Capital Markets Manager Core Responsibilities

A Capital Markets Manager plays a crucial role in bridging finance, investment, and risk management departments, contributing to the organization's strategic goals. Key responsibilities include analyzing market trends, managing investment portfolios, and coordinating capital raising efforts. Essential skills encompass technical knowledge of financial instruments, operational efficiency, and strong problem-solving abilities. Mastering these skills enhances decision-making processes and drives profitability. A well-structured resume effectively highlights these qualifications, demonstrating the candidate's value to potential employers.

Common Responsibilities Listed on Capital Markets Manager Resume

- Develop and execute capital market strategies to optimize funding and investment opportunities.

- Analyze financial data and market trends to provide insights for decision-making.

- Manage relationships with investors, financial institutions, and stakeholders.

- Oversee the preparation and execution of debt and equity offerings.

- Collaborate with risk management to assess market and credit risks.

- Ensure compliance with regulatory requirements and reporting standards.

- Lead cross-functional teams in capital raising initiatives.

- Monitor and report on portfolio performance and market conditions.

- Conduct due diligence for potential investments and acquisitions.

- Provide strategic recommendations to senior management based on market analysis.

- Facilitate training and development for junior staff in capital markets practices.

High-Level Resume Tips for Capital Markets Manager Professionals

In the competitive landscape of capital markets, a well-crafted resume serves as a crucial tool for professionals aspiring to become Capital Markets Managers. This document often represents the first impression a candidate makes on a potential employer, making it essential to convey not just skills but also notable achievements in a compelling manner. A strong resume can set you apart in a crowded field, showcasing your ability to navigate complex financial landscapes and drive results. This guide aims to provide practical and actionable resume tips specifically tailored for Capital Markets Manager professionals, helping you to maximize your chances of success.

Top Resume Tips for Capital Markets Manager Professionals

- Tailor your resume to the job description by using specific keywords and phrases that align with the role and responsibilities outlined in the posting.

- Highlight relevant experience in capital markets, including roles in trading, investment banking, or financial analysis, to demonstrate your industry knowledge.

- Quantify your achievements with concrete metrics, such as percentage increases in revenue, investment performance, or cost reductions, to substantiate your impact.

- Showcase your understanding of market trends and financial instruments relevant to capital markets, including derivatives, equities, and fixed income.

- Include certifications and licenses that are pertinent to the capital markets industry, such as CFA, CAIA, or FINRA licenses, to enhance your credibility.

