Charge-Off Specialist Core Responsibilities

A Charge-Off Specialist plays a critical role in managing delinquent accounts, requiring a blend of technical, operational, and problem-solving skills. They collaborate with various departments, such as collections, finance, and compliance, to evaluate accounts for charge-off eligibility and develop strategies for recovery. Successful specialists possess strong analytical abilities and detailed knowledge of financial regulations, which contribute to the organization's goals of minimizing loss and maintaining financial health. A well-structured resume should highlight these competencies to attract potential employers.

Common Responsibilities Listed on Charge-Off Specialist Resume

- Analyze delinquent accounts to determine charge-off eligibility.

- Collaborate with the collections team to implement recovery strategies.

- Prepare and maintain reports on charge-off activities and trends.

- Ensure compliance with financial regulations and internal policies.

- Communicate effectively with customers regarding outstanding balances.

- Assist in the development of charge-off policies and procedures.

- Monitor and assess the performance of charge-off accounts.

- Coordinate with legal and compliance departments on sensitive cases.

- Utilize data analysis tools to identify patterns in account delinquencies.

- Provide training and support to junior staff as needed.

- Facilitate the documentation and reporting of charge-off decisions.

High-Level Resume Tips for Charge-Off Specialist Professionals

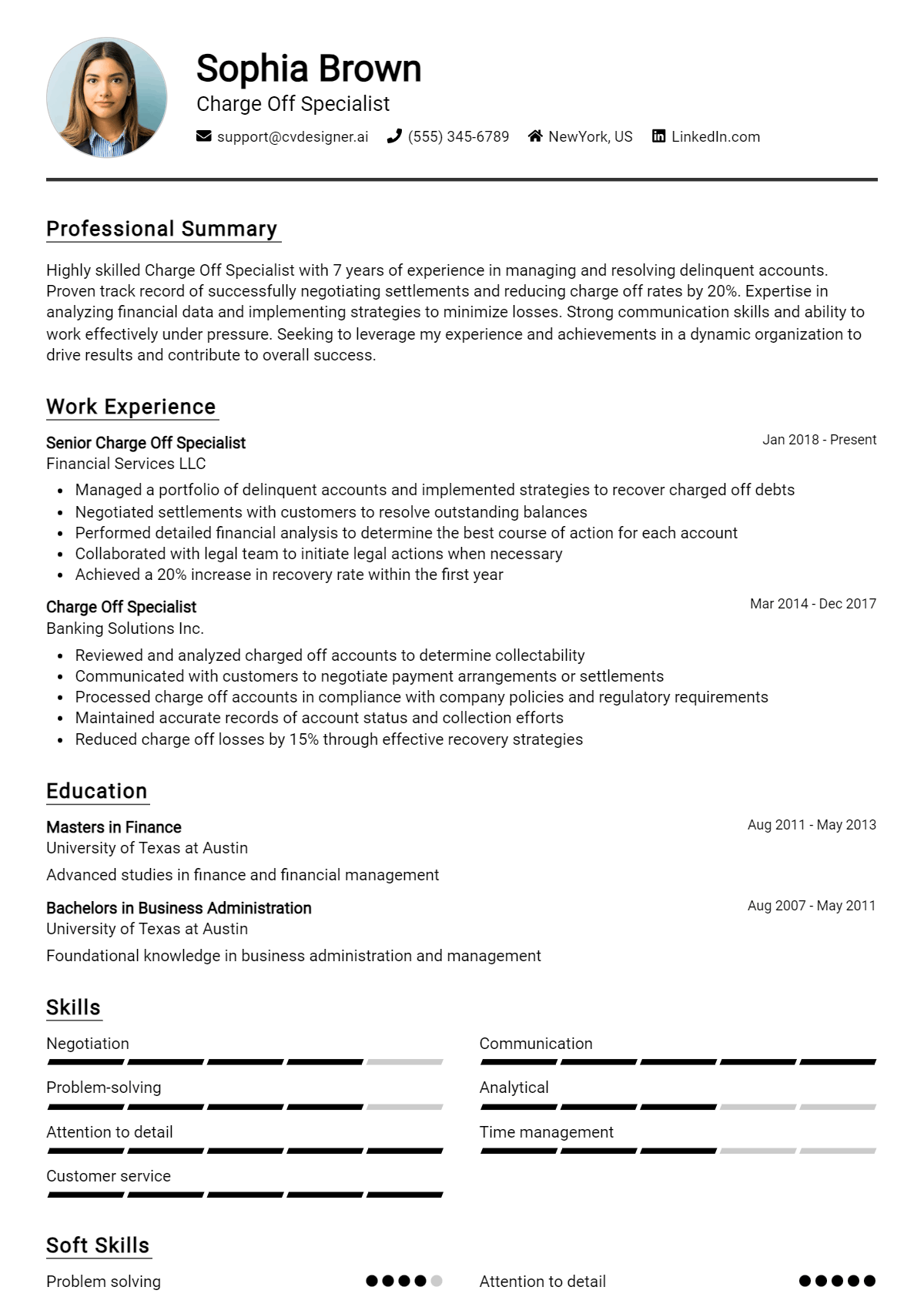

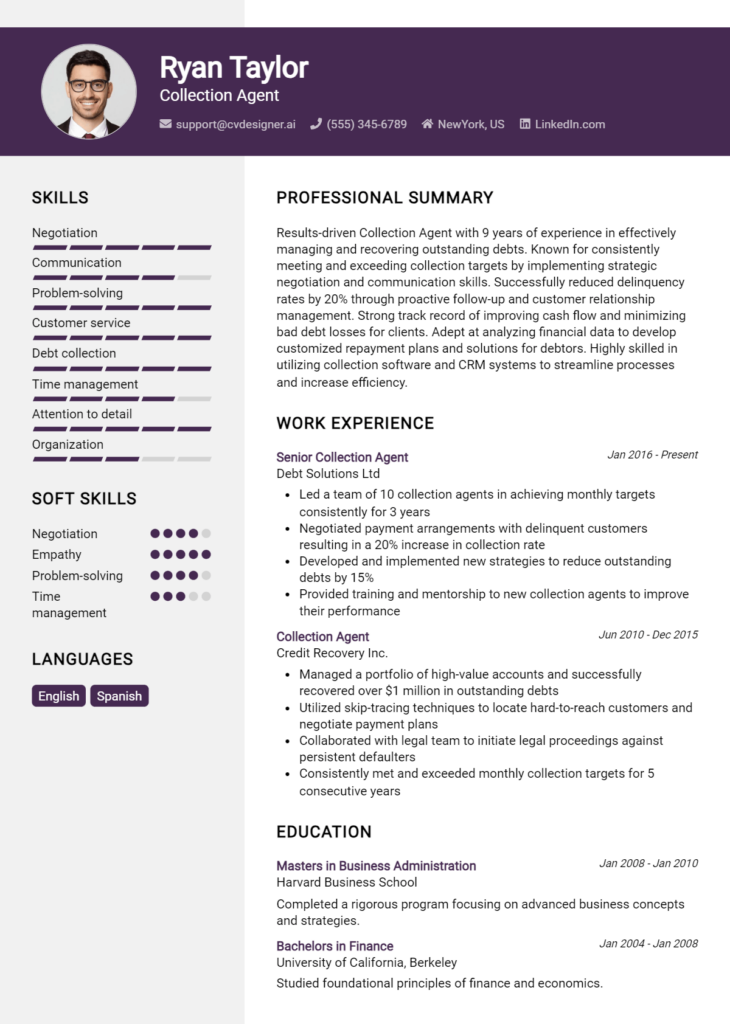

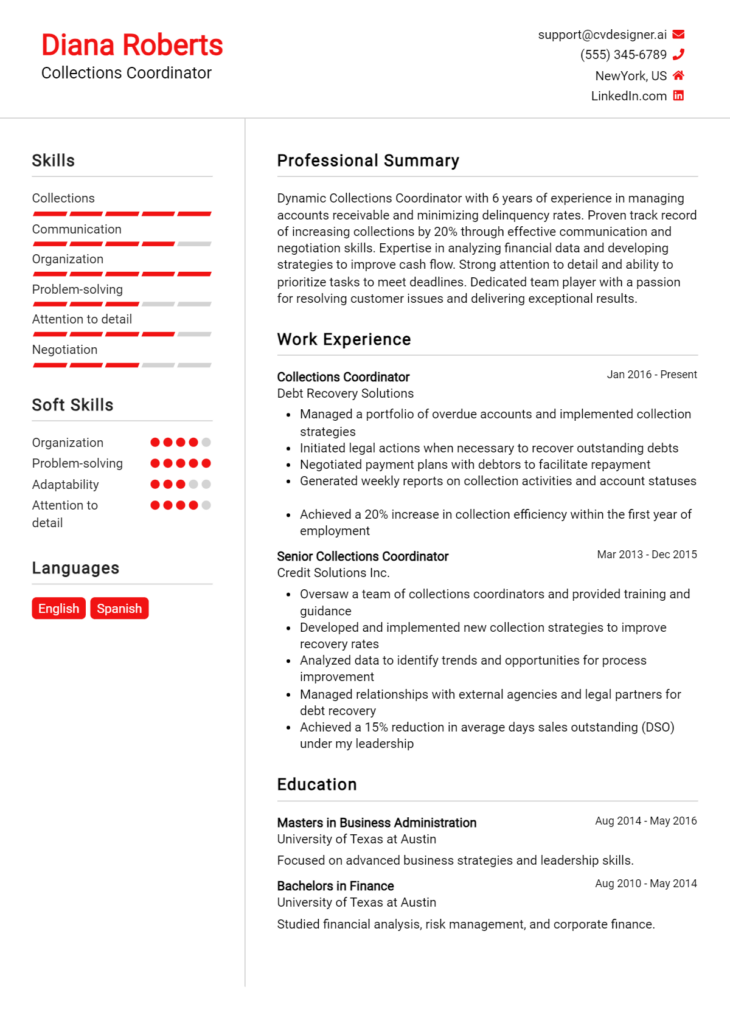

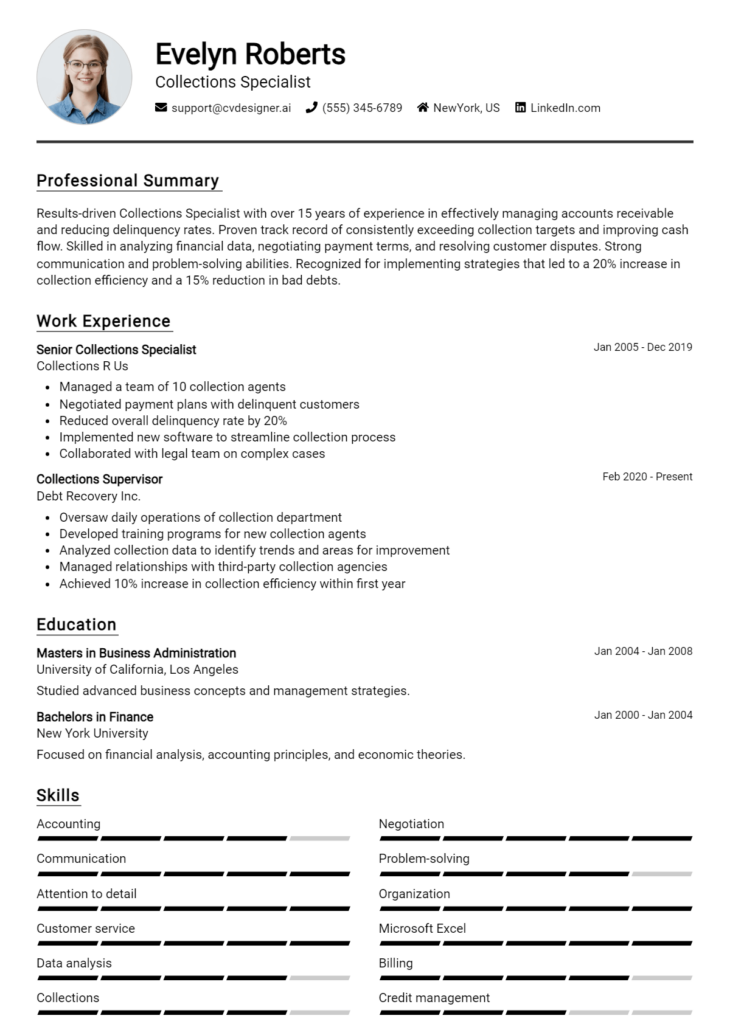

In the competitive field of finance and collections, a well-crafted resume can be the difference between landing an interview and being overlooked. For Charge-Off Specialist professionals, your resume serves as the first impression you make on potential employers, encapsulating not just your skills but also your achievements in managing charge-offs, collections, and customer interactions. It’s vital that your resume reflects your expertise and demonstrates your ability to handle financial challenges effectively. In this guide, we will provide practical and actionable resume tips specifically tailored for Charge-Off Specialist professionals, empowering you to create a document that stands out in the hiring process.

Top Resume Tips for Charge-Off Specialist Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases that match the employer's needs.

- Highlight your relevant experience in charge-offs and collections, detailing the types of accounts you've managed and the strategies you've employed.

- Quantify your achievements by including metrics such as the percentage of accounts recovered, reduction in charge-off rates, or revenue generated through collections.

- Showcase industry-specific skills such as knowledge of credit reporting, compliance with regulations, and proficiency in debt recovery software.

- Include a professional summary at the top of your resume that succinctly outlines your qualifications and career goals.

- Utilize bullet points for clarity and conciseness, making it easy for hiring managers to scan your resume quickly.

- Emphasize your communication skills, highlighting your ability to negotiate with clients and resolve conflicts effectively.

- Make sure to mention any relevant certifications or training related to credit management or financial analysis.

- Keep the format clean and professional, ensuring that your resume is easy to read and visually appealing.

- Proofread your resume multiple times to eliminate any spelling or grammatical errors that could detract from your professionalism.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job in the Charge-Off Specialist field. A polished and targeted resume will not only showcase your qualifications but also demonstrate your commitment to the role, making you a more attractive candidate to potential employers.

