Insurance Customer Service Representative Core Responsibilities

An Insurance Customer Service Representative plays a crucial role in bridging various departments, ensuring seamless communication between clients, underwriting, and claims processing. Key responsibilities include addressing customer inquiries, processing policy applications, and resolving issues efficiently. Essential skills include technical proficiency with insurance software, operational knowledge of policy regulations, and strong problem-solving abilities. Mastering these skills contributes significantly to organizational goals, enhancing customer satisfaction and retention. A well-structured resume can effectively showcase these qualifications, demonstrating the candidate's value to potential employers.

Common Responsibilities Listed on Insurance Customer Service Representative Resume

- Responding to customer inquiries via phone, email, or chat.

- Assisting clients in understanding their insurance policies.

- Processing new insurance applications and renewals.

- Resolving claims-related issues and providing updates.

- Maintaining accurate customer records in the database.

- Coordinating with underwriting and claims departments.

- Educating customers on policy benefits and coverage options.

- Identifying opportunities for upselling or cross-selling policies.

- Ensuring compliance with industry regulations and company policies.

- Gathering customer feedback to improve service quality.

- Training new team members on customer service protocols.

High-Level Resume Tips for Insurance Customer Service Representative Professionals

In the competitive field of insurance, a well-crafted resume is crucial for Insurance Customer Service Representative professionals seeking to make a lasting impression on potential employers. Your resume often serves as the first point of contact, and it needs to effectively showcase your skills, achievements, and understanding of the industry. A strong resume not only highlights your qualifications but also conveys your commitment to providing exceptional customer service. This guide will equip you with practical and actionable tips specifically tailored for creating a standout resume that resonates with hiring managers in the insurance sector.

Top Resume Tips for Insurance Customer Service Representative Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that reflect the specific responsibilities and qualifications mentioned in the posting.

- Highlight your customer service experience, focusing on roles where you directly interacted with clients and provided support, showcasing your ability to resolve issues effectively.

- Quantify your achievements by including metrics such as customer satisfaction ratings, call resolution times, or retention rates to demonstrate your impact in previous positions.

- Include industry-specific skills such as knowledge of insurance policies, claims processing, and familiarity with relevant software or customer relationship management (CRM) tools.

- Utilize a clean and professional format that enhances readability, ensuring that your resume is easy to scan for key information.

- Incorporate action verbs to convey your accomplishments and responsibilities dynamically, such as "resolved," "managed," "coordinated," and "enhanced."

- Highlight any relevant certifications or training, such as a license to sell insurance or customer service training, to underscore your qualifications.

- Showcase soft skills that are vital in customer service roles, such as communication, empathy, problem-solving, and conflict resolution, with specific examples.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and skills that align with the insurance customer service role.

By implementing these tips, Insurance Customer Service Representative professionals can significantly enhance their resumes, making them more appealing to potential employers. A focused and tailored resume not only increases the chances of landing an interview but also sets the stage for showcasing your expertise and dedication to providing outstanding customer service in the insurance industry.

Why Resume Headlines & Titles are Important for Insurance Customer Service Representative

When applying for a position as an Insurance Customer Service Representative, crafting a compelling resume headline or title is crucial. This brief yet impactful phrase serves as the first impression a hiring manager will have of a candidate, effectively summarizing their key qualifications and unique selling points. A strong headline not only grabs attention but also conveys the candidate's suitability for the role, allowing hiring managers to quickly assess their fit. It should be concise, relevant, and tailored specifically to the job being applied for, setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Insurance Customer Service Representative

- Keep it concise: Aim for one to two impactful phrases.

- Be role-specific: Use terminology that aligns with the insurance industry.

- Highlight key skills: Include your most relevant skills or experiences.

- Use action verbs: Start with a strong action verb to convey proactivity.

- Showcase achievements: If applicable, include quantifiable accomplishments.

- Tailor to the job description: Reflect the keywords and requirements from the job posting.

- Avoid clichés: Steer clear of generic phrases that lack specificity.

- Maintain professionalism: Ensure the tone reflects your professionalism and dedication.

Example Resume Headlines for Insurance Customer Service Representative

Strong Resume Headlines

"Customer-Centric Insurance Professional with 5+ Years in Claims Resolution"

“Bilingual Customer Service Expert Specializing in Policy Management and Client Retention”

“Experienced Insurance Representative Dedicated to Enhancing Customer Satisfaction Through Proactive Support”

“Detail-Oriented Claims Specialist with Proven Track Record in Streamlining Processes”

Weak Resume Headlines

“Insurance Professional Looking for Job”

“Customer Service Representative”

Strong headlines are effective because they convey specific skills, experiences, and achievements that directly relate to the role of an Insurance Customer Service Representative, making a memorable first impression. In contrast, weak headlines fail to impress due to their vagueness and lack of pertinent information, leaving hiring managers with no compelling reason to consider the candidate further. By using clear, targeted language, strong headlines not only capture attention but also set the stage for showcasing the candidate's full potential.

Writing an Exceptional Insurance Customer Service Representative Resume Summary

The resume summary is a critical component for an Insurance Customer Service Representative as it serves as the first impression a hiring manager will have of a candidate. A well-crafted summary quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the demands of the role. It should be concise yet impactful, tailored specifically to the job being applied for, ensuring that it effectively communicates the candidate's value proposition and suitability for the position.

Best Practices for Writing a Insurance Customer Service Representative Resume Summary

- Quantify Achievements: Use numbers to showcase your successes, such as how many clients you assisted or the percentage of customer satisfaction improvements.

- Focus on Key Skills: Highlight skills that are directly relevant to customer service in the insurance sector, such as communication, problem-solving, and empathy.

- Tailor to the Job Description: Customize your summary for each application by incorporating keywords and requirements listed in the job posting.

- Be Concise: Limit your summary to 2-3 sentences to maintain clarity and keep the reader engaged.

- Showcase Relevant Experience: Briefly mention your background in the insurance industry or customer service roles that demonstrate your expertise.

- Highlight Customer-Centric Accomplishments: Emphasize achievements that reflect your ability to enhance customer experiences and resolve issues efficiently.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of proactivity and competence.

