Credit Risk Manager Core Responsibilities

A Credit Risk Manager is pivotal in identifying, assessing, and mitigating financial risks associated with credit. This role requires strong analytical skills, operational knowledge, and exceptional problem-solving abilities to effectively collaborate with finance, legal, and compliance departments. By evaluating credit policies and implementing risk assessment strategies, a Credit Risk Manager ensures the organization meets its financial objectives. A well-structured resume highlighting these qualifications can significantly enhance a candidate's appeal in the competitive job market.

Common Responsibilities Listed on Credit Risk Manager Resume

- Conduct comprehensive credit risk assessments and analyses.

- Develop and implement credit risk policies and procedures.

- Monitor and report on credit risk exposure and trends.

- Collaborate with cross-functional teams to align risk strategies.

- Evaluate creditworthiness of clients and counterparties.

- Utilize quantitative models to forecast potential losses.

- Prepare and present risk reports to senior management.

- Ensure compliance with regulatory requirements and internal standards.

- Advise stakeholders on risk management best practices.

- Conduct stress testing and scenario analysis for credit portfolios.

- Manage relationships with external credit agencies.

- Identify emerging credit risks and recommend proactive measures.

High-Level Resume Tips for Credit Risk Manager Professionals

In the competitive landscape of financial services, a well-crafted resume is vital for Credit Risk Manager professionals seeking to make a lasting impression on potential employers. Often the first point of contact, your resume serves as a powerful marketing tool that not only showcases your skills but also highlights your achievements within the industry. A compelling resume can set you apart from other candidates, effectively communicating your expertise in risk assessment, compliance, and strategic decision-making. This guide will provide practical and actionable resume tips specifically tailored for Credit Risk Manager professionals, helping you to create a document that resonates with hiring managers and recruiters.

Top Resume Tips for Credit Risk Manager Professionals

- Tailor your resume to the specific job description by incorporating relevant keywords and phrases that align with the role.

- Highlight your experience in credit risk analysis, credit scoring models, and risk management frameworks to demonstrate your expertise.

- Quantify your achievements wherever possible, using metrics to illustrate the impact of your decisions on reducing risk or increasing profitability.

- Showcase industry-specific skills such as familiarity with regulatory requirements, credit assessment tools, and financial modeling techniques.

- Include professional certifications relevant to credit risk management, such as FRM (Financial Risk Manager) or PRM (Professional Risk Manager).

