Tax Manager Cover Letter Examples

Explore additional Tax Manager cover letter samples and guides and see what works for your level of experience or role.

How to Format a Tax Manager Cover Letter?

Crafting an impactful cover letter is essential for a Tax Manager, as it serves as your first impression to potential employers. The way you format your cover letter can significantly influence how your qualifications are perceived. A well-structured letter not only highlights your expertise in tax regulations and compliance but also demonstrates your organizational skills and attention to detail—attributes that are vital in the accounting field.

In this guide, we'll outline the key components of a professional cover letter, specifically tailored for tax professionals.

We'll focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is crucial in presenting your qualifications and professionalism effectively. Let’s break down each part and explore how to make your Tax Manager cover letter stand out.

The Importance of a Cover Letter Header for a Tax Manager

A well-structured cover letter header is crucial for a Tax Manager application as it sets the tone for the entire document. It provides essential contact information, dates, and recipient details, ensuring clarity and professionalism from the very start. A clear header allows hiring managers to quickly identify who the application is from, when it was sent, and to whom it is addressed. This attention to detail reflects the candidate's organizational skills and professionalism, both of which are vital in the field of tax management.

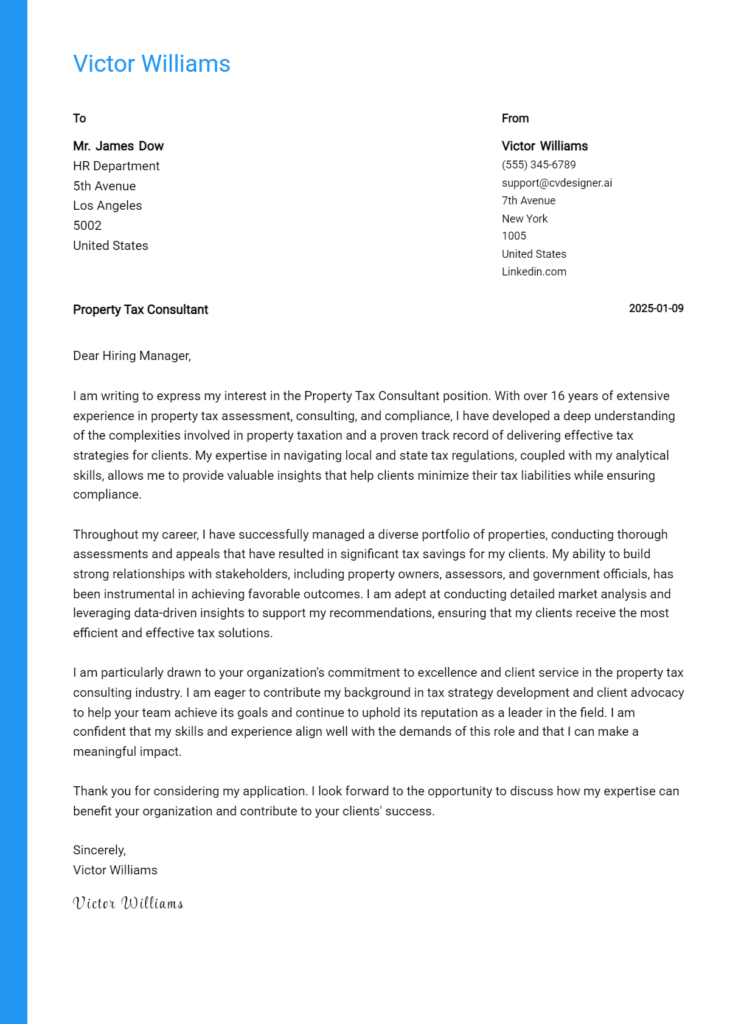

Strong Example

John Doe 123 Tax Lane Finance City, ST 12345 (123) 456-7890 johndoe@email.com October 15, 2023 Jane Smith Hiring Manager ABC Tax Solutions 456 Accounting Blvd Finance City, ST 67890

Weak Example

johndoe@email.com October 15, 2023 ABC Tax Solutions Finance City, ST

The Importance of a Cover Letter Greeting for a Tax Manager

The greeting of your cover letter is a crucial component that sets the tone for the entire document. It serves as your first impression and is an opportunity to demonstrate both professionalism and a personalized touch. Addressing the hiring manager directly not only shows respect but also indicates that you have taken the time to research the company and its personnel. Avoiding generic greetings, such as "To Whom It May Concern," can significantly enhance your letter's impact. Instead, make an effort to find the recipient's name, which helps to establish a connection and makes your application stand out.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Well-Crafted Cover Letter Introduction for a Tax Manager

