Wealth Manager Cover Letter Examples

Explore additional Wealth Manager cover letter samples and guides and see what works for your level of experience or role.

How to Format a Wealth Manager Cover Letter?

Crafting a compelling cover letter for a Wealth Manager position is essential for making a strong first impression. The formatting of your cover letter is not just about aesthetics; it reflects your professionalism and attention to detail—qualities that are paramount in wealth management. A well-structured cover letter serves to engage the hiring manager, effectively showcasing your expertise in financial planning, investment strategies, and client relationship management.

In this guide, we will outline how to format your cover letter, providing insights and wealth management-specific examples to help you create a persuasive document.

We’ll cover the critical components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section plays a crucial role in presenting your qualifications and demonstrating your suitability for the role. Let’s delve into each part to ensure your Wealth Manager cover letter stands out.

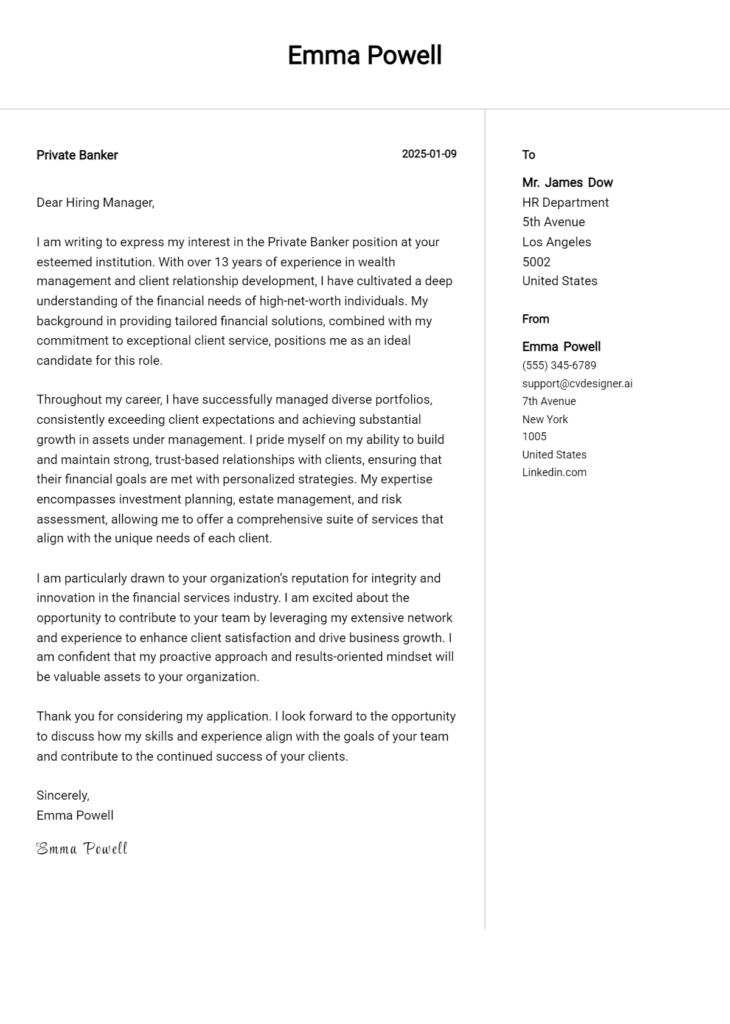

Importance of the Cover Letter Header for a Wealth Manager

The cover letter header is a critical component of a Wealth Manager's application as it sets the tone for professionalism and clarity. A well-structured header not only provides essential contact information but also establishes your credibility in the financial sector. It should include your name, address, phone number, email, the date, and the recipient's details, ensuring that the hiring manager can easily reach you. A clear and professional header reflects your attention to detail, which is crucial in wealth management, where precision and organization are paramount.

Strong Example

John Doe 123 Wealth Ave Finance City, FC 12345 (123) 456-7890 johndoe@email.com October 1, 2023 Jane Smith Hiring Manager Wealth Management Firm 456 Investment Rd Finance City, FC 67890

Weak Example

john doe email: johndoe@email.com 123-456-7890 10/1/2023 jane s Wealth Firm

The Importance of a Strong Cover Letter Greeting for Wealth Managers

The greeting of a cover letter serves as the first impression, setting the tone for the reader's perception of the applicant. A well-crafted greeting demonstrates professionalism and shows that the candidate has taken the time to personalize their application by addressing the hiring manager directly. This attention to detail can help differentiate a candidate in a competitive field like wealth management. To create an impactful greeting, avoid generic salutations such as "To Whom It May Concern." Instead, invest time in researching the recipient's name and title whenever possible, as this effort conveys a genuine interest in the role and the organization.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Compelling Cover Letter Introduction for a Wealth Manager

A well-crafted cover letter introduction is crucial for a Wealth Manager as it serves as the first impression to the hiring manager. This introduction should not only capture attention but also express genuine interest in the role while succinctly showcasing the candidate's key skills or notable achievements. A strong introduction sets the tone for the rest of the cover letter, making it more likely that the hiring manager will continue reading. Conversely, a weak introduction may fail to engage, leaving a lackluster impression that could jeopardize the candidate’s chances. Below are examples of both strong and weak introductions to illustrate the difference.

