Insurance Loss Adjuster Core Responsibilities

An Insurance Loss Adjuster plays a pivotal role in assessing and managing claims, requiring a unique blend of technical knowledge, operational insight, and problem-solving abilities. This professional bridges various departments, working closely with underwriters, claims processors, and legal teams to ensure accurate evaluations and fair settlements. A well-structured resume highlighting these skills is essential, as it reflects the adjuster's capability to contribute to the organization’s goals by efficiently managing claims and fostering client trust.

Common Responsibilities Listed on Insurance Loss Adjuster Resume

- Evaluate insurance claims to determine validity and coverage.

- Conduct thorough investigations and inspections of damaged properties.

- Interview claimants, witnesses, and involved parties to gather information.

- Review policy documents to assess liability and coverage limits.

- Prepare detailed reports and documentation on claim findings.

- Negotiate settlements with claimants and service providers.

- Collaborate with legal teams on complex claims and disputes.

- Maintain up-to-date knowledge of industry regulations and trends.

- Communicate effectively with clients to provide updates and support.

- Analyze data to identify trends and potential fraud indicators.

- Assist in training and mentoring junior adjusters.

High-Level Resume Tips for Insurance Loss Adjuster Professionals

In the competitive field of insurance adjusting, a well-crafted resume is not just a formality; it is a crucial tool that can significantly influence your career trajectory. For Insurance Loss Adjuster professionals, the resume serves as the first impression you make on potential employers, encapsulating your skills, experiences, and achievements in a concise format. Given the complexities of the role, your resume should effectively communicate your ability to assess claims, negotiate settlements, and navigate the intricacies of insurance policies. This guide will provide practical and actionable resume tips specifically tailored for Insurance Loss Adjuster professionals to help you stand out in a crowded job market.

Top Resume Tips for Insurance Loss Adjuster Professionals

- Tailor your resume to each job description by including keywords and phrases that align with the specific requirements of the position.

- Highlight relevant experience in claims assessment, negotiations, and customer service to showcase your competency in the field.

- Quantify your achievements where possible, such as stating the dollar amounts saved for clients or the percentage of claims resolved successfully.

- Include industry-specific certifications, such as AIC (Associate in Claims) or CPCU (Chartered Property Casualty Underwriter), to demonstrate your professional development.

- Utilize a clear and organized format, ensuring that your contact information, work experience, and education are easy to locate.

- Showcase your analytical skills by detailing specific instances where you used data to inform decision-making in loss assessments.

- Incorporate soft skills like communication, negotiation, and problem-solving, as these are vital for interacting with clients and other stakeholders.

- Use action verbs to describe your responsibilities and accomplishments, making your resume more engaging and impactful.

- Keep your resume to one or two pages in length, focusing on the most relevant information to maintain the reader's attention.

By implementing these tips, you can significantly enhance your resume's effectiveness, increasing your chances of landing a job in the Insurance Loss Adjuster field. A strong resume not only highlights your qualifications but also demonstrates your commitment to professionalism, making a compelling case for why you should be chosen for the role.

Why Resume Headlines & Titles are Important for Insurance Loss Adjuster

In the competitive field of insurance, a well-crafted resume is essential for standing out to potential employers. For an Insurance Loss Adjuster, the resume headline or title serves as the first impression, summarizing key qualifications and enticing hiring managers to delve deeper into the candidate's experience. A strong headline quickly conveys the applicant's expertise and relevance to the role, making it crucial for capturing attention in a crowded job market. It should be concise, directly related to the position being applied for, and highlight the candidate's unique strengths, ultimately setting the stage for a compelling resume.

Best Practices for Crafting Resume Headlines for Insurance Loss Adjuster

- Keep it concise, ideally no more than 10 words.

- Use specific job titles that reflect the position you’re applying for.

- Incorporate relevant keywords from the job description.

- Highlight your most impressive qualifications or achievements.

- Avoid generic phrases that lack specificity.

- Make it impactful by using action-oriented language.

- Ensure it aligns with your overall career goals.

- Consider including years of experience or relevant certifications.

