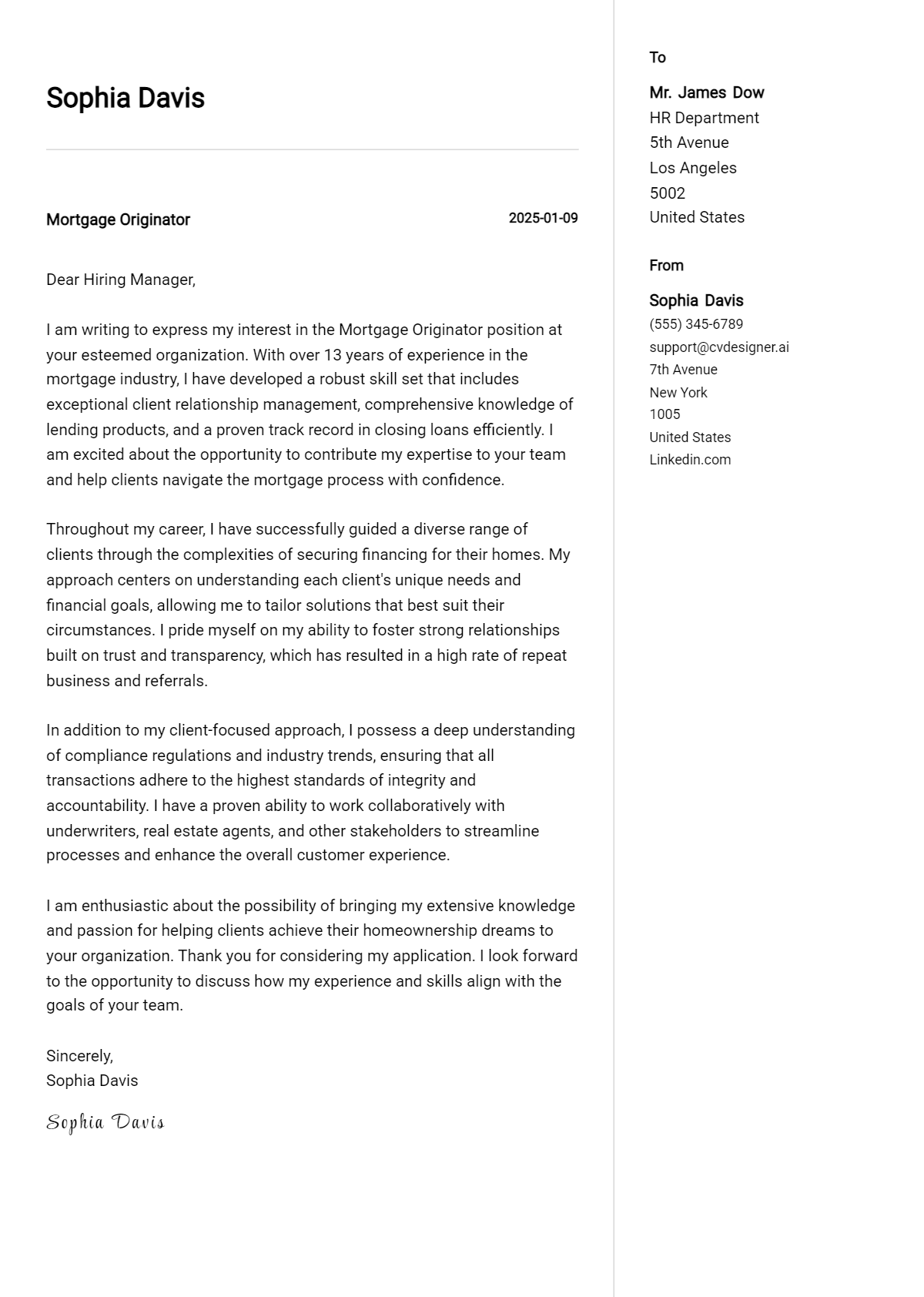

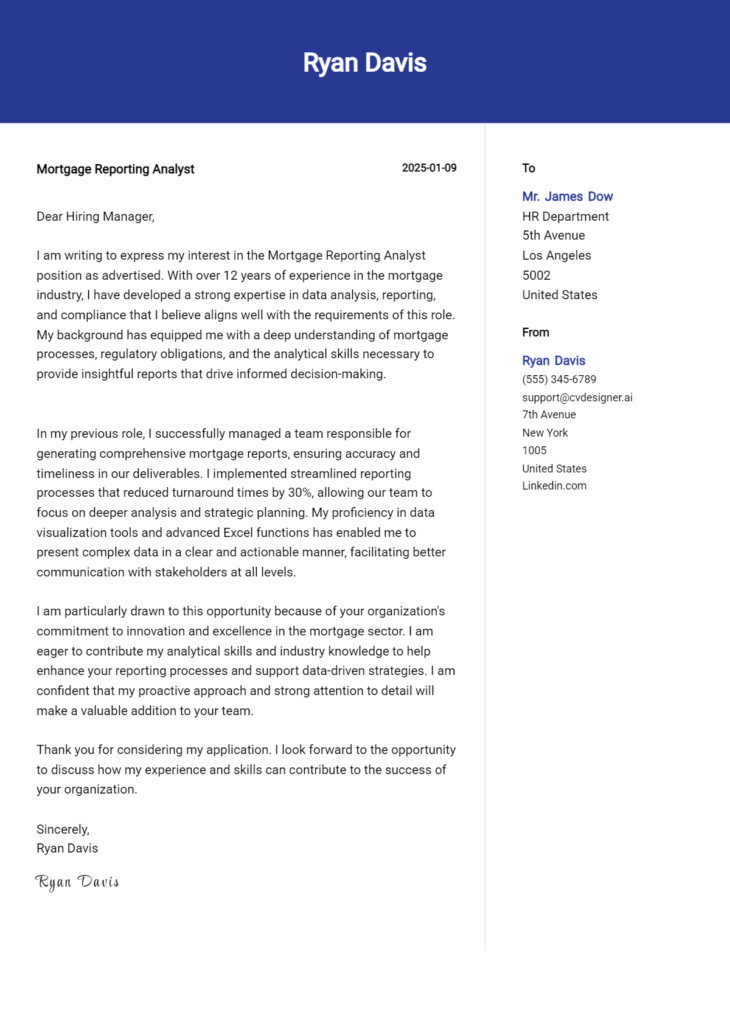

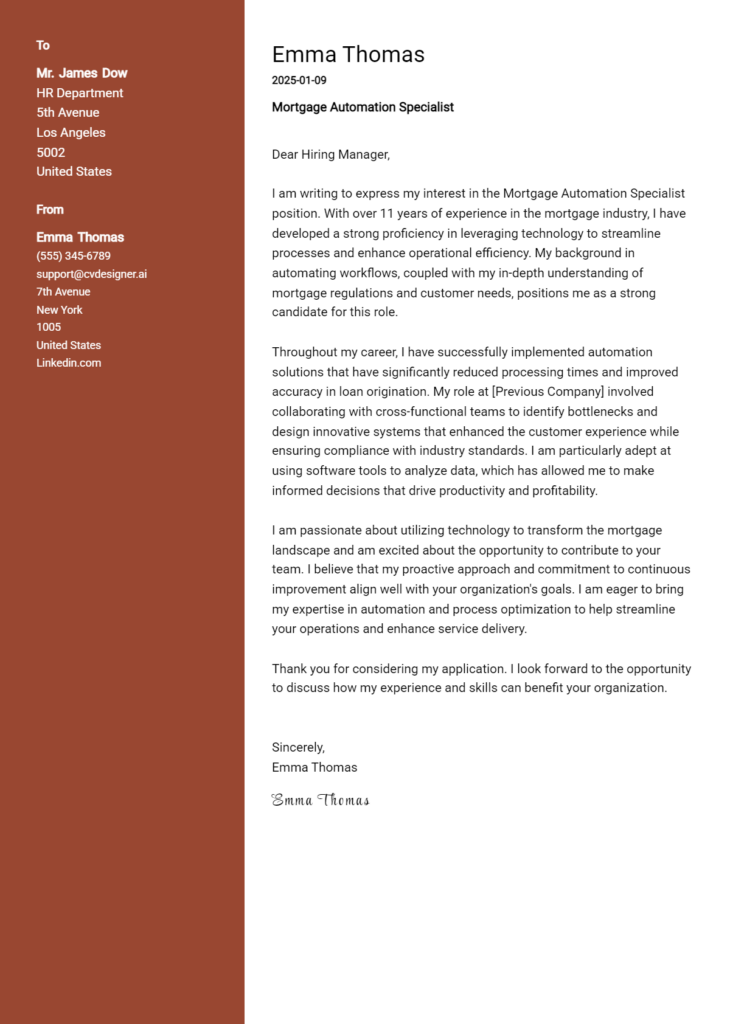

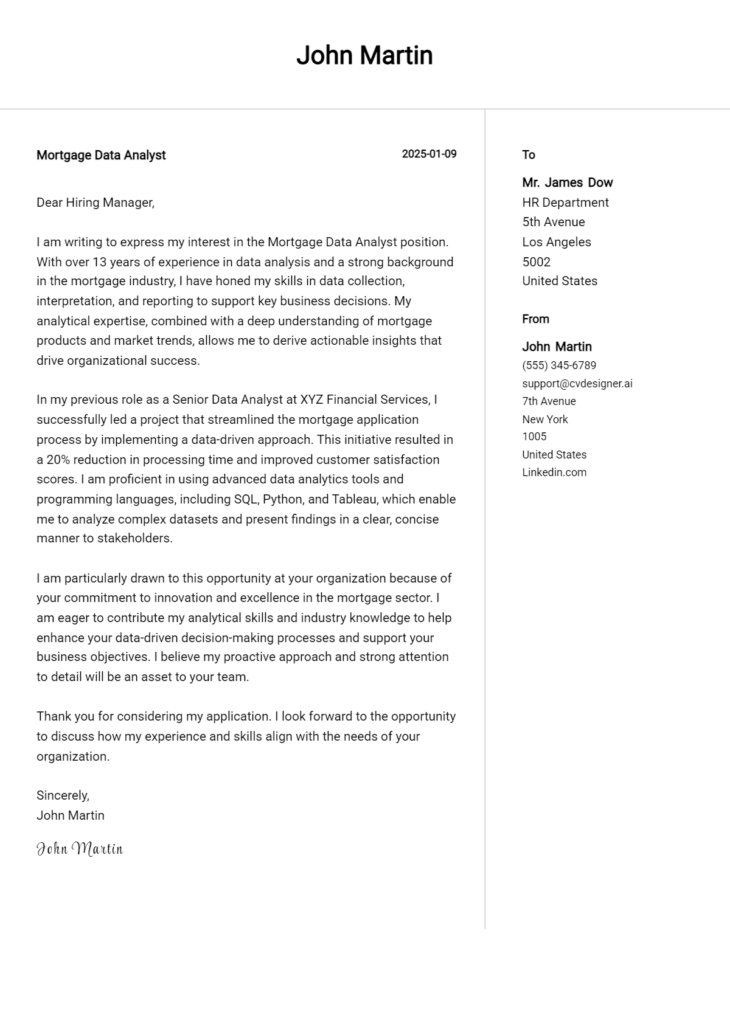

Mortgage Originator Cover Letter Examples

Explore additional Mortgage Originator cover letter samples and guides and see what works for your level of experience or role.

How to Format a Mortgage Originator Cover Letter?

Crafting an effective cover letter is essential for a Mortgage Originator, as it serves as your first impression to potential employers. Unlike other professions, the mortgage industry requires not only a strong grasp of financial principles but also exceptional interpersonal skills and attention to detail. A well-structured cover letter showcases your ability to communicate clearly and persuasively, which is vital in building client relationships and closing deals. The format of your cover letter can capture the hiring manager's attention and demonstrate your professionalism, setting you apart in a competitive job market.

In this guide, we'll explore how to structure your cover letter, providing specific insights tailored for Mortgage Originators to help you create a persuasive document.

