Cash Flow Manager Core Responsibilities

A Cash Flow Manager is pivotal in ensuring the financial health of an organization by monitoring, analyzing, and optimizing cash flow. This role requires strong technical, operational, and problem-solving skills to bridge various departments, such as finance, accounting, and operations. By effectively managing cash flow, the professional supports the organization’s strategic goals, enabling timely decision-making. A well-structured resume that highlights these competencies can significantly enhance a candidate's visibility and attractiveness to potential employers.

Common Responsibilities Listed on Cash Flow Manager Resume

- Develop and implement cash flow forecasting models.

- Analyze cash flow patterns and identify trends.

- Collaborate with finance, accounting, and operations teams to optimize liquidity.

- Prepare detailed reports on cash flow performance for management review.

- Monitor accounts receivable and payable to ensure timely collections and payments.

- Manage cash reserves and investment strategies.

- Identify and mitigate cash flow risks and discrepancies.

- Provide strategic recommendations to improve financial performance.

- Ensure compliance with financial regulations and policies.

- Conduct scenario analysis to anticipate future cash needs.

- Facilitate communication between departments regarding cash flow implications.

- Support budgeting and forecasting processes for improved cash management.

High-Level Resume Tips for Cash Flow Manager Professionals

In today's competitive job market, a well-crafted resume is crucial for Cash Flow Manager professionals seeking to make a strong first impression on potential employers. As the first point of contact between a candidate and a hiring manager, your resume must effectively showcase your skills, experience, and accomplishments in financial management. A thoughtfully designed resume not only highlights your expertise in cash flow analysis and forecasting but also positions you as a strong candidate who can contribute to the company's financial health. This guide will provide practical and actionable resume tips specifically tailored for Cash Flow Manager professionals, helping you stand out in the hiring process.

Top Resume Tips for Cash Flow Manager Professionals

- Tailor your resume to match the specific job description by incorporating relevant keywords and phrases.

- Highlight your experience in cash flow management, including specific roles and responsibilities you've held in previous positions.

- Quantify your achievements by using metrics and numbers, such as percentage improvements in cash flow or reductions in expenses.

- Showcase your proficiency with financial software and tools that are commonly used in cash flow management.

- Include industry-specific skills, such as forecasting, budgeting, and financial analysis, to demonstrate your expertise.

- Use a clear and professional format that enhances readability and allows key information to stand out.

- Emphasize your ability to collaborate with cross-functional teams to optimize cash flow and improve financial decision-making.

- Incorporate any relevant certifications or professional development related to finance or cash management.

- Focus on recent and relevant experiences, ensuring that your resume reflects your most current skills and accomplishments.

- Consider adding a summary statement at the top of your resume that encapsulates your career objectives and key qualifications.

By implementing these tips, you can significantly increase your chances of landing a job in the Cash Flow Manager field. A polished and strategic resume that effectively highlights your skills and achievements will not only capture the attention of hiring managers but also demonstrate your capability to contribute to their organization's financial success.

Why Resume Headlines & Titles are Important for Cash Flow Manager

In the competitive field of finance, a Cash Flow Manager plays a crucial role in maintaining the financial health of an organization by effectively overseeing cash flow operations, forecasting future financial conditions, and ensuring liquidity. When it comes to applying for positions in this domain, a well-crafted resume headline or title is vital. It serves as the first impression a hiring manager will have and can significantly influence their decision to read further. A strong headline not only grabs attention but also succinctly summarizes a candidate's key qualifications, skills, or achievements relevant to the Cash Flow Manager role. Therefore, it is essential that this element of the resume is concise, relevant, and directly related to the job being pursued.

Best Practices for Crafting Resume Headlines for Cash Flow Manager

- Be concise: Limit your headline to one impactful sentence.

- Use specific language: Tailor your headline to reflect the Cash Flow Manager role.

- Highlight key qualifications: Emphasize your most relevant skills and experiences.

- Incorporate industry keywords: Use terminology that resonates with the finance sector.

- Showcase achievements: Mention specific accomplishments that illustrate your expertise.

- Avoid jargon: Use clear, straightforward language to convey your message.

- Keep it professional: Maintain a formal tone that aligns with industry standards.