Example Resume Headlines for Insurance Loss Adjuster

Strong Resume Headlines

Detail-Oriented Insurance Loss Adjuster with 10+ Years of Experience

Certified Claims Adjuster Specializing in Property Damage Assessment

Results-Driven Loss Adjuster with Proven Track Record in Fraud Detection

Weak Resume Headlines

Insurance Professional

Looking for a Job in Adjusting

The strong headlines are effective because they are specific, showcasing the candidate's experience, certifications, and areas of expertise that are directly relevant to the role of an Insurance Loss Adjuster. They immediately communicate value and set a professional tone. In contrast, the weak headlines fail to impress due to their vagueness and lack of focus, which do not provide hiring managers with any insight into the candidate's qualifications or suitability for the position.

Writing an Exceptional Insurance Loss Adjuster Resume Summary

A resume summary is a crucial component for an Insurance Loss Adjuster as it serves as the candidate's first impression to hiring managers. A well-crafted summary succinctly highlights key skills, relevant experience, and significant accomplishments that align with the demands of the role. By quickly capturing the attention of hiring professionals, a strong summary can differentiate a candidate from the competition, making it imperative that it is concise, impactful, and tailored specifically to the job being applied for.

Best Practices for Writing a Insurance Loss Adjuster Resume Summary

- Quantify Achievements: Use numbers and data to highlight your successes and impact in previous roles.

- Focus on Skills: Emphasize the key skills that are most relevant to the Insurance Loss Adjuster position.

- Tailor to the Job Description: Customize your summary to reflect the specific requirements and language of the job listing.

- Be Concise: Aim for a clear and direct summary that is typically 2-4 sentences long.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of proactivity and effectiveness.

- Highlight Industry Knowledge: Mention any relevant certifications or knowledge of industry standards and regulations.

- Showcase Problem-Solving Abilities: Illustrate your capacity to handle complex cases and resolve disputes effectively.

- Include Soft Skills: Mention interpersonal skills that are crucial for effective communication with clients and stakeholders.

