Insurance Sales Agent Cover Letter Examples

Explore additional Insurance Sales Agent cover letter samples and guides and see what works for your level of experience or role.

How to Format an Insurance Sales Agent Cover Letter

Creating a well-structured cover letter is essential for an Insurance Sales Agent, as it not only showcases your qualifications but also reflects your ability to communicate effectively—a vital skill in sales. A professional presentation can make a strong first impression on hiring managers, demonstrating your attention to detail and commitment to excellence. An organized cover letter allows you to highlight your sales achievements, industry knowledge, and customer service skills in a clear and compelling manner.

In this guide, we will outline the key components of a standout cover letter for an Insurance Sales Agent, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section is crucial in conveying your qualifications and professionalism. Let’s explore how to structure each part to ensure your cover letter captures the attention of potential employers.

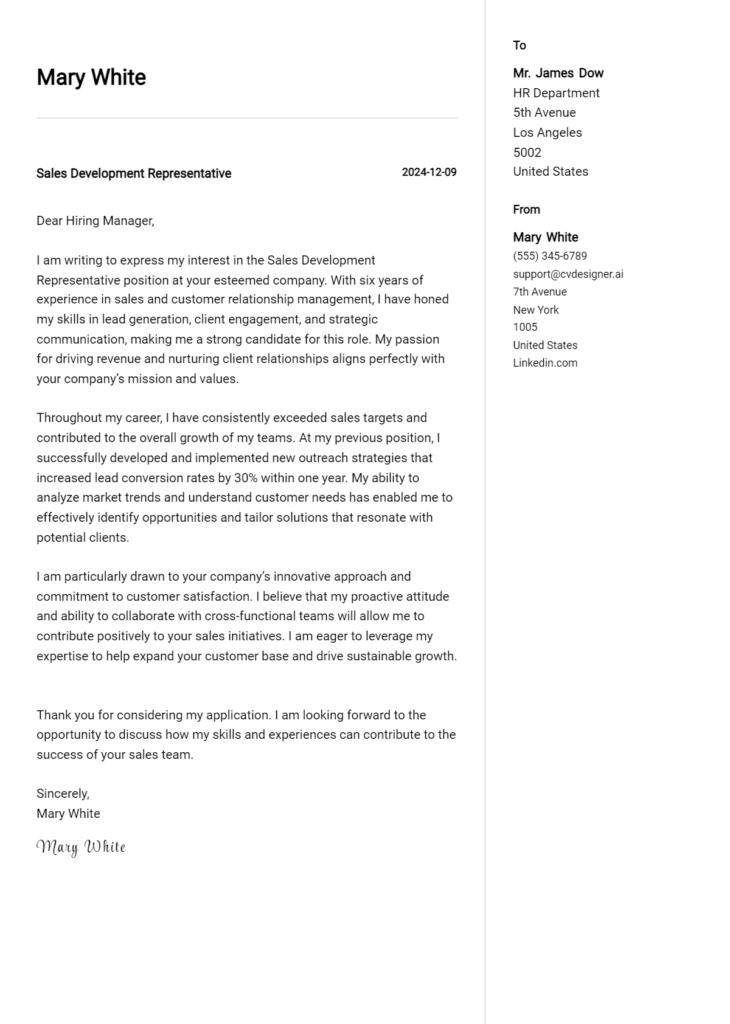

Importance of the Cover Letter Header for an Insurance Sales Agent

The cover letter header is a critical component of your application as an Insurance Sales Agent, serving as the first impression you make on potential employers. A well-structured header not only provides essential contact information but also sets a tone of professionalism and clarity. It should include your name, address, phone number, email, the date, and the recipient's details. This organization allows hiring managers to quickly identify who you are and how to reach you, which is vital in the competitive insurance sales industry. A clear and professional header reflects your attention to detail and commitment to providing excellent service—qualities that are essential for success in sales.

Strong Example

John Doe 1234 Elm Street Springfield, IL 62701 (555) 123-4567 johndoe@email.com March 1, 2023 Jane Smith Hiring Manager ABC Insurance Company 5678 Oak Avenue Springfield, IL 62702

Weak Example

John D. Email: johndoe@email.com March 1, 2023 To Whom It May Concern

The Importance of the Cover Letter Greeting for an Insurance Sales Agent

The greeting of your cover letter is the first impression you make on the hiring manager, setting the tone for the rest of your application. A well-crafted greeting demonstrates professionalism and shows that you have taken the time to personalize your letter, which can make a significant difference in a competitive field like insurance sales. Instead of using generic greetings, which can come off as impersonal, consider researching the recipient's name to address them directly. This small effort reflects your commitment and attention to detail, qualities that are essential in the insurance industry.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

By utilizing a strong greeting, you not only make a positive impression but also establish a connection that can lead to greater engagement from the reader. Avoiding generic greetings enhances your cover letter's impact, making it more likely to resonate with the hiring manager.

