Corporate Tax Analyst Core Responsibilities

A Corporate Tax Analyst plays a crucial role in ensuring compliance with tax regulations while optimizing the tax position of the organization. Key responsibilities include analyzing tax data, preparing returns, and collaborating with finance, accounting, and legal departments to address complex tax issues. Strong technical skills in tax laws, operational insight, and problem-solving abilities are essential for success. These skills support the organization's financial objectives, and a well-structured resume can effectively highlight these qualifications to potential employers.

Common Responsibilities Listed on Corporate Tax Analyst Resume

- Prepare and review corporate tax returns and supporting documentation.

- Analyze tax regulations and assess their impact on the organization.

- Collaborate with cross-functional teams to ensure compliance.

- Conduct tax research to identify savings opportunities.

- Assist in audits and respond to inquiries from tax authorities.

- Maintain accurate tax records and documentation.

- Develop tax planning strategies to minimize liabilities.

- Monitor changes in tax legislation and advise management accordingly.

- Support financial reporting and forecasting related to taxation.

- Facilitate training sessions on tax compliance for staff.

- Utilize tax software for efficient data management and reporting.

High-Level Resume Tips for Corporate Tax Analyst Professionals

In the competitive landscape of corporate taxation, a well-crafted resume is not just a formality; it's your primary tool for making a lasting first impression on potential employers. As a Corporate Tax Analyst, your resume needs to effectively highlight both your skills and achievements in a way that resonates with hiring managers. It serves as a snapshot of your professional journey, showcasing your analytical capabilities, knowledge of tax laws, and ability to navigate complex financial landscapes. This guide will provide practical and actionable resume tips specifically tailored for Corporate Tax Analyst professionals, ensuring you stand out in a sea of applicants.

Top Resume Tips for Corporate Tax Analyst Professionals

- Tailor your resume to match the specific job description, using keywords and phrases from the posting.

- Highlight relevant experience, including internships and past roles in tax compliance or financial analysis.

- Quantify your achievements with concrete numbers, such as the percentage of tax savings you facilitated or the size of the budgets you managed.

- Showcase industry-specific skills, such as proficiency in tax software (e.g., SAP, Oracle) and familiarity with local and international tax regulations.

- Include certifications, such as CPA or CMA, to demonstrate your commitment to professional development in the field of taxation.

- Utilize a clean and professional format that enhances readability and allows your accomplishments to shine.

- Incorporate a summary statement at the top of your resume that encapsulates your key qualifications and career objectives.

- List relevant coursework or training in taxation, accounting, or finance to showcase your educational background.

- Keep your resume concise, ideally one page, focusing on the most relevant and impactful information.

By implementing these tips, you can significantly enhance your resume's effectiveness, increasing your chances of landing a job in the Corporate Tax Analyst field. A polished and targeted resume not only showcases your expertise but also conveys your dedication to the profession, setting you on the path to a successful career in corporate taxation.

Why Resume Headlines & Titles are Important for Corporate Tax Analyst

In the competitive field of corporate taxation, the role of a Corporate Tax Analyst is pivotal in ensuring compliance with tax regulations and optimizing tax strategies for organizations. A well-crafted resume headline or title serves as a powerful tool to capture the attention of hiring managers, succinctly summarizing a candidate’s key qualifications in one impactful phrase. By providing a concise and relevant overview, a strong headline can set the tone for the entire resume, making it essential for candidates to focus on creating a title that directly relates to the job they are applying for.

Best Practices for Crafting Resume Headlines for Corporate Tax Analyst

- Keep it concise: Aim for one impactful sentence that summarizes your expertise.

- Be role-specific: Tailor the headline to highlight your qualifications for the Corporate Tax Analyst position.

- Include keywords: Use industry-relevant keywords that align with the job description.

- Highlight key strengths: Focus on specific skills or experiences that set you apart from other candidates.

- Avoid jargon: Use clear language that is easily understood by hiring managers.

- Showcase results: If applicable, mention achievements or contributions that demonstrate your value.

- Maintain professionalism: Ensure the tone is formal and aligns with corporate standards.

- Be honest: Represent your qualifications accurately without exaggeration.