A well-crafted cover letter introduction is crucial for a Tax Manager because it serves as the first impression a candidate makes on the hiring manager. This section should not only capture attention but also convey genuine interest in the role. It is an opportunity to highlight key skills and relevant achievements that demonstrate the candidate's suitability for the position. A strong introduction sets the tone for the rest of the cover letter and can significantly influence the hiring manager's decision to continue reading. In contrast, a weak introduction can fail to engage, leaving the candidate overlooked in a competitive field.

Strong Example

Dear [Hiring Manager's Name], As an accomplished Tax Manager with over seven years of experience in developing and implementing tax strategies for diverse organizations, I am excited to apply for the Tax Manager position at [Company Name]. My dedication to maximizing tax efficiency and compliance has resulted in a 30% reduction in tax liabilities for my current employer, and I am eager to bring this expertise to your esteemed team. I have a genuine passion for navigating the complexities of tax regulations, and I am particularly drawn to [Company Name] for its commitment to innovation and excellence in the industry.

Weak Example

To whom it may concern, I am writing to apply for the Tax Manager job. I have some experience in tax and accounting, but I don’t think it’s very relevant. I want to work for your company because it seems like a nice place to work. I hope you consider my application.

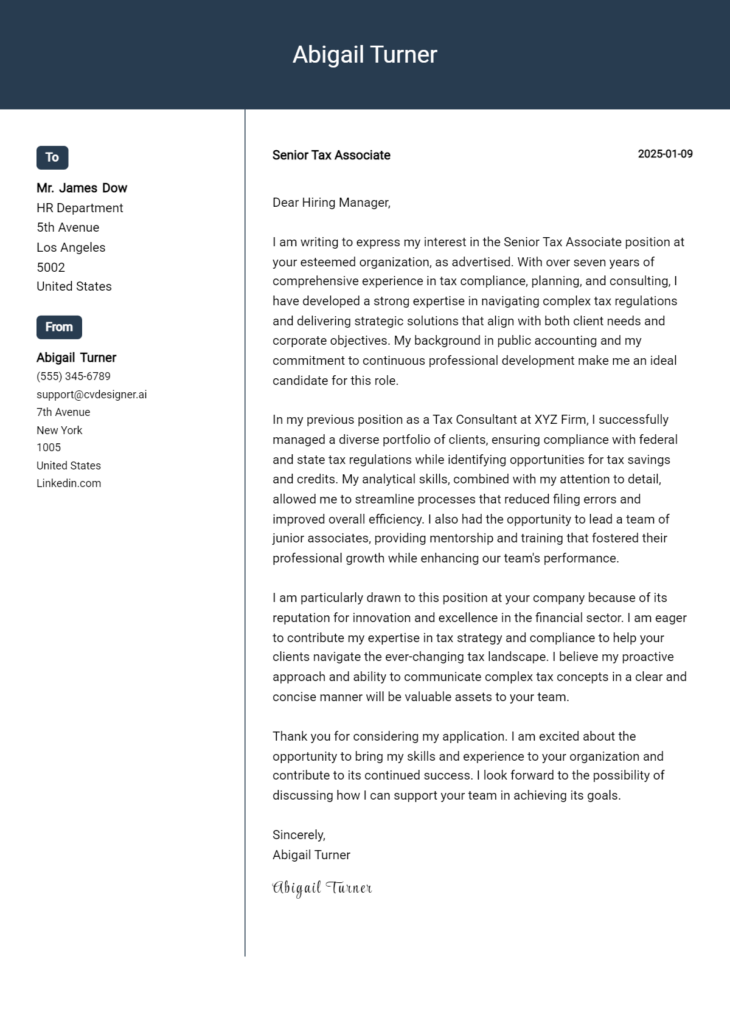

Purpose of the Cover Letter Body for a Tax Manager

The body of a cover letter for a Tax Manager is crucial as it serves to highlight the candidate's relevant skills, experiences, and the unique value they can bring to the organization. This section provides an opportunity to discuss specific projects or accomplishments that demonstrate the candidate's expertise in tax compliance, planning, and strategy. By detailing successful initiatives, such as leading a team through a complex tax audit or implementing a new tax software system that improved efficiency, the candidate can effectively convey their ability to contribute to the company's financial health and regulatory compliance. A well-crafted cover letter body not only showcases qualifications but also reflects the candidate's understanding of the company's needs and how they can help meet those objectives.

