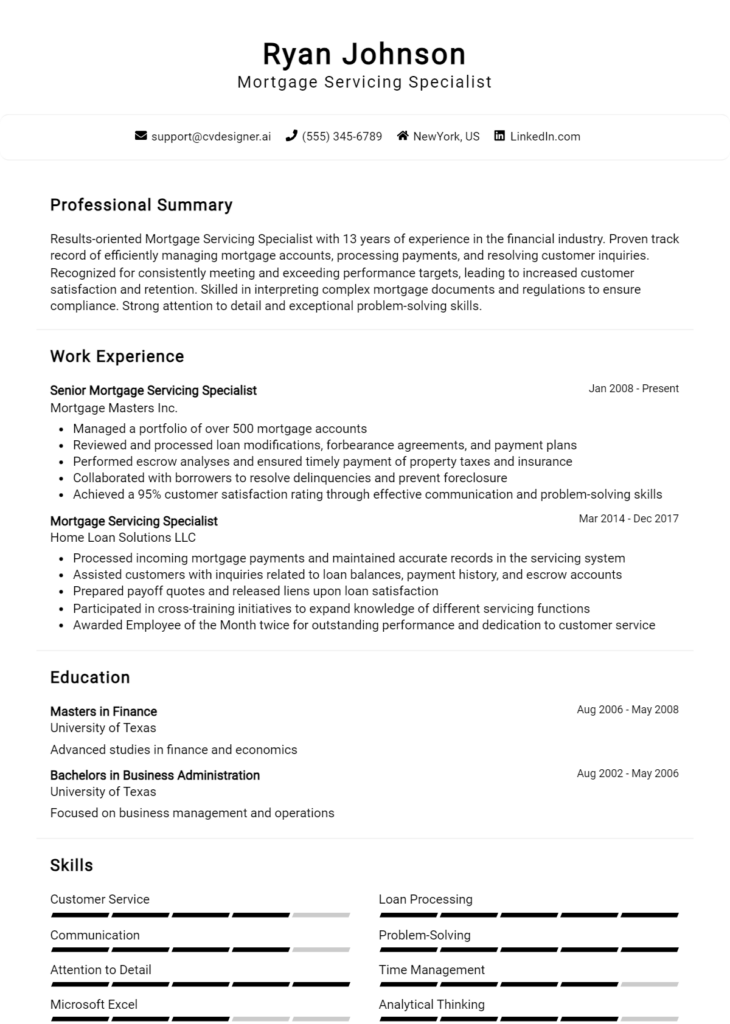

Education and Certifications Section for Mortgage Broker Resume

The education and certifications section of a Mortgage Broker resume is crucial as it serves to showcase the candidate's academic qualifications, industry-specific certifications, and commitment to ongoing professional development. This section not only emphasizes the knowledge and skills acquired through formal education but also highlights relevant coursework, certifications, and specialized training that can enhance the candidate's credibility. By providing a clear picture of their educational background and continuous learning efforts, candidates can effectively align themselves with the requirements of the mortgage broker role, making a strong case for their suitability in a competitive job market.

Best Practices for Mortgage Broker Education and Certifications

- Include only relevant degrees and certifications that pertain to the mortgage and finance industry.

- Detail the level of education achieved, specifying the degree type and major, if applicable.

- Highlight any advanced or industry-recognized credentials, such as Certified Mortgage Consultant (CMC) or Certified Residential Mortgage Specialist (CRMS).

- Include relevant coursework that showcases specialized knowledge applicable to mortgage brokerage.

- List any continuing education or professional development courses related to mortgage lending and regulations.

- Use clear and concise formatting to make this section easy to read and understand.

- Prioritize certifications that are current and recognized within the industry.

- Consider adding any memberships in professional organizations related to real estate or finance.