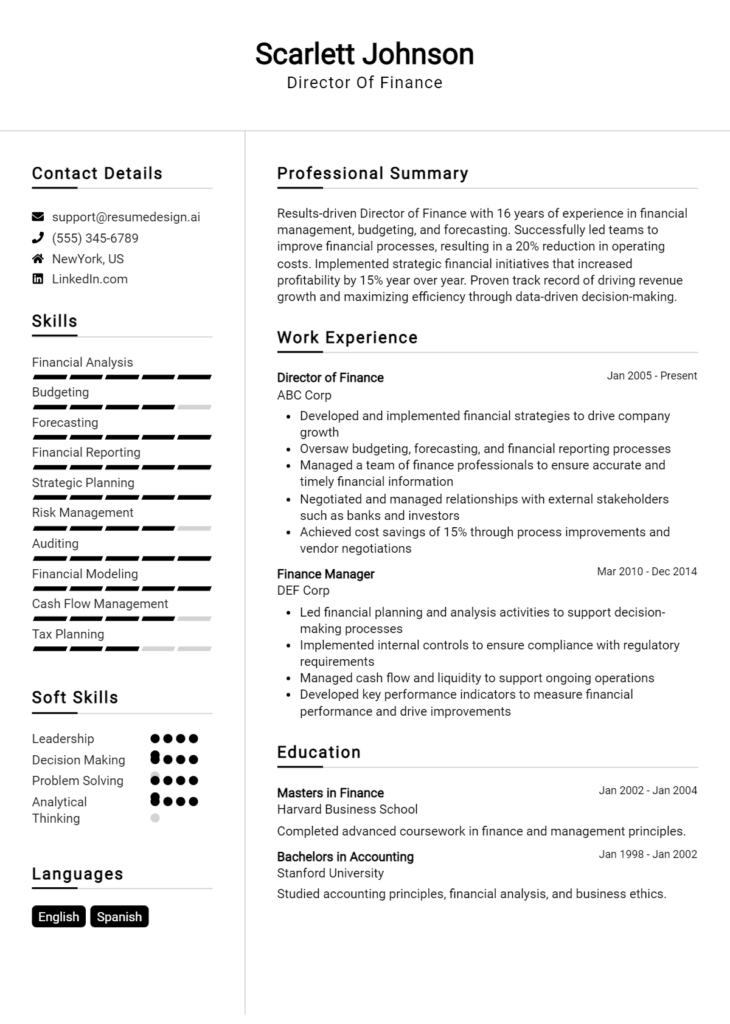

- Utilize a clean, professional format that enhances readability and allows your key accomplishments to stand out.

- Incorporate a summary statement at the top of your resume that succinctly presents your qualifications and career objectives.

- Demonstrate your ability to collaborate with cross-functional teams, emphasizing your communication skills and stakeholder engagement.

- Keep your resume concise, ideally one page, focusing on the most relevant experience and skills that pertain to the job you're applying for.

By implementing these tips, you can significantly increase your chances of landing a job in the Credit Risk Manager field. A well-structured resume that effectively highlights your qualifications and achievements will not only catch the eye of hiring managers but also showcase your readiness to tackle the challenges of this critical role in financial institutions.

Why Resume Headlines & Titles are Important for Credit Risk Manager

In the competitive field of credit risk management, a well-crafted resume headline or title serves as a vital tool for candidates to stand out in a sea of applicants. This succinct phrase is often the first thing hiring managers see, making it crucial for summarizing a candidate's key qualifications and attracting immediate attention. A strong headline can encapsulate years of experience, specialized skills, and notable accomplishments in a way that resonates with recruiters. By being concise, relevant, and directly related to the job being applied for, a powerful resume title can set the tone for the rest of the application, encouraging hiring managers to delve deeper into the candidate's qualifications.

Best Practices for Crafting Resume Headlines for Credit Risk Manager

- Keep it concise: Aim for a headline that is one sentence or phrase long.

- Be role-specific: Tailor the headline to reflect the specific position of Credit Risk Manager.

- Highlight key qualifications: Include significant skills or experiences that are relevant to the role.

- Use action-oriented language: Start with strong action verbs or impactful adjectives.

- Avoid jargon: Use clear, straightforward language that is easily understood.

- Incorporate metrics: If possible, include quantifiable achievements to demonstrate impact.

- Make it unique: Differentiate yourself with a headline that reflects your personal brand.

- Ensure relevance: Align your headline with the job description and company values.

