Insurance Operations Manager Core Responsibilities

An Insurance Operations Manager plays a crucial role in overseeing the daily operations of insurance processes, ensuring efficiency and compliance across various departments. Key responsibilities include managing workflow, optimizing operational procedures, and facilitating communication between underwriting, claims, and customer service teams. Essential skills comprise technical proficiency in insurance software, operational management, and advanced problem-solving abilities. These skills are vital for achieving organizational goals, and a well-structured resume can effectively highlight these qualifications to potential employers.

Common Responsibilities Listed on Insurance Operations Manager Resume

- Oversee daily insurance operations and workflow management.

- Develop and implement operational policies and procedures.

- Coordinate between underwriting, claims, and customer service departments.

- Monitor performance metrics and operational efficiency.

- Ensure compliance with regulatory requirements and company standards.

- Manage training and development programs for staff.

- Analyze data to identify areas for process improvement.

- Resolve operational issues and provide solutions to challenges.

- Prepare reports for senior management on operational performance.

- Foster a collaborative work environment to enhance team productivity.

- Implement technology solutions to streamline operations.

High-Level Resume Tips for Insurance Operations Manager Professionals

In the competitive field of insurance operations, a well-crafted resume serves as a crucial gateway to new opportunities. For Insurance Operations Manager professionals, this document often forms the first impression a potential employer has of their candidacy. A strong resume not only highlights essential skills and relevant experience but also showcases significant achievements that set candidates apart from the competition. In this guide, we will provide practical and actionable resume tips specifically tailored for Insurance Operations Manager professionals, ensuring that your resume effectively communicates your qualifications and value to prospective employers.

Top Resume Tips for Insurance Operations Manager Professionals

- Tailor your resume to align with the specific job description, emphasizing the skills and experiences that match the requirements.

- Highlight relevant experience in insurance operations, including your knowledge of underwriting, claims management, and regulatory compliance.

- Quantify your achievements with metrics, such as percentage improvements in operational efficiency or the number of successful projects led.

- Showcase industry-specific skills, such as risk management, data analysis, and proficiency with insurance software systems.

- Use action verbs to describe your accomplishments, making your contributions clear and impactful.

- Include certifications and professional development courses that demonstrate your commitment to the insurance industry and your ongoing education.

- Incorporate keywords from the job posting to optimize your resume for Applicant Tracking Systems (ATS).

- Keep your resume concise, ideally one to two pages, focusing on the most relevant information.

- Consider including a summary statement at the top of your resume that encapsulates your experience and career goals in insurance operations.

- Proofread your resume carefully to eliminate any typographical errors or inconsistencies that could detract from your professionalism.

By implementing these tips, Insurance Operations Manager professionals can significantly enhance their resumes, improving their chances of capturing the attention of hiring managers and securing interviews. A focused and well-structured resume not only showcases your qualifications but also demonstrates your professionalism and attention to detail, key attributes for success in the insurance industry.

Why Resume Headlines & Titles are Important for Insurance Operations Manager

In the competitive landscape of the insurance industry, the role of an Insurance Operations Manager is pivotal in ensuring efficient processes and optimal service delivery. When applying for such a position, the significance of resume headlines and titles cannot be overstated. A well-crafted headline or title serves as a powerful first impression, allowing candidates to succinctly encapsulate their key qualifications and professional identity in a single, impactful phrase. It acts as an immediate attention-grabber for hiring managers, highlighting the candidate's relevance to the role while conveying their unique value proposition. To be effective, these headlines should be concise, directly related to the job being applied for, and resonate with the needs and expectations of potential employers.

Best Practices for Crafting Resume Headlines for Insurance Operations Manager

- Keep it concise: Aim for one impactful phrase that summarizes your qualifications.

- Make it role-specific: Tailor the headline to reflect the specific position of Insurance Operations Manager.

- Highlight key skills: Include relevant skills or expertise that are critical for the role.

- Use action-oriented language: Choose strong verbs to convey a sense of achievement and proactivity.

- Incorporate industry keywords: Utilize terminology that aligns with the insurance sector to enhance visibility.

- Avoid jargon: Use clear language that is easily understood by hiring managers across various backgrounds.

- Showcase accomplishments: If possible, hint at notable achievements that underscore your capabilities.

- Stay professional: Maintain a formal tone that reflects your professionalism and suitability for the role.

