Financial Planning and Analysis Manager Core Responsibilities

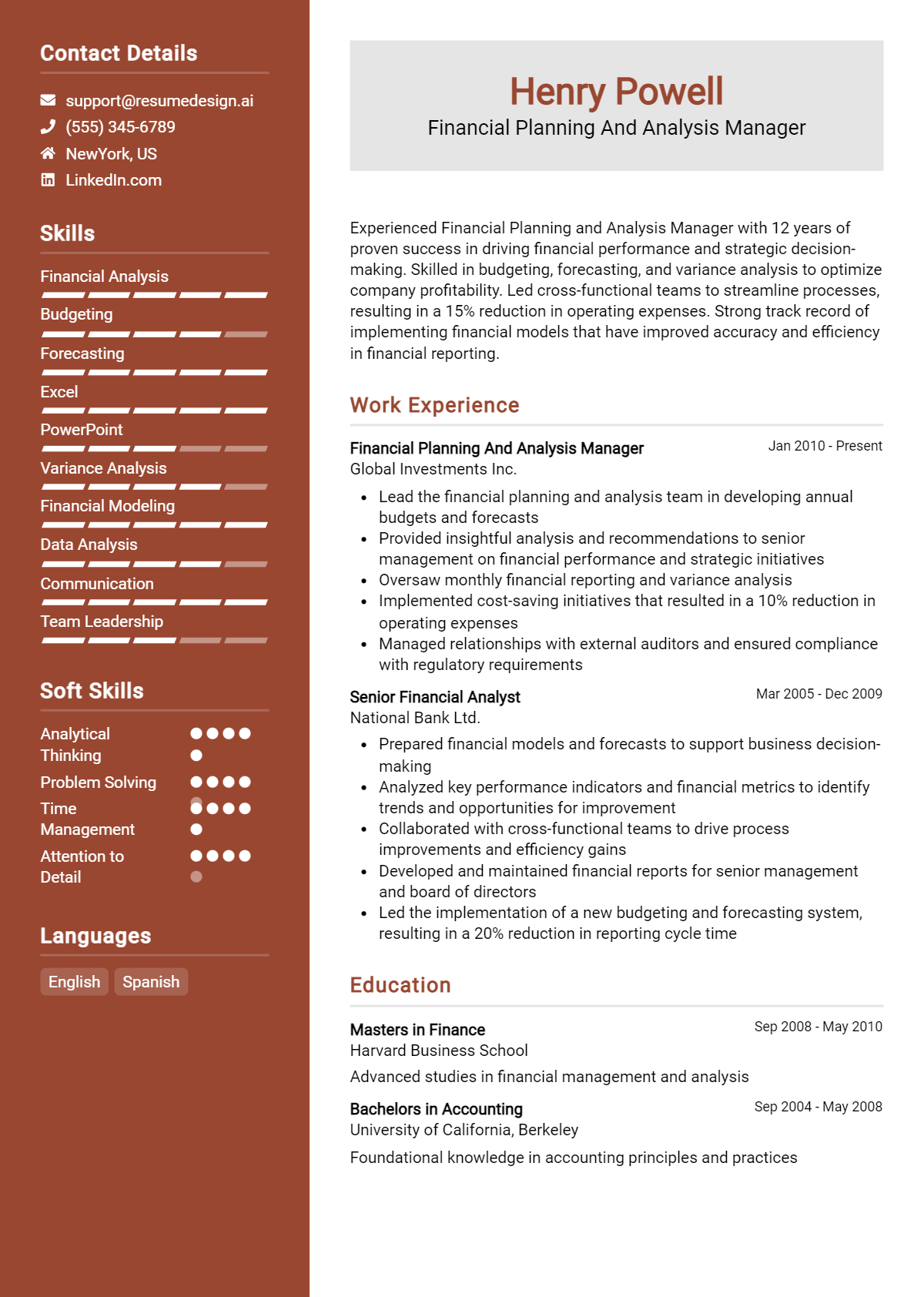

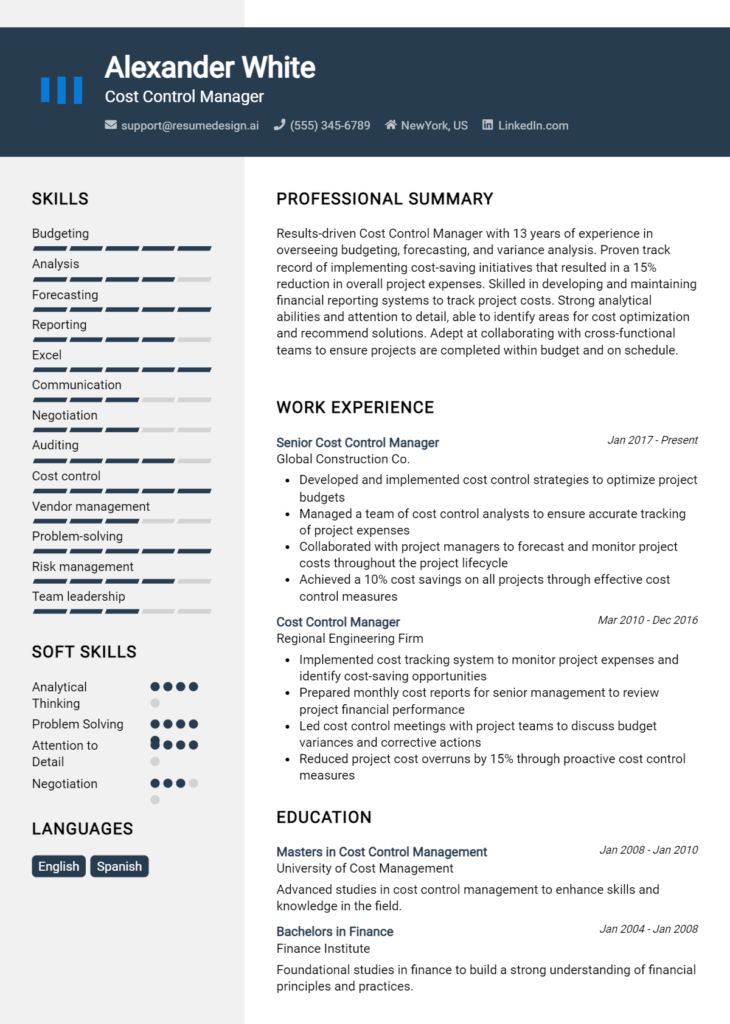

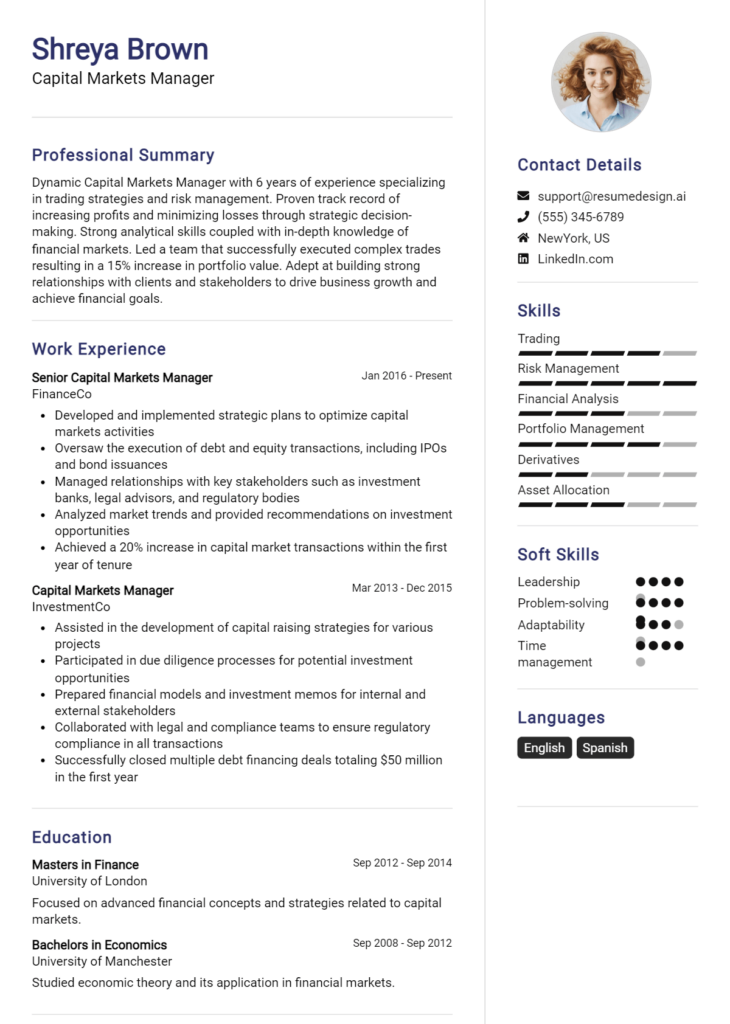

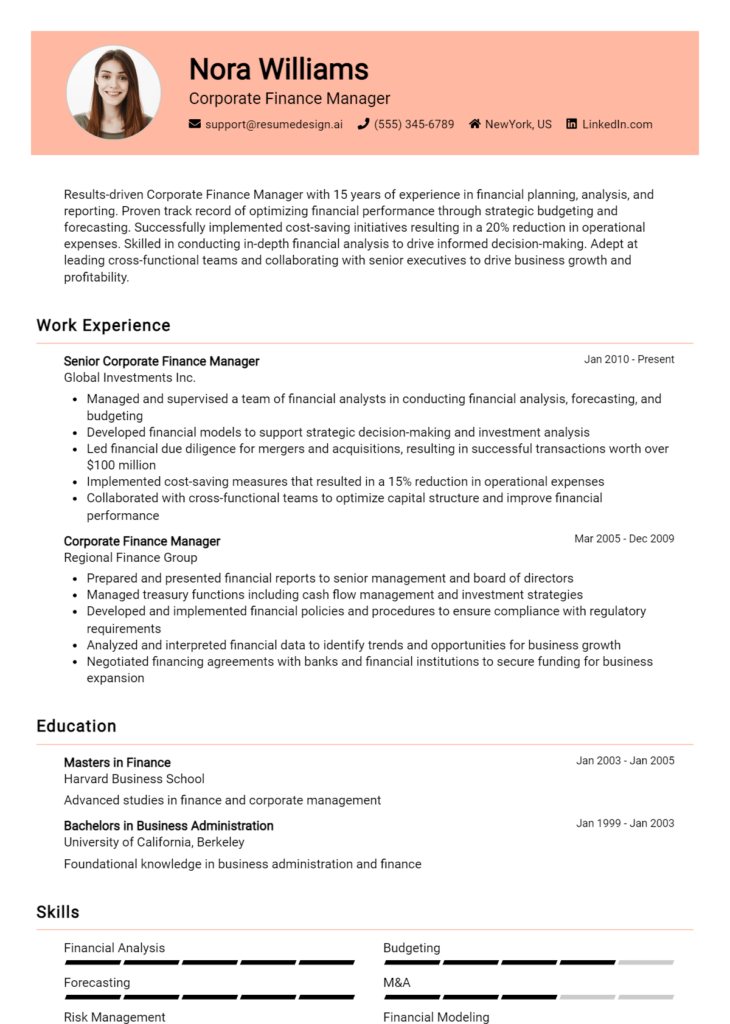

The Financial Planning and Analysis Manager plays a pivotal role in bridging various departments by providing insightful financial analysis and strategic guidance. Key responsibilities include budgeting, forecasting, and financial modeling, which require strong technical skills in data analysis and proficiency in financial software. Operational acumen and problem-solving abilities are essential for identifying trends and making informed decisions that align with organizational goals. A well-structured resume can effectively highlight these competencies, showcasing the candidate's capability to drive financial performance and strategic initiatives.

Common Responsibilities Listed on Financial Planning and Analysis Manager Resume

- Developing and managing annual budgets and forecasts.

- Conducting variance analysis to assess financial performance.

- Preparing monthly, quarterly, and annual financial reports.

- Collaborating with cross-functional teams to gather financial insights.

- Creating financial models to support business decisions.

- Identifying cost-saving opportunities and efficiency improvements.

- Analyzing market trends and economic conditions.

- Presenting financial findings to senior management and stakeholders.

- Ensuring compliance with financial regulations and standards.

- Leading financial audits and internal controls assessments.

- Training and mentoring junior financial analysts.

