Banking Lawyer Core Responsibilities

A Banking Lawyer is pivotal in navigating complex financial regulations and ensuring compliance across various departments. Key responsibilities include advising on banking transactions, drafting and reviewing legal documents, and negotiating contracts. Essential skills encompass technical knowledge of financial law, operational insight into banking processes, and strong problem-solving abilities. These competencies contribute significantly to the organization’s objectives by mitigating risk and enhancing legal frameworks. A well-structured resume can effectively showcase these qualifications, highlighting the candidate’s value to potential employers.

Common Responsibilities Listed on Banking Lawyer Resume

- Advising clients on regulatory compliance and banking laws

- Drafting, reviewing, and negotiating loan agreements and contracts

- Representing financial institutions in legal disputes

- Conducting due diligence for mergers and acquisitions

- Monitoring changes in legislation affecting the banking sector

- Providing guidance on risk management and corporate governance

- Collaborating with internal teams to ensure legal compliance

- Preparing legal opinions and memoranda for clients

- Assisting with the structuring of financial products

- Managing litigation and legal proceedings related to banking matters

- Training staff on legal policies and procedures

- Building and maintaining relationships with regulatory bodies

High-Level Resume Tips for Banking Lawyer Professionals

In the competitive landscape of banking law, a well-crafted resume serves as a critical tool for professionals aiming to make their mark. Given that your resume is often the first impression you make on a potential employer, it is essential that it accurately reflects your skills, experiences, and achievements. A strong resume not only showcases your legal expertise but also conveys your understanding of the banking sector's unique challenges and regulations. This guide will provide practical and actionable resume tips specifically tailored for Banking Lawyer professionals, helping you to stand out in a crowded applicant pool.

Top Resume Tips for Banking Lawyer Professionals

- Tailor your resume to match the specific job description, using relevant keywords to align with the employer's needs.

- Highlight your legal experience in banking law, including specific transactions, cases, or regulatory compliance work.

- Quantify your achievements by including metrics, such as the number of cases won or the amount of capital raised through your legal advice.

- Showcase your industry-specific skills, such as knowledge of financial regulations, contract negotiation, and risk management.

- Include any relevant certifications or memberships in legal associations that pertain to banking law.

- Emphasize your ability to work collaboratively with clients and stakeholders, demonstrating strong communication and interpersonal skills.

- Utilize a clean, professional format that allows for easy readability and highlights key information effectively.

- Incorporate a brief professional summary at the top of your resume that encapsulates your career highlights and aspirations in banking law.

- Keep your resume concise, ideally one page, ensuring that only the most pertinent information is included.

By implementing these tips, you can significantly enhance your chances of landing a job in the Banking Lawyer field. A well-structured resume that effectively showcases your qualifications and experiences will not only grab the attention of hiring managers but also position you as a strong candidate for the roles you aspire to pursue.

Why Resume Headlines & Titles are Important for Banking Lawyer

In the competitive field of banking law, a well-crafted resume headline or title is crucial for standing out among numerous applicants. A strong headline immediately captures the attention of hiring managers, offering a succinct summary of a candidate’s key qualifications and expertise. It serves as the first impression, providing a snapshot of what the candidate brings to the table in just a few impactful words. By ensuring that the headline is concise, relevant, and directly related to the job being applied for, candidates can enhance their chances of making a memorable impact and securing an interview.

Best Practices for Crafting Resume Headlines for Banking Lawyer

- Keep it concise: Aim for one to two impactful phrases.

- Be specific: Tailor the headline to reflect the banking law position you are applying for.

- Highlight key qualifications: Include your top skills or achievements relevant to banking law.

- Use powerful language: Choose strong action verbs and impactful adjectives.

- Focus on results: If possible, quantify your achievements to demonstrate value.

- Align with job descriptions: Use keywords from the job listing to enhance relevance.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Make it memorable: Create a headline that stands out and leaves a lasting impression.

Example Resume Headlines for Banking Lawyer

Strong Resume Headlines

"Experienced Banking Lawyer Specializing in Regulatory Compliance and Risk Management"

“Results-Driven Banking Attorney with 10+ Years in Financial Services and Litigation”

“Dynamic Legal Professional with Proven Track Record in Banking Transactions and Advisory”

“Strategic Banking Lawyer Committed to Delivering Innovative Legal Solutions for Financial Institutions”

Weak Resume Headlines

“Lawyer Looking for a Job”

“Banking Attorney”

“Experienced Professional”

The strong headlines are effective because they are specific, highlighting key strengths and relevant experience that directly relate to the banking law field. They provide immediate insight into the candidate's qualifications and suggest a clear value proposition. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail; they do not convey any unique skills or experiences, making it difficult for hiring managers to assess the candidate's fit for the role. A compelling headline can make all the difference in capturing attention and encouraging further exploration of the resume.

Writing an Exceptional Banking Lawyer Resume Summary

A well-crafted resume summary is crucial for Banking Lawyers as it serves as the first impression for hiring managers. In a field where expertise and precision are paramount, a strong summary quickly captures attention by showcasing key skills, relevant experience, and notable accomplishments. This brief yet impactful section should convey the candidate's unique qualifications and align with the specific requirements of the job they are applying for, ultimately setting the stage for further engagement and consideration.

Best Practices for Writing a Banking Lawyer Resume Summary

- Quantify achievements: Use numbers and metrics to illustrate your impact, such as successful transactions or case outcomes.

- Focus on key skills: Highlight specific legal expertise, such as regulatory compliance or contract negotiation, that are relevant to the position.

- Tailor the summary for the job description: Customize your summary to reflect the qualifications and experiences that align with the specific role.

- Keep it concise: Aim for 2-4 sentences that deliver maximum information in a minimal amount of space.

- Use action verbs: Start sentences with dynamic verbs to convey confidence and proactivity.

- Demonstrate knowledge of the industry: Mention any relevant industry-specific regulations or trends that showcase your expertise.

- Highlight soft skills: Incorporate interpersonal skills like negotiation or communication that are essential in legal roles.

- Showcase continuing education: Include any recent certifications or training that reflect your commitment to staying current in the field.

