Senior Tax Associate Core Responsibilities

A Senior Tax Associate plays a pivotal role in ensuring compliance with tax regulations while collaborating with finance, legal, and operational teams. Key responsibilities include preparing tax returns, conducting research on tax issues, and identifying opportunities for tax savings. Strong analytical, technical, and problem-solving skills are essential to navigate complex tax laws and develop effective strategies. These competencies not only support individual departments but also align with the organization's financial objectives. A well-structured resume can effectively highlight these qualifications, showcasing the candidate's ability to contribute to the overall success of the organization.

Common Responsibilities Listed on Senior Tax Associate Resume

- Prepare and review federal and state tax returns for accuracy and compliance.

- Conduct in-depth research on tax regulations and implications for clients.

- Identify tax-saving opportunities and provide strategic recommendations.

- Collaborate with cross-functional teams to address tax-related issues.

- Assist in the preparation of tax provisions and financial statement disclosures.

- Manage and respond to tax audits and inquiries from tax authorities.

- Develop and maintain strong relationships with clients and stakeholders.

- Stay updated on changes in tax laws and regulations.

- Mentor and train junior tax associates and interns.

- Prepare detailed reports and presentations on tax strategies.

- Support corporate restructuring and other strategic initiatives from a tax perspective.

- Maintain accurate records and documentation for all tax-related activities.

