Financial Compliance Officer Cover Letter Examples

Explore additional Financial Compliance Officer cover letter samples and guides and see what works for your level of experience or role.

How to Format a Financial Compliance Officer Cover Letter?

Crafting a compelling cover letter is essential for a Financial Compliance Officer, as it serves as your first opportunity to demonstrate your understanding of regulatory frameworks and your commitment to ethical standards. Proper formatting not only showcases your professionalism but also reflects your meticulous nature—traits that are indispensable in the compliance field. A well-structured cover letter captures the hiring manager's attention and conveys your qualifications clearly, emphasizing your suitability for the role.

In this guide, we will outline the key components of a professional cover letter, specifically tailored for the financial compliance sector.

We’ll focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is vital in presenting your skills and experiences effectively. Let’s delve into each part and explore how to create a standout cover letter for a Financial Compliance Officer position.

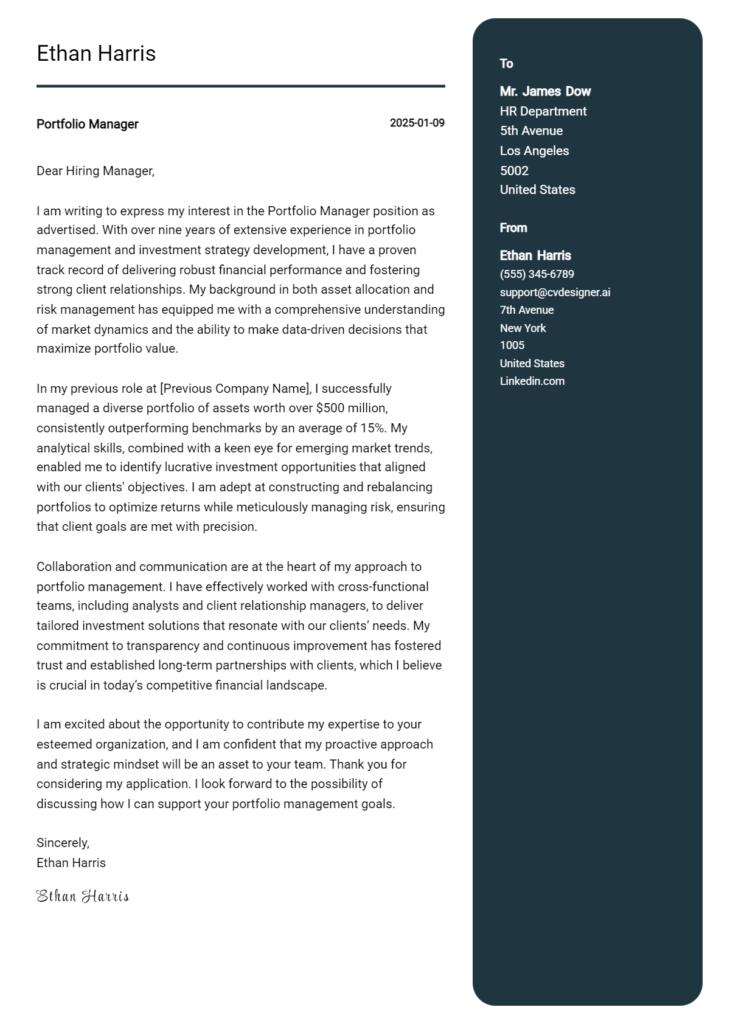

Importance of the Cover Letter Header for a Financial Compliance Officer

The header of a cover letter is crucial as it sets the tone for your application and provides essential contact information. For a Financial Compliance Officer, clarity and professionalism are paramount, given the nature of the role involves adhering to regulations and ensuring compliance within financial institutions. A well-structured header includes your contact information, the date, and the recipient's details, all presented in a clear format. This not only reflects your organizational skills but also demonstrates your attention to detail—qualities that are vital in compliance roles.

Strong Example

John Doe 123 Compliance Lane Finance City, CA 90210 john.doe@email.com (123) 456-7890 October 1, 2023 Jane Smith Hiring Manager XYZ Financial Services 456 Regulation Road Finance City, CA 90210

Weak Example

john doe finance city, ca 10/1/2023 jane smith xyz financial services

The Importance of the Cover Letter Greeting

The greeting of a cover letter is a crucial element that sets the tone for the entire document. It serves as the first impression you make on the hiring manager and can influence their perception of your professionalism and intent. By addressing the hiring manager directly, you not only personalize your application but also demonstrate your enthusiasm for the role of Financial Compliance Officer. A well-crafted greeting shows that you have taken the time to research the company and the individual who will be reviewing your application, which can distinguish you from other candidates. To avoid generic greetings that may come off as impersonal, take the time to find the recipient's name through the company website or LinkedIn. This small effort can significantly enhance the impact of your cover letter.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Well-Crafted Cover Letter Introduction for a Financial Compliance Officer