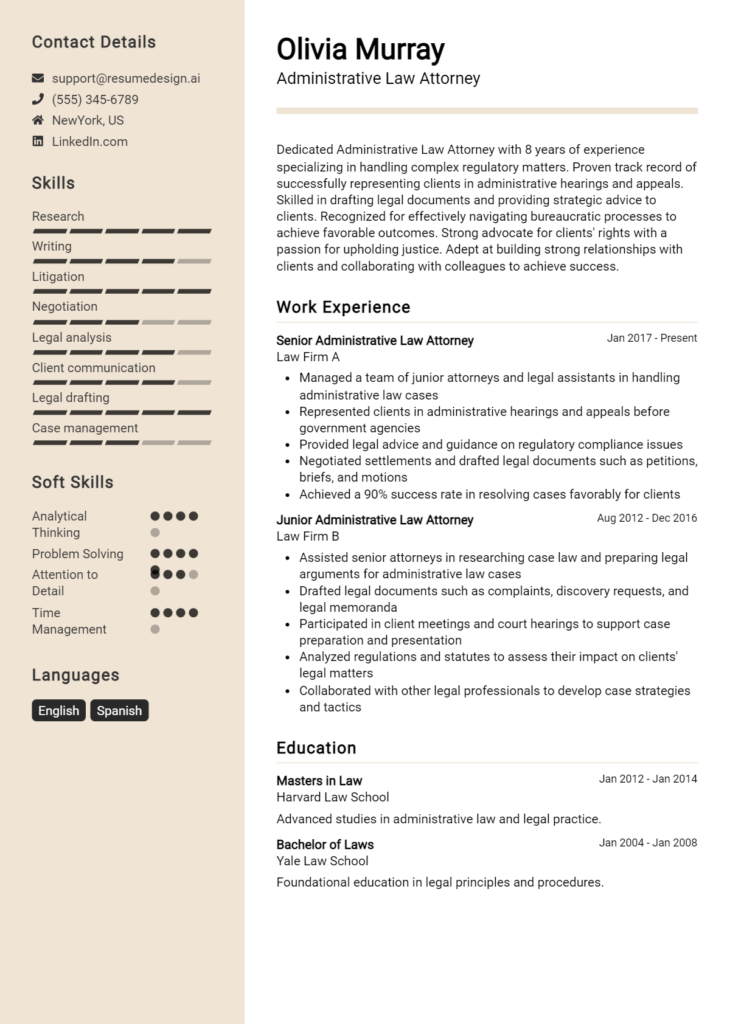

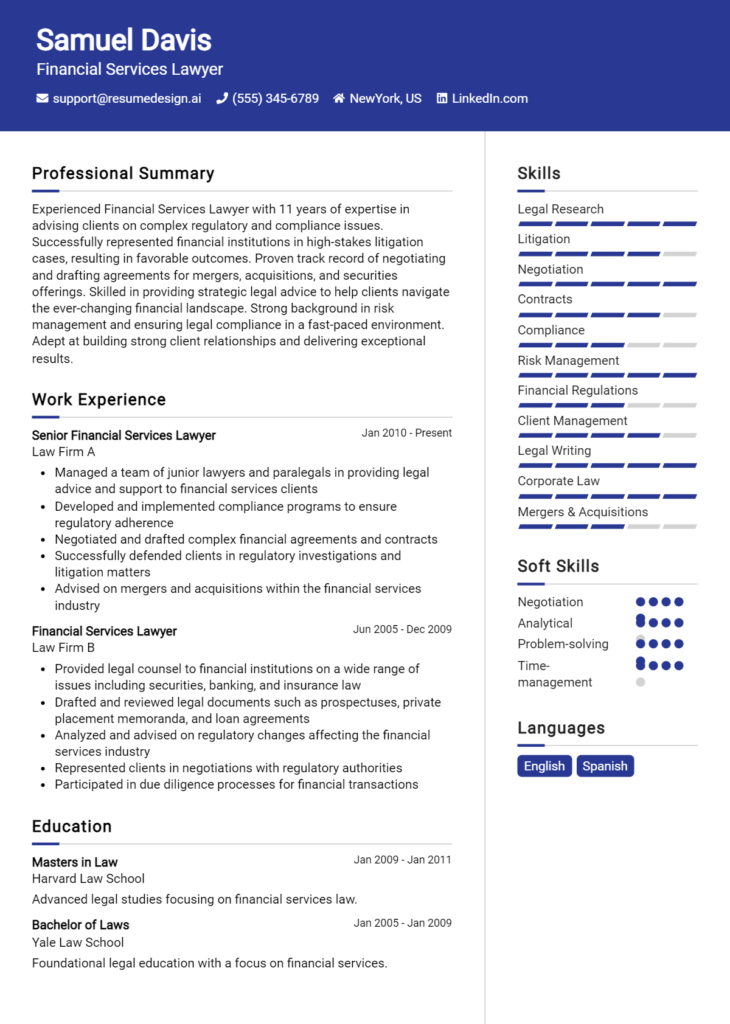

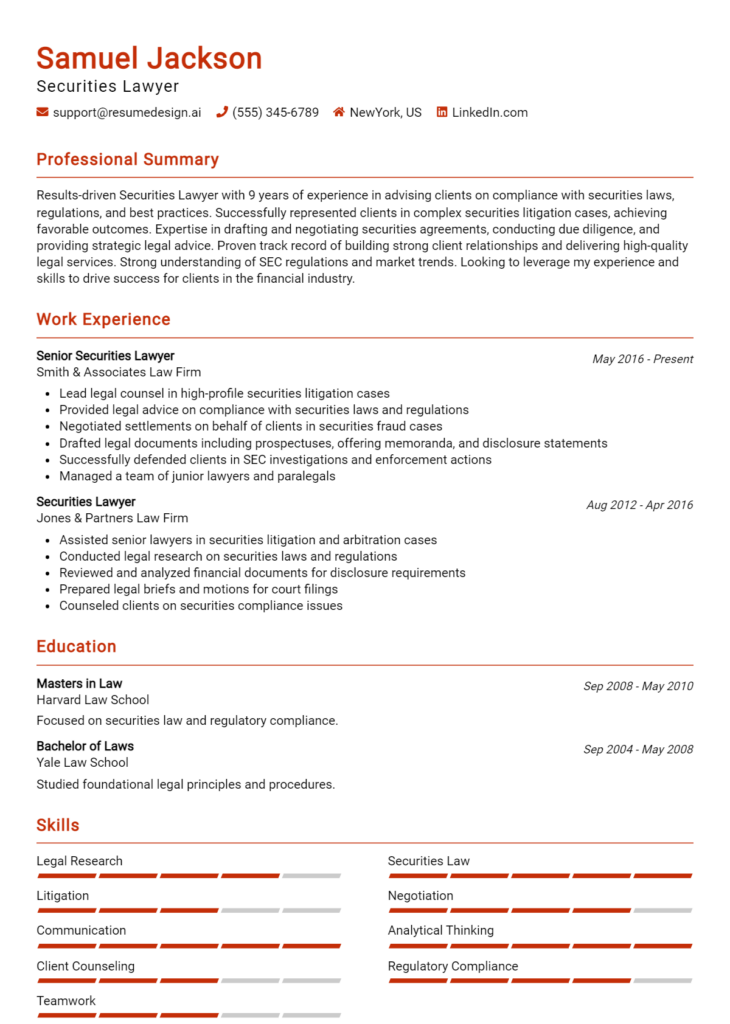

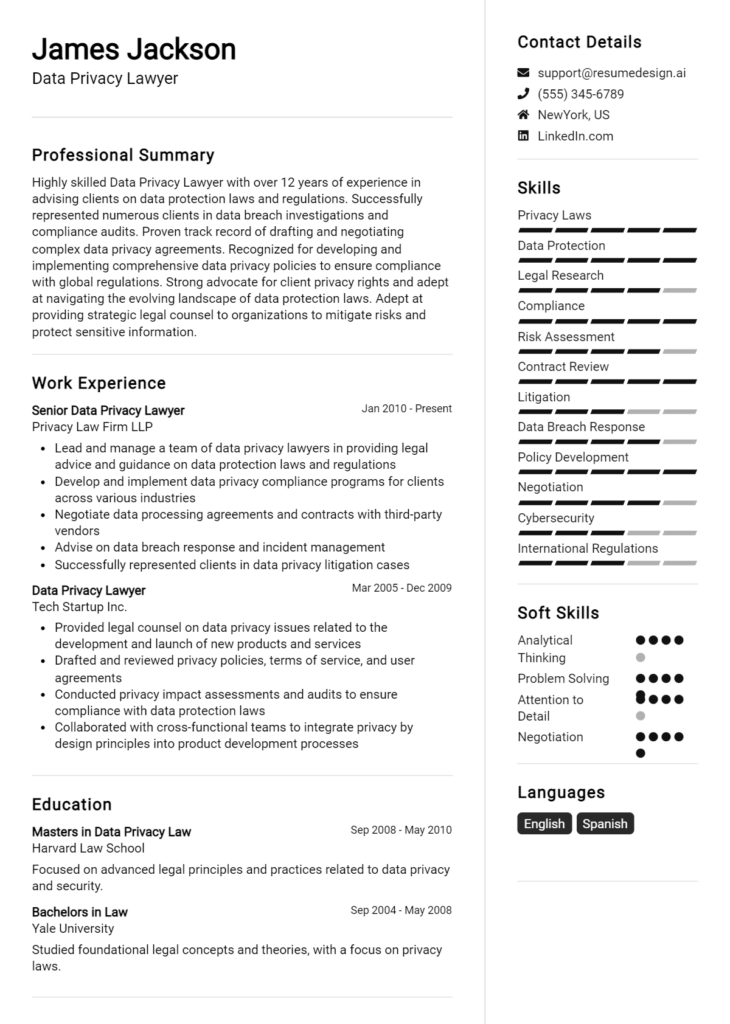

Example Banking Lawyer Resume Summaries

Strong Resume Summaries

Accomplished Banking Lawyer with over 8 years of experience in structuring complex financial transactions and advising multinational corporations on regulatory compliance, resulting in a 30% reduction in legal disputes.

Results-driven Banking Attorney with a proven track record of negotiating high-stakes contracts worth over $500 million, enhancing client satisfaction and loyalty through exceptional legal counsel and strategic risk management.

Detail-oriented Banking Lawyer skilled in managing a diverse portfolio of banking regulations and compliance matters, successfully leading 10+ audits that improved compliance rates by 40% in the past year.

Weak Resume Summaries

I am a lawyer with experience in banking and finance. I can help with various legal issues.

Experienced legal professional seeking a position in banking law. I have a general understanding of the field.

The strong resume summaries effectively highlight specific achievements and qualifications that are directly relevant to a Banking Lawyer role, using quantifiable results to demonstrate the candidate’s impact. In contrast, the weak summaries lack detail, specificity, and measurable outcomes, making them less engaging and memorable for hiring managers. A compelling summary should always provide clear evidence of the candidate's suitability for the position, showcasing their unique value proposition.

Work Experience Section for Banking Lawyer Resume

The work experience section of a Banking Lawyer's resume is pivotal in demonstrating the candidate's expertise and qualifications in the financial services sector. This section serves as a platform to showcase not only the technical skills acquired through previous roles but also the ability to manage teams and deliver high-quality legal solutions. By quantifying achievements and aligning their experiences with industry standards, candidates can effectively convey their value to potential employers, highlighting their contributions to successful transactions, compliance initiatives, and risk management strategies.

Best Practices for Banking Lawyer Work Experience

- Highlight specific legal expertise relevant to banking, such as regulatory compliance, mergers and acquisitions, or risk assessment.

- Quantify achievements by including metrics, such as the value of transactions handled or the percentage of compliance issues resolved.

- Emphasize leadership roles and team management skills, showcasing the ability to lead cross-functional teams.

- Use action-oriented language to demonstrate proactivity and initiative in previous roles.

- Align experiences with the needs of the banking sector by using industry-specific terminology and showcasing relevant skills.

- Focus on results-driven outcomes to illustrate the impact of your contributions on the organization.

- Incorporate collaboration examples that highlight partnerships with clients, regulators, or other stakeholders.

- Keep descriptions concise and relevant to maintain clarity and focus on key achievements.

Example Work Experiences for Banking Lawyer

Strong Experiences

- Led a team of five attorneys in successfully closing a $500 million merger between two financial institutions, ensuring compliance with all regulatory requirements.

- Developed a comprehensive risk management framework that reduced compliance-related fines by 30% over two years.

- Negotiated and drafted over 50 complex financing agreements, achieving a 95% satisfaction rating from clients on service delivery.

- Collaborated with cross-functional teams to implement a new compliance program, resulting in a 40% increase in operational efficiency.

Weak Experiences

- Worked on various legal matters in the banking sector.

- Assisted in preparing documents for banking transactions.

- Participated in team meetings to discuss legal issues.

- Provided legal advice as needed in banking cases.

The examples listed as strong experiences are considered effective because they quantify results, demonstrate clear leadership, and highlight specific contributions that align with the needs of the banking sector. In contrast, the weak experiences lack specificity and measurable outcomes, providing a vague overview of the candidate's responsibilities without showcasing their impact or expertise.

Education and Certifications Section for Banking Lawyer Resume

The education and certifications section of a Banking Lawyer resume is crucial as it establishes the candidate's academic foundation and commitment to the legal and financial sectors. This section not only showcases relevant degrees but also highlights industry-recognized certifications and specialized training that underscore the candidate's expertise in banking law. By providing detailed information about relevant coursework and continuous learning efforts, candidates can enhance their credibility and demonstrate a strong alignment with the job requirements, making them more appealing to potential employers.

Best Practices for Banking Lawyer Education and Certifications

- Include only relevant degrees and certifications that pertain to banking law and finance.

- Detail advanced degrees, such as an LLM in Banking and Finance Law, to showcase specialized knowledge.

- Highlight industry-recognized certifications like the Certified Regulatory Compliance Manager (CRCM) or Certified Anti-Money Laundering Specialist (CAMS).

- Provide context for relevant coursework, particularly if it pertains to banking regulations, financial institutions, or transactional law.

- List continuing legal education (CLE) credits in banking law or related areas to illustrate ongoing professional development.

- Be specific about the institution and the dates of completion to reinforce credibility.

- Consider including honors, awards, or recognitions related to academic achievements or professional certifications.

- Keep the section concise but informative, avoiding unnecessary details that do not enhance your qualifications.

Example Education and Certifications for Banking Lawyer

Strong Examples

- Juris Doctor (JD), Harvard Law School, 2015 - Concentration in Banking and Financial Law

- Master of Laws (LLM) in Banking and Finance Law, University College London, 2016

- Certified Regulatory Compliance Manager (CRCM), American Bankers Association, 2018

- Relevant Coursework: Financial Institutions Law, International Banking Regulations, and Corporate Finance Law

Weak Examples

- Bachelor of Arts in English Literature, State University, 2010

- Certification in Basic Legal Principles, Local Community College, 2014

- Certificate in Hospitality Management, Technical Institute, 2015

- Relevant Coursework: Introduction to Sociology and Creative Writing

The strong examples are considered effective because they directly relate to the field of banking law and demonstrate a high level of education and specialized training that is relevant to the role. They showcase advanced degrees and certifications that enhance the candidate's qualifications. In contrast, the weak examples reflect a lack of focus on banking law, with degrees and certifications that do not contribute to the candidate's expertise in the field, thereby diminishing their credibility in a banking law context.

Top Skills & Keywords for Banking Lawyer Resume

As a Banking Lawyer, possessing the right skills is essential for navigating the complexities of financial regulations, compliance, and transactional law. A well-crafted resume that highlights relevant skills not only showcases your qualifications but also demonstrates your ability to effectively address the legal challenges faced by financial institutions. In this competitive field, both hard and soft skills play a crucial role in your ability to provide legal advice, negotiate contracts, and advocate for your clients. This makes it imperative to curate a resume that emphasizes your strengths and experiences effectively, ensuring you stand out to potential employers.

Top Hard & Soft Skills for Banking Lawyer

Soft Skills

- Excellent communication skills

- Strong analytical thinking

- Negotiation expertise

- Attention to detail

- Problem-solving abilities

- Interpersonal skills

- Time management

- Adaptability

- Leadership qualities

- Ethical judgment

Hard Skills

- Knowledge of banking regulations

- Proficiency in contract law

- Expertise in litigation and dispute resolution

- Familiarity with financial products

- Regulatory compliance

- Risk assessment and management

- Mergers and acquisitions

- Drafting and reviewing legal documents

- Legal research proficiency

- Understanding of corporate governance

For more insights on how to effectively showcase your skills and work experience on your resume, consider tailoring your content to reflect the unique demands of the banking law sector.

