Budget Manager Core Responsibilities

A Budget Manager plays a crucial role in overseeing an organization's financial planning and resource allocation. They collaborate with various departments to create, monitor, and adjust budgets, ensuring that financial objectives align with the company’s strategic goals. Essential skills include technical proficiency in financial software, operational knowledge of budgeting processes, and strong problem-solving abilities to tackle financial discrepancies. A well-structured resume that highlights these qualifications can significantly enhance a candidate's appeal to potential employers.

Common Responsibilities Listed on Budget Manager Resume

- Developing and managing annual budget plans

- Analyzing financial data to identify trends and variances

- Collaborating with department heads to forecast financial needs

- Monitoring expenditures and ensuring compliance with budgetary guidelines

- Preparing detailed financial reports for senior management

- Implementing cost control measures to optimize resource allocation

- Providing training and support to staff on budgeting processes

- Conducting regular audits to ensure financial accuracy

- Advising on financial decisions to improve profitability

- Maintaining relationships with external financial institutions

- Utilizing advanced financial modeling techniques

- Overseeing the preparation of grant budgets and financial statements

High-Level Resume Tips for Budget Manager Professionals

In today’s competitive job market, a well-crafted resume serves as a critical tool for Budget Manager professionals seeking to make a strong first impression on potential employers. This document is often the first glimpse hiring managers have into a candidate’s qualifications, skills, and achievements. A resume that effectively highlights both relevant experience and quantifiable successes not only showcases a candidate's expertise but also sets the stage for future conversations. This guide will provide practical and actionable resume tips specifically tailored for Budget Manager professionals to help you stand out in a crowded field.

Top Resume Tips for Budget Manager Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases that reflect the requirements outlined by the employer.

- Highlight relevant experience by organizing your work history in reverse chronological order, emphasizing roles that directly relate to budget management.

- Quantify your achievements with specific metrics, such as percentage improvements in budget efficiency or cost reductions you implemented.

- Include industry-specific skills such as financial forecasting, variance analysis, and knowledge of budgeting software to demonstrate your expertise.

- Utilize action verbs to describe your responsibilities and achievements, creating a dynamic narrative that engages the reader.

- Incorporate certifications and professional development courses that are relevant to budget management, such as CPA or CFA, to enhance your credentials.

- Showcase your analytical skills by highlighting projects where you successfully analyzed financial data to inform strategic decisions.

- Maintain a clean and professional layout, ensuring that your resume is easy to read and visually appealing, which can help keep the reader engaged.

- Include a summary statement that encapsulates your experience and goals, providing a quick overview of what you bring to the table.

By implementing these tips, Budget Manager professionals can significantly increase their chances of landing a job in their field. A well-tailored resume that effectively communicates relevant skills and achievements not only showcases your qualifications but also reflects your commitment to excellence in financial management.

Why Resume Headlines & Titles are Important for Budget Manager

Resume headlines and titles play a crucial role in a Budget Manager's resume, as they serve as the first impression a hiring manager receives. A well-crafted headline can instantly capture attention and succinctly summarize a candidate's key qualifications, making it easier for employers to identify potential fits for the role. This pivotal phrase should be concise, relevant, and directly aligned with the job being applied for, ensuring that it resonates with the specific demands of the Budget Manager position.

Best Practices for Crafting Resume Headlines for Budget Manager

- Keep it concise: Aim for 10-15 words to maintain clarity and impact.

- Be role-specific: Use keywords related to the Budget Manager position to demonstrate relevancy.

- Highlight key achievements: Incorporate quantifiable results or accolades to stand out.

- Use strong action verbs: Start with dynamic verbs to convey confidence and proactivity.

- Avoid generic terms: Steer clear of vague phrases that fail to communicate expertise.

- Tailor for each application: Customize your headline for each job to align with specific requirements.

- Consider including years of experience: Mentioning your experience level can add credibility.

- Reflect your personal brand: Ensure the headline aligns with your professional identity and aspirations.

Example Resume Headlines for Budget Manager

Strong Resume Headlines

"Results-Driven Budget Manager with Over 10 Years of Experience in Financial Strategy"

“Expert Budget Analyst Specializing in Cost Reduction and Revenue Optimization”

“Dynamic Financial Manager with Proven Success in Managing Multi-Million Dollar Budgets”

“Strategic Budget Manager Committed to Enhancing Financial Performance through Data-Driven Decisions”

Weak Resume Headlines

“Budget Manager with Some Experience”

“Financial Professional Seeking New Opportunities”

The strong resume headlines listed above are effective because they clearly convey the candidate's expertise, experience, and specific achievements related to the Budget Manager role. They utilize impactful language and precise information that immediately communicates value to hiring managers. In contrast, the weak headlines lack specificity and depth, failing to showcase the candidate's qualifications or unique strengths, which can lead to missed opportunities in the competitive job market.

Writing an Exceptional Budget Manager Resume Summary

A well-crafted resume summary is essential for a Budget Manager as it serves as the first impression for hiring managers. This brief yet impactful section succinctly highlights key skills, relevant experience, and notable accomplishments that align with the job role. In a competitive job market, a strong summary can quickly capture a hiring manager's attention, showcasing a candidate's qualifications and potential contributions to the organization. It should be concise, impactful, and tailored specifically to the job being applied for, ensuring that it resonates with the employer's needs.

Best Practices for Writing a Budget Manager Resume Summary

- Quantify Achievements: Use numbers to highlight your accomplishments, such as budget sizes managed or percentage reductions in costs.

- Focus on Key Skills: Emphasize skills that are directly relevant to the budget management role, such as financial analysis, forecasting, and reporting.

- Tailor for the Job Description: Customize your summary to align with the specific requirements and responsibilities outlined in the job posting.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey a sense of proactivity and effectiveness.

- Highlight Relevant Experience: Mention years of experience in budget management or related fields to establish credibility.

- Showcase Industry Knowledge: If applicable, reference familiarity with industry-specific regulations or financial software to demonstrate expertise.

- Keep It Concise: Aim for 3-5 sentences that deliver a powerful message without overwhelming the reader.

