Collection Agent Core Responsibilities

A Collection Agent plays a crucial role in managing a company's receivables by communicating with clients to recover outstanding debts. Key responsibilities include negotiating payment plans, maintaining accurate records, and collaborating with various departments such as finance and customer service. Essential skills include technical proficiency in collection software, operational efficiency, and strong problem-solving abilities. These competencies not only enhance the agent's performance but also contribute to the organization's financial health. A well-structured resume can effectively showcase these qualifications, emphasizing their impact on the company's overall objectives.

Common Responsibilities Listed on Collection Agent Resume

- Contacting clients to discuss overdue accounts and payment options.

- Negotiating payment arrangements and settlements.

- Maintaining detailed records of interactions and payments.

- Utilizing collection software to track accounts and monitor progress.

- Collaborating with the finance team to reconcile accounts.

- Providing exceptional customer service while managing collections.

- Adhering to legal regulations and ethical standards in collections.

- Preparing reports on collection activities and outcomes.

- Identifying and escalating issues to management as needed.

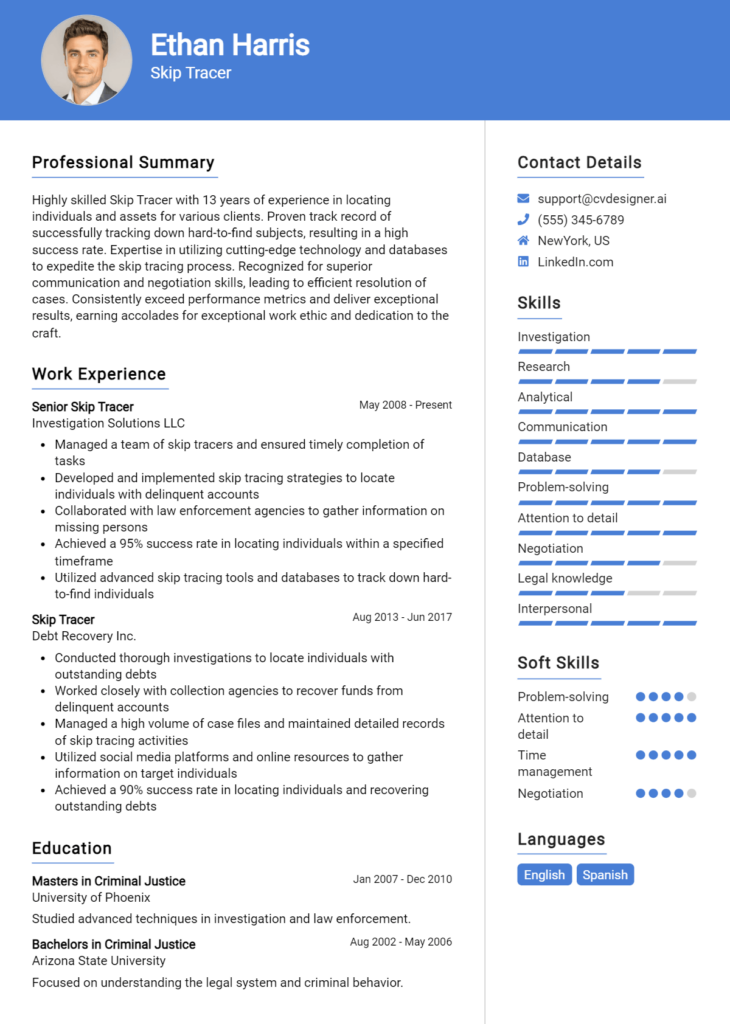

- Conducting skip tracing to locate debtors when necessary.

- Training new collection staff on processes and software.

- Staying updated on industry trends and best practices in collections.

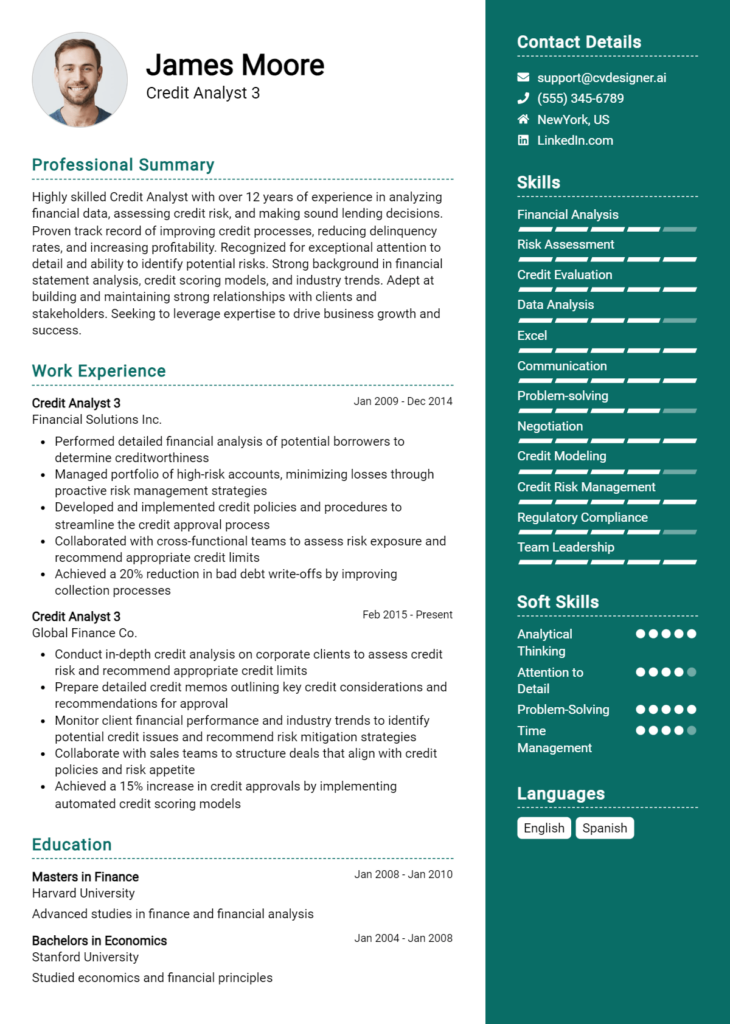

High-Level Resume Tips for Collection Agent Professionals

In the competitive field of collections, a well-crafted resume can make all the difference between landing an interview and getting lost in a sea of applications. As the first impression a candidate makes on a potential employer, a resume must not only highlight essential skills and qualifications but also effectively showcase achievements that demonstrate a proven track record in the collections industry. This guide aims to provide practical and actionable resume tips specifically tailored for Collection Agent professionals, ensuring that your resume stands out to hiring managers and reflects your unique capabilities in this vital role.

