Credit And Collections Analyst Cover Letter Examples

Explore additional Credit And Collections Analyst cover letter samples and guides and see what works for your level of experience or role.

How to Format a Credit and Collections Analyst Cover Letter?

Crafting a compelling cover letter is crucial for a Credit and Collections Analyst, as it serves as your first opportunity to demonstrate your financial acumen and attention to detail. Proper formatting not only showcases your professionalism but also reflects your analytical skills, which are essential in managing credit risk and collections efficiently. A well-structured cover letter guides the hiring manager through your qualifications, highlighting your ability to communicate effectively and manage financial relationships.

In this guide, we will outline how to format your cover letter, providing specific examples and insights tailored for the Credit and Collections Analyst role.

We will focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is vital in presenting your qualifications and reinforcing your suitability for the position. Let’s delve into each part and explore how to make your cover letter stand out in the competitive field of credit and collections.

Importance of the Cover Letter Header for a Credit and Collections Analyst

The header of a cover letter is crucial as it sets the tone for the rest of the document, showcasing your professionalism and attention to detail. For a Credit and Collections Analyst, clarity is vital, as this role demands precision and organization. The header should include your contact information, the date, and the recipient's details, ensuring that the hiring manager can easily reach you. A well-structured header not only reflects your communication skills but also demonstrates your understanding of business etiquette, which is essential in financial roles.

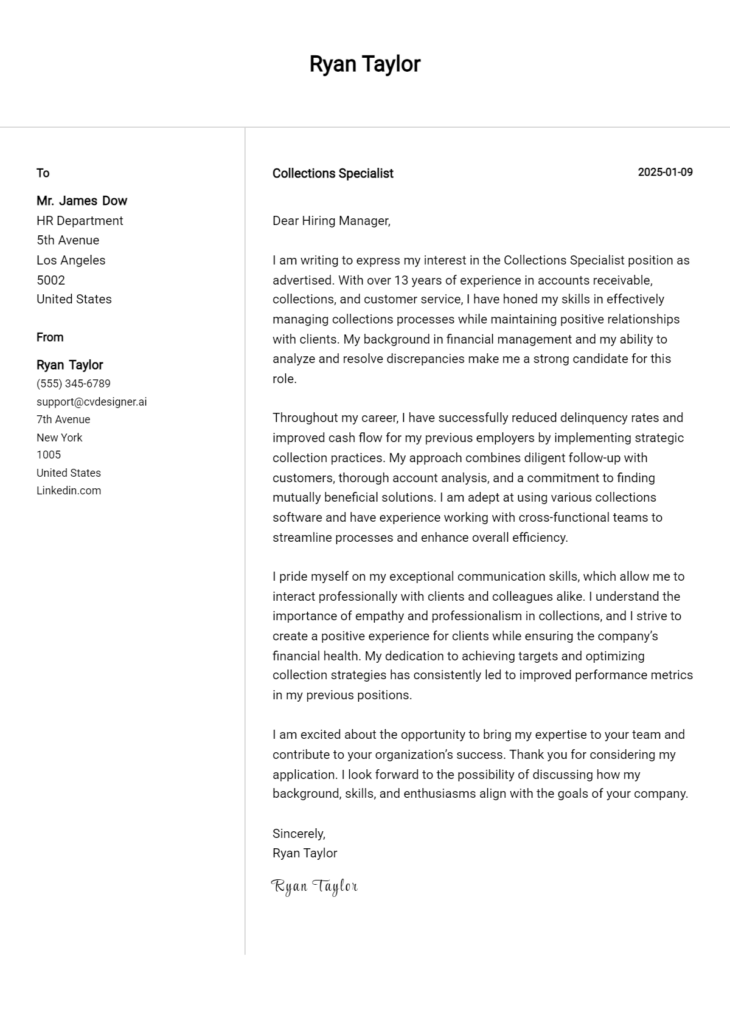

Strong Example

John Doe 123 Financial St. Cityville, ST 12345 john.doe@email.com (123) 456-7890 October 1, 2023 Ms. Jane Smith Hiring Manager XYZ Corporation 456 Business Rd. Cityville, ST 67890

Weak Example

john doe cityville 10/1/23 to whom it may concern

The Importance of the Cover Letter Greeting for a Credit and Collections Analyst

The greeting of your cover letter is crucial as it sets the tone for the rest of your communication. A well-crafted greeting demonstrates professionalism and shows that you have taken the time to personalize your application. By addressing the hiring manager directly, you create a connection and convey genuine interest in the position. Avoiding generic greetings like "To Whom It May Concern" is essential, as it can come off as impersonal or lazy. Instead, take the initiative to research the recipient's name, which can often be found on the company's website or LinkedIn. This small effort can make a significant impact on how your application is received.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Compelling Cover Letter Introduction for a Credit and Collections Analyst

