Trust and Estate Planner Core Responsibilities

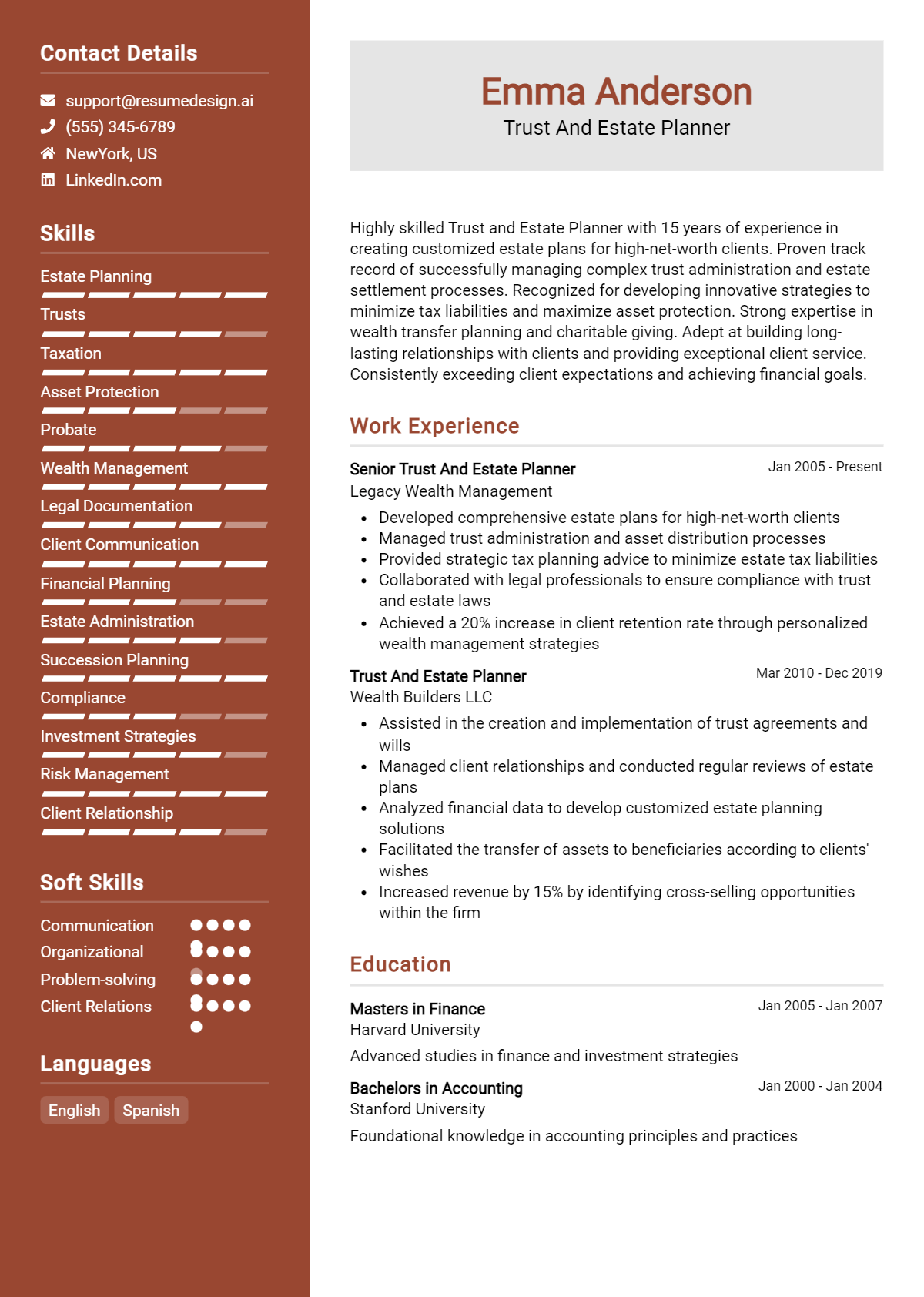

A Trust and Estate Planner plays a crucial role in guiding clients through the complexities of wealth management, estate planning, and asset protection. Key responsibilities include developing comprehensive estate plans, conducting client consultations, and ensuring compliance with legal regulations. This role requires strong analytical, technical, and problem-solving skills to navigate various financial and legal departments effectively. A well-structured resume that highlights these capabilities showcases a candidate's ability to contribute to organizational goals and client satisfaction.

