State and Local Tax Consultant Core Responsibilities

A State and Local Tax Consultant is essential in navigating complex tax regulations, requiring strong technical, operational, and problem-solving skills. This role bridges finance, legal, and operational departments by ensuring compliance with state and local tax laws while optimizing tax strategies. Success hinges on analytical abilities to interpret tax codes, assess risks, and propose solutions. Effectively showcasing these competencies on a well-structured resume can significantly contribute to an organization's fiscal goals and enhance career advancement opportunities.

Common Responsibilities Listed on State and Local Tax Consultant Resume

- Conduct thorough research and analysis of state and local tax laws and regulations.

- Prepare and review state and local tax returns for accuracy and compliance.

- Advise clients on tax implications of business decisions and transactions.

- Assist in tax audits and respond to inquiries from tax authorities.

- Develop and implement tax planning strategies to minimize liabilities.

- Collaborate with cross-functional teams to ensure tax considerations are integrated.

- Provide training and guidance on state and local tax issues to staff.

- Monitor changes in tax legislation and assess their impact on clients.

- Draft technical memoranda and reports summarizing tax positions and strategies.

- Support mergers, acquisitions, and restructuring efforts with tax due diligence.

- Utilize tax software and tools to enhance efficiency in tax compliance tasks.

- Build and maintain relationships with clients and tax authorities.

High-Level Resume Tips for State and Local Tax Consultant Professionals

In the competitive field of State and Local Tax Consulting, a well-crafted resume is essential for making a strong first impression on potential employers. Your resume serves as the initial showcase of your skills, experiences, and accomplishments, and it needs to effectively communicate your qualifications in a way that resonates with hiring managers. Given the technical nature of the role, it is crucial that your resume not only highlights your expertise in tax regulations and compliance but also demonstrates your ability to deliver tangible results. This guide will provide practical and actionable resume tips specifically tailored for State and Local Tax Consultant professionals, ensuring you stand out in a crowded job market.

Top Resume Tips for State and Local Tax Consultant Professionals

- Tailor your resume to each job description by incorporating relevant keywords and phrases that align with the employer's needs.

- Highlight your relevant experience in state and local tax regulations, compliance, and audits to showcase your expertise in the field.

- Quantify your achievements by including specific metrics, such as the amount of tax savings generated for clients or the number of successful audits completed.

- Emphasize your industry-specific skills, such as proficiency in tax software, knowledge of state tax codes, and analytical abilities.

- Include certifications and licenses relevant to state and local taxation, such as CPA or EA, to enhance your credibility.