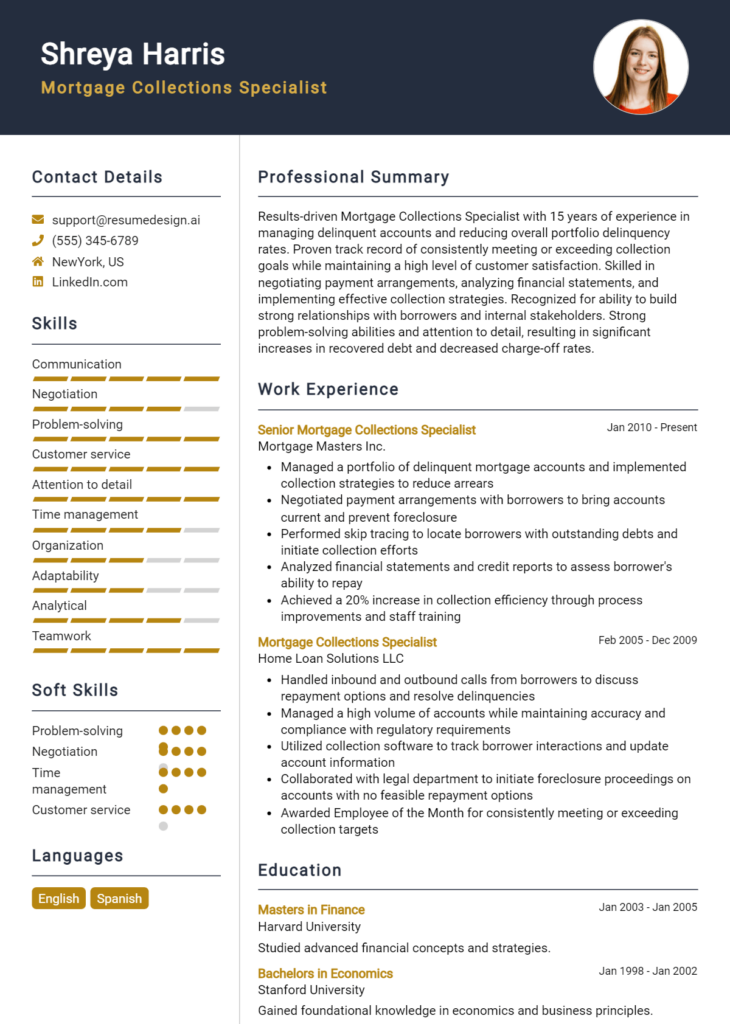

Example Education and Certifications for Mortgage Broker

Strong Examples

- Bachelor of Science in Finance, University of California, Los Angeles (UCLA)

- Certified Mortgage Consultant (CMC) - National Association of Mortgage Brokers

- Real Estate Principles and Practices - Completed coursework at the Community College of Denver

- Certified Residential Mortgage Specialist (CRMS) - Mortgage Bankers Association

Weak Examples

- Associate Degree in General Studies - Unrelated to mortgage brokerage

- Certification in Basic Computer Skills - Not relevant to mortgage brokerage

- High School Diploma - Lacks advanced education required for the role

- Outdated Mortgage Broker Certification from 2005 - No longer recognized

The strong examples listed highlight relevant degrees and certifications that are directly applicable to the mortgage broker role, showcasing a solid academic foundation and industry-recognized qualifications. In contrast, the weak examples reflect qualifications that lack relevance to the mortgage industry, either due to their general nature or because they are outdated and not aligned with current industry standards. This distinction helps potential employers quickly assess the candidate's suitability for the position.