- Reflect your unique value: Communicate what sets you apart from other candidates.

Example Resume Headlines for Cash Flow Manager

Strong Resume Headlines

Dynamic Cash Flow Manager with 10+ Years of Experience in Financial Forecasting and Liquidity Management

Results-Driven Cash Flow Specialist Focused on Optimizing Cash Flow and Reducing Operational Costs

Experienced Financial Professional Excelling in Cash Flow Analysis and Strategic Financial Planning

Proven Cash Flow Manager with a Track Record of Enhancing Cash Efficiency by 30% Year-Over-Year

Weak Resume Headlines

Finance Professional Seeking New Opportunities

Cash Flow Manager

Experienced in Finance

The strong headlines are effective because they clearly articulate the candidate's strengths and experiences relevant to the Cash Flow Manager position, capturing the essence of what makes them a strong contender. They include specific achievements and industry-related terminology that resonate with hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail. They do not convey any unique value or qualifications, making it difficult for hiring managers to see how the candidate stands out in a competitive job market.

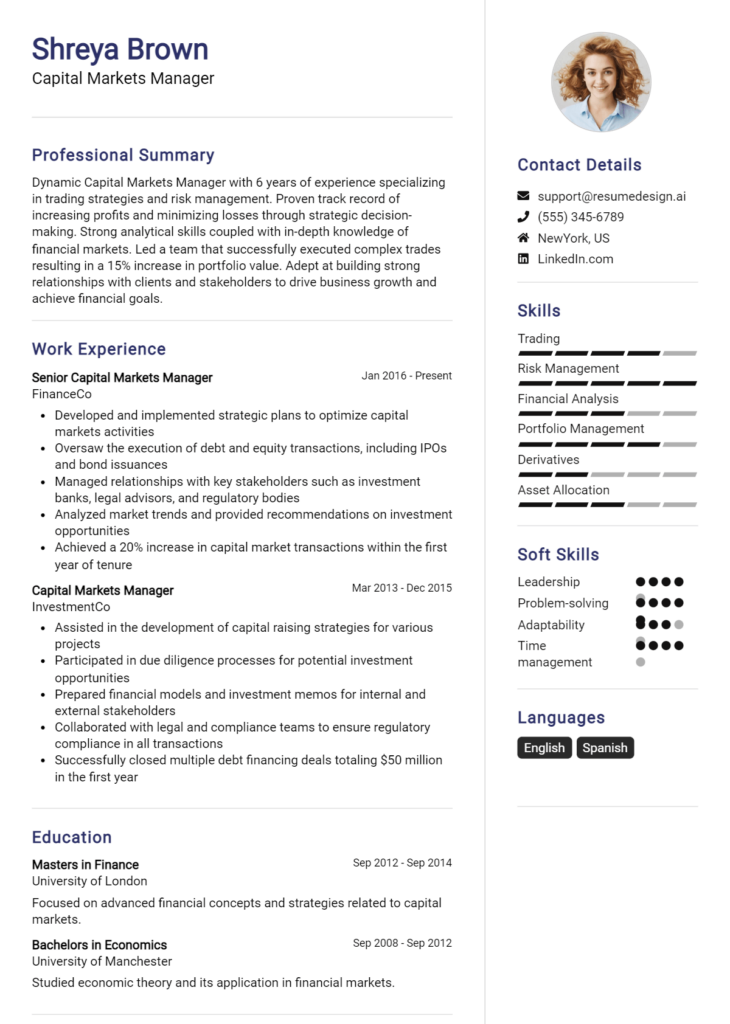

Writing an Exceptional Cash Flow Manager Resume Summary

In the competitive field of finance, a well-crafted resume summary is crucial for a Cash Flow Manager. This brief yet impactful introduction serves as the first impression for hiring managers, allowing candidates to effectively showcase their key skills, experience, and relevant accomplishments. A strong summary can quickly capture attention, providing a snapshot of the candidate's qualifications that align with the job requirements. It should be concise, engaging, and tailored to the specific position, setting the stage for the rest of the resume.

Best Practices for Writing a Cash Flow Manager Resume Summary

- Quantify Achievements: Use numbers and metrics to highlight your accomplishments, such as improvements in cash flow percentages or reductions in costs.

