Equity Trader Cover Letter Examples

Explore additional Equity Trader cover letter samples and guides and see what works for your level of experience or role.

How to Format an Equity Trader Cover Letter?

Crafting a compelling cover letter for an Equity Trader position is essential in demonstrating your financial acumen and market insight. A well-structured cover letter not only showcases your qualifications but also reflects your ability to communicate effectively—an essential trait for anyone in the fast-paced world of trading. The format you choose can significantly impact the first impression you make on hiring managers, highlighting your attention to detail and professionalism, both of which are critical in the finance industry.

In this guide, we will outline the key components of a professional cover letter, providing you with valuable insights and trader-specific examples to help you create a persuasive document.

We'll focus on the essential elements of an effective cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section serves a crucial purpose in emphasizing your qualifications and commitment to excellence. Let’s delve into each part and explore how to make your Equity Trader cover letter truly exceptional.

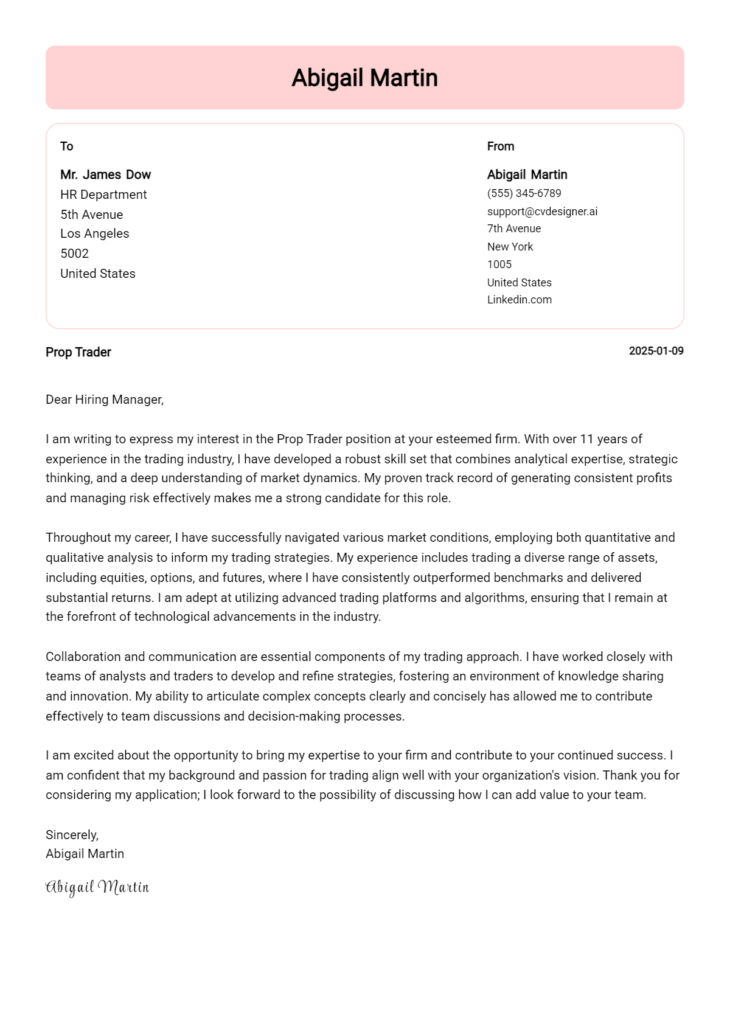

Importance of the Cover Letter Header for an Equity Trader

The cover letter header is a crucial element of your job application, particularly for an Equity Trader position, where clarity and professionalism are paramount. A well-structured header provides essential information at a glance, including your contact details, the date, and the recipient's information. This sets a formal tone and ensures that your letter is easily identifiable and accessible to the hiring manager. A strong header reflects your attention to detail and organizational skills, qualities that are vital in the fast-paced world of trading.

