Insurance Broker Core Responsibilities

An Insurance Broker plays a crucial role in connecting clients with suitable insurance products while navigating complex policies and regulations. Key responsibilities include assessing client needs, providing tailored insurance solutions, negotiating terms with insurers, and ensuring compliance with industry standards. Essential skills encompass technical knowledge of insurance products, operational acumen, and strong problem-solving abilities. These competencies bridge various departments, facilitating client satisfaction and organizational goals. A well-structured resume effectively highlights these qualifications, showcasing the broker’s expertise and value.

Common Responsibilities Listed on Insurance Broker Resume

- Assessing client insurance needs and recommending suitable coverage

- Negotiating insurance terms and premiums with providers

- Providing expert advice on risk management strategies

- Conducting market research to identify competitive insurance solutions

- Preparing and presenting insurance proposals to clients

- Ensuring compliance with regulatory requirements

- Managing client relationships and addressing inquiries

- Maintaining accurate records and documentation

- Monitoring policy renewals and claims processes

- Collaborating with underwriting and claims departments

- Staying updated on industry trends and changes

- Participating in continued education and professional development

High-Level Resume Tips for Insurance Broker Professionals

In the competitive world of insurance brokerage, a well-crafted resume is not just a document; it's your first opportunity to make a strong impression on potential employers. Your resume serves as a marketing tool that showcases your skills, achievements, and unique value proposition as an insurance broker. Given that hiring managers often sift through numerous applications, it's essential that your resume stands out by effectively reflecting your expertise and contributions to the industry. In this guide, we will provide practical and actionable resume tips specifically tailored for Insurance Broker professionals, ensuring you present yourself in the best possible light.

Top Resume Tips for Insurance Broker Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases that match the employer's requirements.

- Highlight relevant experience in the insurance sector, focusing on roles that directly relate to brokerage and client management.

- Quantify your achievements, such as the number of clients managed or policies sold, to provide concrete evidence of your impact.

- Showcase industry-specific skills, including knowledge of insurance regulations, risk assessment, and claims processing.

- Include any relevant certifications or licenses, such as the Chartered Insurance Professional (CIP) or Registered Insurance Broker (RIBO) designations.

