Financial Regulatory Reporting Analyst Cover Letter Examples

Explore additional Financial Regulatory Reporting Analyst cover letter samples and guides and see what works for your level of experience or role.

How to Format a Financial Regulatory Reporting Analyst Cover Letter?

Creating a well-structured cover letter is essential for a Financial Regulatory Reporting Analyst, as it not only conveys your qualifications but also demonstrates your meticulous approach to financial compliance and reporting. The format of your cover letter is critical in making a strong first impression on hiring managers, who are often looking for candidates with a keen eye for detail and a solid understanding of regulatory requirements. A well-organized cover letter can effectively highlight your analytical skills and dedication to maintaining compliance in the financial sector.

In this guide, we'll explore how to structure your cover letter, providing tailored insights and examples specific to the financial regulatory reporting field.

We'll focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is vital in showcasing your qualifications and professionalism. Let’s break down each part and explain how to make your cover letter stand out in the competitive landscape of financial regulatory reporting.

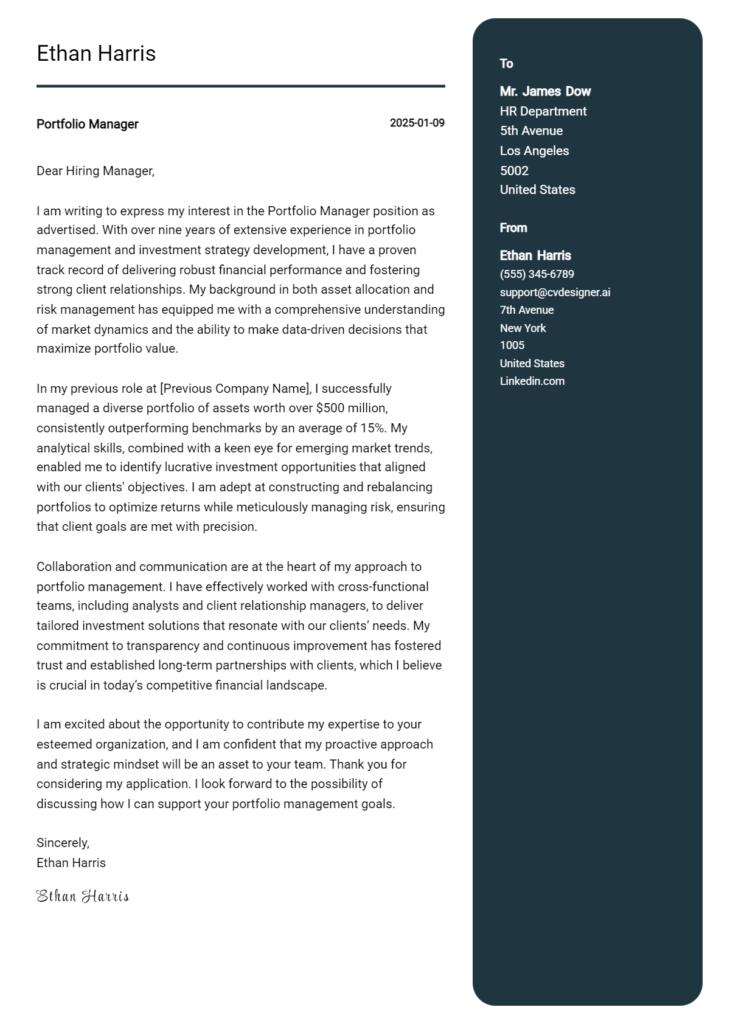

Importance of the Cover Letter Header for a Financial Regulatory Reporting Analyst

The cover letter header is a crucial element that sets the tone for your application as a Financial Regulatory Reporting Analyst. It serves as the first impression and provides essential information that helps the hiring manager quickly identify who you are and how to contact you. A clear and professional header should include your contact information, the date, and the recipient's details, ensuring that the letter is both easy to read and formally structured. Clarity and professionalism in the header reflect your attention to detail, which is vital in the financial regulatory domain.

Strong Example

Jane Doe 123 Financial St. Cityville, ST 12345 jane.doe@email.com (123) 456-7890 October 23, 2023 Mr. John Smith Hiring Manager XYZ Financial Services 456 Corporate Ave. Business City, ST 67890

Weak Example

jane doe 10/23/2023 To Whom It May Concern XYZ Financial Services

The Importance of a Cover Letter Greeting

The greeting of your cover letter is a critical element that sets the tone for the entire document. It serves as the first impression you make on the hiring manager and demonstrates your professionalism and attention to detail. By addressing the hiring manager directly, you show that you have taken the time to personalize your application rather than sending out a generic letter. To create a strong greeting, avoid using impersonal salutations like "To Whom It May Concern." Instead, take the initiative to research the recipient's name, which may involve looking at the company's website or LinkedIn profile. A tailored greeting not only enhances your credibility but also helps establish a connection with the reader.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Well-Crafted Cover Letter Introduction for a Financial Regulatory Reporting Analyst

A well-crafted cover letter introduction is crucial for any job application, especially for a role like a Financial Regulatory Reporting Analyst. This initial paragraph serves as the first impression you make on the hiring manager, and its primary goal is to capture their attention while effectively conveying your enthusiasm for the position. A strong introduction not only reflects your genuine interest in the role but also highlights your relevant skills or achievements that align with the job requirements. In contrast, a weak introduction can leave a lackluster impression, making it challenging for you to stand out in a competitive job market. Below are examples of both strong and weak cover letter introductions for a Financial Regulatory Reporting Analyst.

