Tax Lawyer Core Responsibilities

Tax Lawyers play a crucial role in bridging legal, financial, and operational departments within an organization. Their core responsibilities include providing expert legal advice on tax compliance, representing clients in disputes, and developing tax strategies that align with business objectives. Essential skills include technical knowledge of tax laws, strong analytical abilities, and effective problem-solving techniques. Mastering these skills is vital for achieving organizational goals, and a well-structured resume can effectively highlight these qualifications to potential employers.

Common Responsibilities Listed on Tax Lawyer Resume

- Advising clients on tax implications of transactions

- Drafting and reviewing tax-related documents

- Representing clients in tax audits and disputes

- Conducting legal research on tax laws and regulations

- Developing tax planning strategies for individuals and corporations

- Collaborating with financial and accounting teams

- Monitoring changes in tax legislation

- Providing guidance on international tax issues

- Negotiating settlements with tax authorities

- Preparing and filing tax returns

- Educating clients on tax compliance and best practices

- Analyzing financial documents for tax-related concerns

High-Level Resume Tips for Tax Lawyer Professionals

In the competitive field of tax law, a well-crafted resume is crucial for making a strong first impression on potential employers. As the initial point of contact, your resume serves as a powerful marketing tool that showcases your unique skills, achievements, and professional background. For tax lawyers, it is essential to convey not only legal expertise but also an understanding of the intricacies of tax regulations and compliance. This guide will provide practical and actionable resume tips specifically tailored for tax lawyer professionals, ensuring your application stands out in a crowded job market.

Top Resume Tips for Tax Lawyer Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases.

- Highlight your legal expertise by detailing your education, certifications, and any specialized training in tax law.

- Showcase your relevant experience, including internships, clerkships, or positions held in law firms focused on tax matters.

- Quantify your achievements by including specific metrics, such as successful cases handled, percentage of tax savings achieved for clients, or the number of audits resolved favorably.

- Emphasize your understanding of current tax regulations and any relevant software tools you are proficient in.

- Incorporate strong action verbs to convey your contributions effectively, such as "advised," "negotiated," and "defended."

- Include any published articles or speaking engagements to demonstrate your thought leadership in the tax law field.

- Keep your resume concise and focused, ideally no longer than one page, while ensuring it is easy to read with clear headings and bullet points.

- Proofread thoroughly to eliminate any grammatical errors or inconsistencies that could detract from your professionalism.

By implementing these tips, you can significantly increase your chances of landing a job in the tax lawyer field. A well-structured, tailored resume that effectively highlights your skills and achievements will capture the attention of hiring managers and set you on the path to a successful career in tax law.

Why Resume Headlines & Titles are Important for Tax Lawyer

In the competitive field of tax law, a resume's headline or title plays a crucial role in capturing the attention of hiring managers. A strong headline can serve as an immediate introduction to the candidate, summarizing their key qualifications in a succinct and impactful manner. It should be concise, relevant, and directly tied to the specific job being applied for, allowing the candidate to stand out in a crowded job market. By clearly articulating expertise and value, a well-crafted headline sets the tone for the entire resume and encourages hiring managers to delve deeper into the applicant's qualifications.

Best Practices for Crafting Resume Headlines for Tax Lawyer

- Keep it concise: Aim for a headline that is brief yet informative, ideally one sentence or phrase.

- Be specific: Tailor the headline to the tax law role, highlighting relevant expertise or specialization.

- Use impactful language: Choose strong action verbs and descriptive adjectives that convey confidence and competence.

- Focus on key qualifications: Incorporate your most important skills, certifications, or accomplishments that align with the job description.

- Highlight unique value: Differentiate yourself by mentioning any specialized knowledge or unique experiences.

- Avoid jargon: Use clear language that can be easily understood, avoiding overly technical terms unless necessary.

- Align with the job title: Ensure the headline reflects the position you are applying for to demonstrate relevance.

- Keep it professional: Maintain a formal tone that reflects the seriousness of the legal profession.