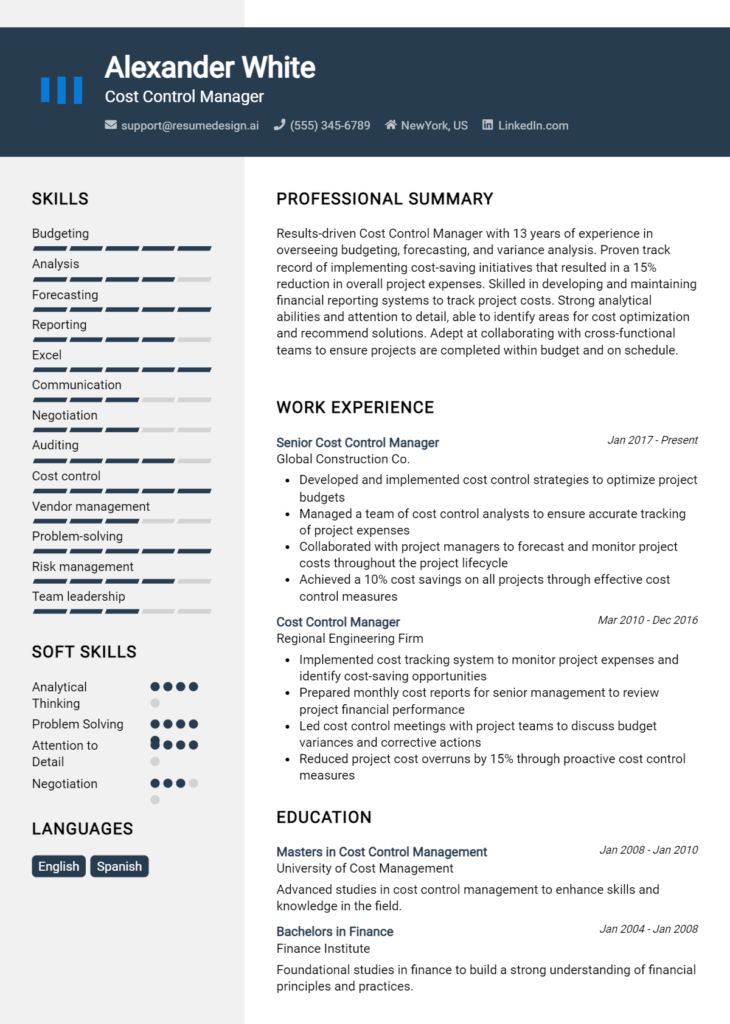

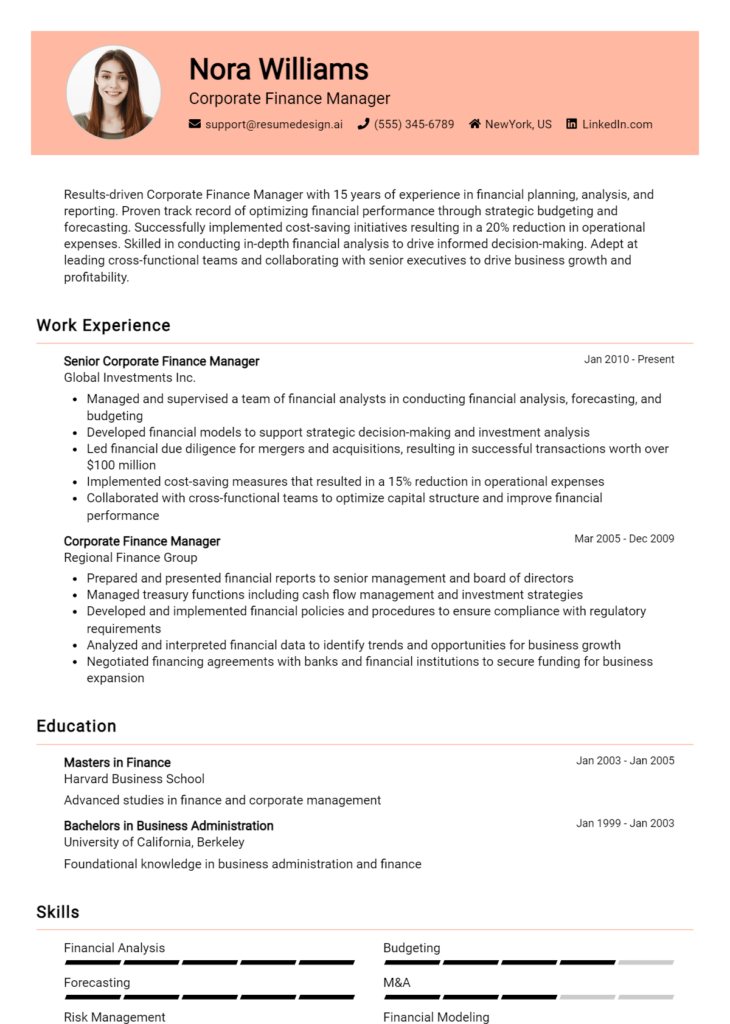

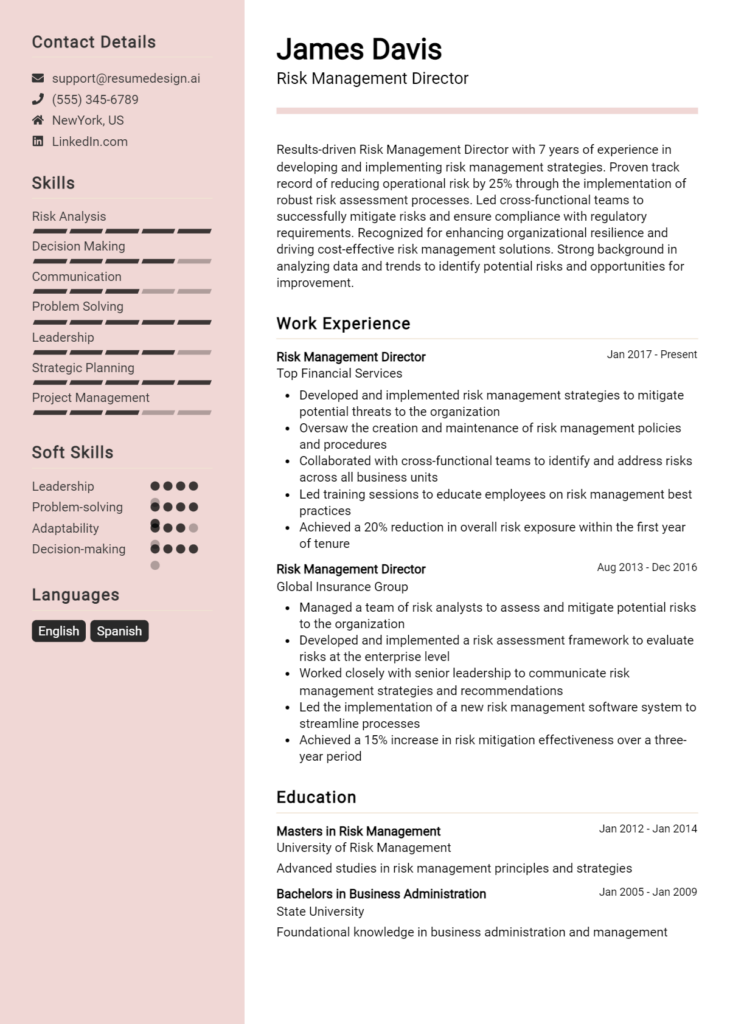

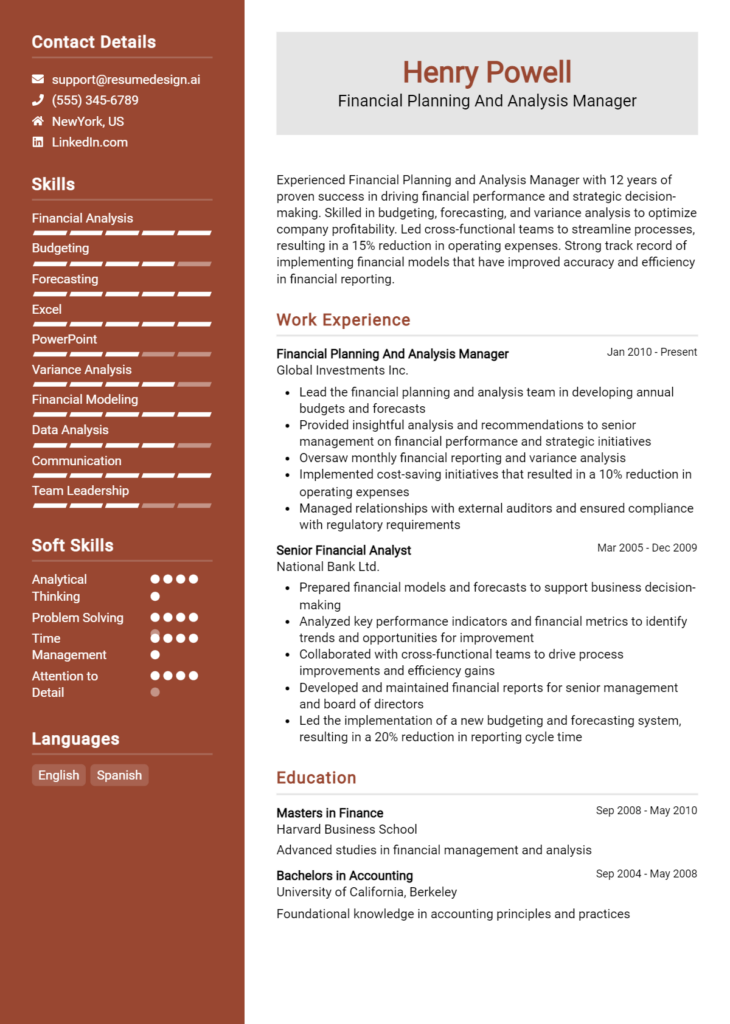

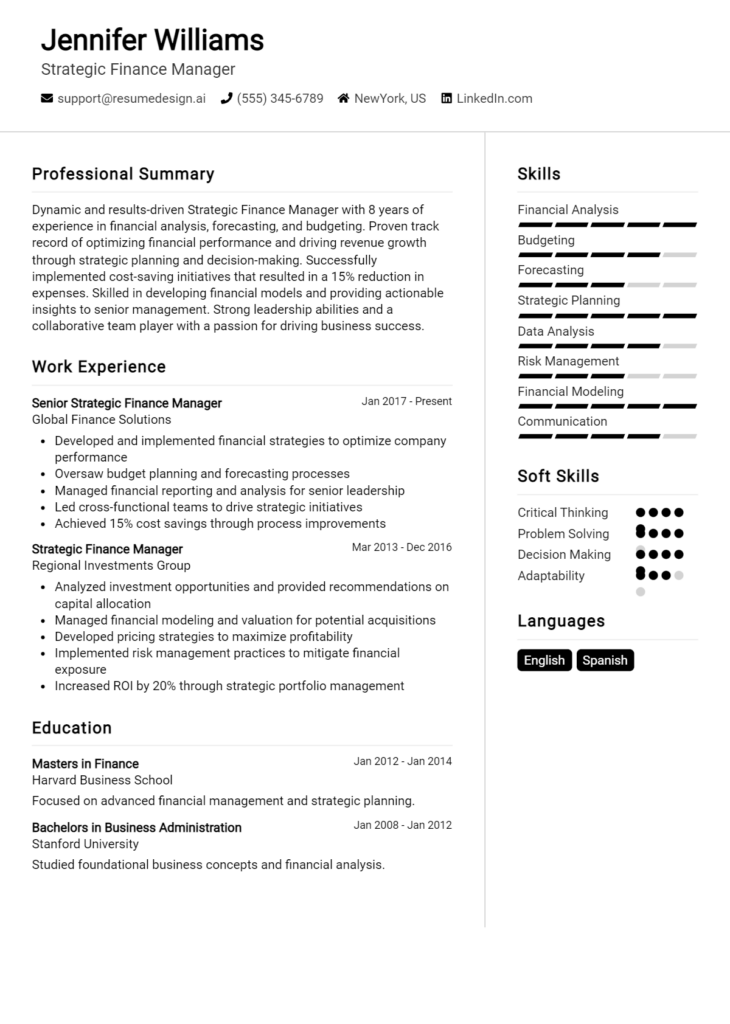

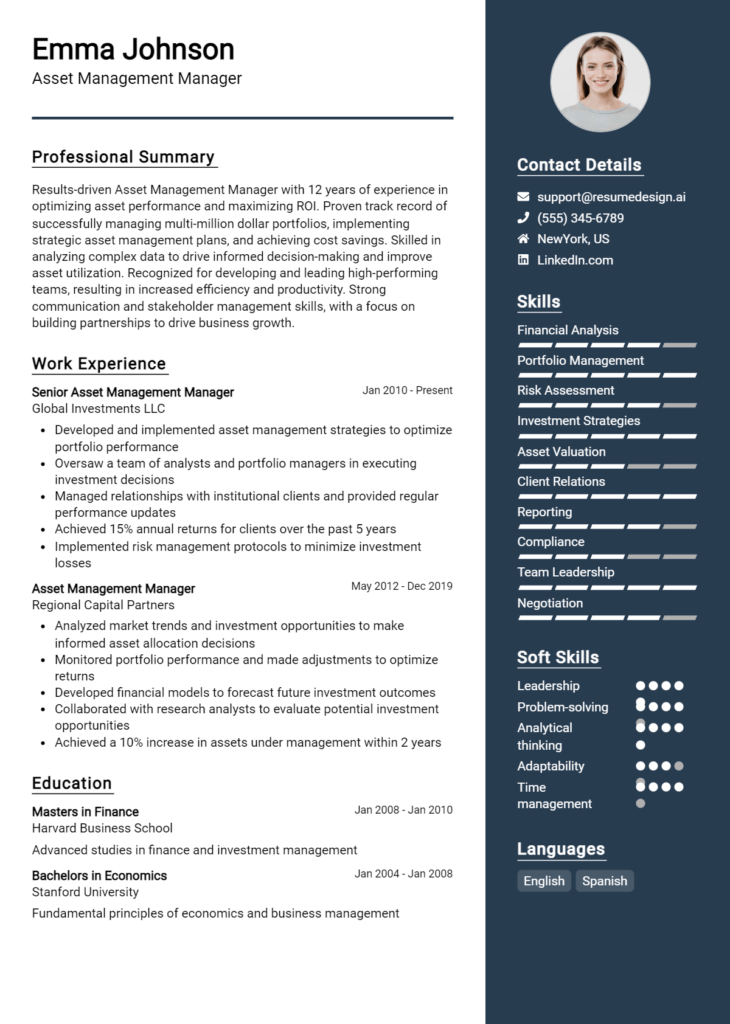

