Interest Rate Risk Manager Core Responsibilities

An Interest Rate Risk Manager plays a crucial role in assessing and managing the financial institution's exposure to interest rate fluctuations. Key responsibilities include analyzing market trends, developing risk mitigation strategies, and collaborating with finance, treasury, and compliance departments. This position demands strong technical skills in financial modeling, operational expertise in risk assessment, and exceptional problem-solving abilities. A well-structured resume that highlights these qualifications can significantly impact the organization's success by ensuring effective risk management practices.

Common Responsibilities Listed on Interest Rate Risk Manager Resume

- Conduct regular interest rate risk assessments and analyses.

- Develop and implement risk management strategies and policies.

- Collaborate with financial and treasury departments to align risk management objectives.

- Create financial models to project interest rate impacts on the organization.

- Monitor and report on interest rate exposure and risk metrics.

- Ensure compliance with regulatory requirements related to interest rate risk.

- Prepare detailed reports for senior management and stakeholders.

- Conduct stress testing and scenario analysis to evaluate risk tolerance.

- Advise on the implications of interest rate movements on investment portfolios.

- Train team members on risk management principles and practices.

- Stay updated on market trends and economic factors affecting interest rates.

High-Level Resume Tips for Interest Rate Risk Manager Professionals

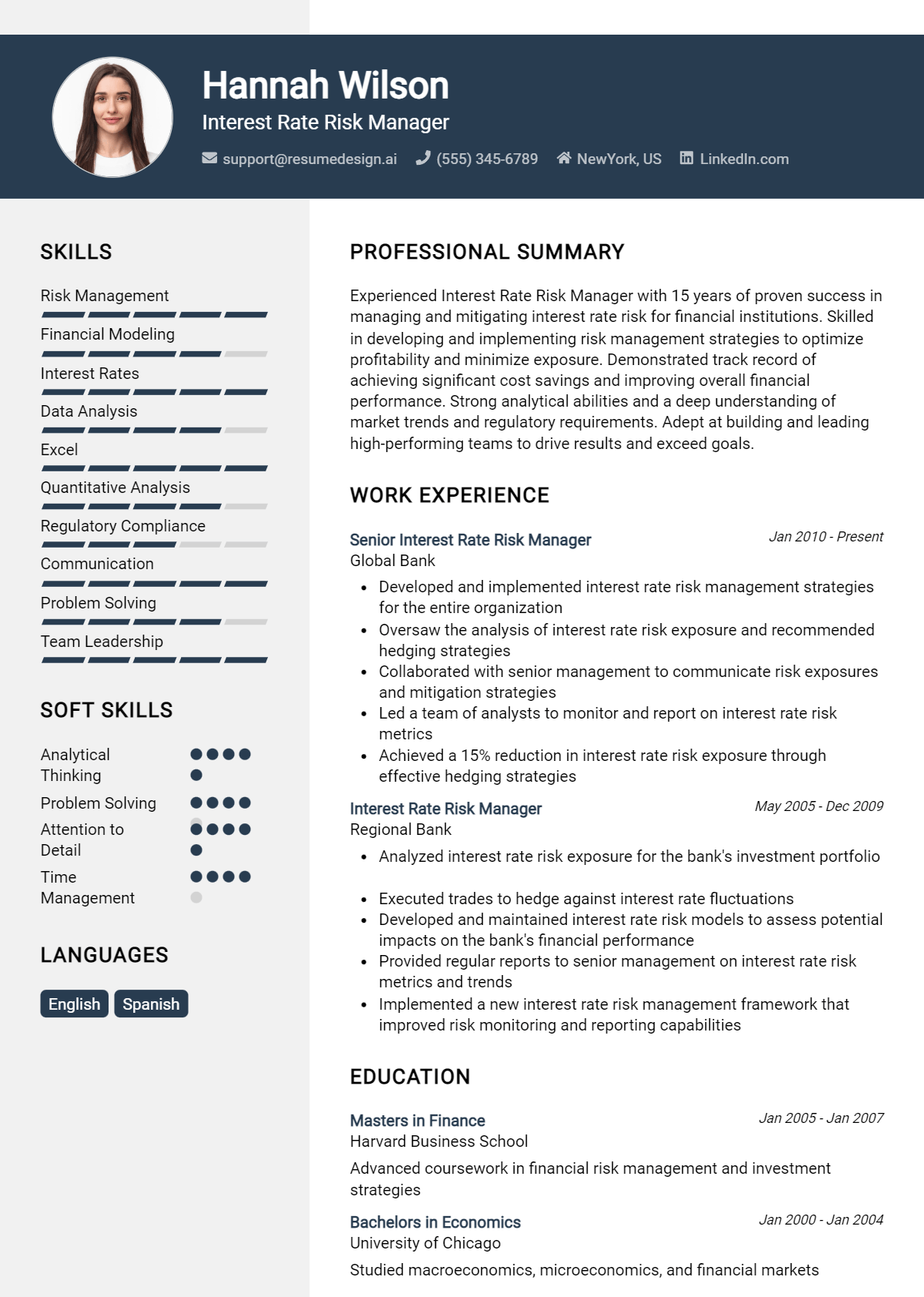

In the competitive landscape of finance and risk management, a well-crafted resume is not just a document; it is a powerful marketing tool that can open doors to new opportunities. For Interest Rate Risk Manager professionals, this document serves as the first impression you make on potential employers, making it crucial to highlight both your skills and achievements effectively. Your resume should showcase your ability to navigate the complexities of interest rate exposure while demonstrating your value to prospective organizations. This guide will provide practical and actionable resume tips specifically tailored for Interest Rate Risk Manager professionals, ensuring you present yourself as the ideal candidate in this specialized field.

Top Resume Tips for Interest Rate Risk Manager Professionals

- Tailor your resume for each job application by aligning your skills and experiences with the specific requirements outlined in the job description.

- Highlight relevant experience in interest rate risk management, including your roles in assessing, monitoring, and mitigating interest rate risk.