- Proofread for Clarity: Ensure there are no grammatical errors or typos, as professionalism is key in finance-related positions.

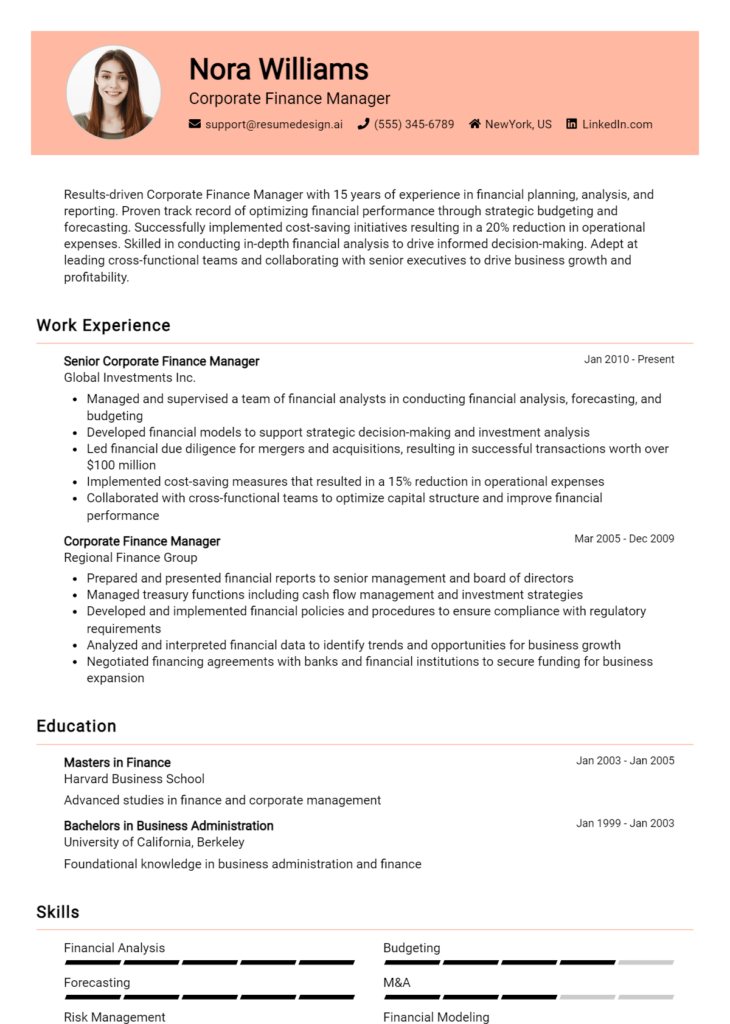

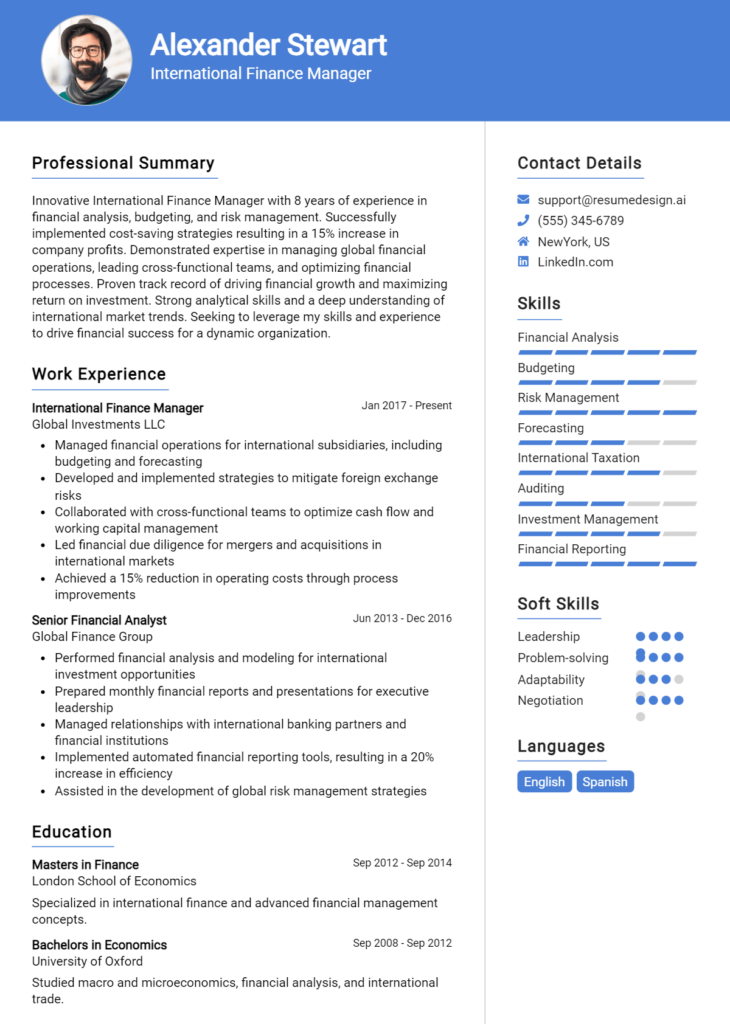

Example Budget Manager Resume Summaries

Strong Resume Summaries

Dynamic Budget Manager with over 8 years of experience in financial planning and analysis, successfully managing budgets exceeding $10 million. Achieved a 15% reduction in operational costs through strategic resource allocation and process optimization.

Results-driven Budget Manager skilled in forecasting and reporting, with a proven track record of increasing budget accuracy by 20% year-over-year. Expert in leveraging financial software to streamline budgeting processes and enhance decision-making.

Seasoned Budget Manager with a background in the non-profit sector, adept at managing complex budgets and securing funding through meticulous financial oversight. Developed a multi-year budget plan that improved funding allocation efficiency by 30%.

Weak Resume Summaries

Experienced budget manager looking for a new opportunity. I have worked with budgets and financial reports.

Budget Manager with some experience in financial management. I am good at numbers and like to work with teams.

The examples of strong resume summaries are considered effective because they include specific achievements, quantifiable outcomes, and relevant skills that align closely with the Budget Manager role. They provide clear evidence of the candidate's capabilities and past successes. In contrast, the weak summaries lack detail and specificity, making them vague and less compelling to hiring managers. Without quantifiable results or relevant experience, they fail to convey the candidate's true potential or value to the organization.

