Tax Manager Core Responsibilities

A Tax Manager plays a crucial role in overseeing an organization’s tax strategy, ensuring compliance with tax regulations, and optimizing tax liabilities. This position requires strong technical knowledge of tax laws and regulations, as well as operational skills for effective collaboration across finance, accounting, and legal departments. Problem-solving abilities are essential to navigate complex tax scenarios and contribute to the organization’s financial goals. A well-structured resume highlighting these qualifications can significantly enhance a candidate’s appeal to potential employers.

Common Responsibilities Listed on Tax Manager Resume

- Develop and implement tax strategies to minimize liabilities.

- Ensure compliance with federal, state, and local tax laws.

- Prepare and review tax returns and reports.

- Conduct tax research and analysis on various matters.

- Coordinate with external auditors and tax authorities.

- Provide tax training and guidance to internal teams.

- Monitor changes in tax legislation and assess impacts.

- Assist in financial planning and forecasting related to taxes.

- Manage tax audits and disputes effectively.

- Collaborate with cross-functional teams to align tax strategies.

- Evaluate and implement tax technology solutions.

High-Level Resume Tips for Tax Manager Professionals

In the competitive landscape of tax management, a well-crafted resume is essential for professionals seeking to make a strong first impression on potential employers. Your resume serves as a window into your skills, qualifications, and achievements, showcasing what you bring to the table. For Tax Managers, it’s crucial that this document reflects not only your expertise in tax laws and compliance but also your ability to lead teams and drive financial success. This guide aims to provide practical and actionable resume tips specifically tailored for Tax Manager professionals, ensuring your application stands out in a crowded field.

Top Resume Tips for Tax Manager Professionals

- Tailor your resume to the specific job description, emphasizing the skills and experiences that align with the requirements of the position.

- Highlight relevant experience in tax planning, compliance, and audit management to demonstrate your comprehensive understanding of the tax landscape.

- Quantify your achievements by using metrics and numbers, such as the percentage of tax savings you achieved for clients or the size of the budgets you managed.

- Showcase industry-specific skills, such as proficiency in tax software, familiarity with regulatory changes, or expertise in specific tax codes.

- Include certifications such as CPA, EA, or other relevant designations that enhance your credibility and demonstrate your commitment to the profession.

- Utilize action verbs to describe your responsibilities and achievements, making your contributions clear and impactful.

- Incorporate keywords from the job listing to pass through Applicant Tracking Systems (ATS) and increase your visibility to hiring managers.

- Keep your resume concise, ideally within one or two pages, focusing on the most relevant experiences and skills for the role.

- Consider adding a professional summary at the top of your resume that succinctly encapsulates your career goals and key qualifications.

By implementing these tips, Tax Manager professionals can significantly increase their chances of landing a job in this competitive field. A polished and strategically crafted resume not only showcases your qualifications but also aligns your unique experiences with the needs of potential employers, setting you on the path to professional success.

Why Resume Headlines & Titles are Important for Tax Manager

In the competitive field of taxation, a Tax Manager’s resume must stand out to capture the attention of hiring managers. Resume headlines and titles play a crucial role in this process, as they serve as the first impression of a candidate's qualifications. A strong headline can succinctly summarize a candidate’s expertise and achievements, providing a snapshot that is both compelling and relevant to the position being applied for. By crafting a concise and targeted headline, candidates can immediately engage hiring managers and set the tone for the rest of their resume.

Best Practices for Crafting Resume Headlines for Tax Manager

- Keep it concise: Aim for a headline that is no more than one or two lines.

- Be specific: Tailor the headline to reflect the specific role of Tax Manager.

- Highlight key qualifications: Focus on your most impressive skills and achievements.

- Use industry keywords: Incorporate terms relevant to tax management to enhance visibility.

- Showcase your value: Emphasize how your experience can benefit the employer.

- Avoid generic phrases: Steer clear of clichéd titles that lack uniqueness.

- Be honest: Ensure that your headline accurately reflects your experience and qualifications.

- Use action verbs: Start with dynamic verbs to convey an active and results-oriented approach.

