Tax Technology Specialist Core Responsibilities

A Tax Technology Specialist plays a crucial role in integrating tax processes with technology across various departments, ensuring compliance and efficiency. Key responsibilities include analyzing tax data, automating tax processes, and collaborating with IT to implement software solutions. Essential skills include technical expertise, operational insight, and strong problem-solving abilities, which are vital for driving organizational goals. A well-structured resume can effectively highlight these qualifications, demonstrating the candidate's value to potential employers.

Common Responsibilities Listed on Tax Technology Specialist Resume

- Develop and maintain tax technology solutions to streamline processes.

- Collaborate with cross-functional teams to integrate tax software.

- Analyze tax data for accuracy and compliance with regulations.

- Identify opportunities for automation and process improvement.

- Assist in the implementation of tax reporting tools and systems.

- Provide technical support and training for tax software users.

- Monitor changes in tax laws and adjust technology solutions accordingly.

- Prepare documentation for system enhancements and updates.

- Conduct data analysis to support tax planning and strategy.

- Ensure timely and accurate tax filings and reporting.

- Collaborate with external vendors for software upgrades and maintenance.

- Support audits by providing necessary data and system access.

High-Level Resume Tips for Tax Technology Specialist Professionals

In today's competitive job market, a well-crafted resume is crucial for Tax Technology Specialist professionals aiming to make a positive first impression on potential employers. Your resume serves as the initial representation of your skills, experiences, and accomplishments, making it essential that it effectively showcases what you bring to the table. A strong resume not only highlights your technical capabilities but also reflects your understanding of the evolving tax landscape and technology integration. In this guide, we will provide practical and actionable resume tips specifically tailored for Tax Technology Specialist professionals, ensuring you stand out in this specialized field.

Top Resume Tips for Tax Technology Specialist Professionals

- Tailor your resume to each job description by incorporating keywords from the posting to demonstrate relevance.

- Begin with a strong summary statement that encapsulates your experience and unique value proposition in tax technology.

- Highlight relevant experience in both tax compliance and technological solutions, emphasizing your dual expertise.

- Quantify your achievements by including metrics such as the percentage of tax savings achieved or the number of successful system implementations.

- Showcase proficiency with tax software and tools, such as ERP systems or data analytics platforms, to highlight technical skills.

- Include certifications and relevant coursework, such as CPA, EA, or specialized tax technology training, to bolster your qualifications.

- Demonstrate your problem-solving skills by providing examples of how you’ve improved tax processes or resolved complex issues.

- Incorporate industry-specific jargon and terminologies to reflect your familiarity with the tax technology landscape.

- Keep formatting clean and professional, using bullet points for easy readability and ensuring consistency in font and style.

- Proofread your resume multiple times to eliminate any spelling or grammatical errors, as attention to detail is crucial in this field.

By implementing these tips, you can significantly increase your chances of landing a job in the Tax Technology Specialist field. A tailored, detail-oriented resume that effectively highlights your skills and accomplishments will not only capture the attention of hiring managers but also convey your professionalism and readiness to contribute to their organization.

Why Resume Headlines & Titles are Important for Tax Technology Specialist

In the competitive field of tax technology, having a well-crafted resume headline or title is crucial for a Tax Technology Specialist. A strong headline acts as an eye-catching summary that encapsulates a candidate's core qualifications and expertise in a single, impactful phrase. This initial hook is vital as it can immediately grab the attention of hiring managers, distinguishing the applicant from the multitude of other candidates. The headline should be concise, relevant, and tailored to the specific job being applied for, allowing hiring managers to quickly assess the applicant's alignment with the role.

Best Practices for Crafting Resume Headlines for Tax Technology Specialist

- Keep it concise: Aim for one to two impactful sentences.

- Be role-specific: Include keywords relevant to the Tax Technology Specialist position.

- Highlight key qualifications: Focus on skills, experience, or certifications that set you apart.

- Showcase achievements: Incorporate quantifiable results or accomplishments if possible.

- Use industry terminology: Familiarize yourself with terms commonly used in tax technology.

- Tailor for each application: Customize your headline for the specific job description you’re applying for.

- Avoid jargon: Ensure clarity and avoid overly complex language that may confuse readers.

- Make it memorable: Use strong adjectives or action verbs to create a lasting impression.

