International Tax Manager Core Responsibilities

An International Tax Manager plays a crucial role in navigating complex tax regulations across multiple jurisdictions. This professional bridges finance, legal, and compliance departments, ensuring tax strategies align with the organization’s goals. Key responsibilities include managing tax compliance, analyzing international tax treaties, and advising on transfer pricing. Success in this role necessitates strong technical, operational, and problem-solving skills. A well-structured resume that highlights these qualifications can significantly enhance career opportunities in this dynamic field.

Common Responsibilities Listed on International Tax Manager Resume

- Develop and implement international tax strategies to optimize tax efficiency.

- Oversee compliance with global tax regulations and reporting requirements.

- Conduct transfer pricing analyses and documentation.

- Collaborate with cross-functional teams to ensure adherence to tax policies.

- Manage tax audits and respond to inquiries from tax authorities.

- Provide guidance on foreign tax credits and tax treaties.

- Monitor changes in international tax legislation and assess their impact.

- Prepare and review tax provisions for financial statements.

- Conduct risk assessments related to international tax matters.

- Train and mentor junior tax staff on international tax issues.

- Support mergers and acquisitions with tax due diligence.

- Maintain relationships with external tax advisors and consultants.

High-Level Resume Tips for International Tax Manager Professionals

In the competitive landscape of international tax, a well-crafted resume is crucial for professionals aiming to make a lasting impression on potential employers. As the first point of contact between a candidate and an employer, your resume must not only showcase your skills and qualifications but also reflect your achievements and contributions in the field. For International Tax Managers, this means highlighting your expertise in cross-border taxation, compliance, and strategic planning. This guide will provide practical and actionable resume tips specifically tailored for International Tax Manager professionals to enhance your application and stand out in the hiring process.

Top Resume Tips for International Tax Manager Professionals

- Tailor your resume to each job description by incorporating relevant keywords that match the specific requirements of the position.

- Highlight your experience with international tax regulations, compliance, and reporting to demonstrate your expertise in the field.

- Quantify your achievements by including metrics such as tax savings, successful audits, or compliance improvements to add credibility to your claims.

- Showcase your proficiency in tax software and tools commonly used in international tax management to emphasize your technical skills.

- Include any certifications or advanced degrees relevant to international tax, such as a CPA or an LLM in Taxation, to bolster your qualifications.

- Detail your experience working with multinational corporations or cross-border transactions to highlight your understanding of complex tax issues.

- Emphasize your ability to stay updated on changes in tax legislation and global tax trends, showcasing your commitment to continuous learning.

- Incorporate soft skills such as communication, collaboration, and problem-solving, as these are essential for managing relationships with stakeholders.

- Ensure your resume is well-organized, visually appealing, and free of errors to demonstrate professionalism and attention to detail.

By implementing these tips, you can significantly enhance your resume and increase your chances of landing a job in the International Tax Manager field. A targeted and well-structured resume will not only help you stand out among other candidates but also effectively communicate your unique qualifications and readiness to contribute to prospective employers in a dynamic global landscape.

Why Resume Headlines & Titles are Important for International Tax Manager

In the competitive landscape of international taxation, a well-crafted resume headline or title is essential for an International Tax Manager. This succinct phrase serves as the first impression for hiring managers, quickly summarizing the candidate's key qualifications and career focus. A strong headline can immediately capture attention, setting the tone for the rest of the resume. It should be concise, relevant, and directly tied to the job being applied for, making it easier for employers to understand the candidate's expertise and suitability for the role at a glance.

Best Practices for Crafting Resume Headlines for International Tax Manager

- Keep it concise: Aim for a headline that is short and impactful, ideally one to two lines.

- Be specific: Use industry-related keywords and phrases that directly relate to the position.

- Highlight key strengths: Focus on unique skills or experiences that set you apart from other candidates.

- Use action-oriented language: Start with strong verbs or descriptors to convey confidence and capability.

- Tailor for the job: Customize your headline for each application to reflect the specific role and company.

- Include measurable achievements: Where possible, reference quantifiable successes to demonstrate your impact.

- Avoid jargon: Use clear, straightforward language to ensure easy understanding by all hiring managers.

- Reflect your career goals: Convey not just what you have done, but what you aim to achieve in your next role.

Example Resume Headlines for International Tax Manager

Strong Resume Headlines

"Results-Driven International Tax Manager with 10+ Years of Experience in Multinational Compliance and Planning"

“Strategic International Tax Advisor Specializing in Cross-Border Transactions and Risk Mitigation”

“Dynamic Tax Professional with Proven Track Record in Reducing Global Tax Liabilities by 30%”

“Expert International Tax Manager with Extensive Knowledge of OECD Guidelines and Transfer Pricing”

Weak Resume Headlines

“Tax Manager Looking for New Opportunities”

“Experienced Professional in Taxation”

The strong headlines are effective because they are specific, result-oriented, and tailored to the role of an International Tax Manager, showcasing the candidate's expertise and accomplishments. They immediately convey the value the candidate brings to a potential employer. In contrast, the weak headlines lack specificity and do not provide any insight into the candidate's unique qualifications, making them forgettable and unimpressive in a crowded job market.

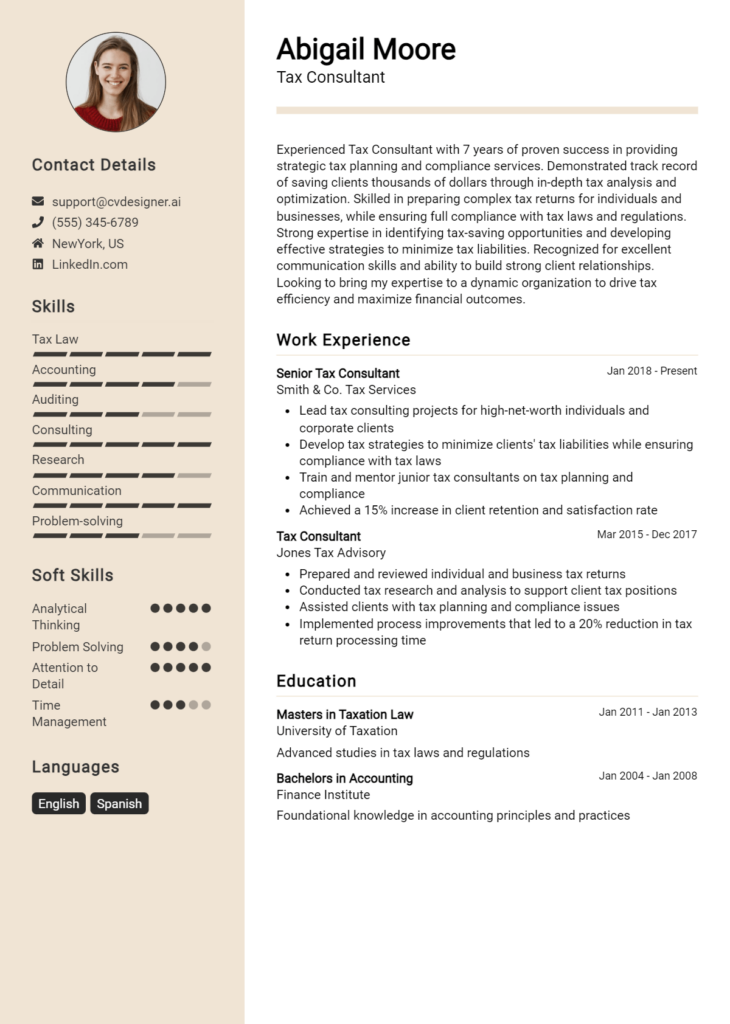

Writing an Exceptional International Tax Manager Resume Summary

A well-crafted resume summary is crucial for an International Tax Manager, as it serves as the first impression a hiring manager will have of a candidate. This concise section quickly captures attention by highlighting key skills, relevant experience, and significant accomplishments that align with the job role. A strong summary not only provides a snapshot of the candidate's qualifications but also sets the tone for the rest of the resume. To be effective, it should be impactful, succinct, and tailored specifically to the position being applied for, making it an essential component in the competitive field of international tax management.