- Quantify your achievements with specific metrics, such as percentage improvements in risk assessment processes or successful implementation of risk mitigation strategies.

- Showcase industry-specific skills, such as proficiency in risk management software or familiarity with regulatory standards related to interest rate risk.

- Include certifications or training relevant to interest rate risk management, such as CFA or FRM, to demonstrate your commitment to professional development.

- Utilize action verbs to describe your accomplishments, emphasizing your proactive approach to risk management and problem-solving.

- Incorporate keywords from the job description to ensure your resume passes through applicant tracking systems.

- Maintain a clean and professional layout that prioritizes readability and allows key information to stand out.

- Consider including a summary statement at the top of your resume that encapsulates your experience and career goals in interest rate risk management.

By implementing these tailored tips, you can create a compelling resume that not only captures the attention of hiring managers but also significantly increases your chances of landing a job in the Interest Rate Risk Manager field. A polished resume that effectively showcases your relevant skills and accomplishments will position you as a strong candidate ready to take on the challenges of managing interest rate risk in today's financial landscape.

Why Resume Headlines & Titles are Important for Interest Rate Risk Manager

In the competitive field of interest rate risk management, crafting a compelling resume is essential for standing out among applicants. A strong resume headline or title serves as the first impression for hiring managers, quickly summarizing a candidate's key qualifications in a single impactful phrase. It acts as a powerful hook that can grab attention and set the tone for the rest of the resume. A concise, relevant headline not only reflects the candidate's expertise but also aligns with the specific requirements of the position being applied for, making it a crucial element of a successful job application.

Best Practices for Crafting Resume Headlines for Interest Rate Risk Manager

- Be concise: Aim for a headline that is brief yet informative.

- Use role-specific terminology: Incorporate industry jargon to demonstrate expertise.

- Highlight key achievements: Include measurable results or accomplishments where applicable.

- Focus on relevant skills: Tailor the headline to emphasize skills that are critical for the role.

- Make it impactful: Use strong action verbs and confident language to convey authority.

- Avoid buzzwords: Stay clear of clichés that do not add value or specificity.

- Align with the job description: Mirror the language and requirements found in the job posting.

- Revise and refine: Continuously improve the headline based on feedback and evolving career goals.

