Debt Recovery Specialist Cover Letter Examples

Explore additional Debt Recovery Specialist cover letter samples and guides and see what works for your level of experience or role.

How to Format a Debt Recovery Specialist Cover Letter?

Crafting a compelling cover letter for a Debt Recovery Specialist position is essential to making a positive impression on potential employers. The way you format your cover letter not only showcases your qualifications but also reflects your organizational skills and ability to communicate effectively—both critical traits in the debt recovery field. A well-structured cover letter captures the hiring manager's attention while demonstrating your professionalism and attention to detail.

In this guide, we'll cover how to structure your cover letter, offering insights and debt recovery-specific examples to help you create a persuasive document.

We'll focus on the essential components of a professional cover letter, including:

- Cover Letter Header

- Cover Letter Greeting

- Cover Letter Introduction

- Cover Letter Body

- Cover Letter Closing

Each section plays a vital role in highlighting your qualifications and suitability for the role. Let’s break down each part and explain how to make your Debt Recovery Specialist cover letter stand out.

Importance of the Cover Letter Header for a Debt Recovery Specialist

A well-structured cover letter header is essential for a Debt Recovery Specialist as it sets the tone for the entire document. It provides the necessary contact information, ensuring that the employer can easily reach you. The header should include your name, address, phone number, and email, followed by the date and the recipient's details, including their name, title, company, and address. Clarity and professionalism in the header reflect your attention to detail, an important trait in debt recovery roles where precision is critical.

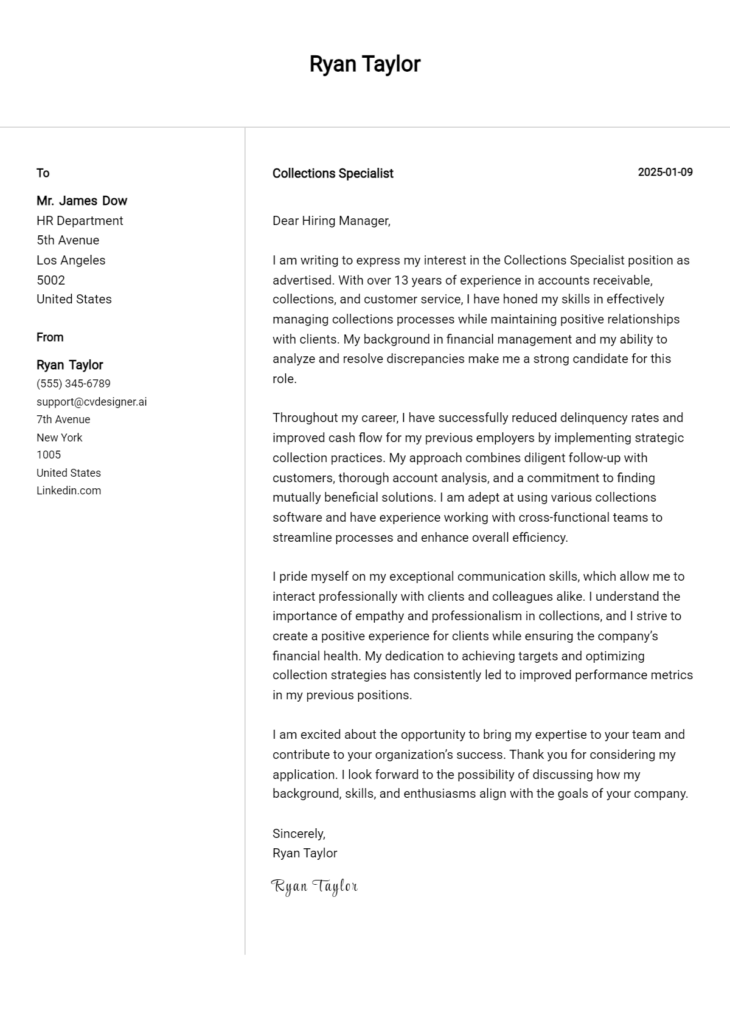

Strong Example

John Doe 123 Main Street Cityville, ST 12345 (123) 456-7890 john.doe@email.com October 1, 2023 Jane Smith Hiring Manager ABC Debt Recovery Services 456 Elm Street Cityville, ST 12345

Weak Example

jdoe@email.com 10/01/23 Hi, ABC Company

Importance of the Cover Letter Greeting for a Debt Recovery Specialist

The greeting of a cover letter is more than just a formality; it sets the tone for the entire document and establishes a connection between you and the hiring manager. A well-crafted greeting demonstrates professionalism and shows that you have taken the time to personalize your application. Addressing the hiring manager directly can create a sense of engagement and respect, which is especially important in fields like debt recovery, where building rapport is crucial. To avoid generic greetings that can make your application blend in with the rest, take a few moments to research the recipient's name. This small effort can significantly enhance the impression you make.