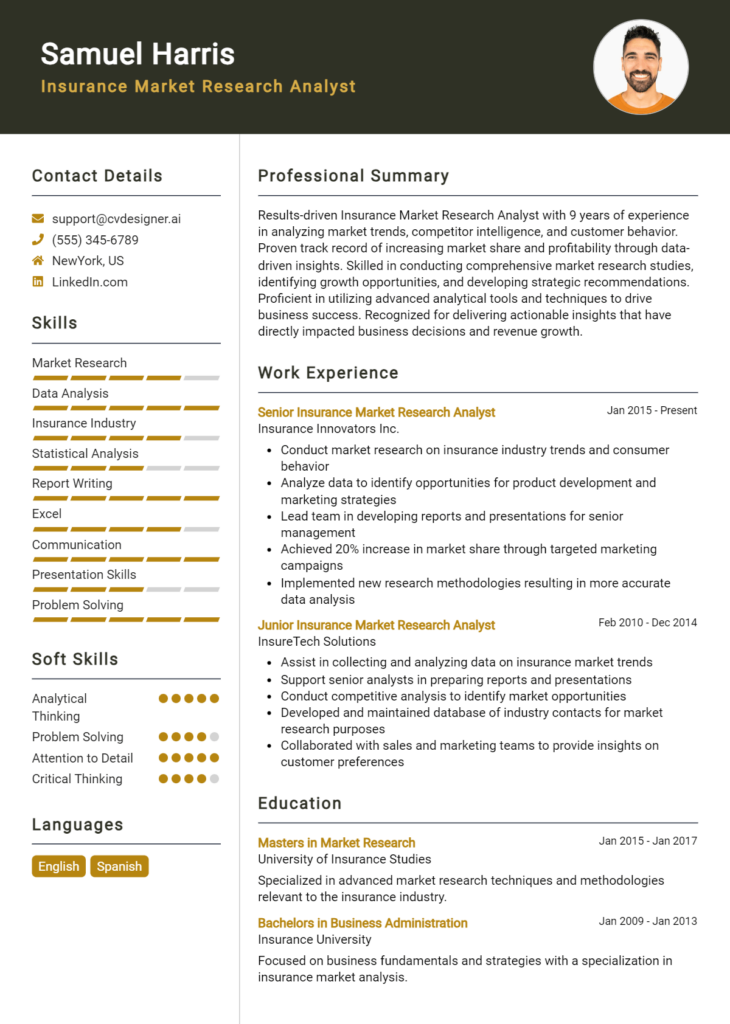

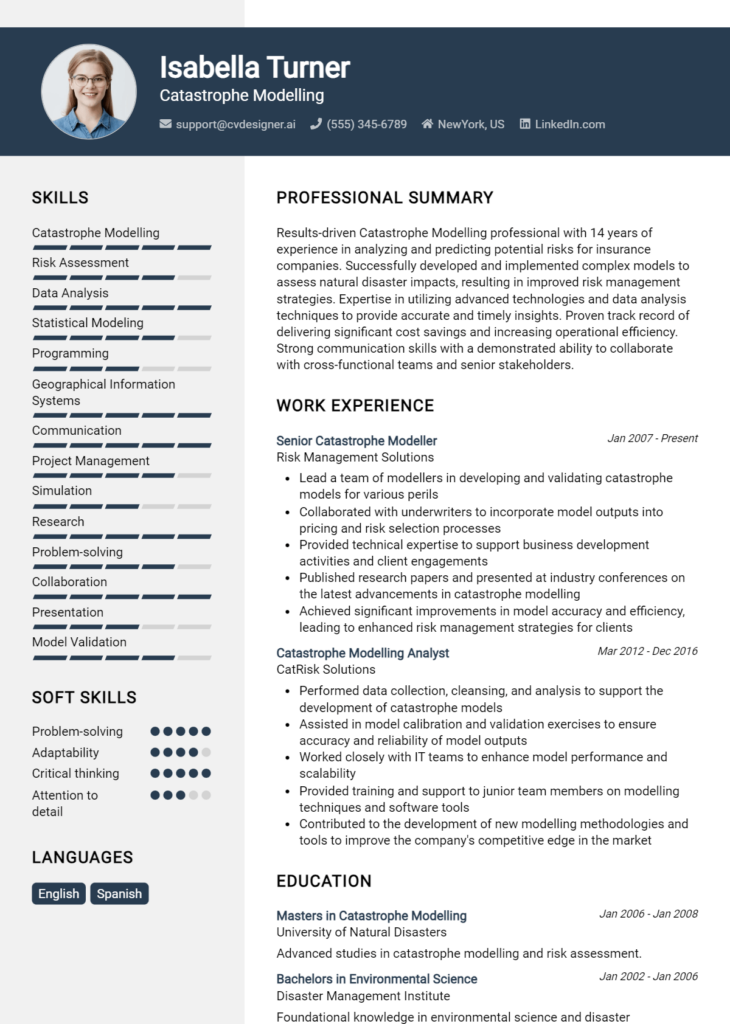

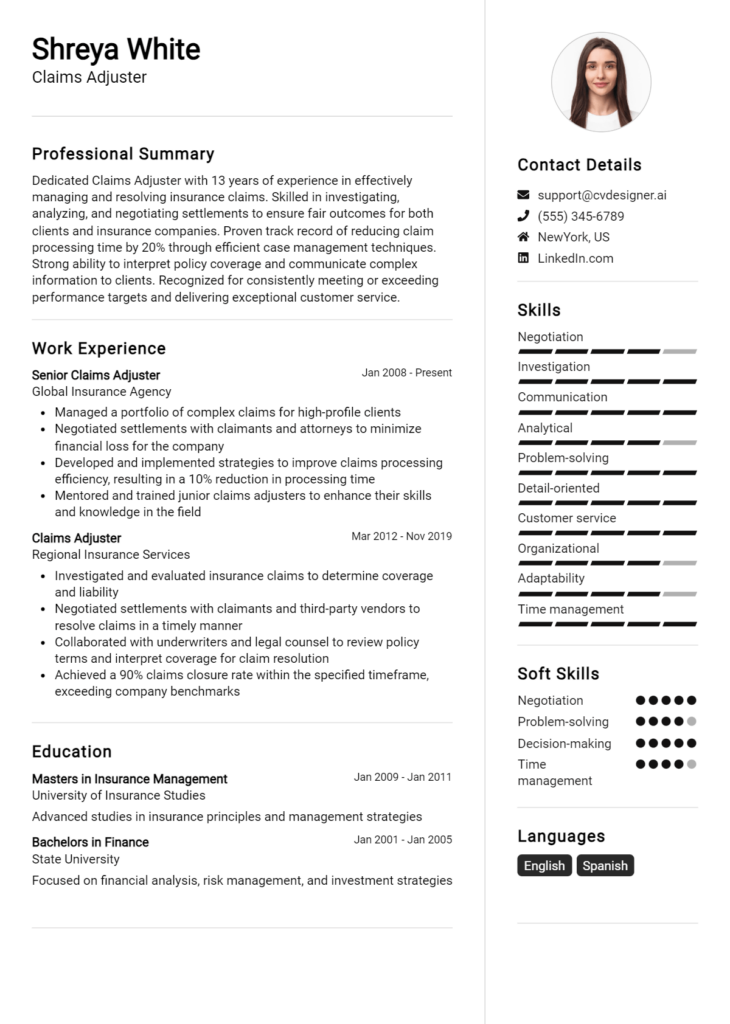

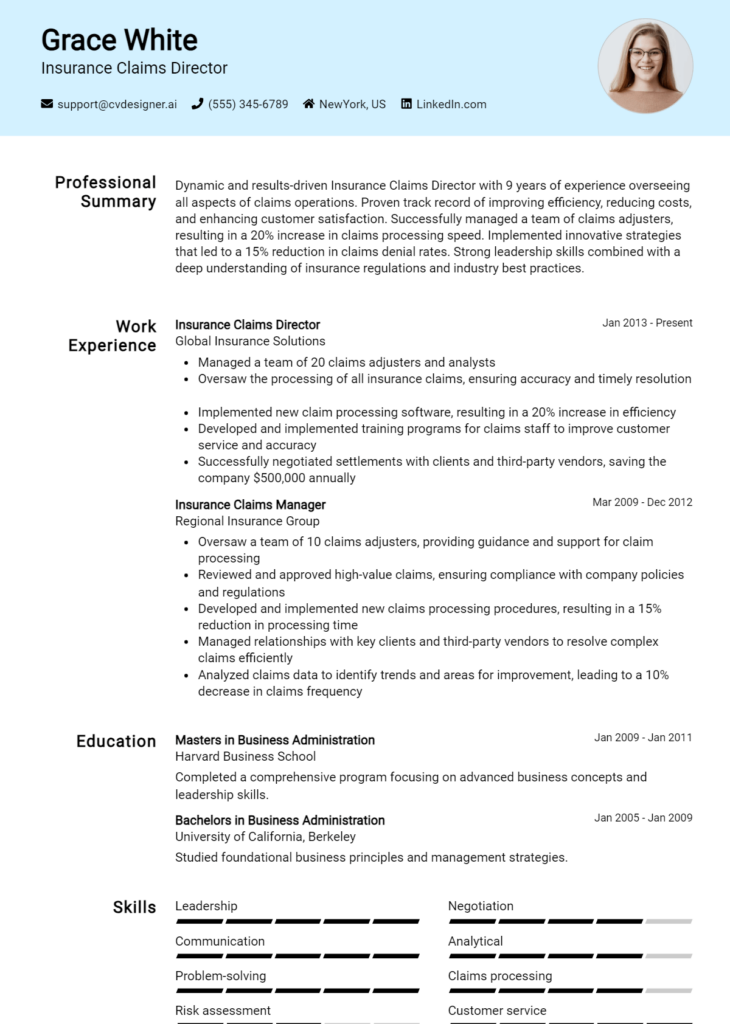

- Utilize a clean and professional layout that enhances readability, ensuring your most important information stands out.

- Incorporate a brief summary or objective statement at the top of your resume that clearly outlines your career goals and what you bring to the table.

- Emphasize your strong communication and negotiation skills, as these are crucial in building and maintaining client relationships.

- Proofread your resume multiple times to eliminate any spelling or grammatical errors, as attention to detail is key in the insurance industry.

By implementing these tailored resume tips, you can significantly enhance your chances of landing a job in the Insurance Broker field. A well-structured and focused resume not only highlights your qualifications but also demonstrates your commitment to professionalism and excellence, making you an attractive candidate for potential employers.

Why Resume Headlines & Titles are Important for Insurance Broker

In the competitive field of insurance brokering, a well-crafted resume can be the difference between landing an interview and being overlooked. The use of impactful resume headlines and titles is crucial, as they serve as the first impression for hiring managers. A strong headline or title not only grabs attention but also succinctly summarizes a candidate's key qualifications in a single, powerful phrase. In a fast-paced hiring environment, a concise and relevant headline can effectively showcase a candidate's suitability for the role, making it imperative to tailor it directly to the job being applied for.

Best Practices for Crafting Resume Headlines for Insurance Broker

- Keep it concise: Aim for one to two lines that capture your qualifications.

- Be role-specific: Tailor your headline to reflect the specific insurance broker position.

- Highlight key strengths: Incorporate skills or achievements that stand out in the industry.

- Use action words: Start with strong verbs to convey confidence and proactivity.

- Include relevant certifications: Mention any relevant licenses or certifications that add value.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Reflect your unique selling proposition: What makes you different than other candidates?

- Test different versions: Experiment with various headlines to see which resonates best.

