Accounts Receivable Clerk Core Responsibilities

The Accounts Receivable Clerk plays a crucial role in managing incoming payments and maintaining financial records, which supports the overall financial health of the organization. Key responsibilities include processing invoices, tracking payments, and resolving discrepancies. This position requires strong technical skills, attention to detail, and excellent problem-solving abilities to ensure accurate and timely financial reporting. Effective communication bridges the finance department with sales and customer service teams, fostering collaboration and enhancing organizational goals. A well-structured resume highlighting these qualifications can effectively showcase a candidate's ability to contribute to the company's success.

Common Responsibilities Listed on Accounts Receivable Clerk Resume

- Process and post customer payments accurately and timely.

- Prepare and distribute invoices to customers.

- Reconcile customer accounts and resolve discrepancies.

- Maintain detailed records of all transactions and communications.

- Monitor accounts for overdue payments and follow up as necessary.

- Assist with month-end closing activities and reporting.

- Generate and analyze accounts receivable aging reports.

- Collaborate with sales teams to address customer inquiries.

- Implement and improve processes for efficient collection of receivables.

- Utilize accounting software and tools for data entry and reporting.

- Support audit processes by providing required documentation.

- Develop and maintain positive relationships with clients and customers.

High-Level Resume Tips for Accounts Receivable Clerk Professionals

A well-crafted resume is essential for Accounts Receivable Clerk professionals, as it serves as the first impression a candidate makes on potential employers. In a competitive job market, a resume must effectively showcase not only relevant skills but also notable achievements that demonstrate a candidate's value. A strong resume can set you apart from other applicants, making it imperative to highlight your qualifications and experiences in a compelling manner. This guide will provide practical and actionable resume tips specifically tailored for Accounts Receivable Clerk professionals, helping you to create a standout application that resonates with hiring managers.

Top Resume Tips for Accounts Receivable Clerk Professionals

- Tailor your resume to match the specific job description, using keywords and phrases that align with the requirements of the position.

- Highlight relevant experience in accounts receivable processes, such as billing, collections, and payment processing.

- Quantify your achievements by using specific numbers or percentages to demonstrate your impact, such as reducing overdue accounts by a certain percentage.

- Include industry-specific skills such as proficiency in accounting software (e.g., QuickBooks, SAP) and knowledge of relevant regulations.

- Arrange your resume in a clear and logical format, ensuring that sections such as experience, education, and skills are easily identifiable.

- Emphasize soft skills that are critical in the role, such as attention to detail, communication skills, and problem-solving abilities.

- Use action verbs to describe your responsibilities and accomplishments, enhancing the dynamic nature of your experience.

- Keep your resume concise, ideally one page, while ensuring that all relevant information is included without overwhelming the reader.

- Proofread your resume to eliminate any grammatical errors or typos, as attention to detail is crucial in the accounts receivable field.

By implementing these tips, you can significantly increase your chances of landing a job in the Accounts Receivable Clerk field. A well-structured and targeted resume will not only highlight your qualifications but also showcase your readiness to contribute effectively to potential employers, making you a standout candidate in a competitive job market.

Why Resume Headlines & Titles are Important for Accounts Receivable Clerk

In the competitive field of accounts receivable, having a well-crafted resume is essential for standing out to hiring managers. A resume headline or title serves as the first impression, summarizing a candidate's key qualifications in a concise and impactful way. A strong headline grabs attention and immediately communicates the candidate's relevance to the job, showcasing their skills and experience in a single phrase. It should be tailored specifically to the role of Accounts Receivable Clerk, ensuring that it is both relevant and engaging to potential employers.

Best Practices for Crafting Resume Headlines for Accounts Receivable Clerk

- Be concise: Limit your headline to one impactful phrase.

- Make it role-specific: Tailor the headline to reflect the Accounts Receivable Clerk position.

- Highlight key skills: Include essential skills relevant to the role, such as attention to detail or financial acumen.

- Showcase experience: Mention years of experience or notable achievements in the field.

- Use action words: Begin with strong action verbs to convey confidence and proactivity.

- Avoid jargon: Keep language simple and clear to ensure it resonates with hiring managers.

- Incorporate keywords: Use industry-specific keywords that align with the job description.

- Be authentic: Ensure that your headline accurately reflects your abilities and experiences.

Example Resume Headlines for Accounts Receivable Clerk

Strong Resume Headlines

Detail-Oriented Accounts Receivable Clerk with Over 5 Years of Experience in Streamlining Collections

Results-Driven Accounts Receivable Specialist Skilled in Reducing DSO by 30%

Proven Accounts Receivable Clerk with Expertise in Managing High-Volume Transactions

Dedicated Financial Professional with a Track Record of Improving Cash Flow Management

Weak Resume Headlines

Accounts Receivable Clerk Looking for a Job

Experienced in Finance

The strong headlines are effective because they are specific, quantifiable, and directly related to the role of an Accounts Receivable Clerk. They highlight relevant skills and achievements, making an immediate impact on hiring managers. In contrast, the weak headlines fail to impress due to their vagueness and lack of detail; they do not convey the candidate's unique qualifications or relevance to the role, ultimately blending into a sea of other resumes.

