Tax Policy Analyst Core Responsibilities

A Tax Policy Analyst plays a crucial role in analyzing tax legislation, assessing its impact on the organization, and advising on compliance strategies. This position requires strong technical and operational skills, alongside problem-solving abilities to navigate complex tax regulations. The analyst effectively collaborates across departments, bridging finance, legal, and compliance functions to align tax policies with organizational goals. A well-structured resume highlighting these qualifications is essential for showcasing expertise and enhancing career opportunities.

Common Responsibilities Listed on Tax Policy Analyst Resume

- Conduct thorough analyses of tax legislation and regulations.

- Develop and recommend tax strategies to minimize liabilities.

- Collaborate with finance and legal teams to ensure compliance.

- Monitor changes in tax policies and assess their implications.

- Prepare detailed reports and presentations for stakeholders.

- Assist in tax audits and documentation processes.

- Provide training on tax-related matters to internal staff.

- Evaluate the effectiveness of existing tax policies and procedures.

- Engage with external tax advisors and regulatory bodies.

- Support strategic planning through tax-related insights.

- Utilize data analysis tools to enhance tax reporting accuracy.

- Participate in cross-functional projects related to tax compliance.

High-Level Resume Tips for Tax Policy Analyst Professionals

In today's competitive job market, a well-crafted resume serves as a crucial tool for Tax Policy Analyst professionals aiming to make a lasting impression on potential employers. With hiring managers often sifting through numerous applications, your resume is your first opportunity to stand out and showcase your unique blend of skills and achievements. It’s essential that your resume not only highlights your qualifications but also aligns with the specific demands of the tax policy landscape. This guide will provide practical and actionable resume tips tailored specifically for Tax Policy Analyst professionals, empowering you to present your best self on paper.

Top Resume Tips for Tax Policy Analyst Professionals

- Tailor your resume to the job description by incorporating relevant keywords and phrases that align with the specific position.

- Highlight your educational background, emphasizing degrees in taxation, finance, or public policy, and any relevant certifications.

- Showcase relevant experience, including internships, research projects, or roles in tax-related organizations.

- Quantify your achievements with specific metrics, such as the percentage of tax savings you identified or the number of policies you analyzed.

- Emphasize your understanding of tax laws, regulations, and compliance issues relevant to the role.

- Include soft skills that are essential for the role, such as analytical thinking, problem-solving, and effective communication.

- Demonstrate your familiarity with tax software and analytical tools commonly used in the industry.

- Keep the layout clean and professional, ensuring it is easy to read and free of clutter.

- Incorporate a summary statement that clearly defines your career objectives and what you bring to the table.

- Proofread your resume multiple times to eliminate any spelling or grammatical errors, as attention to detail is critical in this field.

By implementing these tips, you can significantly increase your chances of landing a job in the Tax Policy Analyst field. A polished and targeted resume not only showcases your qualifications but also demonstrates your commitment to the profession, making you a more attractive candidate to potential employers.

Why Resume Headlines & Titles are Important for Tax Policy Analyst

In the competitive field of tax policy analysis, a well-crafted resume headline or title plays a crucial role in capturing the attention of hiring managers. This concise phrase serves as the first impression, summarizing a candidate's key qualifications and areas of expertise in just a few words. An impactful headline can quickly convey relevance, making it easier for employers to identify the candidate as a strong fit for the position. Therefore, it is essential for job seekers to create headlines that are not only relevant to the role but also succinct and compelling, effectively setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Tax Policy Analyst

- Keep it concise – Aim for one impactful phrase that summarizes your qualifications.

- Be role-specific – Tailor your headline to reflect the Tax Policy Analyst position you’re applying for.

- Highlight key skills – Incorporate relevant skills or areas of expertise.

- Use action-oriented language – Employ verbs that convey your proactive approach and accomplishments.

- Avoid buzzwords – Steer clear of overused terms that lack specificity.

- Focus on achievements – Mention notable accomplishments or experiences that set you apart.

- Stay professional – Maintain a formal tone that aligns with the expectations of the industry.

- Revise for clarity – Ensure your headline communicates your value clearly and effectively.