Example Resume Headlines for Credit Risk Manager

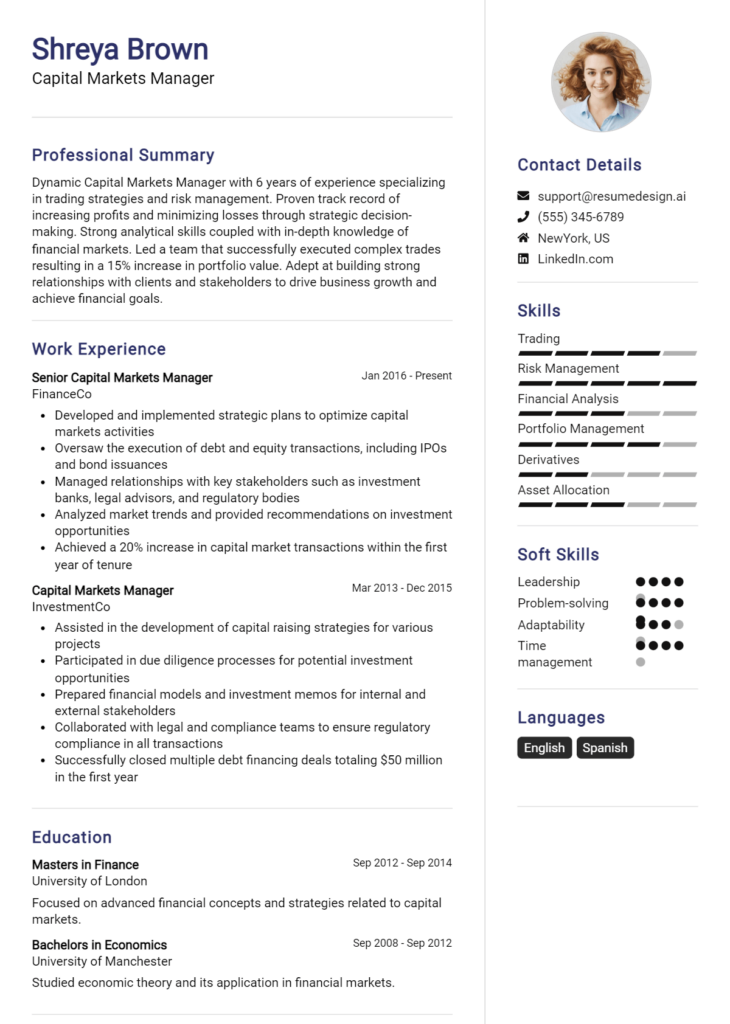

Strong Resume Headlines

Dynamic Credit Risk Manager with 10+ Years of Experience in Mitigating Financial Risks and Enhancing Portfolio Performance

Results-Driven Credit Risk Analyst Specializing in Predictive Modeling and Strategic Risk Assessment

Experienced Credit Risk Professional with Proven Track Record in Reducing Default Rates by 30%

Weak Resume Headlines

Credit Risk Manager

Professional with Experience in Finance

The strong resume headlines are effective because they convey specific skills, years of experience, and measurable accomplishments, making them impactful and relevant to the position. In contrast, the weak headlines fail to impress as they are vague and lack detail, making it difficult for hiring managers to gauge the candidate's qualifications or unique value. By using strong, targeted headlines, candidates can immediately capture attention and set themselves apart in a competitive job market.

Writing an Exceptional Credit Risk Manager Resume Summary

A resume summary is a crucial component for a Credit Risk Manager, as it serves as the first impression a hiring manager receives. A well-crafted summary succinctly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job role. This concise and impactful statement should be tailored specifically to the job the candidate is applying for, effectively showcasing their qualifications and setting the stage for the rest of the resume.

Best Practices for Writing a Credit Risk Manager Resume Summary

- Quantify Achievements: Use numbers to demonstrate the impact of your work, such as reduced credit losses or improved risk assessment accuracy.

- Focus on Relevant Skills: Highlight skills that are directly applicable to credit risk management, such as credit analysis, risk modeling, and regulatory compliance.

- Tailor to the Job Description: Customize your summary to reflect the specific requirements and keywords from the job posting.

- Keep It Concise: Aim for 3-5 sentences that deliver your message clearly without unnecessary detail.

- Showcase Industry Knowledge: Mention familiarity with market trends, credit policies, and best practices in risk management.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey confidence and proactivity.

- Highlight Leadership Experience: If applicable, include your experience in leading teams or initiatives that improved credit risk processes.

- Include Certifications: If you hold relevant certifications (e.g., CFA, FRM), mention them as they add credibility to your expertise.

