Tax Compliance Specialist Core Responsibilities

A Tax Compliance Specialist is pivotal in ensuring adherence to tax regulations and laws while collaborating with various departments, such as finance, legal, and human resources. Key responsibilities include preparing tax returns, conducting audits, and analyzing financial data, which require strong technical, operational, and problem-solving skills. These competencies not only facilitate compliance but also support the organization’s strategic objectives. A well-structured resume highlighting these qualifications can significantly enhance career prospects in this field.

Common Responsibilities Listed on Tax Compliance Specialist Resume

- Prepare and file federal, state, and local tax returns.

- Conduct tax research and stay updated on changes in tax laws.

- Review financial statements for tax compliance.

- Assist in audits by gathering necessary documentation.

- Provide guidance on tax-related inquiries from internal departments.

- Analyze financial data to identify tax savings opportunities.

- Ensure timely payment of taxes and compliance with deadlines.

- Develop and implement tax compliance policies and procedures.

- Collaborate with external tax advisors and authorities.

- Maintain accurate tax records and documentation.

- Prepare reports for management on tax liabilities and compliance status.

High-Level Resume Tips for Tax Compliance Specialist Professionals

In today's competitive job market, a well-crafted resume is essential for Tax Compliance Specialist professionals looking to make a strong first impression on potential employers. Your resume serves as a personal marketing tool that not only showcases your skills and achievements but also reflects your professionalism and attention to detail—qualities that are crucial in the field of tax compliance. A thoughtfully designed resume can set you apart from other candidates and open the door to exciting career opportunities. This guide will provide practical and actionable resume tips specifically tailored for Tax Compliance Specialist professionals, ensuring that your application stands out in a crowded field.

Top Resume Tips for Tax Compliance Specialist Professionals

- Tailor your resume to match the specific job description, highlighting relevant skills and experiences that align with the role.

- Use industry-specific terminology to demonstrate your expertise and familiarity with tax compliance regulations and practices.

- Showcase your relevant experience by detailing your previous roles, responsibilities, and accomplishments in the tax compliance field.

- Quantify your achievements wherever possible, using metrics and data to illustrate how you have positively impacted previous employers.

- Include certifications and training related to tax compliance, such as CPA, EA, or specialized tax software proficiency.

- Highlight your analytical skills by mentioning specific examples of how you've solved complex tax-related issues.

- Incorporate keywords from the job posting to help your resume pass through applicant tracking systems (ATS) used by many employers.

- Keep your resume concise and focused, ideally fitting it onto one or two pages, with clear headings and organized sections.

- Proofread your resume multiple times to eliminate any errors in grammar or spelling, reflecting your attention to detail.

By implementing these tips, you can significantly increase your chances of landing a job in the Tax Compliance Specialist field. A polished and well-structured resume not only highlights your qualifications but also conveys your commitment to excellence in tax compliance, making you a standout candidate in the eyes of potential employers.

Why Resume Headlines & Titles are Important for Tax Compliance Specialist

In the competitive field of tax compliance, a well-crafted resume headline or title can serve as a powerful first impression for hiring managers. For a Tax Compliance Specialist, this brief statement is crucial as it encapsulates the essence of the candidate's qualifications and expertise in one impactful phrase. A strong headline not only grabs attention but also provides a quick summary of the applicant's skills, experience, and value proposition, making it easier for recruiters to assess fit in a glance. It is essential that the headline is concise, relevant, and directly related to the job being applied for to ensure it resonates with potential employers.

Best Practices for Crafting Resume Headlines for Tax Compliance Specialist

- Keep it concise—aim for one impactful sentence.

- Use role-specific keywords relevant to tax compliance.

- Highlight your most significant qualifications or achievements.

- Focus on what differentiates you from other candidates.

- Use active language to convey confidence and expertise.

- Avoid jargon unless it is widely recognized in the industry.

- Tailor the headline for each job application to maximize relevance.

- Consider including years of experience or specific certifications to enhance credibility.

Example Resume Headlines for Tax Compliance Specialist

Strong Resume Headlines

"Detail-Oriented Tax Compliance Specialist with 5+ Years of Experience in IRS Regulations"

"Certified Tax Professional Specializing in Corporate Tax Compliance and Audit Support"

"Results-Driven Tax Compliance Expert with Proven Track Record in Reducing Tax Liabilities"

"Experienced Tax Compliance Specialist Committed to Accuracy and Regulatory Adherence"

Weak Resume Headlines

"Tax Specialist Looking for a Job"

"Resume of a Tax Professional"

The strong headlines are effective because they clearly communicate the candidate's specific skills and experiences that are directly relevant to the role, creating an immediate connection with hiring managers. In contrast, the weak headlines fail to impress as they lack specificity and do not convey any unique value, rendering them forgettable and ineffective in a competitive job market.