A well-crafted cover letter introduction is crucial for a Financial Compliance Officer as it serves as the first impression to the hiring manager. This initial paragraph should capture their attention, expressing genuine interest in the role while simultaneously highlighting key skills or notable achievements relevant to compliance and financial regulations. A strong introduction not only sets the tone for the rest of the letter but also establishes the candidate's credibility and suitability for the position. In contrast, a weak introduction can fail to engage the reader and may lead to the candidate being overlooked. Here are examples of both a strong and a weak introduction to illustrate this point.

Strong Example

Dear [Hiring Manager's Name], I am excited to apply for the Financial Compliance Officer position at [Company Name], as I am passionate about ensuring financial integrity and regulatory adherence. With over five years of experience in compliance roles within the financial sector, I have successfully led initiatives that reduced compliance risks by 30% while enhancing reporting accuracy. My expertise in navigating complex regulatory landscapes aligns perfectly with your team’s mission to uphold the highest standards of compliance and transparency.

Weak Example

Dear [Hiring Manager's Name], I want to apply for the Financial Compliance Officer job. I have some experience in compliance and am looking for a new opportunity. I think I could do this job, and I can work hard.

Purpose of the Cover Letter Body for a Financial Compliance Officer

The body of the cover letter for a Financial Compliance Officer serves as a critical platform for candidates to effectively communicate their relevant skills, experiences, and the unique value they would bring to the organization. It provides an opportunity to highlight specific projects or accomplishments that demonstrate a strong understanding of regulatory requirements and compliance frameworks. By articulating quantifiable achievements, such as successfully leading compliance audits or implementing risk management strategies, candidates can differentiate themselves from others in the field. This section not only reflects their technical abilities but also showcases their commitment to maintaining the integrity and transparency of financial operations, which is vital in a compliance-focused role.

Strong Example

In my previous role as a Compliance Analyst at XYZ Corporation, I successfully led a project to overhaul our internal compliance auditing process, which resulted in a 30% reduction in compliance-related discrepancies over a one-year period. By developing a comprehensive training program for staff on regulatory changes, I ensured that the team was well-equipped to handle evolving compliance requirements. Additionally, my collaboration with cross-functional teams to enhance our risk assessment protocols not only improved our compliance score during external audits but also fostered a culture of accountability within the organization. My proactive approach and dedication to continuous improvement make me a strong candidate for the Financial Compliance Officer position at your esteemed company.

Weak Example

I have worked in compliance for several years and know a lot about financial regulations. I have helped my company with audits and made sure everything was done correctly. I think I would be a good fit for the Financial Compliance Officer position because I have experience and I pay attention to details. I am looking forward to the opportunity to work for your company.

Importance of the Cover Letter Closing for a Financial Compliance Officer

The closing paragraph of a cover letter is crucial for leaving a lasting impression on potential employers. For a Financial Compliance Officer, it's essential to succinctly summarize your qualifications, express enthusiasm for the role, and encourage the next steps, such as reviewing your resume or scheduling an interview. A strong closing can reinforce your suitability for the position, while a weak one may fail to capture the employer's attention or convey your genuine interest.

Strong Example

Thank you for considering my application for the Financial Compliance Officer position. With over five years of experience in regulatory compliance and a proven track record of ensuring adherence to financial regulations, I am excited about the opportunity to contribute to your team. I look forward to discussing how my skills and background align with your needs. Please feel free to contact me to schedule a convenient time for an interview.

Weak Example

Thanks for reading my cover letter. I hope you find my resume interesting and maybe we can talk later. I guess that would be good.

When applying for the role of a Financial Compliance Officer, a well-crafted cover letter can be your ticket to standing out from the competition. This position demands a unique blend of technical expertise, problem-solving skills, and a commitment to teamwork. It's essential to highlight not only your knowledge of the Software Development Life Cycle (SDLC) but also your passion for continuous learning in an ever-evolving regulatory landscape. Below are some tips to help you effectively convey your qualifications and enthusiasm in your cover letter.

Cover Letter Writing Tips for Financial Compliance Officer

Highlight Your Technical Skills: Begin by showcasing your technical proficiencies that are relevant to financial compliance. Include specific software and tools you are proficient in, such as compliance management systems or data analysis software. Mention any certifications you hold, such as Certified Compliance & Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), to further validate your expertise.