Example Resume Headlines for Tax Technology Specialist

Strong Resume Headlines

"Results-Driven Tax Technology Specialist with 7+ Years of Experience in Automation and Compliance Solutions"

“Innovative Tax Technology Expert Specializing in Data Analytics and Regulatory Compliance”

“Certified Tax Technology Professional with Proven Track Record in Streamlining Tax Processes”

“Dynamic Tax Technology Specialist Focused on Enhancing Efficiency Through Advanced Software Solutions”

Weak Resume Headlines

“Tax Specialist”

“Experienced Professional Looking for a Job”

“Tax Technology and Other Skills”

The strong headlines are effective because they clearly articulate the candidate's expertise, experience, and specific focus areas in tax technology, making them relevant and appealing to hiring managers. They utilize industry terminology and highlight unique qualifications or achievements, ensuring that the candidate stands out. In contrast, the weak headlines fail to impress due to their vague nature, lack of specificity, and generic phrasing, which leaves hiring managers with little insight into the candidate's qualifications or suitability for the role.

Writing an Exceptional Tax Technology Specialist Resume Summary

A well-crafted resume summary is crucial for a Tax Technology Specialist as it serves as the first impression to hiring managers. A strong summary succinctly captures attention by highlighting key skills, relevant experience, and notable accomplishments tailored to the specific job role. In an industry where accuracy and technical proficiency are paramount, a concise and impactful summary can differentiate a candidate from others, effectively setting the tone for the rest of the resume.

Best Practices for Writing a Tax Technology Specialist Resume Summary

- Quantify Achievements: Use numbers to showcase the impact of your work, such as tax savings generated or efficiency improvements.

- Focus on Skills: Highlight technical skills relevant to tax technology, such as proficiency in tax software, data analysis, or compliance management.

- Tailor to Job Description: Customize your summary to align with the requirements and keywords found in the job listing.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of proactivity and results-driven performance.

- Keep It Concise: Aim for 2-4 sentences that effectively summarize your qualifications without unnecessary fluff.

- Showcase Relevant Experience: Emphasize experience in tax technology projects, system implementations, or process improvements.

- Highlight Certifications: If applicable, mention relevant certifications or training that enhance your qualifications in tax technology.

- Demonstrate Problem-Solving Skills: Mention instances where you have identified and resolved tax-related technology challenges.