Example Resume Headlines for Interest Rate Risk Manager

Strong Resume Headlines

Dynamic Interest Rate Risk Manager with 10+ Years of Experience in Financial Analysis and Risk Mitigation

Proven Track Record of Enhancing Interest Rate Strategies to Maximize Profitability and Minimize Risk

Strategic Interest Rate Risk Analyst Skilled in Developing Effective Hedging Strategies and Regulatory Compliance

Weak Resume Headlines

Experienced Manager

Risk Management Professional Seeking Opportunities

The strong headlines are effective because they provide a clear and immediate understanding of the candidate’s qualifications, experience, and unique value proposition. Each strong headline emphasizes specific skills and achievements relevant to the interest rate risk management role, making it easier for hiring managers to see the candidate’s fit for the position. In contrast, the weak headlines fall flat due to their vagueness and lack of specificity; they fail to convey the candidate's distinct strengths or relevance to the job, making them less likely to capture the attention of potential employers.

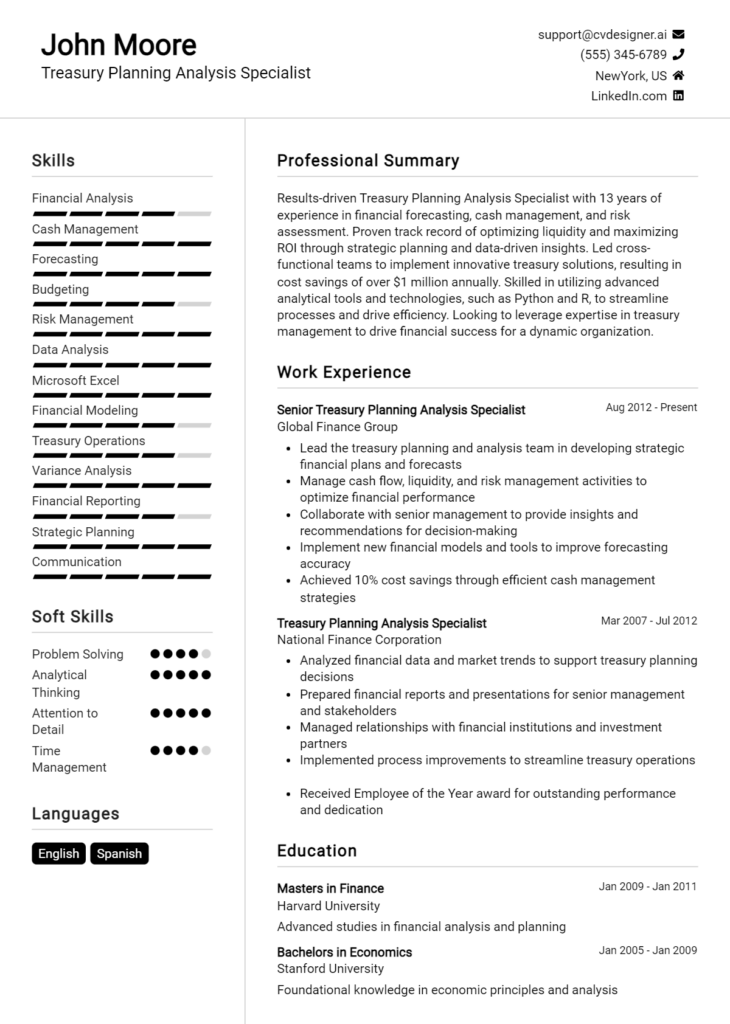

Writing an Exceptional Interest Rate Risk Manager Resume Summary

A resume summary is a critical component for an Interest Rate Risk Manager, as it serves as the first impression a hiring manager will have of a candidate. A well-crafted summary quickly captures attention by showcasing the applicant’s key skills, experiences, and accomplishments that are directly relevant to the role. It should encapsulate the candidate's professional identity in a concise and impactful manner, tailored to the specific job they are applying for. By highlighting relevant expertise in interest rate risk management, financial analysis, and risk mitigation strategies, a strong resume summary can set a candidate apart in a competitive job market.

Best Practices for Writing a Interest Rate Risk Manager Resume Summary

- Quantify achievements to provide concrete evidence of your impact.

- Focus on key skills relevant to interest rate risk management, such as financial modeling and regulatory compliance.

- Tailor the summary to reflect the specific job description and requirements.

- Use industry-specific terminology to demonstrate knowledge and expertise.

- Keep it concise—aim for 3-5 sentences that deliver your message clearly.

- Highlight leadership experience or involvement in cross-functional teams.

