Cash Manager Core Responsibilities

A Cash Manager plays a vital role in overseeing an organization’s cash flow, ensuring liquidity and financial stability. Key responsibilities include monitoring cash balances, forecasting cash requirements, and managing banking relationships. Effective Cash Managers possess strong technical skills in financial analysis, operational efficiency, and problem-solving abilities, allowing them to collaborate seamlessly with various departments such as accounting, finance, and treasury. Showcasing these qualifications on a well-structured resume is essential for demonstrating value and alignment with the organization’s goals.

Common Responsibilities Listed on Cash Manager Resume

- Monitor and manage daily cash flow and liquidity

- Prepare cash forecasts and financial reports

- Develop and implement cash management strategies

- Oversee bank relationships and negotiate terms

- Ensure compliance with financial regulations and policies

- Analyze cash flow patterns and variances

- Coordinate with accounting and finance teams for reporting

- Identify opportunities for cost reduction and efficiency

- Lead cash management projects and initiatives

- Train and mentor junior finance staff

- Utilize financial software for cash management tasks

- Report on cash position to senior management

High-Level Resume Tips for Cash Manager Professionals

In the competitive finance sector, a well-crafted resume is paramount for Cash Manager professionals seeking to make their mark. Your resume serves as the first impression you make on a potential employer, acting as a critical marketing tool that reflects your skills, experience, and achievements. It not only demonstrates your qualifications but also showcases your understanding of finance management and cash flow strategies. This guide aims to provide practical and actionable resume tips specifically tailored for Cash Manager professionals, ensuring that your document stands out in a crowded field.

Top Resume Tips for Cash Manager Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that match the role.

- Highlight your relevant experience in cash management, treasury functions, and financial forecasting.

- Quantify your achievements by including specific metrics, such as cost savings, revenue growth, or improved cash flow.

- Showcase industry-specific skills such as liquidity management, risk assessment, and regulatory compliance.

- Include certifications or training relevant to cash management, such as Certified Treasury Professional (CTP) or Certified Cash Manager (CCM).

- Utilize a clean and professional format that enhances readability and emphasizes key sections.

- Focus on your problem-solving abilities and decision-making skills in cash flow management scenarios.

- Incorporate action verbs to convey a sense of initiative and impact in your previous roles.

- Keep your resume concise, ideally one to two pages, ensuring all content is relevant and impactful.

By implementing these tips, you can significantly increase your chances of landing a job in the Cash Manager field. A targeted, achievement-focused resume will not only highlight your qualifications but also position you as a strong candidate ready to contribute to the financial success of your future employer.

Why Resume Headlines & Titles are Important for Cash Manager

In the competitive landscape of finance, a Cash Manager plays a pivotal role in overseeing an organization's cash flow, ensuring liquidity, and managing investment strategies. A well-crafted resume headline or title is crucial for job applicants in this field, as it serves as the first impression for hiring managers. A strong headline can immediately capture attention and summarize a candidate's key qualifications in a succinct and impactful manner. It should be concise, relevant, and directly tied to the specific job being applied for, making it easier for decision-makers to assess the candidate's fit for the position at a glance.

Best Practices for Crafting Resume Headlines for Cash Manager

- Keep it concise; aim for 5-10 words.

- Include specific keywords relevant to the Cash Manager role.

- Highlight your most significant accomplishments or skills.

- Tailor the headline to match the job description closely.

- Avoid jargon and overly complex language.

- Use action-oriented language to convey impact.

- Focus on results and quantifiable achievements.

- Make sure it reflects your unique selling proposition.

Example Resume Headlines for Cash Manager

Strong Resume Headlines

"Results-Driven Cash Manager with 10+ Years of Experience in Treasury Management"

“Strategic Cash Flow Expert Specializing in Risk Management and Financial Planning”

“Detail-Oriented Cash Manager with Proven Record of Reducing Costs by 15%”

“Dynamic Financial Leader with Expertise in Cash Forecasting and Investment Strategies”

Weak Resume Headlines

“Cash Manager Seeking Opportunities”

“Experienced Finance Professional”

Strong resume headlines are effective because they not only highlight specific strengths and achievements but also resonate with the key requirements of the Cash Manager role. They provide a clear and immediate sense of the candidate's qualifications and the value they bring to the organization. In contrast, weak headlines fail to impress as they are vague, lack specificity, and do not convey the candidate’s unique capabilities or relevance to the job, making it difficult for hiring managers to see what sets the applicant apart from the competition.