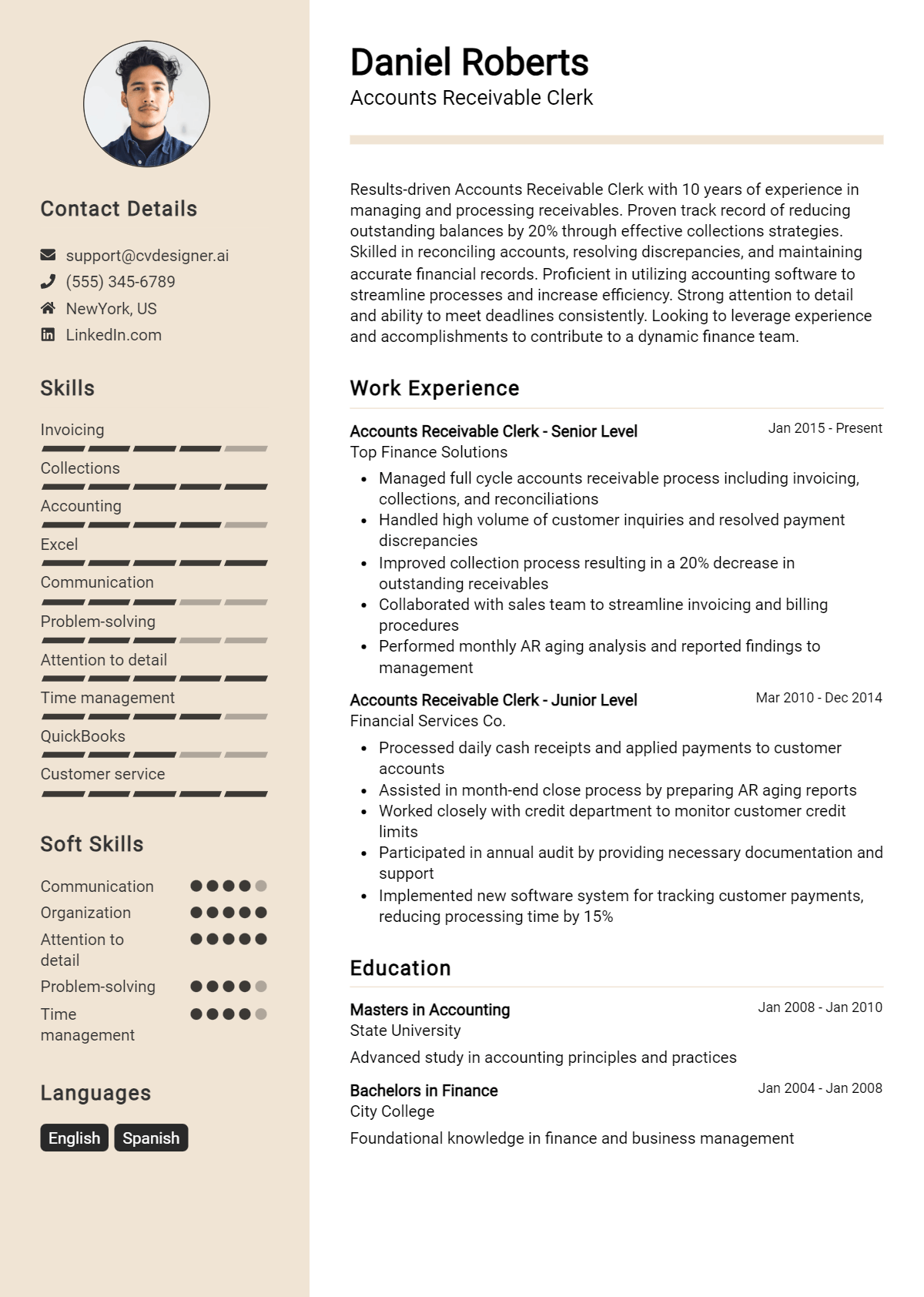

Writing an Exceptional Accounts Receivable Clerk Resume Summary

Writing a compelling resume summary is crucial for an Accounts Receivable Clerk, as it serves as the first impression to hiring managers. A strong resume summary quickly captures attention by succinctly showcasing key skills, relevant experience, and notable accomplishments that align with the job role. It should be concise and impactful, demonstrating the candidate's suitability for the position while tailored to the specific job description. An effective summary not only highlights the candidate's qualifications but also sets the tone for the rest of the resume, compelling hiring managers to read on.

Best Practices for Writing a Accounts Receivable Clerk Resume Summary

- Quantify Achievements: Use numbers to highlight successes, such as percentage of collections improved or amount of revenue recovered.

- Focus on Relevant Skills: Emphasize skills pertinent to accounts receivable, such as proficiency in accounting software, attention to detail, and communication skills.