Best Practices for Writing a International Tax Manager Resume Summary

- Quantify achievements: Use numbers and percentages to demonstrate your impact and contributions.

- Focus on relevant skills: Highlight specific skills that are directly related to the international tax field.

- Tailor the summary: Customize your summary for each job application based on the job description.

- Keep it concise: Aim for 2-4 sentences that capture your qualifications without overwhelming the reader.

- Use action verbs: Start sentences with strong action verbs to convey proactivity and achievement.

- Showcase your expertise: Mention areas of specialization, such as transfer pricing, tax compliance, or international regulations.

- Include certifications: If applicable, reference relevant certifications (e.g., CPA, CTA) that enhance your credibility.

- Demonstrate leadership: If you have managed teams or projects, highlight these experiences to show your leadership capabilities.

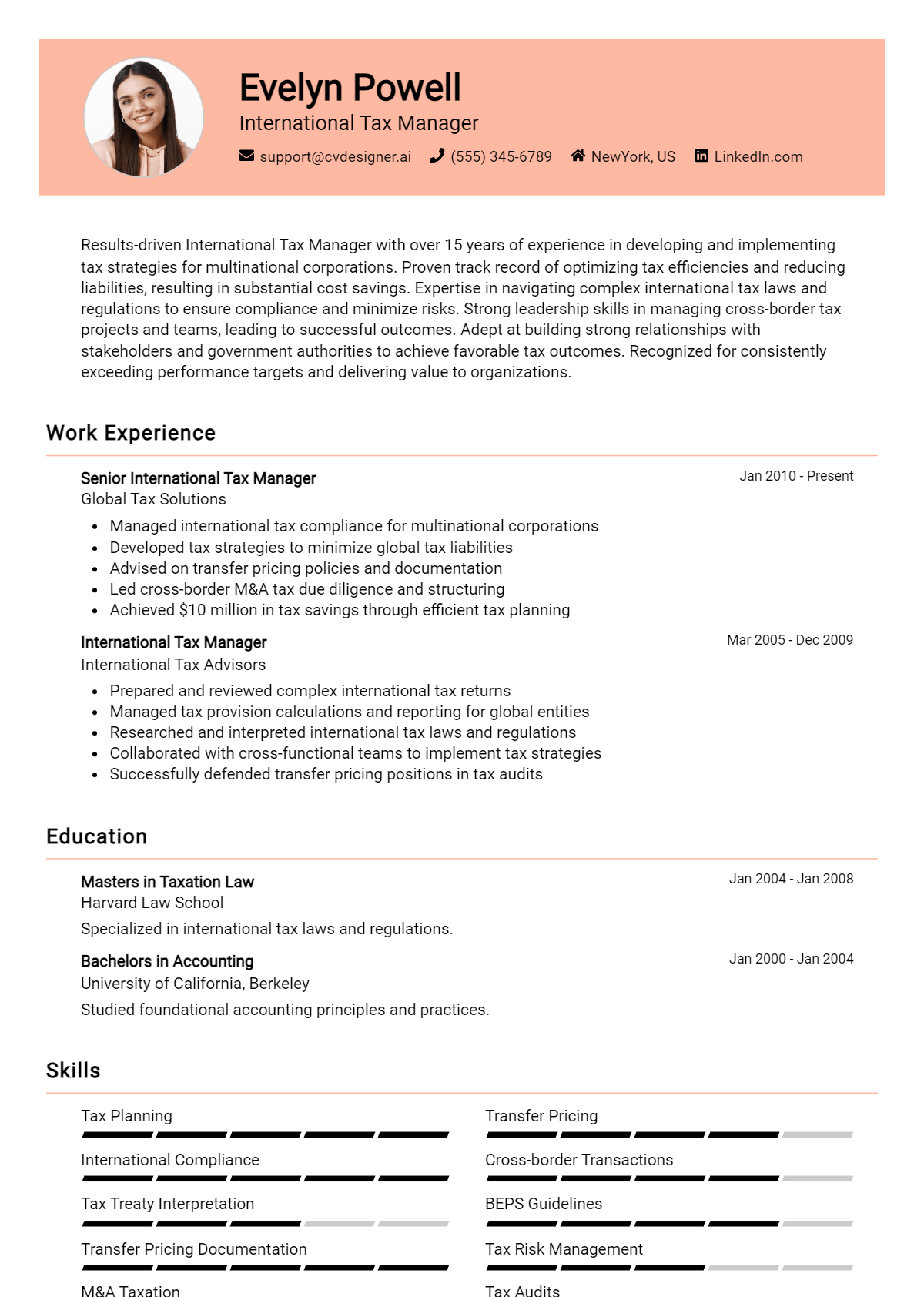

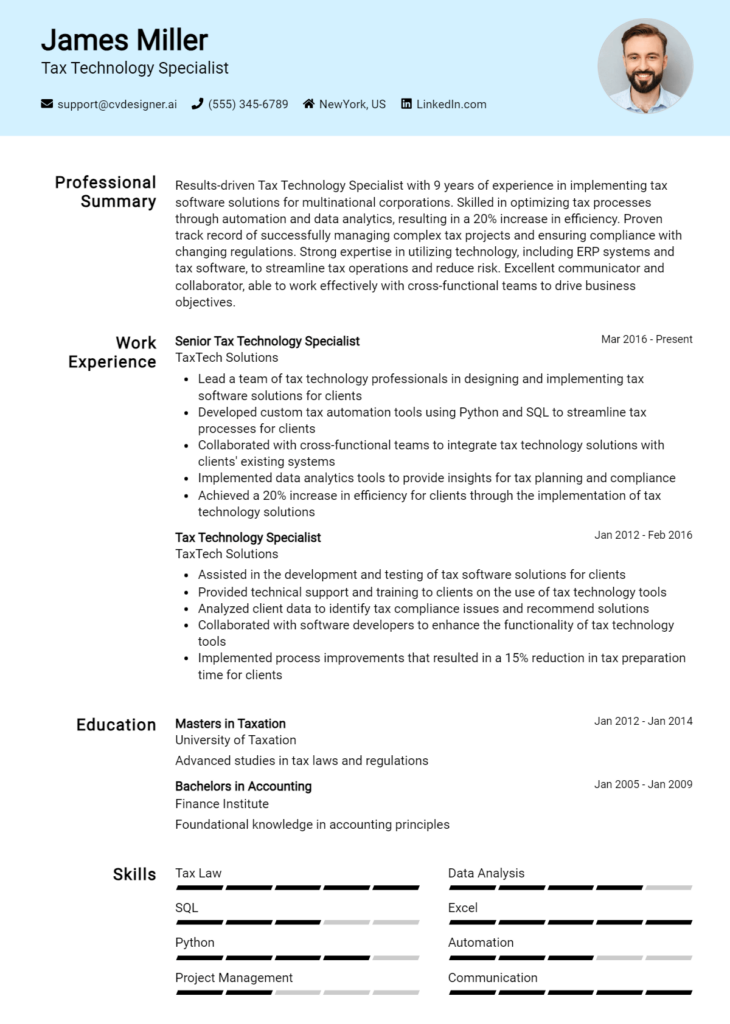

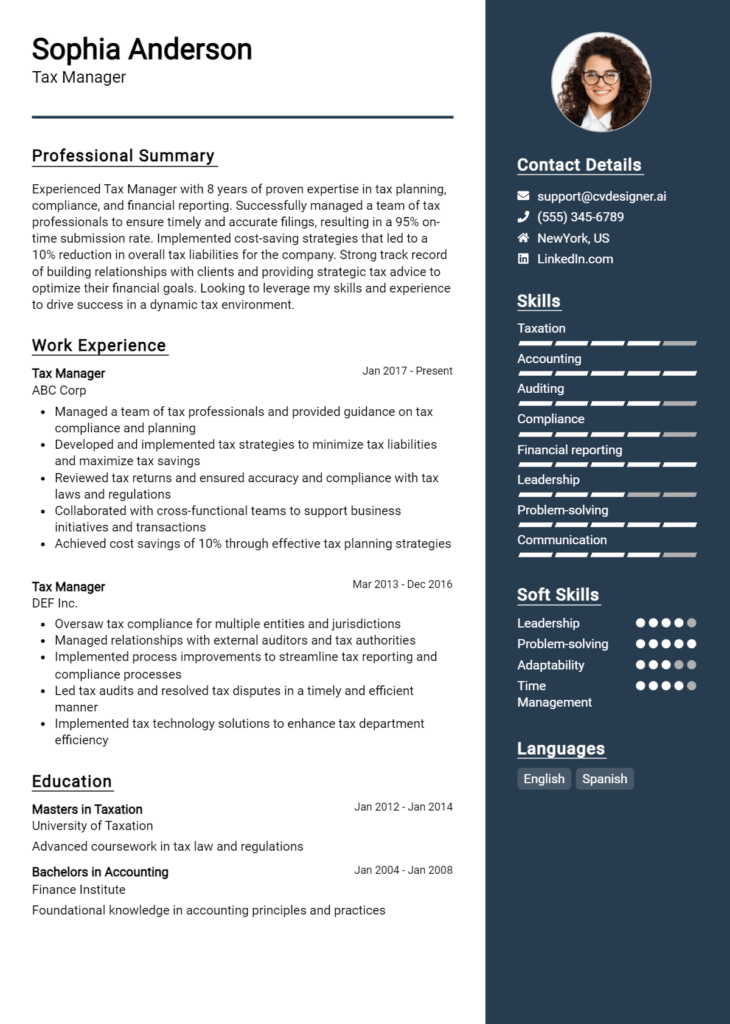

Example International Tax Manager Resume Summaries

Strong Resume Summaries

Dynamic International Tax Manager with over 8 years of experience in optimizing global tax strategies, resulting in a 25% reduction in effective tax rate for multinational clients. Expert in transfer pricing regulations and compliance, adept at navigating complex international tax laws.

Results-driven tax professional with a proven track record of leading cross-border tax compliance projects, achieving over $5 million in tax savings through strategic planning and risk management. Holds a CPA and specializes in international mergers and acquisitions.