Example Tax Technology Specialist Resume Summaries

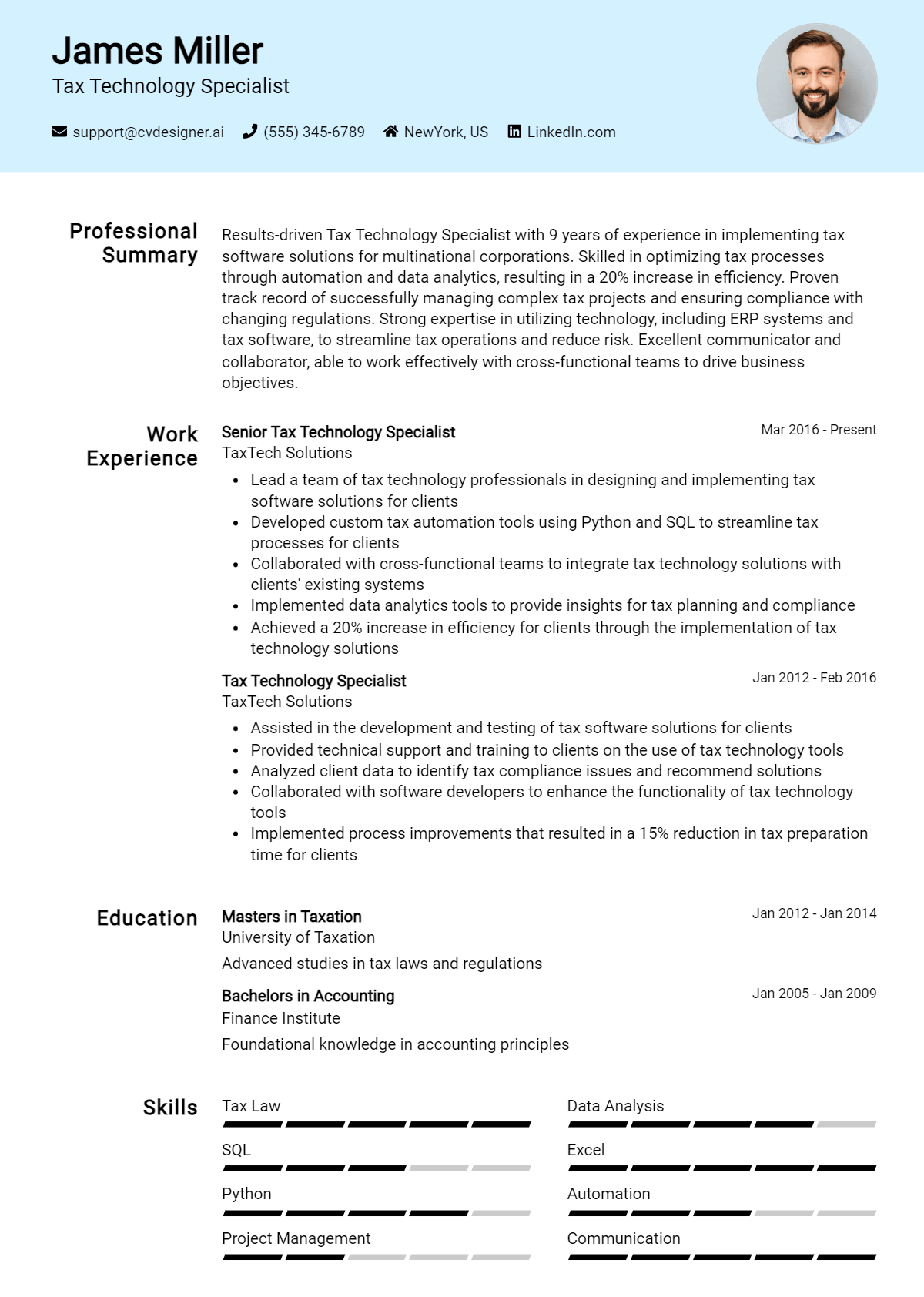

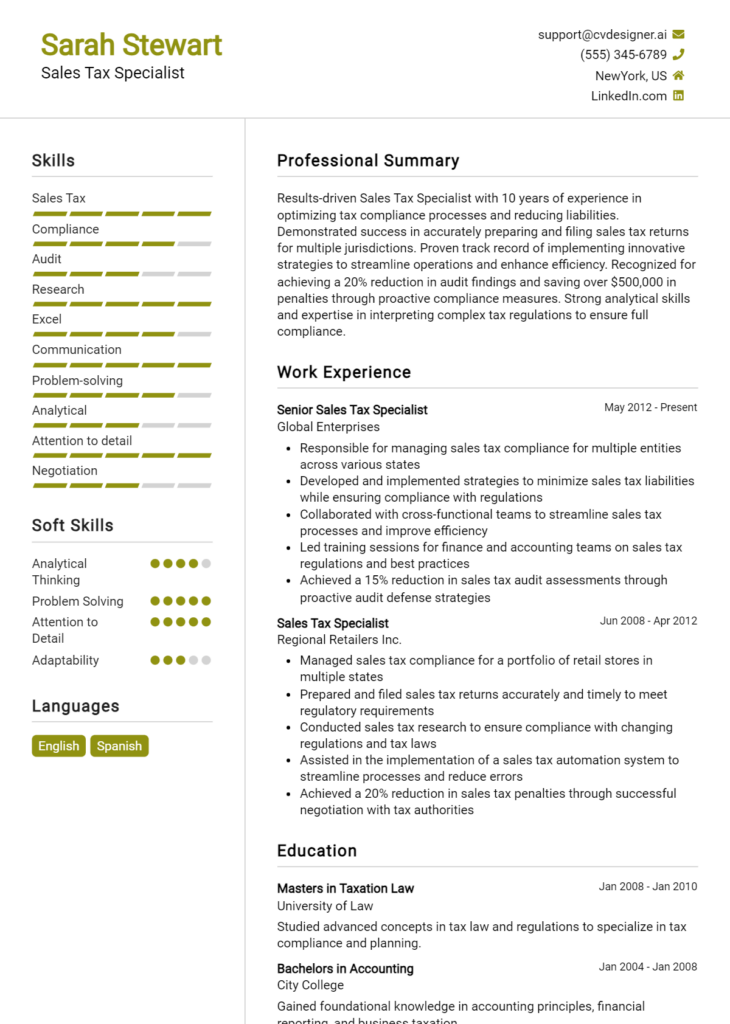

Strong Resume Summaries

Results-driven Tax Technology Specialist with over 7 years of experience optimizing tax compliance processes, resulting in a 30% reduction in audit discrepancies. Proficient in leveraging advanced tax software and data analytics to enhance tax reporting accuracy and efficiency.