Example Resume Headlines for Insurance Broker

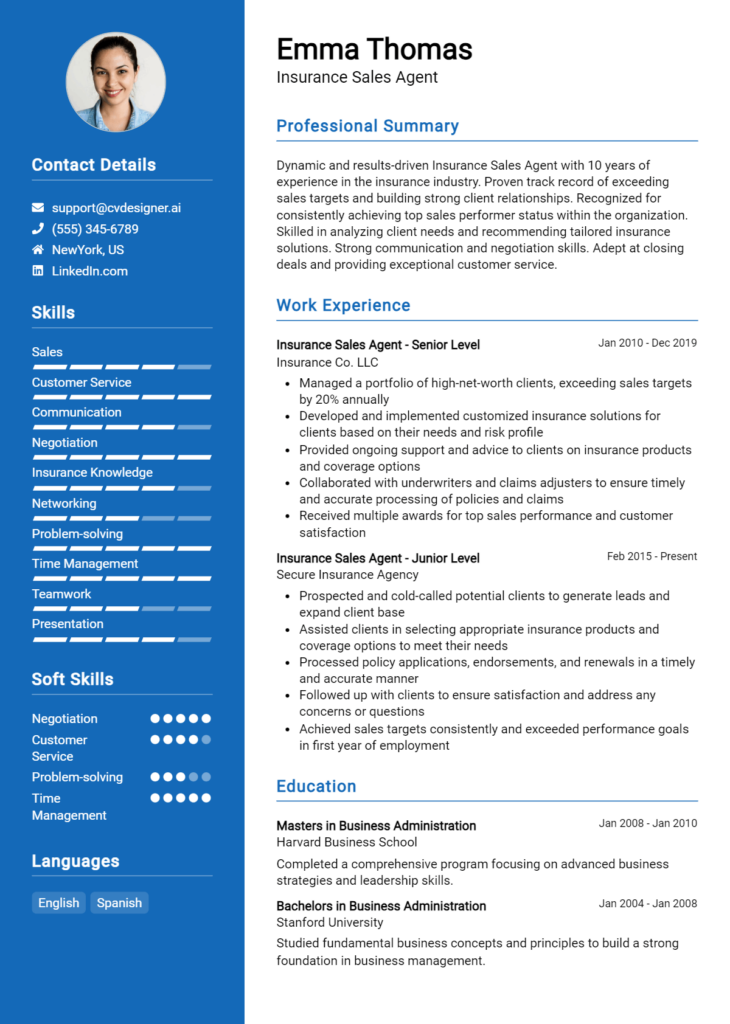

Strong Resume Headlines

Dynamic Insurance Broker with 5+ Years of Experience in Commercial Insurance Solutions

Results-Driven Insurance Specialist with Proven Track Record in Client Retention and Satisfaction

Licensed Insurance Broker Specializing in Tailored Risk Management Strategies

Expert in Navigating Complex Insurance Markets to Deliver Optimal Client Solutions

Weak Resume Headlines

Insurance Broker

Experienced Professional Seeking New Opportunities

Strong resume headlines are effective because they immediately convey a candidate’s expertise and uniqueness, drawing the attention of hiring managers. They utilize specific language that highlights relevant skills and accomplishments, making it clear why the candidate stands out in the field. In contrast, weak headlines fail to impress due to their vagueness and lack of specificity, leaving hiring managers with no compelling reason to consider the candidate further. By avoiding generic terms and focusing on impactful messaging, candidates can significantly enhance their chances of making a memorable first impression.

Writing an Exceptional Insurance Broker Resume Summary

A well-crafted resume summary is crucial for an Insurance Broker as it serves as the first impression for hiring managers. This brief but impactful paragraph quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments tailored to the role. A strong summary not only emphasizes the candidate's qualifications but also aligns them with the specific needs of the employer, making it easier for hiring managers to see the value the candidate brings. By being concise yet compelling, the summary sets the stage for the rest of the resume and encourages further reading.

Best Practices for Writing a Insurance Broker Resume Summary

- Quantify achievements: Use specific numbers or percentages to highlight your successes.

- Focus on relevant skills: Emphasize skills that align with the job description.

- Tailor for each application: Customize your summary for each role you apply to.

- Keep it concise: Aim for 2-4 sentences that pack a punch.

- Use action verbs: Start sentences with dynamic verbs to convey confidence and proactivity.

- Highlight industry knowledge: Mention your understanding of insurance products and regulations.

- Showcase client relationship skills: Emphasize experience in managing client portfolios and building trust.

- Include certifications: Mention relevant licenses or certifications that enhance your credibility.