Example Resume Headlines for Corporate Tax Analyst

Strong Resume Headlines

"Detail-Oriented Corporate Tax Analyst with 5+ Years of Experience in Compliance and Strategy Optimization"

“Results-Driven Tax Analyst Specializing in Multistate Tax Compliance and Risk Mitigation”

“Corporate Tax Analyst with Proven Expertise in Data Analysis and Tax Planning Strategies”

Weak Resume Headlines

“Tax Analyst Seeking Opportunities”

“Experienced Professional in Finance”

Strong headlines are effective because they provide a clear and compelling snapshot of the candidate’s qualifications, ensuring that hiring managers can quickly grasp their suitability for the role. In contrast, weak headlines fail to impress due to their vagueness and lack of specificity, making it difficult for employers to identify the candidate's unique strengths or relevance to the position. By focusing on impactful and tailored headlines, candidates can significantly enhance their chances of standing out in a crowded job market.

Writing an Exceptional Corporate Tax Analyst Resume Summary

A well-crafted resume summary is crucial for a Corporate Tax Analyst, as it serves as the first impression for hiring managers. A strong summary efficiently captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job role. This brief yet impactful statement should be customized for each application, ensuring that it highlights the most pertinent qualifications and reflects the candidate's unique value proposition. In today's competitive job market, a compelling resume summary can make the difference between landing an interview and getting overlooked.

Best Practices for Writing a Corporate Tax Analyst Resume Summary

- Quantify your achievements to provide concrete evidence of your contributions and results.

- Focus on relevant skills that are specifically mentioned in the job description.

- Keep the summary concise, ideally within 3-5 sentences.

- Use action-oriented language to convey your impact and expertise effectively.

- Tailor your summary for each job application to align closely with the employer's needs.

- Highlight any specialized certifications or software proficiency relevant to tax analysis.

- Incorporate industry-specific terminology to demonstrate your familiarity with corporate tax matters.

- Showcase your ability to navigate complex tax regulations and provide strategic insights.