- Tailor the Summary: Customize the summary for each job application by including keywords from the job description.

- Keep it Concise: Aim for 2-4 sentences that encapsulate critical information without unnecessary fluff.

- Showcase Accomplishments: Highlight specific achievements that demonstrate your effectiveness in previous roles.

- Use Action Verbs: Begin sentences with strong action verbs to convey initiative and competence.

- Highlight Industry Knowledge: Mention expertise in relevant regulations, processes, or software that are specific to accounts receivable.

- Maintain Professional Tone: Keep the language professional and focused, avoiding casual phrases or jargon.

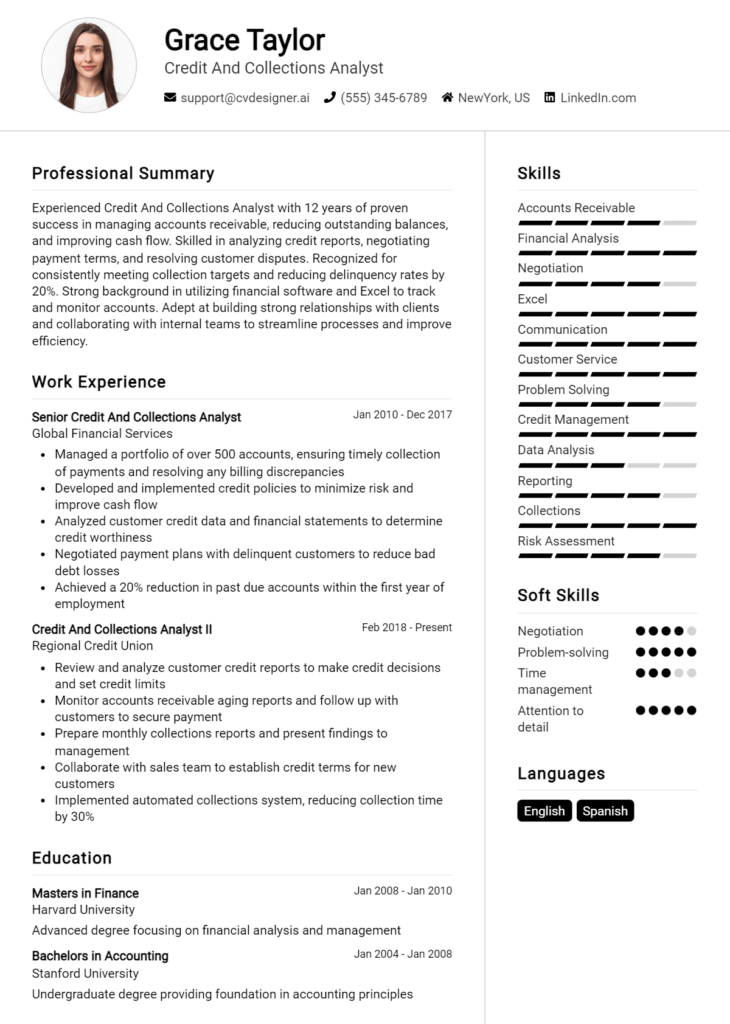

Example Accounts Receivable Clerk Resume Summaries

Strong Resume Summaries

Detail-oriented Accounts Receivable Clerk with over 5 years of experience in managing invoicing and collections processes. Successfully reduced outstanding receivables by 30% within a year through targeted follow-up strategies and enhanced client communication.

Proficient in QuickBooks and Excel, I have a proven track record of processing over 1,000 invoices monthly while maintaining a 98% accuracy rate. Recognized for my ability to resolve discrepancies swiftly and improve cash flow for the organization.

Results-driven Accounts Receivable professional with expertise in credit management and collections. Achieved a 40% increase in collection efficiency by implementing a new tracking system, leading to a significant reduction in days sales outstanding (DSO).

Weak Resume Summaries

Experienced accounting professional looking for a position in accounts receivable.

Detail-oriented individual with some knowledge of invoicing and collections.

The examples of strong resume summaries illustrate clear, quantifiable achievements and specific skills that directly relate to the responsibilities of an Accounts Receivable Clerk. They offer concrete evidence of the candidate's capabilities and successes, making them stand out to hiring managers. In contrast, the weak resume summaries lack substance, providing vague information without measurable outcomes or relevant detail, which fails to engage potential employers effectively.