Example Resume Headlines for Tax Lawyer

Strong Resume Headlines

Experienced Tax Lawyer with Proven Track Record in Corporate Taxation

Dedicated Tax Attorney Specializing in International Tax Compliance

Strategic Tax Planner with Over 10 Years of Experience in Tax Law

Results-Driven Tax Lawyer with Expertise in Estate Planning and Trusts

Weak Resume Headlines

Tax Lawyer Seeking Opportunities

Legal Professional with Some Tax Experience

The strong headlines are effective because they clearly communicate the candidate's expertise and specific areas of focus, immediately positioning them as qualified for the role. They use powerful language and highlight relevant experience, making them memorable and engaging. In contrast, the weak headlines fail to impress due to their vagueness and lack of specificity. They do not convey any unique qualifications or strengths, making it difficult for hiring managers to see what sets the candidate apart from others in the field.

Writing an Exceptional Tax Lawyer Resume Summary

A well-crafted resume summary is crucial for a Tax Lawyer as it serves as the first impression to hiring managers, quickly encapsulating the candidate's key skills, relevant experience, and notable accomplishments. In a competitive field where precision and expertise are paramount, an impactful summary not only grabs attention but also establishes the candidate's qualifications for the role. A strong summary should be concise yet powerful, directly addressing the specific requirements of the job the applicant is pursuing, ultimately setting the stage for a deeper dive into their professional background.

Best Practices for Writing a Tax Lawyer Resume Summary

- Quantify achievements where possible to illustrate impact and effectiveness.

- Focus on relevant skills specific to tax law, such as compliance, litigation, and negotiation.

- Tailor the summary to align with the job description, emphasizing pertinent experiences.

- Use action verbs to convey a sense of proactivity and results-driven performance.

- Keep the summary concise, ideally no more than 3-4 sentences, to maintain clarity.

- Highlight unique qualifications, such as specializations in certain tax areas or certifications.

- Incorporate industry-specific terminology to showcase familiarity and expertise.

- Avoid generic phrases and focus on what sets you apart from other candidates.

Example Tax Lawyer Resume Summaries

Strong Resume Summaries

Dynamic Tax Lawyer with over 8 years of experience in federal and state tax regulations, successfully representing clients in high-stakes litigation resulting in a 95% success rate. Proven expertise in tax compliance and strategic planning, having saved clients an estimated $3 million through innovative tax strategies.

Detail-oriented Tax Attorney with a track record of advising Fortune 500 companies on complex tax structures, achieving a 30% reduction in overall tax liabilities. Skilled in conducting thorough audits and developing comprehensive tax planning strategies tailored to client needs.

Experienced Tax Counsel with a focus on international tax law, facilitating cross-border transactions that generated over $5 million in tax savings for multinational clients. Renowned for exceptional negotiation skills and an in-depth understanding of tax treaties and compliance.

Weak Resume Summaries

Tax Lawyer with experience in various legal matters and a focus on helping clients with their tax issues. I am a dedicated professional looking for new opportunities.

Knowledgeable Tax Attorney seeking to leverage my skills in a challenging position. I have worked on tax cases and am familiar with some regulations.

The strong resume summaries stand out due to their specificity, quantifiable results, and direct relevance to the Tax Lawyer role, showcasing the candidate's achievements and expertise in a compelling way. In contrast, the weak summaries lack detail, quantifiable outcomes, and appear overly generic, failing to communicate the candidate's unique qualifications or impact effectively.

Work Experience Section for Tax Lawyer Resume

The work experience section of a Tax Lawyer resume is vital as it serves as a testament to a candidate's technical skills, leadership capabilities, and commitment to producing high-quality legal outcomes. This section allows potential employers to evaluate how well a candidate can navigate the complexities of tax law, manage diverse teams, and deliver effective legal solutions that meet or exceed client expectations. To stand out, candidates should quantify their achievements, demonstrating the impact of their work, and align their experiences with industry standards to showcase their qualifications effectively.

Best Practices for Tax Lawyer Work Experience

- Highlight specific technical skills relevant to tax law, such as knowledge of IRS regulations and compliance requirements.