Top Resume Tips for Collection Agent Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the employer's requirements.

- Highlight your relevant experience in collections, including previous roles, responsibilities, and the types of accounts you managed.

- Quantify your achievements with specific metrics, such as the percentage of debts collected or the number of accounts resolved successfully.

- Showcase your communication skills, emphasizing your ability to negotiate and maintain positive relationships with clients.

- Include industry-specific certifications or training that demonstrate your commitment to professional development in collections.

- Utilize a clean and professional format that enhances readability while maintaining a strong visual appeal.

- List technical skills relevant to collections, such as proficiency in collection software, CRM systems, and data analysis tools.

- Incorporate testimonials or references from previous supervisors or clients who can vouch for your effectiveness as a Collection Agent.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and achievements that pertain to the role.

- Include a strong summary statement at the beginning of your resume that encapsulates your experience, skills, and career goals in the collections field.

By implementing these tips, Collection Agent professionals can significantly increase their chances of landing a job in this competitive field. A well-structured resume that effectively highlights your qualifications and achievements not only captures the attention of hiring managers but also positions you as a strong candidate ready to excel in the collections industry.

Why Resume Headlines & Titles are Important for Collection Agent

In the competitive field of collections, the role of a Collection Agent is not only to recover debts but also to maintain positive relationships with clients and customers. A well-crafted resume headline or title is crucial for making a strong first impression on hiring managers. This brief yet powerful phrase serves as a snapshot of a candidate’s qualifications and expertise, immediately capturing attention and summarizing key attributes relevant to the position. A compelling headline should be concise, relevant, and directly related to the job being applied for, ultimately setting the tone for the rest of the resume and increasing the likelihood of landing an interview.

Best Practices for Crafting Resume Headlines for Collection Agent

- Keep it concise and to the point, ideally under 10 words.

- Use role-specific keywords that match the job description.

- Highlight key skills or achievements relevant to collections.

- Avoid generic phrases; be specific about your expertise.

- Showcase your experience level (e.g., "Experienced" or "Entry-Level").

- Consider including metrics or quantifiable achievements when possible.

- Make it impactful by using action-oriented language.

- Tailor each headline to the specific job you are applying for.

Example Resume Headlines for Collection Agent

Strong Resume Headlines

"Results-Driven Collection Agent with 5+ Years of Experience"

“Skilled Negotiator with Proven Track Record in Debt Recovery”

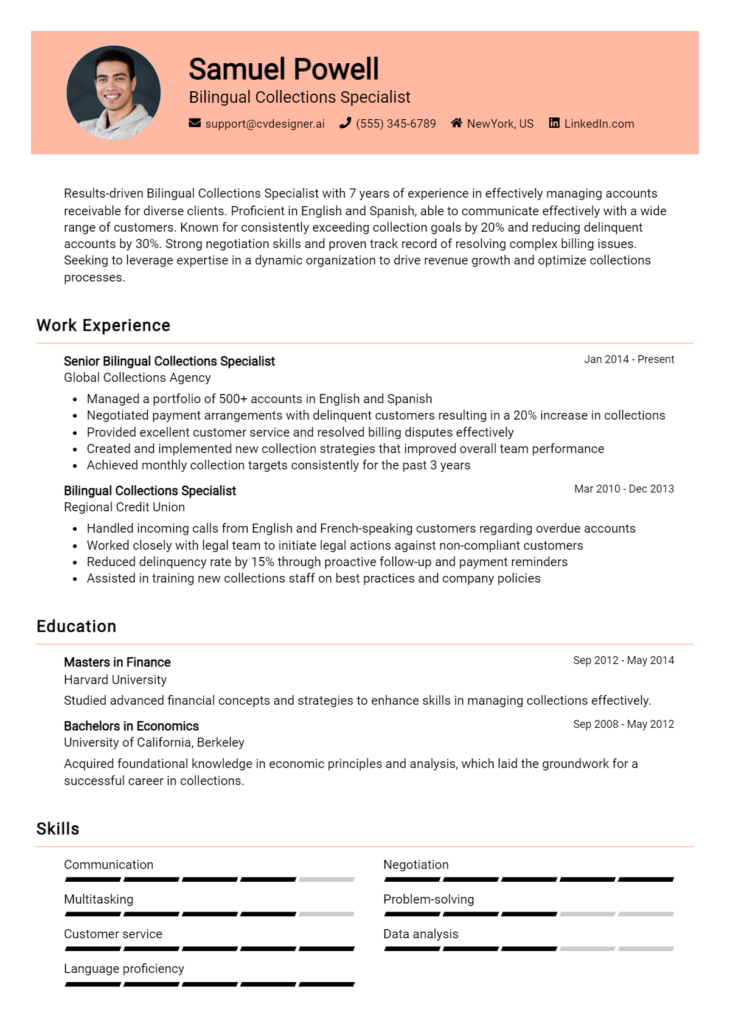

“Bilingual Collection Specialist with Expertise in Customer Relations”

“Proficient Collection Agent with 95% Success Rate in Debt Recovery”

Weak Resume Headlines

“Collection Agent Seeking Job”

“Hardworking Professional”

Strong resume headlines are effective because they clearly communicate the candidate’s qualifications and unique value propositions in a concise manner. They use specific language that conveys expertise, achievements, and relevant skills, making it easy for hiring managers to see the candidate’s fit for the role at a glance. In contrast, weak headlines fail to impress because they are vague and non-specific, lacking any meaningful information that could differentiate the candidate from others. By avoiding generic phrases and instead focusing on quantifiable achievements, candidates can create headlines that resonate with employers and enhance their chances of being noticed.