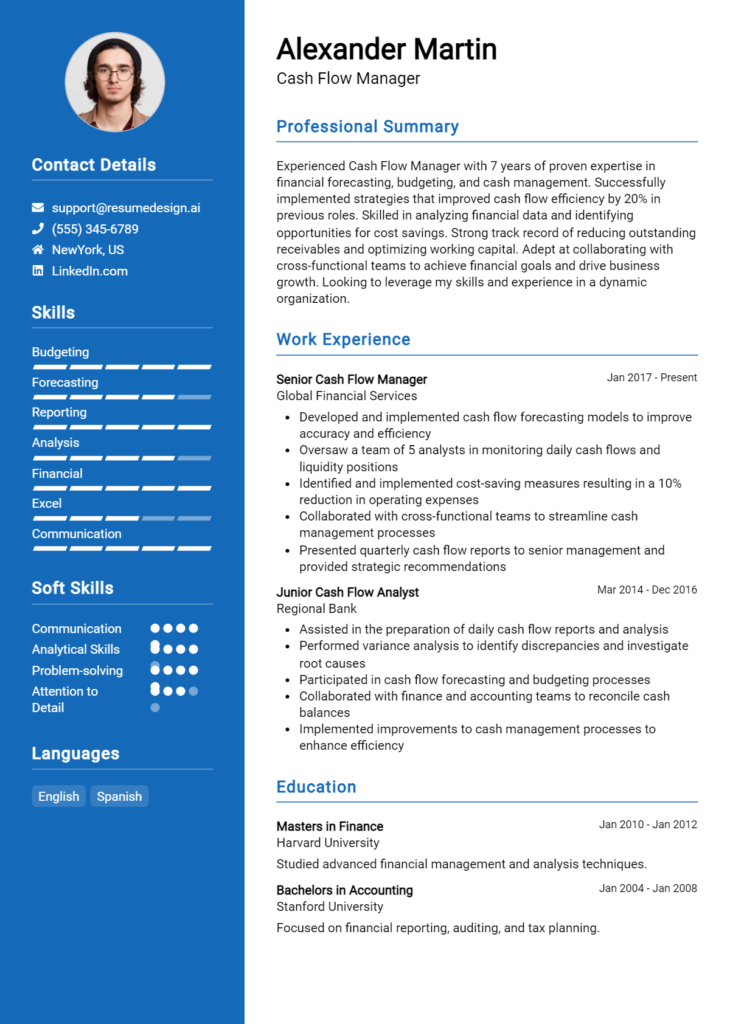

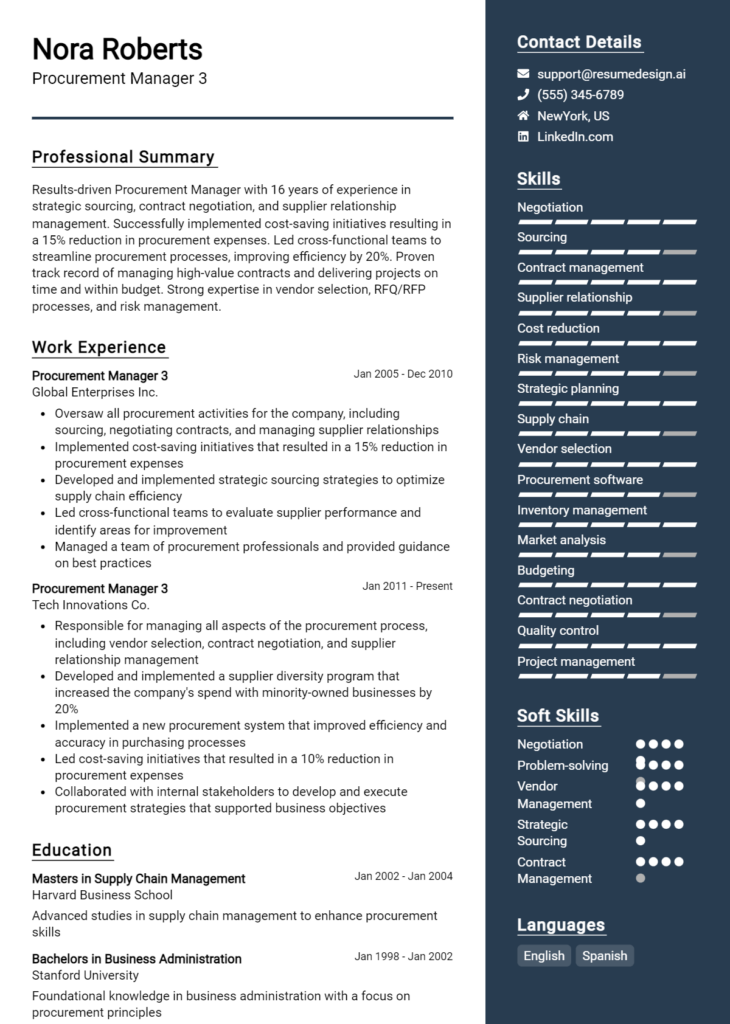

- Utilize a clean, professional layout that emphasizes clarity and readability, ensuring that your most important information stands out.