High-Level Resume Tips for Senior Tax Associate Professionals

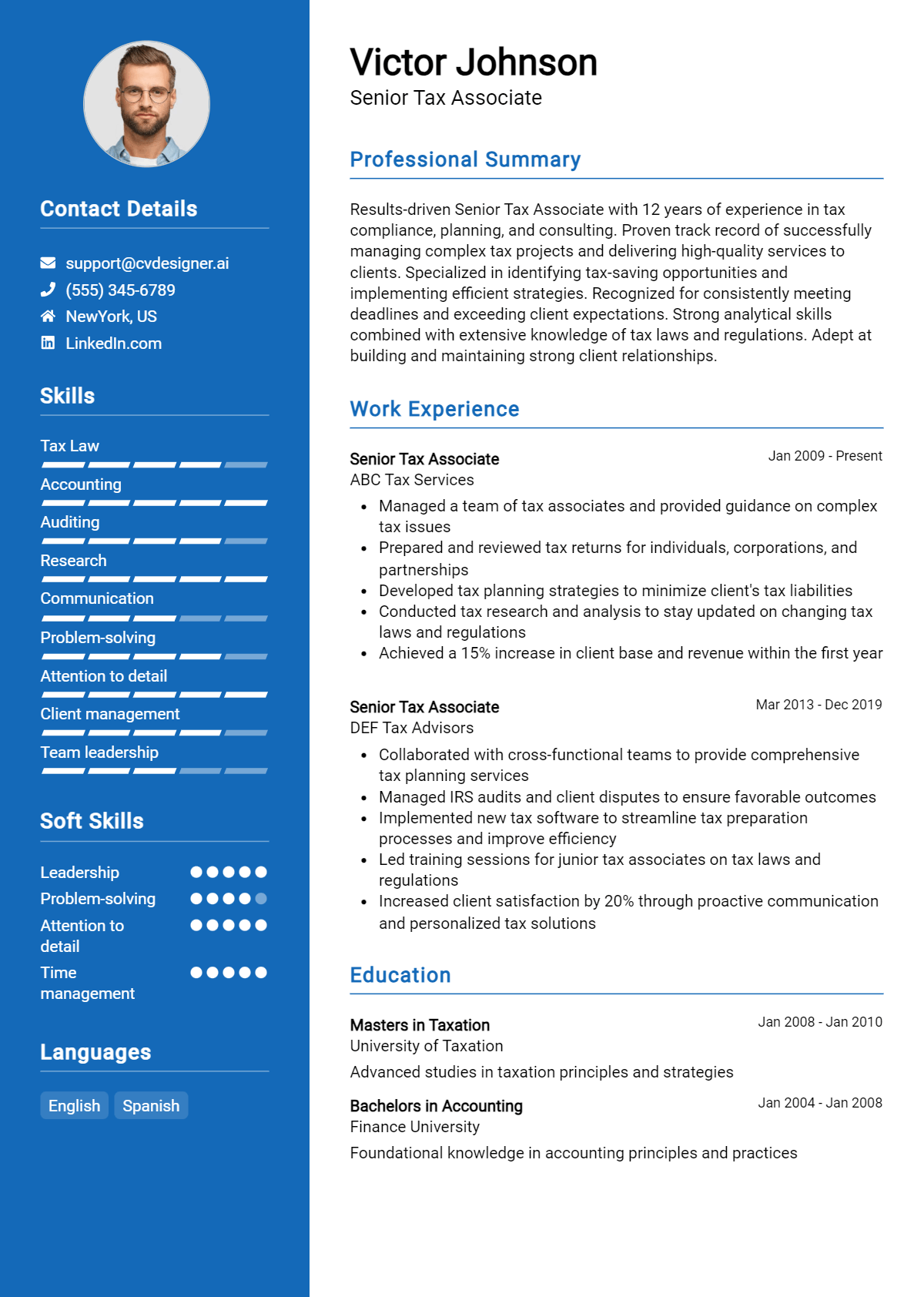

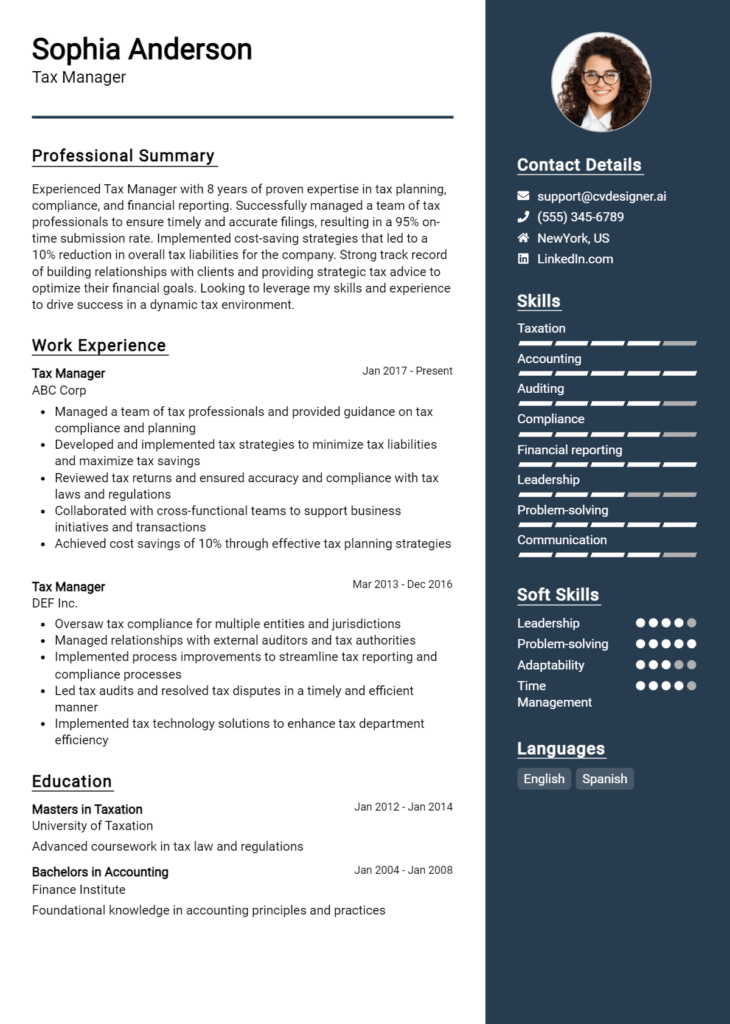

In today’s competitive job market, a well-crafted resume is crucial for Senior Tax Associate professionals seeking to make a lasting impression. As the first point of contact with potential employers, your resume must effectively showcase your skills, experience, and achievements in the field of taxation. It should not only reflect your technical abilities but also communicate your understanding of complex tax regulations and your capacity to add value to an organization. This guide will provide practical and actionable resume tips specifically tailored for Senior Tax Associate professionals, enabling you to stand out in a crowded applicant pool.

Top Resume Tips for Senior Tax Associate Professionals

- Tailor your resume to the specific job description by incorporating keywords and phrases that align with the requirements of the position.

- Highlight relevant experience in taxation, including previous roles, responsibilities, and projects that demonstrate your expertise.

- Quantify your achievements by using metrics to illustrate the impact of your work, such as tax savings achieved or compliance improvements.

- Showcase industry-specific skills such as knowledge of tax software, familiarity with IRS regulations, and experience with various tax strategies.

- Include certifications such as CPA, EA, or other relevant designations to enhance your credibility and expertise in the field.

- Utilize a clean and professional format that enhances readability and emphasizes key sections of your resume.

- Incorporate a summary statement at the top that succinctly outlines your experience, skills, and career objectives.

- Highlight your ability to work collaboratively with cross-functional teams, particularly in areas such as finance and accounting.

- Demonstrate your commitment to continuous professional development by listing relevant training, workshops, or courses you have completed.

Implementing these tips can significantly increase your chances of landing a job in the Senior Tax Associate field. A tailored, achievement-focused resume not only showcases your qualifications but also demonstrates your proactive approach and attention to detail—qualities that are highly valued in the taxation profession. By presenting your skills and experiences effectively, you position yourself as a strong candidate ready to contribute to an organization’s success.

