Financial Planner Cover Letter Examples

Explore additional Financial Planner cover letter samples and guides and see what works for your level of experience or role.

How to Format a Financial Planner Cover Letter?

Crafting a compelling cover letter is essential for financial planners, as it serves as your first opportunity to make a lasting impression on potential employers. The way you format your cover letter not only showcases your qualifications but also reflects your organizational skills and professionalism—key attributes in the financial planning industry. A well-structured cover letter can effectively communicate your expertise in managing finances, developing client relationships, and creating tailored financial strategies.

In this guide, we will outline how to structure your cover letter, providing insights and financial planning-specific examples to enhance your application. We will focus on the crucial components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is vital for highlighting your qualifications and demonstrating your commitment to the profession. Let’s delve into each part and explore how to make your financial planner cover letter shine.

Importance of a Cover Letter Header for a Financial Planner

The cover letter header is a crucial component of your application as a Financial Planner, as it sets the tone for your professionalism and attention to detail. A well-structured header not only provides your contact information and the date but also includes the recipient's details, ensuring clarity and proper communication. This is especially important in the financial industry, where trust and precision are paramount. A clear and professional header can make a significant first impression, demonstrating your organizational skills and respect for the recipient's time.

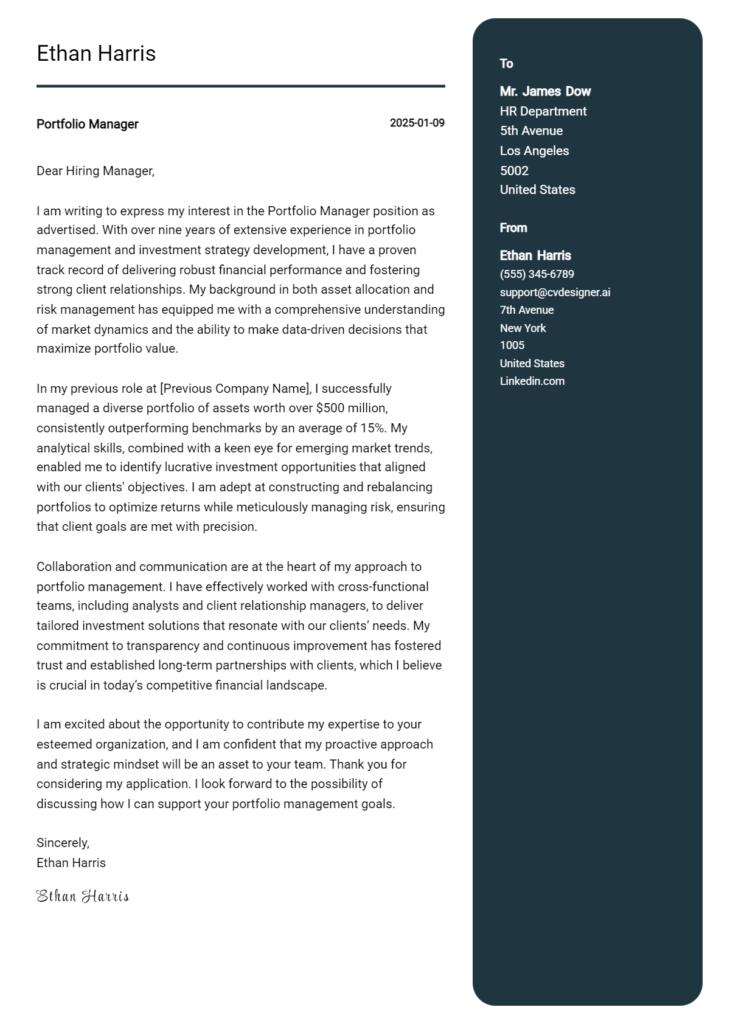

Strong Example

John Doe 123 Financial Lane Moneytown, ST 12345 (123) 456-7890 john.doe@email.com October 1, 2023 Jane Smith Hiring Manager Wealth Management Solutions 456 Investment Blvd Capital City, ST 67890

Weak Example

john doe moneytown, ST 10/1/2023 jane

The Importance of the Cover Letter Greeting for a Financial Planner

The greeting of a cover letter is a critical component that sets the tone for the rest of the correspondence. A well-crafted greeting not only showcases your professionalism but also demonstrates a level of personalization that can make a strong impression on the hiring manager. By addressing the recipient directly, you convey respect and attention to detail, which are essential qualities for a Financial Planner. To make your greeting stand out, it's important to avoid generic salutations like "To Whom It May Concern." Instead, take the time to research the hiring manager's name, which can often be found on the company website or LinkedIn. This small effort can help establish a connection and show your genuine interest in the role.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

Importance of a Well-Crafted Cover Letter Introduction for a Financial Planner

A well-crafted cover letter introduction is pivotal for a Financial Planner, as it serves as the first impression on the hiring manager. This opening paragraph must not only capture attention but also succinctly express the candidate’s enthusiasm for the role. Additionally, it should highlight key skills or notable achievements that align with the job requirements. A strong introduction sets the tone for the rest of the cover letter, compelling the reader to delve deeper into the candidate's qualifications. In contrast, a weak introduction can fail to engage the hiring manager, potentially leading to a missed opportunity. Below are examples of both effective and ineffective cover letter introductions for a Financial Planner.

Strong Example

Dear [Hiring Manager's Name], As a dedicated Financial Planner with over five years of experience in crafting personalized financial strategies, I was excited to discover the opening at [Company Name]. My proven track record in helping clients achieve their financial goals—evidenced by a 95% client retention rate—along with my passion for empowering individuals to make informed financial decisions, makes me an ideal candidate for this role. I am eager to contribute my expertise and commitment to excellence to your esteemed team.