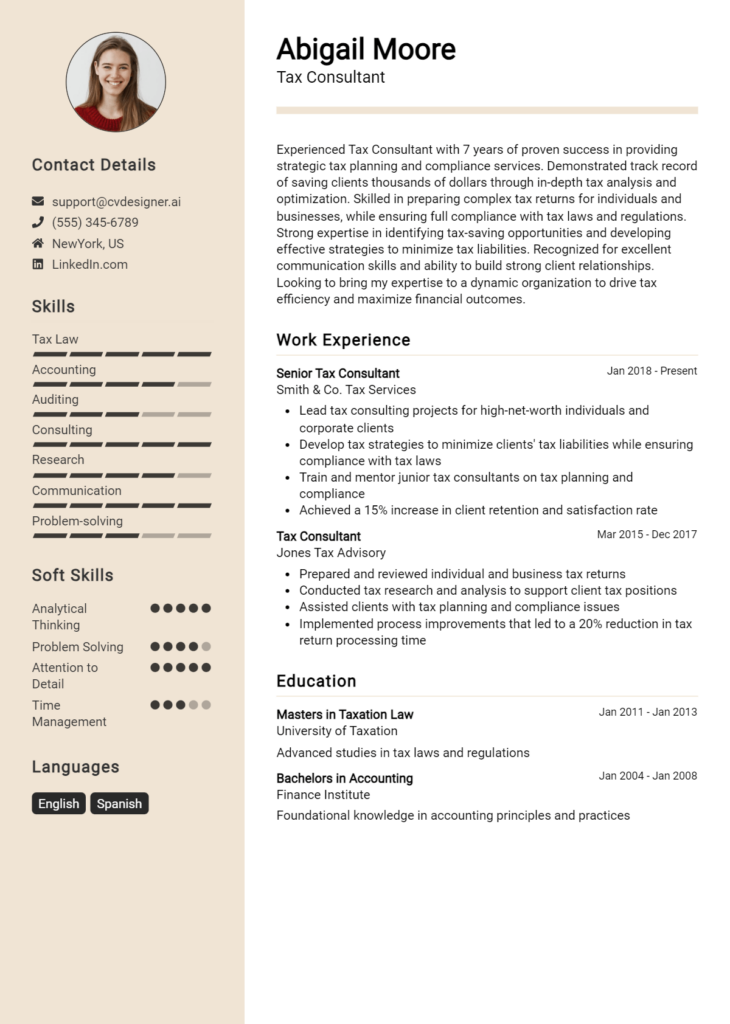

Writing an Exceptional Tax Compliance Specialist Resume Summary

A well-crafted resume summary is crucial for a Tax Compliance Specialist as it serves as the first impression for hiring managers. This concise overview highlights a candidate's key skills, relevant experience, and noteworthy accomplishments, quickly capturing the attention of potential employers. A strong summary not only emphasizes qualifications but also aligns with the specific job requirements, making it easier for hiring managers to see the candidate’s fit for the role. By being impactful and tailored, a resume summary can significantly increase the chances of moving forward in the hiring process.

Best Practices for Writing a Tax Compliance Specialist Resume Summary

- Quantify Achievements: Use numbers and percentages to illustrate the impact of your work.

- Focus on Relevant Skills: Highlight skills that directly relate to tax compliance, such as knowledge of tax laws, auditing experience, and proficiency with tax software.

- Tailor to Job Description: Customize your summary for each application to reflect the requirements and language of the job posting.

- Be Concise: Keep your summary brief and to the point, ideally within 3-5 sentences.

- Showcase Accomplishments: Mention specific achievements that demonstrate your capabilities and successes in previous roles.

- Use Action Verbs: Start sentences with strong action verbs to convey confidence and proactivity.

- Maintain Professional Tone: Ensure the language is formal and professional, suitable for the accounting and finance sector.

- Proofread: Check for grammatical errors and typos to ensure a polished presentation.

