Financial Compliance Manager Core Responsibilities

A Financial Compliance Manager is crucial in ensuring that an organization adheres to financial regulations and internal policies. This role requires strong technical skills, operational awareness, and problem-solving abilities to effectively bridge various departments, such as finance, legal, and operations. By identifying compliance gaps and implementing robust controls, they contribute to the organization's overall goals. A well-structured resume highlighting these competencies can significantly enhance a candidate's appeal to potential employers.

Common Responsibilities Listed on Financial Compliance Manager Resume

- Develop and implement compliance policies and procedures.

- Conduct regular audits and risk assessments to identify compliance issues.

- Monitor regulatory changes and assess their impact on the organization.

- Collaborate with legal and finance teams to ensure adherence to laws.

- Provide training and guidance to staff on compliance matters.

- Prepare and present compliance reports to senior management.

- Investigate compliance violations and recommend corrective actions.

- Maintain up-to-date knowledge of industry trends and best practices.

- Coordinate with external auditors and regulatory bodies.

- Support the development of compliance-related technology solutions.

- Establish and manage compliance metrics and performance indicators.

- Advise on compliance implications of new business initiatives.

High-Level Resume Tips for Financial Compliance Manager Professionals

In the competitive landscape of financial compliance, a well-crafted resume is crucial for professionals seeking to make a lasting impression on potential employers. As the first point of contact, your resume serves as a window into your skills, experiences, and achievements, showcasing your ability to navigate the complexities of regulatory environments. A strong resume not only highlights relevant qualifications but also demonstrates your understanding of industry standards and compliance practices. This guide will provide you with practical and actionable resume tips specifically tailored for Financial Compliance Manager professionals, ensuring that you stand out in a crowded job market.

Top Resume Tips for Financial Compliance Manager Professionals

- Tailor your resume to match the job description, emphasizing keywords and phrases relevant to the specific role.

- Highlight relevant experience in financial compliance, risk management, and regulatory frameworks.

- Quantify your achievements by including measurable outcomes, such as the percentage of compliance improvement or cost reductions achieved.

- Showcase your understanding of industry regulations, such as Sarbanes-Oxley, Dodd-Frank, or GDPR, by mentioning specific projects or initiatives.

- Include certifications such as Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP) to enhance your qualifications.

- Utilize a clean and professional format, ensuring that your resume is easy to read and free of errors.

- Incorporate action verbs to convey your contributions effectively, such as "led," "developed," or "implemented."

- List relevant technical skills, including compliance software and data analysis tools, to demonstrate your proficiency in essential areas.

- Consider including a summary statement at the top of your resume to provide a quick snapshot of your qualifications and career goals.

By implementing these tips, you can significantly increase your chances of landing a job in the Financial Compliance Manager field. A carefully crafted resume that effectively showcases your skills and achievements will not only attract the attention of hiring managers but also position you as a strong candidate ready to contribute to an organization’s compliance efforts.

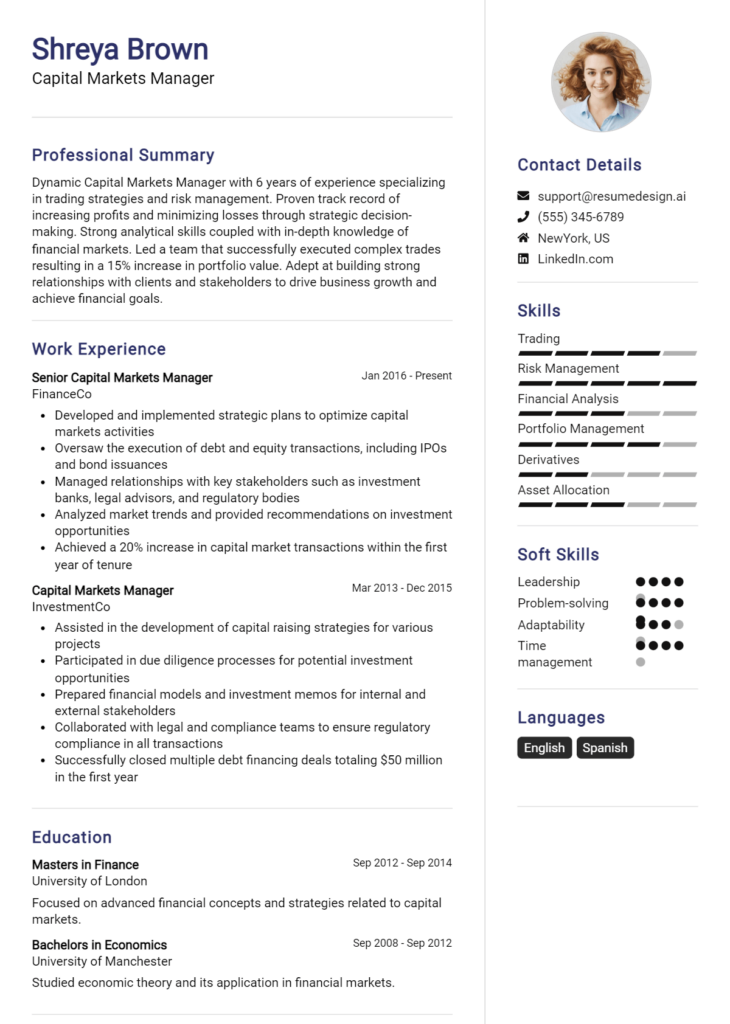

Why Resume Headlines & Titles are Important for Financial Compliance Manager

In the competitive landscape of financial compliance, a well-crafted resume headline or title holds significant importance for candidates applying to the role of Financial Compliance Manager. A strong headline serves as a first impression, immediately capturing the attention of hiring managers and summarizing a candidate's key qualifications in a compelling manner. It should be concise, relevant, and directly related to the position being sought, providing a snapshot of the applicant's expertise and value proposition. An impactful title can set the tone for the entire resume, distinguishing the candidate from others and making a memorable impact right from the start.

Best Practices for Crafting Resume Headlines for Financial Compliance Manager

- Keep it concise—aim for one to two impactful phrases.

- Make it role-specific by including the job title and relevant keywords.

- Highlight key qualifications or accomplishments that align with the job.

- Use action-oriented language to convey confidence and expertise.

- Avoid vague language that fails to communicate specific skills or experiences.

- Incorporate industry-specific terminology to demonstrate knowledge and relevance.

- Tailor the headline for each application to match the job description.

- Consider including measurable achievements to enhance credibility.