Strong Example:

Dear [Hiring Manager's Name], I am excited to apply for the Financial Regulatory Reporting Analyst position at [Company Name], as I believe my extensive background in regulatory compliance and financial reporting aligns perfectly with your needs. With over five years of experience in preparing accurate financial statements and ensuring adherence to regulatory standards, I have successfully contributed to my current team by reducing reporting errors by 30% through meticulous analysis and process improvements. I am eager to bring my expertise in data analysis and regulatory frameworks to [Company Name] and support your commitment to excellence in financial reporting.

Weak Example:

To Whom It May Concern, I am writing to apply for the Financial Regulatory Reporting Analyst job. I have some experience in finance, and I believe I can do well in this position. I have worked in several finance-related jobs, but I am not sure how my skills specifically apply to this role. I hope you consider my application.

Purpose of the Cover Letter Body for a Financial Regulatory Reporting Analyst

The cover letter body for a Financial Regulatory Reporting Analyst serves as a crucial platform for candidates to effectively communicate their relevant skills, experiences, and the unique value they bring to the prospective employer. This section should detail specific projects or accomplishments that demonstrate the candidate's ability to navigate complex regulatory environments, analyze financial data, and ensure compliance with reporting standards. By articulating these experiences, the candidate not only showcases their technical proficiency but also their commitment to maintaining the integrity of financial reporting, ultimately making a compelling case for why they are the ideal fit for the role.

Strong Example

In my previous role at XYZ Financial Services, I successfully led a project that streamlined our regulatory reporting process, reducing submission time by 30%. This involved implementing a new automated system that enhanced data accuracy and compliance with the Dodd-Frank Act. My efforts not only improved efficiency but also resulted in a significant reduction in penalties for late submissions. With a strong background in financial analysis and a keen eye for detail, I am confident that my skills align perfectly with the requirements of the Financial Regulatory Reporting Analyst position at your company.

Weak Example

I have worked in finance for several years and know a lot about regulatory reporting. I think I would be good at this job. In my last job, I did some reporting tasks and worked with spreadsheets. I am interested in your company and would like to help with regulatory issues.

Importance of the Cover Letter Closing for a Financial Regulatory Reporting Analyst

The closing paragraph of a cover letter is crucial as it serves to summarize your qualifications, reiterate your enthusiasm for the role, and encourage the hiring manager to take the next steps, such as reviewing your resume or scheduling an interview. A strong closing can leave a lasting impression and demonstrate your proactive attitude, while a weak closing may fail to convey your genuine interest or assertiveness.

Strong Example

Thank you for considering my application for the Financial Regulatory Reporting Analyst position. With my extensive experience in regulatory compliance and my passion for data analysis, I am excited about the opportunity to contribute to your team's success. I look forward to discussing how my skills align with your needs and would welcome the chance to interview at your earliest convenience. Please feel free to contact me to schedule a meeting, and I will be happy to provide any additional information you may require.

Weak Example

I hope you think about my application for the Financial Regulatory Reporting Analyst job. I guess I would be good at it. If you want to talk, you can look at my resume. Thanks.

When applying for a Financial Regulatory Reporting Analyst position, your cover letter serves as your first opportunity to make a strong impression on potential employers. This document should not only highlight your qualifications but also demonstrate your understanding of the role and the industry. By showcasing your technical skills, problem-solving abilities, knowledge of the Software Development Life Cycle (SDLC), teamwork capabilities, and a commitment to continuous learning, you can effectively position yourself as a strong candidate. The following tips will help you craft an impactful cover letter that stands out.

Tips for Writing an Effective Cover Letter for Financial Regulatory Reporting Analyst

Highlight Technical Skills: Begin your cover letter by emphasizing your technical expertise relevant to financial regulatory reporting. Mention specific tools and software you are proficient in, such as SQL, Excel, or reporting frameworks. Providing examples of how you've utilized these skills in past roles will help to illustrate your capability and readiness for the position.

Demonstrate Problem-Solving Abilities: Financial regulatory reporting often involves navigating complex regulations and resolving discrepancies. Use your cover letter to share a brief story or example of a challenge you faced in a previous role and how you successfully addressed it. This not only showcases your analytical skills but also your ability to think critically under pressure.

