Investment Manager Core Responsibilities

An Investment Manager plays a crucial role in bridging finance, research, and client relations by analyzing investment opportunities and managing portfolios. Key responsibilities include evaluating market trends, conducting financial analysis, and developing investment strategies. Essential skills encompass strong analytical, operational, and problem-solving abilities, which enable the manager to make informed decisions that align with the organization's overall goals. A well-structured resume can effectively highlight these qualifications, showcasing a candidate's potential for success in this dynamic field.

Common Responsibilities Listed on Investment Manager Resume

- Conducting market research and analysis to identify investment opportunities.

- Developing and implementing investment strategies aligned with client objectives.

- Monitoring portfolio performance and making recommendations for adjustments.

- Collaborating with financial analysts and other departments to assess risks.

- Preparing detailed reports and presentations for stakeholders.

- Managing client relationships and providing regular updates on investment performance.

- Staying informed on economic trends and regulatory changes affecting investments.

- Evaluating potential investments through due diligence processes.

- Advising clients on asset allocation and investment diversification.

- Utilizing financial modeling tools to forecast potential returns.

- Participating in team meetings to strategize on investment initiatives.

- Ensuring compliance with financial regulations and company policies.

High-Level Resume Tips for Investment Manager Professionals

In the competitive field of investment management, a well-crafted resume is not just a document; it's your first opportunity to make a lasting impression on potential employers. Your resume serves as a marketing tool that highlights your skills, achievements, and unique value proposition in a concise manner. For investment managers, where analytical skills, strategic thinking, and industry knowledge are paramount, your resume must effectively showcase these attributes to stand out in a saturated job market. This guide will provide practical and actionable resume tips specifically tailored for investment manager professionals to help you present your qualifications in the best light possible.

Top Resume Tips for Investment Manager Professionals

- Tailor your resume to match the job description, emphasizing the skills and experiences that align with the specific requirements of the position.

- Highlight relevant experience in investment management, including roles in asset allocation, portfolio management, or financial analysis.

- Quantify your achievements with specific metrics, such as portfolio growth percentages, risk-adjusted returns, or successful fundraising efforts.

- Incorporate industry-specific terminology and jargon to demonstrate your familiarity with investment concepts and tools.

- Showcase your educational background, particularly any relevant degrees or certifications such as CFA or MBA.

- Include a summary statement at the top that encapsulates your professional background and key strengths in investment management.

- Demonstrate your analytical and decision-making capabilities through examples of complex investment decisions you’ve made.

- Highlight any leadership roles or teamwork experiences that illustrate your ability to collaborate and influence others in achieving financial goals.

- Keep your resume concise and focused, ideally limiting it to one or two pages, while ensuring it remains visually appealing and easy to read.

By implementing these targeted resume tips, you can significantly enhance your chances of landing a job in the investment manager field. A well-structured and impactful resume not only reflects your professional journey but also showcases your potential to add value to prospective employers, making you a compelling candidate in a competitive landscape.

Why Resume Headlines & Titles are Important for Investment Manager

In the competitive field of investment management, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers. A strong headline serves as a snapshot of a candidate's key qualifications and professional identity, allowing them to stand out in a crowded applicant pool. By summarizing a candidate's expertise in a concise and impactful phrase, a compelling resume title can entice hiring managers to delve deeper into the resume. It's essential that this headline is not only relevant to the investment management role but also tailored to highlight specific skills and achievements that align with the job being applied for.

Best Practices for Crafting Resume Headlines for Investment Manager

- Keep it concise: Aim for a headline that is brief yet informative, ideally one line.

- Be role-specific: Tailor the headline to reflect the specific investment management position being pursued.

- Highlight key qualifications: Focus on the most relevant skills or experiences that set you apart.

- Use powerful language: Choose strong action verbs and impactful adjectives to convey your strengths.

- Avoid jargon: While industry terms can demonstrate expertise, excessive jargon may alienate readers.

- Incorporate metrics when possible: Quantify achievements to demonstrate your effectiveness and value.

- Align with job description: Reflect the language and requirements found in the job posting.

- Stay professional: Maintain a formal tone appropriate for the finance and investment sector.

Example Resume Headlines for Investment Manager

Strong Resume Headlines

Dynamic Investment Manager with 10+ Years of Experience in Portfolio Optimization

Results-Driven Financial Analyst Specializing in Risk Management and Asset Allocation

Seasoned Investment Professional with Proven Track Record of Exceeding Fund Performance Targets

Weak Resume Headlines

Investment Manager Looking for Opportunities

Finance Professional with Experience

The strong headlines effectively communicate the candidate's experience and specific strengths, immediately conveying expertise and relevance to potential employers. They utilize impactful language and focus on measurable achievements, which helps differentiate the candidate in a competitive job market. In contrast, the weak headlines fail to provide any unique information or insights about the candidate, making them forgettable and generic. They lack specificity and do not align with the professional tone expected in the investment management field, ultimately diminishing the candidate's chances of making a positive impression.

Writing an Exceptional Investment Manager Resume Summary

A well-crafted resume summary is essential for an Investment Manager as it serves as the first impression that hiring managers will have of a candidate. This brief yet impactful introduction quickly captures attention by showcasing the most relevant skills, experiences, and accomplishments that align with the job role. A strong summary not only highlights what the candidate brings to the table but also sets the tone for the rest of the resume. Given the competitive nature of investment management, it’s crucial that this section is concise, impactful, and tailored specifically to the job being applied for, ensuring that it resonates with the employer’s needs.

Best Practices for Writing a Investment Manager Resume Summary

- Quantify Achievements: Use numbers and percentages to highlight your impact and contributions.

- Focus on Relevant Skills: Highlight key skills that are directly related to investment management, such as risk assessment, portfolio management, and financial analysis.

- Tailor to Job Description: Customize your summary to reflect the specific requirements and language found in the job posting.

- Be Concise: Aim for 2-4 sentences that deliver maximum impact without unnecessary detail.

- Utilize Action Verbs: Start sentences with strong action verbs to convey confidence and initiative.

- Showcase Industry Knowledge: Mention any relevant market trends or sectors you specialize in to demonstrate your expertise.

- Highlight Professional Certifications: If applicable, include relevant certifications or licenses that lend credibility to your qualifications.

- Reflect Your Career Goals: Convey your aspirations and how they align with the prospective employer's objectives.

Example Investment Manager Resume Summaries

Strong Resume Summaries

Dynamic Investment Manager with over 8 years of experience in developing high-yield investment portfolios, achieving an average annual return of 15% while managing $500M in assets. Proven expertise in risk assessment and financial modeling.

Results-driven Investment Manager skilled in strategic asset allocation and market analysis, having successfully increased client portfolios by an average of 20% year-over-year. Holds a CFA designation and extensive knowledge of the tech sector.

Analytical Investment Manager with a solid track record of identifying profitable investment opportunities, resulting in a 30% increase in profitability for diverse client portfolios. Experienced in managing a team of analysts to optimize investment strategies.

Weak Resume Summaries

Experienced investment manager looking for new opportunities. Good with numbers and financial reports.

Investment professional with a background in finance. Interested in positions in investment management.