Example Resume Headlines for Financial Compliance Manager

Strong Resume Headlines

Results-Driven Financial Compliance Manager with 10+ Years of Regulatory Expertise

Proven Track Record in Risk Management and Compliance Strategy Development

Dynamic Financial Compliance Leader Specializing in Audit and Regulatory Affairs

Expert in Implementing Effective Compliance Programs and Reducing Financial Risks

Weak Resume Headlines

Financial Professional Seeking Opportunities

Manager with Experience in Finance

Looking for a Job in Compliance

The strong headlines are effective because they clearly articulate the candidate's expertise, experience, and focus within the financial compliance domain, making them immediately relevant to hiring managers. In contrast, the weak headlines are vague and generic, failing to provide any substantive information about the candidate’s qualifications or unique value. They do not inspire confidence or interest, which can lead to the resume being overlooked in favor of more compelling options.

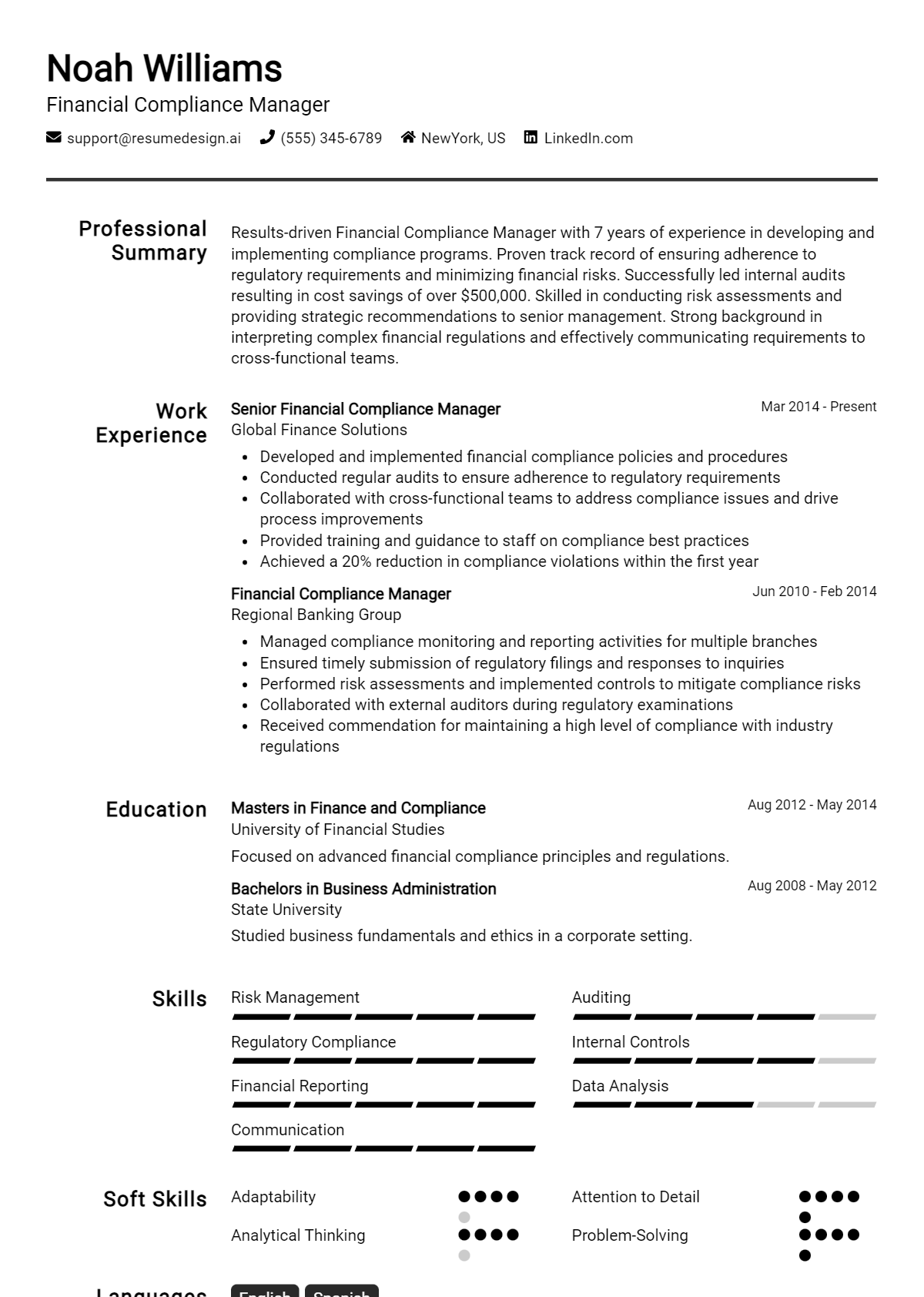

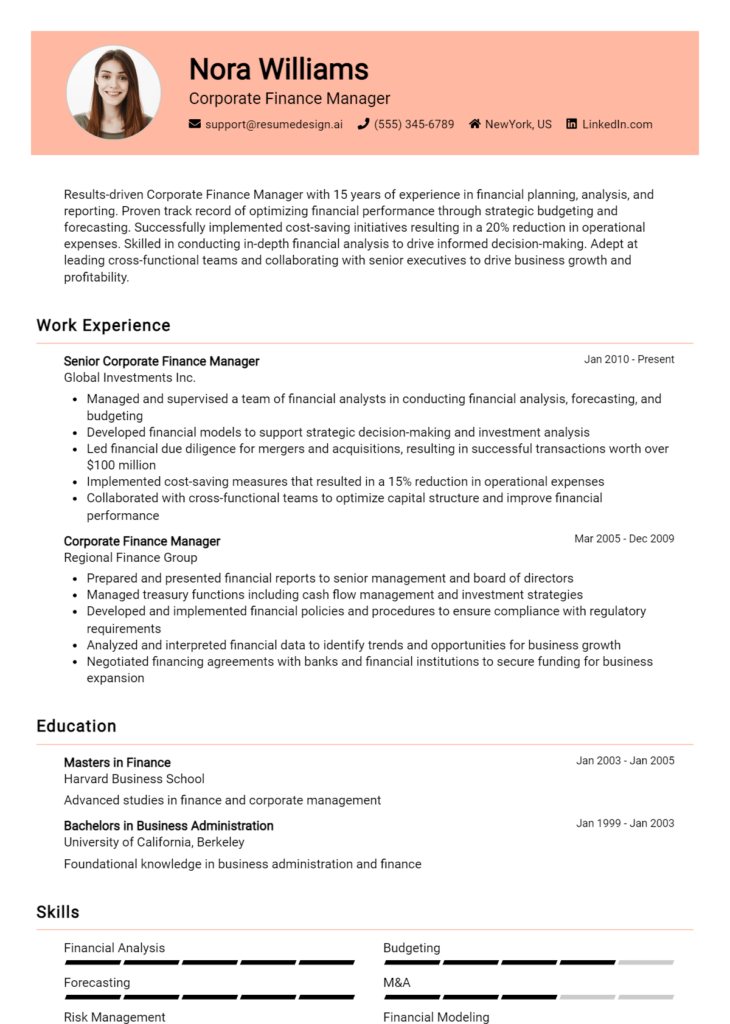

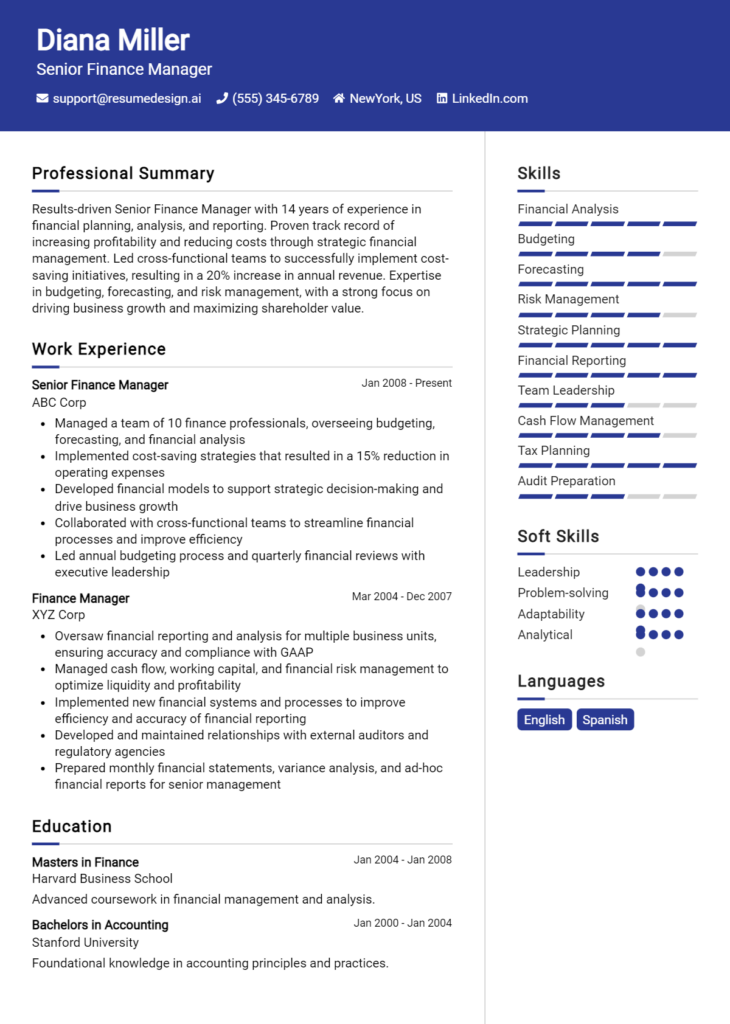

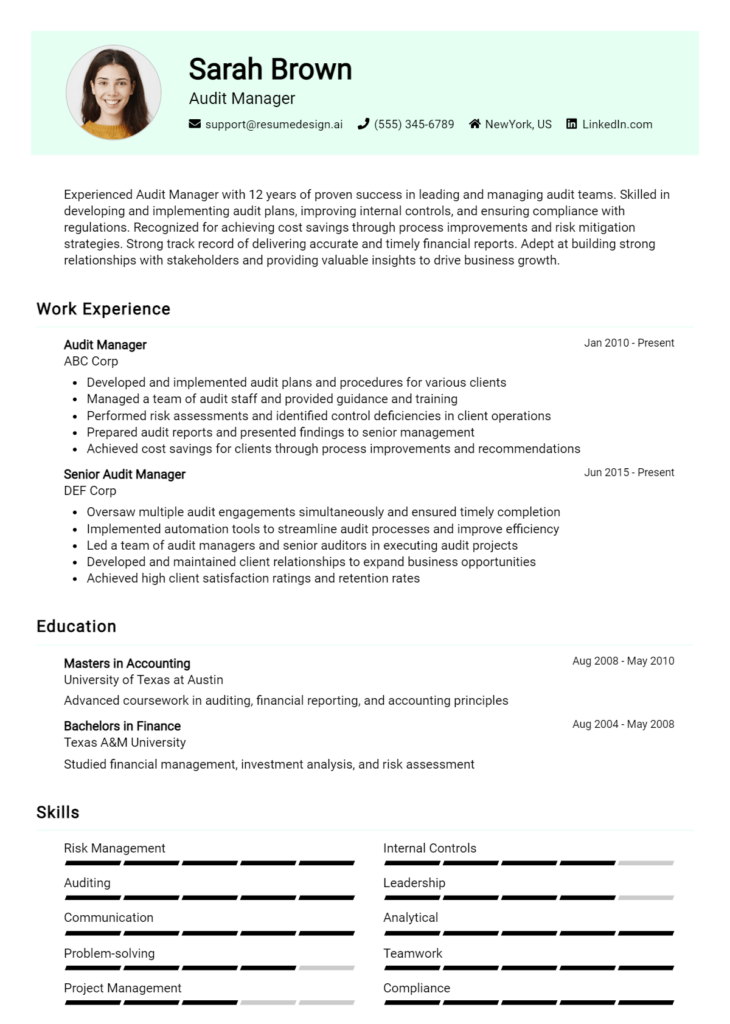

Writing an Exceptional Financial Compliance Manager Resume Summary

A resume summary for a Financial Compliance Manager is a crucial component that serves as the first impression for hiring managers. It succinctly encapsulates the candidate's key skills, relevant experience, and notable accomplishments, making it essential for capturing attention in a competitive job market. A robust summary should be concise and impactful, tailored specifically to the job being applied for, allowing candidates to highlight their unique qualifications and demonstrate their fit for the role at a glance.

Best Practices for Writing a Financial Compliance Manager Resume Summary

- Quantify Achievements: Use numbers and percentages to illustrate your accomplishments and impact.