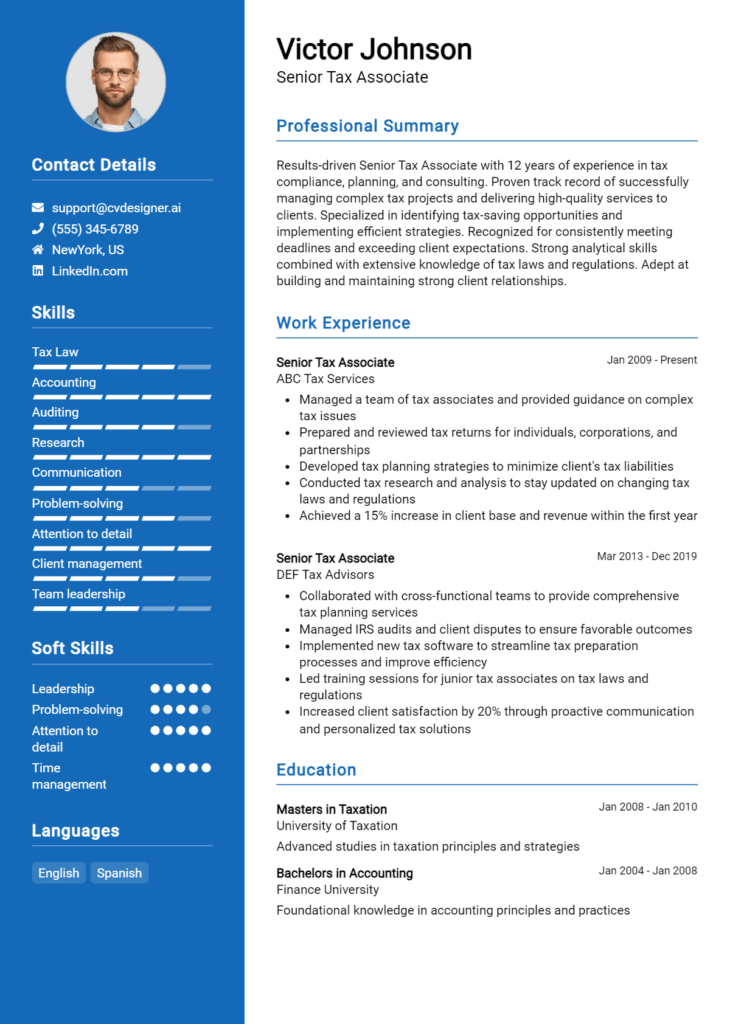

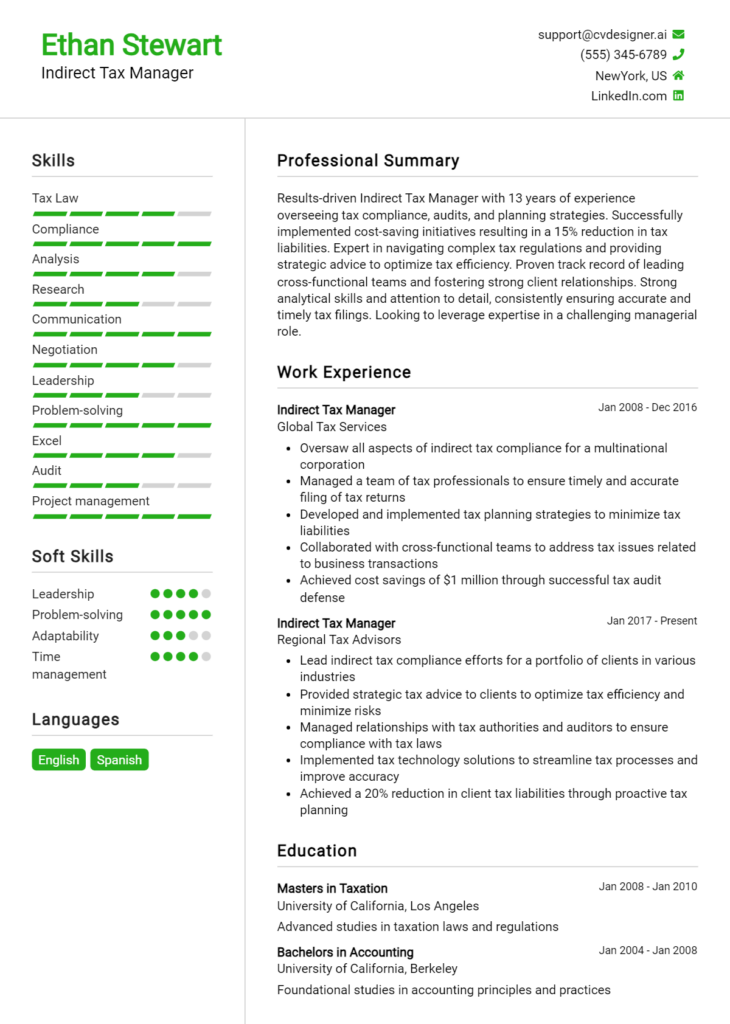

- Utilize a clean and professional format to ensure your resume is easy to read and visually appealing.

- Incorporate a summary statement at the top of your resume that captures your career goals and key qualifications in tax consulting.

- Showcase your soft skills, such as communication and problem-solving abilities, which are essential in client interactions and negotiations.

- Keep your resume concise, ideally one page, by focusing on the most relevant experiences and achievements.

By implementing these tips into your resume, you can significantly increase your chances of landing a job in the State and Local Tax Consultant field. A well-structured and tailored resume will not only showcase your qualifications but also demonstrate your commitment to the profession, making you a compelling candidate for potential employers.

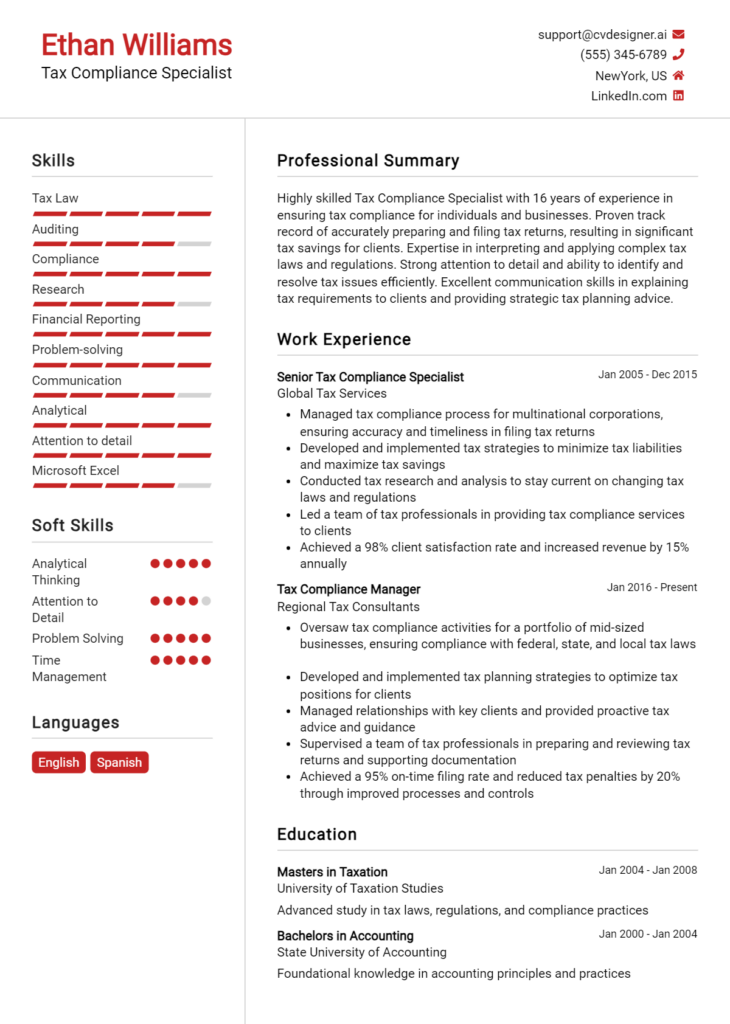

Why Resume Headlines & Titles are Important for State and Local Tax Consultant

In the competitive field of State and Local Tax Consulting, a well-crafted resume headline or title plays a critical role in capturing the attention of hiring managers. A strong headline serves as a powerful introduction, summarizing a candidate's key qualifications and professional brand in a single impactful phrase. By being concise and directly related to the job being applied for, an effective headline can quickly convey the candidate's value proposition, making it easier for hiring managers to see how they align with the specific needs of the role. In essence, a compelling resume headline can set the tone for the rest of the application and significantly enhance the candidate's chances of making a memorable first impression.

Best Practices for Crafting Resume Headlines for State and Local Tax Consultant

- Keep it concise—aim for one impactful phrase.

- Use keywords relevant to the State and Local Tax field.

- Highlight your most significant skills or achievements.

- Be specific about your area of expertise or specialization.

- Tailor the headline for each job application.

- Avoid jargon or overly complex language.

- Make it attention-grabbing without being gimmicky.

- Position yourself as a solution provider for potential employers.

Example Resume Headlines for State and Local Tax Consultant

Strong Resume Headlines

"Experienced State and Local Tax Consultant Specializing in Compliance and Risk Management"

“Results-Driven Tax Consultant with 10+ Years of Experience in State Tax Planning and Strategy"

“Dynamic Tax Professional with Proven Expertise in State Tax Credits and Incentives"

Weak Resume Headlines

“Tax Consultant Looking for Opportunities"

“Experienced Professional in Finance"

The strong resume headlines are effective because they are specific, informative, and tailored to the role of a State and Local Tax Consultant. They clearly indicate the candidate's expertise and key skills, making it easy for hiring managers to identify their potential contributions. In contrast, the weak headlines are vague and lack focus, making it challenging for hiring managers to understand the candidate's qualifications or how they fit the specific role. This lack of clarity diminishes the impact of the resume and fails to draw interest from potential employers.