Work Experience Section for Budget Manager Resume

The work experience section of a Budget Manager resume is crucial as it highlights the candidate's relevant technical skills, leadership capabilities, and the ability to deliver high-quality financial products and services. This section not only provides evidence of the candidate's previous roles and responsibilities but also demonstrates their proficiency in managing budgets, analyzing financial data, and leading teams effectively. By quantifying achievements and aligning their experiences with industry standards, candidates can create a compelling narrative that showcases their value to potential employers.

Best Practices for Budget Manager Work Experience

- Highlight relevant technical skills such as financial forecasting, budgeting software proficiency, and data analysis.

- Use quantifiable results to demonstrate the impact of your work, such as percentage reductions in costs or improvements in budget accuracy.

- Showcase collaboration by detailing experiences where you worked with cross-functional teams or led team initiatives.

- Align your experiences with industry standards, ensuring your skills and achievements resonate with what employers are seeking.

- Focus on leadership experiences, illustrating how you've guided teams or projects toward successful financial outcomes.

- Use strong action verbs to describe your contributions, enhancing the impact of your statements.

- Prioritize experiences that reflect your ability to adapt to changing financial environments or regulations.

- Tailor your work experience descriptions to the specific job you are applying for, emphasizing the most relevant experiences.

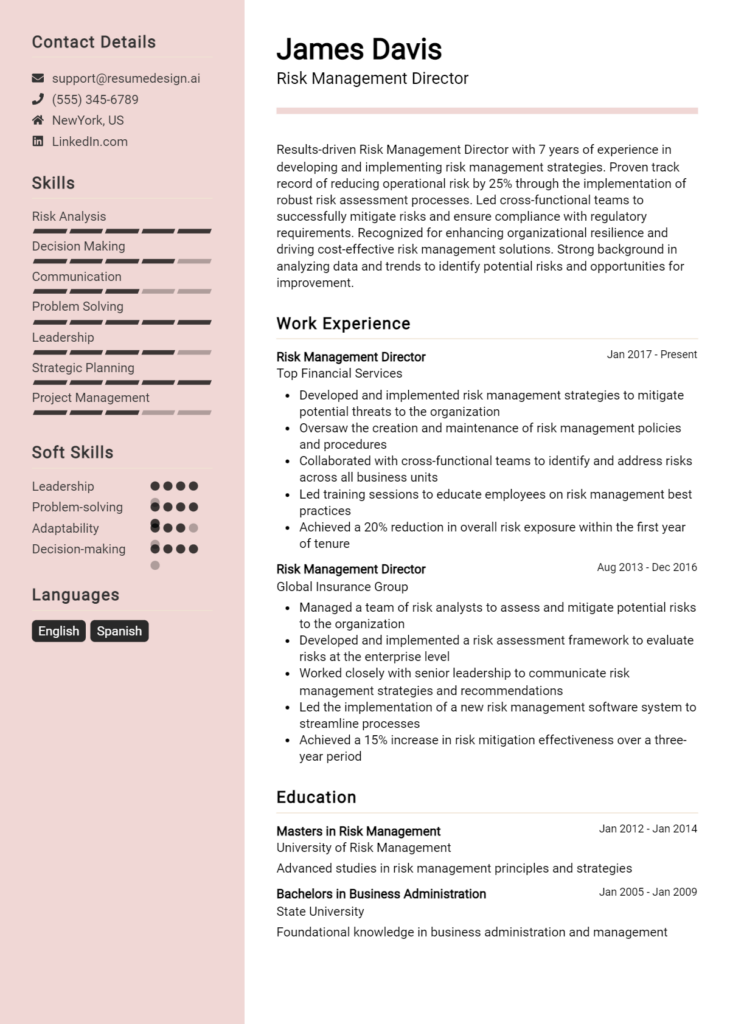

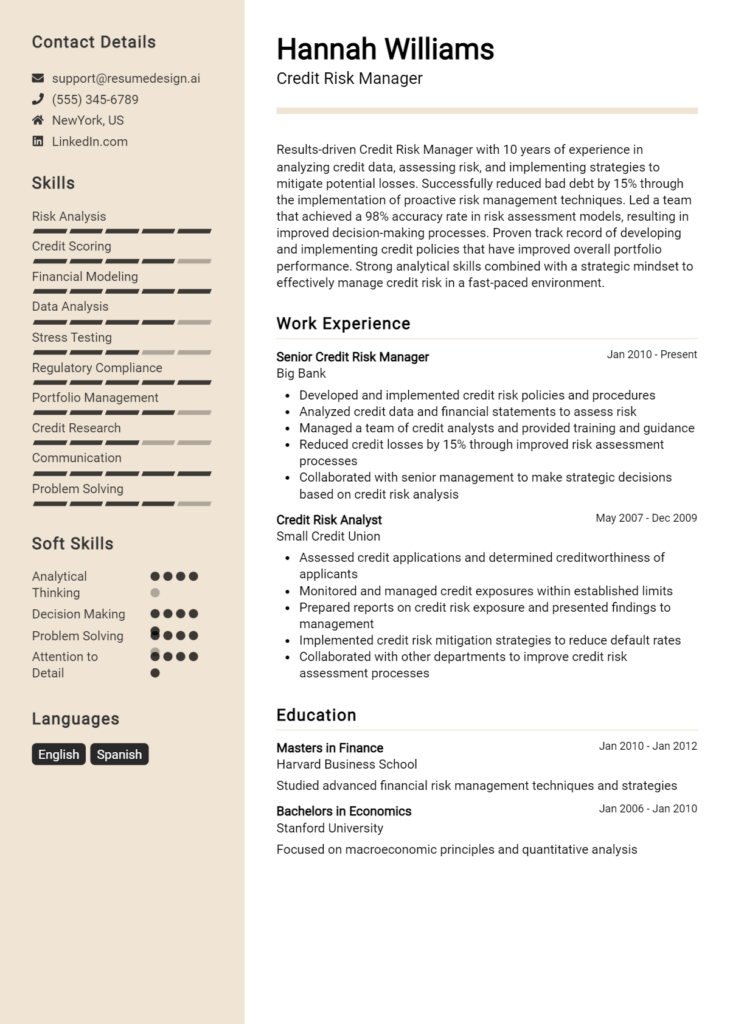

Example Work Experiences for Budget Manager

Strong Experiences

- Led a team of 5 in the successful implementation of a new budgeting software, resulting in a 30% reduction in processing time for budget approvals.

