Corporate Banker Core Responsibilities

A Corporate Banker plays a crucial role in bridging various departments by managing financial relationships with corporate clients. Key responsibilities include assessing client creditworthiness, structuring loan agreements, and providing tailored financial solutions. Proficiency in financial analysis, operational management, and problem-solving is essential for success, enabling bankers to support organizational goals effectively. A well-structured resume that highlights these technical and interpersonal skills can significantly enhance career prospects in this competitive field.

Common Responsibilities Listed on Corporate Banker Resume

- Develop and maintain relationships with corporate clients.

- Conduct financial analysis to assess client needs and creditworthiness.

- Structure and negotiate loan agreements and financial products.

- Collaborate with internal departments, including risk management and compliance.

- Monitor and analyze market trends to provide strategic advice.

- Prepare and present financial proposals to clients.

- Ensure adherence to regulatory requirements and internal policies.

- Manage client portfolios and conduct regular reviews.

- Identify cross-selling opportunities for additional financial products.

- Provide exceptional customer service to enhance client satisfaction.

- Assist in the development of marketing strategies for corporate banking products.

High-Level Resume Tips for Corporate Banker Professionals

In the competitive world of corporate banking, a well-crafted resume is not just a document; it is your first opportunity to make a lasting impression on potential employers. With hiring managers often sifting through countless applications, your resume needs to stand out by effectively showcasing your skills, experience, and achievements. It serves as a marketing tool that encapsulates your professional journey and highlights your value proposition in the corporate banking landscape. This guide will provide practical and actionable resume tips specifically tailored for Corporate Banker professionals, ensuring that your resume reflects your qualifications and catches the eye of hiring decision-makers.

Top Resume Tips for Corporate Banker Professionals

- Tailor your resume to the job description by using relevant keywords and phrases that align with the requirements of the position.

- Highlight your experience in corporate finance, investment strategies, and risk management, as these are crucial for a corporate banking role.

- Quantify your achievements by including specific metrics, such as the percentage of revenue growth you contributed to or the number of successful deals closed.

- Emphasize your knowledge of financial regulations and compliance, which are essential in maintaining the integrity of banking operations.

- Include industry-specific skills, such as financial modeling, credit analysis, and portfolio management, to demonstrate your expertise.

- Showcase your ability to build and maintain client relationships, as interpersonal skills are vital in corporate banking.

- Incorporate relevant certifications or professional development courses, like CFA or CFI, to enhance your credentials.

- Use a clear and concise format that is easy to read, with distinct headings and bullet points to guide the reader through your qualifications.

- Keep your resume to one or two pages, ensuring you focus on the most pertinent information that showcases your strengths.

By implementing these tips, you can significantly increase your chances of landing a job in the Corporate Banker field. A tailored and impactful resume that effectively communicates your skills and achievements will not only capture the attention of hiring managers but also position you as a strong candidate in a competitive job market.

Why Resume Headlines & Titles are Important for Corporate Banker

In the competitive field of corporate banking, a well-crafted resume headline or title serves as a powerful marketing tool for candidates. It is the first thing hiring managers see and can make a significant difference in capturing their attention. A strong headline succinctly summarizes a candidate's key qualifications, showcasing their value proposition in just a few words. This concise and relevant statement should directly relate to the job being applied for, effectively setting the tone for the rest of the resume and enticing employers to read further.

Best Practices for Crafting Resume Headlines for Corporate Banker

- Keep it concise: Aim for a headline that is no longer than 10-15 words.

- Be role-specific: Tailor your headline to reflect the specific position you are applying for.

- Highlight key strengths: Focus on your most relevant skills and accomplishments.

- Use industry keywords: Incorporate terms that are commonly used in corporate banking.

- Showcase value: Convey how your experience can benefit the employer.

- Avoid generic phrases: Steer clear of clichés that do not add value to your headline.

- Format for impact: Use strong language and action verbs to create a compelling statement.

- Reflect your career level: Indicate your experience level, whether entry-level or senior management.

Example Resume Headlines for Corporate Banker

Strong Resume Headlines

Results-Driven Corporate Banker with Over 10 Years of Experience in Client Relationship Management

Strategic Financial Advisor with Expertise in Risk Management and Portfolio Optimization

Dynamic Corporate Banking Professional Specializing in Credit Analysis and Financial Solutions

Weak Resume Headlines

Banker with Experience

Seeking a Corporate Banking Position

Strong headlines are effective because they quickly communicate a candidate's unique strengths and relevant experience, making them stand out in a crowded job market. They use specific language that aligns with the job requirements, which helps to engage hiring managers right away. In contrast, weak headlines lack specificity and fail to convey any meaningful information about the candidate’s qualifications, making them forgettable and ineffective in capturing the employer's interest.