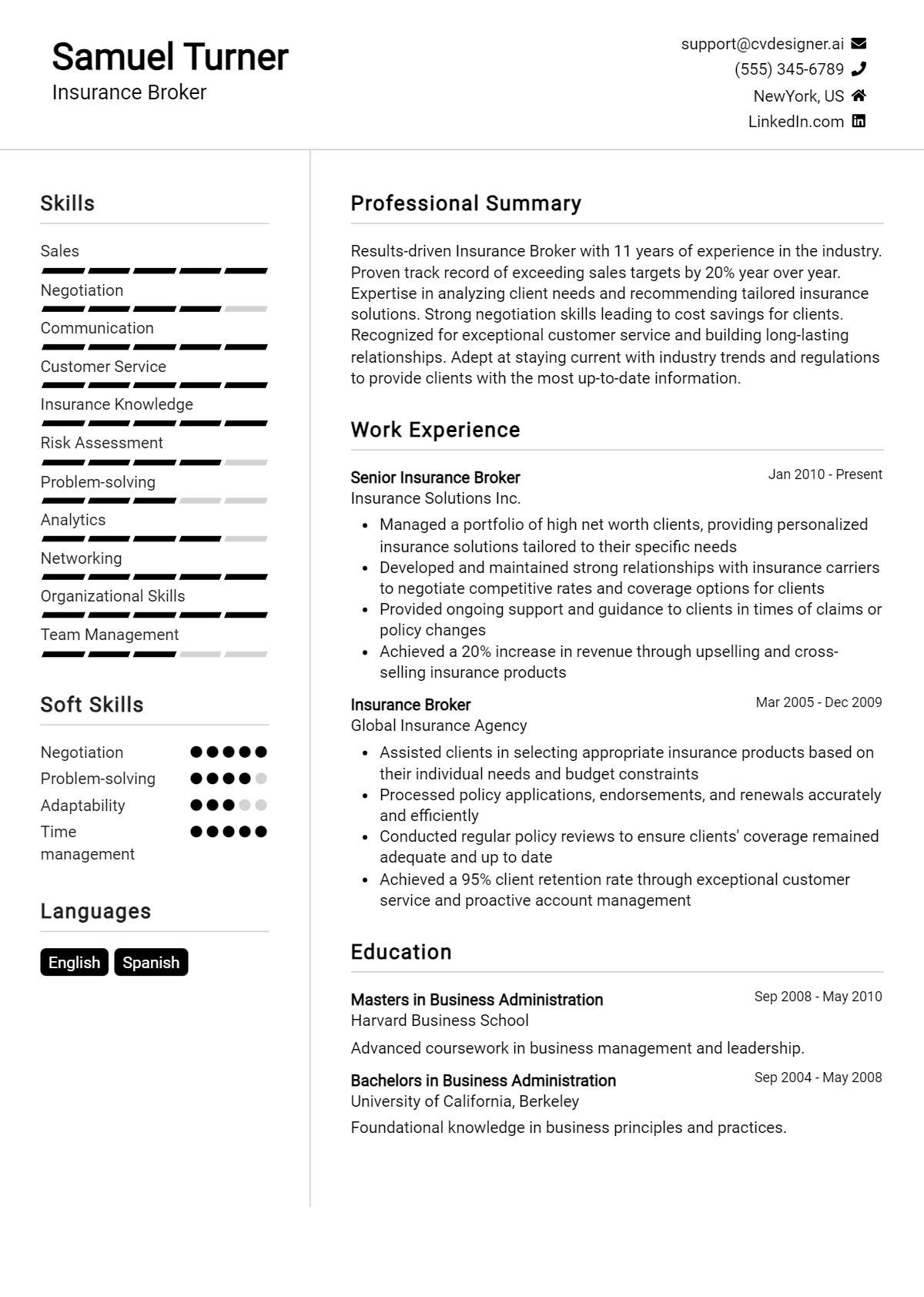

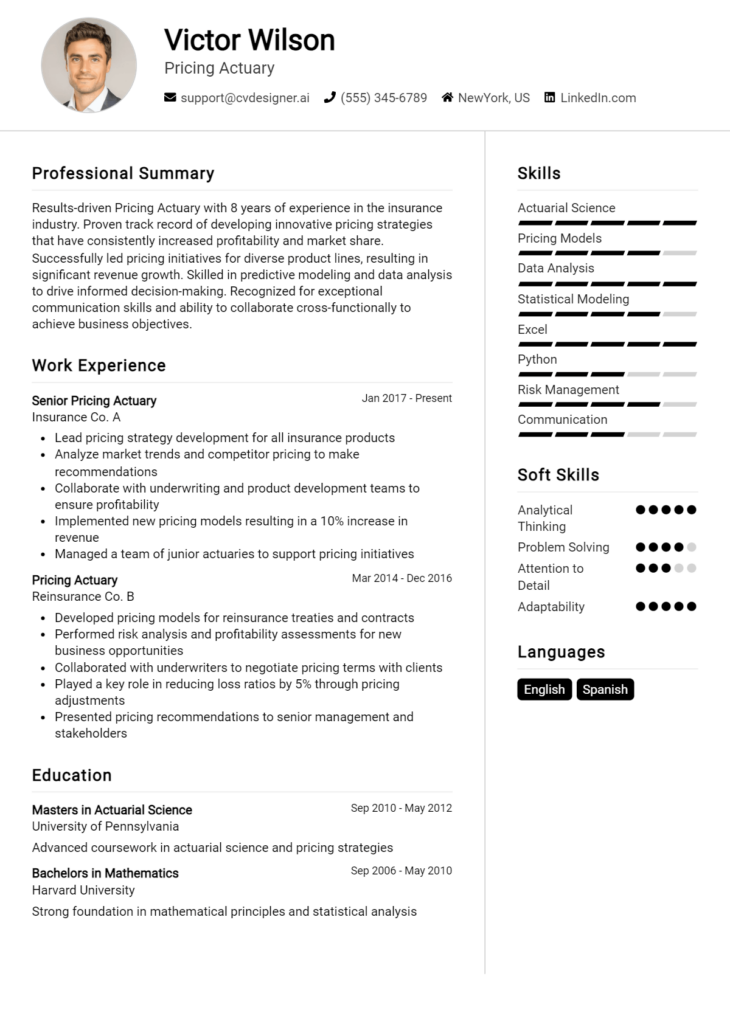

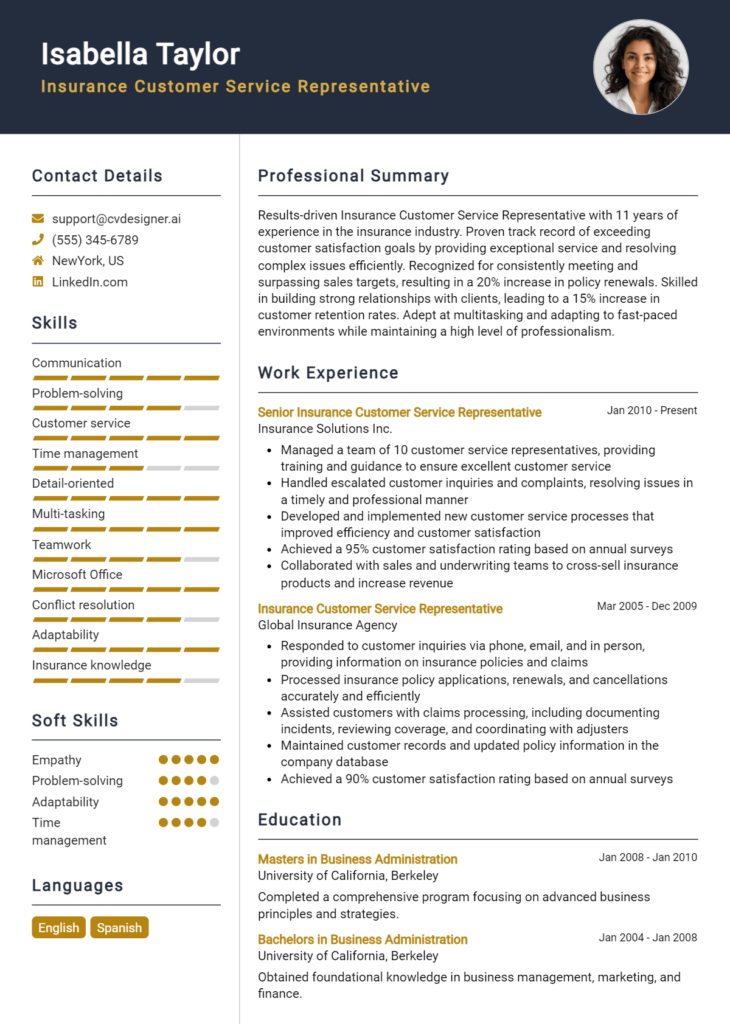

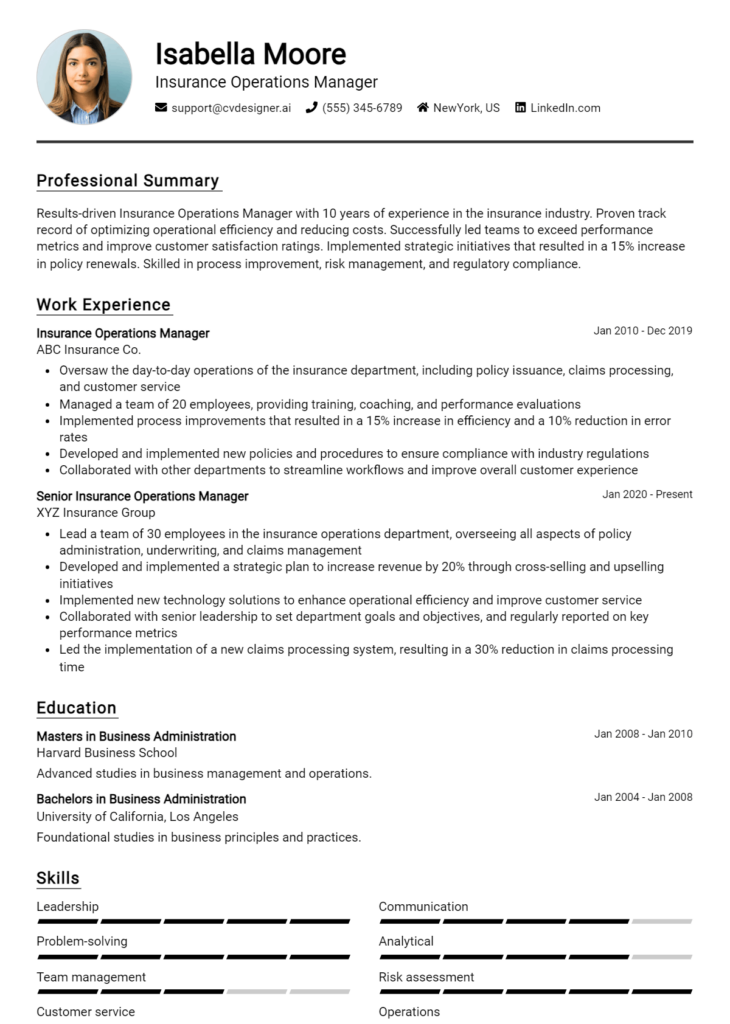

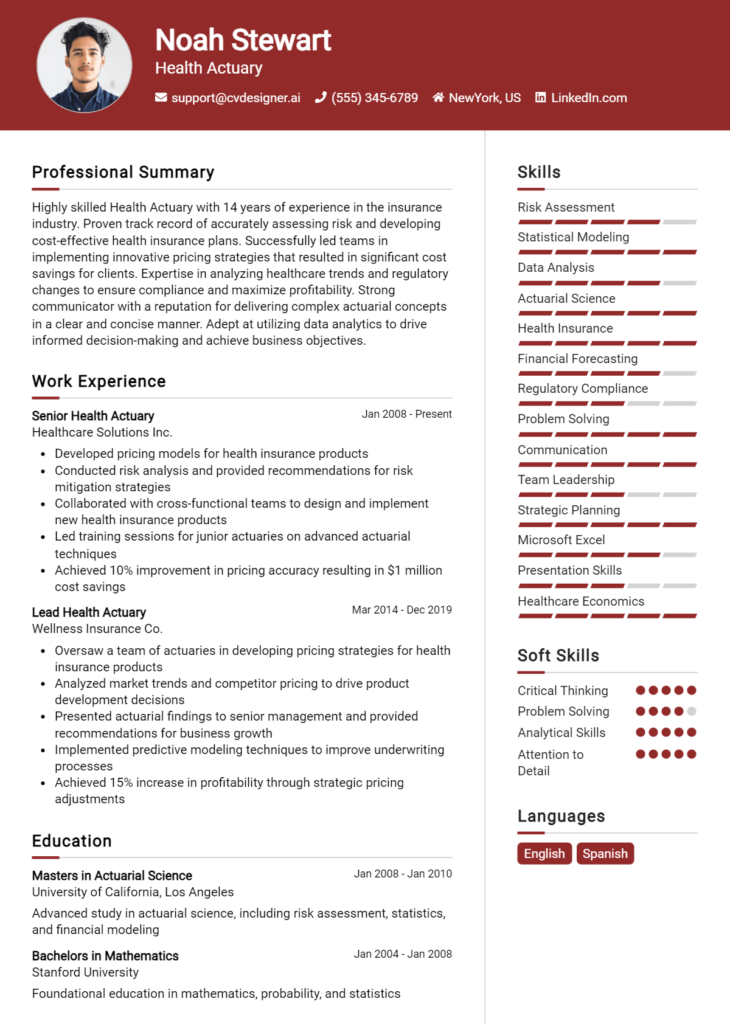

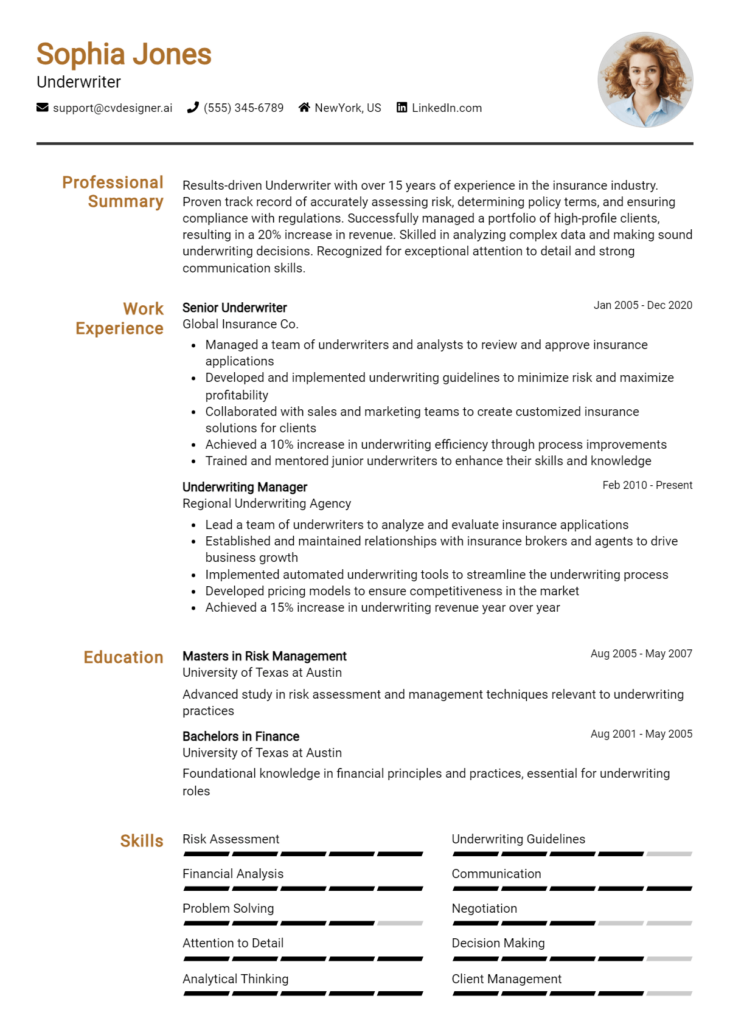

Example Insurance Broker Resume Summaries

Strong Resume Summaries

Dynamic Insurance Broker with over 5 years of experience, successfully managing a diverse portfolio of clients resulting in a 30% increase in client retention rates. Proficient in analyzing risk, developing tailored insurance solutions, and maintaining compliance with industry regulations.

Results-driven Insurance Broker with a proven track record of negotiating policies that save clients an average of 20% on premiums. Expertise in commercial and personal insurance markets, complemented by strong relationship-building skills.

Experienced Insurance Broker with 7+ years providing strategic risk management solutions to high-net-worth clients. Recognized for developing customized insurance plans that meet client needs and exceed sales targets by 40% year-over-year.

Detail-oriented Insurance Broker with a solid background in underwriting and claims management. Successfully reduced claims processing time by 25% through improved communication and organizational skills.

Weak Resume Summaries

Insurance Broker with several years of experience looking for a new opportunity in the insurance field.

Dedicated professional with a background in insurance seeking to leverage skills in a new position.

The examples provided highlight the difference between strong and weak resume summaries. Strong summaries are specific, quantifiable, and demonstrate direct relevance to the Insurance Broker role, showcasing skills and accomplishments that set the candidates apart. In contrast, weak summaries lack detail, fail to quantify results, and come across as generic, making them less impactful to hiring managers.