Example Corporate Tax Analyst Resume Summaries

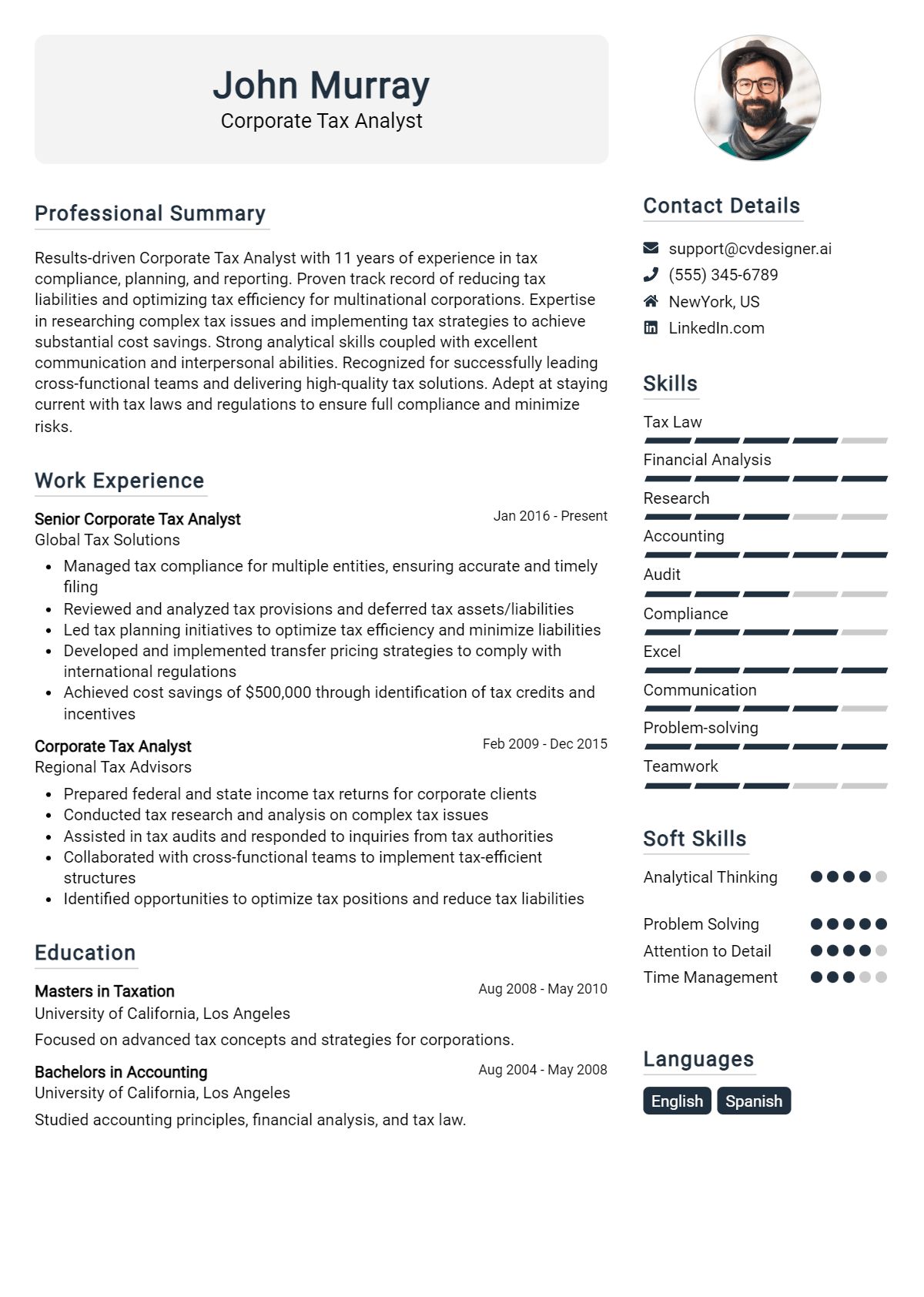

Strong Resume Summaries

Detail-oriented Corporate Tax Analyst with over five years of experience in managing compliance and reporting for multinational corporations. Successfully reduced tax liabilities by 20% through strategic planning and meticulous analysis.

Results-driven tax professional with a proven track record of conducting in-depth research and analysis to optimize tax strategies. Achieved a 15% increase in tax credits for clients by implementing innovative approaches to tax law.

Dedicated Corporate Tax Analyst skilled in utilizing advanced tax software and data analytics to streamline reporting processes. Contributed to an annual savings of $300,000 through effective risk management and compliance strategies.

Weak Resume Summaries

Experienced tax analyst with a background in various tax-related tasks. Capable of handling corporate taxes and compliance.

Corporate Tax Analyst looking for a job. I have some experience in tax and compliance.

The strong resume summaries are considered effective because they provide specific quantifiable achievements, relevant skills, and a clear connection to the Corporate Tax Analyst role. They demonstrate a candidate's ability to produce tangible results and use industry-specific language. In contrast, the weak summaries lack detail, specificity, and measurable outcomes, making them too generic and less compelling for hiring managers.

Work Experience Section for Corporate Tax Analyst Resume

The work experience section is a crucial component of a Corporate Tax Analyst resume as it effectively showcases the candidate's technical skills, management capabilities, and ability to deliver high-quality results. This section allows applicants to illustrate their proficiency in navigating complex tax regulations, managing teams, and implementing strategic initiatives that meet organizational goals. By quantifying achievements and aligning their experience with industry standards, candidates can significantly enhance their appeal to potential employers, demonstrating not only what they have accomplished but also how they can contribute to future success.

Best Practices for Corporate Tax Analyst Work Experience

- Highlight specific tax regulations and compliance standards you have worked with.

- Quantify your achievements with measurable results, such as cost savings or efficiency improvements.

- Demonstrate leadership by describing team management and mentoring experiences.

- Include examples of collaboration with cross-functional teams to enhance tax strategies.

- Tailor your experience to align with the job description and industry standards.

- Use action verbs to convey your contributions and impact effectively.

- Focus on outcomes that benefited the organization, showcasing your value as an analyst.

- Document continuous education or certifications that enhance your technical expertise.