- Emphasize your ability to communicate complex financial concepts to non-financial stakeholders.

- Showcase any certifications or advanced degrees relevant to risk management.

Example Interest Rate Risk Manager Resume Summaries

Strong Resume Summaries

Dynamic Interest Rate Risk Manager with over 8 years of experience in assessing and mitigating financial risk. Successfully reduced interest rate exposure by 30% through the implementation of advanced risk modeling techniques, enhancing the firm's portfolio performance. Proficient in regulatory compliance and skilled in communicating financial strategies to executive leadership.

Results-oriented professional with a proven track record of managing interest rate risk for a $2 billion investment portfolio. Leveraged quantitative analysis to develop and execute hedging strategies, resulting in a 15% increase in net returns. Strong expertise in risk assessment frameworks and financial derivatives.

Highly analytical Interest Rate Risk Manager with expertise in developing innovative risk management solutions. Played a pivotal role in establishing a comprehensive risk management policy that improved compliance by 25%. Recognized for exceptional collaboration with cross-functional teams to optimize financial performance.

Weak Resume Summaries

Interest Rate Risk Manager with experience in financial markets. I have worked on various projects related to risk management and am looking for a new opportunity.

Dedicated professional seeking a position as an Interest Rate Risk Manager. I have some skills in finance and risk assessment but need to gain more experience.

The examples provided above highlight distinct differences in quality. Strong resume summaries effectively showcase specific achievements, quantify results, and demonstrate relevance to the role, making them impactful and memorable. In contrast, the weak summaries lack detail, quantifiable outcomes, and specificity, making them less compelling and potentially overlooked by hiring managers. A well-articulated summary can significantly enhance a candidate's chances of standing out in the hiring process.

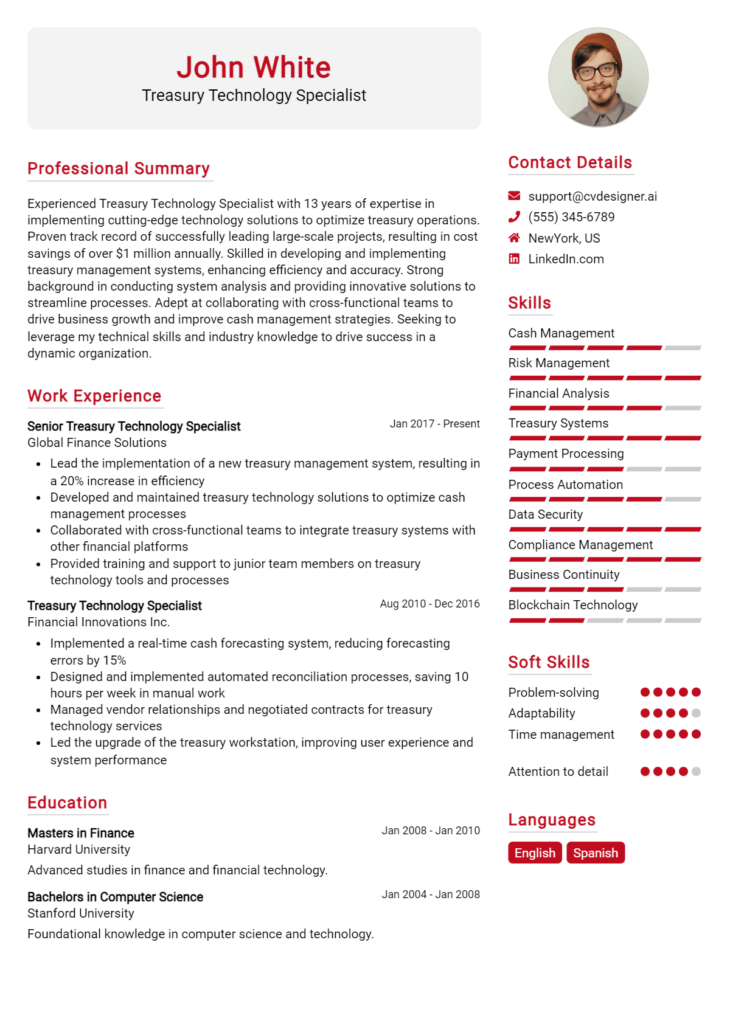

Work Experience Section for Interest Rate Risk Manager Resume

The work experience section of an Interest Rate Risk Manager resume is critical in demonstrating a candidate's technical proficiency, leadership capabilities, and commitment to delivering high-quality results. This section provides a platform to showcase not only the relevant roles held but also the tangible achievements that align with industry standards. By quantifying accomplishments and emphasizing collaborative efforts, candidates can effectively illustrate their ability to manage risk, optimize financial strategies, and lead teams towards successful outcomes. A well-crafted work experience section can make a significant difference in presenting a candidate as a strong fit for the role.

