Health Insurance Claims Adjuster Core Responsibilities

A Health Insurance Claims Adjuster plays a crucial role in evaluating and processing insurance claims, requiring a blend of technical, operational, and problem-solving skills. They collaborate across departments, including healthcare providers, underwriting, and customer service, to ensure accurate claim assessments and timely resolutions. Strong analytical abilities and attention to detail are essential for identifying discrepancies and ensuring compliance with regulations. A well-structured resume can effectively showcase these skills, highlighting the adjuster's contribution to the organization’s goals of efficiency and customer satisfaction.

Common Responsibilities Listed on Health Insurance Claims Adjuster Resume

- Review and analyze insurance claims for completeness and accuracy.

- Investigate claims by gathering relevant documentation and evidence.

- Communicate with claimants, providers, and other stakeholders for clarification.

- Determine the validity of claims based on policy coverage and guidelines.

- Negotiate settlements and resolve discrepancies in claims.

- Maintain detailed records of claims processes and decisions.

- Adhere to regulatory requirements and compliance standards.

- Prepare reports and summaries on claims for management review.

- Provide guidance and training to junior staff regarding claims processing.

- Stay updated on industry trends and changes in insurance laws.

Why Resume Headlines & Titles are Important for Health Insurance Claims Adjuster

In the competitive field of health insurance claims adjustment, a well-crafted resume headline or title plays a vital role in capturing the attention of hiring managers. A strong headline not only serves as a concise introduction to a candidate's professional identity but also summarizes their key qualifications and strengths in a powerful phrase. This initial glimpse into a candidate's capabilities can significantly influence a hiring manager's decision to delve deeper into their resume. Therefore, it is essential for candidates to create headlines that are concise, relevant, and directly related to the health insurance claims adjuster position they are applying for.

Best Practices for Crafting Resume Headlines for Health Insurance Claims Adjuster

- Keep it concise: Aim for one impactful phrase that encapsulates your qualifications.

- Be role-specific: Tailor your headline to reflect the specific job title you are applying for.

- Highlight key skills: Incorporate essential skills or experience relevant to health insurance claims adjustment.

- Use action-oriented language: Start with strong verbs that convey your capabilities and achievements.

- Avoid jargon: Ensure your headline is easily understood by those outside your specific field.

- Showcase certifications: If applicable, mention relevant certifications or licenses in your headline.

- Make it unique: Differentiate yourself from other candidates by showcasing your unique value proposition.

- Stay professional: Maintain a tone that reflects professionalism and aligns with industry standards.

Example Resume Headlines for Health Insurance Claims Adjuster

Strong Resume Headlines

Detail-Oriented Health Insurance Claims Adjuster with 5+ Years of Experience in Complex Case Analysis

Certified Claims Specialist Excelling in Rapid Resolution of High-Volume Insurance Claims

Proven Track Record in Reducing Claim Processing Time by 30% Through Data-Driven Strategies

Dynamic Health Insurance Professional Skilled in Compliance and Risk Management

Weak Resume Headlines

Looking for a Job in Insurance

Claims Adjuster with Some Experience

Strong headlines are effective because they immediately convey a candidate's qualifications, skills, and experiences that are relevant to the position, making a memorable impression on hiring managers. They highlight specific achievements and certifications that differentiate the candidate from others. In contrast, weak headlines tend to be vague or generic, failing to provide any meaningful insight into the candidate's capabilities. This lack of specificity can lead to a lack of interest from hiring managers who are looking for clear indicators of a candidate's potential to succeed in the role.

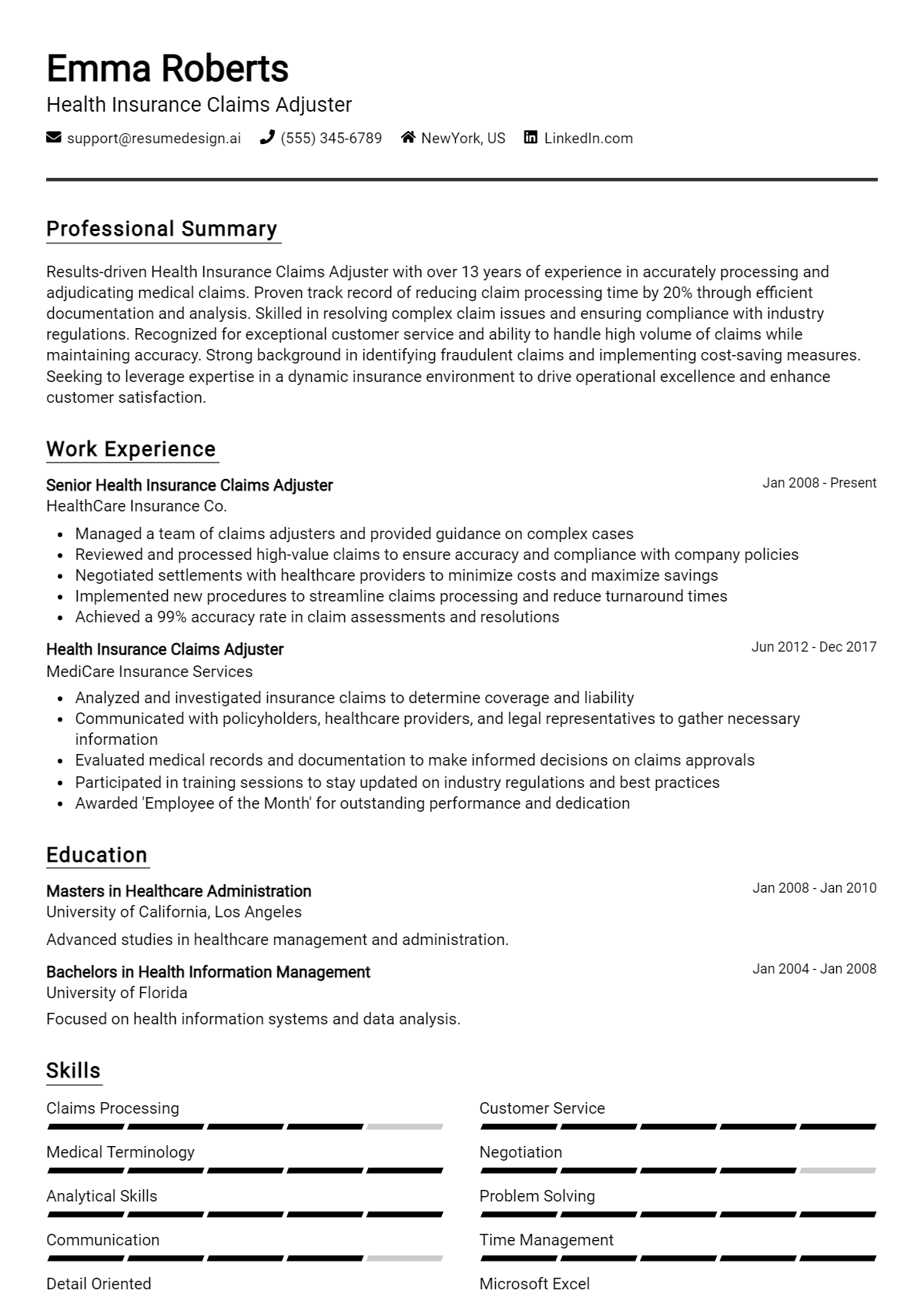

Writing an Exceptional Health Insurance Claims Adjuster Resume Summary

A well-crafted resume summary is crucial for a Health Insurance Claims Adjuster as it serves as an engaging introduction that captures the attention of hiring managers within seconds. This brief yet powerful section highlights the candidate's key skills, relevant experience, and significant accomplishments in the field, providing a snapshot that aligns with the specific job requirements. A strong summary is concise, impactful, and tailored to the job description, making it easier for hiring managers to assess the candidate's qualifications and fit for the role at a glance.