Example Resume Headlines for Insurance Operations Manager

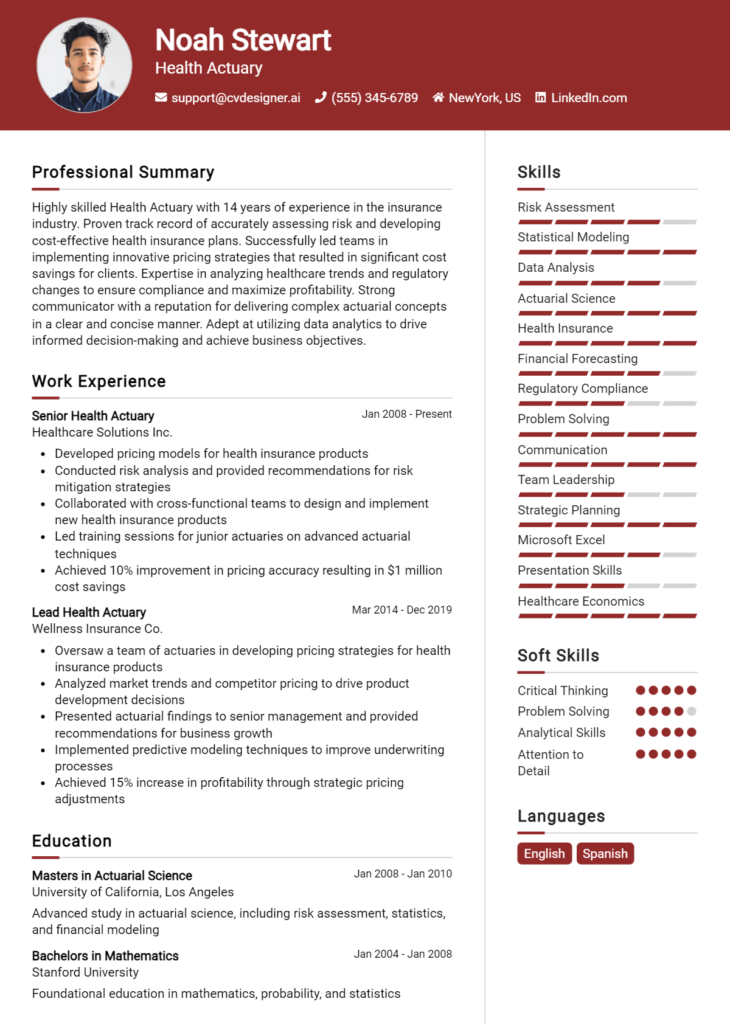

Strong Resume Headlines

"Results-Driven Insurance Operations Manager with 10+ Years of Experience in Streamlining Processes"

“Dynamic Leader in Insurance Operations: Proven Track Record of Reducing Costs by 20%”

“Strategic Insurance Operations Manager Specializing in Risk Management and Compliance Excellence”

“Innovative Insurance Operations Expert Focused on Enhancing Client Satisfaction and Operational Efficiency”

Weak Resume Headlines

“Manager Looking for Work in Insurance”

“Insurance Professional”

“Experienced in Operations”

The strong headlines are effective because they are specific and highlight the candidate's unique strengths and achievements, making them memorable and relevant to the role of an Insurance Operations Manager. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail; they do not convey any significant qualifications or expertise, leaving hiring managers with little reason to consider the candidate further. A strong headline sets the tone for the entire resume, while a weak one can undermine even the most impressive qualifications.

Writing an Exceptional Insurance Operations Manager Resume Summary

A well-crafted resume summary is crucial for an Insurance Operations Manager, as it serves as the first impression for hiring managers. This brief yet impactful section of your resume quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job role. A strong summary should be concise, engaging, and specifically tailored to the position you are applying for, ensuring that it resonates with the hiring team and sets the stage for the rest of your application.

Best Practices for Writing a Insurance Operations Manager Resume Summary

- Quantify Achievements: Use numbers and statistics to illustrate your success and impact in previous roles.

- Focus on Skills: Highlight core competencies and technical skills relevant to insurance operations.

- Tailor Your Summary: Customize your summary to reflect the specific job description and company culture.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Be Concise: Aim for 3-5 sentences that provide a clear snapshot of your qualifications.

- Showcase Leadership: If applicable, mention your experience in leading teams or projects effectively.

- Include Industry Knowledge: Reference specific areas of expertise, such as claims processing, underwriting, or regulatory compliance.

- Highlight Problem-Solving Skills: Emphasize your ability to address challenges and implement solutions in the operations arena.