Example Resume Headlines for Tax Policy Analyst

Strong Resume Headlines

Tax Policy Analyst with 5+ Years of Experience in Legislative Analysis and Compliance

Results-Driven Tax Policy Expert Specializing in Economic Impact Assessment

Strategic Tax Analyst with Proven Track Record in Policy Development and Implementation

Experienced Tax Policy Researcher Focused on Data-Driven Solutions for Complex Tax Issues

Weak Resume Headlines

Tax Policy Analyst Seeking Opportunities

Experienced Professional in Tax

Looking for a Job in Tax Policy

The strong headlines are effective because they provide specific information about the candidate's experience, skills, and focus areas, immediately positioning them as qualified and relevant for the role. In contrast, the weak headlines lack detail and specificity, making it difficult for hiring managers to gauge the candidate's qualifications or interest in the role. By failing to highlight unique skills or experience, weak headlines blend into the crowd, failing to capture attention or convey value.

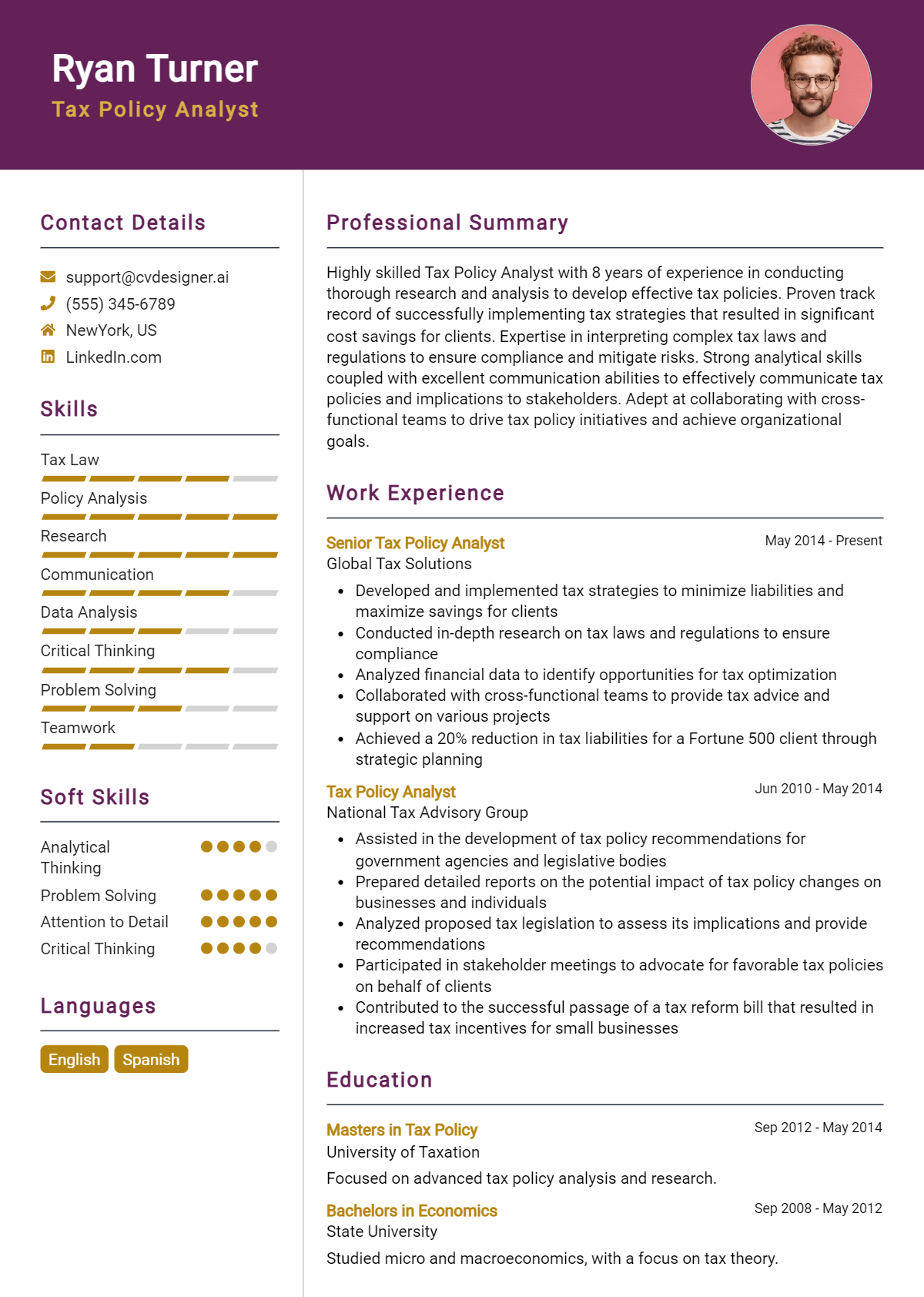

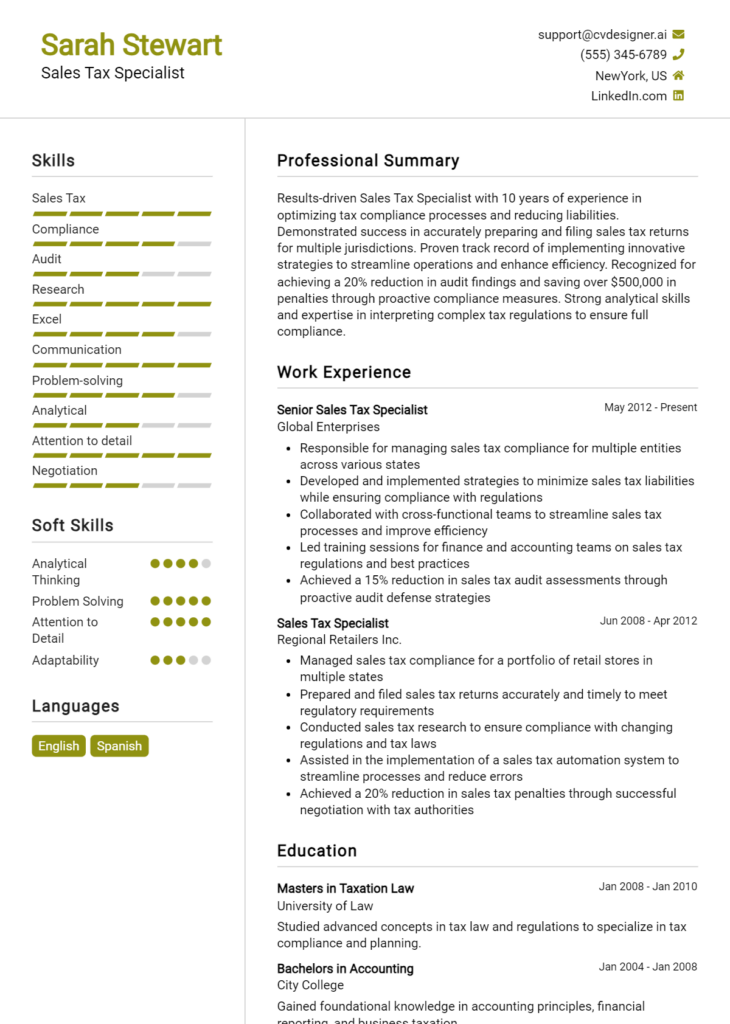

Writing an Exceptional Tax Policy Analyst Resume Summary

A resume summary is a critical component for a Tax Policy Analyst, as it serves as the first impression a candidate makes on hiring managers. A strong summary quickly captures attention by effectively showcasing key skills, relevant experience, and noteworthy accomplishments that align with the job role. It should be concise yet impactful, providing a snapshot of the candidate's qualifications that encourages the reader to delve deeper into the resume. By tailoring the summary to the specific job being applied for, candidates can demonstrate their understanding of the role and how their background makes them an ideal fit.

Best Practices for Writing a Tax Policy Analyst Resume Summary

- Quantify Achievements: Use numbers and percentages to highlight specific accomplishments.

- Focus on Relevant Skills: Emphasize skills that are directly related to tax policy analysis.

