Insurance Data Analyst Core Responsibilities

As an Insurance Data Analyst, professionals are tasked with analyzing complex datasets to inform decision-making across departments such as underwriting, claims, and marketing. Key responsibilities include data collection, trend analysis, and reporting insights to enhance operational efficiency. Essential skills encompass technical proficiency in statistical tools, strong problem-solving abilities, and effective communication to bridge gaps between teams. A well-structured resume highlighting these competencies is crucial for demonstrating how they contribute to the organization’s strategic objectives.

Common Responsibilities Listed on Insurance Data Analyst Resume

- Collecting and analyzing insurance data for trends and insights

- Creating and maintaining reports to support business decisions

- Collaborating with underwriting and claims teams to improve processes

- Developing predictive models to assess risk

- Utilizing statistical software for data analysis

- Presenting findings to stakeholders in clear, actionable formats

- Monitoring industry trends to inform strategic planning

- Ensuring data accuracy and integrity across systems

- Assisting in the design of data collection methodologies

- Providing insights to optimize pricing and product development

- Conducting ad-hoc analysis to address operational challenges

- Training staff on data management best practices

High-Level Resume Tips for Insurance Data Analyst Professionals

In today's competitive job market, a well-crafted resume is essential for Insurance Data Analyst professionals looking to make a lasting impression on potential employers. Often, your resume serves as the first point of contact between you and your future employer, making it crucial to showcase not just your skills but also your tangible achievements in the field. A strong resume should effectively communicate your expertise in data analysis, risk assessment, and the insurance industry, positioning you as a standout candidate. This guide will provide practical and actionable resume tips specifically tailored for Insurance Data Analyst professionals, helping you to refine your application and increase your chances of success.

Top Resume Tips for Insurance Data Analyst Professionals

- Tailor your resume to match the job description by incorporating relevant keywords and phrases that align with the specific role.

- Highlight your technical skills, such as proficiency in data analysis tools (e.g., SQL, R, Python) and software (e.g., SAS, Tableau) commonly used in the insurance industry.

- Showcase your relevant work experience, detailing specific roles and responsibilities that demonstrate your expertise in data analysis and decision-making.

- Quantify your achievements by including metrics and data points that illustrate your contributions, such as percentage improvements or cost savings.

- Include industry-specific knowledge, such as familiarity with regulatory standards, underwriting processes, and risk management strategies.

- Utilize a clean and professional format that enhances readability, making it easy for hiring managers to quickly identify key information.

- Incorporate a summary statement at the top of your resume that succinctly outlines your career goals and key competencies.

- List relevant certifications and trainings, such as Chartered Property Casualty Underwriter (CPCU) or Associate in Risk Management (ARM), to bolster your qualifications.

- Emphasize your problem-solving abilities and analytical thinking through examples of how you've tackled challenges in previous roles.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job in the Insurance Data Analyst field. A well-structured and tailored resume not only highlights your qualifications but also demonstrates your commitment to the role, setting you apart from other candidates in this competitive industry.

Why Resume Headlines & Titles are Important for Insurance Data Analyst

In the competitive field of insurance data analysis, a well-crafted resume headline or title serves as your first opportunity to make a lasting impression on hiring managers. It acts as a concise summary that highlights your key qualifications and areas of expertise, allowing you to stand out among numerous applicants. A strong headline can immediately capture attention, setting the tone for the rest of your resume. It should be relevant to the specific job you are applying for, ensuring that it effectively communicates your value proposition in just a few words.

Best Practices for Crafting Resume Headlines for Insurance Data Analyst

- Keep it concise: Aim for one impactful phrase that encapsulates your expertise.

- Make it role-specific: Tailor your headline to reflect the specific position you’re applying for.

- Highlight key strengths: Focus on your most relevant skills or experiences that align with the job description.

- Use industry-specific terminology: Incorporate relevant jargon or keywords that resonate within the insurance sector.

- Avoid clichés: Steer clear of overused phrases that lack originality and specificity.

- Showcase accomplishments: If possible, include quantifiable achievements to demonstrate your impact.