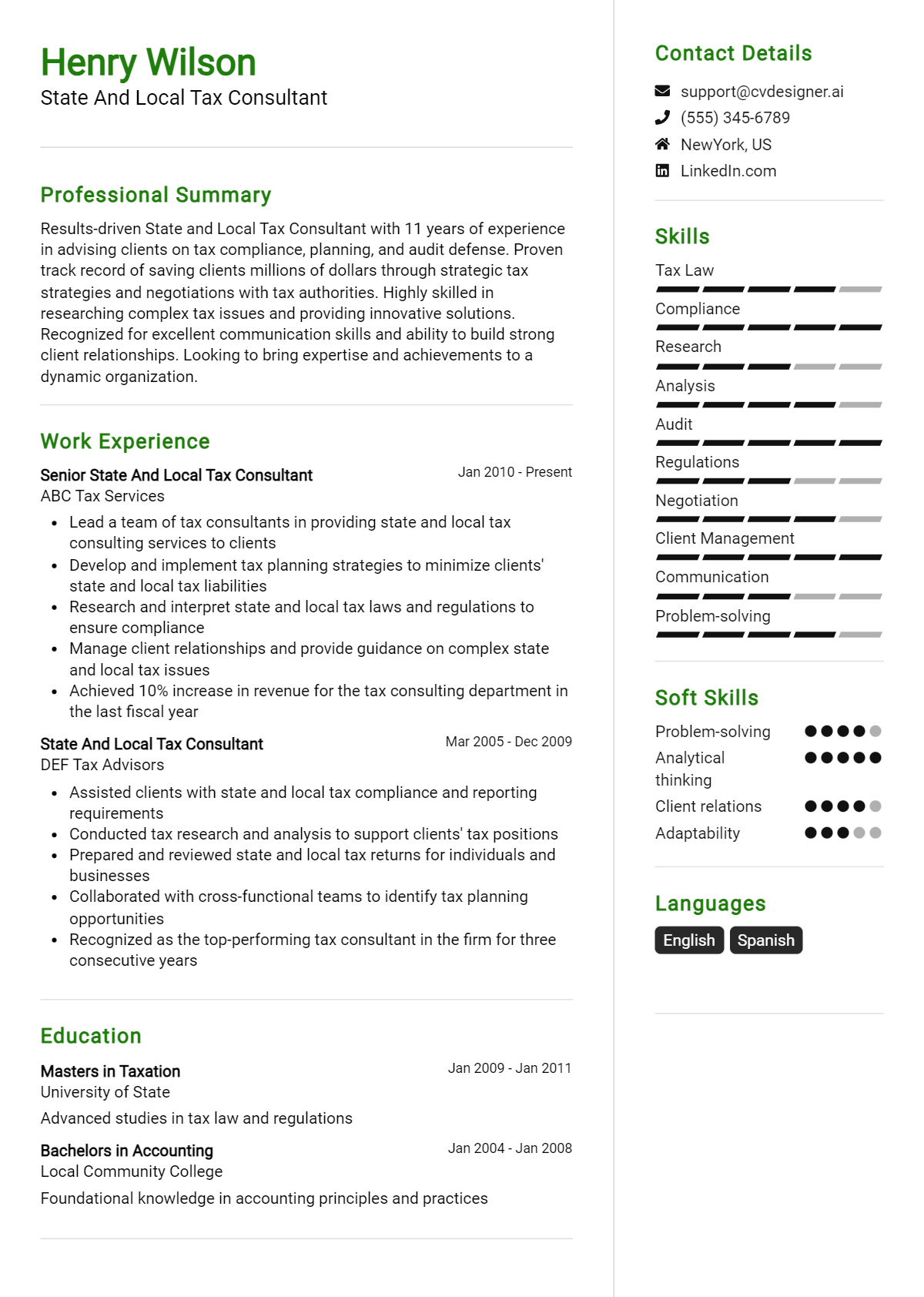

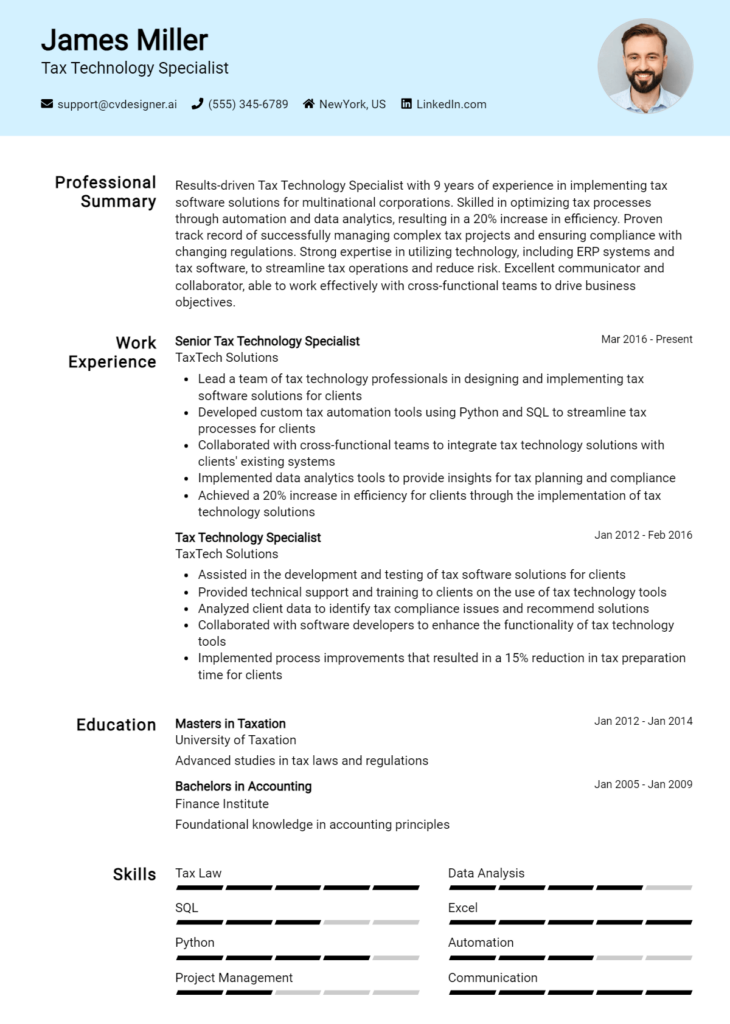

Writing an Exceptional State and Local Tax Consultant Resume Summary

A resume summary is a critical component for a State and Local Tax Consultant, as it serves as the first impression for hiring managers. A well-crafted summary quickly captures attention by highlighting key skills, relevant experience, and significant accomplishments that relate directly to the role. In a competitive job market, the ability to present a concise and impactful summary tailored to the specific job can set a candidate apart, demonstrating both their qualifications and enthusiasm for the position.

Best Practices for Writing a State and Local Tax Consultant Resume Summary

- Quantify achievements: Use numbers and percentages to illustrate your contributions and successes.

- Focus on relevant skills: Highlight specific skills that are directly applicable to state and local tax consulting.

- Tailor for the job description: Customize your summary to align with the requirements and language used in the job posting.

- Keep it concise: Aim for 3-5 sentences that are easy to read and impactful.

- Use action verbs: Start sentences with strong action verbs to convey a sense of proactivity and results-oriented performance.

- Showcase industry knowledge: Reference your understanding of state and local tax regulations and compliance issues.

- Highlight professional designations: Mention any relevant certifications or qualifications that enhance your credibility as a consultant.

- Emphasize teamwork and communication: Illustrate your ability to work collaboratively and communicate effectively with clients and stakeholders.

Example State and Local Tax Consultant Resume Summaries

Strong Resume Summaries

Dynamic State and Local Tax Consultant with over 7 years of experience in optimizing tax compliance strategies for mid-sized corporations. Achieved a 15% reduction in state tax liabilities for clients through targeted planning and risk assessment, while ensuring adherence to evolving regulations.

Results-driven tax professional with a proven track record of successfully navigating complex state tax laws. Delivered over $1M in tax savings for clients through innovative strategies and comprehensive audits, leveraging expertise in technology to streamline processes and improve reporting accuracy.

Experienced State and Local Tax Consultant specializing in multistate tax planning and compliance. Recognized for enhancing client satisfaction scores by 20% through exceptional service delivery and proactive communication, leading to increased client retention and referrals.

Weak Resume Summaries

Tax consultant with some experience in state and local tax issues who is looking for a new job.

Knowledgeable professional interested in helping businesses with their tax needs. Good at working with others and understanding tax regulations.

The strong resume summaries are considered effective because they provide specific achievements, quantify results, and directly relate to the skills and experiences sought in a State and Local Tax Consultant. They showcase the candidate's impact in previous roles and demonstrate a proactive approach to tax consulting. In contrast, the weak summaries are vague and lack measurable outcomes. They do not provide any substantial information about the candidate's qualifications or how they can contribute to a potential employer, making them less compelling to hiring managers.