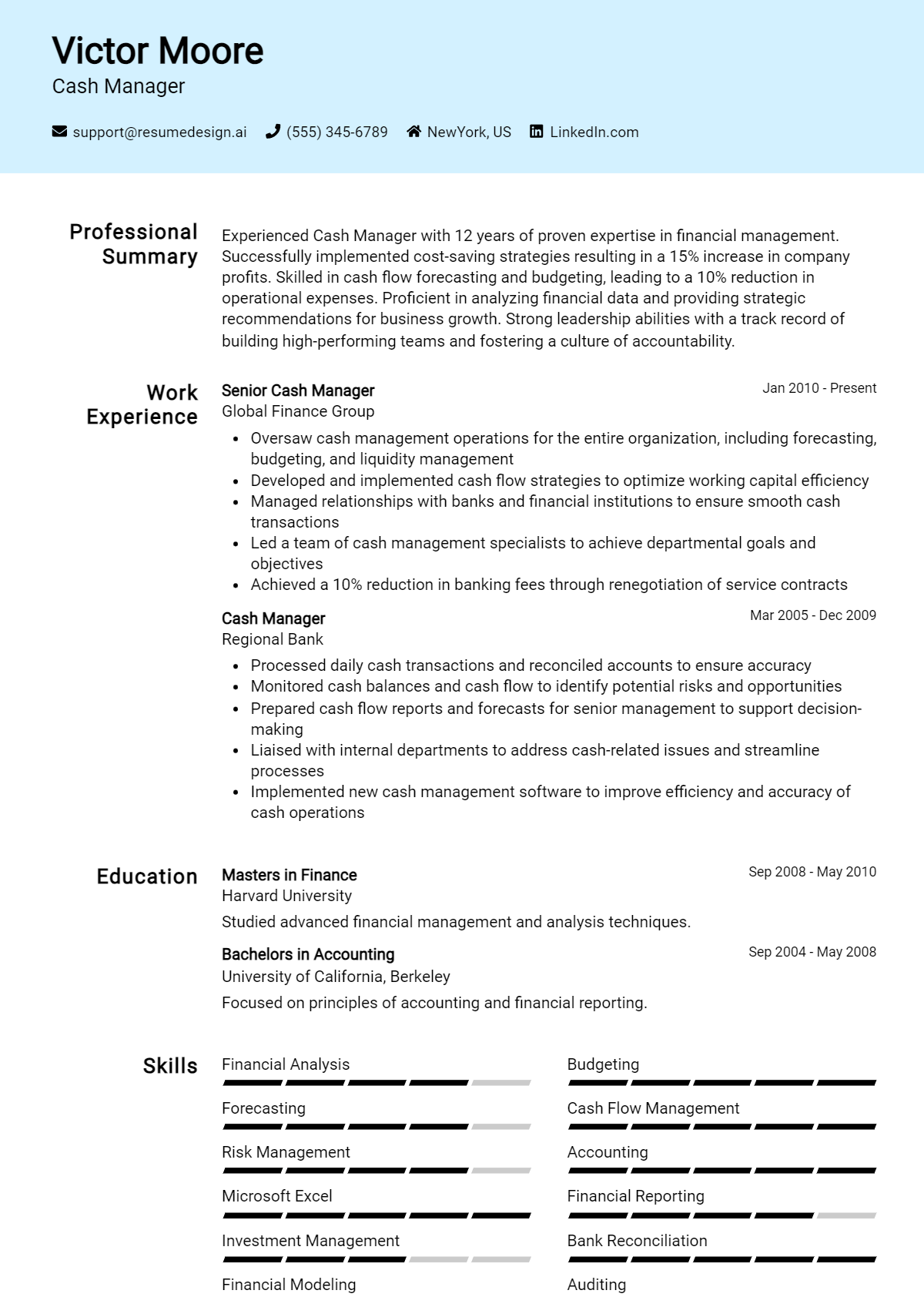

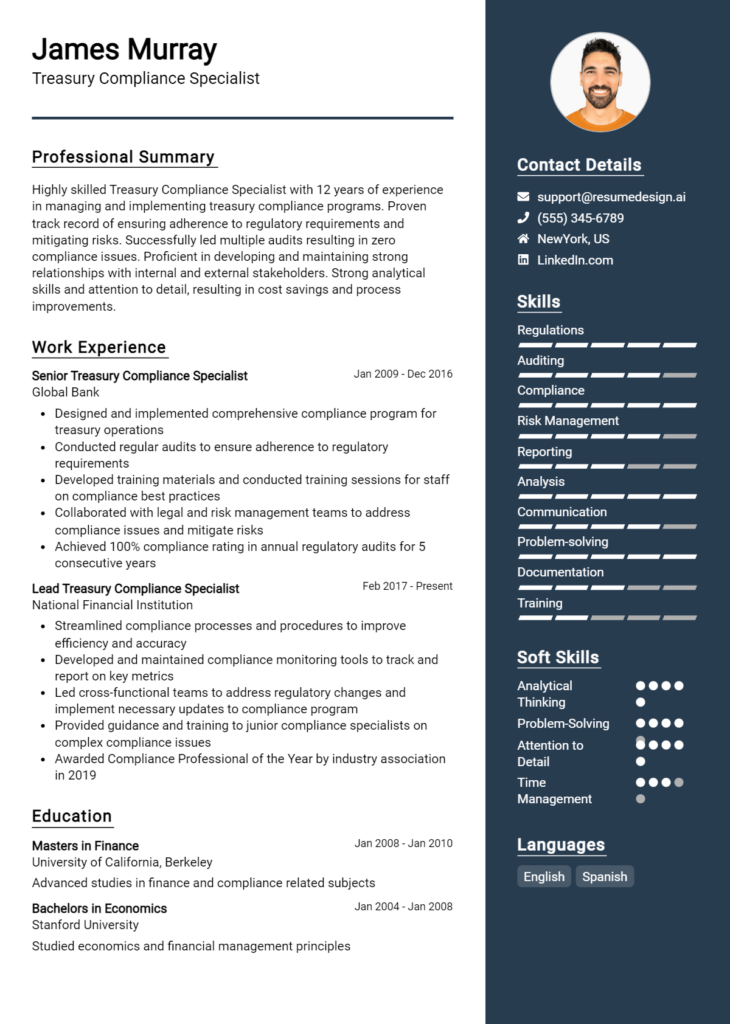

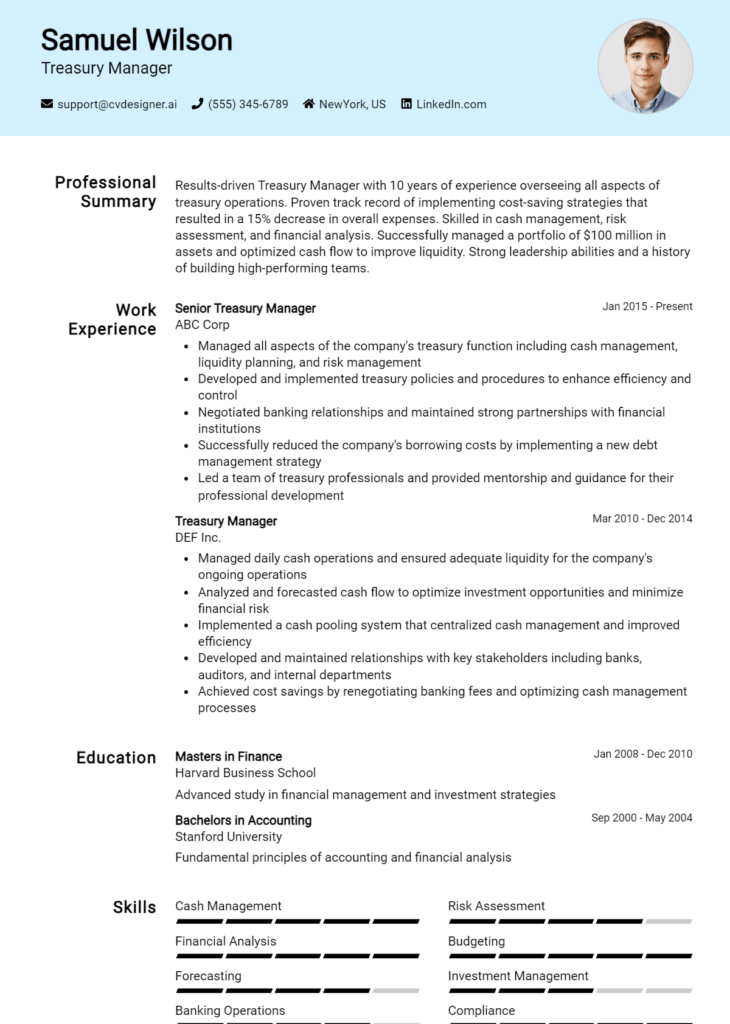

Writing an Exceptional Cash Manager Resume Summary

A well-crafted resume summary is crucial for a Cash Manager as it serves as the first impression a candidate makes on hiring managers. This brief yet impactful section succinctly encapsulates the candidate's key skills, relevant experience, and significant accomplishments, making it easier for employers to quickly assess their qualifications. An exceptional summary not only grabs attention but also sets the tone for the rest of the resume, demonstrating a clear alignment with the job requirements. Therefore, it is essential that the summary be concise, impactful, and customized to resonate with the specific job the candidate is applying for.

Best Practices for Writing a Cash Manager Resume Summary

- Quantify Achievements: Use specific numbers to highlight your accomplishments and impact.

- Focus on Key Skills: Identify and include the most relevant skills that align with the job description.

- Tailor for the Job: Customize your summary for each application to reflect the requirements and responsibilities of the position.

- Use Action Verbs: Begin sentences with strong action verbs to convey confidence and proactivity.

- Be Concise: Aim for 3-5 sentences that deliver maximum information with minimal words.

- Highlight Relevant Experience: Prioritize experience that directly relates to cash management functions.

- Showcase Problem-Solving Abilities: Mention specific challenges you've overcome in previous roles.

- Maintain Professional Tone: Keep the language professional and avoid casual phrasing.

