Insurance Sales Agent Core Responsibilities

Insurance Sales Agents play a pivotal role in bridging various departments within an organization, such as marketing, customer service, and claims. Their core responsibilities include educating clients about insurance products, assessing their needs, and providing tailored solutions. Essential skills encompass technical knowledge of policies, operational efficiency, and strong problem-solving capabilities. These skills not only drive sales but also enhance customer satisfaction, contributing to the organization's overall goals. A well-structured resume can effectively showcase these qualifications, highlighting a candidate's potential for success in this dynamic field.

Common Responsibilities Listed on Insurance Sales Agent Resume

- Develop and maintain client relationships through effective communication.

- Conduct needs assessments to provide personalized insurance solutions.

- Explain policy features, benefits, and pricing to clients.

- Assist clients in completing insurance applications and claims.

- Stay updated on industry trends and regulatory changes.

- Collaborate with underwriting and claims departments for seamless service.

- Generate leads through networking and referrals.

- Meet sales targets and contribute to team goals.

- Provide ongoing support to clients for policy renewals and adjustments.

- Utilize CRM software to manage client information effectively.

- Attend training sessions to enhance product knowledge and sales techniques.

- Resolve client inquiries and complaints in a timely manner.

High-Level Resume Tips for Insurance Sales Agent Professionals

In the competitive field of insurance sales, a well-crafted resume is crucial for making a strong first impression on potential employers. This document serves as your professional introduction, showcasing not only your skills and qualifications but also your achievements and experiences that set you apart from other candidates. Given the importance of this initial encounter, your resume must effectively reflect your ability to connect with clients, understand their needs, and provide tailored insurance solutions. This guide will provide practical and actionable resume tips specifically tailored for Insurance Sales Agent professionals, helping you present your best self to prospective employers.

Top Resume Tips for Insurance Sales Agent Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the specific role you are applying for.

- Highlight your relevant experience, focusing on previous roles in sales or customer service that demonstrate your ability to build relationships and drive results.

- Quantify your achievements by using metrics such as sales targets met, percentage of clients retained, or number of policies sold, to provide concrete evidence of your success.

- Showcase industry-specific skills such as knowledge of various insurance products, regulatory compliance, and proficiency with CRM software.

- Include a summary statement at the top of your resume that encapsulates your professional identity, key strengths, and career goals in the insurance field.

- Utilize action verbs to describe your responsibilities and accomplishments, creating a dynamic narrative that conveys your impact in previous positions.

- Incorporate any relevant certifications or licenses, such as a state insurance license or designations like Certified Insurance Counselor (CIC), to enhance your credibility.

- Keep your resume concise and focused, ideally one page, ensuring that the most relevant information is easily accessible to hiring managers.

- Proofread your resume carefully to eliminate any errors or typos that could undermine your professionalism and attention to detail.

By implementing these tips, you can significantly increase your chances of landing a job in the Insurance Sales Agent field. A well-structured and targeted resume not only highlights your qualifications but also demonstrates your understanding of the industry and your commitment to delivering exceptional service to clients.

Why Resume Headlines & Titles are Important for Insurance Sales Agent

In the competitive field of insurance sales, crafting a compelling resume is essential for standing out among numerous candidates. One of the key elements of an effective resume is the headline or title, which serves as the first impression for hiring managers. A strong headline can instantly capture attention and succinctly summarize a candidate's key qualifications, making it easier for employers to see the value they bring to the position. It should be concise, relevant, and directly related to the insurance sales role being applied for, ensuring that it aligns well with the job description and highlights the candidate's strengths.

Best Practices for Crafting Resume Headlines for Insurance Sales Agent

- Be concise: Limit your headline to one impactful phrase.

- Use industry-specific language: Incorporate terminology familiar to hiring managers in the insurance field.

- Highlight key skills: Focus on core competencies that are highly relevant to the insurance sales role.

- Include measurable achievements: If possible, mention quantifiable results that demonstrate your success in sales.

- Make it role-specific: Tailor your headline to reflect the specific position you are applying for.

- Utilize action-oriented language: Use strong action verbs to convey confidence and expertise.

- Avoid clichés: Steer clear of overused phrases that lack originality.

- Reflect your personality: Infuse your headline with a hint of your personal brand to create a memorable impression.

Example Resume Headlines for Insurance Sales Agent

Strong Resume Headlines

Dynamic Insurance Sales Agent with 7+ Years of Proven Success in Exceeding Sales Targets

Top-Performing Insurance Professional Specializing in Client Relationship Management and Retention Strategies

Results-Driven Sales Agent with Expertise in Life and Health Insurance Solutions

Award-Winning Insurance Sales Specialist with a Track Record of Doubling Client Portfolios

Weak Resume Headlines

Insurance Sales Agent

Experienced Salesperson Looking for a Job

The strong headlines are effective because they not only showcase the candidate's experience and skills but also convey a sense of achievement and specialization, making them memorable to hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of specific information, leaving hiring managers with little reason to consider the candidate further. A well-crafted headline can set the tone for the entire resume and significantly enhance a candidate's chances of landing an interview.

Writing an Exceptional Insurance Sales Agent Resume Summary

Crafting a resume summary is a critical step for an Insurance Sales Agent, as it serves as the first impression to potential employers. A well-written summary succinctly highlights the candidate's key skills, relevant experience, and notable accomplishments, quickly capturing the attention of hiring managers. In a competitive field like insurance sales, where strong interpersonal skills and a proven track record can set candidates apart, a concise and impactful summary tailored to the specific job application can make all the difference in securing that all-important interview.

Best Practices for Writing a Insurance Sales Agent Resume Summary

- Quantify Achievements: Use specific numbers to demonstrate your success, such as sales targets met or customer satisfaction ratings.

- Focus on Relevant Skills: Highlight skills that are directly related to insurance sales, such as communication, negotiation, and customer service.

- Tailor to Job Description: Customize your summary for each position by including keywords and phrases from the job listing.

- Keep it Concise: Aim for 3-5 sentences that succinctly convey your strengths without overwhelming the reader.

- Showcase Industry Knowledge: Mention any relevant certifications or training that enhance your credibility as an insurance sales agent.

