Payment Processing Specialist Core Responsibilities

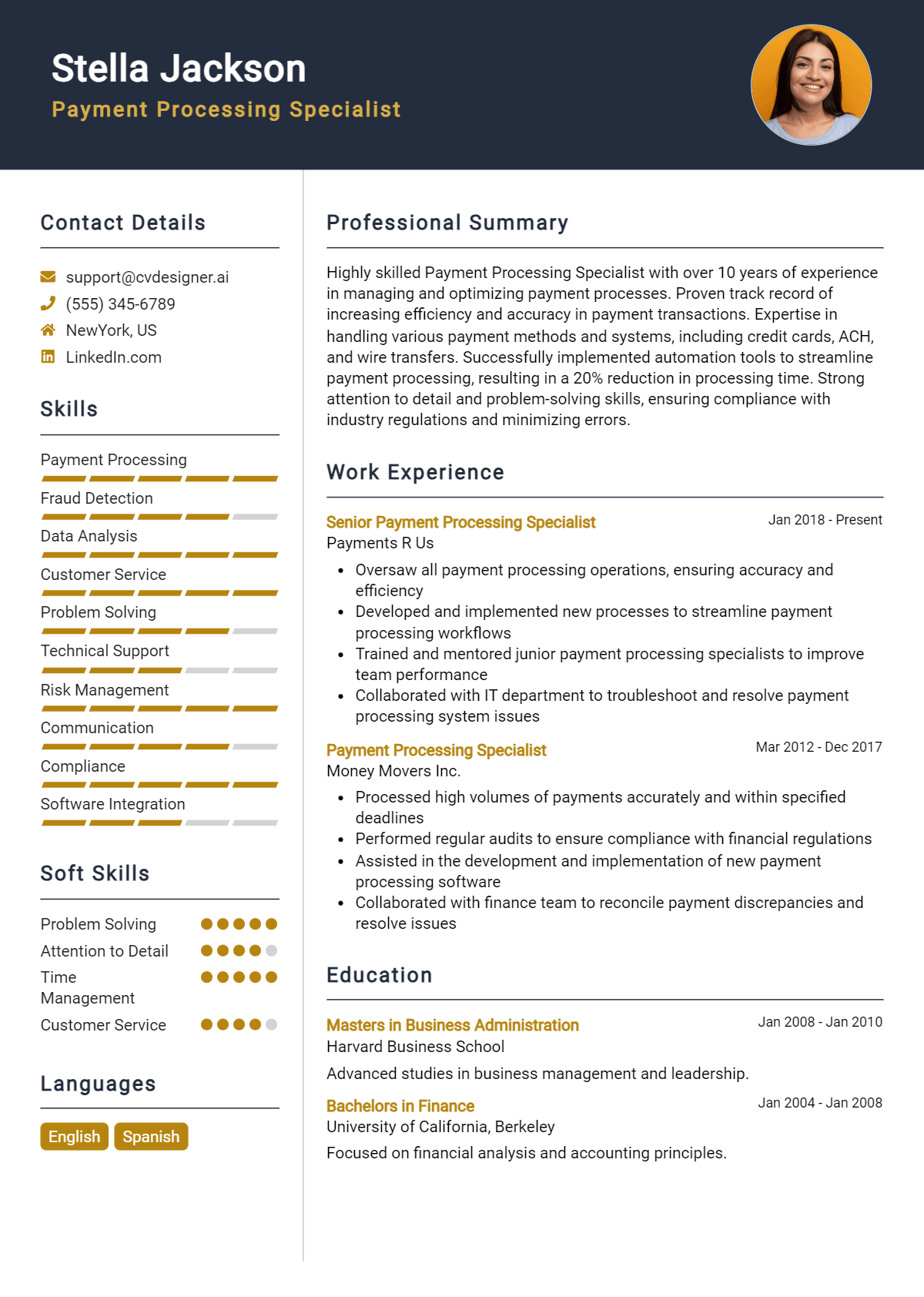

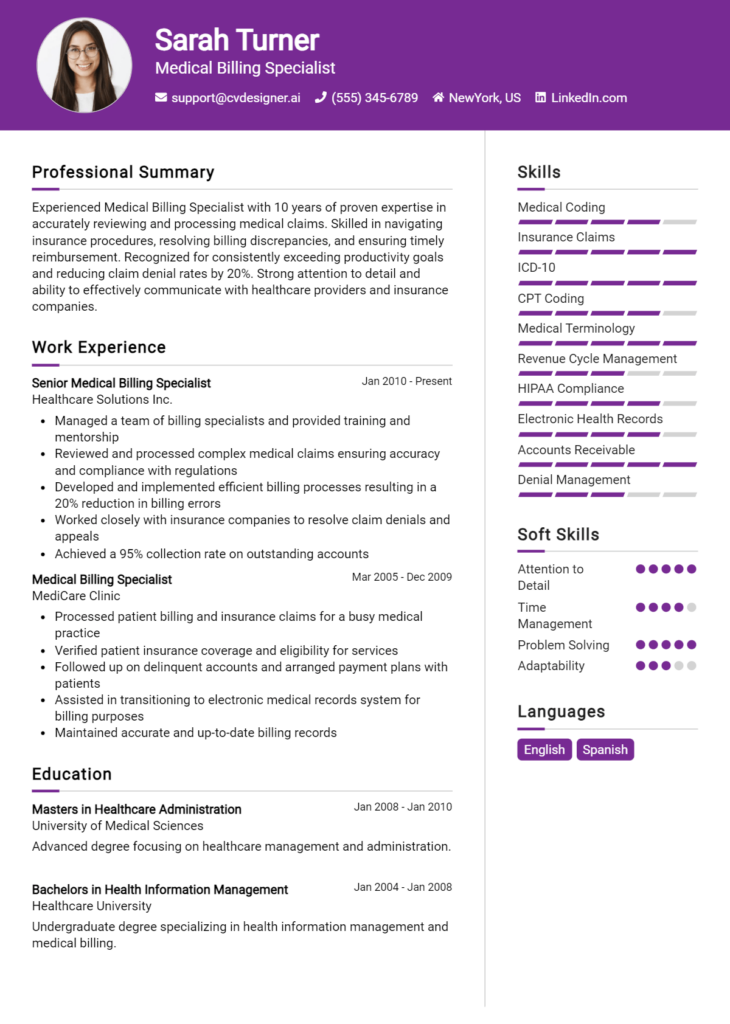

A Payment Processing Specialist plays a crucial role in ensuring seamless financial transactions within an organization. This position requires a blend of technical expertise, operational efficiency, and strong problem-solving skills to effectively manage payment systems, resolve discrepancies, and collaborate with finance, IT, and customer service departments. By demonstrating these abilities, the specialist contributes significantly to the organization’s financial health. A well-structured resume is essential to highlight these skills and experiences, showcasing a candidate’s readiness to support the company’s goals.

Common Responsibilities Listed on Payment Processing Specialist Resume

- Manage and process incoming and outgoing payments accurately and efficiently.

- Reconcile payment discrepancies and investigate transaction issues.

- Collaborate with finance and accounting teams to ensure compliance with financial policies.

- Maintain and update payment processing systems and software.

- Generate and analyze reports on payment activities and trends.

- Implement best practices for payment processing and security.

- Assist in training staff on payment processing procedures.

- Communicate with vendors and clients regarding payment statuses and inquiries.

- Monitor and ensure adherence to payment processing regulations and standards.

- Provide technical support for payment software issues.

- Identify opportunities for process improvements and cost efficiencies.

High-Level Resume Tips for Payment Processing Specialist Professionals

In the competitive field of payment processing, a well-crafted resume acts as your first line of defense in making a positive impression on potential employers. It serves as a powerful marketing tool that not only showcases your relevant skills and experiences but also highlights your achievements in the industry. A strong resume can set you apart from other candidates, reflecting your understanding of the nuances of payment processing and your ability to contribute effectively to a prospective employer’s success. This guide will provide you with practical and actionable resume tips specifically tailored for Payment Processing Specialist professionals, ensuring your resume captures the attention of hiring managers.

