Anti-Money Laundering Specialist Core Responsibilities

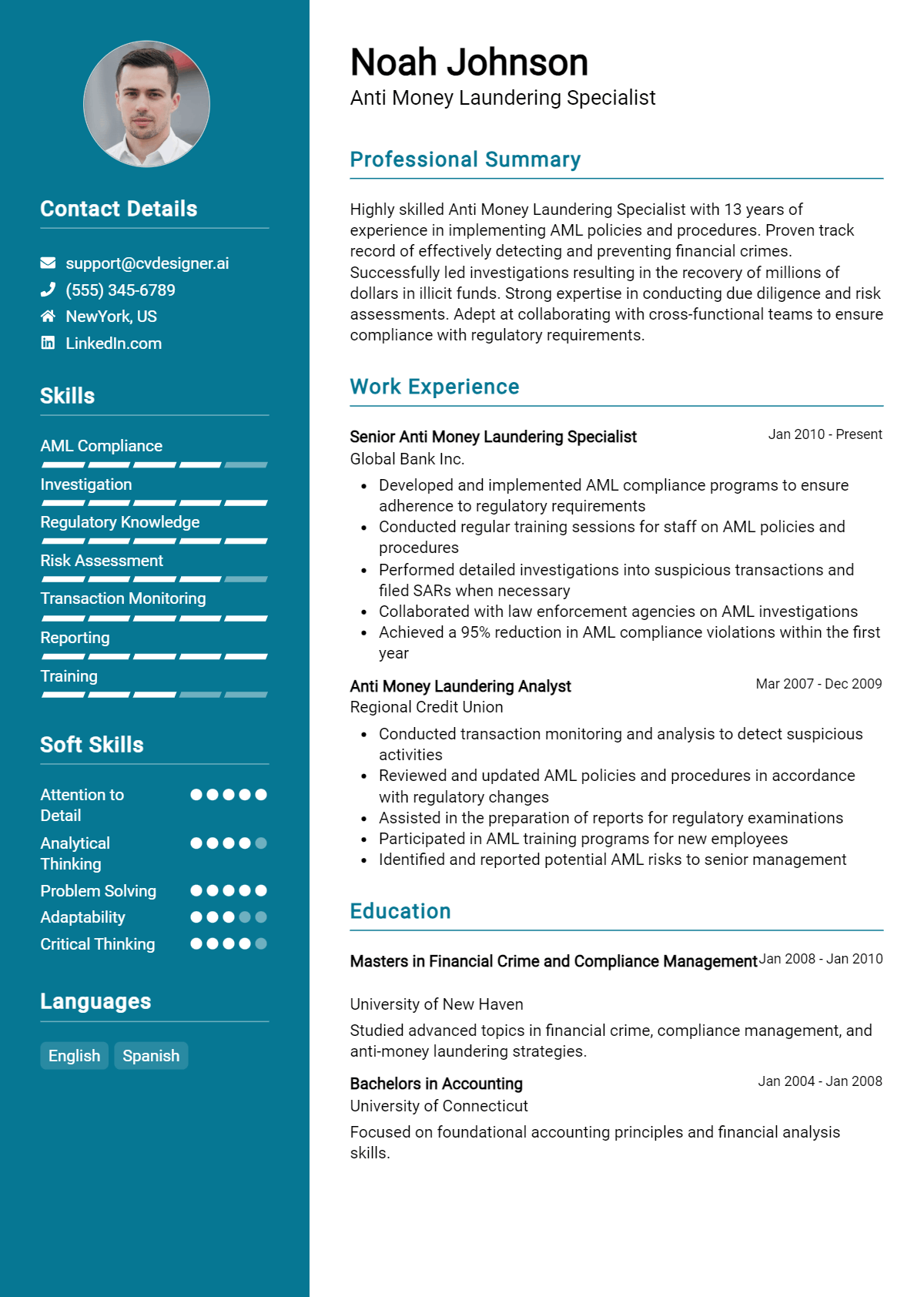

An Anti-Money Laundering (AML) Specialist plays a crucial role in safeguarding financial institutions by monitoring and analyzing transactions to detect suspicious activities. This position requires strong technical knowledge of regulatory frameworks, operational skills for implementing compliance measures, and problem-solving abilities to investigate anomalies. By collaborating with various departments like compliance, legal, and finance, AML Specialists ensure adherence to laws and contribute to the organization's integrity. A well-structured resume showcasing these qualifications is essential for demonstrating expertise and value in this vital role.