Example Credit Risk Manager Resume Summaries

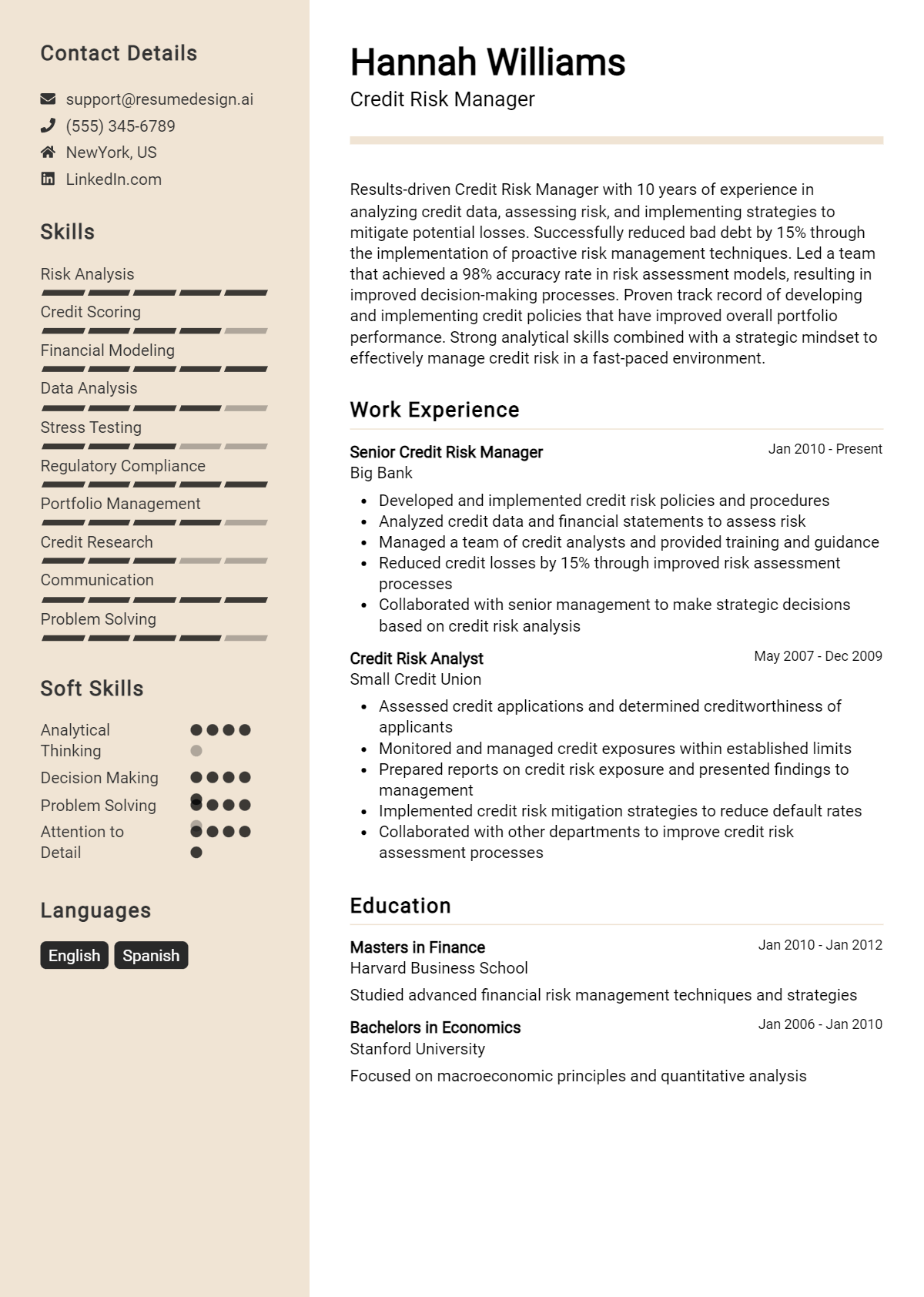

Strong Resume Summaries

Results-driven Credit Risk Manager with over 8 years of experience in developing risk assessment models that reduced default rates by 25%. Proven track record in leading cross-functional teams to enhance credit policies and ensure compliance with regulatory standards.

Strategic Credit Risk Analyst with expertise in quantitative analysis and a history of improving risk mitigation strategies, achieving a 30% increase in portfolio performance over 2 years. Skilled in utilizing advanced analytics tools to support decision-making processes.