- Avoid Jargon: Ensure your language is accessible and straightforward, steering clear of overly technical terms that might confuse the reader.

Example Insurance Customer Service Representative Resume Summaries

Strong Resume Summaries

Dedicated Insurance Customer Service Representative with over 5 years of experience in enhancing client satisfaction, achieving a 95% customer retention rate. Proven ability to manage high-volume inquiries while resolving complex issues efficiently.

Dynamic professional with 4 years in the insurance sector, consistently recognized for reducing claim processing time by 30% through effective communication and problem-solving skills. Passionate about delivering exceptional service and building client relationships.

Results-driven Customer Service Representative with a track record of exceeding sales targets by 20% annually. Skilled in utilizing CRM software to streamline operations and enhance customer experience in the insurance industry.

Weak Resume Summaries

I am an experienced customer service representative looking for a new opportunity in the insurance field. I believe I can help customers and make them happy.

Motivated individual with some experience in customer service. I aim to provide good service to clients in the insurance industry.

The strong resume summaries stand out because they are specific, quantifiable, and directly relevant to the role of an Insurance Customer Service Representative. Each of these examples highlights tangible achievements and skills that demonstrate the candidate's value. In contrast, the weak resume summaries are vague and lack detail, failing to convey qualifications or a clear sense of what the candidate can offer to potential employers. They do not provide measurable outcomes or specific skills, which diminishes their impact.

Work Experience Section for Insurance Customer Service Representative Resume

The work experience section is a vital component of an Insurance Customer Service Representative resume, as it provides a comprehensive view of a candidate's relevant skills and accomplishments in the industry. This section not only highlights technical expertise in insurance products and customer service protocols but also demonstrates the candidate's ability to manage teams and deliver high-quality service. By quantifying achievements and aligning experiences with industry standards, candidates can effectively showcase their value to potential employers, thereby increasing their chances of securing an interview.

Best Practices for Insurance Customer Service Representative Work Experience

- Use specific metrics to quantify your achievements, such as customer satisfaction scores or policy retention rates.

- Highlight technical skills relevant to insurance software and customer relationship management (CRM) tools.

- Include examples of leadership roles, such as training new hires or leading a team project.

- Showcase collaboration with other departments, such as underwriting or claims, to improve customer service outcomes.

- Tailor your experience to reflect industry standards and job-specific requirements outlined in the job description.

- Utilize action verbs to describe your responsibilities and contributions effectively.

- Focus on problem-solving abilities by detailing how you addressed customer issues and improved processes.

- Keep the format clean and professional, using bullet points for easy readability.

Example Work Experiences for Insurance Customer Service Representative

Strong Experiences

- Implemented a new customer feedback system that increased customer satisfaction ratings by 25% within six months.

- Led a team of 10 in streamlining the claims process, resulting in a 15% reduction in processing time and a 20% increase in resolution rates.

- Trained and mentored 15 new customer service representatives, improving their performance metrics by an average of 30% in the first quarter.

- Collaborated with the underwriting team to develop training materials that improved policy understanding, reducing errors by 40%.

Weak Experiences

- Handled customer inquiries and provided information about insurance products.

- Worked with team members to achieve department goals.

- Assisted in various administrative tasks related to customer service.

- Participated in team meetings and contributed to discussions.

The examples listed as strong experiences demonstrate clear, quantifiable outcomes and specific contributions to team success, showcasing technical leadership and collaboration effectively. In contrast, the weak experiences lack detail and measurable achievements, making them less impactful and failing to highlight the candidate's true capabilities in the insurance customer service field.

Education and Certifications Section for Insurance Customer Service Representative Resume

The education and certifications section of an Insurance Customer Service Representative resume is crucial in showcasing a candidate's academic background, industry-relevant certifications, and commitment to continuous learning. This section serves as a testament to the candidate's preparedness for the role, underlining their understanding of insurance concepts and customer service principles. By providing details on relevant coursework, specialized training, and certifications, candidates can significantly enhance their credibility and demonstrate their alignment with the job's requirements, ultimately making them more appealing to potential employers.

Best Practices for Insurance Customer Service Representative Education and Certifications

- Prioritize relevant degrees and certifications directly related to insurance and customer service.

- Include specific coursework that highlights skills applicable to the role, such as communication or conflict resolution.

- List advanced or industry-recognized credentials, such as the Insurance Service Representative (ISR) designation.

- Keep information concise and relevant, avoiding unnecessary details about unrelated degrees.

- Highlight any ongoing education or professional development courses that demonstrate a commitment to staying updated in the field.

- Format the section in a clear, easy-to-read manner to enhance visual appeal and accessibility.

- Consider adding dates to show recent education or certifications, indicating current knowledge and skills.

- Be honest about qualifications, avoiding exaggeration or misleading information.

Example Education and Certifications for Insurance Customer Service Representative

Strong Examples

- Bachelor of Science in Business Administration with a focus on Risk Management, XYZ University, 2022

- Certified Customer Service Professional (CCSP), Customer Service Institute, 2023

- Coursework in Insurance Principles and Practices, ABC Community College, 2021

- Licensed Insurance Agent, State of California, 2021

Weak Examples

- Associate Degree in Culinary Arts, DEF College, 2018

- Certification in Fitness Training, GHI Institute, 2019

- High School Diploma, Random High School, 2017

- Outdated Certification in Office Management, JKL Organization, 2015

The examples categorized as strong are considered relevant because they directly align with the skills and knowledge required for an Insurance Customer Service Representative position. They demonstrate a solid educational foundation in business and insurance, as well as certifications that signify competency in customer service. Conversely, the weak examples reflect qualifications that are unrelated to the job role, indicating a lack of focus on industry-specific knowledge or skills, which can detract from the candidate's suitability for the position.

Top Skills & Keywords for Insurance Customer Service Representative Resume

As an Insurance Customer Service Representative, your resume must effectively showcase a blend of essential skills that highlight your ability to assist clients and navigate complex insurance systems. Skills play a critical role in demonstrating your competency and suitability for the job, as they reflect both your technical knowledge and interpersonal abilities. Employers seek candidates who can communicate clearly, empathize with clients, and resolve issues efficiently while maintaining a professional demeanor. By emphasizing the right combination of soft and hard skills in your resume, you can significantly enhance your chances of standing out in a competitive job market.