- Focus on Key Skills: Emphasize skills relevant to cash flow management, such as forecasting, budgeting, and financial analysis.

- Tailor to the Job Description: Customize your summary to reflect the specific requirements and keywords from the job posting.

- Be Concise: Keep your summary to 2-4 sentences, ensuring it is direct and to the point.

- Highlight Relevant Experience: Mention specific experience in cash flow management, including previous roles and industries.

- Showcase Problem-Solving Abilities: Illustrate how you have effectively managed cash flow challenges in past positions.

- Use Action Verbs: Start sentences with strong verbs to convey confidence and impact.

- Maintain Professional Tone: Ensure the summary reflects a professional demeanor suitable for a managerial role.

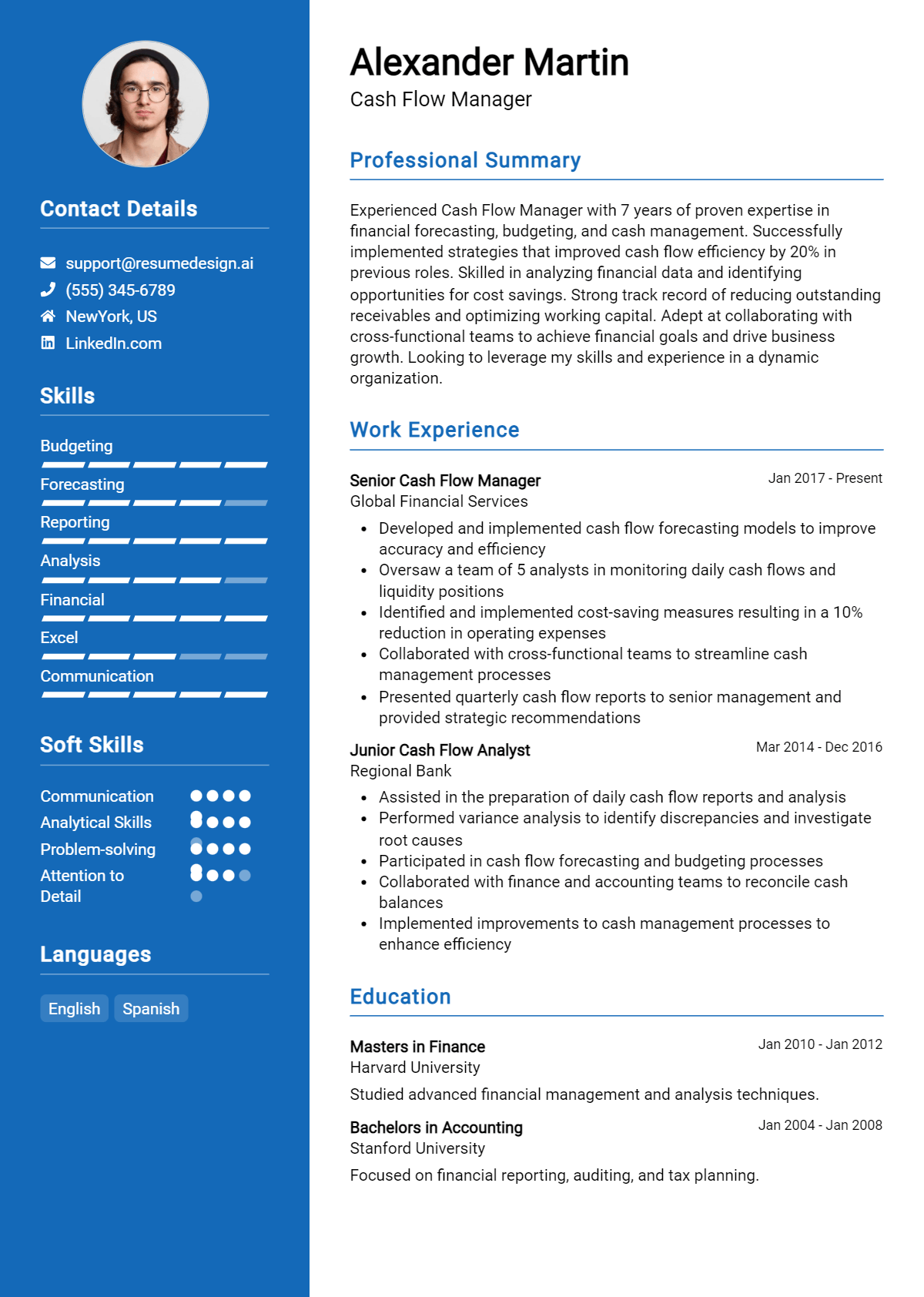

Example Cash Flow Manager Resume Summaries

Strong Resume Summaries

Dynamic Cash Flow Manager with over 8 years of experience optimizing cash flow processes, resulting in a 30% increase in liquidity for a mid-sized manufacturing firm. Expert in cash flow forecasting, budgeting, and financial analysis, with a proven track record of reducing operational costs by 15% through strategic planning.

Results-driven financial professional with 10 years of experience in cash management and working capital optimization. Successfully managed a portfolio of over $50 million, achieving a 25% improvement in cash conversion cycles through effective cash flow strategies and collaboration with cross-functional teams.

Detail-oriented Cash Flow Manager with a strong background in financial modeling and analysis. Increased cash reserves by 40% in the past fiscal year by implementing robust cash management systems and enhancing forecasting accuracy.

Weak Resume Summaries

Experienced finance professional looking for a position in cash flow management. I have a good understanding of finance and budgeting.

Detail-oriented individual with some experience in cash flow. I am seeking a role where I can utilize my skills.

