Chief Investment Officer Core Responsibilities

The Chief Investment Officer (CIO) plays a pivotal role in aligning investment strategies with the organization’s overall objectives, requiring a blend of technical, operational, and problem-solving skills. This role acts as a bridge between financial, operational, and strategic departments, ensuring cohesive collaboration. A successful CIO must demonstrate expertise in market analysis, risk management, and portfolio optimization while maintaining effective communication across teams. A well-structured resume highlighting these competencies is essential in showcasing a candidate's ability to drive the organization’s investment success.

Common Responsibilities Listed on Chief Investment Officer Resume

- Develop and implement investment strategies aligned with organizational goals.

- Oversee the management of investment portfolios and asset allocation.

- Conduct market research and analysis to identify investment opportunities.

- Monitor and assess market trends, economic indicators, and competitive landscape.

- Collaborate with finance and risk management teams to mitigate risks.

- Report investment performance and strategies to executive leadership.

- Manage relationships with external investment managers and advisors.

- Ensure compliance with regulatory requirements and internal policies.

- Mentor and develop investment team members to enhance skill sets.

- Evaluate and integrate new technologies for investment analysis.

- Prepare detailed reports and presentations for stakeholders.

- Drive continuous improvement in investment processes and performance metrics.

High-Level Resume Tips for Chief Investment Officer Professionals

In the competitive landscape of investment management, a well-crafted resume serves as a critical tool for Chief Investment Officer (CIO) professionals seeking to make their mark. As the first impression a candidate makes on potential employers, your resume must effectively showcase not only your skills but also your achievements in the industry. A compelling resume should reflect your leadership capabilities, strategic thinking, and proven track record in investment performance. This guide will provide practical and actionable resume tips specifically tailored for Chief Investment Officer professionals to help you stand out in a crowded field.

Top Resume Tips for Chief Investment Officer Professionals

- Tailor your resume to the job description by emphasizing relevant experience and skills that align with the specific requirements of the CIO role.

- Highlight your leadership experience by detailing your role in managing teams, driving investment strategies, and influencing organizational growth.

- Quantify your achievements with specific metrics, such as percentage increases in portfolio performance, assets under management, or successful investment projects.

- Showcase your industry-specific skills, including risk management, financial modeling, and market analysis, to demonstrate your expertise.

- Include relevant certifications, such as CFA or CAIA, to bolster your qualifications and indicate your commitment to professional development.