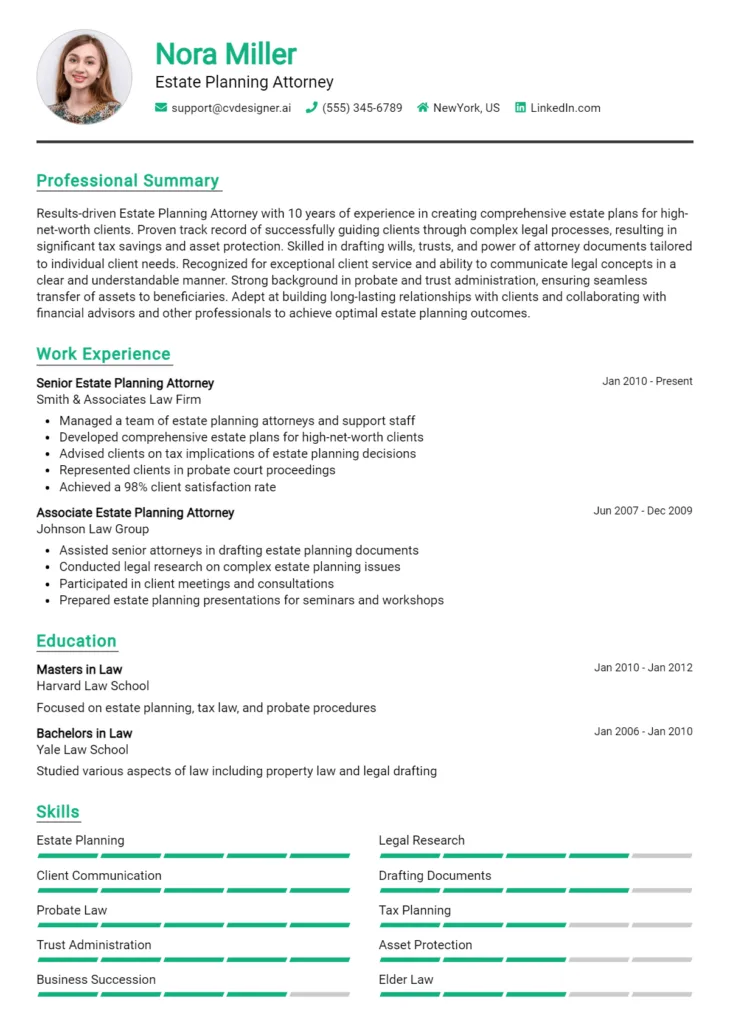

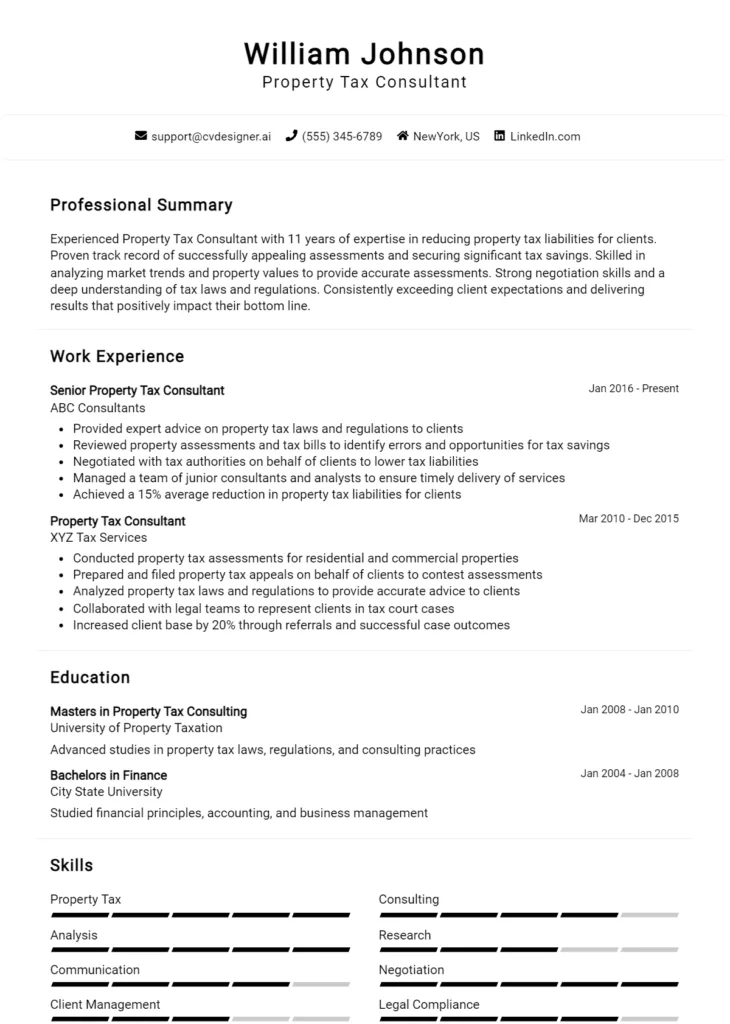

Example Resume Headlines for Tax Manager

Strong Resume Headlines

"Results-Driven Tax Manager with Over 10 Years of Experience in Corporate Tax Compliance"

“Strategic Tax Manager Specializing in International Tax Planning and Risk Mitigation”

“Experienced Tax Manager with Proven Track Record of Reducing Tax Liabilities by 30%”

Weak Resume Headlines

“Tax Manager Looking for Opportunities”

“Experienced Professional in Finance”

The strong headlines are effective because they clearly communicate the candidate's specific expertise and accomplishments, which positions them as an asset to potential employers. They utilize relevant keywords and present quantifiable results, making them memorable and impactful. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail. They do not convey the candidate's unique qualifications or value proposition, making them easily forgettable in a sea of applicants.

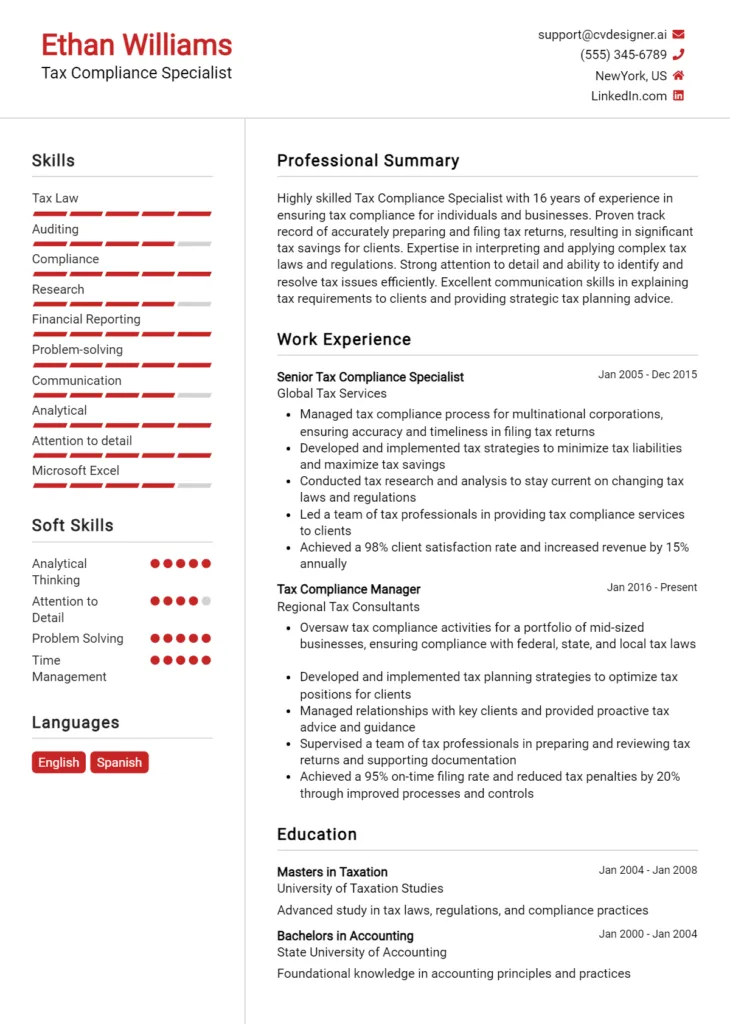

Writing an Exceptional Tax Manager Resume Summary

A well-crafted resume summary is crucial for a Tax Manager as it serves as a first impression and can significantly influence hiring managers. This concise introduction quickly highlights the candidate's key skills, relevant experience, and notable accomplishments, ensuring they stand out in a competitive job market. An impactful summary should be tailored to the specific job at hand, allowing the hiring manager to immediately see how the candidate's qualifications align with the needs of the organization. In just a few sentences, a strong summary can effectively convey the candidate's value proposition, making it essential for landing an interview.

Best Practices for Writing a Tax Manager Resume Summary

- Quantify achievements when possible to demonstrate impact (e.g., "Reduced tax liabilities by 20%").

- Focus on key skills relevant to tax management, such as compliance, tax planning, and risk assessment.

- Tailor the summary to the job description, using keywords that align with the employer's needs.

- Keep it concise, ideally between 3-5 sentences, to maintain the reader’s attention.

- Highlight relevant certifications or specialized training, such as CPA or MST.

- Use action verbs to convey a sense of proactivity and results-driven attitude.

- Include industry-specific knowledge, such as familiarity with tax software or regulations.

- Reflect personal attributes that contribute to team dynamics, such as leadership and communication skills.