The examples above illustrate the difference between strong and weak resume summaries. Strong summaries effectively quantify achievements, specify relevant skills, and demonstrate direct relevance to the Cash Flow Manager role, making them impactful and memorable. In contrast, weak summaries lack detail, are overly generic, and fail to convey the candidate's specific qualifications and successes, which diminishes their chances of capturing a hiring manager's attention.

Work Experience Section for Cash Flow Manager Resume

The work experience section of a Cash Flow Manager resume is critical as it serves as a platform to demonstrate the candidate's technical skills, leadership capabilities, and their ability to deliver high-quality financial products. This section not only reflects the candidate's hands-on experience in managing cash flow but also showcases their proficiency in financial analysis, forecasting, and strategic planning. Quantifying achievements, such as improved cash flow efficiency or reduced operational costs, is essential in this section to provide concrete evidence of their impact. Aligning past experiences with industry standards ensures that the candidate presents a competitive profile that meets the expectations of potential employers.

Best Practices for Cash Flow Manager Work Experience

- Highlight relevant technical skills, such as proficiency in cash flow forecasting and financial modeling.

- Include quantifiable results, such as percentage increases in cash reserves or reductions in cash cycle times.

- Demonstrate leadership by showcasing examples of team management and cross-departmental collaboration.

- Use action verbs to convey a sense of proactivity and initiative in your role.

- Align your experience with industry standards and best practices in cash flow management.

- Tailor your work experience to the specific requirements of the job you are applying for.

- Incorporate relevant certifications or training that enhance your credibility as a Cash Flow Manager.

- Include any technology or tools you have employed to optimize cash flow processes.