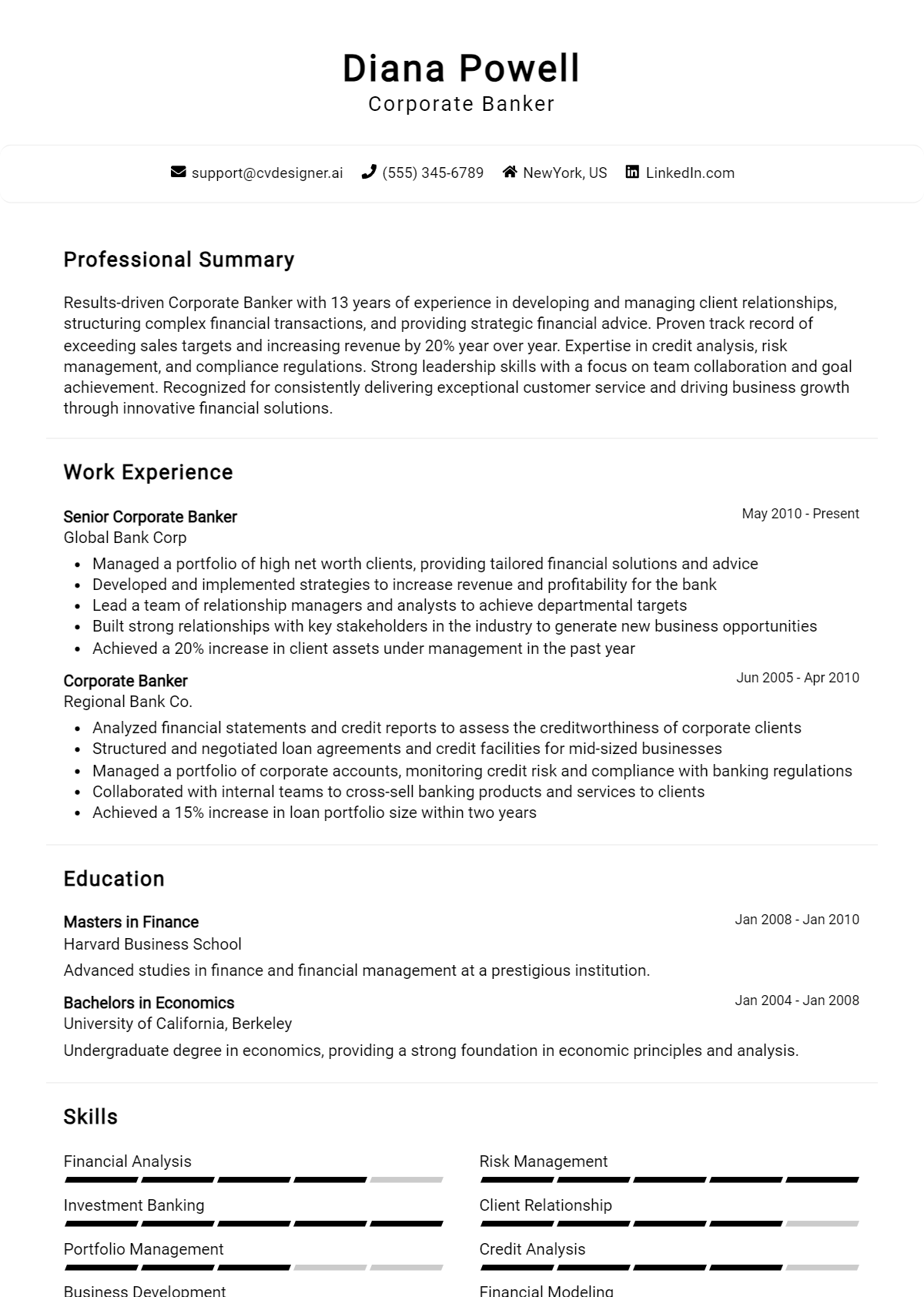

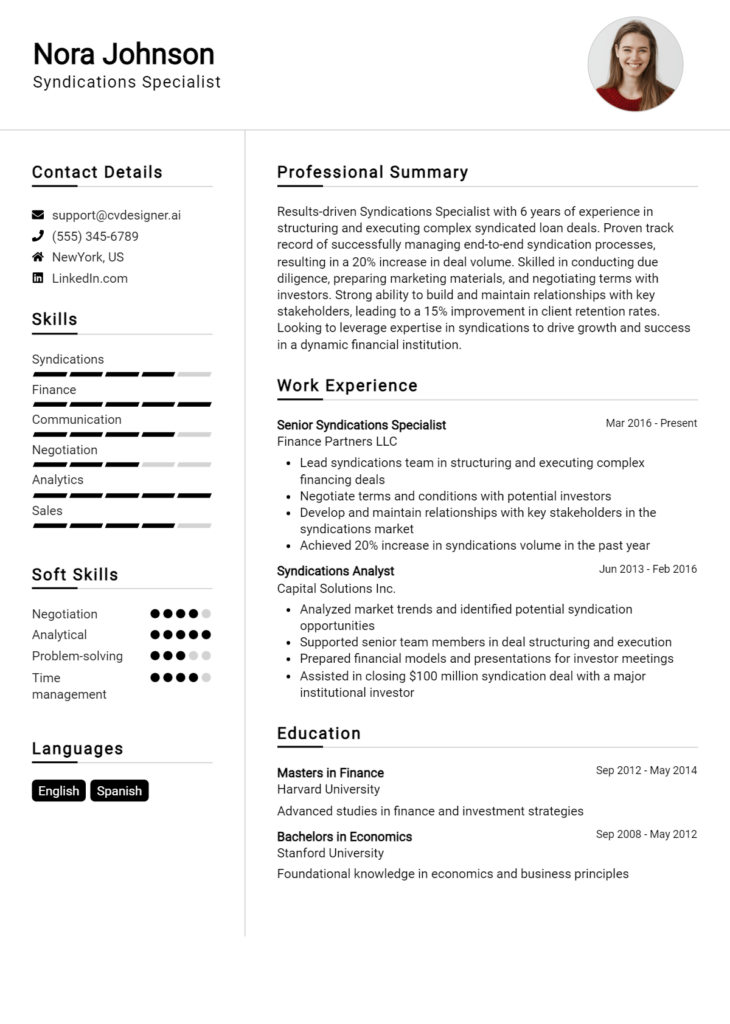

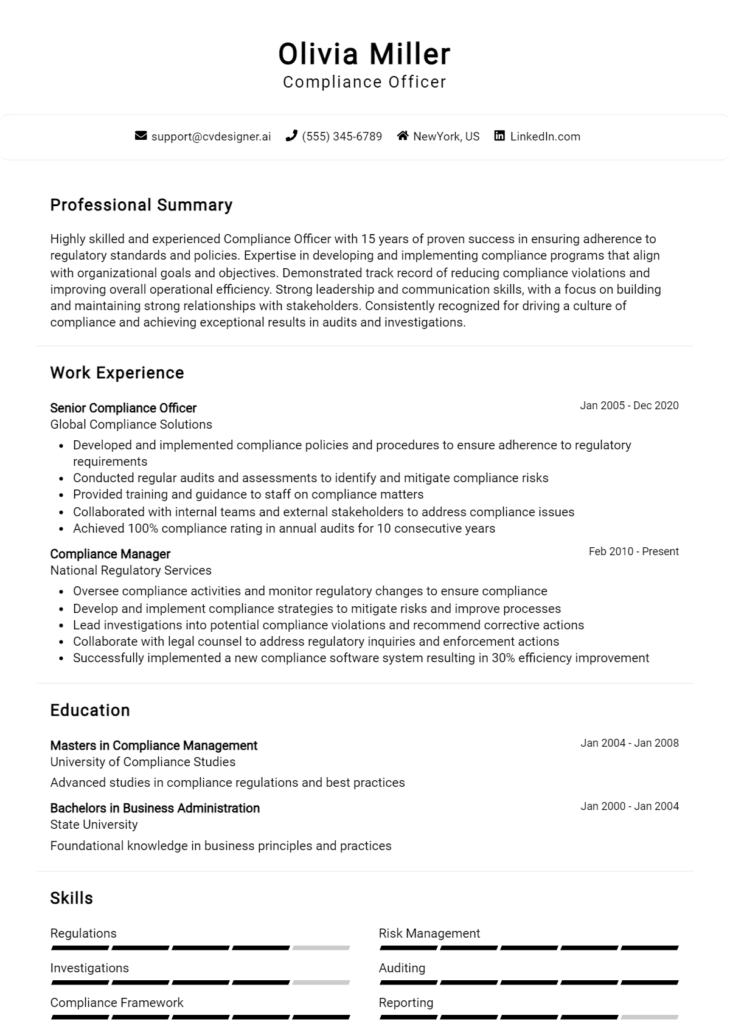

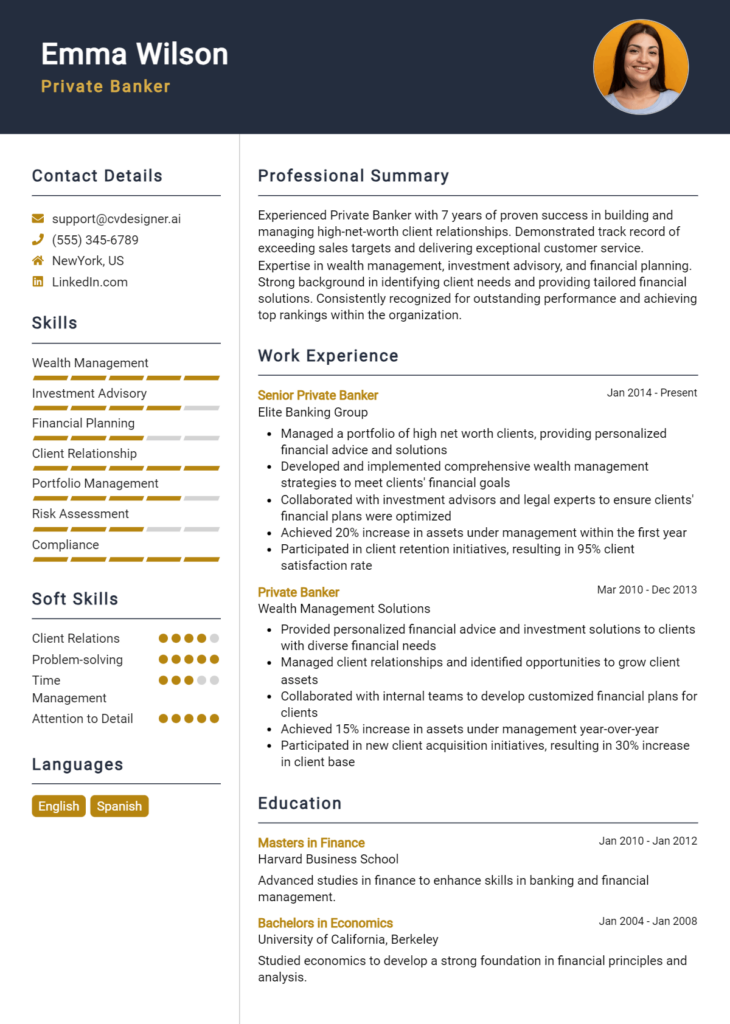

Writing an Exceptional Corporate Banker Resume Summary

A resume summary is a crucial component for any Corporate Banker seeking to make a strong impression on potential employers. It serves as a brief yet powerful introduction that encapsulates the candidate's key skills, relevant experience, and notable accomplishments. In a competitive job market, a well-crafted summary quickly captures the attention of hiring managers, providing them with an immediate understanding of the candidate's qualifications. This section should be concise, impactful, and specifically tailored to the job description to effectively highlight how the applicant meets the unique demands of the Corporate Banking role.

Best Practices for Writing a Corporate Banker Resume Summary

- Quantify achievements: Use numbers and percentages to demonstrate the impact of your contributions.

- Focus on relevant skills: Highlight the specific skills that align with the job requirements, such as financial analysis, relationship management, or credit underwriting.

- Tailor the summary: Customize your resume summary for each job application to reflect the key phrases and skills mentioned in the job description.

- Be concise: Keep your summary to 2-4 sentences to maintain clarity and engagement.

- Showcase industry knowledge: Mention your understanding of market trends and regulations within the banking sector.

- Include key accomplishments: Briefly highlight awards, recognitions, or successful projects that set you apart from other candidates.

- Maintain a professional tone: Use formal language that aligns with the corporate environment and reflects your professionalism.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