- Be clear and direct: Ensure that your headline communicates your professional identity without ambiguity.

- Stay relevant: Continuously update your headline to reflect your latest skills and experiences related to the industry.

Example Resume Headlines for Insurance Data Analyst

Strong Resume Headlines

"Data-Driven Insurance Analyst with 5+ Years of Experience in Risk Assessment and Predictive Modeling"

“Proficient Insurance Data Analyst Specializing in Data Visualization and Regulatory Compliance”

“Results-Oriented Analyst with Expertise in Big Data Analytics and Claims Optimization”

Weak Resume Headlines

“Insurance Analyst Looking for a Job”

“Experienced Professional in Data Analysis”

The strong headlines are effective because they provide specific information about the candidate's skills, experiences, and areas of expertise, immediately signaling to hiring managers that the applicant is a strong fit for the role. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail, making it difficult for employers to gauge the candidate's qualifications or differentiate them from other applicants. A compelling headline can serve as a powerful tool in establishing a candidate's presence and relevance in the competitive job market for insurance data analysts.

Writing an Exceptional Insurance Data Analyst Resume Summary

A well-crafted resume summary is crucial for an Insurance Data Analyst, as it serves as the first impression to hiring managers. This brief yet powerful paragraph quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments tailored to the job role. A strong summary is concise, impactful, and specifically aligned with the requirements of the position, ensuring that the candidate stands out in a competitive job market.

Best Practices for Writing a Insurance Data Analyst Resume Summary

- Quantify Achievements: Use numbers and percentages to showcase the impact of your work, such as improved efficiency or increased revenue.

- Focus on Relevant Skills: Highlight technical skills such as data analysis, statistical software proficiency, and knowledge of insurance regulations.

- Tailor to the Job Description: Reflect the language and requirements found in the job posting to demonstrate alignment with the employer’s needs.

- Keep It Concise: Aim for 2-4 sentences that deliver maximum information without unnecessary detail.

- Showcase Industry Knowledge: Include insights into the insurance industry and how your analysis can drive business decisions.

- Include Professional Experience: Mention your years of experience and specific roles that relate to data analysis within the insurance sector.

- Highlight Soft Skills: Don't overlook essential interpersonal skills, such as communication and teamwork, which are vital for presenting data insights effectively.

- Use Action Verbs: Start with strong action verbs to convey confidence and proactivity in your work approach.

Example Insurance Data Analyst Resume Summaries

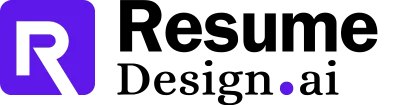

Strong Resume Summaries

Detail-oriented Insurance Data Analyst with over 5 years of experience in leveraging data analytics to enhance underwriting processes, resulting in a 15% reduction in claims costs. Proficient in SQL, R, and Tableau, with a strong background in predictive modeling and risk assessment.

Results-driven Insurance Data Analyst skilled in statistical analysis and data visualization, having improved reporting accuracy by 30% through the implementation of automated data collection processes. Experienced in collaborating with cross-functional teams to support strategic decision-making.

Dynamic Insurance Data Analyst with a proven track record of using advanced analytics to drive business performance. Successfully led a project that increased policy renewal rates by 25% by analyzing customer data trends and implementing targeted marketing strategies.

Weak Resume Summaries

I am an experienced data analyst looking for a job in the insurance industry. I have some skills and knowledge related to data analysis.

Proficient in data analysis with experience in various fields. I am eager to contribute to your company and help with data-related tasks.

The examples provided illustrate a clear distinction between strong and weak resume summaries. Strong summaries are specific, quantifying achievements and emphasizing relevant skills that directly relate to the Insurance Data Analyst role. In contrast, weak summaries lack detail, are overly generic, and fail to convey the candidate's impact or suitability for the position, making them less compelling to hiring managers.