Common Responsibilities Listed on Trust and Estate Planner Resume

- Develop customized estate plans tailored to client needs.

- Conduct thorough client consultations to assess financial situations.

- Prepare legal documents, including wills and trusts.

- Collaborate with attorneys, accountants, and financial advisors.

- Ensure compliance with estate and tax laws.

- Monitor changes in legislation affecting estate planning.

- Provide education and resources to clients about estate planning.

- Review and update existing estate plans as necessary.

- Perform risk assessments and recommend strategies for asset protection.

- Maintain accurate records and documentation for clients.

- Assist clients in preparing for charitable giving and legacy planning.

High-Level Resume Tips for Trust and Estate Planner Professionals

A well-crafted resume is essential for Trust and Estate Planner professionals looking to make a strong first impression on potential employers. In a competitive field where attention to detail and expertise are paramount, your resume serves as a crucial marketing tool that showcases your skills, achievements, and qualifications. It is often the first glimpse hiring managers will have of you, making it vital that your resume effectively communicates your value and relevance to the position. This guide will provide practical and actionable resume tips specifically tailored for Trust and Estate Planner professionals, empowering you to create a standout document that captures your unique qualifications.

Top Resume Tips for Trust and Estate Planner Professionals

- Tailor your resume to each job description, emphasizing the skills and experiences that align with the specific requirements of the position.

- Highlight relevant experience in estate planning, tax law, and trust management, ensuring it is prominently featured in your work history.

- Quantify your achievements where possible, such as the number of successful estate plans created or the total value of assets managed.

- Include industry-specific skills such as knowledge of probate processes, estate tax strategies, and fiduciary responsibilities.

- Utilize professional language and terminology that resonates with hiring managers in the trust and estate planning field.

- Showcase relevant certifications and licenses, such as Certified Trust and Fiduciary Advisor (CTFA) or Certified Financial Planner (CFP).

- Incorporate a summary or objective statement that clearly outlines your career goals and what you bring to the role.

- Keep your resume concise, ideally one page, focusing on the most pertinent information that highlights your qualifications.

- Use action verbs to describe your responsibilities and achievements, creating a dynamic and engaging narrative about your professional journey.

By implementing these tips, you can significantly increase your chances of landing a job in the Trust and Estate Planner field. A well-structured and tailored resume will not only highlight your professional strengths but also demonstrate your commitment to the role, setting you apart from other candidates in this specialized industry.

Why Resume Headlines & Titles are Important for Trust and Estate Planner

In the competitive field of trust and estate planning, a well-crafted resume headline or title is crucial for capturing the attention of hiring managers. This brief yet powerful phrase serves as the first impression of a candidate's qualifications, summarizing their expertise and unique value in a single line. A strong headline not only highlights key qualifications but also aligns closely with the specific requirements of the position, making it immediately relevant and compelling. By being concise and targeted, a strategic resume headline can effectively differentiate a candidate from others, setting the stage for a deeper exploration of their skills and experiences.

Best Practices for Crafting Resume Headlines for Trust and Estate Planner

- Keep it concise, ideally within 10-12 words.

- Use industry-specific terminology to demonstrate expertise.

- Incorporate quantifiable achievements or skills to add substance.

- Tailor the headline to match the job description closely.

- Avoid jargon or overly complex language that may confuse readers.

- Highlight your unique selling points, such as certifications or specializations.

- Use action-oriented language to convey a sense of professionalism and initiative.

- Ensure the headline reflects your career level, whether entry-level, mid-career, or senior-level.

Example Resume Headlines for Trust and Estate Planner

Strong Resume Headlines

Certified Trust and Estate Planner with 10+ Years of Experience in Wealth Management

Expert in Estate Tax Strategies and Trust Administration for High-Net-Worth Clients

Proven Record of Developing Comprehensive Estate Plans that Minimize Tax Liability

Dedicated Trust and Estate Planner Specializing in Family Wealth Preservation

Weak Resume Headlines

Trust Planner

Experienced Professional in Estate Planning

Strong headlines are effective because they quickly convey the candidate's specific expertise and accomplishments, making them stand out in a crowded job market. They highlight the candidate's unique strengths and align closely with the needs of hiring managers seeking highly specialized skills. Conversely, weak headlines lack specificity and fail to communicate the candidate's value proposition, making them less memorable and impactful. They often come across as generic, which does not engage the reader or inspire further interest in the candidate's qualifications.