Detail-oriented Tax Technology Specialist with a proven track record of implementing innovative tax solutions that increased departmental efficiency by 25%. Adept in tax software integration and training teams on best practices to ensure compliance and accuracy.

Experienced Tax Technology Specialist with expertise in automating tax workflows, achieving a 40% decrease in processing time. Skilled in managing cross-functional teams to implement system upgrades that streamline compliance and reporting processes.

Strategic Tax Technology Specialist with 5 years of experience in tax data management and analysis, successfully reducing operational costs by 15% through technology-driven solutions. Strong background in project management and regulatory compliance.

Weak Resume Summaries

Tax Technology Specialist with experience in the tax field looking for a new opportunity. I am a hard worker and a quick learner.

Motivated individual seeking a position in tax technology. I have skills that can be useful in various tasks related to tax.

The strong resume summaries effectively communicate specific achievements, demonstrate relevant skills, and include quantifiable outcomes that showcase the candidate's impact in previous roles. In contrast, the weak summaries lack detail and fail to highlight any measurable success or relevant experience, making them less compelling to hiring managers seeking a qualified Tax Technology Specialist.

Work Experience Section for Tax Technology Specialist Resume

The work experience section of a Tax Technology Specialist resume is a critical component that effectively highlights the candidate's technical skills, leadership abilities, and commitment to delivering high-quality products. This section serves as an opportunity to showcase not only the professional journey but also how past roles have equipped the candidate with the expertise necessary to excel in tax technology. It is essential to quantify achievements and align experiences with industry standards to demonstrate the impact of one's contributions, making a compelling case to potential employers.

Best Practices for Tax Technology Specialist Work Experience

- Highlight specific technical skills relevant to tax technology, such as data analysis, software proficiency, and automation techniques.

- Quantify achievements with metrics, such as percentage improvements in efficiency, cost savings, or successful project completions.

- Emphasize leadership experiences, showcasing the ability to manage teams and guide projects to successful outcomes.

- Focus on collaboration by detailing experiences working with cross-functional teams or stakeholders to achieve project goals.

- Align experience descriptions with industry standards and terminology to resonate with hiring managers and applicant tracking systems.

- Use action verbs to convey proactivity and impact, making descriptions more dynamic and engaging.

- Include relevant certifications or training that bolster technical knowledge and expertise in tax technology.

- Tailor the work experience section to reflect the skills and experiences most sought after in the job market.