- Include quantifiable results, such as the percentage of tax liabilities reduced or the amount of money saved for clients.

- Demonstrate leadership by detailing experiences managing teams or mentoring junior lawyers.

- Use action verbs to describe responsibilities and accomplishments, making statements more impactful.

- Align your experiences with industry standards and current tax law trends to show relevance.

- Prioritize achievements that reflect collaborative efforts, emphasizing teamwork and communication.

- Tailor the descriptions to reflect the specific skills sought by potential employers in the tax law sector.

- Maintain clarity and conciseness to ensure readability while providing enough detail to showcase expertise.

Example Work Experiences for Tax Lawyer

Strong Experiences

- Successfully negotiated a settlement with the IRS that reduced a client's tax liability by 30%, saving them over $500,000.

- Led a team of five attorneys in a complex tax litigation case, resulting in a favorable ruling that set a precedent for future cases.

- Developed and implemented a tax compliance program for a Fortune 500 company, decreasing audit risks by 40% over two years.

- Conducted comprehensive tax training workshops for junior associates, improving team efficiency and knowledge retention by 25%.

Weak Experiences

- Worked on various tax-related projects without specifying outcomes or responsibilities.

- Assisted in filing tax returns for clients.

- Helped with tax research and analysis.

- Participated in team meetings about tax matters.

The examples listed as strong experiences demonstrate clear, quantifiable outcomes and illustrate the candidate's technical leadership and collaborative efforts. They reflect specific achievements that provide tangible evidence of effectiveness in the role. In contrast, the weak experiences lack detail and specificity, failing to communicate the candidate's contributions or the impact of their work. These vague statements do not effectively showcase the candidate's skills or accomplishments, which may leave employers questioning the candidate's qualifications.

Education and Certifications Section for Tax Lawyer Resume

The education and certifications section of a Tax Lawyer resume is crucial as it serves as a testament to the candidate's academic achievements and professional qualifications. This section not only showcases the foundational legal education that is essential for practicing law but also highlights industry-relevant certifications and continuous learning efforts that demonstrate the candidate's commitment to staying abreast of the constantly evolving tax landscape. By including relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and alignment with the specific requirements of the tax law field.

Best Practices for Tax Lawyer Education and Certifications

- Prioritize relevant degrees such as Juris Doctor (JD) and Master of Laws (LL.M) in Taxation.

- Include industry-recognized certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA).

- Detail any specialized training or continuing education courses related to tax law.

- Highlight coursework that is directly applicable to tax law, such as Tax Policy, Corporate Taxation, and Estate Planning.

- Organize the section in reverse chronological order, starting with the most recent qualifications.

- Avoid listing outdated or irrelevant degrees that do not pertain to the field of tax law.

- Consider including honors or distinctions received during your education to further validate expertise.

- Ensure clarity and precision in formatting to enhance readability and professionalism.

Example Education and Certifications for Tax Lawyer

Strong Examples

- Juris Doctor (JD), Harvard Law School, 2015

- LL.M in Taxation, New York University School of Law, 2016

- Certified Public Accountant (CPA), New York State, 2017

- Continuing Education in International Taxation, American Bar Association, 2020

Weak Examples

- Bachelor of Arts in History, University of California, 2010

- Certification in Paralegal Studies, Community College, 2012

- Online Course in Basic Accounting, 2018

- High School Diploma, Local High School, 2006

The strong examples are considered effective because they directly relate to the qualifications and skills necessary for a Tax Lawyer role, demonstrating advanced education and relevant certifications that are respected within the legal and tax communities. In contrast, the weak examples are less impactful as they include irrelevant degrees and certifications that do not contribute to the candidate's expertise in tax law, thereby failing to establish their qualifications for the role effectively.