Common Responsibilities Listed on Anti-Money Laundering Specialist Resume

- Conducting risk assessments to identify potential money laundering threats.

- Monitoring transactions for suspicious activity using advanced analytics tools.

- Preparing detailed reports on findings and recommendations for compliance.

- Collaborating with law enforcement and regulatory agencies when necessary.

- Developing and implementing AML training programs for staff.

- Staying updated on regulatory changes and industry best practices.

- Reviewing and enhancing internal policies and procedures.

- Performing due diligence on clients and high-risk transactions.

- Investigating alerts generated by transaction monitoring systems.

- Maintaining accurate records of investigations and reporting them to management.

- Assisting in audits and examinations by regulatory bodies.

- Providing insights for improving the organization's AML strategies.

High-Level Resume Tips for Anti-Money Laundering Specialist Professionals

In the competitive field of Anti-Money Laundering (AML) compliance, a well-crafted resume is not just a formality; it's a vital tool that can open doors to new opportunities. Your resume serves as the first impression you make on potential employers, and it needs to encapsulate your skills, achievements, and dedication to the fight against financial crime. It should clearly demonstrate your understanding of AML regulations and your ability to implement effective compliance strategies. This guide will provide practical and actionable resume tips specifically tailored for Anti-Money Laundering Specialist professionals, ensuring you stand out in a crowded job market.

Top Resume Tips for Anti-Money Laundering Specialist Professionals

- Tailor your resume to each job description by using keywords and phrases from the posting to align your skills with the employer's needs.

- Highlight your relevant experience prominently, particularly roles directly related to AML, compliance, or risk management.

- Quantify your achievements where possible, such as by stating the percentage reduction in suspicious activity reports (SARs) or successful audits you’ve overseen.

- Showcase industry-specific skills such as knowledge of FinCEN regulations, BSA compliance, and familiarity with AML software tools.

- Include relevant certifications, such as Certified Anti-Money Laundering Specialist (CAMS) or Anti-Money Laundering Certified Associate (AMLCA), to enhance your credibility.

- Incorporate a summary statement at the top of your resume that succinctly conveys your expertise and career goals in AML.

- Use action verbs to describe your responsibilities and accomplishments to create a dynamic and engaging narrative.

- Maintain a clean, professional format that is easy to read, ensuring that key information is easily accessible to hiring managers.

- Consider including a section for continuing education or professional development that highlights your commitment to staying current in the field.

By implementing these tips, you can significantly enhance your resume and increase your chances of securing a position as an Anti-Money Laundering Specialist. A well-structured and tailored resume not only showcases your qualifications but also demonstrates your understanding of the complexities and importance of AML compliance in today's financial landscape.

Why Resume Headlines & Titles are Important for Anti-Money Laundering Specialist

In the competitive field of anti-money laundering (AML), a well-crafted resume is essential for standing out among a pool of qualified candidates. The resume headline or title serves as the first impression of a candidate's qualifications, providing a succinct summary of their expertise and focus. A strong headline can immediately capture the attention of hiring managers, offering a clear snapshot of what the candidate brings to the table. Thus, it is critical that this element is concise, relevant, and directly aligned with the job being applied for, as it sets the tone for the entire resume.

Best Practices for Crafting Resume Headlines for Anti-Money Laundering Specialist

- Keep it concise—aim for one impactful phrase.

- Use industry-specific terminology to highlight expertise.

- Incorporate relevant certifications or qualifications.

- Focus on key skills that align with the job description.

- Highlight years of experience in the AML field.

- Use action-oriented language to convey proactivity.

- Tailor the headline for each specific job application.

- Make sure it reflects the value you can bring to the organization.

Example Resume Headlines for Anti-Money Laundering Specialist

Strong Resume Headlines

"Certified Anti-Money Laundering Specialist with 5+ Years of Experience in Risk Assessment"

“Proven Track Record in Detecting and Preventing Financial Crimes in Banking Sector”

“Detail-Oriented AML Analyst Specializing in Transaction Monitoring and Compliance”

Weak Resume Headlines

“Just Another AML Specialist”

“Looking for a Job in Finance”

The strong headlines are effective because they convey specific qualifications and relevant experience that align with the demands of the anti-money laundering role. They use precise language that resonates with hiring managers, presenting the candidate as a valuable asset to the organization. In contrast, the weak headlines lack clarity and specificity, failing to communicate the candidate’s unique strengths or qualifications, making them easily forgettable in a competitive job market.