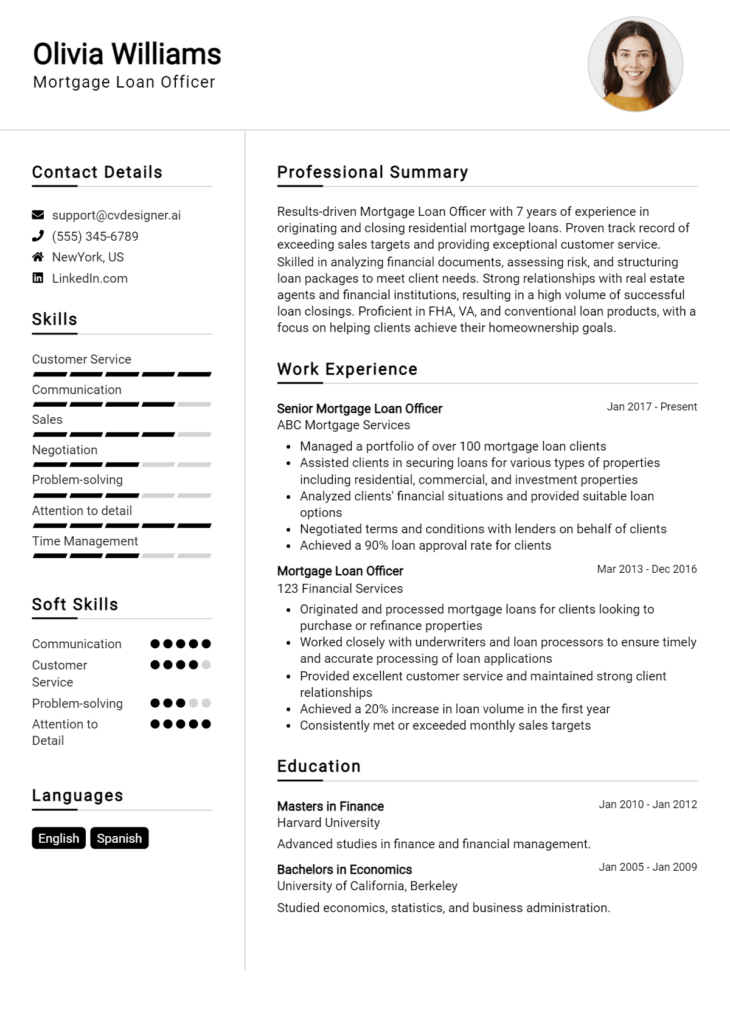

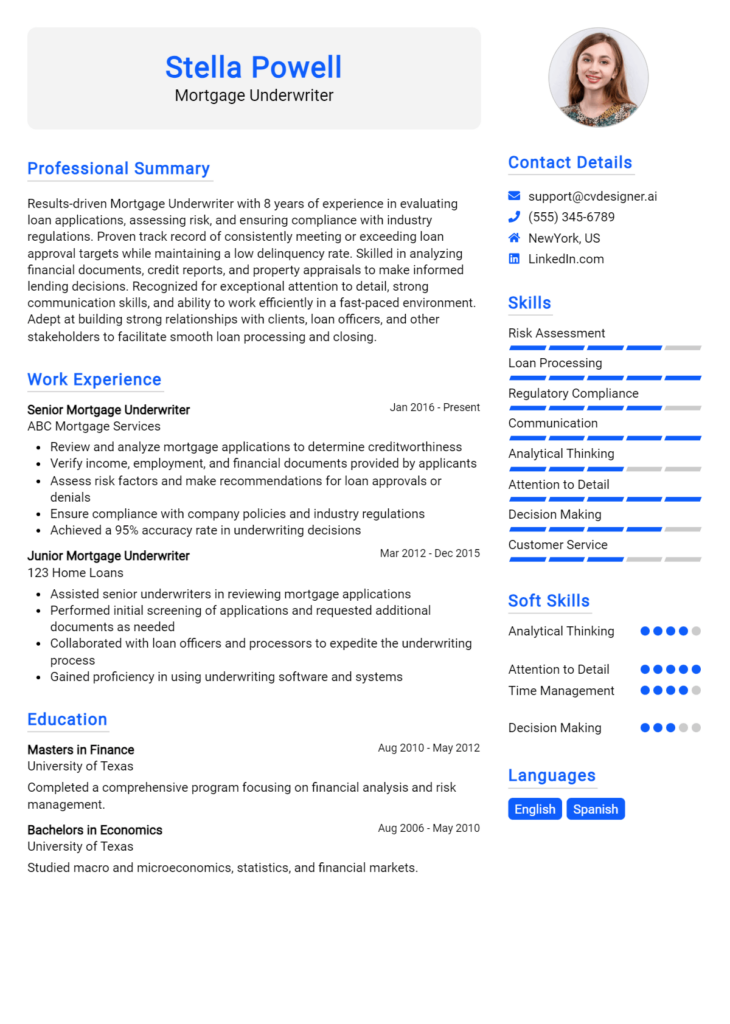

Top Skills & Keywords for Mortgage Broker Resume

A well-crafted resume is crucial for a mortgage broker, as it serves as the first impression to potential employers and clients. Highlighting the right skills can set you apart in a competitive job market. Skills not only demonstrate your qualifications but also showcase your ability to navigate the complexities of the mortgage industry. A comprehensive understanding of both hard and soft skills is essential, as they reflect your technical proficiency and interpersonal abilities. In this field, having a robust skills section can enhance your resume and underscore your suitability for the role. For more information on enhancing your resume, check out skills and work experience.