Dedicated Credit Risk Manager with 10 years of experience in the banking sector, successfully managing a $500 million loan portfolio. Recognized for implementing innovative risk management frameworks that decreased credit loss rates by 15% while maintaining strong customer relationships.

Weak Resume Summaries

Experienced professional looking for a challenging position in credit risk management. I have various skills and knowledge in finance and risk assessment.

Credit Risk Manager with a background in finance and some experience in risk analysis. I am eager to contribute to a new team and help with credit-related tasks.

The examples of strong resume summaries are considered effective because they provide specific achievements, quantifiable results, and relevant skills that directly relate to the role of a Credit Risk Manager. In contrast, the weak summaries lack detail, fail to highlight any measurable accomplishments, and come across as generic and uninspired, making them less likely to capture the attention of hiring managers.

Work Experience Section for Credit Risk Manager Resume

The work experience section of a Credit Risk Manager resume is vital for showcasing the candidate's technical skills, leadership abilities, and commitment to delivering high-quality results. This section serves as a platform to highlight not only the candidate's relevant roles and responsibilities but also quantifiable achievements that align with industry standards. A well-crafted work experience section demonstrates expertise in risk assessment, team management, and the implementation of risk mitigation strategies, making it essential for potential employers to evaluate the candidate's fit for the role.

Best Practices for Credit Risk Manager Work Experience

- Clearly articulate specific technical skills relevant to credit risk management, such as statistical analysis, credit modeling, and regulatory compliance.

- Include quantifiable results that demonstrate the impact of your work, such as percentage reductions in default rates or improvements in risk assessment accuracy.

- Emphasize collaboration by detailing experiences where you worked with cross-functional teams or partnered with stakeholders to achieve objectives.

- Use action verbs to convey your contributions, such as "developed," "managed," "analyzed," and "implemented."

- Tailor your work experience to align with the specific requirements of the job you are applying for, using relevant keywords from the job description.

- Highlight leadership experiences, particularly in managing teams or projects that resulted in successful outcomes.

- Maintain a clean and organized format that allows hiring managers to quickly assess your qualifications and achievements.

- Regularly update your work experience section to reflect your most recent and relevant accomplishments in the field.