High-Level Resume Tips for Financial Planning and Analysis Manager Professionals

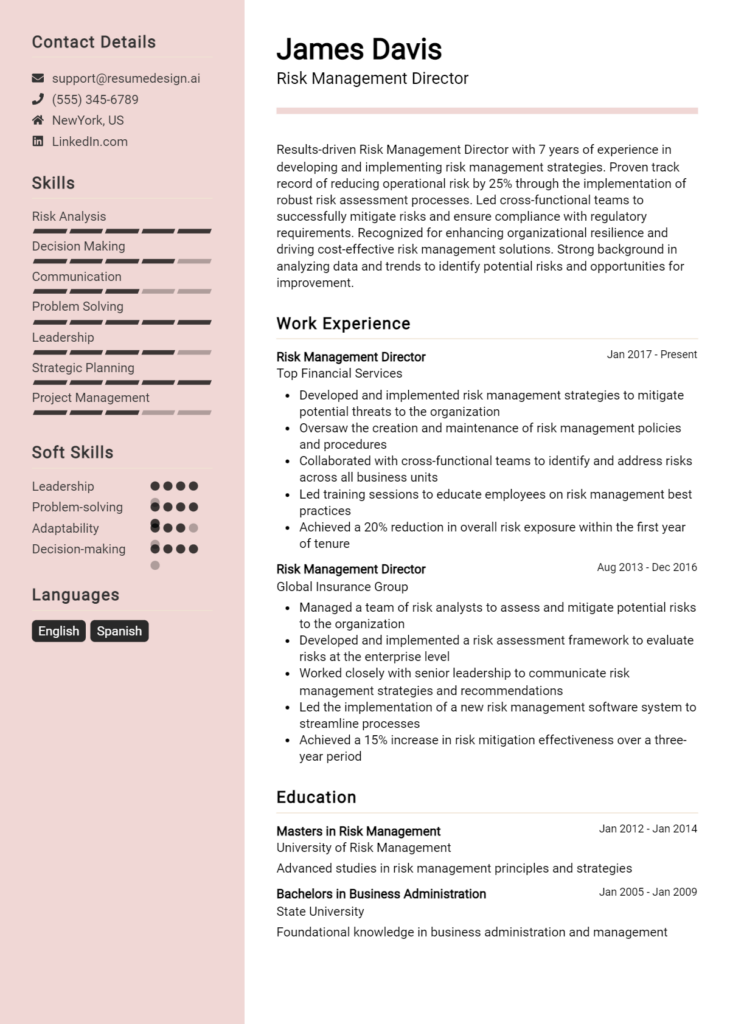

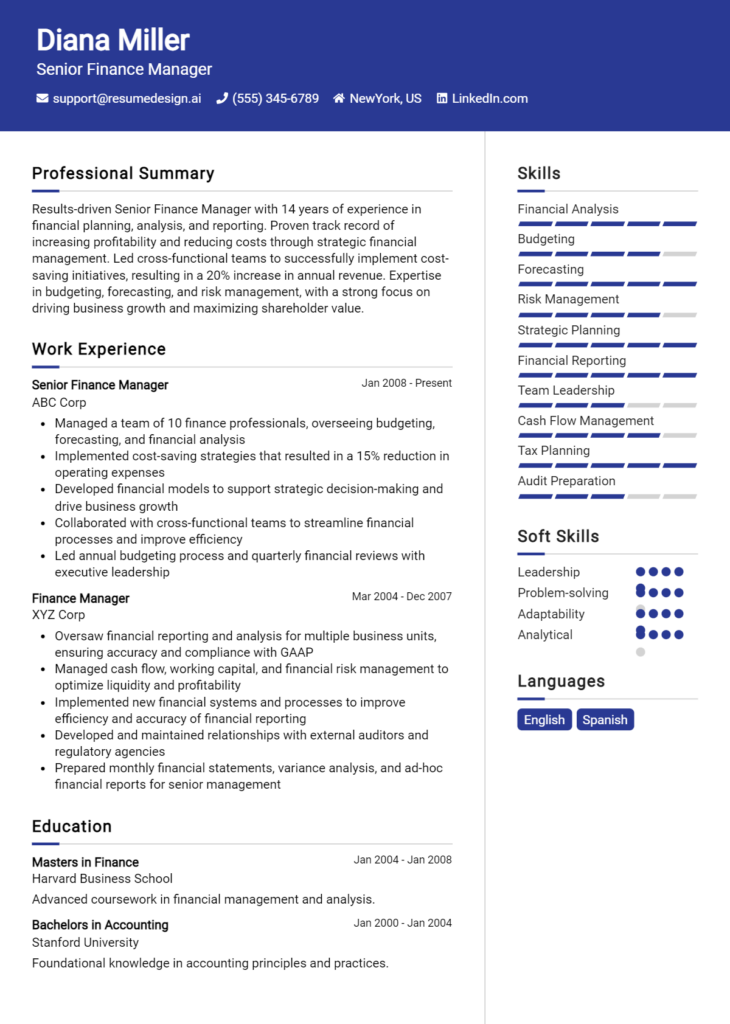

A well-crafted resume is crucial for Financial Planning and Analysis Manager professionals, as it serves as the first impression a candidate makes on a potential employer. In a competitive job market, your resume must effectively showcase not only your technical skills and industry knowledge but also your achievements and contributions to previous roles. A compelling resume can set you apart from other candidates and highlight your strategic thinking and analytical capabilities, which are key in financial management. This guide will provide practical and actionable resume tips specifically tailored for Financial Planning and Analysis Manager professionals, ensuring that your application stands out.

Top Resume Tips for Financial Planning and Analysis Manager Professionals

- Tailor your resume to each job description by using keywords and phrases that align with the requirements of the position.

- Highlight relevant experience in financial analysis, budgeting, forecasting, and strategic planning.

- Quantify your achievements with concrete numbers, such as percentage increases in revenue or cost savings achieved through your initiatives.

- Showcase industry-specific skills, such as proficiency in financial modeling, advanced Excel techniques, and familiarity with financial software tools.

- Include certifications or advanced degrees relevant to financial planning and analysis, such as CFA or MBA.

- Demonstrate your ability to collaborate with cross-functional teams and communicate financial insights to non-financial stakeholders.

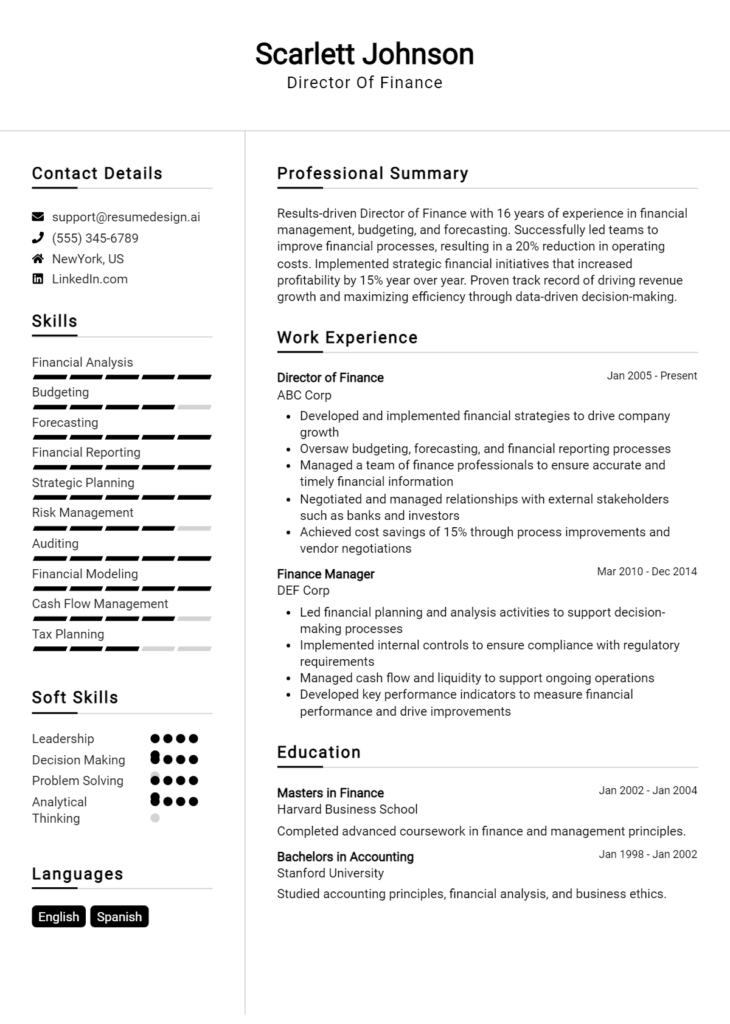

- Utilize a clean and professional format that enhances readability and draws attention to key information.

- Incorporate action verbs to illustrate your contributions and impact, such as "developed," "analyzed," and "optimized."

- Keep your resume concise, ideally one to two pages, focusing on the most relevant information for the role.

- Proofread for accuracy and clarity, ensuring there are no grammatical errors or typos that could undermine your professionalism.

By implementing these tips, you can significantly increase your chances of landing a job in the Financial Planning and Analysis Manager field. A polished and targeted resume not only demonstrates your qualifications but also reflects your commitment to professionalism, making you an attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Financial Planning and Analysis Manager

In the competitive field of financial planning and analysis, a well-crafted resume headline or title plays a pivotal role in capturing the attention of hiring managers. For a Financial Planning and Analysis Manager, this succinct phrase serves as a powerful introduction that encapsulates the candidate's key qualifications and strengths. A strong headline can instantly convey expertise in financial strategy, analytical skills, and leadership experience, making it easier for hiring managers to assess a candidate's fit for the role. It should be concise, relevant, and directly related to the job being applied for, providing a snapshot of what the candidate brings to the table.

Best Practices for Crafting Resume Headlines for Financial Planning and Analysis Manager

- Keep it concise – Aim for one impactful sentence that summarizes your value.

- Be role-specific – Tailor your headline to reflect the Financial Planning and Analysis Manager position.

- Highlight key skills – Incorporate critical skills relevant to financial planning and analysis.

- Use action-oriented language – Begin with strong action verbs to convey dynamism.

- Include quantifiable achievements – Reference specific accomplishments or metrics to enhance credibility.

- Stay relevant – Ensure your headline aligns with the job description and company needs.

- Avoid jargon – Use clear language that is easily understood by hiring managers.

- Make it impactful – Choose words that evoke a strong impression of your expertise and capabilities.