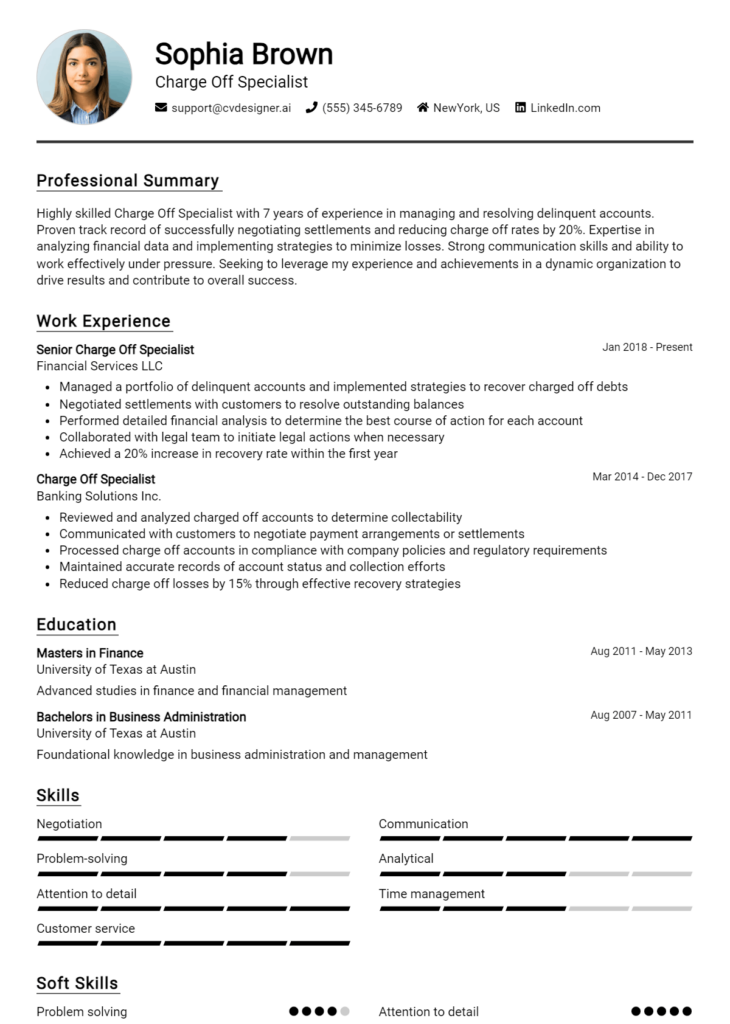

Work Experience Section for Accounts Receivable Clerk Resume

The work experience section is a critical component of an Accounts Receivable Clerk resume as it provides potential employers with insight into the candidate's practical skills and capabilities. This section not only showcases technical expertise in areas such as invoicing, payment processing, and data management but also highlights the candidate's ability to collaborate effectively within a team environment. By quantifying achievements and aligning work experience with industry standards, candidates can demonstrate their value and readiness to contribute to an organization's financial health and operational efficiency.

Best Practices for Accounts Receivable Clerk Work Experience

- Highlight specific software and tools used, such as ERP systems, Excel, and accounting software.

- Quantify achievements, such as reducing days sales outstanding (DSO) or increasing collection rates.

- Describe your role in team projects or initiatives that improved processes or efficiency.

- Use action verbs to convey impact, such as "streamlined," "implemented," or "managed."

- Tailor your experience to match the job description, emphasizing relevant skills and experiences.

- Include metrics that demonstrate your contributions, such as the number of accounts managed or the volume of transactions processed.

- Showcase any leadership roles taken, such as training new team members or leading projects.

- Keep descriptions concise and focused on outcomes rather than just responsibilities.