- Incorporate soft skills such as leadership, communication, and negotiation abilities, which are critical for success in managing teams and client relationships.

- Keep your resume concise, ideally one to two pages, focusing on the most relevant experiences and skills that align with the Capital Markets Manager position.

- Consider adding a summary statement at the top of your resume that encapsulates your experience and goals, providing a snapshot of what you bring to the table.

By implementing these tips, you can significantly enhance the effectiveness of your resume, making it a powerful advocate for your candidacy in the Capital Markets Manager field. A well-optimized resume not only highlights your qualifications but also positions you as a strong contender in a competitive job market, increasing your chances of landing that desired role.

Why Resume Headlines & Titles are Important for Capital Markets Manager

In the competitive landscape of capital markets, where precision and strategic insight are paramount, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers. A strong headline serves as a powerful summary of a candidate's qualifications, showcasing their expertise and unique selling points in a single, impactful phrase. It should be concise, relevant, and directly related to the job being applied for, effectively prompting recruiters to delve deeper into the resume. In an industry where first impressions matter, a compelling resume headline can set the tone for the entire application, making it essential for candidates aiming to stand out in a crowded field.

Best Practices for Crafting Resume Headlines for Capital Markets Manager

- Keep it concise: Aim for a headline that is one to two lines long.

- Be role-specific: Tailor the headline to reflect the specific position you are applying for.

- Highlight key skills: Focus on core competencies that are highly valued in capital markets.

- Use strong action words: Start with powerful verbs to convey confidence and authority.

- Quantify achievements when possible: Incorporate measurable results to add credibility.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Reflect your unique selling points: Identify what sets you apart from other candidates.

- Align with job descriptions: Ensure your headline resonates with the requirements listed in the job posting.

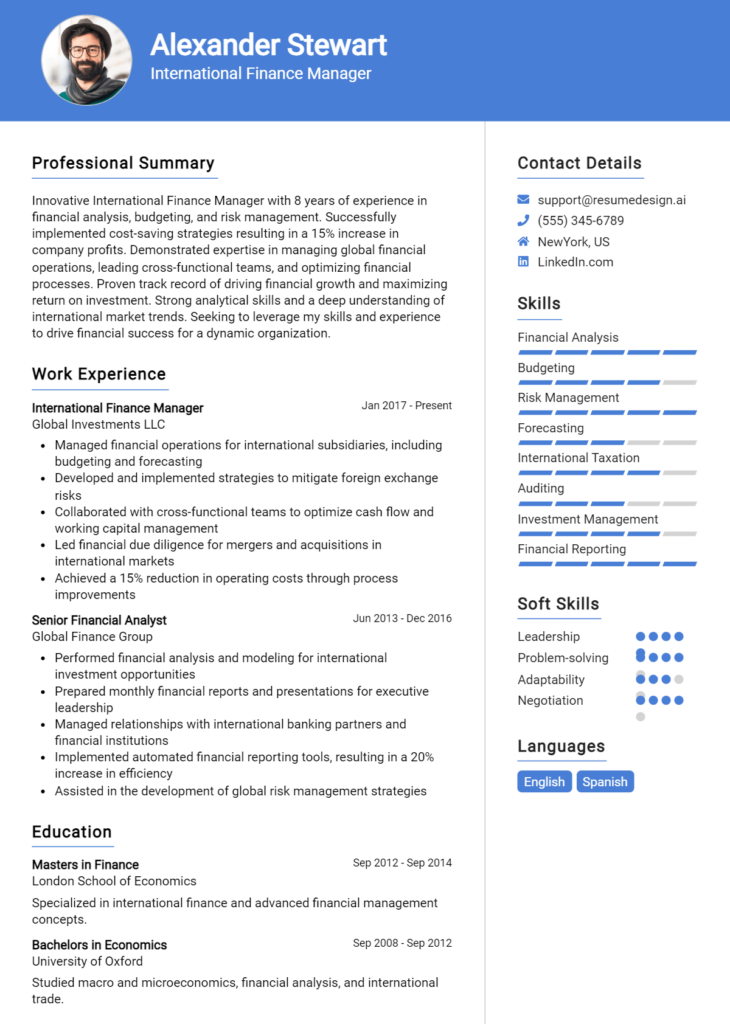

Example Resume Headlines for Capital Markets Manager

Strong Resume Headlines

"Results-Driven Capital Markets Manager with 10+ Years of Experience in Equity Trading and Risk Management"

“Strategic Capital Markets Professional Specializing in Debt Issuance and Financial Structuring”

“Dynamic Leader in Capital Markets with Proven Track Record of Boosting Portfolio Performance by 30%”

Weak Resume Headlines

“Experienced Manager Looking for a Job”

“Finance Professional”

The strong headlines are effective because they immediately convey the candidate's experience, specific areas of expertise, and impressive achievements, making them stand out to hiring managers. They use targeted language that aligns with the expectations of the capital markets industry, demonstrating a clear understanding of the role. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity, which do not provide any meaningful insight into the candidate's qualifications or value. As a result, they may lead to the resume being overlooked in favor of more compelling options.