Accomplished International Tax Manager with expertise in VAT/GST compliance and planning for over 10 countries, enhancing operational efficiency by 30%. Known for building strong relationships with regulatory bodies to facilitate seamless audits.

Weak Resume Summaries

Experienced tax professional looking for a new opportunity in international tax management. Good with numbers and regulations.

Tax manager with some experience in international tax. Seeking to apply skills in a new role.

The strong resume summaries are considered effective because they provide specific achievements, quantify results, and highlight relevant skills that directly relate to the role of an International Tax Manager. They showcase the candidate's expertise and value proposition clearly and concisely. In contrast, the weak summaries are vague, lack measurable outcomes, and do not convey a strong sense of relevance or impact, making them less compelling to hiring managers.

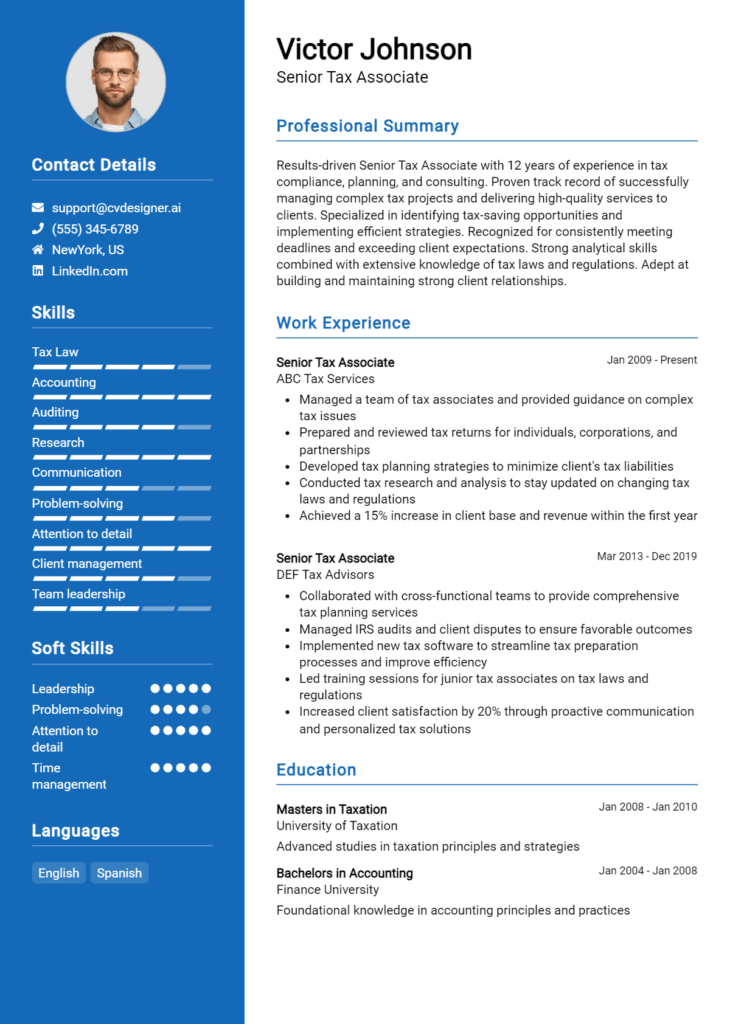

Work Experience Section for International Tax Manager Resume

The work experience section of an International Tax Manager resume is critical as it highlights the candidate's technical expertise, leadership capabilities, and their proficiency in delivering high-quality results in a complex regulatory environment. This section serves as a platform to demonstrate not only the specific tax-related skills that are essential for the role, but also the candidate's ability to manage teams effectively and contribute to the overall success of their organization. By quantifying achievements and aligning past experiences with industry standards, candidates can provide a compelling narrative of their professional journey, showcasing their value to potential employers.

Best Practices for International Tax Manager Work Experience

- Highlight specific technical skills relevant to international tax regulations and compliance.