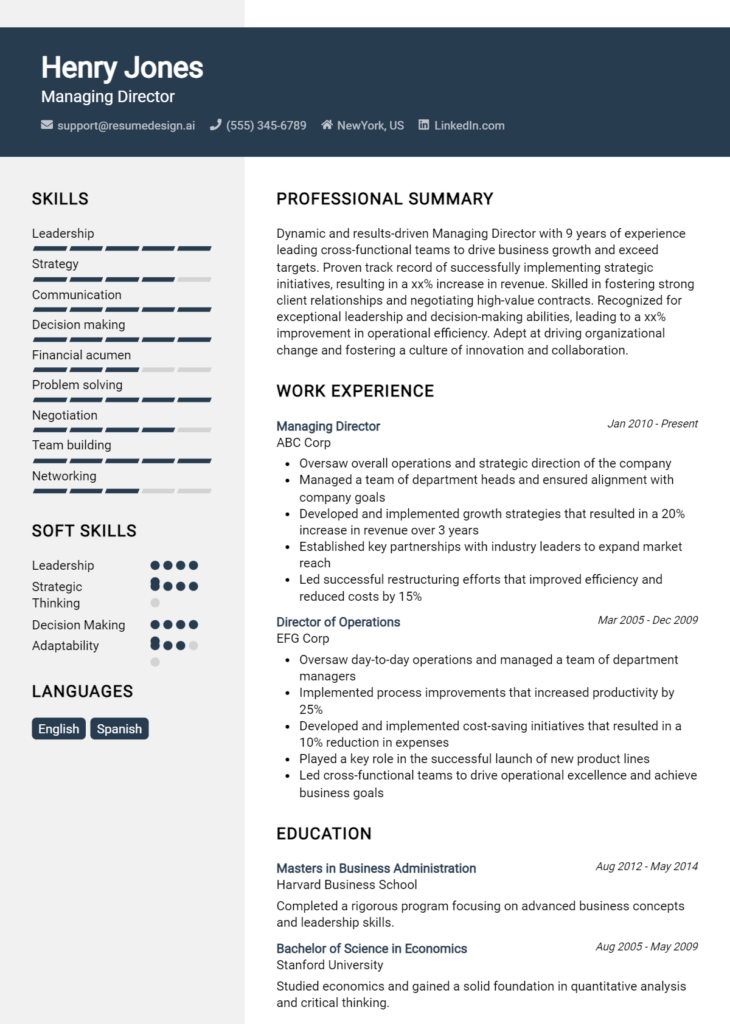

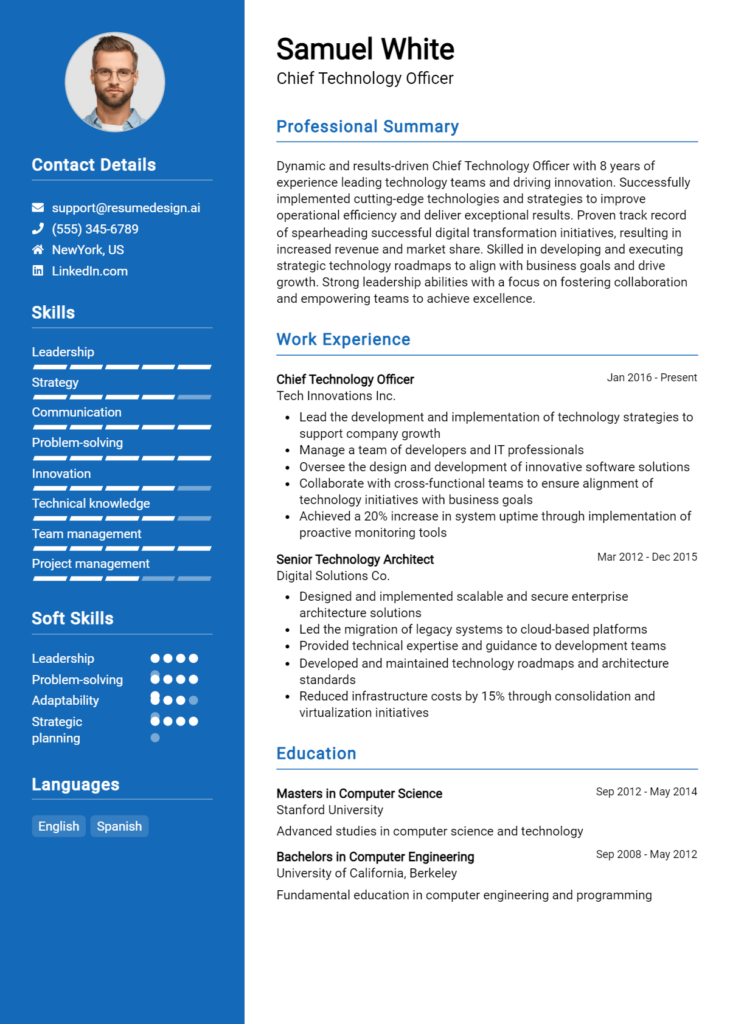

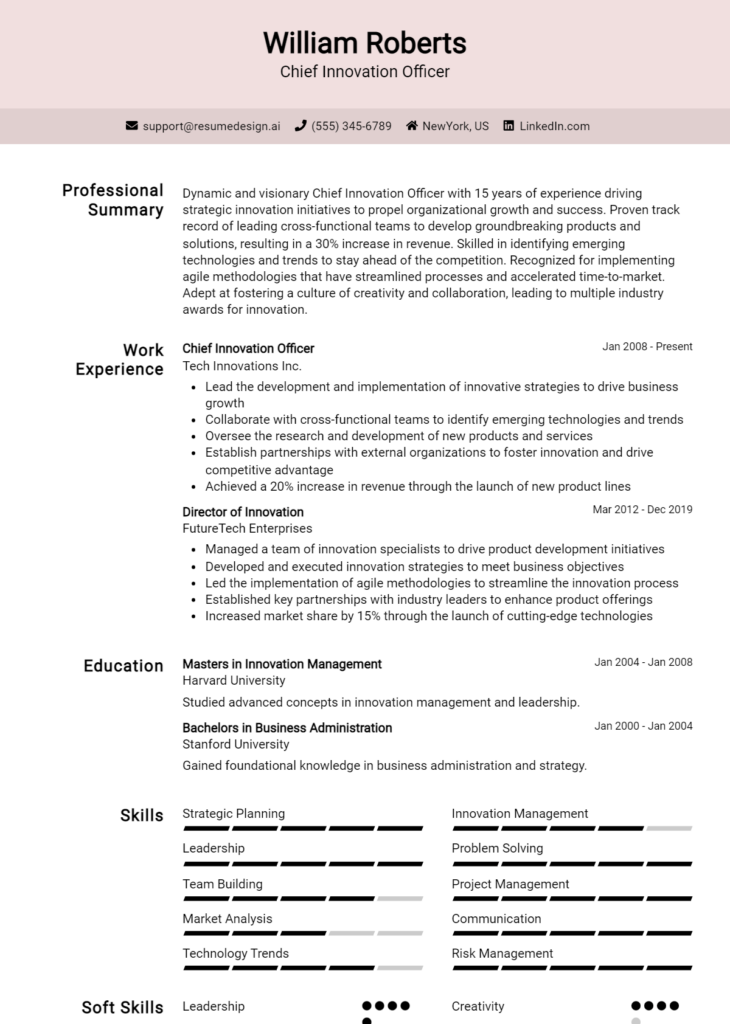

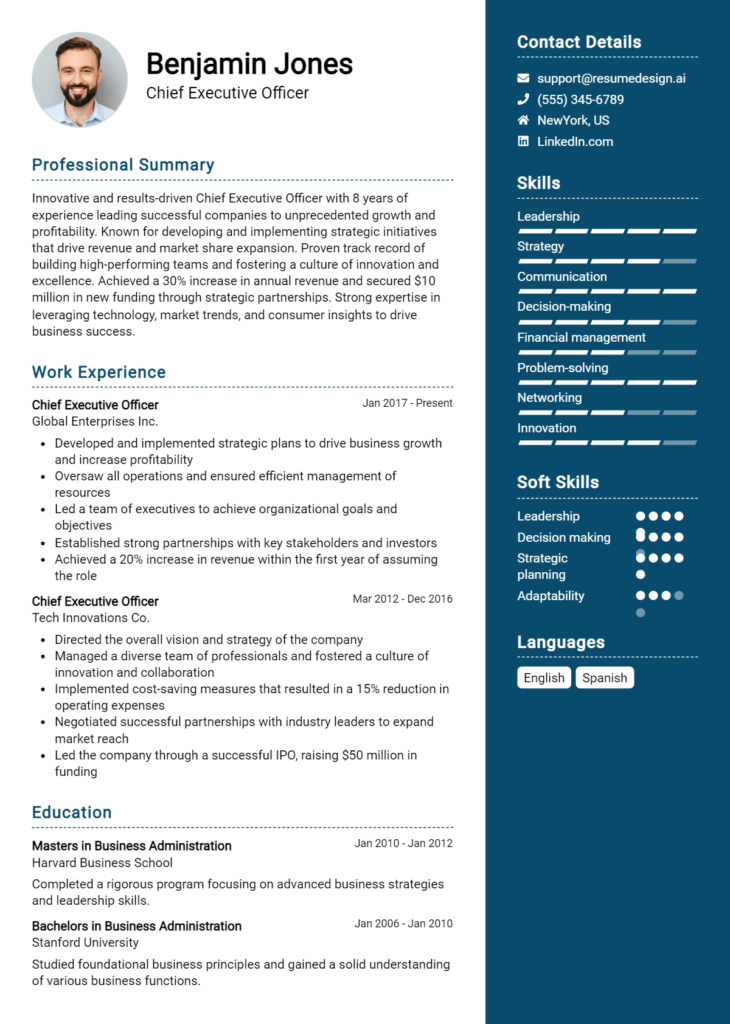

- Utilize a clean and professional format that enhances readability, ensuring that key information is easy to find at a glance.

- Incorporate keywords from the job posting to optimize your resume for applicant tracking systems (ATS) and ensure it reaches hiring managers.

- Clearly articulate your vision and strategic approach to investment management, showcasing how you have successfully navigated market challenges.