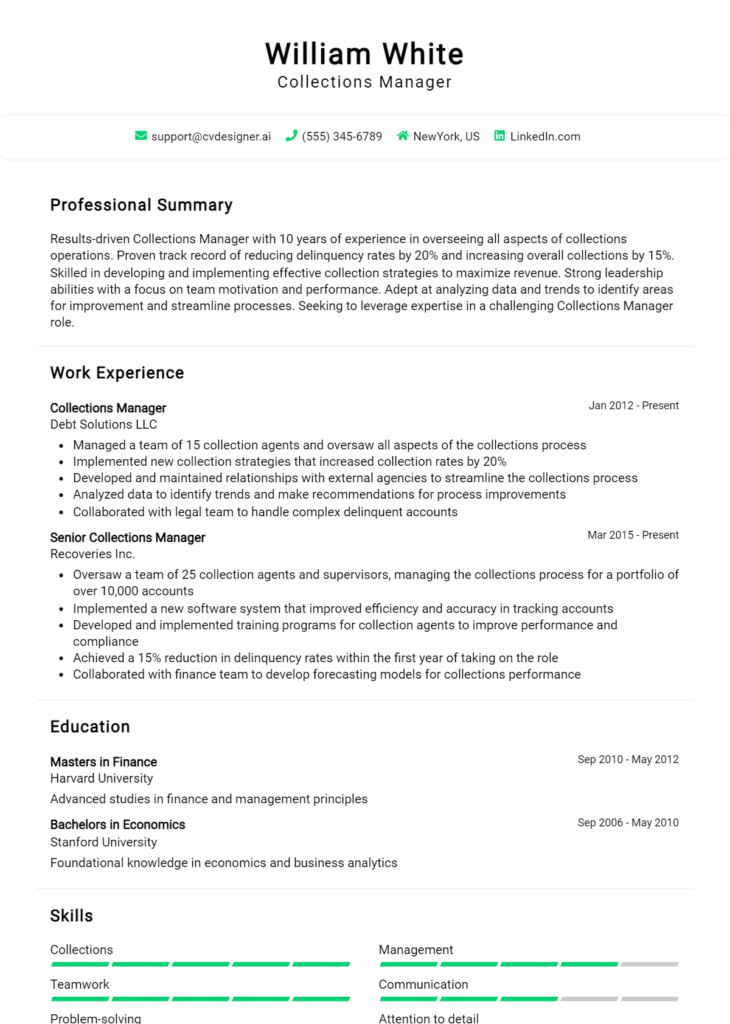

Why Resume Headlines & Titles are Important for Charge-Off Specialist

In the competitive field of debt collection and financial recovery, a Charge-Off Specialist plays a crucial role in managing delinquent accounts and minimizing losses for financial institutions. Crafting a standout resume is essential for candidates seeking this position, and a compelling resume headline or title serves as a powerful introduction to their qualifications. A strong headline can capture the attention of hiring managers within seconds, summarizing a candidate's expertise, skills, and relevant experience in a concise and impactful manner. It should be directly related to the Charge-Off Specialist role, setting the tone for the rest of the resume and making a memorable first impression.

Best Practices for Crafting Resume Headlines for Charge-Off Specialist

- Keep it concise—aim for one impactful phrase.

- Use role-specific keywords relevant to Charge-Off Specialist duties.

- Highlight key skills or accomplishments that align with the job description.

- Avoid generic terms; be specific about your expertise.

- Incorporate quantifiable achievements when possible.

- Maintain a professional tone that reflects the industry standards.

- Tailor your headline for each job application to enhance relevance.

- Use action-oriented language to convey confidence and authority.

Example Resume Headlines for Charge-Off Specialist

Strong Resume Headlines

Results-Driven Charge-Off Specialist with 5+ Years of Experience in Debt Recovery

Detail-Oriented Financial Analyst Specializing in Charge-Off Management

Proven Track Record in Reducing Charge-Off Rates by 30% Through Effective Strategies

Weak Resume Headlines

Looking for a Job in Finance

Experienced Professional

The strong headlines are effective because they immediately communicate specific skills and accomplishments that pertain directly to the Charge-Off Specialist role, showcasing the candidate's value to potential employers. They use targeted language and measurable results, which not only grab attention but also demonstrate a clear understanding of the position's requirements. In contrast, the weak headlines fail to impress due to their vagueness and lack of relevant information, leaving hiring managers with little incentive to explore the candidate's resume further. Clear, impactful headlines create a strong foundation for a successful job application.

Writing an Exceptional Charge-Off Specialist Resume Summary

A resume summary is a crucial component for a Charge-Off Specialist as it serves as a powerful first impression for hiring managers. A well-crafted summary quickly captures attention by highlighting the candidate's key skills, relevant experience, and notable accomplishments in the field of charge-off management and debt recovery. In a competitive job market, a strong summary should be concise and impactful, tailored to the specific job the candidate is applying for, ensuring that it addresses the unique requirements and expectations of the employer.

Best Practices for Writing a Charge-Off Specialist Resume Summary

- Quantify achievements whenever possible to demonstrate the impact of your work.