- Developed and managed a departmental budget of $2 million, achieving a 15% cost savings through strategic resource allocation and process improvements.

- Collaborated with cross-functional teams to create a financial forecasting model that increased accuracy by 25%, significantly enhancing decision-making processes.

- Presented quarterly budget reviews to the executive team, facilitating discussions that led to the reallocation of funds that improved project ROI by 20%.

Weak Experiences

- Managed budgets for various projects without specific detail on outcomes or improvements.

- Assisted in budget planning processes but did not specify contributions or achievements.

- Involved in team meetings regarding budgets, without clarifying the role or impact of participation.

- Performed general financial tasks without quantifiable results or indications of leadership.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable outcomes and demonstrate leadership and collaboration, providing a clear picture of the candidate's contributions and impact. In contrast, weak experiences lack detail, measurable results, and fail to communicate the candidate's role effectively, ultimately diminishing their potential appeal to employers.

Education and Certifications Section for Budget Manager Resume

The education and certifications section of a Budget Manager resume is crucial as it serves to underscore the candidate's academic qualifications and professional development relevant to the role. This section not only showcases the candidate's foundational knowledge acquired through formal education but also highlights industry-recognized certifications that demonstrate a commitment to continuous learning and adherence to best practices in financial management. By providing relevant coursework, specialized training, and certifications, candidates can significantly enhance their credibility and align themselves with the expectations of prospective employers in the financial sector.

Best Practices for Budget Manager Education and Certifications

- Include degrees that are relevant to finance, accounting, or business management.

- Highlight industry-recognized certifications such as CPA, CMA, or CFA.

- Provide details on relevant coursework that aligns with budgeting, forecasting, and financial analysis.

- List any specialized training or workshops attended that pertain to budgeting or financial management.

- Keep the section focused and concise, only including information that adds value to the role of a Budget Manager.

- Use clear and professional formatting to enhance readability and impact.

- Consider mentioning any ongoing education efforts, such as pursuing advanced certifications or degrees.

- Prioritize the most recent and relevant qualifications to stay current with industry standards.