Stand Out with a Winning Banking Lawyer Cover Letter

I am writing to express my interest in the Banking Lawyer position at [Company Name], as advertised on [Job Board/Company Website]. With a robust background in financial regulations, corporate law, and a proven track record of successfully navigating complex banking transactions, I am excited about the opportunity to contribute my expertise to your esteemed firm. My experience in advising clients on compliance with banking laws, as well as my ability to craft innovative legal solutions, has equipped me with the skills necessary to excel in this role.

During my tenure at [Previous Firm/Company], I successfully represented a diverse range of clients, from multinational banks to fintech startups, in various financial transactions and regulatory matters. My work involved conducting thorough legal research, drafting and negotiating agreements, and ensuring compliance with both local and international banking regulations. I pride myself on my attention to detail and my ability to communicate complex legal concepts in a clear and concise manner, which has fostered strong relationships with clients and stakeholders alike.

I am particularly drawn to [Company Name] because of its commitment to innovation and excellence in the banking sector. I am eager to leverage my skills in risk management and dispute resolution to help your clients navigate the evolving landscape of financial services. I am also excited about the prospect of collaborating with a talented team of professionals who share my passion for delivering high-quality legal counsel and support.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am eager to contribute to your team and help shape the future of banking law.

Common Mistakes to Avoid in a Banking Lawyer Resume

When crafting a resume for a Banking Lawyer position, it’s crucial to present your qualifications and experience in a clear and compelling manner. However, many candidates fall prey to common pitfalls that can detract from their professional image and reduce their chances of landing an interview. By being aware of these mistakes, you can refine your resume to better highlight your expertise in banking law and make a stronger impression on potential employers.

Vague Job Descriptions: Using generic terms that don't specify your responsibilities or achievements can make your experience seem less impactful. Be specific about your roles in previous positions.

Overloading with Legal Jargon: While familiarity with legal terminology is essential, overwhelming the reader with jargon can hinder understanding. Use clear language to communicate your skills and achievements.

Ignoring Relevant Keywords: Many employers use applicant tracking systems (ATS) to filter resumes. Failing to include relevant keywords from the job description can result in your resume being overlooked.

Neglecting Soft Skills: While technical legal skills are critical, soft skills like communication, negotiation, and teamwork are equally important. Ensure your resume highlights these attributes.

Not Tailoring the Resume: Sending out a generic resume for every application can be detrimental. Customize your resume to align with the specific requirements and culture of each firm or organization.

Using an Unprofessional Format: A cluttered or overly creative resume format can distract from your qualifications. Opt for a clean, professional layout that enhances readability.

Forgetting to Quantify Achievements: Simply stating your responsibilities without quantifying your achievements can make them seem less impressive. Use metrics to demonstrate the impact of your work.

Omitting Continuing Education and Certifications: Staying updated with the latest banking laws and regulations is crucial. Ensure you include any relevant courses or certifications that enhance your qualifications.

Conclusion

As a Banking Lawyer, your expertise plays a crucial role in navigating the complex landscape of financial regulations, compliance, and transactions. Throughout this article, we’ve highlighted the essential skills required for success in this role, including a deep understanding of banking laws, strong negotiation abilities, and proficiency in contract drafting. We also discussed the importance of staying updated with the latest industry trends and regulatory changes to provide the best advice to your clients.

In conclusion, it's vital to ensure that your resume reflects these competencies and stands out in a competitive job market. We encourage you to take a moment to review your Banking Lawyer Resume and make any necessary updates to showcase your qualifications effectively.

To assist you in this process, consider utilizing the following resources:

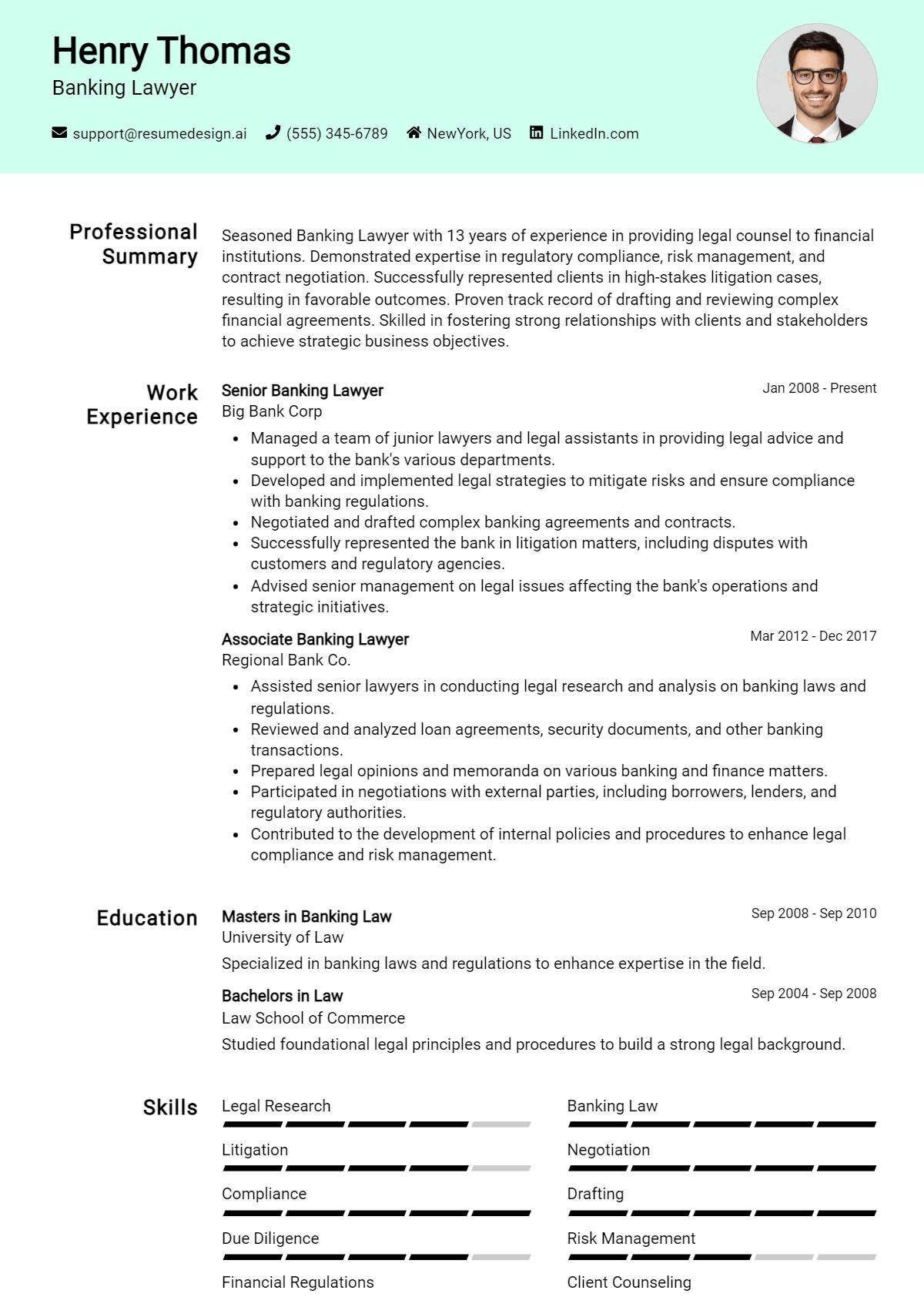

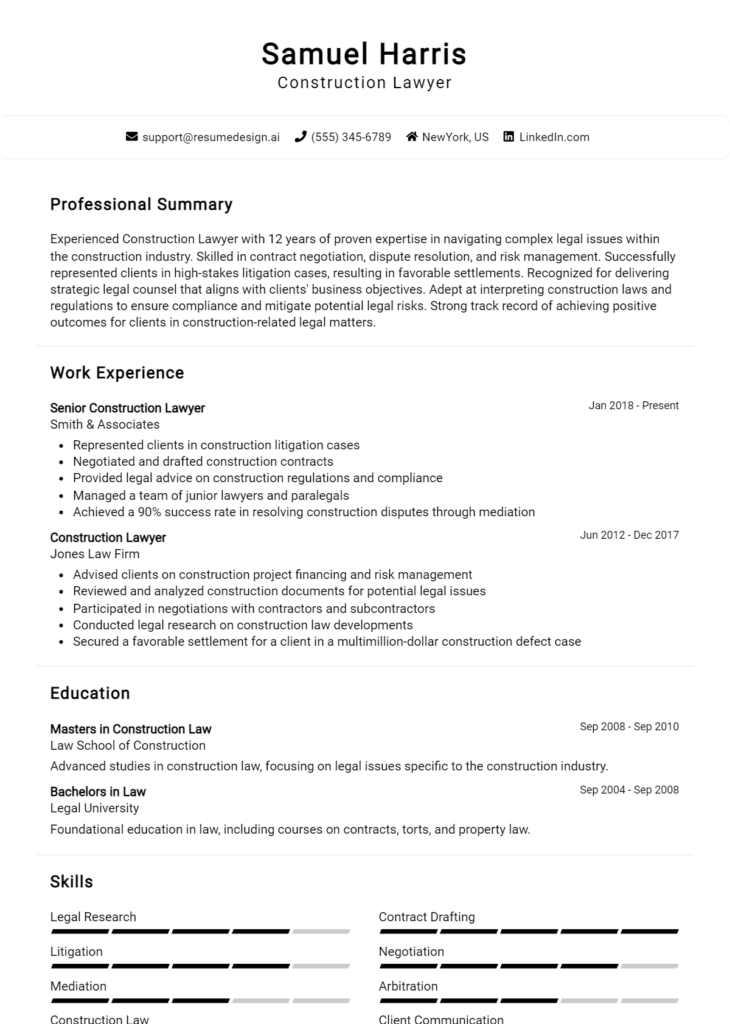

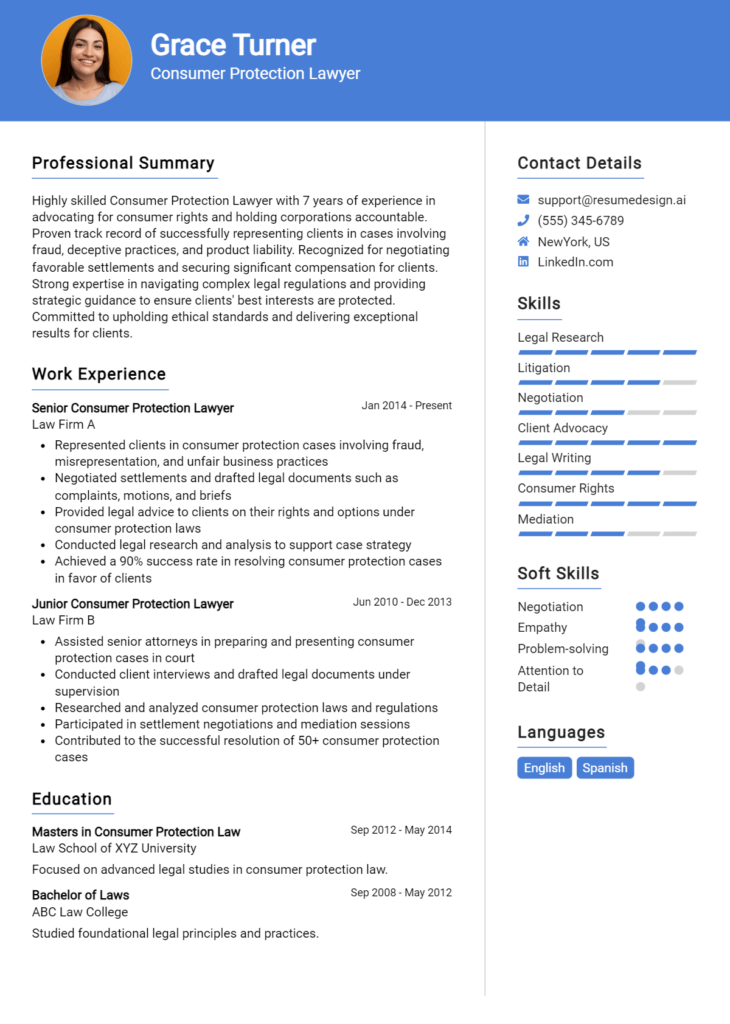

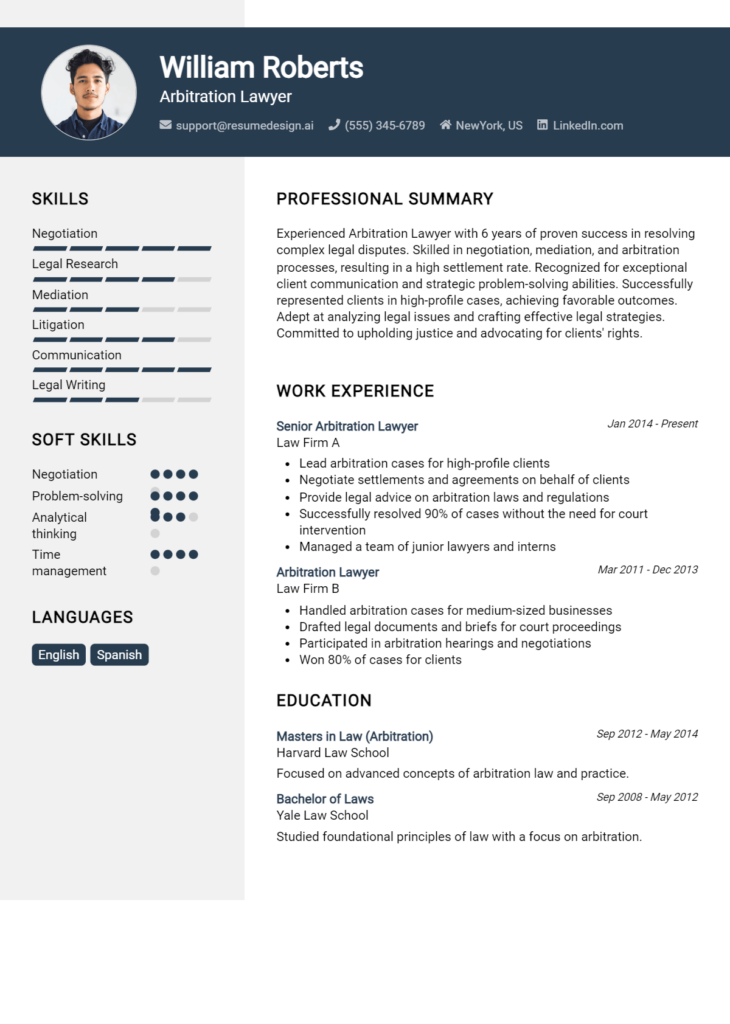

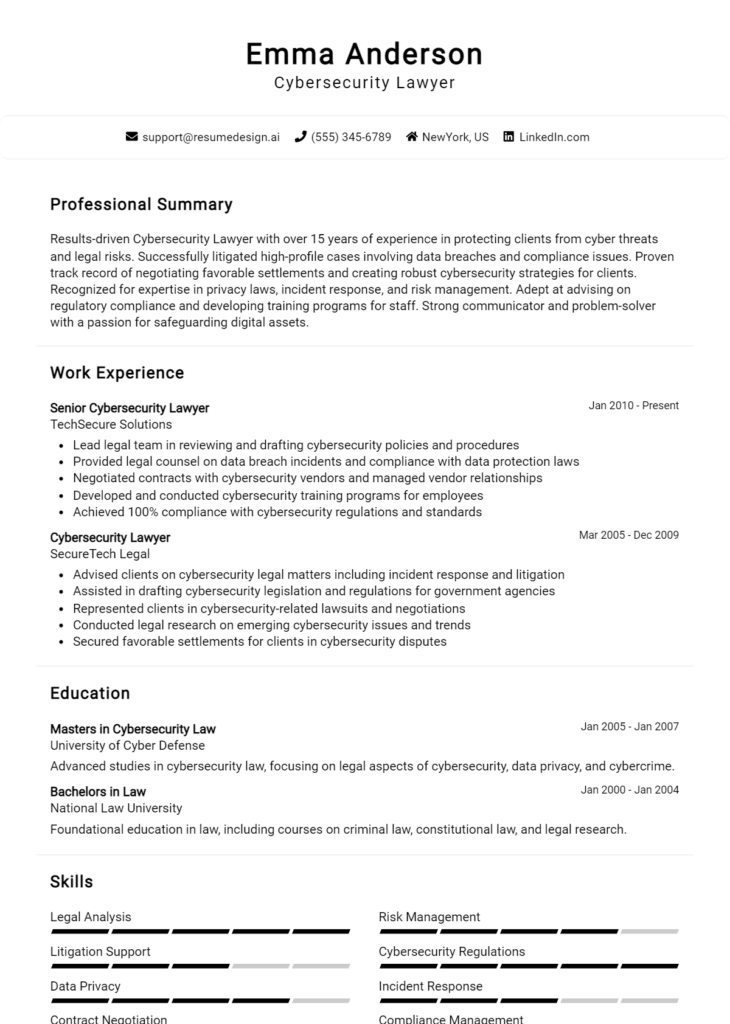

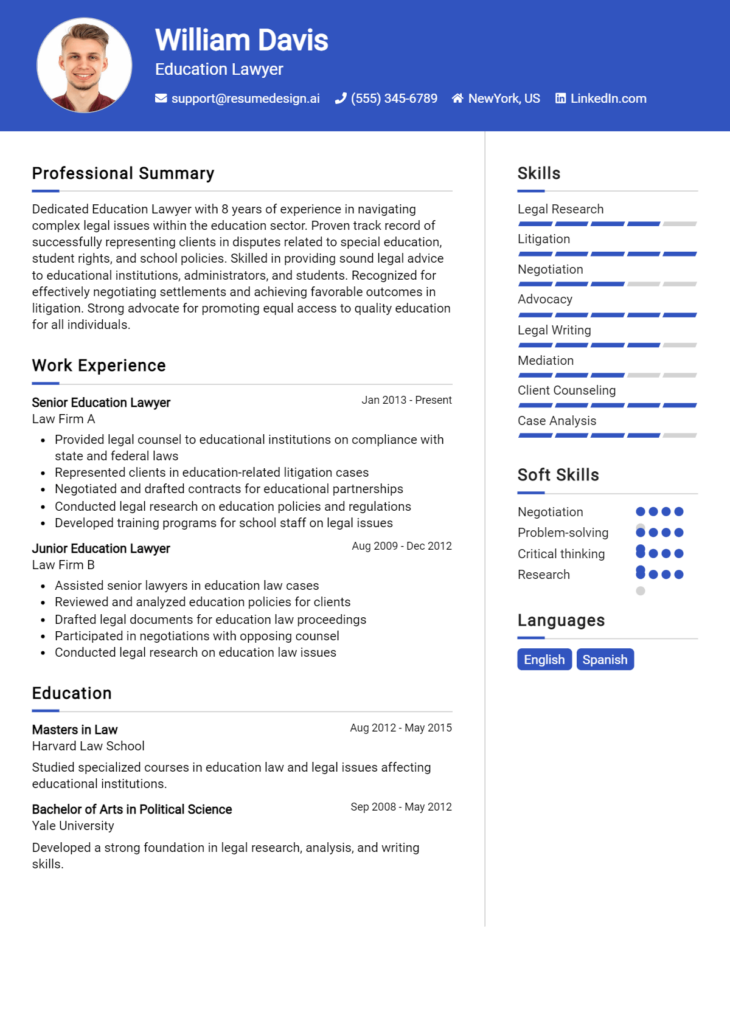

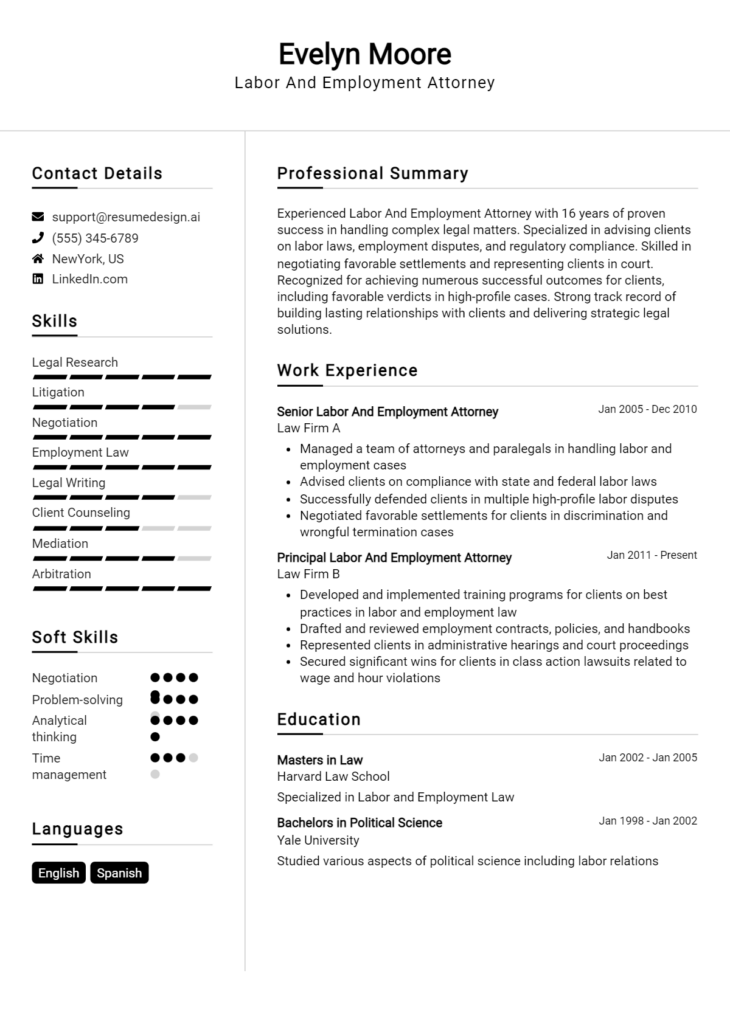