Example Resume Headlines for Financial Planning and Analysis Manager

Strong Resume Headlines

“Strategic Financial Planning Manager with 10+ Years of Experience Driving Revenue Growth”

“Results-Oriented FP&A Leader Specializing in Data-Driven Decision Making and Operational Efficiency”

“Dynamic Financial Analysis Expert with Proven Track Record of Enhancing Profitability and Reducing Costs”

Weak Resume Headlines

“Finance Manager”

“Experienced Professional Seeking Opportunities”

The strong headlines are effective because they immediately communicate the candidate's experience, skills, and accomplishments in a way that is both specific and engaging. They utilize impactful language that highlights the candidate's unique qualifications, making them stand out in a crowded job market. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, leaving hiring managers with little insight into the candidate's capabilities or value proposition. A compelling headline is essential for making a memorable first impression and increasing the chances of securing an interview.

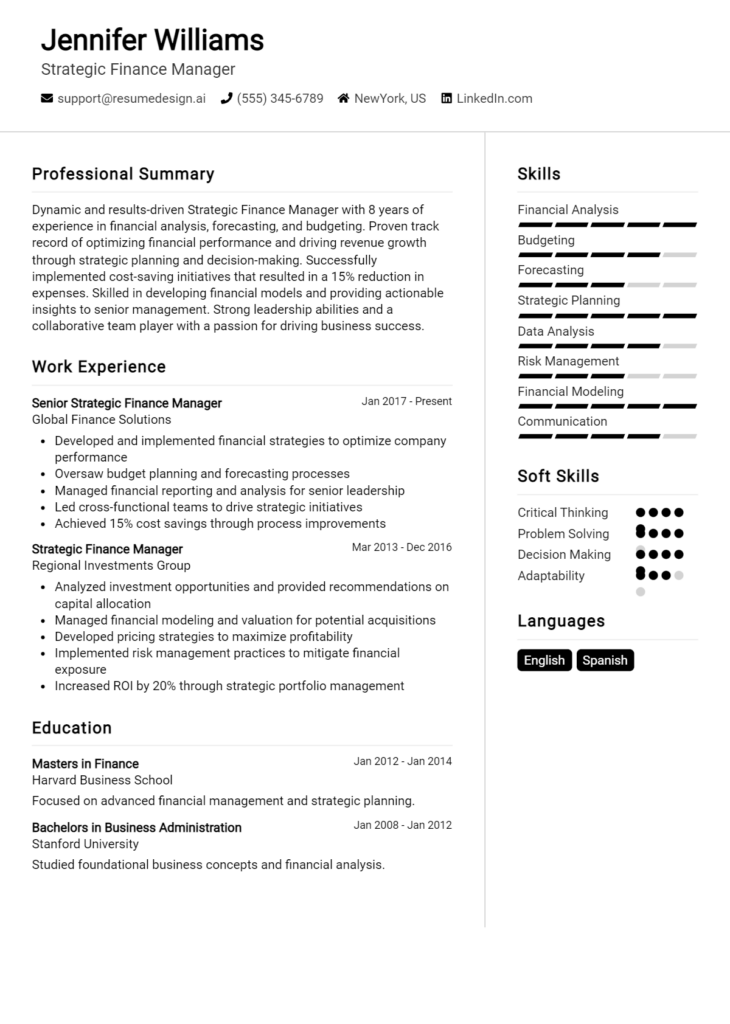

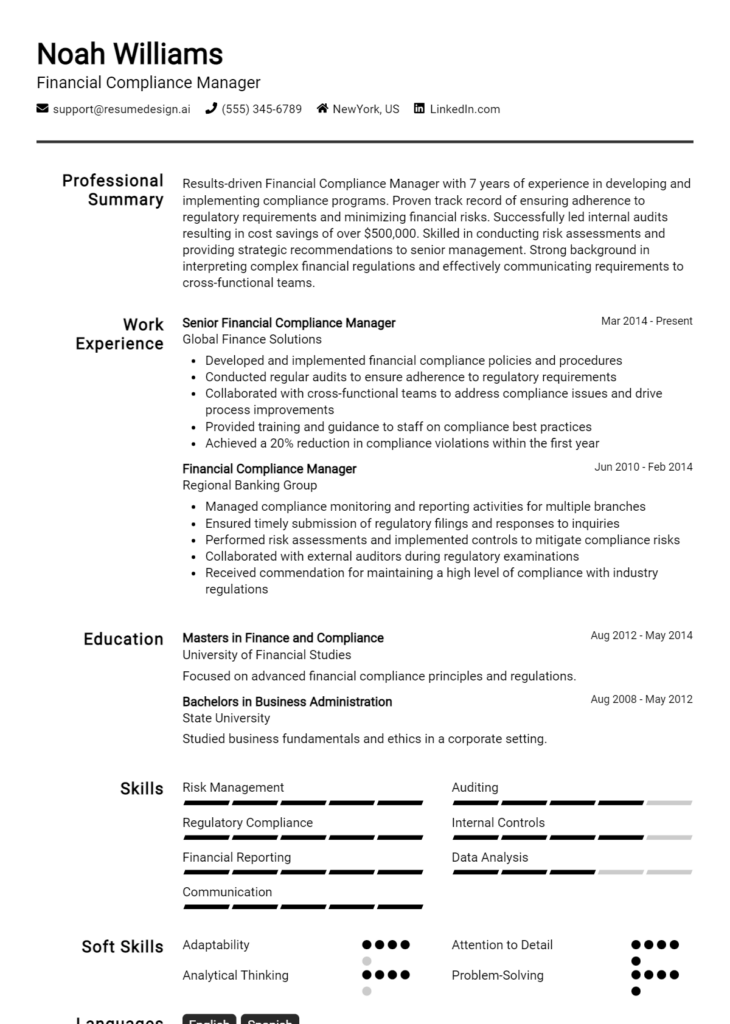

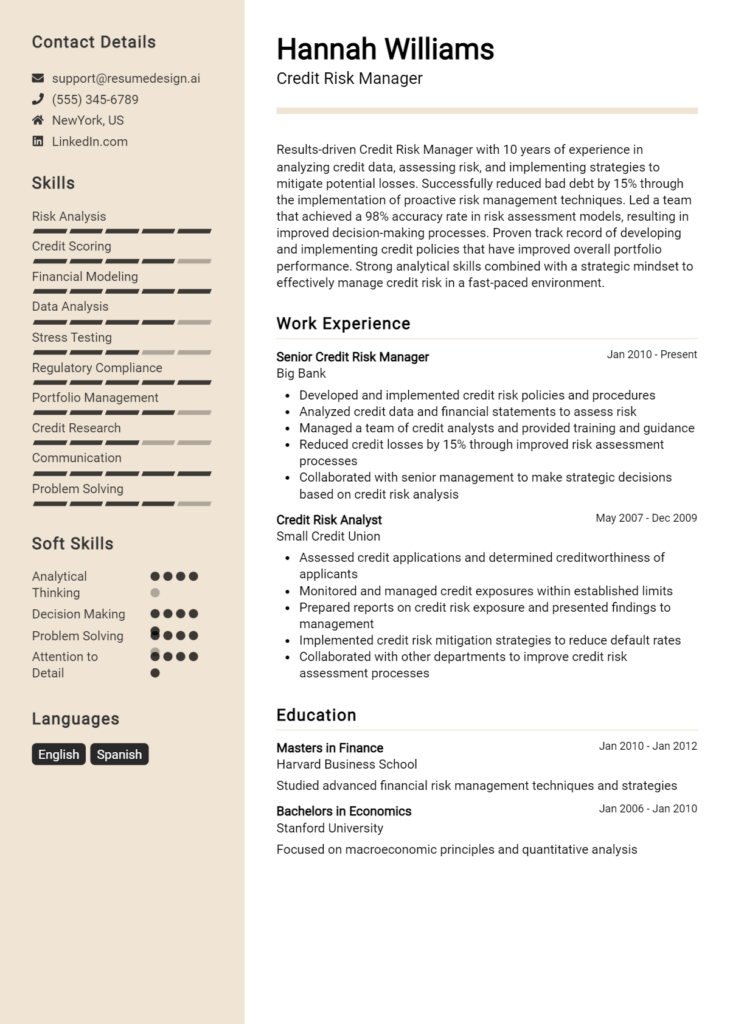

Writing an Exceptional Financial Planning and Analysis Manager Resume Summary

A resume summary is a critical component for a Financial Planning and Analysis Manager as it serves as the first impression to hiring managers. A well-crafted summary succinctly highlights the candidate's key skills, experience, and accomplishments, making it easier for decision-makers to quickly assess the applicant's suitability for the role. It should be concise, impactful, and tailored specifically to the job being applied for, showcasing the most relevant qualifications and value the candidate can bring to the organization.