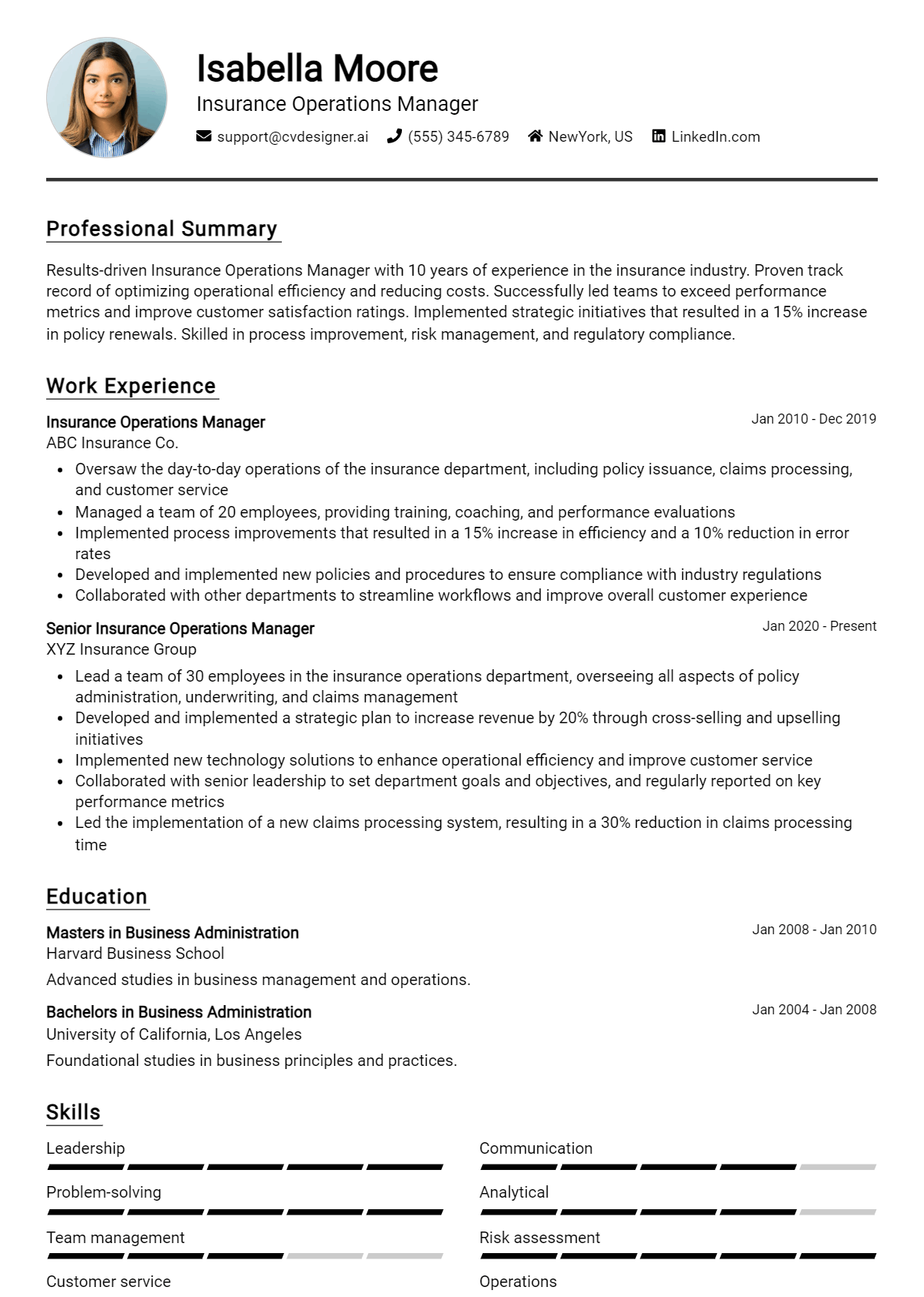

Example Insurance Operations Manager Resume Summaries

Strong Resume Summaries

Dynamic Insurance Operations Manager with over 8 years of experience in optimizing claims processing, resulting in a 25% reduction in turnaround time. Proven track record in leading cross-functional teams to enhance operational efficiency and compliance with industry regulations.

Results-driven professional with expertise in underwriting and risk assessment, having successfully decreased loss ratios by 15% through strategic policy revisions and staff training initiatives. Adept at leveraging data analytics to drive operational improvements.

Accomplished Insurance Operations Manager known for designing innovative workflows that increased productivity by 30%, while maintaining a customer satisfaction rate of over 95%. Strong leadership skills with experience managing teams of up to 20 employees.

Weak Resume Summaries

Experienced manager in insurance operations looking for a new opportunity in the field.

Insurance Operations Manager with a good understanding of the industry and a desire to improve processes.

The strong resume summaries are effective because they provide specific, quantifiable achievements and clearly outline relevant skills and experiences that directly relate to the Insurance Operations Manager role. In contrast, the weak summaries lack detail and do not convey any measurable outcomes or specialized knowledge, making them less compelling to potential employers.

Work Experience Section for Insurance Operations Manager Resume

The work experience section of an Insurance Operations Manager resume is critical as it serves as a testament to the candidate's capabilities in the industry. This section not only highlights the technical skills acquired throughout one's career but also showcases the ability to effectively manage teams and deliver high-quality insurance products. Employers look for evidence of leadership, strategic initiative, and operational excellence, making it essential for candidates to quantify their achievements and align their experiences with industry standards. The ability to clearly present accomplishments provides a competitive edge and demonstrates a deep understanding of the insurance landscape.

Best Practices for Insurance Operations Manager Work Experience

- Use action verbs to describe your contributions and responsibilities.

- Quantify achievements with specific metrics (e.g., percentage increases in efficiency or reductions in claims processing time).

- Highlight technical skills relevant to insurance operations, such as familiarity with underwriting software or risk assessment tools.