Strong Example

Dear [Hiring Manager's Name], As a seasoned Wealth Manager with over eight years of experience in personalized financial planning and asset management, I am excited to apply for the Wealth Manager position at [Company Name]. Throughout my career, I have successfully guided high-net-worth clients in achieving their financial goals, resulting in a 30% increase in client satisfaction rates and over $100 million in managed assets. I am particularly drawn to [Company Name] due to its reputable commitment to client-centric service and innovative investment strategies.

Weak Example

Hi there, I am writing to apply for the Wealth Manager job. I have worked in finance for a while and think I would be a good fit. I've helped some clients with their money, and I hope to bring my skills to your company.

Purpose of the Cover Letter Body for a Wealth Manager

The cover letter body for a Wealth Manager serves to succinctly convey the candidate's relevant skills, experiences, and the unique value they bring to the prospective employer. This section is critical for demonstrating how past accomplishments align with the company's goals and client needs. It provides an opportunity to highlight specific projects, such as successfully managing a high-net-worth portfolio, implementing financial strategies that led to significant growth, or developing new client relationships that enhanced the firm's reputation. By showcasing quantifiable achievements, candidates can effectively illustrate their capabilities and potential contributions to the firm's success.

Strong Example

Dear [Hiring Manager's Name], I am excited to apply for the Wealth Manager position at [Company Name]. In my previous role at [Previous Company Name], I successfully managed a portfolio of over $200 million, achieving an annual return of 12% through strategic asset allocation and risk management techniques. One of my key projects involved redesigning investment strategies for a select group of high-net-worth clients, which resulted in a 30% increase in client satisfaction scores. I pride myself on building long-term relationships and have expanded my client base by 25% in under two years by utilizing personalized financial planning and investment advice tailored to each client's unique goals. Sincerely, [Your Name]

Weak Example

Dear [Hiring Manager's Name], I am interested in the Wealth Manager position at [Company Name]. I have some experience in finance and have worked with clients before. I think I would be a good fit for your company because I like helping people with their money. I have done some projects, but I don’t have specific details to share. I am eager to learn more and contribute to your team. Best regards, [Your Name]

Importance of the Cover Letter Closing for a Wealth Manager

The closing of a cover letter is crucial for a Wealth Manager as it serves to summarize the candidate's qualifications, reiterate their enthusiasm for the role, and encourage the hiring manager to take the next steps, such as reviewing the resume or scheduling an interview. A strong closing leaves a lasting impression and reinforces the candidate's fit for the position, while a weak closing can diminish the impact of the overall application.

Strong Example

In conclusion, I am excited about the opportunity to bring my extensive experience in wealth management and client relationship building to your esteemed firm. I believe my proven track record of providing tailored financial strategies aligns perfectly with your team's goals. I look forward to the possibility of discussing how I can contribute to the continued success of your clients and your organization. Thank you for considering my application; I hope to discuss my qualifications further in an interview.

Weak Example

I think I would probably be a good fit for this job. I have some experience in wealth management. Please look at my resume for more details. Thanks for your time.

Writing an effective cover letter for a Wealth Manager position is crucial for making a strong first impression. A well-crafted cover letter allows candidates to showcase their technical skills, problem-solving abilities, knowledge of the Software Development Life Cycle (SDLC), teamwork capabilities, and a commitment to continuous learning. By focusing on these areas, candidates can demonstrate their value to potential employers and stand out in a competitive job market. Here are some tips to help you create a compelling cover letter:

Cover Letter Writing Tips for Wealth Manager

Highlight Technical Skills: Begin your cover letter by clearly outlining your technical skills that are relevant to wealth management. Mention your proficiency in financial modeling, investment analysis, or portfolio management software. Use specific examples to illustrate how these skills have contributed to your past successes.

Emphasize Problem-Solving Abilities: Wealth managers often face complex financial challenges that require innovative solutions. Share a brief story or example that showcases your problem-solving abilities. Describe a situation where you identified a client’s financial issue and implemented a successful strategy to resolve it, demonstrating your analytical thinking and resourcefulness.