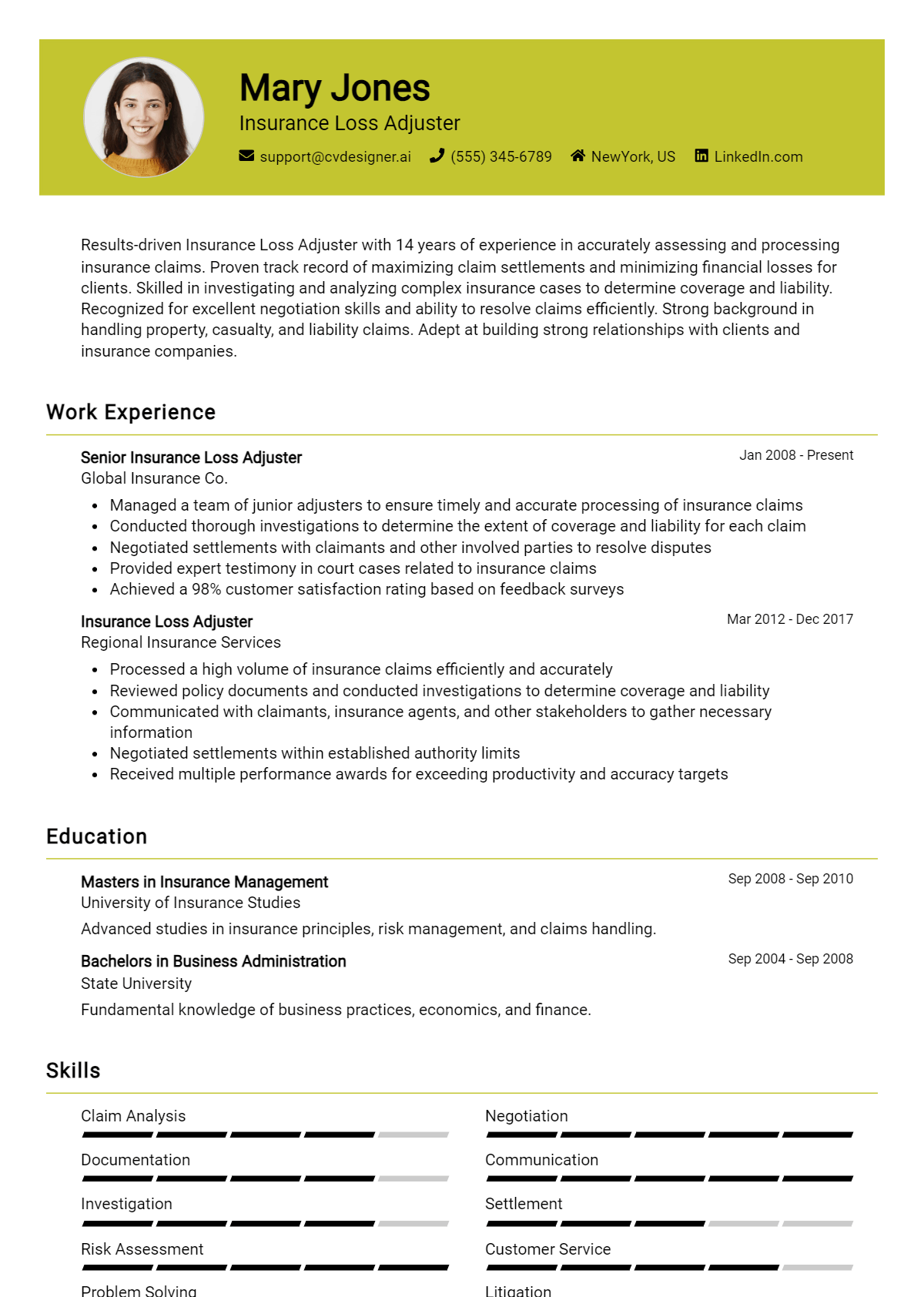

Example Insurance Loss Adjuster Resume Summaries

Strong Resume Summaries

Detail-oriented Insurance Loss Adjuster with over 7 years of experience in assessing property damage and ensuring fair settlements. Successfully managed claims totaling over $5 million, utilizing strong negotiation skills to achieve a 95% client satisfaction rate.

Proven Insurance Loss Adjuster with a track record of reducing claims processing time by 30% through efficient case management and exceptional analytical skills. Certified in adjusting and appraising, committed to delivering accurate assessments and prompt resolutions.

Experienced Insurance Loss Adjuster skilled in evaluating complex claims and providing expert recommendations. Achieved a 20% increase in claim recoveries through meticulous documentation and effective communication with stakeholders.

Weak Resume Summaries

Insurance Loss Adjuster with some experience in the field. Looking for a new opportunity to apply my skills.

Dedicated professional with a background in claims management. I am interested in working as an Insurance Loss Adjuster.

The strong resume summaries are effective because they provide specific metrics and highlight relevant skills and experiences that directly relate to the job. They demonstrate the candidate's capabilities and achievements in a clear and compelling manner. In contrast, the weak summaries lack detail and fail to convey any measurable successes or unique qualifications, making them unmemorable and generic.

Work Experience Section for Insurance Loss Adjuster Resume

The work experience section of an Insurance Loss Adjuster resume is vital in demonstrating a candidate's qualifications and suitability for the role. This section serves as a platform to showcase technical skills acquired through hands-on experience, the ability to manage teams effectively, and a commitment to delivering high-quality outcomes in complex situations. By quantifying achievements and aligning past experiences with industry standards, candidates can provide tangible evidence of their expertise, making a compelling case for their candidacy.

Best Practices for Insurance Loss Adjuster Work Experience

- Highlight specific technical skills relevant to loss adjusting, such as claims assessment and risk evaluation.

- Include quantifiable results, such as the number of claims processed or the percentage of claims resolved in favor of the client.

- Emphasize leadership roles in team settings, showcasing your ability to manage and mentor junior adjusters.

- Detail collaboration with other professionals, such as attorneys, underwriters, and contractors, to achieve optimal results.

- Use action verbs to begin each bullet point, making statements dynamic and engaging.

- Tailor your experience to reflect the specific requirements of the job you are applying for, ensuring relevance.