- Emphasize team management experiences, including training, mentoring, or leading cross-functional teams.

- Align your experience with industry standards and best practices to demonstrate compliance and operational excellence.

- Include examples of successful project management, showcasing your ability to deliver results on time and within budget.

- Focus on collaboration with other departments, highlighting your role in fostering interdepartmental communication and teamwork.

- Tailor your work experience to the job description, ensuring that the skills and experiences you highlight resonate with the prospective employer's needs.

Example Work Experiences for Insurance Operations Manager

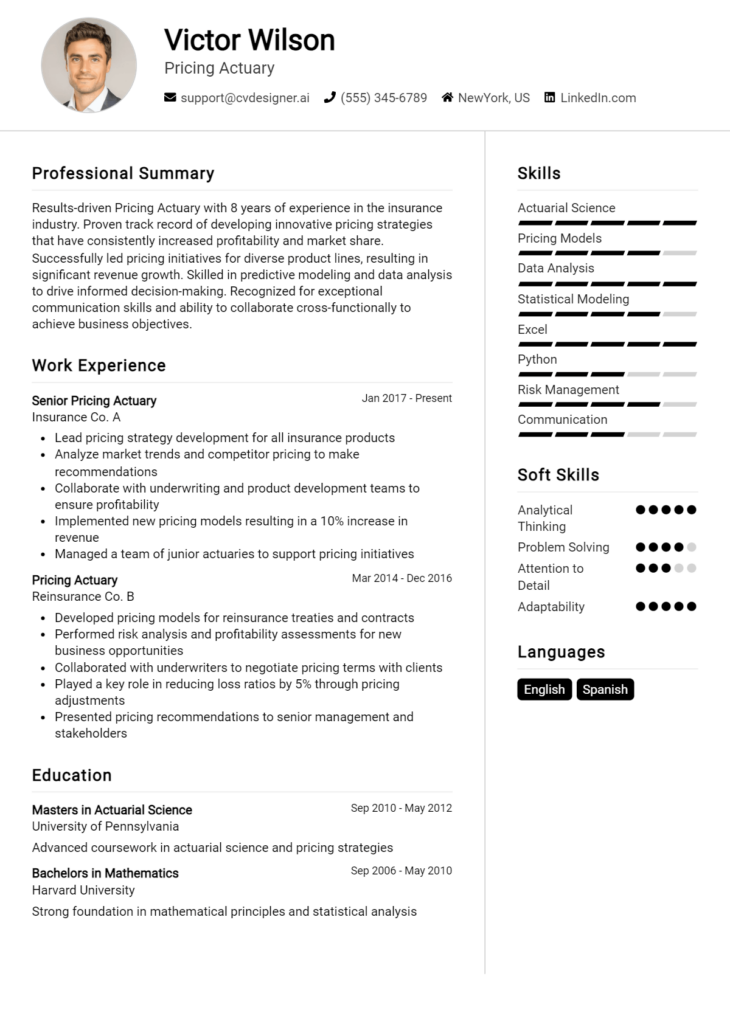

Strong Experiences

- Led a team of 15 underwriters, resulting in a 30% increase in productivity and a 20% decrease in turnaround time for policy approvals over two years.

- Implemented a new claims management software that improved claims processing efficiency by 40%, saving the department over $200,000 annually.

- Developed and conducted training programs for staff on regulatory compliance, which resulted in a 95% pass rate on internal audits.

- Collaborated with IT to enhance data analytics capabilities, enabling more accurate risk assessments and a 15% reduction in underwriting losses.

Weak Experiences

- Responsible for overseeing the insurance team without specific achievements or outcomes noted.

- Worked on various projects related to insurance operations but did not specify roles or results.

- Involved in training new employees without detailing the impact or effectiveness of the training.

- Participated in meetings to discuss process improvements with no mention of implementation or success metrics.

The examples labeled as strong demonstrate clear, quantifiable outcomes and specific contributions to the organization, reflecting both technical expertise and effective team management. In contrast, the weak examples lack specificity and measurable results, failing to convey the candidate's impact or effectiveness in their role. Strong experiences provide concrete evidence of capabilities, while weak experiences leave potential employers without a clear understanding of the candidate's qualifications.

Education and Certifications Section for Insurance Operations Manager Resume

The education and certifications section of an Insurance Operations Manager resume is crucial in showcasing the candidate's academic credentials and industry-specific qualifications. This section not only highlights formal education but also underscores the candidate's commitment to continuous learning and professional development through relevant certifications and specialized training. By detailing coursework and credentials that align with the job requirements, candidates can enhance their credibility and demonstrate a solid foundation in insurance operations, compliance, risk management, and other essential areas. Providing this information effectively positions candidates as well-prepared and knowledgeable professionals in the competitive insurance landscape.

Best Practices for Insurance Operations Manager Education and Certifications

- Focus on relevant degrees such as Business Administration, Finance, or Risk Management.