Top Hard & Soft Skills for Insurance Customer Service Representative

Soft Skills

- Excellent communication skills

- Active listening

- Empathy and emotional intelligence

- Problem-solving abilities

- Patience and resilience

- Attention to detail

- Time management

- Adaptability and flexibility

- Teamwork and collaboration

- Conflict resolution

Hard Skills

- Knowledge of insurance policies and regulations

- Proficiency in customer relationship management (CRM) software

- Data entry and management

- Familiarity with claims processing

- Basic accounting and financial principles

- Technical proficiency in Microsoft Office Suite

- Ability to analyze and interpret policy documents

- Understanding of risk assessment and underwriting

- Familiarity with state and federal insurance laws

- Knowledge of sales techniques and upselling strategies

For further insights into enhancing your resume, consider exploring various skills and work experience that can make your application more compelling.

Stand Out with a Winning Insurance Customer Service Representative Cover Letter

Dear Hiring Manager,

I am excited to apply for the Insurance Customer Service Representative position at [Company Name] as advertised. With a robust background in customer service and a keen understanding of the insurance industry, I am confident in my ability to contribute positively to your team. My experience working in fast-paced environments has equipped me with the skills necessary to handle inquiries, resolve concerns, and provide exceptional support to clients while ensuring compliance with company policies and regulations.

During my previous role at [Previous Company Name], I successfully managed a high volume of customer interactions, addressing inquiries related to policy details, claims processing, and billing issues. My dedication to delivering personalized service resulted in a 20% increase in customer satisfaction ratings within my department. I am adept at utilizing various software platforms to track and manage customer interactions, ensuring that all information is accurate and up-to-date. Additionally, my ability to communicate complex insurance concepts in a clear and concise manner has enabled me to build strong relationships with clients, fostering trust and loyalty.

I am particularly drawn to [Company Name] because of its commitment to providing top-notch service and innovative insurance solutions. I admire your focus on customer-centric practices and believe that my proactive approach to problem-solving aligns perfectly with your company’s values. I am eager to bring my expertise in customer service and my passion for helping others to your team, contributing to the continued success of [Company Name].

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experience can benefit your organization. I am excited about the possibility of joining your team and am confident that I can make a meaningful impact as an Insurance Customer Service Representative.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Customer Service Representative Resume

When crafting a resume for the role of an Insurance Customer Service Representative, it's crucial to present your qualifications and experience in a clear and compelling manner. However, many candidates fall into common pitfalls that can undermine their chances of landing an interview. By being aware of these mistakes, you can tailor your resume to better reflect your skills and suitability for the position, ultimately enhancing your chances of success.

Generic Objective Statement: Using a vague or generic objective statement fails to capture the attention of hiring managers. Instead, customize your objective to reflect your specific career goals and the value you bring to the role.

Lack of Relevant Experience: Omitting pertinent experience or failing to showcase transferable skills can weaken your application. Highlight any customer service, sales, or insurance-related experience, even if it comes from different industries.

Ignoring Keywords: Many companies use applicant tracking systems (ATS) to filter resumes. Neglecting to include relevant keywords from the job description can lead to your resume being overlooked. Tailor your resume with industry-specific terms and phrases.

Overloading with Responsibilities: Simply listing job duties without demonstrating achievements can leave your resume lacking impact. Focus on quantifiable results and accomplishments that showcase your effectiveness in previous roles.

Unprofessional Formatting: A cluttered or overly complex layout can distract from your content. Opt for a clean, professional format with clear headings, bullet points, and a consistent font to ensure readability.

Typos and Grammatical Errors: Submitting a resume with spelling or grammatical errors reflects poorly on your attention to detail. Always proofread your document multiple times or use tools to catch errors before submission.

Neglecting Soft Skills: Customer service roles heavily rely on soft skills such as communication, empathy, and problem-solving. Failing to highlight these skills can make your resume less appealing to prospective employers.

Inconsistent Employment History: Gaps in employment or frequent job changes should be addressed. Be prepared to explain these in your cover letter or during an interview, and consider using a functional resume format if needed to highlight skills over specific job timelines.

Conclusion

As we conclude our exploration of the Insurance Customer Service Representative role, it’s essential to reflect on the vital skills and experiences that can set you apart in this competitive field. We’ve discussed the importance of effective communication, empathy, and problem-solving abilities, as well as the necessity for a strong understanding of insurance products and regulations. Additionally, building rapport with clients and maintaining a customer-centric approach are crucial for success.

Now, as you consider your next steps in pursuing a fulfilling career as an Insurance Customer Service Representative, take a moment to review and refine your resume. Highlight your relevant skills and experiences that align with the demands of this role.