Example Work Experiences for Credit Risk Manager

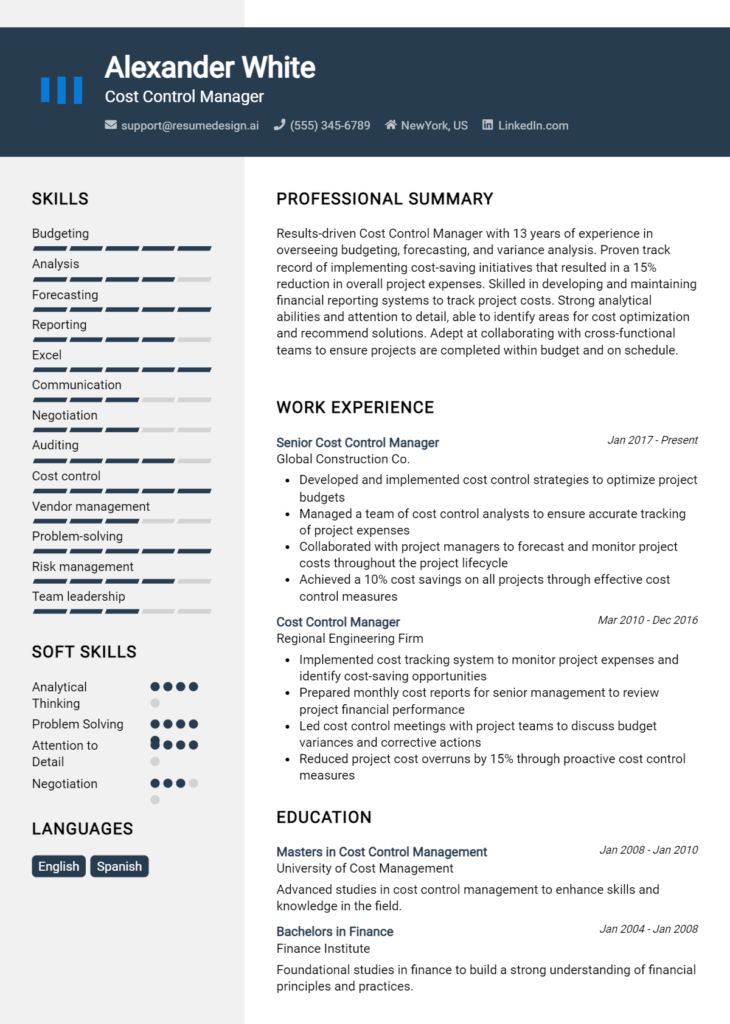

Strong Experiences

- Led a team of 5 analysts to develop a new credit risk assessment model, resulting in a 20% decrease in loan default rates over 18 months.

- Implemented a data-driven approach to credit scoring that improved prediction accuracy by 30%, enhancing the bank's risk management framework.

- Collaborated with IT and compliance departments to redesign the risk reporting system, reducing turnaround time for reports by 40% and ensuring adherence to regulatory standards.

- Managed the credit risk portfolio of over $500 million, achieving a consistent return on risk-adjusted capital above industry benchmarks.

Weak Experiences

- Worked on credit risk projects that involved data analysis.

- Assisted in developing credit risk policies and procedures.

- Helped the team with various tasks related to credit risk management.

- Participated in meetings discussing credit risk strategies.

The examples of strong experiences are considered effective because they provide specific, quantifiable outcomes and demonstrate leadership and collaboration within the context of credit risk management. In contrast, the weak experiences lack detail and fail to highlight significant contributions or measurable results, making them less impactful in conveying the candidate's qualifications for the role.