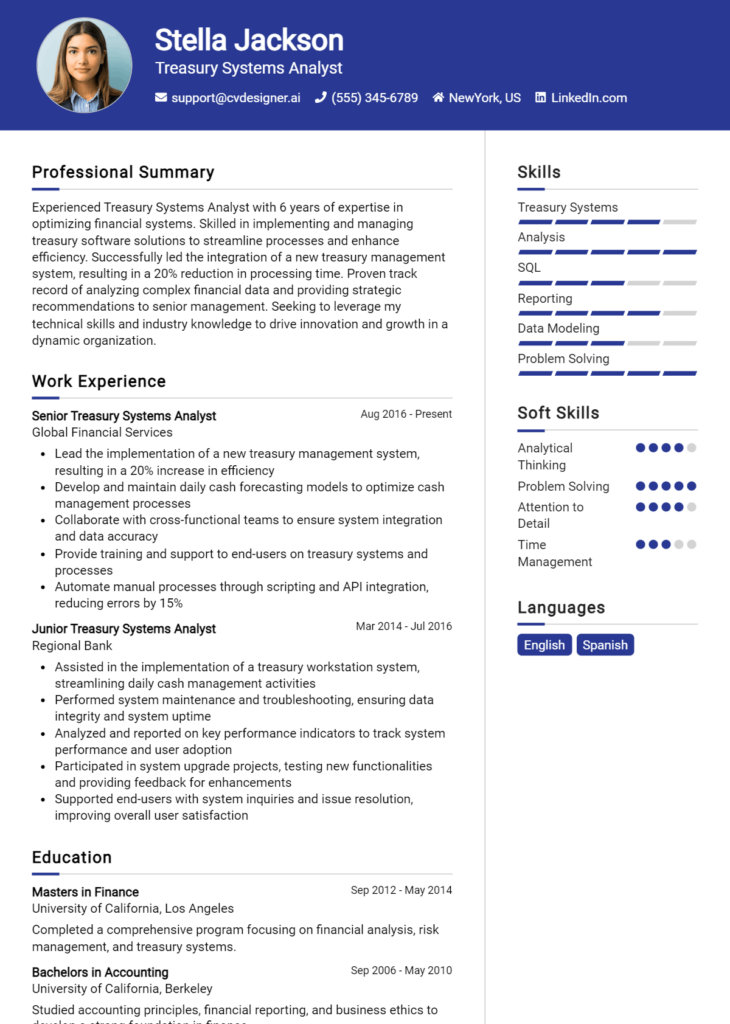

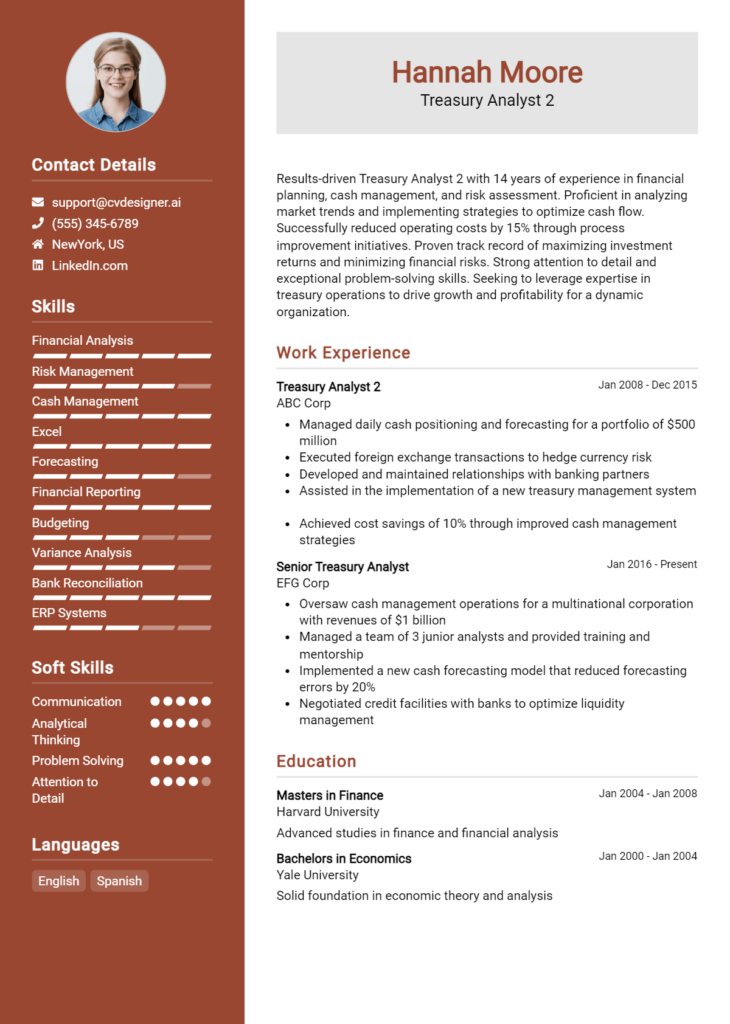

Example Cash Manager Resume Summaries

Strong Resume Summaries

Dynamic Cash Manager with over 8 years of experience optimizing cash flow and improving financial processes, resulting in a 25% reduction in operational costs. Proven ability to manage multi-million dollar budgets while ensuring compliance with financial regulations.

Results-driven Cash Manager skilled in forecasting and cash flow analysis, having successfully increased liquidity by 30% for a Fortune 500 company in the last fiscal year. Expertise in leading cross-functional teams to streamline financial operations and enhance reporting accuracy.

Proficient Cash Manager with a track record of implementing innovative financial strategies that improved cash reserves by $2 million within 12 months. Strong analytical skills combined with a keen understanding of market trends and risk management.

Weak Resume Summaries

Experienced Cash Manager looking for a new opportunity in finance. I have worked with money and budgets in the past.

Cash Manager with skills in various financial processes. I am eager to contribute to a new team and improve cash handling.

The strong resume summaries are considered effective because they provide clear, quantifiable results that demonstrate the candidate’s impact and relevance to the Cash Manager role. They highlight specific accomplishments and skills that align with the job requirements, making them compelling to hiring managers. In contrast, the weak summaries lack detail and specificity, failing to convey the candidate's unique qualifications or measurable success, resulting in a less appealing presentation to potential employers.