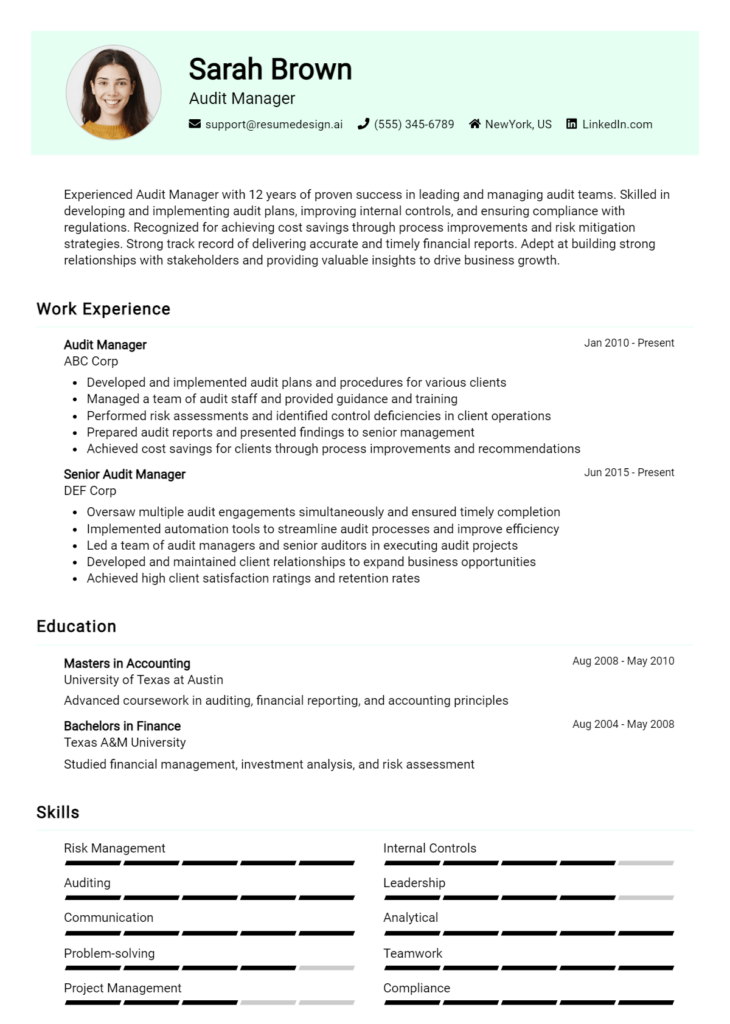

Writing an Exceptional Capital Markets Manager Resume Summary

A well-crafted resume summary is crucial for a Capital Markets Manager as it acts as a powerful introduction that can quickly capture the attention of hiring managers. In a competitive job market, a strong summary succinctly showcases key skills, relevant experience, and notable accomplishments that align with the specific requirements of the role. By highlighting the candidate's unique qualifications and demonstrating their potential value to the organization, the summary sets the tone for the rest of the resume. It should be concise, impactful, and tailored to reflect the nuances of the job description, ensuring that it resonates with prospective employers and invites them to learn more about the applicant.

Best Practices for Writing a Capital Markets Manager Resume Summary

- Quantify achievements: Use specific numbers to illustrate your successes and impact.

- Focus on relevant skills: Highlight skills that are directly applicable to capital markets and investment strategies.

- Tailor the summary: Customize your summary for the specific job description to align with the company's needs.

- Keep it concise: Aim for 3-5 sentences that are clear and to the point.

- Use action verbs: Start sentences with strong action verbs to convey confidence and effectiveness.

- Include industry terminology: Use relevant jargon that demonstrates your expertise in capital markets.

- Showcase leadership experience: If applicable, highlight any leadership roles or responsibilities you have held.

- Reflect professional growth: Mention any progression in roles or responsibilities to demonstrate career advancement.

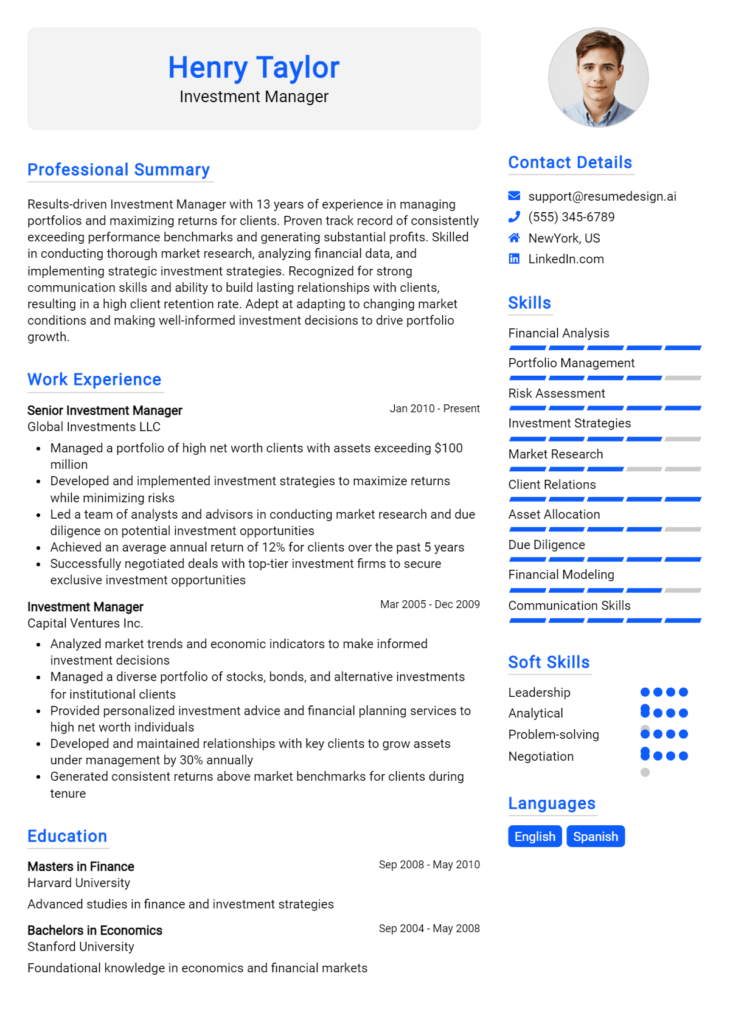

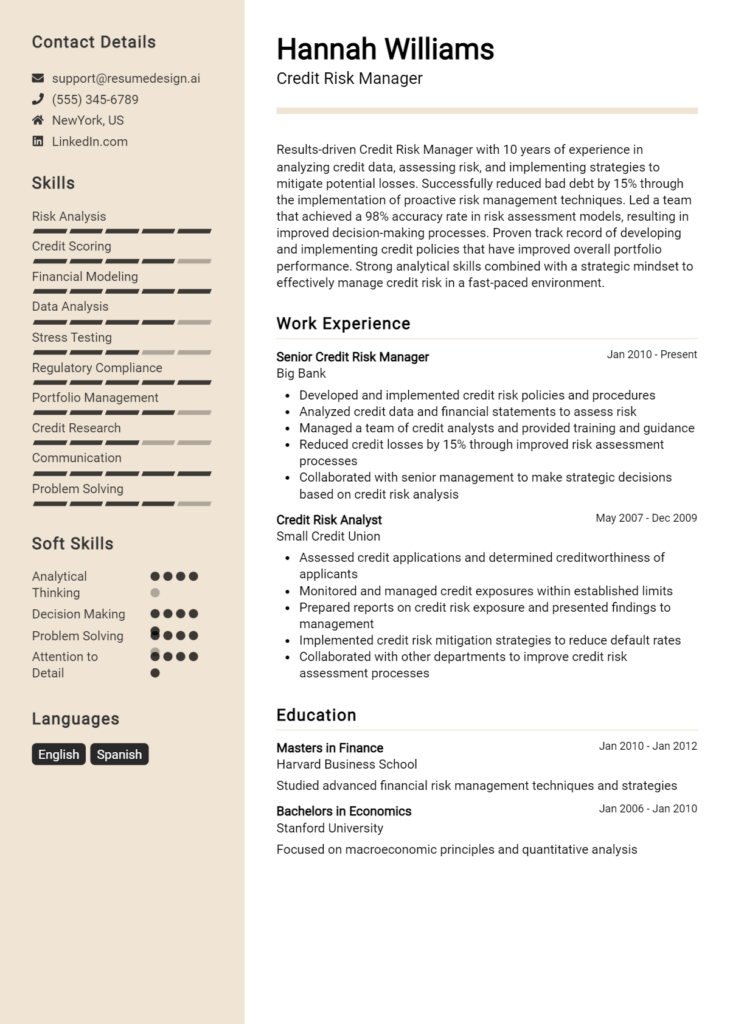

Example Capital Markets Manager Resume Summaries

Strong Resume Summaries

Results-driven Capital Markets Manager with over 10 years of experience leading strategic investment initiatives, achieving a 25% increase in portfolio returns over the past three years. Proven track record in managing multi-million dollar transactions and optimizing investment strategies through detailed market analysis and risk assessment.