Example Work Experiences for Corporate Tax Analyst

Strong Experiences

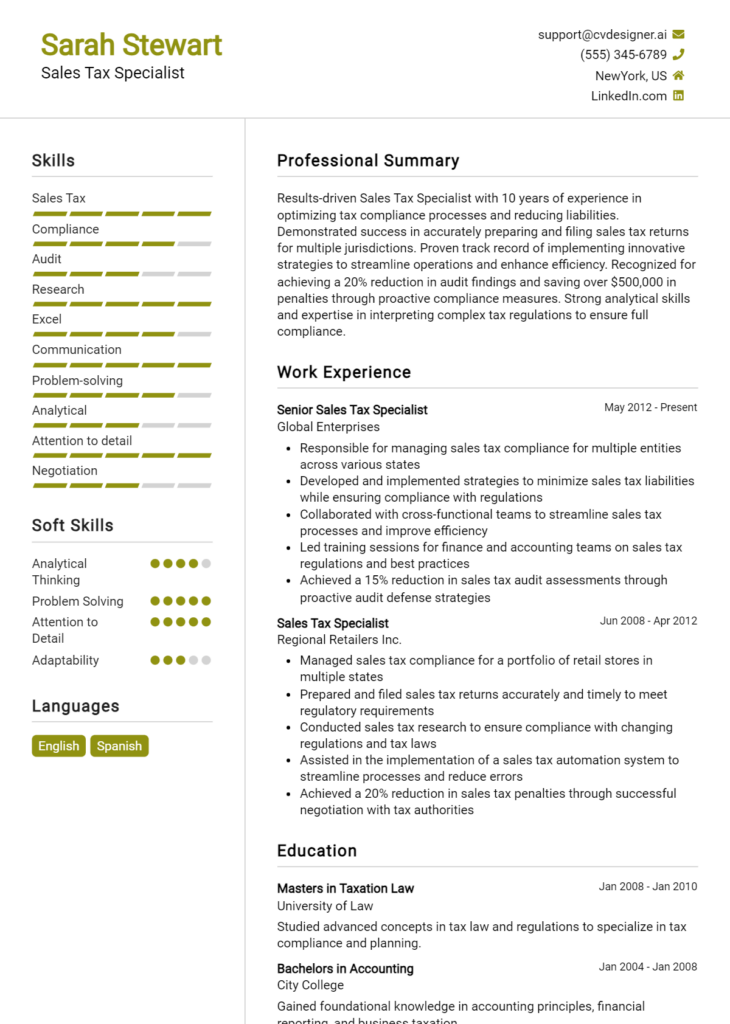

- Led a team of three analysts to successfully reduce corporate tax liabilities by 15% over two fiscal years, resulting in a savings of $500,000 for the organization.

- Implemented a new tax compliance software that improved reporting accuracy by 30%, streamlining the audit process and reducing the time needed for tax preparation.

- Collaborated with the finance department to develop tax-efficient strategies that increased cash flow by 20%, enhancing overall company profitability.

- Trained and mentored junior analysts, improving their performance and technical knowledge, which led to a 25% increase in team productivity.

Weak Experiences

- Assisted in tax-related tasks and occasionally reviewed documents.

- Worked on some tax projects without specifying the outcomes or impact.

- Participated in team meetings regarding tax issues but did not take a leading role.

- Helped with filing tax returns but did not mention any specific achievements or improvements.

The examples provided demonstrate a clear distinction between strong and weak experiences. Strong experiences are characterized by quantifiable outcomes, leadership roles, and impactful contributions that reflect the candidate's technical expertise and collaboration skills. In contrast, weak experiences lack specificity and measurable results, making them less compelling to potential employers. By focusing on concrete achievements and the ability to drive results, candidates can present themselves as valuable assets in the corporate tax landscape.

Education and Certifications Section for Corporate Tax Analyst Resume

The education and certifications section of a Corporate Tax Analyst resume is crucial as it serves to showcase the candidate's academic background and relevant qualifications. This section not only highlights the foundational knowledge gained through formal education but also emphasizes the importance of industry-relevant certifications and ongoing professional development. By detailing relevant coursework, certifications, and any specialized training, candidates can significantly enhance their credibility and demonstrate a commitment to staying updated in a constantly evolving field, thereby aligning themselves more closely with the specific requirements of the role.