- Demonstrate problem-solving skills by providing examples of complex cases handled successfully.

- Maintain a clear and concise format for easy readability, focusing on the most impactful experiences.

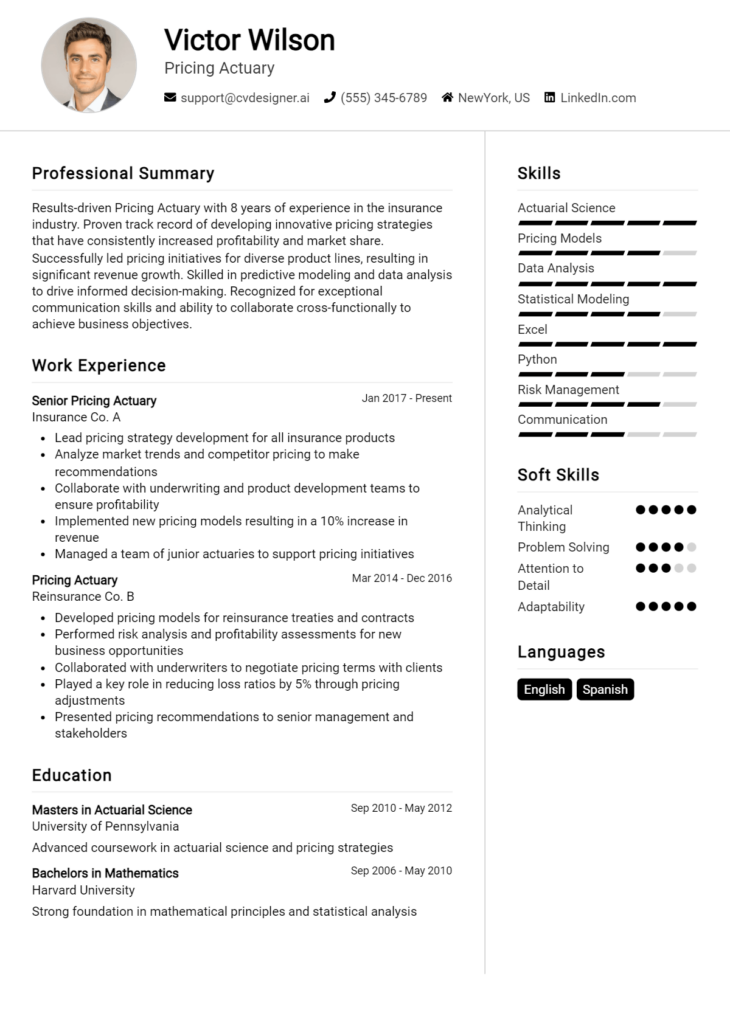

Example Work Experiences for Insurance Loss Adjuster

Strong Experiences

- Successfully managed a portfolio of over 200 insurance claims, achieving a 95% satisfaction rate from clients through diligent follow-up and proactive communication.

- Implemented a new claims assessment software that reduced processing time by 30%, allowing for quicker settlements and improved service quality.

- Led a team of five junior adjusters in a high-stakes multi-million dollar property damage claim, coordinating efforts that resulted in a favorable resolution for the client within three months.

- Collaborated with legal teams to negotiate settlements on complex liability claims, resulting in a 15% increase in recovery amounts over previous years.

Weak Experiences

- Worked on various claims without specific details on responsibilities or outcomes.

- Assisted in the claims process, but did not specify how contributions affected overall performance.

- Participated in team meetings and discussions, lacking clarity on individual impact or achievements.

- Handled claims for several clients without mentioning the volume or success rates.

The examples provided are considered strong because they illustrate specific achievements and quantifiable results, showcasing the candidate's technical expertise and ability to collaborate effectively. In contrast, the weak experiences are vague and lack concrete details or outcomes, failing to demonstrate the candidate's impact or relevance to the insurance loss adjusting role.