Best Practices for Writing a Financial Planning and Analysis Manager Resume Summary

- Quantify Achievements: Use numbers and metrics to demonstrate your impact, such as revenue growth or cost savings.

- Focus on Relevant Skills: Highlight specific skills that align with the job description, such as financial modeling, budgeting, and forecasting.

- Customize for Each Application: Tailor your summary to reflect the requirements and language of the job posting.

- Showcase Leadership Experience: If applicable, mention any team management or project leadership roles you've held.

- Keep It Concise: Aim for 3-5 sentences that are direct and to the point, avoiding unnecessary jargon.

- Emphasize Industry Knowledge: Highlight familiarity with the industry or sector relevant to the role, demonstrating your understanding of the market.

- Incorporate Keywords: Use relevant keywords from the job description to pass through Applicant Tracking Systems (ATS).

- Reflect Professional Growth: Mention progression in your career to show your ongoing development and commitment to the field.

Example Financial Planning and Analysis Manager Resume Summaries

Strong Resume Summaries

Results-driven Financial Planning and Analysis Manager with over 8 years of experience in optimizing financial processes and driving strategic initiatives. Achieved a 20% reduction in operational costs through process re-engineering and enhanced forecasting accuracy, contributing to a 15% increase in annual revenue.

Dynamic FP&A Manager with expertise in financial modeling and data analysis. Led a cross-functional team to implement a new budgeting system that improved forecasting accuracy by 30%, resulting in better resource allocation and a 10% increase in profit margins.

Detail-oriented Financial Planning and Analysis Manager adept at leveraging advanced analytical skills to support business strategy. Spearheaded a financial review process that identified $1M in savings opportunities, significantly enhancing overall financial performance.

Weak Resume Summaries

Experienced financial manager looking for new opportunities in financial planning and analysis.

Financial Planning and Analysis professional with a solid background in finance seeking to bring skills to a new company.

The strong resume summaries provided showcase specific achievements, relevant skills, and quantifiable outcomes that directly relate to the Financial Planning and Analysis Manager role. They effectively communicate the candidate's value and impact within previous positions. In contrast, the weak summaries are vague and lack any concrete examples or differentiation, making it difficult for hiring managers to gauge the candidate's qualifications or contributions to past roles.