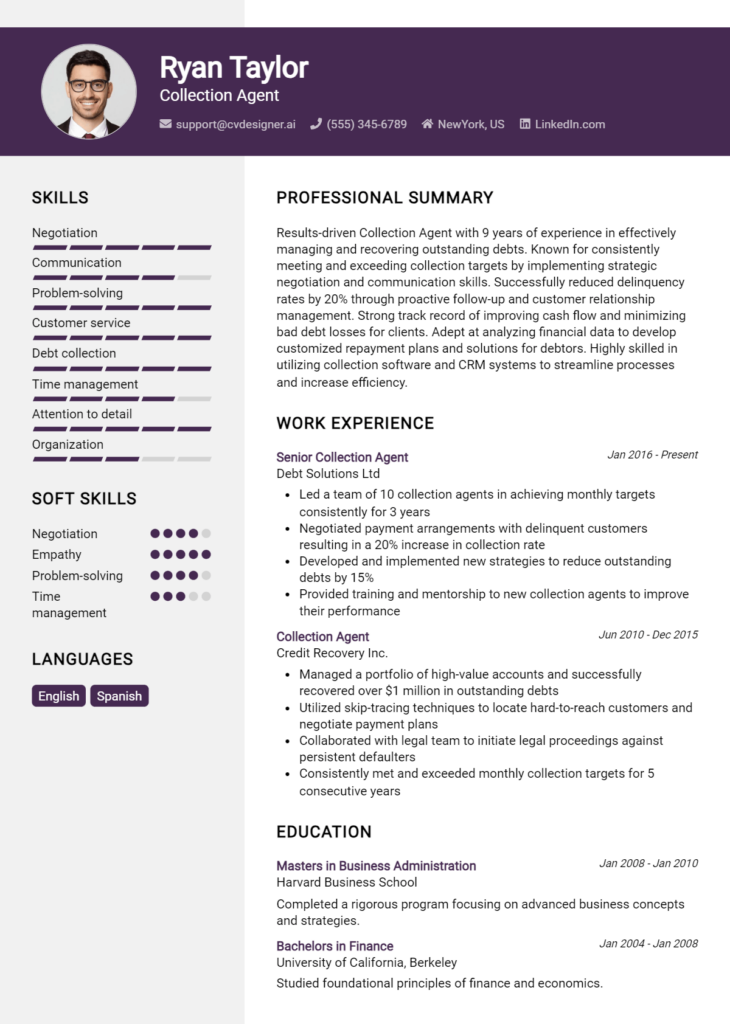

Example Work Experiences for Accounts Receivable Clerk

Strong Experiences

- Successfully reduced DSO from 45 days to 30 days over six months through proactive follow-up and improved invoicing accuracy.

- Managed a portfolio of 200+ client accounts, achieving a 98% collection rate by implementing a new payment reminder system.

- Collaborated with the sales team to resolve discrepancies, leading to a 15% increase in customer satisfaction ratings.

- Trained and mentored 3 junior clerks on best practices in accounts receivable processes, enhancing team efficiency by 20%.

Weak Experiences

- Responsible for accounts receivable tasks.

- Worked with various clients on payments.

- Helped the team with collections.

- Assisted in entering data into the system.

The examples labeled as strong demonstrate clear, quantifiable outcomes and show how the candidate's actions had a direct impact on the organization, reflecting both technical skills and collaboration. In contrast, the weak experiences lack specificity and measurable results, making it difficult for potential employers to gauge the candidate's contributions and effectiveness in their previous roles.

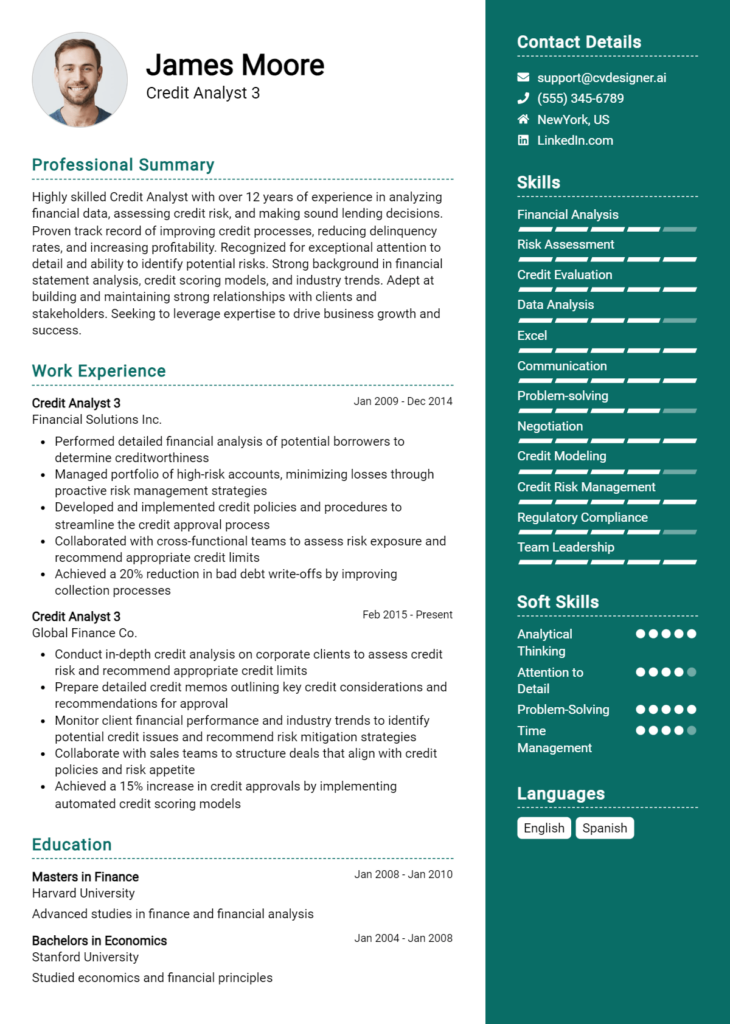

Education and Certifications Section for Accounts Receivable Clerk Resume

The education and certifications section of an Accounts Receivable Clerk resume is crucial as it underscores the candidate's academic achievements and specialized training relevant to the financial sector. This section not only showcases the foundational knowledge gained through formal education but also highlights any industry-recognized certifications that reflect the candidate's commitment to continuous learning and professional development. By including pertinent coursework and certifications, candidates can significantly enhance their credibility and demonstrate their readiness for the responsibilities associated with the role of an Accounts Receivable Clerk.

Best Practices for Accounts Receivable Clerk Education and Certifications

- Focus on relevant degrees, such as Accounting, Finance, or Business Administration.