Example Corporate Banker Resume Summaries

Strong Resume Summaries

Results-driven Corporate Banker with over 8 years of experience in managing a portfolio of high-net-worth clients, achieving a 25% increase in asset growth through strategic financial planning and tailored investment solutions.

Dynamic Corporate Banking professional with a proven track record of closing deals worth over $50 million annually, leveraging expertise in risk assessment and relationship management to exceed client expectations.

Detail-oriented Corporate Banker skilled in credit analysis and underwriting, successfully reducing loan default rates by 15% through rigorous evaluation processes and proactive client communication.

Accomplished Corporate Banker with extensive knowledge of commercial lending, recognized for expanding market share by 30% in two years by cultivating strong relationships with local businesses and providing customized financial solutions.

Weak Resume Summaries

Corporate Banker with experience in finance looking for a challenging position.

Dedicated professional with skills in banking and finance, seeking to contribute to a team.

Experienced banker interested in corporate finance opportunities with a focus on client relations.

The strong resume summaries are considered effective because they provide quantifiable results, specific skills, and a direct relevance to the Corporate Banking role, allowing hiring managers to see the candidates' potential contributions at a glance. In contrast, the weak summaries lack detail, are overly generic, and fail to demonstrate the candidate's unique qualifications or achievements, making them less compelling in a competitive job market.