Dynamic Capital Markets professional with a strong background in equity trading and asset management, successfully executing trades worth over $500 million annually. Skilled in developing innovative financial models and leveraging market trends to maximize profitability.

Accomplished Capital Markets Manager with expertise in fixed income securities and derivatives, having driven revenue growth of 30% year-over-year. Adept at building and leading high-performing teams, fostering client relationships, and executing complex financial strategies.

Weak Resume Summaries

Experienced finance professional with knowledge in capital markets looking for a new opportunity. Strong analytical skills and a good understanding of market trends.

Capital Markets Manager with some experience in trading and investment strategies. Seeking to apply my skills in a challenging environment.

The strong resume summaries are considered effective because they are specific, demonstrate quantifiable results, and directly relate to the responsibilities of a Capital Markets Manager. They provide clear evidence of the candidate's capabilities and accomplishments, making them stand out to hiring managers. In contrast, the weak summaries lack detail and focus, failing to convey any significant achievements or relevant skills, which can leave a hiring manager unimpressed or uninterested.

Work Experience Section for Capital Markets Manager Resume

The work experience section of a Capital Markets Manager resume is essential as it serves as a critical showcase of the candidate's technical skills, leadership capabilities, and the ability to deliver high-quality financial products and services. This section not only highlights the direct experience in capital markets but also demonstrates how the candidate has effectively managed teams and projects. By quantifying achievements and aligning past experiences with industry standards and best practices, candidates can effectively illustrate their professional value and potential contributions to prospective employers.

Best Practices for Capital Markets Manager Work Experience

- Clearly outline your technical expertise in financial modeling, risk management, and market analysis.

- Quantify your achievements with specific metrics, such as percentage increases in revenue or successful project completions.

- Highlight your leadership experience by showcasing team management and mentoring roles.

- Focus on collaboration by detailing cross-departmental projects and partnerships.

- Utilize industry-specific terminology to align with the expectations of capital markets professionals.

- Include relevant certifications or training that enhance your qualifications in capital markets.

- Describe your role in achieving compliance with regulations and managing risks.

- Employ action verbs to convey a sense of proactivity and impact in your roles.

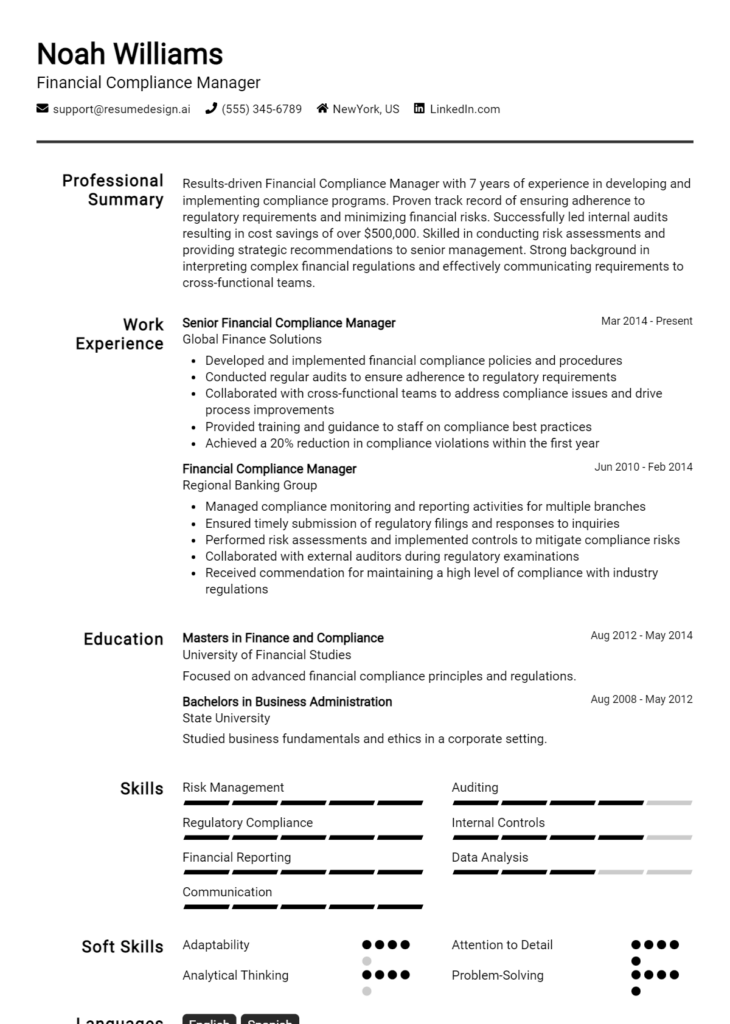

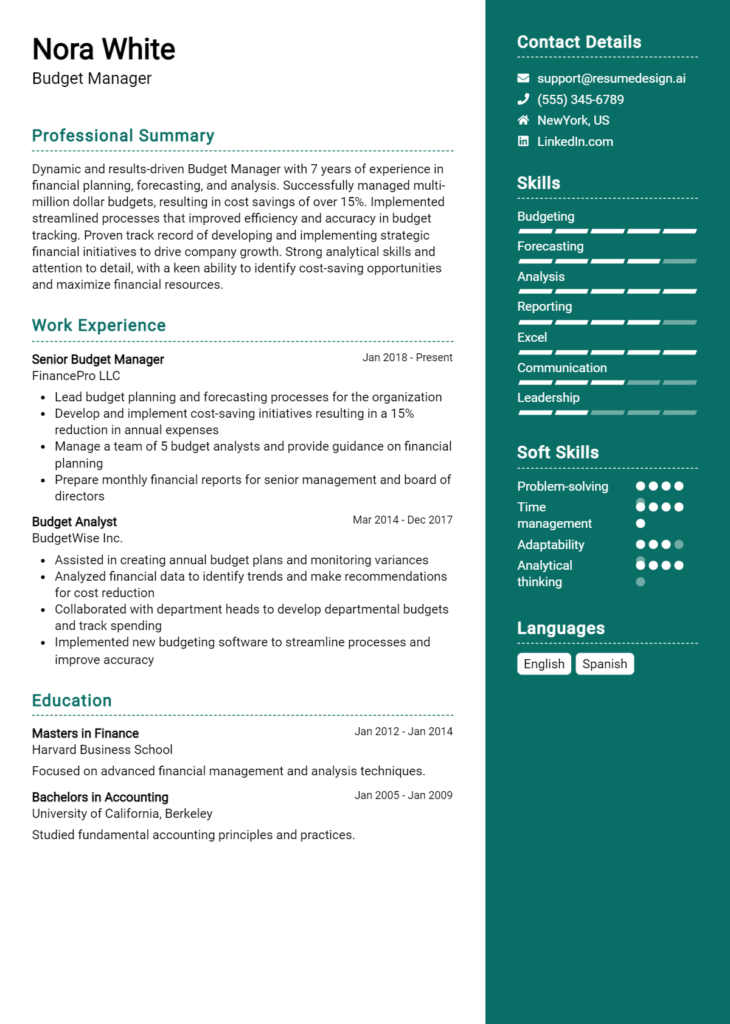

Example Work Experiences for Capital Markets Manager

Strong Experiences

- Led a team of 10 analysts to develop a new risk assessment model that reduced operational risks by 30%, resulting in $2 million in annual savings.