Top Resume Tips for Payment Processing Specialist Professionals

- Tailor your resume for each application by closely aligning your skills and experiences with the job description.

- Highlight relevant experience in payment processing, including specific roles and responsibilities held in previous positions.

- Quantify your achievements by using metrics such as transaction volumes, error reduction percentages, and efficiency improvements.

- Showcase industry-specific skills such as knowledge of payment gateways, fraud detection methods, and compliance regulations.

- Utilize action verbs to describe your responsibilities and accomplishments, making your contributions stand out.

- Include relevant certifications or training in payment processing or financial services to demonstrate your commitment to the industry.

- Incorporate keywords from the job posting to pass through applicant tracking systems and catch the employer's attention.

- Maintain a clean and professional format, using bullet points for clarity and ensuring easy readability.

- Consider adding a summary statement at the beginning of your resume that encapsulates your experience and career goals.

- Proofread thoroughly to eliminate any grammatical errors or typos, as attention to detail is crucial in the payment processing field.

By implementing these tips, you can significantly enhance your resume, increasing your chances of landing a job in the Payment Processing Specialist field. A resume that effectively showcases your skills, experiences, and achievements not only attracts the attention of hiring managers but also conveys your professionalism and readiness to succeed in a dynamic industry.

Why Resume Headlines & Titles are Important for Payment Processing Specialist

In the competitive field of payment processing, a well-crafted resume headline or title is essential for capturing the attention of hiring managers. A strong headline serves as a concise summary of a candidate's key qualifications, skills, and value proposition, allowing them to stand out among a sea of applicants. It should be relevant to the Payment Processing Specialist role and immediately convey the applicant's expertise, making it easier for hiring managers to assess their fit for the position at a glance. An impactful headline can set the tone for the entire resume and encourage a deeper review of the candidate's qualifications.

Best Practices for Crafting Resume Headlines for Payment Processing Specialist

- Keep it concise: Aim for a headline that is short and to the point.

- Be role-specific: Tailor your headline to reflect the specific position you are applying for.

- Highlight key skills: Incorporate relevant skills that align with the job requirements.

- Use action-oriented language: Choose powerful verbs that convey your contributions and strengths.

- Include quantifiable achievements: If possible, reference measurable accomplishments that demonstrate your impact.

- Make it unique: Avoid generic phrases; instead, focus on what makes you stand out as a candidate.

- Stay relevant: Ensure that every word in your headline relates directly to the role of a Payment Processing Specialist.

- Use proper formatting: Use capitalization appropriately to enhance readability and impact.

Example Resume Headlines for Payment Processing Specialist

Strong Resume Headlines

"Detail-Oriented Payment Processing Specialist with 5+ Years of Experience in Fraud Prevention and Transaction Management"

“Results-Driven Payment Processing Expert Specializing in Streamlining Transactions and Enhancing Customer Satisfaction”

“Certified Payment Processing Professional with Proven Track Record in Reducing Processing Errors by 30%”

“Efficient Payment Processing Specialist Committed to Upholding Compliance and Security Standards”

Weak Resume Headlines

“Payment Specialist Looking for a Job”

“Experienced Worker in Payments”

The strong resume headlines are effective because they provide specific information about the candidate's skills, experience, and achievements that are relevant to the Payment Processing Specialist position. They use clear and impactful language that immediately communicates the value the candidate brings to the role. In contrast, the weak headlines fail to impress because they are vague, lack specificity, and do not convey any particular strengths or qualifications. This lack of focus makes it difficult for hiring managers to see the candidate's unique contributions or suitability for the role.

Writing an Exceptional Payment Processing Specialist Resume Summary

A well-crafted resume summary is crucial for a Payment Processing Specialist as it serves as the first impression a hiring manager receives about a candidate. This brief yet impactful section quickly captures attention by highlighting essential skills, relevant experience, and notable accomplishments that align with the specific job role. A strong summary not only conveys the candidate's qualifications but also sets the tone for the rest of the resume, making it imperative that it is concise, targeted, and tailored to the job application.

Best Practices for Writing a Payment Processing Specialist Resume Summary

- Quantify Achievements: Use numbers and percentages to illustrate your success in previous roles.