Demonstrate Problem-Solving Abilities: Use specific examples from your previous roles to illustrate how you tackled complex compliance issues. Describe a situation where you identified a compliance gap and the steps you took to resolve it. This not only shows your analytical skills but also your ability to think critically under pressure.

Showcase Your Knowledge of SDLC: If applicable, discuss your familiarity with the Software Development Life Cycle and how it relates to compliance. Explain how you have contributed to ensuring compliance within software development projects, such as participating in requirement gathering, testing, and validation phases to align with regulatory standards.

Emphasize Teamwork and Collaboration: Financial compliance is often a team effort. Highlight your experience working in cross-functional teams to meet compliance goals. Provide examples of how you have collaborated with different departments, such as IT or legal, to implement compliance strategies effectively.

Express Your Commitment to Continuous Learning: The regulatory environment is constantly changing, making it vital for compliance officers to stay updated. Mention any recent training, workshops, or certifications you have pursued. Express your eagerness to engage in ongoing education and professional development to enhance your skills and adapt to new regulations.

By incorporating these elements into your cover letter, you will present a compelling case for why you are the ideal candidate for the Financial Compliance Officer position.

Common Mistakes to Avoid in a Financial Compliance Officer Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of financial compliance. Avoiding common mistakes can significantly enhance your chances of making a positive impression. Here are some pitfalls to watch out for:

Generic Language: Using a one-size-fits-all approach can come off as insincere. Tailor your cover letter to the specific job and organization by mentioning the company's values or recent projects.

Lack of Specificity: Failing to provide concrete examples of your skills and experiences can weaken your application. Highlight specific achievements that demonstrate your expertise in financial regulations and compliance.

Ignoring Keywords: Many companies use applicant tracking systems to filter resumes and cover letters. Ensure you incorporate relevant keywords from the job description to increase your visibility.

Overly Formal or Casual Tone: Striking the right tone is crucial. Avoid sounding too formal or overly casual; aim for a professional yet approachable voice that reflects your personality.

Typos and Grammatical Errors: Simple mistakes can undermine your professionalism. Always proofread your cover letter multiple times and consider using grammar-checking tools.

Vague Objective Statements: Avoid generic objectives, as they can detract from your qualifications. Instead, clearly state how your background aligns with the role and how you can contribute to the organization.

Neglecting to Show Enthusiasm: A lack of enthusiasm can make your application seem lackluster. Express genuine interest in the position and the company to convey your motivation.

By steering clear of these mistakes and presenting a well-crafted cover letter, you'll be better positioned to capture the attention of hiring managers in the financial compliance sector.

Cover Letter FAQs for Financial Compliance Officer

What should I include in my cover letter for a Financial Compliance Officer position?

In your cover letter, focus on showcasing your knowledge of relevant regulations, such as Sarbanes-Oxley, Dodd-Frank, and GDPR. Highlight your experience in compliance audits, risk assessment, and internal controls. Include specific examples of successful projects where you improved compliance processes or mitigated risks. Additionally, mention any certifications you hold, such as Certified Compliance and Ethics Professional (CCEP) or Certified Risk Management Professional (CRMP). Tailor your letter to the job description, emphasizing how your skills align with the company’s needs and compliance goals.

How should I structure my cover letter?

Begin with a professional header that includes your contact information and the hiring manager’s details. Start with a strong opening paragraph that states the position you’re applying for and expresses your enthusiasm for the role. In the body paragraphs, focus on your relevant experience and qualifications, using bullet points for clarity if needed. Conclude with a closing paragraph that reiterates your interest and invites further discussion. Finally, include a polite closing statement and your signature. Keep the letter concise, ideally one page.

How can I make my cover letter stand out?

To make your cover letter stand out, personalize it for the specific company and role. Research the company’s compliance culture and mention how your values align with theirs. Use strong action verbs and quantifiable achievements to demonstrate your impact in previous roles. For instance, instead of saying you "managed compliance issues," specify that you "reduced compliance violations by 30% through targeted training programs." Additionally, showcasing soft skills such as attention to detail, analytical thinking, and communication can set you apart. Consider including a brief story that illustrates your passion for compliance and the positive outcomes of your work.

Should I address potential weaknesses in my cover letter?

If you have gaps in your experience or a shift in your career focus, it can be beneficial to address these briefly in your cover letter. Acknowledge the gap or change, and then pivot to demonstrate how your skills are transferable and relevant to the Financial Compliance Officer position. Emphasize your enthusiasm for compliance and any relevant experiences that have prepared you for this role. However, keep this discussion concise and avoid dwelling on negatives. Instead, focus on your strengths and how they will contribute positively to the prospective employer's compliance efforts.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.