Best Practices for Interest Rate Risk Manager Work Experience

- Highlight technical skills related to interest rate modeling and risk assessment.

- Quantify achievements with specific metrics, such as percentage reductions in risk exposure or cost savings.

- Showcase leadership experiences, including managing teams or projects.

- Emphasize collaboration with cross-functional teams to achieve financial objectives.

- Use industry-specific terminology to demonstrate familiarity with current market practices.

- Detail the use of software and tools relevant to interest rate risk management.

- Include certifications or additional training that enhance your qualifications.

- Tailor your experience to match the requirements of the job description.

Example Work Experiences for Interest Rate Risk Manager

Strong Experiences

- Led a team of analysts in developing a new interest rate risk model, resulting in a 30% increase in forecasting accuracy and a 15% reduction in potential losses.

- Implemented a strategic risk management framework that lowered the organization’s interest rate exposure by $5 million, enhancing overall financial stability.

- Collaborated with treasury and investment teams to optimize the asset-liability management strategy, achieving a 20% improvement in net interest income.

- Presented quarterly risk assessment reports to executive leadership, facilitating informed decision-making that aligned with corporate risk appetite.

Weak Experiences

- Worked on various projects related to interest rates without specific outcomes or responsibilities mentioned.

- Assisted in risk management tasks that did not clarify the impact on the organization.

- Involved in team meetings regarding interest rate discussions but did not actively contribute to outcomes.

- Performed general analysis of financial data without outlining significant contributions or results.

The examples provided showcase the distinction between strong and weak experiences. Strong experiences effectively quantify achievements and demonstrate leadership and technical expertise, which are essential for the role of an Interest Rate Risk Manager. In contrast, weak experiences lack specificity and measurable outcomes, failing to convey the candidate's impact or capabilities in the field. A compelling work experience section should clearly articulate how the candidate has contributed to risk management and financial success within their organization.