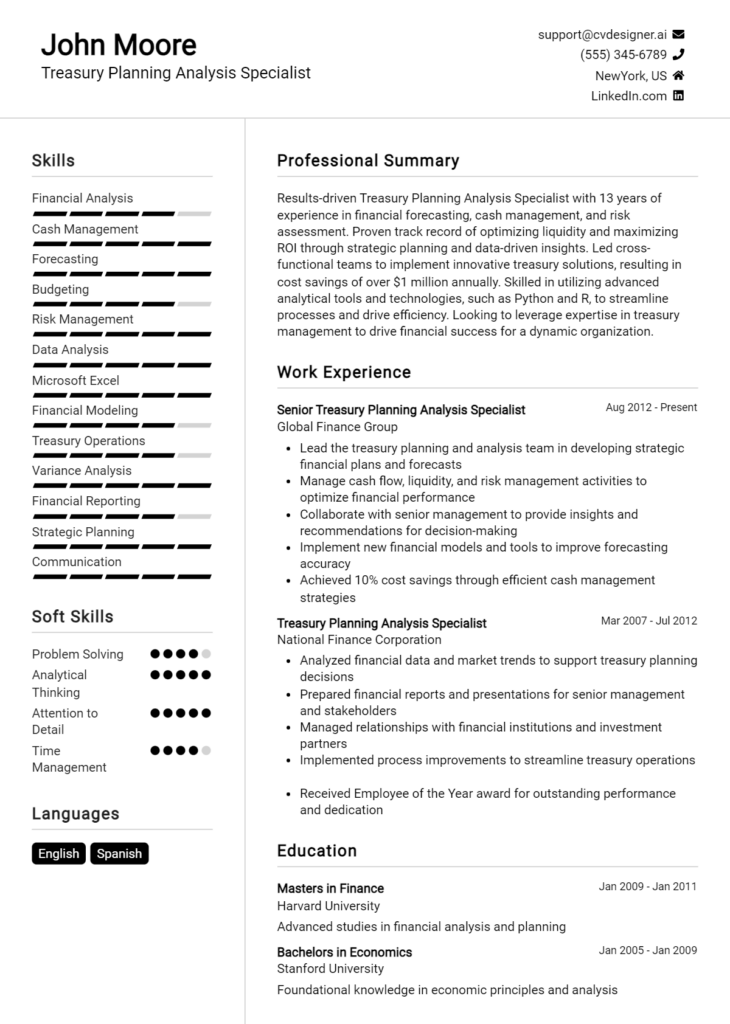

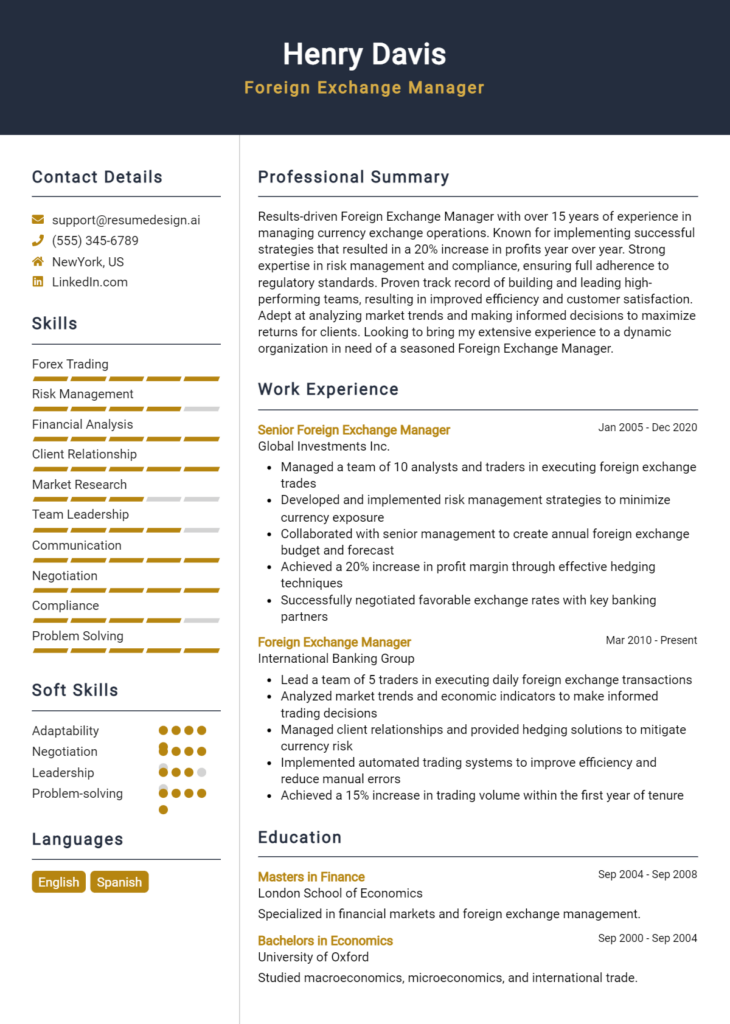

Work Experience Section for Cash Manager Resume

The work experience section of a Cash Manager resume is a critical component that provides employers with a clear picture of a candidate’s professional journey and competencies. This section not only showcases the candidate's technical skills in cash management, financial analysis, and budgeting but also highlights their ability to lead teams and drive high-quality financial outcomes. By quantifying achievements and aligning past experiences with industry standards, candidates can demonstrate their value and readiness for the role, making this section indispensable for standing out in a competitive job market.

Best Practices for Cash Manager Work Experience

- Highlight technical skills relevant to cash management, such as treasury operations, cash forecasting, and liquidity management.

- Use quantifiable results to demonstrate impact, such as percentage improvements in cash flow or reductions in costs.

- Emphasize leadership roles and team management experience, showcasing your ability to mentor and guide financial teams.

- Align your experience with industry standards and best practices to show familiarity with current trends and regulations.

- Incorporate specific software and tools you have used, such as ERP systems, financial modeling software, or cash management platforms.

- Detail collaborative projects that required cross-departmental communication and teamwork, highlighting your interpersonal skills.

- Focus on strategic contributions, explaining how your efforts supported broader organizational goals.

- Regularly update this section to reflect your most recent and relevant experiences and skills.