Best Practices for Writing a Health Insurance Claims Adjuster Resume Summary

- Quantify achievements by including specific metrics and results to demonstrate impact.

- Highlight relevant skills such as analytical abilities, attention to detail, and knowledge of insurance policies.

- Customize the summary for the specific job description to reflect the employer's needs.

- Use action-oriented language to convey confidence and proactivity.

- Keep it concise—ideally 2-4 sentences that deliver maximum information in minimal space.

- Avoid clichés and generalities; instead, focus on unique qualifications that set you apart.

- Incorporate industry keywords to enhance visibility in applicant tracking systems (ATS).

- Showcase your problem-solving abilities and experience in managing claims effectively.

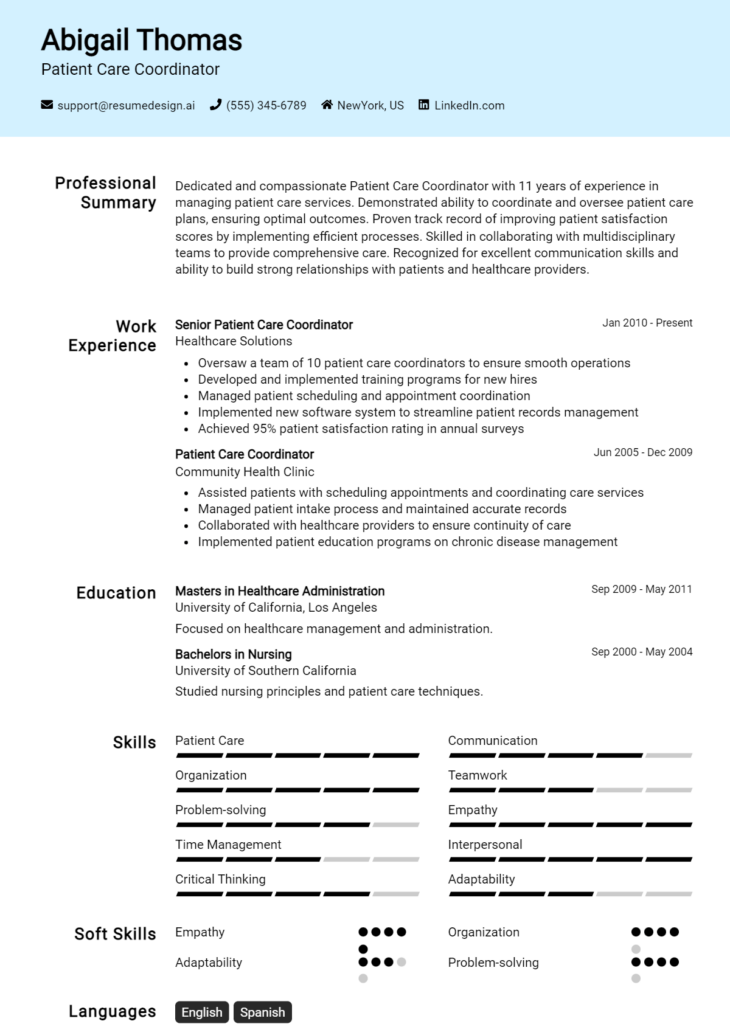

Example Health Insurance Claims Adjuster Resume Summaries

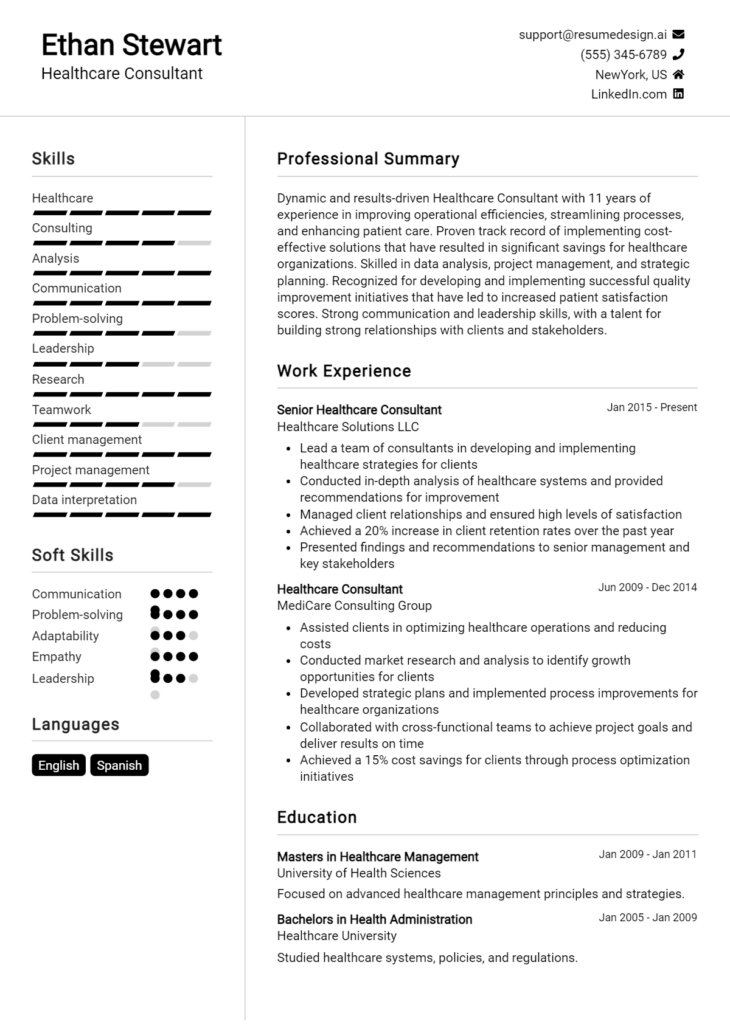

Strong Resume Summaries

Detail-oriented Health Insurance Claims Adjuster with over 5 years of experience managing claims for a major insurance provider. Achieved a 20% reduction in processing time by streamlining workflows and implementing efficient claim verification processes.

Results-driven professional with a proven track record of approving and denying claims accurately, contributing to a 15% decrease in fraudulent claims. Proficient in analyzing medical records and collaborating with healthcare providers to ensure compliance with insurance policies.

Experienced Claims Adjuster skilled in negotiating settlements and resolving disputes swiftly, leading to a 95% satisfaction rate among clients. Successfully processed over 2,000 claims annually while maintaining compliance with state and federal regulations.