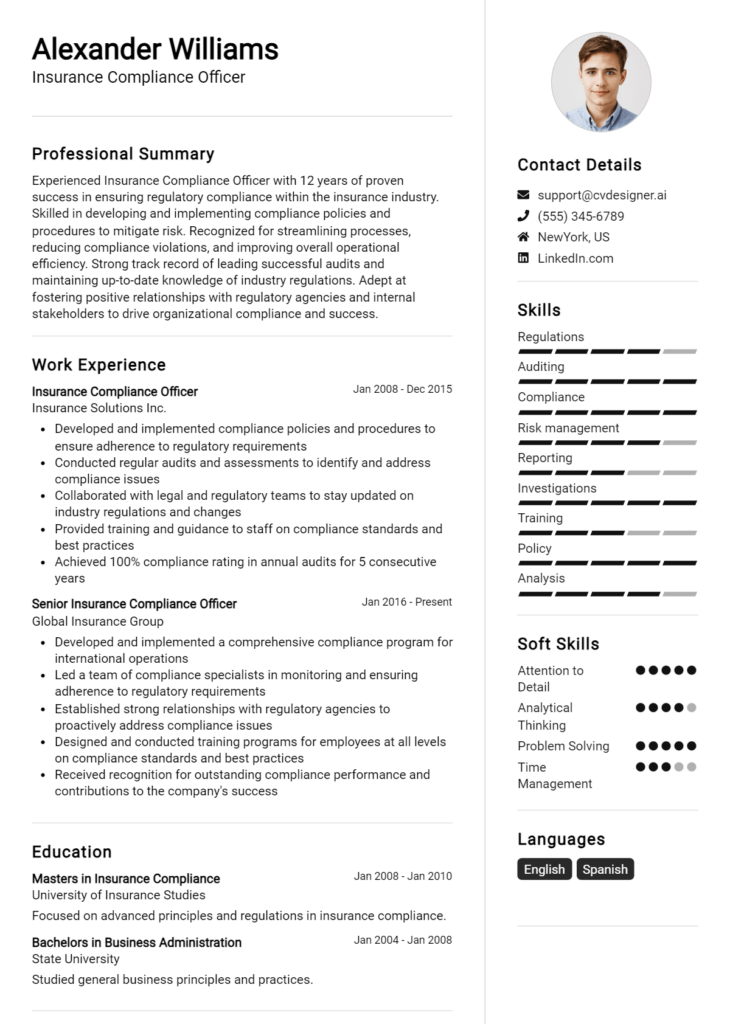

Work Experience Section for Insurance Broker Resume

The work experience section of an Insurance Broker resume is a critical component that illustrates a candidate's professional journey and expertise in the industry. This section not only highlights the technical skills necessary for effective insurance brokerage but also showcases the ability to manage teams and deliver high-quality products that meet client needs. By quantifying achievements and aligning experiences with industry standards, candidates can significantly enhance their appeal to potential employers, demonstrating their value and capability in driving results within the insurance sector.

Best Practices for Insurance Broker Work Experience

- Use specific metrics to quantify achievements, such as percentage increases in client retention or revenue growth.

- Highlight technical skills relevant to the insurance industry, such as risk assessment and policy analysis.

- Demonstrate leadership abilities by detailing team management experiences and outcomes.

- Focus on collaboration by mentioning partnerships with clients, carriers, and other stakeholders.

- Align your experiences with industry standards to show familiarity with best practices and regulations.

- Use action verbs to convey a sense of proactivity and impact in your roles.

- Customize your work experience for each application to match the specific requirements of the job posting.

- Incorporate any relevant certifications or training that enhance your qualifications as an insurance broker.

Example Work Experiences for Insurance Broker

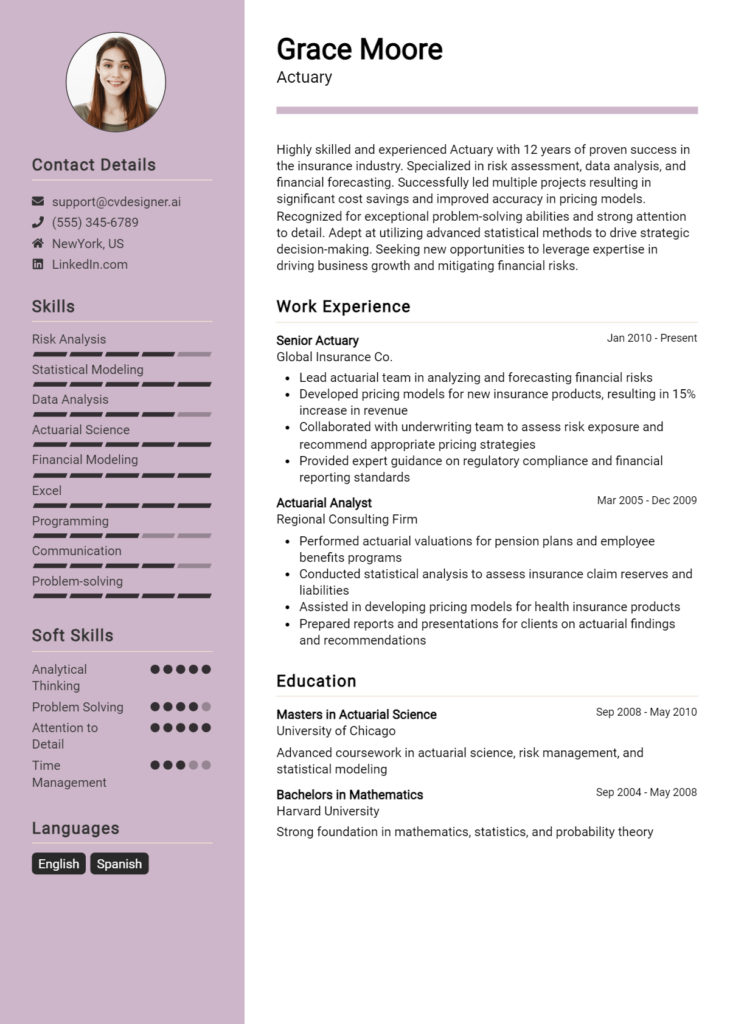

Strong Experiences

- Increased client retention rates by 30% over two years by implementing a personalized follow-up strategy that deepened client relationships.

- Led a team of five brokers to achieve a 25% growth in policy sales within one fiscal year through targeted marketing campaigns.

- Developed and executed a training program for new hires that improved onboarding efficiency by 40%, reducing time to productivity.

- Collaborated with underwriters to streamline the policy approval process, resulting in a 15% reduction in turnaround time for client applications.

Weak Experiences

- Worked with clients to help them with insurance policies.

- Assisted in some team meetings without specifying contributions.

- Responsible for various tasks related to insurance processing.

- Helped with customer service inquiries occasionally.

The examples provided illustrate a clear distinction between strong and weak experiences. Strong experiences are characterized by specific, quantifiable outcomes and demonstrate a proactive approach to leadership and collaboration. These statements convey a sense of achievement and impact, essential for a successful insurance broker. In contrast, weak experiences lack detail and specificity, making it difficult for potential employers to gauge the candidate's contributions and effectiveness in their roles.