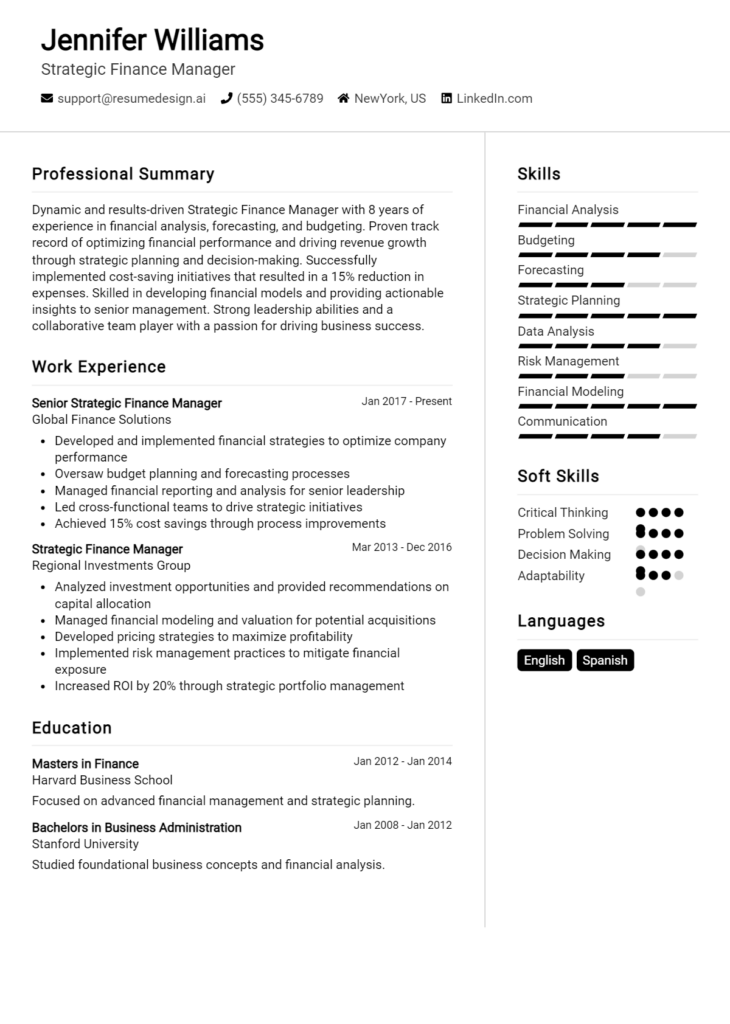

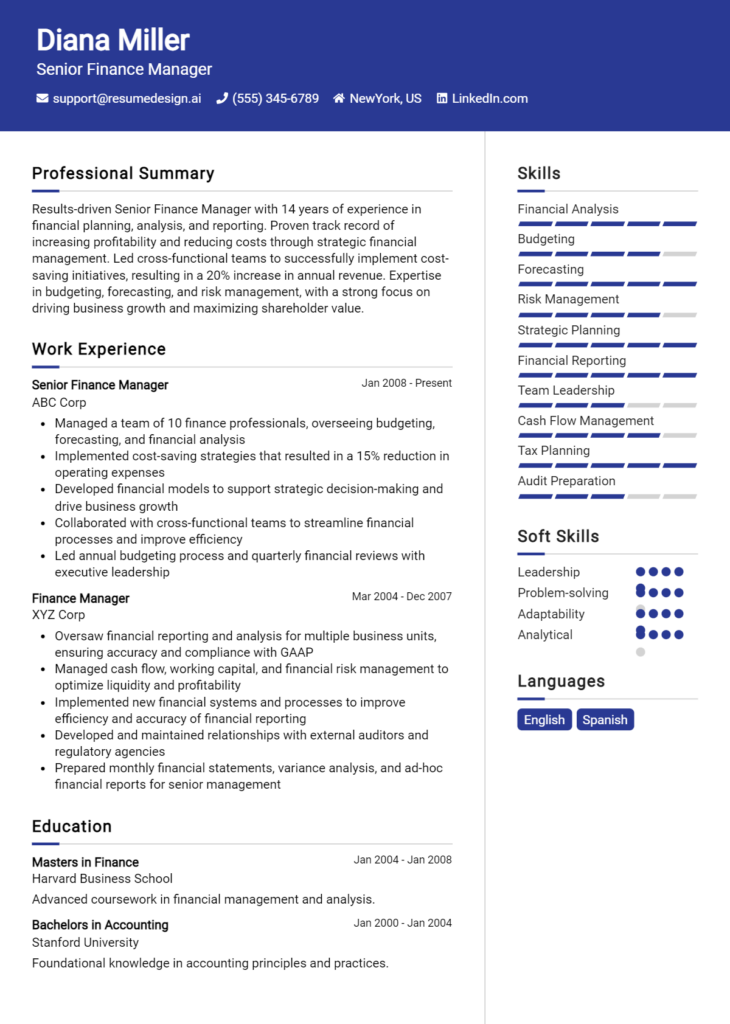

Example Education and Certifications for Budget Manager

Strong Examples

- MBA in Finance, University of XYZ, Graduated May 2022

- Certified Management Accountant (CMA), 2023

- Bachelor of Science in Accounting, University of ABC, Graduated May 2020

- Advanced Budgeting and Forecasting Workshop, Financial Management Institute, 2021

Weak Examples

- Associate Degree in General Studies, Community College, 2019

- Certification in Basic Computer Skills, 2020

- High School Diploma, 2018

- Outdated certification in QuickBooks from 2015

The strong examples provided are considered relevant and impactful as they directly align with the requirements of a Budget Manager role, showcasing advanced education and industry-recognized certifications that are current and applicable. In contrast, the weak examples reflect qualifications that are either outdated, irrelevant to the budgeting function, or lack the necessary depth and specialization that employers seek in a Budget Manager candidate. This distinction emphasizes the importance of showcasing pertinent educational achievements and certifications to create a compelling resume.