Top Hard & Soft Skills for Mortgage Broker

Soft Skills

- Communication Skills

- Customer Service Orientation

- Negotiation Skills

- Problem-Solving Ability

- Attention to Detail

- Time Management

- Empathy

- Adaptability

- Team Collaboration

- Relationship Building

- Conflict Resolution

- Active Listening

- Analytical Thinking

- Stress Management

Hard Skills

- Mortgage Loan Processing

- Understanding of Financial Regulations

- Credit Analysis

- Real Estate Knowledge

- Risk Assessment

- Proficiency in Mortgage Software

- Financial Reporting

- Market Research

- Data Analysis

- Knowledge of Loan Products

- Regulatory Compliance

- Interest Rate Analysis

- Sales Skills

- Documentation Management

- Financial Forecasting

- Underwriting Knowledge

- Budgeting and Financial Planning

Stand Out with a Winning Mortgage Broker Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Mortgage Broker position at [Company Name], as advertised on [where you found the job posting]. With over [X years] of experience in the mortgage industry, I have developed a comprehensive understanding of the lending process, strong relationships with lenders, and a proven track record of helping clients achieve their homeownership dreams. I am excited about the opportunity to bring my expertise to your esteemed team and contribute to your mission of providing exceptional service to clients.

In my previous role at [Previous Company Name], I successfully guided clients through the mortgage application process, ensuring that they understood each step and felt supported throughout. My ability to analyze financial documents and assess clients’ needs allowed me to recommend tailored mortgage solutions that aligned with their financial goals. I pride myself on my strong communication skills and my commitment to building lasting relationships, which have helped me achieve a high client satisfaction rate and numerous referrals. I am confident that my proactive approach and client-centered mindset will help me excel as a Mortgage Broker at [Company Name].

What sets me apart from other candidates is my dedication to continuous learning and staying current with industry trends and regulations. I have actively pursued professional development opportunities, such as attending workshops and obtaining relevant certifications, to enhance my skills and knowledge. I believe that my passion for the field, combined with my analytical abilities and commitment to ethical practices, makes me a strong fit for your team. I am eager to leverage my expertise to help [Company Name] maintain its reputation for excellence and client satisfaction in the competitive mortgage market.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my background, skills, and enthusiasm can contribute to the success of [Company Name]. I am available for an interview at your earliest convenience and can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Mortgage Broker Resume

When crafting a resume as a mortgage broker, it's essential to present your qualifications and experience in the best possible light. However, many candidates make common mistakes that can undermine their chances of securing an interview. Understanding these pitfalls can help you create a more effective and compelling resume that highlights your skills and captures the attention of potential employers. Here are some common mistakes to avoid:

Vague Job Titles: Using generic titles like "Sales Professional" instead of "Mortgage Broker" can confuse employers about your specific expertise in the mortgage industry.

Lack of Quantifiable Achievements: Failing to include metrics or quantifiable results (e.g., "closed $5 million in loans in 2022") can make your accomplishments seem less impactful and diminish your credibility.

Overly Complex Language: Using jargon or technical terms that are not easily understood can alienate hiring managers who may not be familiar with specific industry language.

Ignoring Relevant Skills: Omitting key skills such as knowledge of loan products, financial analysis, and customer service can lead to missed opportunities, as employers look for specific qualifications.

Poor Formatting: A cluttered or unprofessional layout can make your resume hard to read, causing hiring managers to overlook important information.

Typos and Grammatical Errors: Mistakes in spelling or grammar can give the impression of carelessness and lack of attention to detail, which is crucial in the finance industry.

Lack of Customization: Sending out a one-size-fits-all resume without tailoring it to the specific mortgage broker job can reduce your chances of standing out among other candidates.

Not Including Continuing Education: Failing to mention any certifications, licenses, or ongoing education in mortgage lending can make your resume less competitive, especially in a constantly evolving industry.

Conclusion

As a Mortgage Broker, you play a crucial role in helping clients navigate the complexities of home financing. Throughout this article, we’ve explored the essential skills and qualifications that define a successful mortgage broker, including strong communication abilities, in-depth knowledge of loan products, and exceptional customer service. We’ve also highlighted the importance of building a solid network of lenders and real estate professionals to enhance your service offerings.

In addition, we discussed the significance of staying updated with industry regulations and trends to better assist your clients in making informed decisions. Remember, your expertise not only impacts your clients' financial futures but also shapes your professional reputation in the market.

As you reflect on your career and the insights shared, it’s time to take action. Review your Mortgage Broker resume to ensure it effectively showcases your skills and experiences. Whether you’re looking to refine your current resume or create a new one, there are excellent resources available to help you stand out in a competitive job market. Consider using resume templates to give your resume a professional edge, or try out the resume builder for a user-friendly experience. You can also explore resume examples to gain inspiration and insights into what makes a great resume. Don’t forget the importance of a compelling introduction; check out the cover letter templates to complement your application materials.

Now is the perfect time to invest in your career. Update your resume today and take the next step towards achieving your professional goals!