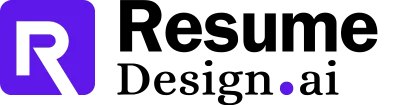

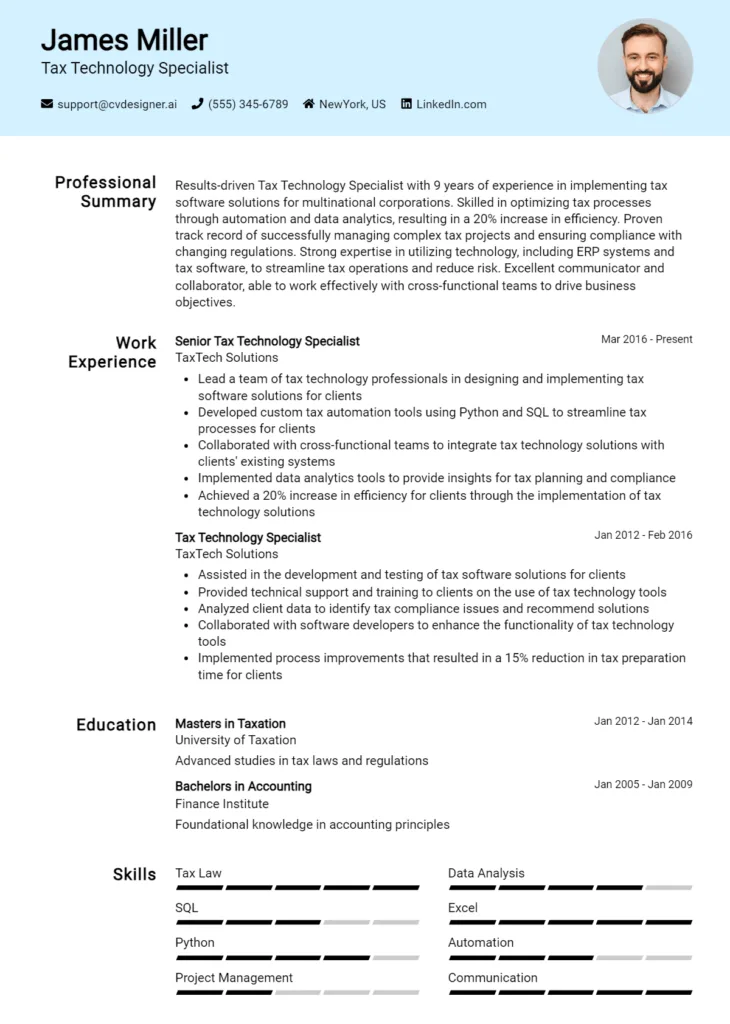

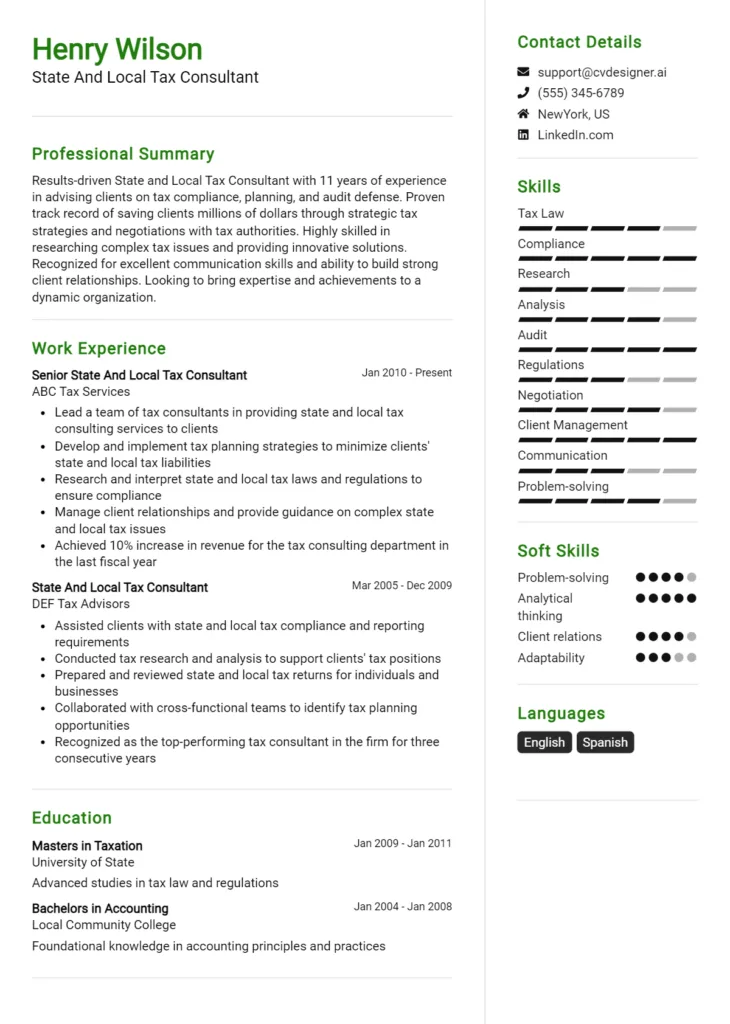

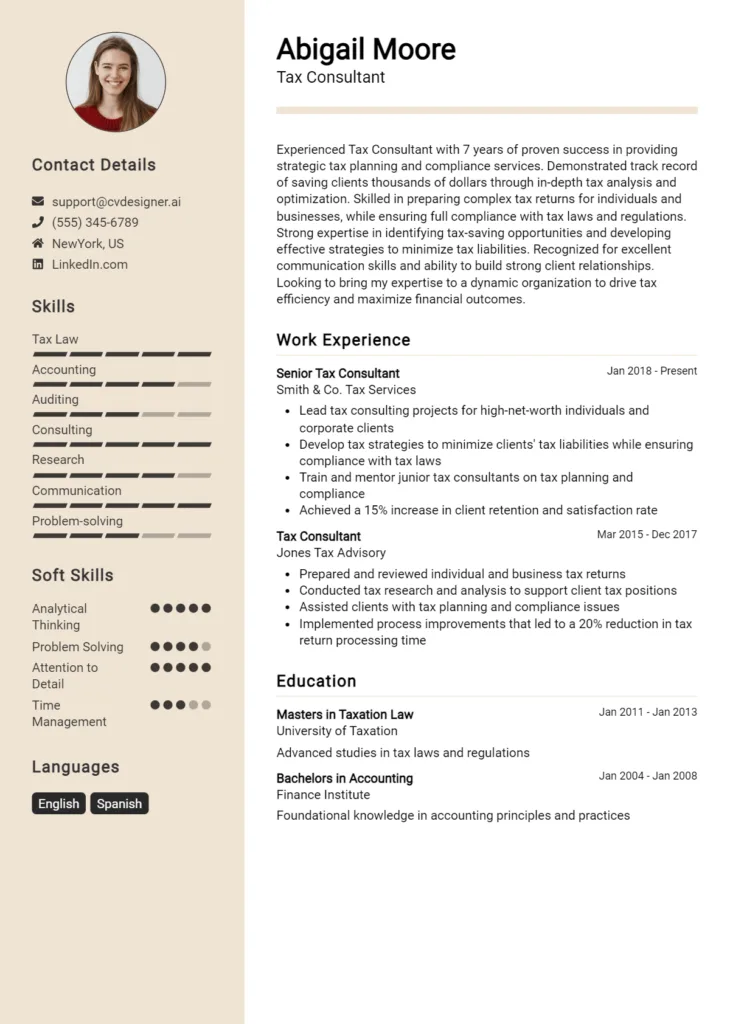

Example Tax Manager Resume Summaries

Strong Resume Summaries

Results-oriented Tax Manager with over 8 years of experience in corporate tax compliance and planning. Successfully reduced tax liabilities by 25% through strategic planning and thorough audits, while maintaining 100% compliance with federal and state regulations.

Detail-focused Tax Manager with a proven track record of managing multi-million dollar tax projects. Led a team that achieved a 30% increase in audit efficiency, resulting in a $500K savings for the organization.

Dynamic Tax Manager specializing in international tax regulations, with 10 years of experience. Streamlined tax reporting processes, decreasing turnaround time by 40% while ensuring compliance with local and international standards.

Weak Resume Summaries

Experienced Tax Manager looking for a new opportunity. Skilled in various tax-related tasks.