Weak Resume Summaries

Motivated claims adjuster with some experience in the insurance industry looking for a new opportunity.

Health Insurance Claims Adjuster seeking to work in a challenging environment where I can use my skills.

The strong resume summaries effectively showcase specific achievements, quantifiable results, and relevant skills, making them compelling to hiring managers. In contrast, the weak summaries lack detail and specificity, making them too vague and generic to stand out in a competitive job market. By focusing on measurable outcomes and tailoring the content to the role, candidates can significantly improve their chances of securing an interview.

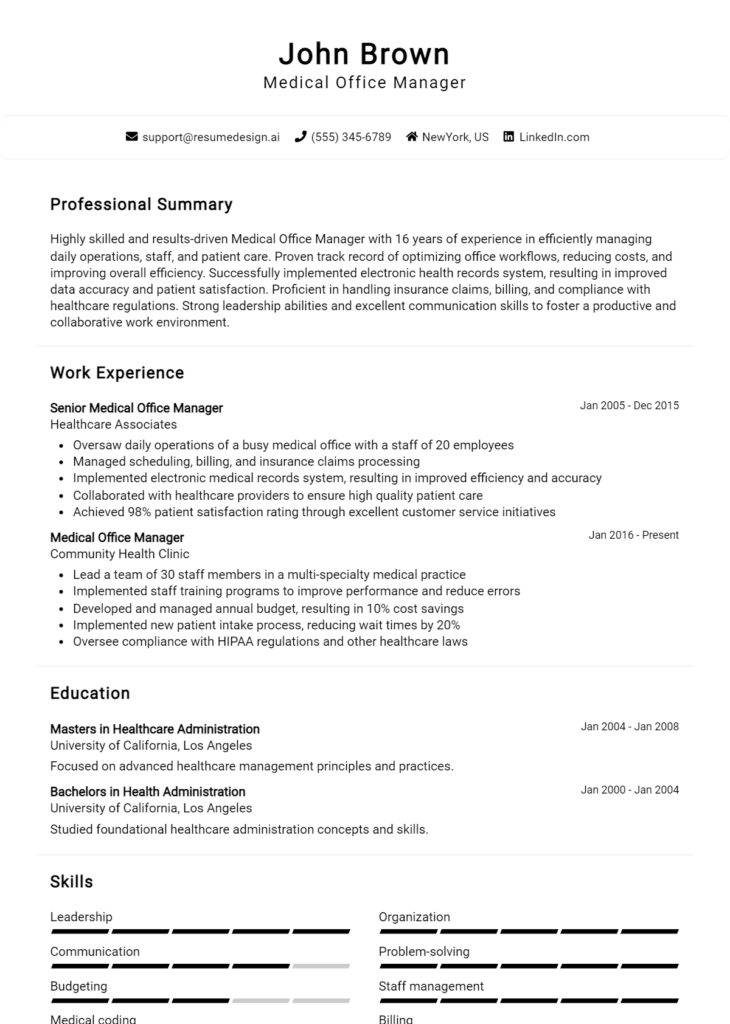

Work Experience Section for Health Insurance Claims Adjuster Resume

The work experience section of a Health Insurance Claims Adjuster resume is critical in demonstrating a candidate's qualifications and readiness for the role. This section not only highlights technical skills such as claims processing and policy analysis but also emphasizes the ability to manage teams effectively and deliver high-quality outcomes in a fast-paced environment. By quantifying achievements and aligning experiences with industry standards, candidates can present a compelling case for their expertise and value to potential employers.

Best Practices for Health Insurance Claims Adjuster Work Experience

- Use action verbs to convey responsibility and impact.

- Quantify results wherever possible, such as the percentage of claims processed accurately or the time taken to resolve disputes.

- Highlight technical skills relevant to the role, such as proficiency in claims management software and regulatory compliance.

- Demonstrate collaboration by mentioning cross-functional teamwork with healthcare providers, legal teams, or other departments.

- Include specific examples of problem-solving in claims adjustments or appeals processes.

- Tailor experiences to align with the job description and industry standards.

- Show progression in responsibilities, indicating growth and increased expertise over time.

- Maintain clarity and specificity to avoid vague statements that do not convey your contributions effectively.