- Tailor for the Job Description: Customize the summary to reflect the requirements and responsibilities of the position.

- Use Action-Oriented Language: Start sentences with strong action verbs to convey proactivity.

- Keep it Concise: Limit the summary to 3-5 sentences to maintain clarity and impact.

- Highlight Industry Knowledge: Mention familiarity with current tax laws and regulations.

- Showcase Analytical Skills: Emphasize analytical and problem-solving capabilities relevant to tax policy.

- Include Soft Skills: Incorporate important soft skills such as communication and teamwork that are essential for collaboration.

Example Tax Policy Analyst Resume Summaries

Strong Resume Summaries

Detail-oriented Tax Policy Analyst with over 5 years of experience in analyzing tax legislation and its economic impact. Successfully led a project that reduced compliance costs by 20% for a major client, resulting in $1.5 million in savings.

Results-driven analyst specializing in tax policy reform, with a proven track record of drafting legislation that increased revenue by 15% over two years. Adept at collaborating with cross-functional teams to implement effective tax strategies.

Experienced Tax Policy Analyst with expertise in federal and state tax regulations. Spearheaded a comprehensive review that identified $500,000 in potential tax credits, enhancing client benefits and compliance.

Weak Resume Summaries

Dedicated tax professional with experience in policy analysis. Looking to further my career in a challenging environment.

Tax Policy Analyst with knowledge of tax laws. I am a team player and eager to contribute to the organization.

The above examples illustrate the distinction between strong and weak resume summaries. The strong summaries effectively quantify achievements and highlight specific skills and experiences directly relevant to the role of a Tax Policy Analyst. In contrast, the weak summaries are vague, lacking concrete details and quantifiable outcomes, making them less impactful and memorable to hiring managers.