Tax Manager with a background in accounting and finance. I have managed tax projects and worked with clients.

The examples of strong resume summaries are effective because they include specific achievements, quantify results, and directly relate to the skills and responsibilities of a Tax Manager. In contrast, the weak summaries lack detail and specificity, making them too generic and unmemorable. They do not communicate the candidate's value or provide a compelling reason for a hiring manager to consider them for the position.

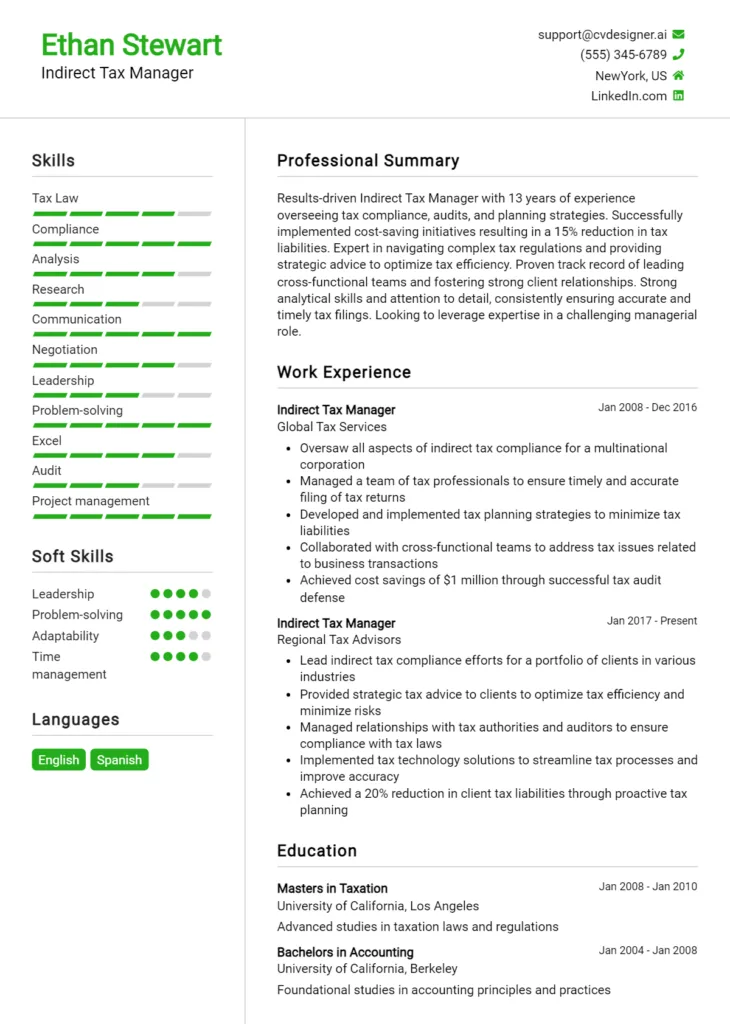

Work Experience Section for Tax Manager Resume

The work experience section of a Tax Manager resume is pivotal in illustrating the candidate's technical skills and expertise in tax regulations, compliance, and strategy. This section not only highlights the individual's ability to manage teams effectively but also demonstrates their capacity to deliver high-quality outcomes in a fast-paced environment. By quantifying achievements and aligning work experiences with industry standards, candidates can provide compelling evidence of their impact and proficiency, making them stand out to potential employers.

Best Practices for Tax Manager Work Experience

- Detail specific tax software and tools used to demonstrate technical proficiency.

- Quantify achievements such as percentage reductions in tax liabilities or audit findings.

- Highlight leadership roles in team projects or initiatives to showcase managerial skills.

- Provide examples of successful collaboration with cross-functional teams.

- Align experience descriptions with industry standards and relevant regulations.

- Use action verbs to convey a sense of initiative and leadership.

- Include professional development activities such as certifications or training related to tax management.

- Tailor the work experience to the specific job description to enhance relevance.