- Managed a successful capital raising initiative that raised $50 million in funding through strategic investor relations, exceeding targets by 25%.

- Collaborated with cross-functional teams to implement a trading platform upgrade, improving transaction efficiency by 40% and enhancing user satisfaction scores.

- Developed and executed investment strategies that outperformed market benchmarks by an average of 15% over three consecutive years.

Weak Experiences

- Assisted with various projects in the capital markets area without specifying the nature of the projects or outcomes.

- Worked on a team to analyze market trends but did not mention specific contributions or results.

- Helped with risk management tasks; however, the impact of these tasks was not clearly defined.

- Involved in client communications but did not quantify the effectiveness or results of these interactions.

The examples provided illustrate the contrast between strong and weak work experiences in the capital markets field. Strong experiences are characterized by specific, quantifiable outcomes and clear descriptions of leadership and collaboration, which directly relate to the role's requirements. In contrast, weak experiences lack specificity and measurable results, making it difficult for potential employers to gauge the candidate's impact and capabilities in the capital markets arena.

Education and Certifications Section for Capital Markets Manager Resume

The education and certifications section of a Capital Markets Manager resume is crucial for showcasing the candidate's academic background, industry-relevant qualifications, and commitment to continuous professional development. This section not only highlights the essential degrees and certifications that align with the demands of the role but also emphasizes any specialized training and relevant coursework that can enhance the candidate's credibility. A well-structured education and certifications section signals to potential employers that the candidate possesses the necessary knowledge and skills to succeed in the competitive landscape of capital markets.

Best Practices for Capital Markets Manager Education and Certifications

- Prioritize relevance by including degrees and certifications directly related to capital markets, finance, or investment management.

- Provide specific details, such as majors, minors, and notable projects or coursework that align with capital markets functions.

- Highlight advanced degrees (e.g., MBA with a concentration in finance) and industry-recognized certifications (e.g., CFA, FRM) to demonstrate expertise.

- Include dates of completion for degrees and certifications to showcase your most up-to-date qualifications.

- Consider mentioning any honors or awards received during your education to further establish credibility.

- Keep the format clear and organized for easy readability, using bullet points or a clean layout.

- Update this section regularly to reflect any new certifications or relevant courses taken after graduation.

- Include continuing education efforts, such as workshops or seminars, that demonstrate commitment to staying current in the field.

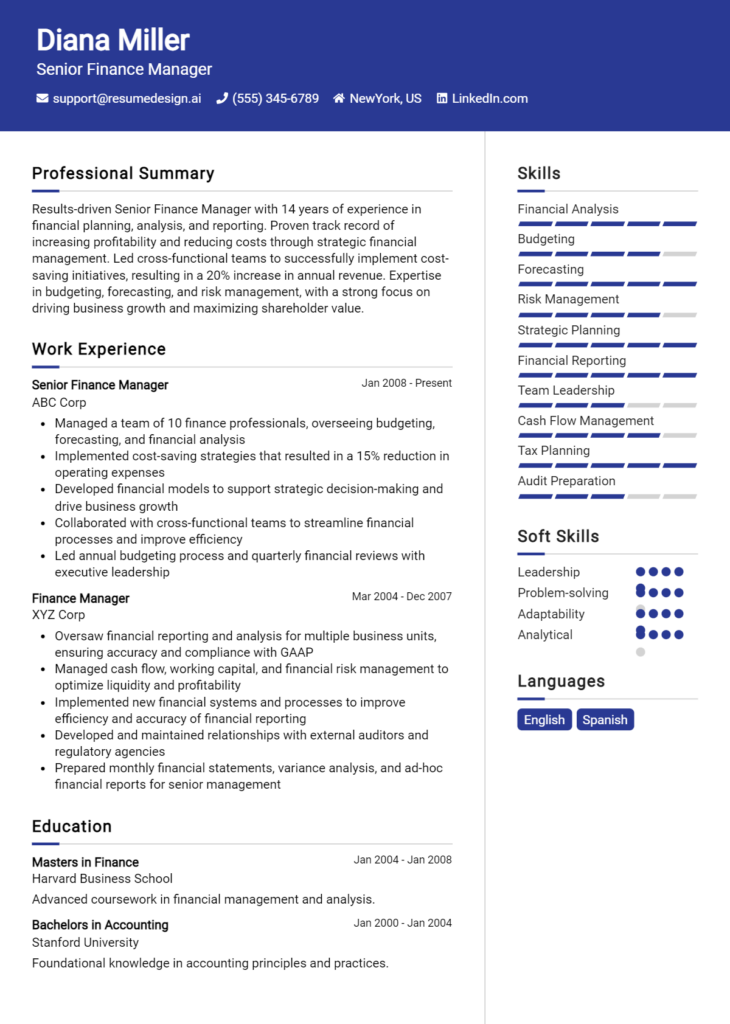

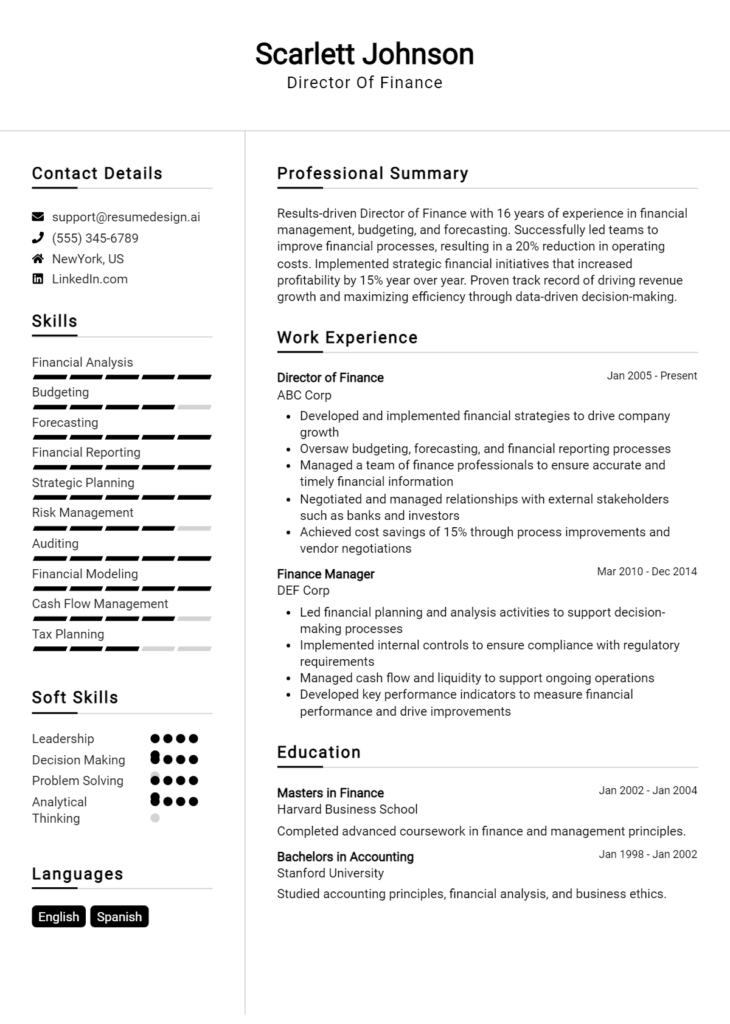

Example Education and Certifications for Capital Markets Manager

Strong Examples

- MBA in Finance, University of Chicago - Booth School of Business, 2022

- Chartered Financial Analyst (CFA) Level II Candidate, 2023

- Certificate in Investment Management, New York Institute of Finance, 2021

- Relevant Coursework: Advanced Financial Analysis, Portfolio Management, Risk Assessment