Why Resume Headlines & Titles are Important for Senior Tax Associate

In the competitive field of tax accounting, a Senior Tax Associate plays a crucial role in ensuring compliance with tax laws, optimizing tax strategies, and providing expert guidance to clients. In this context, resume headlines and titles become vital tools for candidates aiming to stand out. A well-crafted headline can immediately capture the attention of hiring managers, summarizing a candidate's key qualifications and strengths in a single, impactful phrase. It should be concise, relevant, and tailored specifically to the job being applied for, effectively setting the tone for the rest of the resume.

Best Practices for Crafting Resume Headlines for Senior Tax Associate

- Keep it concise—aim for one impactful phrase.

- Make it role-specific—include the title of the position you are applying for.

- Highlight key qualifications—focus on your most relevant skills or achievements.

- Use action words—begin with strong verbs to convey confidence.

- Avoid jargon—ensure that the language is clear and easily understood.

- Tailor for each application—customize the headline to align with the job description.

- Include quantifiable achievements—if possible, incorporate numbers that reflect your success.

- Maintain a professional tone—ensure the language is appropriate for the industry.

Example Resume Headlines for Senior Tax Associate

Strong Resume Headlines

"Results-Driven Senior Tax Associate with Over 10 Years of Experience in Corporate Tax Planning"

“Expert in Tax Compliance and Strategy, Specializing in Multinational Corporations”

“Dedicated Senior Tax Professional with Proven Track Record of Reducing Tax Liabilities by 30%”

Weak Resume Headlines

“Tax Associate Looking for Opportunities”

“Experienced Professional in Tax”

The strong headlines are effective because they immediately convey specific strengths and achievements that are relevant to the role of a Senior Tax Associate, making them memorable and compelling. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail; they do not provide any meaningful information about the candidate's qualifications or what they can bring to the position. This contrast highlights the importance of crafting a headline that not only grabs attention but also clearly communicates value to potential employers.