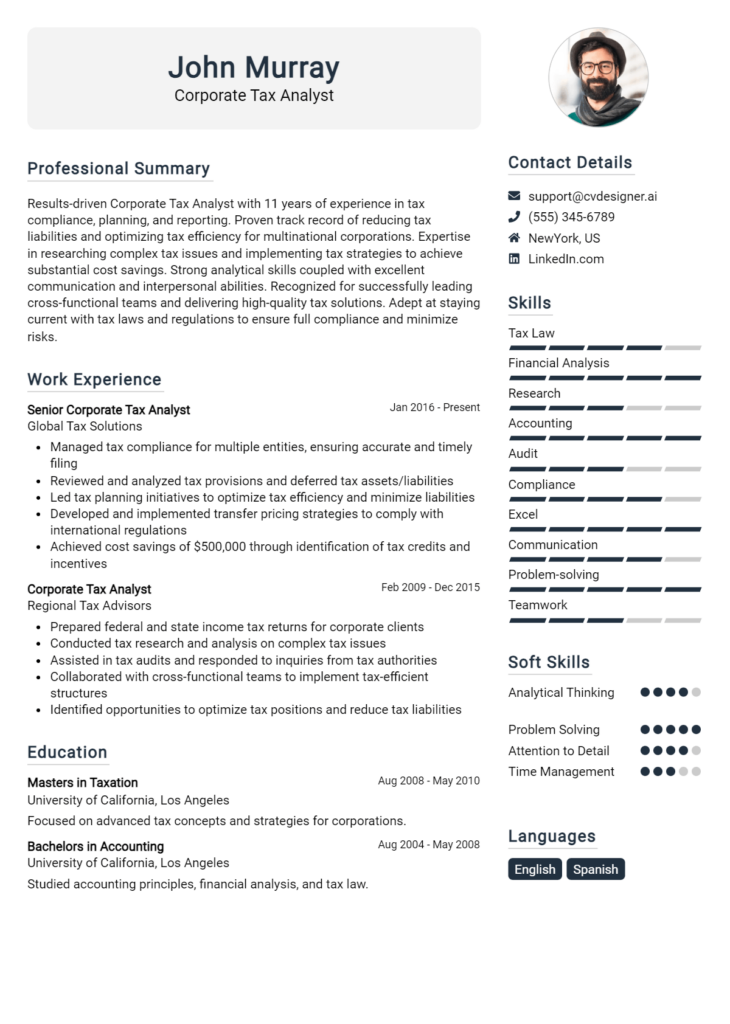

Work Experience Section for Tax Policy Analyst Resume

The work experience section of a Tax Policy Analyst resume is critical in demonstrating the candidate's expertise and proficiency in the field. This section serves as a platform to illustrate not only the technical skills acquired through previous roles but also the ability to effectively manage teams and deliver high-quality products. By quantifying achievements and aligning experiences with industry standards, candidates can present a compelling case for their suitability for the role. A well-crafted work experience section not only highlights past responsibilities but also showcases the impact of an analyst's contributions to tax policy initiatives and outcomes.

Best Practices for Tax Policy Analyst Work Experience

- Use clear and concise language to describe responsibilities and achievements.

- Quantify results where possible, such as percentage improvements or monetary savings.

- Highlight specific technical skills relevant to tax policy analysis, such as statistical software or data visualization tools.

- Demonstrate collaboration by mentioning cross-departmental projects or team leadership experiences.

- Align experiences with industry standards and terminology to appeal to hiring managers.

- Focus on outcomes and impacts of projects rather than just tasks performed.

- Include relevant certifications or training that enhance expertise in tax policy.

- Tailor the work experience content to match the job description of the position being applied for.

Example Work Experiences for Tax Policy Analyst

Strong Experiences

- Led a team of 5 analysts to develop a comprehensive tax reform proposal, resulting in a 15% increase in tax compliance across small businesses.

- Implemented a data analysis project that identified $2 million in potential tax revenues, enhancing budget forecasts for the state government.

- Collaborated with cross-functional teams to create a tax policy impact assessment tool, improving stakeholder decision-making efficiency by 40%.

- Authored a white paper on emerging tax trends, which was presented at a national conference, receiving recognition from industry leaders.

Weak Experiences

- Worked on tax-related projects.

- Assisted in the analysis of tax policies.

- Participated in team meetings about tax issues.

- Helped with data collection for reports.

The strong experiences are considered impactful because they highlight specific achievements, quantify results, and demonstrate leadership and collaboration in significant projects. In contrast, the weak experiences lack detail, measurable outcomes, and do not effectively convey the candidate's contributions or expertise, making them less compelling to potential employers.