Example Work Experiences for Tax Technology Specialist

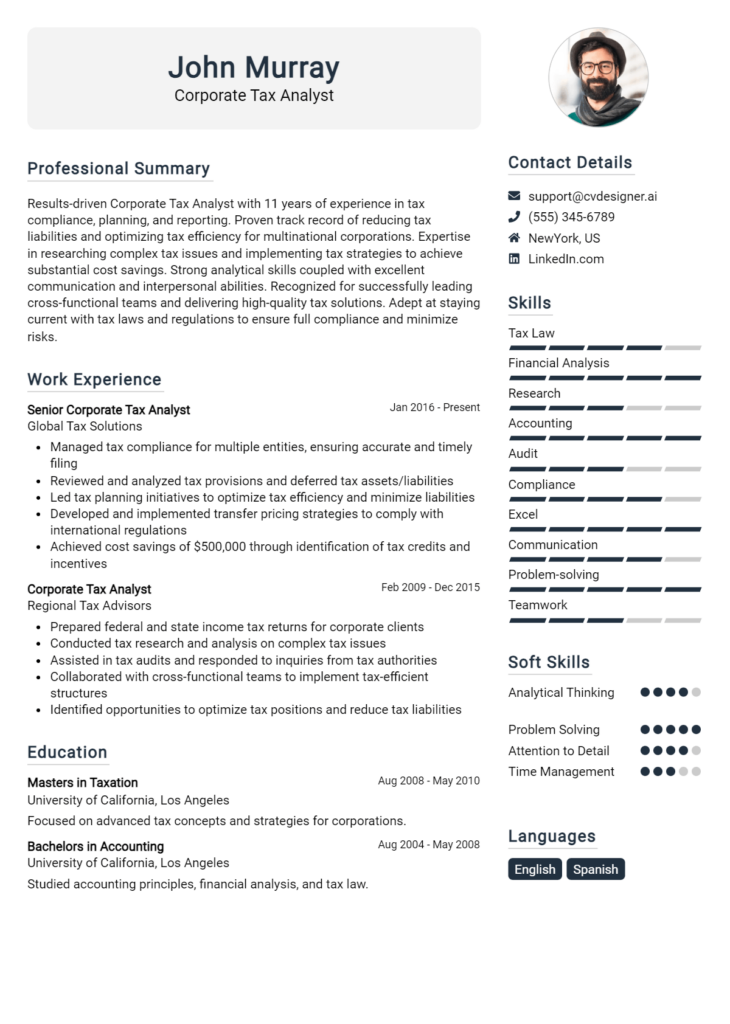

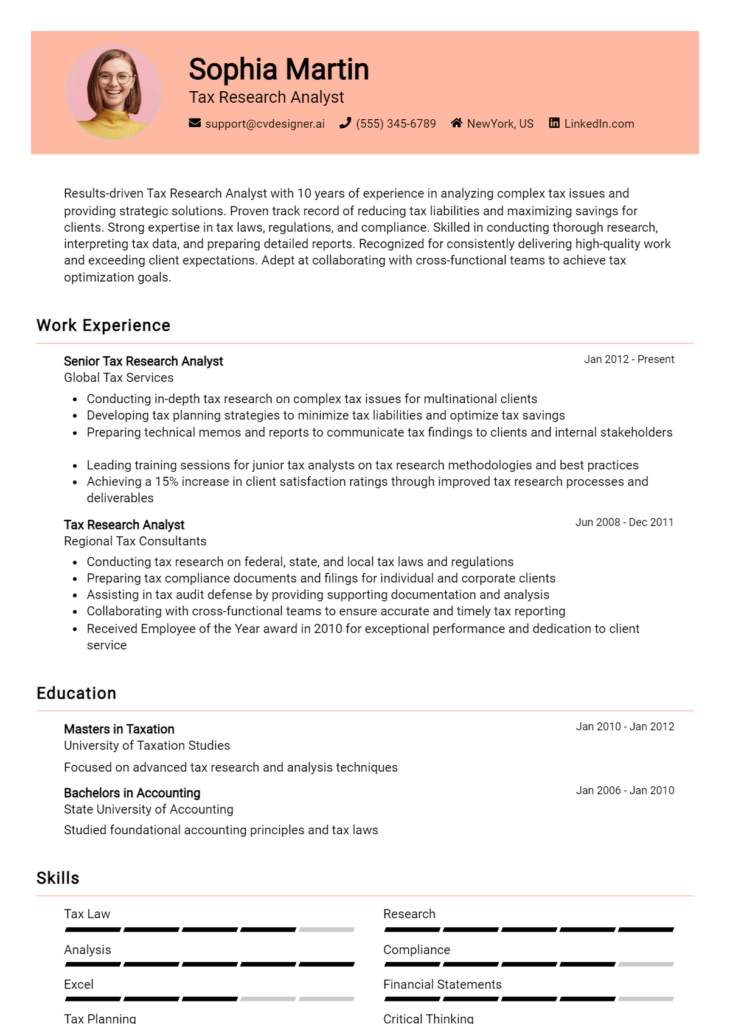

Strong Experiences

- Led a cross-functional team in implementing a tax automation software solution, resulting in a 30% reduction in processing time and a 20% decrease in compliance errors.

- Developed and optimized data analytics processes that improved reporting accuracy by 40%, facilitating better decision-making for tax strategy initiatives.

- Managed a project to integrate new tax compliance technologies, contributing to a 15% increase in operational efficiency and achieving on-time delivery within budget constraints.

- Collaborated with IT and finance departments to streamline tax data collection, resulting in a 25% reduction in data entry time and enhanced data integrity.