- Include industry-recognized certifications like the Chartered Property Casualty Underwriter (CPCU) or Associate in Insurance Services (AIS).

- Highlight any specialized training related to insurance operations or regulatory compliance.

- Use specific details about coursework that directly relates to insurance management and operations.

- Ensure the information is current and reflects ongoing professional development.

- List any leadership or management training that showcases your ability to lead teams and projects.

- Incorporate any relevant workshops or seminars attended that demonstrate engagement with industry trends.

- Be concise but thorough, ensuring clarity on how your education supports your qualifications for the role.

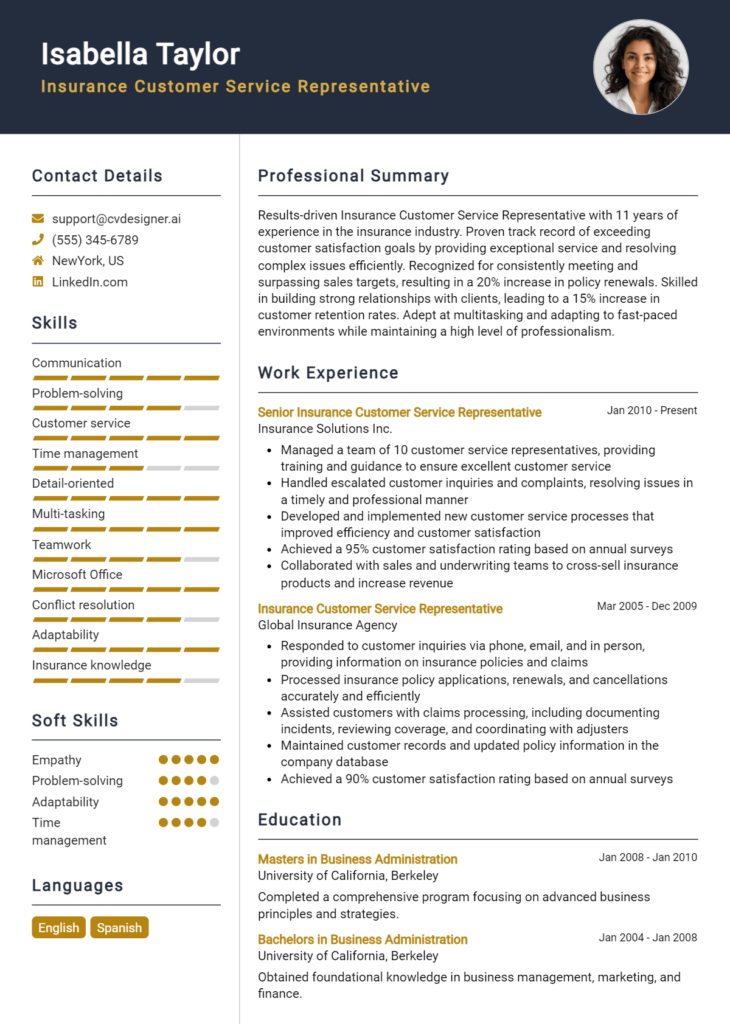

Example Education and Certifications for Insurance Operations Manager

Strong Examples

- MBA in Insurance and Risk Management, University of Southern California, 2020

- Chartered Property Casualty Underwriter (CPCU), 2021

- Certified Insurance Operations Manager (CIOM), 2022

- Relevant Coursework: Advanced Risk Assessment, Insurance Regulations, Operational Management in Insurance

Weak Examples

- Bachelor's Degree in Art History, University of California, 2015

- Certification in Basic First Aid, 2021

- Online Course: Introduction to Social Media Marketing, 2022

- High School Diploma, 2010

The examples categorized as strong are considered relevant because they directly align with the qualifications and skills necessary for an Insurance Operations Manager role, demonstrating an advanced understanding of the insurance industry. They reflect a commitment to professional development and the acquisition of knowledge that is crucial to the position. Conversely, the weak examples lack relevance to the insurance field, showcasing degrees and certifications that do not support the candidate's alignment with the job requirements, thus failing to enhance their credibility in this specific domain.

Top Skills & Keywords for Insurance Operations Manager Resume

The role of an Insurance Operations Manager is pivotal within the insurance industry, requiring a blend of technical expertise and interpersonal skills to effectively oversee operations, manage teams, and ensure compliance with regulatory standards. A well-crafted resume that highlights essential skills can significantly enhance a candidate's chances of landing an interview. By showcasing both hard and soft skills, applicants can demonstrate their qualifications and readiness to tackle the challenges of the role. The right combination of skills not only reflects a candidate's competency but also their ability to adapt to an ever-evolving industry landscape.