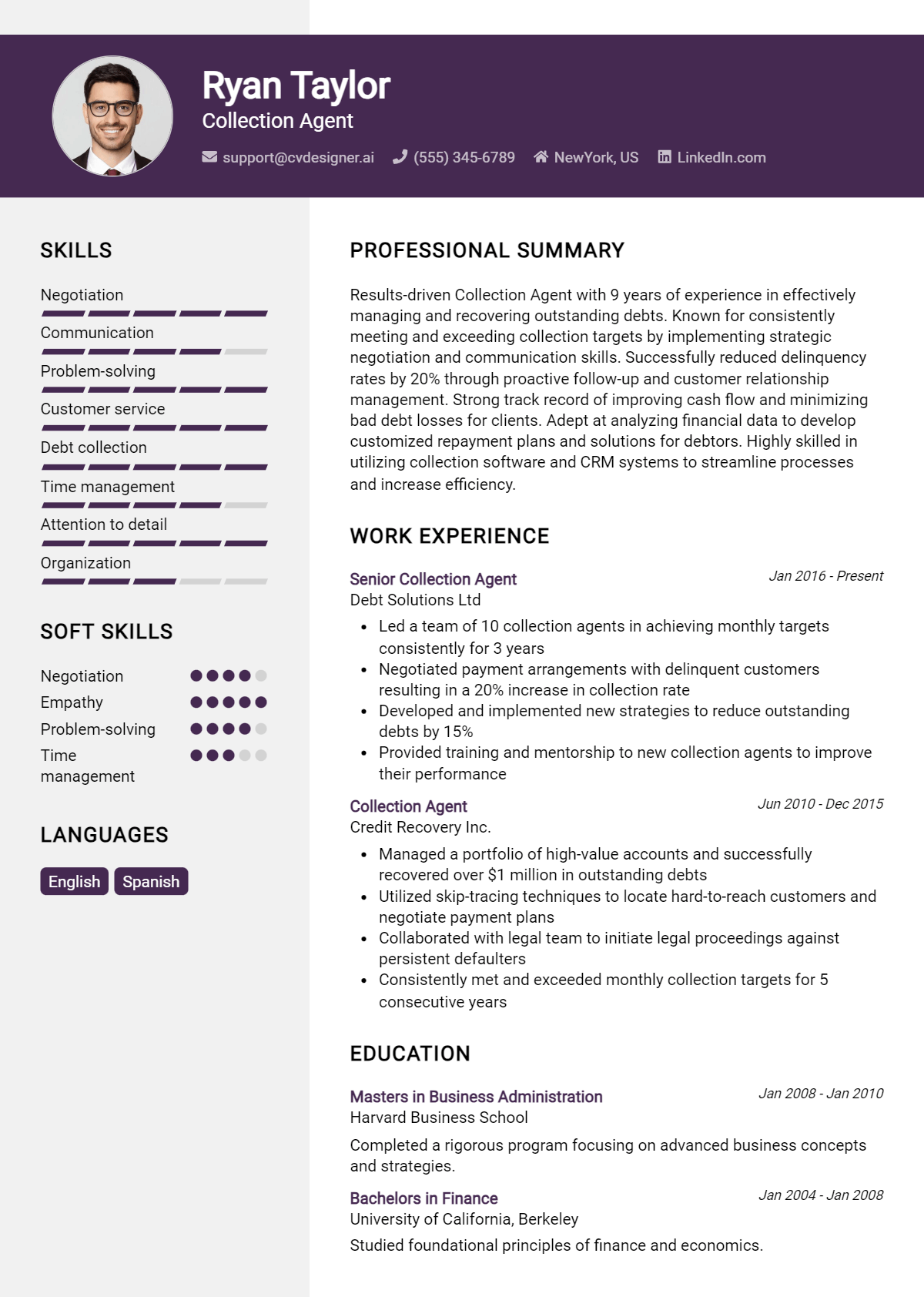

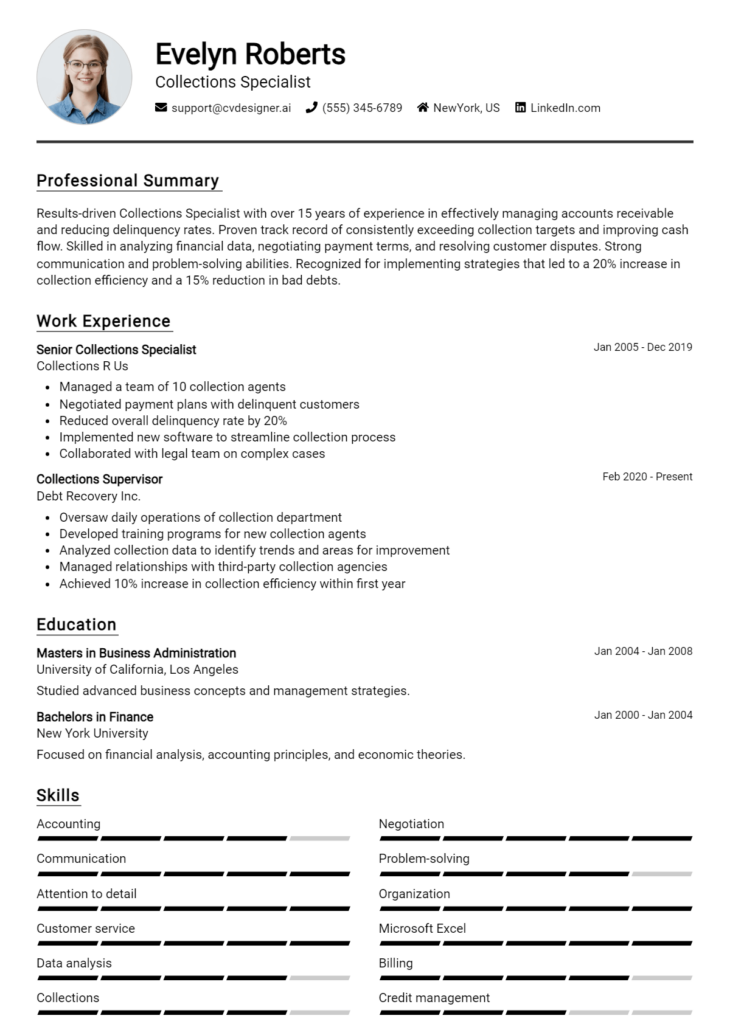

Writing an Exceptional Collection Agent Resume Summary

A resume summary is a critical component for a Collection Agent, as it serves as the first impression to potential employers, quickly capturing their attention. A strong summary effectively highlights key skills, relevant experience, and notable accomplishments that align with the job role. This concise and impactful overview not only showcases the candidate's qualifications but also demonstrates their understanding of the collection industry and how they can contribute to the organization's success. Tailoring the summary to the specific job being applied for ensures that hiring managers recognize the candidate's relevance and suitability for the position.

Best Practices for Writing a Collection Agent Resume Summary

- Quantify achievements: Use numbers and percentages to illustrate your accomplishments, such as the amount of debt recovered or the percentage of successful collections.

- Focus on relevant skills: Highlight specific skills that are essential for a Collection Agent, such as negotiation, communication, and problem-solving abilities.

- Tailor the summary: Customize the summary for each job application by reflecting the language and requirements found in the job description.

- Be concise: Aim for 2-3 sentences that encapsulate your qualifications without overwhelming the reader.

- Use action verbs: Start sentences with dynamic verbs to convey a sense of proactivity and effectiveness.

- Showcase industry knowledge: Mention familiarity with collection laws and ethical practices to demonstrate professionalism and expertise.

- Highlight customer service experience: Emphasize any experience in customer service, as it is crucial for handling sensitive conversations with debtors.

- Include certifications: If applicable, mention any relevant certifications or training that enhance your qualifications as a Collection Agent.