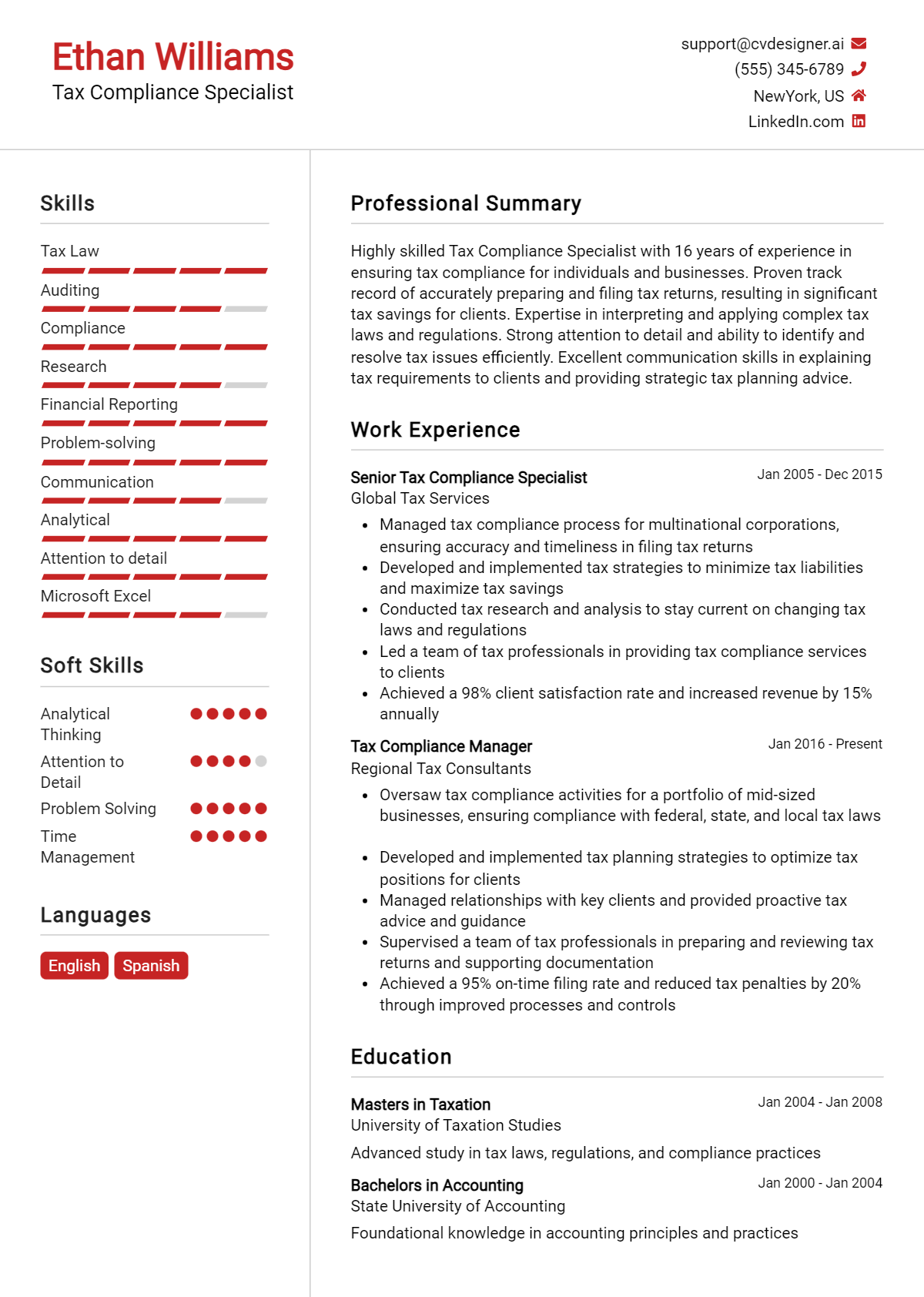

Example Tax Compliance Specialist Resume Summaries

Strong Resume Summaries

Detail-oriented Tax Compliance Specialist with over 5 years of experience in preparing and reviewing federal and state tax returns, resulting in a 30% reduction in errors through meticulous auditing. Proficient in tax software, including QuickBooks and TurboTax, and well-versed in current tax legislation.

Results-driven Tax Compliance Specialist with a proven track record of managing complex tax compliance projects, achieving a 20% increase in on-time filings over the past three years. Expertise in identifying tax-saving opportunities and developing strategies that saved clients over $1 million in potential liabilities.

Experienced Tax Compliance Specialist skilled in navigating intricate tax regulations and ensuring compliance for diverse client portfolios. Successfully led a team that completed over 200 tax returns annually, improving client satisfaction scores by 25% through streamlined processes and effective communication.

Weak Resume Summaries

Tax Compliance Specialist looking for new opportunities in the field. Experienced with tax returns and some software.

Dedicated professional with a background in tax compliance. Seeking a position where I can utilize my skills.

The strong resume summaries are considered effective because they provide specific information about the candidate's experience, quantify achievements, and directly relate to the responsibilities of a Tax Compliance Specialist. In contrast, the weak summaries are vague and lack any measurable outcomes or detailed skills, failing to capture the hiring manager's attention or demonstrate the candidate's true potential.