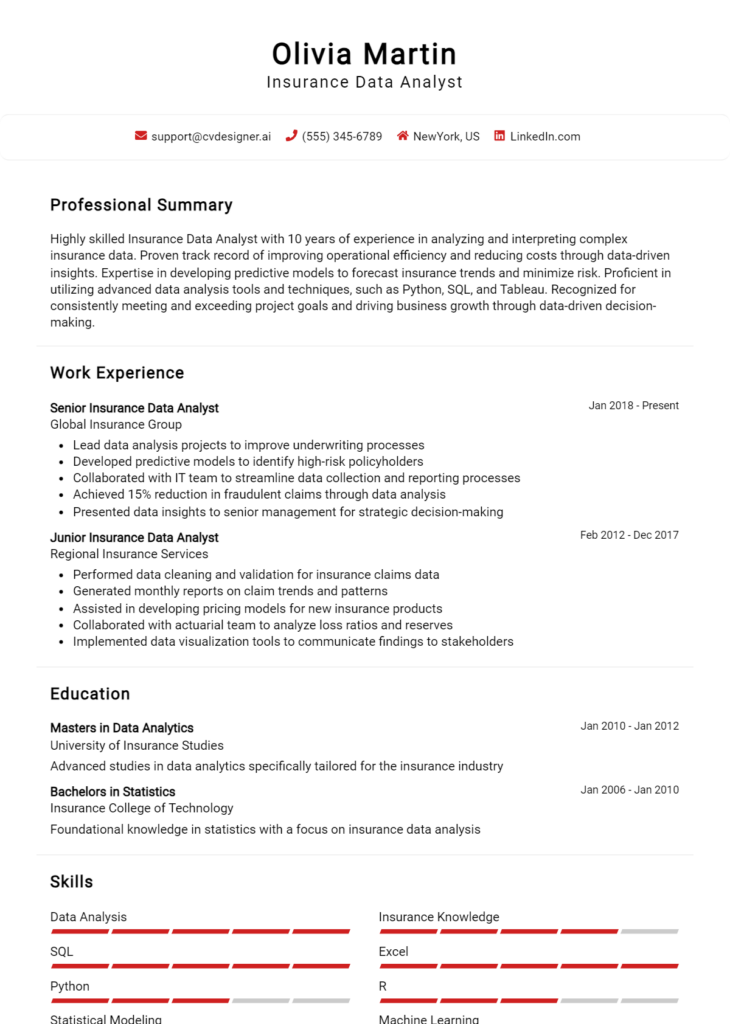

Education and Certifications Section for Insurance Broker Resume

The education and certifications section is a critical component of an Insurance Broker resume, as it showcases the candidate's academic foundation and professional qualifications. This section not only highlights the formal education that underpins their expertise but also emphasizes industry-relevant certifications and ongoing learning efforts. By providing details about relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the demands of the insurance industry. A well-structured education and certifications section signals to potential employers that the candidate is knowledgeable, committed to professional development, and equipped to handle the complexities of the insurance brokerage field.

Best Practices for Insurance Broker Education and Certifications

- Focus on relevant degrees and coursework directly related to insurance or finance.

- Highlight industry-recognized certifications such as Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC).

- Include any specialized training programs that enhance your skills in risk management or client relations.

- Keep the section concise while ensuring that all information provided is pertinent to the role.

- List certifications in reverse chronological order to emphasize the most recent qualifications.

- Use clear headings and bullet points to improve readability and organization.

- Include any relevant continuing education courses to showcase your commitment to lifelong learning.

- Be specific about the institutions where you earned your degrees and certifications to add credibility.

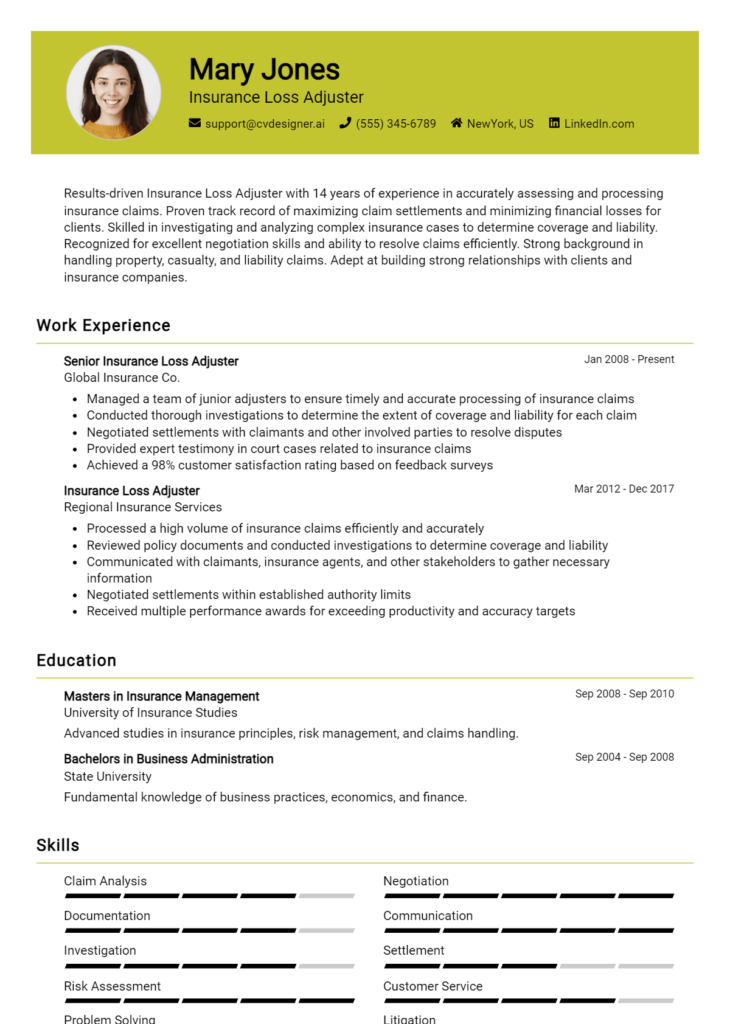

Example Education and Certifications for Insurance Broker

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2020

- Certified Insurance Counselor (CIC), National Alliance for Insurance Education & Research, 2021

- Chartered Property Casualty Underwriter (CPCU), The Institutes, 2022

- Relevant Coursework: Risk Management, Insurance Law, and Ethics in Insurance, University of XYZ

Weak Examples

- Associate Degree in General Studies, Community College, 2018

- Certification in Basic Computer Skills, Online Course, 2019

- High School Diploma, Anytown High School, 2016

- Outdated Insurance Certification, 2015

The strong examples listed demonstrate relevance to the insurance brokerage field, showcasing degrees and certifications that align with industry standards and requirements. These credentials reflect a candidate's preparedness and dedication to the profession. In contrast, the weak examples lack relevance and do not provide any significant value for an Insurance Broker position. They include outdated certifications and general qualifications that do not enhance the candidate's profile or suggest a commitment to the industry.

