Accounts Receivable Manager Core Responsibilities

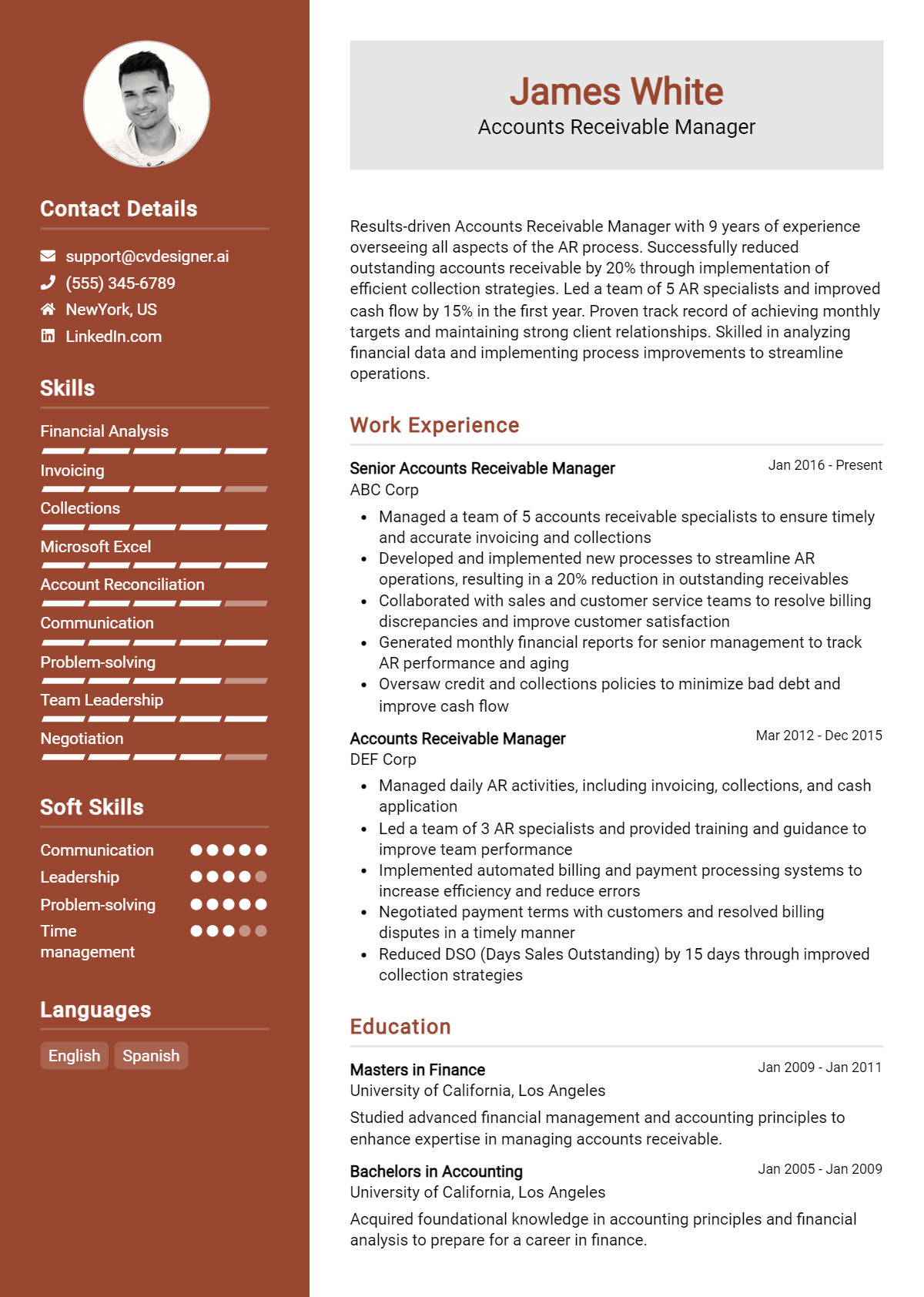

The Accounts Receivable Manager plays a vital role in ensuring financial stability by managing incoming payments and maintaining accurate records. This position requires strong technical skills in accounting software, operational efficiency in overseeing collections processes, and exceptional problem-solving abilities to address discrepancies. Bridging finance, sales, and customer service departments, the manager contributes to organizational goals by optimizing cash flow and fostering client relationships. A well-structured resume highlighting these competencies can effectively showcase a candidate's qualifications and readiness for the role.

Common Responsibilities Listed on Accounts Receivable Manager Resume

- Oversee the accounts receivable process, ensuring timely and accurate invoicing.