- Focus on Relevant Skills: Highlight skills that are specifically mentioned in the job description.

- Tailor for Each Job: Customize your summary to reflect the requirements of the position you are applying for.

- Use Action Verbs: Start sentences with strong action verbs to convey a sense of proactivity and results.

- Keep it Concise: Aim for 2-4 sentences that encapsulate your value without unnecessary details.

- Showcase Industry Knowledge: Include terminology and insights relevant to payment processing to demonstrate your expertise.

- Highlight Soft Skills: Mention interpersonal skills like communication and problem-solving, which are vital in processing payments.

- Avoid Jargon: Use clear language that can be easily understood, avoiding overly technical terms unless necessary.

Example Payment Processing Specialist Resume Summaries

Strong Resume Summaries

Detail-oriented Payment Processing Specialist with over 5 years of experience in high-volume transaction environments. Successfully reduced payment processing errors by 30% through meticulous attention to detail and improved reconciliation processes.

Results-driven professional skilled in managing payment systems for multinational companies, achieving a 25% increase in transaction speed while maintaining 99% accuracy. Proficient in data analysis and risk management.

Dedicated Payment Processing Specialist with a proven track record of enhancing customer satisfaction scores by 40% through efficient dispute resolution and seamless transaction processing. Adept at utilizing advanced payment technologies.

Weak Resume Summaries

Experienced in payment processing and related tasks. Good at working with numbers.

Payment Processing Specialist looking for a job to utilize my skills in a fast-paced environment.

The examples above illustrate the contrast between strong and weak resume summaries. Strong summaries are effective because they quantify achievements, incorporate relevant skills, and demonstrate direct applicability to the Payment Processing Specialist role. In contrast, weak summaries lack specificity and measurable outcomes, rendering them generic and less compelling to hiring managers.