Writing an Exceptional Anti-Money Laundering Specialist Resume Summary

A well-crafted resume summary is crucial for an Anti-Money Laundering (AML) Specialist as it serves as the first impression on hiring managers, encapsulating the candidate's key skills, relevant experience, and notable accomplishments in a succinct manner. In the highly specialized field of AML, where attention to detail and analytical skills are paramount, a strong summary can effectively capture the hiring manager's attention and set the tone for the rest of the resume. It should be concise, impactful, and tailored specifically to the job being applied for, ensuring that the candidate stands out in a competitive job market.

Best Practices for Writing a Anti-Money Laundering Specialist Resume Summary

- Quantify Achievements: Use numbers to highlight your successes, such as the percentage of suspicious activities you identified or the amount of recoveries made.

- Focus on Relevant Skills: Highlight key skills that are specifically mentioned in the job description, such as regulatory knowledge, analytical skills, and investigative techniques.

- Tailor for the Job: Customize the summary for each job application, reflecting the specific requirements and responsibilities outlined in the job posting.

- Be Concise: Aim for 3-5 sentences that provide a quick overview of your qualifications without overwhelming the reader.

- Use Action-Oriented Language: Start sentences with strong action verbs that convey a sense of initiative and impact.

- Highlight Certifications: If you hold relevant certifications (e.g., CAMS, CFE), mention them to strengthen your credibility in the field.

- Showcase Industry Knowledge: Mention familiarity with regulatory frameworks and compliance standards relevant to the position.

- Include Soft Skills: Don’t forget to highlight soft skills such as communication, teamwork, and problem-solving that are essential for collaboration in AML investigations.

Example Anti-Money Laundering Specialist Resume Summaries

Strong Resume Summaries

Detail-oriented Anti-Money Laundering Specialist with over 5 years of experience in conducting comprehensive investigations and risk assessments, successfully identifying and reporting over $2 million in suspicious transactions. Proven expertise in regulatory compliance and proficiency in using AML software, including Actimize and SAS.

Dynamic AML professional with a track record of implementing effective monitoring systems that reduced false positives by 30%. Expert in analyzing complex financial data and providing actionable insights to senior management, contributing to a 25% increase in compliance adherence.

Results-driven Anti-Money Laundering Specialist skilled in developing and executing training programs that enhanced team knowledge on AML regulations, leading to a 40% improvement in detection rates of fraudulent activities. Holds CAMS certification and proficient in KYC and due diligence processes.

Weak Resume Summaries

Anti-Money Laundering Specialist with some experience in the field. Good at analyzing data and following regulations.

Dedicated professional looking for a job in AML. Familiar with compliance and investigation processes but lacks specific accomplishments.

The strong resume summaries are considered effective because they provide quantifiable results, specific skills, and align closely with the job role, demonstrating the candidate's direct relevance to the position. In contrast, the weak summaries are vague and lack measurable outcomes, making them less impactful and memorable to hiring managers. They fail to convey the candidate's unique value proposition and do not engage the reader effectively.

Work Experience Section for Anti-Money Laundering Specialist Resume

The work experience section of an Anti-Money Laundering Specialist resume is essential as it provides a detailed account of the candidate's professional history, demonstrating their technical skills, team management capabilities, and the ability to deliver high-quality outcomes in a fast-paced regulatory environment. This section not only highlights specific experiences that align with industry standards but also quantifies achievements, which is critical in showcasing the candidate's effectiveness in combating financial crime and ensuring compliance with relevant laws. By presenting measurable results and clearly defined responsibilities, candidates can effectively communicate their qualifications and suitability for the role.

Best Practices for Anti-Money Laundering Specialist Work Experience

- Highlight relevant technical skills, such as knowledge of AML regulations, KYC procedures, and data analysis tools.

- Use quantifiable results to demonstrate impact, such as the percentage of suspicious activity reports filed or the reduction in false positives.

- Showcase any collaboration with law enforcement or regulatory agencies to emphasize teamwork and communication skills.

- Include specific examples of leading or training teams in AML practices to illustrate leadership capabilities.

- Detail the use of technology in AML efforts, highlighting proficiency in software tools like transaction monitoring systems.