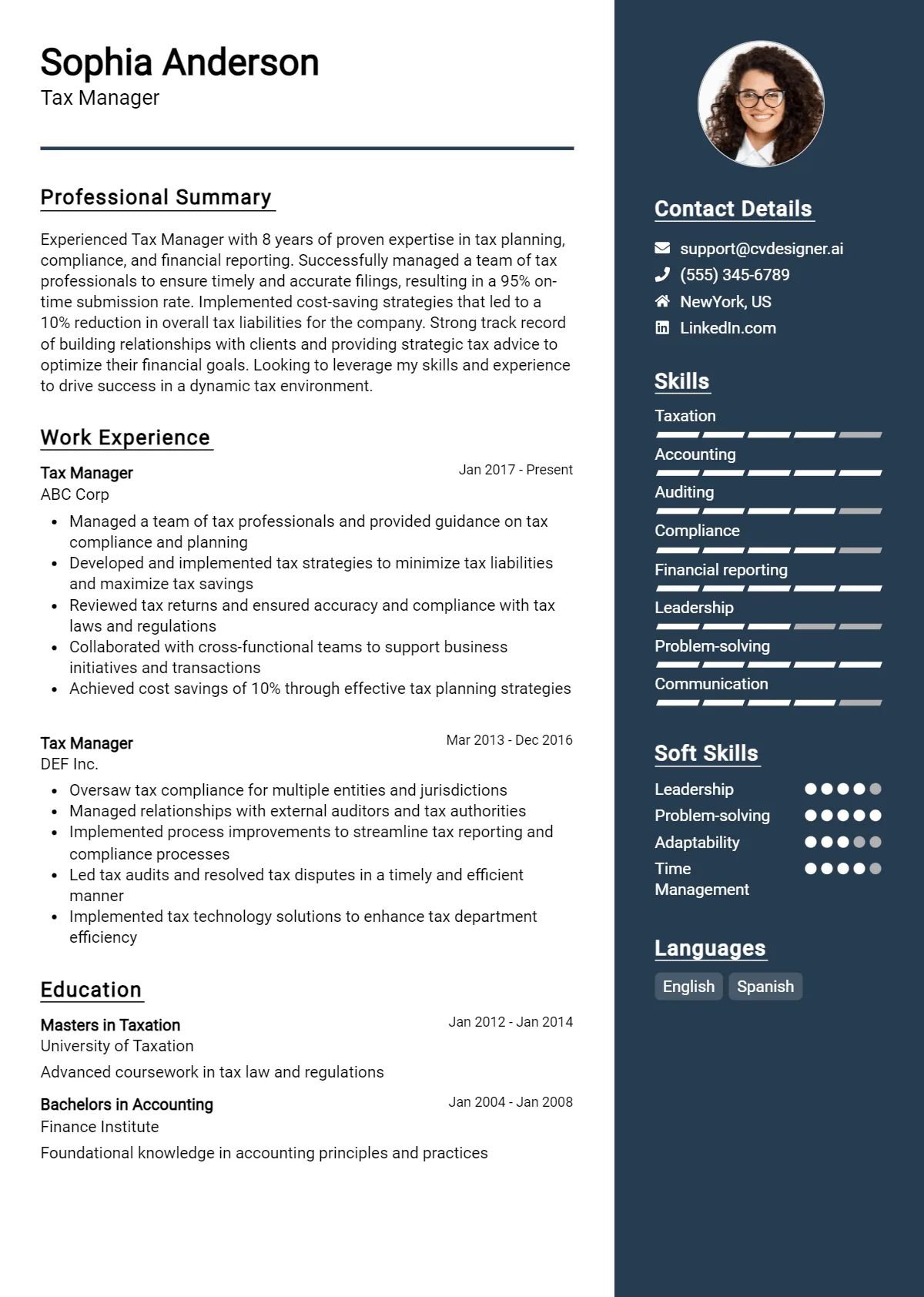

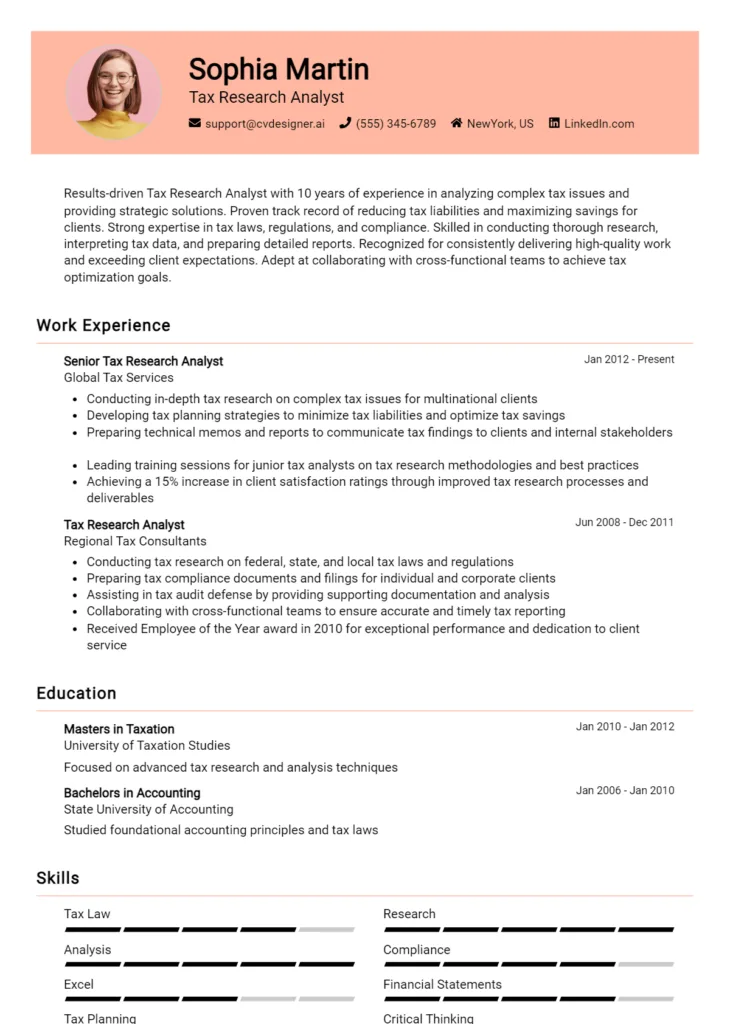

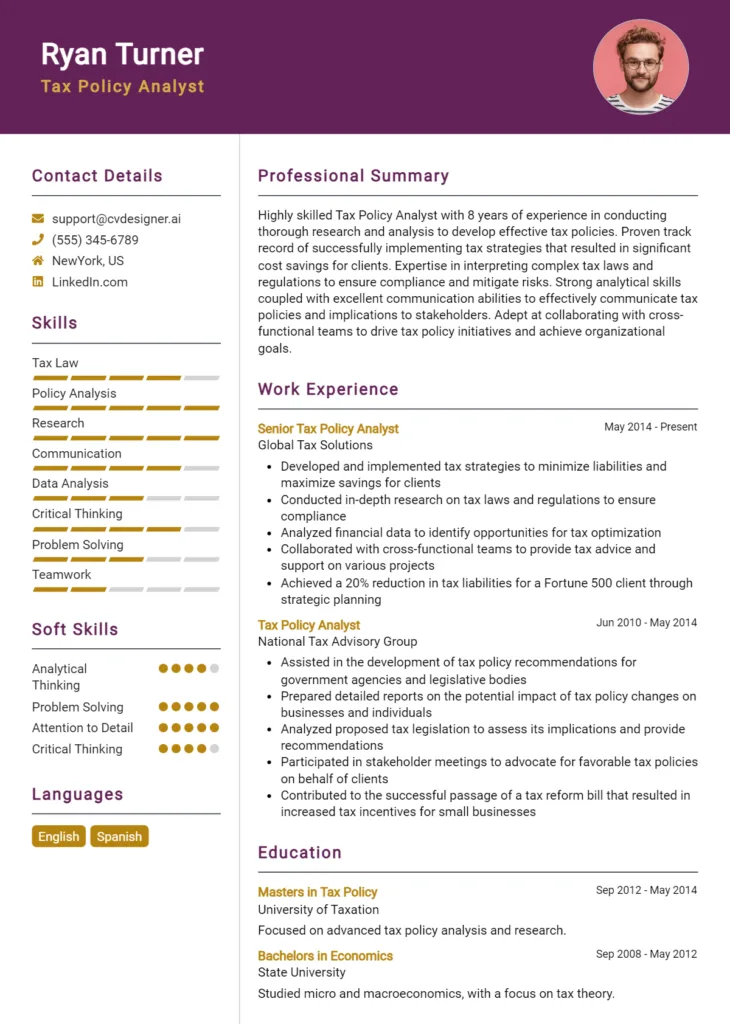

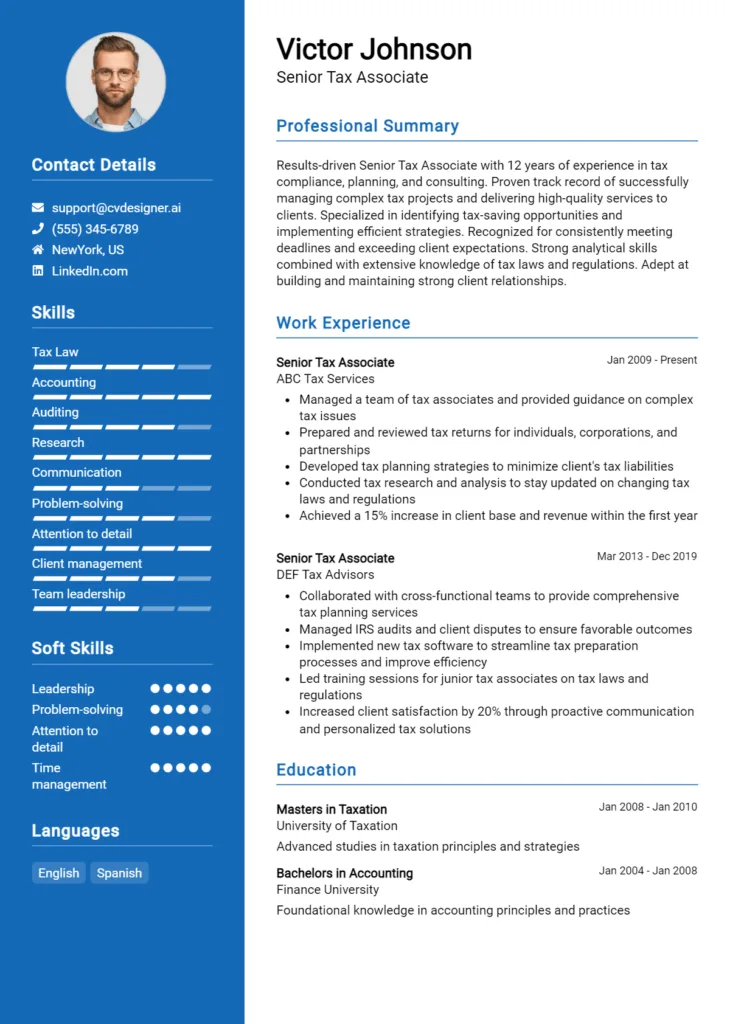

Example Work Experiences for Tax Manager

Strong Experiences

- Led a team of 5 tax professionals in preparing and filing federal and state tax returns, resulting in a 15% reduction in audit discrepancies year-over-year.