Top Skills & Keywords for Tax Lawyer Resume

In the competitive field of tax law, a well-crafted resume is essential for standing out to potential employers. Highlighting the right skills can significantly enhance a Tax Lawyer's resume, showcasing not only legal expertise but also the ability to navigate complex tax regulations and provide effective counsel. Both hard and soft skills play a crucial role in demonstrating a candidate's qualifications and suitability for the role, as these skills reflect their ability to communicate, negotiate, and strategize effectively in high-pressure situations. By leveraging skills relevant to tax law, candidates can present themselves as well-rounded professionals capable of meeting the diverse needs of their clients.

Top Hard & Soft Skills for Tax Lawyer

Soft Skills

- Strong Communication Skills

- Analytical Thinking

- Problem-Solving Abilities

- Negotiation Skills

- Attention to Detail

- Time Management

- Client Relationship Management

- Adaptability

- Team Collaboration

- Ethical Judgment

Hard Skills

- Tax Law Knowledge

- Regulatory Compliance

- Tax Planning Strategies

- Legal Research Proficiency

- Litigation Experience

- Financial Acumen

- Familiarity with Tax Software

- Drafting Legal Documents

- Case Management

- Understanding of International Taxation

By incorporating these essential skills into their resumes, tax lawyers can effectively convey their expertise and bolster their work experience to potential employers.

Stand Out with a Winning Tax Lawyer Cover Letter

I am writing to express my interest in the Tax Lawyer position at [Company Name], as advertised on [where you found the job listing]. With a Juris Doctorate from [Your Law School] and over [X years] of experience specializing in tax law, I have developed a comprehensive understanding of the intricacies involved in tax compliance, planning, and dispute resolution. My passion for tax law, combined with my commitment to providing exceptional legal services, makes me a strong candidate for this role.

Throughout my career, I have successfully represented a diverse clientele, ranging from individual taxpayers to large corporations, in complex tax matters. My experience includes negotiating settlements with tax authorities, advising clients on tax-efficient strategies, and conducting thorough legal research to support case arguments. In my previous position at [Previous Company], I played a pivotal role in a high-stakes audit defense that resulted in a favorable settlement for our client, saving them significant financial resources and safeguarding their reputation.

I pride myself on my strong analytical skills and attention to detail, which I believe are crucial for a successful Tax Lawyer. I am adept at interpreting and applying tax laws and regulations, and I stay current with the ever-evolving tax landscape to ensure that my clients receive the most accurate and effective legal advice. Furthermore, my excellent communication skills allow me to simplify complex legal concepts, ensuring that my clients are well-informed and confident in the decisions they make.

I am excited about the opportunity to contribute to [Company Name] and to work alongside a team of dedicated professionals who share my commitment to excellence in tax law. I look forward to the possibility of discussing how my background, skills, and enthusiasms align with the goals of your firm. Thank you for considering my application; I hope to speak with you soon.

Common Mistakes to Avoid in a Tax Lawyer Resume

Creating a compelling resume as a tax lawyer is crucial to stand out in a competitive job market. However, many applicants make common mistakes that can undermine their chances of landing an interview. Understanding these pitfalls can help you craft a more effective resume that highlights your qualifications and experience. Here are some frequent mistakes to avoid when preparing your tax lawyer resume:

Generic Objective Statement: Using a one-size-fits-all objective can make your resume seem impersonal. Tailor your objective to reflect your specific career goals and the unique value you bring to the firm.

Overloading with Jargon: While legal terminology is important, overloading your resume with jargon can make it difficult for HR personnel to understand your qualifications. Strive for clarity and balance technical terms with accessible language.

Neglecting Achievements: Simply listing job duties fails to showcase your accomplishments. Quantify your successes, such as “Successfully reduced client tax liabilities by 30%” to demonstrate your impact.

Ignoring Formatting: A cluttered or inconsistent format can distract from your content. Use clear headings, bullet points, and consistent font styles to enhance readability and professionalism.

Omitting Relevant Experience: Failing to include internships, clerkships, or volunteer opportunities in tax law can weaken your resume. Make sure to highlight all relevant experiences, even if they were not full-time positions.

Not Tailoring for Each Job: Sending out a generic resume for multiple positions can lessen your chances of getting noticed. Tailor your resume for each application by emphasizing the skills and experiences that align with the job description.