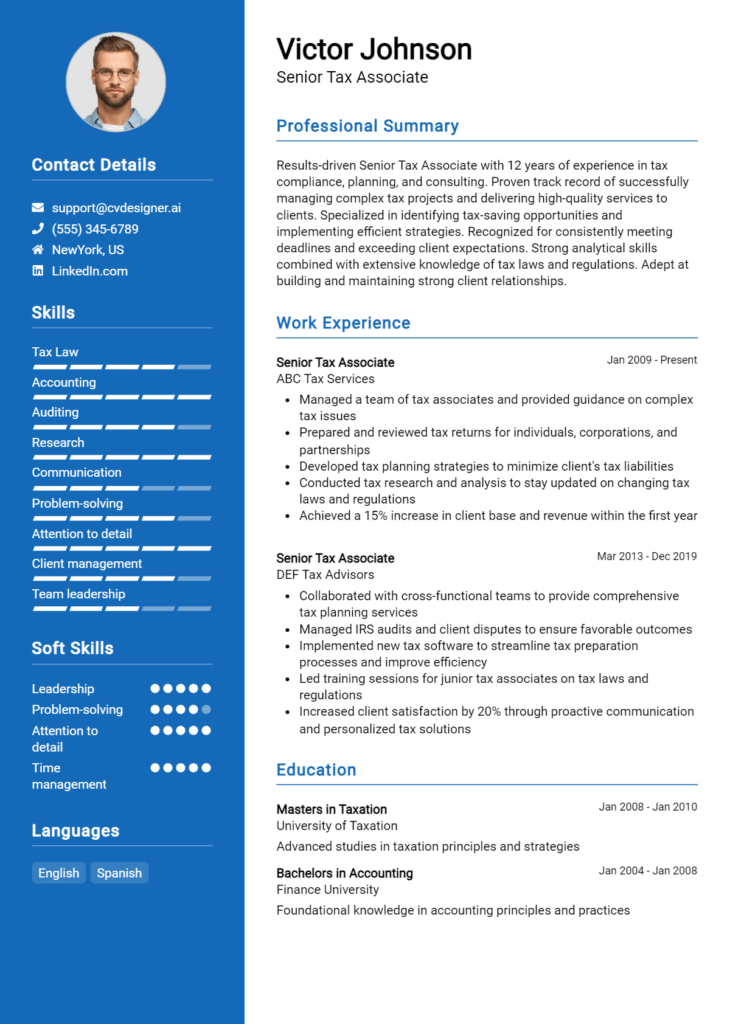

Work Experience Section for Tax Compliance Specialist Resume

The work experience section of a Tax Compliance Specialist resume is crucial for demonstrating the candidate's technical skills and expertise in tax regulations and compliance procedures. This section not only highlights the individual's ability to manage teams effectively but also showcases their capacity to deliver high-quality results that meet industry standards. By quantifying achievements and aligning past experiences with the specific requirements of the tax compliance field, candidates can provide potential employers with a clear picture of their value and contributions to previous organizations.

Best Practices for Tax Compliance Specialist Work Experience

- Clearly articulate technical skills related to tax compliance, such as familiarity with tax software and regulatory frameworks.

- Quantify results achieved in previous roles, such as percentage reductions in audit findings or improvements in compliance rates.

- Highlight experiences that demonstrate leadership in managing teams or projects within tax departments.

- Include specific examples of collaboration with cross-functional teams, illustrating the ability to work effectively with others.

- Use action verbs to convey a sense of proactivity and impact in previous roles.

- Align experiences with industry standards and best practices to showcase relevance and expertise.

- Focus on continuous improvement initiatives that led to enhanced compliance processes or efficiencies.

- Tailor the work experience section to match the job description of the role being applied for, emphasizing relevant experiences.