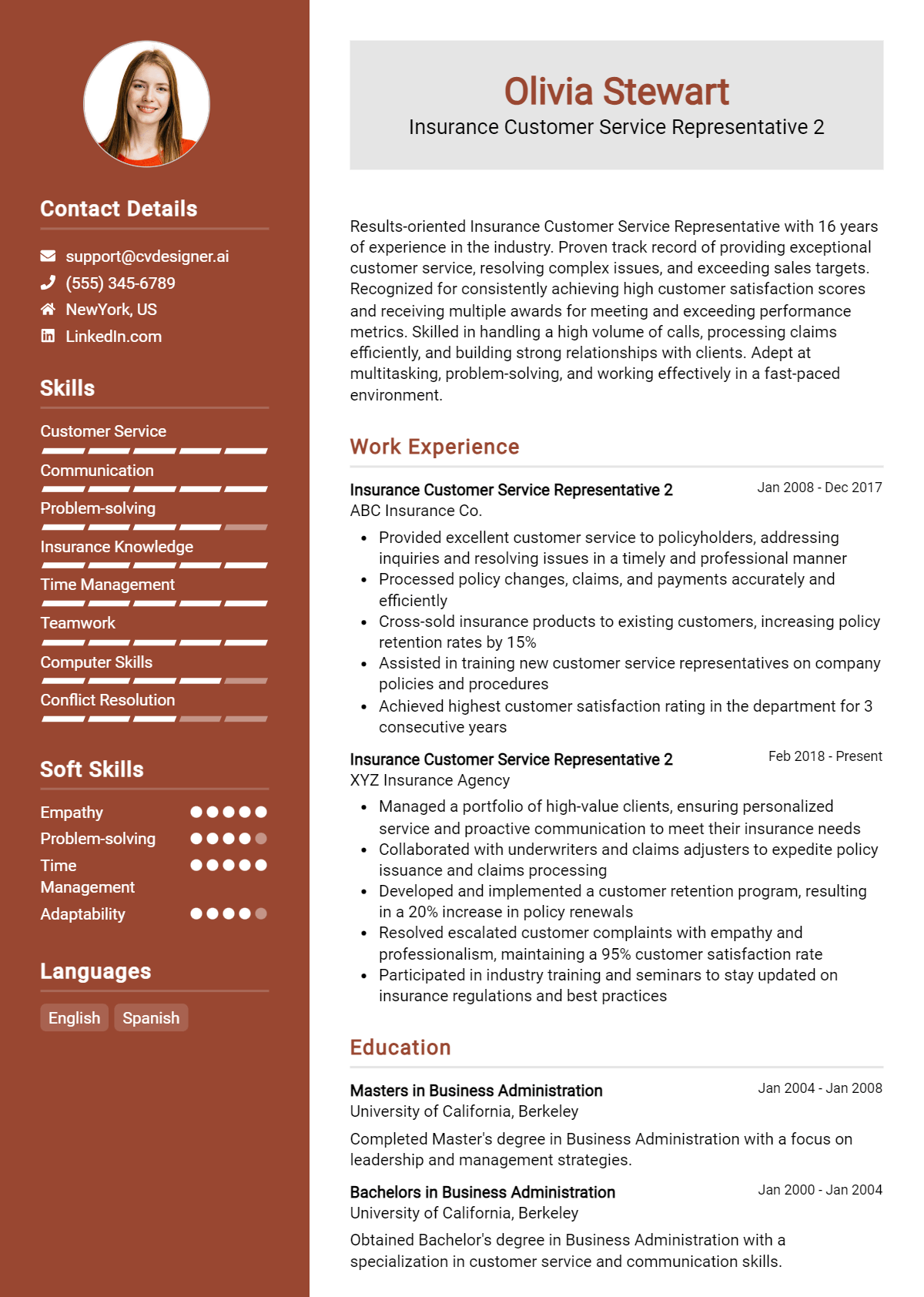

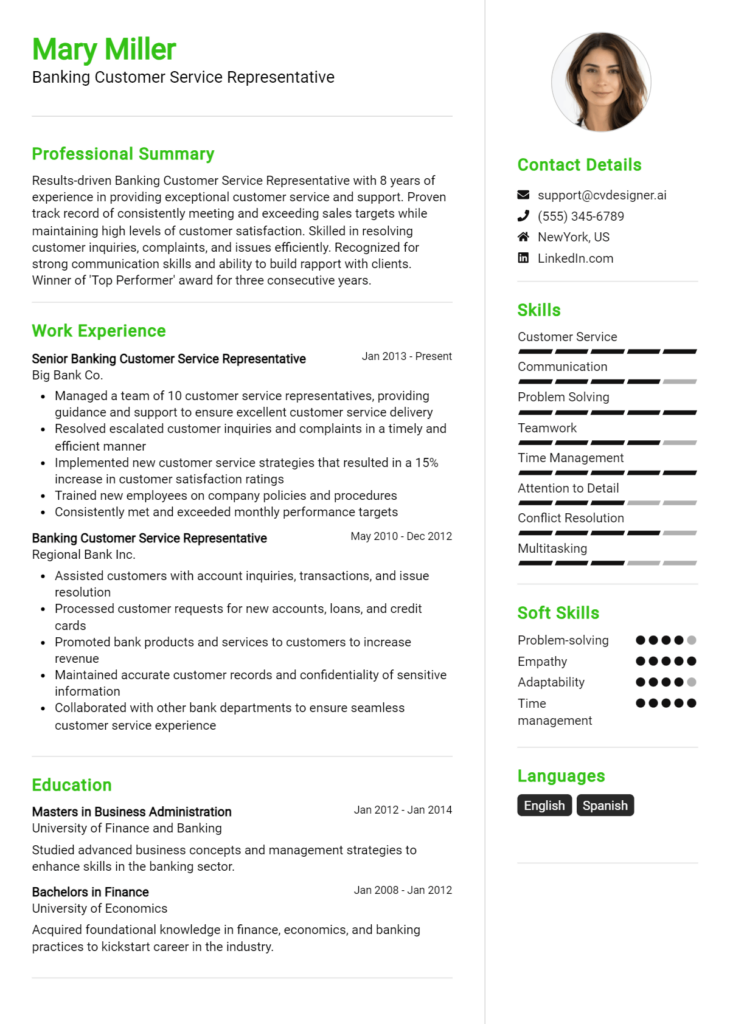

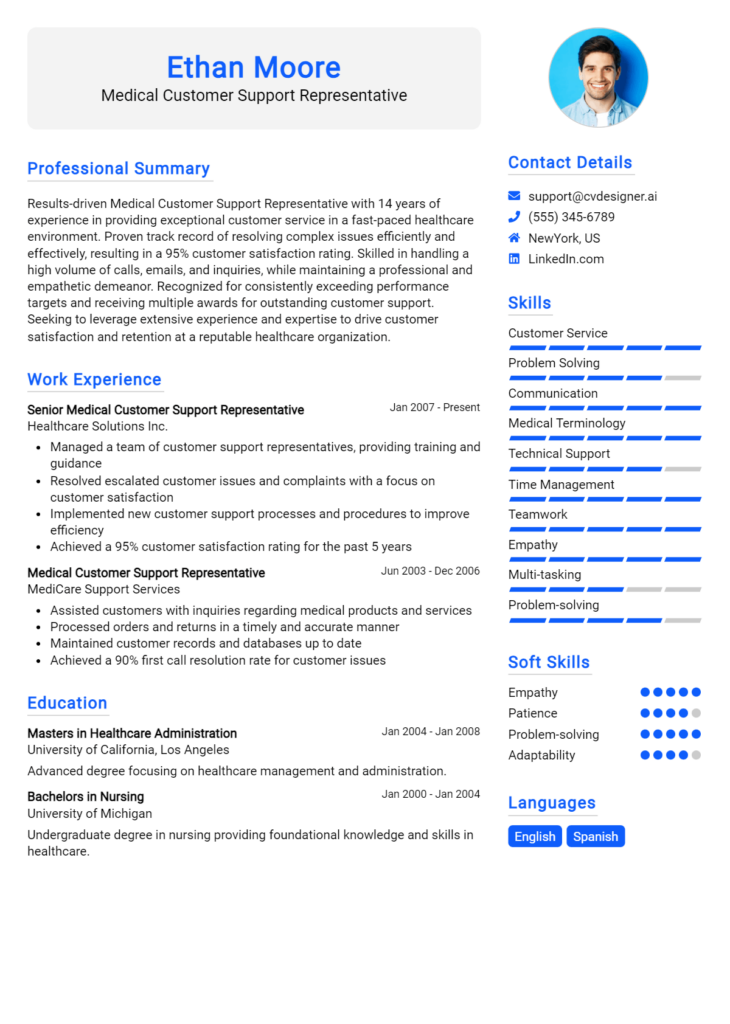

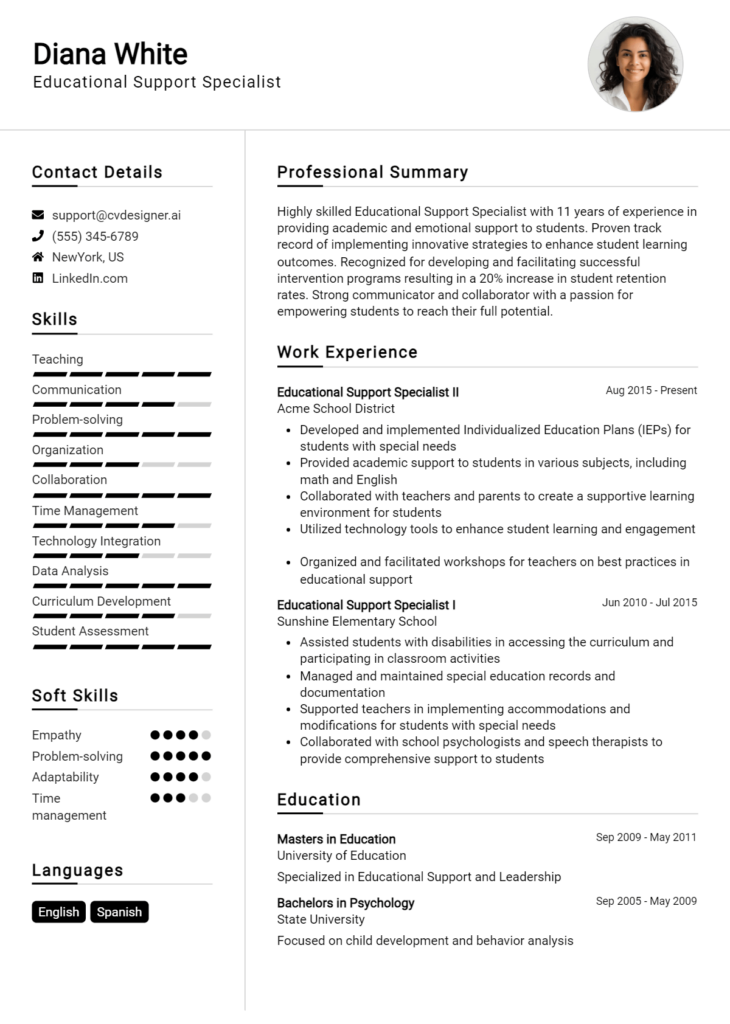

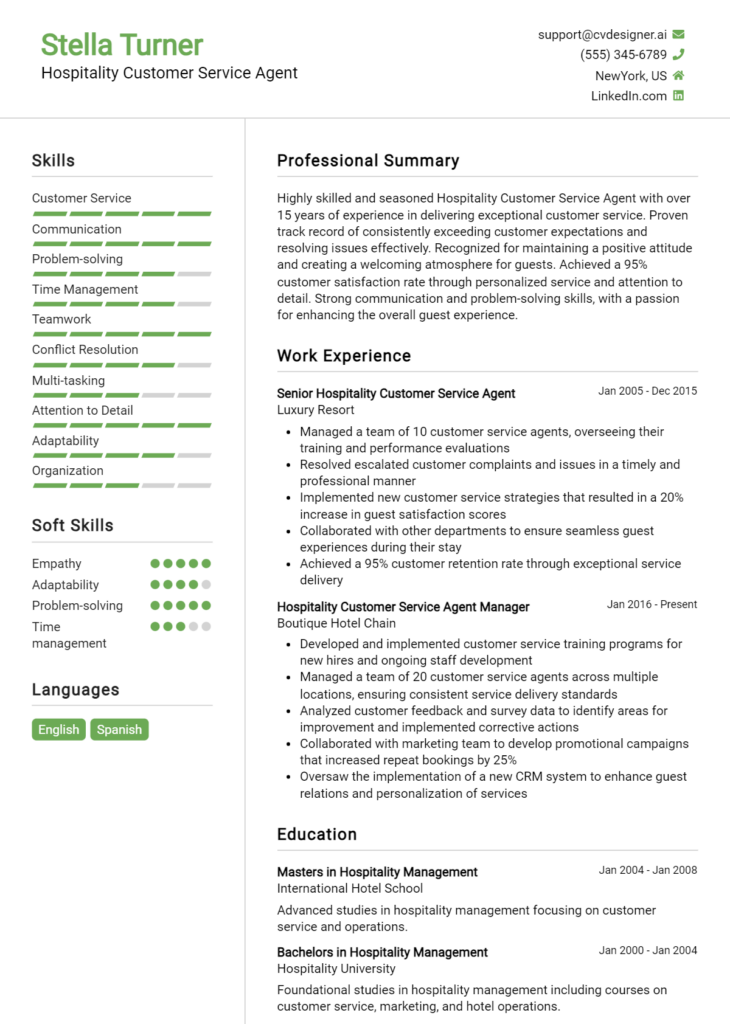