- Highlight Customer-Centric Achievements: Emphasize your ability to build relationships and retain clients, which is crucial in sales roles.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and decisiveness.

- Avoid Jargon: Use clear and simple language that is easy to understand, steering clear of overly technical terms unless necessary.

Example Insurance Sales Agent Resume Summaries

Strong Resume Summaries

Dynamic insurance sales agent with over 5 years of experience, consistently exceeding sales targets by 30%. Proven ability to build strong client relationships, resulting in a 95% customer retention rate.

Results-driven insurance sales professional with a track record of generating $1 million in premiums annually. Skilled in assessing client needs and tailoring insurance solutions to maximize satisfaction and coverage.

Accomplished insurance agent with a comprehensive understanding of diverse insurance products and services. Recognized for achieving the highest sales volume in the region for two consecutive years, increasing market share by 15%.

Detail-oriented sales agent with a background in financial services, adept at conducting thorough policy reviews and educating clients on coverage options. Successfully increased upselling rates by 40% through effective communication and personalized service.

Weak Resume Summaries

Insurance sales agent with experience in the field. Looking for a job to utilize my skills.

Dedicated professional with a background in sales who is seeking opportunities in insurance. I am hardworking and eager to learn.

The examples of strong resume summaries stand out due to their specificity and quantifiable achievements, showcasing the candidate's direct relevance to the insurance sales role. They provide concrete evidence of past success and clearly communicate the skills that will benefit potential employers. In contrast, the weak summaries are vague and lack detail, failing to convey any measurable outcomes or critical skills necessary for the position, which diminishes their impact on hiring managers.

Work Experience Section for Insurance Sales Agent Resume

The work experience section of an Insurance Sales Agent resume is critical as it provides a comprehensive overview of the candidate's professional journey, highlighting their technical skills and competencies in a competitive field. This section not only illustrates the candidate's ability to manage teams and foster collaboration but also emphasizes their capacity to deliver high-quality insurance products tailored to clients' needs. Moreover, quantifying achievements—be it through sales metrics, client retention rates, or successful project implementations—adds credibility and demonstrates the candidate's alignment with industry standards and expectations.

Best Practices for Insurance Sales Agent Work Experience

- Focus on quantifiable results, such as percentage increases in sales or customer satisfaction ratings.

- Highlight specific technical skills relevant to insurance sales, such as proficiency in insurance software or data analysis tools.

- Emphasize collaboration by detailing teamwork experiences and cross-departmental projects.

- Use action verbs to convey a sense of leadership and initiative in past roles.

- Align experience descriptions with industry standards and common requirements for insurance sales agents.

- Include relevant certifications or training that enhance technical expertise.

- Tailor each experience to the job description of the position being applied for, ensuring a clear connection between past roles and prospective responsibilities.

- Keep the language clear and concise to maintain the reader's engagement and highlight key points effectively.

Example Work Experiences for Insurance Sales Agent

Strong Experiences

- Achieved a 30% increase in annual sales revenue by implementing targeted marketing strategies and personalized customer outreach.

- Led a team of 5 agents in developing a new client onboarding process that improved customer retention rates by 25% over 12 months.

- Utilized advanced CRM software to analyze client data, resulting in a 15% increase in policy renewals through personalized follow-ups.

- Collaborated with underwriters to create tailored insurance packages that met the unique needs of over 200 clients, enhancing overall satisfaction scores by 40%.

Weak Experiences

- Worked in sales and helped customers with their insurance needs.

- Participated in team meetings and contributed to discussions about sales strategies.

- Handled customer inquiries and processed paperwork for insurance policies.

- Assisted in training new agents on basic insurance practices.

The examples of strong experiences are considered effective because they provide specific, quantifiable outcomes that showcase the candidate's technical leadership and ability to collaborate successfully. These achievements are framed in a way that highlights both individual contributions and teamwork, making them impactful. Conversely, the weak experiences lack detail and measurable results, making them vague and unimpressive. They do not illustrate the candidate's skills or accomplishments clearly, failing to demonstrate how the candidate can add value in a new role.

Education and Certifications Section for Insurance Sales Agent Resume

The education and certifications section of an Insurance Sales Agent resume plays a vital role in establishing the candidate's qualifications and expertise in the field. This section not only showcases the academic background of the applicant but also highlights industry-relevant certifications and ongoing education efforts. By providing details about relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their commitment to professional development. In an industry where trust and knowledge are paramount, a well-crafted education and certifications section can effectively align the candidate with the demands of the job role.

Best Practices for Insurance Sales Agent Education and Certifications

- Include only relevant degrees and certifications that pertain to the insurance industry.

- List certifications in order of importance and relevance to the job role.

- Highlight advanced or specialized credentials such as Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC).

- Include relevant coursework that provides insight into your knowledge of insurance principles.

- Use clear and concise formatting for easy readability—bullets and bold text can help emphasize key points.

- Update this section regularly to reflect new certifications or courses completed.

- Consider including continuing education credits or workshops attended to show commitment to ongoing learning.

- Ensure all entries are current and recognize any expired certifications appropriately.

Example Education and Certifications for Insurance Sales Agent

Strong Examples

- Bachelor of Science in Finance, University of California, 2020

- Chartered Property Casualty Underwriter (CPCU), 2021

- Certified Insurance Counselor (CIC), 2022

- Relevant Coursework: Risk Management, Insurance Principles, and Ethics in Insurance

Weak Examples

- Associate Degree in General Studies, Community College, 2018

- Certification in Basic Computer Skills, 2019

- High School Diploma, 2016

- Outdated Life Insurance License (Expired 2020)

The examples provided are considered strong because they directly relate to the qualifications and skills necessary for an Insurance Sales Agent. They reflect an educational background in finance and specialized certifications that enhance the candidate's professional profile. In contrast, the weak examples demonstrate a lack of relevant qualifications and outdated credentials, which do not align with the expectations of the role and fail to showcase the candidate's potential value in the insurance sector.