Strong Example:

John Doe 123 Market St. New York, NY 10001 (123) 456-7890 johndoe@email.com October 1, 2023 Jane Smith Hiring Manager XYZ Trading Firm 456 Wall St. New York, NY 10005

Weak Example:

johndoe@email.com 123 Market St. New York, NY October 1st XYZ Trading Firm 456 Wall St.

The Importance of the Cover Letter Greeting for an Equity Trader

The greeting of a cover letter is a crucial component that sets the tone for the entire application. A well-crafted greeting demonstrates professionalism and shows that the applicant has taken the time to personalize their message, which can make a significant difference in a competitive job market. By addressing the hiring manager directly, the candidate establishes a connection and conveys genuine interest in the position. To avoid generic greetings such as "To Whom It May Concern," it's essential to research the recipient's name, which can often be found on the company's website or LinkedIn. This personal touch not only reflects the candidate's initiative but also increases the likelihood of making a positive first impression.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

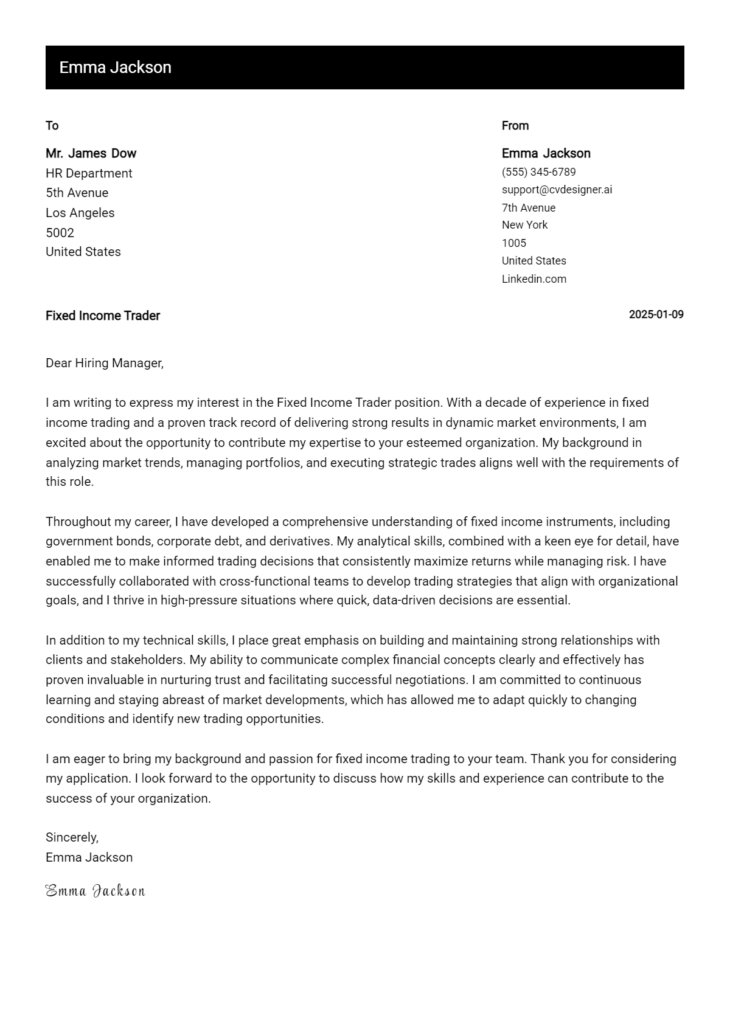

The Importance of a Well-Crafted Cover Letter Introduction for an Equity Trader

A compelling cover letter introduction is crucial for an Equity Trader as it serves as the first impression to the hiring manager. This introductory paragraph should not only capture attention but also articulate the candidate's enthusiasm for the role while briefly highlighting relevant skills and accomplishments. A strong introduction can set the tone for the rest of the cover letter, making it more persuasive and engaging. In contrast, a weak introduction may fail to spark interest and could lead to the candidate being overlooked. Below are examples of both strong and weak cover letter introductions for an Equity Trader position.