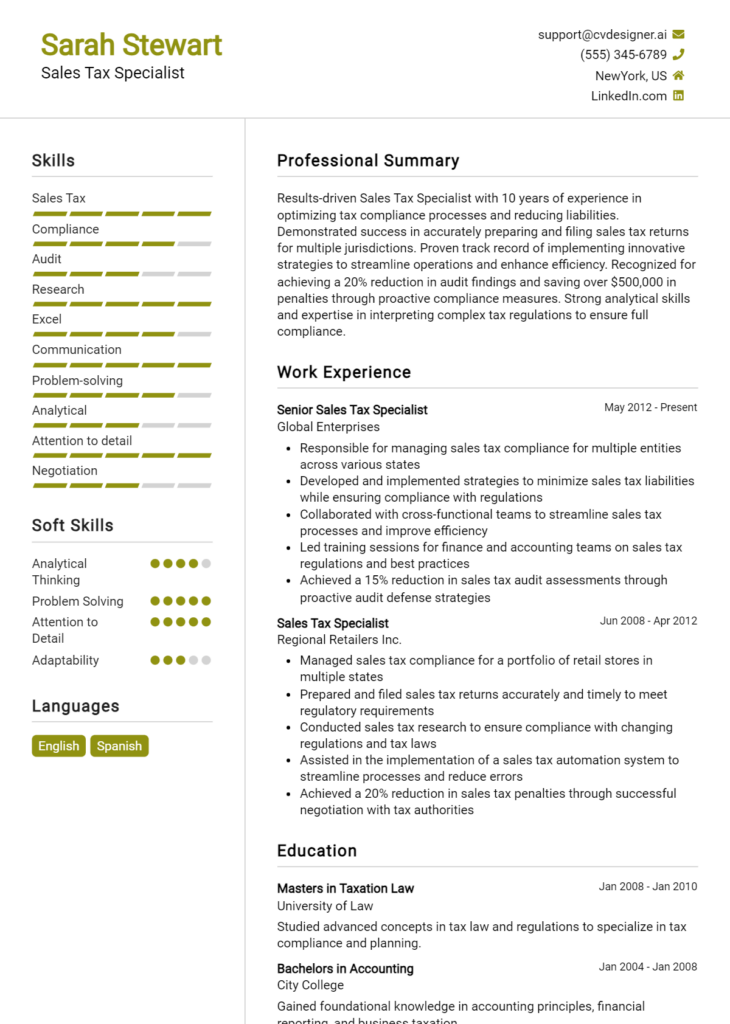

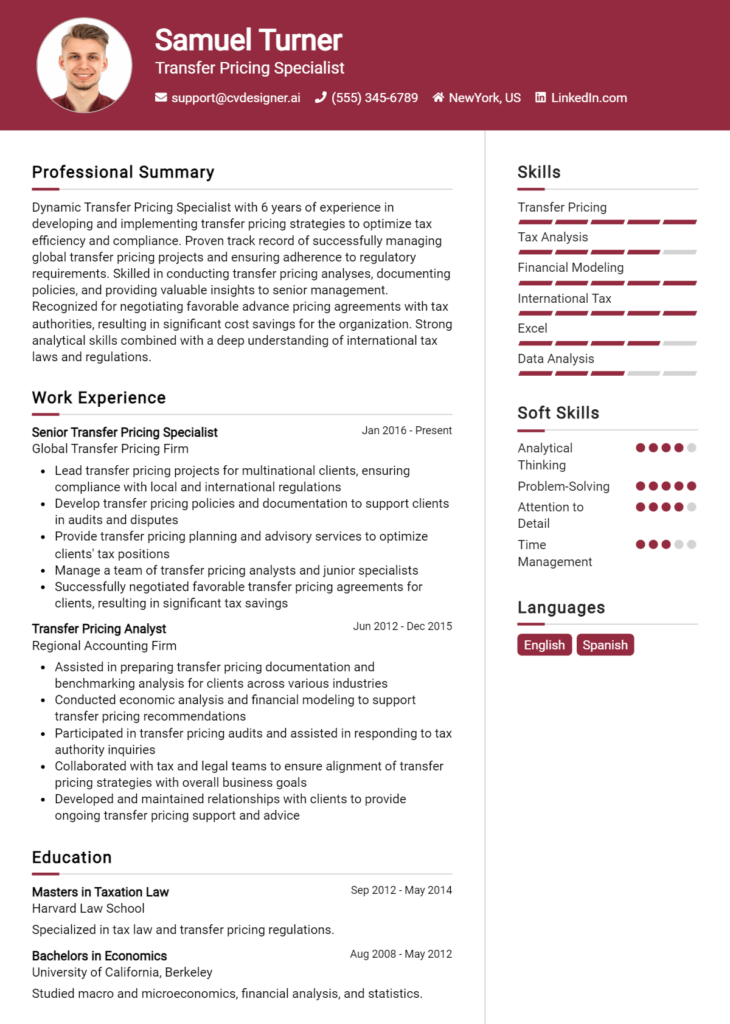

Work Experience Section for State and Local Tax Consultant Resume

The work experience section of a State and Local Tax Consultant resume is critical as it serves as a showcase for the candidate's technical skills and their ability to manage teams while delivering high-quality results. This section provides potential employers with insights into the candidate's practical application of tax principles, their leadership capabilities, and their contributions to successful projects. It is essential to quantify achievements wherever possible and align work experience with industry standards, as this not only emphasizes the candidate's effectiveness but also their understanding of the complexities of state and local tax regulations.

Best Practices for State and Local Tax Consultant Work Experience

- Highlight specific technical skills relevant to state and local tax regulations.

- Quantify achievements with concrete metrics, such as percentage increases in compliance or reductions in tax liabilities.

- Emphasize team management and collaboration experiences, showcasing leadership roles.

- Use action verbs to describe responsibilities and accomplishments clearly.

- Tailor work experiences to align with the requirements of the position being applied for.

- Include any relevant certifications or specialized training in tax consulting.

- Detail successful project outcomes, including timelines and stakeholder engagement.

- Showcase problem-solving abilities with examples of overcoming tax-related challenges.

Example Work Experiences for State and Local Tax Consultant

Strong Experiences

- Led a team of five consultants in a multi-state tax compliance project, resulting in a 30% reduction in audit risks and a $2 million savings in tax liabilities for the client.

- Developed and implemented a new tax strategy for a Fortune 500 company, achieving a 15% increase in tax credits claimed over three consecutive years.

- Collaborated with cross-functional teams to streamline tax reporting processes, reducing preparation time by 40% and enhancing accuracy through automated solutions.

- Conducted comprehensive training sessions for junior consultants on state tax regulations, improving overall team performance metrics by 25% within one quarter.

Weak Experiences

- Assisted in tax projects.

- Worked on various tax-related tasks.

- Participated in team meetings about tax issues.

- Helped with compliance documentation.

The examples of strong experiences are considered effective because they provide specific, quantifiable outcomes that demonstrate the candidate's impact in previous roles, showcasing both technical leadership and collaborative efforts. In contrast, the weak experiences lack detail and measurable results, making them less compelling and failing to convey the candidate's true capabilities and contributions in the field of state and local tax consulting.