- Focus on Relevant Skills: Highlight skills that align with the job description and are critical for a Financial Compliance Manager.

- Tailor to the Job Description: Customize your summary to reflect the specific requirements and responsibilities of the position.

- Use Strong Action Verbs: Start sentences with powerful verbs to convey confidence and proactivity.

- Keep it Concise: Aim for 3-5 sentences that deliver key information without overwhelming the reader.

- Highlight Industry Knowledge: Mention familiarity with regulatory frameworks and compliance standards relevant to the financial sector.

- Showcase Leadership Abilities: If applicable, include experiences that demonstrate your ability to lead compliance initiatives or teams.

- Incorporate Keywords: Use industry-specific keywords that reflect your expertise and appeal to Applicant Tracking Systems (ATS).

Example Financial Compliance Manager Resume Summaries

Strong Resume Summaries

Results-driven Financial Compliance Manager with over 10 years of experience in developing compliance programs that reduced audit findings by 30%. Proven track record in managing regulatory reporting processes and ensuring adherence to SEC and FINRA regulations.

Detail-oriented Financial Compliance Manager skilled in risk assessment and mitigation strategies, successfully leading a team to achieve a 95% compliance rate in annual audits. Adept at training and mentoring staff on compliance policies and procedures.

Dynamic Financial Compliance Manager with expertise in AML and KYC regulations, having implemented a comprehensive training program that increased employee knowledge by 40% and decreased compliance breaches by 25% in one year.

Weak Resume Summaries

Experienced financial manager with a strong background in compliance and regulations.

I have worked in finance for many years and understand the importance of compliance in the industry.

The strong resume summaries are effective because they provide specific, quantifiable achievements and highlight relevant skills that directly relate to the role of Financial Compliance Manager. They also convey a sense of leadership and expertise in compliance matters. In contrast, the weak summaries lack detail and specificity, making them generic and unmemorable. They do not effectively demonstrate the candidate's fit for the position or the impact they have made in previous roles.