Top Skills & Keywords for Insurance Sales Agent Resume

As an Insurance Sales Agent, possessing the right skills is crucial for success in a competitive market. A well-crafted resume that highlights both hard and soft skills can significantly enhance your chances of landing an interview. Soft skills enable agents to build relationships, understand client needs, and effectively communicate the value of their products. Meanwhile, hard skills demonstrate technical knowledge and proficiency in the insurance industry. By showcasing a balanced mix of these abilities, you can present yourself as a well-rounded candidate who is equipped to thrive in the dynamic field of insurance sales.

Top Hard & Soft Skills for Insurance Sales Agent

Soft Skills

- Excellent communication skills

- Active listening

- Empathy and rapport building

- Problem-solving abilities

- Negotiation skills

- Time management

- Adaptability

- Customer service orientation

- Team collaboration

- Persuasiveness

Hard Skills

- Knowledge of insurance products and policies

- Proficiency in CRM software

- Sales techniques and strategies

- Regulatory compliance understanding

- Data analysis and reporting

- Risk assessment skills

- Financial acumen

- Marketing strategies

- Lead generation tactics

- Policy underwriting knowledge

For a deeper dive into how these skills and relevant work experience can elevate your resume, consider tailoring your content to highlight these areas effectively.

Stand Out with a Winning Insurance Sales Agent Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Sales Agent position at [Company Name], as advertised on [where you found the job listing]. With a strong background in sales and customer service, combined with my ability to build relationships and effectively communicate complex insurance products, I am confident in my ability to contribute positively to your team and help clients secure the coverage they need.

In my previous role at [Previous Company Name], I successfully increased my sales volume by 30% within my first year by leveraging my expertise in identifying clients' needs and providing tailored insurance solutions. My approach is centered on understanding each customer's unique situation, which allows me to present policies that not only meet their requirements but also provide peace of mind. I pride myself on my ability to cultivate long-term relationships, ensuring that clients feel valued and supported throughout their insurance journey.

Moreover, I am highly skilled in using digital tools and platforms to enhance customer engagement and streamline the sales process. I believe that effective communication and follow-up are crucial in the insurance industry, and I utilize technology to maintain connections with clients while keeping them informed about policy updates and new offerings. My dedication to customer satisfaction and my proactive approach to problem-solving have consistently resulted in positive feedback and referrals from clients.

I am excited about the opportunity to join [Company Name] and contribute to its reputation for exceptional service and innovative insurance solutions. I am eager to bring my strong work ethic, passion for helping others, and proven sales skills to your esteemed team. Thank you for considering my application; I look forward to the possibility of discussing how I can help drive success at [Company Name].

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Sales Agent Resume

When crafting a resume as an Insurance Sales Agent, it's crucial to present your qualifications and experience in a clear, concise, and compelling manner. However, many candidates make common mistakes that can hinder their chances of landing an interview. By being aware of these pitfalls, you can ensure that your resume stands out in a competitive job market and effectively showcases your skills and accomplishments in insurance sales.

Generic Objective Statement: Using a vague objective statement that doesn’t relate to the specific position can make your resume seem unfocused. Tailoring your objective to reflect your goals for the insurance role can create a stronger impression.

Lack of Quantifiable Achievements: Failing to include metrics or specific achievements can make your accomplishments seem less impactful. Using numbers to highlight sales growth, client retention rates, or policy renewals can demonstrate your effectiveness in the role.

Overly Complicated Language: Utilizing jargon or overly technical terms can confuse hiring managers. It's important to use clear and straightforward language that showcases your expertise without alienating the reader.

Neglecting Relevant Experience: Omitting relevant past experiences or transferable skills can weaken your application. Be sure to highlight any sales experience, customer service roles, or relevant training that aligns with the insurance industry.

Ignoring Formatting Consistency: Inconsistent formatting—such as varying font sizes, styles, or bullet points—can distract from the content of your resume. Maintaining uniformity in formatting helps create a professional appearance that makes your resume easy to read.

Failing to Customize for Each Application: Sending the same resume for multiple job applications can result in missed opportunities. Tailor your resume for each role to emphasize the skills and experiences that are most relevant to the specific insurance position.

Listing Duties Instead of Accomplishments: Focusing solely on job responsibilities without highlighting your successes can make your resume blend in with others. Instead, prioritize accomplishments that illustrate your contributions and impact in previous roles.

Not Proofreading for Errors: Spelling or grammatical errors can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times and consider having someone else review it to catch any mistakes.

Conclusion

As an Insurance Sales Agent, your primary responsibilities include building relationships with clients, providing them with tailored insurance solutions, and ensuring they understand their coverage options. Key skills for success in this role include excellent communication, strong sales techniques, and a deep understanding of various insurance products. Your ability to identify client needs and offer appropriate recommendations can significantly impact your sales performance and client satisfaction.

In this competitive industry, having a standout resume is crucial to securing your next job opportunity. Take the time to review your Insurance Sales Agent resume to ensure it highlights your relevant experience, skills, and achievements effectively. A well-crafted resume can set you apart from other candidates and open doors to new possibilities.