Work Experience Section for Payment Processing Specialist Resume

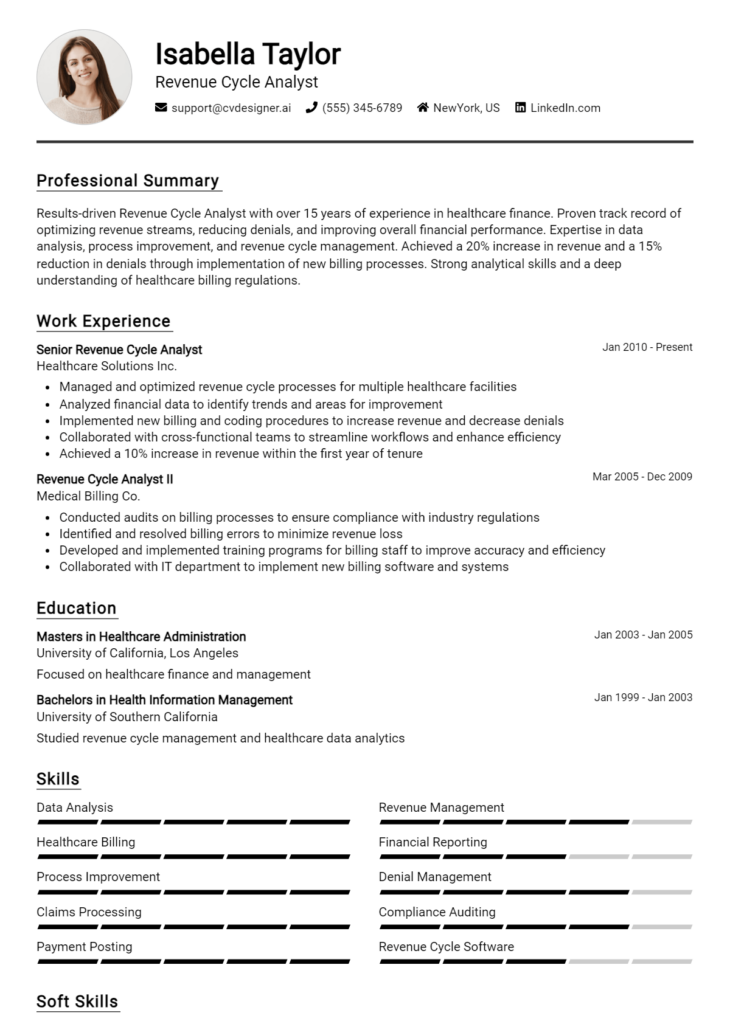

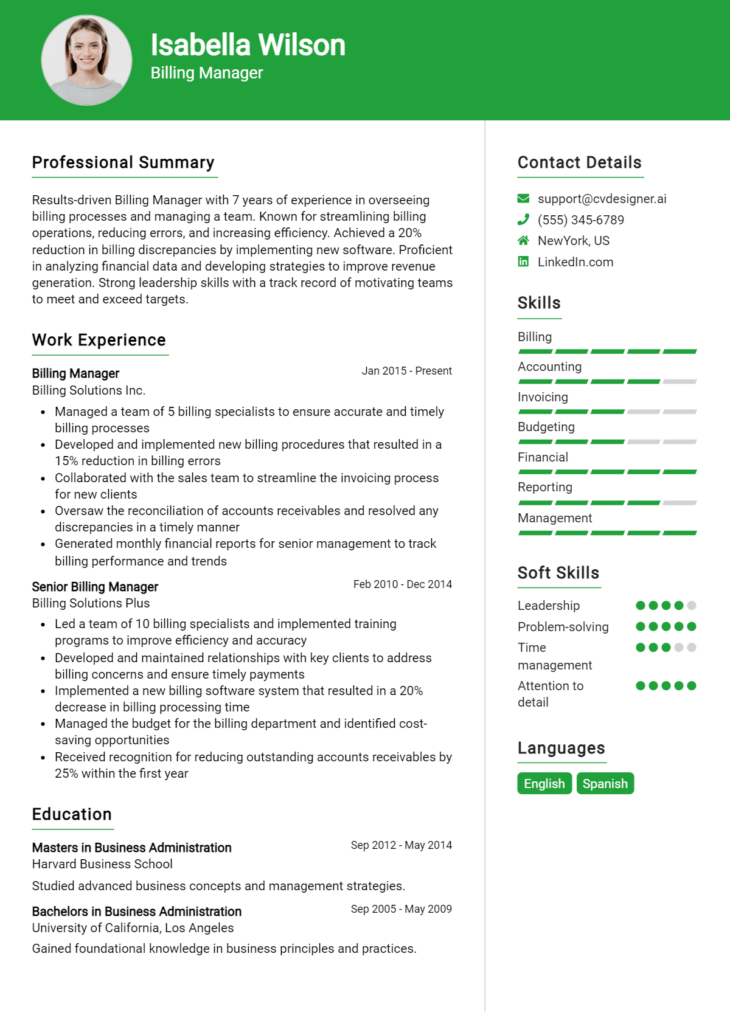

The work experience section of a Payment Processing Specialist resume is crucial as it serves as a platform for candidates to demonstrate their technical skills and expertise in managing payment systems. This section not only highlights the applicant's ability to deliver high-quality products but also showcases their experience in leading teams and collaborating effectively with stakeholders. By quantifying achievements and aligning their experience with industry standards, candidates can significantly enhance their appeal to potential employers, making it essential to present this information in a clear and impactful manner.

Best Practices for Payment Processing Specialist Work Experience

- Clearly outline specific technical skills relevant to payment processing systems.

- Quantify achievements with metrics such as transaction volume, error rates, and processing times.

- Highlight leadership roles and team management experience in projects.

- Demonstrate collaboration with cross-functional teams, such as finance and IT.

- Utilize action verbs to convey responsibility and impact effectively.

- Align experience descriptions with industry standards and best practices.

- Include relevant certifications or training that enhances technical expertise.

- Tailor the work experience section to match the specific job description whenever possible.

Example Work Experiences for Payment Processing Specialist

Strong Experiences

- Led a team of five in optimizing payment processing workflows, resulting in a 30% reduction in transaction errors and a 20% increase in processing speed.

- Implemented a new payment gateway that increased transaction capacity by 50%, facilitating a smoother customer experience during peak sales periods.