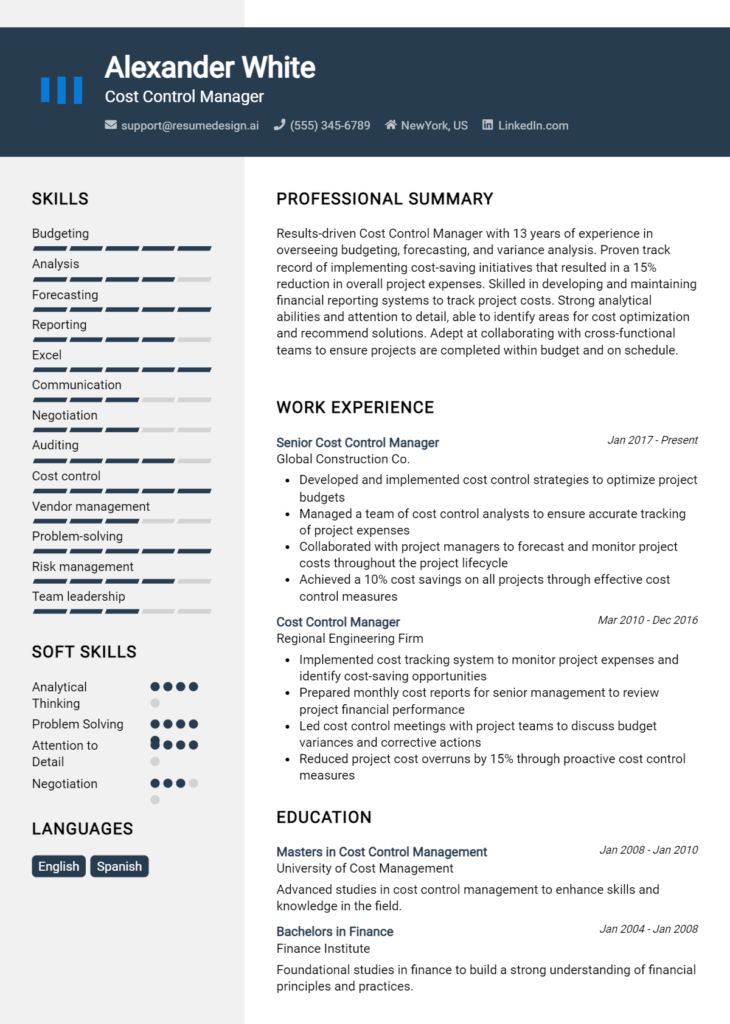

Example Work Experiences for Cash Flow Manager

Strong Experiences

- Implemented a new cash flow forecasting model that increased forecasting accuracy by 30%, resulting in a more efficient allocation of resources.

- Led a cross-functional team to streamline cash management processes, reducing cash cycle time from 45 days to 30 days, which improved liquidity.

- Developed and executed a cash flow optimization strategy that reduced operational costs by 15%, contributing to a $500,000 increase in annual revenue.

- Managed a team of five financial analysts, fostering collaboration that resulted in a 25% reduction in reporting errors and improved financial reporting timelines.

Weak Experiences

- Responsible for cash flow management tasks.

- Assisted the finance team with various projects.

- Worked on improving cash flow processes.

- Participated in team meetings related to financial reporting.

The examples listed as strong experiences stand out because they are specific, quantifiable, and demonstrate a clear impact on the organization’s financial performance. They reflect leadership, initiative, and technical expertise, making the candidate a valuable asset. In contrast, the weak experiences lack detail and measurable outcomes, failing to convey the candidate's contributions or skills effectively. These vague statements do not provide a compelling narrative of the candidate's capabilities and achievements, making it difficult for employers to assess their qualifications.