- Manage collections activities, following up on overdue accounts.

- Develop and implement credit policies and procedures.

- Analyze accounts receivable aging reports to identify trends.

- Coordinate with the sales team to resolve billing discrepancies.

- Prepare monthly financial reports related to receivables.

- Ensure compliance with accounting standards and company policies.

- Train and mentor accounts receivable staff for optimal performance.

- Communicate effectively with clients regarding payment terms and disputes.

- Utilize accounting software to maintain accurate financial records.

- Collaborate with other departments to support overall financial goals.

High-Level Resume Tips for Accounts Receivable Manager Professionals

A well-crafted resume is essential for Accounts Receivable Manager professionals, as it serves as the first impression a candidate makes on potential employers. In a competitive job market, your resume must effectively showcase not only your skills and qualifications but also your notable achievements in the field. A well-structured resume can highlight your expertise in managing accounts, improving cash flow, and driving financial efficiency, making you a standout candidate. This guide will provide practical and actionable resume tips specifically tailored for Accounts Receivable Manager professionals to help you create a compelling resume that resonates with hiring managers.

Top Resume Tips for Accounts Receivable Manager Professionals

- Tailor your resume to the specific job description by using relevant keywords and phrases from the posting.

- Showcase your relevant experience prominently, focusing on roles that directly relate to accounts receivable management.

- Quantify your achievements with concrete numbers, such as the percentage of overdue accounts reduced or the amount of cash flow improved.

- Highlight industry-specific skills such as knowledge of accounting software (e.g., SAP, QuickBooks) and familiarity with financial regulations.

- Include certifications relevant to accounts receivable, such as Certified Accounts Receivable Professional (CARP) or Certified Credit and Collections Professional (CCCP).

- Use action verbs to describe your responsibilities and achievements, such as “managed,” “streamlined,” and “optimized.”

- Focus on your problem-solving abilities by providing examples of how you successfully handled challenging customer accounts or disputes.

- Keep your resume to one or two pages, ensuring it’s concise yet comprehensive enough to cover your key qualifications.

- Incorporate a professional summary at the top of your resume that encapsulates your career highlights and unique value proposition.

- Proofread your resume to eliminate any spelling or grammatical errors, as attention to detail is crucial in accounts receivable roles.

By implementing these tips, you can significantly enhance the effectiveness of your resume, increasing your chances of landing a job in the Accounts Receivable Manager field. A clear and targeted resume not only showcases your qualifications but also demonstrates your professionalism and attention to detail, traits highly valued by employers in this sector.

Why Resume Headlines & Titles are Important for Accounts Receivable Manager

In the competitive field of accounts receivable management, a well-crafted resume headline or title serves as the first impression for hiring managers. It is crucial to create a headline that not only grabs attention but also succinctly summarizes the candidate's key qualifications and expertise in a single impactful phrase. A strong resume headline can immediately indicate relevance to the job being applied for, helping to differentiate candidates in a crowded applicant pool. Therefore, it should be concise, relevant, and directly aligned with the role of an Accounts Receivable Manager, showcasing the candidate's strengths and inviting further review of their resume.

Best Practices for Crafting Resume Headlines for Accounts Receivable Manager

- Keep it concise: Aim for a headline that is brief yet informative, ideally one to two lines long.

- Be specific: Use industry-related keywords and specific terms relevant to accounts receivable management.

- Highlight key strengths: Emphasize your most relevant skills or achievements that align with the job description.

- Use action-oriented language: Start with strong action verbs to create a dynamic impression.

- Tailor for the job: Customize your headline for each application to match the specific role and company culture.

- Avoid jargon: Use clear language that can be understood by hiring managers who may not be familiar with technical terms.

- Incorporate metrics: If applicable, include quantifiable achievements to add credibility to your headline.

- Stay professional: Ensure the tone of the headline is formal and appropriate for the corporate environment.

Example Resume Headlines for Accounts Receivable Manager

Strong Resume Headlines

Results-Driven Accounts Receivable Manager with 10+ Years of Experience in Reducing DSO by 25%.

Detail-Oriented Accounts Receivable Specialist Skilled in Credit Risk Assessment and Collection Strategies.

Dynamic Accounts Receivable Manager with a Proven Track Record of Streamlining Processes and Increasing Cash Flow.

Weak Resume Headlines

Accounts Receivable Manager Looking for a Job.

Experienced Professional in Finance.

The strong resume headlines are effective because they convey specific qualifications, achievements, and relevant skills that align with the role of an Accounts Receivable Manager. They use impactful language and metrics, immediately communicating value to the employer. In contrast, the weak headlines fail to impress due to their generic nature, lack of specificity, and absence of compelling details that would capture a hiring manager's interest. By avoiding vague terms and focusing on concrete contributions, candidates can enhance their chances of standing out in the hiring process.