- Implemented a new tax compliance software that streamlined processes, reducing preparation time by 30% and increasing accuracy.

- Collaborated with finance and legal departments to develop tax strategies that saved the company $500,000 in tax liabilities over two years.

- Managed the tax planning process for a $10 million merger, ensuring compliance and optimizing tax benefits.

Weak Experiences

- Worked on tax returns as part of a team.

- Assisted with various tax-related tasks.

- Helped to prepare documents for audits.

- Participated in team meetings about tax compliance.

The examples categorized as strong highlight specific achievements, quantifiable results, and a clear demonstration of technical expertise and leadership. In contrast, the weak experiences lack detail and fail to convey any significant impact or contribution, making them less compelling to potential employers. Strong experiences not only provide context but also show how the candidate has added value in previous roles, while weak experiences remain vague and unimpressive, failing to highlight the candidate's true capabilities.

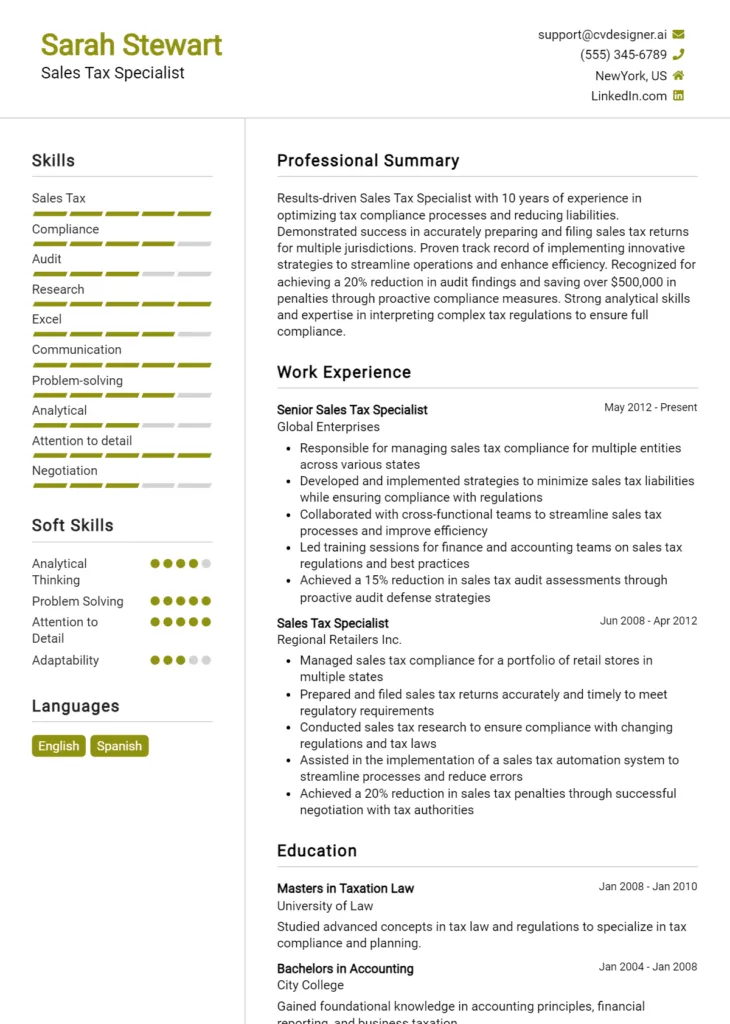

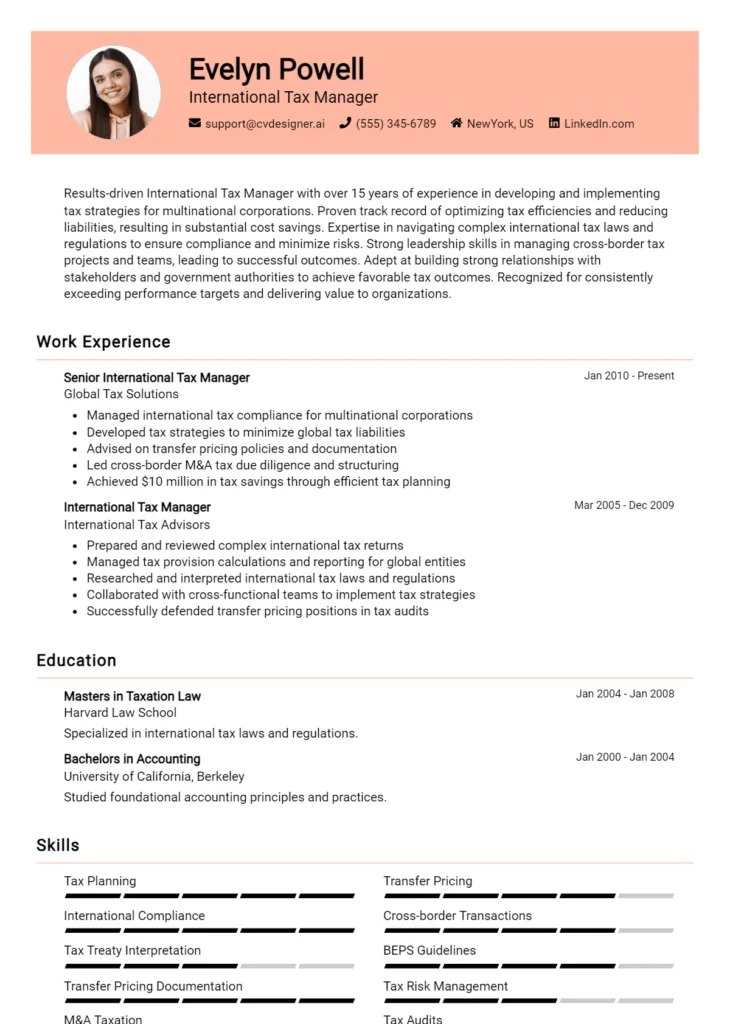

Education and Certifications Section for Tax Manager Resume

The education and certifications section of a Tax Manager resume is crucial because it showcases the candidate's academic qualifications and industry-specific credentials. This section not only highlights the necessary educational background, such as degrees in accounting or finance, but also emphasizes relevant certifications like CPA (Certified Public Accountant) or EA (Enrolled Agent). Additionally, it reflects the candidate's commitment to continuous learning and professional development, which is essential in the ever-evolving field of taxation. By providing details on relevant coursework, specialized training, and certifications, candidates can significantly enhance their credibility and demonstrate their alignment with the demands of the Tax Manager role.