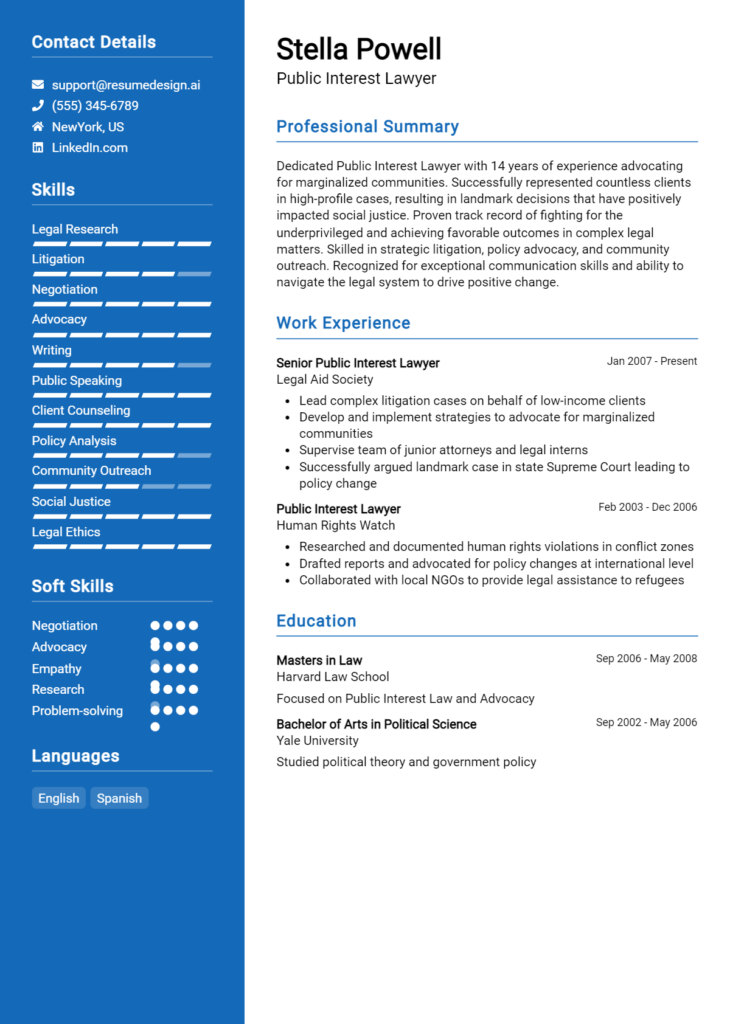

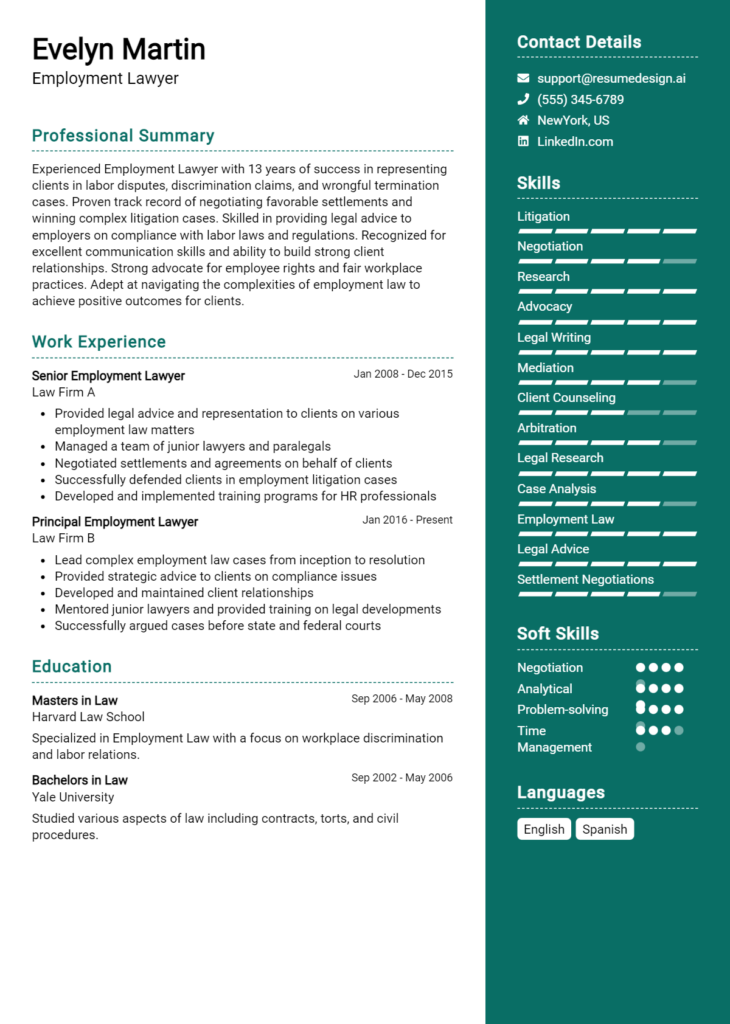

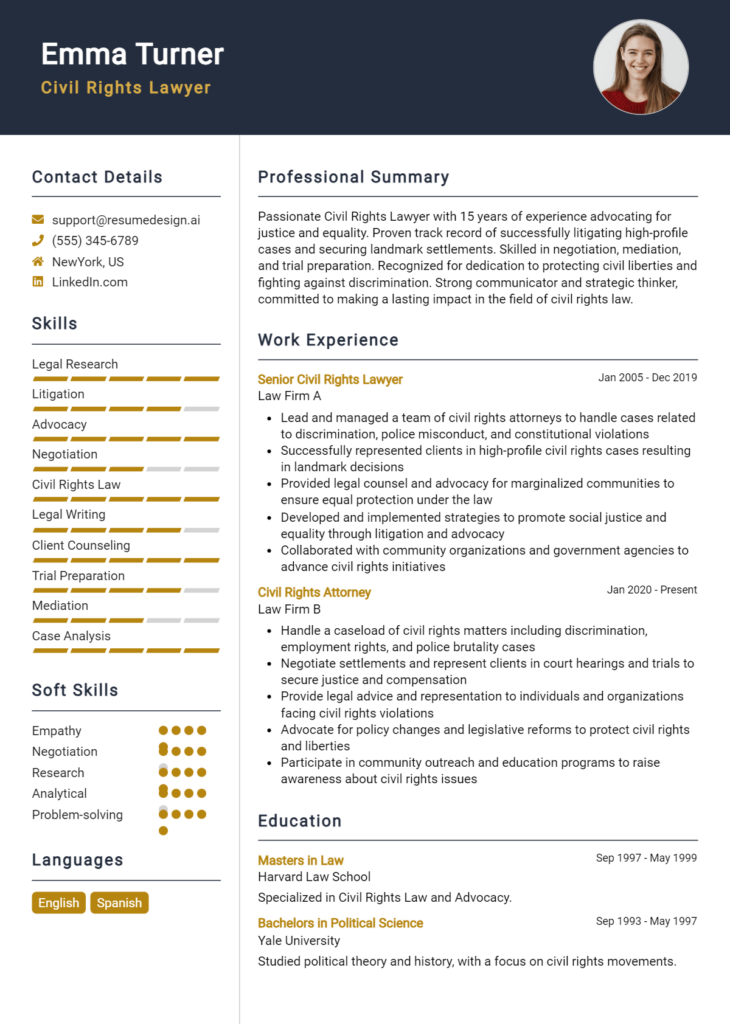

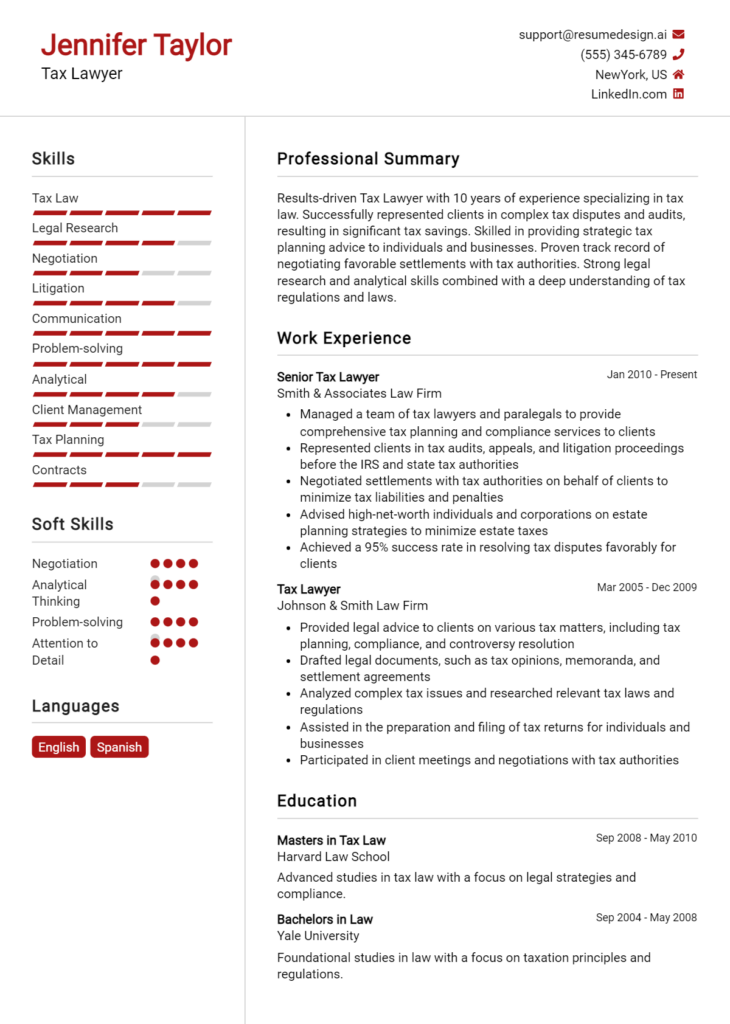

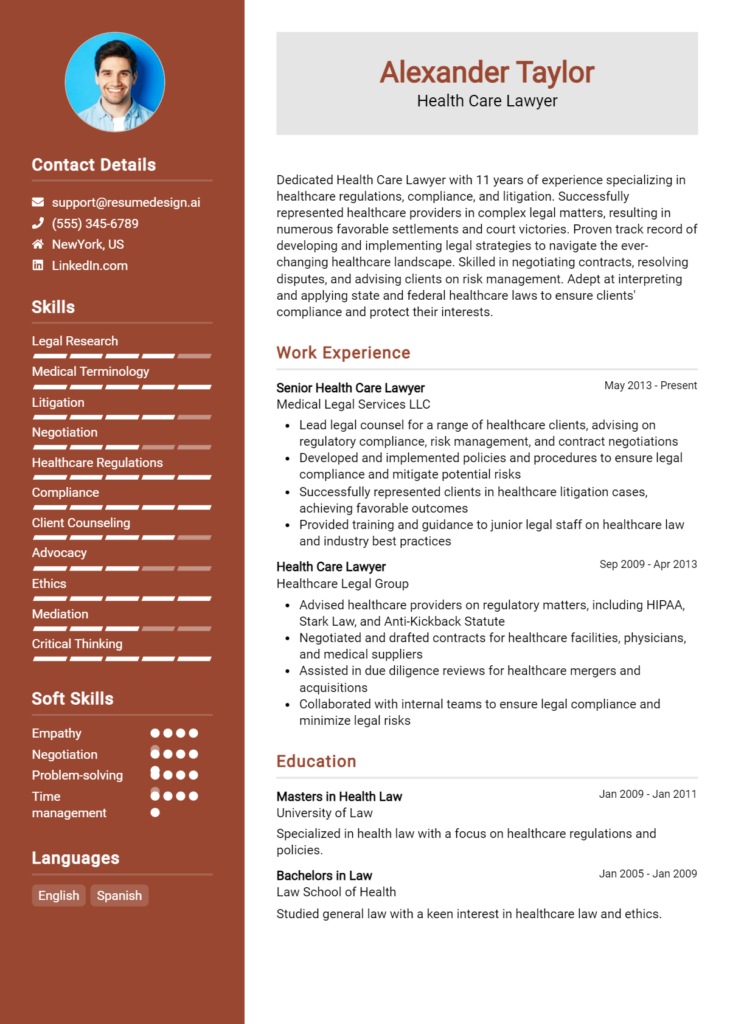

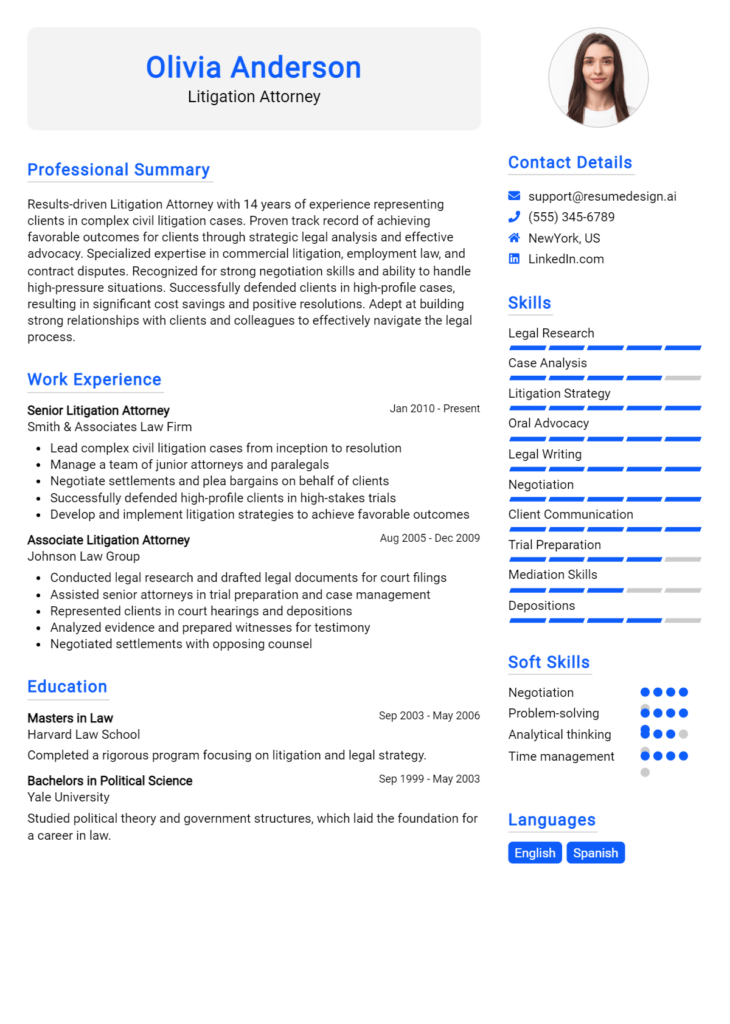

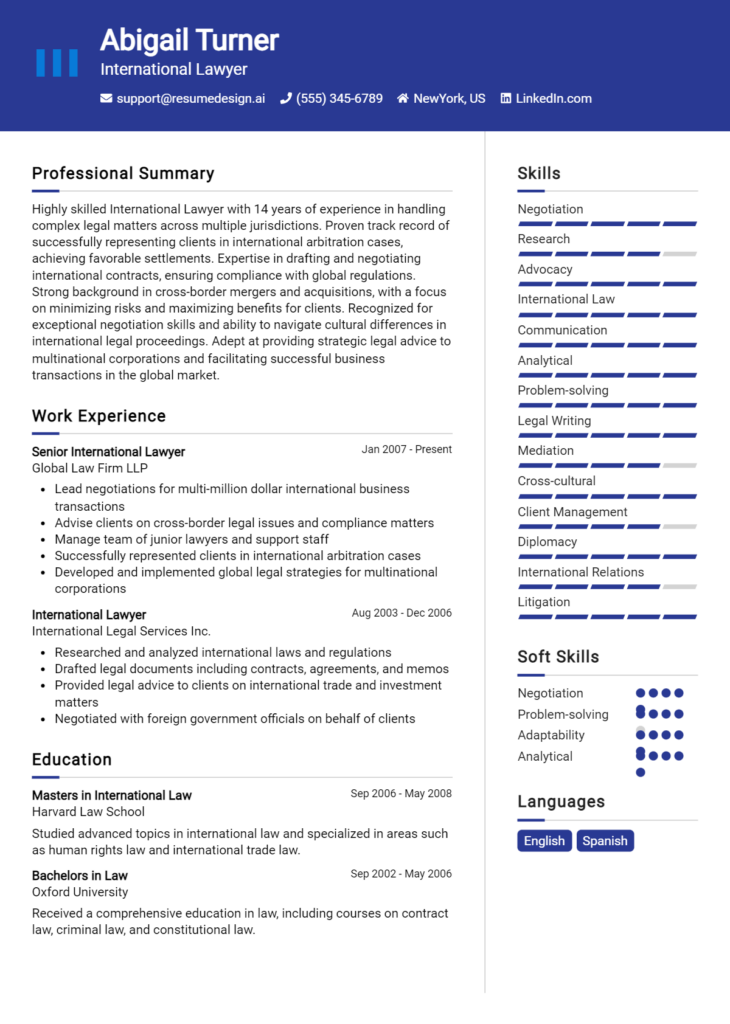

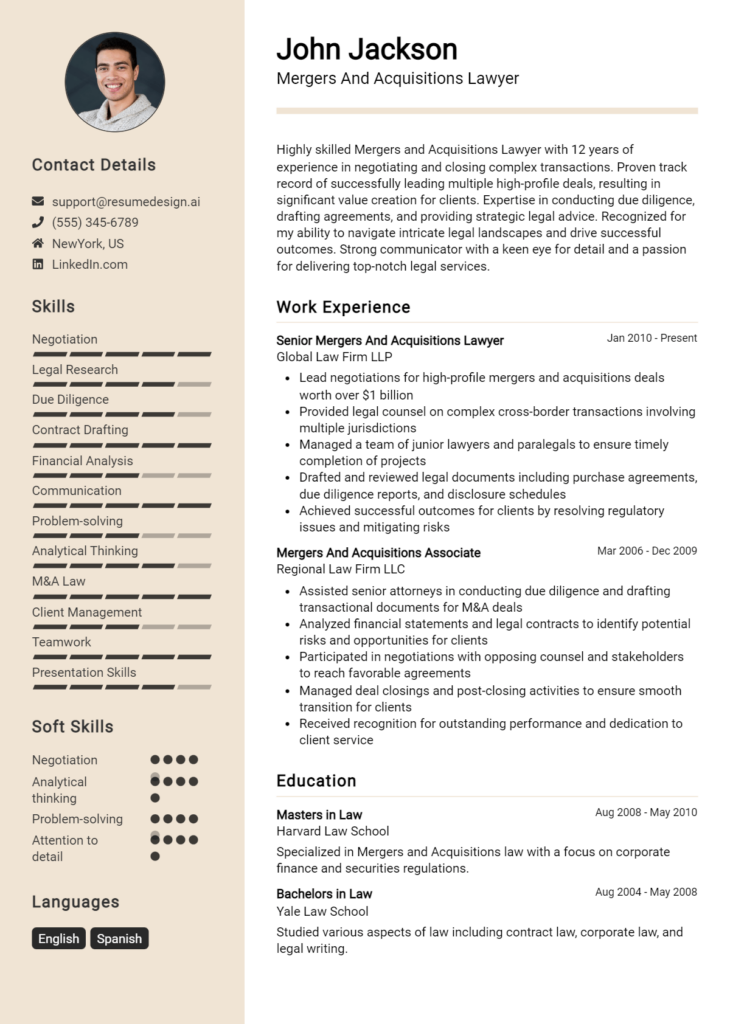