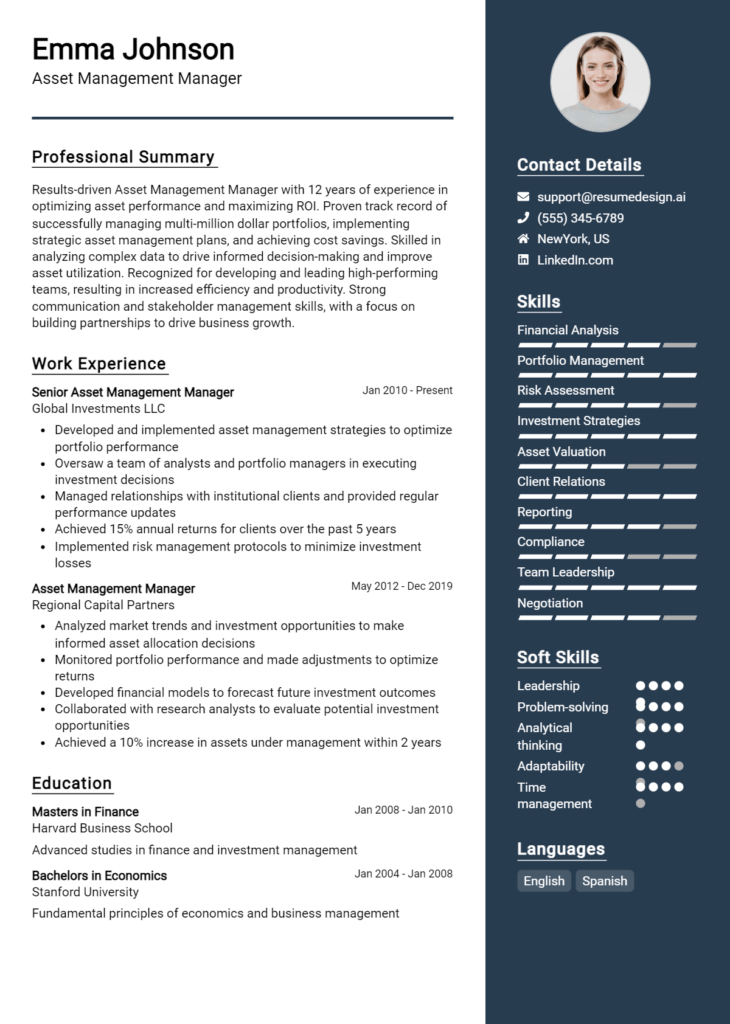

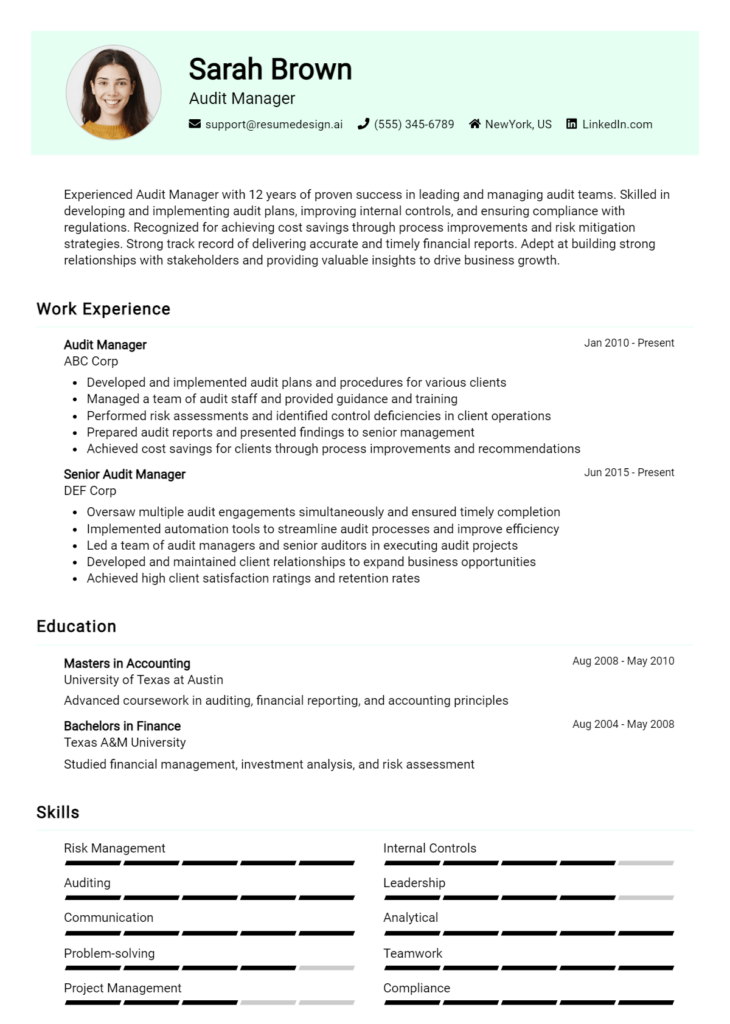

Top Skills & Keywords for Budget Manager Resume

As a Budget Manager, the importance of showcasing relevant skills on your resume cannot be overstated. Employers seek candidates who not only possess technical expertise in financial management but also demonstrate strong interpersonal abilities to collaborate effectively with diverse teams. A well-rounded resume that highlights both hard and soft skills will set you apart from other applicants and showcase your ability to navigate the complexities of budgeting and financial planning. This blend of skills is essential for ensuring organizational financial health and strategic resource allocation. To enhance your chances of landing the desired position, focus on emphasizing these key skills in your resume.

Top Hard & Soft Skills for Budget Manager

Soft Skills

- Analytical Thinking

- Communication Skills

- Problem-Solving

- Attention to Detail

- Time Management

- Team Leadership

- Adaptability

- Negotiation Skills

- Strategic Planning

- Conflict Resolution

- Interpersonal Skills

- Decision Making

- Presentation Skills

- Customer Focus

- Empathy

Hard Skills

- Budget Forecasting

- Financial Reporting

- Cost Analysis

- Financial Modeling

- Data Analysis

- Accounting Principles

- ERP Software Proficiency

- Excel Proficiency

- Variance Analysis

- Risk Management

- Strategic Financial Planning

- Tax Compliance

- Regulatory Knowledge

- Audit Coordination

- Performance Metrics

- Project Management

- Cash Flow Management

- Investment Analysis

Developing a comprehensive understanding of these skills and effectively presenting your work experience will significantly enhance the appeal of your Budget Manager resume.

Stand Out with a Winning Budget Manager Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Budget Manager position at [Company Name], as advertised on [Where You Found the Job Posting]. With over [X years] of experience in financial management and budgeting, I am confident in my ability to contribute effectively to your team. My expertise in developing, implementing, and monitoring budgets has not only facilitated improved operational efficiency but has also supported strategic decision-making processes in my previous roles.

In my most recent position at [Previous Company Name], I successfully managed a budget of over [specific amount], ensuring alignment with organizational goals while maximizing resource allocation. I implemented comprehensive forecasting techniques that improved budget accuracy by [specific percentage], which significantly enhanced our financial planning processes. Additionally, my proficiency in financial software and analytical tools allows me to analyze complex financial data and provide actionable insights for executive leadership.

I am particularly drawn to this opportunity at [Company Name] because of your commitment to [mention any specific value or initiative of the company]. I am eager to bring my strategic vision and financial acumen to your organization, ensuring that budgetary practices not only meet regulatory requirements but also drive growth and innovation. I believe that my background in collaborating with cross-functional teams will help foster a culture of transparency and accountability in budget management.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the goals of [Company Name]. I am enthusiastic about the opportunity to contribute to your team and help drive financial success.

Sincerely,

[Your Name]

[Your Contact Information]

[LinkedIn Profile or Professional Website, if applicable]

Common Mistakes to Avoid in a Budget Manager Resume

Crafting a resume for a Budget Manager position requires attention to detail and a clear demonstration of financial acumen. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a compelling resume that highlights your qualifications and effectively showcases your expertise in budget management.

Vague Job Descriptions: Failing to provide specific descriptions of your past roles can leave hiring managers unclear about your actual responsibilities and achievements. Be precise about your contributions and the impact you had on the organization.

Ignoring Quantifiable Achievements: Not including numbers or metrics to demonstrate your success is a missed opportunity. Use figures to illustrate how you improved budget accuracy, reduced costs, or managed funds effectively.

Overlooking Relevant Skills: Budget management requires a mix of technical and soft skills. Neglecting to list crucial skills like financial analysis, forecasting, and communication can make your resume less competitive.

Using Generic Language: Utilizing clichéd phrases or buzzwords can make your resume blend in with others. Instead, personalize your language and tailor it to reflect your unique experiences and accomplishments.

Formatting Issues: A cluttered or poorly organized resume can detract from the content. Ensure that your resume is well-structured, easy to read, and visually appealing to make a strong first impression.

Failing to Customize for Each Job Application: Sending out a one-size-fits-all resume can signal a lack of interest in the specific position. Take the time to tailor your resume for each job, highlighting relevant experiences that align with the job description.

Neglecting to Include Professional Development: Not mentioning any certifications, training, or ongoing education can make you seem less committed to your profession. Highlight any relevant courses or certifications that enhance your qualifications.

Omitting Keywords from the Job Description: Many companies use Applicant Tracking Systems (ATS) to screen resumes. Failing to include relevant keywords from the job posting may result in your resume being overlooked. Be sure to incorporate industry-specific terms that align with the job requirements.

Conclusion

As a Budget Manager, your role is pivotal in ensuring financial health and strategic allocation of resources within an organization. Key responsibilities include developing budgets, monitoring expenditures, and analyzing financial data to guide decision-making. Effective communication and analytical skills are essential, as you will often collaborate with various departments to align financial goals with operational strategies.