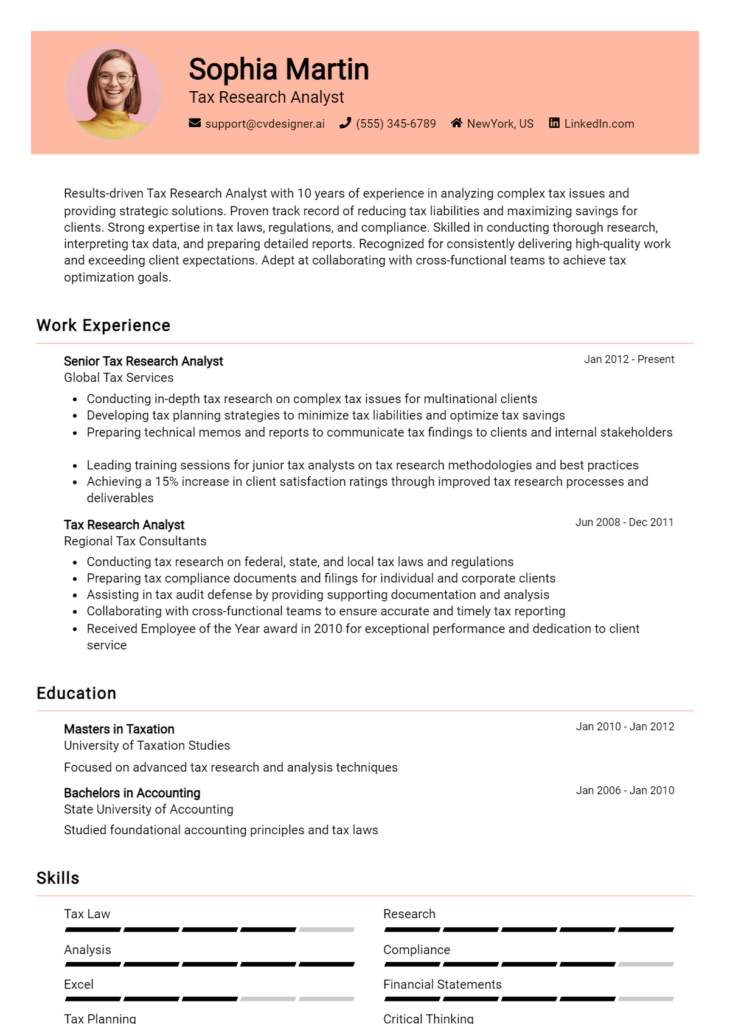

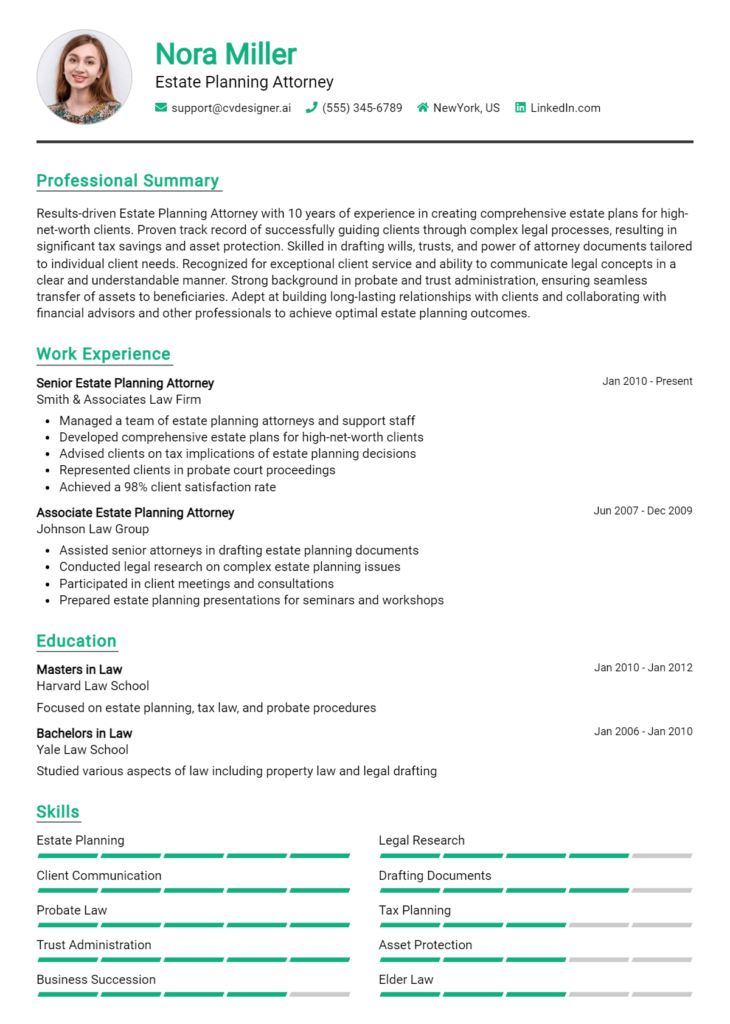

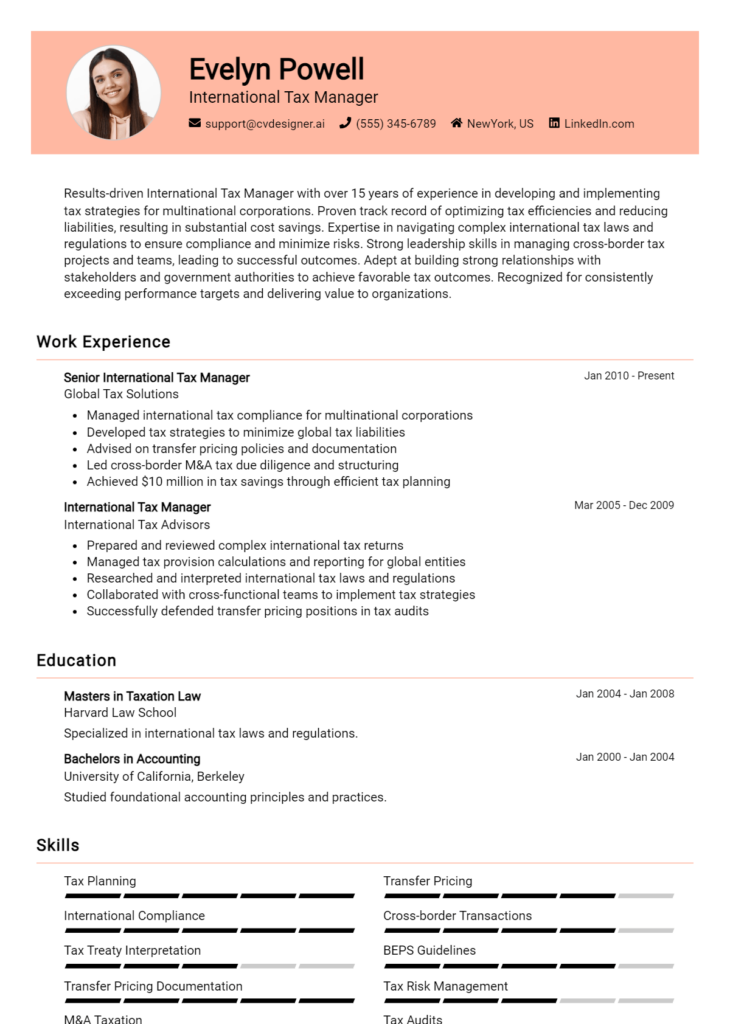

Education and Certifications Section for State and Local Tax Consultant Resume

The education and certifications section in a State and Local Tax Consultant resume plays a crucial role in establishing the candidate's qualifications and expertise in this specialized field. This section not only highlights the applicant's academic achievements but also showcases their commitment to continuous professional development through industry-relevant certifications and specialized training. By detailing relevant coursework and credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role, making them more appealing to potential employers.

Best Practices for State and Local Tax Consultant Education and Certifications

- Include only relevant degrees and certifications that pertain to state and local tax matters.