Education and Certifications Section for Insurance Loss Adjuster Resume

The education and certifications section of an Insurance Loss Adjuster resume is crucial for showcasing a candidate's academic achievements and professional qualifications. This section not only highlights the candidate's foundational knowledge in relevant fields but also emphasizes industry-specific certifications and continuous learning efforts that are vital in the ever-evolving insurance landscape. By detailing relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the requirements of the job role, setting themselves apart from the competition.

Best Practices for Insurance Loss Adjuster Education and Certifications

- Include only relevant degrees and certifications that pertain to the insurance and loss adjusting fields.

- Detail advanced or specialized certifications, such as Chartered Property Casualty Underwriter (CPCU) or Associate in Claims (AIC).

- Provide specific coursework that relates to loss adjustment, risk assessment, or insurance law.

- List any continuing education courses or workshops that reflect a commitment to professional development.

- Use clear and concise formatting to enhance readability, such as bullet points and consistent date formatting.

- Highlight any affiliations with professional organizations that relate to the insurance industry.

- Keep the section updated with the most current credentials and remove any outdated qualifications.

- Consider including relevant licenses, such as a state insurance adjuster license, to demonstrate compliance with regulatory requirements.

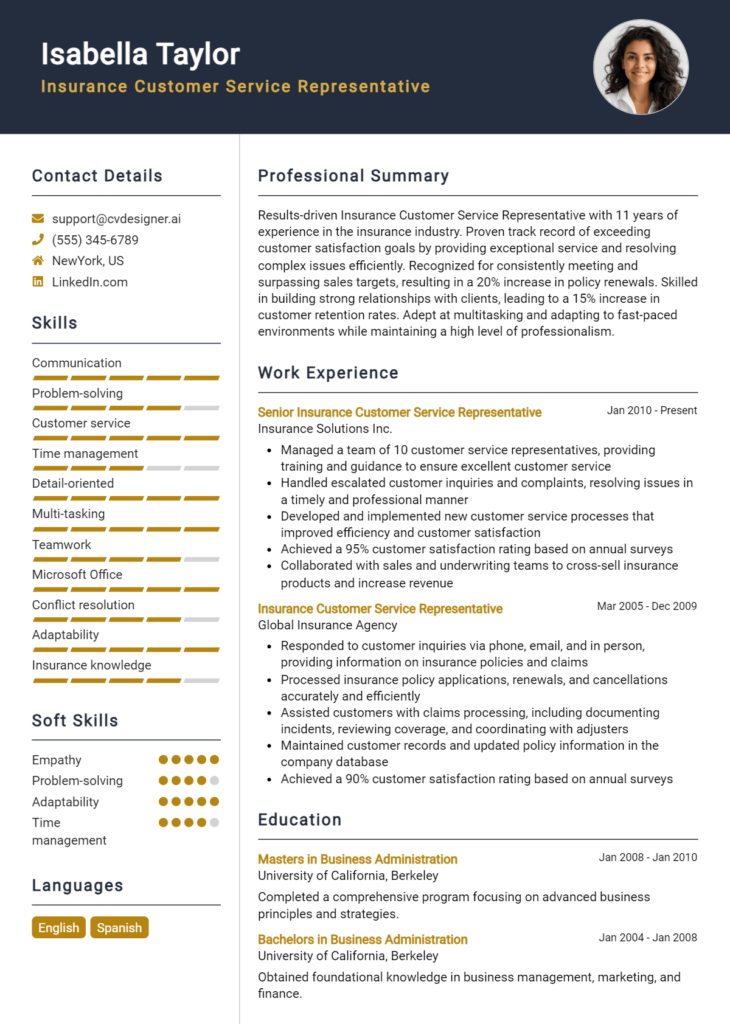

Example Education and Certifications for Insurance Loss Adjuster

Strong Examples

- Bachelor of Science in Risk Management and Insurance, University of ABC, Graduated May 2021

- Chartered Property Casualty Underwriter (CPCU), Earned 2022

- Associate in Claims (AIC), Earned 2023

- Relevant Coursework: Insurance Law, Loss Adjusting Techniques, Risk Assessment Strategies

Weak Examples

- Bachelor of Arts in Philosophy, University of XYZ, Graduated May 2018

- Certified Personal Trainer (CPT), Earned 2020

- Diploma in Computer Networking, Graduated 2019

- Completed a workshop on Effective Communication, January 2021

The strong examples are considered relevant as they directly align with the skills and knowledge necessary for an Insurance Loss Adjuster, showcasing degrees and certifications that are recognized within the industry. In contrast, the weak examples reflect qualifications that do not pertain to the insurance field, diminishing the candidate's suitability for the role and failing to demonstrate a commitment to the specific requirements of loss adjusting.