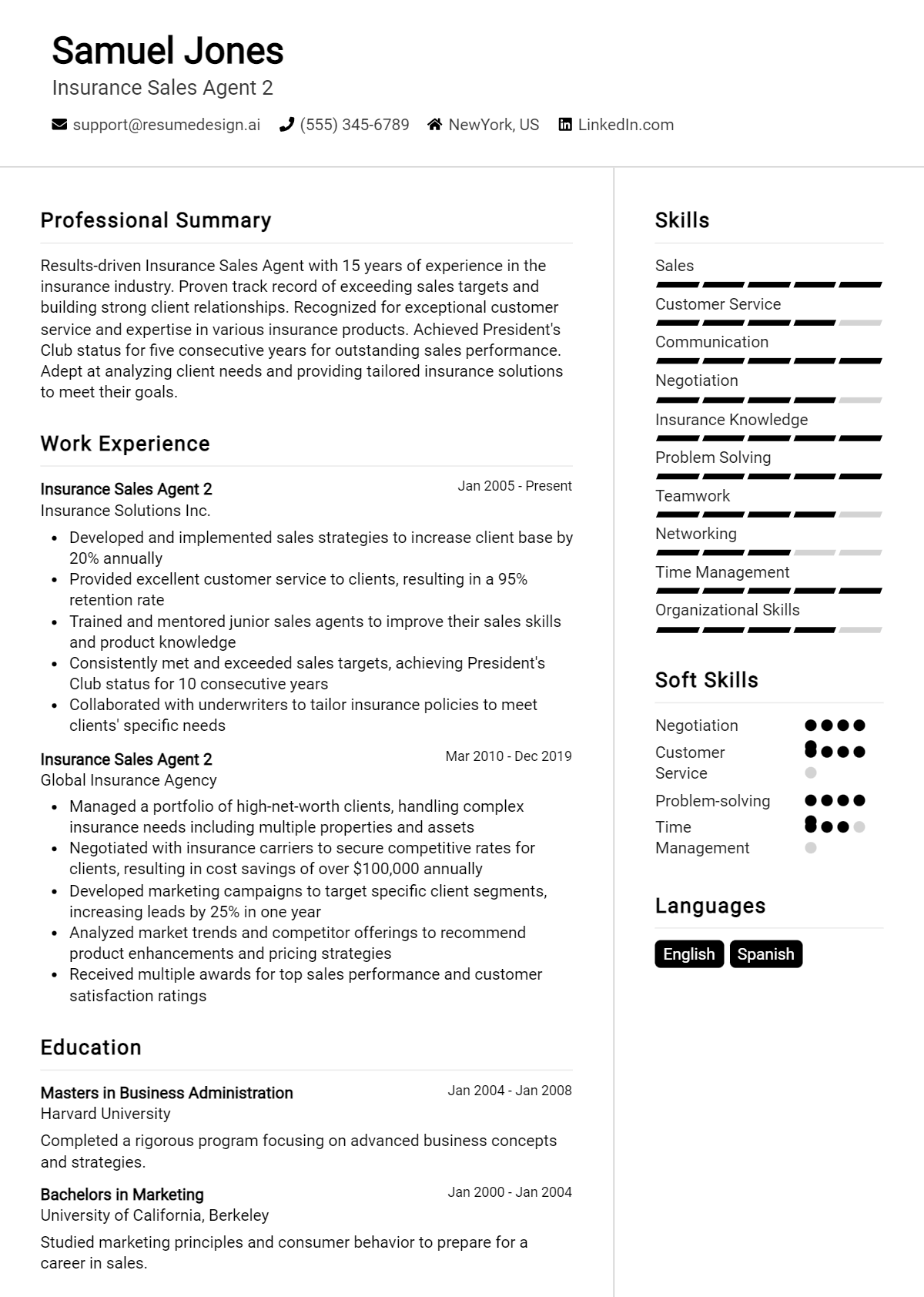

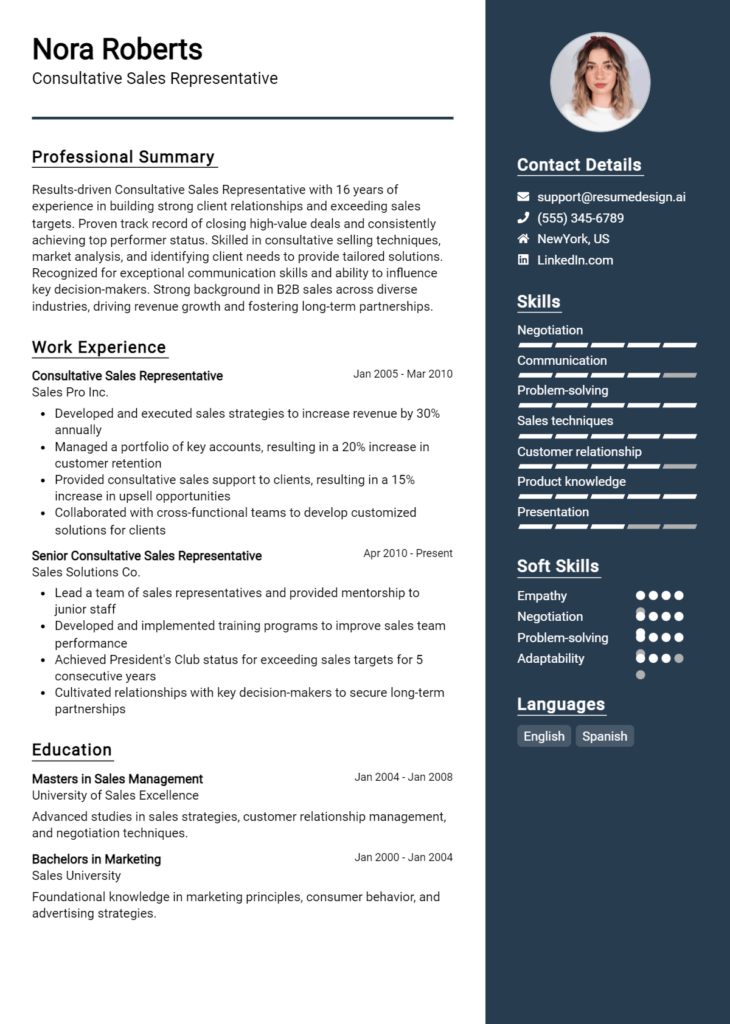

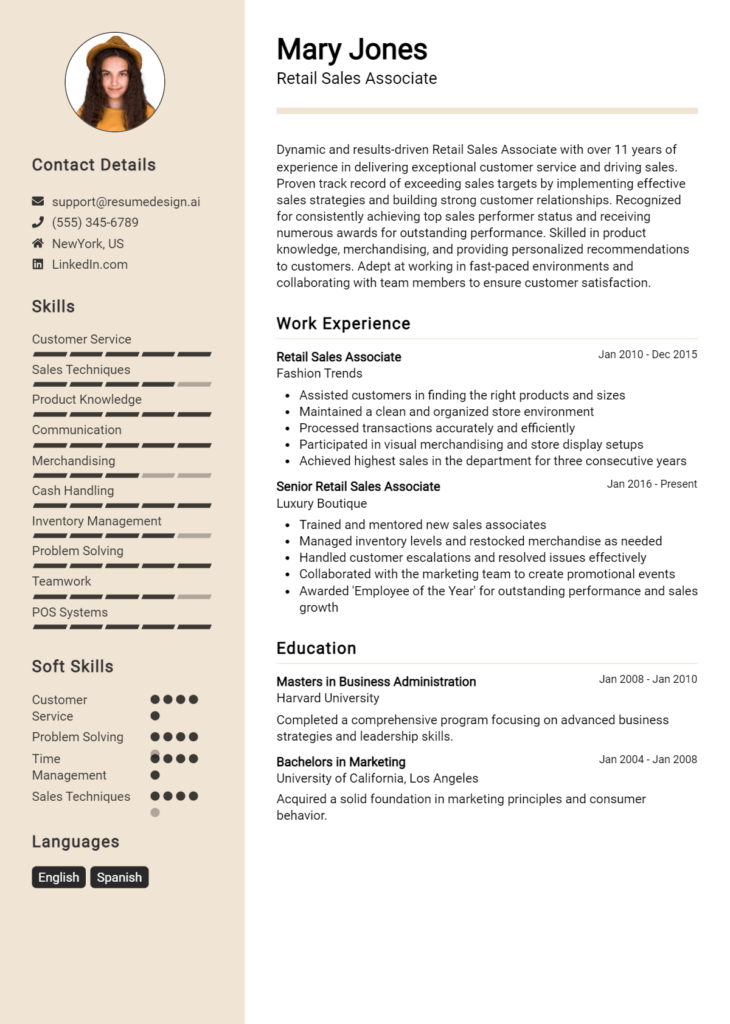

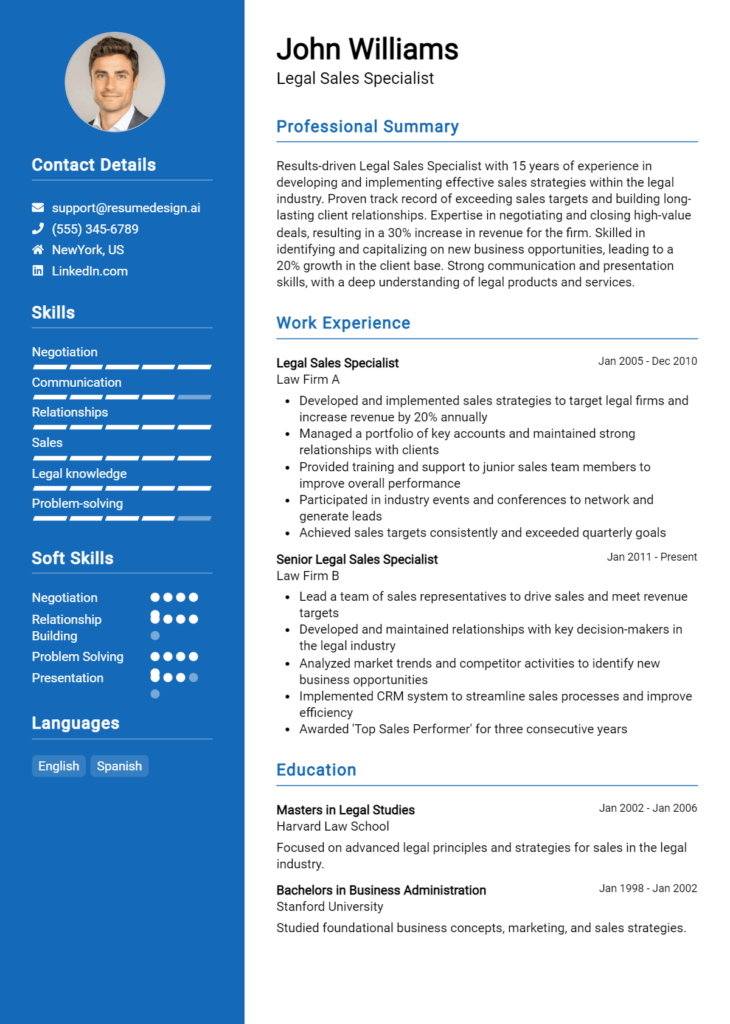

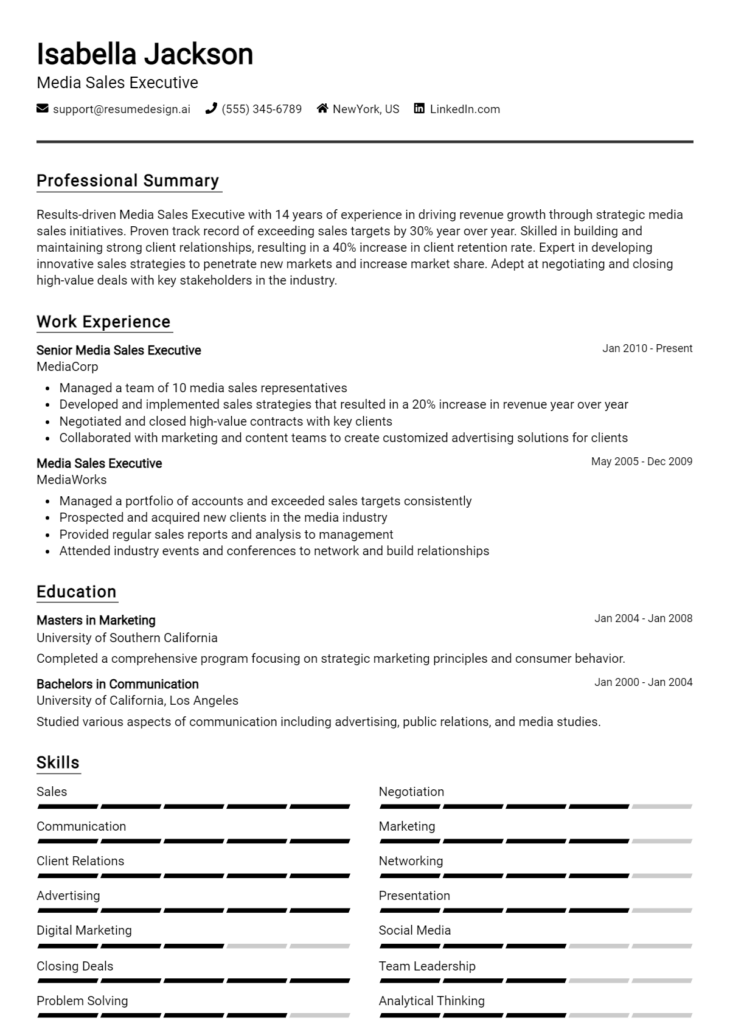

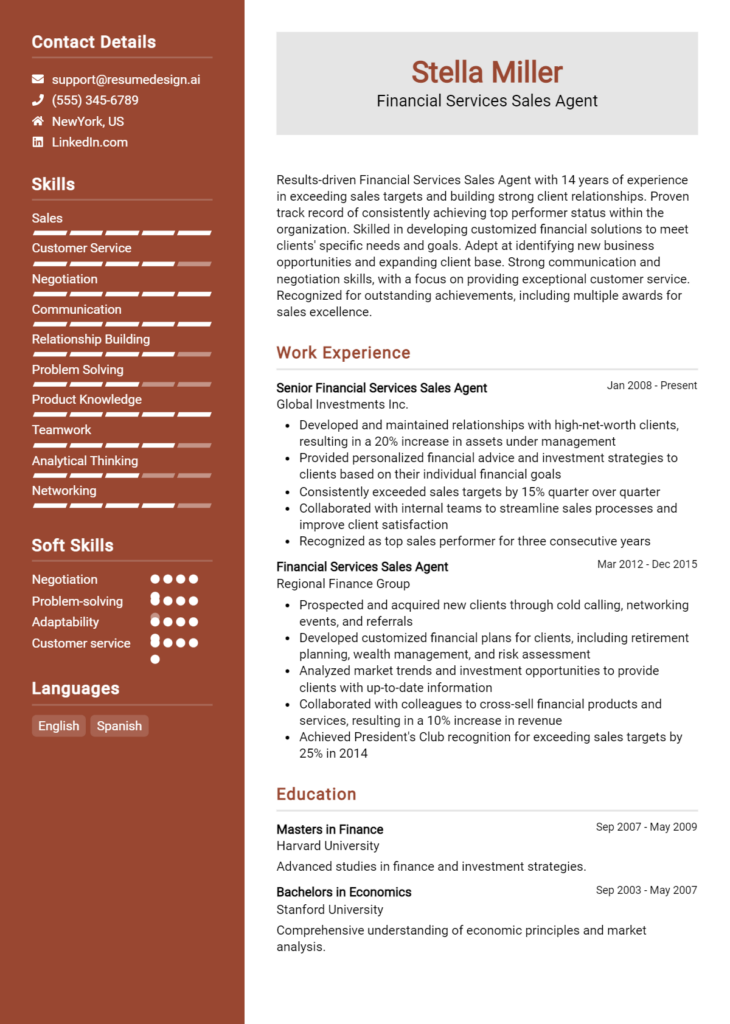