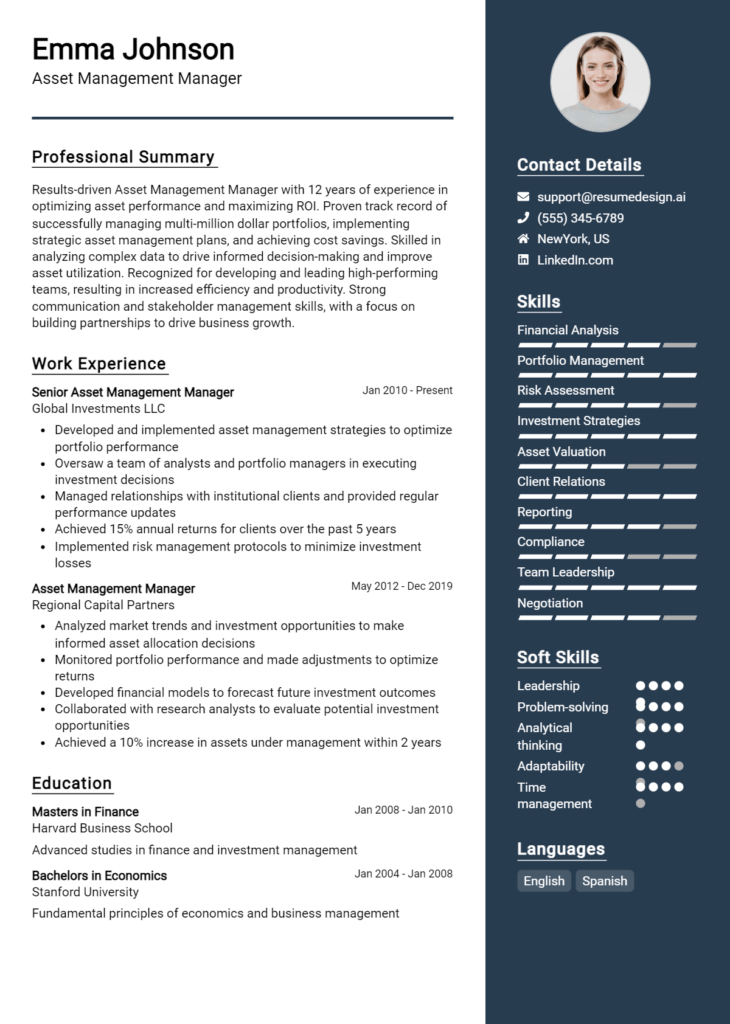

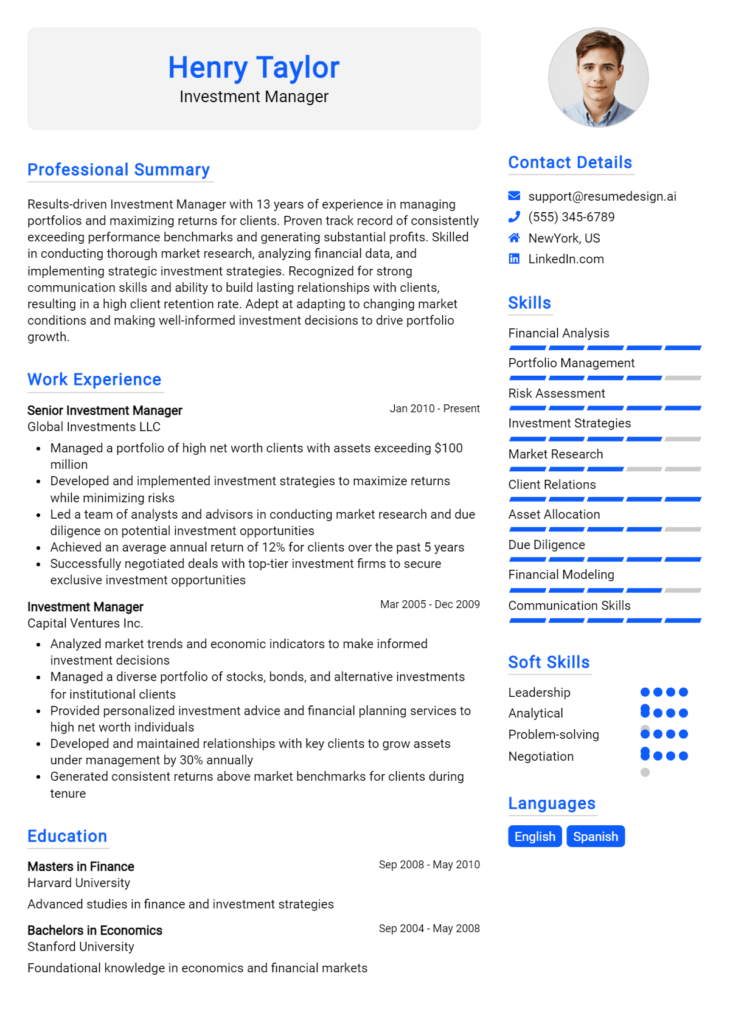

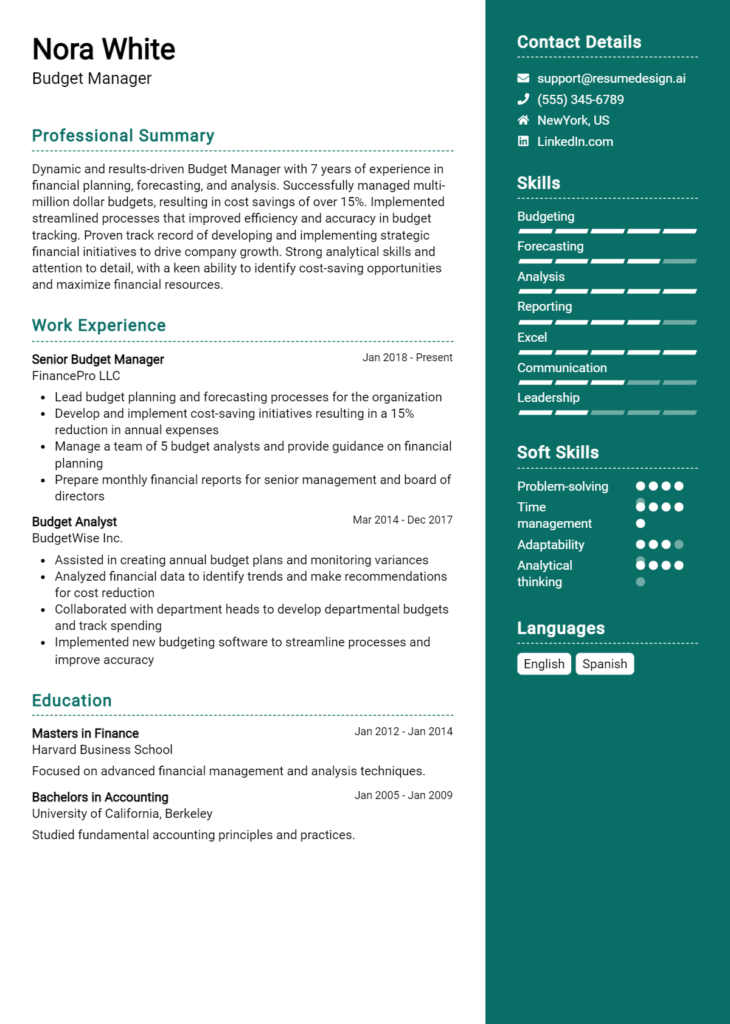

Work Experience Section for Financial Planning and Analysis Manager Resume

The work experience section of a Financial Planning and Analysis Manager resume serves as a critical component that highlights the candidate's technical skills, leadership abilities, and capacity to deliver high-quality financial products. This section not only details past roles and responsibilities but also quantifies achievements that demonstrate the candidate's impact on business outcomes. By aligning experiences with industry standards and showcasing measurable results, candidates can effectively illustrate their value to potential employers, making it essential to present this section with clarity and precision.

Best Practices for Financial Planning and Analysis Manager Work Experience

- Utilize specific financial terminology to showcase your technical expertise.

- Quantify achievements through metrics such as revenue growth, cost savings, or improved efficiency.

- Highlight leadership roles and team management experiences to demonstrate your ability to lead cross-functional teams.

- Align your experiences with industry benchmarks and standards to show your understanding of market dynamics.

- Include examples of successful project management, emphasizing your role in delivering high-quality financial analyses.

- Collaborate with stakeholders across different departments; illustrate this with examples of teamwork that led to successful outcomes.

- Focus on results-driven statements that convey your contributions and impact on the organization.

- Keep descriptions concise and impactful, ensuring readability and engagement for hiring managers.

Example Work Experiences for Financial Planning and Analysis Manager

Strong Experiences

- Led a team of 5 analysts to streamline the annual budgeting process, reducing preparation time by 30% and improving accuracy by 15%.

- Implemented a financial forecasting model that increased forecast accuracy by 25%, resulting in a $2 million reduction in excess inventory costs.

- Spearheaded a cross-departmental initiative to optimize capital allocation, which resulted in a 20% increase in ROI on new projects over two years.

- Collaborated closely with the executive team to develop a strategic financial plan that supported a 15% increase in revenue year-over-year.

Weak Experiences

- Responsible for financial analysis and reporting tasks.

- Assisted in preparing budgets and forecasts.

- Worked with various teams on financial projects.

- Helped to improve financial processes.

The examples of strong experiences are deemed impactful due to their specificity, quantifiable results, and clear demonstration of leadership and collaboration. They effectively showcase the candidate's contributions to the organization and their ability to drive significant financial improvements. Conversely, the weak experiences lack detail and metrics, making them unimpressive and failing to highlight the candidate's true capabilities and achievements in the financial planning and analysis domain.