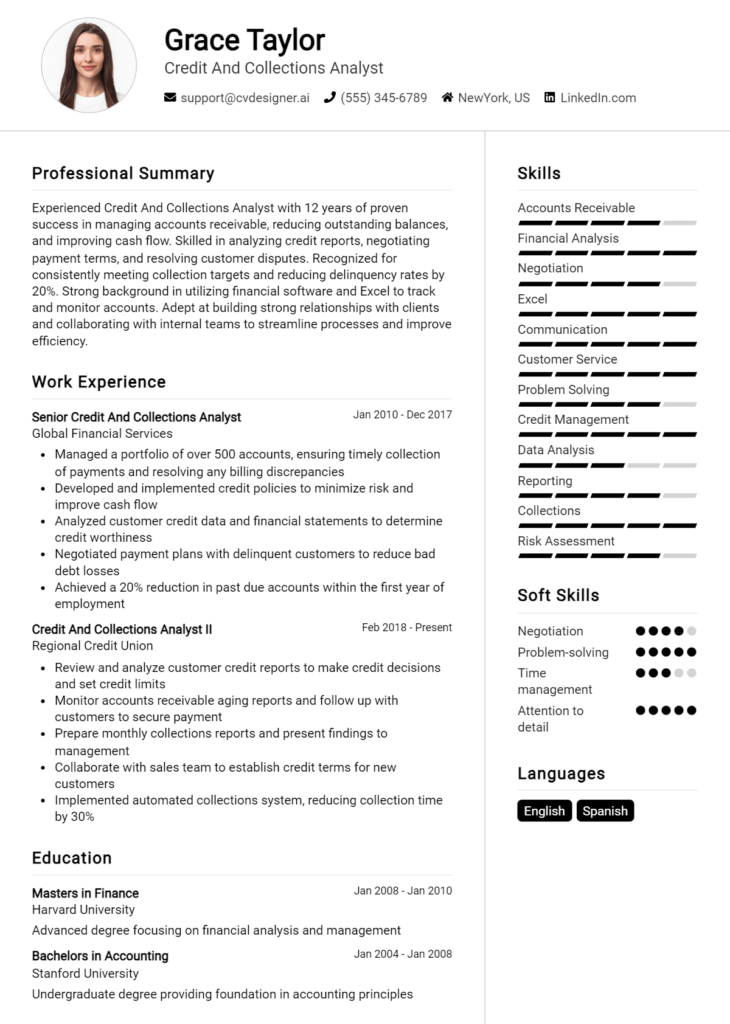

Example Collection Agent Resume Summaries

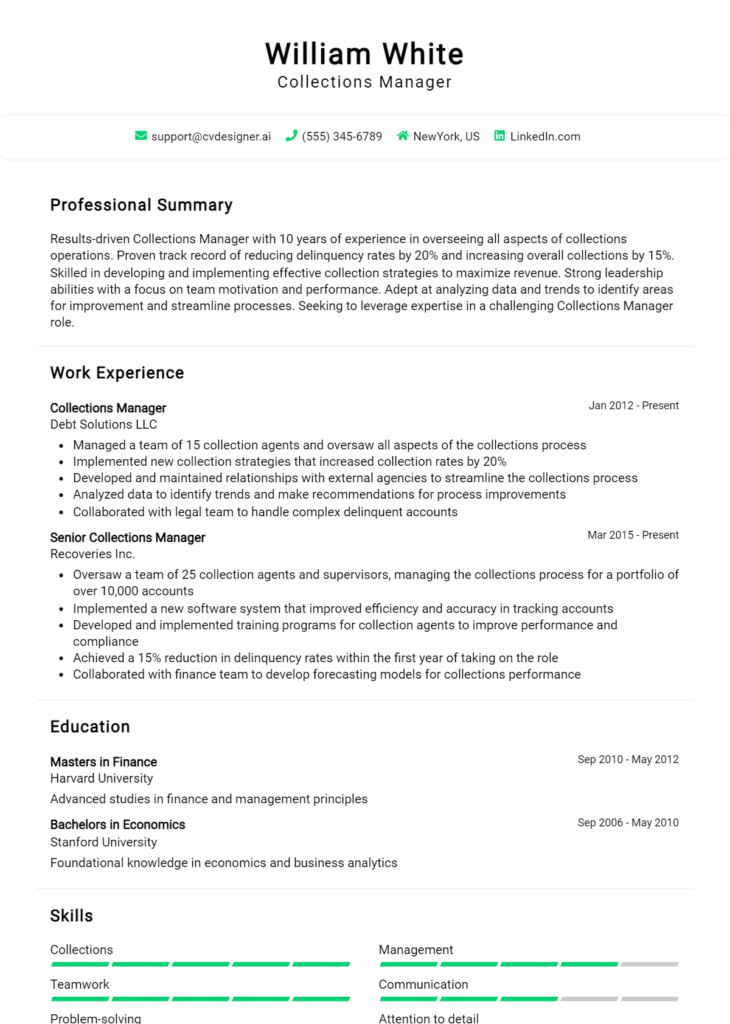

Strong Resume Summaries

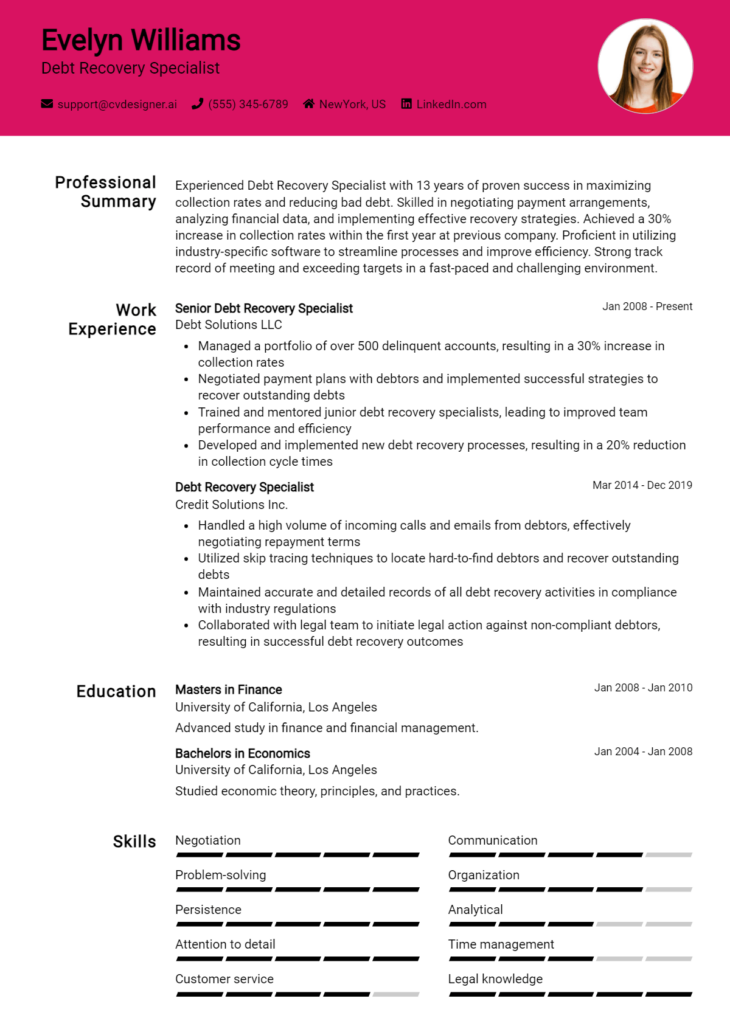

Results-driven Collection Agent with over 5 years of experience recovering delinquent accounts, achieving a 95% success rate in collections and reducing outstanding debt by 30% in the past year. Proficient in negotiating payment plans and building rapport with clients to facilitate resolution.

Dedicated Collection Specialist with a proven track record of increasing collection rates by 40% through effective communication and conflict resolution strategies. Adept in compliance with federal regulations and maintaining customer satisfaction while recovering debts.

Detail-oriented Collection Agent with 7 years of experience in high-volume environments, consistently exceeding monthly recovery targets by 20%. Skilled in using various collection software tools to streamline processes and enhance efficiency.

Weak Resume Summaries

Experienced in collections and have dealt with various clients. Looking for a job where I can use my skills.

Collection Agent with some knowledge of debt recovery and customer service. I am eager to find a new opportunity.

The strong resume summaries effectively highlight quantifiable achievements, specific skills, and direct relevance to the Collection Agent role, showcasing the candidates as accomplished professionals. In contrast, the weak summaries are vague, lacking in detail and measurable outcomes, making it difficult for hiring managers to assess the candidates' qualifications or potential contributions to the organization.