Writing an Exceptional Accounts Receivable Manager Resume Summary

An exceptional resume summary is crucial for an Accounts Receivable Manager as it serves as the candidate's first impression to hiring managers. A well-crafted summary quickly captures attention by highlighting key skills, relevant experience, and significant accomplishments that align with the job role. This brief yet impactful section should encapsulate the essence of a candidate's professional journey, showcasing their ability to manage accounts, minimize overdue payments, and enhance cash flow. A tailored resume summary not only demonstrates the candidate's fit for the position but also sets the stage for the rest of the resume, making it essential for job seekers to invest time in crafting a strong opening statement.

Best Practices for Writing a Accounts Receivable Manager Resume Summary

- Quantify achievements to provide concrete evidence of your impact, such as percentages of overdue accounts reduced.

- Focus on key skills relevant to accounts receivable management, such as proficiency in financial software and regulatory compliance.

- Tailor the summary to match the specific job description, using keywords and phrases that align with the employer's requirements.

- Keep the summary concise—ideally 3-5 sentences—to ensure it remains impactful and easy to read.

- Highlight leadership abilities, especially if you have managed teams or improved processes in previous roles.

- Incorporate industry-specific terminology to demonstrate your knowledge and expertise in the field.

- Showcase any certifications or advanced training that may set you apart from other candidates.

- Use strong action verbs to convey your achievements and responsibilities effectively.

Example Accounts Receivable Manager Resume Summaries

Strong Resume Summaries

Dynamic Accounts Receivable Manager with over 8 years of experience in optimizing cash flow and reducing overdue accounts by 30% through strategic process improvements. Proficient in using ERP systems and financial software to enhance reporting accuracy and compliance. Recognized for leading a team that streamlined billing procedures, resulting in a 20% increase in on-time payments.

Results-driven Accounts Receivable Manager with a proven track record of managing a $5 million portfolio and achieving a 25% reduction in days sales outstanding (DSO). Expertise in negotiating payment plans and resolving disputes efficiently. Adept at training and mentoring staff to implement best practices in accounts receivable processes.

Detail-oriented Accounts Receivable Manager with a strong background in credit management and collections, successfully improving collection rates by 40% over two years. Skilled in analyzing customer financials and implementing tailored credit solutions. Committed to fostering long-term client relationships while ensuring compliance with financial regulations.

Weak Resume Summaries

Accounts Receivable Manager with experience in finance. I have worked in various roles and understand the importance of managing accounts.

Experienced professional looking for a position in accounts receivable management. I have managed accounts and have some knowledge of financial processes.

The strong resume summaries are considered effective because they provide specific, quantified achievements and demonstrate a clear connection to the responsibilities of an Accounts Receivable Manager. They highlight relevant skills and experience, making the candidate stand out to hiring managers. In contrast, the weak summaries lack detail and measurable outcomes, making them too generic and less compelling, failing to convey the candidate's qualifications or impact in previous roles.

Work Experience Section for Accounts Receivable Manager Resume

The work experience section of an Accounts Receivable Manager resume is vital as it highlights the candidate's technical skills, leadership capabilities, and ability to deliver high-quality financial outcomes. This section serves as a platform to showcase not only the candidate’s hands-on experience in managing accounts receivable processes but also their success in optimizing cash flow, enhancing team performance, and implementing best practices. By quantifying achievements and aligning experiences with industry standards, candidates can effectively demonstrate their value to potential employers, illustrating how their contributions have positively impacted the organizations they've worked for.

Best Practices for Accounts Receivable Manager Work Experience

- Use clear, concise language to describe past roles and responsibilities.

- Quantify achievements with specific metrics (e.g., reduced DSO by 15%).

- Highlight experience with financial software and technologies relevant to accounts receivable.

- Showcase leadership experience in managing teams or projects.

- Emphasize collaboration with cross-functional teams, such as sales and customer service.

- Align work experience with industry standards and best practices in finance.

- Include examples of process improvements and their positive impacts on the organization.

- Use action verbs to convey a sense of accomplishment and proactivity.

Example Work Experiences for Accounts Receivable Manager

Strong Experiences

- Led a team of 10 in the accounts receivable department, achieving a 20% reduction in Days Sales Outstanding (DSO) within one year through process optimization and enhanced collections strategies.

- Implemented a new invoicing system that decreased billing errors by 30%, resulting in improved cash flow and customer satisfaction ratings.