Strong Example

Dear Hiring Manager, I am excited to apply for the Tax Manager position at XYZ Corporation. With over seven years of experience in tax compliance and strategy, I successfully led a team that navigated a complex IRS audit, resulting in a favorable outcome that saved the company over $500,000 in potential penalties. Additionally, I spearheaded the implementation of an advanced tax software system that streamlined our reporting processes and reduced turnaround time by 30%. My proactive approach and strong analytical skills allow me to identify tax-saving opportunities that align with corporate goals, making me a strong fit for your team. Sincerely, John Doe

Weak Example

Dear Hiring Manager, I am writing to express my interest in the Tax Manager role at your company. I have done some tax work in my previous jobs. I think I would be a good fit because I know about taxes. I once helped with a tax return, and it went okay. I am eager to learn and grow in the field. Thank you for considering my application. Best, Jane Smith

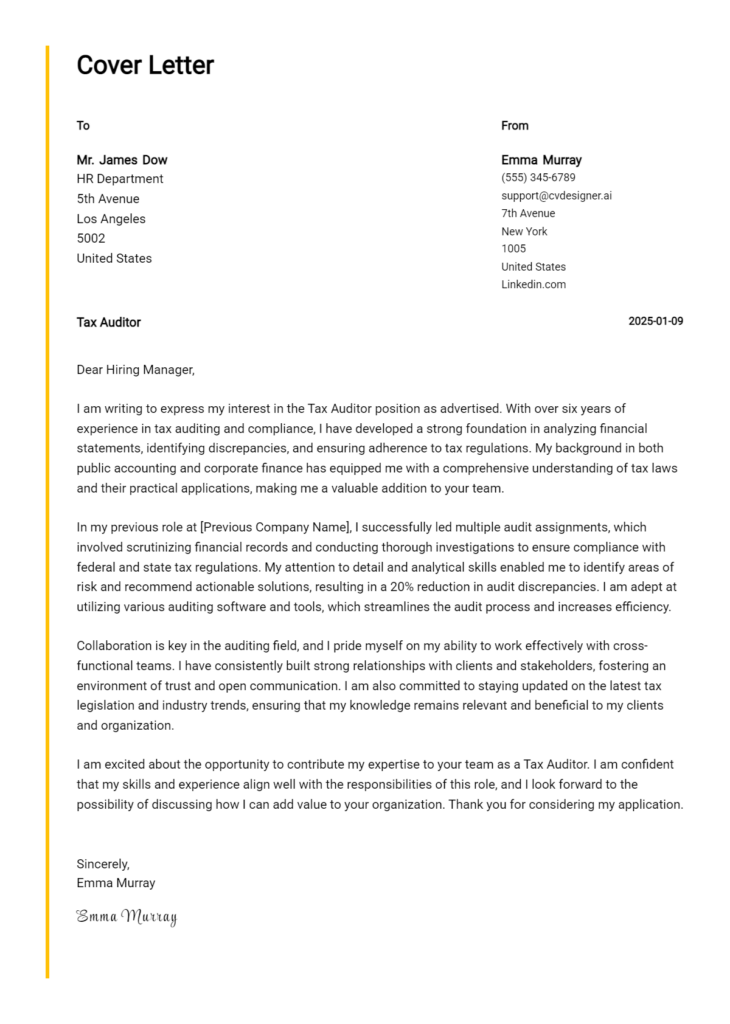

Importance of the Cover Letter Closing for a Tax Manager

The closing paragraph of a cover letter is crucial as it serves to summarize the applicant's qualifications, reiterate their interest in the position, and encourage the employer to take the next steps, such as reviewing the resume or scheduling an interview. A strong closing leaves a lasting impression and reinforces the candidate's enthusiasm for the role, while a weak closing may diminish the overall impact of the cover letter. Below are examples of both strong and weak closing paragraphs for a Tax Manager position.