Work Experience Section for Insurance Data Analyst Resume

The work experience section of an Insurance Data Analyst resume is a vital component that highlights a candidate's professional journey and technical prowess. This section not only demonstrates the individual’s ability to handle complex datasets and utilize analytical tools but also reflects their capacity to lead teams and ensure the delivery of high-quality products. By quantifying achievements and aligning their experience with industry standards, candidates can effectively illustrate their value to potential employers, making it clear how their background and skills can contribute to the success of the organization.

Best Practices for Insurance Data Analyst Work Experience

- Emphasize technical skills relevant to the insurance industry, such as proficiency in statistical software and data visualization tools.

- Quantify results, using specific metrics to showcase the impact of your work on business outcomes.

- Highlight collaborative projects, demonstrating your ability to work with cross-functional teams.

- Use action verbs to convey a strong sense of initiative and leadership in your role.

- Align your experiences with industry standards and job descriptions to ensure relevance.

- Include diverse experiences, such as internships or relevant projects, to show a well-rounded skill set.

- Tailor your descriptions to reflect both technical and soft skills necessary for the position.

- Keep the language clear and concise, avoiding jargon that may not be familiar to all readers.

Example Work Experiences for Insurance Data Analyst

Strong Experiences

- Led a project to develop a predictive analytics model that improved underwriting accuracy by 25%, resulting in a reduction of claims costs by $500,000 annually.

- Collaborated with a team of data scientists to automate reporting processes, reducing report generation time from 10 hours to 2 hours per week.

- Implemented a data quality assurance program that increased data integrity by 30%, significantly enhancing the reliability of analytics for decision-making.

- Managed a cross-departmental team to deploy a customer segmentation analysis, which increased targeted marketing effectiveness and improved customer retention by 15%.

Weak Experiences

- Worked with data in various projects.

- Helped the team with reporting tasks.

- Participated in meetings about data analysis.

- Supported the team with various tasks as needed.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable outcomes and demonstrate leadership and collaborative efforts that directly contributed to organizational goals. In contrast, weak experiences lack detail and quantifiable results, making them less impactful and failing to showcase the candidate's true capabilities and contributions in the field of insurance data analysis.

Education and Certifications Section for Insurance Data Analyst Resume

The education and certifications section of an Insurance Data Analyst resume is crucial for establishing a candidate's academic foundation and showcasing their commitment to professional development. This section not only highlights relevant degrees and industry-recognized certifications but also reflects the candidate's dedication to continuous learning in a rapidly evolving field. By including relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the demands of the job role, making a compelling case for their candidacy.

Best Practices for Insurance Data Analyst Education and Certifications

- Prioritize relevant degrees in fields such as mathematics, statistics, finance, or data analytics.

- Include industry-recognized certifications such as Certified Analytics Professional (CAP) or Associate in Insurance Data Analytics (AIDA).

- List relevant coursework that showcases key skills, such as predictive modeling, risk assessment, or data visualization.

- Highlight any specialized training programs or workshops focused on insurance analytics or data management tools.

- Be specific about the date of certification and institution, ensuring they are current and relevant.

- Consider including GPA if it is impressive (3.5 or above) or if you graduated with honors.

- Use clear formatting to make the section easy to read and navigate.

- Tailor the section to align with the specific requirements listed in the job description.