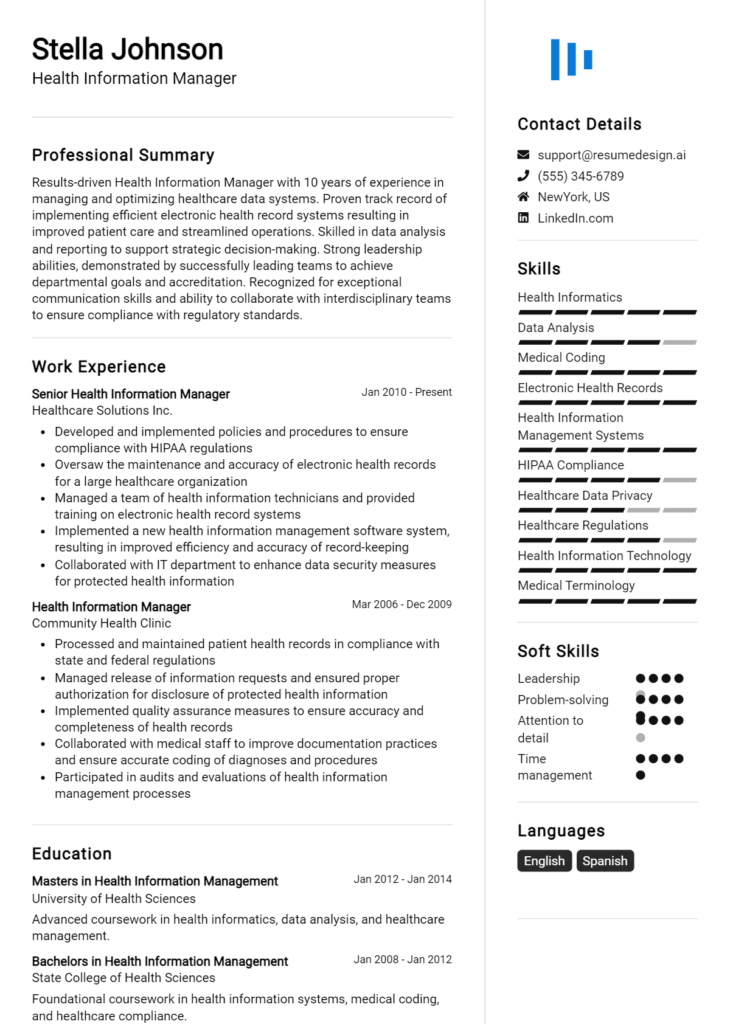

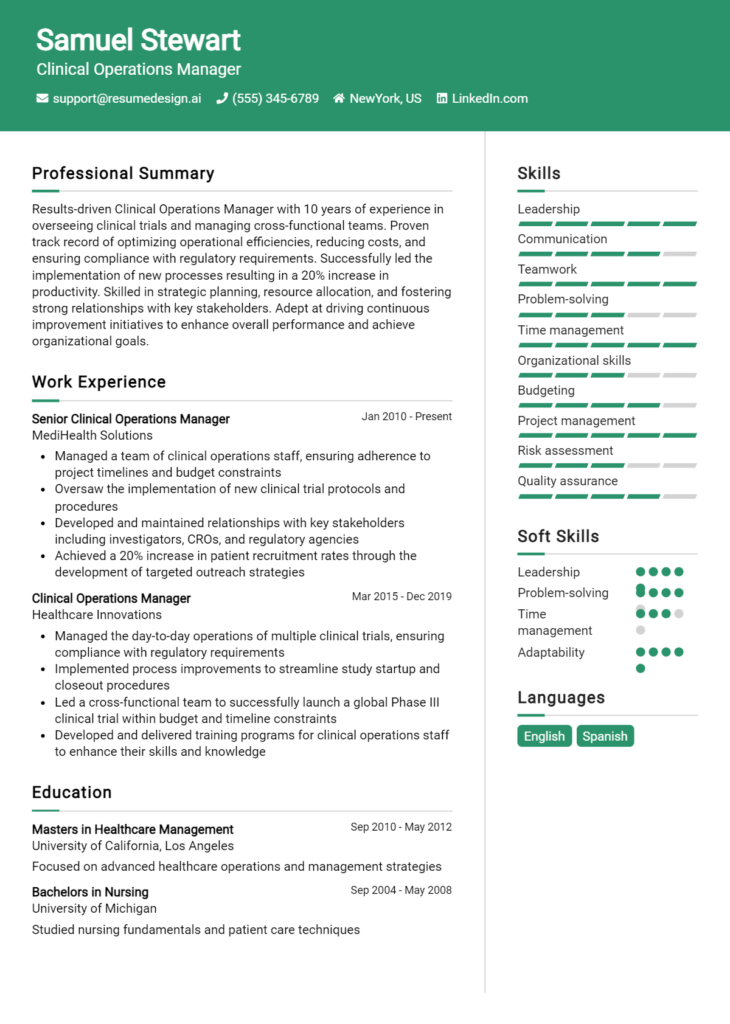

Example Work Experiences for Health Insurance Claims Adjuster

Strong Experiences

- Processed over 1,200 claims monthly with a 98% accuracy rate, significantly reducing error rates and increasing customer satisfaction.

- Led a team of 5 claims adjusters in a project that streamlined the claims review process, decreasing average resolution time by 30%.

- Implemented a new electronic claims management system that improved processing speed by 25%, resulting in annual savings of $45,000.

- Collaborated with healthcare providers to address discrepancies in claims, achieving a 15% reduction in appeals and enhancing relationships.

Weak Experiences

- Worked on claims processing tasks.

- Helped a team with various projects related to claims.

- Reviewed claims and made adjustments as needed.

- Participated in meetings about claims issues.

The examples of strong experiences are considered impactful because they provide specific, measurable achievements that demonstrate the candidate's technical expertise, leadership abilities, and collaborative efforts. In contrast, the weak experiences lack detail and quantification, making them less impressive and failing to convey the candidate's true capabilities and contributions within the role.

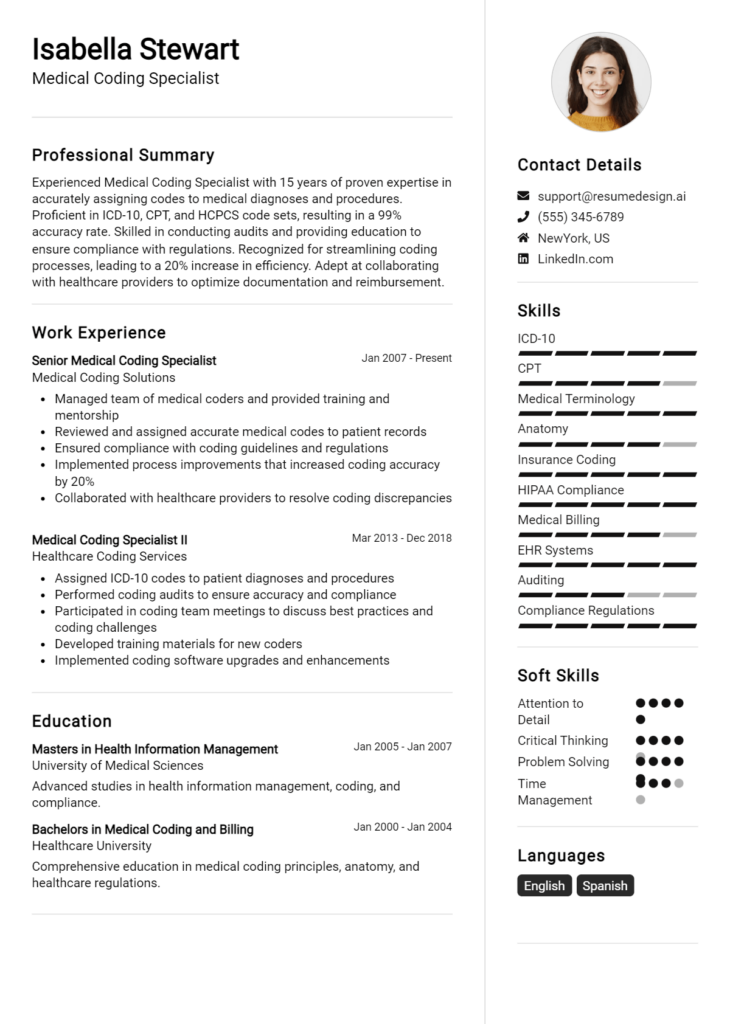

Education and Certifications Section for Health Insurance Claims Adjuster Resume

The education and certifications section of a Health Insurance Claims Adjuster resume is pivotal in establishing the candidate's qualifications and commitment to the field. This section not only showcases the individual's academic background but also highlights relevant industry certifications and ongoing learning initiatives. By including specific coursework, recognized certifications, and specialized training programs, candidates can significantly bolster their credibility and demonstrate alignment with the expectations of the job role. A well-crafted education and certifications section can serve as a key differentiator in a competitive job market, showcasing the candidate's readiness and expertise in health insurance claims processing.

Best Practices for Health Insurance Claims Adjuster Education and Certifications

- Focus on relevant degrees and certifications that align with the health insurance industry.

- Include specific coursework related to health insurance, claims processing, and medical terminology.

- Highlight any advanced or industry-recognized credentials, such as CPCU or AHIP certifications.

- Organize the information in reverse chronological order, starting with the most recent credentials.

- Use bullet points for clarity and readability, making it easy for hiring managers to scan.

- Consider adding continuing education courses to demonstrate a commitment to professional development.

- Be concise but detailed enough to convey the depth of your qualifications.

- Avoid listing outdated or irrelevant certifications that do not add value to your application.