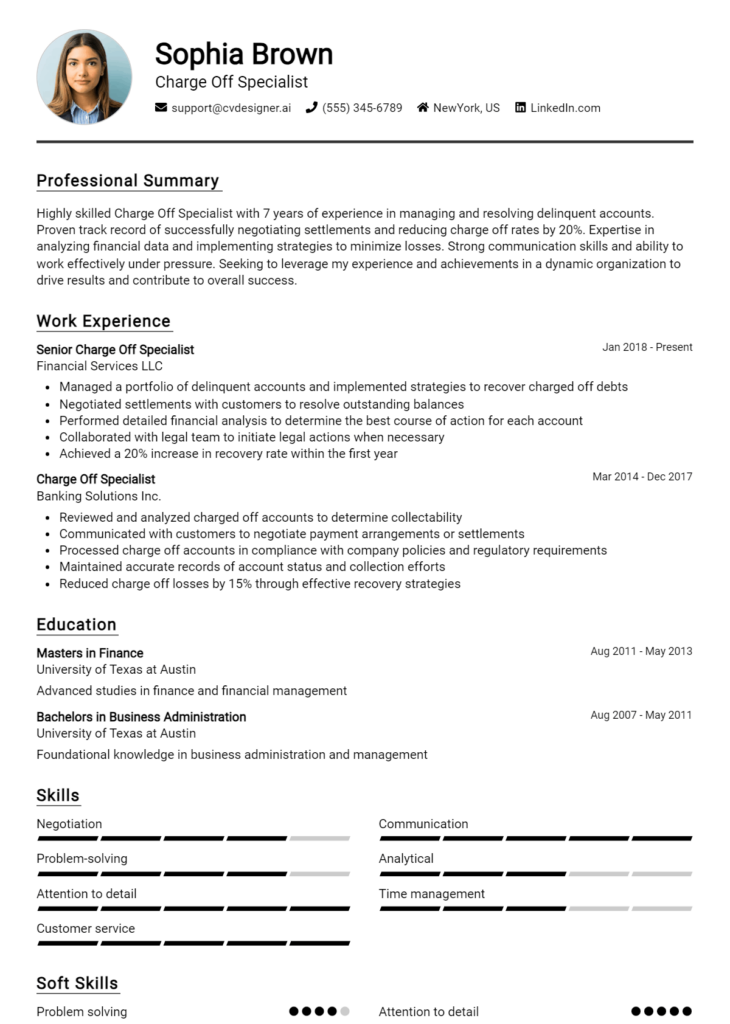

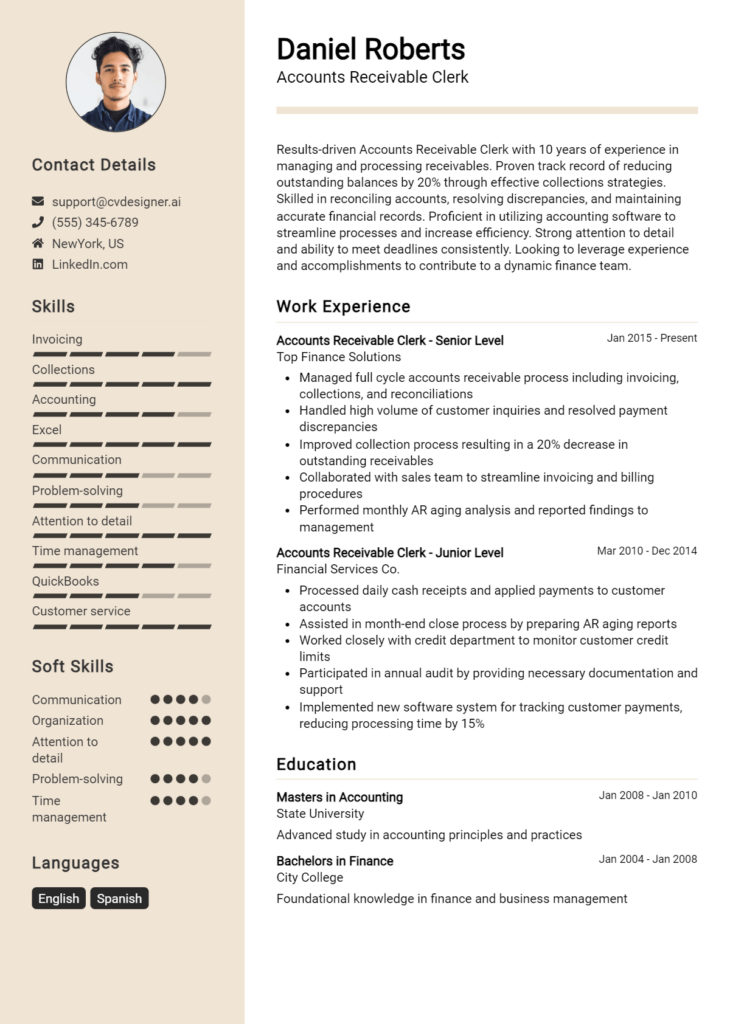

Work Experience Section for Collection Agent Resume

The work experience section of a Collection Agent resume plays a critical role in demonstrating the candidate's qualifications and suitability for the position. This section not only highlights the technical skills acquired through previous roles but also showcases the candidate's ability to manage teams effectively and deliver high-quality results in a fast-paced environment. By quantifying achievements and ensuring that experience aligns with industry standards, candidates can effectively communicate their value to potential employers and set themselves apart from other applicants.

Best Practices for Collection Agent Work Experience

- Clearly articulate your technical skills related to debt collection software and compliance regulations.

- Quantify your achievements with specific metrics, such as percentage of debts collected or reduction in delinquency rates.

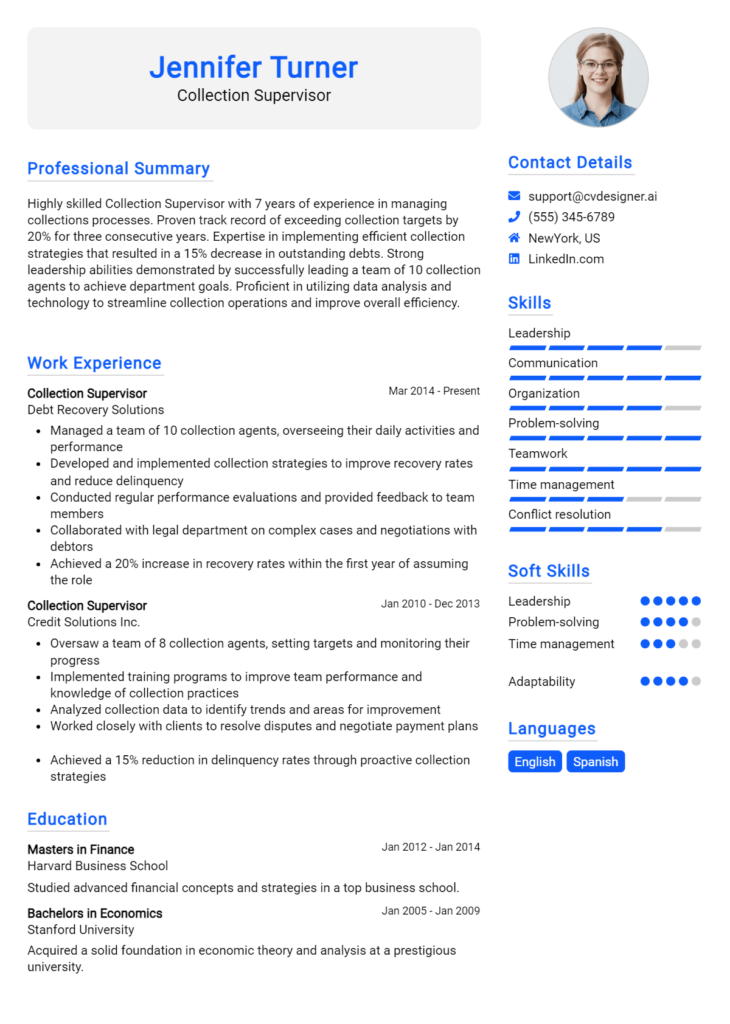

- Highlight any leadership roles or team projects to demonstrate your ability to collaborate and manage effectively.