- Quantify achievements with metrics, such as percentage reductions in tax liabilities or cost savings.

- Detail leadership roles in managing teams or projects, emphasizing collaborative efforts.

- Use industry-specific terminology to align with standards in international tax management.

- Include relevant certifications or training that enhance your qualifications.

- Showcase experience with multinational corporations or cross-border transactions.

- Emphasize problem-solving abilities and strategic decision-making in tax planning.

- Provide examples of successful tax audits or negotiations with tax authorities.

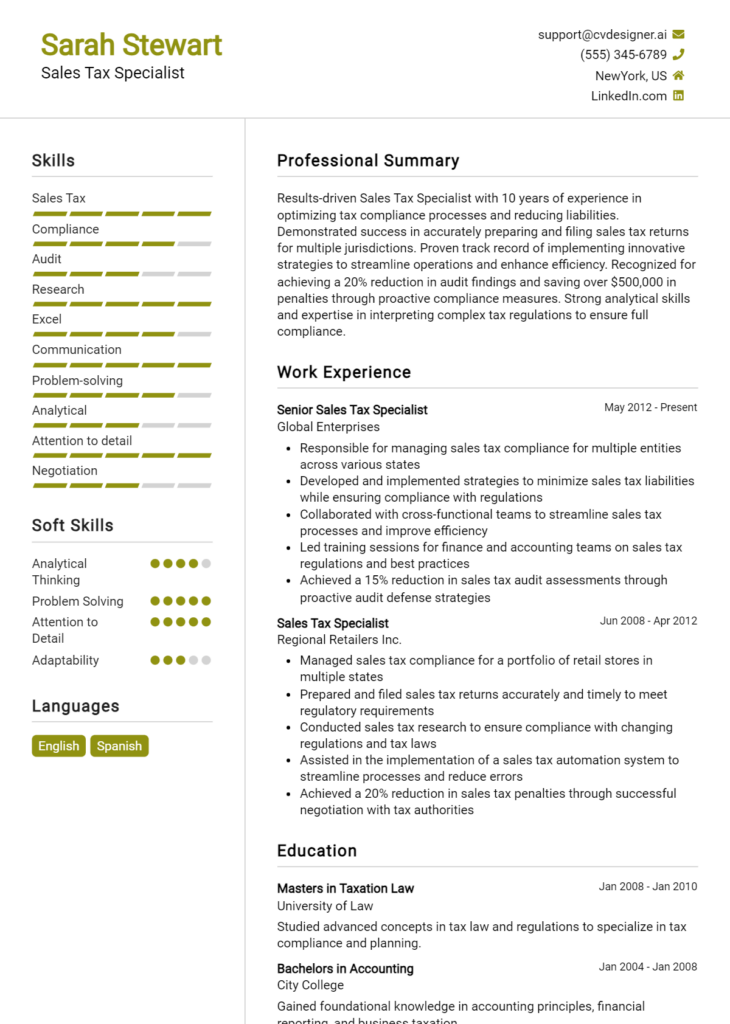

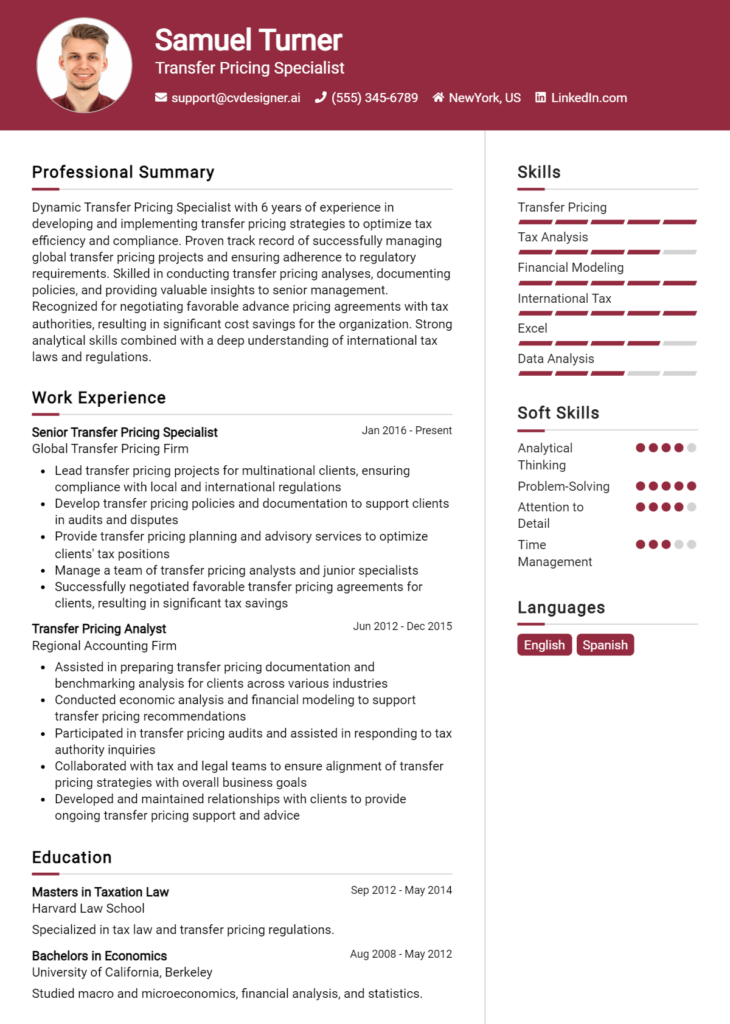

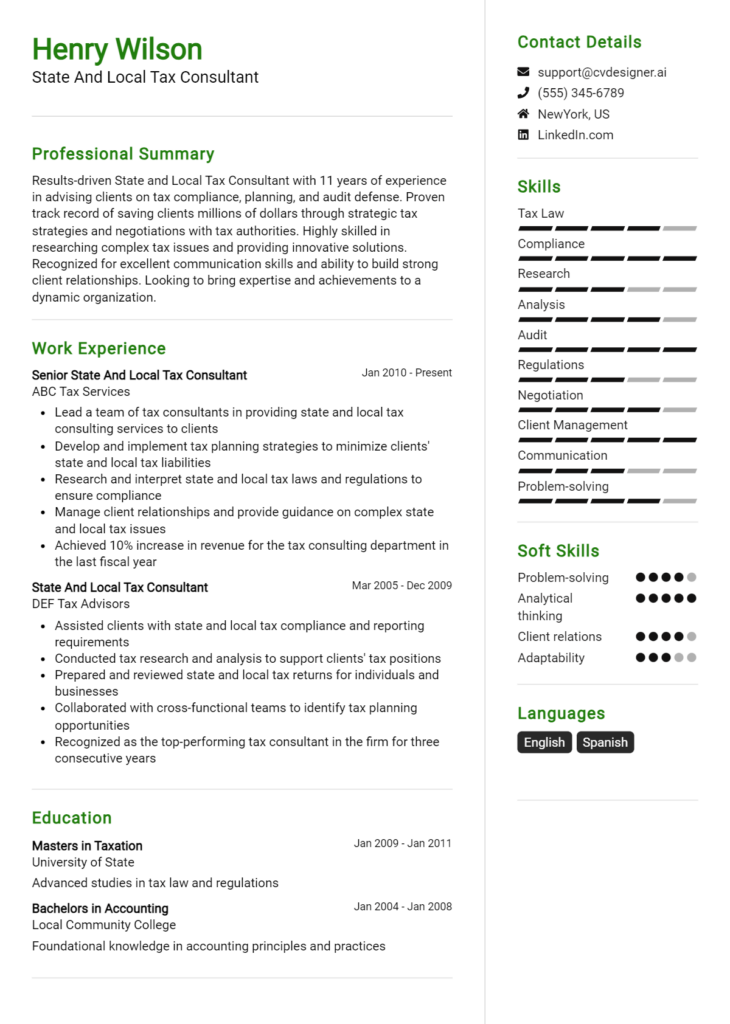

Example Work Experiences for International Tax Manager

Strong Experiences

- Led a team of 5 in executing a global tax restructuring project that resulted in a 30% reduction in effective tax rate for the organization, saving approximately $2 million annually.