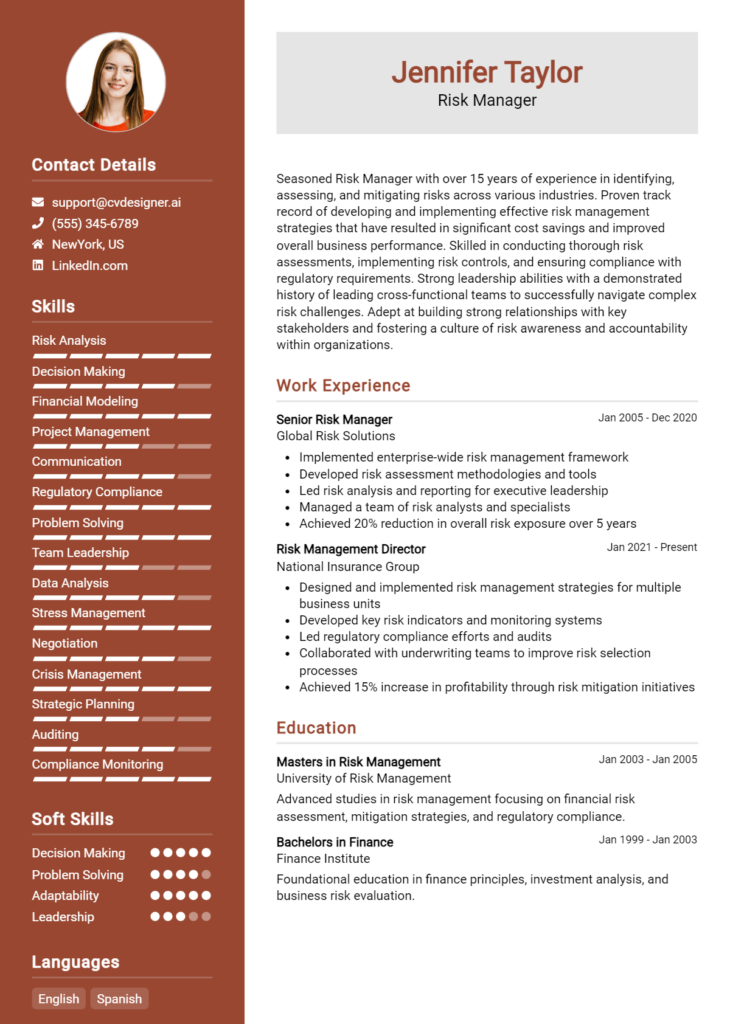

Top Skills & Keywords for Insurance Broker Resume

As an Insurance Broker, demonstrating a robust set of skills is crucial for crafting an impactful resume. Potential employers look for candidates who not only possess industry-specific knowledge but also exhibit strong interpersonal abilities. Skills are the backbone of your resume, showcasing your qualifications and enhancing your appeal in a competitive job market. Highlighting both hard and soft skills can help you effectively convey your expertise and capabilities. A well-rounded skill set will not only make you a more attractive candidate but also equip you to excel in the diverse challenges of the insurance industry.

Top Hard & Soft Skills for Insurance Broker

Soft Skills

- Excellent communication skills

- Strong negotiation abilities

- Active listening

- Empathy and customer service orientation

- Problem-solving skills

- Time management

- Adaptability and flexibility

- Relationship-building

- Critical thinking

- Attention to detail

- Conflict resolution

- Team collaboration

- Decision-making

- Persuasiveness

- Networking skills

Hard Skills

- Knowledge of insurance policies and regulations

- Risk assessment and management

- Proficiency in insurance software (e.g., AMS, CRM systems)

- Market research and analysis

- Financial literacy

- Data analysis and reporting

- Understanding of underwriting processes

- Sales strategies and techniques

- Compliance knowledge

- Familiarity with claims processes

- Customer relationship management

- Contract negotiation

- Technical writing for policy documentation

- Proficiency in Microsoft Office Suite

- Presentation skills

- Knowledge of digital marketing strategies for lead generation

By focusing on these essential skills, you can create a compelling resume that effectively highlights your qualifications. Moreover, don't forget to emphasize your relevant work experience to provide a comprehensive view of your capabilities and accomplishments in the field.

Stand Out with a Winning Insurance Broker Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Insurance Broker position at [Company Name] as advertised on [Job Board/Company Website]. With over [X years] of experience in the insurance industry and a proven track record of building strong client relationships and providing tailored insurance solutions, I am confident in my ability to contribute to your team and help clients navigate their insurance needs effectively. My extensive knowledge of various insurance products, coupled with my commitment to exceptional customer service, positions me as an ideal candidate for this role.

Throughout my career, I have successfully managed a diverse portfolio of clients, offering personalized risk assessments and insurance strategies that align with their unique circumstances. My ability to analyze market trends and stay informed about regulatory changes has enabled me to provide clients with comprehensive advice and valuable insights. I pride myself on my communication skills, which allow me to explain complex insurance terms in a clear and relatable manner, ensuring that clients feel informed and supported throughout the decision-making process.

At [Previous Company Name], I spearheaded initiatives to enhance customer engagement, resulting in a [percentage]% increase in client retention over [specific time period]. I believe that building trust and rapport with clients is essential, and I strive to foster long-term relationships while consistently exceeding their expectations. I am particularly drawn to [Company Name] because of its commitment to innovation and client-centric approach in the insurance market, and I am excited about the opportunity to bring my expertise in problem-solving and negotiation to your team.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am eager to contribute to your success and help clients achieve peace of mind through comprehensive insurance coverage.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Insurance Broker Resume

When crafting a resume for an insurance broker position, it's crucial to present your qualifications and experiences effectively. However, many candidates make common mistakes that can undermine their chances of landing an interview. A well-prepared resume should highlight relevant skills, achievements, and industry knowledge while avoiding pitfalls that could detract from your professionalism. Here are some common mistakes to watch out for in your insurance broker resume:

Generic Objective Statement: Using a vague objective statement can fail to capture the attention of hiring managers. Tailor your objective to reflect your specific goals and how they align with the company's needs.

Lack of Relevant Experience: Failing to emphasize relevant work experience can weaken your resume. Highlight positions that involved sales, customer service, or specific insurance-related tasks to demonstrate your suitability for the role.

Ignoring Industry Jargon: Not incorporating industry-specific terminology can make your resume less impactful. Use appropriate terms that resonate with hiring managers and show your familiarity with the insurance sector.

Too Much Detail: Including excessive information can overwhelm readers. Focus on key accomplishments and responsibilities that showcase your skills rather than listing every task you performed.

Neglecting to Quantify Achievements: Omitting measurable results can diminish the effectiveness of your resume. Whenever possible, include numbers or percentages to illustrate your successes, such as increased sales or client retention rates.

Poor Formatting: A cluttered or inconsistent layout can make your resume difficult to read. Use clear headings, bullet points, and consistent fonts to ensure your information is easily digestible.

Spelling and Grammar Errors: Typos and grammatical mistakes can create a negative impression. Thoroughly proofread your resume to eliminate errors that could suggest a lack of attention to detail.

Failing to Tailor for Each Job Application: Sending the same resume for multiple applications can be detrimental. Customize your resume for each position by emphasizing the skills and experiences most relevant to the specific job description.

Conclusion

As an insurance broker, your role involves not only understanding the intricacies of insurance products but also effectively communicating their value to clients. Key responsibilities include assessing clients' needs, providing tailored insurance solutions, and negotiating terms with insurers. Additionally, staying updated on industry trends and regulatory changes is crucial for success in this dynamic field.

Furthermore, building strong relationships with clients and maintaining a high level of customer service can set you apart from your competition. The ability to analyze risks and explain complex policies in a straightforward manner is essential for earning trust and loyalty.

As you consider advancing your career as an insurance broker, it's vital to ensure your resume reflects your skills, experience, and achievements accurately. Now is the perfect time to review your Insurance Broker Resume. Take advantage of the resources available to you, such as resume templates, which can help you design a professional-looking document. If you're looking to create something unique, try out the resume builder for a more personalized approach. You can also explore resume examples to gather inspiration and see what works best for you. Don’t forget to craft a compelling cover letter using our cover letter templates, which can help you make a strong first impression.

Take action today and ensure your resume stands out in the competitive insurance industry!