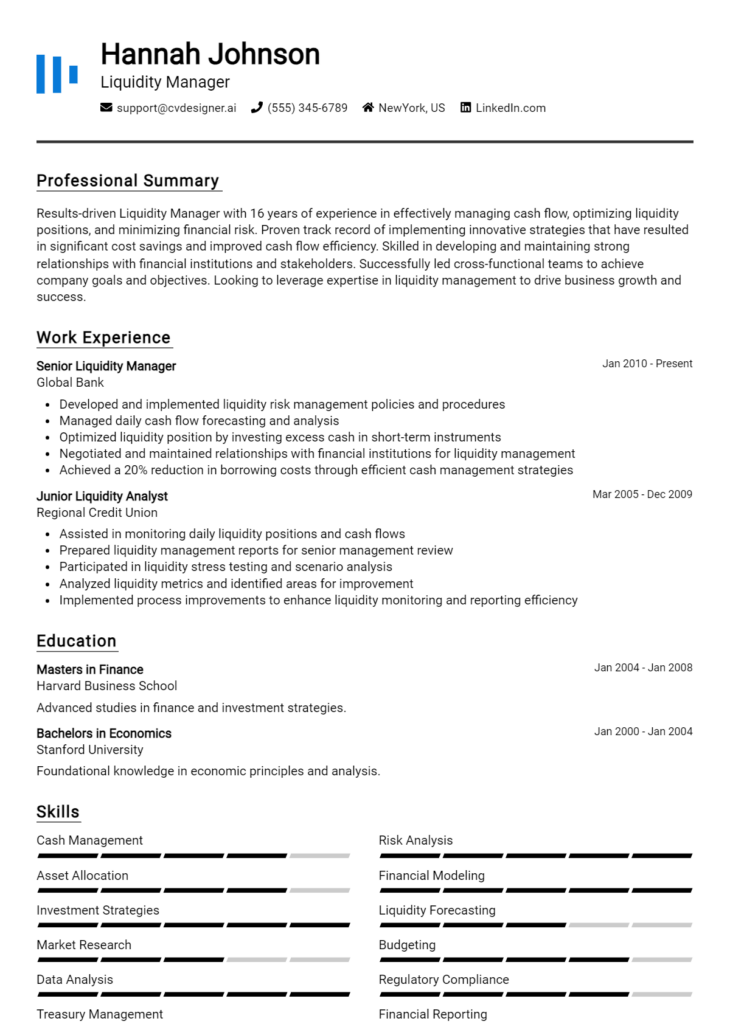

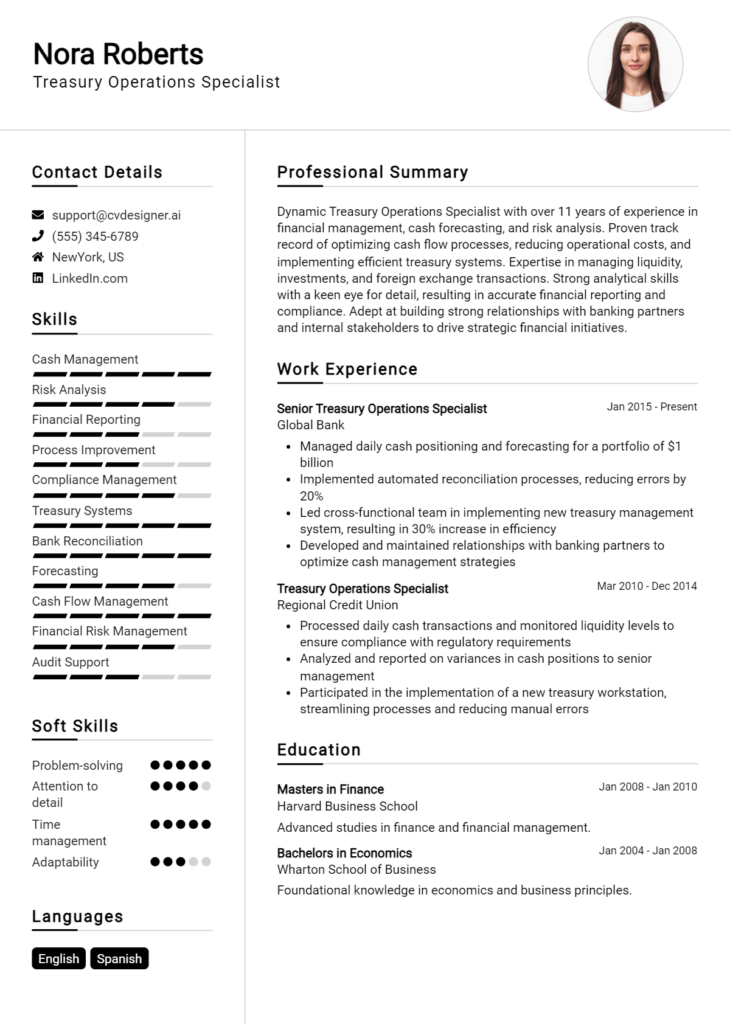

Example Work Experiences for Cash Manager

Strong Experiences

- Successfully implemented a new cash forecasting model that improved accuracy by 25%, resulting in enhanced liquidity management.

- Led a team of 5 finance professionals to streamline cash management processes, achieving a 15% reduction in operational costs within one fiscal year.

- Collaborated with IT to integrate a new cash management software, reducing manual processes by 40% and increasing reporting efficiency.

- Developed and executed cash flow strategies that increased cash reserves by 30%, supporting the company’s expansion into new markets.

Weak Experiences

- Managed cash flow in the finance department without specifying methods or outcomes.

- Worked on cash management tasks as part of a team, but did not describe specific contributions.

- Helped with financial reports but lacked detail on the impact or scale of the reports.

- Assisted in budgeting processes with no clear results or achievements noted.

The examples provided highlight the importance of specificity and quantifiable outcomes in a Cash Manager's work experience. Strong experiences are characterized by clear metrics and impactful contributions that demonstrate the candidate's technical expertise and leadership abilities. In contrast, weak experiences lack detail, measurable results, and fail to convey the candidate's role or impact, making them less compelling to potential employers.