- Focus on key skills that are relevant to the charge-off process, such as analytical abilities and negotiation skills.

- Tailor the summary to match the job description, using keywords and phrases found in the listing.

- Keep it concise, ideally 2-4 sentences long, to maintain the hiring manager's attention.

- Highlight specific accomplishments, such as successful debt recovery rates or process improvements.

- Use strong action verbs to convey confidence and proactivity in your role.

- Showcase familiarity with relevant regulations and compliance standards in the charge-off process.

- Emphasize your ability to work collaboratively with other departments, such as collections and customer service.

Example Charge-Off Specialist Resume Summaries

Strong Resume Summaries

Dynamic Charge-Off Specialist with over 5 years of experience in debt recovery and account management, achieving a 30% increase in recovery rates through strategic negotiation and relationship-building techniques.

Results-oriented professional skilled in charge-off analysis and compliance, successfully reducing charge-off rates by 25% in one year through improved process efficiencies and team training initiatives.

Detail-oriented Charge-Off Specialist with a proven track record of managing high-volume accounts, consistently meeting recovery goals and enhancing client satisfaction scores by 15% through effective communication and resolution strategies.

Weak Resume Summaries

Experienced in charge-offs and debt collection.

Looking for a position where I can use my skills in finance.

The strong resume summaries are effective because they provide specific, quantifiable achievements and showcase relevant skills tailored to the Charge-Off Specialist role. Each summary clearly indicates the candidate's experience and impact on previous positions, making them more appealing to hiring managers. In contrast, the weak summaries lack detail and specificity, failing to convey the candidate's unique value or contributions to previous employers, which can leave hiring managers uninterested.