Best Practices for Corporate Tax Analyst Education and Certifications

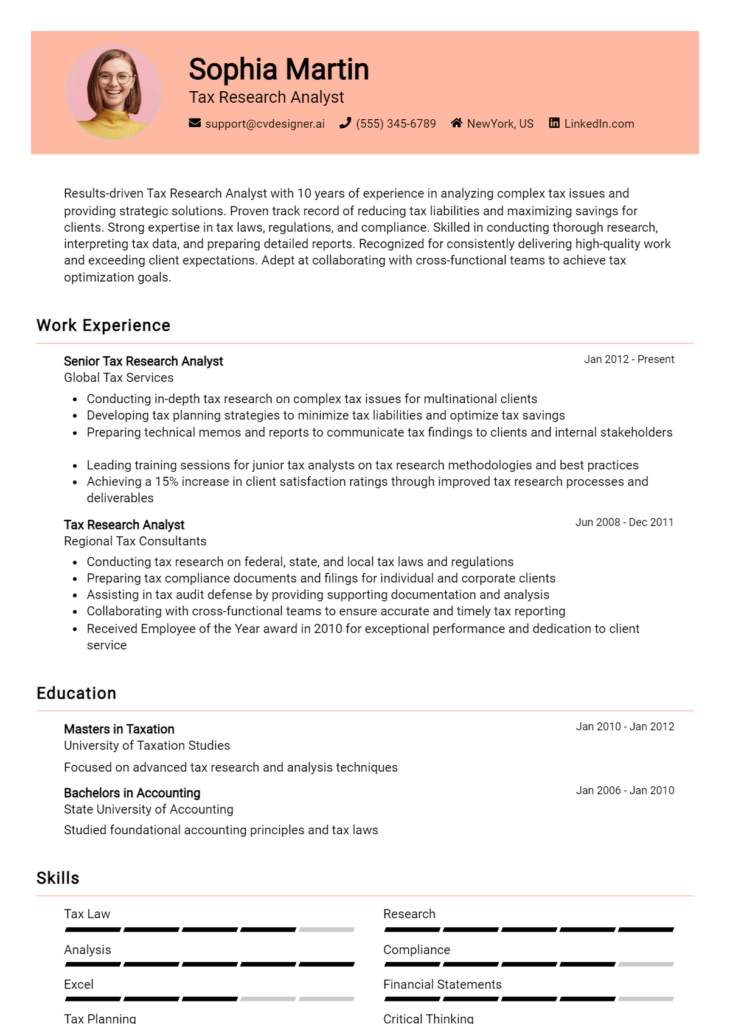

- Include only relevant degrees and certifications that pertain to corporate tax analysis or finance.

- Provide specific coursework that directly relates to corporate tax, accounting, or finance-related topics.

- Highlight advanced certifications such as CPA, CMA, or CFP, which indicate a higher level of expertise.

- List certifications in order of importance, starting with the most prestigious or relevant first.

- Include the institution's name and the year of completion to provide context.

- Consider mentioning ongoing professional development courses to showcase continuous learning.

- Use bullet points for clarity and conciseness, making it easy for hiring managers to skim through.

- Tailor this section for each job application to align with the specific skills and qualifications outlined in the job description.

Example Education and Certifications for Corporate Tax Analyst

Strong Examples

- M.S. in Taxation, University of Example, 2022

- Certified Public Accountant (CPA), 2023

- Advanced Corporate Taxation Course, National Tax Association, 2021

- B.S. in Accounting, Example State University, 2020

Weak Examples

- B.A. in English Literature, Example University, 2018

- Certificate in Basic Cooking Techniques, Local Community College, 2020

- High School Diploma, Example High School, 2016

- Unrelated online course in Graphic Design, 2021

The strong examples are considered relevant because they showcase degrees and certifications directly linked to the requirements of a Corporate Tax Analyst, demonstrating both academic and professional qualifications that reflect industry standards. In contrast, the weak examples lack relevance to the position, showcasing educational backgrounds and certifications that do not align with the skills and knowledge necessary for a successful career in corporate taxation, thereby diminishing the candidate's credibility in this specific field.