- Include industry-recognized certifications, such as Certified Accounts Receivable Professional (CARP) or Certified Credit and Collection Specialist (CCCS).

- Highlight any specialized training in accounting software or ERP systems like QuickBooks or SAP.

- Detail relevant coursework, particularly in financial management, bookkeeping, and tax regulations.

- Keep the information up-to-date by including recent certifications and training attended.

- Use clear formatting that makes it easy for hiring managers to quickly assess qualifications.

- Avoid overly general degrees or certifications that do not directly apply to the role.

- Showcase any honors or achievements obtained during your education that can enhance your profile.

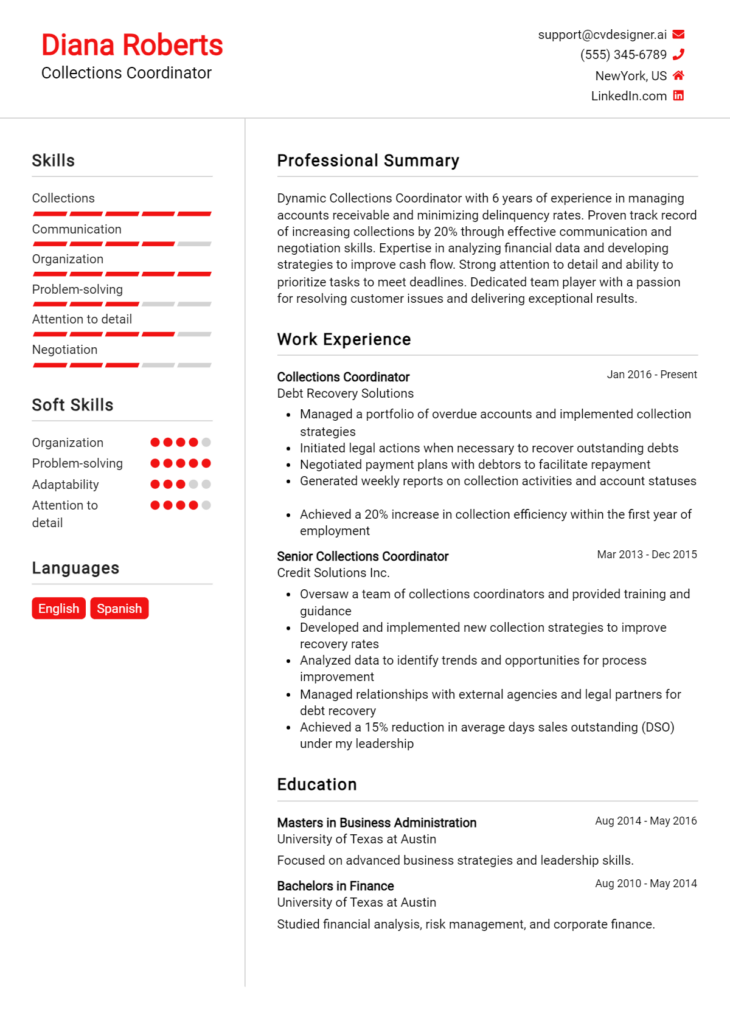

Example Education and Certifications for Accounts Receivable Clerk

Strong Examples

- Bachelor of Science in Accounting, State University, Graduated May 2022

- Certified Accounts Receivable Professional (CARP), National Association of Credit Management, 2023

- Coursework in Financial Management and Advanced Bookkeeping, City Community College

- Certificate in QuickBooks Online, Online Learning Platform, Completed June 2023

Weak Examples

- Associate Degree in General Studies, Community College, 2020

- Certificate in Microsoft Office, 2019

- Bachelor of Arts in English Literature, University College, 2021

- High School Diploma, Graduated 2018

The strong examples are considered valuable because they present relevant educational qualifications and certifications that directly align with the skills required for an Accounts Receivable Clerk. These examples reflect a focused background in accounting and finance, as well as ongoing professional development. Conversely, the weak examples highlight qualifications that lack direct relevance to the role or are outdated, making them less impactful for potential employers. This distinction emphasizes the importance of tailoring educational credentials to the specific job requirements in the financial sector.