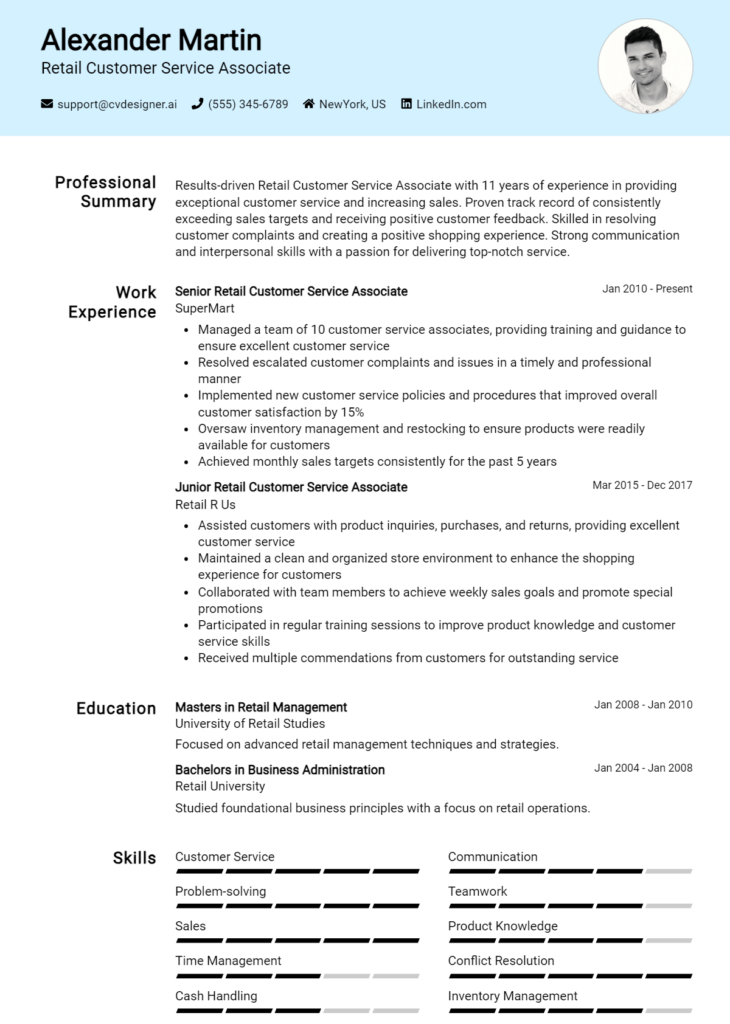

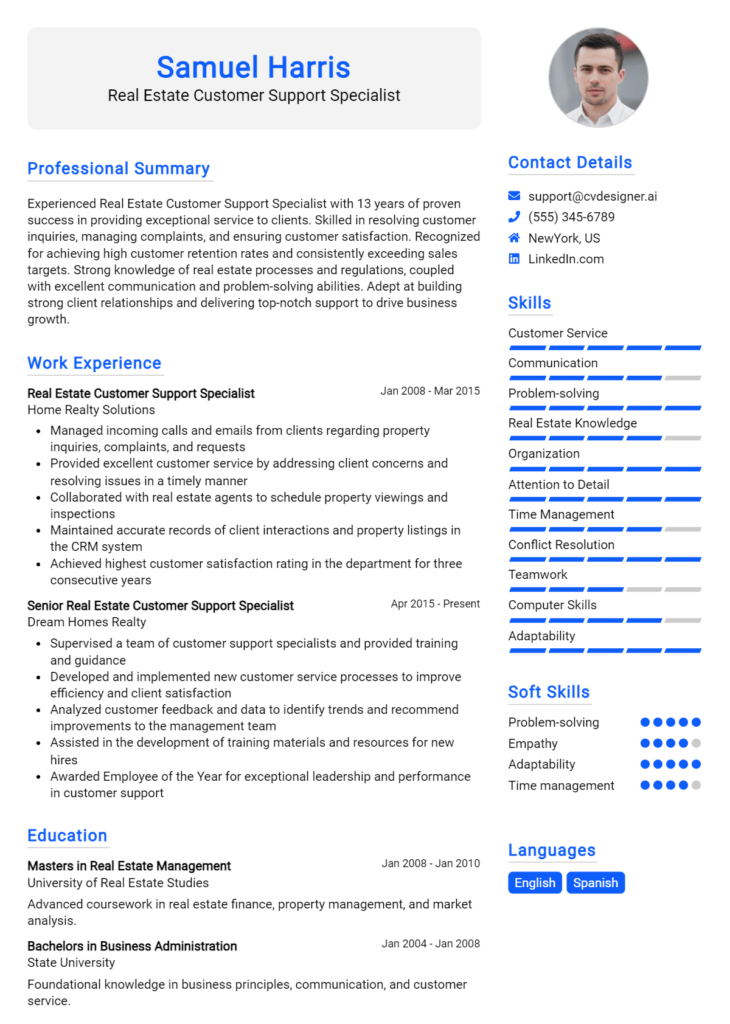

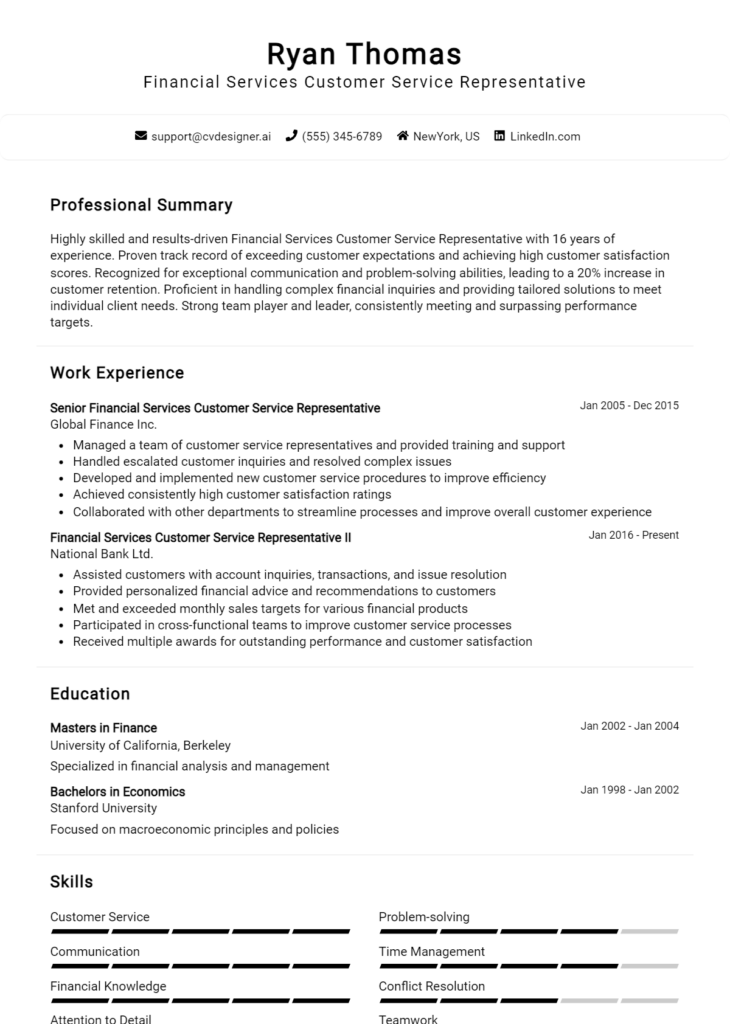

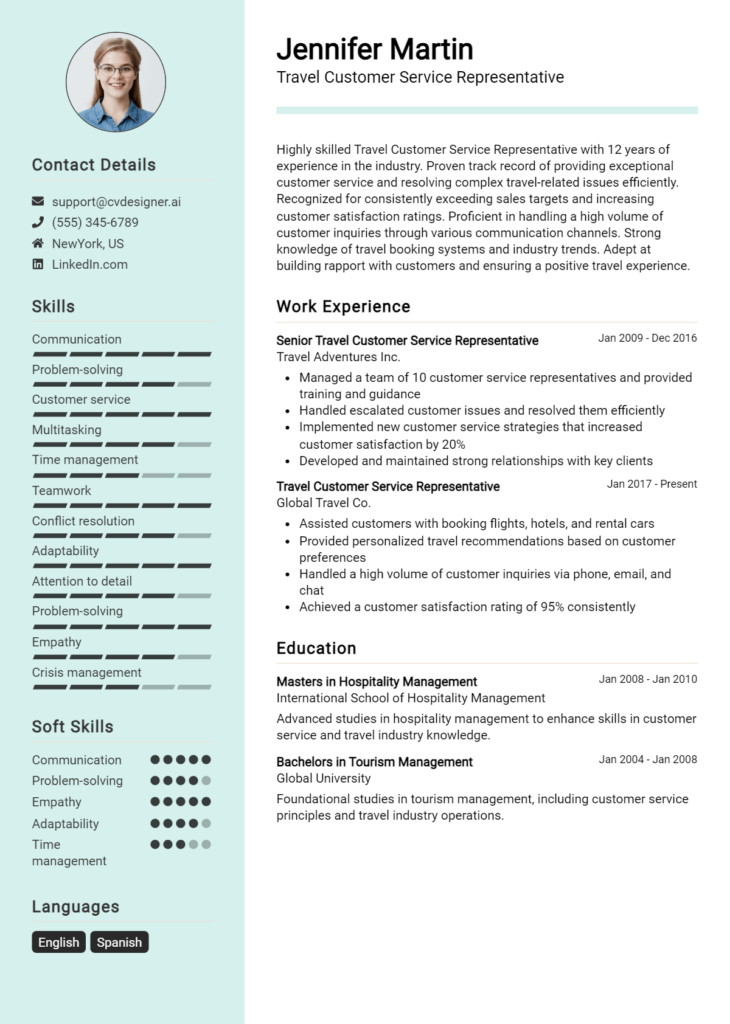