Writing an Exceptional Trust and Estate Planner Resume Summary

In the competitive field of Trust and Estate Planning, a well-crafted resume summary serves as a vital first impression for job seekers. It provides hiring managers with a snapshot of a candidate's qualifications, highlighting essential skills, experience, and accomplishments relevant to the role. A strong summary effectively captures attention by being concise, impactful, and tailored to the specific job description, allowing candidates to stand out in a crowded applicant pool and increasing their chances of securing an interview.

Best Practices for Writing a Trust and Estate Planner Resume Summary

- Quantify Achievements: Use numbers and percentages to demonstrate your impact, such as the amount of assets managed or the number of successful estate plans created.

- Focus on Relevant Skills: Highlight key skills that are directly applicable to Trust and Estate Planning, such as legal knowledge, financial acumen, and interpersonal communication.

- Tailor the Summary: Customize your summary for each job application to align with the specific requirements and keywords found in the job description.

- Be Concise: Aim for 2-4 sentences that effectively summarize your qualifications without overwhelming the reader.

- Use Action Verbs: Start sentences with strong action verbs to convey your contributions and achievements dynamically.

- Showcase Problem-Solving Abilities: Emphasize experiences where you successfully navigated complex legal or financial challenges.

- Highlight Certifications: Include relevant certifications or licenses that establish your credibility and expertise in the field.

- Maintain Professional Tone: Ensure your language reflects professionalism and confidence, suitable for the legal and financial sectors.

Example Trust and Estate Planner Resume Summaries

Strong Resume Summaries

Dynamic Trust and Estate Planner with over 8 years of experience managing complex estate plans for high-net-worth individuals, achieving a 95% client satisfaction rate and securing over $120 million in assets. Proven track record in navigating intricate tax regulations and developing tailored strategies that minimize taxation and maximize legacy preservation.

Detail-oriented estate planning professional with a focus on comprehensive trust administration. Successfully drafted and executed over 200 estate plans, resulting in a 30% increase in client retention and an average asset growth of 15% per portfolio. Adept at building strong relationships with clients to understand their unique needs and goals.

Results-driven Trust and Estate Planner with a robust background in financial advising and legal compliance. Increased firm revenue by 40% through innovative estate planning solutions and workshops that educated clients on trust management. Licensed attorney with expertise in trust law and asset protection strategies.

Weak Resume Summaries

Experienced professional looking for a position in Trust and Estate Planning. Good at managing client relationships and providing legal advice.

Trust and Estate Planner with several years in the industry. I help clients with their estate plans and am familiar with various legal documents.

The strong resume summaries are considered effective because they incorporate specific achievements, quantifiable results, and relevant skills that clearly align with the expectations of a Trust and Estate Planner role. In contrast, the weak summaries lack detail and specificity, making them vague and generic, which fails to convey the candidate's true value to potential employers.

Work Experience Section for Trust and Estate Planner Resume

The work experience section of a Trust and Estate Planner resume is critical as it provides potential employers with a clear understanding of the candidate's professional background and expertise in the field. This section not only highlights the candidate's technical skills, such as knowledge of estate laws and tax regulations but also demonstrates their ability to manage teams and deliver high-quality service to clients. By quantifying achievements and aligning their experience with industry standards, candidates can effectively showcase their value and suitability for the role, making this section an essential component of a compelling resume.

Best Practices for Trust and Estate Planner Work Experience

- Clearly outline relevant technical skills related to estate planning and trust management.

- Quantify achievements wherever possible to demonstrate impact, such as increased client satisfaction or successful asset management.

- Highlight leadership roles, showcasing your ability to manage and mentor teams effectively.

- Include specific examples of collaboration with legal professionals, financial advisors, or family clients.

- Tailor your experiences to align with industry standards and job descriptions to enhance relevance.

- Use action verbs to convey a sense of proactivity and effectiveness in your roles.

- Focus on results-oriented language that emphasizes outcomes achieved through your efforts.

- Keep descriptions concise but informative to maintain the reader's attention and interest.