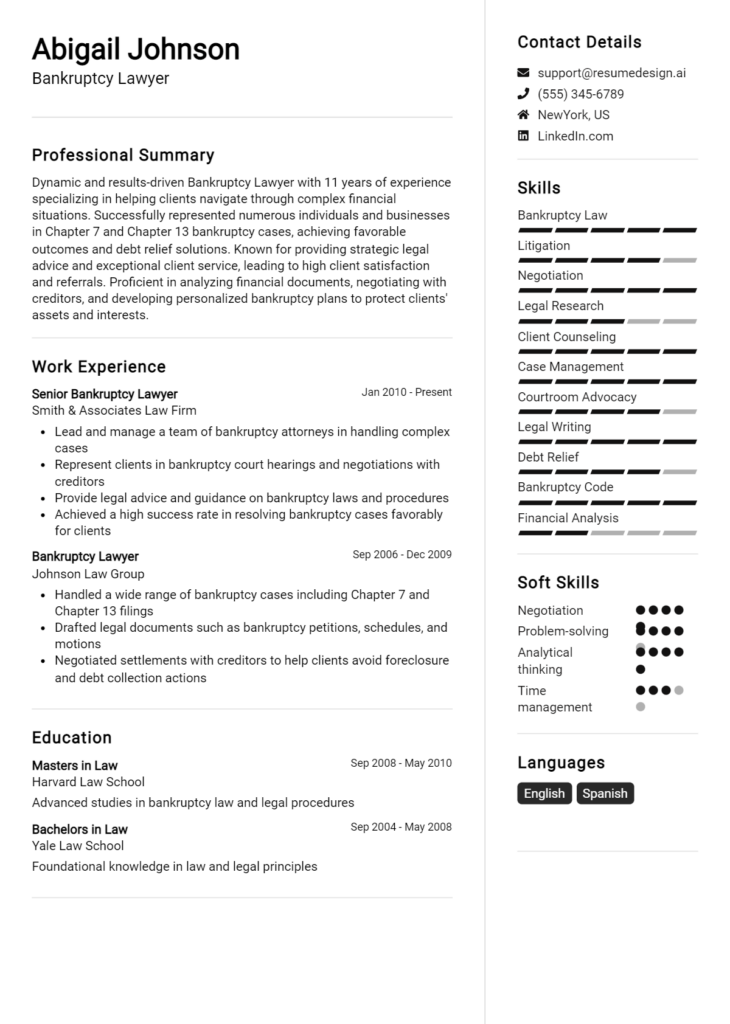

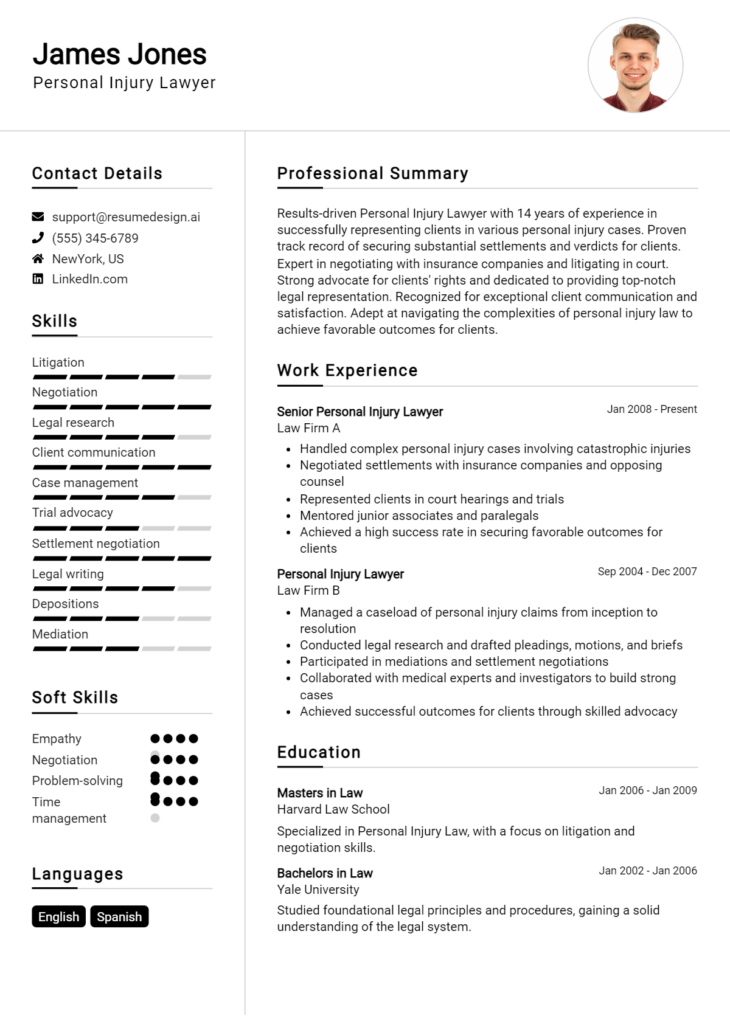

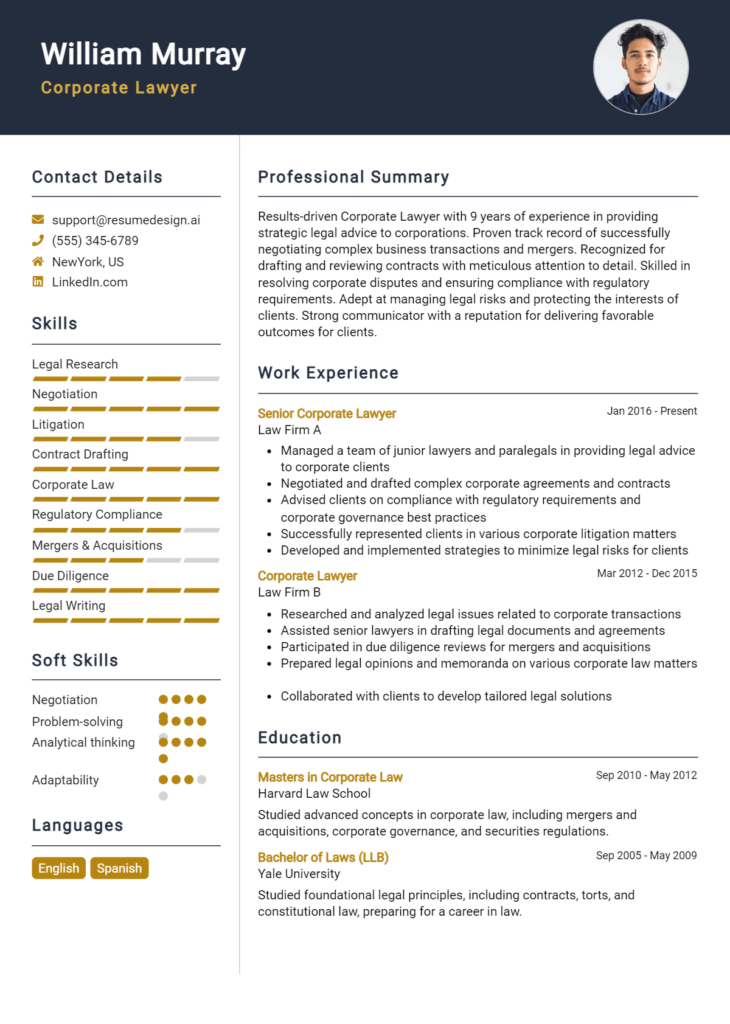

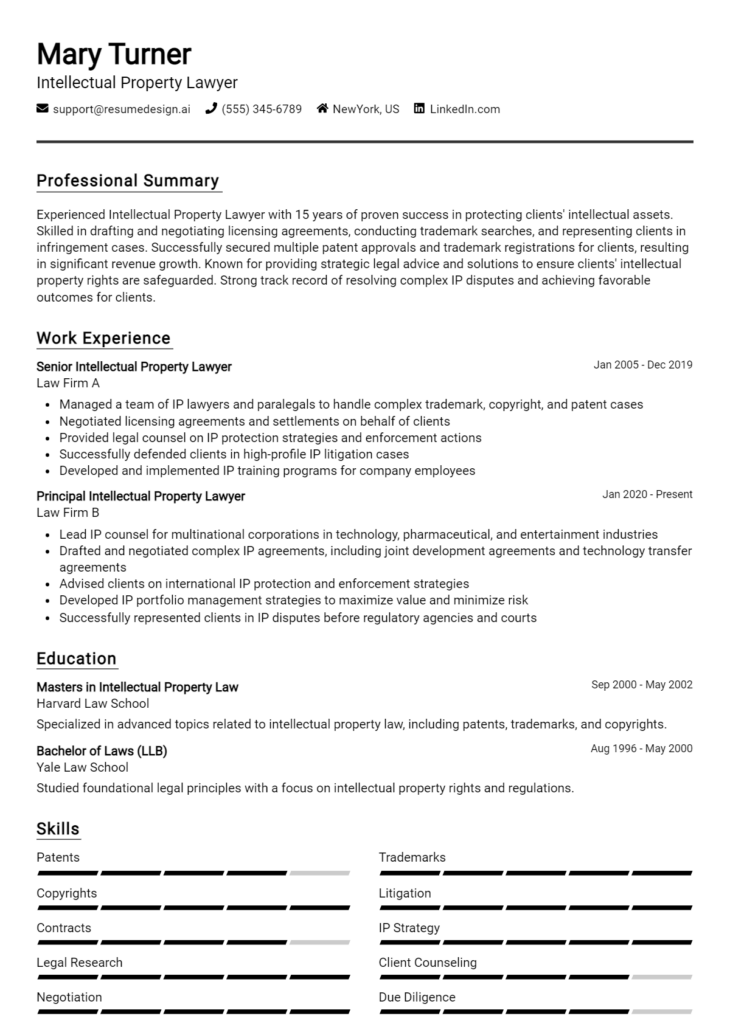

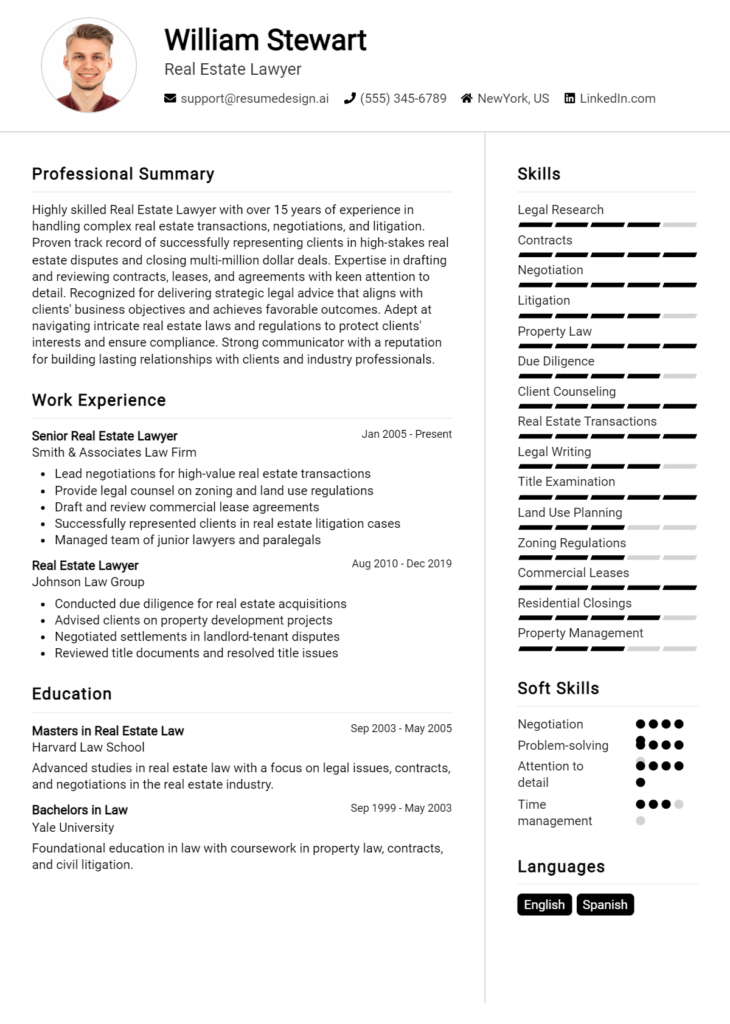

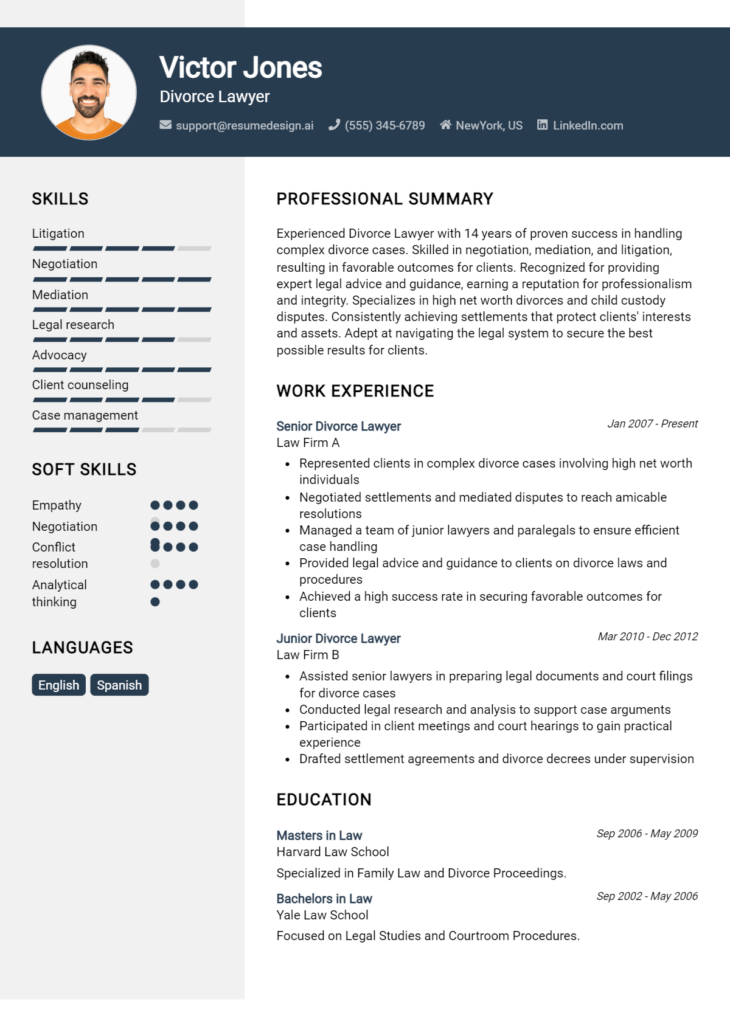

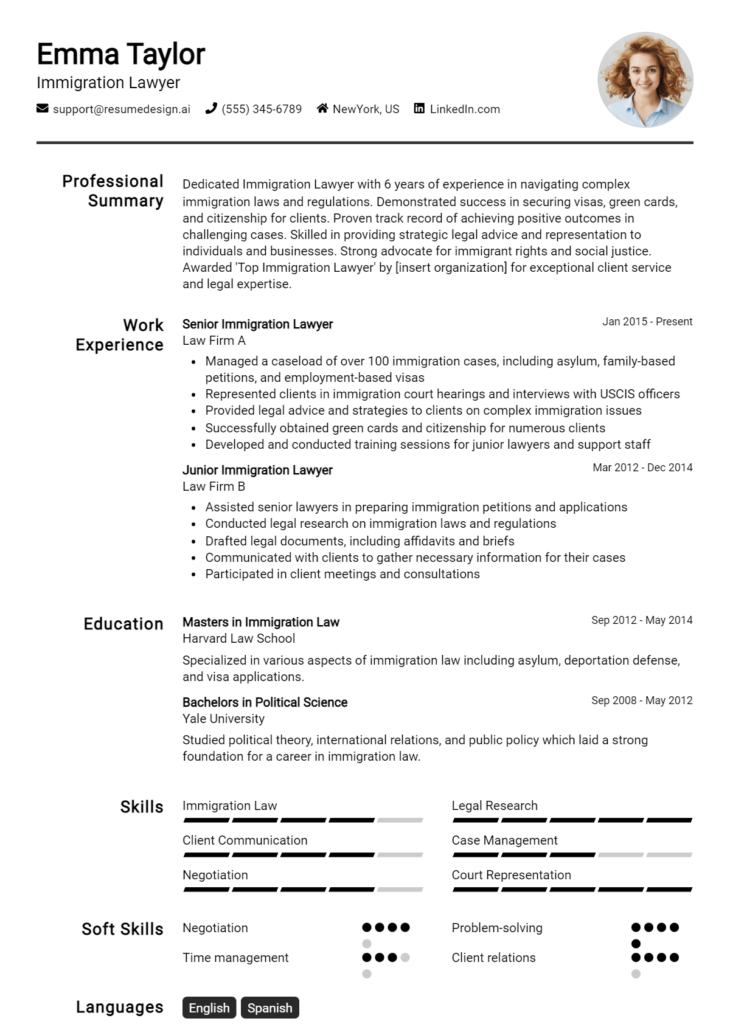