Best Practices for Tax Manager Education and Certifications

- Include only relevant degrees and certifications that pertain to tax management and accounting.

- List advanced degrees, such as a Master's in Taxation or an MBA with a focus on Finance.

- Highlight industry-recognized certifications, such as CPA, CMA (Certified Management Accountant), or EA.

- Provide details of specialized training or workshops related to tax laws, regulations, and software.

- Consider including honors or distinctions received during academic pursuits.

- Be specific about relevant coursework that aligns with the responsibilities of a Tax Manager.

- Keep the section organized and clearly formatted for easy readability.

- Update the section regularly to reflect any new qualifications or ongoing education.

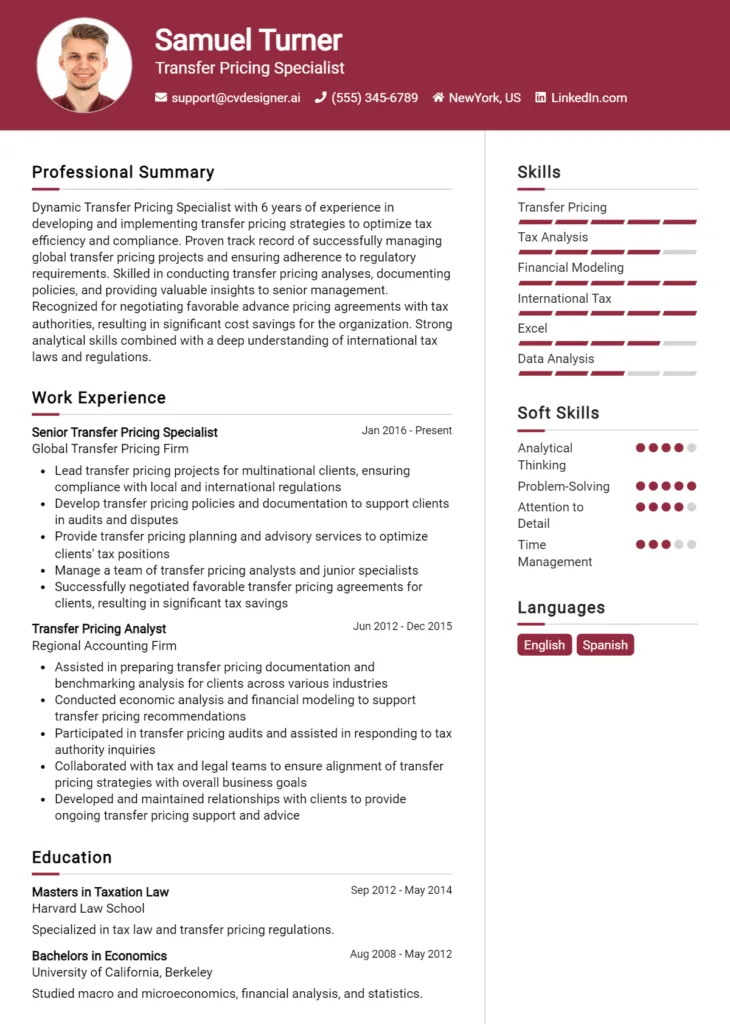

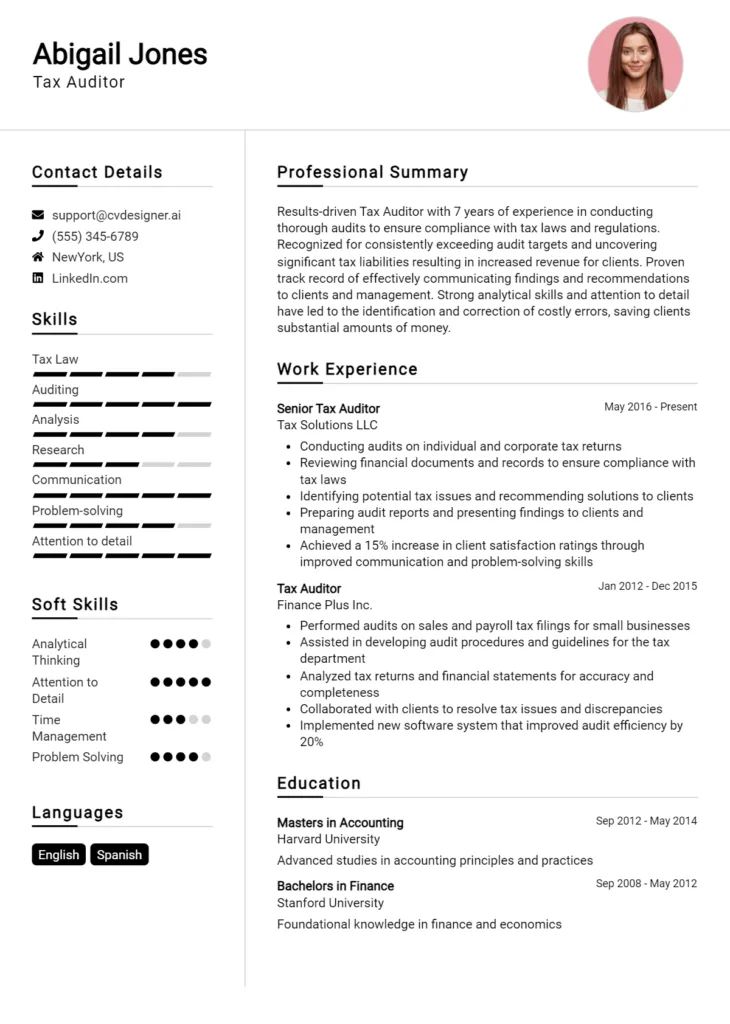

Example Education and Certifications for Tax Manager

Strong Examples

- M.S. in Taxation, University of XYZ, Graduated May 2022

- CPA (Certified Public Accountant), State Board of Accountancy, Licensed since 2020

- Advanced Certificate in International Taxation, ABC Institute, Completed 2021

- Relevant Coursework: Tax Policy Analysis, Corporate Taxation, and Estate Planning

Weak Examples

- B.A. in History, University of ABC, Graduated 2018

- Certification in General Business Management, XYZ Training Center, Completed 2019

- Outdated CPA certification from 2015, currently inactive

- Coursework in Psychology with no relevance to taxation

The strong examples are considered effective because they directly relate to the skills and knowledge required for a Tax Manager, showcasing advanced education and relevant certifications that indicate a commitment to the field. In contrast, the weak examples highlight qualifications that lack relevance to tax management, such as unrelated degrees and outdated certifications, which do not support the candidate's suitability for the role.