- List certifications from recognized professional organizations, such as the AICPA or state tax authorities.

- Highlight advanced degrees, such as a Master’s in Taxation or an MBA with a focus on taxation.

- Detail any specialized training programs or workshops attended that relate to state and local taxation.

- Provide the dates of completion for degrees and certifications to show currency and relevance.

- Include relevant coursework that emphasizes skills and knowledge applicable to state and local tax consulting.

- Organize the section clearly, making it easy for hiring managers to identify key qualifications.

- Use bullet points for clarity and to enhance readability of the information presented.

Example Education and Certifications for State and Local Tax Consultant

Strong Examples

- Master of Science in Taxation, University of Illinois, 2021

- Certified Public Accountant (CPA), State of California, 2020

- Certificate in State and Local Taxation, National Association of State Tax Officials, 2022

- Relevant Coursework: Federal Taxation, State and Local Tax Policy, Tax Research Techniques

Weak Examples

- Bachelor of Arts in History, University of Texas, 2010

- Certification in QuickBooks, 2015

- Online Course in Excel for Beginners, 2021

- Certificate in Business Administration, 2018

The examples provided illustrate a clear distinction between strong and weak qualifications. Strong examples focus on degrees and certifications that are directly relevant to state and local tax consulting, showcasing advanced education and specialized training in the field. In contrast, weak examples reflect outdated or irrelevant qualifications that do not align with the requirements of the role, such as unrelated degrees or certifications that lack industry recognition. This highlights the importance of relevance and specificity in the education and certifications section of a resume.