Importance of a Well-Crafted Cover Letter Introduction for an Insurance Sales Agent

A well-crafted cover letter introduction is essential for an Insurance Sales Agent, as it serves as the first impression to the hiring manager. This opening paragraph should not only capture their attention but also clearly express the candidate’s enthusiasm for the role. Moreover, it should briefly highlight key skills or achievements that demonstrate the candidate’s suitability for the position. A strong introduction sets the tone for the rest of the cover letter, making the candidate stand out in a competitive job market. Conversely, a weak introduction may fail to engage the reader, missing the opportunity to make a compelling case for the candidate's candidacy.

Strong Example

Dear [Hiring Manager's Name], As a passionate and results-driven insurance sales professional with over five years of experience in exceeding sales targets and building lasting client relationships, I am excited to apply for the Insurance Sales Agent position at [Company Name]. My proven track record in identifying customer needs and delivering tailored insurance solutions not only aligns with your company’s mission of providing exceptional service but also showcases my commitment to helping clients secure their financial future. I am eager to bring my expertise and dedication to your team.

Weak Example

Hello, I’m writing to apply for the job of Insurance Sales Agent. I have some experience in sales and think I could do well in this role. I am interested in working at your company, but I’m not sure what specific skills I have that would be beneficial.

Purpose of the Cover Letter Body for an Insurance Sales Agent

The body of a cover letter for an Insurance Sales Agent serves as a crucial section where candidates can effectively showcase their skills, experiences, and the unique value they bring to the company. This section allows applicants to highlight specific projects or accomplishments that demonstrate their sales abilities, customer service skills, and industry knowledge. By providing concrete examples, candidates can illustrate their potential to drive sales and foster client relationships, making a compelling case for why they would be an asset to the organization.

Strong Example

I am excited to apply for the Insurance Sales Agent position at XYZ Insurance, where my dedication to client satisfaction and proven sales record can contribute to your team's success. In my previous role at ABC Insurance, I implemented a targeted outreach strategy that increased our client base by 30% within six months. By leveraging my strong communication skills and deep understanding of insurance products, I was able to educate clients on their options, ultimately resulting in a 25% increase in policy renewals. I am eager to bring my proactive approach and commitment to excellence to XYZ Insurance.

Weak Example

I think I would be a good fit for the Insurance Sales Agent position. I have worked in sales for a while and have some experience with insurance. I believe I can help your company. I did some things at my last job, but I can't remember the details right now. I like to work with people and think I can sell insurance to customers.

Importance of the Cover Letter Closing for an Insurance Sales Agent

The closing paragraph of a cover letter is crucial for an Insurance Sales Agent, as it serves to summarize the candidate's qualifications, reiterate their enthusiasm for the position, and encourage the hiring manager to take the next step, such as reviewing the attached resume or scheduling an interview. A strong closing leaves a lasting impression and reinforces the candidate's suitability for the role, while a weak closing may diminish the overall impact of the application.

Strong Example

Thank you for considering my application for the Insurance Sales Agent position. With my extensive background in sales and customer service, coupled with my passion for helping individuals secure their futures, I am confident in my ability to contribute to your team. I look forward to the possibility of discussing my application in more detail and am eager to bring my expertise to your esteemed company. Please feel free to contact me at your convenience to schedule an interview. Thank you once again for your time and consideration.

Weak Example

Thanks for reading my letter. I think I would be a decent fit for the Insurance Sales Agent job. If you want, you can look at my resume. I’m available for an interview, but I’m not sure when.

Crafting an effective cover letter for an Insurance Sales Agent position is essential to stand out in a competitive job market. A well-written cover letter not only highlights your qualifications but also demonstrates your passion for the industry and your commitment to providing exceptional service. To effectively showcase your technical skills, problem-solving abilities, knowledge of the Sales Development Life Cycle (SDLC), teamwork, and a desire for continuous learning, consider the following tips.

Tips for Writing a Cover Letter for an Insurance Sales Agent

Highlight Your Technical Skills: Be explicit about the technical skills that are relevant to the insurance industry. This could include familiarity with quoting software, customer relationship management (CRM) systems, and data analysis tools. Mention any certifications or training that enhance your technical proficiency, as these can set you apart from other candidates.

Demonstrate Problem-Solving Abilities: Use specific examples from your past experience to illustrate your problem-solving skills. Describe situations where you successfully resolved client issues or navigated complex insurance scenarios, showcasing your ability to think critically and provide solutions under pressure.