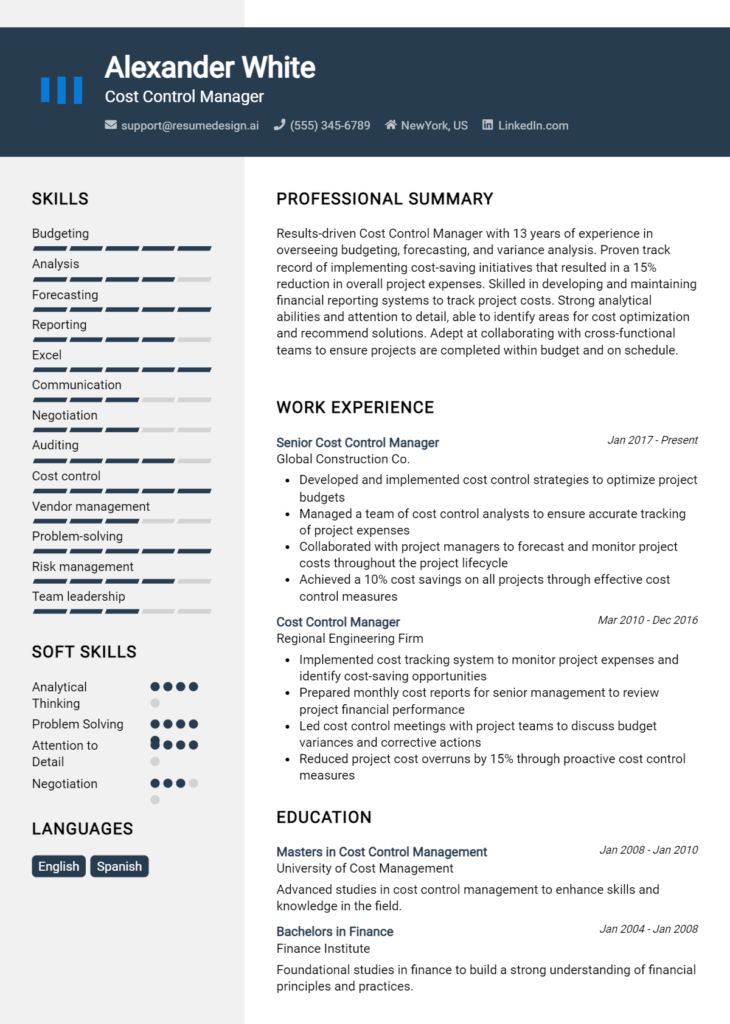

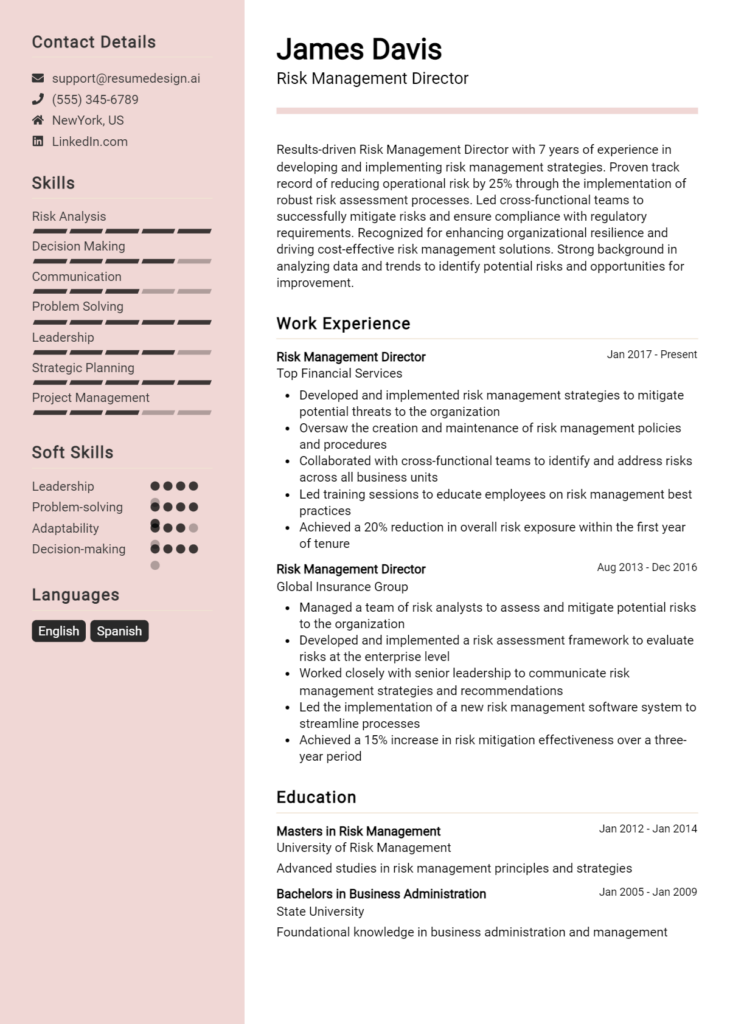

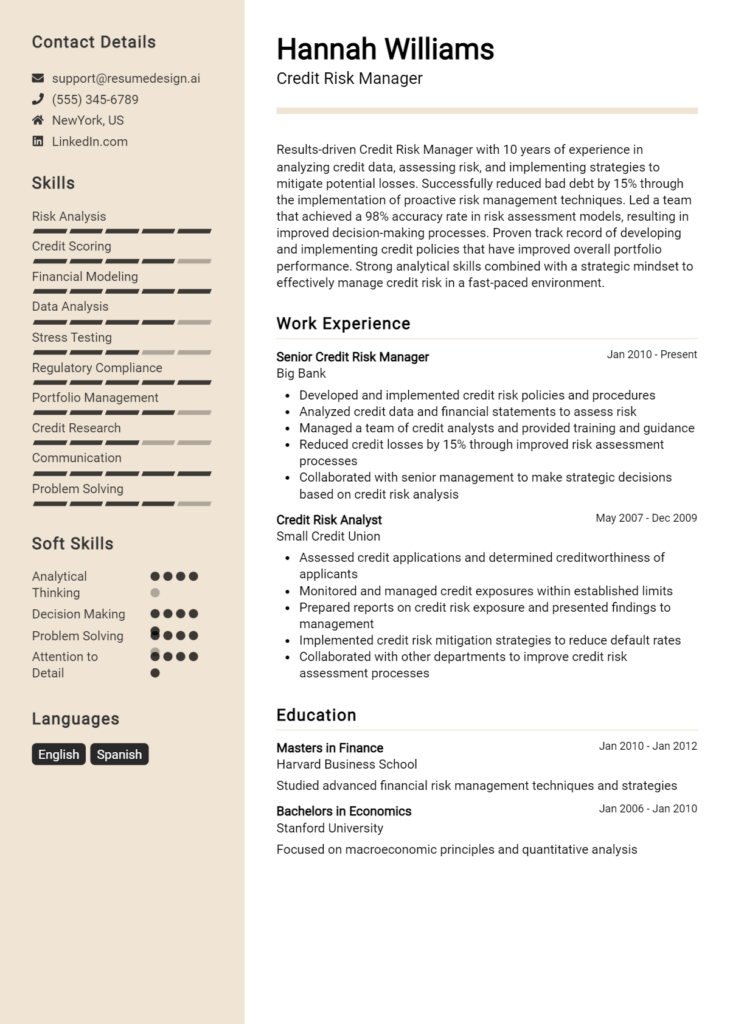

Work Experience Section for Financial Compliance Manager Resume

The work experience section of a Financial Compliance Manager resume is pivotal in demonstrating the candidate's technical skills, leadership capabilities, and commitment to delivering high-quality compliance solutions. This section not only highlights the candidate's previous roles and responsibilities but also showcases their ability to manage teams effectively and navigate complex regulatory landscapes. Quantifying achievements—such as increased compliance rates or reduced audit findings—provides tangible evidence of success and aligns the candidate's experience with industry standards, making them a more attractive choice for potential employers.

Best Practices for Financial Compliance Manager Work Experience

- Clearly articulate technical skills related to financial regulations and compliance frameworks.

- Quantify achievements with specific metrics, such as percentage improvements or cost savings.

- Highlight leadership roles and team management experiences to demonstrate collaboration.

- Align experiences with industry standards and best practices to enhance credibility.

- Use action verbs to convey a sense of initiative and impact.

- Tailor your work experience to reflect the specific requirements of the job you are applying for.

- Include relevant certifications or training that enhance your qualifications.

- Demonstrate problem-solving skills through examples of overcoming compliance challenges.

Example Work Experiences for Financial Compliance Manager

Strong Experiences

- Led a cross-functional team in implementing a new compliance management system, resulting in a 30% reduction in compliance-related incidents over 12 months.

- Developed and executed a comprehensive training program that improved employee compliance knowledge by 40%, as measured by pre- and post-training assessments.

- Managed regulatory audits for multiple business units, achieving a 95% compliance rate and significantly reducing potential fines.

- Collaborated with IT to enhance data security measures, resulting in a 50% decrease in data breaches related to financial transactions.

Weak Experiences

- Worked on compliance issues without specifying the impact or results.

- Assisted in audits and other compliance activities, but did not quantify contributions.

- Participated in team meetings regarding compliance but did not describe role or outcomes.

- Involved in training sessions without mentioning the effectiveness or reach of the training.

The examples provided highlight the distinction between strong and weak work experiences in a resume. Strong experiences are characterized by clear, quantifiable outcomes and a demonstration of leadership and collaboration, which provide a compelling narrative of the candidate's capabilities. In contrast, weak experiences lack specificity and measurable impact, making it difficult for potential employers to assess the candidate's true contributions and effectiveness in previous roles.