Example Work Experiences for Tax Compliance Specialist

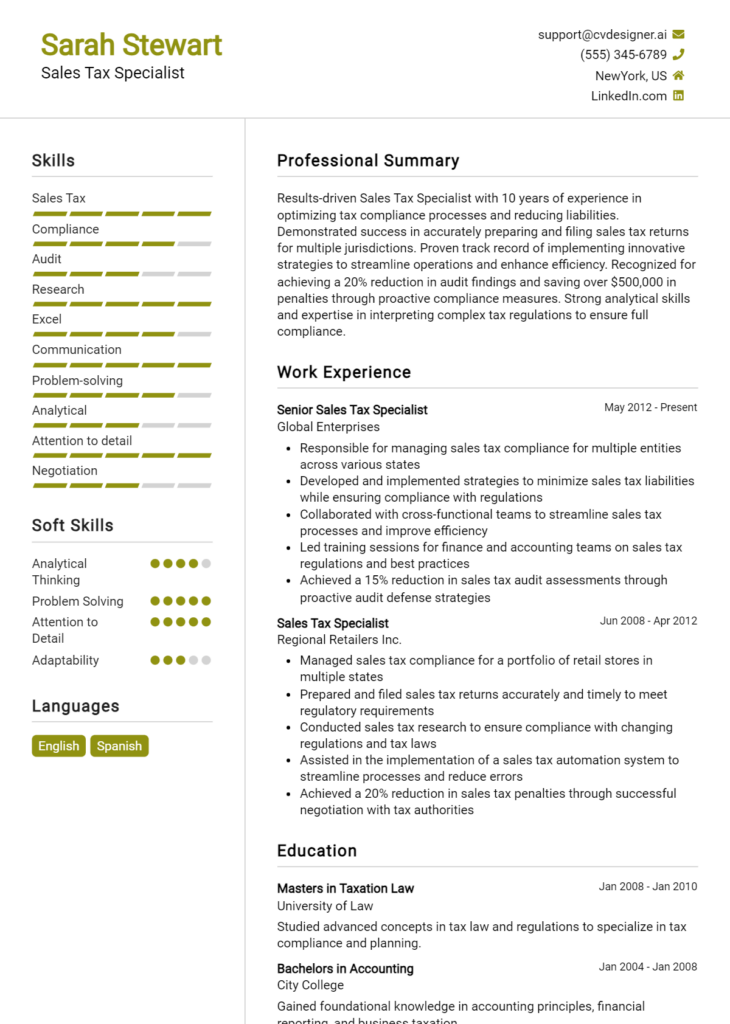

Strong Experiences

- Led a team of 5 in a project that reduced tax audit discrepancies by 30% over a 12-month period through enhanced compliance training and process optimization.

- Implemented a new tax software solution that increased reporting accuracy by 40% and decreased processing time by 25%, resulting in significant cost savings for the firm.

- Collaborated with finance and legal departments to develop a comprehensive compliance strategy that maintained a 100% pass rate during external audits for three consecutive years.

- Streamlined tax reporting processes, which resulted in a 15% reduction in filing time, allowing for timely submissions and avoidance of penalties.

Weak Experiences

- Responsible for tax compliance tasks in previous jobs.

- Helped the team with various projects related to tax matters.

- Worked on improving tax processes occasionally.

- Participated in tax audits and provided support when needed.

The examples categorized as strong experiences effectively demonstrate quantifiable outcomes, technical leadership, and collaboration, providing clear evidence of the candidate's impact in previous roles. In contrast, the weak experiences lack specificity and measurable achievements, making them less compelling for hiring managers. Strong experiences convey a clear narrative of success and expertise, while weak experiences fail to illustrate the candidate's value and contributions in a meaningful way.