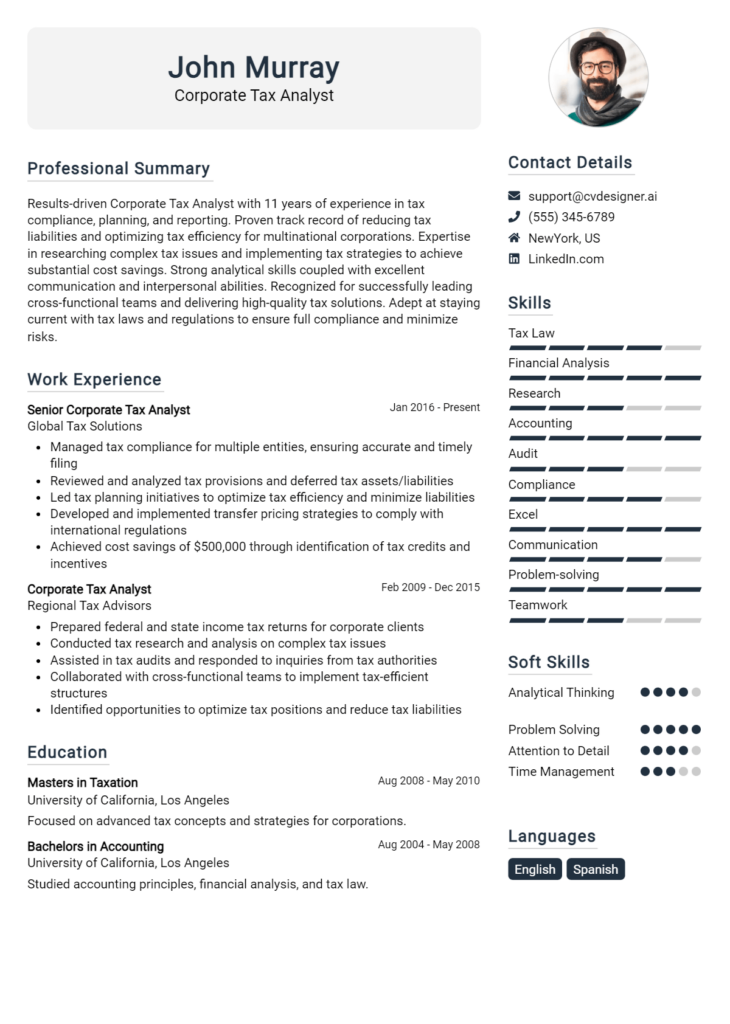

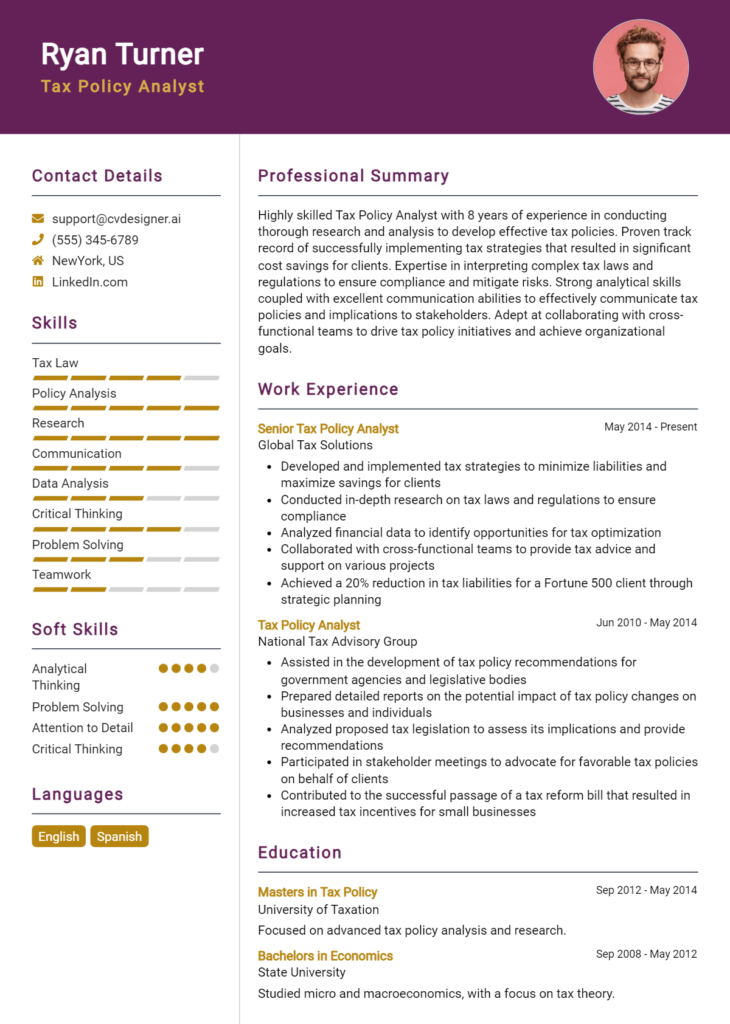

Top Skills & Keywords for State and Local Tax Consultant Resume

The role of a State and Local Tax Consultant is integral to ensuring compliance with tax regulations and optimizing a client's tax position. A well-crafted resume that highlights essential skills can set a candidate apart in a competitive job market. Skills not only demonstrate a candidate's capabilities but also provide insight into their ability to navigate complex tax codes and regulations. By focusing on both hard and soft skills, candidates can effectively showcase their expertise and interpersonal abilities, which are critical in consulting environments. This blend of skills enhances a consultant's value, making them a trustworthy advisor to clients seeking comprehensive tax solutions.

Top Hard & Soft Skills for State and Local Tax Consultant

Soft Skills

- Strong analytical thinking

- Excellent communication abilities

- Problem-solving aptitude

- Attention to detail

- Time management skills

- Client relationship management

- Adaptability and flexibility

- Team collaboration

- Negotiation skills

- Critical thinking

Hard Skills

- In-depth knowledge of state and local tax laws

- Proficiency with tax software (e.g., CCH Axcess, Thomson Reuters)

- Tax compliance and reporting expertise

- Experience with tax audits and dispute resolution

- Familiarity with multistate tax regulations

- Ability to conduct tax research and analysis

- Understanding of financial statements and reporting

- Knowledge of sales tax, income tax, and property tax regulations

- Strong proficiency in Excel and data analysis tools

- Project management skills

For a comprehensive overview of how to highlight your skills and work experience in your resume, consider integrating these elements effectively to enhance your candidacy as a State and Local Tax Consultant.

Stand Out with a Winning State and Local Tax Consultant Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the State and Local Tax Consultant position at [Company Name], as advertised on [where you found the job listing]. With a strong background in tax compliance and consulting, combined with my passion for helping clients navigate the complexities of state and local tax regulations, I am confident in my ability to contribute effectively to your team. Having worked with a diverse range of clients across multiple industries, I possess the analytical and problem-solving skills necessary to develop tailored solutions that meet their unique tax needs.

In my previous role at [Previous Company Name], I successfully managed various state and local tax projects, including sales and use tax audits, property tax assessments, and income tax compliance. I have a proven track record of identifying tax-saving opportunities and ensuring compliance with ever-changing regulations. My ability to communicate complex tax concepts clearly and effectively has allowed me to build strong relationships with clients and help them understand their obligations and opportunities in a straightforward manner. I am particularly adept at leveraging technology to streamline processes and enhance the accuracy of tax reporting.

I am particularly drawn to [Company Name] due to its reputation for excellence in client service and innovative tax strategies. I am eager to leverage my expertise in state and local tax matters to help your clients optimize their tax positions while minimizing exposure to risks. I am excited about the opportunity to collaborate with a team of dedicated professionals who share my commitment to delivering exceptional service and value. Thank you for considering my application; I look forward to the possibility of discussing how my skills and experiences align with the goals of your firm.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