A well-crafted cover letter introduction is crucial in making a strong first impression on hiring managers for a Credit and Collections Analyst position. This opening paragraph should not only capture attention but also convey the candidate’s enthusiasm for the role. It must succinctly highlight relevant skills or achievements that set the candidate apart from others. An engaging introduction will encourage the hiring manager to read further, ultimately increasing the chances of securing an interview. Below are examples of both strong and weak cover letter introductions.

Strong Example

Dear [Hiring Manager's Name], I am excited to apply for the Credit and Collections Analyst position at [Company Name], where my proven track record in optimizing collections strategies and enhancing cash flow can contribute to your team. With over five years of experience in credit analysis and a history of reducing outstanding receivables by 30%, I am eager to leverage my analytical skills and attention to detail to support [Company Name]'s financial goals.

Weak Example

To whom it may concern, I am writing to express my interest in the Credit and Collections Analyst position. I have some experience in this field and think I might be a good fit for the job. I hope to bring my skills to your company.

Purpose of the Cover Letter Body for a Credit and Collections Analyst

The body of a cover letter for a Credit and Collections Analyst serves to effectively communicate the candidate's relevant skills, experiences, and the unique value they can bring to the company. This section allows candidates to highlight specific projects or accomplishments that demonstrate their proficiency in managing credit and collections processes, analyzing financial data, and improving cash flow. By providing concrete examples, candidates can paint a vivid picture of their capabilities and how they can contribute to the organization’s financial health.

Strong Example

I am excited to apply for the Credit and Collections Analyst position at ABC Corporation. In my previous role at XYZ Ltd., I successfully led a project that streamlined our collections process, reducing the average days sales outstanding (DSO) from 45 to 30 days within six months. By implementing a new tracking system and enhancing communication with clients, I not only improved our cash flow but also strengthened customer relationships. My analytical skills, coupled with my ability to work collaboratively across departments, have consistently resulted in exceeding collection targets by at least 15% each quarter. I am eager to bring this same level of dedication and success to ABC Corporation.

Weak Example

I am interested in the Credit and Collections Analyst job. I have worked in finance for a few years and have done some collections work. I think I would be good at the job because I know how to use spreadsheets. I hope to help improve the company’s collections. I look forward to hearing from you.

Importance of the Cover Letter Closing for a Credit and Collections Analyst

The closing paragraph of a cover letter is crucial for leaving a lasting impression on potential employers. For a Credit and Collections Analyst, it should succinctly summarize the candidate's qualifications, express enthusiasm for the role, and encourage the hiring manager to take the next steps, such as reviewing the resume or scheduling an interview. A strong closing reinforces the applicant's fit for the position and demonstrates proactive engagement, while a weak closing may fail to convey confidence or interest.

Strong Example

Thank you for considering my application for the Credit and Collections Analyst position. With my extensive experience in financial analysis and a proven track record of improving collection rates, I am confident in my ability to contribute effectively to your team. I am genuinely excited about the opportunity to bring my skills to [Company Name] and help optimize your collection processes. I look forward to the possibility of discussing my application further and am eager to arrange a time for an interview. Thank you again for your consideration.

Weak Example

Thanks for reading my cover letter. I hope you like my resume. I think I would be good at the job. Please let me know if you want to talk.

These tips will assist candidates in crafting an effective cover letter for a Credit and Collections Analyst position. A well-structured cover letter can be a powerful tool to highlight your technical skills, problem-solving capabilities, familiarity with Software Development Life Cycle (SDLC), teamwork experience, and dedication to continuous learning in the financial sector. By emphasizing these attributes, you can set yourself apart from other candidates and demonstrate your suitability for the role.

Cover Letter Writing Tips for Credit and Collections Analyst

Showcase Your Technical Skills: Clearly outline your technical competencies relevant to credit and collections, such as proficiency in financial software, data analysis tools, and Excel. Use specific examples to illustrate how you've successfully utilized these skills in past roles. This not only demonstrates your capabilities but also shows your readiness to handle the demands of the job.

Emphasize Problem-Solving Abilities: Highlight instances where you've resolved complex credit issues or improved collection processes. Describe the challenges you faced, the solutions you implemented, and the positive outcomes that resulted. This reflects your analytical mindset and your ability to think critically under pressure, crucial traits for a Credit and Collections Analyst.