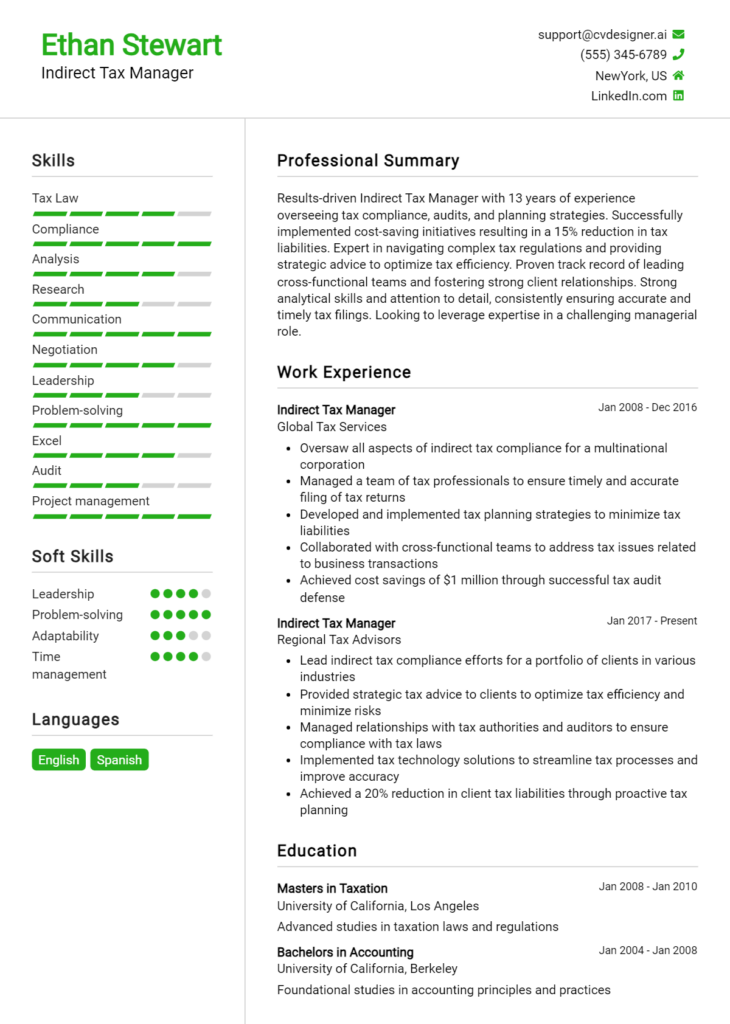

Education and Certifications Section for Tax Compliance Specialist Resume

The education and certifications section of a Tax Compliance Specialist resume is crucial in establishing the candidate's qualifications and expertise in the field. This section serves to showcase the candidate's academic background, highlighting relevant degrees, industry-recognized certifications, and commitment to continuous learning. By providing information on pertinent coursework, certifications, and specialized training, candidates can significantly enhance their credibility and demonstrate their alignment with the job role. A well-structured education and certifications section not only reflects the candidate's knowledge but also assures potential employers of their ability to navigate the complexities of tax compliance effectively.

Best Practices for Tax Compliance Specialist Education and Certifications

- Include only relevant degrees and certifications that pertain to tax compliance and accounting.

- List certifications such as CPA (Certified Public Accountant), EA (Enrolled Agent), or other recognized designations prominently.

- Provide specific coursework that relates directly to tax law, compliance, and regulations.

- Highlight any continuing education courses that demonstrate up-to-date knowledge of tax legislation changes.

- Use a clear format, including the institution name, degree or certification title, and date of completion.

- Prioritize advanced degrees or certifications that are in high demand in the industry.

- Consider including honors or distinctions earned during educational pursuits to showcase exceptional performance.

- Be concise and ensure that the information is organized, making it easy for hiring managers to review.

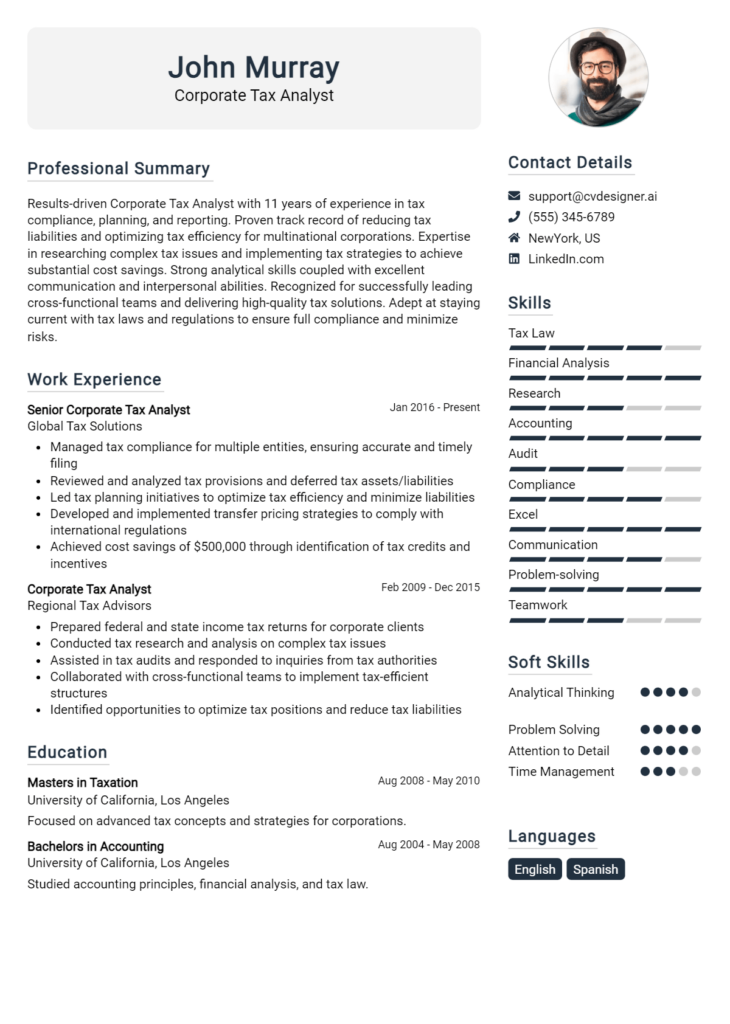

Example Education and Certifications for Tax Compliance Specialist

Strong Examples

- M.S. in Taxation, University of XYZ, Graduated May 2022

- Certified Public Accountant (CPA), Licensed in State ABC, Issued June 2021

- Enrolled Agent (EA), National Association of Enrolled Agents, Certified July 2020

- Relevant Coursework: Federal Income Taxation, Corporate Tax Compliance, Advanced Tax Planning Strategies