[LinkedIn Profile or Website, if applicable]

Common Mistakes to Avoid in a State and Local Tax Consultant Resume

When crafting a resume for a State and Local Tax Consultant position, it’s essential to present your qualifications and experience in a clear and compelling manner. However, many candidates make critical errors that can hinder their chances of landing an interview. Being aware of these common pitfalls can help you create a stronger, more effective resume that highlights your expertise and suitability for the role.

Lack of Specificity: Failing to detail specific tax laws or regulations you’ve worked with can make your resume too vague. Be sure to include the exact areas of state and local tax you have experience in.

Ignoring Keywords: Many employers use Applicant Tracking Systems (ATS) to filter resumes. Not incorporating relevant keywords from the job description can result in your resume being overlooked.

Overly Technical Language: While technical expertise is important, using jargon that may not be understood by all readers can alienate hiring managers. Balance technical terms with clear explanations.

Neglecting Soft Skills: State and Local Tax Consultants must often communicate complex information to clients. Failing to showcase your interpersonal skills, such as communication and problem-solving, can be a missed opportunity.

Inconsistent Formatting: A cluttered or inconsistent format can distract from your qualifications. Ensure that your resume has a clean, professional layout with uniform font sizes and styles.

Omitting Relevant Achievements: Listing job duties without highlighting specific accomplishments can make your resume less impactful. Quantify your achievements with metrics or examples to demonstrate your effectiveness.

Long Paragraphs: Using large blocks of text can make your resume hard to read. Opt for bullet points and concise sentences to improve readability and highlight key information.

Failing to Tailor the Resume: Sending out a generic resume to multiple employers is a common mistake. Tailor your resume for each position by aligning your experience with the specific requirements of the job.

Conclusion

As a State and Local Tax Consultant, it’s essential to stay updated on the nuances of tax regulations and compliance requirements at both the state and local levels. This role demands not only a solid understanding of tax laws but also the ability to analyze complex financial data, provide strategic advice to clients, and facilitate effective communication between stakeholders. Your resume should clearly reflect your expertise in tax consulting, showcasing relevant skills, experiences, and accomplishments that demonstrate your value to potential employers.

In summary, remember to highlight your analytical skills, problem-solving abilities, and experience in navigating state and local tax codes. Include specific examples of how you have helped clients minimize their tax liabilities or improve their compliance processes. A well-crafted resume can set you apart in a competitive job market.

Now is the perfect time to review and refine your State and Local Tax Consultant resume. Utilize available resources to enhance your application materials. Explore resume templates to find a layout that best showcases your qualifications. Consider using the resume builder for an efficient way to create a professional-looking resume. Additionally, look at resume examples for inspiration and to ensure you're on the right track. Don’t forget to complement your resume with a compelling introduction by using our cover letter templates. Take action today and make your resume stand out in the field of State and Local Tax Consulting!