- Provide insights into your networking and relationship-building capabilities, as these are crucial for CIOs in fostering partnerships and collaborations.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a position in the Chief Investment Officer field. A focused and strategically constructed resume will not only highlight your qualifications but also tell a compelling story of your career trajectory, ultimately making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Chief Investment Officer

In the competitive landscape of investment management, the role of a Chief Investment Officer (CIO) is pivotal in steering an organization's investment strategy and decision-making processes. A well-crafted resume headline or title serves as a powerful first impression, capturing the attention of hiring managers and succinctly summarizing a candidate's key qualifications. A strong headline should be concise, relevant, and directly related to the job being applied for, providing a snapshot of the candidate’s experience and expertise that encourages further review of the resume.

Best Practices for Crafting Resume Headlines for Chief Investment Officer

- Keep it concise: Aim for one impactful phrase that encapsulates your expertise.

- Make it role-specific: Tailor your headline to reflect the specific position of Chief Investment Officer.

- Highlight key achievements: Include metrics or notable accomplishments when possible.

- Use strong action verbs: Start with powerful words that convey leadership and initiative.

- Focus on relevant skills: Incorporate skills that align with the job requirements.

- Be clear and direct: Avoid jargon and ensure clarity in your wording.

- Showcase your value proposition: Communicate what sets you apart from other candidates.

- Avoid clichés: Steer clear of overused phrases that don’t add value to your headline.

Example Resume Headlines for Chief Investment Officer

Strong Resume Headlines

Visionary Chief Investment Officer with 15+ years of experience in driving multi-billion dollar portfolio growth.

Dynamic Investment Leader Specializing in Risk Management and Strategic Asset Allocation.

Results-Driven CIO with Proven Expertise in Enhancing Returns through Innovative Investment Strategies.

Weak Resume Headlines

Chief Investment Officer Seeking New Opportunities.

Experienced Investment Professional.

The strong headlines are effective because they provide a clear and compelling summary of the candidate's expertise and achievements, immediately setting them apart from other applicants. They utilize specific language that highlights leadership, experience, and key accomplishments, making it easy for hiring managers to see the candidate’s potential value. In contrast, the weak headlines lack specificity and impact, failing to convey any substantial information about the candidate’s qualifications or unique strengths, which can lead to them being overlooked in a competitive hiring process.

Writing an Exceptional Chief Investment Officer Resume Summary

A resume summary is a critical component for a Chief Investment Officer (CIO) as it serves as the first impression for hiring managers. A strong summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments in the investment field. It is essential that this summary is concise and impactful, tailored specifically to the job description to demonstrate alignment with the company's needs and objectives. A well-crafted summary can set the tone for the rest of the resume, making it easier for potential employers to recognize the candidate's value and expertise in a competitive job market.

Best Practices for Writing a Chief Investment Officer Resume Summary

- Quantify achievements: Use specific numbers or percentages to highlight past successes and impact.

- Focus on skills: Emphasize key investment-related skills such as portfolio management, risk assessment, and strategic planning.

- Tailor the summary: Customize the summary for each job application by incorporating keywords from the job description.

- Highlight leadership experience: Showcase any previous leadership roles and your ability to guide teams or departments.

- Showcase industry knowledge: Mention familiarity with market trends, financial regulations, and investment strategies relevant to the role.

- Maintain brevity: Keep the summary to 3-5 sentences to ensure clarity and directness.

- Use action verbs: Start sentences with strong action verbs to convey confidence and proactivity.

Example Chief Investment Officer Resume Summaries

Strong Resume Summaries

Results-driven Chief Investment Officer with over 15 years of experience managing diverse investment portfolios, achieving an average annual return of 12%. Expert in strategic asset allocation and risk management, leading teams to successfully navigate market volatility.

Dynamic CIO with a proven track record of increasing assets under management by 30% within three years through innovative investment strategies and robust client relationship management. Skilled in leveraging data analytics for informed decision-making.

Accomplished Chief Investment Officer with expertise in private equity and fixed income, successfully raising $500 million in capital for new fund initiatives. Renowned for fostering a performance-driven culture and mentoring high-performing investment teams.

Weak Resume Summaries

Experienced investment professional looking for a challenging opportunity. Strong background in finance and investment.

Chief Investment Officer with a variety of skills and experiences in the investment industry. Passionate about making good investment decisions.

The strong resume summaries are considered effective because they clearly articulate specific achievements, quantifiable results, and relevant skills that align with the CIO role. They provide concrete examples of success and demonstrate the candidate’s ability to deliver tangible outcomes. In contrast, the weak summaries lack specificity and fail to highlight any measurable achievements or relevant skills, making them too vague and generic to capture the interest of hiring managers.