Weak Examples

- Bachelor's in Fine Arts, University of DEF, Graduated May 2018

- Certification in Basic Computer Skills, Issued January 2021

- Diploma in Culinary Arts, Culinary Institute of GHI, Graduated December 2019

- General Studies Coursework: Introduction to Philosophy, History of Art

The examples provided illustrate a clear distinction between strong and weak qualifications. Strong examples demonstrate relevance to the tax compliance field through degrees and certifications that are directly applicable to the role, showcasing specialized knowledge and expertise. In contrast, weak examples reflect educational paths and certifications that have no direct relation to tax compliance, thereby diminishing the candidate's credibility and alignment with the job requirements. This highlights the importance of tailoring the education and certifications section to ensure it effectively supports the candidate's job application.

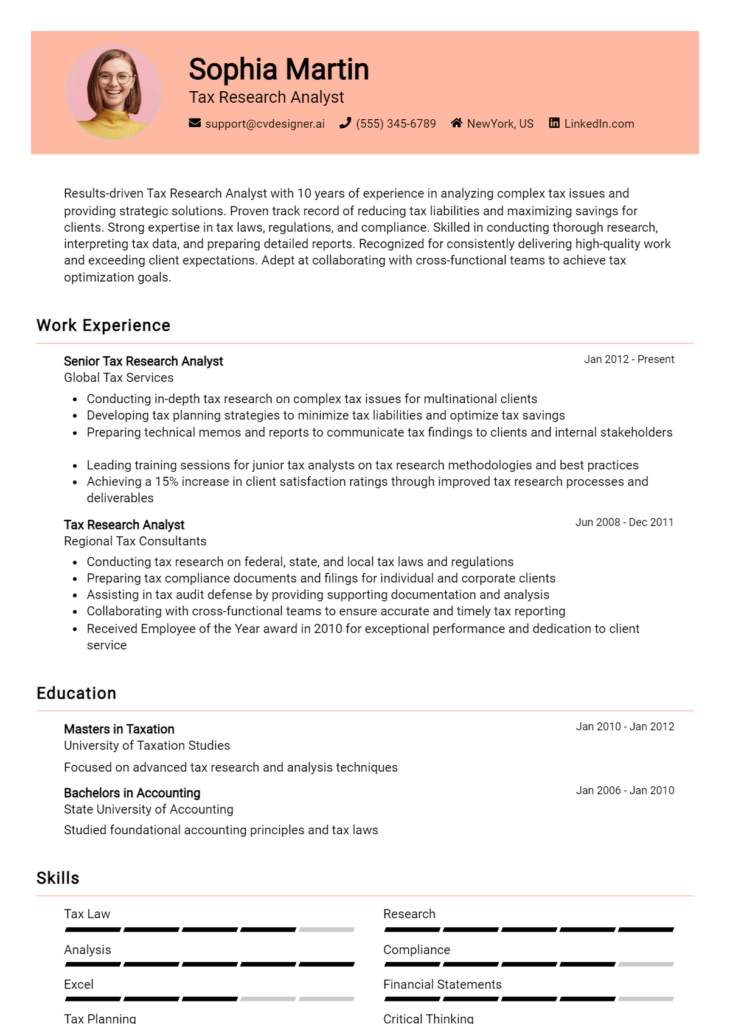

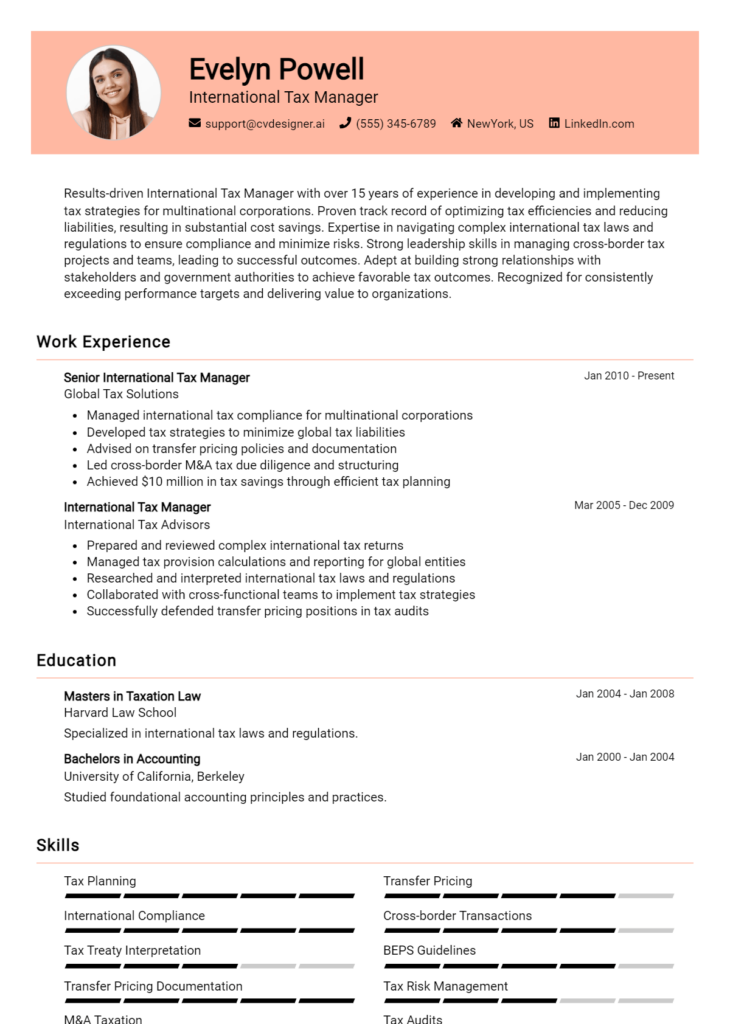

Top Skills & Keywords for Tax Compliance Specialist Resume

As a Tax Compliance Specialist, having a well-crafted resume that highlights relevant skills is crucial for standing out in a competitive job market. The role demands a unique combination of analytical abilities, attention to detail, and strong interpersonal skills to navigate complex tax regulations effectively. Employers seek candidates who not only possess the technical know-how but also demonstrate the soft skills necessary for collaboration and communication in a team-oriented environment. By emphasizing the right skills in your resume, you can showcase your qualifications and increase your chances of landing the desired position. For more insights on effectively structuring your resume, consider exploring the importance of skills and work experience.

Top Hard & Soft Skills for Tax Compliance Specialist

Soft Skills

- Attention to detail

- Analytical thinking

- Problem-solving

- Communication skills

- Time management

- Team collaboration

- Adaptability

- Customer service orientation

- Critical thinking

- Conflict resolution

Hard Skills

- Knowledge of tax regulations

- Proficiency in tax software (e.g., TurboTax, H&R Block)

- Financial analysis

- Data entry and management

- Familiarity with accounting principles

- Tax return preparation

- Audit procedures

- Compliance reporting

- Risk assessment

- Microsoft Excel proficiency

Stand Out with a Winning Tax Compliance Specialist Cover Letter

Dear [Hiring Manager's Name],

I am writing to express my interest in the Tax Compliance Specialist position at [Company Name] as advertised on [Job Board/Company Website]. With a solid background in tax regulations and compliance, coupled with my attention to detail and analytical skills, I am confident in my ability to contribute effectively to your team. My experience in navigating complex tax codes and my commitment to helping clients maintain compliance make me a strong candidate for this role.