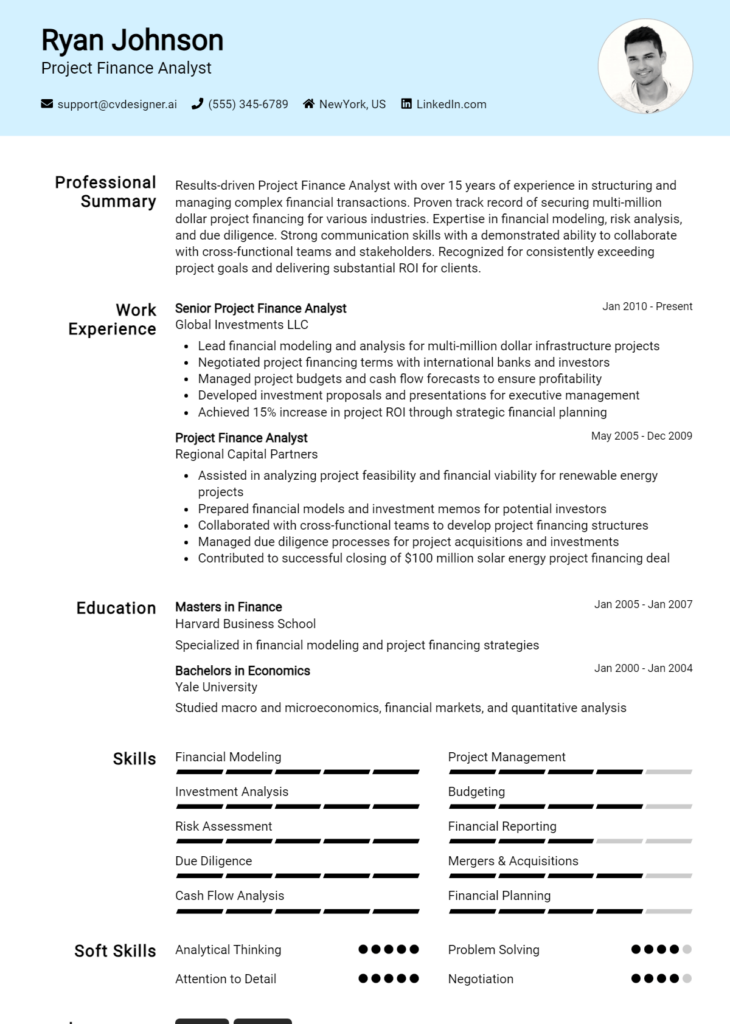

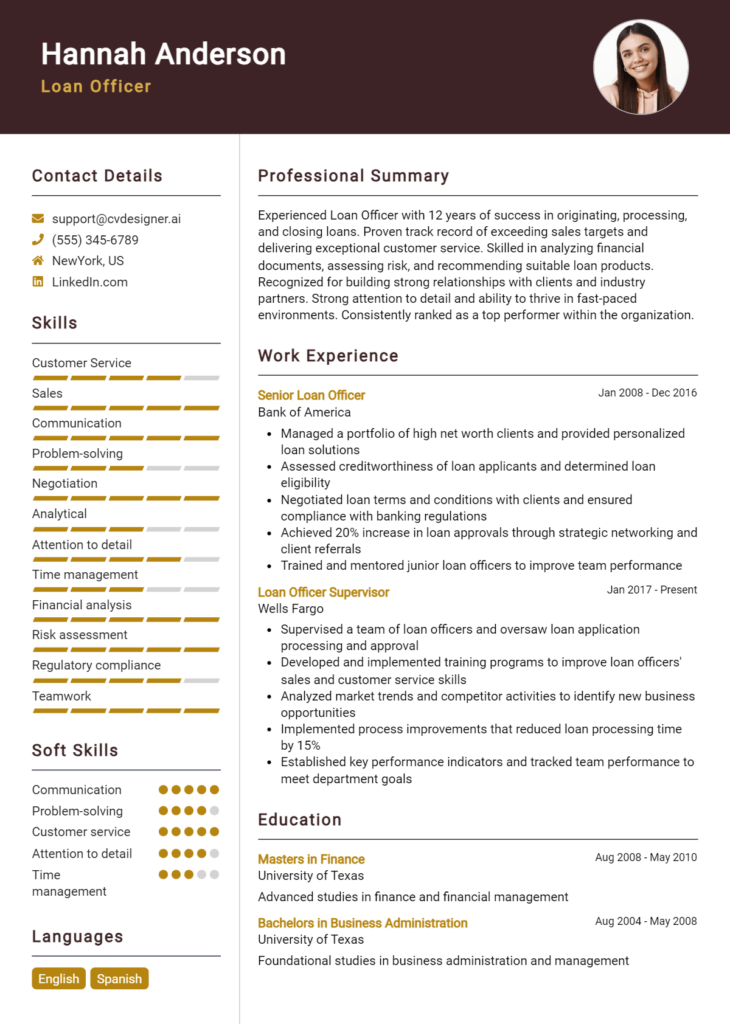

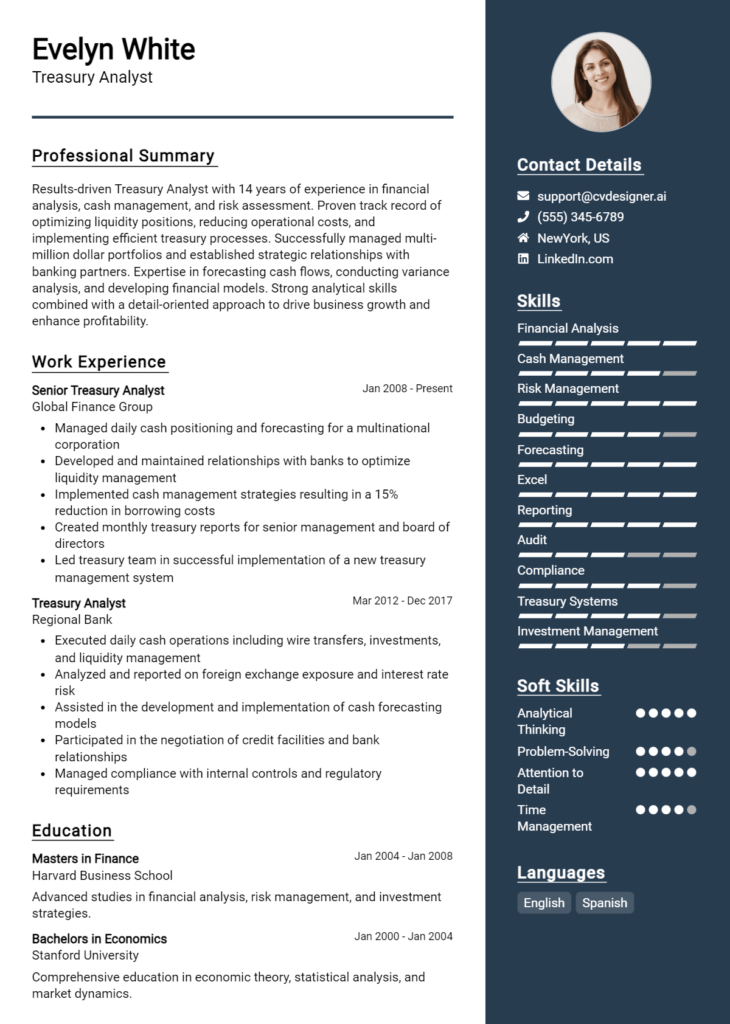

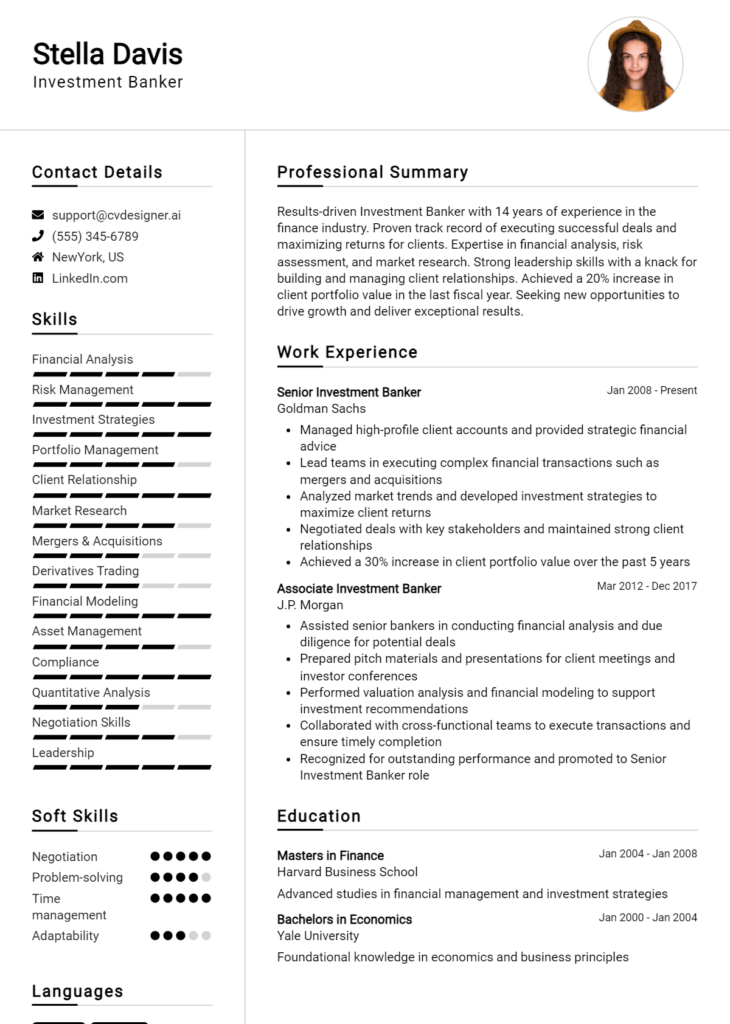

Work Experience Section for Corporate Banker Resume

The work experience section of a Corporate Banker resume is critical in demonstrating the candidate's technical expertise, leadership capabilities, and commitment to delivering high-quality financial products and services. This section not only highlights the specific skills acquired through previous roles but also provides concrete evidence of the candidate's ability to manage teams effectively and navigate complex banking operations. By quantifying achievements and aligning experiences with industry standards, candidates can present a compelling case for their suitability in the competitive landscape of corporate banking.

Best Practices for Corporate Banker Work Experience

- Utilize industry-specific terminology to demonstrate technical expertise.

- Quantify achievements with measurable outcomes, such as revenue growth or cost savings.

- Highlight collaborative projects that showcase teamwork and leadership skills.

- Focus on results-oriented statements rather than generic job duties.

- Tailor experiences to align with the specific requirements of the position being applied for.

- Emphasize your role in successful initiatives, including project management and client relationships.

- Include relevant certifications or training that enhance your qualifications.

- Keep descriptions concise while ensuring clarity and impact.

Example Work Experiences for Corporate Banker

Strong Experiences

- Led a team of 10 in the successful execution of a $25 million corporate loan, resulting in a 15% increase in client satisfaction scores.

- Developed and implemented a financial analysis framework that improved risk assessment accuracy by 30%, directly contributing to a 20% reduction in default rates.

- Managed a portfolio of corporate clients, achieving a 40% increase in cross-selling opportunities through strategic relationship management.

- Collaborated with cross-functional teams to launch a new product line, generating $5 million in revenue within the first year of introduction.

Weak Experiences

- Responsible for handling client accounts.

- Worked on various projects related to banking.

- Participated in team meetings to discuss financial strategies.

- Assisted in the preparation of loan documentation.

The examples of strong experiences are characterized by their specificity and quantifiable results, showcasing the candidate's impact and leadership in significant projects. In contrast, the weak experiences are vague and lack measurable outcomes, failing to demonstrate the candidate's contributions or skills effectively. Strong statements provide a clearer picture of capabilities, while weak statements leave room for interpretation, making them less compelling to potential employers.