Weak Examples

- Bachelor of Arts in History, State University, 2010

- Certified Personal Trainer (CPT), National Academy of Sports Medicine, 2018

- Online Course in Basic Cooking Skills, 2022

- High School Diploma, Local High School, 2005

The strong examples provided demonstrate a clear alignment with the requirements of a Capital Markets Manager, showcasing degrees and certifications relevant to finance and investment management. In contrast, the weak examples illustrate qualifications that are either unrelated to the capital markets field or outdated, failing to enhance the candidate’s suitability for the role. Strong credentials reflect a candidate's dedication to their profession and a robust understanding of the intricacies of capital markets, while weak credentials may raise questions about their commitment and expertise in the industry.

Top Skills & Keywords for Capital Markets Manager Resume

In the competitive landscape of capital markets, having a well-crafted resume is crucial for a Capital Markets Manager. The right combination of skills can significantly enhance a candidate's appeal to potential employers. Highlighting both hard and soft skills not only showcases technical expertise but also emphasizes interpersonal attributes that are essential for navigating complex financial environments. A strong skills section can be a deciding factor in differentiating candidates and demonstrating their fit for roles that demand analytical thinking, strategic decision-making, and effective communication.

Top Hard & Soft Skills for Capital Markets Manager

Soft Skills

- Strong communication skills

- Leadership and team management

- Problem-solving abilities

- Negotiation skills

- Adaptability and flexibility

- Analytical thinking

- Attention to detail

- Time management

- Relationship building

- Emotional intelligence

- Strategic thinking

- Client-focused mindset

- Conflict resolution

- Collaboration and teamwork

- Networking abilities

- Decision-making skills

Hard Skills

- Financial modeling and analysis

- Knowledge of securities laws and regulations

- Risk management expertise

- Proficient in investment strategies

- Data analysis and interpretation

- Advanced Excel skills

- Familiarity with trading platforms

- Portfolio management techniques

- Market research proficiency

- Understanding of fixed income and equity markets

- Quantitative analysis skills

- Financial forecasting

- Experience with compliance and regulatory reporting

- Knowledge of derivatives and structured products

- Use of financial software (e.g., Bloomberg, FactSet)

- Familiarity with macroeconomic indicators

- Valuation techniques

- Understanding of capital raising processes

For more insights on how to effectively showcase your skills and work experience, consider exploring additional resources tailored to enhance your resume.

Stand Out with a Winning Capital Markets Manager Cover Letter

I am writing to express my interest in the Capital Markets Manager position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in the financial services industry, I have honed my skills in capital market operations, investment strategies, and client relationship management. I am excited about the opportunity to contribute to your team, leveraging my expertise to drive growth and enhance the firm's portfolio performance.

In my previous role at [Previous Company Name], I successfully led a team responsible for managing a diverse range of assets, optimizing investment strategies that resulted in a [specific percentage]% increase in returns over [time period]. My experience in analyzing market trends and conducting risk assessments has equipped me with the necessary tools to make informed decisions that align with organizational goals. Additionally, I have spearheaded initiatives that improved operational efficiency, reducing transaction costs by [specific amount or percentage], which directly benefited our clients.

Building and maintaining strong relationships with stakeholders is a cornerstone of my approach. I pride myself on my ability to communicate complex financial concepts in a clear and engaging manner, which has fostered trust and collaboration with clients and internal teams alike. I am particularly drawn to [Company Name] because of its reputation for innovation and excellence in the capital markets sector, and I am eager to bring my unique perspective and strategic vision to your esteemed organization.

I am excited about the possibility of joining [Company Name] as a Capital Markets Manager and am confident that my background and passion for the industry will make a positive impact. I look forward to discussing how my experience and skills align with the goals of your team. Thank you for considering my application.

Common Mistakes to Avoid in a Capital Markets Manager Resume

When crafting a resume for a Capital Markets Manager position, it's crucial to present your qualifications and experiences in a clear, professional manner. However, many candidates make common mistakes that could hinder their chances of landing an interview. Avoiding these pitfalls can significantly enhance the effectiveness of your resume and showcase your suitability for the role. Here are some common mistakes to steer clear of:

Overloading with jargon: While industry-specific terms can demonstrate expertise, excessive use can make your resume difficult to read. Aim for clarity and balance.

Lack of quantifiable achievements: Failing to include specific metrics or results can make your accomplishments seem vague. Use numbers to illustrate the impact of your work (e.g., “Increased portfolio returns by 15%”).

Ignoring keywords from the job description: Not aligning your resume with the job posting can lead to missing out on opportunities. Tailor your content to include relevant keywords that match the role.

Using a generic format: A one-size-fits-all resume may not capture attention. Customize the layout and content to reflect your unique qualifications and the specific demands of the Capital Markets Manager position.

Neglecting soft skills: While technical skills are vital, overlooking soft skills such as leadership, communication, and problem-solving can be a mistake. Highlight these attributes to show you are well-rounded.

Omitting continuing education: In the fast-paced world of capital markets, continuous learning is essential. Failing to mention relevant certifications or courses can make you seem less competitive.

Excessive length: A resume that is too lengthy can overwhelm hiring managers. Aim for a concise document that effectively summarizes your experience in one to two pages.

Not proofreading: Spelling and grammatical errors can undermine professionalism. Always proofread your resume to ensure it is polished and free from mistakes.

Conclusion

As a Capital Markets Manager, your role is critical in navigating the complex landscape of financial markets, managing investment portfolios, and advising clients on capital structure solutions. Key responsibilities often include analyzing market trends, developing strategic investment strategies, and collaborating with various stakeholders to optimize capital allocation. Additionally, effective communication skills and a deep understanding of regulatory environments are essential for success in this position.

In conclusion, it's crucial to ensure that your resume reflects the depth of your expertise and aligns with the expectations of potential employers in the capital markets sector. Take a moment to review and refine your Capital Markets Manager resume, highlighting your achievements, skills, and certifications that set you apart from the competition.

To assist you in this process, explore the variety of resources available to enhance your resume. You can find resume templates that provide a professional layout, use the resume builder for a customized approach, and check out resume examples for inspiration. Additionally, consider utilizing cover letter templates to complement your application and make a strong impression.

Don't miss the opportunity to present yourself effectively in this competitive field—take action today!