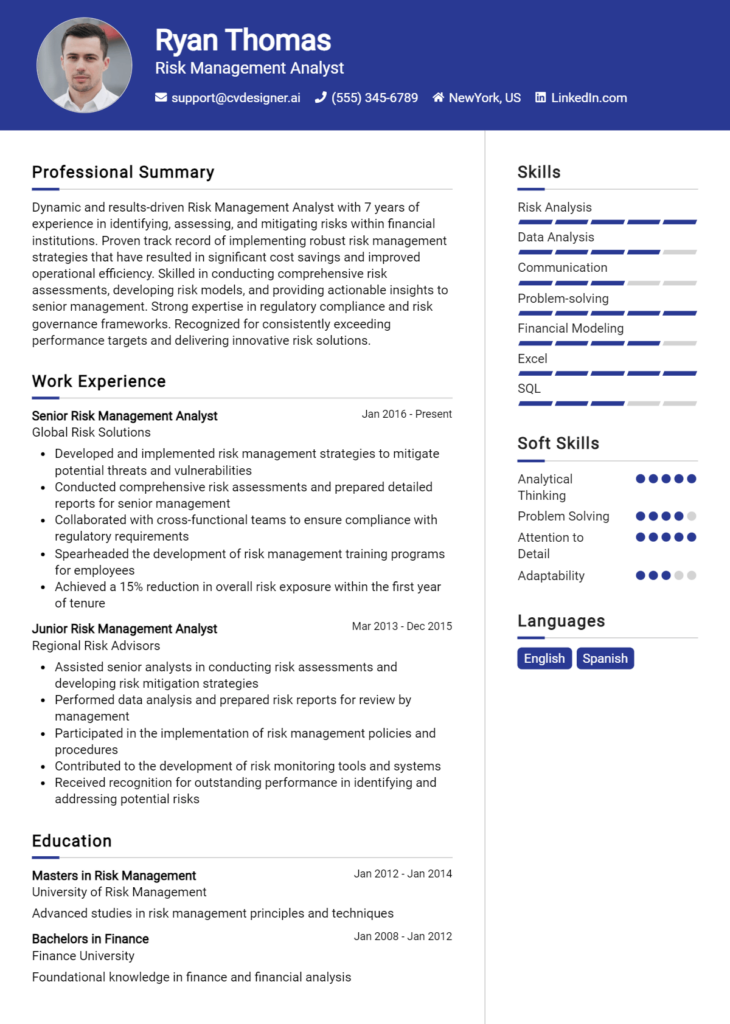

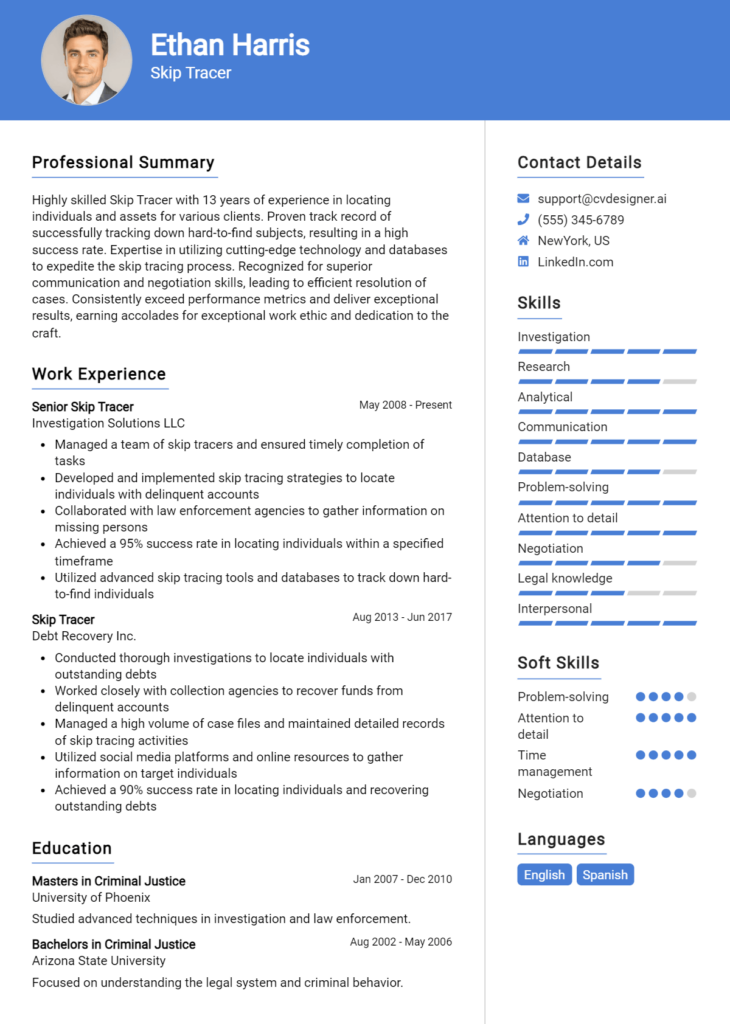

Work Experience Section for Charge-Off Specialist Resume

The work experience section of a Charge-Off Specialist resume is critical as it not only highlights the candidate's relevant background but also emphasizes their technical skills, leadership capabilities, and commitment to delivering high-quality results. This section serves as a platform for candidates to demonstrate their proficiency in handling charge-off processes, managing diverse teams, and implementing effective strategies that align with industry standards. By quantifying achievements and presenting concrete examples of past performance, candidates can effectively illustrate their value to potential employers.

Best Practices for Charge-Off Specialist Work Experience

- Utilize clear and concise language to describe your roles and responsibilities.

- Highlight specific technical skills related to charge-off management and debt recovery.

- Quantify achievements, such as percentage reductions in charge-off rates or improvements in recovery metrics.

- Demonstrate collaboration by mentioning cross-functional teams and projects.

- Focus on results-driven statements that show your impact on the organization.

- Use industry-specific terminology to align with employer expectations.

- Tailor each experience to reflect the requirements of the job you are applying for.

- Maintain a professional format that enhances readability and organization.

Example Work Experiences for Charge-Off Specialist

Strong Experiences

- Led a team of 10 in implementing a new charge-off policy that resulted in a 25% decrease in delinquent accounts over 12 months.

- Developed a data-driven analysis system that improved recovery rates by 30%, generating an additional $500,000 in annual revenue.

- Collaborated with legal and compliance teams to streamline charge-off processes, reducing processing time by 40%.

Weak Experiences

- Worked on charge-off tasks and managed some accounts.

- Assisted with team projects that involved charge-offs.

- Handled paperwork related to charge-off cases.

The examples of strong experiences are considered effective because they showcase specific achievements, demonstrate leadership, and quantify the impact of the candidate's work. Each bullet point provides clear metrics and results that highlight the candidate's ability to drive improvements in charge-off processes. In contrast, the weak experiences lack detail and measurable outcomes, making them less compelling and failing to convey the candidate's true capabilities and contributions to previous roles.