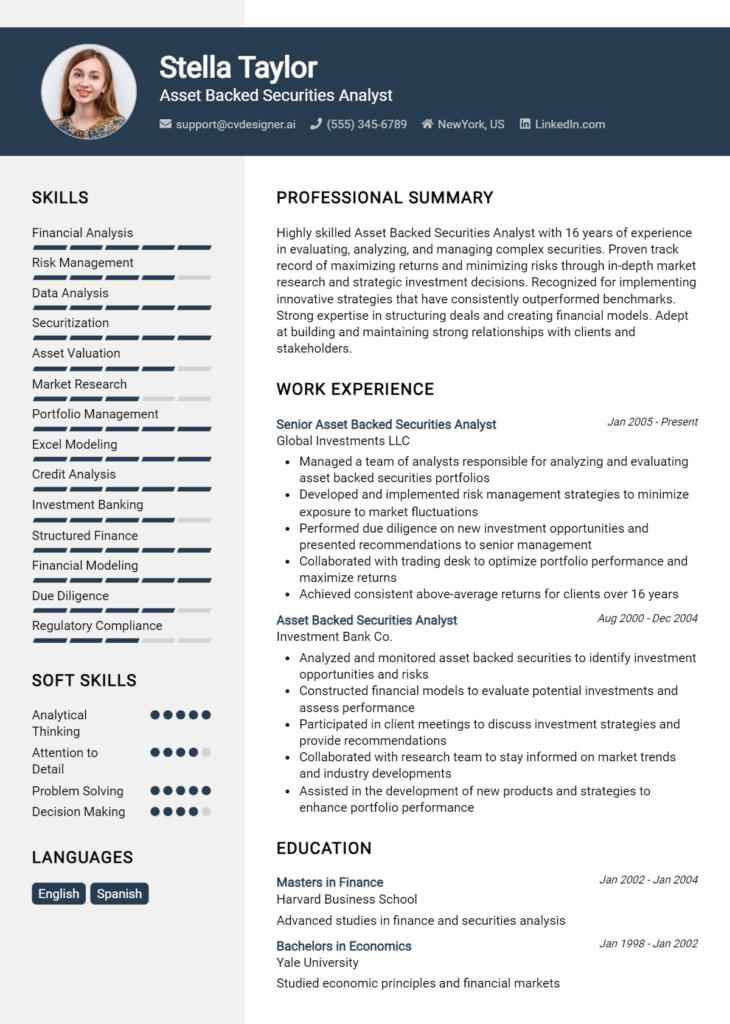

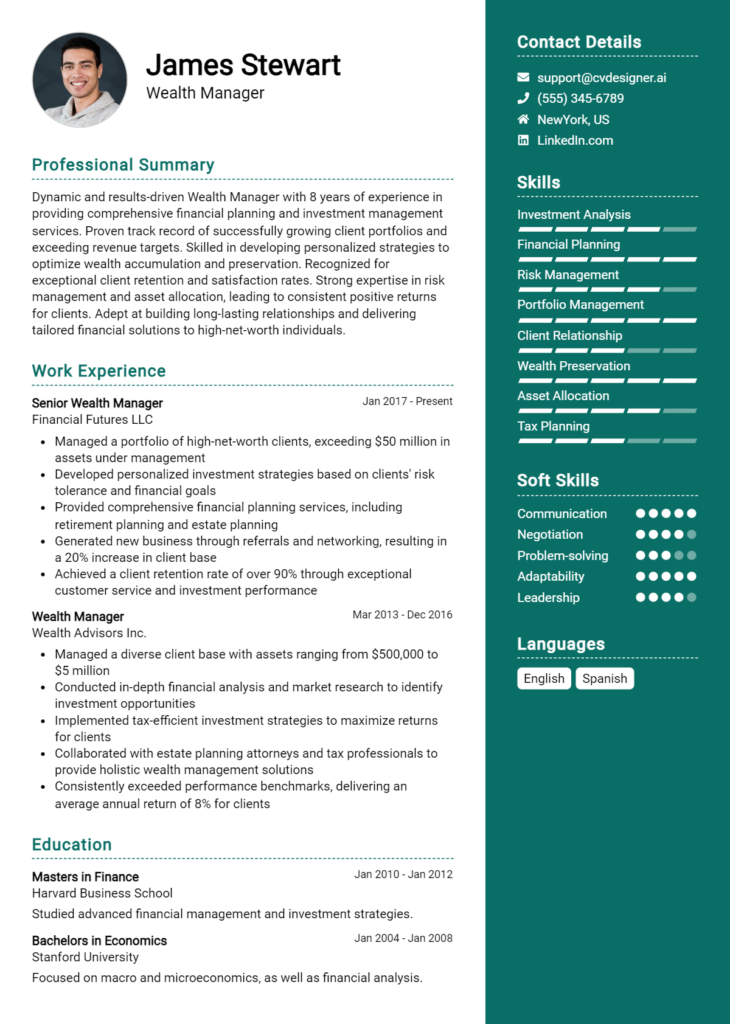

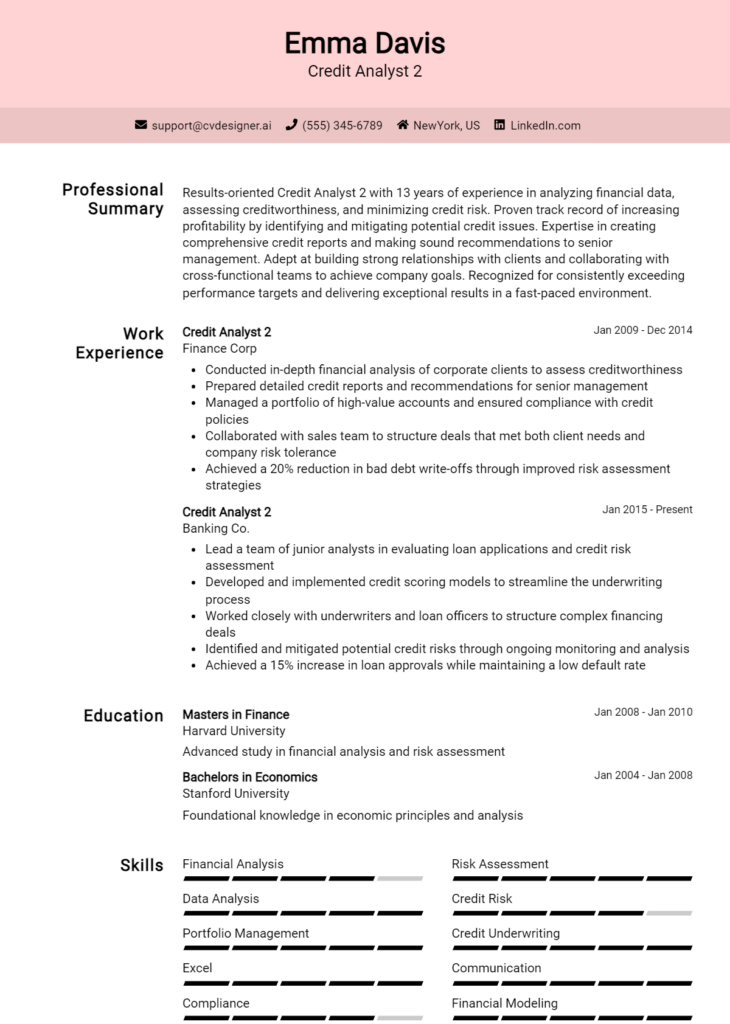

Education and Certifications Section for Corporate Banker Resume

The education and certifications section is a crucial component of a Corporate Banker resume, as it provides a clear representation of the candidate's academic qualifications, industry-relevant certifications, and commitment to continuous learning. This section serves to enhance the candidate’s credibility by showcasing degrees, specialized training, and relevant coursework that align with the demands of the role. By presenting this information effectively, candidates can demonstrate their dedication to the banking sector and their preparedness to tackle the complexities of corporate banking.

Best Practices for Corporate Banker Education and Certifications

- Include degrees from recognized institutions that are relevant to finance, economics, or business.

- Highlight industry-recognized certifications, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

- List relevant coursework that showcases expertise in corporate finance, investment analysis, and risk management.

- Emphasize any specialized training or workshops that demonstrate a commitment to professional development.

- Maintain clarity and conciseness, avoiding unnecessary jargon while ensuring all information is easily understandable.

- Order education and certifications chronologically, starting with the most recent and relevant qualifications.

- Consider including GPA or honors if they are particularly strong and relevant to the banking field.

- Regularly update this section to reflect new qualifications and training that enhance your profile.