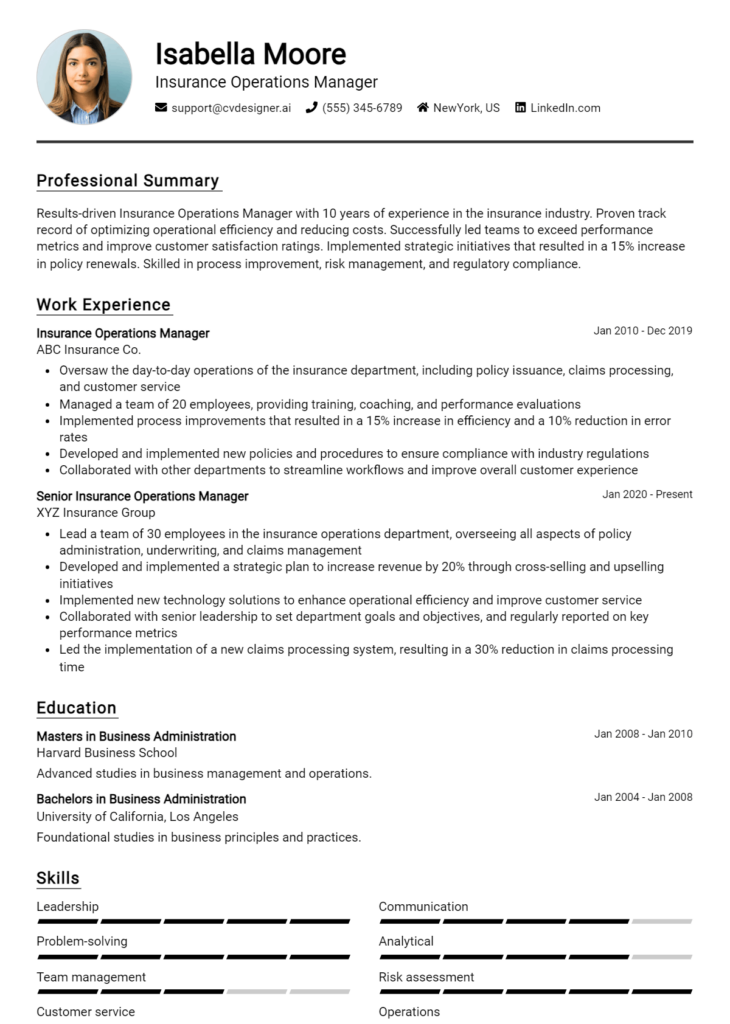

Top Skills & Keywords for Insurance Loss Adjuster Resume

As an Insurance Loss Adjuster, possessing the right skills is crucial for effectively assessing claims, negotiating settlements, and providing exceptional service to clients. A well-crafted resume that highlights relevant skills can significantly enhance your chances of standing out in a competitive job market. Both hard and soft skills play an essential role in demonstrating your capability to handle complex situations, manage relationships, and ensure compliance with industry regulations. By focusing on these attributes, you can present a comprehensive picture of your qualifications and readiness for the challenges of the role.

Top Hard & Soft Skills for Insurance Loss Adjuster

Soft Skills

- Strong communication skills

- Excellent negotiation abilities

- Critical thinking and problem-solving

- Empathy and customer service orientation

- Attention to detail

- Time management and organizational skills

- Adaptability and flexibility

- Team collaboration

- Conflict resolution

- Professional integrity

Hard Skills

- Knowledge of insurance policies and practices

- Proficiency in claims management software

- Ability to conduct detailed investigations

- Familiarity with legal regulations and compliance

- Data analysis and report generation

- Risk assessment and evaluation techniques

- Photography and documentation skills

- Understanding of construction and property damage

- Proficient in Microsoft Office Suite

- Strong analytical skills

By incorporating these skills into your resume and showcasing your work experience, you can create a compelling narrative that highlights your expertise as an Insurance Loss Adjuster.