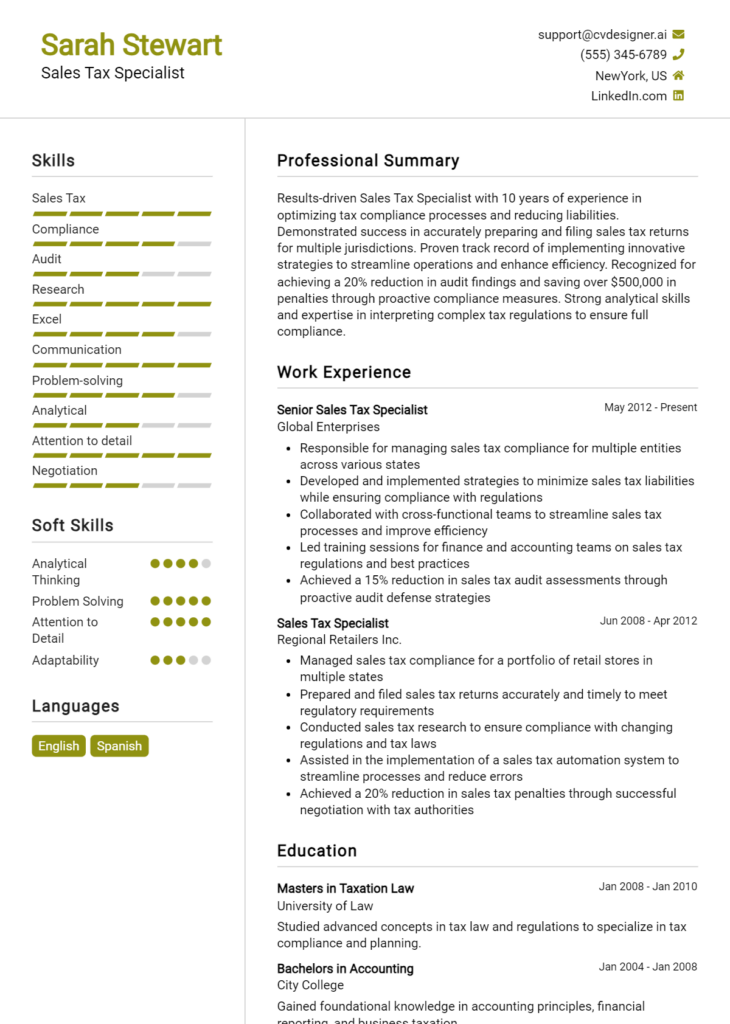

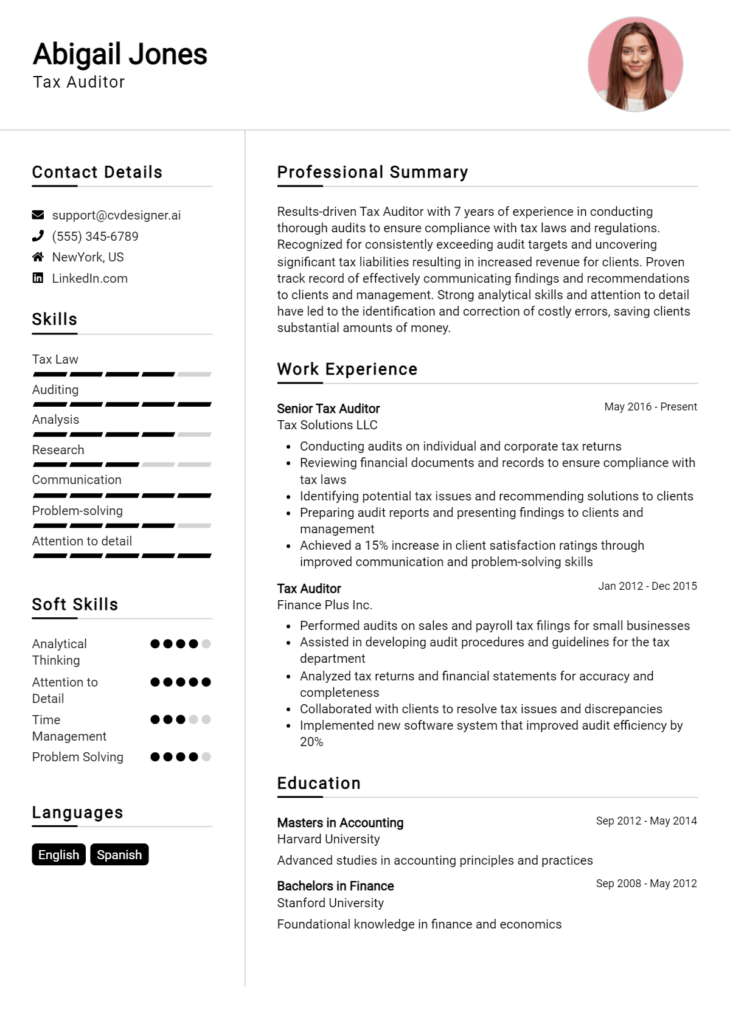

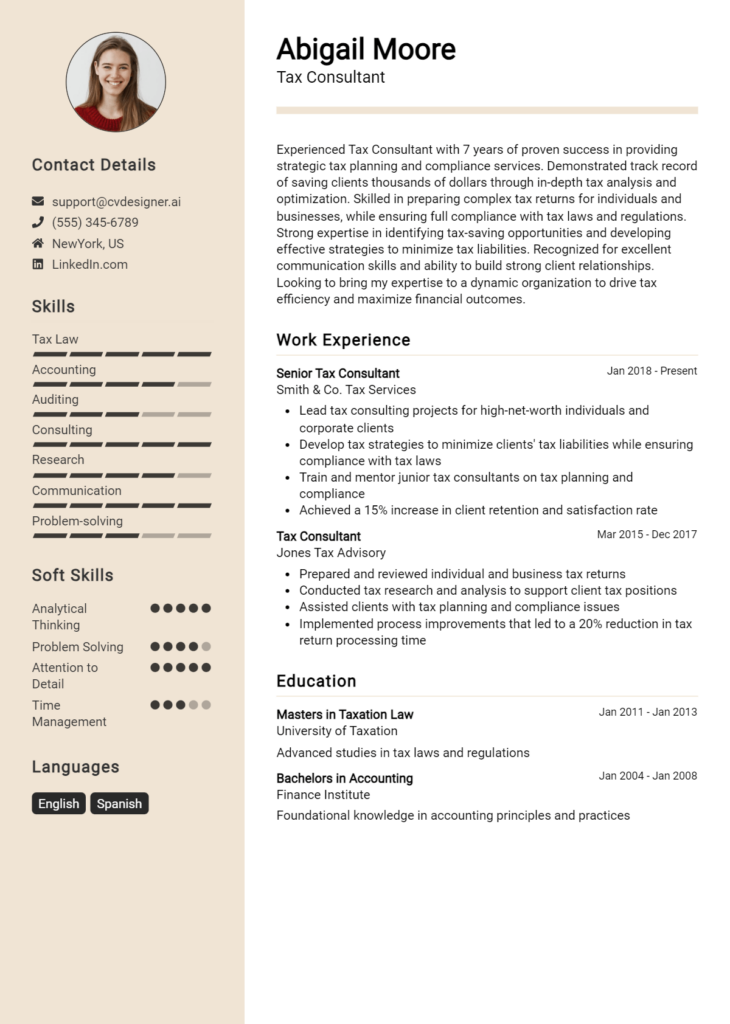

Writing an Exceptional Senior Tax Associate Resume Summary

A resume summary is a critical component for a Senior Tax Associate as it serves as the first impression a hiring manager receives. This brief paragraph quickly captures attention by highlighting key skills, relevant experience, and notable accomplishments that align with the job role. An exceptional summary is concise and impactful, tailored specifically to the job description, allowing candidates to stand out in a competitive field. It succinctly communicates what the candidate brings to the table, setting the tone for the rest of the resume and encouraging the hiring manager to read further.

Best Practices for Writing a Senior Tax Associate Resume Summary

- Quantify achievements: Use numbers to demonstrate your impact, such as savings generated or audits completed.

- Focus on relevant skills: Highlight skills that are specifically mentioned in the job description.

- Tailor the summary: Customize your summary for each application to reflect the requirements of the position.

- Keep it concise: Aim for 3-4 sentences that convey your message clearly and effectively.

- Use action verbs: Start sentences with strong verbs to convey confidence and proactivity.

- Highlight certifications: Mention relevant certifications, such as CPA or MST, to validate your expertise.

- Emphasize industry knowledge: Showcase familiarity with tax regulations, laws, and compliance requirements.

- Showcase teamwork: If applicable, mention experience in collaborating with cross-functional teams to underline your collaborative skills.

Example Senior Tax Associate Resume Summaries

Strong Resume Summaries

Dynamic Senior Tax Associate with over 8 years of experience in corporate tax compliance and planning. Successfully managed over 50 tax returns annually, resulting in a 15% reduction in audit risks through meticulous documentation and strategic tax planning.

Detail-oriented tax professional with a proven track record of identifying tax-saving opportunities, leading to $1 million in reduced liabilities for clients over the last fiscal year. Expert in federal and state tax regulations with extensive experience in conducting complex tax research.

Results-driven Senior Tax Associate with 10+ years of experience in advising multinational corporations on tax strategies. Developed and implemented tax compliance processes that improved efficiency by 30%, ensuring all filings were completed ahead of deadlines.

Weak Resume Summaries

Experienced tax professional looking for a new opportunity in tax. I have worked in various tax roles and have some experience with tax returns.

Senior Tax Associate with knowledge of tax matters. I am seeking a challenging position and hope to contribute to the team.

The strong resume summaries are considered effective because they provide specific, quantifiable results and directly relate to the skills and experiences relevant to the Senior Tax Associate role. They showcase the candidate's achievements and expertise in a way that is compelling and tailored to the job description. Conversely, the weak summaries lack detail and specificity, making them vague and less engaging, which may fail to capture the interest of hiring managers.