When crafting your greeting, aim for warmth and professionalism, ensuring that you establish a strong first impression.

Strong Greeting Example

Dear Ms. Johnson,

Weak Greeting Example

To Whom It May Concern,

The Importance of a Strong Cover Letter Introduction for a Debt Recovery Specialist

A well-crafted cover letter introduction is crucial for a Debt Recovery Specialist as it sets the tone for the entire application. This introductory paragraph should not only capture the hiring manager's attention but also convey the candidate's genuine interest in the role. Furthermore, it should briefly highlight key skills or achievements that make the candidate the ideal fit for the position. A compelling introduction can differentiate a candidate from others, showcasing their unique qualifications and enthusiasm for contributing to the organization's success.

Strong Example

Dear [Hiring Manager's Name], I am excited to apply for the Debt Recovery Specialist position at [Company Name], as advertised on [Job Board]. With over five years of experience in debt recovery and a proven track record of successfully reducing outstanding debts by over 30%, I am confident in my ability to contribute effectively to your team. My strong negotiation skills and commitment to customer service have enabled me to maintain positive relationships with clients while achieving outstanding recovery results.

Weak Example

To Whom It May Concern, I want to apply for the Debt Recovery Specialist job at your company. I have some experience in debt collection, and I think I would be a good fit. I have worked in various roles before, but I’m not sure if they are relevant. I just really need a job, and I hope you will consider my application.

Purpose of the Cover Letter Body for a Debt Recovery Specialist

The body of a cover letter for a Debt Recovery Specialist serves as a critical platform for candidates to effectively communicate their skills, experiences, and the unique value they can bring to the organization. This section allows candidates to highlight specific projects or accomplishments that demonstrate their expertise in debt recovery, negotiation, and client relationship management. By detailing previous successes, such as recovering a substantial percentage of overdue accounts or implementing effective recovery strategies, candidates can present themselves as competent and results-driven professionals. The cover letter body should not only outline relevant experiences but also convey a proactive approach to challenges in debt recovery processes.

Strong Example

As a Debt Recovery Specialist with over five years of experience, I successfully managed a portfolio of over 500 accounts, recovering over 85% of overdue debts within 90 days. In my previous role at XYZ Financial Services, I implemented a new recovery strategy that reduced the average collection time by 30%, resulting in an increase of $200,000 in annual revenue. My strong negotiation skills and ability to build rapport with clients have consistently resulted in favorable outcomes, positioning me as a top performer on my team. I am eager to bring my proven track record and innovative approach to debt recovery to your organization.

Weak Example

I have worked in debt recovery for a few years and have some experience. I think I would be a good fit for your company. I have helped recover debts, but I don't remember the specifics. I am good at talking to people and resolving issues. I hope to contribute positively to your team if given the chance.

Importance of the Cover Letter Closing for a Debt Recovery Specialist

The closing paragraph of your cover letter is crucial, especially for a Debt Recovery Specialist role. It serves as your final opportunity to summarize your qualifications, express enthusiasm for the position, and prompt the hiring manager to take action, such as reviewing your resume or scheduling an interview. A strong closing not only reinforces your candidacy but also leaves a lasting impression, while a weak closing can diminish the impact of your application.

Strong Example

Thank you for considering my application for the Debt Recovery Specialist position at [Company Name]. With my extensive experience in debt collection, strong negotiation skills, and commitment to customer service, I am excited about the opportunity to contribute to your team. I look forward to the possibility of discussing how my background can align with the goals of [Company Name]. Please feel free to contact me at your earliest convenience to schedule an interview. Thank you for your time and consideration.

Weak Example

Thanks for looking at my cover letter. I think I would be good at the job. Please check my resume. Hope to hear from you.

These tips will help candidates craft an effective cover letter for a Debt Recovery Specialist position. A well-structured cover letter is crucial for standing out in a competitive job market. It's essential to highlight not only your technical skills and problem-solving abilities but also your knowledge of the Software Development Life Cycle (SDLC), teamwork capabilities, and a commitment to continuous learning. By showcasing these qualities, you can present yourself as a well-rounded candidate eager to contribute to the organization.