Top Skills & Keywords for Corporate Tax Analyst Resume

In the competitive field of corporate tax analysis, possessing the right skills is essential for standing out in the job market. A well-crafted resume that highlights both hard and soft skills can significantly enhance an applicant's chances of landing their desired position. Employers look for candidates who not only have a solid foundation in tax regulations and compliance but also possess the interpersonal skills necessary to collaborate effectively within a team. By emphasizing these skills, a Corporate Tax Analyst can demonstrate their ability to navigate complex tax scenarios while contributing positively to the workplace culture.

Top Hard & Soft Skills for Corporate Tax Analyst

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem-Solving

- Communication Skills

- Team Collaboration

- Time Management

- Adaptability

- Critical Thinking

- Client Relationship Management

- Ethical Judgment

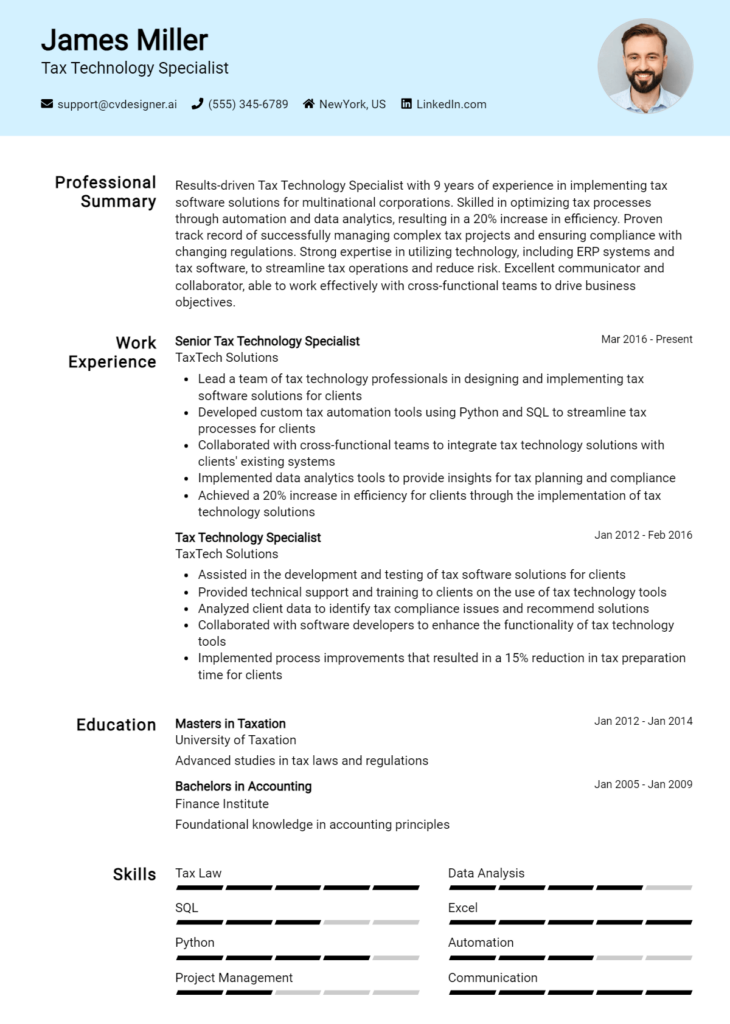

Hard Skills

- Tax Compliance and Regulations

- Financial Statement Analysis

- Proficiency in Tax Software (e.g., Thomson Reuters, CCH Axcess)

- Data Analysis and Interpretation

- Knowledge of GAAP and IFRS

- Excel and Spreadsheet Proficiency

- Research Skills

- Risk Assessment

- Knowledge of International Taxation

- Reporting and Documentation Skills

For more on enhancing your skills and showcasing your work experience, consider tailoring your resume to align with the specific requirements of the Corporate Tax Analyst role.