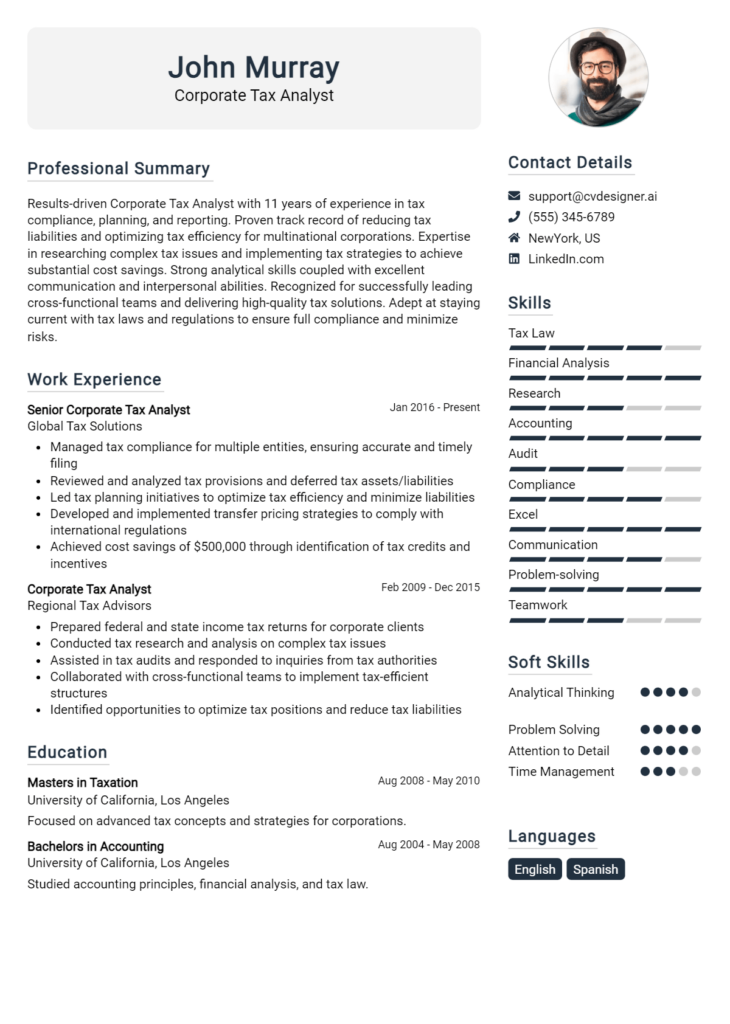

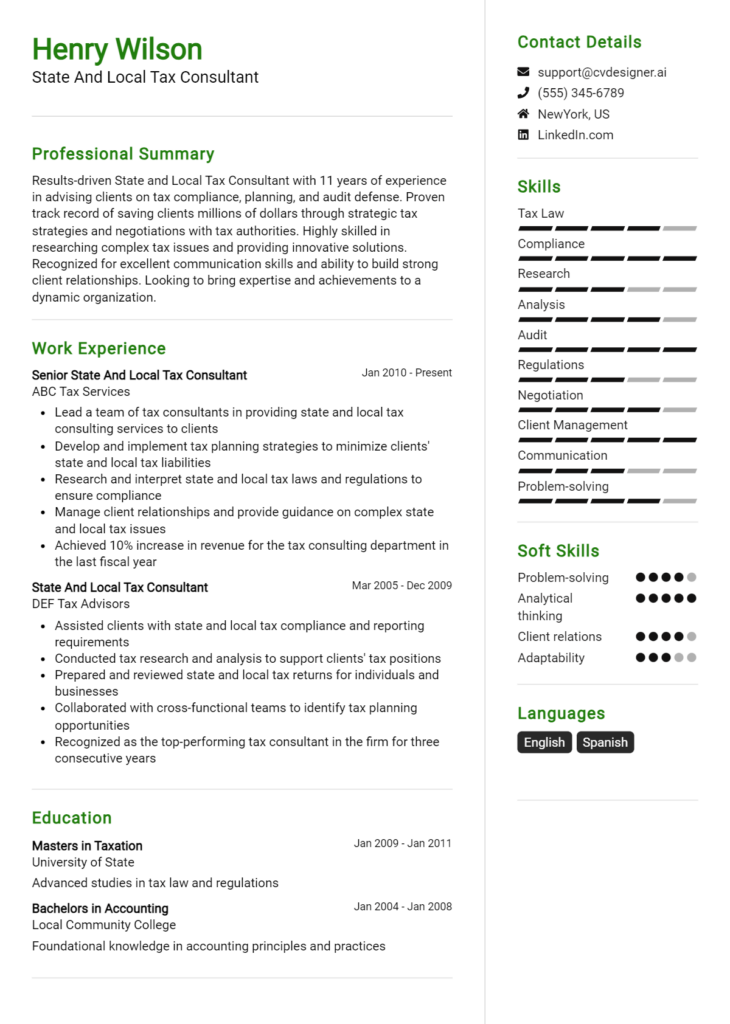

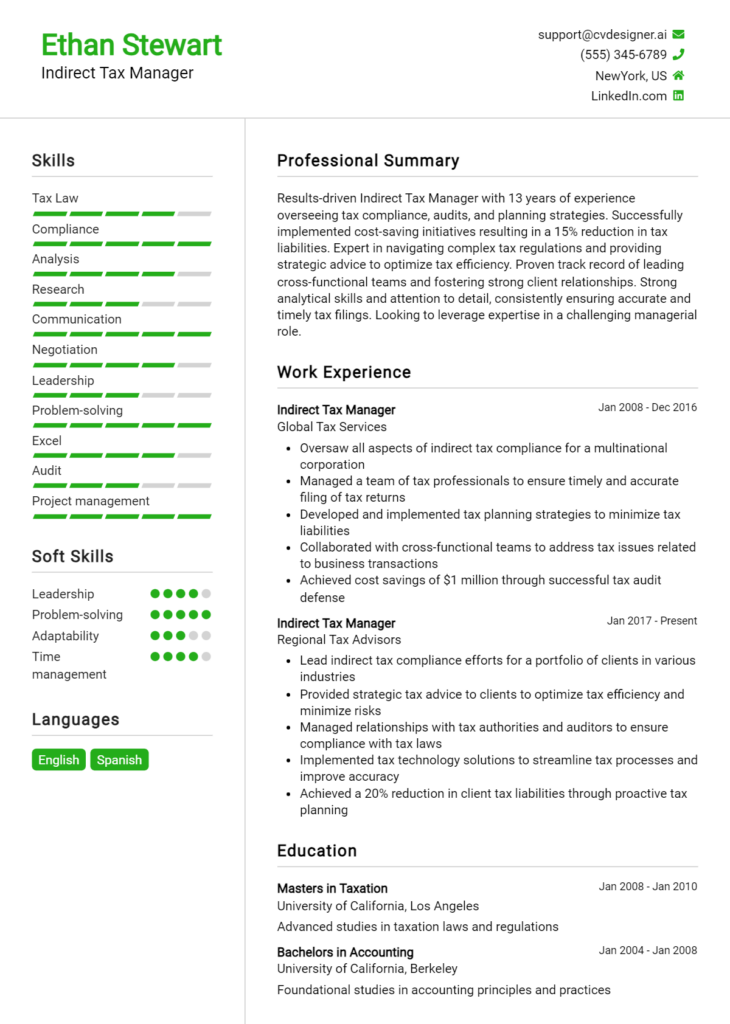

Work Experience Section for Senior Tax Associate Resume

The work experience section of a Senior Tax Associate resume is critical as it serves as a platform to illustrate the candidate's technical skills, leadership capabilities, and commitment to delivering high-quality tax solutions. This section not only highlights the candidate's relevant past roles but also provides tangible evidence of their ability to manage teams effectively and contribute to the overall success of their organizations. By quantifying achievements and aligning experiences with industry standards, candidates can demonstrate their value and expertise in the competitive field of taxation.

Best Practices for Senior Tax Associate Work Experience

- Focus on quantifiable results, such as tax savings achieved or audit success rates.

- Highlight specific technical skills relevant to tax compliance, planning, and reporting.

- Emphasize leadership roles in team projects or initiatives.

- Use action verbs to convey a sense of proactivity and responsibility.

- Align experiences with industry standards, showcasing familiarity with regulatory changes.

- Include relevant certifications and training that bolster technical expertise.

- Demonstrate collaboration with cross-functional teams, illustrating teamwork and communication skills.

- Tailor the work experience section to focus on the most relevant positions and achievements for the role applied for.

Example Work Experiences for Senior Tax Associate

Strong Experiences

- Led a team of 5 in the successful execution of a multi-state tax compliance project, resulting in a 15% reduction in overall tax liabilities for clients.