Weak Experiences

- Involved in various tax-related projects and tasks.

- Assisted in implementing software solutions without specifying contributions or outcomes.

- Worked with team members to complete assignments.

- Participated in meetings regarding tax technology improvements.

The examples listed as strong experiences are considered effective because they provide specific, quantifiable outcomes and clearly highlight the candidate's leadership and technical expertise. Each bullet point illustrates a tangible impact on the organization, showcasing the ability to drive results. In contrast, the weak experiences suffer from vagueness and lack of detail; they fail to convey the candidate's contributions or the significance of their roles, making it difficult for potential employers to assess the candidate's qualifications and effectiveness.

Education and Certifications Section for Tax Technology Specialist Resume

The education and certifications section of a Tax Technology Specialist resume is crucial for showcasing a candidate's academic background and professional development in a rapidly evolving field. This section not only highlights relevant degrees but also emphasizes industry-specific certifications and continuous learning efforts that demonstrate a commitment to staying current with technological advancements and regulatory changes. Including relevant coursework, certifications, and specialized training can greatly enhance a candidate's credibility and alignment with the job role, making it easier for potential employers to assess their qualifications and expertise in tax technology.

Best Practices for Tax Technology Specialist Education and Certifications

- Prioritize relevant degrees such as Accounting, Finance, Information Technology, or Taxation.

- Include industry-recognized certifications like Certified Public Accountant (CPA), Certified Management Accountant (CMA), or Chartered Global Management Accountant (CGMA).

- List relevant coursework that directly pertains to tax technology, data analytics, or information systems.

- Highlight any specialized training or workshops attended related to tax software or technology platforms.

- Be specific about the dates obtained for certifications to indicate the currency of qualifications.

- Use clear and concise language to describe educational achievements and certifications.

- Consider adding memberships in professional organizations related to tax and technology.

- Tailor the education and certifications section to align with the requirements of the job description.

Example Education and Certifications for Tax Technology Specialist

Strong Examples

- Bachelor of Science in Accounting, University of XYZ, 2020

- Certified Information Systems Auditor (CISA), 2022

- Master’s Certificate in Taxation, ABC University, 2021

- Completed coursework in Data Analytics for Accounting Professionals, 2020

Weak Examples

- Bachelor of Arts in History, University of ABC, 2018

- Certification in Basic Computer Skills, 2019

- Diploma in Office Administration, 2017

- Outdated certification in QuickBooks 2005, no recent updates or training

The strong examples are considered relevant and impactful because they directly align with the skills and knowledge required for a Tax Technology Specialist, showcasing advanced qualifications and recent educational achievements. In contrast, the weak examples lack relevance to the field, highlighting outdated or unrelated qualifications that do not contribute to the candidate's expertise in tax technology. This distinction emphasizes the importance of aligning educational background and certifications with the specific demands of the job role.

Top Skills & Keywords for Tax Technology Specialist Resume

As a Tax Technology Specialist, possessing the right skills is crucial for effectively navigating the complexities of tax compliance and technology integration. A well-crafted resume not only showcases technical expertise but also highlights soft skills that are essential for collaboration, problem-solving, and communication within cross-functional teams. By incorporating both hard and soft skills, candidates can demonstrate their ability to leverage technology for tax solutions and adapt to the ever-evolving landscape of tax regulations. This balanced skill set is vital for standing out in a competitive job market. For more information on the importance of skills in your resume, consider the following essential competencies.

Top Hard & Soft Skills for Tax Technology Specialist

Soft Skills

- Analytical Thinking

- Problem-Solving

- Attention to Detail

- Communication Skills

- Team Collaboration

- Adaptability

- Time Management

- Critical Thinking

- Client Relationship Management

- Project Management

Hard Skills

- Tax Software Proficiency (e.g., SAP, Oracle)

- Data Analysis and Visualization

- Knowledge of Tax Compliance Regulations

- Programming Languages (e.g., Python, SQL)

- ERP Systems Implementation

- Familiarity with Accounting Principles

- Cloud Computing Skills

- Cybersecurity Awareness

- Business Process Optimization

- Automation Tools (e.g., RPA, AI Integration)

Having a comprehensive blend of these hard and soft skills will enable Tax Technology Specialists to effectively contribute to their organizations, ensuring compliance while maximizing efficiency through technological advancements.