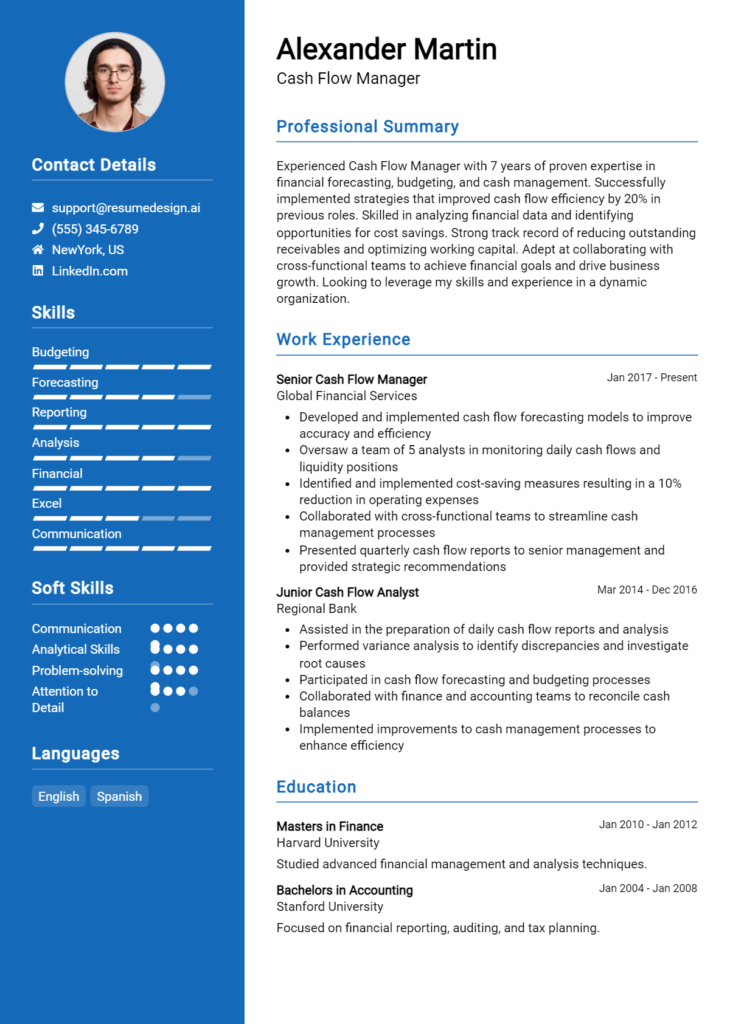

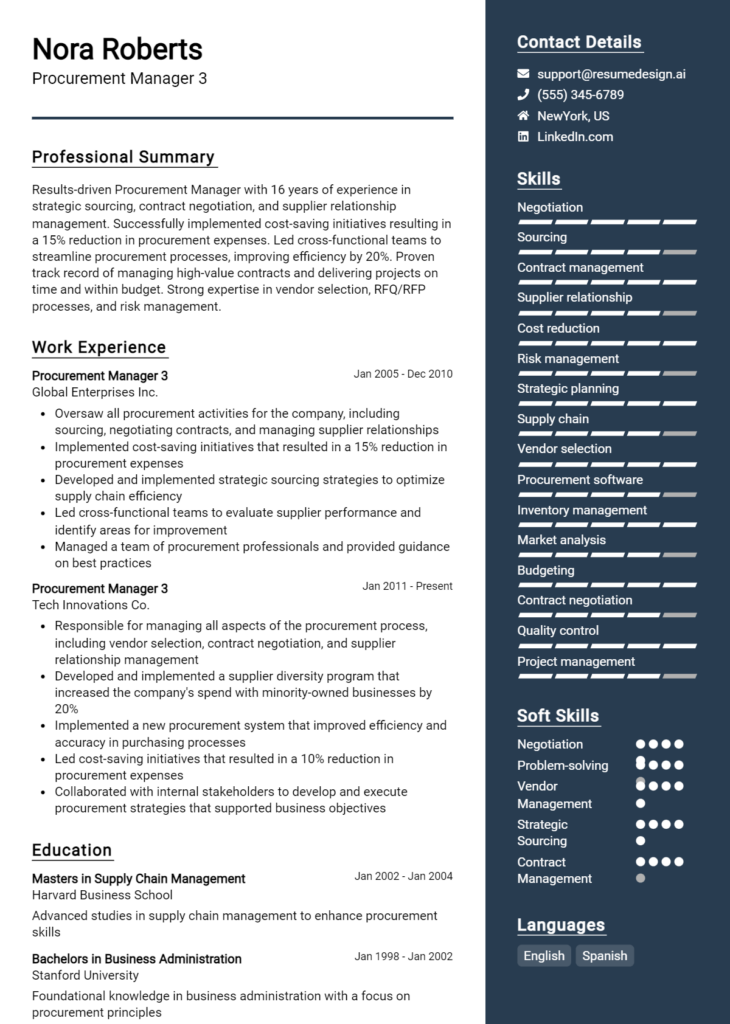

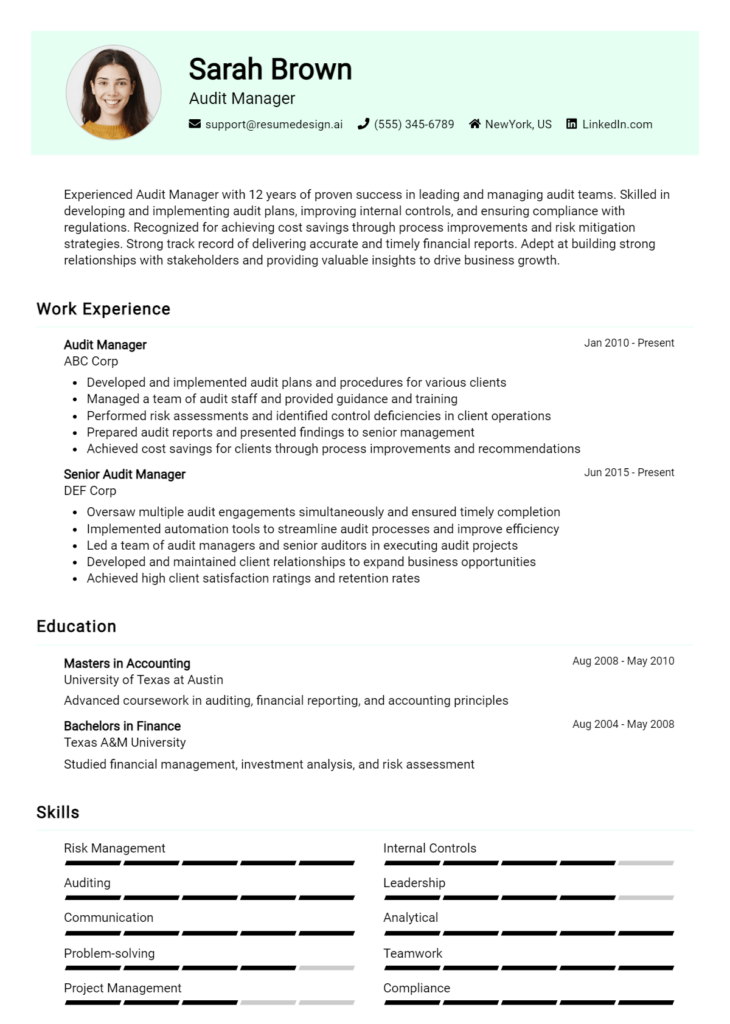

Education and Certifications Section for Financial Planning and Analysis Manager Resume

The Education and Certifications section of a Financial Planning and Analysis Manager resume is critical as it showcases the candidate's academic qualifications, relevant certifications, and commitment to continuous professional development. This section not only reflects the candidate's foundational knowledge and skills pertinent to financial analysis and strategic planning but also demonstrates their proactive approach to staying updated with industry standards. By including relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and align themselves more closely with the specific requirements of the job role, thereby increasing their chances of securing an interview.

Best Practices for Financial Planning and Analysis Manager Education and Certifications

- Prioritize relevant degrees such as Finance, Accounting, Business Administration, or Economics.

- Include industry-recognized certifications like CFA, CPA, or FP&A to demonstrate expertise.

- List any specialized training programs or workshops that pertain to financial analysis and strategic planning.

- Highlight relevant coursework that aligns with key skills required for the position, such as advanced financial modeling or budgeting.

- Ensure that all information is current; avoid listing outdated or irrelevant qualifications.

- Use clear and concise formatting to make this section easy to read and visually appealing.

- Consider including honors or distinctions received during your academic career to add further credibility.

- Tailor this section to match the specific job description, emphasizing qualifications that are directly applicable to the role.

Example Education and Certifications for Financial Planning and Analysis Manager

Strong Examples

- MBA in Finance, Harvard Business School, 2020

- Chartered Financial Analyst (CFA), Level II Candidate

- Certified Financial Planner (CFP), 2021

- Advanced Financial Modeling and Valuation Analyst (FMVA), Corporate Finance Institute, 2022

Weak Examples

- Bachelor of Arts in Philosophy, University of California, 2010

- Certification in Basic Accounting, 2015

- Online Course in Personal Finance, 2018

- High School Diploma, Graduated 2005

The strong examples are considered effective because they reflect relevant and advanced qualifications that directly contribute to the competencies required for a Financial Planning and Analysis Manager role. These credentials showcase a solid academic background and recognized certifications that affirm the candidate's expertise in financial analysis. Conversely, the weak examples lack relevance to the job, featuring outdated or generic qualifications that do not align with the expectations of a managerial position in financial planning and analysis, thereby diminishing the candidate's appeal to potential employers.