- Align experiences with industry standards and best practices to demonstrate a thorough understanding of the AML landscape.

- Use action verbs to convey a proactive approach to problem-solving and compliance management.

- Tailor the experience section to the job description to ensure relevance and alignment with employer expectations.

Example Work Experiences for Anti-Money Laundering Specialist

Strong Experiences

- Led a team of 5 in the investigation and reporting of over 200 suspicious transactions, resulting in a 30% increase in compliance with regulatory reporting requirements.

- Implemented a new transaction monitoring system that reduced false positive alerts by 40%, significantly increasing the efficiency of the compliance department.

- Collaborated with law enforcement agencies on high-profile cases, contributing to the successful identification and prosecution of money laundering operations.

- Developed and executed a comprehensive training program for 50+ employees on AML best practices, enhancing overall team competency and awareness.

Weak Experiences

- Worked on various compliance tasks and attended meetings.

- Helped with the investigation of suspicious activities occasionally.

- Participated in training sessions related to AML processes.

- Assisted in filing reports when necessary.

The strong experiences listed showcase clear achievements, measurable outcomes, and demonstrate the candidate's ability to lead teams effectively and collaborate with external agencies. In contrast, the weak experiences are vague and lack quantifiable results, failing to illustrate the candidate's true impact or technical expertise in the field. Highlighting specific accomplishments and responsibilities is key to making a strong impression on potential employers.

Education and Certifications Section for Anti-Money Laundering Specialist Resume

The education and certifications section of an Anti-Money Laundering Specialist resume is crucial as it underscores the candidate's academic credentials, industry-relevant qualifications, and commitment to ongoing professional development. This section not only provides prospective employers with insights into the candidate's formal education but also highlights specialized training and certifications that are essential in the fight against financial crime. By including relevant coursework and recognized certifications, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role.

Best Practices for Anti-Money Laundering Specialist Education and Certifications

- Include degrees related to finance, criminal justice, or economics to showcase relevant academic background.

- List industry-recognized certifications such as Certified Anti-Money Laundering Specialist (CAMS) or Certified Financial Crime Specialist (CFCS).

- Provide specific coursework that directly relates to anti-money laundering, compliance, or financial regulations.

- Highlight any additional training or workshops attended that focus on current trends in financial crime prevention.

- Use clear formatting to distinguish between degrees, certifications, and relevant training for better readability.

- Prioritize the most relevant and advanced credentials to emphasize your qualifications for the role.

- Include dates of completion for certifications to demonstrate up-to-date knowledge and skills.

- Avoid listing outdated or irrelevant qualifications that do not pertain to the anti-money laundering field.

Example Education and Certifications for Anti-Money Laundering Specialist

Strong Examples

- Bachelor of Science in Criminal Justice, University of XYZ, 2020

- Certified Anti-Money Laundering Specialist (CAMS), 2021

- Master’s in Finance with a focus on Risk Management, ABC University, 2022

- Advanced Anti-Money Laundering Training, Financial Crime Institute, 2023

Weak Examples

- Bachelor of Arts in History, University of ABC, 2018

- Certification in Basic Accounting Practices, 2010

- Diploma in Office Administration, College of DEF, 2015

- Online Course in General Business Principles, 2020

The examples listed as strong are considered relevant because they directly align with the skills and knowledge required for a career as an Anti-Money Laundering Specialist. They showcase degrees and certifications that focus on compliance, risk management, and financial crime prevention. In contrast, the weak examples represent qualifications that lack relevance to the field of anti-money laundering, either being outdated, unrelated, or too general to demonstrate a candidate's expertise in financial compliance and crime prevention.

Top Skills & Keywords for Anti-Money Laundering Specialist Resume

As an Anti-Money Laundering (AML) Specialist, possessing the right skills is crucial to effectively combat financial crime and ensure compliance with regulatory standards. The role demands a keen analytical mindset, attention to detail, and a thorough understanding of financial systems. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing an interview. By showcasing your expertise in AML practices, regulatory compliance, and risk assessment alongside interpersonal abilities like communication and problem-solving, you present yourself as a well-rounded candidate ready to tackle the complexities of the financial sector.