Strong Example

Dear [Hiring Manager's Name], As a dedicated Equity Trader with over five years of experience in fast-paced financial environments, I am excited to apply for the Equity Trader position at [Company Name]. My track record of consistently outperforming market benchmarks, coupled with my expertise in technical analysis and risk management, has equipped me with the skills necessary to contribute effectively to your team. I am particularly drawn to [Company Name] due to its innovative trading strategies and commitment to excellence, and I am eager to bring my analytical mindset and strategic approach to your esteemed organization.

Weak Example

Hello, I am applying for the Equity Trader job. I have worked in finance for a few years and think I could do well in this role. I have some experience with trading and numbers, and I hope you consider my application.

Purpose of the Cover Letter Body for an Equity Trader

The body of a cover letter for an Equity Trader serves as a critical platform for candidates to effectively communicate their qualifications, experiences, and potential contributions to the firm. This section highlights specific projects or accomplishments that demonstrate the candidate's ability to analyze market trends, execute trades successfully, and manage risk. A well-crafted cover letter body not only showcases relevant skills, such as quantitative analysis and strategic decision-making, but also provides evidence of past performance that aligns with the company's goals. By illustrating their value through tangible achievements, candidates can differentiate themselves from others in a competitive job market.

Strong Example

I successfully managed a $10 million portfolio at XYZ Capital, achieving a return of 15% over the last fiscal year, significantly outperforming the S&P 500. My role involved executing high-frequency trades and employing algorithmic strategies that reduced transaction costs by 20%. Moreover, I led a team project that developed an innovative risk assessment model, which was adopted firm-wide and resulted in a 30% decrease in exposure during volatile market conditions. These experiences have honed my analytical skills and equipped me with the tools necessary to make informed trading decisions that align with your firm's objectives.

Weak Example

I have some experience in trading and I like the stock market. I worked at a company where I did some trading and sometimes made money. I think I would be a good fit for your team because I am interested in finance. I have a basic understanding of stocks, and I am eager to learn more.

The Importance of the Cover Letter Closing for an Equity Trader

The closing paragraph of a cover letter is crucial as it serves to summarize your qualifications, reiterate your enthusiasm for the position, and encourage the hiring manager to take the next steps, such as reviewing your resume or scheduling an interview. A strong closing leaves a lasting impression and reinforces your suitability for the role, while a weak closing can diminish the impact of your entire letter.

Strong Example

Thank you for considering my application for the Equity Trader position at [Company Name]. With my extensive background in market analysis and a proven track record of successful trades, I am excited about the opportunity to contribute to your team. I am confident that my skills align well with the goals of [Company Name], and I look forward to the possibility of discussing how I can help drive your trading strategies forward. Please feel free to review my resume, and I hope to speak with you soon about scheduling an interview.

Weak Example

I guess that’s all I have to say. I hope you’ll look at my resume. Thanks for your time.

These tips will assist candidates in crafting an effective cover letter for an Equity Trader position. A well-written cover letter is crucial for showcasing not only your technical skills and problem-solving abilities but also your knowledge of the software development life cycle (SDLC), teamwork capabilities, and a passion for continuous learning. By emphasizing these attributes, you can present yourself as a well-rounded candidate ready to thrive in the fast-paced world of equity trading.

Cover Letter Writing Tips for Equity Trader

Highlight Technical Skills: Begin by clearly showcasing your technical skills relevant to equity trading, such as expertise in trading platforms, familiarity with programming languages (like Python or R), and proficiency with data analysis tools. Include specific examples of how you have used these skills to analyze market trends or execute trades effectively.

Demonstrate Problem-Solving Abilities: Equity trading often involves quick decision-making and the ability to solve complex problems under pressure. Use your cover letter to narrate a specific situation where you successfully addressed a trading challenge, illustrating your analytical thinking and ability to adapt to changing market conditions.

Showcase SDLC Knowledge: Understanding the software development life cycle is essential in today's technology-driven trading environment. Discuss any past experiences where you contributed to the development or improvement of trading systems or tools, emphasizing your role in each phase of the SDLC—requirements gathering, design, implementation, testing, and maintenance.