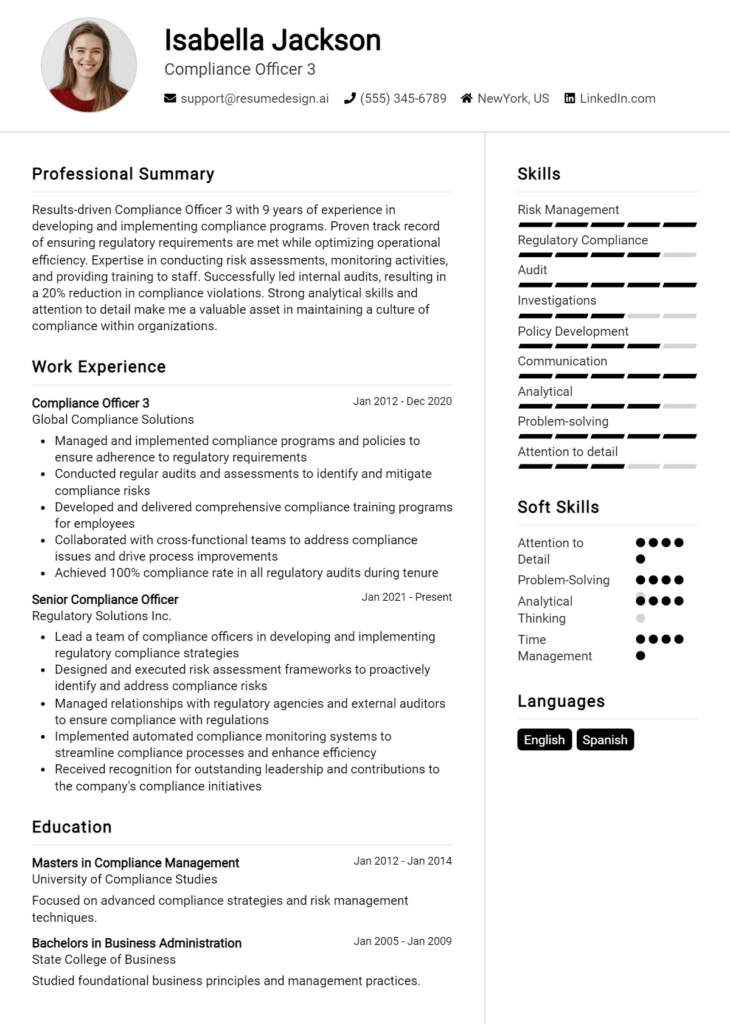

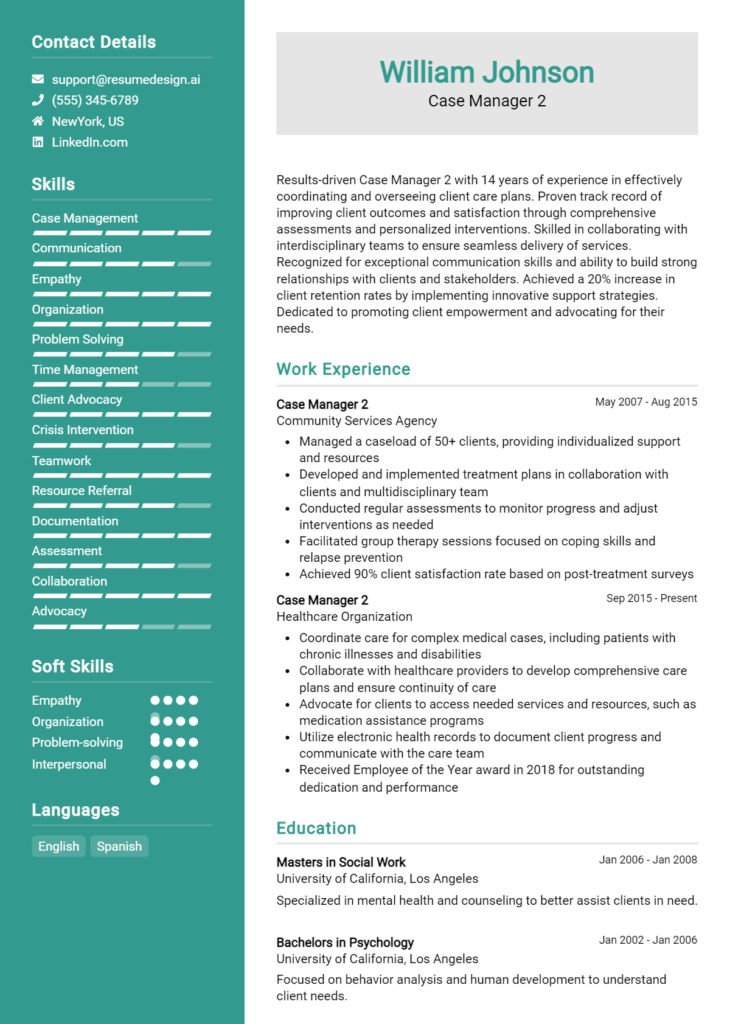

Example Education and Certifications for Health Insurance Claims Adjuster

Strong Examples

- Bachelor of Science in Health Administration, XYZ University, 2022

- Certified Professional Coder (CPC), AAPC, 2023

- Certificate in Health Insurance and Managed Care, ABC Institute, 2021

- Medical Terminology and Health Insurance Claims Processing, Online Course, 2023

Weak Examples

- Bachelor of Arts in History, XYZ University, 2015

- Certification in Basic Computer Skills, 2018

- Diploma in Graphic Design, ABC School, 2020

- Outdated CPR Certification, 2016

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Health Insurance Claims Adjuster, demonstrating both relevance and recentness. In contrast, the weak examples reflect educational achievements that lack direct application to the role, showcasing outdated or irrelevant qualifications that do not contribute to the candidate's suitability for the position.