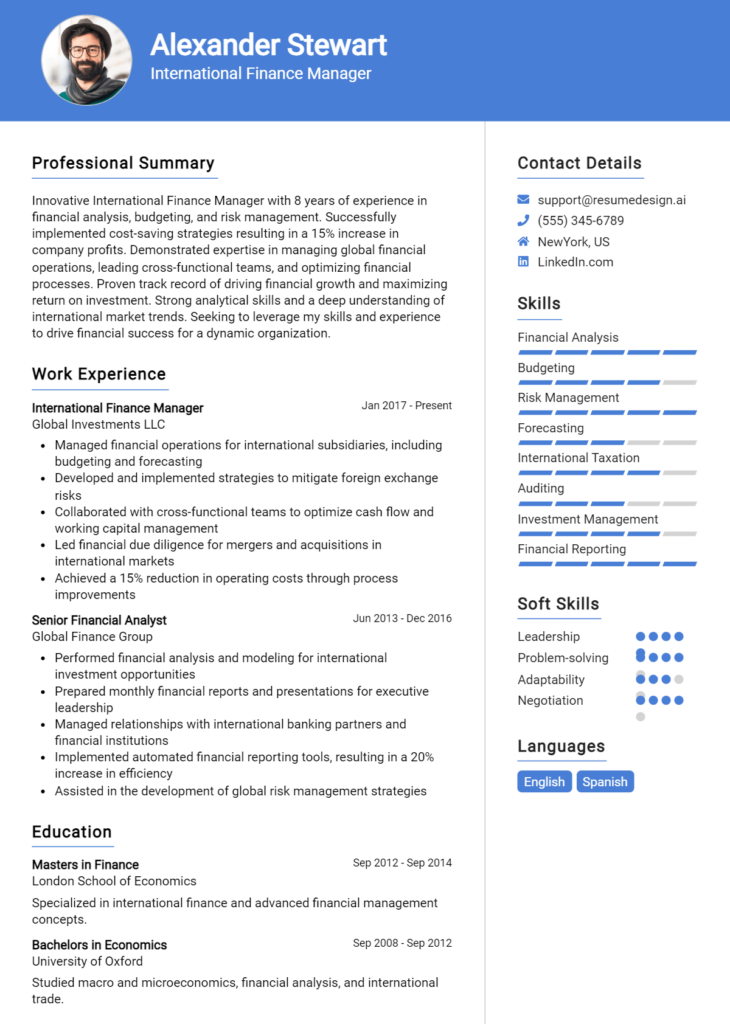

Top Skills & Keywords for Financial Planning and Analysis Manager Resume

A Financial Planning and Analysis (FP&A) Manager plays a crucial role in driving the financial health of an organization. In this competitive landscape, a well-crafted resume that highlights relevant skills can make all the difference in landing that dream job. The right combination of hard and soft skills not only showcases your technical expertise but also demonstrates your ability to collaborate, communicate, and lead within a financial team. Employers are looking for candidates who can navigate complex financial data, provide strategic insights, and influence business decisions. Therefore, focusing on these key skills in your resume is essential for standing out among other applicants.

Top Hard & Soft Skills for Financial Planning and Analysis Manager

Soft Skills

- Strong communication skills

- Analytical thinking

- Problem-solving abilities

- Leadership and team management

- Adaptability and flexibility

- Attention to detail

- Time management

- Interpersonal skills

- Strategic thinking

- Negotiation skills

Hard Skills

- Financial modeling

- Budgeting and forecasting

- Advanced Excel proficiency

- Data analysis and interpretation

- Knowledge of financial software (e.g., SAP, Oracle)

- Variance analysis

- Financial reporting

- Risk management

- Cost analysis

- Understanding of accounting principles

By effectively showcasing these skills on your resume, you can enhance your work experience and present yourself as a well-rounded candidate for the FP&A Manager position.

Stand Out with a Winning Financial Planning and Analysis Manager Cover Letter

As a seasoned Financial Planning and Analysis Manager with over seven years of experience in strategic financial management and performance analysis, I am excited to apply for the position at your esteemed organization. My strong analytical skills, coupled with my ability to drive data-driven decision-making, have enabled me to contribute significantly to the financial health and operational efficiency of my previous employers. I am particularly drawn to your company due to its commitment to innovation and excellence, and I am eager to bring my expertise in financial modeling, forecasting, and budgeting to your team.

In my previous role at XYZ Corporation, I successfully led a team that developed comprehensive financial models which enhanced our forecasting accuracy by 20%. I implemented new budgeting processes that streamlined operations and improved departmental accountability. By collaborating closely with cross-functional teams, I was able to identify key performance indicators that aligned with our strategic goals, ultimately driving a 15% increase in revenue year-over-year. I am confident that my proactive approach and strong leadership abilities will allow me to make a valuable contribution to your organization.

I am also adept at leveraging advanced analytical tools to provide actionable insights that support executive decision-making. My experience in conducting variance analysis and scenario planning has equipped me to identify potential risks and opportunities swiftly, enabling timely and informed adjustments to financial strategies. I am passionate about fostering a culture of continuous improvement and look forward to bringing my collaborative spirit to your team, ensuring that we not only meet but exceed our financial objectives.

Thank you for considering my application. I am eager to discuss how my background and skills align with the goals of your organization. I look forward to the opportunity to further elaborate on how I can contribute to the success of your financial planning and analysis efforts.

Common Mistakes to Avoid in a Financial Planning and Analysis Manager Resume

A well-crafted resume is crucial for a Financial Planning and Analysis (FP&A) Manager, as it serves as a first impression to potential employers. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can present a stronger, more polished resume that highlights your skills, experiences, and qualifications effectively. Here are some of the most frequent errors to steer clear of:

Using a Generic Template: Relying on a one-size-fits-all resume template can make your application appear unoriginal and unprofessional. Tailor your resume to reflect the specific requirements of the FP&A role.

Neglecting Quantifiable Achievements: Failing to include measurable accomplishments can weaken your resume. Always quantify your contributions, such as “Increased revenue by 15% through improved financial forecasting.”

Overloading with Technical Jargon: While industry-specific terms are important, excessive jargon can confuse hiring managers. Strive for a balance between demonstrating expertise and maintaining clarity.

Lacking a Clear Structure: A disorganized resume can be difficult to read. Use clear headings, bullet points, and a logical flow to ensure your qualifications stand out.

Ignoring Soft Skills: FP&A roles require strong communication and leadership abilities. Omitting these skills can create an incomplete picture of your capabilities. Incorporate examples that showcase both technical and interpersonal skills.

Omitting Relevant Certifications: Not listing relevant certifications, such as CFA or CPA, can diminish your credibility. Ensure these are prominently displayed if they directly relate to the position.

Writing an Overly Long Resume: Lengthy resumes can overwhelm hiring managers. Aim for a concise, one-page document that highlights your most relevant experiences and skills.

Failing to Tailor the Resume for Each Application: Sending the same resume for multiple applications can be detrimental. Customize your resume to align with the job description and emphasize experiences that directly relate to the specific FP&A role you’re applying for.

Conclusion

As we explored the critical role of a Financial Planning and Analysis (FP&A) Manager, it became clear that this position is vital for guiding organizations toward their financial goals. The FP&A Manager is responsible for budgeting, forecasting, and analyzing financial data to support strategic decision-making. They must possess strong analytical skills, attention to detail, and the ability to communicate complex financial information clearly to stakeholders.

Moreover, the importance of a well-crafted resume for this role cannot be overstated. A compelling FP&A resume should highlight relevant experience, technical skills in financial modeling, and proficiency with analytical tools. It should also demonstrate your ability to contribute to an organization's financial strategy and performance.

Now is the perfect time to review your Financial Planning and Analysis Manager resume. Ensure that it reflects your expertise and aligns with the expectations of potential employers. To assist you in this process, consider utilizing resources such as resume templates, which can provide a professional layout; a resume builder, which simplifies the creation process; resume examples to inspire your content; and cover letter templates to complement your application. Take action today to enhance your resume and stand out in the competitive job market!