Example Education and Certifications for Corporate Banker

Strong Examples

- MBA in Finance, University of Chicago Booth School of Business, 2021

- Chartered Financial Analyst (CFA), 2022

- Financial Risk Manager (FRM), 2023

- Relevant Coursework: Corporate Finance, Investment Banking, and Mergers & Acquisitions

Weak Examples

- Bachelor of Arts in History, University of California, 2010

- Certification in Basic Computer Skills, 2015

- High School Diploma, Anytown High School, 2008

- Online Course in Public Speaking, 2020

The examples listed as strong are considered valuable because they directly pertain to the skills and knowledge required in corporate banking, showcasing advanced degrees and recognized certifications that enhance the candidate's qualifications. In contrast, the weak examples illustrate educational qualifications and certifications that lack relevance to the corporate banking field, thus failing to support the candidate's credibility or expertise in the industry.

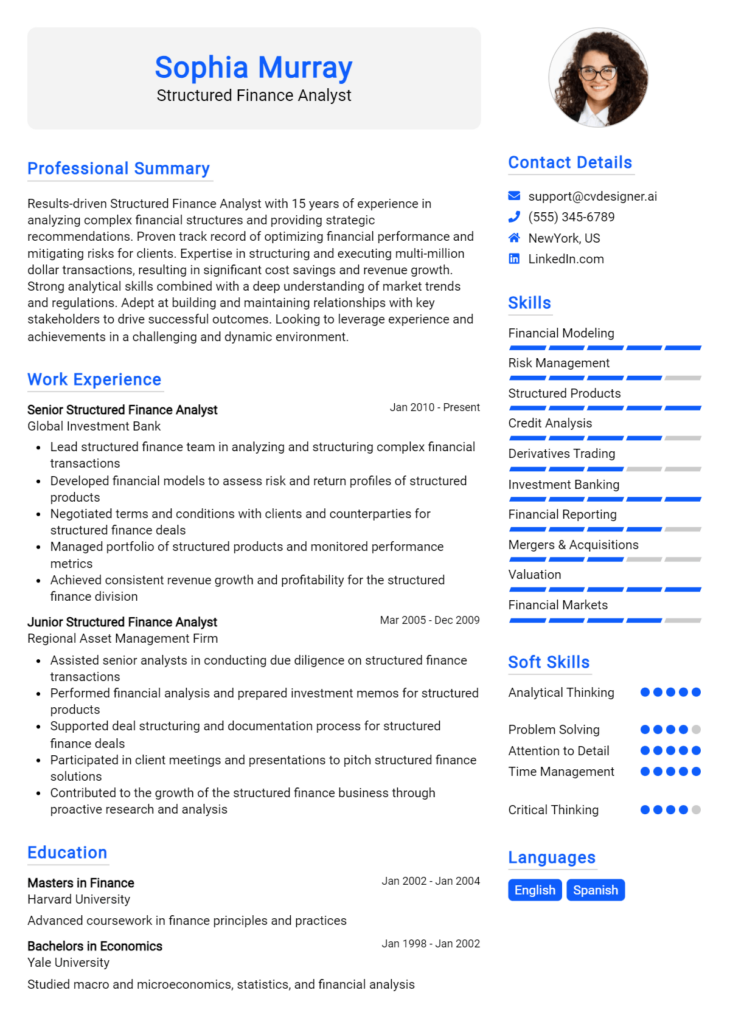

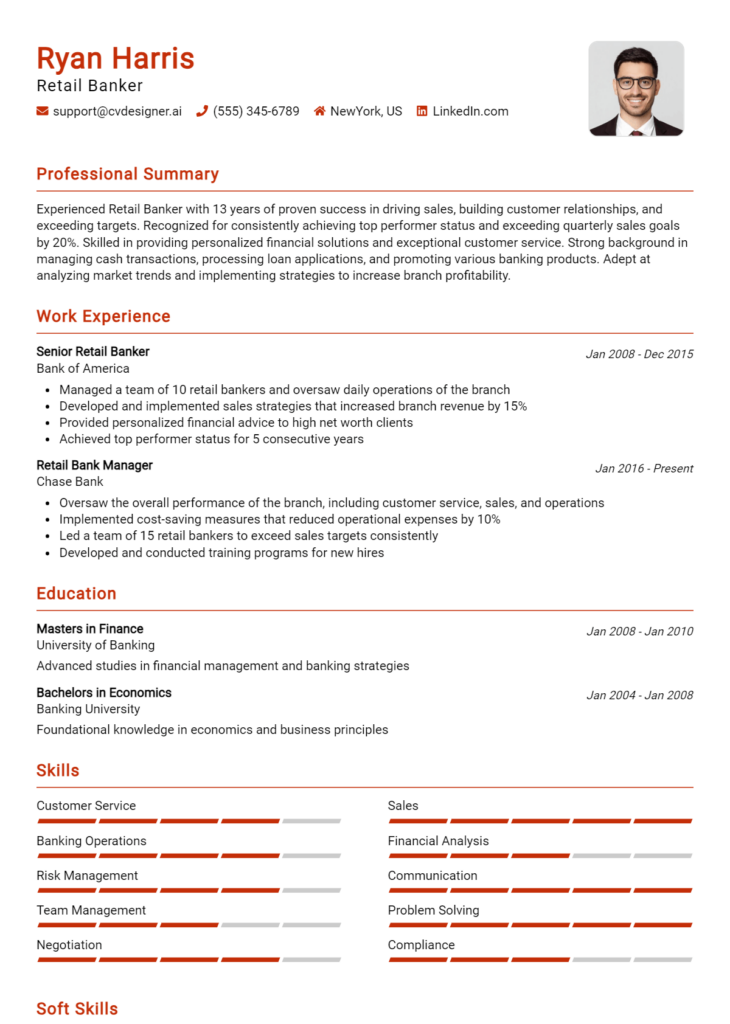

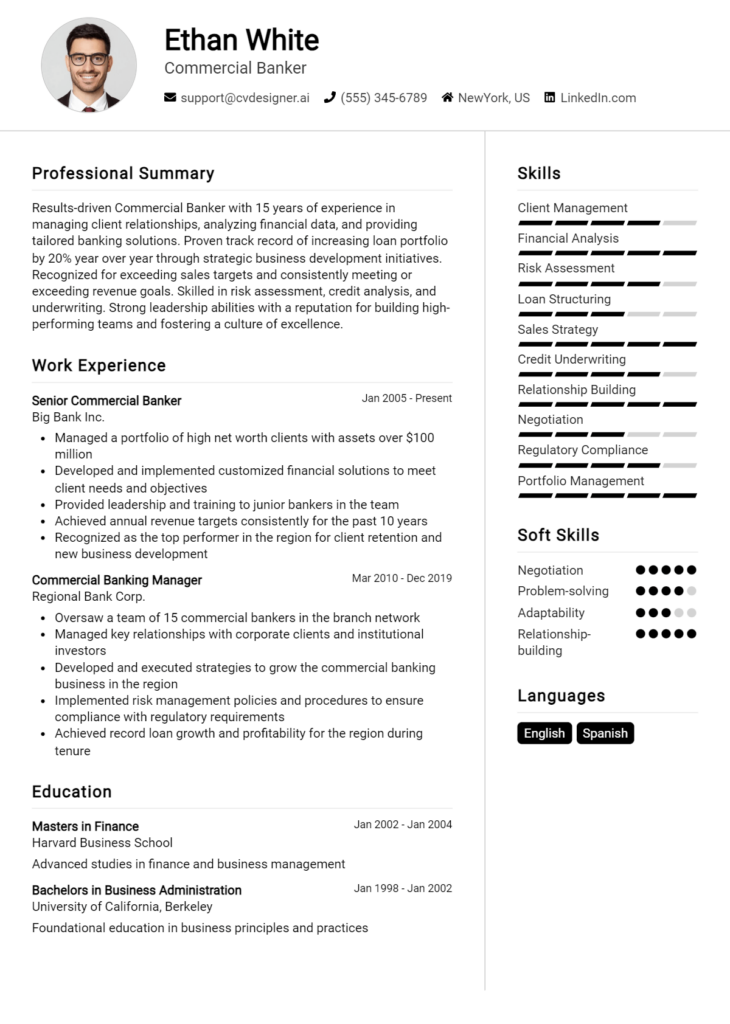

Top Skills & Keywords for Corporate Banker Resume

In the competitive field of corporate banking, showcasing the right skills on your resume is crucial for standing out to potential employers. A well-crafted resume highlights both hard and soft skills that reflect your expertise and ability to navigate the complexities of financial analysis, client management, and market trends. Employers look for candidates who not only possess technical knowledge but also demonstrate strong interpersonal skills, problem-solving abilities, and strategic thinking. By effectively integrating these skills into your resume, you can demonstrate your readiness to contribute to the financial success of an organization. For more insights on how to present your skills and work experience, consider the following key skills essential for a Corporate Banker.

Top Hard & Soft Skills for Corporate Banker

Soft Skills

- Excellent communication skills

- Strong analytical thinking

- Relationship building

- Negotiation skills

- Problem-solving ability

- Attention to detail

- Time management

- Adaptability

- Team collaboration

- Customer service orientation

Hard Skills

- Financial modeling

- Credit analysis

- Risk assessment

- Regulatory compliance knowledge

- Investment analysis

- Market research

- Financial reporting

- Proficiency in banking software

- Business development

- Knowledge of financial regulations

Stand Out with a Winning Corporate Banker Cover Letter

Dear [Hiring Manager's Name],

I am excited to apply for the Corporate Banker position at [Company Name], as advertised on [where you found the job listing]. With a solid background in commercial banking and a proven track record of managing client relationships, I am confident in my ability to contribute effectively to your team. My experience in analyzing financial statements, structuring loan agreements, and providing tailored financial solutions has equipped me with the skills necessary to excel in this role.

During my time at [Previous Company Name], I successfully managed a diverse portfolio of corporate clients, helping them navigate complex financial landscapes. I developed and maintained strong relationships with key stakeholders, which not only resulted in a 20% increase in client retention but also expanded our client base by identifying new business opportunities. My analytical skills, combined with my ability to communicate clearly and persuasively, enable me to provide valuable insights and recommendations that align with both client needs and organizational goals.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in corporate banking. I admire your focus on sustainable finance and the support you provide to businesses in achieving their growth objectives. I am eager to bring my expertise in risk assessment, financial modeling, and strategic planning to your team, ensuring that we continue to deliver exceptional service to our clients while driving profitability and efficiency.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am keen to contribute to your team and help foster strong, long-lasting relationships with corporate clients. Please feel free to contact me at your convenience to schedule a conversation.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Corporate Banker Resume