Work Experience Section for Chief Investment Officer Resume

The work experience section is a critical component of a Chief Investment Officer (CIO) resume, as it provides a comprehensive overview of a candidate's professional journey and accomplishments in the investment management field. This section highlights the candidate's technical skills in portfolio management, investment analysis, and market research, while also showcasing their ability to lead and manage teams effectively. Moreover, it demonstrates a track record of delivering high-quality products and services that align with industry standards. Quantifying achievements—such as increased returns, reduced risks, and successful project completions—adds weight to the experience and helps employers gauge the candidate's impact in previous roles.

Best Practices for Chief Investment Officer Work Experience

- Focus on quantifiable results, such as percentage increases in portfolio returns or reductions in costs.

- Include relevant technical skills, like financial modeling, risk assessment, and investment strategy development.

- Showcase your leadership capabilities by detailing team management, mentorship, and cross-departmental collaboration.

- Align your experiences with industry standards and trends to demonstrate your knowledge of current market conditions.

- Utilize action verbs to convey a sense of proactivity and initiative in your roles.

- Customize your work experience to reflect the specific requirements of the CIO position you are applying for.

- Incorporate relevant certifications or qualifications that enhance your credibility as a candidate.

- Maintain clarity and conciseness to ensure that your achievements are easily digestible for the reader.

Example Work Experiences for Chief Investment Officer

Strong Experiences

- Led a team that achieved a 25% increase in annual portfolio returns, outperforming the market average by 10% over three consecutive years.

- Developed and implemented an innovative risk management strategy that reduced potential losses by 30%, enhancing overall portfolio stability.

- Collaborated with cross-functional teams to launch a new investment product, resulting in $50 million in assets under management within the first year.

- Mentored junior analysts, leading to a 40% increase in their performance metrics and successful career advancements within the organization.

Weak Experiences

- Responsible for managing investments.

- Worked on projects related to financial analysis.

- Participated in team meetings and discussions.

- Involved in some investment strategy development.

The experiences listed as strong exemplify clear, quantifiable outcomes and demonstrate effective technical leadership and collaboration. They present the candidate as results-driven and proactive, with a significant impact on their previous organizations. In contrast, the weak experiences lack specific details and measurable achievements, making them less compelling and failing to convey the candidate's full capabilities or contributions in their roles.

Education and Certifications Section for Chief Investment Officer Resume

The education and certifications section of a Chief Investment Officer (CIO) resume is crucial for showcasing the candidate's academic qualifications and commitment to ongoing professional development. This section not only underscores the foundational knowledge acquired through formal education but also highlights industry-relevant certifications that validate the candidate's expertise. By including relevant coursework, specialized training, and certifications, candidates can strengthen their credibility and demonstrate their alignment with the demands of the CIO role, which requires a deep understanding of investment strategies, risk management, and financial markets.

Best Practices for Chief Investment Officer Education and Certifications

- Focus on relevant degrees such as Finance, Economics, or Business Administration.

- Include industry-recognized certifications like Chartered Financial Analyst (CFA) or Certified Investment Management Analyst (CIMA).

- Highlight advanced degrees (e.g., MBA) that enhance your strategic thinking and leadership skills.

- Detail relevant coursework that aligns with investment management, portfolio theory, or risk assessment.

- List continuous learning efforts, such as workshops or seminars on emerging investment trends.

- Prioritize certifications that demonstrate specialized knowledge in areas like alternative investments or asset allocation.

- Ensure all listed credentials are current and relevant to maintain credibility.

- Consider including memberships in professional organizations that enhance your industry network and knowledge.

Example Education and Certifications for Chief Investment Officer

Strong Examples

- MBA in Finance, Harvard Business School, 2020

- Chartered Financial Analyst (CFA), CFA Institute, 2019

- Certified Investment Management Analyst (CIMA), Investment Management Consultants Association, 2021

- Coursework in Advanced Portfolio Management, Stanford University, 2018

Weak Examples

- Bachelor of Arts in English Literature, State University, 2005

- Certification in Basic Accounting, Local Community College, 2010

- High School Diploma, Anytown High School, 2000

- Certification in Microsoft Office Suite, 2015

The strong examples are considered effective because they demonstrate a direct alignment with the skills and knowledge required for the Chief Investment Officer role, showcasing advanced qualifications and relevant industry certifications. In contrast, the weak examples reflect outdated or irrelevant educational backgrounds and certifications that do not contribute to the candidate's credibility in the investment management field, ultimately undermining their potential for success in a CIO position.