Show Knowledge of the SDLC: While the SDLC is primarily known in software development, you can draw parallels in how you approach sales cycles. Discuss your understanding of the sales process—from prospecting to closing—and how you adapt your strategy based on client needs and market conditions. This demonstrates that you have a structured approach to your work.

Emphasize Teamwork: Insurance sales often require collaboration with various stakeholders, including underwriters, claims adjusters, and customers. Describe your experience working in a team environment, highlighting how you contributed to team goals and fostered a collaborative culture. This shows potential employers that you value teamwork and can work effectively with others.

Express a Passion for Continuous Learning: The insurance industry is constantly evolving, and staying updated with trends, regulations, and best practices is crucial. Mention any recent training, workshops, or industry certifications you have pursued. This illustrates your commitment to personal and professional growth, which is a valuable trait in a sales environment.

By integrating these tips into your cover letter, you can create a compelling narrative that positions you as a strong candidate for the Insurance Sales Agent role. For additional resources, check out our cover letter templates and consider using a cover letter builder to streamline your writing process.

Common Mistakes to Avoid in an Insurance Sales Agent Cover Letter

Avoiding common mistakes in your cover letter is crucial for making a positive impression on potential employers in the insurance sales industry. A well-crafted cover letter can set you apart from other candidates, highlighting your skills and enthusiasm for the role. Here are some common pitfalls to watch out for:

Generic Greetings: Using "To Whom It May Concern" can make your application feel impersonal. Instead, try to find the hiring manager's name for a more tailored approach.

Lack of Specificity: Failing to mention specific skills related to the insurance sales role can weaken your application. Highlight your sales achievements and knowledge of insurance products to show your fit for the job.

Repetitive Content: Simply restating your resume can bore employers. Use your cover letter to elaborate on key experiences and showcase your personality.

Typos and Grammatical Errors: These mistakes can create a negative impression. Always proofread your cover letter or use tools to check for errors before submitting.

Neglecting the Format: A poorly structured cover letter can deter hiring managers. Follow a professional cover letter format to ensure clarity and readability.

Excessive Length: Keep your cover letter concise; ideally, it should not exceed one page. Focus on the most relevant experiences to maintain the reader's interest.

Overlooking the Call to Action: Failing to express your desire for an interview can leave your cover letter feeling incomplete. Conclude with a strong call to action, inviting the employer to discuss your application further.

For more guidance, consider exploring cover letter examples to inspire your writing.

Cover Letter FAQs for Insurance Sales Agent

What should I include in my cover letter for an Insurance Sales Agent position?

When writing your cover letter for an Insurance Sales Agent role, focus on showcasing your sales skills, industry knowledge, and customer service experience. Start with a compelling introduction that highlights your enthusiasm for the role and the company. In the body, emphasize relevant accomplishments, such as sales targets you've exceeded or successful client relationships you've built. Mention your understanding of various insurance products and how you can help clients find the right coverage. Finally, express your eagerness to contribute to the company's growth while demonstrating your commitment to ethical practices in insurance sales.

How can I tailor my cover letter for a specific Insurance Sales Agent job?

To tailor your cover letter effectively, research the company and the specific job description. Highlight any skills or experiences that align with the job requirements. For example, if the company emphasizes customer relationship management, provide examples from your past roles where you excelled in this area. Use keywords from the job listing to demonstrate your compatibility with the position. Additionally, mention any relevant certifications or training that set you apart from other candidates. Personalizing your cover letter shows genuine interest and can make a strong impression on hiring managers.

How long should my cover letter be for an Insurance Sales Agent application?

Your cover letter should ideally be one page long, consisting of three to four paragraphs. Aim for around 250-400 words to ensure you provide sufficient detail without overwhelming the reader. Start with a strong opening paragraph that grabs attention, followed by a couple of paragraphs detailing your qualifications, experiences, and achievements relevant to the Insurance Sales Agent role. Conclude with a closing paragraph that reiterates your enthusiasm for the position and invites further discussion. Keeping your cover letter concise and focused will enhance its effectiveness and readability.

Should I include my sales achievements in my cover letter?

Absolutely! Including your sales achievements in your cover letter is crucial for demonstrating your effectiveness as an Insurance Sales Agent. Highlight specific metrics, such as the percentage by which you exceeded sales targets or the number of policies you sold in a given timeframe. Use quantifiable results to paint a clear picture of your capabilities. This not only shows your competence but also your ability to drive revenue for the company. Make sure to connect these achievements to how they can benefit the prospective employer, making your case even stronger.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.