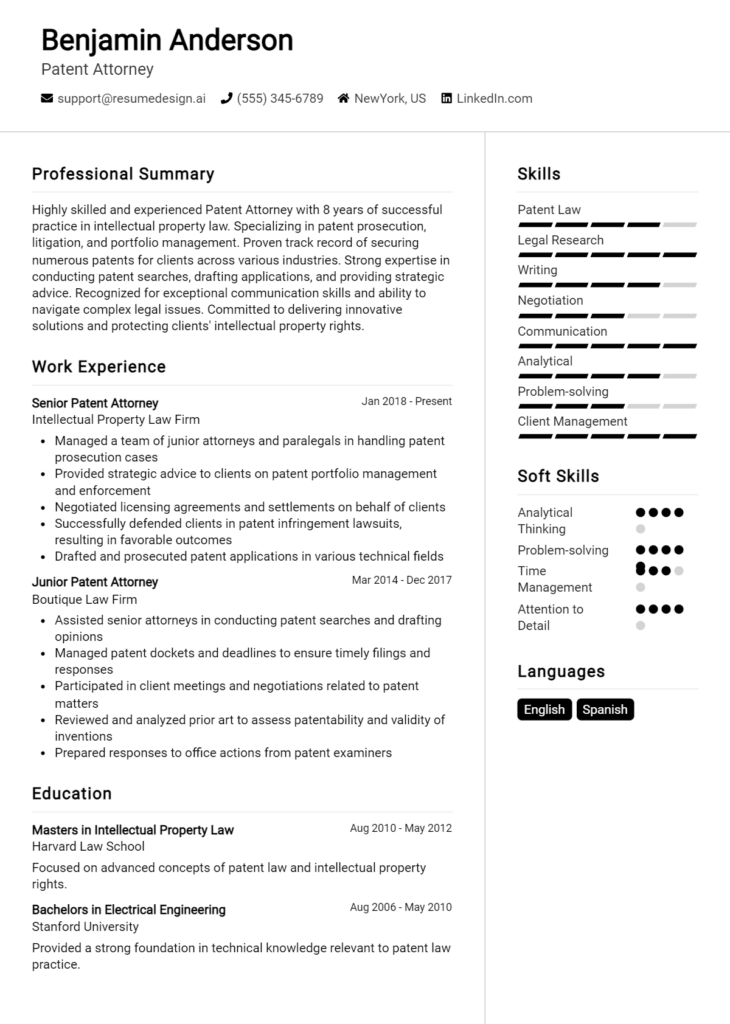

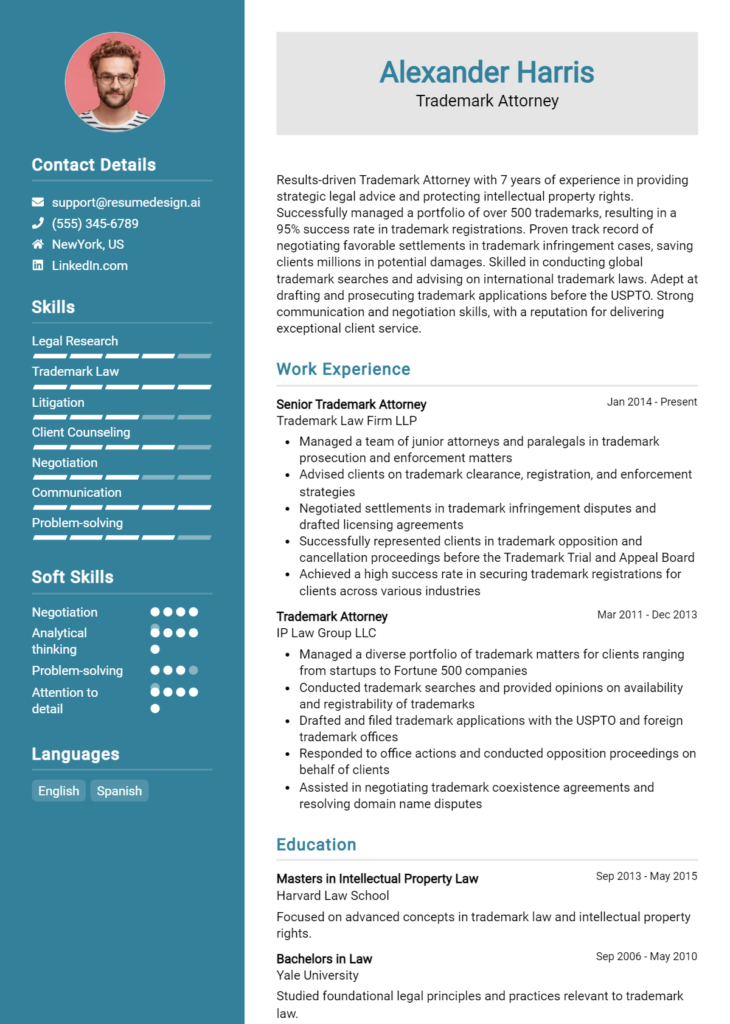

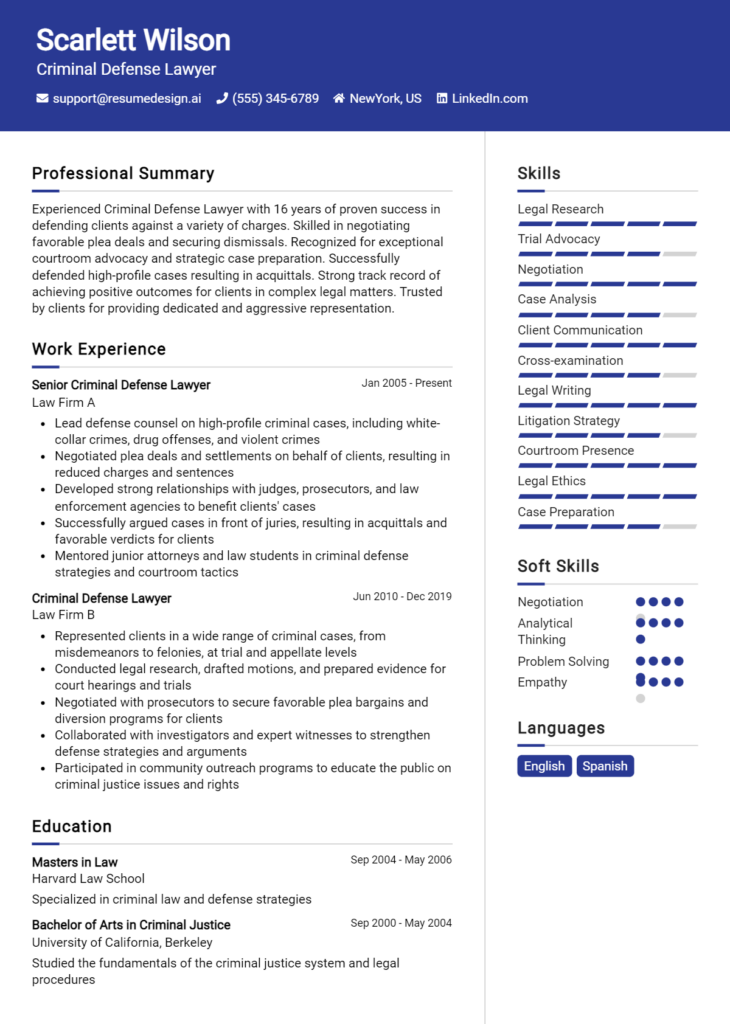

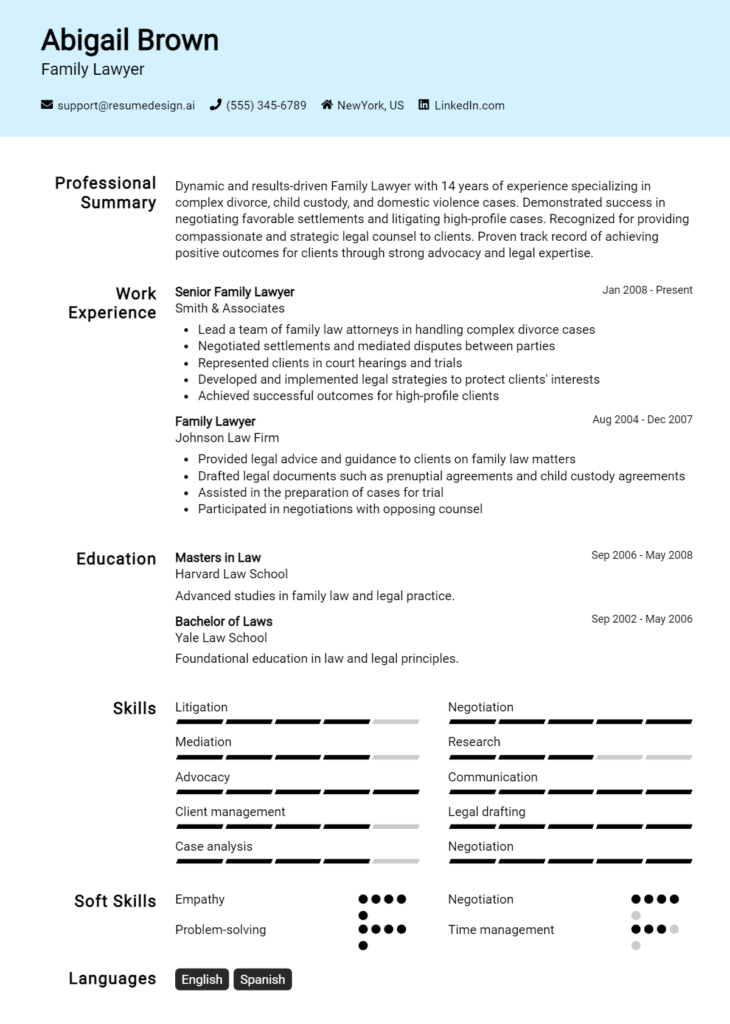

- Explore resume templates to find a format that suits your professional style.

- Use the resume builder for an easy and efficient way to create a polished resume.

- Check out resume examples for inspiration on how to present your experience and skills.

- Don’t forget about cover letter templates to complement your application and make a strong first impression.

Take the next step in advancing your career by refining your resume today!