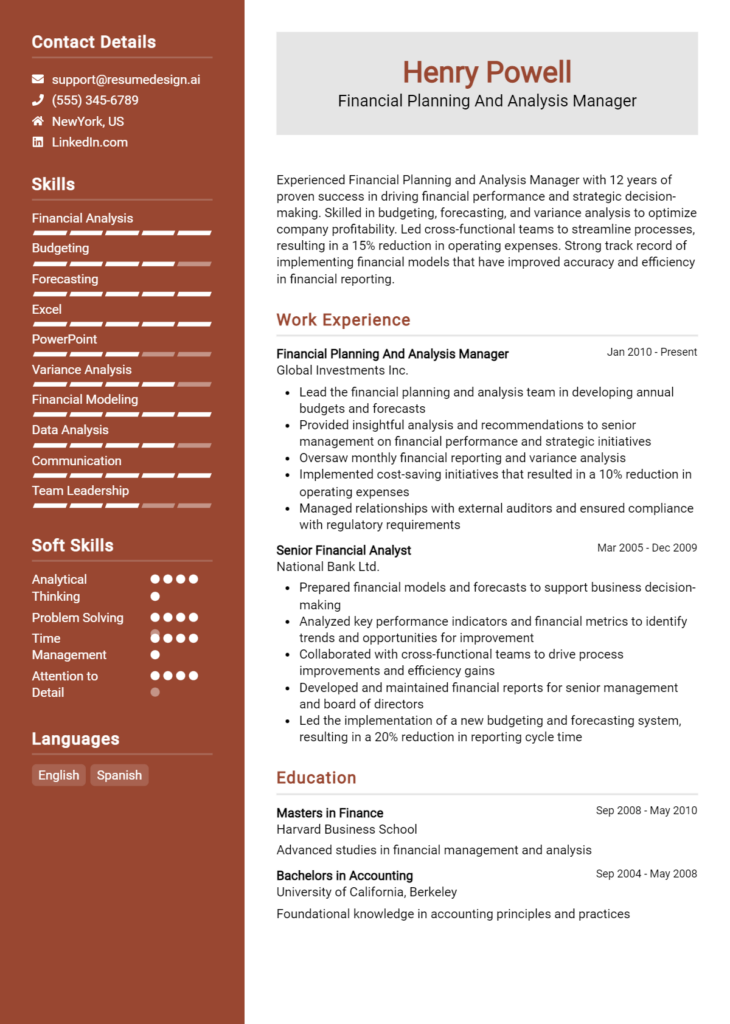

Education and Certifications Section for Credit Risk Manager Resume

The education and certifications section of a Credit Risk Manager resume plays a crucial role in showcasing a candidate's academic achievements, industry-specific credentials, and commitment to ongoing professional development. This section provides potential employers with insight into the candidate's foundational knowledge, technical skills, and understanding of credit risk management principles. By listing relevant degrees, specialized certifications, and pertinent coursework, candidates can significantly enhance their credibility and demonstrate their alignment with the requirements of the job role, making it easier for hiring managers to recognize their qualifications and potential contributions to the organization.

Best Practices for Credit Risk Manager Education and Certifications

- Include degrees in finance, economics, or related fields to establish a strong educational background.

- List industry-recognized certifications such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to enhance credibility.

- Provide details on relevant coursework that demonstrates specialized knowledge in credit risk analysis, financial modeling, or risk management.

- Highlight any continuing education programs or workshops that reflect a commitment to staying updated on industry trends.

- Ensure the format is clear and concise, making it easy for employers to quickly assess qualifications.

- Tailor the section to emphasize credentials that are particularly relevant to the job description.

- Use bullet points for readability and to allow for quick scanning of information.

- Consider including GPA or honors if they reflect academic excellence in relevant coursework.

Example Education and Certifications for Credit Risk Manager

Strong Examples

- MBA in Finance from the University of Chicago Booth School of Business.

- Chartered Financial Analyst (CFA) Level II Candidate.

- Certified Risk Management Professional (CRMP) with a focus on credit risk assessment.

- Relevant coursework: Advanced Credit Risk Modeling, Financial Derivatives, and Corporate Finance.

Weak Examples

- Bachelor’s degree in General Studies from a non-accredited institution.

- Certification in Basic Accounting (not relevant to credit risk management).

- Outdated qualification: Diploma in Banking from a program discontinued over a decade ago.

- Coursework in unrelated fields such as Art History or English Literature.

Strong examples are considered effective because they directly relate to the skills and knowledge required for a Credit Risk Manager role, showcasing relevant education and certifications that enhance the candidate's profile. Conversely, weak examples are ineffective as they either lack relevance to the credit risk field, are outdated, or do not demonstrate a commitment to professional development within the industry, which can diminish the candidate's appeal to potential employers.

Top Skills & Keywords for Credit Risk Manager Resume

The role of a Credit Risk Manager is pivotal in safeguarding an organization’s assets and ensuring sound financial decisions. A well-crafted resume that highlights relevant skills can set candidates apart in a competitive job market. Skills not only showcase your technical capabilities but also reflect your ability to navigate complex financial landscapes and manage potential risks. Employers look for both hard and soft skills to ensure that candidates can not only analyze data but also communicate effectively with stakeholders and make informed decisions. This balance is essential for effective risk management and contributes to the overall success of the organization.

Top Hard & Soft Skills for Credit Risk Manager

Soft Skills

- Analytical Thinking

- Effective Communication

- Problem-Solving

- Decision-Making

- Attention to Detail

- Team Collaboration

- Time Management

- Adaptability

- Interpersonal Skills

- Leadership Ability

- Negotiation Skills

- Conflict Resolution

- Emotional Intelligence

- Strategic Thinking

Hard Skills

- Credit Risk Assessment

- Financial Analysis

- Regulatory Compliance

- Risk Modeling Techniques

- Data Analysis Software (e.g., SAS, R)

- Portfolio Management

- Quantitative Analysis

- Risk Mitigation Strategies

- Financial Reporting

- Knowledge of Credit Scoring Systems

- Statistical Analysis

- Proficiency in Microsoft Excel

- Credit Policy Development

- Experience with Risk Management Software

For a deeper understanding of how to effectively incorporate these skills into your resume, and to see how to present your work experience in a way that highlights your qualifications for the Credit Risk Manager role, consider exploring additional resources.