In addition to technical expertise, a successful Budget Manager must stay updated on industry trends and regulatory changes that may impact financial planning. Building a strong network and demonstrating leadership qualities can further enhance your effectiveness in this role.

In conclusion, if you aspire to excel as a Budget Manager or advance in your current position, it's crucial to have a well-crafted resume that highlights your skills and achievements. We encourage you to take a moment to review your Budget Manager resume and ensure it reflects your qualifications effectively.

To assist you in this process, explore our range of resources:

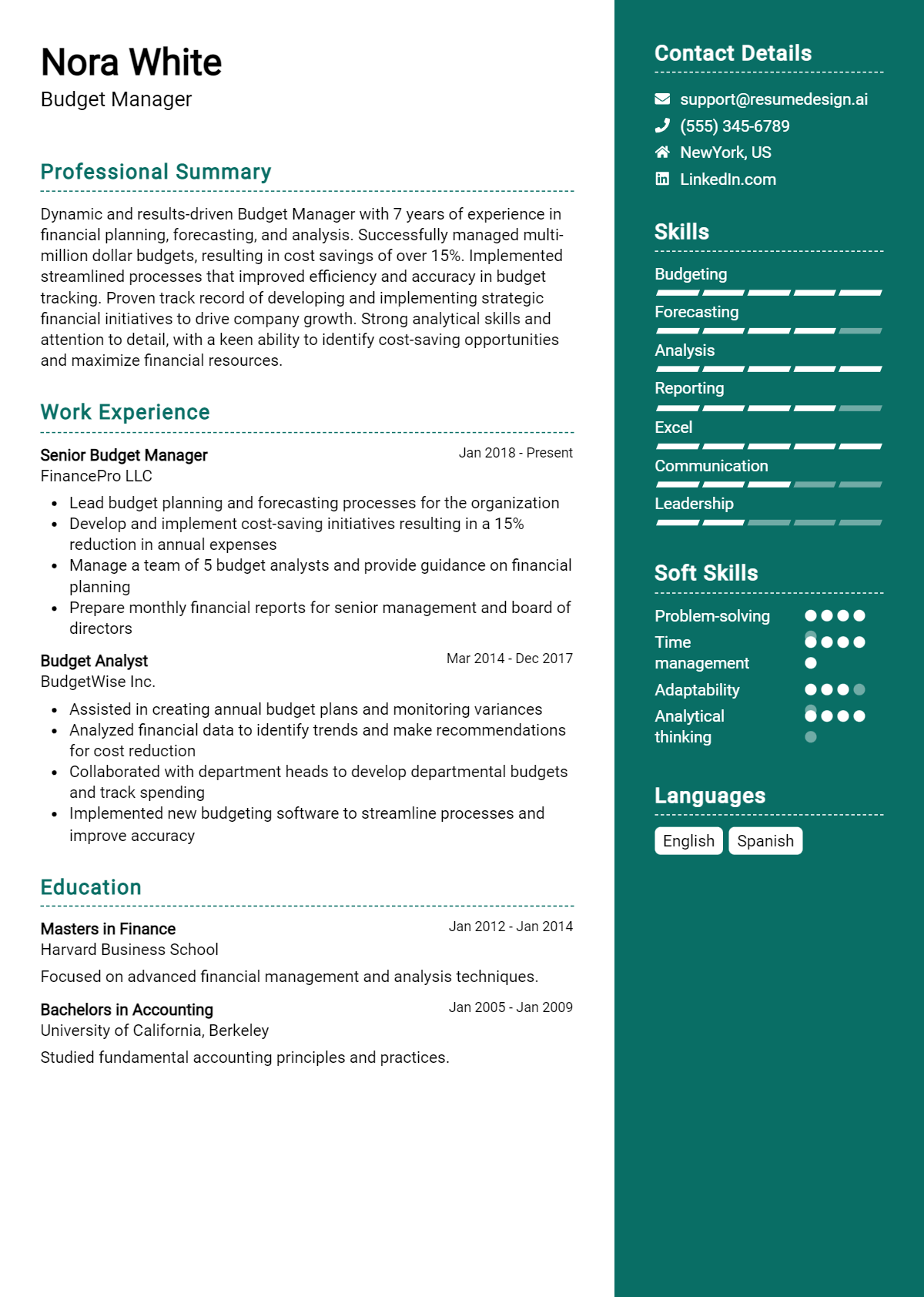

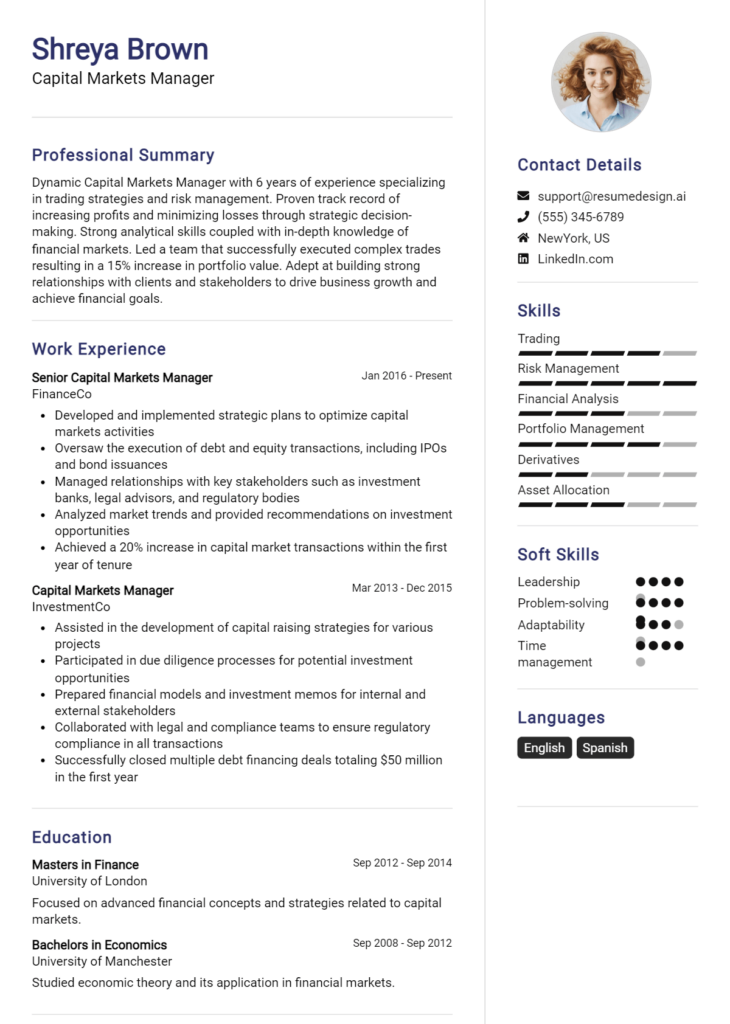

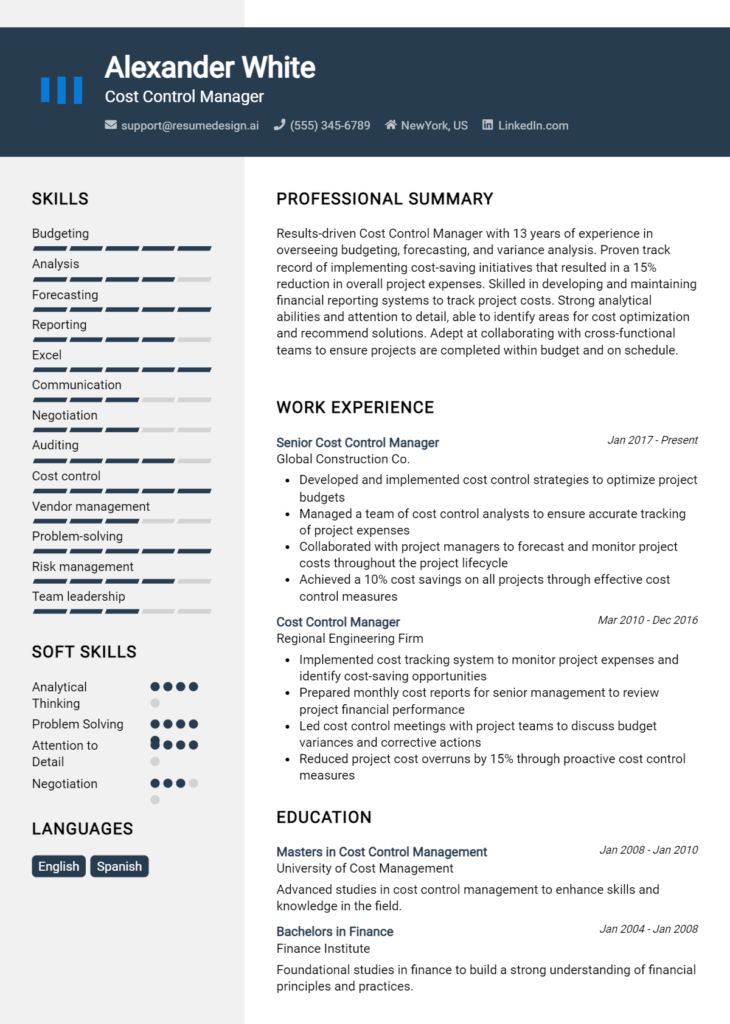

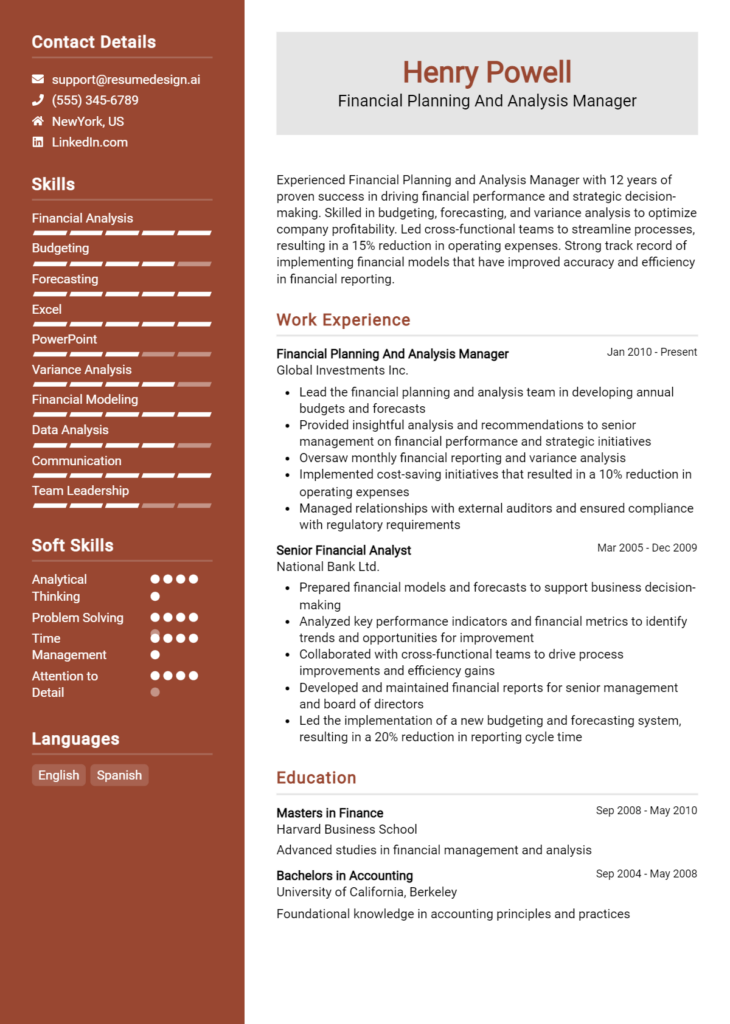

- Check out our resume templates for a professional layout.

- Use our resume builder for a user-friendly experience in creating your resume.

- Browse through our resume examples to gain inspiration from successful Budget Managers.

- Don't forget to enhance your application with our cover letter templates that can help you make a strong first impression.

Take action today and ensure your resume stands out in the competitive job market!