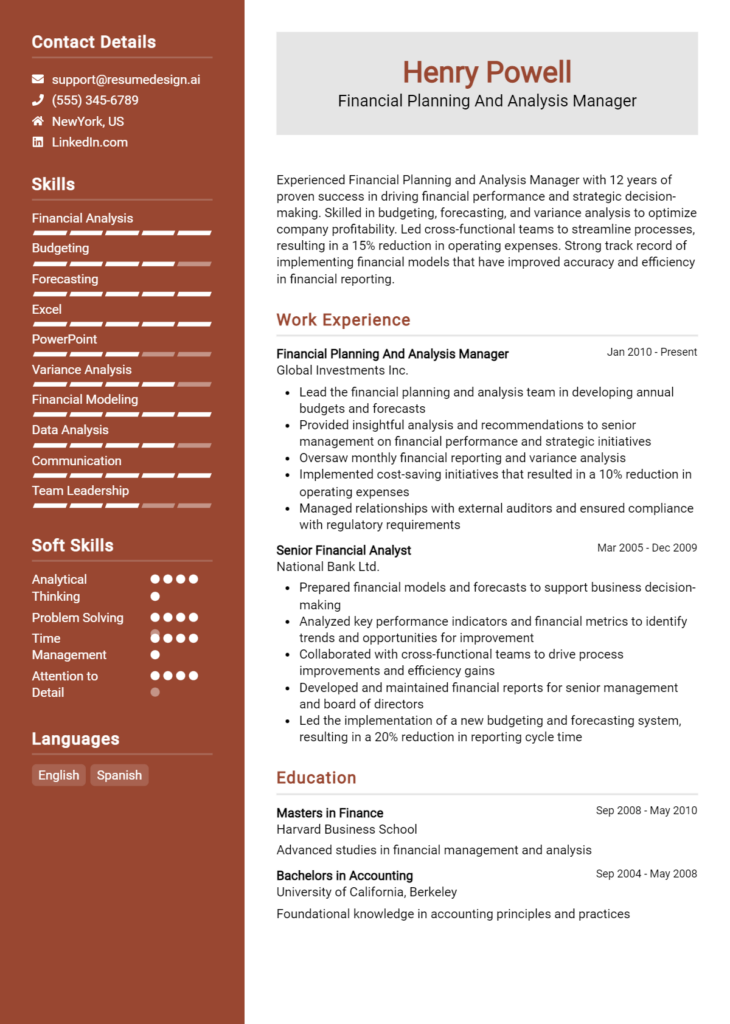

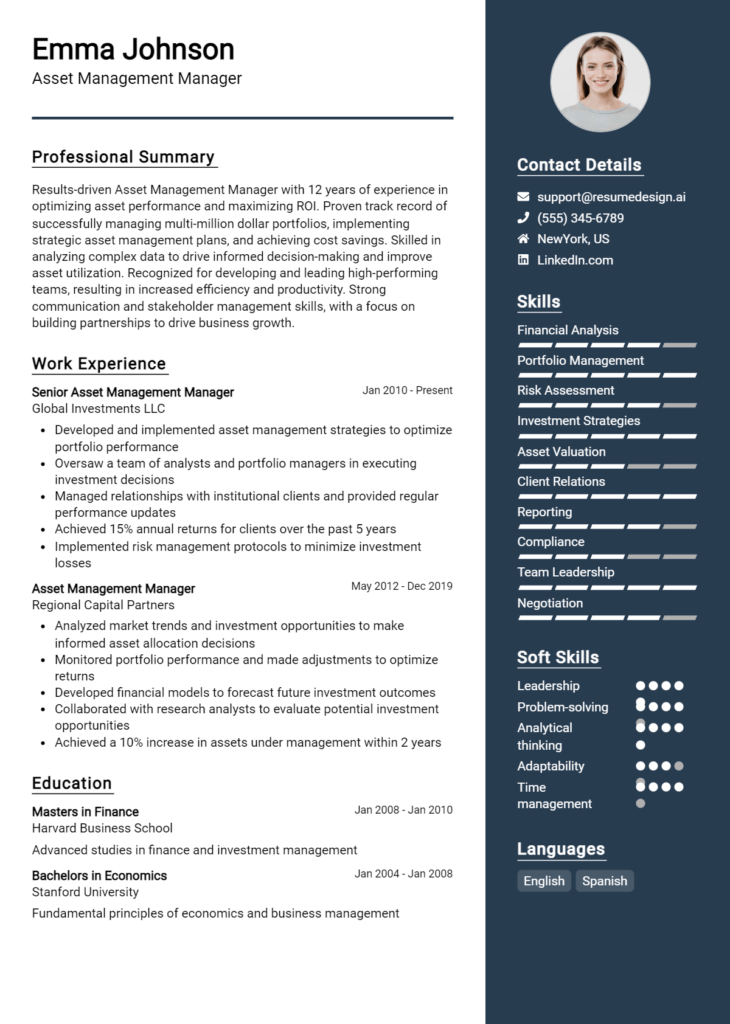

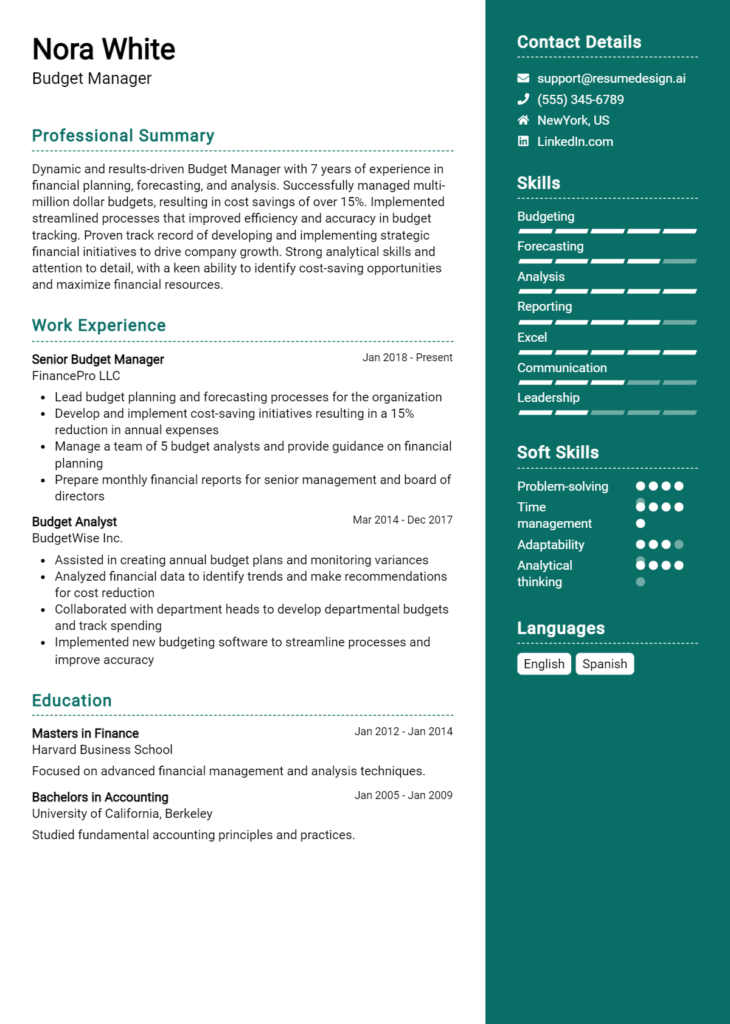

Education and Certifications Section for Financial Compliance Manager Resume

The education and certifications section of a Financial Compliance Manager resume plays a crucial role in establishing the candidate's qualifications and expertise within the industry. This section serves to showcase the academic background that underpins a solid understanding of financial regulations and compliance standards. Additionally, it highlights industry-relevant certifications that reflect the candidate's commitment to continuous learning and professional development. By providing relevant coursework, recognized certifications, and any specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the requirements of the job role, making them more appealing to potential employers.