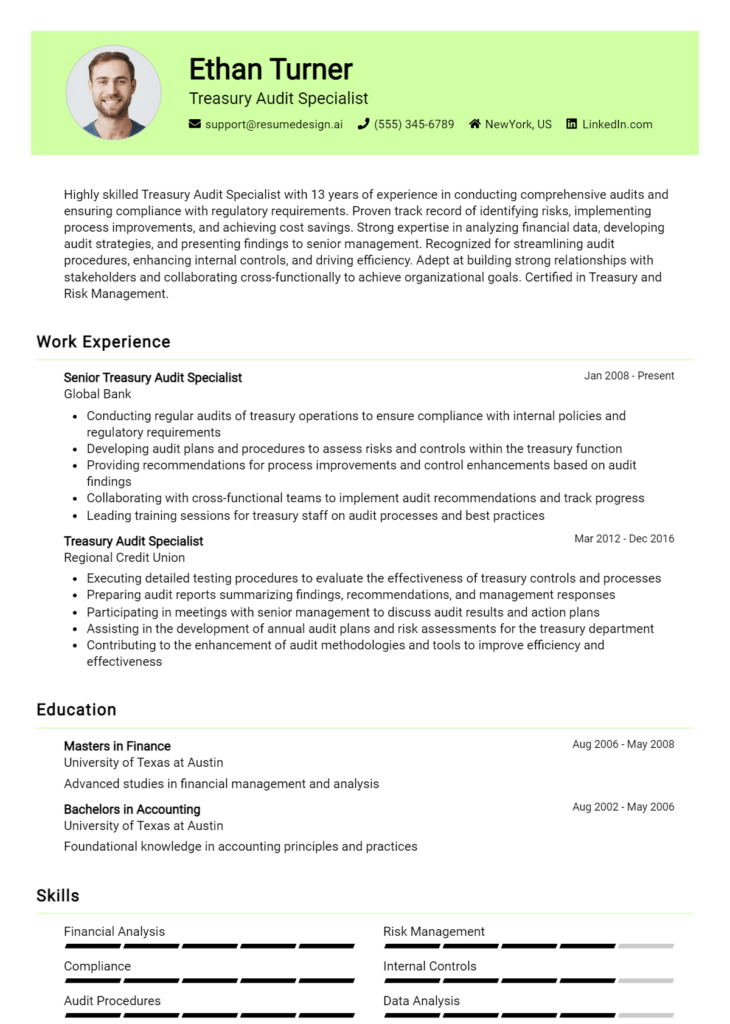

Education and Certifications Section for Interest Rate Risk Manager Resume

The education and certifications section of an Interest Rate Risk Manager resume plays a critical role in establishing the candidate's qualifications and suitability for the position. This section not only showcases the academic background necessary for understanding complex financial concepts but also emphasizes any industry-relevant certifications that indicate a commitment to professional development and expertise in the field. By highlighting relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role. Continuous learning is essential in the ever-evolving landscape of finance, making this section a vital component of a compelling resume.

Best Practices for Interest Rate Risk Manager Education and Certifications

- Prioritize relevant degrees in finance, economics, or risk management.

- Include industry-recognized certifications such as FRM (Financial Risk Manager) or PRM (Professional Risk Manager).

- Detail relevant coursework that directly applies to interest rate risk management.

- Highlight advanced degrees, such as an MBA with a concentration in finance or risk management.

- Showcase any specialized training programs or workshops attended in interest rate risk management.

- Maintain clarity and conciseness, ensuring that each credential adds value to your application.

- Update this section regularly to reflect new certifications and educational achievements.

- Consider including relevant honors or distinctions received during your studies.

Example Education and Certifications for Interest Rate Risk Manager

Strong Examples

- M.S. in Finance, University of XYZ, 2020

- FRM Certification, Global Association of Risk Professionals (GARP), 2021

- Financial Risk Management Coursework, ABC Institute, 2019

- Advanced Risk Management Workshop, DEF Training Center, 2022

Weak Examples

- Bachelor’s Degree in History, University of XYZ, 2010

- Certification in Basic Accounting, Not a Recognized Institution, 2015

- Online Course in Personal Finance, 2020

- High School Diploma, 2005

The strong examples are considered effective because they directly relate to the field of interest rate risk management, showcasing advanced degrees and recognized certifications that indicate a deep understanding of financial principles and risk assessment. In contrast, the weak examples reflect qualifications that are either irrelevant to the role or lack industry recognition, failing to demonstrate the candidate's expertise and commitment to the field. By clearly distinguishing between strong and weak educational backgrounds, candidates can better focus on presenting qualifications that will resonate with hiring managers in the finance sector.

Top Skills & Keywords for Interest Rate Risk Manager Resume

As an Interest Rate Risk Manager, possessing a diverse set of skills is crucial for navigating the complexities of financial markets and managing the risks associated with interest rate fluctuations. A well-crafted resume highlighting these skills not only demonstrates your expertise but also showcases your ability to contribute to an organization’s financial stability and growth. Employers look for candidates who can analyze market trends, develop risk management strategies, and communicate effectively with various stakeholders. By incorporating the right mix of soft and hard skills into your resume, you can effectively position yourself as a strong candidate in this competitive field.

Top Hard & Soft Skills for Interest Rate Risk Manager

Soft Skills

- Analytical Thinking

- Problem-Solving

- Strong Communication Skills

- Attention to Detail

- Decision-Making

- Adaptability

- Team Collaboration

- Time Management

- Leadership

- Strategic Planning

- Negotiation Skills

- Conflict Resolution

- Interpersonal Skills

- Emotional Intelligence

Hard Skills

- Knowledge of Financial Regulations

- Risk Assessment and Management Techniques

- Familiarity with Interest Rate Derivatives

- Proficiency in Financial Modeling

- Experience with Risk Management Software

- Data Analysis and Statistical Techniques

- Understanding of Macroeconomic Indicators

- Financial Statement Analysis

- Asset-Liability Management (ALM)

- Knowledge of Treasury Operations

- Reporting and Compliance Skills

- Quantitative Analysis

- Knowledge of Market Instruments

- Stress Testing and Scenario Analysis

- Familiarity with Regulatory Frameworks

- Portfolio Management Skills

- Experience with Financial Risk Metrics

For more information on how to tailor your resume with the right skills and showcase your relevant work experience, consider these essential components to enhance your professional profile.