Cover Letter Writing Tips for Debt Recovery Specialist

Highlight Technical Skills

Clearly outline your technical expertise relevant to debt recovery, such as proficiency in debt management software, data analysis tools, and customer relationship management (CRM) systems. Use specific examples to demonstrate how your technical skills have led to successful outcomes in previous roles, ensuring that you align them with the requirements of the job description.Demonstrate Problem-Solving Abilities

Provide concrete examples of your problem-solving skills in action. Discuss specific challenges you faced in debt recovery scenarios and how you navigated them to achieve positive results. This not only shows your capability but also your proactive approach to overcoming obstacles in the field.Showcase SDLC Knowledge

If applicable, mention your understanding of the Software Development Life Cycle (SDLC) and how it relates to debt recovery processes. Explain how your knowledge of SDLC can help in implementing or improving debt recovery systems, keeping the organization at the forefront of industry practices.Emphasize Teamwork

Collaborative skills are vital in debt recovery, as you often work with other departments, such as legal and finance. Highlight your experience in teamwork and collaboration, citing examples of successful projects where you contributed to a team’s goals and how this led to improved debt recovery outcomes for your previous employers.Express a Passion for Continuous Learning

The debt recovery landscape is always evolving, so convey your commitment to ongoing education and professional development. Mention any relevant certifications, courses, or workshops you have completed or are pursuing. This demonstrates your dedication to staying informed about industry trends, regulations, and best practices, which is a valuable asset to any employer.

For more assistance in crafting your cover letter, consider utilizing cover letter templates or a cover letter builder to ensure your application stands out.

Common Mistakes to Avoid in a Debt Recovery Specialist Cover Letter

Crafting a compelling cover letter is essential for standing out in the competitive field of debt recovery. Avoiding common mistakes can significantly enhance your chances of securing an interview. Here are some pitfalls to watch out for when writing your cover letter:

Generic Greetings: Addressing the letter with a generic "To Whom It May Concern" can come off as impersonal. Always try to find the hiring manager's name and personalize your greeting.

Lack of Specificity: Failing to mention specific skills or experiences relevant to debt recovery can weaken your application. Tailor your letter to highlight your expertise in financial negotiations and customer relations.

Excessive Length: A cover letter should be concise and to the point. Aim for no more than one page, focusing on key qualifications. For guidance on structure, check out this cover letter format.

Neglecting Keywords: Not including relevant industry keywords can lead your application to be overlooked. Review the job description and incorporate terms that demonstrate your knowledge of debt recovery processes.

Typos and Grammatical Errors: These mistakes undermine professionalism. Always proofread your cover letter or use tools to check for errors before submitting.

Overemphasis on Salary: Focusing too much on compensation can be off-putting. Instead, emphasize your passion for the role and how you can contribute to the company's success.

Ignoring the Call to Action: Failing to express your eagerness for an interview or next steps can leave your letter feeling incomplete. Clearly state your interest in discussing your qualifications further.

For additional inspiration, explore these cover letter examples to see what works best for your application.

Cover Letter FAQs for Debt Recovery Specialist

What should I include in my cover letter for a Debt Recovery Specialist position?

Your cover letter should include a brief introduction outlining your interest in the Debt Recovery Specialist position, followed by a summary of your relevant experience. Highlight specific skills such as negotiation, communication, and analytical abilities that are crucial for debt recovery. Include examples of past successes in recovering debts or managing difficult conversations with clients. Additionally, mention any relevant qualifications, such as certifications in collections or finance, and express your understanding of relevant laws and regulations. Conclude with a strong closing statement that reiterates your enthusiasm for the role and your desire to contribute to the company's success.

How can I demonstrate my skills in debt recovery in a cover letter?

To effectively demonstrate your skills in debt recovery, provide specific examples from your previous experience. For instance, mention situations where you successfully negotiated repayment plans or resolved disputes with clients. Use quantifiable metrics, such as the percentage of debts collected or the reduction of outstanding balances under your management. Additionally, emphasize your proficiency with debt recovery software or systems, as well as your understanding of compliance with legal regulations. Be sure to connect these skills to the job description, showing how your expertise aligns with the needs of the employer.

Should I address any gaps in my experience in my cover letter?

Yes, addressing gaps in your experience can be beneficial, but it should be done strategically. If you have gaps in your employment history or lack specific experience in debt recovery, briefly explain the reasons in a positive light. For example, you might mention taking time off for personal development or pursuing additional education. Focus on transferable skills gained during that time, such as customer service or financial analysis. Highlight how these experiences have prepared you for the Debt Recovery Specialist role. Framing your gaps constructively will help maintain a positive tone and reinforce your suitability for the position.

How important is the closing statement in my cover letter?

The closing statement in your cover letter is crucial as it leaves a lasting impression on the reader. It should summarize your enthusiasm for the Debt Recovery Specialist position and express your eagerness to contribute to the organization's success. A strong closing will reiterate your qualifications and invite further conversation. You might say something like, “I am excited about the opportunity to leverage my skills in debt recovery to help [Company Name] enhance its financial performance.” Additionally, include a call to action, such as looking forward to the possibility of discussing your application further. A well-crafted closing statement can significantly impact the employer's perception of your candidacy.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.