Top Hard & Soft Skills for Insurance Operations Manager

Soft Skills

- Leadership

- Communication

- Problem-solving

- Team Collaboration

- Time Management

- Critical Thinking

- Adaptability

- Conflict Resolution

- Customer Service Orientation

- Attention to Detail

Hard Skills

- Data Analysis

- Risk Management

- Insurance Underwriting

- Regulatory Compliance

- Process Improvement

- Claims Management

- Financial Acumen

- Policy Development

- Project Management

- Technology Proficiency (e.g., CRM software, claims processing systems)

For further insights, you can explore various skills that are vital for your career progression and learn how to effectively present your work experience in your resume.

Stand Out with a Winning Insurance Operations Manager Cover Letter

As a seasoned professional with over eight years of experience in the insurance industry, I am writing to express my interest in the Insurance Operations Manager position at [Company Name]. My extensive background in operations management, combined with a passion for enhancing efficiency and customer satisfaction, makes me a perfect fit for this role. I am confident that my skill set aligns well with your organization's goals, and I am excited about the opportunity to contribute to your team's success.

In my previous role at [Previous Company Name], I successfully led a team of over 20 employees in streamlining operational processes, resulting in a 30% reduction in processing times and a 15% increase in customer satisfaction ratings. By implementing data-driven strategies and fostering a culture of continuous improvement, I was able to identify inefficiencies and develop solutions that not only met but exceeded performance targets. My ability to analyze complex data and translate it into actionable strategies has proven invaluable in driving operational excellence.

Moreover, my strong communication and leadership skills have enabled me to effectively collaborate with cross-functional teams, ensuring alignment between departments and enhancing overall organizational performance. I believe that a successful Insurance Operations Manager should not only focus on metrics but also prioritize team development and employee engagement. I am committed to mentoring my team members, providing them with the tools and resources they need to excel in their roles and contribute to the company's overarching objectives.

I am excited about the possibility of bringing my unique expertise to [Company Name] and helping to shape the future of your operations. Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of your organization.

Common Mistakes to Avoid in a Insurance Operations Manager Resume

When crafting a resume for the role of an Insurance Operations Manager, it's essential to present a clear and compelling narrative of your experience and skills. However, many candidates inadvertently make mistakes that can detract from their qualifications and hinder their chances of landing an interview. Below are some common pitfalls to avoid when creating your resume:

Generic Objective Statements: Using a one-size-fits-all objective that lacks specificity can fail to capture the attention of hiring managers. Tailor your objective to reflect your career aspirations and how they align with the role.

Neglecting Quantifiable Achievements: Failing to include specific metrics and accomplishments can make your experience seem less impactful. Always quantify your achievements (e.g., “increased efficiency by 20%” or “managed a team of 10”) to showcase your contributions.

Overloading with Jargon: While industry terms can demonstrate your expertise, overusing jargon can alienate readers. Strive for a balance that showcases your knowledge without making your resume difficult to read.

Ignoring ATS Compatibility: Many companies use Applicant Tracking Systems (ATS) to screen resumes. Ignoring this can result in your resume being overlooked. Use standard headings and keywords relevant to the job description to improve ATS compatibility.

Lack of Focus on Leadership Skills: As an Insurance Operations Manager, leadership is crucial. Failing to highlight your leadership experience and skills can downplay your suitability for the role. Ensure your resume emphasizes your ability to lead teams and drive operational success.

Poor Formatting: A cluttered or unprofessional layout can distract from your qualifications. Use clear headings, bullet points, and consistent formatting to enhance readability and maintain a professional appearance.

Inadequate Tailoring for Each Application: Sending out the same resume for multiple applications can be detrimental. Tailor your resume for each position by aligning your skills and experiences with the specific job requirements and company culture.

Omitting Soft Skills: While technical skills are important, soft skills such as communication, problem-solving, and interpersonal abilities are equally vital in a managerial role. Ensure these qualities are highlighted throughout your resume to present a well-rounded profile.

Conclusion

As an Insurance Operations Manager, your role is pivotal in overseeing the efficiency and effectiveness of insurance processes within an organization. Key responsibilities include managing claims processing, ensuring compliance with regulations, optimizing operational workflows, and leading teams to enhance customer service. Additionally, strong analytical skills and a deep understanding of insurance products are essential for driving strategic initiatives and improving overall performance.

In conclusion, if you're looking to advance your career or secure a new position as an Insurance Operations Manager, it's crucial to have a well-crafted resume that highlights your skills and accomplishments. We encourage you to take a moment to review your resume and ensure it reflects your expertise in insurance operations management.