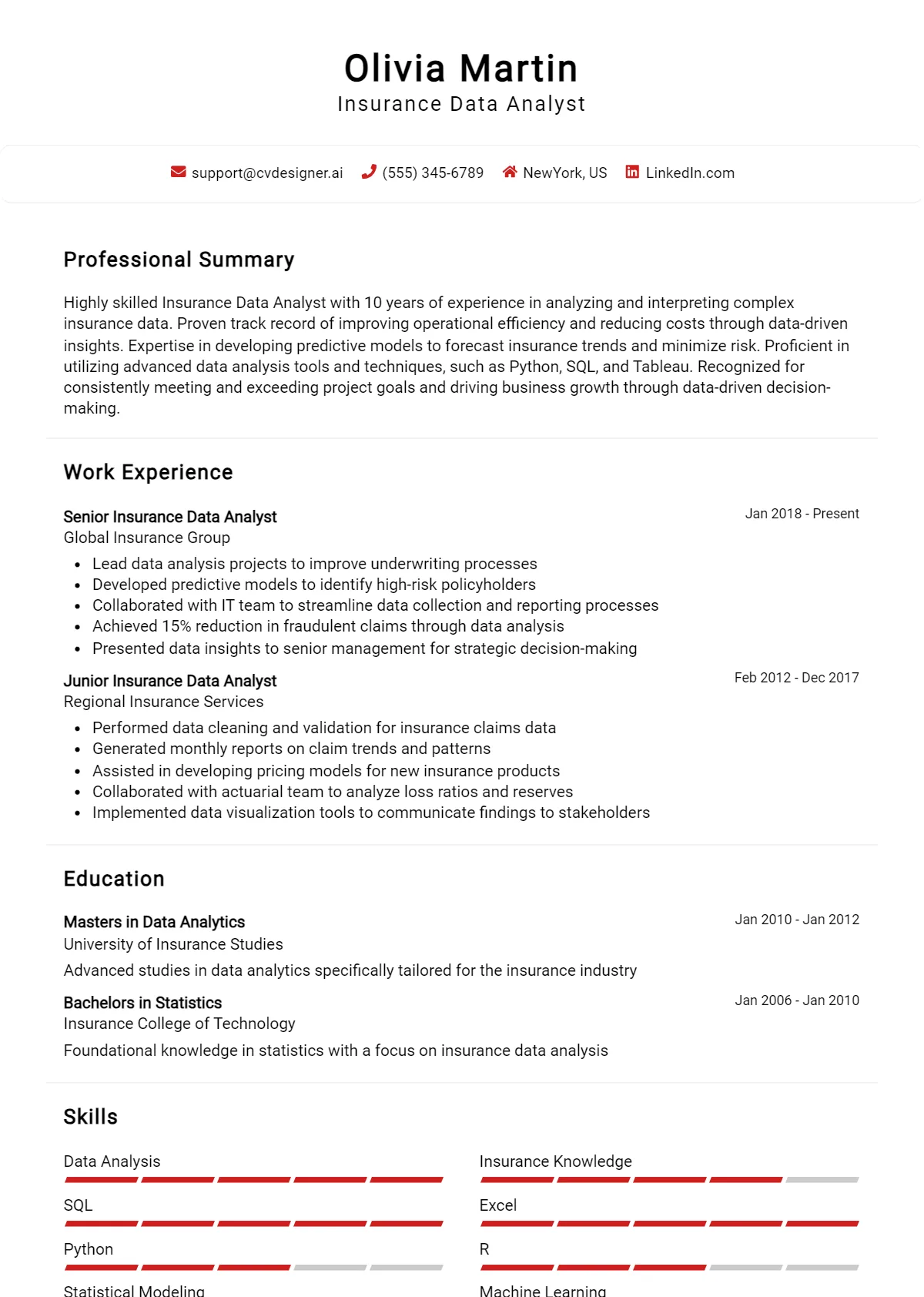

Example Education and Certifications for Insurance Data Analyst

Strong Examples

- Bachelor of Science in Data Analytics, University of XYZ, Graduated May 2022

- Certified Analytics Professional (CAP), Issued October 2023

- Advanced Predictive Modeling and Risk Assessment, Coursera, Completed June 2023

- Associate in Insurance Data Analytics (AIDA), Issued March 2023

Weak Examples

- Bachelor of Arts in English Literature, University of ABC, Graduated May 2020

- Certification in Basic Office Software, Issued January 2021

- Completed a workshop on Creative Writing, May 2022

- High School Diploma, Graduated June 2018

The examples labeled as strong are considered relevant because they directly align with the skills and knowledge required for an Insurance Data Analyst role, demonstrating both academic proficiency and recognized industry standards. In contrast, the weak examples lack relevance to the field, showcasing educational credentials and certifications that do not contribute to the candidate's competency in data analysis or insurance—ultimately diminishing their qualifications for the desired position.