- Utilize action verbs to describe your contributions and accomplishments.

- Tailor your descriptions to align with the job requirements of the position you are applying for.

- Include any relevant certifications or training that bolster your credibility in the field.

- Showcase your problem-solving skills by detailing how you handled challenging situations or disputes.

- Maintain a professional tone and format to enhance readability and professionalism.

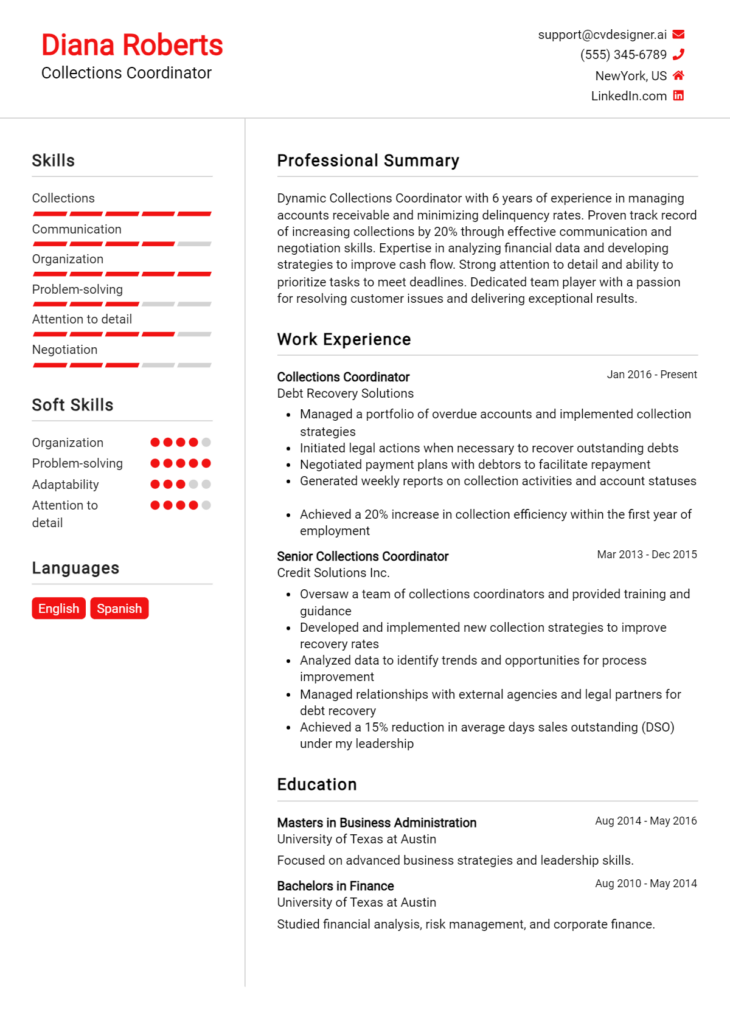

Example Work Experiences for Collection Agent

Strong Experiences

- Successfully reduced the overdue accounts by 30% within six months through strategic negotiation techniques and personalized customer engagement.

- Led a team of five agents in a high-volume call center, boosting team productivity by 25% through the implementation of training programs and performance incentives.

- Utilized advanced collection software to analyze accounts, resulting in a 40% increase in the recovery of previously uncollectible debts.

- Collaborated with the legal department to develop compliance strategies that decreased violations by 50%, ensuring adherence to industry regulations.

Weak Experiences

- Worked in a call center handling collections.

- Helped some customers with their payment plans.

- Participated in team meetings to discuss collections.

- Assisted with various tasks as needed in the department.

The examples provided illustrate the distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable outcomes that demonstrate a candidate's impact and leadership abilities, while weak experiences are vague and lack detail, failing to convey significant contributions or achievements. Highlighting measurable results and relevant skills in the work experience section is essential for standing out in a competitive job market.