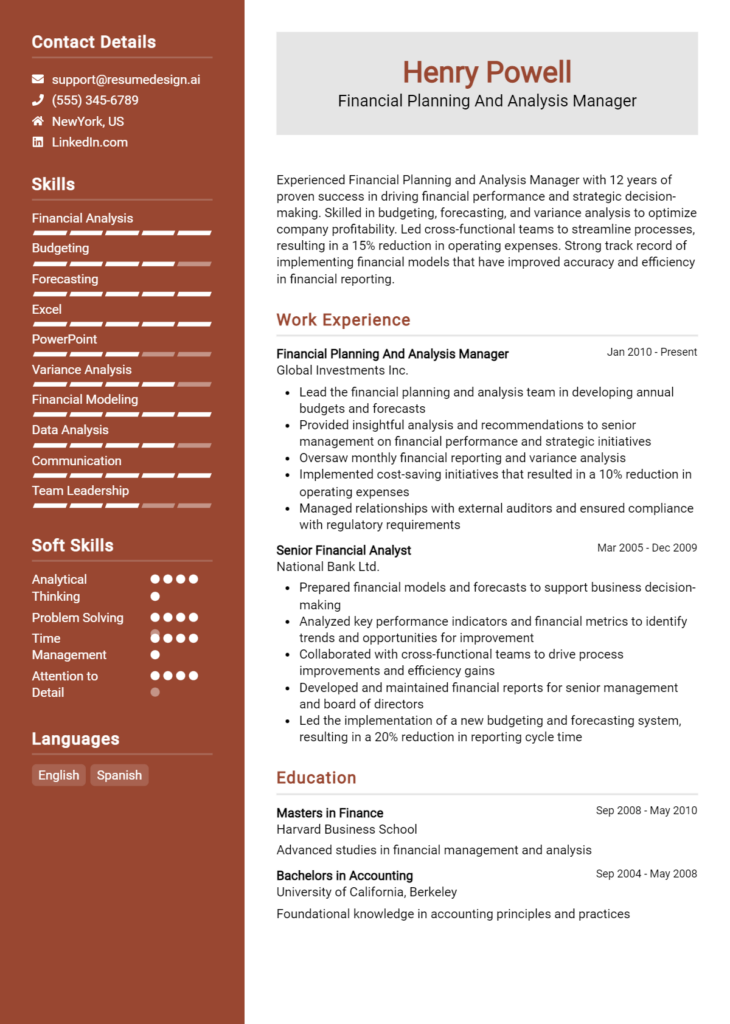

Education and Certifications Section for Cash Flow Manager Resume

The education and certifications section of a Cash Flow Manager resume is a vital component that underscores a candidate's academic qualifications and industry-specific expertise. This section not only showcases the applicant's formal education but also highlights relevant certifications and ongoing professional development, demonstrating a commitment to staying updated in the ever-evolving financial landscape. By including pertinent coursework, recognized certifications, and specialized training, candidates can greatly enhance their credibility, effectively aligning their qualifications with the demands of the job role.

Best Practices for Cash Flow Manager Education and Certifications

- Focus on relevant degrees, such as Finance, Accounting, or Business Administration.

- Include industry-recognized certifications like Certified Management Accountant (CMA) or Certified Treasury Professional (CTP).

- Highlight specialized training or workshops that pertain to cash management and financial analysis.

- Provide details on relevant coursework, emphasizing subjects like financial forecasting and risk management.

- List any advanced degrees, such as a Master’s in Finance or MBA, to demonstrate higher-level expertise.

- Keep the format consistent and easy to read, using bullet points for clarity.

- Update the section regularly to reflect the most current qualifications and education.

- Consider including ongoing education efforts, such as webinars or online courses, to showcase a commitment to continuous learning.

Example Education and Certifications for Cash Flow Manager

Strong Examples

- MBA in Finance, University of XYZ, Graduated May 2022

- Certified Treasury Professional (CTP), Association for Financial Professionals, 2023

- Coursework in Financial Risk Management, University of ABC

- Bachelor’s Degree in Accounting, College of DEF, Graduated May 2020

Weak Examples

- General Studies Degree, Unnamed Institution, Graduated 2015

- Certification in Basic Computer Skills, 2019

- High School Diploma, Anytown High School, Graduated 2010

- Outdated certification in QuickBooks (2010)

The strong examples are considered effective because they directly relate to the skills and knowledge necessary for a Cash Flow Manager, demonstrating both academic rigor and relevant professional credentials. In contrast, the weak examples lack relevance to the role and do not provide the advanced knowledge or specialized skills needed, potentially undermining the candidate's qualifications and suitability for the position.

Top Skills & Keywords for Cash Flow Manager Resume

A well-crafted resume for a Cash Flow Manager is essential in showcasing the specific skills that make a candidate stand out in the competitive finance sector. Highlighting both hard and soft skills is crucial, as employers seek professionals who not only possess technical expertise but also demonstrate strong interpersonal abilities. A Cash Flow Manager plays a vital role in ensuring the financial health of an organization by effectively managing cash flow, forecasting, and strategic planning. Therefore, emphasizing relevant skills on a resume can significantly enhance a candidate's prospects, making them a more attractive option for potential employers. To learn more about essential skills for your resume, you can explore this skills resource.

Top Hard & Soft Skills for Cash Flow Manager

Soft Skills

- Analytical Thinking

- Problem-Solving

- Attention to Detail

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Negotiation Skills

- Leadership

- Emotional Intelligence

- Strategic Planning

- Conflict Resolution

Hard Skills

- Financial Modeling

- Cash Flow Forecasting

- Budgeting

- Financial Analysis

- Accounting Principles

- Risk Management

- Reporting and Analytics

- Proficiency in Financial Software (e.g., QuickBooks, SAP)

- Excel and Data Manipulation

- Regulatory Compliance

- Investment Analysis

- Treasury Management

- Knowledge of Tax Regulations

- Cost Control Techniques

Highlighting these skills effectively within your resume will not only demonstrate your qualifications but also show your readiness to contribute to the financial success of the organization. Additionally, don't forget to detail your relevant work experience to further strengthen your application.