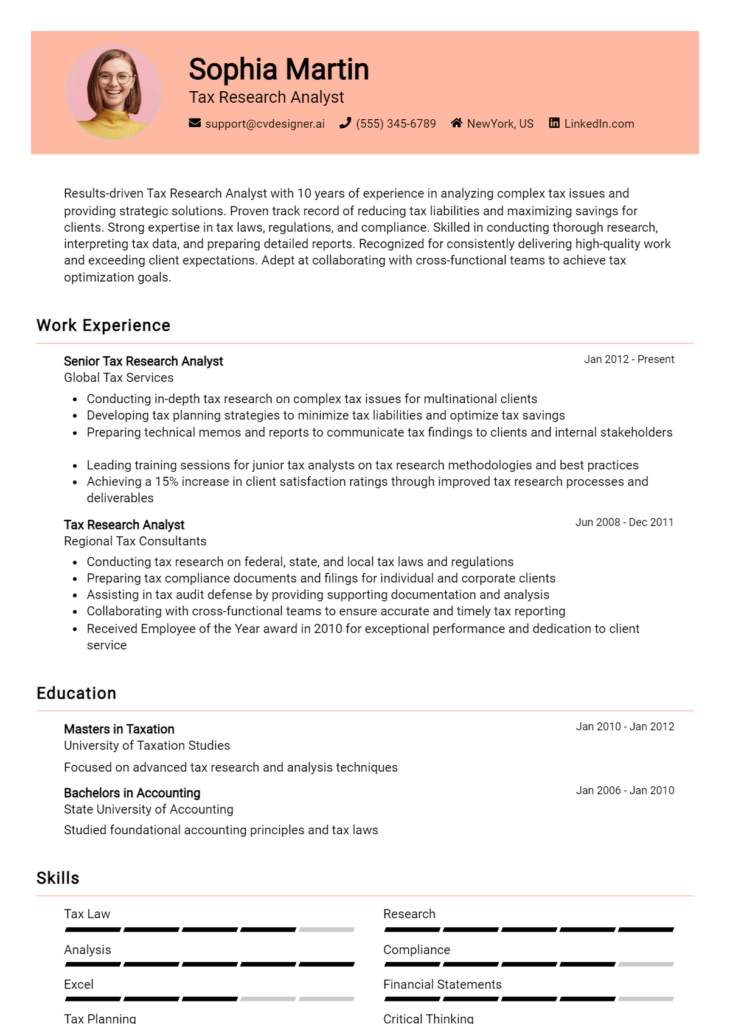

Education and Certifications Section for Tax Policy Analyst Resume

The education and certifications section of a Tax Policy Analyst resume is crucial in showcasing a candidate's academic foundation and commitment to the field. This section not only highlights relevant degrees and industry-recognized certifications but also emphasizes the candidate's dedication to continuous learning and professional development. By detailing pertinent coursework, specialized training, and certifications, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role, making them more competitive in the job market.

Best Practices for Tax Policy Analyst Education and Certifications

- Include only relevant degrees and certifications that pertain to tax policy, economics, or public policy.

- Detail coursework that aligns with key responsibilities of a Tax Policy Analyst, such as tax law, economic analysis, and public finance.

- Highlight advanced degrees (master's or doctoral) as they can indicate a deeper level of expertise.

- Incorporate industry-recognized certifications, such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA).

- List certifications in chronological order, starting with the most recent to showcase ongoing education.

- Keep the section concise yet informative, ensuring clarity and focus on qualifications that enhance your suitability for the role.

- Use bullet points for readability and to make it easy for recruiters to scan for key qualifications.

- Consider mentioning any relevant workshops or training sessions that demonstrate specialized skills or knowledge in tax policy analysis.

Example Education and Certifications for Tax Policy Analyst

Strong Examples

- M.A. in Public Policy, University of Chicago, 2022

- Certified Public Accountant (CPA), 2021

- Relevant Coursework: Advanced Tax Law, Economic Policy Analysis, Public Finance.

- Certificate in Tax Policy from the National Tax Association, 2023

Weak Examples

- Bachelor of Arts in History, University of California, 2010

- Certification in Microsoft Office, 2015

- Online Course: Introduction to Cooking, 2022

- High School Diploma, 2008

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Tax Policy Analyst, showcasing relevant educational backgrounds and certifications that enhance the candidate's credibility in the field. In contrast, the weak examples illustrate qualifications that lack relevance to the job role, such as unrelated degrees or certifications that do not contribute to the candidate's expertise in tax policy analysis, which may detract from their suitability for the position.

Top Skills & Keywords for Tax Policy Analyst Resume

A well-crafted resume for a Tax Policy Analyst position is crucial for demonstrating the candidate's qualifications and potential value to employers. The right mix of skills can effectively convey an applicant's ability to analyze complex tax policies, conduct research, and provide actionable insights. Highlighting both hard and soft skills is essential, as it showcases not only technical expertise but also the interpersonal abilities needed for collaboration and communication in a team-oriented environment. This balance is key to standing out in a competitive job market.

Top Hard & Soft Skills for Tax Policy Analyst

Soft Skills

- Analytical Thinking

- Problem Solving

- Attention to Detail

- Communication Skills

- Team Collaboration

- Critical Thinking

- Time Management

- Adaptability

- Research Skills

- Interpersonal Skills

- Negotiation Skills

- Creativity

- Ethical Judgment

- Emotional Intelligence

- Conflict Resolution

- Empathy

- Presentation Skills

Hard Skills

- Tax Law Knowledge

- Economic Analysis

- Data Analysis and Interpretation

- Statistical Software Proficiency (e.g., SAS, R, SPSS)

- Policy Analysis Techniques

- Microsoft Excel and Advanced Spreadsheet Skills

- Familiarity with Regulatory Compliance

- Financial Modeling

- Legislative Research

- Report Writing

- Database Management

- Tax Software Proficiency (e.g., QuickBooks, TurboTax)

- Microsoft PowerPoint for Presentations

- Risk Assessment Techniques

- Quantitative Analysis

- Project Management Skills

- Knowledge of International Taxation

For more insights on the importance of skills, you can explore skills related to this role. Additionally, detailing relevant work experience can further enhance your resume's effectiveness.