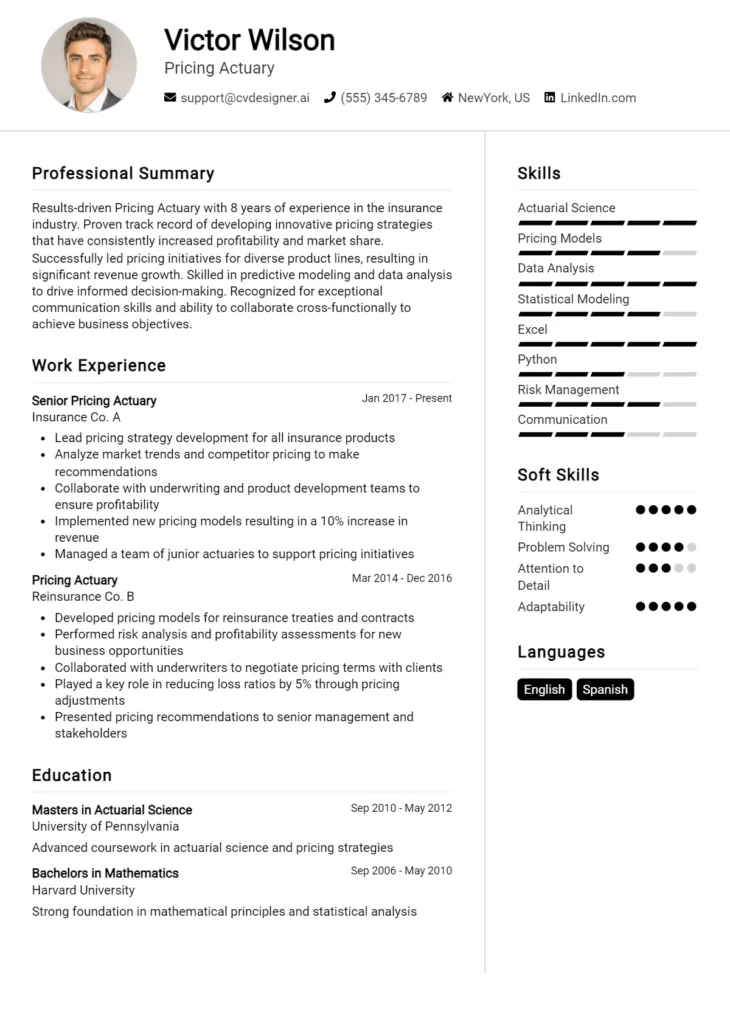

Top Skills & Keywords for Insurance Data Analyst Resume

An effective resume for an Insurance Data Analyst not only highlights relevant work experience but also emphasizes critical skills that demonstrate analytical capabilities and industry knowledge. Employers seek candidates who possess a blend of technical and interpersonal skills, as these are vital for interpreting complex data, generating insights, and communicating findings to stakeholders. By tailoring your resume to showcase both hard and soft skills, you will enhance your appeal to prospective employers in the insurance sector.

Top Hard & Soft Skills for Insurance Data Analyst

Soft Skills

- Attention to Detail

- Critical Thinking

- Problem-Solving

- Communication Skills

- Team Collaboration

- Adaptability

- Time Management

- Analytical Mindset

- Interpersonal Skills

- Decision-Making

Hard Skills

- Data Analysis and Interpretation

- Proficiency in SQL

- Experience with Statistical Software (e.g., R, Python, SAS)

- Knowledge of Data Visualization Tools (e.g., Tableau, Power BI)

- Familiarity with Insurance Regulations and Compliance

- Risk Assessment Techniques

- Database Management

- Advanced Excel Skills

- Predictive Modeling

- Understanding of Actuarial Principles

By incorporating these skills into your resume, you can effectively showcase your qualifications and stand out in the competitive field of insurance data analysis. Additionally, don’t forget to highlight relevant work experience that demonstrates your proficiency in these areas.

Stand Out with a Winning Insurance Data Analyst Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my enthusiasm for the Insurance Data Analyst position at [Company Name], as advertised on [where you found the job listing]. With a strong background in data analysis, a deep understanding of the insurance industry, and a passion for leveraging data to drive decision-making, I am confident in my ability to contribute effectively to your team. My experience with statistical analysis and data visualization tools, combined with my commitment to delivering actionable insights, makes me an ideal candidate for this role.