- Managed vendor relationships that improved payment reconciliation processes, reducing discrepancies by 40% over six months.

- Trained and mentored junior staff on payment processing systems, enhancing team productivity and knowledge retention.

Weak Experiences

- Worked on payment systems without specifying any achievements or contributions.

- Assisted with payment processing tasks in a vague capacity.

- Responsible for managing payments, but did not detail the impact or outcomes of those efforts.

- Participated in team meetings related to payment processing without clarifying the role or contributions made.

The examples provided above illustrate the difference between strong and weak experiences in a resume. Strong experiences are characterized by specific, quantifiable outcomes that reflect a candidate's contributions and leadership in payment processing. They provide clear evidence of skills and accomplishments, making them compelling to potential employers. In contrast, weak experiences lack detail and measurable results, which diminishes their impact and fails to convey the candidate's true capabilities and value in the field.

Education and Certifications Section for Payment Processing Specialist Resume

The education and certifications section of a Payment Processing Specialist resume is crucial as it serves to highlight the candidate's academic background and industry-relevant qualifications. This section not only showcases formal education but also emphasizes certifications and continuous learning efforts that are essential in the fast-evolving financial landscape. By including relevant coursework, specialized training, and recognized credentials, candidates can significantly enhance their credibility and demonstrate their alignment with the specific requirements of the job role, making them more appealing to potential employers.

Best Practices for Payment Processing Specialist Education and Certifications

- Prioritize relevant degrees such as Finance, Accounting, or Business Administration.

- Include industry-recognized certifications like Certified Payments Professional (CPP) or Accredited ACH Professional (AAP).

- Detail coursework related to payment processing, financial systems, or risk management.

- Highlight continuous education efforts such as workshops or seminars on payment technology.

- List any specialized training that showcases proficiency in payment processing software or tools.

- Ensure that all entries are up-to-date and reflect current industry standards.

- Use clear formatting to present information in an easily digestible manner.

- Tailor the section to match the job description, emphasizing the most relevant qualifications.

Example Education and Certifications for Payment Processing Specialist

Strong Examples

- Bachelor of Science in Finance, University of XYZ, 2020

- Certified Payments Professional (CPP), National Association of Payment Professionals, 2021

- Introduction to Payment Systems, Coursera, Completed 2022

- Advanced ACH Processing Certification, American Bankers Association, 2023

Weak Examples

- Bachelor of Arts in History, University of ABC, 2018

- Basic Computer Skills Course, Local Community Center, 2019

- Certification in Microsoft Office, 2017

- High School Diploma, 2015

The strong examples listed demonstrate relevant degrees and certifications that directly align with the Payment Processing Specialist role, showcasing the candidate's preparedness and expertise in the field. In contrast, the weak examples reflect a lack of relevance to payment processing and do not support the candidate's qualifications for the position. Including specific and pertinent qualifications strengthens a resume, while irrelevant or outdated information may dilute a candidate's appeal to employers.

Top Skills & Keywords for Payment Processing Specialist Resume

As a Payment Processing Specialist, showcasing the right skills in your resume is crucial for standing out in a competitive job market. Employers seek candidates who not only possess technical expertise but also demonstrate strong interpersonal abilities. Highlighting a blend of hard and soft skills can effectively convey your qualifications and suitability for the role. By focusing on relevant skills, you can illustrate your proficiency in payment systems and customer interaction, which are essential for ensuring smooth transaction processes and maintaining positive client relationships.

Top Hard & Soft Skills for Payment Processing Specialist

Soft Skills

- Attention to Detail

- Communication Skills

- Problem Solving

- Time Management

- Customer Service Orientation

- Adaptability

- Team Collaboration

- Analytical Thinking

- Conflict Resolution

- Stress Management

Hard Skills

- Knowledge of Payment Processing Systems

- Familiarity with PCI Compliance

- Proficiency in Data Entry

- Experience with Financial Software

- Understanding of Fraud Detection Techniques

- Knowledge of Banking Regulations

- Ability to Reconcile Transactions

- Proficient in Microsoft Excel

- Data Analysis Skills

- Technical Troubleshooting

By effectively integrating these skills into your work experience section, you can create a compelling narrative that showcases your capabilities and sets you apart as a qualified candidate in the field of payment processing.