Weak Example

To Whom It May Concern, I am writing to apply for the Financial Planner position. I have some experience in finance and think I might be a good fit for your company. I can help clients with their money and have worked in a few different jobs before.

Purpose of the Cover Letter Body for a Financial Planner

The cover letter body for a Financial Planner serves as a crucial platform to highlight the candidate's relevant skills, experiences, and the unique value they can bring to the company. It allows the candidate to showcase specific projects or accomplishments that demonstrate their expertise in financial analysis, investment strategies, client relationship management, and comprehensive financial planning. By effectively communicating their achievements, such as successfully managing a diverse portfolio or developing tailored financial plans that enhanced clients' financial health, candidates can make a compelling case for why they are the ideal fit for the role.

Strong Example

In my previous role at ABC Financial Services, I successfully managed a portfolio of over $5 million for high-net-worth clients, achieving an average annual return of 8% over three years. One notable project involved creating a diversified investment strategy that reduced risk exposure while maximizing returns, leading to a 15% increase in client satisfaction ratings. Additionally, I developed a comprehensive financial plan for a couple aiming for early retirement, which not only met their financial goals but also resulted in them referring three new clients to our firm. My ability to analyze market trends and tailor financial advice to meet individual client needs positions me as a valuable asset to your team.

Weak Example

I have worked in finance for several years and have some experience with clients. I think my background could help your company. I have done some financial planning, and I am familiar with different investment options. I also like helping people with their money. I believe I can be a good fit for the position.

Importance of the Cover Letter Closing for a Financial Planner

The closing paragraph of a cover letter is a critical component that can significantly impact the hiring decision for a Financial Planner. It serves to summarize your qualifications, reiterate your enthusiasm for the role, and guide the employer toward the next steps—such as reviewing your resume or scheduling an interview. A strong closing leaves a lasting impression, showcasing your professionalism and genuine interest in the position. Conversely, a weak closing can diminish the overall impact of your application, making you seem less engaged or serious about the opportunity.

Strong Example

Thank you for considering my application for the Financial Planner position at [Company Name]. With my extensive background in financial analysis and personalized client strategies, I am excited about the opportunity to contribute to your team. I look forward to discussing how my skills can align with your goals. Please feel free to reach out to schedule an interview at your convenience. I am eager to bring my expertise to [Company Name] and help clients achieve their financial dreams.

Weak Example

I hope you read my resume and think about it. I guess I would be okay for the job. Let me know if you want to talk more about it.

These tips will assist aspiring Financial Planners in crafting an impactful cover letter that stands out to potential employers. In this competitive field, it's essential to highlight your technical skills, problem-solving abilities, knowledge of the Software Development Life Cycle (SDLC), teamwork experience, and a commitment to continuous learning. A well-structured cover letter can effectively convey your qualifications and enthusiasm for the role.

Cover Letter Writing Tips for Financial Planner

Highlight Technical Skills

Clearly outline your technical expertise related to financial planning software, data analysis tools, and financial modeling techniques. Use specific examples to demonstrate how these skills have helped you achieve positive outcomes in previous roles or projects. Quantifying your achievements can make your skills more tangible to employers.Showcase Problem-Solving Abilities

Provide examples of complex financial problems you have successfully solved in your past experiences. Discuss the analytical methods you employed and the impact of your solutions on clients or your organization. This will illustrate your capacity to navigate challenges and provide valuable insights to clients.Demonstrate SDLC Knowledge

If applicable, mention your familiarity with the Software Development Life Cycle as it pertains to financial tools or software development projects. Explain how your understanding of this process can enhance project delivery and improve financial planning outcomes, showcasing your ability to integrate technology effectively into your work.Emphasize Teamwork Experience

Financial planning often involves collaboration with other professionals, such as accountants and investment advisors. Illustrate your teamwork skills by sharing specific instances where you worked effectively in a team setting to achieve a common goal. Highlight your ability to communicate and coordinate with others to develop comprehensive financial strategies.Express Passion for Continuous Learning

The financial landscape is constantly evolving, and employers value candidates who demonstrate a commitment to professional development. Mention any relevant certifications, courses, or workshops you have completed or are pursuing. Discuss how you stay updated on industry trends and your eagerness to apply new knowledge to enhance your financial planning skills.

Common Mistakes to Avoid in a Financial Planner Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of financial planning. Avoiding common mistakes can significantly enhance your chances of making a positive impression. Here are some pitfalls to watch out for and tips on how to avoid them:

Generic Templates: Using a one-size-fits-all template can make your cover letter feel impersonal. Tailor it to reflect the specific company and the role you’re applying for by mentioning their values and goals.

Lack of Specificity: Failing to provide specific examples of your achievements can weaken your application. Include measurable outcomes from your previous roles, such as successful portfolio management or client retention rates.

Overly Formal Language: While professionalism is important, overly formal language can create distance. Aim for a conversational tone that reflects your personality while remaining respectful.

Ignoring the Job Description: Not aligning your skills and experiences with the job description can lead to missed opportunities. Highlight how your background meets the specific requirements listed in the job posting.

Typos and Grammatical Errors: These can undermine your credibility. Always proofread your cover letter multiple times and consider asking a friend or colleague to review it as well.

Neglecting to Show Enthusiasm: A lack of enthusiasm can make your application blend in. Convey your passion for financial planning and the value you could bring to the firm.

Failure to Include a Call to Action: Not inviting the employer to contact you can leave your application feeling incomplete. End with a strong statement expressing your eagerness for an interview to discuss how you can contribute to their team.

By being mindful of these mistakes, you can create a strong cover letter that effectively showcases your qualifications and enthusiasm for the financial planner position.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.