When crafting a resume for a corporate banking position, it's crucial to present your qualifications and experience in the best light possible. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more compelling resume that showcases your skills and aligns with the expectations of hiring managers in the finance sector.

Using a Generic Resume: Tailoring your resume for each specific role is essential. A one-size-fits-all approach may not highlight the most relevant skills or experiences needed for a corporate banking position.

Neglecting Quantifiable Achievements: Failing to include quantifiable results can make your accomplishments seem less impactful. Use specific numbers, percentages, or outcomes to demonstrate the success of your initiatives.

Overloading with Jargon: While industry terminology can be important, using too much jargon may confuse hiring managers. Strive for clarity and ensure your resume is easily understandable.

Ignoring Soft Skills: Corporate banking isn’t just about numbers—communication, negotiation, and relationship management are critical. Make sure to include relevant soft skills alongside technical expertise.

Listing Duties Instead of Achievements: Many candidates focus on their day-to-day responsibilities rather than their achievements. Highlight how you contributed to your organization’s success to stand out.

Omitting Relevant Education and Certifications: In the finance industry, education and certifications can be key differentiators. Ensure you prominently display your relevant degrees and any professional designations.

Poor Formatting and Layout: A cluttered or overly complex resume can detract from your content. Use clear headings, bullet points, and consistent formatting to make your resume easy to read.

Failing to Proofread: Typos and grammatical errors can create a poor impression. Always proofread your resume multiple times or have someone else review it to catch any mistakes.

Conclusion

As a Corporate Banker, your role is pivotal in facilitating financial transactions and providing strategic advice to businesses. You are responsible for managing client relationships, assessing creditworthiness, and structuring financing solutions tailored to client needs. The key skills that stand out in this profession include financial analysis, risk management, negotiation, and a deep understanding of the market dynamics affecting your clients’ industries.

In this highly competitive field, having a well-crafted resume is essential to showcase your expertise and achievements effectively. Highlighting your experience in managing corporate accounts, your ability to analyze complex financial data, and your success in securing funding for clients can set you apart from other candidates.

To ensure your resume is polished and impactful, consider utilizing professional tools that can elevate your application. Explore a variety of resume templates designed specifically for Corporate Bankers, or use the resume builder for a streamlined approach to crafting your document. Additionally, reviewing resume examples can provide inspiration and guidance on how to effectively present your qualifications. Don’t forget the importance of a compelling cover letter; check out the cover letter templates available to enhance your application package.

Take the time now to review and refine your Corporate Banker resume. Your next career opportunity could be just around the corner!