We will focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is crucial in emphasizing your qualifications and professionalism. Let’s break down each part and explain how to make your Mortgage Originator cover letter shine.

Importance of the Cover Letter Header for a Mortgage Originator

The cover letter header is a critical component of a mortgage originator's application, as it sets the tone for professionalism and clarity. A well-structured header not only provides essential information such as the applicant's contact details, the date of the letter, and the recipient's information, but also conveys attention to detail and respect for the hiring manager's time. Clear formatting and accurate information help ensure that your application stands out positively in a competitive job market.

Strong Example

John Doe 123 Main Street City, State, Zip johndoe@email.com (123) 456-7890 [Date: October 1, 2023] Hiring Manager XYZ Mortgage Company 456 Elm Street City, State, Zip

Weak Example

John D. No. 123 Email: johndoe@email 10/1/23 To Whom It May Concern,

The Importance of a Cover Letter Greeting for a Mortgage Originator

The greeting of your cover letter is a critical component that sets the tone for the rest of your communication. It serves not only as an introduction but also as a demonstration of your professionalism and attention to detail. By addressing the hiring manager directly, you personalize your message and show genuine interest in the position. Avoiding generic greetings, such as "To Whom It May Concern," can make a significant difference in how your application is perceived. Instead, take the time to research the recipient's name, as this effort reflects your commitment and enthusiasm for the role of a Mortgage Originator. Below are examples of strong and weak greetings to illustrate this point.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Strong Cover Letter Introduction for a Mortgage Originator

A well-crafted cover letter introduction is crucial for a Mortgage Originator as it sets the tone for the entire application. This initial paragraph should engage the hiring manager, demonstrating not only your enthusiasm for the role but also highlighting your relevant skills and achievements. In a competitive job market, a strong introduction can differentiate you from other candidates, making it clear why you are the ideal fit for the position. Below are examples that illustrate the impact of a well-structured introduction.

Strong Example

Dear [Hiring Manager's Name], With over five years of experience in the mortgage industry and a proven track record of closing high-value loans, I was excited to see the Mortgage Originator position at [Company Name]. My commitment to providing exceptional customer service, coupled with my expertise in navigating complex loan processes, has consistently resulted in client satisfaction and increased referrals. I am eager to bring my skills and passion for helping individuals achieve their homeownership dreams to your esteemed team.

Weak Example

Hi there, I found the job listing for a Mortgage Originator, and I thought I should apply. I have worked in finance for a while, and I think I could do this job. I am familiar with mortgages and have helped some people get loans. I hope you consider my application.

Purpose of the Cover Letter Body for a Mortgage Originator

The cover letter body for a Mortgage Originator serves as a crucial platform for candidates to highlight their relevant skills, experiences, and the unique value they can bring to a potential employer. This section allows candidates to detail specific projects or accomplishments that demonstrate their expertise in the mortgage industry, such as successfully closing a high volume of loans or implementing innovative customer service strategies that improved client satisfaction. By showcasing tangible successes and relevant experiences, candidates can effectively differentiate themselves from others in the field, illustrating not only their qualifications but also their potential impact on the company's growth and client relationships.

Strong Example

Dear Hiring Manager, I am excited to apply for the Mortgage Originator position at XYZ Mortgage Company. With over five years of experience in the mortgage industry, I have successfully closed more than 200 loans, averaging a 95% satisfaction rating from my clients. In my previous role at ABC Lending, I spearheaded a project to streamline the loan application process, reducing approval times by 30%. This initiative not only improved client satisfaction but also increased our team's efficiency, allowing us to handle a higher volume of loans without sacrificing quality. I am eager to bring my proven track record and commitment to excellence to XYZ Mortgage Company, where I can contribute to your continued success and growth in the industry. Sincerely, [Your Name]

Weak Example

Dear Hiring Manager, I am writing to express my interest in the Mortgage Originator position. I have been in the mortgage business for a few years and have done some loans. I think I can do well at your company because I have experience. I hope you consider me for the role. Best, [Your Name]

Importance of the Cover Letter Closing for a Mortgage Originator

The closing paragraph of a cover letter is crucial for a Mortgage Originator, as it serves to summarize the applicant's qualifications, reiterate their enthusiasm for the role, and prompt the hiring manager to take the next steps. A strong closing reinforces the applicant's fit for the position, while a weak closing can leave a lackluster impression. It is essential to convey confidence and eagerness to discuss how one's skills can contribute to the company's success.