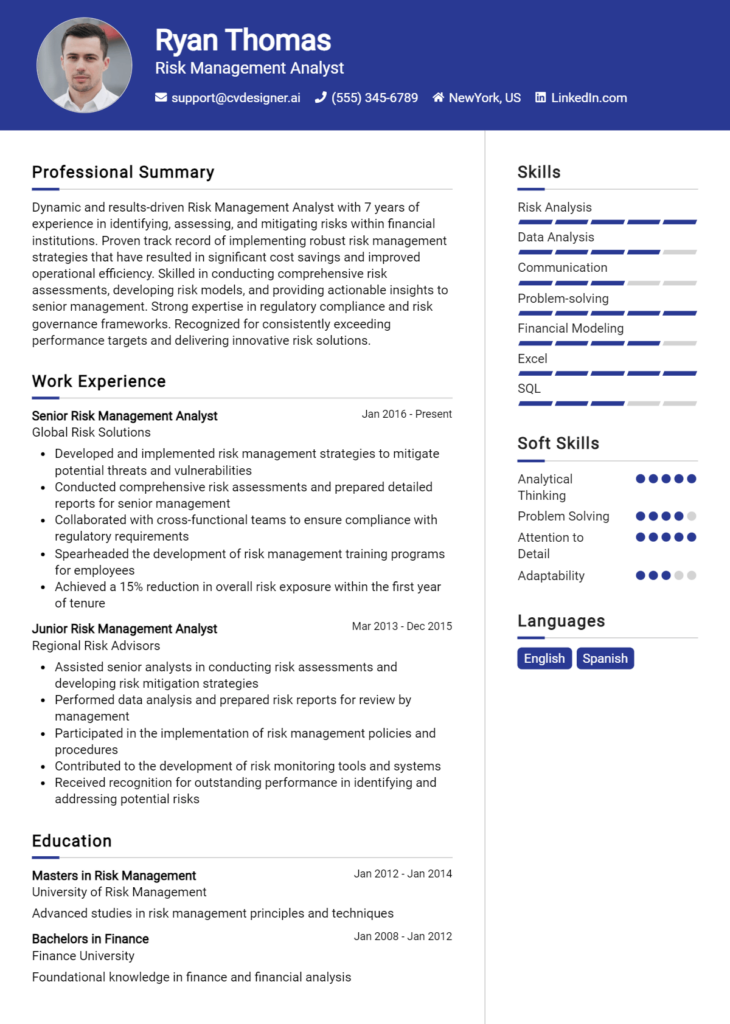

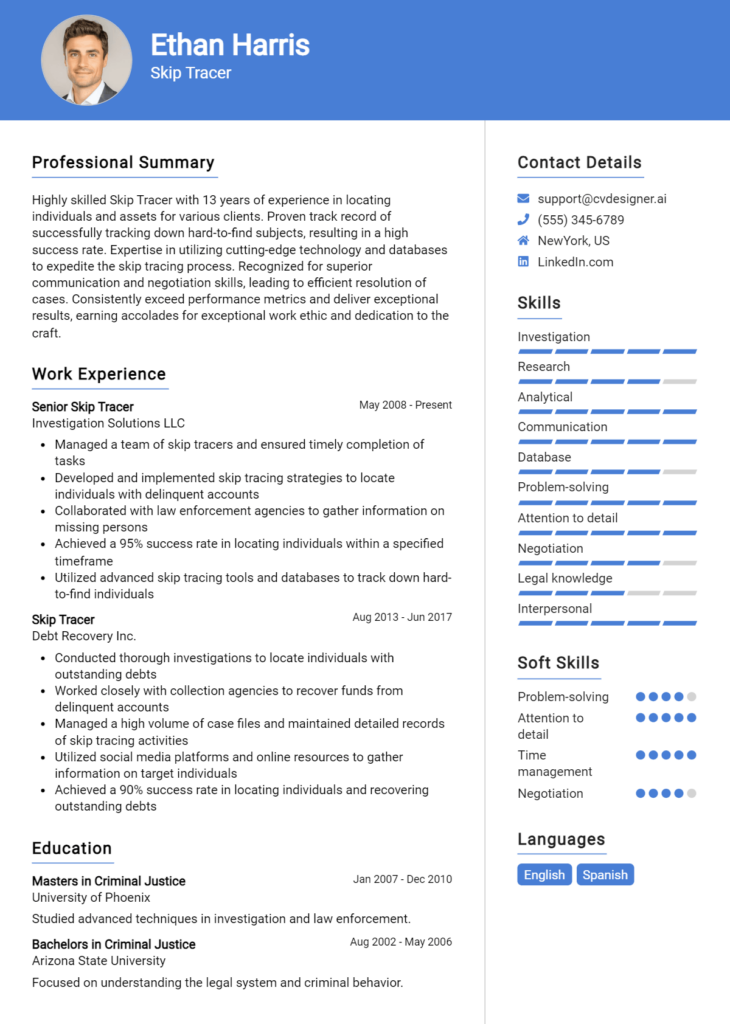

Top Skills & Keywords for Accounts Receivable Clerk Resume

Having a well-crafted resume is essential for an Accounts Receivable Clerk, as this role plays a critical part in maintaining the financial health of a company. Highlighting the right skills can significantly enhance your resume, making it more appealing to potential employers. Employers typically look for a blend of both soft and hard skills that indicate a candidate's ability to manage accounts effectively, communicate with clients, and contribute to overall financial operations. By showcasing these skills, you can demonstrate your qualification for the role and your readiness to handle the responsibilities that come with it.