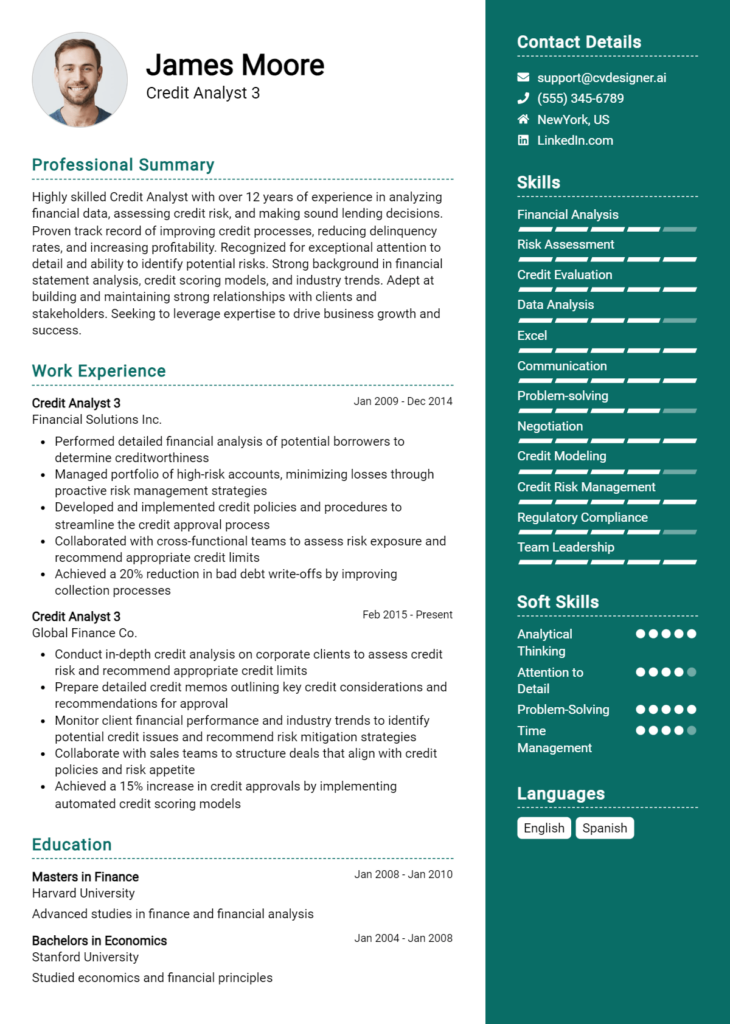

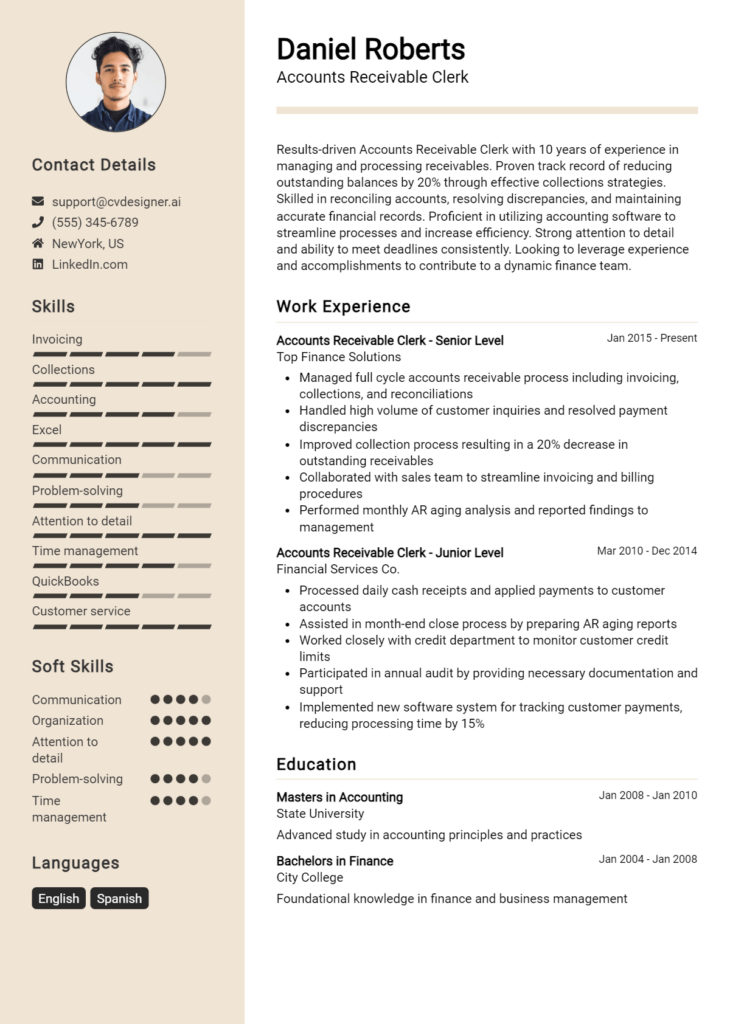

Education and Certifications Section for Charge-Off Specialist Resume

The education and certifications section of a Charge-Off Specialist resume is crucial for demonstrating the candidate's academic background and commitment to the field. This section not only highlights relevant educational qualifications but also showcases industry-specific certifications and ongoing learning efforts that are vital in a rapidly evolving financial landscape. By providing details on relevant coursework, recognized certifications, and specialized training, candidates can significantly enhance their credibility and illustrate their alignment with the requirements of the Charge-Off Specialist role.

Best Practices for Charge-Off Specialist Education and Certifications

- Focus on relevant degrees, such as finance, accounting, or business administration.

- Include industry-recognized certifications, such as Certified Credit and Collection Specialist (CCCS) or Certified Financial Services Auditor (CFSA).

- Detail any specialized training related to charge-off management, debt recovery, or risk assessment.