Emphasize Teamwork: The ability to collaborate effectively with colleagues, analysts, and other traders is vital in equity trading. Use your cover letter to provide examples of successful team projects that you were a part of, highlighting your communication skills and how you contributed to achieving common goals.

Convey a Passion for Continuous Learning: The financial markets are constantly evolving, and a commitment to lifelong learning is essential for success in this field. Share your enthusiasm for staying updated on market trends, new technologies, and trading strategies, mentioning any relevant courses, certifications, or workshops you have completed to further enhance your skills.

Common Mistakes to Avoid in an Equity Trader Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of equity trading. Avoiding common pitfalls can significantly enhance your chances of making a positive impression on potential employers. Here are some frequent mistakes to watch out for:

Generic Greetings: Using "To Whom It May Concern" shows a lack of effort. Always try to find the hiring manager's name for a personal touch.

Vague Language: Avoid ambiguous statements about your skills or experiences. Be specific about your accomplishments and how they relate to the role.

Lack of Focus: A cover letter should be targeted. Avoid discussing unrelated job experiences; instead, focus on trading-specific skills like analysis, risk management, and market knowledge.

Ignoring the Job Description: Not tailoring your cover letter to the specific job listing can make your application seem generic. Highlight relevant experiences that match the requirements outlined in the job description.

Typos and Grammatical Errors: Mistakes can undermine your professionalism. Proofread your letter multiple times and consider asking a colleague to review it.

Overly Formal Language: While professionalism is essential, overly formal language can come off as stiff. Aim for a conversational tone that reflects your personality while remaining respectful.

Failing to Show Enthusiasm: A lack of passion can be off-putting. Convey your excitement for the role and the company to demonstrate your genuine interest.

By steering clear of these common mistakes, you can create a strong cover letter that highlights your qualifications and makes a lasting impression.

Cover Letter FAQs for Equity Trader

What should I include in my cover letter as an Equity Trader?

In your cover letter, focus on highlighting your relevant experience, skills, and achievements in equity trading. Begin with a strong introduction that states your interest in the position and the company. Include specific examples of your trading strategies, performance metrics, and any relevant certifications, such as a CFA. Emphasize your analytical skills, risk assessment abilities, and familiarity with trading platforms and market trends. Additionally, mention your teamwork and communication skills, which are essential in collaborative trading environments. Conclude with a call to action, expressing your eagerness to discuss your qualifications in an interview.

How can I tailor my cover letter for a specific Equity Trader position?

To tailor your cover letter, research the company and the specific role you’re applying for. Look for details about their trading strategies, the types of securities they focus on, and their company culture. Use this information to customize your cover letter by aligning your skills and experiences with the company’s needs. For example, if they emphasize quantitative analysis, highlight your experience with data analysis tools or successful quantitative trading strategies. Use keywords from the job description to demonstrate that you understand the role and how you can contribute. Personalizing your cover letter shows genuine interest and can set you apart from other candidates.

How can I demonstrate my trading accomplishments in my cover letter?

When discussing your trading accomplishments, use quantifiable metrics to illustrate your success. For instance, mention how you achieved a specific return on investment (ROI) or reduced portfolio risk through strategic trading decisions. Highlight any awards or recognitions you received for outstanding trading performance. To make your accomplishments more impactful, provide context by explaining the market conditions you faced and the strategies you employed to navigate them. This approach not only showcases your skills but also demonstrates your ability to adapt and thrive in dynamic environments. Remember to keep your examples concise and relevant to the position you are applying for.

Should I mention my education in my cover letter for an Equity Trader role?

Yes, mentioning your education is important in your cover letter, especially if you have a degree in finance, economics, or a related field. Highlight any relevant coursework, projects, or research that relate to equity trading. If you have pursued certifications such as the Chartered Financial Analyst (CFA) designation or passed relevant licensing exams, be sure to include these as well. Your educational background can provide credibility and demonstrate your foundational knowledge of financial markets and trading principles. However, keep the focus on practical experiences and skills that directly relate to the equity trading role, ensuring a balance between education and hands-on expertise.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.