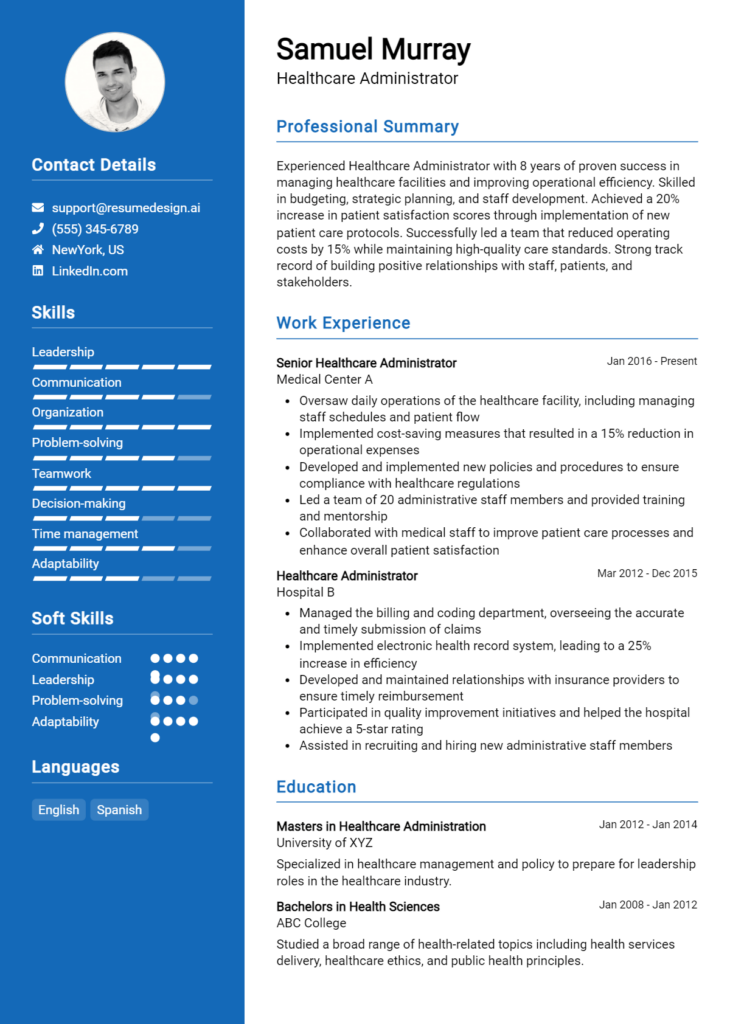

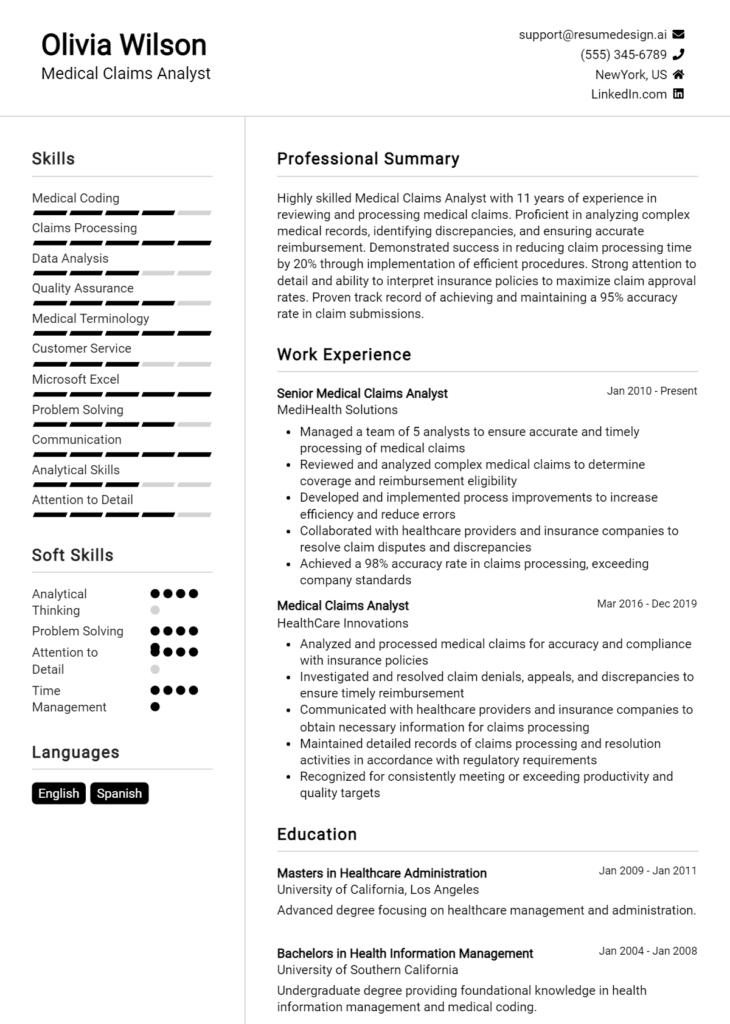

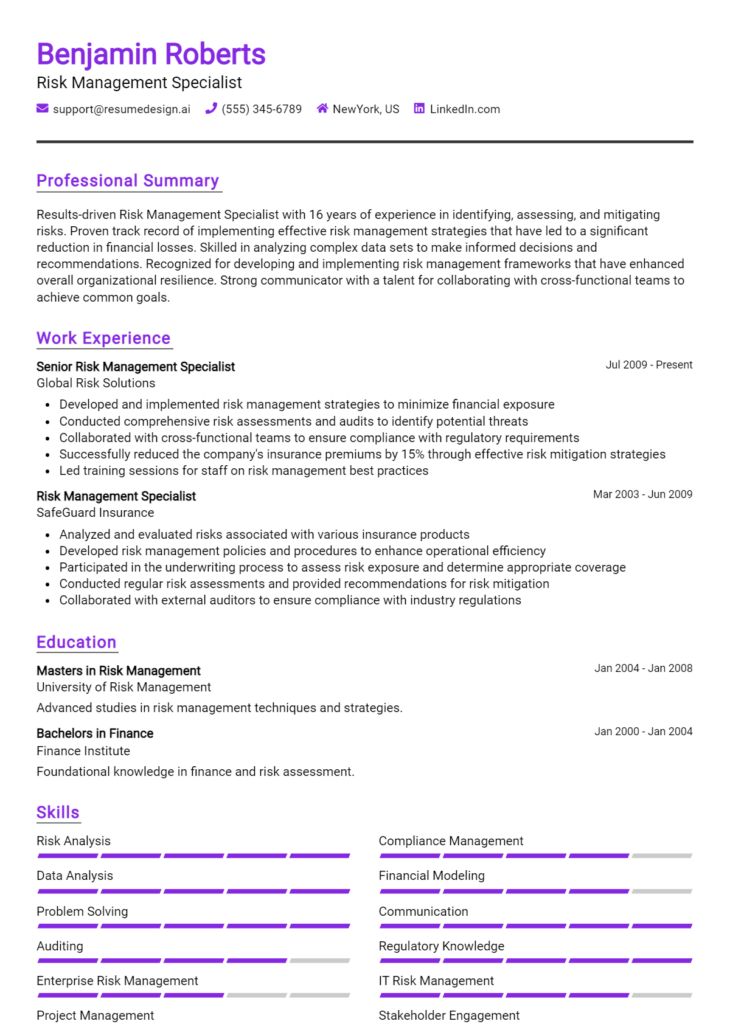

Top Skills & Keywords for Health Insurance Claims Adjuster Resume

A well-crafted resume for a Health Insurance Claims Adjuster is critical in showcasing the unique skills required for the role. Employers look for candidates who not only possess technical knowledge but also exhibit strong interpersonal abilities. The right combination of hard and soft skills can significantly enhance a candidate's appeal, demonstrating their capability to navigate the complexities of insurance claims while effectively communicating with clients and colleagues. By highlighting relevant skills, applicants can illustrate their value and readiness to excel in this vital position within the healthcare industry.

Top Hard & Soft Skills for Health Insurance Claims Adjuster

Soft Skills

- Attention to Detail

- Strong Communication Skills

- Problem-Solving Abilities

- Empathy and Compassion

- Time Management

- Critical Thinking

- Customer Service Orientation

- Adaptability

- Team Collaboration

- Conflict Resolution

Hard Skills

- Knowledge of Insurance Policies

- Claims Processing Software Proficiency

- Medical Terminology Understanding

- Data Analysis

- Regulatory Compliance Knowledge

- Risk Assessment

- Billing Procedures Familiarity

- Documentation Skills

- Fraud Detection Techniques

- Proficient in Microsoft Office Suite

By focusing on these essential skills, candidates can create a compelling resume that effectively conveys their qualifications. Additionally, emphasizing relevant work experience will further strengthen their application, demonstrating a proven track record in the field.