The examples of strong resume summaries effectively demonstrate the candidate’s quantifiable achievements, specific skills, and relevance to the investment management role, making them stand out to hiring managers. In contrast, the weak summaries are vague, lack measurable outcomes, and do not convey any unique value proposition, rendering them ineffective in capturing attention or showcasing the candidate's true potential.

Work Experience Section for Investment Manager Resume

The work experience section of an Investment Manager resume is crucial as it provides a comprehensive overview of the candidate’s professional background and showcases their technical skills, ability to manage teams, and track record of delivering high-quality investment products. This section serves as a testament to the candidate's capabilities and achievements in the finance industry, highlighting their proficiency in investment analysis, portfolio management, and strategic decision-making. Quantifying achievements—such as percentage increases in portfolio performance or successful deal closures—can significantly enhance the impact of this section. Furthermore, aligning previous experiences with industry standards ensures that candidates can illustrate their qualifications effectively, making them stand out in a competitive job market.

Best Practices for Investment Manager Work Experience

- Use quantifiable metrics to highlight achievements (e.g., "Increased portfolio returns by 15% over two years").

- Detail specific technical skills utilized in previous roles (e.g., financial modeling, risk assessment).

- Emphasize leadership experience, including managing teams and projects.

- Align experiences with industry standards, using relevant jargon and terminology.

- Focus on collaborative efforts and contributions to team success.

- Use action verbs to convey a sense of initiative and accomplishment.

- Highlight continuous professional development, such as certifications and training.

- Tailor the work experience section to the specific job description for better alignment.

Example Work Experiences for Investment Manager

Strong Experiences

- Led a team that managed a $500 million equity portfolio, achieving a 20% annualized return, outperforming the benchmark by 5%.

- Implemented advanced financial modeling techniques that improved investment analysis accuracy by 30%, facilitating better decision-making.

- Collaborated with cross-functional teams to develop a new investment product, resulting in over $100 million in sales within the first year.

- Conducted thorough risk assessments that reduced portfolio volatility by 10%, enhancing client satisfaction and retention rates.

Weak Experiences

- Worked on various investment projects without specifying outcomes or contributions.

- Assisted in team tasks and meetings, but failed to highlight specific roles or responsibilities.

- Involved in financial reporting, but did not quantify improvements or results achieved.

- Participated in investment reviews with little detail on personal impact or leadership.

The examples listed as "strong experiences" are considered effective because they provide specific metrics and outcomes that demonstrate the candidate's ability to deliver results, while also highlighting leadership and collaboration skills. In contrast, the "weak experiences" lack detail, quantifiable achievements, and clear contributions, making them less impactful and failing to convey the candidate's true capabilities in the investment management field.

Education and Certifications Section for Investment Manager Resume

The education and certifications section of an Investment Manager resume is crucial in establishing the candidate's academic qualifications and professional credibility. This section not only showcases the candidate's educational background but also highlights industry-relevant certifications and a commitment to continuous learning. By providing relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the expectations of the investment management role. A well-structured education and certifications section can set a candidate apart in a competitive job market, making it clear that they possess the knowledge and skills necessary to succeed in the field.

Best Practices for Investment Manager Education and Certifications

- Prioritize relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Detail any specialized training or workshops related to investment management.

- List relevant coursework that demonstrates expertise in investment analysis, portfolio management, or risk assessment.

- Use clear formatting and bullet points to enhance readability and organization.

- Keep the section concise but informative, focusing on the most pertinent qualifications.

- Update the section regularly to reflect new certifications or educational achievements.

- Highlight any honors or distinctions received during your academic career to showcase excellence.

Example Education and Certifications for Investment Manager

Strong Examples

- MBA in Finance, University of Chicago Booth School of Business, 2021

- CFA Level II Candidate, CFA Institute, Expected Completion 2024

- Certificate in Investment Management, New York Institute of Finance, 2022

- Relevant Coursework: Advanced Portfolio Management, Investment Analysis, Financial Derivatives

Weak Examples

- Bachelor of Arts in History, University of California, 2015

- Certification in Basic Accounting, Local Community College, 2016

- High School Diploma, Springfield High School, 2010

- Certificate in Microsoft Excel, Online Course, 2021

The strong examples are considered relevant and impactful because they align closely with the qualifications expected of an Investment Manager, showcasing advanced academic achievements and recognized industry certifications. In contrast, the weak examples demonstrate a lack of relevance to investment management, either by focusing on unrelated fields or providing certifications that do not align with the expectations of the role, ultimately diminishing the candidate's perceived qualifications for the position.

Top Skills & Keywords for Investment Manager Resume

As an Investment Manager, possessing the right skills is crucial for crafting a compelling resume that stands out in a competitive job market. Your skills not only reflect your qualifications but also demonstrate your capability to analyze market trends, manage portfolios, and make strategic investment decisions. Employers seek candidates who can combine both hard and soft skills to navigate the complexities of financial markets effectively. Highlighting these skills on your resume can significantly enhance your chances of landing an interview, as they showcase your ability to contribute to the organization's success. For more guidance on how to effectively showcase your skills and work experience, consider the following key competencies.

Top Hard & Soft Skills for Investment Manager

Soft Skills

- Analytical Thinking

- Communication Skills

- Negotiation Skills

- Problem-Solving Abilities

- Team Leadership

- Time Management

- Adaptability

- Interpersonal Skills

- Client Relationship Management

- Decision-Making

Hard Skills

- Financial Analysis

- Portfolio Management

- Investment Strategies

- Risk Assessment

- Market Research

- Valuation Techniques

- Regulatory Compliance

- Financial Modeling

- Asset Allocation

- Performance Measurement

Stand Out with a Winning Investment Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Investment Manager position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in investment analysis and portfolio management, I have a proven track record of delivering strong returns while mitigating risk. My analytical skills, coupled with my deep understanding of market trends and economic indicators, enable me to make informed investment decisions that align with clients' goals and risk appetites.

Throughout my career, I have successfully managed diverse portfolios, focusing on both equities and fixed-income securities. At my previous role with [Previous Company Name], I implemented strategic investment strategies that resulted in a [specific percentage] increase in portfolio performance over [specific timeframe]. My hands-on approach to research and analysis, combined with effective communication skills, allows me to present complex financial concepts in a clear and concise manner, fostering trust and understanding with clients and stakeholders alike.

I am particularly drawn to [Company Name] due to its reputation for innovative investment strategies and commitment to client satisfaction. I am excited about the opportunity to contribute my skills in risk assessment, strategic planning, and financial analysis to your team. I am confident that my proactive approach and dedication to continuous improvement will make a significant impact on your investment initiatives.

Thank you for considering my application. I look forward to the opportunity to discuss how my expertise aligns with the goals of [Company Name] and how I can contribute to the continued success of your investment team.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Investment Manager Resume

When crafting a resume for an Investment Manager position, it's crucial to present a professional and polished document that accurately reflects your skills and experiences. However, many candidates fall into common pitfalls that can detract from their qualifications and lessen their chances of securing an interview. Here are several mistakes to avoid in your Investment Manager resume:

Generic Objective Statement: Using a vague or generic objective statement fails to convey your specific career goals and can make your resume blend in with others. Tailor your objective to highlight your intentions and fit for the Investment Manager role.

Overloading with Jargon: While it's important to showcase your industry knowledge, using excessive jargon can confuse hiring managers. Focus on clear, concise language that effectively communicates your expertise.