Stand Out with a Winning Payment Processing Specialist Cover Letter

I am writing to express my interest in the Payment Processing Specialist position at [Company Name], as advertised on [where you found the job posting]. With a solid background in financial operations and a keen understanding of payment systems, I believe I am well-equipped to contribute effectively to your team. My experience in managing transactions, analyzing payment data, and ensuring compliance with industry regulations has prepared me to excel in this role.

In my previous position at [Previous Company Name], I was responsible for overseeing the daily processing of payments, which included reconciling discrepancies, conducting audits, and resolving issues that arose during transactions. Through implementing streamlined processes and leveraging technology, I successfully reduced transaction processing time by 20%, while maintaining a high level of accuracy and customer satisfaction. My attention to detail and problem-solving skills have always enabled me to identify and mitigate risks, ensuring the integrity of financial data.

I am particularly drawn to this opportunity at [Company Name] due to your commitment to innovation and excellence in financial services. I am eager to bring my expertise in payment systems and my proactive approach to process improvement to your organization. I thrive in fast-paced environments and am excited about the possibility of collaborating with a talented team to enhance the payment processing experience for your clients.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and experiences align with the goals of [Company Name]. I am confident that my dedication to efficiency and accuracy in payment processing will make a positive impact on your team.

Common Mistakes to Avoid in a Payment Processing Specialist Resume

When crafting a resume for a Payment Processing Specialist position, it's crucial to present your skills and experiences effectively. However, many candidates make common mistakes that can undermine their qualifications and diminish their chances of landing an interview. Avoiding these pitfalls can significantly enhance your resume and showcase your suitability for the role.

Neglecting Relevant Keywords: Failing to include industry-specific keywords can cause your resume to be overlooked by Applicant Tracking Systems (ATS) and hiring managers. Tailor your resume to match the specific language used in the job description.

Lack of Quantifiable Achievements: Instead of listing generic job duties, highlight specific achievements with quantifiable results. For example, mention the volume of transactions processed or improvements in processing times.

Using a Generic Template: Many candidates opt for generic resume templates that do not reflect their unique qualifications. Customize your resume layout and content to stand out and convey your personal brand.

Overloading with Information: Including excessive information can dilute your key messages. Focus on the most relevant experiences and skills, ensuring your resume is concise and easy to read.

Ignoring Formatting Consistency: Inconsistent formatting can create a disorganized appearance. Ensure uniformity in font sizes, styles, bullet points, and spacing throughout your resume.

Not Highlighting Technical Skills: As a Payment Processing Specialist, you should emphasize your technical skills, such as familiarity with payment gateways, software, and data analysis tools. Failing to do so may overlook your essential qualifications.

Lack of Tailored Objective Statement: A generic objective statement can make your resume feel impersonal. Craft a tailored statement that reflects your career goals and aligns with the specific role you’re applying for.

Forgetting to Proofread: Typos and grammatical errors can create a negative impression. Always proofread your resume or have someone else review it to ensure it is error-free and professionally presented.

Conclusion

In summary, the role of a Payment Processing Specialist is vital in ensuring efficient transaction handling and maintaining financial accuracy for businesses. Key responsibilities include managing payment transactions, reconciling accounts, and addressing any discrepancies that may arise. A successful specialist must possess strong analytical skills, attention to detail, and a solid understanding of payment systems and compliance regulations.

As you reflect on your qualifications and experiences, now is a great time to review and enhance your Payment Processing Specialist resume. Make sure it highlights your relevant skills, achievements, and experience in a clear and professional manner.

To assist you in crafting the perfect resume, consider utilizing our resources. Explore our resume templates to find a design that suits your style. You can also take advantage of our resume builder for a guided and efficient process. Looking for inspiration? Check out our resume examples to see how others have successfully showcased their expertise. Don’t forget the importance of a compelling introduction; our cover letter templates can help you make a strong first impression.

Take action today to ensure your resume stands out in the competitive job market for Payment Processing Specialists!