- Collaborated with the sales department to establish credit policies that reduced bad debt by 25% while maintaining customer relationships.

- Developed training programs for new team members, which enhanced team efficiency and reduced onboarding time by 40%.

Weak Experiences

- Took part in the accounts receivable process.

- Helped with collections activities.

- Managed some reports related to billing.

- Assisted the finance team with various tasks.

The examples listed as strong experiences reflect clear, quantifiable outcomes and demonstrate specific leadership and technical skills that align with the accounts receivable manager role. They show how the candidate made a tangible impact on their previous organizations. In contrast, the weak experiences are vague, lacking specific metrics or detailed descriptions of the candidate's contributions, making it difficult for potential employers to assess their value and effectiveness in the role.

Education and Certifications Section for Accounts Receivable Manager Resume

The education and certifications section of an Accounts Receivable Manager resume is crucial for showcasing a candidate's academic qualifications and professional development. This section not only highlights the foundational knowledge gained through formal education but also emphasizes the importance of industry-specific certifications that demonstrate expertise in financial management, credit analysis, and collections processes. By including relevant coursework, recognized certifications, and specialized training, candidates can significantly enhance their credibility and align themselves with the specific requirements of the job role, thereby increasing their chances of securing an interview.

Best Practices for Accounts Receivable Manager Education and Certifications

- Include only relevant degrees and certifications that pertain to accounts receivable and finance.

- List the most recent education first, followed by earlier qualifications.

- Highlight any advanced degrees, such as a Master's in Business Administration (MBA) or a Master's in Accounting.

- Incorporate industry-recognized certifications, such as Certified Credit and Collection Specialist (CCCS) or Certified Accounts Receivable Manager (CARM).

- Detail relevant coursework that showcases specific skills or knowledge applicable to accounts receivable management.

- Keep descriptions concise but informative, avoiding excessive jargon while clearly communicating qualifications.

- Include ongoing education or training to demonstrate commitment to professional development.

- Consider adding honors or awards received during academic or certification programs to further validate expertise.

Example Education and Certifications for Accounts Receivable Manager

Strong Examples

- MBA in Finance, University of XYZ, 2020

- Certified Accounts Receivable Manager (CARM), National Association of Credit Management, 2021

- Bachelor’s Degree in Accounting, University of ABC, 2017

- Coursework in Financial Management and Credit Analysis, University of DEF, 2019

Weak Examples

- Associate Degree in General Studies, Community College, 2015

- Certification in Basic Computer Skills, Online Training, 2018

- High School Diploma, Local High School, 2010

- Outdated certification in General Accounting Principles, 2016

The strong examples listed are considered effective because they directly relate to the skills and knowledge required for an Accounts Receivable Manager role, showcasing advanced education and relevant certifications. In contrast, the weak examples lack specificity and relevance to the position, highlighting general or outdated qualifications that do not support the candidate's suitability for the role. This distinction underscores the importance of carefully selecting educational and certification details that resonate with the job requirements.

Top Skills & Keywords for Accounts Receivable Manager Resume

As an Accounts Receivable Manager, the importance of showcasing relevant skills on your resume cannot be overstated. Your ability to manage and oversee the accounts receivable process significantly impacts a company's cash flow and overall financial health. Employers seek candidates who not only possess the technical knowledge required to manage financial transactions but also demonstrate strong interpersonal skills to interact effectively with clients and team members. A well-crafted resume highlighting both hard and soft skills will set you apart from other candidates and illustrate your capability to excel in this role. For a deeper dive into the essential skills required for this position, check out our skills resource.

Top Hard & Soft Skills for Accounts Receivable Manager

Hard Skills

- Financial Reporting

- Accounts Reconciliation

- Credit Management

- Cash Application

- Invoice Processing

- Regulatory Compliance

- Accounting Software Proficiency (e.g., QuickBooks, SAP)

- Data Analysis and Reporting

- Payment Processing Systems

- Tax Compliance Knowledge

- Asset Management

- Audit Preparation

- Financial Analysis

- Collections Management

- Risk Assessment

- Budgeting and Forecasting

- ERP System Familiarity

- Revenue Recognition Principles

Soft Skills

- Communication Skills

- Leadership and Team Management

- Problem-Solving Abilities

- Time Management

- Attention to Detail

- Negotiation Skills

- Adaptability

- Conflict Resolution

- Customer Service Orientation

- Critical Thinking

- Interpersonal Skills

- Organizational Skills

- Empathy and Understanding

- Decision-Making Skills

- Relationship Building

- Strategic Thinking

- Collaboration

- Emotional Intelligence

These skills reflect the diverse capabilities required to thrive as an Accounts Receivable Manager. Highlighting both your technical expertise and your soft skills in your resume can significantly enhance your chances of landing that desired role. For guidance on how to effectively present your work experience, remember to focus on quantifiable achievements that demonstrate your expertise in managing accounts receivable processes.