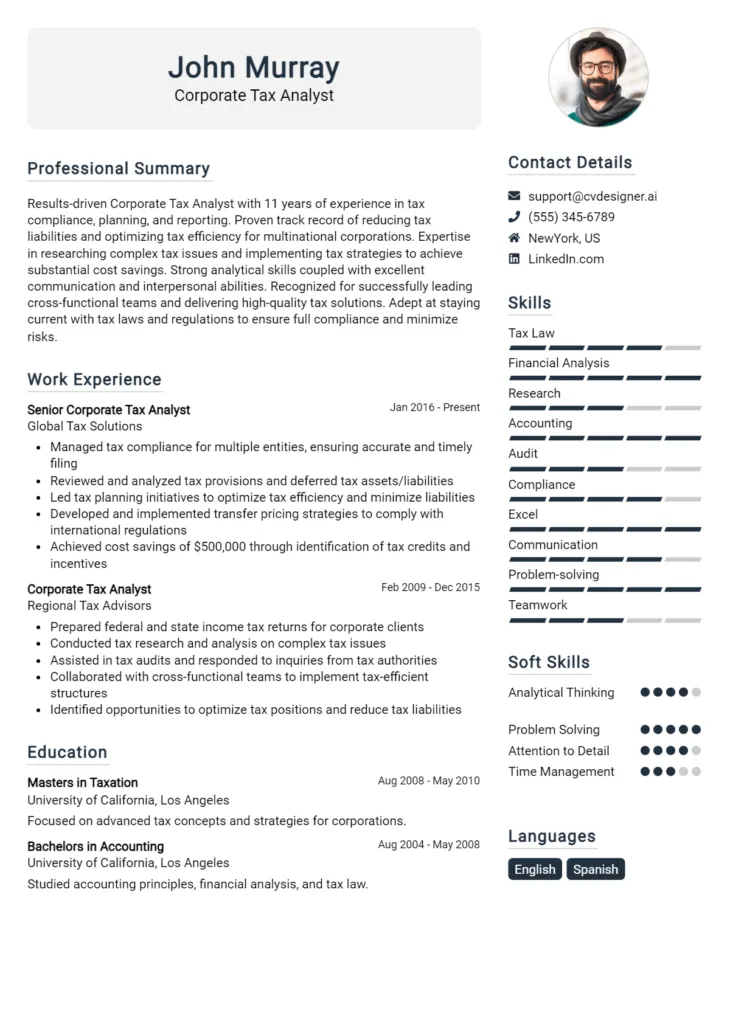

Top Skills & Keywords for Tax Manager Resume

As the role of a Tax Manager is pivotal in ensuring compliance with tax regulations while optimizing tax strategies for an organization, having the right skills is essential for crafting an effective resume. A well-rounded blend of soft and hard skills can significantly enhance a candidate's appeal to potential employers. Soft skills reflect interpersonal abilities and emotional intelligence, which are crucial for managing teams and communicating complex tax concepts to stakeholders. On the other hand, hard skills demonstrate technical proficiency and knowledge specific to the tax field. Highlighting these skills effectively in a resume can set a candidate apart from the competition and showcase their capability to navigate the complexities of tax management.

Top Hard & Soft Skills for Tax Manager

Soft Skills

- Strong communication skills

- Analytical thinking

- Attention to detail

- Problem-solving abilities

- Leadership and team management

- Time management

- Adaptability

- Client relationship management

- Negotiation skills

- Conflict resolution

Hard Skills

- Tax compliance expertise

- Proficiency in tax software (e.g., QuickBooks, TurboTax)

- Knowledge of federal, state, and local tax regulations

- Financial analysis

- Preparation of tax returns

- Budgeting and forecasting

- Tax planning and strategy development

- Strong understanding of accounting principles

- Risk assessment and management

- Data analysis and reporting

For a comprehensive overview of how to highlight these essential skills alongside your work experience, be sure to incorporate them strategically in your resume to maximize your chances of landing the desired position.

Stand Out with a Winning Tax Manager Cover Letter

I am writing to express my interest in the Tax Manager position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of progressive experience in tax planning, compliance, and strategy, I am excited about the opportunity to contribute my expertise to your esteemed organization. My background includes extensive knowledge of federal and state tax regulations, as well as a proven track record of optimizing tax strategies to enhance financial performance.

In my previous role at [Previous Company Name], I successfully led a team of tax professionals in managing complex tax compliance projects, resulting in a [specific achievement, e.g., "15% reduction in tax liabilities over two years"]. My hands-on approach to tax planning and my ability to analyze and interpret tax laws have equipped me with the skills necessary to navigate the intricacies of tax regulations. I excel at collaborating with cross-functional teams to ensure alignment between financial and tax strategies, thereby maximizing the overall effectiveness of the organization’s financial operations.

I am particularly impressed by [Company Name]’s commitment to [specific value, project, or initiative of the company], and I am eager to bring my strategic insight and leadership abilities to your team. I am adept at utilizing advanced tax software and tools to streamline processes and improve accuracy while maintaining compliance with all regulations. My strong analytical skills and attention to detail enable me to identify potential tax-saving opportunities that align with your company's goals.

I would welcome the opportunity to discuss how my experience and skills can contribute to the ongoing success of [Company Name]. Thank you for considering my application. I look forward to the possibility of working together to achieve exceptional results in your tax initiatives.

Common Mistakes to Avoid in a Tax Manager Resume

When crafting a resume for a Tax Manager position, it's essential to present your qualifications and experience in a clear and compelling manner. However, many candidates fall into common pitfalls that can diminish their chances of landing an interview. Understanding these mistakes can help you create a more effective resume that highlights your skills and expertise in tax management. Here are some frequent errors to avoid:

Vague Job Descriptions: Failing to provide specific details about your previous roles can leave potential employers unsure of your actual responsibilities and accomplishments. Use concrete examples and quantifiable results.

Ignoring Industry Keywords: Not incorporating relevant keywords from the job description can make your resume less likely to pass through Applicant Tracking Systems (ATS). Tailor your resume for each application to align with the required skills and qualifications.

Overly Complex Language: Using jargon or overly technical language can alienate hiring managers who may not be familiar with niche terms. Aim for clarity and simplicity to effectively convey your experience.

Neglecting Soft Skills: Tax management is not just about technical knowledge; soft skills like communication, teamwork, and problem-solving are equally important. Failing to mention these can make your resume seem one-dimensional.

Too Much Focus on Duties Rather Than Achievements: Listing daily tasks without showcasing your accomplishments can diminish the impact of your experience. Highlight what you achieved in your roles, such as successful audits or cost savings.

Inconsistent Formatting: A resume that lacks uniformity in fonts, bullet points, and spacing can appear unprofessional. Stick to a clean and consistent format to enhance readability.

Not Including Continuing Education: The tax field is constantly evolving, and neglecting to mention any ongoing education, certifications, or training can make you seem outdated. Highlight any relevant courses or certifications.

Long-Winded Resumes: A lengthy resume can deter hiring managers from reading it in full. Aim for brevity and focus on the most relevant information, ideally keeping your resume to one or two pages.

Conclusion

As we have explored the essential responsibilities, skills, and qualifications for a Tax Manager role, it’s clear that this position requires a strong blend of analytical abilities, attention to detail, and a comprehensive understanding of tax regulations. Tax Managers play a critical role in ensuring compliance, optimizing tax strategies, and providing valuable insights to organizations.

In summary, a successful Tax Manager must be adept in financial analysis, possess excellent communication skills, and stay abreast of changing tax laws. Furthermore, leadership qualities and the ability to work collaboratively with other departments are crucial for guiding teams and making informed decisions.

Now is the perfect time to review your Tax Manager resume to ensure it highlights your relevant experience and skills effectively. Take advantage of the variety of resources available to help you craft a standout application. Consider using resume templates to lay out your information professionally. You can also utilize the resume builder for a more personalized touch. To inspire your writing, browse through resume examples that resonate with your career path. And don’t forget to enhance your job application with tailored cover letter templates that complement your resume.

Take the next step in your career by refining your application today!