- Implemented a comprehensive tax compliance strategy for a multinational corporation, achieving a 100% success rate in audits over three consecutive years.

- Collaborated with cross-functional teams to design tax-efficient supply chain solutions that enhanced operational efficiency and reduced costs by 15%.

- Developed and delivered training programs on international tax compliance to over 100 staff members, improving overall team proficiency by 25% as measured by post-training assessments.

Weak Experiences

- Worked on various tax projects without specific details on outcomes or contributions.

- Assisted in preparing tax returns for clients, but did not specify the volume or complexity of the returns.

- Participated in team meetings and discussions regarding tax issues without describing any specific achievements or responsibilities.

- Gained experience in tax compliance but failed to mention any measurable impact or improvements made during the tenure.

The examples provided illustrate the distinction between strong and weak experiences. Strong experiences are characterized by specific achievements that quantify results, showcase leadership roles, and emphasize collaborative efforts, creating a clear picture of the candidate's impact in previous roles. In contrast, weak experiences tend to lack detail, measurable outcomes, and significant contributions, making it difficult for potential employers to understand the candidate's true capabilities and value in the international tax arena.

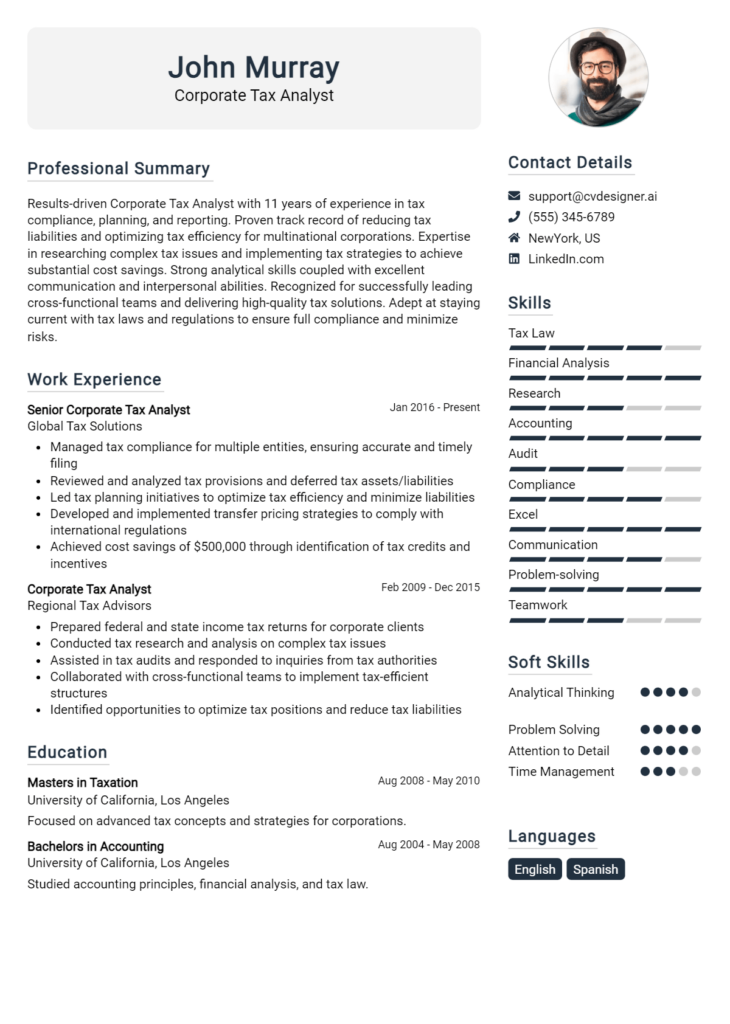

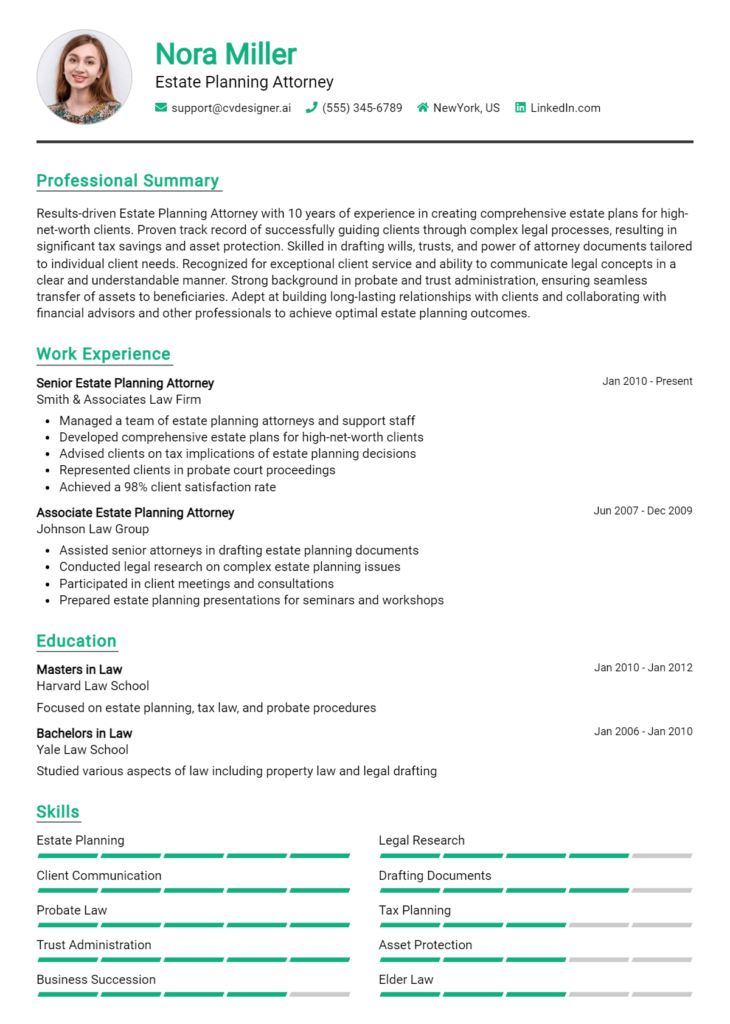

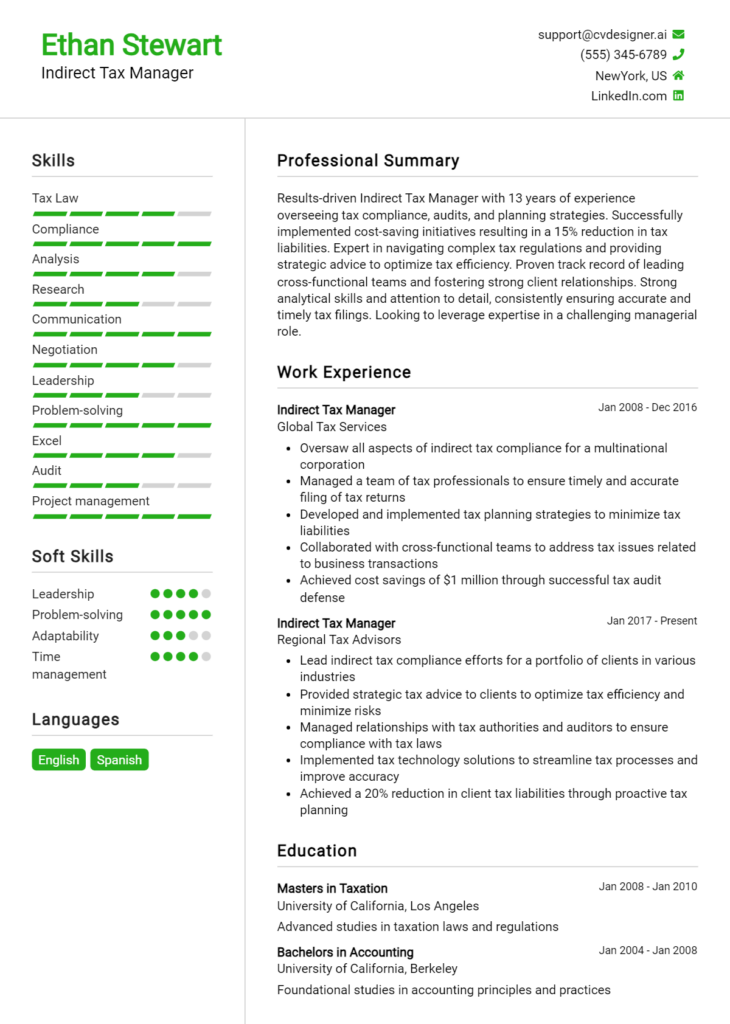

Education and Certifications Section for International Tax Manager Resume

The education and certifications section of an International Tax Manager resume plays a crucial role in establishing the candidate's qualifications and expertise in the field. This section not only highlights the academic background of the applicant, showcasing degrees from accredited institutions, but it also emphasizes industry-relevant certifications and ongoing professional development efforts. By providing details on relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role. In the competitive landscape of international tax management, a well-crafted education and certifications section can set a candidate apart from others by underscoring their commitment to excellence and continuous learning.