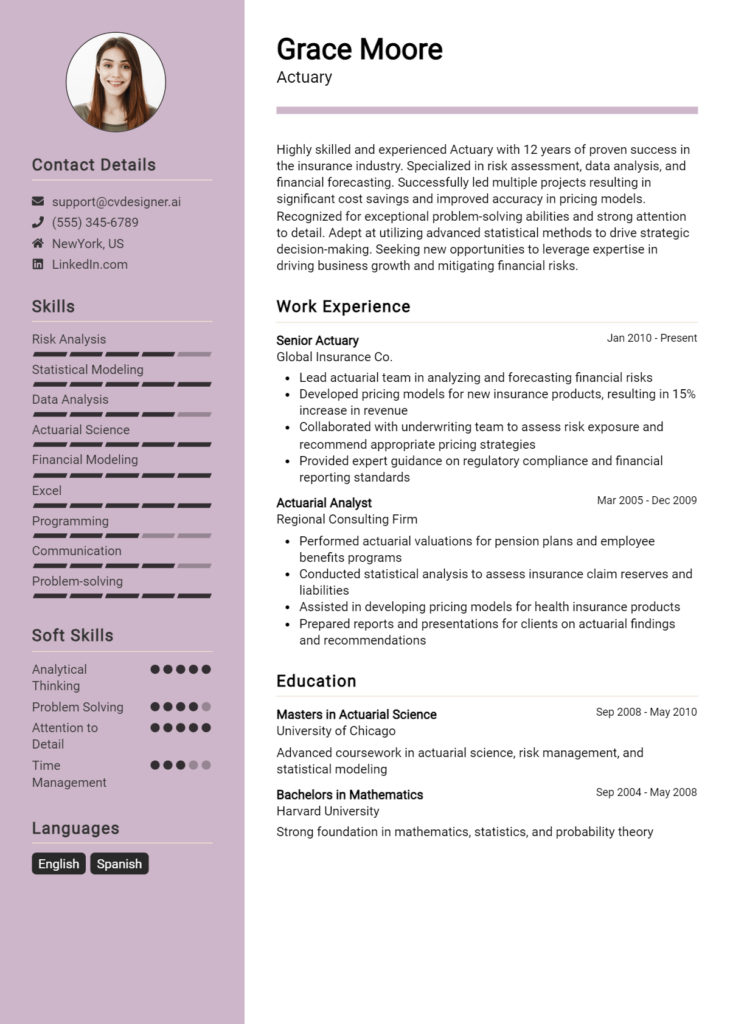

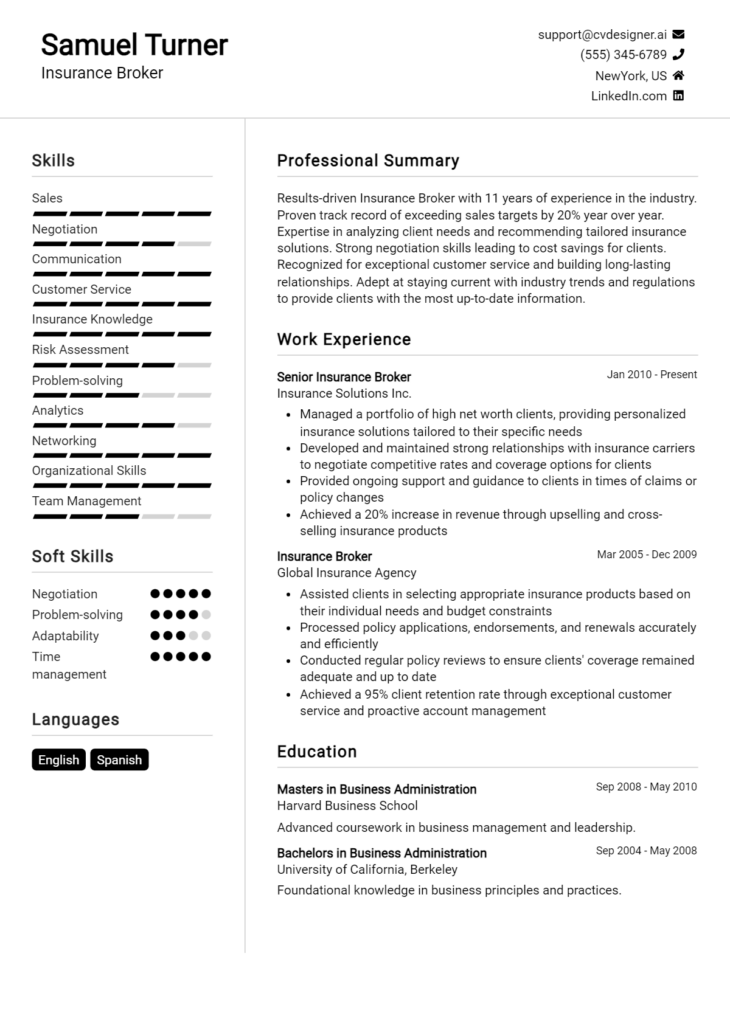

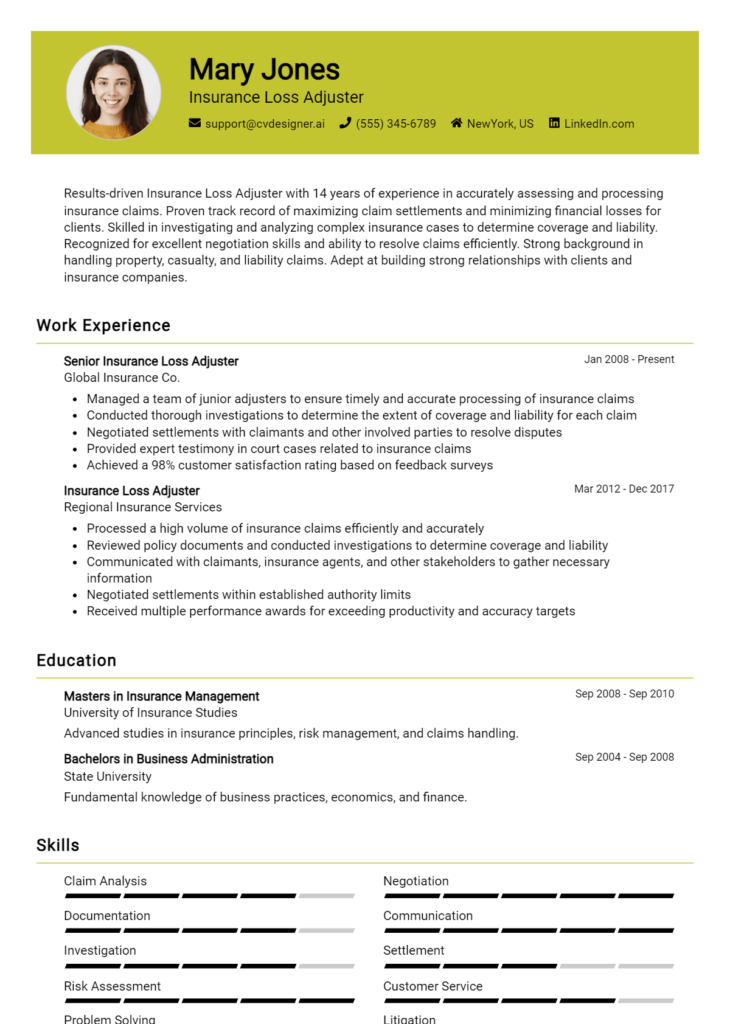

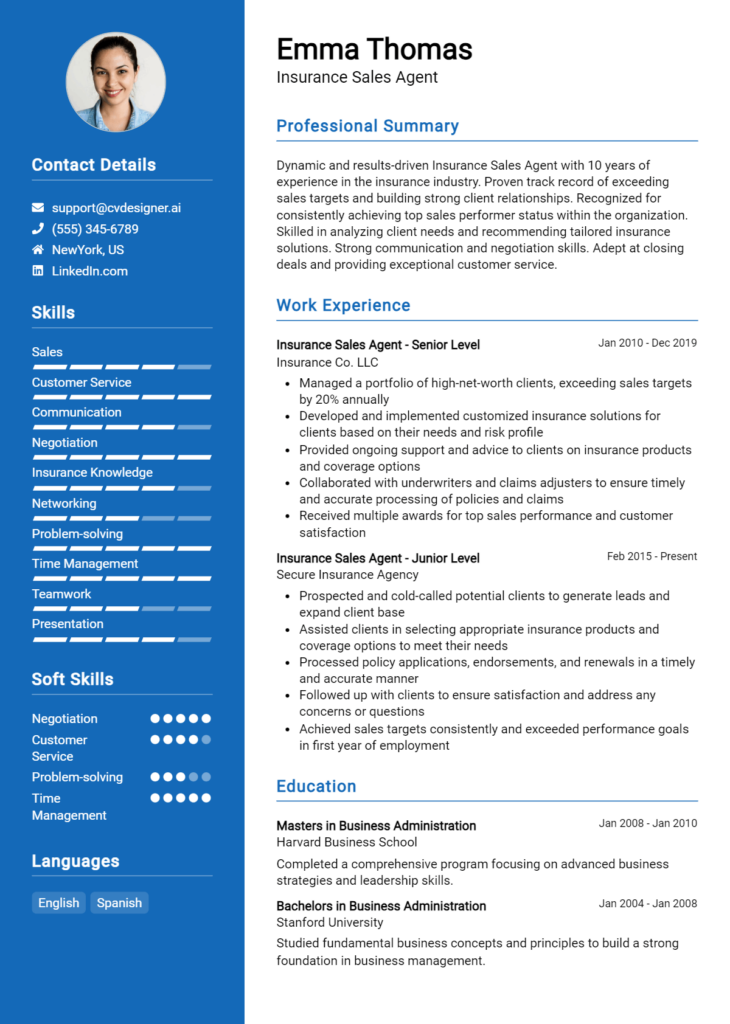

To assist you in this process, we recommend utilizing available resources such as resume templates, which can provide a professional layout; the resume builder, allowing you to create a customized document easily; and resume examples to inspire your content. Additionally, don't overlook the importance of a strong first impression with a compelling application; check out our cover letter templates to complement your resume effectively.

Take charge of your career today—review your resume and make sure it stands out in the competitive field of insurance operations!