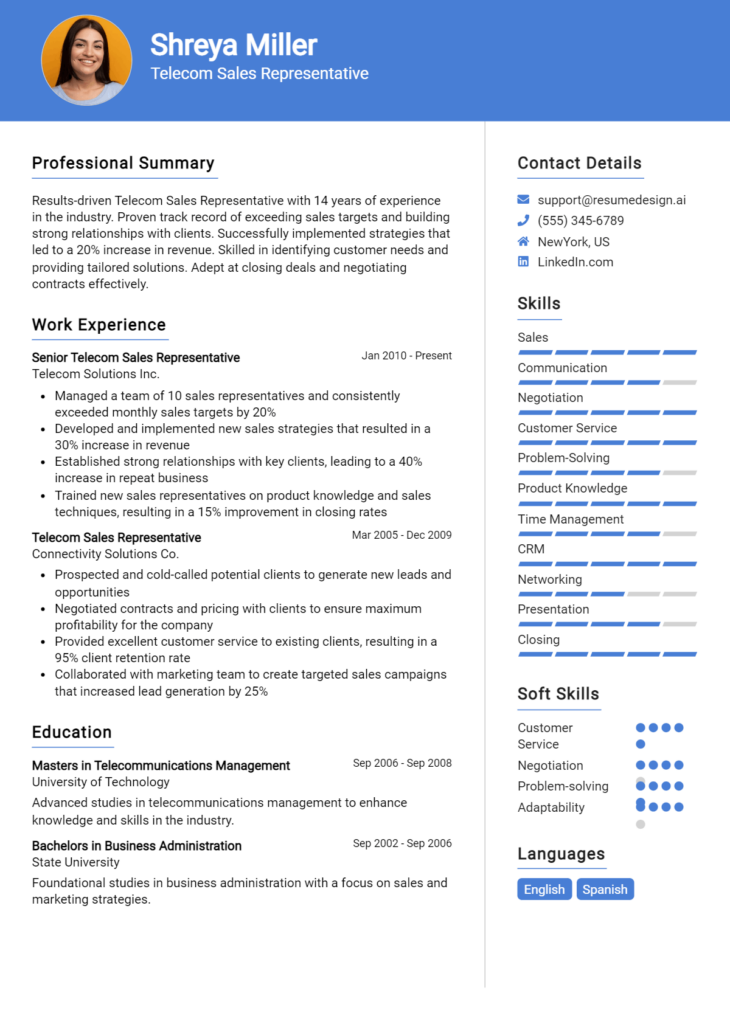

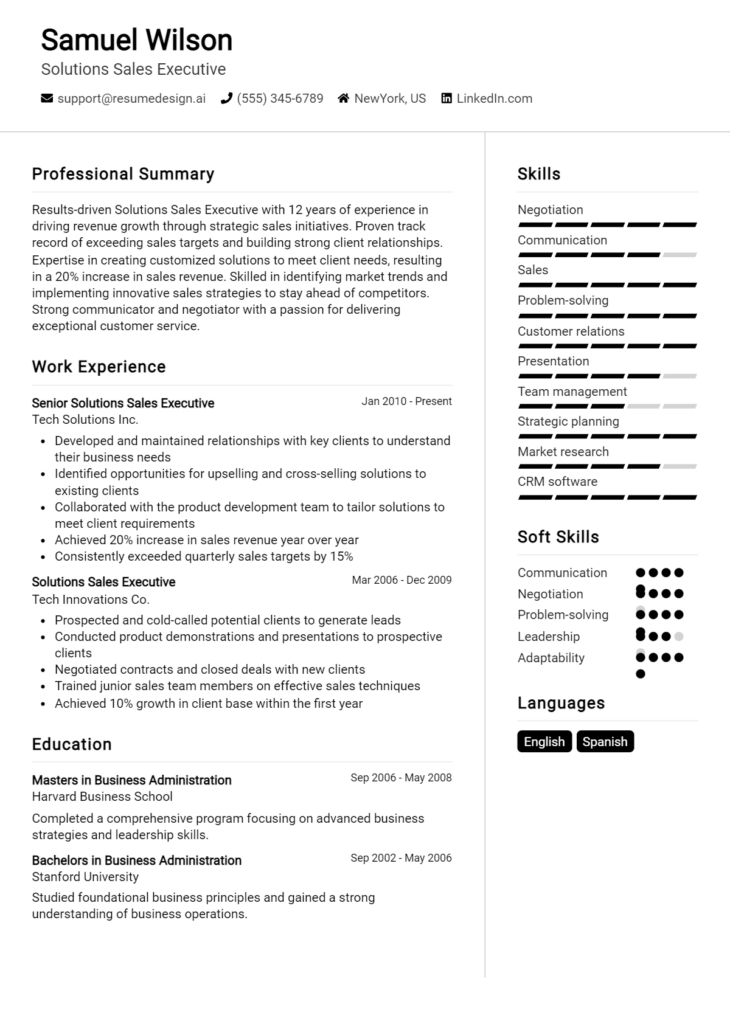

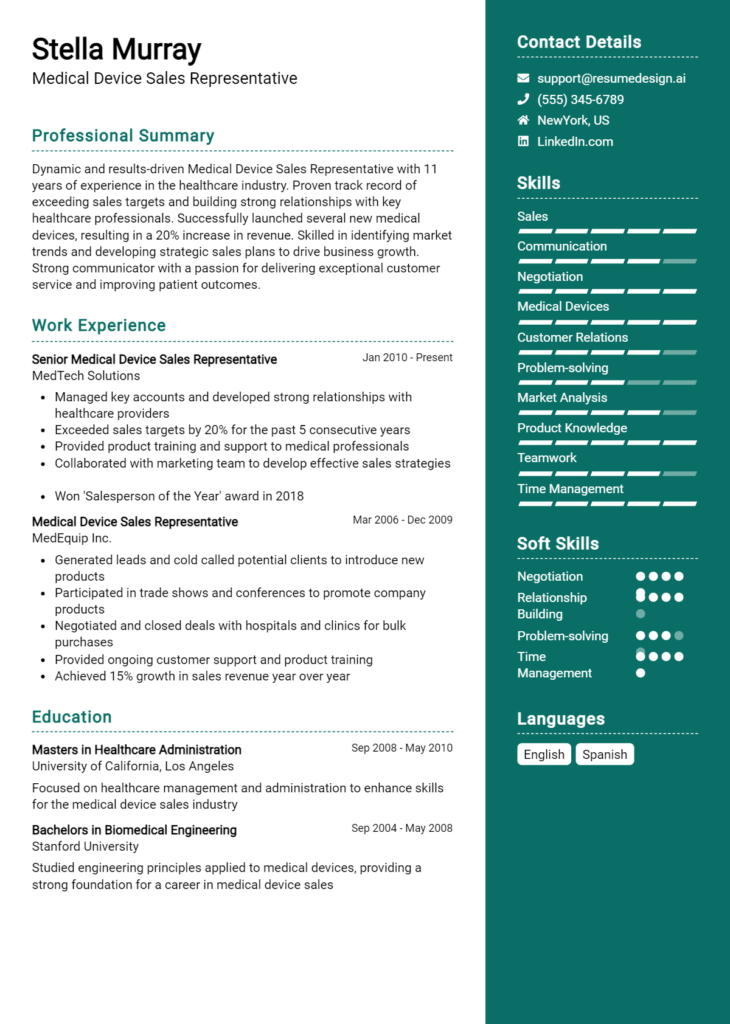

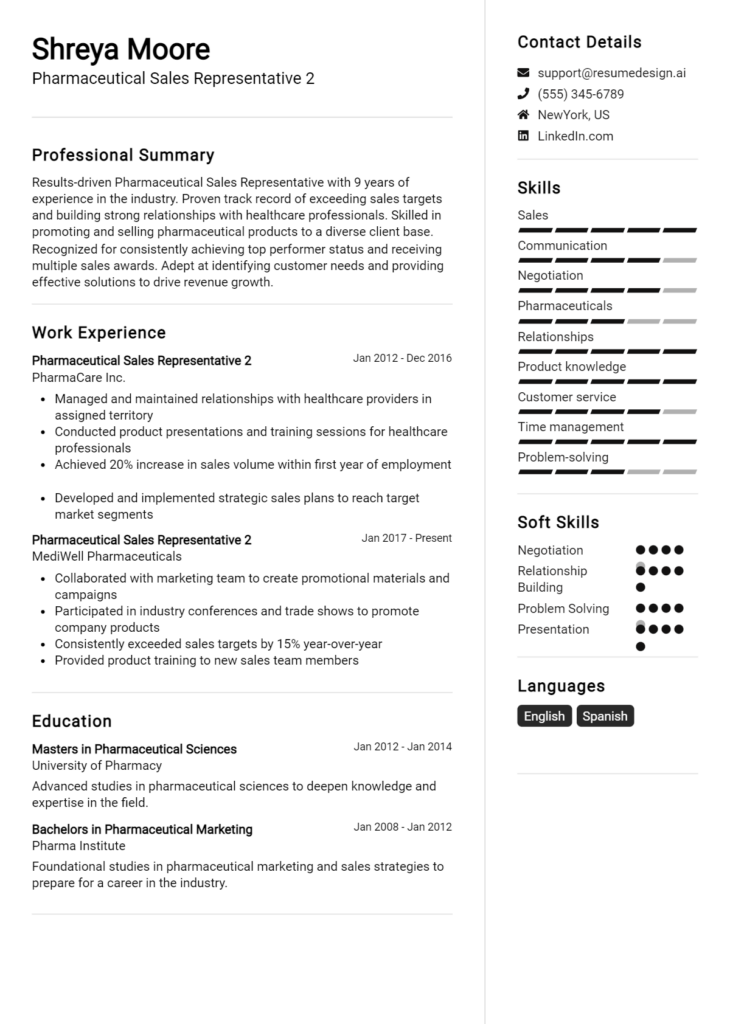

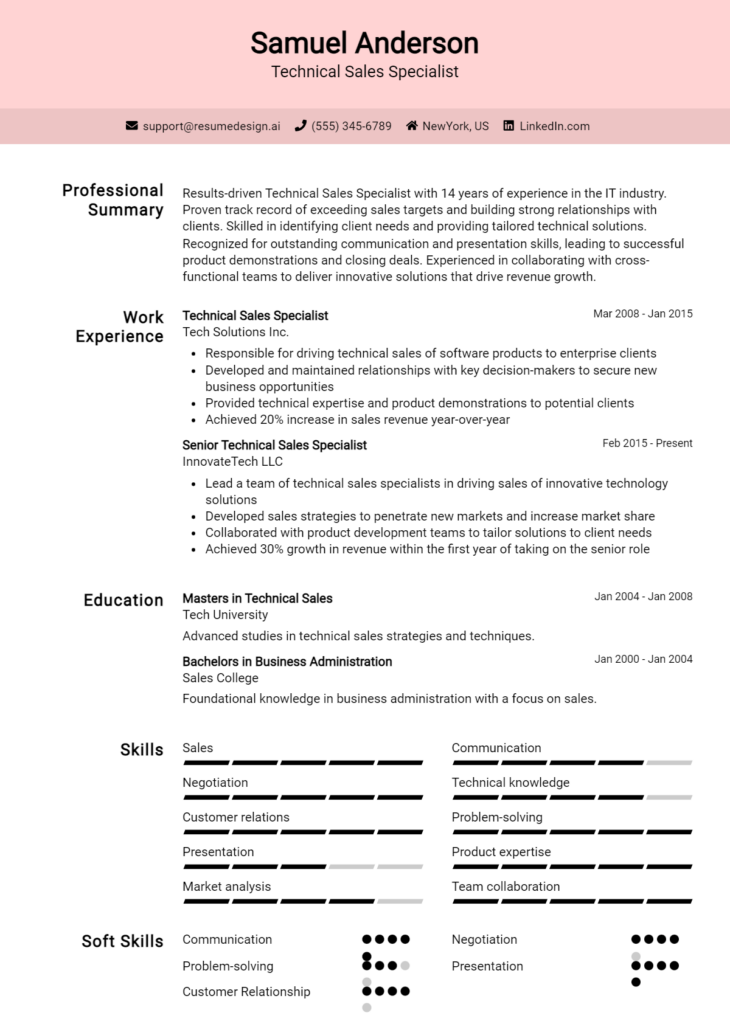

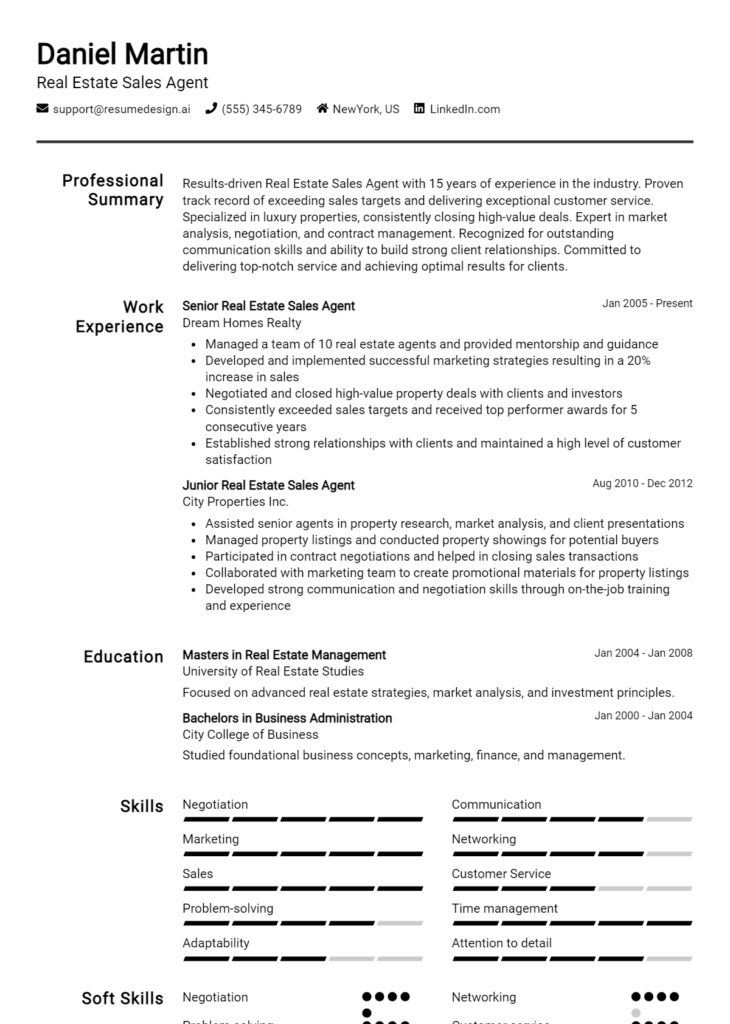

To enhance your resume, consider utilizing available resources such as resume templates, which can provide a professional layout to showcase your strengths. You can also use a resume builder for an easy and efficient way to create a polished resume tailored to the insurance sales field. Additionally, exploring resume examples can offer inspiration and guidance on how to best present your qualifications. Don’t forget the importance of a strong introduction—check out our cover letter templates to ensure you make a great first impression with potential employers.

Take action today: review your resume, utilize these tools, and prepare to take the next step in your career as an Insurance Sales Agent!