Stand Out with a Winning Health Insurance Claims Adjuster Cover Letter

Dear Hiring Manager,

I am writing to express my interest in the Health Insurance Claims Adjuster position at [Company Name]. With a solid background in claims processing and a keen understanding of health insurance policies, I am confident in my ability to contribute effectively to your team. My experience has equipped me with a unique blend of analytical skills and customer service expertise, allowing me to navigate complex claims with precision and empathy.

In my previous role at [Previous Company Name], I successfully managed a high volume of health insurance claims, ensuring timely and accurate processing while maintaining compliance with regulatory standards. I have a proven track record of identifying discrepancies in claims submissions and resolving issues efficiently, which has resulted in a significant reduction in claim processing times. My attention to detail and strong organizational skills enable me to manage multiple cases simultaneously without sacrificing quality.

I am particularly drawn to this opportunity at [Company Name] because of your commitment to innovative healthcare solutions and exceptional customer service. I share your dedication to improving the claims experience for clients, which I believe is essential in fostering trust and satisfaction. I am eager to bring my skills in claims assessment and problem-solving to your team, and I am excited about the prospect of contributing to your mission of delivering high-quality health insurance services.

Thank you for considering my application. I look forward to the opportunity to discuss how my background and skills align with the needs of your team. I am enthusiastic about the possibility of joining [Company Name] and contributing to the success of your claims department.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Health Insurance Claims Adjuster Resume

When crafting a resume for a Health Insurance Claims Adjuster position, it’s crucial to avoid common pitfalls that can detract from your qualifications and experience. A well-structured resume not only highlights your skills but also demonstrates your attention to detail—an essential trait for this role. Here are some frequent mistakes job seekers make, which can hinder their chances of landing an interview:

Generic Objective Statement: Using a one-size-fits-all objective can make your resume feel impersonal. Tailor your objective to reflect your specific interest in the health insurance field and the role you're applying for.

Ignoring Relevant Keywords: Failing to incorporate industry-specific terminology and keywords from the job description can result in your resume being overlooked by Applicant Tracking Systems (ATS).

Lack of Quantifiable Achievements: Simply listing job duties instead of quantifiable accomplishments (e.g., "Processed 200 claims per month with a 98% accuracy rate") fails to showcase your effectiveness and contributions.

Poor Formatting: A cluttered or overly complicated layout can make your resume difficult to read. Stick to a clean, professional format that highlights key information and is easy to navigate.

Spelling and Grammar Errors: Typos and grammatical mistakes can reflect poorly on your attention to detail. Always proofread your resume or have someone else review it to catch any errors.

Inadequate Tailoring for Different Applications: Sending the same resume for multiple positions can miss the mark. Customize your resume for each application to align your skills and experiences with the specific requirements of the job.

Neglecting Professional Development: Failing to mention relevant certifications or continued education in health insurance can be a missed opportunity to demonstrate your commitment to professional growth.

Overemphasizing Irrelevant Experience: Including unrelated work experience can dilute the focus of your resume. Highlight experiences that are directly applicable to claims adjusting and the healthcare industry.

Conclusion

As a Health Insurance Claims Adjuster, you play a crucial role in evaluating and processing claims to ensure that policyholders receive the benefits they are entitled to. Your responsibilities include investigating claims, reviewing medical records, coordinating with healthcare providers, and making decisions based on policy guidelines and regulations. Attention to detail, analytical skills, and effective communication are essential traits for success in this role.

When crafting your resume, it's important to highlight your relevant experience, skills, and accomplishments. Tailoring your resume to reflect the specific requirements of the Health Insurance Claims Adjuster position can significantly enhance your chances of landing an interview. Be sure to include any certifications, software proficiency, and insights into your methodology for assessing claims.