Best Practices for Financial Compliance Manager Education and Certifications

- Include only relevant degrees, such as Finance, Accounting, or Business Administration, to ensure alignment with the role.

- List industry-recognized certifications, such as Certified Compliance and Ethics Professional (CCEP) or Certified Fraud Examiner (CFE), to enhance credibility.

- Detail relevant coursework that pertains to compliance, risk management, or regulatory frameworks to highlight specialized knowledge.

- Keep the formatting consistent for readability; use bullet points and clear headings to organize information.

- Include ongoing education efforts, such as workshops or seminars, to demonstrate a commitment to staying current in the field.

- Order entries chronologically, starting with the most recent education or certification, to highlight the latest qualifications.

- Avoid listing outdated or irrelevant qualifications that do not pertain to the financial compliance field.

- Consider including honors or distinctions received during education or certification programs to further showcase achievements.

Example Education and Certifications for Financial Compliance Manager

Strong Examples

- MBA in Finance, XYZ University, 2022

- Certified Compliance and Ethics Professional (CCEP), 2023

- Certificate in Risk Management, ABC Institute, 2021

- Relevant Coursework: Financial Regulations, Corporate Governance, and Risk Assessment Strategies

Weak Examples

- Bachelor of Arts in History, University of Somewhere, 2010

- Certification in Basic Computer Skills, 2015

- High School Diploma, 2008

- Certificate in Photography, 2019

The examples listed as strong are considered relevant because they directly pertain to the field of financial compliance and demonstrate advanced qualifications that align with the job role. In contrast, the weak examples highlight educational qualifications and certifications that lack relevance to financial compliance and do not contribute to the candidate's credibility in this specific area, potentially raising questions about their suitability for the position.