Best Practices for International Tax Manager Education and Certifications

- Focus on relevant degrees, such as a Master’s in Taxation or International Business.

- Include certifications from recognized organizations, such as CPA, CMA, or EA.

- List specialized training programs or workshops related to international tax law and regulations.

- Provide details on relevant coursework that aligns with international tax principles.

- Highlight any ongoing education efforts, such as participation in webinars or professional conferences.

- Be specific about the schools, dates of attendance, and any honors received.

- Use clear and concise formatting to enhance readability and impact.

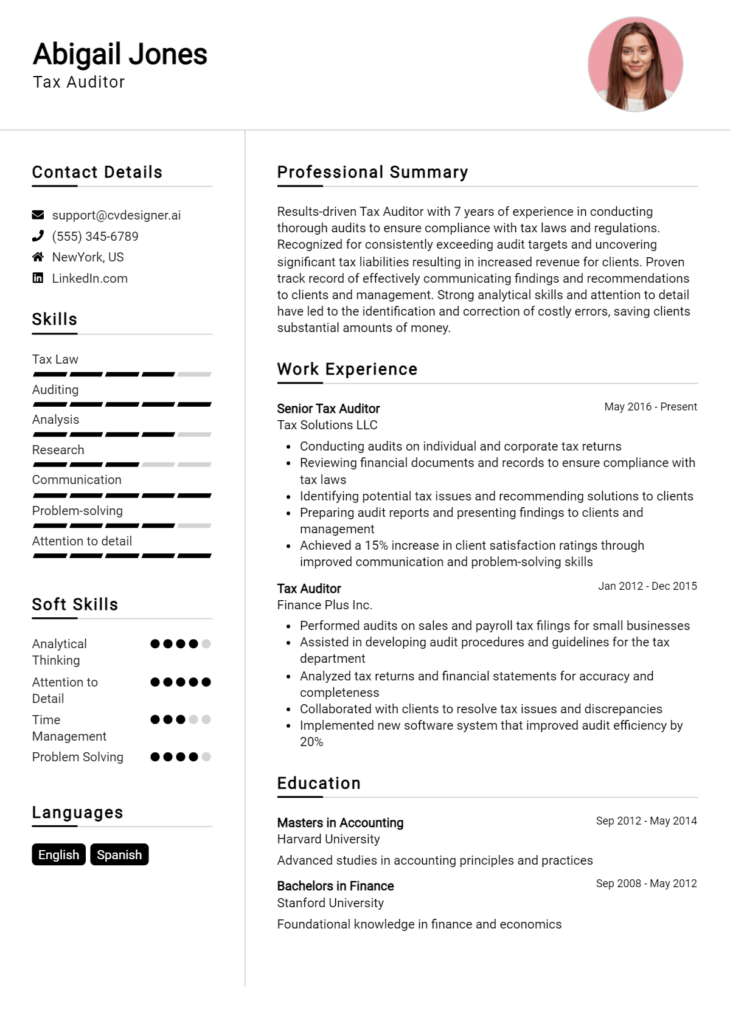

Example Education and Certifications for International Tax Manager

Strong Examples

- M.S. in Taxation, University of Southern California, 2020

- Certified Public Accountant (CPA), State of California, 2021

- International Tax Certificate, American Institute of CPAs, 2022

- Relevant Coursework: International Tax Law, Transfer Pricing Strategies, Global Tax Planning

Weak Examples

- Bachelor of Arts in History, University of Florida, 2015

- Certification in Basic Bookkeeping, 2018

- High School Diploma, Springfield High School, 2010

- Outdated Certification: Tax Preparation Certificate from 2010

The examples provided showcase strong qualifications that are directly relevant to the role of an International Tax Manager, emphasizing advanced degrees and recognized certifications that indicate a deep knowledge of the field. Conversely, the weak examples illustrate qualifications that lack relevance or currency, such as unrelated degrees or outdated certifications that do not support the candidate's expertise in international tax matters. Highlighting strong examples underscores the candidate's preparedness for the complexities of international tax management, while weak examples may raise concerns about their suitability for the position.