Demonstrate Knowledge of SDLC: If applicable, mention any experience you have with the Software Development Life Cycle, particularly in finance-related projects. Explain how your understanding of SDLC principles has helped you contribute to the development or improvement of financial systems or processes. This knowledge can be a significant advantage in a tech-driven financial environment.

Illustrate Teamwork Experience: Credit and collections often require collaboration with various departments. Share examples of how you've worked effectively in teams to achieve common goals, whether it was coordinating with sales teams to resolve disputes or collaborating with IT to enhance reporting tools. This shows your interpersonal skills and ability to work harmoniously in a corporate setting.

Express a Passion for Continuous Learning: The financial landscape is always evolving, and a willingness to adapt is essential. Discuss any relevant courses, certifications, or professional development activities you've pursued. This not only highlights your commitment to personal growth but also signals to potential employers that you are proactive and eager to stay ahead in your field.

By following these tips, you'll be well on your way to crafting a compelling cover letter. For more assistance, consider utilizing cover letter templates or a cover letter builder to streamline the writing process and enhance the presentation of your qualifications.

Common Mistakes to Avoid in a Credit and Collections Analyst Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of Credit and Collections Analysis. By avoiding common mistakes, you can significantly enhance your chances of securing an interview. Here are some pitfalls to watch out for:

Generic Language: Using a one-size-fits-all approach can make your cover letter blend in with the rest. Tailor your letter to the specific job and company to demonstrate your genuine interest.

Ignoring the Job Description: Failing to connect your skills and experiences with the job requirements can be detrimental. Carefully read the job description and align your qualifications with their needs.

Lack of Specific Examples: Vague statements about your skills can weaken your case. Use concrete examples from your experience to showcase your achievements in credit management and collections.

Poor Formatting: A cluttered or unprofessional layout can distract from your content. Adhere to a clean cover letter format that highlights your key points effectively.

Neglecting Proofreading: Spelling and grammatical errors can create a negative impression. Take the time to thoroughly proofread your cover letter or ask someone else to review it.

Focusing Too Much on Salary Expectations: While it’s essential to discuss compensation, placing too much emphasis on it can come off as greedy. Instead, focus on what you can bring to the role.

Not Including a Call to Action: Failing to express your eagerness for an interview can leave your letter feeling incomplete. Conclude with a strong call to action, inviting the hiring manager to discuss your application further.

By steering clear of these mistakes and utilizing effective cover letter examples, you can create a powerful cover letter that makes a lasting impression.

Cover Letter FAQs for Credit and Collections Analyst

What should I include in my cover letter for a Credit and Collections Analyst position?

In your cover letter, focus on highlighting your relevant skills and experiences that align with the responsibilities of a Credit and Collections Analyst. Include specific examples of your experience with credit analysis, managing collections processes, and using financial software. Mention your ability to analyze credit data, assess risk, and develop strategies to improve cash flow. Additionally, emphasize your communication skills and ability to negotiate payment terms effectively. Tailor your letter to the job description, showcasing how your contributions can benefit the company.

How do I demonstrate my analytical skills in my cover letter?

To demonstrate your analytical skills, provide concrete examples from your previous roles where you successfully analyzed credit data or resolved collection issues. Discuss specific tools or methodologies you used, such as financial modeling or risk assessment techniques. You may also mention any relevant certifications or training in financial analysis. Use quantifiable results to illustrate your impact, such as reduced days sales outstanding (DSO) or improved collection rates. This will show potential employers that you possess the analytical capabilities they seek.

Should I address any gaps in my employment in my cover letter?

Yes, addressing employment gaps in your cover letter is important, especially if they are significant. Be honest and succinct in your explanation, focusing on how you used that time productively, such as pursuing further education, obtaining certifications, or gaining relevant experience in other ways. Emphasize how these experiences have prepared you for the Credit and Collections Analyst role. Frame the gap positively, showing your commitment to professional growth and readiness to contribute to the new position.

How can I make my cover letter stand out?

To make your cover letter stand out, personalize it for the specific role by researching the company and its culture. Use a professional yet engaging tone, and avoid generic phrases. Start with a strong opening that captures attention, perhaps by mentioning a key achievement or an insight about the company's credit policies. Throughout the letter, showcase your unique qualifications and relevant successes in previous positions. Finally, conclude with a compelling call to action, expressing your eagerness to discuss how you can add value to their team.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.