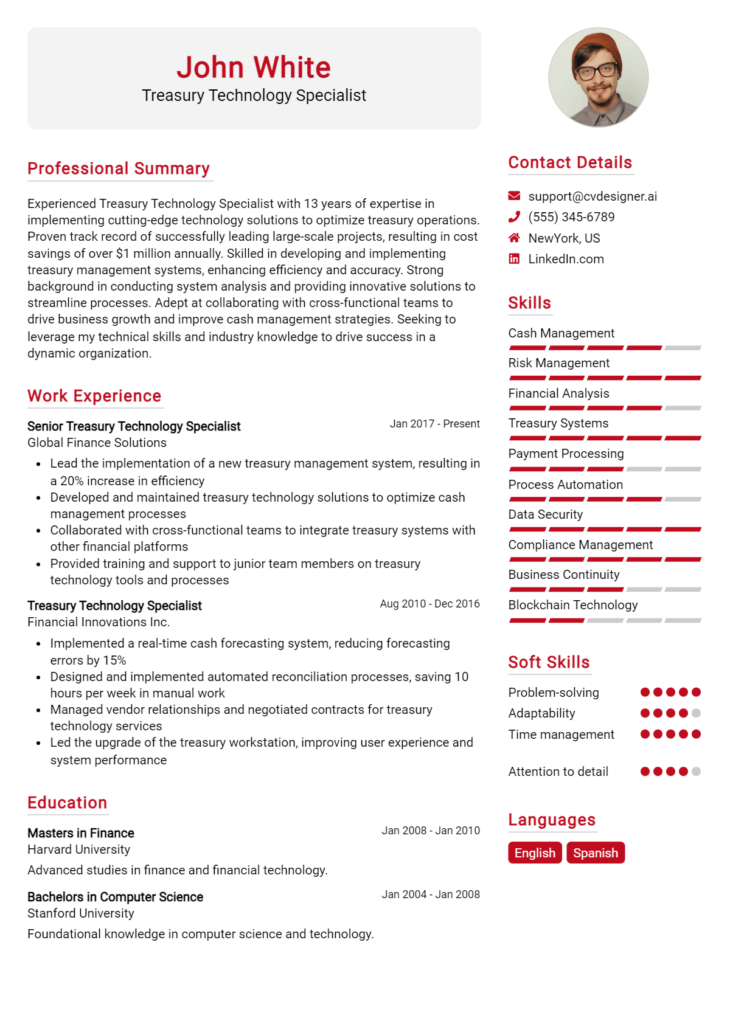

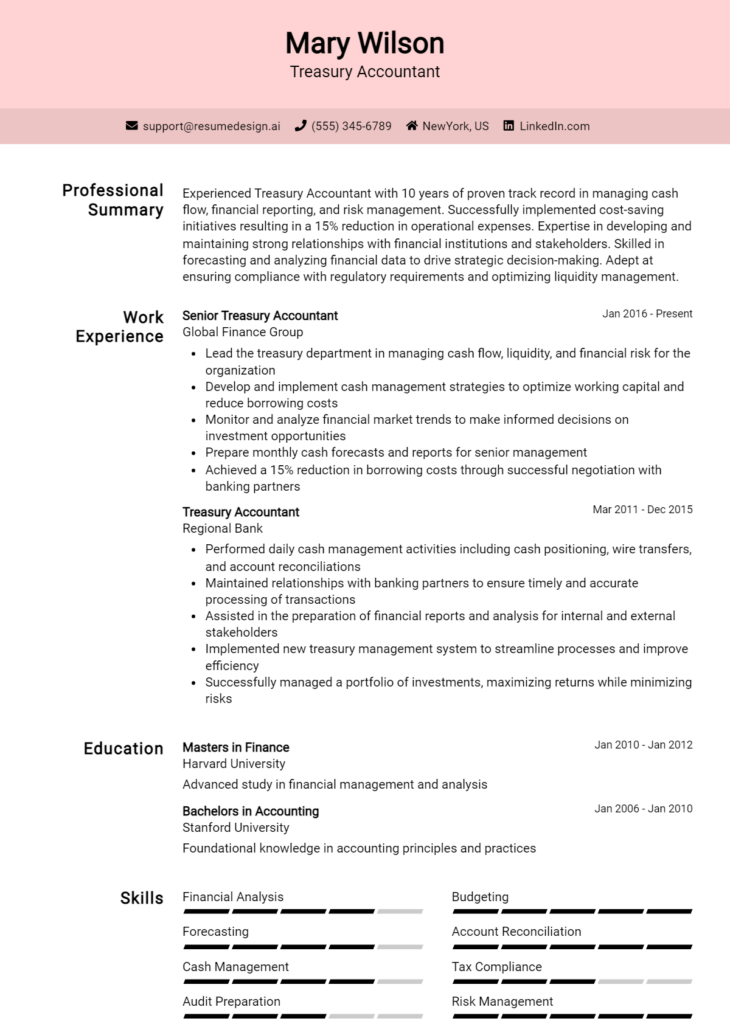

Education and Certifications Section for Cash Manager Resume

The education and certifications section is a crucial component of a Cash Manager's resume, as it showcases the candidate's academic qualifications and commitment to professional development. This section not only highlights relevant degrees and industry-recognized certifications but also emphasizes ongoing learning efforts that are essential in the ever-evolving financial landscape. By providing relevant coursework, specialized training, and credentials, candidates can significantly enhance their credibility, demonstrating their alignment with the demands of the Cash Manager role and their preparedness to contribute effectively to the organization.

Best Practices for Cash Manager Education and Certifications

- Include relevant degrees such as a Bachelor's or Master's in Finance, Accounting, or Business Administration.

- Highlight industry-recognized certifications, such as Certified Treasury Professional (CTP) or Certified Public Accountant (CPA).

- Provide specific coursework that is directly applicable to cash management, such as Financial Analysis or Risk Management.

- List any specialized training or workshops that enhance skills related to cash flow management or financial forecasting.

- Keep the information concise and focused, avoiding excessive detail that does not pertain to the job role.

- Prioritize recent education and certifications to reflect current knowledge and expertise.

- Consider including relevant professional organizations or memberships to demonstrate engagement in the industry.

- Use clear formatting to make this section easy to read and visually appealing.

Example Education and Certifications for Cash Manager

Strong Examples

- Bachelor of Science in Finance, University of XYZ, Graduated May 2020

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2021

- Financial Risk Management Certification, Global Association of Risk Professionals, 2022

- Advanced Cash Management Techniques Workshop, Financial Education Institute, 2023

Weak Examples

- Associate Degree in General Studies, Community College, 2015

- Certificate in Basic Accounting, Online Course, 2016

- Completed a workshop on Personal Finance, 2019

- High School Diploma, 2010

The strong examples provided above are considered effective as they align directly with the requirements and skills pertinent to the Cash Manager role, showcasing relevant degrees, recognized certifications, and specialized training. Conversely, the weak examples reflect qualifications that lack relevance to cash management, such as general studies or basic accounting, which do not demonstrate the depth of knowledge or specialized expertise necessary for a Cash Manager position. This distinction is vital for enhancing a candidate's attractiveness to potential employers.