Strong Example

Thank you for considering my application for the Mortgage Originator position at XYZ Bank. With over five years of experience in mortgage lending and a proven track record of exceeding sales targets, I am excited about the opportunity to contribute to your team's success. I look forward to the possibility of discussing my application further and am eager to explore how my skills can benefit your organization. Please feel free to review my resume, and I hope to schedule an interview soon.

Weak Example

I guess that's it for my cover letter. I hope you like my resume or something. Let me know if you want to talk, but no pressure.

These tips will help candidates craft an effective cover letter for a Mortgage Originator position, emphasizing the importance of showcasing technical skills, problem-solving abilities, knowledge of the Software Development Life Cycle (SDLC), teamwork, and a passion for continuous learning. A well-crafted cover letter can set you apart from other candidates and demonstrate your fit for this dynamic role in the mortgage industry.

Tips for Writing an Effective Cover Letter

Highlight Technical Skills: As a Mortgage Originator, you must be proficient in various software and tools used in the mortgage process. Make sure to mention your experience with loan origination systems, customer relationship management software, and any relevant data analysis tools. This will demonstrate your capability to handle the technical aspects of the job effectively.

Showcase Problem-Solving Abilities: The ability to navigate challenges and provide solutions is essential in this role. Use specific examples from your previous experience to illustrate how you have successfully resolved issues related to loan applications, customer inquiries, or compliance regulations. This will highlight your critical thinking and analytical skills.

Demonstrate Knowledge of SDLC: Understanding the Software Development Life Cycle is increasingly important in the mortgage industry as technology plays a larger role. Mention any experience you have with project management methodologies, software testing, or deployment processes that relate to mortgage solutions. This will show your readiness to adapt to technological advancements within the industry.

Emphasize Teamwork: Mortgage origination often involves collaboration with various stakeholders, including underwriters, real estate agents, and clients. In your cover letter, share examples of successful teamwork experiences, focusing on how you contributed to achieving common goals and enhancing customer satisfaction through effective communication and collaboration.

Express a Passion for Continuous Learning: The mortgage industry is always evolving, and staying updated on trends, regulations, and technologies is crucial. Mention any recent training, certifications, or professional development courses you've undertaken. This will convey your commitment to personal growth and your dedication to providing the best service possible to clients.

For additional guidance on crafting your cover letter, check out these cover letter templates and consider using a cover letter builder to help format and structure your content effectively.

Common Mistakes to Avoid in a Mortgage Originator Cover Letter

Crafting a compelling cover letter is essential for a Mortgage Originator, as it serves as your first impression to potential employers. Avoiding common mistakes can significantly increase your chances of landing an interview. Here are some pitfalls to steer clear of:

Generic Content: Many applicants use a one-size-fits-all approach. Customize your cover letter to reflect the specific company and role by incorporating keywords from the job description.

Lack of Specific Examples: Simply stating your qualifications isn’t enough. Use specific examples from your experience that demonstrate your skills and successes in mortgage origination.

Ignoring the Format: A poorly formatted cover letter can detract from your message. Follow a clear cover letter format to ensure readability and professionalism.

Overly Lengthy: Lengthy cover letters can lose a reader's interest. Aim for a concise, focused letter that highlights your key qualifications in a few paragraphs.

Neglecting to Proofread: Typos and grammatical errors can give a negative impression. Always proofread your cover letter or have someone else review it before submission.

Focusing Too Much on Salary: Avoid discussing salary or benefits in the cover letter, as this can give the impression that you are more interested in compensation than the role itself.

Failing to Include a Call to Action: End your cover letter with a strong call to action, expressing your enthusiasm for the opportunity and inviting the employer to reach out for further discussion.

For more guidance, check out our cover letter examples to see how successful candidates have navigated these common mistakes.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.