Top Skills & Keywords for Chief Investment Officer Resume

The role of a Chief Investment Officer (CIO) is pivotal in shaping the financial strategy and investment decisions of an organization. As the overseer of investment portfolios, a CIO must not only possess a deep understanding of market dynamics but also demonstrate a diverse set of skills that can influence the success of their investment strategies. Crafting a compelling resume that highlights relevant skills is essential for standing out in a competitive job market. Both hard and soft skills play critical roles in a CIO's effectiveness, enabling them to navigate complex financial landscapes, lead teams, and make informed decisions that drive organizational growth.

Top Hard & Soft Skills for Chief Investment Officer

Soft Skills

- Strategic Thinking

- Leadership

- Communication

- Negotiation

- Problem-Solving

- Adaptability

- Interpersonal Skills

- Decision-Making

- Team Collaboration

- Emotional Intelligence

- Critical Thinking

- Time Management

- Conflict Resolution

- Networking

- Mentoring

Hard Skills

- Financial Analysis

- Investment Management

- Portfolio Optimization

- Risk Assessment

- Asset Valuation

- Market Research

- Financial Modeling

- Regulatory Compliance

- Data Analysis and Interpretation

- Economic Forecasting

- Quantitative Analysis

- Performance Metrics

- Alternative Investments

- Trading Strategies

- Capital Markets Knowledge

- Technology Proficiency

- Ethical Investing Principles

For more comprehensive insights into the specific skills and the essential components of work experience in a CIO resume, it's important to tailor each section to reflect your unique qualifications and experiences.

Stand Out with a Winning Chief Investment Officer Cover Letter

As a highly accomplished investment professional with over 15 years of experience in portfolio management, strategic asset allocation, and risk assessment, I am excited to apply for the Chief Investment Officer position at your esteemed organization. My extensive background in finance, combined with my proven ability to enhance investment strategies and drive significant returns, positions me as a strong candidate to lead your investment team. I am eager to leverage my expertise to contribute to your firm’s growth and success.

In my previous role as Senior Portfolio Manager at XYZ Asset Management, I successfully managed a diverse portfolio of over $3 billion in assets, consistently outperforming benchmark indices and achieving a 12% average annual return over five years. By implementing innovative investment strategies and conducting thorough market analyses, I was able to identify lucrative opportunities while effectively managing risk. My collaborative leadership style not only fostered a high-performing team environment but also ensured alignment with the overall investment objectives of the organization.

I am particularly drawn to your firm’s commitment to sustainable investing and its focus on innovative financial solutions. I believe that my experience in integrating ESG factors into investment decisions can enhance your current portfolio offerings. Additionally, I have developed strong relationships with a wide network of institutional investors, which will be instrumental in expanding your firm’s reach and influence in the market. I am passionate about mentoring and developing talent within the investment team, ensuring that we remain competitive and proactive in a rapidly evolving financial landscape.

I am excited about the opportunity to bring my strategic vision and leadership skills to your organization as Chief Investment Officer. I am confident that my expertise in investment management and my commitment to excellence align perfectly with your firm’s goals. I look forward to the possibility of discussing how I can contribute to your team and drive exceptional results for your clients. Thank you for considering my application.

Common Mistakes to Avoid in a Chief Investment Officer Resume

When crafting a resume for a Chief Investment Officer (CIO) position, it's crucial to present a clear, concise, and compelling narrative of your professional journey. However, many candidates make critical mistakes that can undermine their chances of landing an interview. Understanding these common pitfalls can help ensure your resume effectively showcases your qualifications and strategic vision. Here are some key mistakes to avoid:

Vague Job Descriptions: Failing to provide specific details about past roles can leave potential employers unclear about your contributions and achievements. Use quantifiable metrics to illustrate your impact.

Ignoring Industry Keywords: Not incorporating relevant industry terminology may cause your resume to be overlooked by Applicant Tracking Systems (ATS) or hiring managers who are searching for specific skill sets.

Overemphasizing Technical Skills: While technical skills are important, a CIO role also requires strong leadership and strategic thinking abilities. Balance your resume to highlight both your technical and soft skills.