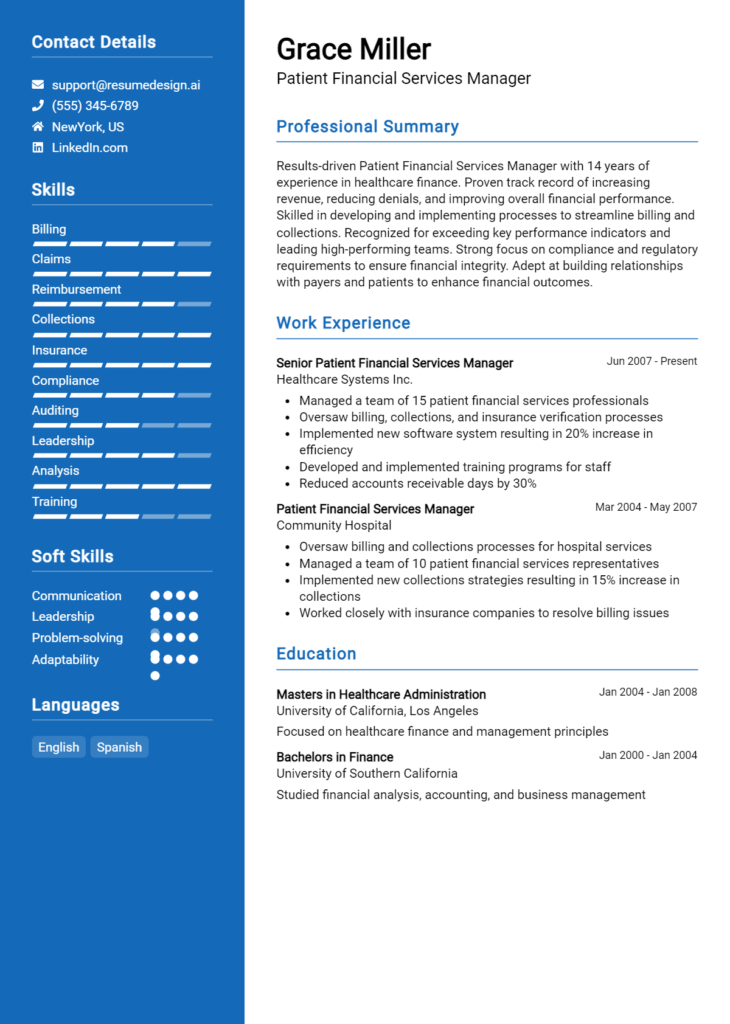

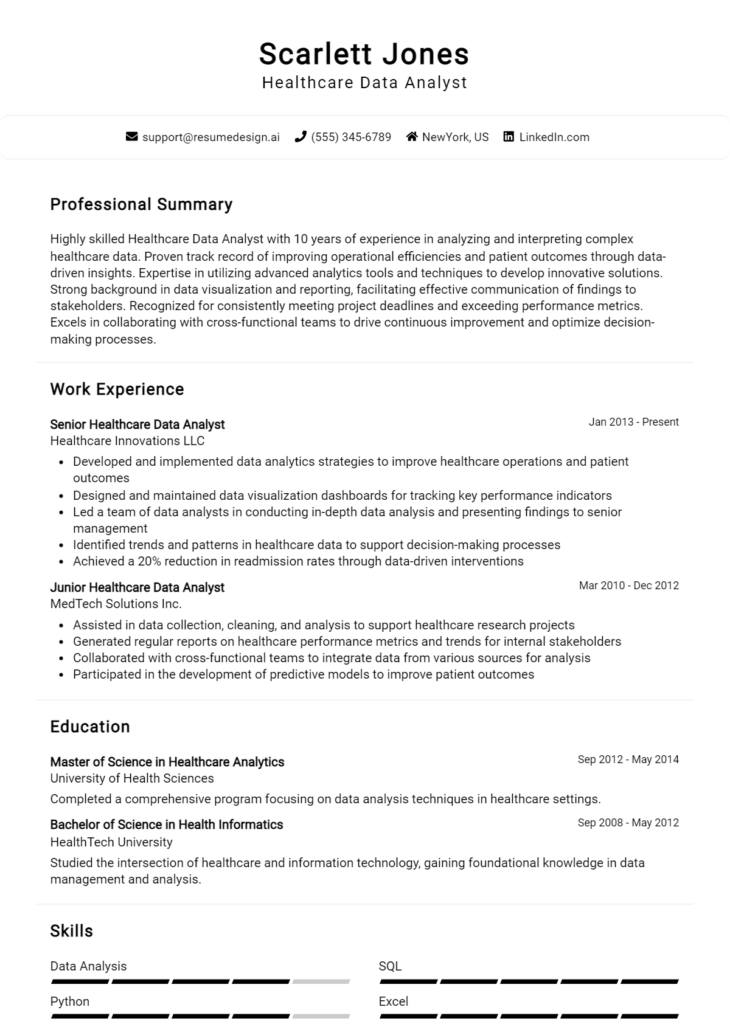

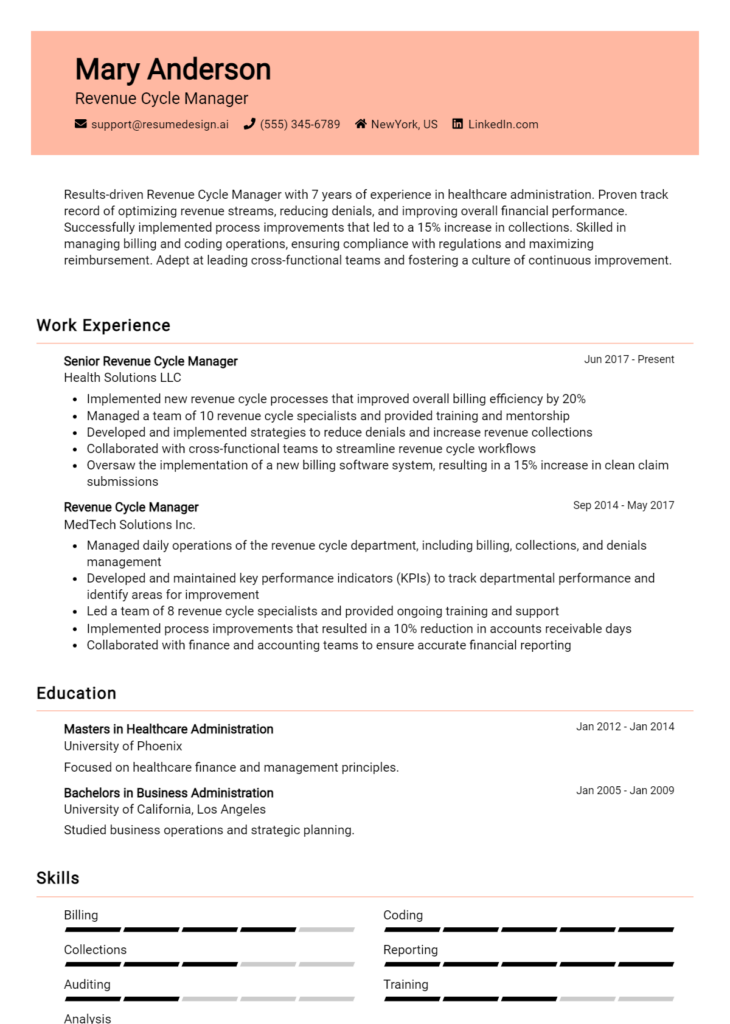

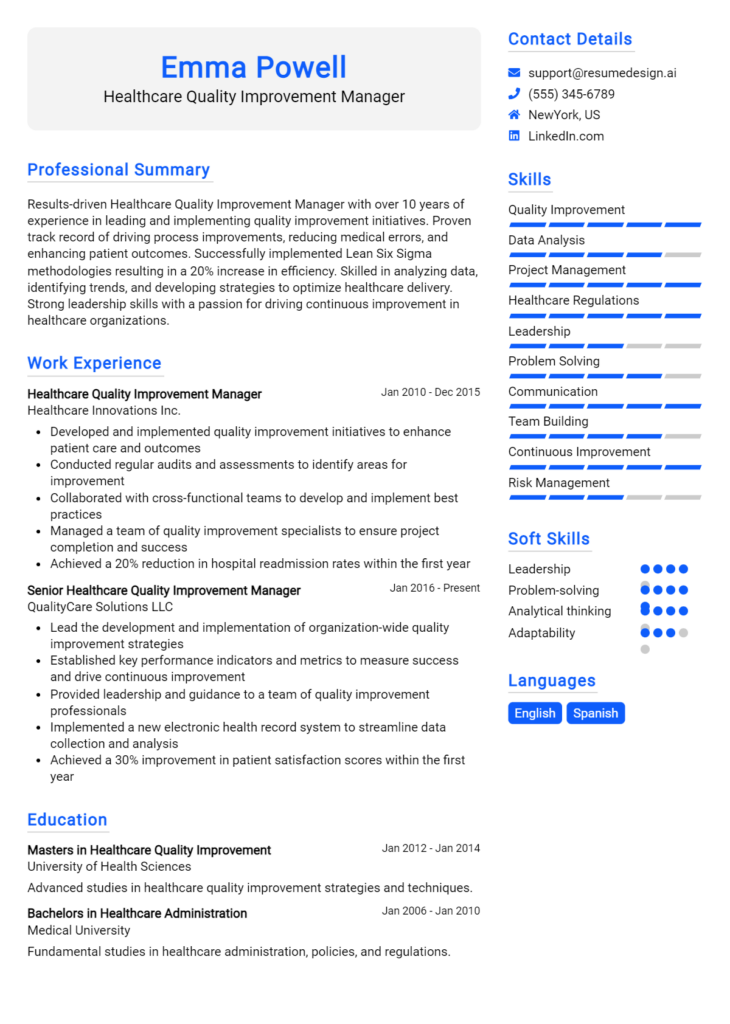

To ensure your resume stands out, consider utilizing professional resources available online. Explore various resume templates that can help you structure your application effectively. Additionally, a resume builder can streamline the process, allowing you to create a polished and professional document with ease. Don't forget to check out resume examples to get inspiration and understand what hiring managers are looking for. Lastly, complement your resume with a compelling cover letter using our cover letter templates to capture the attention of potential employers.

Take action today to review and enhance your Health Insurance Claims Adjuster resume, leveraging these tools to present your qualifications in the best light possible. Your next opportunity could be just around the corner!