Top Hard & Soft Skills for Accounts Receivable Clerk

Soft Skills

- Attention to Detail

- Strong Communication Skills

- Problem-Solving Ability

- Time Management

- Customer Service Orientation

- Adaptability

- Team Collaboration

- Organizational Skills

- Critical Thinking

- Interpersonal Skills

- Conflict Resolution

- Dependability

- Initiative

- Ability to Work Under Pressure

- Negotiation Skills

Hard Skills

- Proficiency in Accounting Software (e.g., QuickBooks, Sage)

- Knowledge of Accounts Receivable Processes

- Data Entry Accuracy

- Financial Reporting

- Knowledge of Billing Procedures

- Excel Proficiency (including VLOOKUP and PivotTables)

- Familiarity with Payment Processing Systems

- Understanding of Financial Regulations

- Experience with Collections Management

- Analytical Skills

- Ability to Manage Multiple Accounts

- Knowledge of Invoicing and Credit Management

- Familiarity with ERP Software

- Basic Bookkeeping

- Attention to Financial Compliance

- Reporting and Documentation Skills

By integrating these skills into your resume, along with relevant work experience, you can effectively position yourself as a strong candidate for the Accounts Receivable Clerk role.

Stand Out with a Winning Accounts Receivable Clerk Cover Letter

I am excited to apply for the Accounts Receivable Clerk position at [Company Name], as advertised on [where you found the job listing]. With a solid background in accounting and a keen attention to detail, I am confident in my ability to contribute effectively to your finance team. My extensive experience in managing accounts receivable processes, coupled with my commitment to accuracy and efficiency, positions me well to excel in this role.

In my previous role at [Previous Company Name], I successfully managed a portfolio of clients, ensuring timely invoicing and effective follow-up on outstanding payments. I implemented a new tracking system that reduced overdue accounts by 20% within six months. My proficiency in accounting software, including QuickBooks and Excel, allows me to streamline processes and generate accurate financial reports. Furthermore, my strong communication skills enable me to build positive relationships with clients, helping to resolve billing discrepancies quickly and professionally.

I am particularly drawn to this opportunity at [Company Name] because of your commitment to [specific value or mission of the company]. I admire your innovative approach to [mention something relevant about the company or industry], and I would be thrilled to contribute to your team by ensuring that the accounts receivable processes are managed efficiently and effectively. I am eager to bring my strong organizational skills and proactive approach to help achieve your financial goals.

Thank you for considering my application. I look forward to the possibility of discussing how I can support the financial operations at [Company Name]. I am excited about the opportunity to bring my skills in accounts receivable management to your esteemed organization and help drive its success.

Common Mistakes to Avoid in a Accounts Receivable Clerk Resume

When crafting a resume for the position of an Accounts Receivable Clerk, it's essential to present a clear and professional image that highlights relevant skills and experiences. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more effective resume that showcases your qualifications and sets you apart from the competition.

Vague Job Descriptions: Using generic job titles or descriptions can make it difficult for hiring managers to understand your specific responsibilities and achievements. Be precise about your past roles and the tasks you handled.

Ignoring Keywords: Many companies use Applicant Tracking Systems (ATS) to filter resumes. Failing to include relevant keywords from the job description can result in your resume being overlooked.

Overloading on Jargon: While industry terminology can be important, using too much jargon can alienate those who may not be familiar with specific terms. Aim for a balance that conveys expertise without confusing the reader.

Lacking Quantifiable Achievements: Simply stating your duties is not enough. Always try to include numbers or percentages to demonstrate your impact, such as "Reduced accounts receivable aging by 20% over six months."

Inconsistent Formatting: A cluttered or inconsistent resume layout can distract from your qualifications. Ensure that fonts, bullet points, and spacing are uniform throughout the document.

Not Tailoring Your Resume: Each job application is unique, and a one-size-fits-all resume can appear impersonal. Customize your resume to align with the specific requirements and responsibilities of the job you are applying for.

Including Irrelevant Experience: While it can be tempting to list every job you've held, including unrelated positions can dilute your message. Focus on experiences that directly relate to accounts receivable or finance.

Typos and Grammatical Errors: Mistakes in spelling or grammar can create a negative impression and suggest a lack of attention to detail. Always proofread your resume multiple times and consider asking someone else to review it.

Conclusion

In conclusion, the role of an Accounts Receivable Clerk is pivotal in maintaining the financial health of an organization. Key responsibilities include managing incoming payments, maintaining accurate records, and ensuring timely invoicing, all of which contribute to effective cash flow management. Attention to detail, strong organizational skills, and proficiency with accounting software are essential traits for success in this position.

As you reflect on your qualifications and experiences, it's a great time to review your Accounts Receivable Clerk resume. Ensure that it effectively highlights your skills and accomplishments in managing accounts receivable, handling customer inquiries, and maintaining financial records.

To assist you in this process, consider utilizing the various tools available to enhance your application. Check out our resume templates for a professional layout, use our resume builder for easy customization, and explore resume examples to gain inspiration from successful candidates. Additionally, don’t forget to craft a compelling introduction with our cover letter templates.

Take action today to ensure your resume stands out in a competitive job market!