- Highlight relevant coursework that demonstrates knowledge of credit analysis, financial regulations, and collections processes.

- Provide the dates of completion for certifications and courses to show recent and continuous learning.

- Use clear and concise language to make the information easily digestible for hiring managers.

- Consider including awards or honors received during education that relate to finance or credit management.

- Tailor this section to emphasize qualifications that align specifically with the job description of a Charge-Off Specialist.

Example Education and Certifications for Charge-Off Specialist

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2021

- Certified Credit and Collection Specialist (CCCS), 2022

- Coursework in Risk Management and Credit Analysis, University of XYZ, 2020

- Advanced Training in Debt Recovery Strategies, Institute of Financial Management, 2023

Weak Examples

- Associate Degree in General Studies, Community College, 2019

- Certification in Basic Office Management, 2018

- High School Diploma, 2017

- Outdated Financial Management Certification, obtained in 2015

The strong examples illustrate qualifications that are directly relevant and current, showcasing a solid foundation in finance and specialized knowledge essential for a Charge-Off Specialist. In contrast, the weak examples highlight educational qualifications and certifications that do not align with the specific requirements of the role, showing a lack of specialization and relevance to the industry. This distinction emphasizes the importance of tailoring educational background and certifications to the job at hand to enhance a candidate's prospects in the hiring process.

Top Skills & Keywords for Charge-Off Specialist Resume

In the competitive field of finance and collections, a well-crafted resume for a Charge-Off Specialist must highlight a balanced mix of both soft and hard skills. These skills are critical as they not only showcase your technical proficiency in handling charge-offs but also your ability to communicate effectively, negotiate with clients, and manage sensitive information. Employers are looking for candidates who can demonstrate a deep understanding of financial regulations, as well as those who possess strong interpersonal abilities to navigate challenging conversations and maintain positive relationships with clients. By emphasizing these skills, you can create a compelling resume that stands out to potential employers.

Top Hard & Soft Skills for Charge-Off Specialist

Soft Skills

- Strong Communication Skills

- Negotiation Abilities

- Problem-Solving Skills

- Attention to Detail

- Empathy and Customer Service Orientation

- Time Management

- Adaptability and Flexibility

- Team Collaboration

- Conflict Resolution

- Analytical Thinking

Hard Skills

- Knowledge of Financial Regulations

- Proficiency in Collections Software

- Data Analysis and Reporting

- Credit Risk Assessment

- Understanding of Charge-Off Processes

- Familiarity with Legal Collection Procedures

- Financial Statement Analysis

- Microsoft Excel Proficiency

- Database Management

- Technical Skills in CRM Systems

Incorporating these skills into your resume can significantly improve your chances of landing an interview, while also complementing your work experience to provide a holistic view of your capabilities.

Stand Out with a Winning Charge-Off Specialist Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Charge-Off Specialist position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in collections and financial services, coupled with my attention to detail and analytical skills, I am confident in my ability to contribute effectively to your team and help optimize the charge-off process.

In my previous role at [Previous Company Name], I successfully managed a portfolio of charged-off accounts, utilizing various strategies to recover outstanding debts while maintaining strong relationships with clients. I implemented data-driven approaches to assess risk and identify trends, which resulted in a 15% increase in recoveries over a six-month period. My experience working closely with both internal and external stakeholders has equipped me with the ability to communicate complex information clearly and effectively, ensuring that all parties understand the processes and implications involved.

Furthermore, I am adept at utilizing various financial software and tools to monitor account status and generate reports, which enhances operational efficiency. I am committed to compliance and ethical standards in all aspects of my work, ensuring that the charge-off procedures align with regulatory requirements while maintaining the integrity of your organization. I am excited about the opportunity to leverage my expertise to help [Company Name] achieve its financial goals and improve customer satisfaction.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am eager to contribute to [Company Name] and help drive success in the charge-off process.

Sincerely,

[Your Name]

[Your LinkedIn Profile or Contact Information]

Conclusion

As a Charge-Off Specialist, your role is crucial in managing accounts that are deemed uncollectible and ensuring that the appropriate actions are taken to recover as much debt as possible. Key responsibilities include analyzing customer accounts, communicating with clients regarding their debt status, and working closely with legal teams when necessary. Successful Charge-Off Specialists possess strong analytical skills, attention to detail, and excellent communication abilities. Additionally, familiarity with financial regulations and debt recovery techniques is vital for navigating this complex field.

In conclusion, if you're looking to advance or start your career as a Charge-Off Specialist, now is the perfect time to refine your resume. Highlight your relevant skills and experiences to make a strong impression on potential employers. Take advantage of the resources available to you, such as resume templates, a user-friendly resume builder, comprehensive resume examples, and tailored cover letter templates. By utilizing these tools, you can create a standout application that showcases your qualifications and helps you secure that desired position. Don’t wait—start reviewing your Charge-Off Specialist resume today!