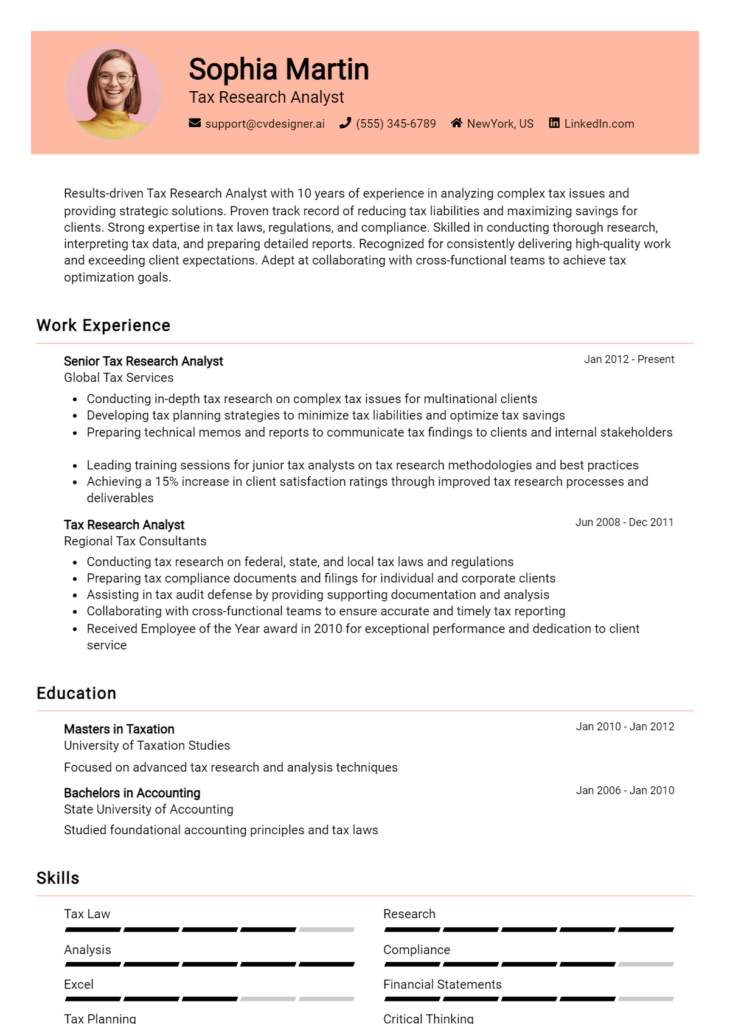

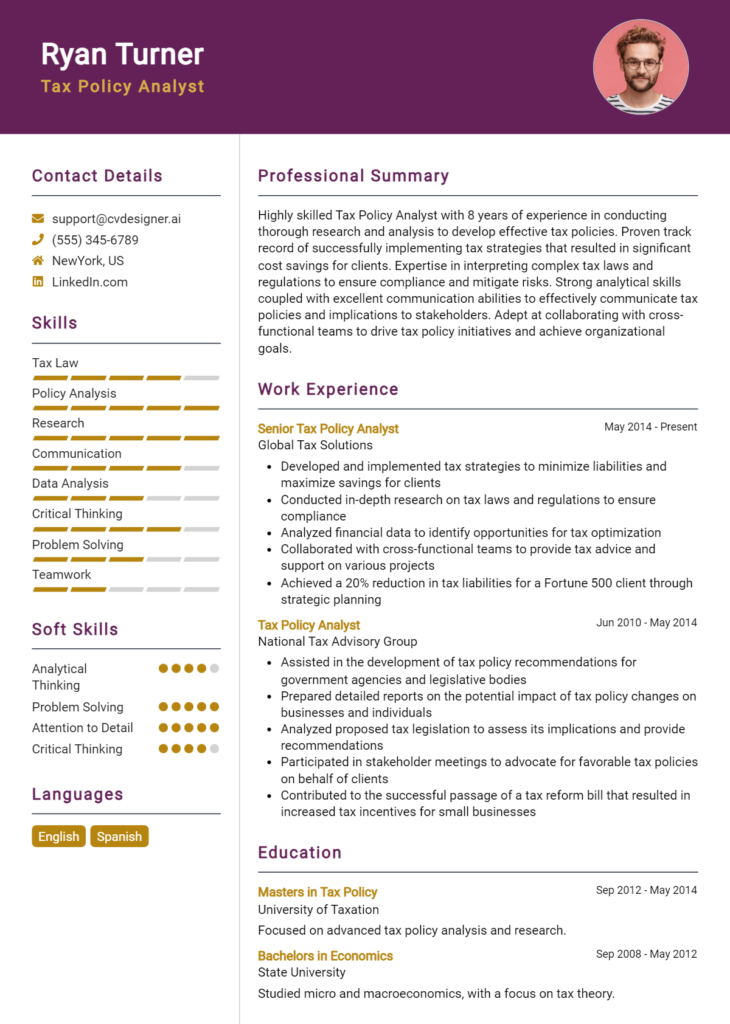

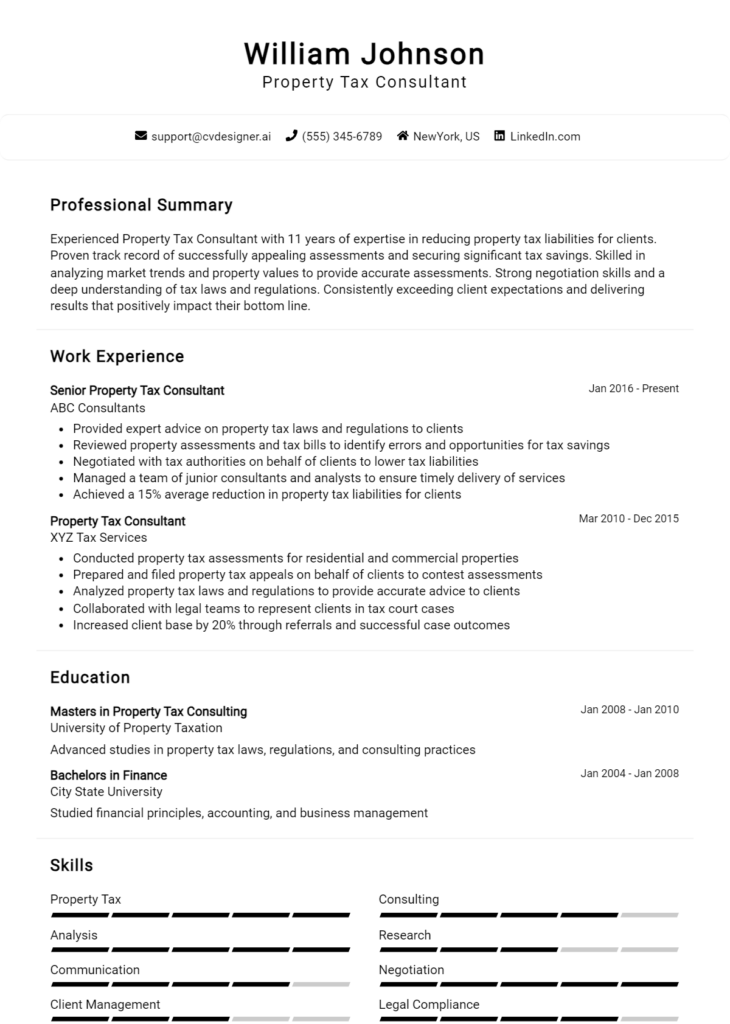

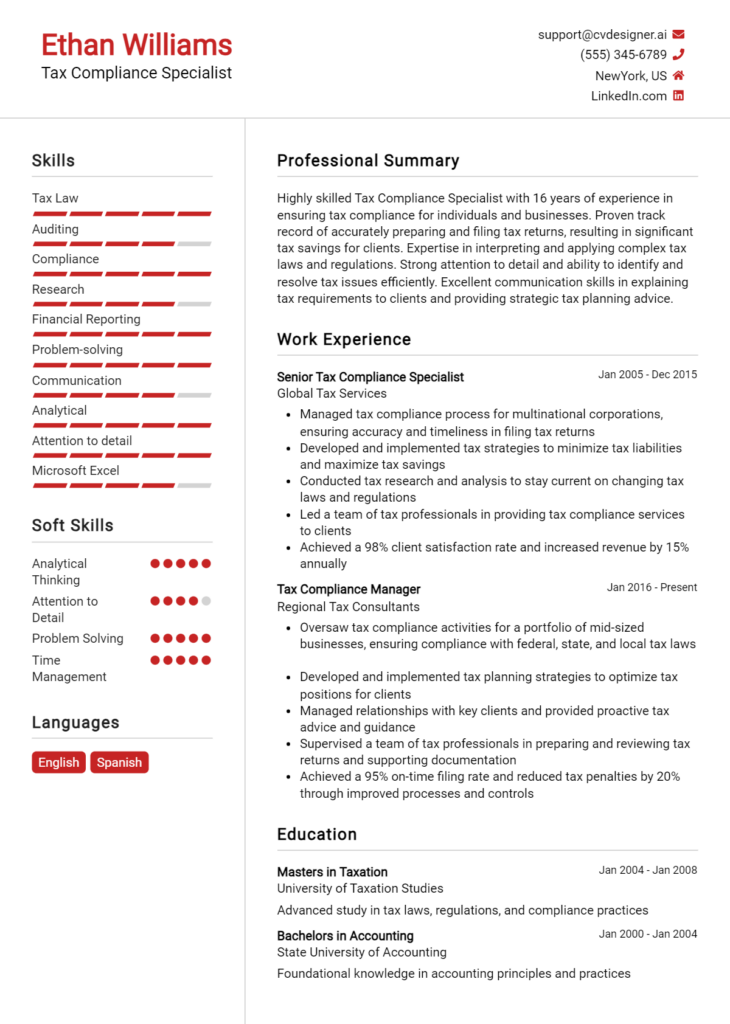

Top Skills & Keywords for International Tax Manager Resume

As an International Tax Manager, possessing the right skills is crucial for navigating the complexities of global tax regulations and compliance. A well-crafted resume should highlight both hard and soft skills that showcase a candidate's expertise and adaptability in a rapidly changing international landscape. These skills not only demonstrate an individual’s technical proficiency but also their ability to collaborate with diverse teams, communicate effectively, and think strategically. By emphasizing these key competencies, candidates can significantly enhance their chances of attracting the attention of potential employers in this competitive field.

Top Hard & Soft Skills for International Tax Manager

Soft Skills

- Strong analytical and critical thinking

- Excellent communication skills

- Problem-solving abilities

- Attention to detail

- Leadership and team management

- Adaptability and flexibility

- Negotiation skills

- Time management and organizational skills

- Ability to work under pressure

- Cultural awareness and sensitivity

Hard Skills

- In-depth knowledge of international tax laws and regulations

- Proficiency in tax compliance and reporting

- Experience with transfer pricing

- Familiarity with tax software and tools

- Financial analysis and modeling

- Understanding of double taxation treaties

- Experience in tax planning and strategy

- Knowledge of VAT/GST regulations

- Ability to conduct tax audits and reviews

- Proficient in financial statement analysis

For more insights on how to effectively showcase your skills and work experience, consider reviewing resources that can help you craft a standout resume tailored to the International Tax Manager role.

Stand Out with a Winning International Tax Manager Cover Letter

I am writing to express my interest in the International Tax Manager position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in international taxation and a strong background in compliance, planning, and strategy, I am confident in my ability to contribute effectively to your team and help navigate the complexities of cross-border tax regulations. My passion for international tax and my commitment to staying updated with global tax laws will enable me to support [Company Name] in achieving its strategic objectives.

In my previous role at [Previous Company Name], I successfully managed the international tax compliance process for multiple jurisdictions, ensuring adherence to local and international regulations. I developed and implemented tax-efficient strategies that resulted in a [specific percentage] reduction in tax liabilities while enhancing the company’s overall financial performance. My experience includes conducting thorough tax research, optimizing transfer pricing policies, and leading cross-functional teams to address tax implications of various business initiatives. I pride myself on my analytical skills and my ability to communicate complex tax concepts to stakeholders at all levels.

I am particularly drawn to [Company Name] because of its commitment to innovation and global expansion. I admire how you [mention a specific project, value, or achievement of the company], and I am eager to bring my expertise in international tax to support your growth initiatives. I am excited about the opportunity to collaborate with your talented team and contribute to the strategic decision-making that enhances your competitive edge in the global marketplace.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experience align with the needs of [Company Name]. I am eager to contribute to your success as an International Tax Manager and help navigate the evolving landscape of global taxation.