Stand Out with a Winning Cash Flow Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Cash Flow Manager position at [Company Name], as advertised on [where you found the job posting]. With a robust background in finance and a proven track record of optimizing cash flow strategies, I am confident in my ability to contribute effectively to your team and help [Company Name] achieve its financial goals. My experience in financial forecasting, budgeting, and liquidity management equips me with the skills necessary to excel in this role.

In my previous role at [Previous Company Name], I successfully implemented cash flow forecasting models that increased cash reserves by 20% over a fiscal year. By analyzing historical cash flow data and market trends, I identified key areas for improvement and collaborated with cross-functional teams to enhance operational efficiency. My attention to detail and analytical mindset allowed me to provide actionable insights that supported strategic decision-making and ensured that the company maintained a healthy liquidity position.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in the industry. I am eager to bring my expertise in cash flow management to your organization and to collaborate closely with your finance team to develop robust strategies that mitigate risk and enhance financial stability. I believe that my proactive approach and ability to navigate complex financial landscapes will make a positive impact on [Company Name]'s operations.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am excited about the possibility of contributing to your team and am available for an interview at your earliest convenience.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Cash Flow Manager Resume

When crafting a resume for a Cash Flow Manager position, it's crucial to present a polished and professional document that effectively highlights your skills and experiences. However, many candidates make common mistakes that can detract from their qualifications and potentially cost them an interview. By being aware of these pitfalls, you can enhance your resume and improve your chances of standing out to potential employers.

Ignoring Quantifiable Achievements: Failing to include specific metrics or achievements can weaken your resume. Use numbers to demonstrate how you've improved cash flow, reduced costs, or increased efficiency.

Overcomplicating Language: Using jargon or overly complex language can make your resume difficult to read. Aim for clarity and conciseness to effectively convey your expertise.

Listing Irrelevant Experience: Including unrelated job experiences can distract from your qualifications. Focus on positions and responsibilities that directly relate to cash flow management or finance.

Neglecting Soft Skills: While technical skills are essential, overlooking soft skills like communication, leadership, and problem-solving can be a mistake. These attributes are critical in managing teams and collaborating with other departments.

Not Tailoring the Resume: A generic resume can come off as unfocused. Tailor your resume to the specific job description, emphasizing relevant experiences and skills that align with the employer's needs.

Poor Formatting: A cluttered or unprofessional layout can detract from your content. Use consistent formatting, clear headings, and bullet points to make your resume easy to read.

Omitting Professional Development: Failing to mention certifications, training, or ongoing education can leave out vital qualifications. Highlight any relevant courses or certifications that enhance your expertise in cash flow management.

Ignoring Typos and Errors: Grammatical mistakes and typos can create a negative impression. Always proofread your resume or consider having someone else review it to catch any errors.

Conclusion

As a Cash Flow Manager, your role is critical in ensuring the financial health of an organization by overseeing the inflow and outflow of cash. Key responsibilities include analyzing cash flow forecasts, managing liquidity, and optimizing working capital. You must also collaborate with various departments to ensure that cash management strategies align with the organization’s overall goals.

In summary, a strong Cash Flow Manager effectively balances immediate financial needs with long-term planning, making strategic decisions that impact the company's financial sustainability. If you’re looking to advance your career in this vital role, take a moment to review your Cash Flow Manager resume.

To enhance your application, consider utilizing various resources available to you. Explore resume templates to get started on a professional design that showcases your skills and experience. Use the resume builder for an easy, step-by-step approach to crafting your resume. Additionally, check out resume examples to inspire your writing and ensure you’re highlighting the right accomplishments. Don’t forget to complement your resume with a compelling cover letter template to make a strong first impression.

Take charge of your career today by refreshing your resume and positioning yourself as an ideal candidate for Cash Flow Manager roles.