Top Hard & Soft Skills for Anti-Money Laundering Specialist

Soft Skills

- Analytical Thinking

- Problem Solving

- Attention to Detail

- Effective Communication

- Team Collaboration

- Ethical Judgment

- Adaptability

- Time Management

- Critical Thinking

- Conflict Resolution

Hard Skills

- Knowledge of AML Regulations (e.g., BSA, USA PATRIOT Act)

- Transaction Monitoring

- Risk Assessment Techniques

- Data Analysis and Reporting

- Financial Crime Investigation

- Familiarity with KYC (Know Your Customer) procedures

- Use of AML Software and Tools

- Understanding of Financial Instruments

- Regulatory Compliance

- Audit and Review Procedures

For a comprehensive understanding of how to effectively incorporate these skills into your resume, make sure to also consider your relevant work experience that demonstrates your capabilities in these areas.

Stand Out with a Winning Anti-Money Laundering Specialist Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Anti-Money Laundering Specialist position at [Company Name], as advertised on [Job Board/Company Website]. With a solid background in financial compliance and a keen eye for detail, I am excited about the opportunity to contribute to your team and help safeguard your organization against financial crimes. My experience in conducting thorough investigations, analyzing complex data, and developing effective compliance programs has equipped me with the skills necessary to excel in this role.

In my previous position at [Previous Company Name], I was responsible for monitoring transactions and identifying suspicious activities in accordance with regulatory requirements. Through my diligent efforts, I successfully increased the detection rate of potential money laundering activities by 30%, ensuring that our compliance protocols met the highest standards. My ability to work collaboratively with law enforcement and regulatory bodies allowed me to implement effective reporting mechanisms that enhanced our organization's reputation and compliance culture.

I am particularly drawn to the opportunity at [Company Name] due to your commitment to innovation in combating financial crime. I am eager to leverage my analytical skills and knowledge of AML regulations, including the Bank Secrecy Act and the USA PATRIOT Act, to support your mission. My proactive approach to risk assessment and my ability to adapt to evolving regulatory landscapes will enable me to contribute positively to your team while helping to mitigate potential risks effectively.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the needs of your organization. I am excited about the opportunity to help [Company Name] maintain its integrity and commitment to compliance in the ever-changing financial landscape.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Anti-Money Laundering Specialist Resume

When crafting a resume for an Anti-Money Laundering (AML) Specialist position, it's crucial to highlight your expertise and experience while avoiding common pitfalls that can undermine your application. Many candidates make mistakes that can detract from their qualifications and diminish their chances of landing an interview. By being aware of these common errors, you can create a more compelling and effective resume that showcases your skills and knowledge in the AML field.

Overloading with Jargon: Using excessive technical terminology can alienate hiring managers. Ensure your resume is approachable and clearly communicates your qualifications.

Neglecting Relevant Certifications: Failing to highlight AML-specific certifications (like CAMS or CFE) can leave hiring managers questioning your credentials. Always include relevant professional designations prominently.

Generic Objective Statements: A vague or generic objective does little to capture attention. Tailor your objective to the specific AML role you are applying for to demonstrate your genuine interest.

Ignoring Quantifiable Achievements: Resumes that lack measurable achievements can seem less impactful. Use specific metrics (e.g., "reduced false positives by 30%") to illustrate your contributions and effectiveness.

Inconsistent Formatting: A disorganized or inconsistent format can make your resume hard to read. Use a clean, professional layout with uniform font sizes and styles for clarity.

Listing Duties Instead of Accomplishments: Simply listing job responsibilities fails to showcase your impact. Focus on what you achieved in your previous roles rather than just what you did.

Omitting Soft Skills: AML positions often require strong analytical and communication skills. Neglecting to mention these can give a skewed view of your capabilities; ensure you incorporate relevant soft skills.

Lack of Tailoring for Each Application: Sending out a one-size-fits-all resume can miss the mark. Customize your resume for each position to align with the specific requirements and priorities of the job description.

Conclusion

As we conclude our exploration of the Anti-Money Laundering Specialist role, it's essential to reflect on the key competencies and skills that define success in this field. From a thorough understanding of regulatory frameworks to the ability to analyze complex financial transactions, the importance of detail-oriented investigation cannot be overstated. We also highlighted the critical role of technology in aiding compliance efforts and the ever-evolving landscape of financial crime prevention.

To position yourself effectively for opportunities in this vital sector, it is crucial to have a compelling resume that showcases your expertise and experience. We encourage you to take a moment to review and refine your Anti-Money Laundering Specialist resume.