Showcase Knowledge of the SDLC: Understanding the Software Development Life Cycle is crucial for a Financial Regulatory Reporting Analyst. In your cover letter, discuss your familiarity with different phases of the SDLC and how it applies to financial reporting processes. Mention any relevant projects where you contributed to system development or improvement.

Emphasize Teamwork and Collaboration: Financial regulatory reporting often requires collaboration with various departments, such as compliance and finance. Highlight your experience working in teams and your ability to communicate effectively with cross-functional groups. Providing examples of successful collaborations can demonstrate your interpersonal skills and commitment to achieving common goals.

Express a Passion for Continuous Learning: The financial regulatory landscape is constantly evolving, and a strong candidate must be committed to staying informed of industry changes. In your cover letter, convey your enthusiasm for continuous learning through relevant certifications, training, or professional development courses you have pursued. This shows employers that you are proactive and dedicated to enhancing your expertise in the field.

Common Mistakes to Avoid in a Financial Regulatory Reporting Analyst Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of financial regulatory reporting. Avoiding common mistakes can significantly enhance your chances of making a positive impression on potential employers. Here are some frequent pitfalls to watch out for:

Generic Salutations: Using "To Whom It May Concern" can make your letter feel impersonal. Instead, research the hiring manager's name and address your letter directly to them.

Repetition of the Resume: Simply restating your resume in the cover letter can bore the reader. Instead, highlight specific experiences and skills that directly relate to the job description.

Lack of Quantifiable Achievements: Failing to include measurable accomplishments can diminish your impact. Use numbers and specific examples to showcase your contributions in previous roles.

Ignoring the Job Description: Not tailoring your cover letter to the specific job can lead to missed opportunities. Carefully read the job description and align your skills and experiences with the requirements mentioned.

Overly Formal or Casual Tone: Striking the right balance in tone is crucial. Maintain professionalism while allowing your personality to shine through to connect with the reader.

Neglecting Proofreading: Spelling and grammatical errors can undermine your professionalism. Always proofread your letter multiple times or ask a peer to review it for clarity and accuracy.

Failing to Express Enthusiasm: A lack of enthusiasm for the role can come across as disinterest. Convey your passion for the field and the specific company to create a more engaging narrative.

By avoiding these mistakes, you can create a cover letter that effectively showcases your qualifications and sets you apart as a strong candidate for the Financial Regulatory Reporting Analyst position.

Cover Letter FAQs for Financial Regulatory Reporting Analyst

What should I include in my cover letter for a Financial Regulatory Reporting Analyst position?

In your cover letter, focus on your educational background in finance or accounting and any relevant certifications, such as CFA or CPA. Highlight your experience with regulatory frameworks like Basel III or Dodd-Frank and your familiarity with reporting tools and software (e.g., SQL, Excel). Emphasize your analytical skills and ability to interpret complex regulations, as well as your attention to detail and accuracy in reporting. Mention specific achievements, such as successful audits or implementation of compliance measures, to demonstrate your impact in previous roles. Tailor your content to align with the job description, showcasing how your skills meet the employer’s needs.

How do I structure my cover letter for a Financial Regulatory Reporting Analyst?

Start with a professional greeting, addressing the hiring manager by name if possible. In the opening paragraph, introduce yourself and state the position you are applying for. The second paragraph should highlight your relevant experience and skills, using specific examples to illustrate your accomplishments. In the third paragraph, discuss your understanding of the regulatory landscape and how your background positions you to excel in this role. Finally, conclude with a strong closing statement that expresses your enthusiasm for the position and invites further discussion. Keep the letter concise, ideally one page, and ensure it is well-organized and free of errors.

How can I demonstrate my knowledge of regulatory frameworks in my cover letter?

To effectively demonstrate your knowledge of regulatory frameworks in your cover letter, provide examples of how you have applied this knowledge in previous roles. Mention specific regulations such as Basel III, Solvency II, or MiFID II and discuss your involvement in compliance initiatives or reporting processes related to these regulations. You can also reference any training or certifications you've completed that pertain to regulatory reporting. Additionally, articulate your understanding of the implications these regulations have on financial reporting and organizational practices. This will show potential employers that you are not only knowledgeable but also capable of applying this knowledge in a practical setting.

Should I include technical skills in my cover letter for this role?

Yes, explicitly including technical skills in your cover letter is crucial for a Financial Regulatory Reporting Analyst position. Highlight your proficiency with data analysis tools and software, such as SQL, Excel, or reporting software like Tableau or Power BI. Discuss your experience with financial modeling and data manipulation, as these skills are vital for regulatory reporting. Additionally, mention any familiarity with programming languages like Python or R, as they can enhance your analytical capabilities. Providing specific examples of how you have used these skills in past roles will reinforce your qualifications and demonstrate your readiness to tackle the technical demands of the job.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.