Stand Out with a Winning Corporate Tax Analyst Cover Letter

I am writing to express my interest in the Corporate Tax Analyst position at [Company Name], as advertised on [Job Board/Company Website]. With a strong background in tax compliance and a keen understanding of corporate tax regulations, I am excited about the opportunity to contribute to your team. My experience working with diverse clients in various industries has equipped me with the analytical skills and attention to detail necessary to navigate complex tax issues effectively.

In my previous role at [Previous Company Name], I successfully managed the preparation and filing of corporate tax returns, ensuring compliance with local, state, and federal regulations. I also conducted thorough research on tax laws and changes, providing valuable insights that helped the team minimize tax liabilities and maximize deductions. My proficiency in tax software and data analysis tools allowed me to streamline processes, reducing filing time by 20%. I am dedicated to maintaining a high standard of accuracy in all tax-related tasks while keeping abreast of evolving tax legislation.

I am particularly drawn to [Company Name] because of its reputation for innovation and commitment to excellence in financial practices. I am eager to leverage my skills in tax analysis and compliance to support your organization’s strategic objectives. I believe that my proactive approach to problem-solving and my ability to communicate complex tax concepts clearly will make me a valuable addition to your team.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the needs of [Company Name]. I am excited about the prospect of contributing to your esteemed firm and helping to navigate the complexities of corporate taxation.

Common Mistakes to Avoid in a Corporate Tax Analyst Resume

When crafting a resume for a Corporate Tax Analyst position, it’s crucial to present your qualifications and experience in a clear and compelling manner. However, many candidates make common mistakes that can hinder their chances of landing an interview. By being aware of these pitfalls, you can create a more effective resume that showcases your skills and aligns with the expectations of potential employers. Here are some common mistakes to avoid:

Lack of Tailoring: Submitting a generic resume without tailoring it to the specific job description can make you seem uninterested or unqualified. Always customize your resume to highlight relevant skills and experiences that match the job requirements.

Overly Complex Language: Using jargon or overly technical terms can confuse hiring managers. Aim for clear and concise language that communicates your expertise without alienating the reader.

Neglecting Quantifiable Achievements: Failing to include measurable accomplishments can make your contributions seem less impactful. Use numbers and statistics to demonstrate your successes, such as percentage reductions in tax liabilities or savings achieved.

Ignoring Formatting Consistency: Inconsistent formatting can create a disorganized appearance. Ensure uniformity in fonts, bullet points, and spacing throughout your resume for a polished look.

Listing Job Duties Instead of Responsibilities: Simply listing job duties does not convey your effectiveness in previous roles. Focus on your specific contributions and the results of your actions to showcase your value.

Omitting Relevant Certifications: Not including relevant certifications, such as CPA or enrolled agent status, can be a missed opportunity. Ensure you prominently display any qualifications that enhance your candidacy.

Excessive Length: A resume that is too long can overwhelm readers. Aim for a one-page resume, or two pages at most, focusing on the most relevant and impactful information.

Failing to Proofread: Typos and grammatical errors can undermine your professionalism. Always proofread your resume multiple times or have someone else review it to catch any mistakes.

Conclusion

As we explored the essential skills and qualifications for a Corporate Tax Analyst, it became clear that a strong foundation in tax regulations, analytical skills, and attention to detail are paramount. Furthermore, the role demands proficiency in tax compliance and reporting, as well as the ability to collaborate with cross-functional teams to navigate complex tax scenarios effectively.

The importance of staying updated with the latest tax laws and industry trends cannot be overstated, as this knowledge enables Corporate Tax Analysts to provide valuable insights and strategic recommendations. Additionally, possessing strong communication skills is crucial for conveying complex tax concepts to stakeholders who may not have a technical background.

In conclusion, if you are looking to embark on or advance your career as a Corporate Tax Analyst, it's essential to ensure that your resume reflects these key competencies and experiences. Take the time to review your resume and consider leveraging resources that can enhance its effectiveness. Check out our resume templates, utilize our resume builder, browse through resume examples, and explore our cover letter templates to create a standout application that showcases your qualifications and helps you land your desired role. Don’t miss the opportunity to present yourself as the ideal candidate for Corporate Tax Analyst positions!