Missing Keywords: Many employers use applicant tracking systems (ATS) to filter resumes. If you don’t include relevant keywords from the job posting, your application might never reach human eyes.

Including Irrelevant Information: Adding unrelated work experience or personal hobbies can dilute the focus of your resume. Stick to information that supports your candidacy as a tax lawyer, ensuring each detail adds value to your application.

Conclusion

As we’ve explored throughout this article, a Tax Lawyer plays a critical role in navigating the complex landscape of tax law, providing essential guidance to individuals and businesses alike. Key responsibilities include advising clients on tax issues, representing them in disputes with tax authorities, and ensuring compliance with tax regulations. Given the intricacies of tax legislation, a Tax Lawyer must possess not only legal expertise but also strong analytical skills and attention to detail.

In light of this, it’s essential for aspiring and current Tax Lawyers to present their qualifications effectively. Your resume is often the first impression you make on potential employers, so it must clearly showcase your skills, experiences, and achievements in tax law. Take the time to review and enhance your Tax Lawyer resume to ensure it stands out in a competitive job market.

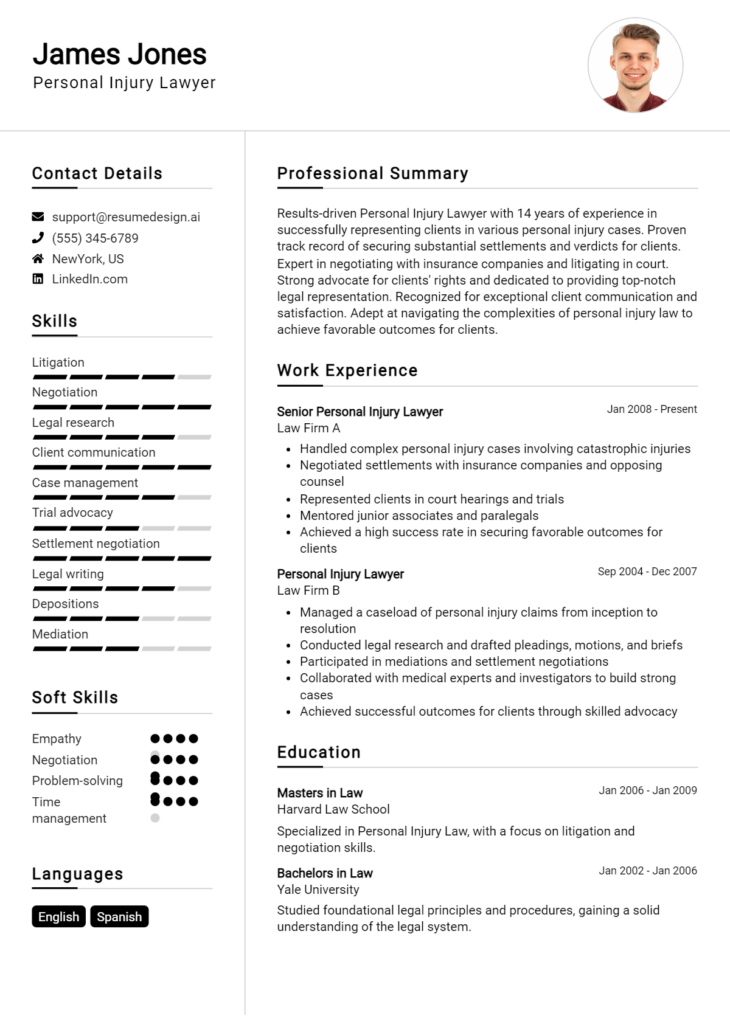

To aid in this process, consider utilizing available tools such as resume templates that offer professional layouts, or a resume builder that can streamline your creation process. You can also explore resume examples for inspiration and ideas on how to format and articulate your qualifications effectively. Additionally, don’t overlook the importance of a strong introduction; a well-crafted cover letter template can complement your resume and provide further insights into your capabilities.

Take action today and ensure your resume reflects the expertise and professionalism that defines a successful Tax Lawyer.