Neglecting Quantifiable Achievements: Failing to include quantifiable results from previous roles can weaken your resume. Use metrics to demonstrate how your investment strategies resulted in increased returns, reduced risks, or enhanced portfolio performance.

Inconsistent Formatting: A resume that lacks a consistent format can appear unprofessional. Ensure uniform font sizes, styles, and bullet points to enhance readability and maintain a clean layout.

Listing Responsibilities Instead of Accomplishments: Simply listing job responsibilities does not differentiate you from other candidates. Instead, focus on your accomplishments and the impact of your work in previous roles.

Ignoring Relevant Skills: Overlooking the inclusion of relevant skills, such as financial analysis, portfolio management, or risk assessment, can make your resume less compelling. Tailor your skills section to match the job description.

Using a One-Size-Fits-All Resume: Sending the same resume to multiple job applications can diminish your chances. Customize your resume for each opportunity to reflect the specific requirements and preferences of the employer.

Omitting Professional Development: Not mentioning certifications, courses, or ongoing education can suggest a lack of commitment to professional growth. Highlight any relevant certifications, such as CFA or CAIA, to showcase your dedication to the field.

Conclusion

As an Investment Manager, your role is pivotal in guiding clients toward achieving their financial goals through strategic investment decisions. You are responsible for analyzing market trends, constructing diversified portfolios, and staying ahead of economic developments to make informed recommendations. Your expertise in risk management and asset allocation helps clients navigate the complexities of the financial landscape.

To excel in this competitive field, it's crucial to present a strong resume that highlights your skills, experiences, and achievements effectively. A well-crafted resume can make a significant difference in capturing the attention of potential employers and securing interviews.

Now is the perfect time to review and update your Investment Manager resume. Ensure that it reflects your most recent accomplishments and aligns with the specific requirements of the roles you are targeting.

To assist you in this process, consider utilizing the following resources:

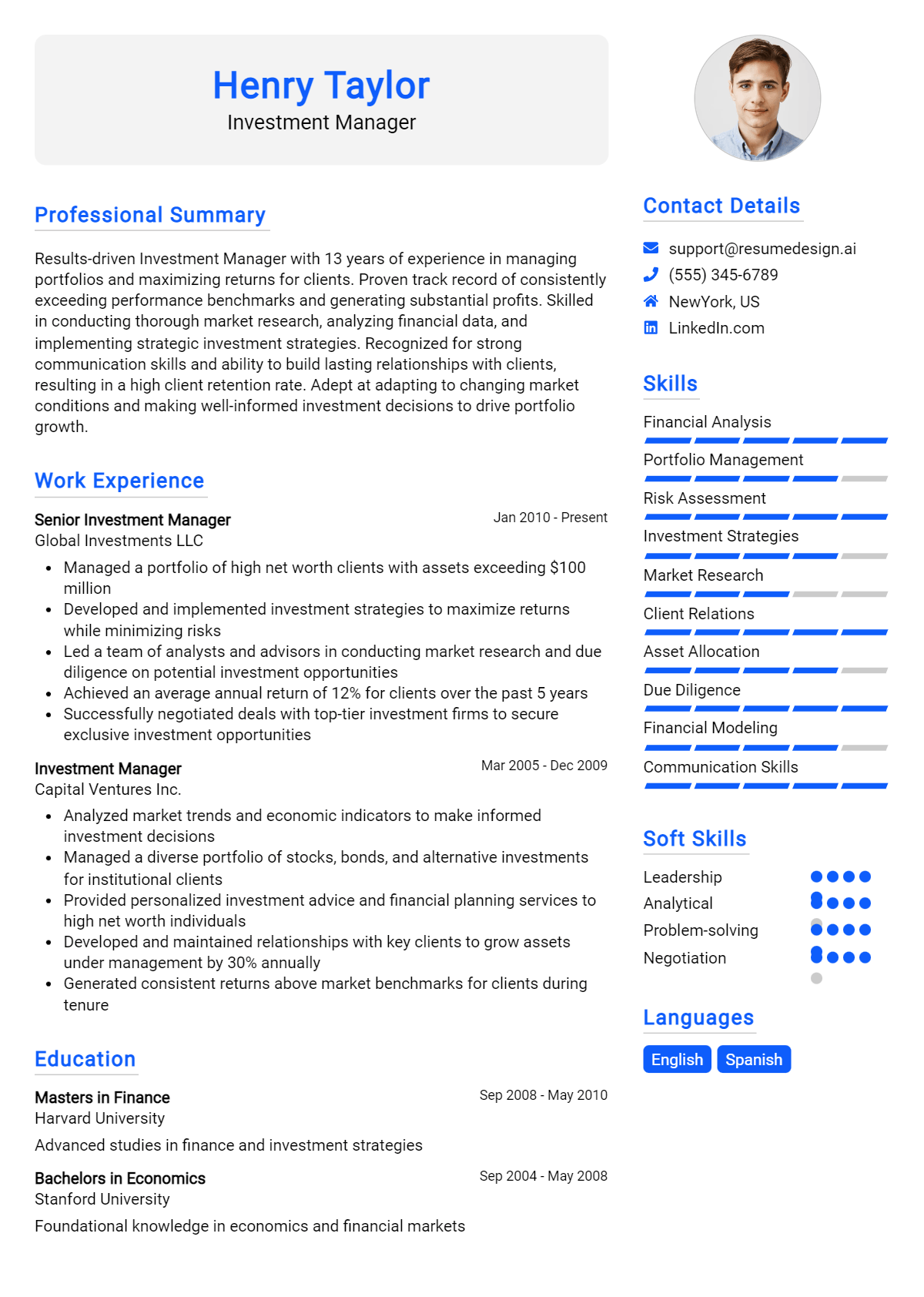

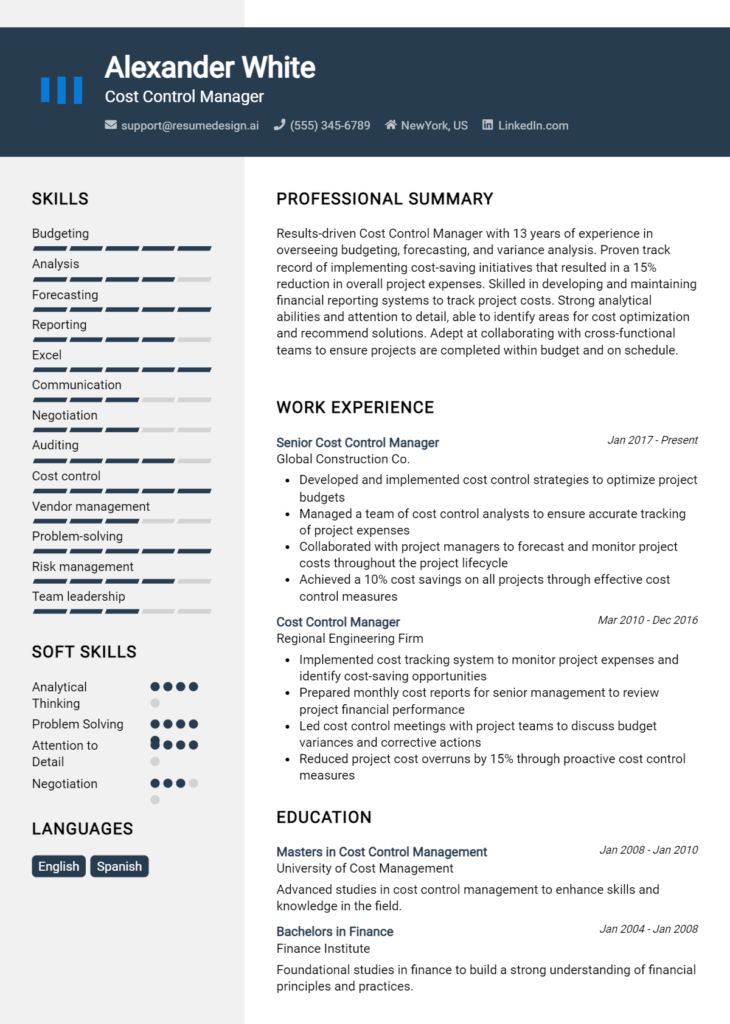

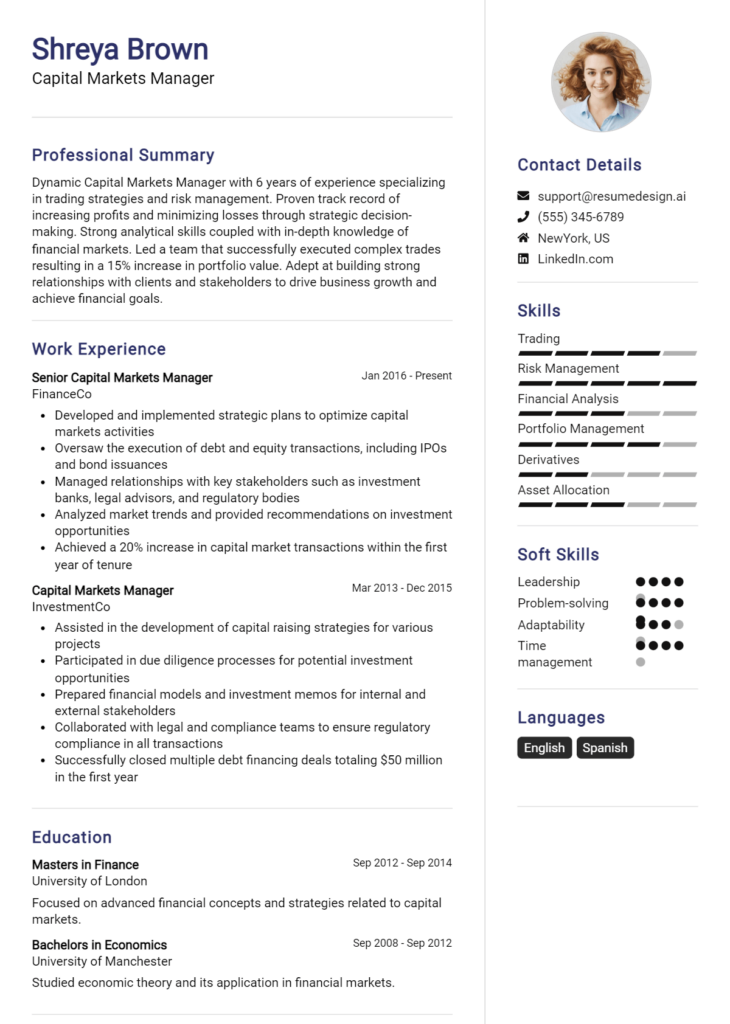

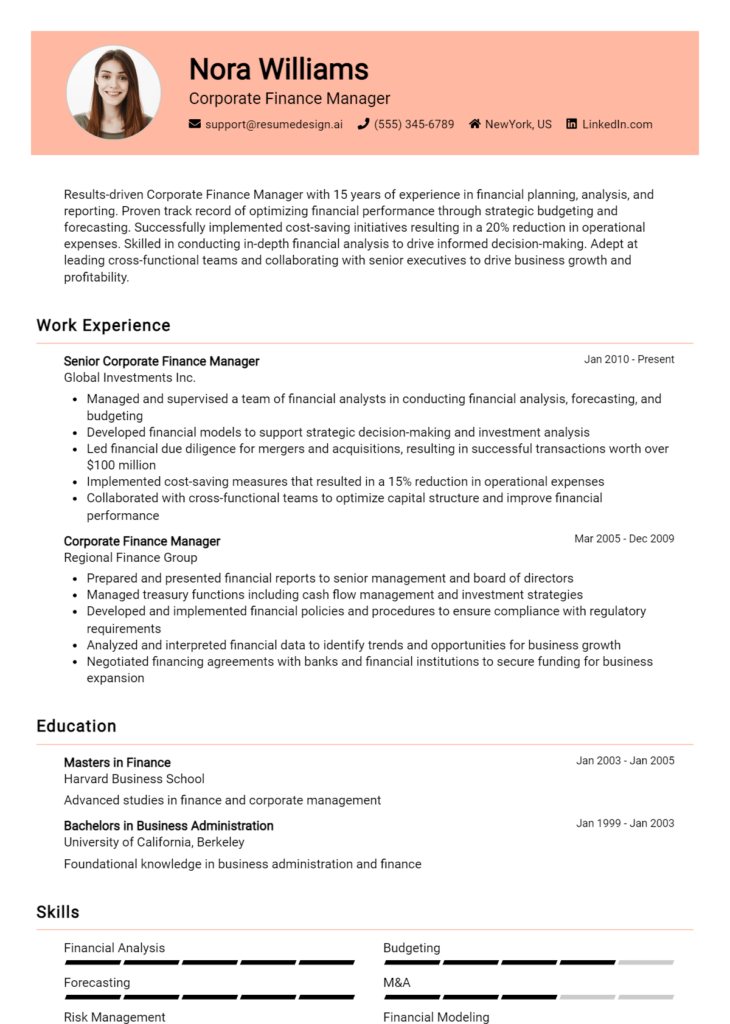

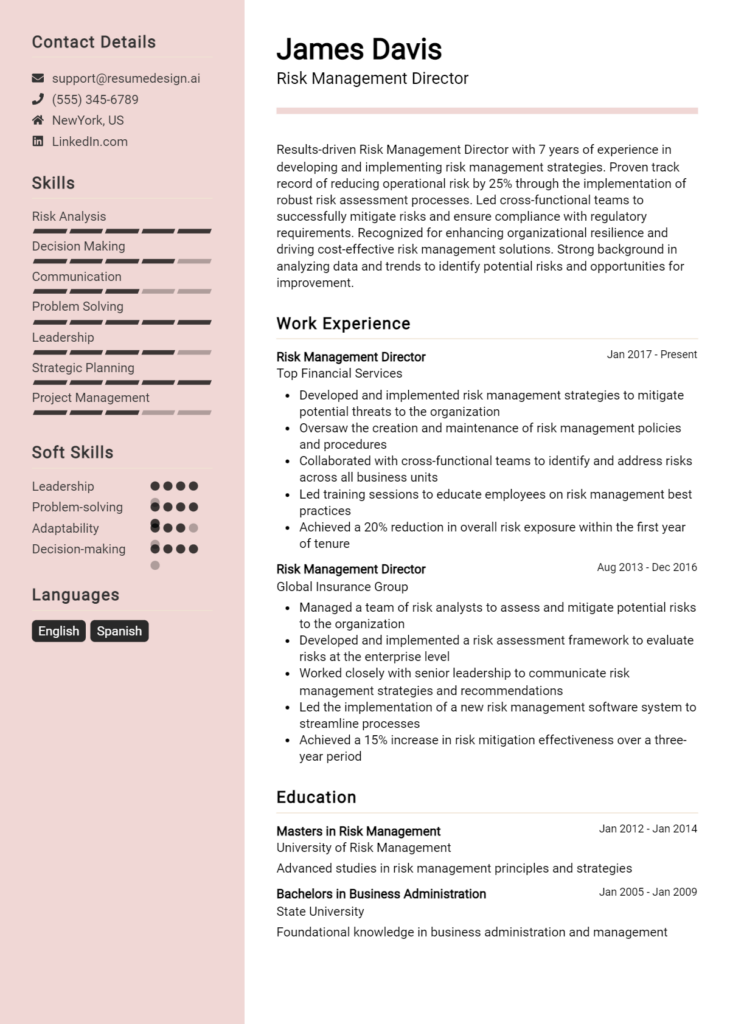

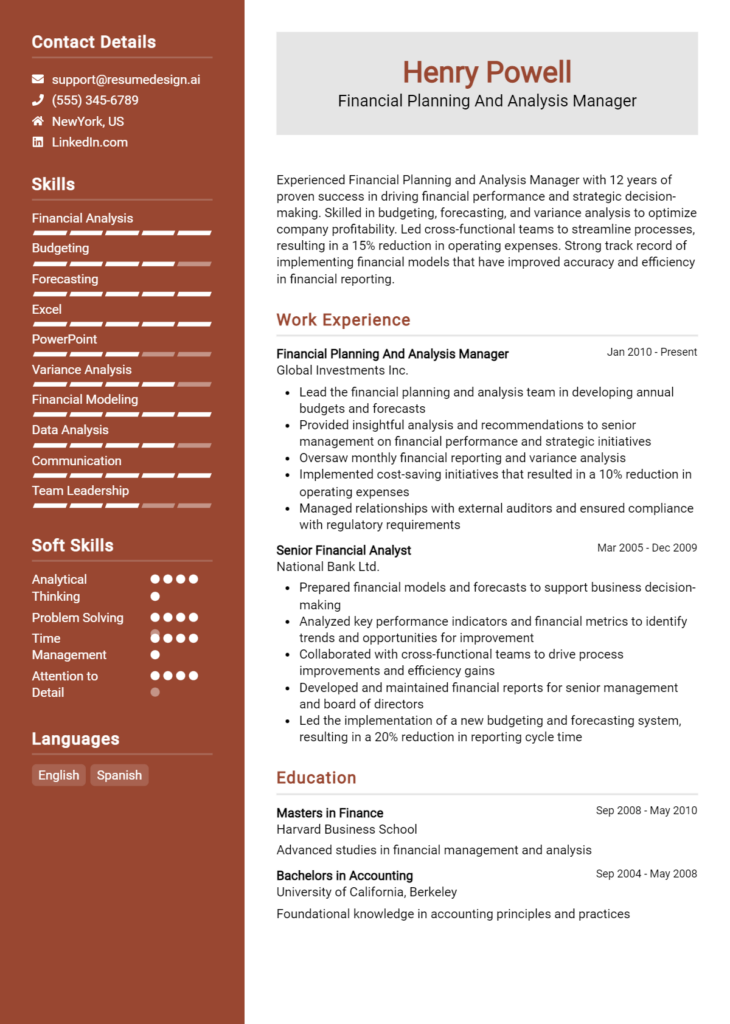