Stand Out with a Winning Accounts Receivable Manager Cover Letter

I am writing to express my interest in the Accounts Receivable Manager position at [Company Name], as advertised on [where you found the job listing]. With over [X years] of experience in accounts receivable and financial management, I have developed a strong skill set that aligns well with the qualifications you are seeking. My background in overseeing accounts receivable operations, optimizing cash flow, and implementing efficient processes has consistently contributed to the financial health of the organizations I have worked with.

In my previous role at [Previous Company Name], I successfully managed a team of [number] accounts receivable specialists, improving collection rates by [percentage]% over [time period]. I implemented an automated invoicing system that reduced billing errors and improved invoice processing time by [percentage]%. My focus on fostering strong relationships with clients and maintaining clear communication has proven effective in resolving disputes swiftly and ensuring timely payments. I am confident that my proactive approach and analytical skills will enhance the efficiency of your accounts receivable department.

Moreover, I hold a [relevant degree or certification], which has equipped me with a solid foundation in financial principles and regulations. I am well-versed in using accounting software such as [specific software], and I am always eager to learn and adapt to new technologies that can streamline operations. I am excited about the opportunity to bring my expertise in accounts receivable management to [Company Name] and contribute to your team’s success.

Thank you for considering my application. I look forward to the possibility of discussing how my experience and vision align with the goals of [Company Name]. I am eager to contribute to your organization and help drive financial performance through effective accounts receivable management.

Common Mistakes to Avoid in a Accounts Receivable Manager Resume

When crafting a resume for the Accounts Receivable Manager position, it’s crucial to present your qualifications effectively. However, many candidates make common mistakes that can hinder their chances of landing an interview. Avoiding these pitfalls can significantly enhance your resume and demonstrate your competency for the role. Here are some frequent errors to watch out for:

Lack of Specificity: Failing to provide specific examples of your achievements can make your resume bland. Use quantifiable metrics to showcase your contributions, such as "reduced days sales outstanding by 15%."

Overly General Descriptions: Using vague language and generic job descriptions can make it difficult for hiring managers to assess your fit for the position. Tailor your experience to highlight relevant skills and accomplishments in accounts receivable.

Ignoring Industry Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Not incorporating industry-related keywords can result in your resume being overlooked. Research job descriptions to identify key terms.

Poor Formatting: A cluttered or unprofessional layout can detract from your qualifications. Ensure your resume is clean, well-structured, and easy to read, using consistent fonts and headings.

Spelling and Grammar Errors: Typos and grammatical mistakes can create a negative impression. Always proofread your resume carefully or ask someone else to review it for errors.

Neglecting Soft Skills: While technical skills are important, soft skills like communication, negotiation, and problem-solving are equally valuable for an Accounts Receivable Manager. Highlight these skills alongside your technical expertise.

Failure to Customize: Submitting a one-size-fits-all resume can be detrimental. Tailor your resume for each application to align your skills and experiences with the specific requirements of the job.

Omitting Professional Development: Not including relevant certifications or continuing education can make you seem stagnant. Always list any certifications, training, or workshops that enhance your qualifications in accounts receivable management.

Conclusion

As an Accounts Receivable Manager, your role is crucial in maintaining the financial health of an organization. You are responsible for overseeing the collection of payments, managing credit risks, and ensuring that cash flow is optimized. Key skills that are essential for this position include attention to detail, analytical thinking, strong communication abilities, and proficiency in accounting software.

In addition, an effective Accounts Receivable Manager should be adept at developing and implementing processes to enhance collection efficiency, as well as building relationships with clients to ensure prompt payments. Your ability to analyze financial data and generate reports also plays a vital role in forecasting cash flow and identifying potential issues before they escalate.

As you reflect on your career as an Accounts Receivable Manager, it’s important to ensure your resume accurately showcases your qualifications and expertise. A well-crafted resume can make a significant difference in your job search. We encourage you to take a moment to review your Accounts Receivable Manager resume and ensure it highlights your most relevant experience and accomplishments.

To aid you in this process, consider utilizing various resources available to enhance your resume. Explore resume templates for professionally designed layouts, use the resume builder for an easy step-by-step creation process, review resume examples for inspiration, and don’t forget to check out cover letter templates to complement your application. Take the next step in your career by ensuring that your resume stands out in the competitive job market!