Stand Out with a Winning Interest Rate Risk Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my enthusiasm for the Interest Rate Risk Manager position at [Company Name], as advertised on [where you found the job listing]. With a robust background in financial analysis, risk assessment, and strategic management, I am excited about the opportunity to contribute to your organization’s success through effective interest rate risk management. My experience in developing and implementing risk management strategies, coupled with my analytical skills, aligns well with the requirements of this role.

In my previous role at [Previous Company Name], I successfully led a team responsible for analyzing interest rate fluctuations and their potential impacts on our portfolio. By utilizing advanced modeling techniques and market analysis, I was able to identify trends and recommend strategic adjustments that minimized risk exposure while optimizing returns. My proactive approach in communicating findings to senior management facilitated informed decision-making, and I am eager to bring this same level of diligence and insight to [Company Name].

Moreover, my familiarity with regulatory requirements and compliance standards in the financial sector equips me to ensure that risk management practices adhere to industry guidelines. I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in financial services. I believe that my strategic mindset and collaborative nature will contribute to fostering a forward-thinking approach to interest rate risk management in your organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name] and how I can contribute to your team's success.

Sincerely,

[Your Name]

[Your Contact Information]

[Your LinkedIn Profile or Professional Website]

Common Mistakes to Avoid in a Interest Rate Risk Manager Resume

When crafting a resume for the role of an Interest Rate Risk Manager, it is essential to present a polished and professional document that highlights relevant skills and experiences. However, many candidates make common mistakes that can undermine their chances of landing an interview. Avoiding these pitfalls can significantly improve the effectiveness of your resume and better showcase your qualifications for this specialized role.

Lack of Quantitative Data: Failing to include specific metrics or achievements can make your resume less impactful. Use numbers to demonstrate your success in managing interest rate risks, such as percentage reductions in risk exposure or improvements in portfolio performance.

Generic Job Descriptions: Using vague or generic descriptions for previous roles can lead to a lack of clarity. Tailor your job descriptions to reflect your specific responsibilities and achievements related to interest rate risk management.

Ignoring Relevant Certifications: Not mentioning relevant certifications, such as Financial Risk Manager (FRM) or Chartered Financial Analyst (CFA), can be a missed opportunity. These credentials can set you apart from other candidates and demonstrate your expertise.

Overlooking Regulatory Knowledge: Interest rate risk management often involves compliance with various regulations. Failing to highlight your knowledge of relevant laws and regulations can create doubts about your suitability for the role.

Poor Formatting: A cluttered or poorly organized resume can detract from your qualifications. Use clear headings, bullet points, and consistent formatting to enhance readability and present information effectively.

Neglecting Soft Skills: While technical skills are crucial, soft skills such as communication, leadership, and problem-solving are also vital for an Interest Rate Risk Manager. Be sure to include examples that showcase these abilities.

Not Tailoring the Resume: Sending out a one-size-fits-all resume can weaken your application. Customize your resume for each job application to align with the specific requirements and language of the job description.

Failure to Proofread: Spelling and grammatical errors can create a negative impression. Always proofread your resume or have someone else review it to ensure it is error-free and professional.

Conclusion

As an Interest Rate Risk Manager, you play a crucial role in safeguarding your organization against fluctuations in interest rates that could impact profitability and financial stability. Throughout this article, we've explored the essential skills and qualifications for this position, including a robust understanding of financial markets, risk management frameworks, and analytical tools. We also highlighted the importance of effective communication and collaboration with other departments to develop comprehensive risk management strategies.

In conclusion, ensuring your resume effectively showcases your expertise and experiences is vital for standing out in this competitive field. Take the time to review your Interest Rate Risk Manager resume and make sure it aligns with industry standards and expectations. Utilize resources like resume templates, resume builder, resume examples, and cover letter templates to enhance your application materials. Equip yourself with the tools necessary to land that pivotal role in your career. Start refining your resume today!