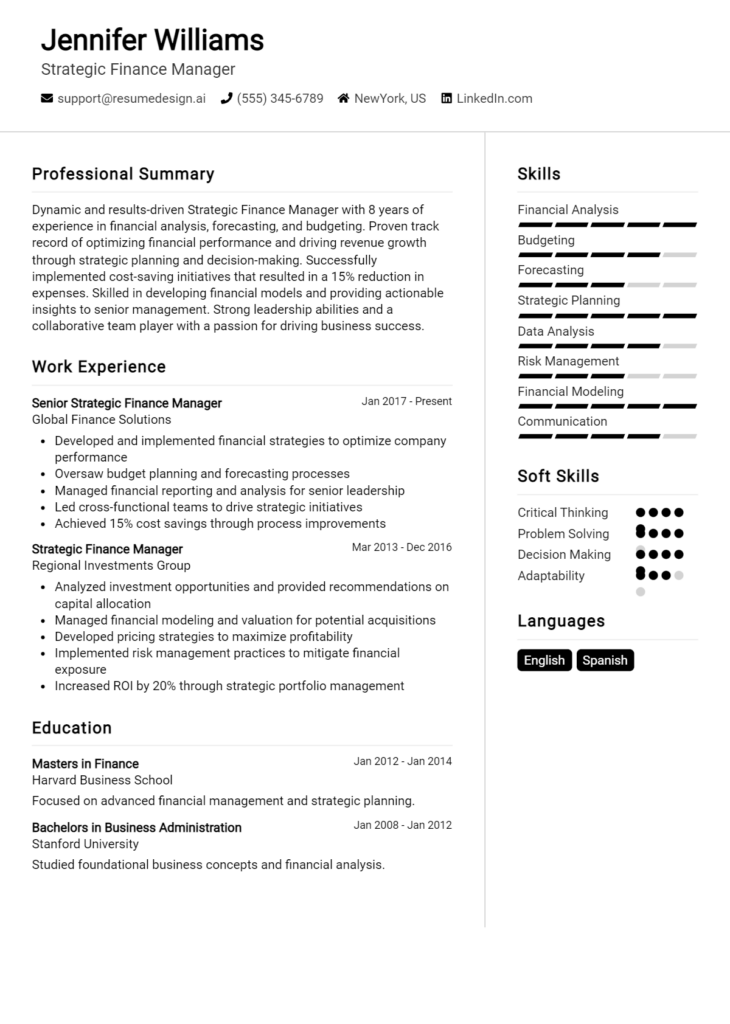

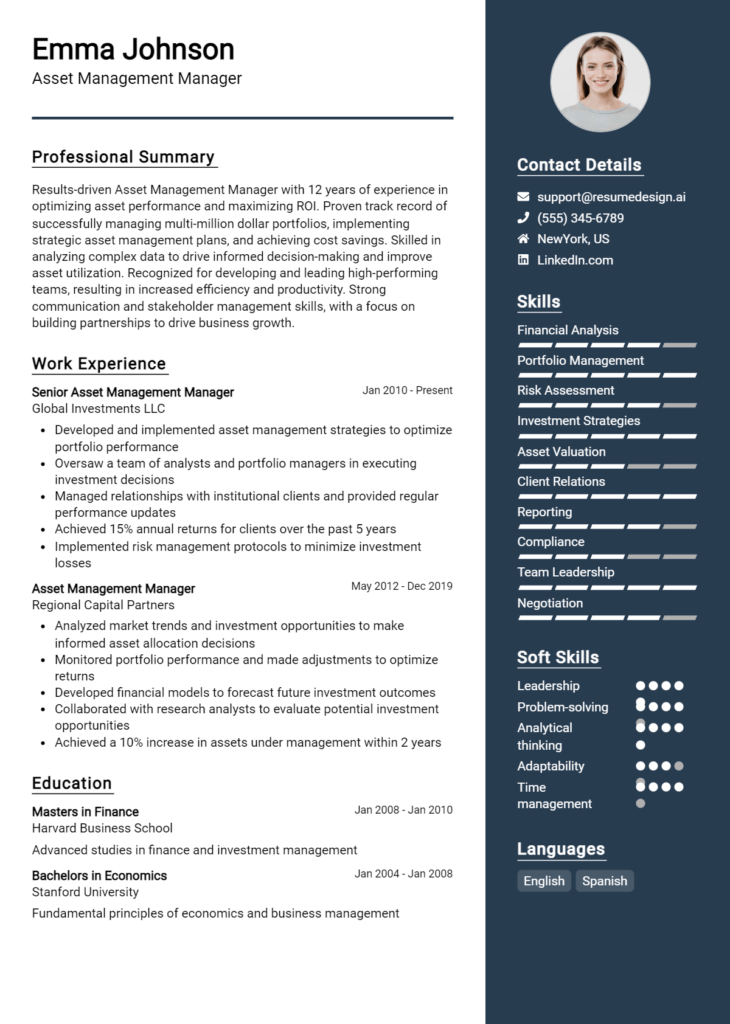

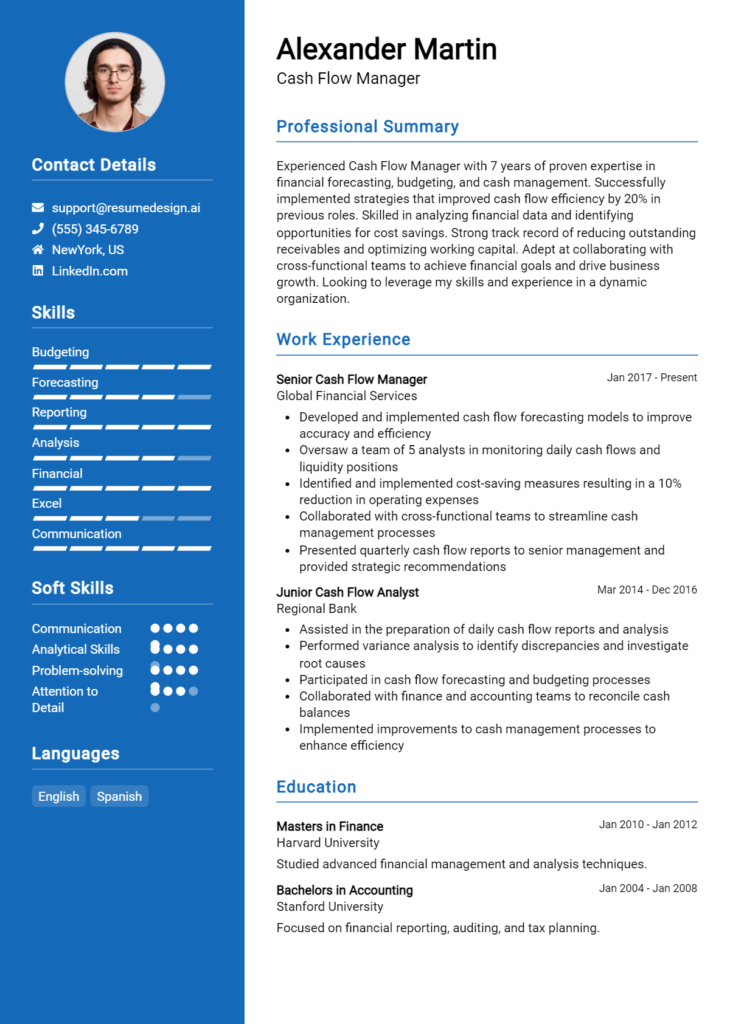

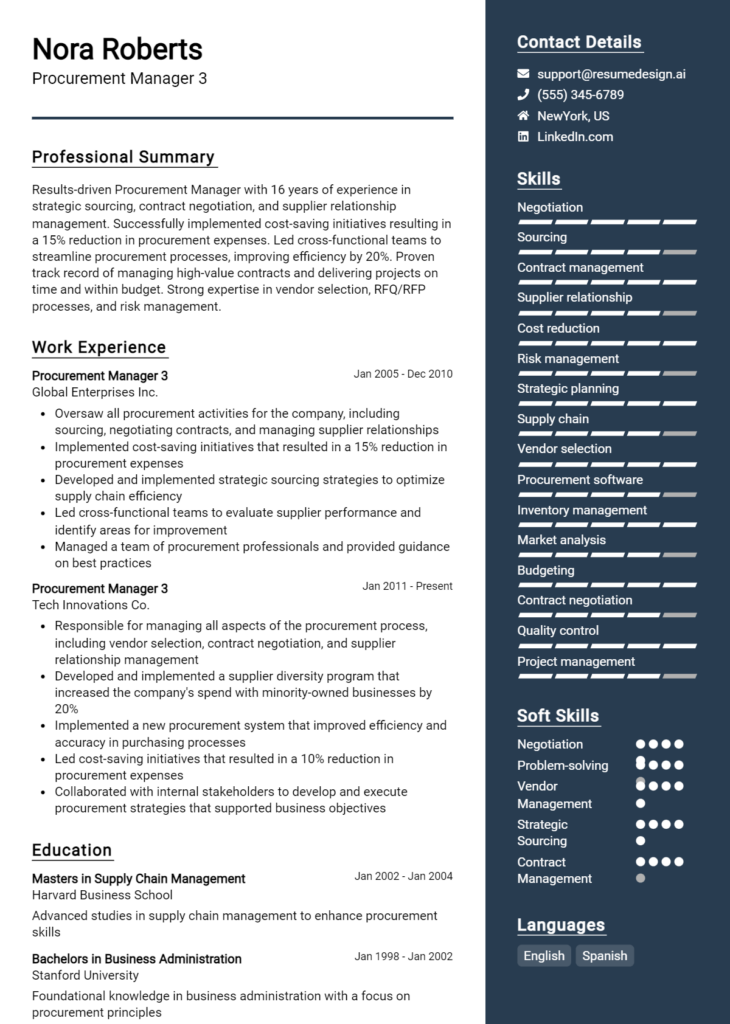

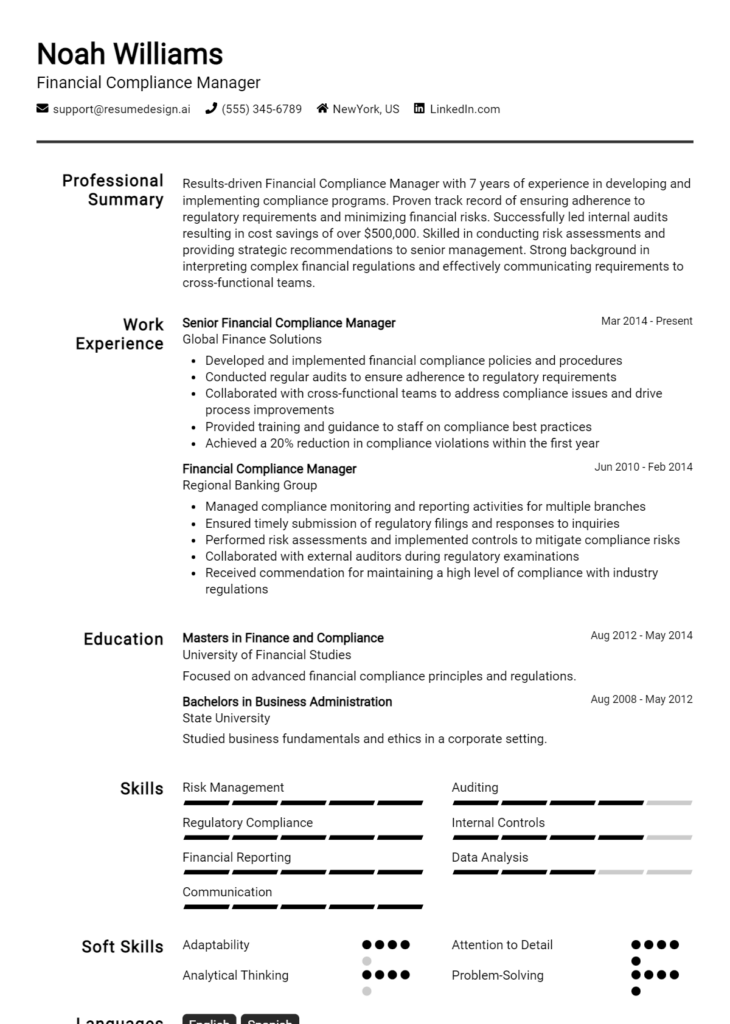