Lack of Clear Leadership Examples: A CIO should demonstrate leadership experience. Failing to include examples of team management, mentorship, or strategic initiatives can diminish your appeal.

Too Much Jargon: Using excessive industry jargon may alienate readers who are not familiar with specific terms. Aim for clarity and ensure that your resume can be understood by a broad audience.

Omitting Relevant Certifications: Important professional credentials, such as CFA or CAIA, should not be overlooked. Including these qualifications can enhance your credibility and show your commitment to professional development.

Neglecting Achievements: Simply listing job responsibilities does not convey your effectiveness. Focus on your accomplishments, such as successful investment strategies or portfolio growth, to demonstrate your value.

Formatting Issues: A cluttered or overly complex format can distract from your content. Ensure your resume is well-organized, easy to read, and visually appealing to make a strong first impression.

Conclusion

As we discussed the pivotal role of a Chief Investment Officer (CIO), it’s clear that this position demands a unique blend of analytical skills, strategic vision, and leadership qualities. A successful CIO not only oversees investment strategies but also aligns them with the organization's broader financial goals. Key responsibilities include managing portfolios, assessing market trends, and making informed decisions that drive growth and profitability. The importance of staying abreast of technological advancements and regulatory changes cannot be overstated, as these factors significantly influence investment landscapes.

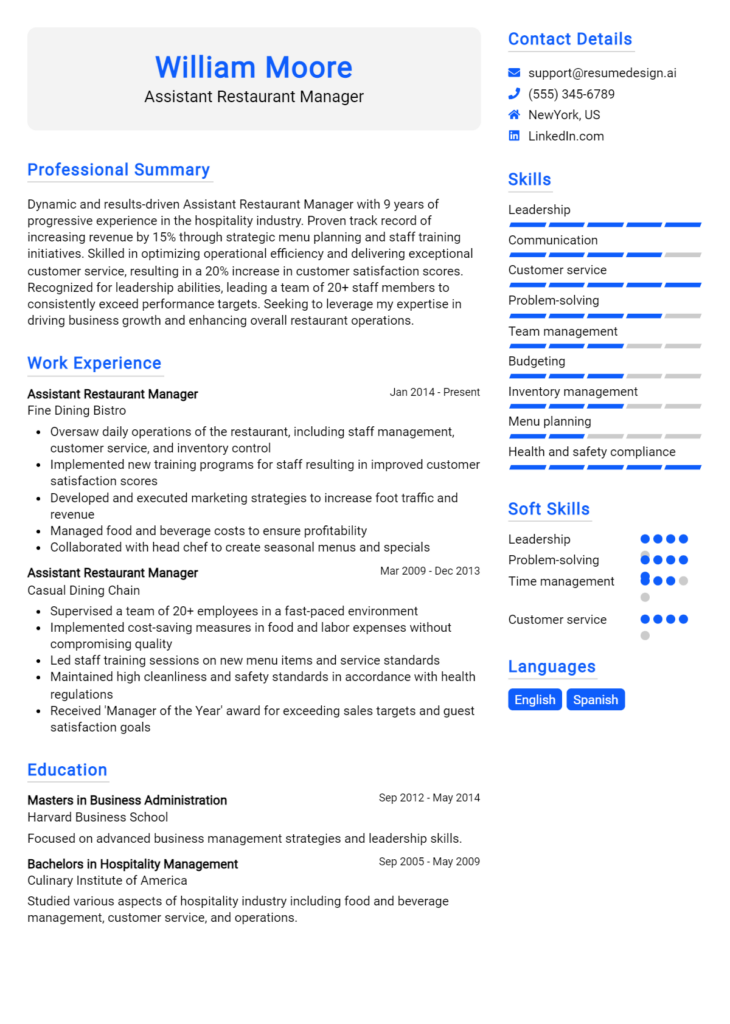

To excel in this competitive field, it’s essential to convey your qualifications effectively. We encourage you to take a moment to review your Chief Investment Officer resume. Updating your resume to highlight your skills, accomplishments, and experiences can significantly enhance your chances of landing that coveted position. Utilize available resources to help you create a standout application. Explore resume templates that can provide a professional layout, use a resume builder for a step-by-step creation process, and look at resume examples for inspiration. Don’t forget to complement your resume with a compelling cover letter using our cover letter templates. Seize the opportunity to present yourself as the ideal candidate for the Chief Investment Officer role!