In my previous role at [Previous Company Name], I successfully managed and analyzed large datasets to identify trends and patterns that informed strategic initiatives. I collaborated with cross-functional teams to develop predictive models that improved underwriting processes and enhanced risk assessment strategies. My proficiency in tools such as SQL, Python, and Tableau allowed me to present complex data in a clear and comprehensible manner, leading to data-driven decisions that increased operational efficiency by [specific percentage or outcome]. I am particularly excited about the opportunity to bring my analytical skills to [Company Name] and contribute to your mission of providing exceptional insurance solutions.

Moreover, I understand the importance of regulatory compliance and risk management in the insurance sector. My ability to interpret regulatory requirements and translate them into data-driven recommendations has empowered my previous employers to navigate compliance challenges effectively. I am eager to apply my expertise to help [Company Name] not only meet regulatory demands but also enhance the overall customer experience through data-driven insights. I believe that my analytical mindset and attention to detail will align well with the goals of your organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences can contribute to the continued success of [Company Name]. I am excited about the possibility of joining your team and helping to harness the power of data in the insurance landscape.

Sincerely,

[Your Name]

[Your LinkedIn Profile]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Data Analyst Resume

When crafting a resume for an Insurance Data Analyst position, it's crucial to present your qualifications and experience effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. Understanding these pitfalls can be the key to creating a compelling resume that stands out. Below are some of the typical mistakes to avoid:

Lack of Relevant Keywords: Failing to include industry-specific keywords related to data analysis and insurance can result in your resume being overlooked by Applicant Tracking Systems (ATS) or hiring managers. Research the job description for relevant terms.

Overly General Descriptions: Using vague terms and general descriptions of past roles can make it difficult for employers to gauge your specific skills and contributions. Instead, provide concrete examples of your accomplishments and responsibilities.

Ignoring Formatting Consistency: Inconsistent formatting, such as varying font sizes and styles, can distract from the content of your resume. Ensure a clean, professional layout with uniform font and spacing for readability.

Neglecting Quantifiable Achievements: Failing to highlight measurable successes can weaken your resume. Use quantifiable metrics to demonstrate the impact of your work, such as “Improved data processing efficiency by 30%.”

Inadequate Tailoring for Each Application: Sending the same generic resume for multiple applications can diminish your chances. Tailor your resume to align with the specific requirements and responsibilities outlined in each job description.

Omitting Soft Skills: While technical skills are critical, neglecting to mention soft skills such as communication, teamwork, and problem-solving can leave a gap in your qualifications. Highlight how these skills complement your technical abilities.

Too Much Focus on Duties Rather Than Impact: Listing job duties without connecting them to the overall impact on the organization can make your resume less compelling. Focus on how your role contributed to the goals and success of your team or company.

Including Irrelevant Information: Adding unrelated experiences or skills can clutter your resume and detract from your qualifications for the position. Focus on including only relevant information that showcases your suitability for the Insurance Data Analyst role.

Conclusion

As an Insurance Data Analyst, you play a crucial role in analyzing complex data sets to drive decision-making and optimize business strategies within the insurance industry. Key responsibilities include collecting and interpreting data, identifying trends, and providing actionable insights to enhance operational efficiency and profitability. Additionally, proficiency in statistical analysis, data visualization tools, and familiarity with industry-specific software is essential for success in this role.

To stand out in a competitive job market, it is vital to have a polished resume that effectively showcases your skills, experiences, and accomplishments. Ensure that your resume reflects not only your analytical capabilities but also your understanding of the insurance sector and your ability to communicate findings to non-technical stakeholders.

Now is the time to take action! Review your Insurance Data Analyst resume and make sure it highlights your relevant experience and skills. You can access a variety of resources to enhance your resume, including resume templates, an easy-to-use resume builder, and resume examples that can inspire your design. Additionally, consider using cover letter templates to complement your application. Don’t miss the opportunity to make a strong impression on potential employers!