Strong Example

Thank you for considering my application for the Tax Manager position at your esteemed firm. With over seven years of experience in tax compliance and strategic planning, I am excited about the opportunity to contribute my expertise to your team. I believe my proactive approach and attention to detail will bring significant value to your organization. I look forward to discussing how my background and skills align with your needs in greater detail. Please feel free to contact me to schedule an interview at your earliest convenience.

Weak Example

Thanks for reading my cover letter. I think I would be a decent fit for the Tax Manager role. I hope you look at my resume. Let me know if you want to talk or something.

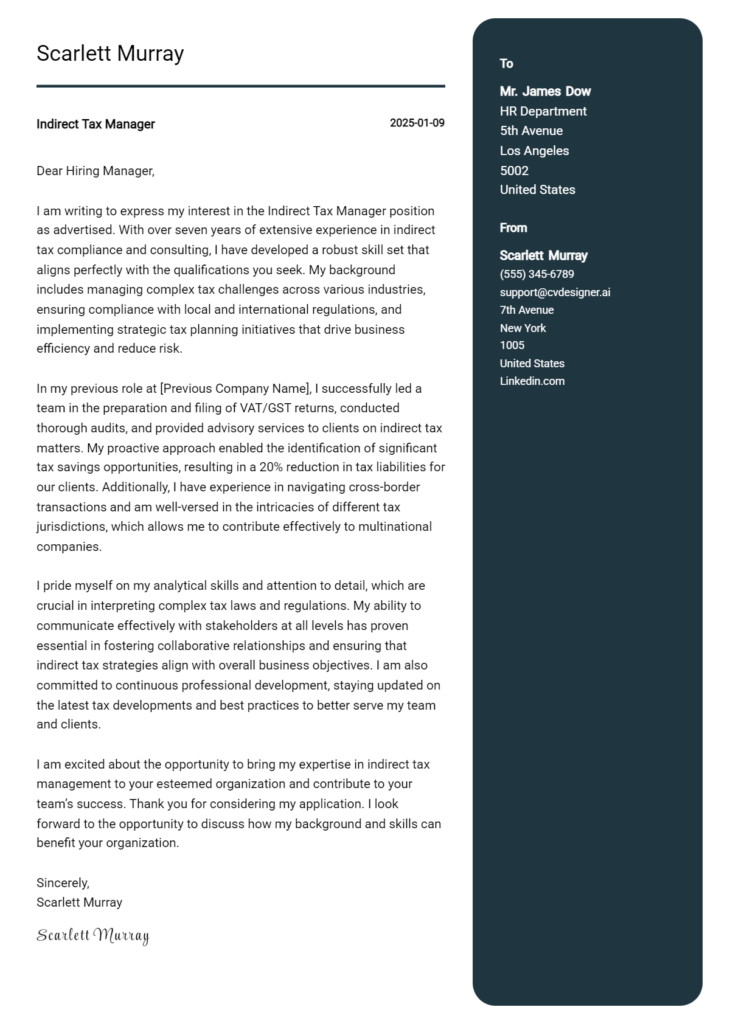

Crafting a compelling cover letter is essential for candidates seeking the role of Tax Manager. This document serves as a vital opportunity to showcase not only your technical skills and problem-solving abilities but also your understanding of the Software Development Life Cycle (SDLC), teamwork, and a commitment to continuous learning. The following tips will guide you in creating an effective cover letter that highlights these key areas and enhances your candidacy.

Cover Letter Writing Tips for Tax Manager

Highlight Technical Skills: Clearly articulate your technical competencies related to tax regulations, compliance, and software tools used in tax management. Mention specific software you are proficient in, such as ERP systems or tax preparation software, to demonstrate your readiness for the role.

Showcase Problem-Solving Abilities: Provide examples of past situations where you successfully identified and resolved tax-related issues. Discuss your analytical approach to problems and how you implemented solutions that benefited your previous employers. This will illustrate your capacity to navigate complex tax scenarios.

Demonstrate SDLC Knowledge: If applicable, mention your experience with the Software Development Life Cycle, especially if it relates to tax software or systems. Explain how your understanding of SDLC can contribute to improving tax processes and enhancing efficiency in your potential role.

Emphasize Teamwork: Tax management often involves collaboration with various departments. Highlight your experience working in teams, your ability to communicate effectively, and how you contribute to achieving common goals. Provide specific examples that demonstrate your collaborative spirit.