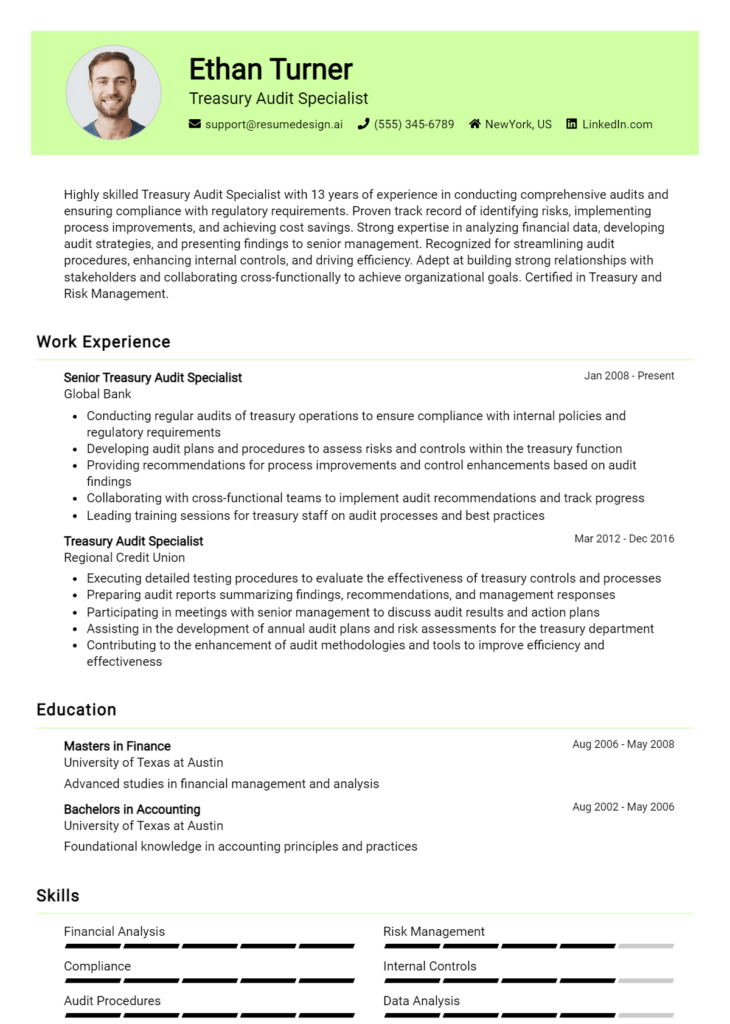

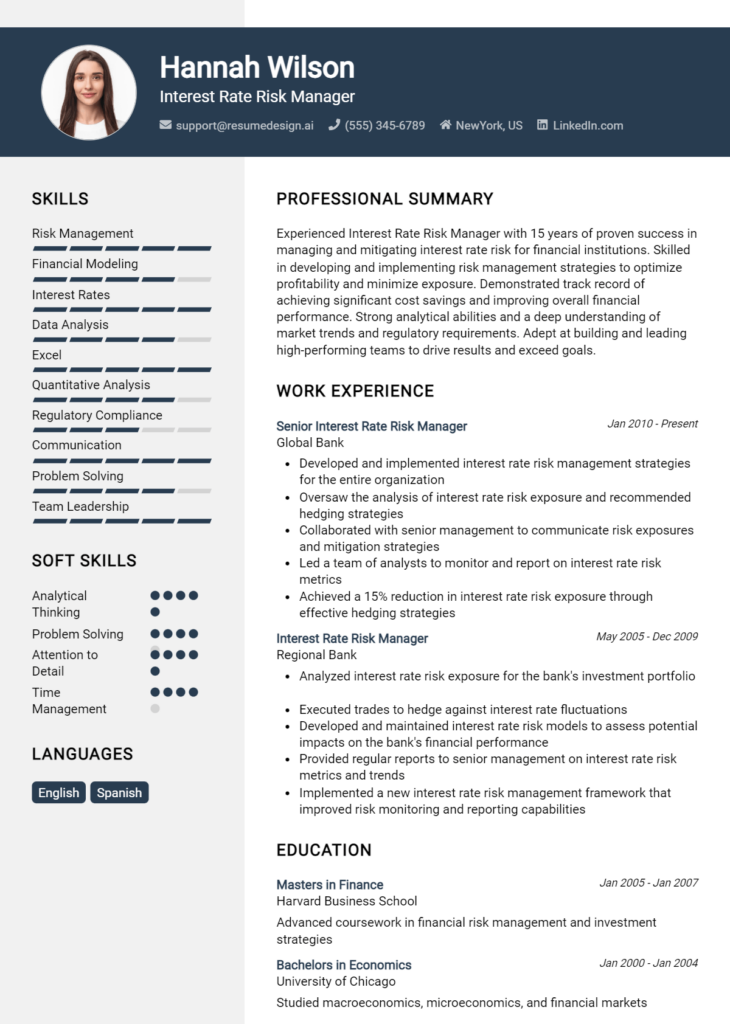

Top Skills & Keywords for Cash Manager Resume

A Cash Manager plays a crucial role in maintaining the financial health of an organization. As such, crafting a compelling resume that highlights the essential skills for this position is vital. The skills listed in a Cash Manager resume not only illustrate the candidate's qualifications but also demonstrate their ability to oversee cash flow, manage financial risks, and optimize the company's liquidity. A well-rounded skill set that combines both hard and soft skills can set a candidate apart in a competitive job market, making it imperative to carefully select and present these abilities.

Top Hard & Soft Skills for Cash Manager

Soft Skills

- Strong analytical thinking

- Excellent communication skills

- Leadership and team management

- Problem-solving abilities

- Attention to detail

- Time management

- Adaptability and flexibility

- Negotiation skills

- Interpersonal skills

- Strategic planning

Hard Skills

- Proficiency in financial software (e.g., SAP, Oracle)

- Cash flow forecasting and management

- Financial reporting and analysis

- Knowledge of banking operations

- Risk management techniques

- Budgeting and financial modeling

- Regulatory compliance

- Investment management

- Data analysis and interpretation

- Advanced Excel skills

For more insights on essential skills and how to effectively showcase your work experience, consider exploring additional resources that can aid in enhancing your resume.

Stand Out with a Winning Cash Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Cash Manager position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in financial management and cash flow optimization, I am confident in my ability to contribute effectively to your team and support your organization’s financial objectives. My background in managing cash flow strategies, forecasting, and liquidity management aligns perfectly with the requirements of this role.

In my previous position at [Previous Company Name], I successfully implemented a cash management system that improved cash flow visibility and reduced discrepancies by [X%]. By analyzing cash flow trends and collaborating with cross-functional teams, I was able to develop strategies that enhanced the overall liquidity position of the company. My proactive approach to identifying potential cash flow challenges has enabled me to devise solutions that not only mitigate risks but also capitalize on investment opportunities that drive profitability.

I am particularly drawn to the opportunity at [Company Name] because of your commitment to innovation and excellence in financial practices. I admire your recent initiatives in [specific initiatives or projects related to finance], and I am eager to bring my expertise in cash management to further enhance your financial operations. I am adept at utilizing financial software and tools to streamline processes, and I have a proven track record of maintaining strong relationships with banks and financial institutions to secure favorable terms.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the goals of [Company Name]. I am excited about the opportunity to contribute to your team and help ensure the efficient management of cash resources.

Sincerely,

[Your Name]

[Your Contact Information]

[LinkedIn Profile or Website, if applicable]

Common Mistakes to Avoid in a Cash Manager Resume

When crafting a resume for a Cash Manager position, candidates often overlook critical details that can make or break their application. A well-structured resume is essential in this competitive field, as it showcases your skills and experiences effectively. However, many applicants fall into common pitfalls that can diminish their chances of landing an interview. Below are some frequent mistakes to avoid when creating your Cash Manager resume:

Vague Job Descriptions: Failing to provide specific details about previous roles can leave hiring managers confused about your actual responsibilities and achievements.

Ignoring Keywords: Not incorporating industry-relevant keywords from the job description can result in your resume being overlooked by Applicant Tracking Systems (ATS).

Lack of Quantifiable Achievements: Instead of merely listing duties, it’s important to highlight quantifiable results, such as “managed cash flow of $5 million” or “reduced expenses by 20%.”

Inconsistent Formatting: A resume that lacks uniformity in font, spacing, or layout can appear unprofessional and distract from your qualifications.

Overly Complex Language: Using jargon or overly complicated language can make your resume difficult to read; clarity and simplicity are key.

Neglecting Soft Skills: Cash Managers require strong interpersonal skills. Focusing solely on technical expertise can overlook essential traits like communication and leadership.

Missing Professional Development: Failing to mention relevant certifications or training can suggest a lack of commitment to professional growth in the financial sector.

Typos and Grammatical Errors: Simple mistakes can undermine your professionalism and attention to detail, which are crucial in managing finances effectively.

By avoiding these common mistakes, you can create a compelling Cash Manager resume that stands out to potential employers.