Stand Out with a Winning Insurance Loss Adjuster Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Loss Adjuster position at [Company Name], as advertised on [where you found the job listing]. With a robust background in claims assessment and a keen eye for detail, I am confident in my ability to contribute effectively to your team and ensure that claims are handled with the utmost integrity and efficiency. My experience in evaluating damages and determining loss values has equipped me with the skills necessary to navigate complex cases and deliver fair resolutions for all parties involved.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of claims, ranging from property damage to liability issues. My proactive approach allowed me to identify potential fraud and mitigate losses for the company. I pride myself on building strong relationships with clients and stakeholders, understanding that clear communication is essential in resolving claims swiftly and satisfactorily. Furthermore, my expertise in utilizing industry-specific software and tools has enhanced my ability to conduct thorough investigations and generate comprehensive reports that support decision-making processes.

I am particularly drawn to [Company Name] because of its reputation for excellence in customer service and commitment to ethical practices. I am eager to bring my analytical skills and problem-solving abilities to your esteemed organization, ensuring that each claim is handled with care and precision. I am excited about the opportunity to contribute to a team that shares my dedication to upholding the highest standards in the insurance industry.

Thank you for considering my application. I look forward to the possibility of discussing how my skills and experiences align with the needs of your team. I am available at your convenience for an interview and can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Common Mistakes to Avoid in a Insurance Loss Adjuster Resume

When crafting a resume for the role of an Insurance Loss Adjuster, it's crucial to present your skills and experiences effectively, as this role demands a keen eye for detail and analytical abilities. However, many candidates make common mistakes that can hinder their chances of standing out in a competitive job market. Below are some pitfalls to avoid when preparing your resume:

Ignoring Keywords from Job Descriptions: Failing to include relevant keywords can make your resume less likely to pass through Applicant Tracking Systems (ATS), which many employers use to filter candidates.

Being Vague About Responsibilities: Simply listing job titles without detailing specific responsibilities or achievements can leave hiring managers unclear about your actual experience and capabilities.

Neglecting Quantifiable Achievements: Not including measurable outcomes, such as the number of claims processed or the percentage of claims settled favorably, can diminish the impact of your achievements.

Using an Unprofessional Format: A cluttered or overly creative resume format can distract from the content. Stick to a clean, professional layout that is easy to read.

Lack of Customization: Submitting a generic resume for multiple positions can signal a lack of interest. Tailor your resume to each job application, highlighting the most relevant experiences.

Omitting Soft Skills: While technical skills are important, neglecting to showcase soft skills like communication, negotiation, and problem-solving can make your application less compelling.

Inconsistent Employment Dates: Gaps or inconsistencies in your employment history can raise red flags for employers. Be honest and clear about your work timeline.

Failing to Proofread: Spelling or grammatical errors can undermine your professionalism. Always proofread your resume or have someone else review it to catch any mistakes.

Conclusion

As an Insurance Loss Adjuster, your role is crucial in assessing insurance claims and determining the appropriate compensation for policyholders. Throughout this article, we explored the key responsibilities, skills, and qualifications required for success in this field. We highlighted the importance of analytical skills, attention to detail, and effective communication, which are essential for navigating complex situations and ensuring fair outcomes for all parties involved.

Additionally, we discussed the various challenges faced by Loss Adjusters, including the need for continuous professional development to stay updated with industry regulations and practices. The significance of building strong relationships with clients, insurers, and stakeholders was also emphasized, as it plays a vital role in the claims process.

In conclusion, if you are pursuing a career as an Insurance Loss Adjuster or looking to advance in your current role, it's essential to have a polished resume that showcases your qualifications and experience effectively. We encourage you to take the time to review and enhance your Insurance Loss Adjuster resume. Utilize valuable resources such as resume templates, a resume builder, resume examples, and cover letter templates to create a standout application. Your next career opportunity awaits!