Stand Out with a Winning Tax Policy Analyst Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Tax Policy Analyst position at [Company Name], as advertised on [where you found the job listing]. With a solid background in public policy analysis, extensive knowledge of tax legislation, and a passion for developing equitable tax systems, I am excited about the opportunity to contribute to your team’s efforts in shaping effective tax policies that benefit both the economy and the community.

In my previous role at [Previous Company Name], I conducted in-depth research on federal and state tax policies, analyzing their impacts on various demographic groups and economic sectors. My experience in utilizing quantitative and qualitative data to inform policy recommendations has honed my ability to present complex tax issues in a clear and concise manner. Additionally, I collaborated with stakeholders to evaluate proposed tax reforms, ensuring that our analyses reflected a comprehensive understanding of the broader economic implications and aligned with best practices in fiscal responsibility.

I am particularly drawn to [Company Name] because of your commitment to innovative policy solutions that prioritize social equity and economic growth. I am eager to leverage my analytical skills and my experience in policy advocacy to support your mission. I am confident that my ability to synthesize large volumes of information and my strong communication skills will enable me to effectively contribute to your team and engage with key stakeholders.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am excited about the possibility of contributing to your impactful work in tax policy and I am available for an interview at your earliest convenience.

Sincerely,

[Your Name]

[Your Contact Information]

[LinkedIn Profile or Website, if applicable]

Common Mistakes to Avoid in a Tax Policy Analyst Resume

When crafting a resume for a Tax Policy Analyst position, it's essential to present your qualifications and experience clearly and effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls will help you create a compelling resume that stands out to hiring managers in the competitive field of tax policy analysis.

Neglecting Tailoring: Failing to customize your resume for each job application can make it appear generic. Highlight relevant skills and experiences that align with the specific requirements of the job description.

Overloading with Jargon: While technical terminology is necessary in tax policy, using too much jargon can confuse readers. Ensure that your resume is accessible to both HR personnel and tax professionals.

Lack of Quantifiable Achievements: Instead of merely listing duties, include specific achievements with measurable outcomes. For example, mention how your analysis led to cost savings or improved compliance rates.

Ignoring Soft Skills: Tax Policy Analysts need strong analytical and communication skills. Neglecting to showcase these soft skills can lead to an incomplete picture of your capabilities.

Poor Formatting: A cluttered or unprofessional resume layout can detract from your qualifications. Use clear headings, bullet points, and consistent formatting to enhance readability.

Inaccurate Information: Any discrepancies or inaccuracies, such as incorrect dates or job titles, can raise red flags for employers. Always double-check your information for accuracy.

Omitting Relevant Education and Certifications: Not highlighting relevant qualifications, such as degrees in economics or finance and certifications like CPA or CFA, can make you seem less qualified.

Skipping a Summary Statement: An effective summary statement at the beginning of your resume can succinctly convey your value proposition and career goals, making it easier for employers to understand your fit for the role.

Conclusion

As a Tax Policy Analyst, understanding the intricacies of tax legislation and its implications on various stakeholders is crucial. This role requires a strong analytical mindset, the ability to conduct thorough research, and excellent communication skills to effectively convey complex tax concepts. Key responsibilities often include evaluating proposed tax policies, analyzing their economic impact, and providing recommendations based on data-driven insights.

In conclusion, if you aspire to excel in the field of tax policy analysis, it's essential to craft a compelling resume that highlights your skills and experiences. Take the time to review your Tax Policy Analyst resume to ensure it showcases your qualifications effectively. Consider utilizing resources such as resume templates, resume builder, resume examples, and cover letter templates to enhance your application. These tools can help you create a professional and polished presentation of your expertise, making you stand out in the competitive job market. Don't miss the opportunity to advance your career—start refining your resume today!