- Implemented a new tax software solution that improved efficiency by 30%, allowing the team to focus on higher-value advisory services.

- Collaborated with legal teams to structure complex transactions, ensuring compliance with IRS regulations and minimizing risks, which resulted in zero audit adjustments.

- Developed and delivered training programs for junior associates, enhancing their understanding of tax regulations and improving team performance by 20% year-over-year.

Weak Experiences

- Assisted with tax preparations and filings.

- Helped the team during tax season.

- Worked on various tax-related tasks.

- Participated in meetings regarding tax issues.

The examples provided highlight the difference between strong and weak experiences based on the level of detail and quantifiable results. Strong experiences clearly showcase specific achievements, technical leadership, and effective collaboration, presenting a compelling narrative of the candidate's contributions. In contrast, weak experiences lack specificity and measurable outcomes, failing to demonstrate the candidate's value or expertise in the field of taxation.

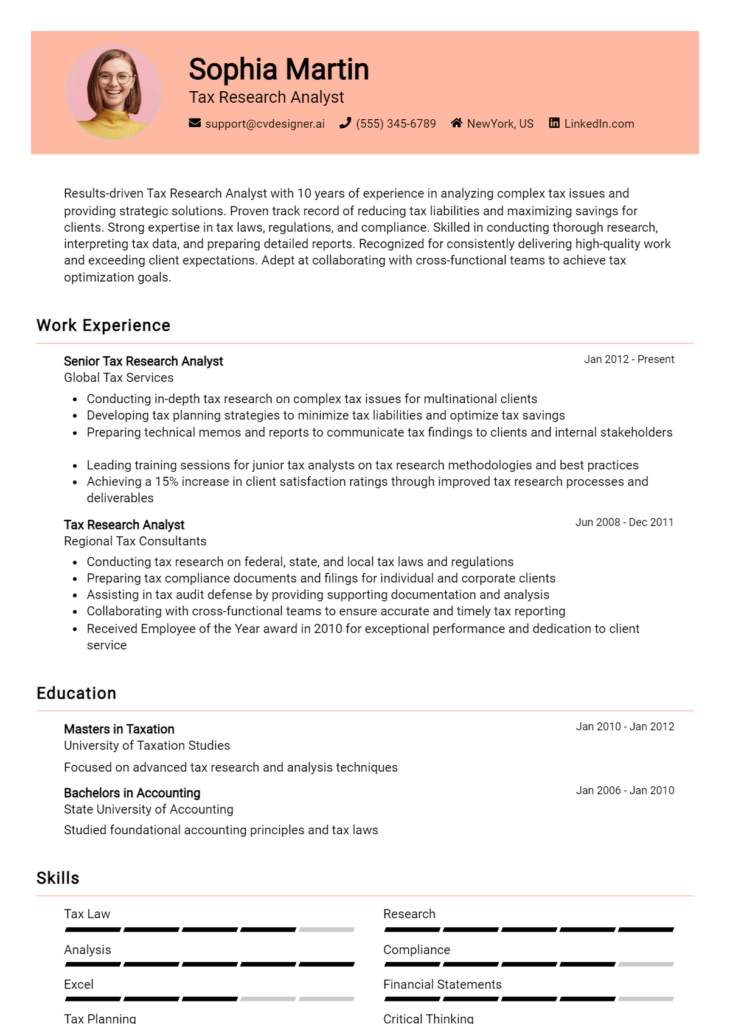

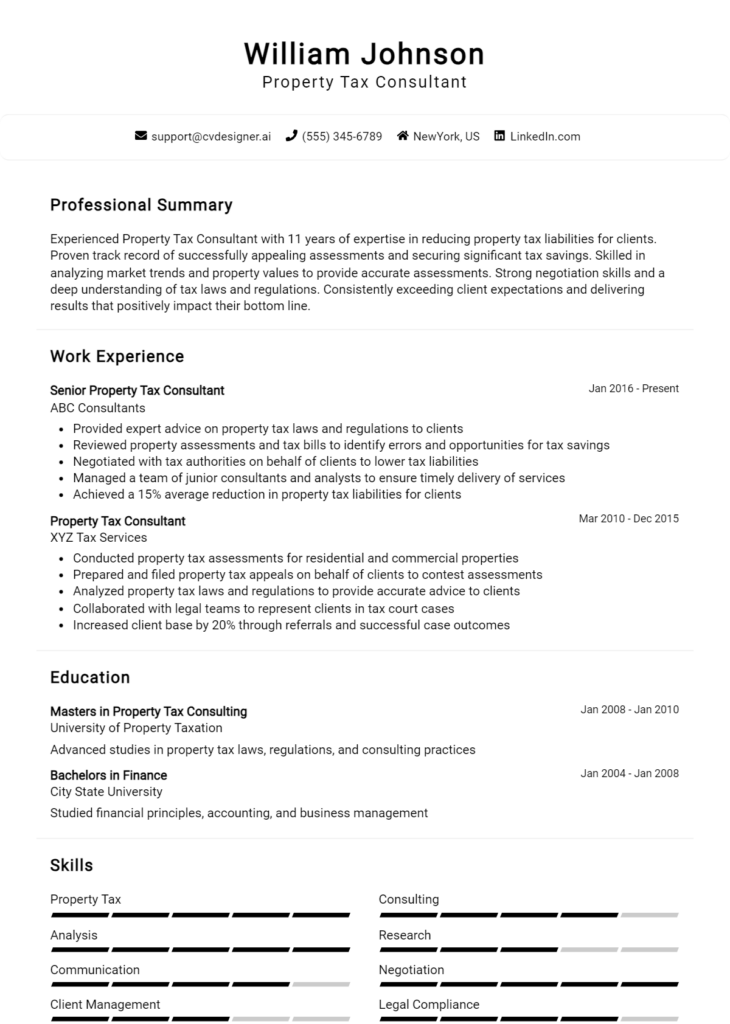

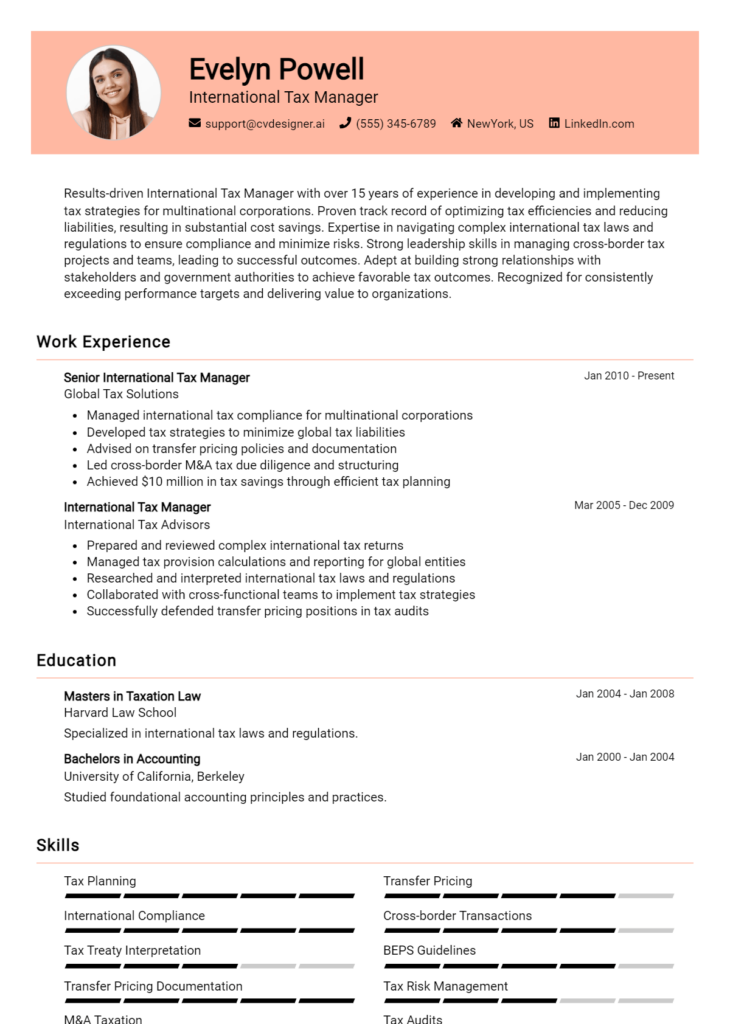

Education and Certifications Section for Senior Tax Associate Resume

The education and certifications section of a Senior Tax Associate resume is crucial as it showcases the candidate's academic background and professional qualifications, which are essential in a field that demands a strong understanding of tax laws and regulations. This section not only highlights relevant degrees and industry-recognized certifications but also emphasizes the candidate's commitment to continuous learning and professional development. By providing detailed information about relevant coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the Senior Tax Associate role.

Best Practices for Senior Tax Associate Education and Certifications