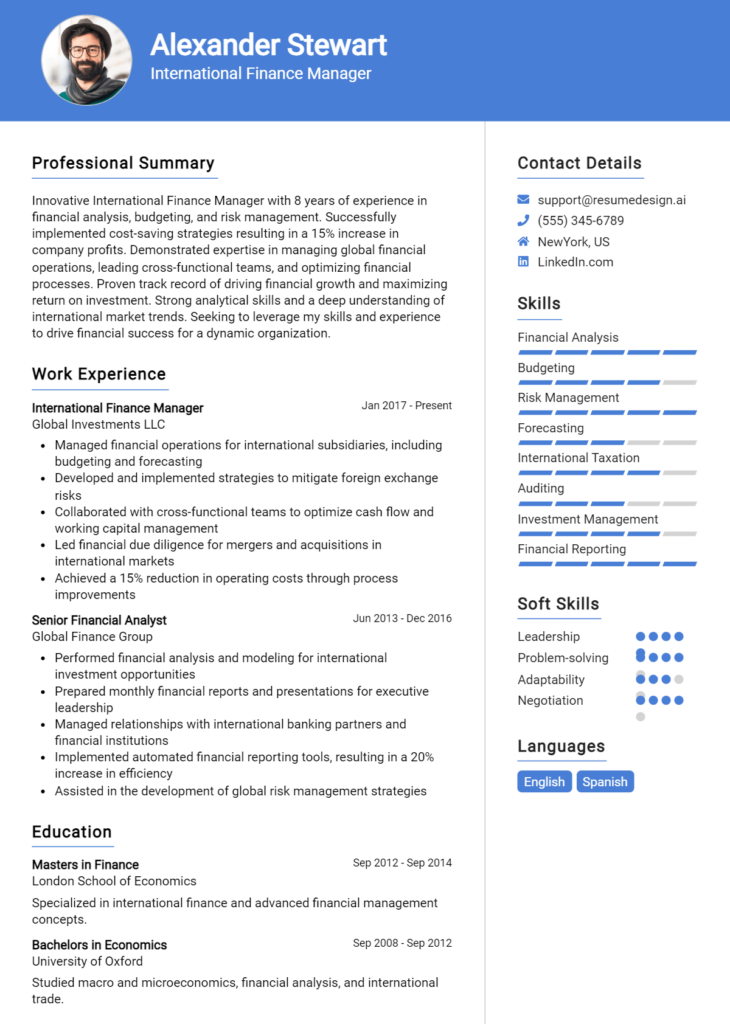

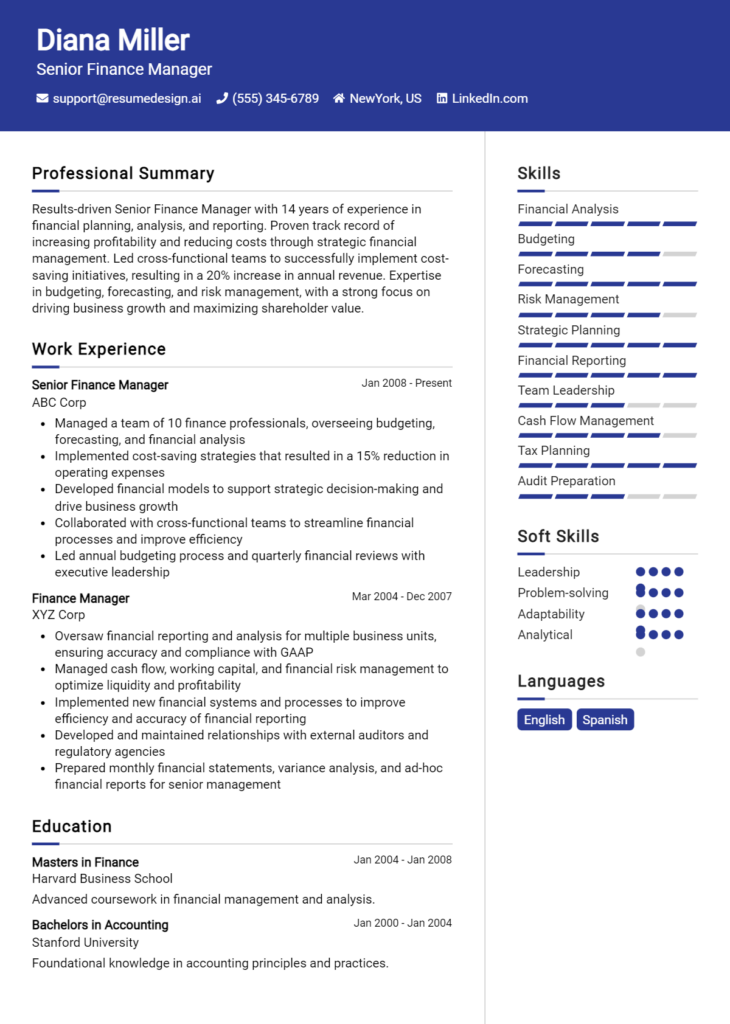

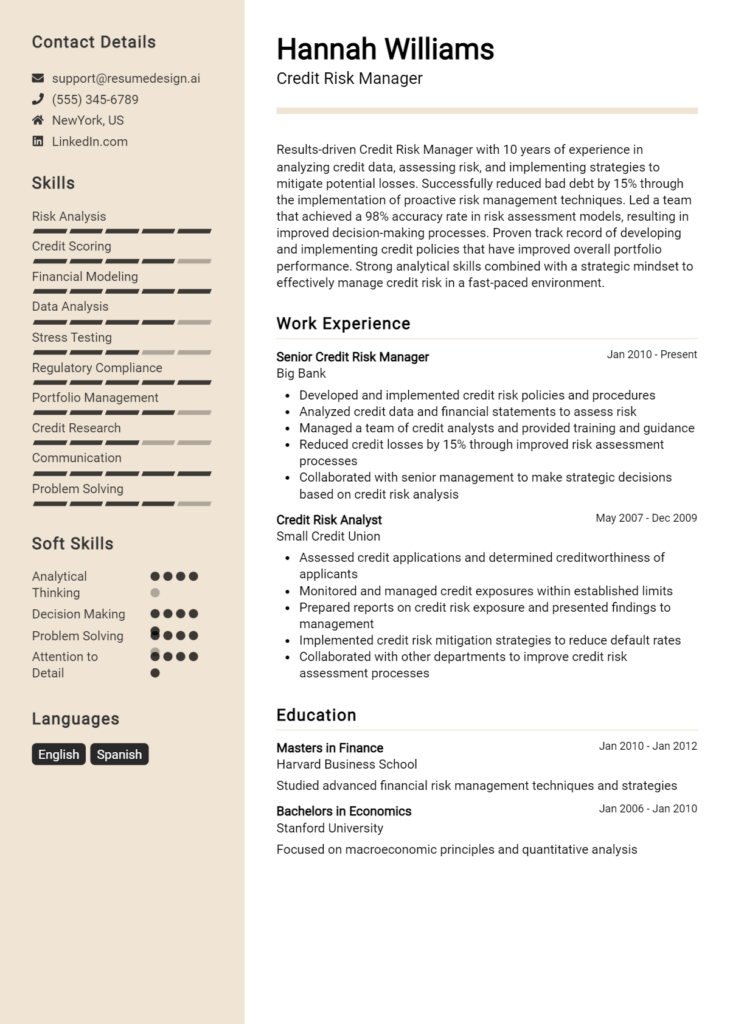

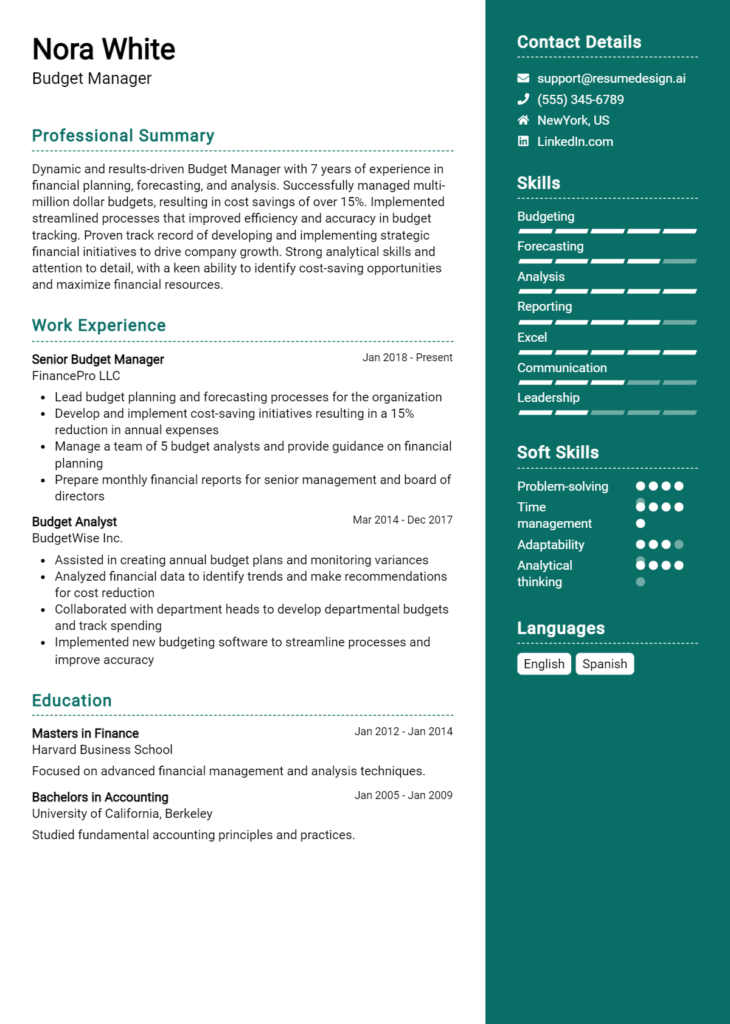

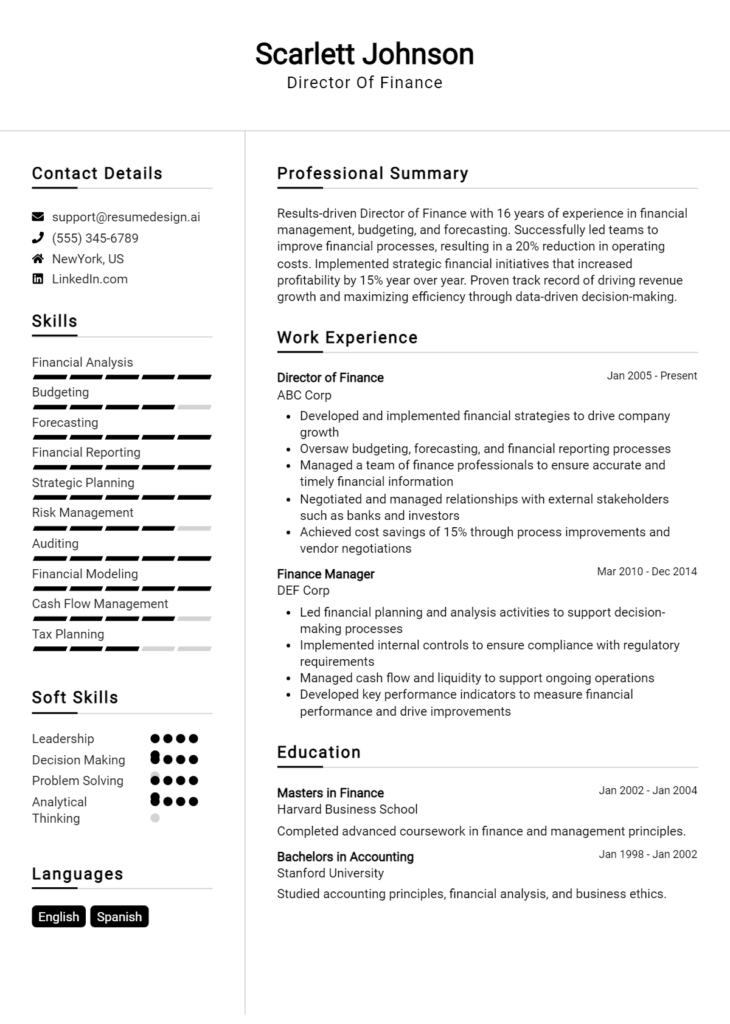

- Explore a variety of resume templates designed to fit the Investment Manager position.

- Use the resume builder for a guided experience that helps you create a polished resume quickly.

- Check out resume examples for inspiration and ideas on how to showcase your unique qualifications.

- Don’t forget to craft a compelling cover letter with our cover letter templates that complements your resume.

Take action today to improve your resume and enhance your chances of landing your dream role as an Investment Manager!