Showcase SDLC Knowledge: If your wealth management experience includes working with financial software systems, mention your understanding of the Software Development Life Cycle (SDLC). Explain how your knowledge of SDLC processes has enabled you to collaborate effectively with IT teams to enhance financial tools or streamline operations, benefiting both clients and the firm.

Demonstrate Teamwork Skills: Wealth management is often a collaborative effort that involves working with various stakeholders, including clients and financial advisors. Highlight your teamwork skills by discussing a project where you successfully collaborated with colleagues to achieve a common goal. Emphasize your ability to communicate effectively and build relationships within a team environment.

Express a Passion for Continuous Learning: The financial landscape is constantly evolving, and as a wealth manager, it’s essential to stay updated on industry trends and best practices. Convey your commitment to continuous learning by mentioning relevant certifications, courses, or professional development activities you’ve pursued. This demonstrates your initiative and dedication to providing the best service to your clients.

By incorporating these tips into your cover letter, you’ll be able to effectively showcase your qualifications and make a positive impression on potential employers in the wealth management field.

Common Mistakes to Avoid in a Wealth Manager Cover Letter

Crafting a compelling cover letter is essential for standing out as a Wealth Manager candidate. Avoiding common pitfalls can significantly enhance your chances of making a positive impression. Here are some frequent mistakes and tips on how to steer clear of them:

Generic Greetings: Using "To Whom It May Concern" can signal a lack of effort. Always try to address the letter to a specific person if possible.

Lack of Personalization: A generic cover letter may fail to resonate. Tailor your content to reflect the company's values and specific job requirements.

Overloading with Jargon: While industry terms are important, overusing jargon can alienate the reader. Use clear language and explain complex concepts succinctly.

Neglecting Achievements: Focusing too much on duties rather than accomplishments can weaken your case. Highlight specific successes and quantifiable results to demonstrate your impact.

Typos and Grammatical Errors: Spelling mistakes can undermine your professionalism. Always proofread your letter or use tools to catch errors before submission.

Being Too Formal or Informal: Striking the right tone is critical. Aim for a professional yet approachable voice that reflects your personality.

Ignoring the Call to Action: Failing to conclude with a strong call to action can leave your letter feeling unfinished. End with a statement expressing your eagerness to discuss your application further.

By being mindful of these common mistakes and implementing these tips, you can create a more effective and engaging cover letter that enhances your candidacy for a Wealth Manager position.

Cover Letter FAQs for Wealth Manager

What should I include in my cover letter as a Wealth Manager?

When writing a cover letter for a Wealth Manager position, focus on including your relevant experience, skills, and achievements. Start with a strong opening that captures the hiring manager's attention. Highlight your educational background, certifications (such as CFP or CFA), and any specific financial expertise you possess. Discuss your experience in portfolio management, client relationship building, and investment strategies. Use quantifiable achievements to demonstrate your capability, such as the percentage increase in client assets or successful wealth management initiatives. Finally, express your passion for helping clients achieve their financial goals and your alignment with the firm's values.

How do I tailor my cover letter for a specific Wealth Management firm?

Tailoring your cover letter involves researching the specific Wealth Management firm to understand its culture, values, and services. Start by mentioning the firm's name and any specific programs, initiatives, or values that resonate with you. Discuss how your skills and experiences align with their approach to wealth management. If the firm specializes in a particular client demographic or investment strategy, highlight your relevant experience in that area. Additionally, demonstrate your knowledge of the firm’s market position and how you can contribute to its success. A personalized cover letter shows genuine interest and indicates that you are a good fit for their team.

How can I demonstrate my relationship-building skills in my cover letter?

Relationship-building is crucial for a Wealth Manager. To showcase this skill in your cover letter, provide specific examples of how you have successfully cultivated client relationships in the past. Consider discussing a scenario where you proactively addressed a client’s financial concerns or helped them achieve a significant financial goal. Use metrics to illustrate your success, such as client retention rates or the growth of your client base. Additionally, emphasize your communication skills and your ability to listen to and understand client needs. This not only showcases your relationship-building abilities but also aligns with the core responsibilities of a Wealth Manager.

Should I include my investment philosophy in my cover letter?

Including your investment philosophy in your cover letter can be beneficial, as it provides insight into your approach to wealth management. Briefly articulate your investment philosophy, emphasizing how it aligns with the firm's values and client objectives. For instance, you could mention whether you prioritize risk management, diversification, or sustainable investing. However, keep it concise and relevant; avoid overly technical jargon that may confuse the reader. A well-articulated investment philosophy demonstrates your expertise and thoughtfulness in financial planning, making you a more compelling candidate for the Wealth Manager role.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.