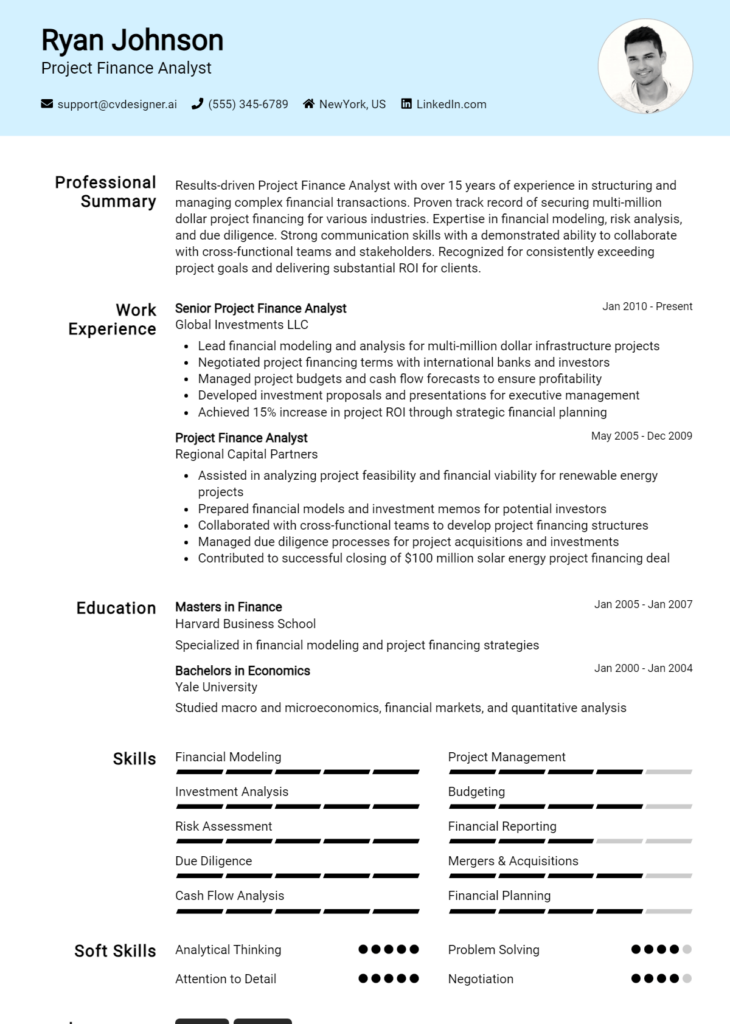

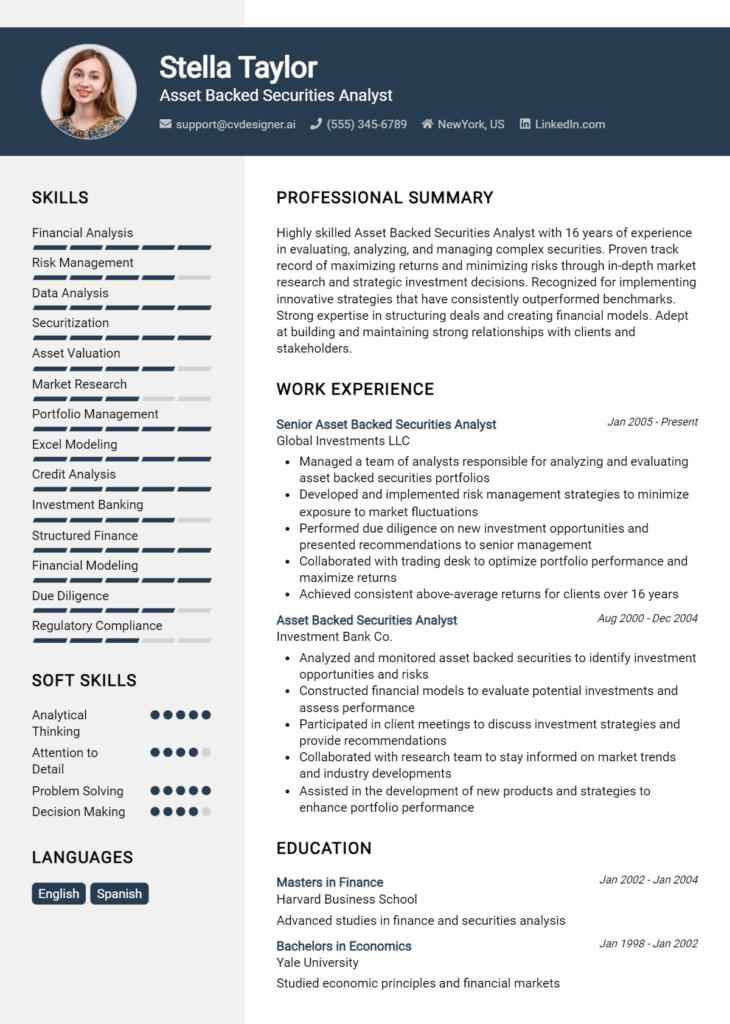

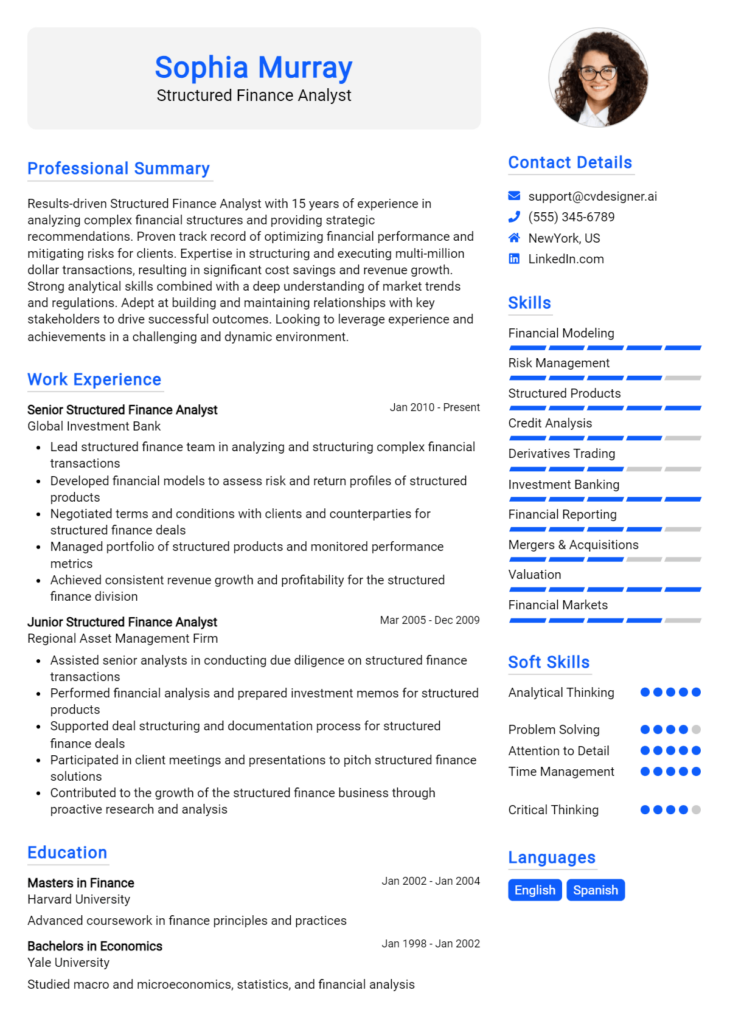

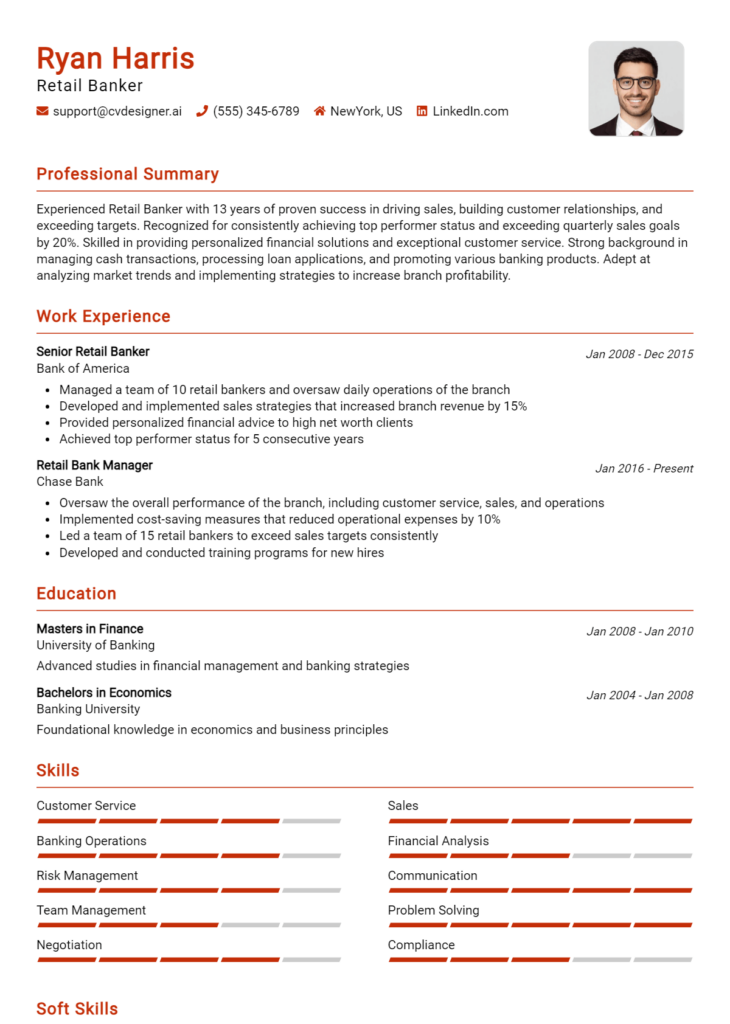

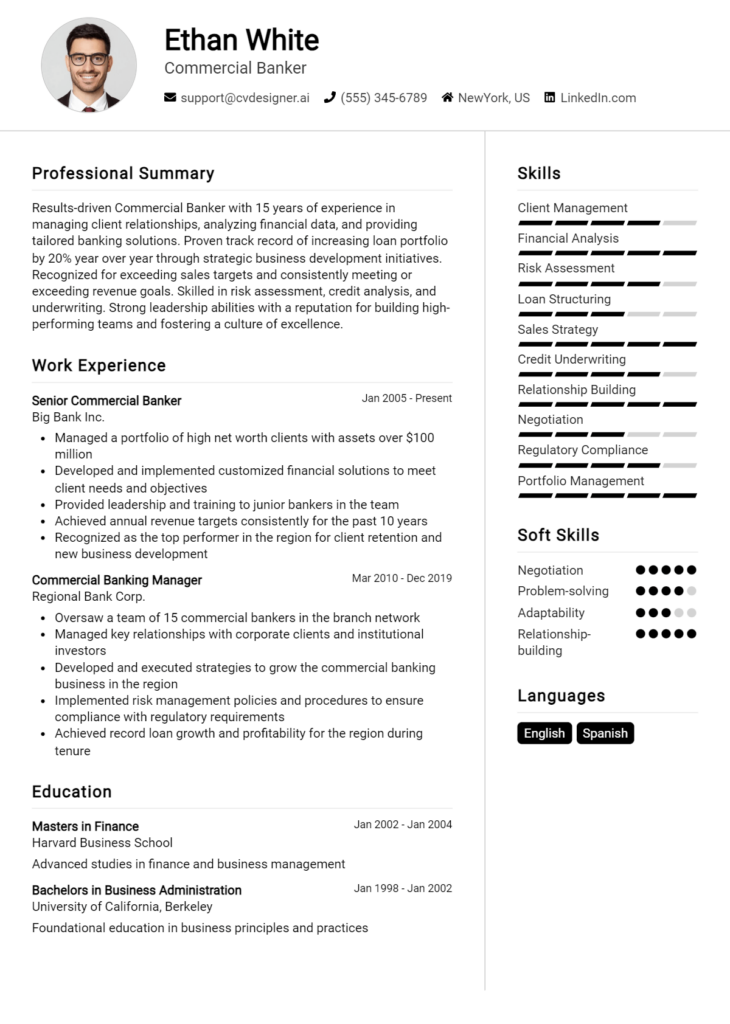

To assist you in this endeavor, there are numerous resources available that can help elevate your application materials. Explore our resume templates, which provide professional layouts tailored for your needs. If you prefer a more customized approach, check out our easy-to-use resume builder that allows you to craft a unique resume that reflects your personal brand. Additionally, you can gain inspiration from our extensive collection of resume examples tailored for various roles, including Anti-Money Laundering Specialists. Don’t forget to enhance your application with a standout cover letter by utilizing our cover letter templates.

Take action today—ensure your resume is as robust as the skills and expertise you bring to the table!