In my previous position at [Previous Company Name], I successfully managed a diverse portfolio of clients, ensuring their tax filings were accurate and submitted on time. I developed a reputation for my meticulous approach to reviewing returns and identifying potential discrepancies before they became issues. My ability to stay up-to-date with evolving tax laws and regulations allowed me to provide valuable insights and recommendations that improved compliance processes and reduced liabilities for my clients.

I am particularly drawn to the opportunity at [Company Name] because of your reputation for excellence and innovation in the tax compliance field. I am eager to bring my expertise in tax analysis and regulatory compliance to your esteemed firm. Additionally, I am enthusiastic about contributing to a collaborative environment where I can further develop my skills while assisting clients in achieving their financial objectives.

Thank you for considering my application. I look forward to the possibility of discussing how my background, skills, and enthusiasms align with the goals of [Company Name]. I am eager to contribute to your team's success and help ensure that your clients remain compliant with all tax obligations.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Conclusion

As a Tax Compliance Specialist, your role is pivotal in ensuring that organizations adhere to tax laws and regulations while optimizing their tax strategies. Throughout this article, we have discussed various aspects of this position, including the critical skills required, such as attention to detail, analytical thinking, and proficiency in tax software. We explored the importance of staying updated with changing tax legislation and the impact of compliance on overall business operations.

Moreover, we highlighted the significance of effective communication and collaboration with other departments to ensure comprehensive tax compliance. Developing a robust understanding of tax codes and regulations is essential for providing accurate advice and guidance to clients or internal stakeholders.

In conclusion, as you navigate your career as a Tax Compliance Specialist, it's vital to present your qualifications effectively. We encourage you to review your resume to ensure it reflects your expertise and accomplishments in this field. Utilize available resources to enhance your application materials. Check out resume templates, experiment with a resume builder, explore resume examples, and consider using cover letter templates to create a compelling presentation of your skills. Take action now to elevate your job application and stand out in the competitive field of tax compliance!