- Include only relevant degrees and certifications that pertain to tax law, accounting, or finance.

- List your highest degree first, followed by any additional degrees or certifications in reverse chronological order.

- Highlight industry-recognized certifications such as CPA, EA, or CMA to enhance credibility.

- Include any continuing education courses or specialized training that demonstrate ongoing professional development.

- Provide specific coursework that directly relates to tax regulations, compliance, or financial analysis.

- Ensure all entries are up-to-date and reflect any recent achievements or advancements in your qualifications.

- Use clear headings and formatting to make this section easily readable and visually appealing.

- Avoid including outdated or irrelevant certifications that do not add value to your application.

Example Education and Certifications for Senior Tax Associate

Strong Examples

- MBA in Accounting, University of XYZ, 2020

- Certified Public Accountant (CPA), State Board of Accountancy, 2019

- Enrolled Agent (EA), Internal Revenue Service, 2021

- Advanced Taxation Coursework, ABC Tax Institute, 2022

Weak Examples

- Bachelor of Arts in History, University of ABC, 2015

- Certification in Basic Computer Skills, 2018

- Outdated Certified Management Accountant (CMA), 2016

- High School Diploma, XYZ High School, 2010

The strong examples provided are considered relevant and valuable as they directly relate to the qualifications and competencies required for a Senior Tax Associate position. They showcase advanced education and up-to-date certifications, reflecting the candidate's expertise in tax matters. Conversely, the weak examples are deemed irrelevant or outdated, such as degrees in unrelated fields or certifications that do not align with current industry standards, thus failing to effectively support the candidate's application for a tax-focused role.