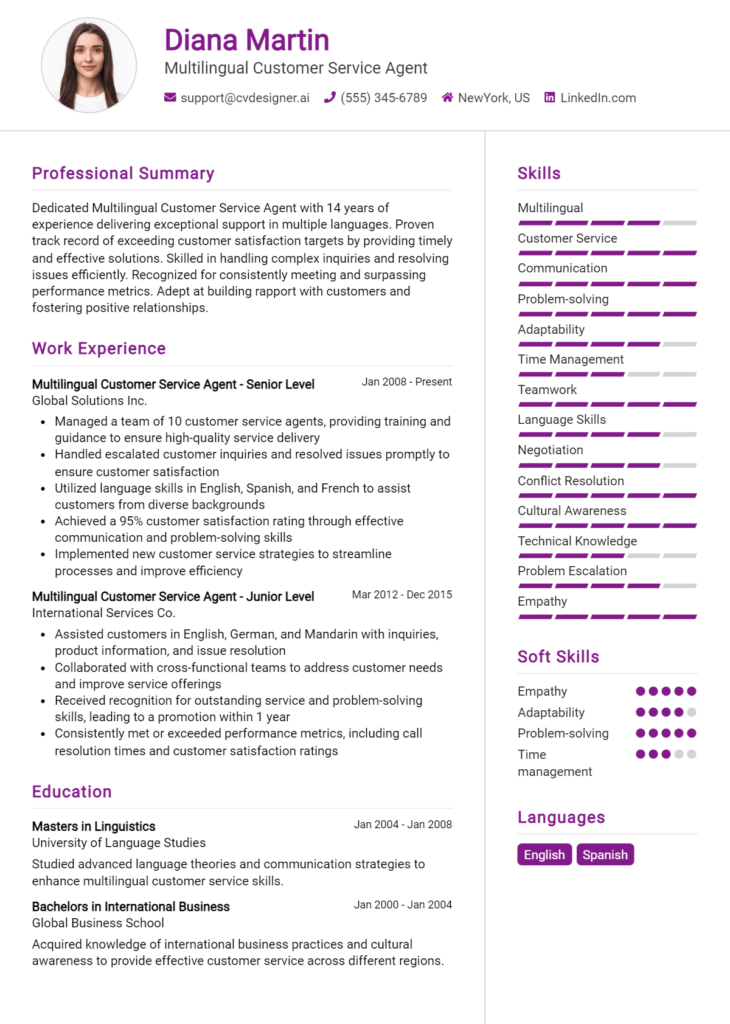

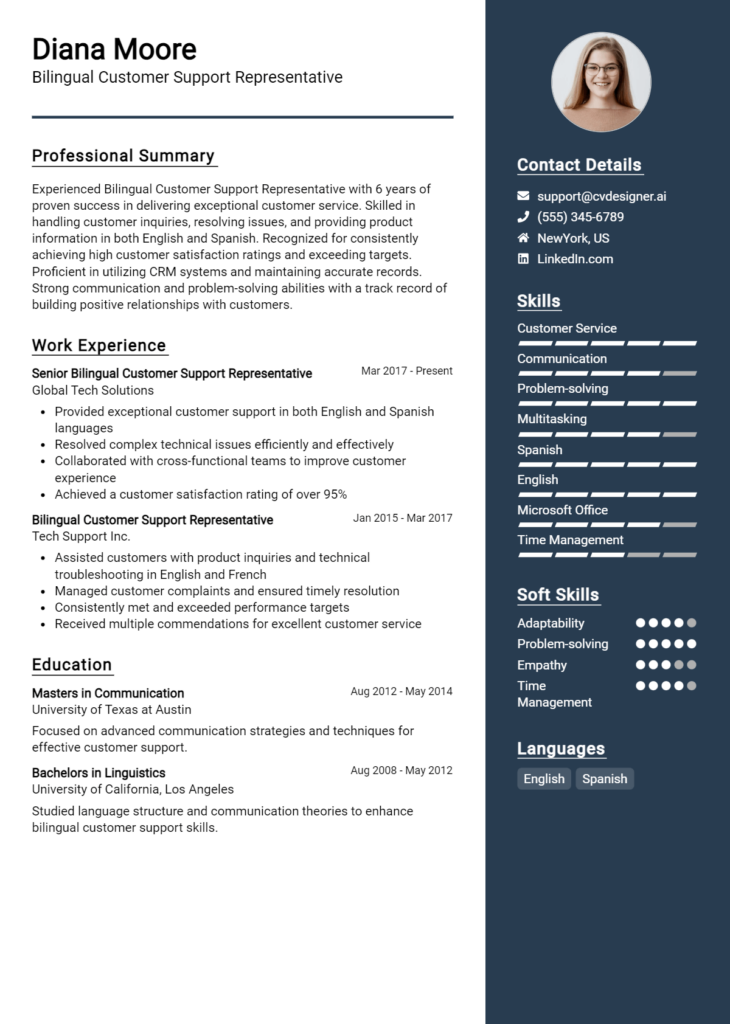

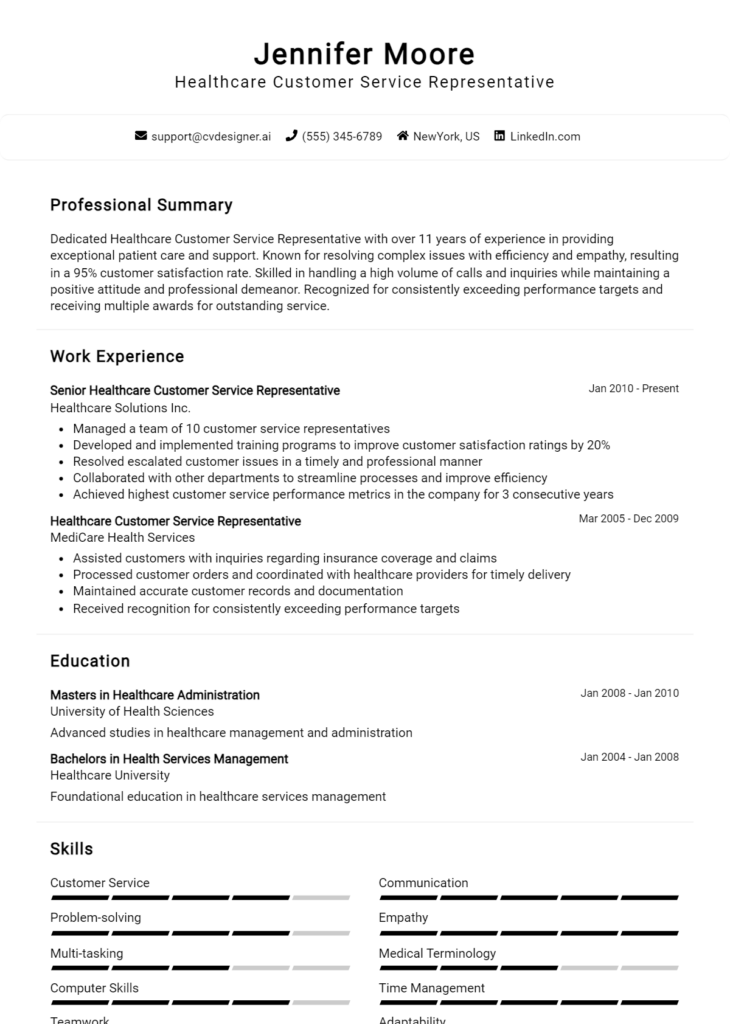

To assist you in this process, there are valuable resources available. Check out resume templates to find a layout that suits your style, utilize the resume builder for an easy and efficient way to craft your resume, explore resume examples for inspiration, and ensure your application stands out with a compelling cover letter template.

Take action today and start polishing your resume to seize the opportunities in the insurance industry!