Stand Out with a Winning Tax Technology Specialist Cover Letter

As a dedicated and detail-oriented Tax Technology Specialist, I am excited to apply my expertise in tax compliance and technology integration to your esteemed organization. With a solid background in tax regulations and a passion for leveraging technology to streamline processes, I am confident in my ability to contribute to your team and enhance your tax operations. My experience in implementing tax software solutions and managing data analytics projects has equipped me with the skills needed to drive efficiency and accuracy in tax reporting.

In my previous role at [Previous Company Name], I successfully led a project that automated the tax filing process, reducing the time spent on manual entries by 30%. By collaborating closely with cross-functional teams, I ensured the integration of tax software with our existing financial systems, resulting in improved data accuracy and compliance. My strong analytical abilities enabled me to identify potential tax-saving opportunities, which ultimately contributed to a significant reduction in our overall tax liability. I am excited about the prospect of bringing this expertise to [Company Name] and helping to optimize your tax technology landscape.

Furthermore, I possess a deep understanding of various tax software platforms, including [Specific Software Names], which allows me to quickly adapt and implement innovative solutions tailored to your organization’s needs. My commitment to staying current with the latest tax regulations and technological advancements ensures that I can provide valuable insights and recommendations to enhance your tax strategy. I am particularly drawn to [Company Name] because of its reputation for embracing technology to drive business success, and I would love the opportunity to be a part of such a forward-thinking team.

I am eager to discuss how my skills and experiences align with the goals of [Company Name]. Thank you for considering my application for the Tax Technology Specialist position. I look forward to the possibility of contributing to your team and helping to shape the future of your tax technology initiatives.

Common Mistakes to Avoid in a Tax Technology Specialist Resume

When crafting a resume for the role of a Tax Technology Specialist, it's essential to present your skills and experience in a way that showcases your expertise in both taxation and technology. However, many candidates inadvertently make mistakes that can hinder their chances of landing an interview. By being aware of these common pitfalls, you can ensure that your resume stands out for the right reasons. Here are some mistakes to avoid:

Vague Job Descriptions: Failing to provide specific examples of your past responsibilities can leave recruiters unsure of your capabilities. Always quantify achievements and detail your role in projects.

Ignoring Keywords: Tax technology roles often require specific technical skills and knowledge. Ignoring keywords from the job description can result in your resume being overlooked by Applicant Tracking Systems (ATS).

Overloading with Technical Jargon: While it's important to showcase your technical skills, overusing jargon can alienate readers. Aim for clear, concise language that highlights your expertise without being overly complex.

Neglecting Soft Skills: A Tax Technology Specialist must often collaborate with other departments. Failing to mention soft skills like communication, teamwork, and problem-solving can paint an incomplete picture of your qualifications.

Lack of Tailoring: Submitting a generic resume for every application can be detrimental. Tailor your resume to align with the specific requirements and culture of each organization.

Forgetting to Highlight Relevant Certifications: Certifications in tax technology or related fields can set you apart. Omitting these can lead to missed opportunities to demonstrate your qualifications.

Poor Formatting: A cluttered or unprofessional layout can distract from your qualifications. Use clean, organized formatting to enhance readability and ensure important information stands out.

Not Including Continuous Learning: The field of tax technology is constantly evolving. Failing to mention ongoing education, training, or professional development can imply a lack of commitment to staying current in your field.

Conclusion

As a Tax Technology Specialist, your role is pivotal in bridging the gap between tax compliance and technology. Throughout this article, we explored the essential skills required for this position, including proficiency in tax software, understanding of regulatory requirements, and the ability to analyze and implement technology solutions that streamline tax processes. We also highlighted the importance of staying updated with the latest tax laws and technological advancements to ensure efficient tax operations.

In conclusion, as you reflect on the insights shared, it's crucial to assess your own qualifications and experiences. A well-crafted resume can significantly enhance your chances of landing a job in this competitive field. We encourage you to take the time to review your Tax Technology Specialist resume and ensure it effectively showcases your skills and achievements.

To assist you in this process, consider utilizing resources such as resume templates, a resume builder, resume examples, and cover letter templates. These tools can help you create a standout application that reflects your expertise and readiness for the challenges in tax technology. Don't wait—start refining your resume today!