Example Work Experiences for Trust and Estate Planner

Strong Experiences

- Successfully developed and implemented estate plans for over 150 clients, resulting in a 95% satisfaction rate and a 20% increase in referrals.

- Led a cross-functional team of five in designing a new trust administration process that reduced processing time by 30% and improved accuracy.

- Negotiated and finalized complex estate settlements totaling over $10 million, ensuring compliance with all legal requirements and maximizing client benefits.

- Collaborated with financial advisors to create integrated plans for high-net-worth clients, enhancing overall service delivery and client retention by 15%.

Weak Experiences

- Assisted in estate planning tasks as needed.

- Worked with clients on various projects.

- Participated in team meetings and discussions about trust management.

- Helped with paperwork related to estate planning.

The examples of strong experiences are considered effective because they provide specific metrics, demonstrate leadership and collaboration, and highlight concrete achievements that illustrate the candidate's impact in their previous roles. In contrast, the weak experiences are vague and lack quantifiable results, making them less compelling and failing to showcase the candidate's true capabilities in the trust and estate planning field.

Education and Certifications Section for Trust and Estate Planner Resume

The education and certifications section of a Trust and Estate Planner resume is crucial as it showcases the candidate's academic qualifications, industry-specific credentials, and commitment to ongoing professional development. This section not only emphasizes relevant coursework that aligns with the responsibilities of a Trust and Estate Planner but also highlights any specialized training or certifications that can enhance the candidate's expertise. By providing a comprehensive overview of educational achievements and certifications, candidates can significantly bolster their credibility and demonstrate their alignment with the demands of the job role.

Best Practices for Trust and Estate Planner Education and Certifications

- Include only relevant degrees and certifications that pertain to estate planning, law, or finance.

- Specify the level of education, such as bachelor’s or master’s degrees, and the field of study.

- Highlight advanced certifications from recognized professional organizations, such as the Certified Trust and Fiduciary Advisor (CTFA) or Accredited Estate Planner (AEP).

- List any specialized training or workshops that demonstrate ongoing education in estate planning and tax law.

- Include relevant coursework that aligns with the key responsibilities of a Trust and Estate Planner.

- Keep the details concise but informative, focusing on qualifications that set you apart from other candidates.

- Update the section regularly to reflect new certifications or relevant educational achievements.

- Use clear formatting to enhance readability, making it easy for hiring managers to quickly identify key qualifications.

Example Education and Certifications for Trust and Estate Planner

Strong Examples

- Master of Laws (LL.M) in Estate Planning, University of Southern California, 2020

- Certified Trust and Fiduciary Advisor (CTFA), American Bankers Association, 2021

- Bachelor of Business Administration (BBA) in Finance, University of Michigan, 2018

- Estate Planning Strategies, Continuing Education Course, National Association of Estate Planners & Councils, 2022

Weak Examples

- Associate Degree in General Studies, Community College, 2015

- Certification in Office Administration, 2017

- High School Diploma, 2010

- Certificate in Basic Tax Preparation, 2019

The strong examples are considered effective because they directly relate to the field of trust and estate planning, showcasing specialized education and certifications that enhance the candidate's qualifications. In contrast, the weak examples are less relevant, focusing on general or outdated qualifications that do not align with the specific requirements of a Trust and Estate Planner role. This distinction highlights the importance of relevance and specificity in the education and certifications section.

Top Skills & Keywords for Trust and Estate Planner Resume

In the field of Trust and Estate Planning, possessing the right skills is crucial for success. A well-crafted resume that highlights both hard and soft skills can significantly enhance a candidate's appeal to potential employers. Trust and Estate Planners must navigate complex legal frameworks, communicate effectively with clients, and exhibit a high level of attention to detail. By showcasing relevant skills, job seekers can demonstrate their qualifications and ability to handle sensitive financial matters, thereby instilling confidence in clients and employers alike.

Top Hard & Soft Skills for Trust and Estate Planner

Soft Skills

- Excellent Communication Skills

- Client Relationship Management

- Empathy and Compassion

- Problem-Solving Abilities

- Time Management

- Negotiation Skills

- Attention to Detail

- Ethical Judgment

- Adaptability

- Team Collaboration

Hard Skills

- Knowledge of Estate Planning Laws

- Tax Law Expertise

- Financial Analysis

- Will and Trust Drafting

- Asset Valuation

- Risk Assessment

- Regulatory Compliance

- Investment Strategies

- Case Management Software Proficiency

- Proficiency in Legal Research Tools

By including a comprehensive list of these skills on a resume, Trust and Estate Planners can effectively communicate their qualifications, while also addressing the importance of relevant work experience in the field.