Express Passion for Continuous Learning: The tax landscape is constantly evolving, and showing a commitment to ongoing education is crucial. Mention any relevant courses, certifications, or seminars you have attended to stay updated on tax laws and practices. This demonstrates your proactive approach to professional development.

Utilizing these tips can significantly enhance your cover letter. For additional guidance, consider exploring cover letter templates or using a cover letter builder to create a polished and professional document.

Common Mistakes to Avoid in a Tax Manager Cover Letter

Crafting a compelling cover letter is essential for a Tax Manager position, as it serves as your first impression to potential employers. Avoiding common pitfalls can significantly enhance your chances of landing an interview. Here are some frequent mistakes to steer clear of, along with tips to improve your cover letter:

Generic Opening: Starting with a vague introduction can diminish your impact. Tailor your opening to the specific company and role to demonstrate genuine interest.

Neglecting Key Qualifications: Failing to highlight relevant skills and experiences can leave hiring managers unimpressed. Review the job description carefully and incorporate key qualifications that align with your background.

Overly Lengthy Content: A lengthy cover letter can lose the reader's attention. Aim for a concise format, ideally one page, to deliver your message effectively. For tips on structure, check out our cover letter format.

Lack of Specific Examples: General statements about your skills can come off as hollow. Use specific examples from your previous work to illustrate your expertise in tax management.

Spelling and Grammar Errors: Typos can undermine your professionalism. Proofread your cover letter multiple times and consider asking someone else to review it before submitting.

Ignoring Company Culture: Not addressing how you align with the company's values and culture can be a missed opportunity. Research the organization and weave this insight into your cover letter.

Missing a Call to Action: Concluding without a clear call to action can leave your letter flat. Express your eagerness to discuss your qualifications further, encouraging the employer to reach out.

By being mindful of these common mistakes, you can craft a more effective cover letter that stands out in the competitive field of tax management. For inspiration, explore our cover letter examples to see how others have successfully navigated these challenges.

Cover Letter FAQs for Tax Manager

What should I include in my cover letter for a Tax Manager position?

In your cover letter for a Tax Manager position, you should include your professional qualifications, relevant experience, and specific skills that align with the job description. Start with a strong opening that captures the hiring manager's attention. Highlight your experience in tax compliance, planning, and strategy, and mention any significant projects or achievements that demonstrate your expertise. It’s essential to showcase your knowledge of tax laws and regulations, your analytical skills, and your ability to lead a team. Additionally, express your enthusiasm for the company and how you can contribute to its goals. Tailoring your cover letter to the specific role will show your genuine interest and attention to detail.

How can I demonstrate my knowledge of tax laws in my cover letter?

To effectively demonstrate your knowledge of tax laws in your cover letter, provide specific examples of how you have applied this knowledge in past roles. Mention any certifications you hold, such as CPA or EA, and describe relevant experiences, such as managing audits, advising clients on tax strategies, or implementing compliance policies. Discuss your familiarity with both federal and state tax regulations, as well as any experience you have in international taxation if applicable. Additionally, consider referencing any continuing education or professional development courses you have completed to stay updated with changing laws. This not only showcases your expertise but also your commitment to professional growth.

How important is it to tailor my cover letter for each application?

Tailoring your cover letter for each application is crucial, especially for a competitive role like Tax Manager. A customized cover letter shows that you have taken the time to understand the specific needs of the company and how your skills align with their objectives. Use the job description as a guide to highlight relevant experiences and accomplishments that directly relate to the responsibilities outlined. Mention the company’s values or recent news to demonstrate your genuine interest. This personalized approach can set you apart from other candidates, making it more likely that the hiring manager will see you as a strong fit for the position.

Should I address my cover letter to a specific person?

Yes, addressing your cover letter to a specific person is highly recommended. If possible, find the name of the hiring manager or the person responsible for the hiring process. This adds a personal touch and demonstrates your initiative in researching the company. You can often find this information on the company’s website, LinkedIn, or by calling the company directly. If you cannot find a specific name, using a general greeting like “Dear Hiring Manager” is acceptable, but it’s best to avoid overly generic terms. Personalizing your salutation makes your cover letter more engaging and shows that you are serious about the application.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.