Common Mistakes to Avoid in a International Tax Manager Resume

When crafting a resume for the role of an International Tax Manager, it’s crucial to present your qualifications and experiences in a way that highlights your expertise in global taxation while avoiding common pitfalls. Many candidates inadvertently undermine their chances by making mistakes that can easily be avoided. Here are some common mistakes to steer clear of when preparing your resume:

Vague Job Descriptions: Providing generic descriptions of past roles can lead to ambiguity. Clearly articulate your responsibilities and achievements to demonstrate your impact in previous positions.

Ignoring Relevant Keywords: Failing to incorporate keywords from the job description may result in your resume being overlooked by applicant tracking systems. Tailor your resume to include key terms relevant to international tax.

Lack of Quantifiable Achievements: Resumes that are heavy on duties but light on accomplishments can lack impact. Use metrics and specific examples to showcase how your work led to cost savings or efficiency improvements.

Overly Complex Language: Using jargon or overly technical language can confuse hiring managers. Strive for clarity and straightforwardness in your writing to ensure your accomplishments are easily understood.

Neglecting Soft Skills: While technical expertise is vital, soft skills like communication and teamwork are equally important. Highlight your ability to collaborate with cross-functional teams and communicate complex tax concepts.

Inconsistent Formatting: A cluttered or inconsistent format can detract from the professionalism of your resume. Use a clean, organized layout with uniform fonts and bullet points for clarity.

Failure to Customize for Each Application: Sending out a generic resume can be detrimental. Tailor each resume to the specific job, emphasizing the most relevant experiences and skills that align with the employer's needs.

Excessive Length: International Tax Managers typically have extensive experience, but a resume that's too long can be off-putting. Aim for a concise, focused document that highlights only the most relevant and impactful information.

Conclusion

As we explored the role of an International Tax Manager, several key points emerged that are essential for anyone considering or currently in this career path. Firstly, the position demands a deep understanding of global tax regulations and compliance requirements, as well as the ability to navigate complex international tax laws. Strong analytical skills and attention to detail are critical, as is the capability to communicate effectively with both internal teams and external stakeholders. Additionally, staying updated on changes in tax legislation across different jurisdictions is paramount for success in this role.

Given the competitive nature of the job market, it's crucial to present a standout resume that highlights your expertise and accomplishments in international taxation. Take a moment to reflect on your current resume and consider how well it represents your skills and experiences.

To aid you in this endeavor, we encourage you to explore a variety of resources available to enhance your resume. Check out resume templates to find a design that suits your style, utilize the resume builder for a streamlined creation process, and review resume examples to gather inspiration from successful candidates in your field. Additionally, don't overlook the importance of a compelling introduction; our cover letter templates can help you craft a persuasive cover letter that complements your resume.

Take action now to refine your resume and position yourself as a strong candidate for the International Tax Manager role!