Stand Out with a Winning Trust and Estate Planner Cover Letter

I am excited to apply for the Trust and Estate Planner position at [Company Name] as advertised on [where you found the job listing]. With a robust background in estate planning, legal compliance, and financial strategy, I am confident in my ability to help clients navigate the complexities of trust and estate management. My experience has equipped me with a deep understanding of the various legal frameworks and financial instruments necessary to create tailored solutions that meet the unique needs of each client.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, guiding them through the intricacies of estate planning while ensuring compliance with federal and state regulations. I have developed comprehensive estate plans that include wills, trusts, and powers of attorney, ensuring that clients’ wishes are honored and their assets are protected. My commitment to building lasting relationships with clients has helped me earn their trust, resulting in a 30% increase in referrals within just one year. I pride myself on my ability to communicate complex legal concepts in an understandable manner, empowering clients to make informed decisions.

I am particularly drawn to the mission of [Company Name] and its commitment to providing personalized service. I believe that my proactive approach to trust and estate planning aligns well with your firm’s values. I am eager to bring my expertise in tax-efficient strategies and my passion for helping individuals and families achieve peace of mind through effective estate planning to your team. Additionally, my ongoing professional development and participation in industry seminars ensure that I stay updated on the latest trends and best practices in the field.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the continued success of [Company Name]. I am excited about the possibility of joining your team and helping clients secure their legacies for future generations.

Common Mistakes to Avoid in a Trust and Estate Planner Resume

When crafting a resume for a Trust and Estate Planner position, it’s crucial to present your qualifications and experience effectively. Many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls can significantly enhance the clarity and professionalism of your resume. Here are some common mistakes to steer clear of:

Vague Job Descriptions: Using generic terms to describe past roles can leave hiring managers confused about your specific responsibilities and achievements. Be precise about what you did in each position.

Neglecting Relevant Certifications: Failing to highlight relevant certifications, such as Certified Trust and Fiduciary Advisor (CTFA) or Accredited Estate Planner (AEP), can lead to missed opportunities. Always include pertinent qualifications.

Overloading with Jargon: While industry-specific terminology can demonstrate expertise, too much jargon can alienate readers. Strive for a balance that showcases your knowledge without overwhelming the reader.

Ignoring Soft Skills: Trust and Estate Planners often need strong interpersonal skills. Omitting soft skills like communication, negotiation, and empathy can make your resume less compelling.

Using an Unprofessional Format: A cluttered or overly creative resume format can distract from your qualifications. Stick to a clean, professional layout that highlights your experience clearly.

Not Tailoring the Resume: Submitting a one-size-fits-all resume can be detrimental. Tailor your resume to each specific job application, aligning your experience with the job description.

Skipping Quantifiable Achievements: Failing to provide quantifiable achievements can weaken your resume. Use numbers and statistics to illustrate your impact, such as the value of estates managed or successful trust implementations.

Lack of a Strong Summary Statement: Neglecting to include a compelling summary at the top of your resume can miss the opportunity to make a strong first impression. Craft a summary that encapsulates your key skills and what you bring to the table.

Conclusion

As we conclude our exploration of the vital role of a Trust and Estate Planner, it's clear that having a well-crafted resume is essential in effectively showcasing your skills and experiences in this specialized field. We discussed the importance of highlighting your expertise in estate law, tax strategies, and client relationship management, as well as the need for strong communication skills and attention to detail.

Now is the perfect time to evaluate your own Trust and Estate Planner resume. Are you effectively communicating your unique qualifications and experiences? Consider utilizing tools that can help enhance your resume and cover letter. For instance, you can access a variety of resume templates to find a design that suits your professional style, or use a resume builder to create a polished document effortlessly. Additionally, browsing through resume examples can provide inspiration and guidance on how to structure your content effectively. Don't forget to complement your resume with a compelling cover letter template that captures your passion and commitment to the profession.

Take action today—review your Trust and Estate Planner resume and ensure it reflects your qualifications and aspirations. Your next career opportunity could be just around the corner!