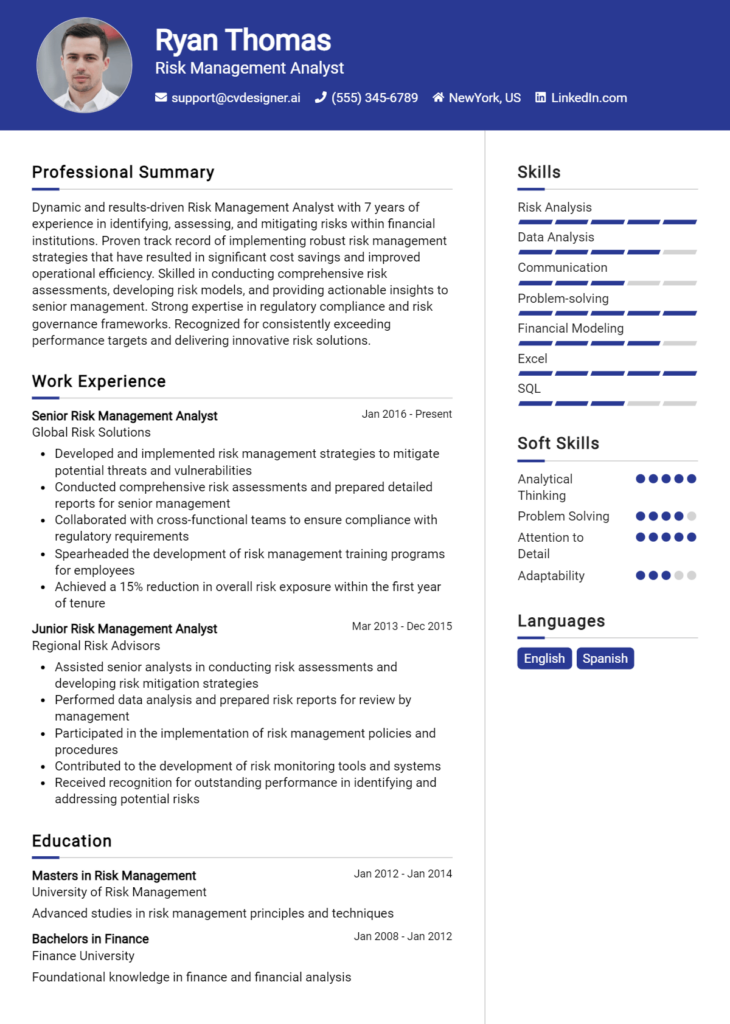

Top Skills & Keywords for Collection Agent Resume

In the competitive field of collections, the significance of a well-crafted resume cannot be overstated. A Collection Agent's resume should effectively showcase a blend of relevant skills that highlight both soft and hard abilities. Soft skills such as communication, empathy, and negotiation are paramount, as they enable agents to connect with clients and resolve disputes amicably. On the other hand, hard skills such as knowledge of collection laws and experience with billing software are crucial for performing job functions efficiently and ethically. By emphasizing these skills, a Collection Agent can demonstrate their qualifications and readiness to contribute positively to a potential employer.

Top Hard & Soft Skills for Collection Agent

Soft Skills

- Excellent communication skills

- Active listening

- Empathy and compassion

- Negotiation skills

- Problem-solving abilities

- Stress management

- Time management

- Adaptability

- Conflict resolution

- Attention to detail

Hard Skills

- Knowledge of debt collection laws and regulations

- Proficiency in billing and collection software

- Familiarity with customer relationship management (CRM) systems

- Data entry and record-keeping

- Ability to analyze financial statements

- Understanding of credit reporting practices

- Proficient in Microsoft Office Suite

- Experience with payment processing systems

- Ability to generate reports and track collections

- Strong organizational skills

By incorporating these essential skills and demonstrating relevant work experience, a Collection Agent can create a compelling resume that stands out to employers.

Stand Out with a Winning Collection Agent Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Collection Agent position at your esteemed organization, as advertised. With a solid background in customer service and debt recovery, I am confident in my ability to contribute effectively to your team. My experience has equipped me with the skills to handle difficult conversations with empathy and professionalism, ensuring that clients feel respected while we work towards mutually beneficial solutions.

Throughout my career, I have successfully managed a diverse portfolio of accounts, utilizing my strong negotiation skills to reach settlements and recover outstanding debts. I pride myself on my ability to maintain accurate records and comply with legal requirements, which ensures both the integrity of the collection process and the protection of client relationships. My proficiency in various collection software and CRM systems has allowed me to streamline operations, resulting in improved recovery rates and increased customer satisfaction.

I am particularly drawn to this opportunity at your company because of your commitment to ethical collection practices and customer care. I believe that my proactive approach and dedication to finding solutions can help foster positive outcomes for both your organization and the clients we serve. I am eager to bring my expertise in collections and my passion for helping others to your team and contribute to achieving your company’s financial goals.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the needs of your team. I am enthusiastic about the opportunity to help enhance your collection efforts while maintaining the high standards of customer service that your company is known for.

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Collection Agent Resume

When crafting a resume for a Collection Agent position, it’s crucial to present your skills and experience effectively to stand out in a competitive job market. However, many candidates make common mistakes that can hinder their chances of landing an interview. Understanding these pitfalls can help you refine your resume and highlight your qualifications more effectively. Here are some common mistakes to avoid:

Vague Job Descriptions: Failing to provide specific details about your previous roles can leave hiring managers unclear about your actual responsibilities and achievements.

Lack of Relevant Skills: Omitting essential skills, such as negotiation tactics, communication abilities, and familiarity with collection software, may weaken your candidacy.

Ignoring Metrics and Achievements: Not quantifying your accomplishments, such as the percentage of debts collected or improvement in collection rates, can make your achievements seem less impactful.

Poor Formatting: A cluttered or inconsistent format can make your resume difficult to read, leading to missed opportunities. Ensure your layout is clean and professional.

Typos and Grammatical Errors: Simple mistakes can create a negative impression, suggesting a lack of attention to detail. Always proofread your resume before submission.

Generic Objective Statements: Using a one-size-fits-all objective statement can detract from the personalized touch that showcases your interest in the specific role and company.

Overloading with Information: Including irrelevant information or excessive detail can dilute the focus of your resume. Stick to what’s most pertinent to the Collection Agent role.

Not Tailoring for Each Application: Failing to customize your resume for each job application can make it appear that you lack genuine interest in the position. Tailoring your resume shows you’ve done your research and understand the role's requirements.

Conclusion

In summary, a Collection Agent plays a crucial role in managing outstanding debts and ensuring timely payments from clients. Key responsibilities include communicating with debtors, negotiating payment plans, maintaining accurate records, and adhering to legal regulations. Successful Collection Agents possess strong communication skills, empathy, problem-solving abilities, and a thorough understanding of the financial landscape.

As you reflect on your qualifications for this role, it's the perfect time to review and enhance your Collection Agent resume. Ensure it highlights your relevant experience and skills effectively. To assist you in this process, consider utilizing the following resources:

- Resume Templates to find a professional layout that suits your style.

- Resume Builder for a user-friendly tool that helps you create a polished resume effortlessly.

- Resume Examples for inspiration and guidance on how to present your experience.

- Cover Letter Templates to craft a compelling introduction to your resume.

Take action now to ensure your resume stands out in this competitive field!