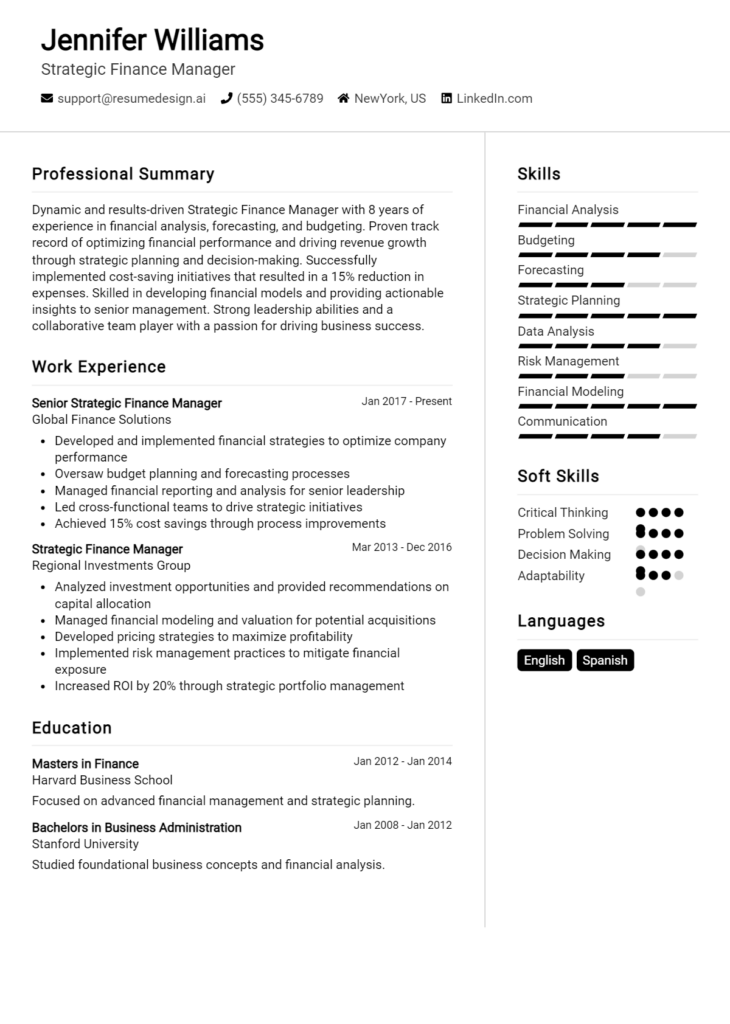

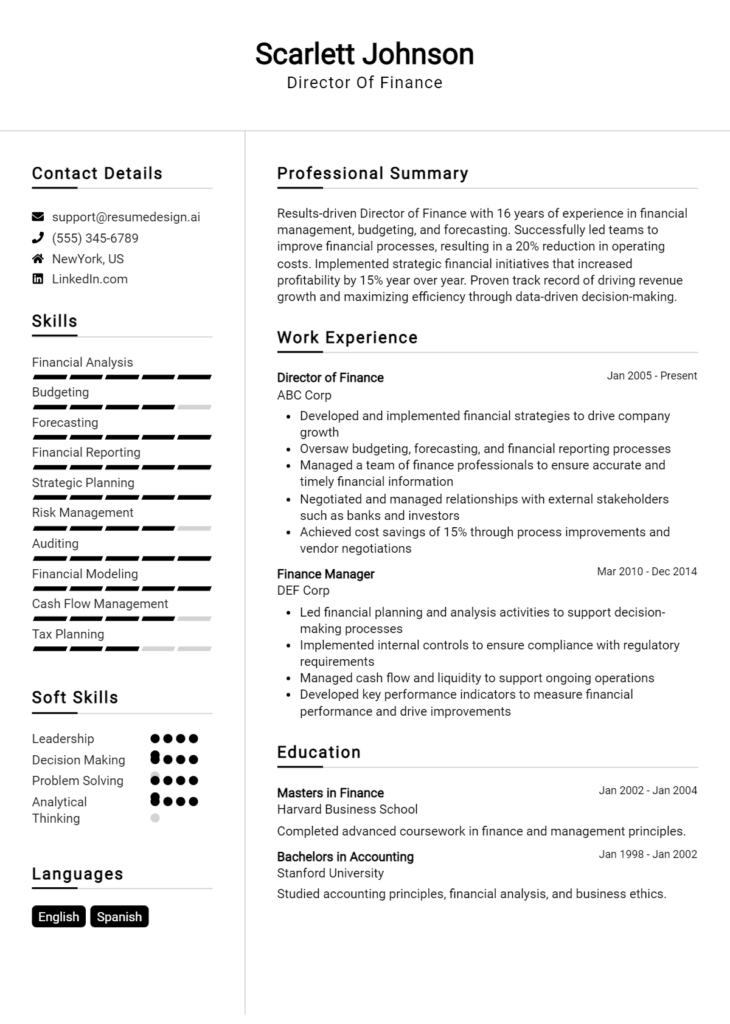

Top Skills & Keywords for Financial Compliance Manager Resume

As a Financial Compliance Manager, possessing the right skills is crucial to ensuring that an organization meets regulatory requirements and maintains financial integrity. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing a job in this competitive field. Financial Compliance Managers must navigate complex regulations, communicate effectively with stakeholders, and implement compliance programs, making a diverse skill set essential. It’s important to showcase your expertise and adaptability through a carefully curated list of skills that resonate with potential employers. Below, we outline the top hard and soft skills that can elevate your Financial Compliance Manager resume.

Top Hard & Soft Skills for Financial Compliance Manager

Soft Skills

- Attention to Detail

- Strong Analytical Thinking

- Effective Communication

- Problem-Solving Abilities

- Leadership and Team Management

- Adaptability and Flexibility

- Time Management

- Interpersonal Skills

- Negotiation Skills

- Ethical Judgment

Hard Skills

- Knowledge of Regulatory Frameworks (e.g., SOX, GDPR)

- Financial Reporting and Analysis

- Risk Management Techniques

- Compliance Auditing

- Proficiency in Compliance Software (e.g., SAP, Oracle)

- Data Analysis and Interpretation

- Understanding of Financial Statements

- Project Management Skills

- Familiarity with Anti-Money Laundering (AML) Regulations

- Knowledge of Internal Controls

By integrating these skills into your resume, you can effectively showcase your qualifications to potential employers. Additionally, highlighting relevant work experience along with these skills can further strengthen your candidacy for a Financial Compliance Manager position.

Stand Out with a Winning Financial Compliance Manager Cover Letter

I am writing to express my enthusiastic interest in the Financial Compliance Manager position at [Company Name]. With over [X years] of experience in financial compliance and a proven track record of ensuring adherence to regulatory requirements, I am confident in my ability to contribute effectively to your team. My background in finance, coupled with my keen understanding of compliance frameworks, allows me to develop and implement robust policies that mitigate risk and enhance operational efficiency.

In my previous role at [Previous Company Name], I successfully led a compliance initiative that reduced regulatory breaches by [percentage]% over two years. By conducting thorough audits and risk assessments, I identified potential compliance gaps and collaborated with various departments to address them proactively. My ability to communicate complex regulatory information clearly and concisely has fostered a culture of compliance throughout the organization, empowering employees to understand and prioritize compliance in their daily tasks.

I am particularly drawn to the opportunity at [Company Name] due to its commitment to ethical practices and corporate governance. I am excited about the prospect of leveraging my expertise in [specific regulatory standards or frameworks relevant to the job] to further strengthen your compliance program. My proactive approach to compliance, combined with my analytical skills, will allow me to identify emerging risks and implement effective strategies to address them.

I look forward to the opportunity to discuss how my experience and vision align with the goals of [Company Name]. Thank you for considering my application. I am eager to contribute to a team that values integrity and compliance, and I am excited about the possibility of bringing my expertise to your esteemed organization.

Common Mistakes to Avoid in a Financial Compliance Manager Resume

Crafting a resume for a Financial Compliance Manager position requires a keen attention to detail and an understanding of the specific qualifications that employers seek. Many candidates inadvertently make common mistakes that can undermine their chances of landing an interview. To help you stand out in a competitive job market, here are some frequent pitfalls to avoid when writing your resume:

Vague Job Descriptions: Using generic terms instead of specific achievements can dilute the impact of your experience. Clearly articulate your responsibilities and contributions in previous roles.

Ignoring Keywords: Failing to include relevant industry keywords can lead to your resume being overlooked by Applicant Tracking Systems (ATS). Tailor your resume with terms that match the job description.

Lack of Quantifiable Achievements: Providing only qualitative descriptions without metrics can make your accomplishments seem less impressive. Use numbers to demonstrate your impact, such as “reduced compliance risks by 30%.”

Overly Complex Language: Using jargon or overly complex language can confuse hiring managers. Aim for clear, concise language that effectively communicates your expertise.

Neglecting Soft Skills: Focusing solely on technical skills while neglecting essential soft skills like communication, leadership, and problem-solving can weaken your resume. Highlight how your soft skills contribute to effective compliance management.

Inadequate Formatting: A cluttered or unprofessional layout can distract from your content. Ensure your resume is well-organized, easy to read, and visually appealing.

Not Tailoring the Resume: Sending a generic resume for every application can be detrimental. Customize your resume for each position to align your qualifications with the specific requirements of the role.

Omitting Relevant Certifications: Failing to mention key certifications, such as Certified Compliance & Ethics Professional (CCEP) or Certified Internal Auditor (CIA), can leave out crucial credentials that enhance your profile. Always include relevant certifications to showcase your expertise.

Conclusion

As a Financial Compliance Manager, your role is crucial in ensuring that your organization adheres to financial regulations and maintains ethical standards. The article outlines several key responsibilities that come with this position, including conducting audits, developing compliance strategies, and staying updated on regulatory changes. Additionally, the importance of effective communication with both internal teams and regulatory bodies was emphasized, as well as the need for strong analytical skills to interpret complex regulations.

In conclusion, it's vital to present your qualifications effectively in your resume to stand out in this competitive field. Take a moment to review your Financial Compliance Manager resume and ensure it highlights your skills and experiences that align with the expectations of potential employers. To assist you in this process, consider utilizing the variety of resources available, such as resume templates, which can provide a strong foundation for your document. Alternatively, explore the resume builder for a user-friendly interface to create a customized resume. If you're looking for inspiration, check out the resume examples to see how others have successfully showcased their qualifications. Additionally, don't overlook the importance of a well-crafted cover letter; visit our cover letter templates to help you articulate your motivation and fit for the role. Take action now to enhance your professional presentation and increase your chances of landing your desired position as a Financial Compliance Manager.