Stand Out with a Winning Credit Risk Manager Cover Letter

As a seasoned Credit Risk Manager with over eight years of experience in the financial services industry, I am excited to express my interest in the Credit Risk Manager position at [Company Name]. My background in assessing credit risk, developing risk mitigation strategies, and utilizing advanced analytical tools has equipped me with the skills necessary to contribute effectively to your team. I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in risk management, which aligns perfectly with my professional values and aspirations.

In my previous role at [Previous Company Name], I successfully led a team that implemented a comprehensive credit risk assessment process that reduced the default rate by 15% within the first year. By leveraging data analytics and modeling techniques, I was able to identify key risk indicators and establish a robust monitoring framework that enhanced our decision-making capabilities. My ability to collaborate with cross-functional teams, including underwriting and compliance, ensured that our strategies were not only effective but also aligned with regulatory requirements and organizational goals.

I am also proficient in utilizing various risk management software and tools, which has allowed me to streamline workflows and improve reporting accuracy. My strong communication skills enable me to present complex risk findings to stakeholders clearly and concisely, fostering an environment of informed decision-making. I am eager to bring my expertise in credit risk analysis, strategic planning, and team leadership to [Company Name], where I believe I can make a significant impact in optimizing your credit portfolio.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the needs of your team. I am enthusiastic about the possibility of contributing to [Company Name]'s continued success and would welcome the chance to speak with you further about my candidacy.

Common Mistakes to Avoid in a Credit Risk Manager Resume

When crafting a resume for the role of a Credit Risk Manager, it's crucial to present qualifications and experiences in a clear, compelling manner. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more effective resume that highlights your skills and suitability for the position. Here are some frequent mistakes to watch out for:

Generic Objective Statements: Using a one-size-fits-all objective statement that lacks specificity can make your resume blend in with others. Tailor your objective to reflect your career goals and how they align with the company’s needs.

Overly Technical Jargon: While industry-specific terminology is important, excessive jargon can confuse hiring managers. Strike a balance by using clear language that highlights your expertise while remaining accessible.

Neglecting Quantifiable Achievements: Failing to provide measurable outcomes from your previous roles can weaken your impact. Always aim to include specific metrics that demonstrate your contributions, such as percentage reductions in credit losses.

Ignoring Formatting Consistency: Inconsistent formatting can make your resume look unprofessional and difficult to read. Ensure uniformity in font, bullet points, and spacing throughout the document.

Listing Responsibilities Instead of Results: Simply listing job duties without focusing on accomplishments can diminish your value. Emphasize the results of your actions and how they benefited your previous employers.

Lack of Relevant Keywords: Not incorporating relevant keywords from the job description can lead to your resume being overlooked during automated screenings. Carefully analyze job postings and integrate these keywords naturally.

Including Irrelevant Experience: Adding unrelated work experiences can dilute the focus of your resume. Concentrate on including roles that are relevant to credit risk management to present a cohesive career narrative.

Ignoring Professional Development: Overlooking certifications, training, or continuous education in credit risk can signal a lack of commitment to your field. Highlight any relevant certifications or courses to showcase your dedication to professional growth.

Conclusion

As a Credit Risk Manager, you play a crucial role in assessing and mitigating financial risks for your organization. Throughout this article, we have explored the key responsibilities associated with this position, including analyzing credit data, developing risk assessment models, and ensuring compliance with regulatory requirements. We also discussed the importance of effective communication and collaboration with various departments to enhance risk management strategies.

In conclusion, it is essential to present your skills and experiences effectively in your resume to stand out in the competitive job market. Take the time to review and update your Credit Risk Manager resume to reflect your qualifications and achievements accurately.

To assist you in this process, consider utilizing a variety of helpful resources. Explore our resume templates for a professional layout, use our resume builder for easy customization, check out resume examples for inspiration, and don't forget about our cover letter templates to complement your application. Start enhancing your resume today to better position yourself for your next career opportunity!