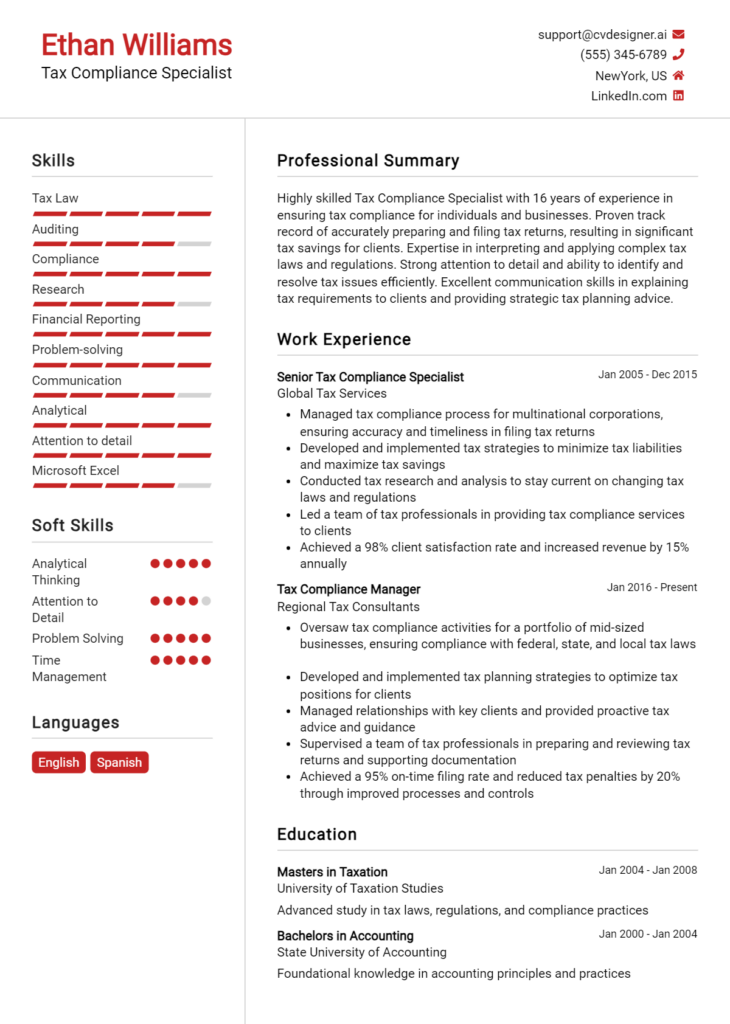

Top Skills & Keywords for Senior Tax Associate Resume

As a Senior Tax Associate, possessing a well-rounded skill set is vital for success in the competitive tax landscape. The complexity of tax regulations and the need for precise financial analysis underscore the importance of highlighting both hard and soft skills on your resume. A strong emphasis on these skills not only demonstrates your expertise but also showcases your ability to adapt to changing tax laws and work effectively within a team. Crafting a resume that features these essential skills can significantly enhance your chances of standing out to employers in the field.

Top Hard & Soft Skills for Senior Tax Associate

Soft Skills

- Attention to Detail

- Analytical Thinking

- Communication Skills

- Problem-Solving Abilities

- Time Management

- Adaptability

- Client Relationship Management

- Team Collaboration

- Ethical Judgment

- Leadership Skills

Hard Skills

- Tax Compliance Knowledge

- Proficiency in Tax Software (e.g., Intuit ProConnect, Thomson Reuters)

- Financial Statement Analysis

- Knowledge of Federal and State Tax Laws

- Tax Return Preparation

- Data Analysis

- Risk Assessment

- Research and Documentation Skills

- Familiarity with International Tax Regulations

- Financial Reporting

Incorporating a diverse range of skills and relevant work experience into your resume can effectively demonstrate your qualifications and readiness for the Senior Tax Associate role.

Stand Out with a Winning Senior Tax Associate Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Senior Tax Associate position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in tax preparation, planning, and compliance, I am confident in my ability to contribute to your team and provide exceptional service to your clients. My proficiency in navigating complex tax regulations, combined with my strong analytical skills and attention to detail, makes me an ideal candidate for this role.

In my previous role at [Previous Company Name], I successfully managed a diverse portfolio of clients, ensuring their tax filings were accurate and submitted timely. I implemented streamlined processes that improved efficiency by [specific percentage or outcome], allowing our team to focus on strategic tax planning and advisory services. My ability to build strong relationships with clients has led to increased satisfaction and retention, which I believe aligns well with [Company Name]'s commitment to delivering outstanding service.

Moreover, I am well-versed in utilizing various tax software and tools, which enhances my ability to analyze data and provide actionable insights. I continuously stay updated on the latest tax laws and regulations, ensuring that I can provide informed guidance to clients and help them navigate the complexities of their tax obligations. I am excited about the opportunity to bring my expertise to [Company Name] and contribute to the continued success of your tax practice.

Thank you for considering my application. I look forward to the possibility of discussing how my background, skills, and enthusiasms align with the goals of [Company Name]. I am eager to bring my dedication to excellence and passion for tax compliance to your esteemed firm.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Common Mistakes to Avoid in a Senior Tax Associate Resume

When crafting a resume for a Senior Tax Associate position, it's essential to avoid common pitfalls that can detract from your qualifications and experience. A well-structured resume can significantly enhance your chances of landing an interview, while mistakes can leave a negative impression on hiring managers. Below are some frequent errors candidates make that you should steer clear of to ensure your resume stands out for the right reasons:

Using a Generic Template: A one-size-fits-all resume can appear impersonal. Tailor your resume to reflect the specific skills and experiences relevant to the Senior Tax Associate role.

Neglecting Keywords: Failing to incorporate industry-specific keywords can lead to your resume being overlooked by applicant tracking systems. Research job descriptions and include relevant terms to enhance visibility.

Excessive Length: A lengthy resume can overwhelm recruiters. Aim for a concise document that highlights your most relevant experiences and accomplishments, ideally limited to one or two pages.

Vague Job Descriptions: Not providing specific details about your roles can diminish the impact of your experience. Use quantifiable achievements and clear descriptions to illustrate your contributions.

Ignoring Soft Skills: While technical skills are crucial, neglecting to showcase soft skills like communication and teamwork can be detrimental. Balance your resume with both technical competencies and interpersonal qualities.

Inconsistent Formatting: A cluttered or inconsistent format can make your resume difficult to read. Maintain uniformity in font, bullet points, and spacing to present a polished appearance.

Omitting Relevant Certifications: In the tax field, certifications such as CPA or EA are vital. Failing to include these credentials can make your application less competitive.

Focusing Solely on Duties: Merely listing job responsibilities doesn't convey your impact. Instead, emphasize accomplishments and results that demonstrate your effectiveness in previous roles.

Conclusion

As a Senior Tax Associate, you play a pivotal role in managing tax compliance, planning, and strategy for your organization or clients. Your expertise in tax regulations, strong analytical skills, and attention to detail are critical for navigating complex tax issues and ensuring compliance with federal and state laws.

In this article, we explored several key aspects of the Senior Tax Associate role, including the importance of staying updated on tax legislation changes, the necessity of effective communication skills for liaising with clients and stakeholders, and the value of experience in tax preparation and audit support. We also highlighted the significance of leveraging technology and data analysis in optimizing tax processes and enhancing efficiency.

As you reflect on your career as a Senior Tax Associate, now is the perfect time to review and enhance your resume. A well-crafted resume can showcase your skills and experiences effectively, making you stand out in a competitive job market. To assist you in this process, consider utilizing helpful resources such as resume templates, a user-friendly resume builder, a variety of resume examples, and cover letter templates. Don’t miss the opportunity to present your qualifications in the best light—take action today!